MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

†Requirements may vary. See card packaging for details or contact card issuer.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Top 5 Prepaid Debit Cards in 2024

Prepaid debit cards are a must-have for anyone looking to spend money internationally.

Whatever you need it for, we’ve drawn up a list of the best prepaid cards for international travel, available in the USA in 2024:

- Serve (by Amex)

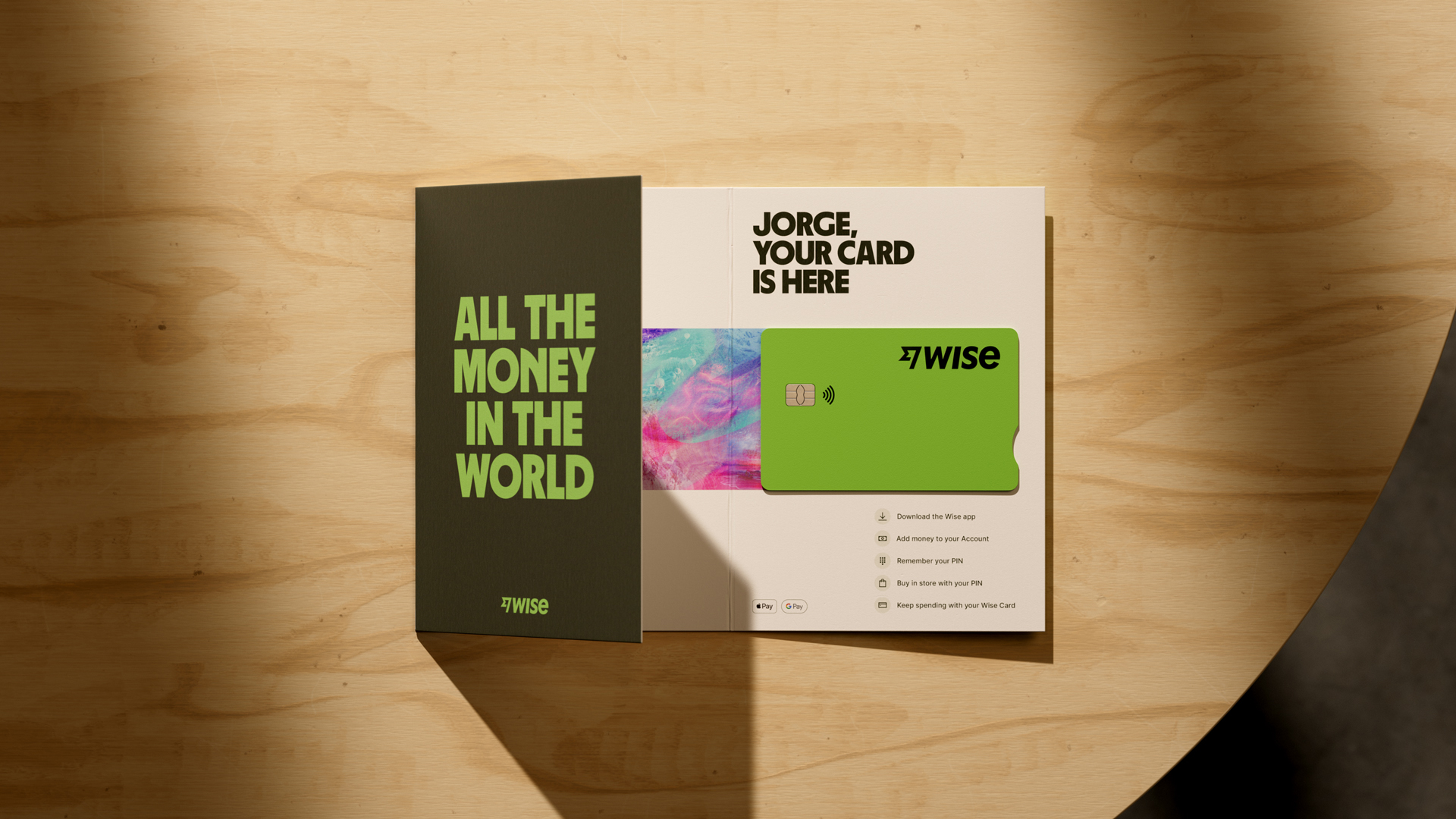

Wise - great all-round prepaid card

- Hold and exchange 40+ currencies with the mid-market exchange rate and no hidden fees

- Auto-convert feature means you can wait for the best exchange rate before converting your USD to other currencies

- Send payments to 160+ countries and get paid easily from 30+ countries with a Wise account

Find out more about the Wise card .

Read our Wise card review .

Open a free Wise account online or in the Wise app and order a linked international debit card for spending and withdrawals in 170+ countries around the world.

You’ll be able to hold and exchange over 50 currencies in the Wise app, with no fee to spend any currency you hold - and all currency exchange uses the mid-market exchange rate with no markup and no hidden fees.

There’s a one time fee of $9 to get your Wise card, with no ongoing charge after that. Some transaction charges apply, depending on the services you use.

Netspend - great for depositing cash and checks

- 130,000+ physical reload locations, plus options to add funds electronically

- Earn cash back and rewards on spending

- Some cards offer a purchase cushion of up to $10 if you run low on funds in your account

Find out more about the Netspend card .

Netspend prepaid cards are available with a broad variety of plan options, including pay as you go, monthly fee and premier plans

You can top up using cash or a check in a physical store location, or have your salary or government benefits deposited to your account for easy spending. You can also deposit checks using just your phone.

Fee structures and plans vary. Check your terms and conditions - particularly for international charges. Foreign transaction fees of 3% - 4% may apply, plus fees to withdraw from international ATMs.

Revolut - great exchange rate

- Hold 25+ currencies, and exchange with the mid-market rate up to your plan limits

- No-fees applied to ATM withdrawals at 55,000+ in network ATMs

- 10 no-fee international transfers per month

Find out more about the Revolut Card .

Read our Revolut card review .

Revolut offers prepaid travel cards and multi-currency accounts you can manage in-app, with a standard plan and 2 higher tier plans which offer more features and no-fee transactions. Use your Revolut account to hold 25+ currencies, exchange between them no-fee up to plan limits ($1,000/month for the no-fee plan), and spend on your linked prepaid card around the world.

Some out of hours and fair usage fees may apply to your account - and you’ll need to pay a monthly fee to unlock the full range of account features and benefits.

Serve - great for instant pick-up

- Get your card online or pick up at a participating retailer for no mailing delays

- Top up at a physical location or using a digital method if you’d prefer

- Different card plans which have their own features and fees, some including cash back options

Find out more about the Serve card.

Serve has several different prepaid debit cards you can use internationally, including some which offer cash back on purchase or other features like fee free direct deposits. You’ll be able to pick up a card in a participating store which means you can start using it pretty much instantly - or order online if you’d rather get everything sorted from home.

Fees apply for different transaction types - including a foreign transaction fee which may be in the region of 3.5%, and international ATM fees which can be around $4.95.

Chime - great for low foreign transaction fees

- No monthly fee, and no foreign transaction fee when you spend with your Chime card overseas

- Fee free ATM withdrawals at 60,000+ locations

- Checking, saving and credit building account options also available

Find out more about the Chime card.

Chime offers a relatively broad range of financial services, including a variety of account options, and linked Visa debit cards which are good for international use as there’s no foreign transaction fee. When you sign up for a Chime debit card you’ll also be able to get instant access to a temporary digital card while you wait for your physical card.

Some card fees are likely to apply, including out of network and international fees applied by merchants and ATM operators.

What is a prepaid debit card?

A prepaid debit card can be used for spending and withdrawals, much like a regular debit card would be.

However, in most cases, a prepaid card is linked to an account you can’t overdraw - so there’s no risk of extra fees if you run short of funds.

International prepaid debit cards can be used to spend in foreign currencies - and often come with extra perks, lower international costs or better exchange rates.

How do I get a prepaid debit card for international travel?

The process to sign up for a prepaid travel card varies by provider, but usually you can choose:

- To apply online and have your card delivered to your home address

- To pick up a card in a physical location and complete verification there

In most cases you’ll have to show or upload proof of your identity for verification, and then load an initial amount onto the card. The good news is that it’s usually more straightforward to sign up for a prepaid card than a credit card as there are no credit checks to complete.

Fees and charges for international prepaid cards

The costs associated with an international prepaid debit card can vary widely based on the provider and card you pick. Have a look at your card’s terms and conditions, and cardholder agreement document to make sure you’re familiar with all the fees, which can include:

- Monthly maintenance fees

- Cash and check reload fees

- Transaction fees

- Foreign exchange fees

- ATM withdrawal fees

- ATM inquiry fees

- Inactivity fees

- Replacement card fees

Check out the Wise card, Chime card, or a standard Revolut account and card if you’re interested in prepaid international debit cards with no ongoing fees and options for currency exchange with no foreign transaction fee.

Are prepaid travel cards safe?

Prepaid travel cards are usually considered safe to use as long as you take normal security precautions - like keeping your account details and card PIN secret.

If your prepaid travel card is stolen you’ll usually be able to freeze or cancel it in an app - and it’s not linked to your main bank account, which can also offer peace of mind. Some providers like Revolut also offer "disposable" virtual cards which can add an extra layer of security when spending with new merchants.

How are deposits on prepaid debit cards protected?

In the US, most reputable prepaid debit card providers offer customers protection under the FDIC insurance scheme , either through their own banking licenses and FDIC membership, or through working with partner banks which are themselves FDIC insured.

If your funds are held by a provider which offers FDIC insurance your funds are usually protected up to $250,000. All of the providers we picked out above do offer customer protections either through safeguarding funds by placing customer money with partner banks, which have FDIC protections in place.

How to add money on a prepaid debit card

How you add funds to your international prepaid card can vary depending on the details of the card. You’ll usually be able to choose from one or more of the following options:

- Have direct deposit payments - such as your salary or government benefits deposited to your account

- Transfer in money yourself from a checking account

- Add money in cash or checks at a physical location - some cards also let you add checks electronically with your phone

Prepaid debit cards: Best MasterCard alternatives

Most of the cards we’ve looked at so far are issued on the Visa network. Visa is one of the card networks with the broadest global coverage - and most merchants and ATMs which offer Visa also allow Mastercard transactions.

It’s useful to have cards on several different networks, just in case there’s a problem with one card or network. Some networks which are commonly used here in the US aren’t as popular in some other regions - such as Discover and American Express. That makes it handy to carry one or more Visa or Mastercard card options alongside your normal cards if they’re on these networks.

In case you’d rather have a Mastercard, we’ve picked out a few top Mastercard prepaid international debit cards as well:

Monzo - great overall alternative

- Range of account functions, to support budgeting, saving and more

- No foreign transaction fees, no ATM fees, no monthly maintenance fees

- Cards are Apple Pay and Google Pay compatible

Find out more about the Monzo card.

PayPal Prepaid Card - great for cash reload

- Add money from your bank, by direct deposit or in person at a physical location

- Earn cash back and rewards with PayPal partner merchants

- 4% foreign transaction fee applies to international spending

Learn more about the PayPal prepaid card.

Ally Bank card - great for everyday use

- FDIC insured with broad range of services including savings, investments and IRA plans

- Manage your money on the move with easy online and mobile banking

- International fees, including a foreign transaction fee when making ATM withdrawals, may apply

Learn more about Ally Bank.

Prepaid travel cards FAQs

Which is the best prepaid debit card for use abroad.

There’s no single best prepaid debit card. It’ll depend on what’s important to you, and how you’ll use the card once you have it.

For example, if you’re looking for a card with the Google exchange rate with no markup you might want to take a look at Wise. If being able to add funds at a physical location is most important , check out Netspend instead.

There are lots of providers out there - so you’ll be able to find the best prepaid travel card for you with a bit of research.

Are prepaid debit cards anonymous?

Prepaid debit cards are still covered by similar financial rules to banks - both here and internationally. That means you’ll usually be asked to show ID when you get a card, for verification.

All of the cards we have profiled here require customers to provide ID to comply with financial legislation, and to keep customers and their money safe. That means they’re not truly anonymous - even though they’re not linked usually to your normal bank account in any way.

Are prepaid debit cards worth it?

Prepaid debit cards are more secure and convenient than carrying lots of foreign currency cash. And if you pick the right provider for your needs you could also find you get a better exchange rate and lower overall costs for your international spending.

The Backpacker Network

Travel Cards for Europe – The Best Options for Travellers!

Choosing the right travel card for Europe can be complicated. There are a lot of factors to consider: exchange rates, fees for spending or withdrawing, type of card, payment processors, plus travel rewards and perks.

Get it right and you’ll be a budgeting ninja – you’ll know exactly how much you’ve spent and how you’re going to pay for everything you need. Get it wrong and you’ll be more clumsy clown than ninja! Hefty bank fees, poor exchange rates and potentially being unable to access your hard-earned money are all risks you take when you pick the wrong bank card for European travel.

We’ve trawled the internet for information about travel money cards, so you don’t have to. This research, combined with our own experiences and recommendations from our backpacking community on the ground, has helped us put together this shortlist of the best travel money cards for Europe.

Top Three European Travel Cards

Disclosure: Some links on this page are affiliate links. We always write our articles before checking if affiliate links are available.

- Available to European Economic Area residents.

- Limited fee-free withdrawals.

- Use the interbank exchange rate.

- Only available to UK residents.

- Unlimited fee-free withdrawals

- Use the Mastercard exchange rate.

- Fee-free withdrawals depending on the country the card was issued in.

- Multi-currency accounts.

- Low fees when transferring money.

Related: (links open in a new tab)

- Cheapest Cities in Europe

- Cheapest Countries in Europe

- Europe Budget Guide

Types of Travel Card for Europe

Debit cards for travel .

You’re bound to be familiar with debit cards. They’re provided with almost every current account as standard. The idea is that money is taken from your account as soon as it’s spent, making it easy to keep track and avoid spending more than you can afford. But not all debit cards are created equal.

Many traditional banks charge ridiculous fees for using your card abroad or withdrawing money from foreign ATMs. On top of this, they often deliver a poor exchange rate, meaning the bank profits from you swapping your money into a foreign currency.

Travel debit cards from digital or challenger banks tend to be much better for use in Europe. There are very few charges and you can usually withdraw at least some cash without paying foreign withdrawal fees. The exchange rate at challenger banks tends to be better too, often sticking to the official Mastercard or interbank rate. This means you can be sure the bank isn’t profiting from you needing some euros!

Prepaid Travel Cards for Europe

A prepaid travel card is essentially a debit card that needs to be topped up from your bank account. You can top them up using online banking, via an app or in certain stores and establishments. When the funds are loaded, you can use the card as a regular debit card.

Until the relatively recent rise of digital banks, prepaid euro cards were an excellent choice for anyone travelling the continent. While they still have plenty of fees attached, they’re cheaper than traditional banks. However, with the swell of challenger banks offering excellent debit cards for travel, there’s no real need to use a prepaid card anymore.

If you do opt for a prepaid euro card, ensure you understand the fees and exchange rates. Prepaid cards that take multiple currencies may offer a fantastic exchange rate if you convert the money to euros straight away. But, if you load the card with your home currency, the exchange rate for each foreign transaction is generally much worse. It’s also worth noting that some even charge you to a small fee to top up!

Credit Cards for Travel in Europe

Travel credit cards are an excellent way to save money in Europe – but only if you’re careful! Make sure you pay off the balance each month. If you don’t, the interest you’ll need to pay will negate any savings you’d otherwise make.

Most credit cards for travel offer fee-free transactions, no matter where you are in Europe. However, very few offer fee-free cash withdrawals – and even if they do, there is usually a higher interest rate attached to withdrawing cash on a credit card.

As well as fee-free transactions, travel credit cards tend to offer points for every pound, dollar or euro you spend. These points add up over time and can be redeemed for air miles, hotel stays and a range of other incentives, including cold hard cash! Exactly what is on offer will depend on your credit card provider, so shop around to make sure you get the best deal!

Direct Debit Travel Card

Direct debit travel cards offer a unique way to save money in Europe: simpler than opening a new bank account, easier than getting a new credit card and far less faff than choosing a good prepaid euro card, direct debit travel cards are changing the game.

They connect to your normal bank account and you use them as a traditional debit card. The only difference is that the transaction goes through the travel card provider who act as an intermediary between your bank and the card machine you’re using. This step means your bank won’t charge you foreign transaction fees, saving you a small fortune!

The Best Money Cards for Europe!

- Available to customers from the European Economic Area as well as many more countries!

- Multi-currency accounts on offer

- Limited free foreign withdrawals

Available to customers from many countries – As well as being available to anyone with an address in the European Economic Area , Revolut offer accounts to anyone from Australia, New Zealand, Singapore, Switzerland, UK, USA, Japan and Brazil. Revolut also offer ‘lite’ accounts to customers from other countries too!

Visa or Mastercard – Whether you get a Mastercard or Visa Revolut debit card will depend on where you live and where your account is registered. Both Visa and Mastercard work across Europe, so you won’t have an issue with either!

Spending and Withdrawals – Revolut allow you to withdraw £200GBP ( the exact amount may be slightly different in your local currency ), or make five withdrawals per month fee-free. After this, a 2% cash withdrawal fee kicks in. You also get limited fee-free card transactions each month. The first £1000GBP spent on your card (not including cash withdrawals) comes with no additional fees. After the first £1000GBP, a 0.5-1% fee applies to every transaction. With Revolut’s paid accounts, the withdrawal and spending limits are higher.

App-Based – Revolt offer full control of your account through the app. You can open a current account, multi-currency account, lock the card and create single-use digital debit cards all from the comfort of your sofa – no more needing to queue up at the bank to tell them you’re going travelling!

Accommodation Bookings – Revolut Stays allows you to book accommodation through the Revolut app and get 3-10% cashback!

You must be 18 and over to open a Revolut account. Read the full T&Cs .

- Free foreign withdrawals

- Deluxe accounts available for an additional fee

- Uses the interbank exchange rate

- Free withdrawals are limited to a certain amount of money each month

- Exchange rate changes at the weekend

- Fee-free foreign spending is limited

Starling Bank

- Fee-free foreign withdrawals and transactions

- Uses the Mastercard exchange rate

- Account set-up is quick and easy

Withdrawals – Starling allow you to withdraw up to £300GBP or make six withdrawals per day . There are no foreign withdrawal fees and Starling uses the Mastercard exchange rate with no markup. There are also no fees for using your card to pay directly when in Europe!

Ethical Banking – Starling seem determined to do things differently. They have clear ethical and environmental goals laid out on their website . While your typical high street bank is investing your money in firearms, tobacco, alcohol and fossil fuels, Starling opt for ethical investing!

Works Across Europe – Starling Bank provide a Mastercard with their accounts. This works almost everywhere in Europe!

Helps You Budget – Thanks to spending notifications, spending categories, saving spaces and goals, Starling helps you accurately budget before and during your trip. You can create a virtual debit card for each saving space, allowing you to closely monitor your spending while you travel in Europe!

- No fees on foreign spending or withdrawals

- Easily replaces your traditional bank

- Full control from your phone

- Only available to those with a UK address

- No fee for foreign transactions

- Multi-currency account – hold up to 50 currencies at once

- Some free foreign withdrawals – the exact amount depends on where you live and where the account is registered

Perfect for Digital Nomads – If your work involves clients in multiple countries, Wise has you covered. A Wise account allows you to be paid in and store multiple currencies.

Visa or Mastercard – Wise provide either a Visa or Mastercard depending on where you live and where your account is registered. However, not all Wise customers are eligible for a debit card with their account, this also depends where you live. See the full list of card-eligible countries here .

Fees for Withdrawing Cash – Wise offer some free cash withdrawals each month. The exact amount you can withdraw before incurring fees depends on where you live and where the account the registered.

Fees for Foreign Transactions – Wise allow you to spend money on your card fee-free but only if you have the correct currencies stored in your account. If not, they charge a small conversion fee for each transaction.

- Available to residents of almost every country

- Can store and spend multiple currencies with one account

- Low international transfer fees

- Not all accounts come with a debit card (it depends on where you live)

- The card doesn’t work in every country

- No foreign transaction fees

- Uses Visa’s live exchange rate

- Works in all European countries

Fees – Although you can access a network of over 60,000 ATMs fee-free in the USA, you’ll need to pay a $2.50USD fee to withdraw money abroad with your Chime debit card. However, there are no international transaction fees with Chime, so you can pay for things on your card without having to stump up for an additional fee.

Exchange Rate – When spending abroad with your Chime debit card, you’ll get the live Visa exchange rate. While fractionally worse than the Mastercard exchange rate, it’s still much better than using a money changer or letting traditional banks dictate the exchange rate. Remember to always pay in the local currency if you see the option on an ATM or card terminal!

App and Website – Both Chime’s smartphone app and website give you an excellent level of control of your account. Make sure you enable international spending either through the app or website, so you can use the card abroad! Failure to do so will prevent the card from working and could see Chime block the card due to suspicious activity!

Withdrawal Limit – Chime offer a generous $500USD daily withdrawal limit. If you’re withdrawing money abroad, you should withdraw the maximum possible to reduce the frequency you’ll be paying the $2.50USD foreign withdrawal fee!

- No rolling monthly fee

- High daily withdrawal limits

- Easy to control your account through the app or website

- Only available to customers in the USA

- No contactless card payments possible (does work with Apple and Google Pay though)

- Not all online payments are supported by Chime

- Connects with your traditional bank account

- Use the Currensea card as you would a normal debit card

- Removes foreign transaction fees usually levied from your bank

Easy to Use – While getting another travel card or opening a new bank account can feel like a hassle, Currensea making spending money in Europe easy! Thanks to open banking laws, a Currensea direct debit travel card hooks straight into your bank account, allowing you to spend money with reduced fees while abroad. Simply use the card as you would your normal debit card and Currensea handle the rest!

Different Plans – Currensea offer three different plans. The free plan offers everything you need for a shorter trip but if you travel a lot, getting either the Premium or Elite plan gives you access to better exchange rates, larger fee-free withdrawals and a range of other perks such as hire car discounts, hotel bonuses and even airport lounge access with the Elite card!

Mastercard – The Currensea direct debit travel card is powered by Mastercard. This means you can use it anywhere that accepts Mastercard (almost everywhere in Europe)!

- No need to set up a new account

- Up to £500GBP fee-free withdrawal each month

- Different plans available depending on your needs

- Small fees for foreign withdrawals after the £500GBP limit is reached

- 0.5% foreign transaction fee with the free account (no transaction fee with paid accounts)

- Still leaves you reliant on your major high street bank

Prepaid Euro Cards

While not necessary in the age of digital banks and FinTech companies, prepaid euro cards are still relatively popular – more popular than they deserve to be, honestly.

Prepaid travel cards tend to have lower fees than your traditional high street bank but the costs are higher than opting for a digital bank or even a direct debit travel card. Some prepaid cards also have nasty hidden fees, such as a fee for loading money onto the card, or a fee for getting any leftover money back after your trip.

We don’t like to recommend prepaid travel cards because they serve little purpose in today’s digital world but in case you’ve already made up your mind, these are the most popular options among travellers to Europe!

- Travelex – Best for Travellers from the USA

- Monese – Top Choice for Travellers from the UK

- Fair FX – Top Choice for Travellers from the EU

- PayPal Prepaid Mastercard – Another Good Option for Travellers from The USA

Travel Money Cards for Europe – Your Questions Answered!

Which cards are accepted in europe.

Mastercard and Visa cards are widely accepted throughout Europe and the rest of the world. You may have a hard time using an American Express card in Europe, although they’re more common than they used to be. Discover cards are less accepted than American Express. If you only have a Discover or American Express card, we recommend supplementing your wallet with a Mastercard or Visa as well!

What is a Travel Card?

Travel cards allow you to access your money, either via card transactions or an ATM, abroad, without incurring high fees from your traditional bank. They come in different forms:

– Travel Credit Cards – Usually just regular credit cards with low or no foreign use fees and often include travel-based incentives like air miles or discounts on hotel stays. – Travel Debit Cards – Can be used like a normal debit card. Often travel debit cards are supplied by a travel-friendly bank but you can also get prepaid travel debit cards that you top up from your traditional bank. You can also get direct debit travel cards which connect to your traditional bank and allow you to bypass your bank’s fees.

Travel Cards for Europe – A Round-Up

Getting the right travel card for Europe won’t make or break your trip but it can mean the difference of a few hundred dollars, even over a couple of weeks of travelling! For a longer adventure, the savings you’ll make will allow you to upgrade your accommodation choices or treat yourself to good restaurants while you travel!

It really is a no-brainer! Grab your travel card, book your flight and head to Europe for a backpacking trip to remember! Have we missed your favourite travel card from our list? Let us know in the comments below!

Tim Ashdown | Writer and Gear Specialist

After a life-changing motorcycle accident, Tim decided life was too short to stay cooped up in his home county of Norfolk, UK. Since then, he has travelled Southeast Asia, walked the Camino de Santiago and backpacked South America. His first book, From Paralysis to Santiago, chronicles his struggle to recover from the motorcycle accident and will be released later this year.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 5 Best Travel Cards for Europe 2024

Europe is one of the top destinations for Australians heading on holiday - with year round attractions depending on whether you’re looking for a beach break, ski trip, or simply some time to eat, drink and soak up the culture. No matter what you’re off to Europe for, you’ll need to pay for things while you’re there. This guide walks through our picks of 5 of the best travel cards available for Australians heading to Europe, with a look at their features, benefits and drawbacks.

5 best travel cards to use in Europe

- Wise - debit card

- Revolut - debit card

- Travelex - prepaid card

- 28 Degrees Platinum - credit card

- Bankwest Zero Platinum Mastercard - credit card

Wise is our pick for travel debit card for Europe

With this card:

- Convert Aussie dollars to Euros at the mid-market exchange rate

- It's very easy to set up and order

- You can receive foreign currency into a multi-currency account linked to the card

- You can transfer money to a bank account overseas

It's not all good news though

- There is a 1.75% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

Click here to see the full list of cards and how Wise compares

Read the full review

What are different types of travel cards?

It can be tricky working out which is the best travel card to use in Europe.

The fact is, the best one for you will really depend on what you need from the card you're using. We've listed what we think are three of the best travel money cards you can use while you're in Europe.

They can be either prepaid, debit or credit cards designed specially for overseas use. You can use travel cards to make purchases online, in stores and to withdraw money at ATMs. There are 3 popular types:

Travel Debit Cards

Prepaid travel cards, travel credit cards.

Let's have a look at each one.

Debit Cards offer the convenience of a credit card, but work differently. They draw money directly from your bank account when you make a purchase. It's designed for everyday money transactions and means that you're not accumulating debt.

If you have spending issues, it's a better option to use your debit card whenever possible. This is because it will prevent you from falling into credit card debt. And for daily purchases, we think a debit card can help you stick to your travel budget, because you can't overdraw money from your account.

Generally, we recommend having the combination of a travel debit and travel credit card for safety, flexibility and convenience on your trip.

Wise - travel debit card for Europe

The Wise card offers a flexible way to pay and make withdrawals with most European currencies covered for holding and exchange. You’ll be able to order your card for a low one time fee, with no ongoing costs to worry about.

Whether you’re spending in euros, British pounds, or any of the other 40+ currencies supported, you’ll get the mid-market exchange rate when you switch from AUD, with low fees from 0.43%. Exchange your AUD to the currency or currencies you need in advance, or just let the card handle the conversion at the point of payment for extra convenience.

- No annual fee, hidden transaction fees, exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR) and New Zealand (NZD)

- It takes 7-14 business days to receive the card

- Can't always access local technical support depending on where you are

- Free cash withdrawals limited to under $350 every 30 days

- Only currently available in the US, UK, Europe, Australia and New Zealand

Revolut - prepaid travel card for Europe

The Revolut prepaid travel card lets you pick the account and card type that suits your personal needs and preferences. Go for a Standard plan with no monthly fee to pay, or upgrade to one of the higher tier account options with ongoing costs, which unlock extra features and benefits. Whichever card you pick you can spend in 150+ countries and get some no fee ATM withdrawals and currency conversion which uses the mid-market rate. Fair usage fees apply once you’ve used your account plan no-fee limit for a particular transaction type.

Click here to see the full list of cards and how Revolut compares

- Very easy to use app

- Free to set up

- No hidden fees or exchange rate mark-ups (except on weekends)

- You can use it to transfer money to a bank account overseas

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

- Ongoing subscription fee for Premium and Metal cards

For prepaid cards, you're able to load the card with a set amount of money in the currencies you need. Ideally you do this before your trip, but often you can reload them as well.

Most prepaid travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

Depending on where you're visiting, there might be better local alternatives available. Check out our lists of the best prepaid cards available in the USA and UK .

With prepaid travel cards you need to be careful. They can have numerous fees and charges, which can make it more expensive than other options. But if you're organised and travelling to multiple cities a prepaid travel card is a good option.

Travelex - prepaid travel card for Europe

The Travelex travel money card can be a convenient pick if you’re in a hurry as you can walk into a Travelex store and get one in just a few minutes. Just take along a suitable ID document, to get your card and account before you travel. You’ll be able to hold and exchange 10 major currencies, which covers euros and pounds. Bear in mind that exchange rates may include a markup - and other European currencies aren’t supported for holding or exchange so while you’ll be able to spend in a selection of other currencies, you won’t be able to buy them in advance to lock in a rate and set your travel budget.

Click here to see the full list of cards and how Travelex compares

- Supports 10 major global currencies for holding and exchange

- Get your card online or in person for extra convenience

- No Travelex fee to spend or make an ATM withdrawal

- Some fee free ways to top up your card balance are available

- Exchange rates are likely to include a markup on the mid-market rate

- Fees may apply when you buy or top up your card

- Relatively low number of supported currencies

- Account closure and inactivity fees may apply

Credit cards have obviously been around for a long time. But now there are specialised travel credit cards. Generally, these cards give you longer to pay back what you've spent but the interest rates after this time can be quite high.

The main advantage with credit cards are the reward points you get in return for your customer loyalty when you spend. But it only works if you pay off the balance in full each month.

Credit cards are great to use for car hire, restaurants and accommodation - larger expenses that are easier for you to pay back over time. Some services only take credit cards to hold purchases so they can definitely be handy while you're travelling.

28 Degrees - travel credit card for Europe

- There are no annual fees

- No overseas purchase fee or currency conversion fee

- You get 55 days interest free on purchases

- Access to free 24/7 concierge service

- Emergency card replacement worldwide

The 28 Degrees Platinum Mastercard has additional benefits including shoppers and repayments benefits cover.

- Can have 9 additional cardholders

- No overseas purchase fee, or currency conversion fee

- No foreign transaction fee

- Free Replacement Card

- High interest rates after the initial 55 days

- Minimum credit limit is $6,000

- No introductory offers or rewards

Bankwest Zero Platinum Mastercard - travel credit card for Europe

The Bankwest Zero Platinum Mastercard has no annual fee to pay, and no foreign transaction fee either. That can make it a good option if you’d prefer to spend using a credit card and then pay off your travel bills later. There’s even a buy now, pay later which may let you split the costs of some eligible purchases into 4 payments with no extra interest to pay. Bear in mind that some fees and costs do apply to this card, particularly if you want to make ATM withdrawals, or if you’d prefer not to pay your bill off in full every month.

- No annual fee to pay

- No Bankwest foreign transaction fee

- Some complimentary travel insurance available for card holders

- Can be used as a payment guarantee, such as when renting a car or checking into a hotel

- Interest applies if you don’t pay your bill in full every period

- Cash advance fee of 3%, and a higher rate of interest compared to card spending

- 6,000 AUD minimum credit limit

- Subject to eligibility requirements and credit checks

FAQ - 5 best travel cards for Europe

Which card is better to use in Europe?

The best card for Europe will depend on exactly where you’re heading and how you like to manage your money. Using a travel debit card or travel prepaid card like Wise travel card or Revolut can be a handy way to hold, exchange, spend and manage your money across a selection of major European currencies, offering flexibility and low costs.

What's the best prepaid card to use in Europe?

There’s no single best prepaid card for Europe, but picking one which covers all the currencies you’ll need is essential. Bear in mind that there are many other European currencies aside from pounds and euros - choose a card which has a broad range of supported currencies for convenience. Wise supports 40+ currencies, while Revolut has 25+ currencies, making either of these a good place to start your research.

Can I use my Australian debit card in Europe?

You can use your Australian debit card in Europe anywhere the network - often Visa or Mastercard - is supported. Bear in mind that you may need to tell your bank you’re planning to travel, to avoid your card being frozen for security reasons. Double check if your debit card has a foreign transaction fee to pay - if it does, using a specialist travel card can mean you pay less overall when you spend in foreign currencies.

What is the best way to pay when travelling in Europe?

Having a selection of ways to pay whenever you travel is a good idea. You may choose to carry some local cash, some AUD for exchange, your Australian debit card and a specialist travel credit or debit card, for example. This should mean you’re covered - even if you find a merchant which can’t accept your preferred payment method.

Which debit card has no fees in Europe?

A travel card from a provider like Wise, Revolut or Travelex lets you hold a foreign currency balance and spend it with no extra fee. Each card has its own features and fees so you’ll need to compare a few to decide which is best for your specific needs.

Is Visa or Mastercard better for Europe?

Both Visa and Mastercard are very widely accepted in Europe. Look out for the symbol displayed on ATMs or at payment terminals in stores.

Need to know more about travelling to Europe?

Passports, Visas and Vaccinations

How Much Things Cost in Europe

Currency in Europe

Banks, ATMs & Currency Exchange

The Best Cards to Use in Europe

7 Common Travel Money Traps to Avoid in Europe

12 Best Prepaid and E-Sim Cards for Europe in 2024

Planning your trip to Europe and wondering what is the best way to stay connected? Don't get stuck with high roaming costs or slow overseas data roaming packages! Get yourself a sim card for traveling in Europe. This is a guide for finding the best European sim card for your trip.

Whether you need a physical prepaid sim card or an e-sim cards for Europe in this guide you will find them both. Find out where to order one, up to date prices as per May 2024 and everything else you need to know before ordering a sim card for traveling to Europe in 2024

For my research finding the best sim card for Europe I traveled to every European country and documented all my travel tips. That is why on Traveltomtom you can find complete guides for finding the best prepaid and e-sim card for Spain , Italy , Switzerland , Greece , Ireland , Portugal , Germany , Poland , France , Sweden , UK , Hungary , Croatia , Austria , Finland , Norway , Netherlands , Belgium , Bulgaria and all others.

In the above guides you can find a comparison between local prepaid sim cards you buy on arrival and sim cards for Europe you buy on the internet.

My recommendation for 2024

Buying a local prepaid sim card is the cheapest way to stay connected when traveling to Europe in 2024. In the links above you will find specific guides for buying a local prepaid sim card per country or airport, which means on arrival in Europe.

But wouldn't it be easy to be online and have data on your phone as soon as the plane lands?

Arrive prepared for your trip to Europe and by ordering a sim card online before your trip. Ordering a sim card for Europe on the internet is super easy and there are amazing tourist sim card deals available.

Here are Traveltomtom's top picks for 2024:

1. Holiday Europe - 50 GB - $59.90 USD

- valid for 28 days

- unlimited calling & texting

- valid in 39 countries - all of Europe

- only $1.2 USD per Gigabyte

Click here for more info or to order a Orange e-sim card for traveling to Europe via SimOptions .

Traveltomtom rates the Orange Holiday Europe eSIM as the best Europe sim card in 2024. For $59.90 USD you get 50 GB data which is just $1.2 USD per Gigabyte and best thing is that this e-sim card is 5G ready, where most of the physical prepaid and e-sim cards for Europe only support 4G/LTE.

2. Bouygues Telecom - 30 GB - $44.90 USD

- valid for 30 days

- $1.5 USD per Gigabyte

Click here for more info or to order a Bouygues Telecom e-sim card for traveling to Europe via SimOptions .

Traveltomtom ranks the Bouygues Telecom e-sim cards as the second best sim card for traveling to Europe in 2024. You get 30 GB data for 30 days for $44.90 USD including unlimited calling and texting. This comes down to $1.5 USD per Gigabyte.

Physical prepaid sim card

If your phone is not e-sim compatible then Traveltomtom recommends an Orange Holiday Europe . This is the best physical prepaid sim card for visiting Europe in 2024.

You get 30 GB data for 15 days including unlimited calling and texting plus 120 minutes to anywhere in the world for $49.90 USD. That is $1.67 USD per Gigabyte. SimOptions is the only sim card provider where you can order a physical prepaid sim card for Europe.

Don't waste your precious holiday time in Europe standing in line at the airport or waste an hour waiting for your turn in a local sim card store. No more language barriers. Order a sim card for Europe online before your trip! How?

This is your ultimate guide, read everything you need to know below and get connected instantly.

Traveltomtom's favorite e-sim providers are Airalo and SimOptions . Why? Traveltomtom has personally used Airalo and SimOptions sim cards for more than 5 years and never faced an issue.

All the sim cards listed in this article are European sim cards with data that you can order online before your trip. The international physical prepaid sim cards will be delivered to your home address before your trip and are activated automatically from its first use. E-sim cards for Europe obviously are delivered via email.

Traveltomtom also recommends world sim cards with global coverage. Check out my article with a comparison of the best international sim cards for travelling in 2024 if you for example continue your trip to Europe to Turkey, Asia or the Middle East.

Sim cards for Europe with unlimited data

Traveltomtom does not recommend sim cards for Europe with unlimited data. With most of these sim cards you will end up frustrated! Always double check at what speed you get unlimited data, because in reality 'unlimited' is mostly not 'unlimited'.

There is pretty much always a FUP (Fair Use Policy) on these Europe sim cards with unlimited data.

For example Holafly sells e-sim cards with unlimited data for Europe, but in the small letters you will find this: the eSIM includes unlimited data for the contracted time. However, please note that the carrier may reserve the right to apply a Fair Usage Policy.

This literally means that if the operator thinks you are using too much data on a day, they reduce your data speed. Holafly does not specify what the FUP is. From my own experience I can tell you that this already applies sometimes after using 2 GB data per day.

When this happens your data speed is reduced to something like 512 Kbps which means you can barely send a photo through WhatsApp and your social media apps won't work for a full 24 hours.

To avoid all this hassle, Traveltomtom does not recommend sim cards for Europe with unlimited data, unless the Fair Use Policy is clearly mentioned and it is above 100 GB data per month or something similar.

To make it all easy for travelers coming to Europe, just buy your sim card online before your trip! Here are the 12 best European prepaid sim cards and e-sim cards for Europe. The best ones are ranked first...

1. Orange Holiday Europe eSIM - 50 GB

This is the latest addition to the family of the Orange sim cards for traveling in Europe. It is the bigger brother of the Orange Holiday Europe sim card. At the moment this sim card is only available as an e-sim card and not as physical prepaid sim card.

This Orange Holiday Europe 50 GB eSIM is the only proper 5G ready sim card for Europe. The rate of only $1.2 USD per Gigabyte makes this the best-buy e-sim card for Europe in 2024.

Price: $59.90 USD

- 50 GB data in all of the EU including Switzerland, UK, Iceland and Norway

- Unlimited calling & texting in Europe

- 120 minutes to any country in the world

- 1000 sms to any country in the world

- Valid 28 days

- Automatically activated from the first time it connects to a supported network in Europe

- Top up available

- ID verification/registration is NOT required

- Sim card comes with a phone number from France starting with +33

Click here to order the Orange Holiday Europe e-sim card for 28 days .

2. Bouygues Telecom My European eSIM - 30 GB

The Bouygues Telecom prepaid sim card for tourists is rated as one the best sim card for traveling to Europe in 2024 by Traveltomtom. Unfortunately the Bouygues Telecom tourist sim card is ONLY available as an e-sim card and not as a physical prepaid sim card, so make sure your phone is e-sim compatible.

Price: $44.90 USD

- 30 GB data in all of the EU countries including UK, Norway, Iceland

- Switzerland is NOT included

- Valid for 30 days

- Top up is possible

- E-sim card comes with a phone number from France starting with +33

- Can receive sms and calls

- You have to activate the e-sim card within 1 year after purchase

- Automatically activates from the first time it connects to a supported network in Europe

Click here to directly order a Bouygues Telecom e-sim card for Europe .

This Bouygues Telecom e-sim card package is called My European eSIM and with $1.5 USD per 1 Gigabyte data is among the best value sim cards for Europe. On top of that this e-sim card is valid for 30 days and therefore it is mentioned second in my list of the best sim cards for Europe in 2024.

3. Orange Holiday Europe - 30 GB (physical and e-sim)

One of the best physical prepaid sim cards for traveling in Europe is the Orange Holiday Europe sim card for tourists, especially if you are looking for a Europe sim card including international minutes. It is available as physical prepaid sim card as well as e-sim card and you can order it directly online.

Price: $49.90 USD

- 30 GB data in all of the EU including Switzerland, UK, Iceland and Norway

- Valid 14 days

- $1.67 USD per Gigabyte

Click here to order this Orange Holiday Europe sim card for Europe as a physical prepaid sim card

You can also order this sim for Europe as an e-sim via SimOptions for the same price.

Great advantage of this Orange tourist sim card for Europe is that it has international calling minutes included. The downside about the Orange Holiday Europe prepaid sim card is that it is valid for only 14 days.

If your trip to Europe is longer than 14 days I recommend you getting a different prepaid or e-sim card for Europe so you don't have to worry about topping up during your holiday.

4. Jetpac (e-sim)

Jetpac is a fairly new e-sim provider and is trying to conquer the market with some incredible e-sim card plans for traveling to Europe.

The Jetpac e-sims work in 28 countries in Europe: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Portugal, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Vatican City.

Pretty much in all popular tourist destinations in Europe, however not in: Poland, Ukraine, Slovakia, Romania, Albania, Cyprus, Serbia, Montenegro, North Macedonia, Bosnia and Herzegovina.

If you are visiting the Balkan on your trip to Europe then Jetpac is not the perfect e-sim for your trip.

Prices and rates Jetpac Europe

Jetpac Global is at the moment the cheapest e-sim card for Europe as they have an offer for just $1 USD. Here are all the e-sim card plans from Jetpac for 2024:

- 1 GB data for 30 days = $1 USD

- 3 GB data for 30 days = $8.5 USD

- 5 GB data for 30 days = $14 USD

- 10 GB data for 30 days = $18 USD

- 15 GB data for 30 days = $28 USD

- 20 GB data for 30 days = $34 USD

- 25 GB data for 30 days = $38 USD

- 30 GB data for 30 days = $40 USD

- 40 GB data for 30 days = $60 USD

Click here to order a Jetpac e-sim card for Europe .

The rate of the best Jetpac e-sim is 30 GB data for $40 USD which comes down to $1.33 USD per Gigabyte.

The Jetpac Global e-sim card plans are valid for 30 days and the validity starts automatically when it connects for the first time to a network in a country where you can use Jetpac and the data pack is valid 1 year from date of purchase.

Jetpac Global is only available as an e-sim card and not as a physical prepaid sim card. The Jetpac Global e-sim cards are data-only and incoming and outgoing calls are not supported.

An extra advantage of Jetpac Global e-sim cards is that they provide free lounge access if your flight is delayed. However, you will have to register your flight before you travel and in case of a delayed or canceled flight a LoungeKey voucher will automatically be provided. This is a complimentary service that no other e-sim cards offer.

For more info check out the Jetpack website .

5. Eurolink eSIM from Airalo

Airalo is a trusted e-sim card provider and offers e-sim cards for pretty much every country in the world. Their Europe e-sim card plans are more expensive than other e-sim cards for Europe.

The Airalo e-sim cards for Europe are partially 5G ready, meaning in some countries you are able to use 5G in some countries you will have to it with 4G/LTE. It is a 50/50 I would say.

5G is available in: Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, France, Greece, Iceland, Ireland, Italy, Latvia, Luxembourg, Malta, Poland, Romania, Spain, Sweden, Switzerland, UK. All other countries there is only 4G/LTE network available.

Eurolink e-sim cards also have plans for 3 months and even for 6 months, which could be a very interesting e-sim for travelers visiting Europe for more than 1 month.

- 1 GB data for 7 days = $5 USD

- 3 GB data for 30 days = $13 USD

- 5 GB data for 30 days = $20 USD

- 10 GB data for 30 days = $37 USD

- 50 GB data for 90 days = $100 USD

- 100 GB data for 180 days = $185 USD

Click here for more info or to order a Eurolink e-sim card for Europe via Airalo .

Eurolink e-sim cards are valid in all of Europe including Iceland, Norway, UK, Switzerland, Ukraine and even in Turkey!

Traveltomtom uses Airalo e-sim cards a lot, but their rates per Gigabyte for Europe are more expensive than the other sim cards mentioned above.

Traveltomtom sometimes uses an Airalo e-sim card for Europe when I continue my Europe trip to Istanbul. Airalo is the best e-sim card for traveling to Europe and Turkey on one trip.

Especially for people looking for e-sim cards for Europe that are valid for 3 or 6 months Airalo is one of the best e-sim cards for Europe.

6. Bouygues Telecom Travel Basic - 15 GB (e-sim)

This is another e-sim card only plan from Bouygues Telecom, basically a cheaper plan. This European sim card is for those travelers who stay less than 15 days and only need about 1 GB per day.

Price: $21.90 USD

- 15 GB data in all of the EU countries including UK, Norway, Iceland

- Valid for 15 days

This Bouygues Telecom sim card is not available as a physical prepaid sim card, only as an e-sim card.

7. Three (3) Data Pack - 10 GB (physical sim)

This Three UK sim card is only available as a physical prepaid sim card and NOT as an e-sim. It will be delivered to your home address and it is plug and play on arrival in Europe.

Price: $24.90 USD

- 10 GB data in all of Europe including Switzerland, UK, Norway, Iceland and up to 30 countries outside of Europe

- Unlimited calls/sms in all of Europe

- Valid 30 days from inserting in phone

- No top up possible

- Sim card comes with a phone number from UK starting with +44

Click here to directly order a Three Data Pack physical sim card for traveling to Europe .

Big plus is that this Europe sim card is 5G ready and includes unlimited calls/sms in Europe and up to 30 other countries around the world like USA, Brazil, Australia, Indonesia, Israel, Singapore, Vietnam, Costa Rica, Colombia and many more.

8. Nomad eSIM for Europe

Nomad has some of the cheapest e-sim cards for traveling in Europe with some amazing value plans. They go as low as $1.3 USD per GB data. The Nomad e-sim cards are from eSIM Go and they support 5G in some countries, not yet everywhere.

- 1 GB data for 7 days = $7 USD

- 3 GB data for 15 days = $13 USD

- 5 GB data for 30 days = $12 USD

- 20 GB data for 30 days = $26 USD

Click here to order a Nomad e-sim card for traveling in Europe .

The Nomad e-sim cards are data-only sim cards for Europe and do not come with a phone number. Incoming and outgoing calls are not supported.

9. O2 Go Card Prepaid sim card - 10 GB (physical and e-sim)

This O2 sim card plan from Czech Republic is available as a physical prepaid sim card as well as an e-sim card. When you order this physical sim card it will be delivered to your home address before your trip to Europe.

- 10 GB data in all of Europe (Switzerland NOT included)

- $2 credit for calls in Europe (top up online available only for EU citizens. For non-EU citizens only within Czech Republic)

- $2 credit for sms in Europe

- Receiving unlimited calls in all of the covered countries in Europe

- Valid for 30 days from its installation, even if not in Europe yet

- It comes with a Czech number starting with +420

Click here to order an O2 Go Card as a physical prepaid sim card and here as an e-sim card .

10. Orange Holiday Zen sim card for Europe - 12 GB

Price: $29.90 USD

- 12 GB data in all of Europe including Switzerland, UK, Iceland and Norway

- Valid for 14 days from the first time it connects to a supported network in Europe

The smaller brother of the Orange Holiday Europe sim card is called the Orange Holiday Zen. Unlimited calls/texting in Europe and 12 GB, so much smaller data plan, but also cheaper.

Click here to order this Orange Holiday Zen sim card for Europe as a physical prepaid sim card and click here to order the Orange Holiday Zen as an e-sim card .

11. Holafly

Holafly sells e-sim cards for Europe with unlimited data. Traveltomtom is not a fan of e-sim cards with 'unlimited' data and I explained to you why in the beginning of this article.

- 1 day 'unlimited' data = $6 USD

- 2 days 'unlimited' data = $10 USD

- 3 days 'unlimited' data = $13 USD

- 4 days 'unlimited' data = $16 USD

- 5 days 'unlimited' data = $21 USD

- 6 days 'unlimited' data = $25 USD

- 7 days 'unlimited' data = $29 USD

- 8 days 'unlimited' data = $31 USD

- 9 days 'unlimited' data = $35 USD

- 10 days 'unlimited' data = $37 USD

- 11 days 'unlimited' data = $40 USD

- 14 days 'unlimited' data = $48 USD

- 20 days 'unlimited' data = $64 USD

- 30 days 'unlimited' data = $75 USD

The Holafly e-sim cards for Europe are data-only and incoming and outgoing calls/sms are NOT supported. These e-sims do also not come with a phone number. The Holafly e-sims operate on the 4G/LTE network and are not 5G ready.

You can use a hotspot on Holafly Europe e-sim cards of up to 500 MB per day.

The Holafly Europe e-sims are valid in the following 32 countries: Austria, Belgium, Bulgaria, Cyprus, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Iceland, Italy, Latvia, Lithuania, Luxembourg, Malta, Norway, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, United Kingdom, Czech Republic, Romania, Sweden, Switzerland, and Ukraine.

Why 'unlimited'? Because there is a Fair Use Policy and Traveltomtom has had bad experiences with this in the past. Suddenly your data speed is slowed down for 24 hours because you apparently used too much data.

If I hate something then it is slow data speed. Therefore Traveltomtom's is not a fan of e-sim cards with 'unlimited' data and I do not want reduced data speed because I apparently hit the FUP (which is not defined).

Therefore the Holafly e-sim cards for Europe are not ranked that high in this list of the best sim cards for traveling to Europe in 2024.

Of course you can also order sim cards for traveling to Europe on Amazon. When searching for 'Sim Card for Europe' on Amazon you will get a long list of available physical prepaid sim cards. There are no e-sim cards available on Amazon.

Here are some examples:

- Orange: 16 GB data (not in UK, Switzerland) + 800 minutes for 28 day = $28 USD + tax

- Three: 10 GB data + unlimited calls/sms for 30 days = $19 USD + tax

- Sim2Roam: 3 GB data for 30 days = $16 USD + tax

- Vodafone: 12 GB data for 14 days = $17 USD + tax

Listed as a last option because it is a jungle finding the best sim card for Europe on Amazon. Plus delivery fees and taxes making it sometimes really expensive.

Free EU data roaming on European sim cards

The European Union came in 2017 finally with the genius idea to let go of roaming charges within the EU countries. Therefore in 2017 people can use their sim card from Spain in Italy and their Germany sim card in Sweden without any extra charges. For people looking for a sim card for Europe travel this was the best news ever of course.

Therefore upon arrival in Europe you can potentially buy a local prepaid sim card for tourists and be connected to the internet in all other countries you visit in Europe. However, there are a lot of exceptions, so keep reading…

The biggest exceptions are: UK, Switzerland and Norway. As you might know these are countries in Europe, but they are NOT part of the European Union, which means roaming costs can apply for these countries.

Brexit threw the UK out of the European Union and one of the major problems is the free EU roaming on UK prepaid sim cards. Most of the prepaid and e-sim cards you buy in the UK do not include free EU roaming anymore. For more info see my guide for buying a sim card in the UK in 2024 .

Why buying a sim card for Europe

A very simple question? Do you want to rely on others when traveling to Europe? Yes, your hotel, bar, restaurant, train and even park have free public WiFi these days. So getting WiFi when traveling is fairly easy. Yet, Traveltomtom still recommend you getting a sim card for Europe.

you may also like...

First of all public WiFi can not be trusted in speed, signal and security. What if the signal in your hotel room is weak and you can't change rooms? Or it is too slow to even upload an Instagram story. Getting connected with your phone makes traveling so much easier, just like real life!

Also another reminder that surfing the internet on public WiFi is through an UNSECURED network. The use of a VPN is recommended in these cases to protect your privacy.

Think about ordering a cab on the streets through a taxi app, or getting directions from Google Maps and finding a nearby restaurants with good reviews or finding out the train schedule to get back to your hotel. So many reasons Traveltomtom recommends getting a sim card for your trip to Europe.

Local prepaid sim cards vs. European sim cards

All sim cards mentioned in this article are sim cards with FREE EU roaming intended for those that visit a couple countries on a short trip. However, if you only travel to 1 or 2 countries in Europe you might be better off buying a local sim card on arrival. Local sim cards are mostly valid in 1 country only. Especially for a trip to Eastern Europe I would recommend buying a local sim card, rather than a European sim card.

For a complete overview of all sim card prices per country have a look at my guide for buying a local sim card in Europe in 2024 .

I love traveling in Europe off the beaten path , have a look at my 12 secret places to visit. I bet some of them you have never even heard of.

Getting connected is the first thing I do when I get to a new country. Depending on the length of my trip that means either buying a local prepaid sim card on arrival or ordering an e-sim card online. Must say that the last years on all my trips to Europe I bought an e-sim card since it is just much easier and less hassle.

Buying a local sim card on arrival in Europe

Sometimes the best European sim card deals you get on arrival in Europe. In France for example you get 150 GB data for €20 EUR ($22 USD) and data bundles in Italy are also very affordable. Most countries in Eastern Europe offer amazing local prepaid sim card deals with up to 75 GB data for just $6 USD but these local prepaid sim cards often do NOT offer free EU data roaming.

Therefore I recommend you to check my complete guide for buying a local sim card in Europe in 2024 , with a specific list of every country in Europe and what prices to expect on arrival before buying a sim card for Europe.

Traveltomtom also wrote sim card guides for all major airports in Europe: Zurich , London Heathrow , London Gatwick , Copenhagen , Amsterdam , Paris , Frankfurt , Dublin , Madrid , Manchester , Lisbon , Rome , Milan , Venice , Vienna , Oslo , Athens , Barcelona , Berlin , Budapest , Geneva , Bucharest , Tirana , Budapest , Prague , Brussels and many more.

I hope all the above tips for finding the best sim card for your trip to Europe in 2024 were helpful. If you still have questions please don’t hesitate to leave me a comment below.

Looking for off the beaten path destinations in Europe then click on the link and I bet most of those places you have never even heard of. Let me fuel you with some more wanderlust.

Because Traveltomtom would also like to visit every country in the world you can already find more than 200 sim card guides on Traveltomtom from all around the world: USA , Canada , Mexico , Colombia , South Africa , Asia , Turkey , Saudi Arabia , Hong Kong , Thailand , Singapore , Brazil , Philippines , Egypt , China , Australia , New Zealand and many more!

So next time you plan your adventure abroad come check out Traveltomtom for the latest prepaid sim card and e-sim card advice for your next holiday destination. Bookmark me!

If interested check out my Instagram profile @traveltomtom to see more of my journey to visit every country in the world . As of May 2024 I have traveled to more than 155 countries, but no rush to reach 197.

View this post on Instagram A post shared by Adventure Travel & Blogger (@traveltomtom)

Enjoy your trip to Europe!

Some links in this article about the best travel sim cards for Europe are affiliate links. If you buy any of the products after using an affiliate links I earn a small commission. Don’t worry this is at absolutely no extra cost to you!

- roadtrip europe

- eastern europe

- europe sim card

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Europe - 2024

If you’re travelling to Europe, a travel money card can make spending and withdrawing cash when you’re away cheaper and more convenient. Different types of travel money cards, including travel debit cards, prepaid travel cards and travel credit cards, are available to support different customer needs. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel debit card for Europe

Before we get into details about different travel money card options, let’s start with the Wise card as a good all-round option that allows you to hold and spend euros, as well as a diverse range of other European and world currencies.

Here are some of the advantages and disadvantages of using the Wise travel money debit card , to help you decide if it's suitable for you.

Hold and exchange 50+ currencies including EUR and a selection of other European and world currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

ATM fees apply once you exceed your plan limits

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Similar to your standard bank card, a travel money card is accepted for online and in-store transactions, as well as cash withdrawals - but the features and fees you’ll get are tailored for international usage. That can lead to benefits such as improved exchange rates and reduced fees compared to your regular card.

If you’re headed to Europe, you could find a travel money card which supports the currency or currencies in the destinations you’re visiting is a good idea. While much of Europe uses the euro, there are actually 29 different European currencies, so you’ll need to double check what’s needed wherever you’re headed.

6 travel money cards for Europe compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for Europe compare to each other.

The features of various travel money cards can differ significantly. Typically, travel debit cards are cost-effective and convenient, while travel credit cards offer advantages such as cashback or rewards, but may result in interest and late payment fees, depending on how you choose to pay.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. The choice between the two will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Generally, Canadian customers are able to select a travel money card from either a regular bank or a specialist provider, with card types available including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Travel debit cards from specialist providers have linked digital accounts you can use to hold and convert a currency balance. It’s common to find a good selection of major European currencies supported, including euros and British pounds. Some more flexible card options, like Wise, also support other European currencies like Norwegian or Danish kroner, Swedish kronor, Romanian lei and more. While different cards have their own features, travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, even when you’re away from home.

Travel debit card Option 1: Wise

Wise is our pick for travel debit card for Europe . There’s no fee to open a Wise account, and no delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

No fee to get your Wise card, free to spend any currency you hold

2 withdrawals, to 350 CAD value per month for free, then 1.5 CAD + 1.75%

Hold EUR and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive EUR, HUF, RON and 6 other currencies for free

Travel debit card Option 2: Canada Post Cash Passport

You can pick up a Canada Post Cash Passport in your local Post Office, and top up your account in CAD. You can then switch your balance to any of the 7 supported major currencies - or you can just allow the card to convert to the currency you need, although there is a foreign exchange fee of 3.25% for doing so. You can use your Canada Post Cash Passport card in ATMs and wherever the network is supported. ATM fees apply which vary by currency.

Supports 7 major currencies, including euros and pounds

No fee to spend currencies you hold in your account

Variable ATM fee, 1.9 EUR when in the the Eurozone for example

1.5% fee for using your card in Canada - plus any applicable fee to convert funds back to CAD if you hold a foreign currency

Pros and cons of using debit travel cards in Europe

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main Canadian bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for Europe?

The best travel debit card for Europe really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as EUR, like Wise. Other providers like Canada Post also support EUR and GBP for your trip to Europe, and the Cash Passport can be conveniently collected in your local Post Office.

Is there a spending limit with a travel debit card in Europe?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in the supported currency of your choice. Once you have a balance you can then pay merchants and make cash withdrawals at home and abroad. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - you may find you pay a foreign transaction fee when overseas, depending on the specific card you select.

Prepaid travel card option 1: BMO Reloadable Mastercard

The BMO Reloadable Mastercard can be topped up in CAD and used when you travel in Europe. You’ll pay a 2.5% foreign transaction fee when overseas, but you’ll still have the advantage that - as with other prepaid and travel cards - this card is not linked to your primary bank account, so it can increase security when spending abroad. There’s a 6.95 CAD annual fee, but as this is a purchase card rather than a credit card, there’s no interest to worry about. You just top up and you can spend up to your account balance freely.

6.95 CAD annual fee, 2.5% foreign transaction fee

5 CAD ATM fee

No interest to worry about

Manage your card online or using your phone, to top up and view balance

Add funds from BMO or other Canadian banks directly

Prepaid travel card option 2: Koho Premium Mastercard

You can get up to 2% cash back with the Koho Premium Mastercard, and there’s no foreign transaction fee to worry about. Instead, you pay a monthly card fee of 9 CAD. The basic card is free to get, or you can upgrade to a Koho metal card for 159 CAD if you want a fancier way to pay when you’re at home and abroad.

9 CAD/month premium fee

No foreign transaction fee

Earn cash back on your spending

Pros and cons of using prepaid travel cards in Europe

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Issued on globally popular networks for good coverage

ATM withdrawals supported globally

Some accounts have extras like options to earn cash back or reward points

Typically only CAD supported - watch out for foreign transaction charges

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Europe?

There’s no single best travel prepaid card for Europe - it’ll come down to your personal preference. If you don’t mind paying a monthly fee you might like the Koho Premium card which waives foreign transaction fees, and other charges like ATM withdrawal fees. Otherwise, if you just want a simple prepaid card and don’t mind the foreign transaction fee when you’re in Europe, the BMO prepaid card might suit you.

Is there a spending limit with a prepaid card in Europe?

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

3. Travel Credit Cards

Travel credit cards typically offer some extra international features compared to regular credit cards, such as low or no foreign transaction fees or extra option to earn rewards when you’re abroad. In general, travel credit cards are safe and convenient but can be more expensive compared to using a debit card option. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: HSBC World Elite Mastercard

The HSBC World Elite Mastercard has been optimised for overseas use, with extra rewards on international spending and travel, plus no foreign transaction fees to pay. There are lots of ways to earn rewards, including variable new customer bonus offers - the downside is that there’s an annual fee of 149 CAD, so you’ll need to check if the benefits outweigh the costs. As with any other credit card, you’ll also need to pay off your bill in full every month to avoid interest charges.

149 CAD annual fee, 5 CAD ATM withdrawal fee

Variable interest rate

Options to earn rewards, including enhanced benefits for travel spending

Travel credit card option 2: Home Trust Preferred Visa Card