- Skip to main content

- Accessibility help

Information

We use cookies to collect anonymous data to help us improve your site browsing experience.

Click 'Accept all cookies' to agree to all cookies that collect anonymous data. To only allow the cookies that make the site work, click 'Use essential cookies only.' Visit 'Set cookie preferences' to control specific cookies.

Your cookie preferences have been saved. You can change your cookie settings at any time.

Tourism statistics

Information on where to find up-to-date information on tourism statistics in Scotland.

Tourism statistics can be found via the following sources:

Office for National Statistics (ONS)

Leisure and tourism Visits and visitors to the UK, the reasons for visiting and the amount of money they spent here. Also UK residents travelling abroad, their reasons for travel and the amount of money they spent. The statistics on UK residents travelling abroad are an informal indicator of living standards.

VisitScotland

Visitors from the UK Our UK market represents a significant proportion of the visitors Scotland welcomes each year. Understanding more about who they are, how they behave and the preferences they have for their visits can offer a real advantage to those in the tourism industry.

International visitors Scotland’s tourism economy enjoys a healthy international market that includes a variety of well-established and emerging demographics. Those who flock from around the globe to enjoy Scotland’s world-class attractions and experiences make a huge contribution to the overall health of our industry – so it’s vital we have a clear understanding of them.

Accommodation The stats behind the stays - whether you’re looking for occupancy information on self-catering properties or caravans.

Industry barometer In partnership with local councils and destination organisations, VisitScotland have been inviting businesses to participate in our survey to capture tourism business performance in their regions.

VisitBritain

Inbound tourism performance in Britain A wealth of data, covering inbound tourism trends , visits to nations, regions, counties and towns in Britain, as well as popular activities undertaken by visitors in Britain.

Scottish Household Survey

Culture and heritage section

There is a problem

Thanks for your feedback

Your feedback helps us to improve this website. Do not give any personal information because we cannot reply to you directly.

Beta This is a new service. Your feedback will help us to improve it.

The impact of COVID-19 on data and statistics

How the COVID-19 pandemic has impacted research and data collection, and in consequence, the data for tourism.

Due to the restrictions caused by the COVID-19 pandemic, the availability of data from research and the ongoing statistical surveys has been severely impacted.

Status of the national tourism statistics

International passenger survey (ips).

The International Passenger Survey is conducted by the Office for National Statistics. The survey was suspended during the initial period of the pandemic, due to factors including extremely limited international visitors and the safety of interviewers undertaking the surveys.

Results from the IPS for 2021 and 2022, and quarterly data for 2023, are now available from the Office for National Statistics website here (This link takes you to an external website). Analyses of Scotland data can be found on the Observatory and there are highlight reports on visitscotland.org here . (This link takes you to an external website). You can also find analyses for the whole of the UK and the nations on the VisitBritain website here (This link takes you to an external website).

The data for 2021 must be used with caution, as the methodology was different than in previous, pre-pandemic years. Full details of the impacts on the data can be found on the ONS website here. We have also included this information on the Observatory pages which use the data for 2021 and 2022.

GB Tourism Survey and GB Day Visits Survey

The GB surveys, commissioned collaboratively by VisitBritain / VisitEngland, VisitScotland and VisitWales, have also been impacted by the COVID restrictions, which came just as a new methodology was being introduced for these surveys. This combined impact has required much work by the partners to ensure that the data is rich and robust.

Data from the Day Visits Survey has been published for 2021 and 2022. You can find analyses from this survey on visitscotland.org here. (this link takes you to an external website)

Data for 2022 from the Tourism Survey, which gathers data on overnight trips, will be published in September.

Scottish Accommodation Occupancy Survey

Reports on occupancy continue to be produced on a regular monthly cycle.

Other research

The uk consumer sentiment tracker.

During the period of disruption, VisitScotland collaborated with VisitBritain/VisitEngland and VisitWales to develop “tracking” research on the sentiment and travel intentions of UK residents. This work also captured insights on their barriers to travel, concerns, and preferred destinations to visit within the UK. As immediate concerns on COVID have waned, the survey is now highlighting the impact of the rising cost of living on travel intentions.

Insights and analyses from this research can be found on the Observatory (for Scotland and the UK ) and on visitscotland.org here . (this link takes you to an external website)

Scotland Visitor Survey

This large-scale survey of visitors in Scotland, conducted in normal times every 2-3 years, had to be cancelled in 2020 due to the COVID restrictions. It has been restarted, with fieldwork running through the main seasons in 2023. This will bring lots of rich insights on the behaviour of visitors in Scotland and will be published on completion of fieldwork and analysis in late 2023 / early 2024.

What are you looking for?

64+ crucial scotland travel & tourism statistics (latest 2024 data).

Millions of tourists from all over the world flock to visit Scotland's best locations each year. Why not? After all, it is home to stunning landscapes and natural sceneries, as well as rich cultural and historical heritage.

From the spectacular glens of the Highlands and dramatic castles in Aberdeen, all the way to the charming people of Glasgow and the capital’s buzzing city life.

Did you know...

- International travellers to Scotland spent £3.15 billion in 2022 alone?

- Nearly 9% of employees in Scotland work in the tourism sector?

Indeed, travel and tourism are an essential part of Scotland’s lifestyle and economy.

This article is a treasure trove of statistics on the travel and tourism industry in Scotland. We will cover everything from how popular this nation is as a tourist destination to the nitty gritty of its financial earnings.

Let’s get right into it!

Sources: After each stat, I have referenced where the data was gathered and curated from. For a full list of all articles used in this roundup, please head to the bottom of the post. At the time of publication, these are the most up-to-date statistics available. Little data was gathered in 2020 due to the Coronavirus pandemic.

Travellerspoint

What percentage of Scotland's economy is tourism?

Scotland’s tourism industry contributes roughly £6 billion to the overall GDP, or around 5%.

Why is Scotland so popular for tourists?

1 in 10 visitors were influenced by a travel feature about Scotland, whereas 8% of visitors were prompted by a TV programme about Scotland.

Where do most tourists to Scotland come from?

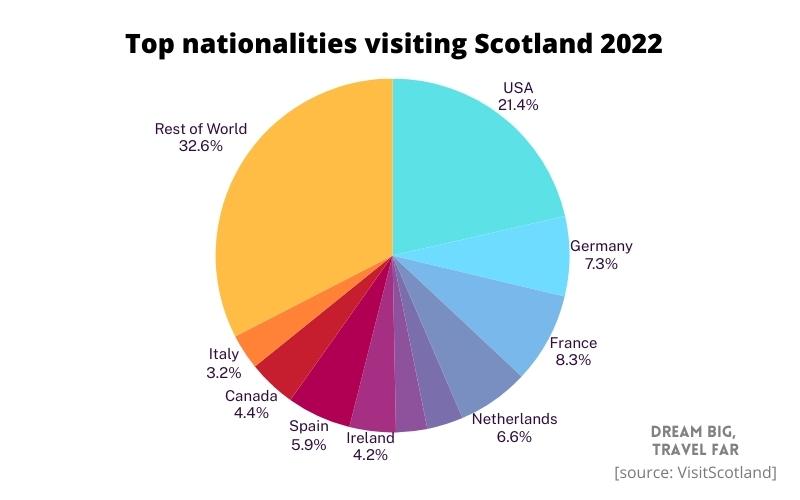

The top 4 source markets for international tourism in Scotland are USA, France, Germany and Netherlands in that order.

Scotland tourism key stats

- In 2022, there were a total of 111.5 million visits to Scotland

- Overseas travellers in Scotland spent about £3.15 billion in 2022 alone

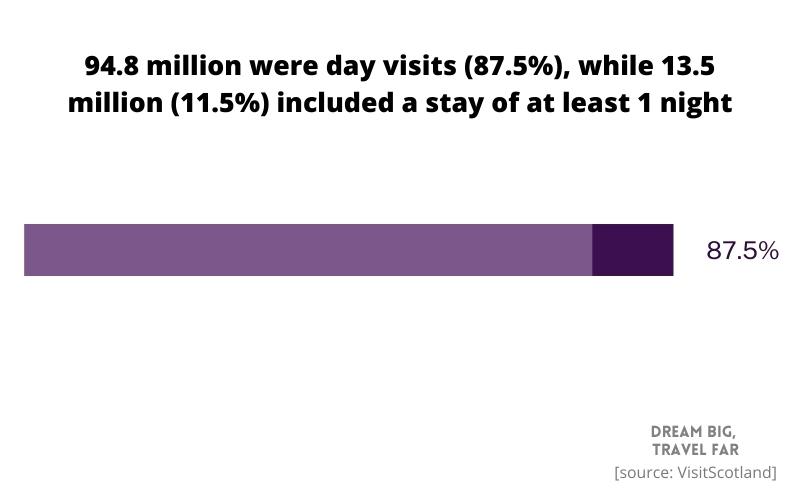

- 94.8 million of total domestic trips made to Scotland in 2022 were day visits, while 13.5 million included a stay of at least 1 night

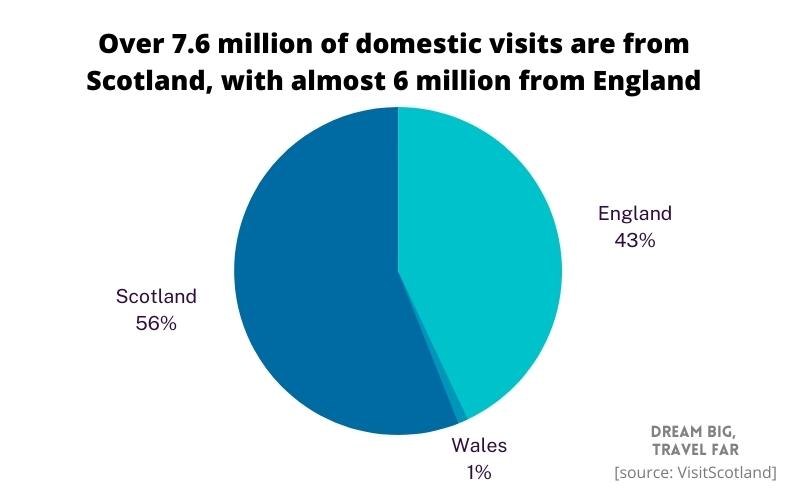

- Over 7.6 million of the visits were from Scotland, while almost 6 million were from England

- 50% of visitors come to Scotland for the scenery and landscape. History & culture is also a core driver for visiting Scotland

- Most international trips to Scotland were made from the USA, France, Germany and Netherlands

- Tourist spending generated £12 billion of economic activity in Scotland

- Scotland’s tourism industry contributes roughly £6 billion to the overall GDP, or around 5%

- In 2019, 209,000 people were employed in the Scotland tourism sector

- 14,970 (8.4%) companies in Scotland are in the Scottish tourism industry

- Over 2012 to 2017, tourism employment in Scotland rose by 13%

- The most popular region in Scotland is Glasgow & Clyde Valley. It received 29.7 million day visits and 3.1 million overnight visits in 2019

- Scotland has more than 11,000 miles of coastline, 137 miles of canals, 31,460 freshwater lochs and 118 inhabited islands

- 16 million people visit Scotland’s coastal destinations annually

- In 2020, 78% of tourism companies in Scotland reported reduced revenue from 2019 due to the Coronavirus pandemic

Travel & Scotland's economy

How does tourism contribute to Scotland’s economy?

1. In 2019, the total expenditure of overnight and day trips was £11.6 billion.

[VisitScotland]

VisitScotland found that 2019 had been the best year for Scotland’s overnight tourism over the last decade. The spending for overnight trips rose by 12% from the previous year

2. In 2022, international visitors to Scotland spent a total of £3.15 billion.

This was a dramatic 586% increase from the £0.46 billion international tourism expenditure in 2021, and has even surpassed the pre-pandemic figures of £2.54 billion in 2019.

3. Domestic day trips to Scotland in 2022 generated around £3.9 billion.

Scottish residents generated less in day trip expenditure in 2022 compared to 2019 (£5.8 billion).

4. In 2022, domestic overnight trips in Scotland generated £3.4 billion.

GB residents in 2022 spent a total of £3.4 billion in overnight trips to Scotland.

5. Tourist spending generated £12 billion of economic activity in Scotland.

Spending by tourists contributes approximately £12 billion for the overall Scottish supply chain. This industry was recognized as an important growth sector in the nation’s 2015 economic strategy.

6. Scotland’s tourism industry contributes roughly £6 billion to the overall GDP, or around 5%.

In terms of GDP, tourism in Scotland represents 5% or £6 billion of the total GDP.

7. VisitScotland, which is the official tourism organisation of Scotland, has an annual budget of over £45 million.

A huge part of Scotland’s tourism is the official tourism organisation, VisitScotland. The government budgets more than £45 million for this entity each year.

International inbound tourism statistics in Scotland

How many international tourists visit Scotland?

8. There were 3.23 million overseas visits to Scotland in 2022 alone.

International tourism expenditure reached the highest record in 2022 despite a slight decrease in number of visits compared to 2019.

9. The average international tourist stays for 9.2 nights in Scotland.

In 2022, the average length of stay for international tourists in Scotland has increased from just 7.9 nights in 2019.

Understandably, overseas tourists spent more time in Scotland per trip compared to the average 3.0 nights for domestic travellers.

10. In 2022, 1.8 million trips were made for holidaying purposes, while 307,000 had been business visits.

The majority of international tourists (58%) come to Scotland for holiday and vacation, while 9% of the visits were for business purposes .

11. Visiting friends and family is the second most common purpose for visiting Scotland, with 922,000 trips made in 2022 for that purpose.

12. the average spend for international tourists in 2022 is £972 per visit, up 32% from £734 in 2019..

Average spending per international trip to Scotland also reached an all-time high in 2022, compared to only £625 back in 2011.

13. The top 4 source markets for international tourism in Scotland are USA, France, Germany and Netherlands in that order.

Scotland is an especially popular tourist destination for tourists from the USA, France , Germany and the Netherlands, all of which make up the top 4 markets for international tourism in Scotland.

14. In 2022, there were 693,000 visits to Scotland from the USA or 21.4% of all international visits.

[VistScotland]

The largest portion of international tourists to Scotland from a country is the USA, with American visitors spending 6.588 million nights and £1.2 billion in 2022.

15. Visitors in Norway also made the top 10 source market for international tourists in Scotland, with 107,000 total visits in 2022.

In 2022, Norwegian visitors spent a total of 518 thousand nights and £75 million in tourism expenditure in Scotland.

16. Italy follows closely behind as the ninth largest source market for international tourists in Scotland, with 105,000 total visits in 2022.

Italian visitors recorded 744 thousand nights spent in Scotland in 2022 and £68 million in tourism expenditure.

Domestic Tourism statistics in Scotland

How many domestic tourists travel to Scotland?

17. In 2019, there were a total of 111.5 million visits to Scotland (both domestic and international).

18. 94.8 million of total domestic trips made to scotland in 2022 were day visits, while 13.5 million included a stay of at least 1 night..

19. UK residents made 13.5 million overnight visits to Scotland.

Out of all the total overnight visits made to Scotland in 2019, 13.5 million were made by UK residents .

20. In 2019, over 7.6 million of the visits were from Scotland, while almost 6 million were from England.

21. In 2019, domestic visitors in the 14-24 and 55-64 age groups saw a huge increase compared to the previous year.

22. 2019 saw a drastic rise in domestic travellers as the number of trips increased by 33% from 2018..

2019 was the best year over the last decade for overnight trips by domestic visitors in Scotland.

23. In 2022, the main reason to travel to Scotland for domestic visitors is holidaying (35.5% of all visits).

35% of domestic visits to Scotland are made for holiday purposes, which included solo travel as well as family trips . Meanwhile, business visits make up 9.6% of all domestic visits in 2022.

24. 62% of domestic travellers spend between 1-3 nights in Scotland. Only 7% spend more than 7 nights per trip.

For most domestic travellers in Scotland, 1 to 3 nights is the ideal length of stay, whereas only 7% of them stay for 8 nights or more at a time.

25. In 2022, the average amount spent per visit to Scotland was £253, or roughly £83 per night.

Motivations for visiting scotland.

What are the main reasons people visit Scotland?

26. The key motivation for visiting Scotland for 50% of visitors is the scenery and landscape.

A 2015/2016 visitor survey conducted by VisitScotland across 19 regions in Scotland over two summer periods (May to September) concluded that 1 in 2 people visit Scotland for the scenery and landscape.

27. The second core driver after that for visiting Scotland is the history & culture.

Following closely to that, 1 in 3 visitors to Scotland are motivated by the rich history and culture of the nation.

28. 24% of European, long haul, and first-time visitors were persuaded to spend holiday in Scotland by word of mouth recommendation from friends, family, or colleagues.

For many European travellers , long haul and first-time visitors to Scotland, recommendation from friends and family is a determining factor for their visit. On the other hand, Scottish residents tend to be driven by the desire to spend vacation at home.

29. 1 in 10 visitors were influenced by a travel feature about Scotland, whereas 8% of visitors were prompted by a TV programme about Scotland.

30. Outlander, both the TV series and books, have had a significant impact in inspiring 17% of visitors to travel to Scotland.

31. 47.8 million day trips to scotland were made in 2019 by domestic travellers to visit friends or family..

Visiting friends and family is also a popular motivation for visiting Scotland. In 2019, residents from the UK made around 47.8 day trips to Scotland for this purpose.

Scotland coastal tourism statistics

How popular are seaside destinations in Scotland?

32. Scotland has more than 11,000 miles of coastline, 137 miles of canals, 31,460 freshwater lochs and 118 inhabited islands.

Scotland’s coasts and seaside areas are a crucial part of the local culture and history. From the picturesque beaches to spectacular waterfalls, lochs, and rivers, many tourists flock to these water-based destinations during their travels.

33. There are 16 million domestic day trips to Scotland’s coastal destinations annually.

Day trip visitors to coastal locations in Scotland tend to indulge in outdoor leisure activities and exploring the beautiful landscape.

34. In 2022, there were 0.8 million domestic overnight trips to seaside and coastal locations in Scotland, down from 2.31 million in 2019.

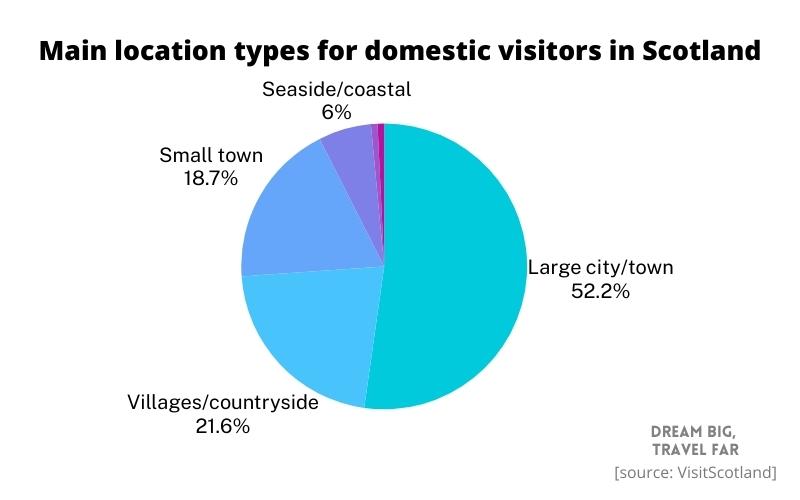

Only 6% of overnight trips in 2022 were to seaside or coastal locations in Scotland, while 52% were to the cities and large towns.

35. Most domestic visitors to Scotland’s coastal regions would visit the South (29%) or North of Scotland (28%).

The most popular coastal regions in Scotland among domestic travelers are the South and North. City destinations like Edinburgh and Glasgow, in the East and West of Scotland respectively, are more popular among city enthusiasts.

36. 38% of international visitors visit a beach.

37. international visitors from poland are the most likely to visit seaside destinations in scotland with 62% of propensity, while those from germany and italy have 51% likelihood to do so..

Among international tourists in Scotland, those from Poland are the most likely to visit a coastal location. They have a 62% propensity to do so, whereas German and Italian travellers are close behind with 51% likelihood each.

Tourism employment in Scotland

How many people are employed in the Scottish tourism industry?

38. In 2021, 209,000, people were employed in the Scotland tourism sector, an 8.7% drop from 2019.

Before the Coronavirus pandemic , the tourism sector in Scotland consisted of 229,000 people, which was roughly 1 in 12 jobs. It’s an especially significant industry in cities and rural regions.

39. 14,970 (8.4%) companies in Scotland are in the Scottish tourism industry.

[Scottish Enterprise]

From around 178,214 registered companies in Scotland, 8.4% are in the tourism industry,

40. In 2017, the tourism sector is most important in the region of Argyll & Bute, where 69 out of 1000 people work in the tourism industry.

41. This is closely followed by Highland and City of Edinburgh, at 68 and 64 people out of 1000 employed in the tourism sector respectively.

42. as of 2021, 33,000 people were employed in the tourism sector in edinburgh., 43. meanwhile, glasgow recorded a total of 31,000 employment in the tourism sector in 2021., 44. the travel industry is least significant in east renfrewshire, where tourism employment accounts to only 0.016% of total employment in the region., 45. over 2012 to 2017, tourism employment in scotland rose by 13%..

The tourism industry is one of the growing industries in Scotland. It saw a 13% increase in employment over a 5-year period from 2012 until 2017.

Tourist destinations in Scotland

What are the most popular tourist destinations in Scotland?

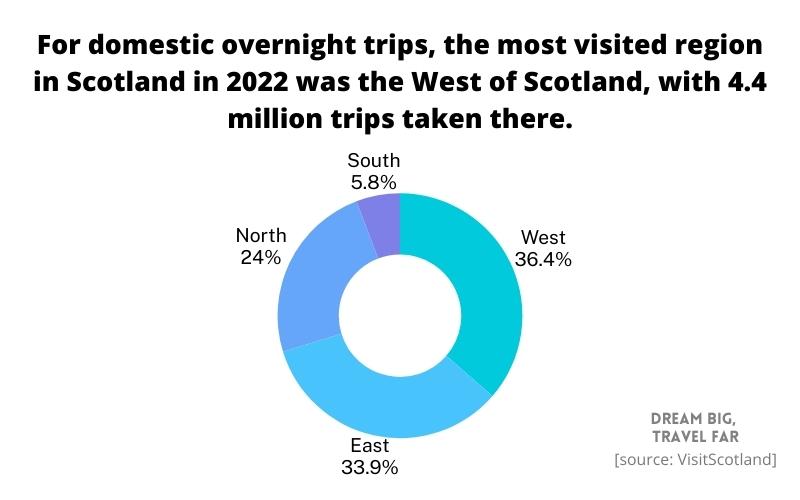

46. For domestic overnight trips, the most visited region in Scotland in 2022 was the West of Scotland, with 4.4 million trips taken there.

Meanwhile, the East of Scotland received 4.1 million domestic overnight trips in 2022.

47. Glasgow & Clyde Valley had been the most popular region to visit in 2019. It received 29.7 million day visits and 3.1 million overnight visits.

48. meanwhile, edinburgh and lothians were the most popular region for overnight visits (5.3 million). it also saw 24.8 million day visits..

Out of the 15 major regions in Scotland as listed on VisitScotland, Glasgow & Clyde Valley is the most popular tourism location overall. Meanwhile, most visitors go to Edinburgh and Lothians for overnight visits.

These two regions are followed in order by: Aberdeen and Aberdeenshire, the Highlands, Ayrshire & Arran, and Kingdom of Fife.

- Aberdeen and Aberdeenshire: 1.3m overnight, 14.6 day visit

- Highland: 2.9m overnight, 9.6m day visits

- Ayrshire & Arran: 742k overnight, 10.4m day visits

- Kingdom of Fife: 705k overnight, 8.6m day visits

49. Free tourist attractions tend to be more popular, with the National Museum exceeding 2.21 million visitors in 2019.

Free tourist attractions receive slightly more visits than paid attractions. The National Museum is the most popular attraction in all of Scotland, as it welcomed over 2.21 million visitors in 2019 alone.

50. The next most visited free attractions in Scotland are the Kelvingrove Art Gallery & Museum, the Scottish National Gallery, and the Riverside Museum in this order.

Museums are no doubt the favorite choice for free attraction amongst visitors. Some famous non-museum destinations in Scotland include St Giles’ Cathedral and Gretna Green Famous Blacksmiths Shop.

51. In 2019, the most visited paid attraction was Edinburgh Castle, which saw around 2.17 million visits.

For paid attractions, the most popular tourist destination would be Edinburgh Castle. It received 2.17 million visits in 2019.

52. The Edinburgh bus tours received 615,000 visitors in 2019.

Travel accommodation in scotland statistics.

How many hotel rooms are there in Scotland?

53. The average Scottish hotel occupancy in 2022 was 61.02%.

During peak season in 2022, the average hotel room in Scotland cost £144.38 per night .

54. As of August 2023, the hotel room occupancy rate in Scotland is 79.40%.

This was a slight decrease from the 84.22% occupancy in August 2022.

55. In 2022, the average peak revenue per available room (RevPAR) for Scottish hotels was £268.20 in February.

56. meanwhile, revpar in august 2023 was recorded at £231.12, a year-on-year increase from £212.01 in august 2022., 57. guesthouses or b&bs in scotland in 2022 had an average occupancy rate of 54.6%, while self-catering accommodations recorded 40.49% in occupancy., 58. guesthouses or b&bs can be a cheaper accommodation alternative in scotland, with the average nightly rate being £56.44 in 2022..

59. The average touring pitch occupancy in Scotland was 60.57% in August 2023.

A touring pitch is space on a campsite that you can rent. The RV industry is a popular one in Scotland.

Impact of Coronavirus on Scotland’s tourism industry

How did the Covid-19 pandemic affect Scottish travel & tourism?

60. In the first quarter of 2020, international visitor trips decreased by 17% while international visitor spend dropped by 3% (compared to first quarter of 2019).

From the most recent update we could find on the impact of the Covid-19 pandemic on Scottish tourism, the report stated that overseas trips had decreased by 17% in Q1 of 2020. Note that lockdown in Scotland was enforced only by the end of Q1, yet the consequences are still apparent.

61. In summer and autumn of 2020, accommodation providers reported only 64% peak occupancy compared to 89% in 2019.

61. 78% of tourism companies reported reduced revenue from 2019., 50. 35% of staff were dismissed in 2020, while 69% had been put on furlough., 62. over march and september 2020, there was an 8.4% decrease of jobs in scotland’s accommodation and food services. .

[Scottish Parliament]

Scotland’s food, hotel and accommodation services industry was the worst impacted amongst the four nations in the UK.

63. Between February 2020 (when Covid-19 began to directly impact the economy) and December 2020, Scottish GDP has fallen by 7.2%.

64. in this time period, the sector most impacted is accommodation and food services which recorded 60% loss in gdp., 65. the arts, culture and recreation sector also experienced an approximately 42% decrease in gdp..

Not all the sectors in the Scottish economy were impacted in the same proportion. Industries directly related to tourism such as accommodation & food services, other services, and arts, culture & recreation suffered the most.

The tourism industry makes up 5% of Scotland’s total GDP. And since being identified as a growth sector back in 2015, this nation has received only more and more visitors each year.

Therefore, it is no surprise that this industry has created many job opportunities, especially in the rural areas that depend on tourists for their main source of income.

Despite the pressure and negative consequences of the recent Coronavirus pandemic, it’s reasonable to think that the Scottish tourism sector will recover and continue to grow.

We hope this post has been useful in telling you everything you might want to know about Scotland travel & tourism statistics.

Did we miss anything important? Please leave a comment below!

You might want to check out these other interesting statistics too:

- Ireland Travel & Tourism Statistics

- Airbnb Statistics

- Female Travel Statistics

- Online Travel Booking Statistics

- VisitScotland 1

- VisitScotland 2

- VisitScotland 3

- VisitScotland 4

- VisitScotland 5

- Scottish Enterprise

- Scottish Parliament

Leave a comment

Let us know what you think.

5 million people can't be wrong

About VisitScotland

VisitScotland is Scotland’s national tourist board. We provide advice, information and inspiration to visitors who are planning a trip to Scotland.

We do this in many ways, including through this website.

What does VisitScotland do?

Adventure conference

Overview of VisitScotland

We benefit Scotland by growing the tourism industry. We want Scotland to be recognised in the global marketplace for its wealth of incredible features.

VisitScotland event, Perth

Supporting Scottish tourism

We work closely with businesses, public agencies and local authorities for two reasons:

- to give visitors the very best of Scotland

- to help the tourism industry make the most of our outstanding places.

The Osprey Bothy

Responsibility, accessibility and equality

We want to make holidays in Scotland accessible to everyone. VisitScotland run several programmes that support tourism businesses and inclusive practices for the widest range of visitors possible.

A previous regional tourism conference activity

Quality Assurance

Our 5-star grading scheme is a clear, reliable sign of exceptional customer service and high-quality facilities. You can find accommodation, attractions and places to eat that come with the VisitScotland seal of approval.

Our locations

VisitScotland has a number of offices.

Edinburgh iCentre

Main office

VisitScotland Waverley Court 4 East Market Street Edinburgh EH8 8BG

See the main office on Google Maps

See all office locations

Find out more

Sorry, something's gone wrong. We can't display this content at the moment.

JavaScript needs to be enabled to watch this video. You can turn this on in your browser settings.

Find all the contact details you need for VisitScotland with phone and email addresses for general enquiries and business requests.

What can you get in a VisitScotland iCentre?

Visit our Information Centres when you are in Scotland for tips, advice, tickets and more.

Find experiences

JavaScript needs to be enabled to see this product search form. You can turn this on in your browser settings.

Other things you might like

As well as this site, VisitScotland run several websites related to the travel and tourism industry in Scotland.

Business Events

Travel trade, media centre, scotland is now, join our newsletter clan.

Get Scotland inspiration direct to your inbox. Don't miss the inside track from our Scotland experts on exciting trip ideas, unique attractions and hidden gems loved by locals.

- Recreation and cultural heritage

Marine tourism

Key message.

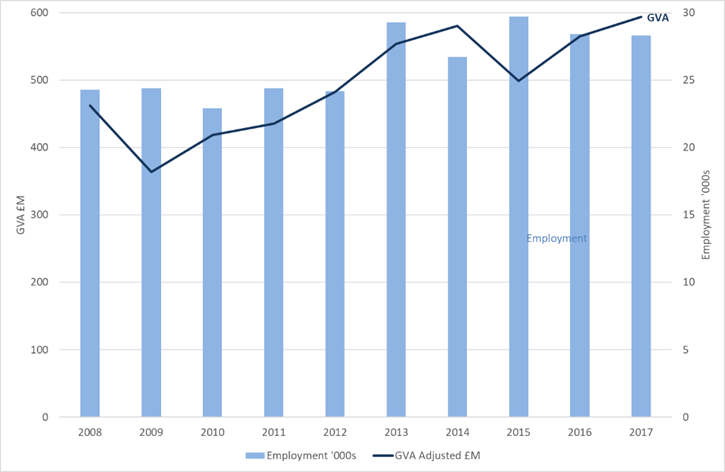

Marine tourism is a key sector for Scotland, generating £594 million Gross Value Added (GVA) and employment for 28,300 people in 2017. The long term trend from 2008 to 2017 showed marine tourism GVA increased by 28% and employment by 16%.

What, why and where?

Marine tourism covers a wide range of activities including: walking/ hiking/ running, beach activities, photography, yachting/ sailing, swimming, wildlife tourism, diving, kayaking, angling, surfing, visitor attractions and increasingly, cruise ship visits. Much of the sector relies on people taking part in activities in places where they are freely permitted: for example sailing where there is freedom of navigation and walking where there is suitable access (paths, beaches etc.). As a result gathering spatial data to locate activity is not straightforward.

Economic figures show that marine tourism accounted for around 14% of all tourism in 2017. While figures from the study of Scottish residents found that the vast majority (89%) of the Scottish public surveyed have visited the Scottish sea or coast in the past year. (Scottish Government, 2020).

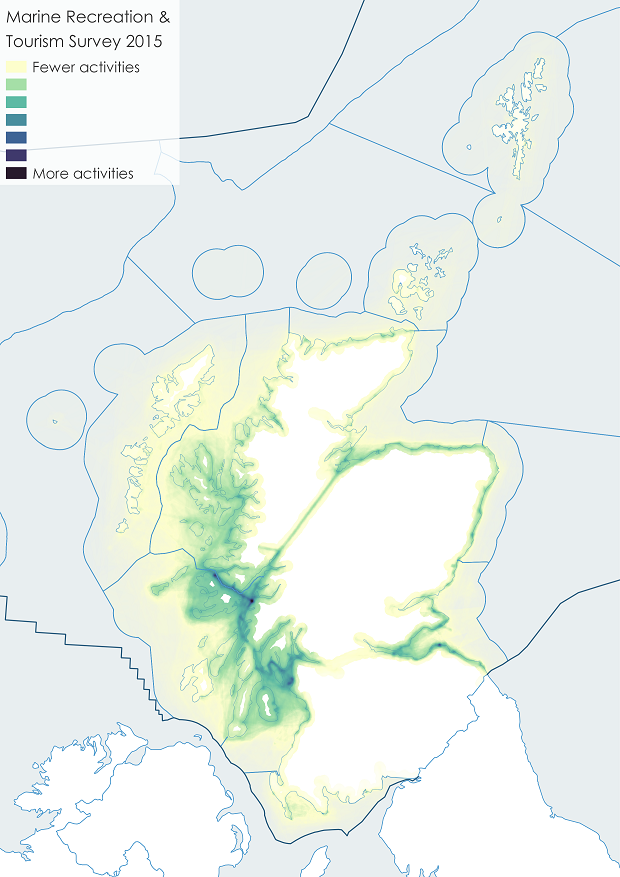

The Scottish Marine Recreation Tourism Survey (SMRTS) (Scottish Government, 2016) was commissioned to inform the National Marine Plan (Scottish Government, 2015). It provided marine planners, the tourism industry and potential investors with information about 23 different recreation and tourism activities undertaken at sea and around the coastline.

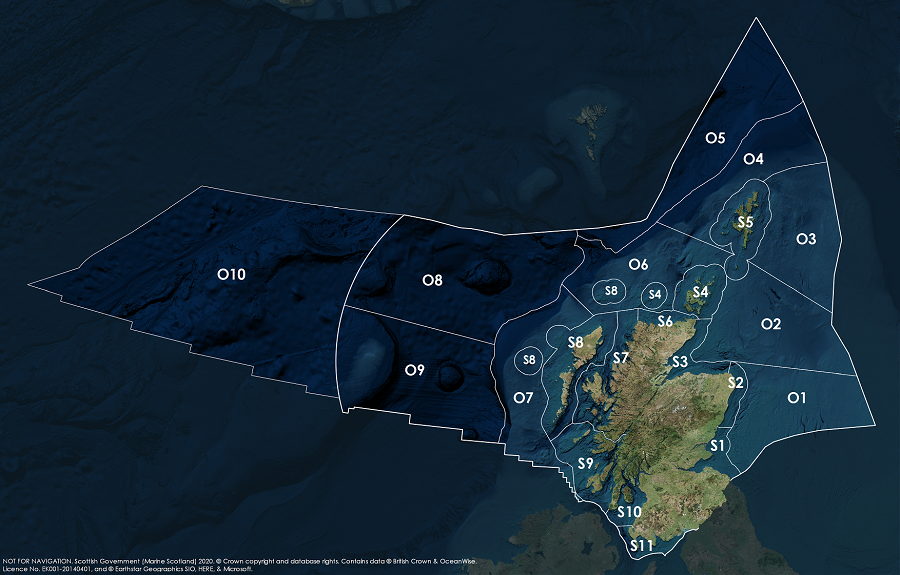

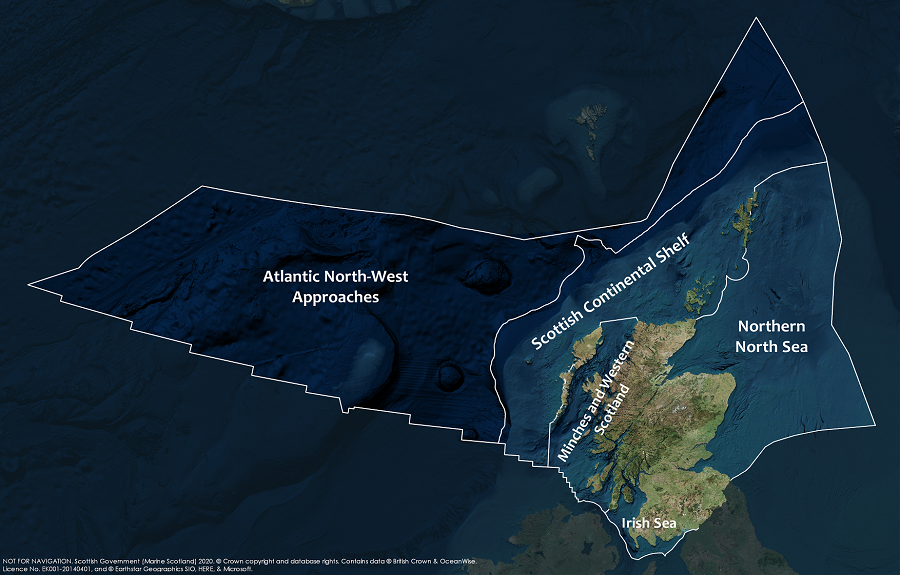

Figure 1: Marine recreation and Tourism Survey 2015 - All activities combined (showing Scottish Marine Regions and Offshore Marine Regions). Darker colouring shows areas of higher activity.

Source: Scottish Marine and Recreation Tourism Survey (Scottish Government, 2016).

The survey encompassed many types of tourism, with differing levels of response and activity. So the results are helpful to identify busy areas and activities with confidence, although less busy areas or activities are reported with less confidence. A nil response to the survey does not mean nil activity.

Scottish Government has designated 2020 the Year of Coasts and Waters. The importance of marine and coastal tourism was a key driver in this designation.

What, why and where? (Extended)

The Scottish Marine Recreation Tourism Survey (SMRTS) report (Scottish Government, 2016) gathered spatial data from over 2,500 respondents and provided improved awareness of what takes place where.

The study notes that ‘ survey design and method for data collection means the survey results are not representative of all marine recreation and tourism activities in Scotland, particularly in more remote areas, and information on activities with fewer participants is not to be taken as an indication that no activity takes place ’. As such the spatial data from SMRTS are helpful but not definitive.

In 2015 the Marine Tourism Development Group (MTDG) published ‘Awakening the Giant – the Marine Tourism Strategy 2015’ which was then revisited in 2018 (MTDG, 2015; MTDG, 2018). The strategy was an industry-led strategy to maximise the potential of Marine Tourism in Scotland. Both the original strategy and the following review set out an ambition for growth, with sailing identified as the largest of the activities within the sector. A key strand of the work was the development of adequate facilities to accommodate growth and changing leisure patterns.

A new strategy ‘Giant Strides’ is currently under development and is expected to be produced in 2020.

Yachting / sailing

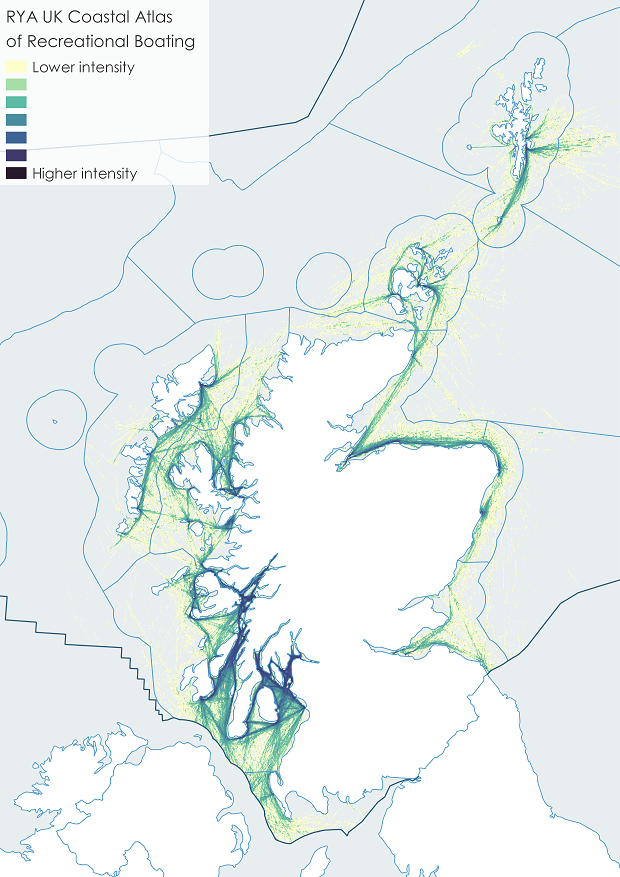

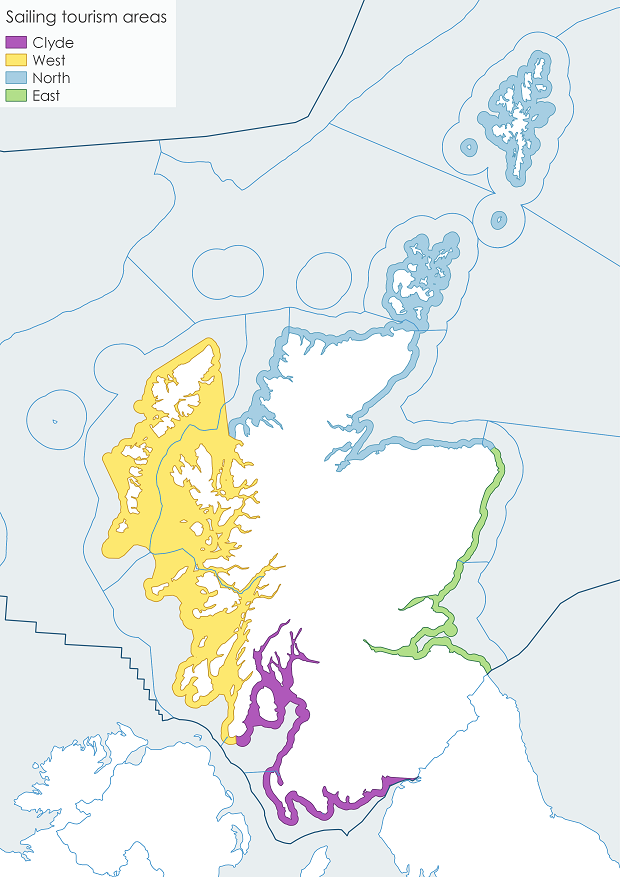

The Royal Yachting Association’s (RYA) ‘Coastal Atlas of Recreational Boating’ (RYA, 2019) included an update on recreational use intensity, based on location records from AIS (Automatic Identification System). AIS provides information about a vessel carrying the system to other vessels and to coastal authorities automatically. Figure a (left) shows the location of recreational boating activity based on the RYA information with Figure a (right) taken from the SMRTS report, and self-reported locations from the SMRTS sample. The AIS data are reasonably representative inshore but become less reliable away from the coast. It should also be noted that not all recreational craft carry AIS. What is apparent is that sailing is concentrated in the Clyde and along the west coast.

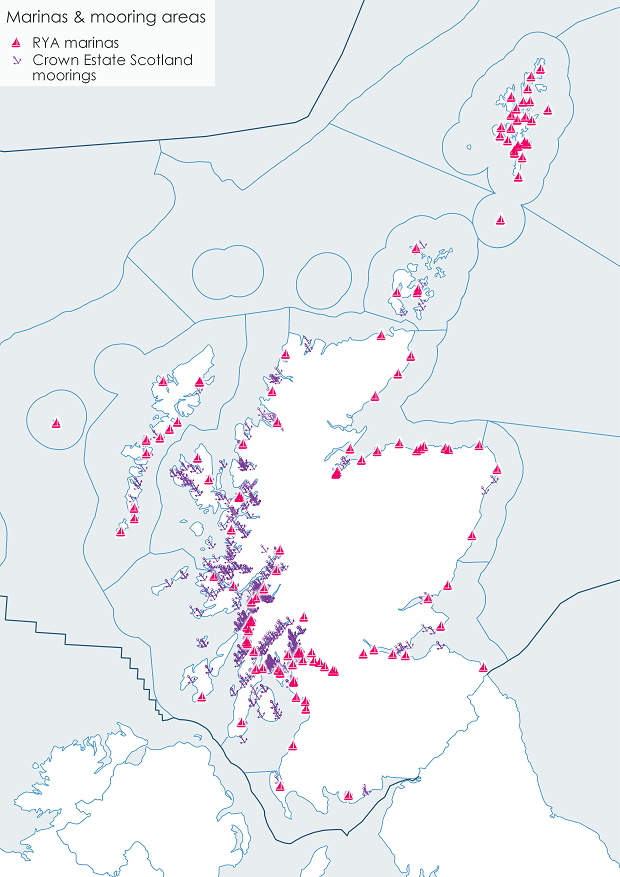

Sailing is particularly dependent upon the range of available infrastructure: there are a number of marinas, harbours offering pontoon berths and dedicated mooring areas around Scotland (Figure b).

The Sailing Tourism in Scotland Report (EKOS, 2016) for The Crown Estate, Highlands and Islands Enterprise and Scottish Canals updated the earlier Sailing Tourism in Scotland Report (2010) for Scottish Enterprise. It undertook economic analysis and growth projections of the Sailing Tourism sector in Scotland and identified strategic development areas around the coastline. The study divided Scotland into four main areas – Clyde, West, North and East (Figure c) which are considered to reflect the geography of the main ‘sub national’ sailing economies.

The 2016 report showed that the total supply was approximately 15,700 berths in 2016 (pontoons and moorings for both residents and visitors) up from 12,600 in 2009, an increase of 25% (Table a). Of these 13,500 are resident berths (up 23%) and 2,200 visitor berths (up 32%). Occupancy of resident berths is 95% which is the same level as in 2009, so demand had kept pace with supply. Nearly three quarters of the capacity (73%) is located in the West and Clyde regions (Table b). Facility improvement and expansion is constantly changing and so such figures can only ever be a snapshot. Since the data were collected in 2016 there have been further investments in marina berths and facilities, for example improved facilities at Tarbert on Loch Fyne and Port Edgar, and pontoons at Lochboisdale and Oban.

The Awakening the Giant Strategy (MTDG, 2015) set out an ambition for growth of sailing as a major part of Marine Tourism. It identified that an additional 3,000 berthing facilities were required to fully realise the potential demand. It is not known yet how the awaited ‘Giant Strides’ strategy due in 2020 may change this figure.

Wildlife tourism

Coastal and marine wildlife tourism attracts visitors to view, study and/or enjoy wildlife on the coast. This includes viewing birds, mammals and coastal habitats from boats or from land vantage points with an emphasis on cliff nesting seabirds or seals at haul-out sites (where seals haul themselves out of the water).

Marine wildlife tourism specialist operators provide access to offshore areas and certain marine species, for example, dolphins, porpoises, basking sharks and seals. The Scottish Marine Wildlife Watching Code (revised in 2017) (SNH, 2017a) is supplemented by the Guide to Best Practice for Watching Marine Wildlife (SNH, 2017b) to help minimise any disturbance to marine life and stay within the law. There is also a network of land based aquaria and marine wildlife centres, Table c.

Cruise ships

The growing cruise ship industry is another important part of the leisure and recreation sector. Between 2010 and 2018 the number of cruise ship visits has more than doubled (Table d). More details are included in the maritime transport section of the assessment.

Research into the cruise sector is ongoing.

Visitor attractions

The Moffat Centre for Travel & Tourism Business Development (Glasgow Caledonian University) creates a regular visitor attraction monitor report (by subscription) based on survey returns from participating attractions. The data from ‘Coastal attractions’, defined as being located within approximately one mile of the coast, reveals that the Clyde and Forth & Tay Scottish Marine Regions (SMR) have the largest visitor numbers (Figure d).

The results in the monitor survey show that (of those who responded to the survey in each of the last three years, and are ‘Coastal attractions’) museums and art galleries represent 45% of visits in 2018. Outdoors and nature attractions were the second most popular at 12% of visits in 2018 (see Table e). Findings from the Moffat Centre monitor are also shown in the Historic Environment and Cultural Heritage assessment.

In the 2019 bathing season there were 86 designated bathing waters, where SEPA monitors water quality from 15 May to 15 September and publishes the sampling results online ( SEPA ). Monitoring results of designated bathing waters is covered in the clean and safe, bathing water microbiology section. The 2019 classifications, calculated at the end of the 2018 bathing water season and applying to each bathing water for the duration of the 2019 season were:

In 2016 Keep Scotland Beautiful introduced Scotland's Beach Awards , assessed on 30 individual criteria points, replacing the earlier Blue Flag / Seaside Award. Table f details recent awards.

Diving, canoeing, kayaking, angling and surfing

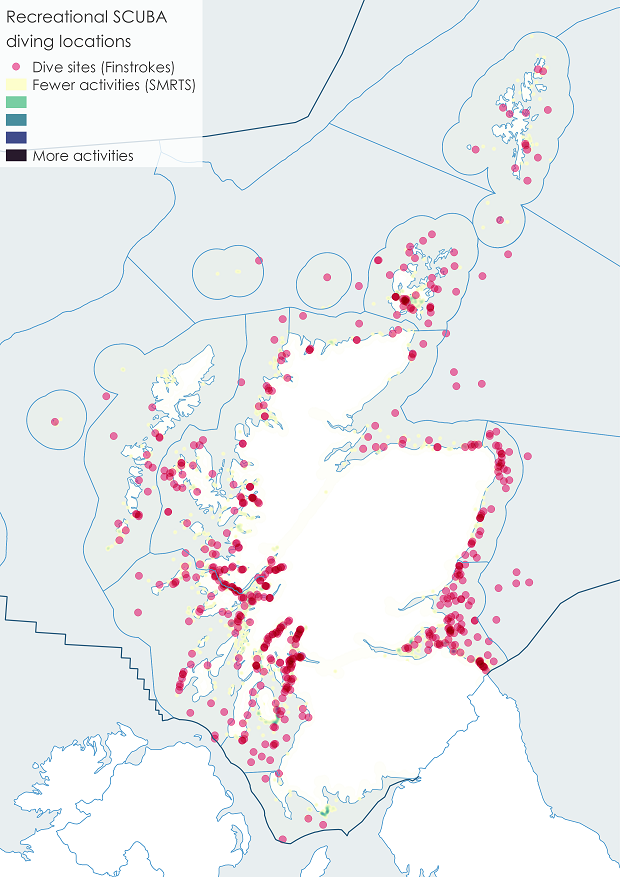

Diving on wrecks or offshore reefs is an important recreational activity particularly in Orkney and along the Berwickshire coast. A number of wrecks are protected (see Historic Environment & Cultural Heritage assessment ).

The 168 respondents to the SMRTS survey who reported taking part in SCUBA diving identified over 2,000 locations where they had been. This information has been used to generate a heat map showing the concentration of SCUBA diving around the Scottish coast.

Figure e: Recreational SCUBA diving locations (showing Scottish Marine Regions and Offshore Marine Regions).

Source: SMRTS (Scottish Government, 2016) & Finstrokes .

Note: the pink circles are semi-transparent, so the dive sites points appear darker when they overlap the underlying ‘fewer / more activities’ SMRTS data.

Canoeing and kayaking take place around sea lochs and in coastal areas, especially on the west coast, while inland canals - the Crinan, Forth and Clyde, Union and Caledonian canals - not only provide transit routes between coastal areas but act as tourism destinations in their own right.

Sea angling

Sea angling is carried out from most regions of the coastline. A wide range of species are caught including cod, tope, bass, rays, pollack, mackerel and spurdog. Species caught vary from region to region and at different times of the year. Information about the capture of some fish is covered in the Salmon and Sea Trout Fishing part of the assessment.

Surfing and windsurfing

Surfing and windsurfing take particular advantage of the Atlantic waves breaking off the Inner Hebrides but surfing is also popular on the east coast.

See West Coast Waters & North Coast 500: two examples of marine and coastal related tourism initiatives

Marine Social Attitudes survey

A study on Scottish resident’s attitudes (Scottish Government, 2020) towards the marine environment found that women in particular as well as residents living in coastal areas are more likely to go walking, do beach activities, or wildlife watch along the coast than men or those who do not live near the coast. Many residents mentioned that while they enjoy using the marine environment for leisure they would like to see better facilities available, such as clean, working toilets, availability of drinking water, and better walkways and access for people with buggies or wheelchairs. The study also found that many have concerns over the negative impact of tourism, particularly in terms of people polluting and littering. Evidence suggests while residents generally consider tourism a good thing, many say that it must be well managed in order to ensure the costs do not outweigh the benefits to Scotland’s marine environment.

Contribution to the economy

Marine tourism generated £594 million Gross Value Added (GVA) and employment for 28,300 people in 2017 (Scottish Government, 2019). This represents 14% of the £4.1 billion GVA from all Scottish tourism. GVA is the value of goods and services produced minus the cost of raw materials and other inputs used to produce them. Marine tourism employment figures account for 38% of employment in the Scottish marine economy (excluding oil and gas extraction). However these figures are headcounts and do not take account of the seasonal and part-time nature of employment in marine tourism.

From 2014 to 2017, the GVA from marine tourism (adjusted to 2017 prices) increased by 2%, while the longer term trend from 2008 to 2017 (Figure 3) showed that marine tourism GVA increased by 28%. From 2014 to 2017 employment increased by 6%, while the longer term trend, from 2008 to 2017, showed a 16% increase.

Source: Scotland’s Marine Economic Statistics. (Scottish Government, 2019).

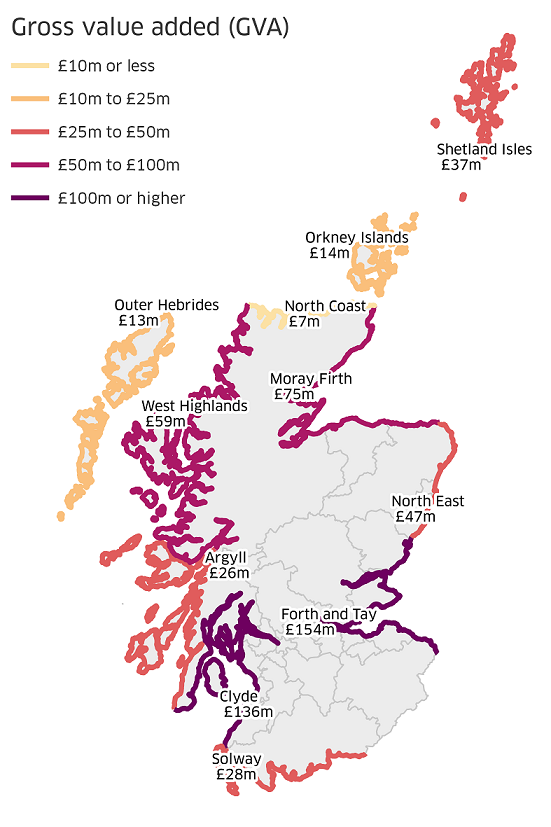

Economic values for leisure and tourism can be provided by Scottish Marine Region (SMR) (see Table g, in ‘Read More’ section). Information by local authority is unavailable due to the small number of responses for some areas and the need to protect the confidentiality of individual businesses. While SMRs are geographies that relate to the sea, marine tourism is earned on land and so the figure shows outputs around the coast.

The Sailing Tourism in Scotland report (EKOS, 2016), concluded that Scotland’s sailing tourism economy is worth £130 million and supports 2,700 jobs.

Contribution to the economy (Extended)

The Forth and Tay region was the largest contributor to marine tourism GVA in 2017 at £154 million (26% of the GVA), while the Clyde region contributed 7,200 jobs, (26% of the employment), which was slightly higher than the Forth and Tay.

The methodology used in the Marine Economic Statistics (Scottish Government, 2019) for the leisure and recreation builds on the methodology developed as part of the Scottish Marine Recreation Tourism Survey (SMRTS) report (Scottish Government, 2016).

Marine tourism and recreation has been defined as including “activities which involve travel away from one’s “habitual” place of residence, which have as their host or focus the marine environment and/or the coastal zone”. It was assumed that all tourism businesses located in postcodes wi thin 100 metres of the coastline were engaging in marine tourism and recreation or dependent on the marine environment. While this assumption may not be strictly accurate (includes some businesses that are not marine-related, and not include some that are marine-related) it provides a reasonable and replicable method of estimating marine tourism and recreation businesses with existing data.

The industry categories (from Scotland’s Annual Business Survey ) that are included are:

- Hotels and similar accommodation.

- Holiday and other short-stay accommodation.

- Camping grounds, recreational vehicle parks and trailer parks.

- Restaurants and mobile food service activities.

- Beverage serving activities.

- Tour operator activities.

- Other reservation service and related activities.

- Museum activities.

- Operation of historical sites and buildings and similar visitor attractions.

- Botanical and zoological gardens and nature reserve activities.

- Operation of sports facilities.

- Other sports activities (not including activities of racehorse owners).

- Activities of amusement parks and theme parks.

- Other amusement and recreation activities.

Table g shows the marine tourism contribution to GVA by SMR and how that has changed since 2014 (the first reported marine tourism GVA). The source for the marine tourism GVA figures is the Scottish Annual Business Survey (SABS). This is a sample survey, so more detailed breakdowns of the data will result in reduced statistical quality. In particular, when the data are disaggregated to SMR, small changes can have a have a very marked effect on figures from one year to the next. The SMR marine tourism GVA trend arrow is derived from the % change and any change less than or equal to 5% is included in ‘No change’. Trend arrows are not calculated on small values (GVA of less than 20 million in 2017) due to the volatility of the sample. This direction of travel is used for the trend assessment. The 2017 value allows the individual SMR value to be put into context with marine tourism as a whole.

Examples of socio-economic effects

- Contributes to a healthier, happier nation.

- Contributes to the economy, drives inclusive growth and underpins supply chains.

- Provides employment in rural and coastal locations.

- Major events (e.g. West Highland Yachting Week and Tiree Wave Classic) give coastal communities a distinct and global profile.

- Seasonal nature not as robust as non-seasonal industries.

- Vulnerable to economic downturns.

- Activities can compete for space.

Pressures on the environment

An OSPAR agreed list of marine pressures is used to help assessments of human activities in the marine environment. The marine pressure list has been adapted for use in Scotland via work on the Feature Activity Sensitivity Tool (FeAST) . Leisure and recreation activities can be associated with 13 marine pressures – please read the pressure descriptions and benchmarks for further detail.

Pressures on the environment (Extended)

The list of marine pressures is used to help standardise assessments of activities on the marine environment, and is adapted from an agreed list prepared by OSPAR Intercessional Correspondence Group on Cumulative Effects (ICG-C) (see OSPAR 2014-02 ‘ OSPAR Joint Assessment and Monitoring Programme (JAMP) 2014-2021’ Update 2018’ (Table II).

The Feature Activity Sensitivity Tool (FeAST) uses the marine pressure list to allow users to investigate the sensitivity of Scottish marine features. It also associates all pressures that might be exerted by a defined list of activities at a particular benchmark. The extent and impact of each pressure from a given activity will vary according to its intensity or frequency. The extent and impact of the pressure will also vary depending on the sensitivity of the habitat or species on which it is acting. The existence of multiple activities, and potentially multiple pressures, at specific locations will result in a cumulative impact on the environment.

FeAST is a developing tool. A snap shot from 2019 was used for the development of SMA2020. Please consult the FeAST webpage for further information and up to date information.

The list of pressures below associated with this activity is given in alphabetical order. Clicking the pressure will give you more information on the pressure and examples of how it may be associated with the activity.

Forward look

The Year of Coasts and Waters 2020 will focus attention on Scotland’s seas and coasts.

Marine and coastal tourism also features as a key sector in other Scottish Government work, such as City Deals, regeneration projects such as that currently being undertaken in North Ayrshire and the wider Programme for Government Commitment to develop the South of Scotland as a tourism destination. The effect of the Themed Year and other initiatives will be evaluated in appropriate data in future years.

The SMRTS 2015 survey highlighted the importance of good environmental conditions and abundant marine wildlife to marine tourists and particularly to many recreational boaters. The joint British Marine and RYA initiative The Green Blue , a website that promotes sustainable boating for cleaner and healthier waters, has been reinvigorated (2019) and RYA has been working with NatureScot to minimise any adverse effects of recreational boating on Priority Marine Features.

The cruise ship industry is expected to continue to expand. The industry is confident that 1 million passengers a year will occur either in 2019 or 2020. A study (Cruise Scotland, 2010), when 248,923 visitors arrived, forecast 830,000 passengers by 2025, so growth continues ahead of expectations.

Forward look (Extended)

The Year of Coasts and Waters 2020 will focus attention on Scotland’s seas and coasts based around four themes:

- Our Natural Environment & Wildlife.

- Our Historic Environment & Cultural Heritage.

- Activities & Adventure.

- Food & Drink.

The broad scope of the Themed Year will highlight the social, rural, environmental and economic policies and projects in development across the Scottish Government and wider public sector.

In response to the growing switch away from hydrocarbon fuel, there may be more vessels with electrical propulsion but the nature of this technology is still unclear. It is not yet clear to what extent the effects of climate change and the disposal of end-of-life boats is being considered by recreational boaters.

Under two scenarios the Sailing Tourism in Scotland Report (EKOS, 2016) indicated potential growth for the 4 sailing areas (Table h).

The report noted that a lack of facilities in the East had constrained a growth in demand, which could be satisfied over a longer timeframe by the proposed future developments at Dundee and Granton.

Work has started on a new 75 berth marina at Newton, Stornoway, the first phase of a 20-year plan. The Outer Hebrides is already a key sailing destination for visitors, and Stornoway is an important link in a chain of marinas stretching from the Butt of Lewis to the Isle of Barra.

Economic trend assessment

GVA from marine tourism in Scotland has increased from £580 M in 2014 to £594 in 2017 (2017 prices) an increase of 2% (2014 is used as the base line to remain consistent with the earliest that the disaggregated SMR data for marine tourism is available).

National trend

Scottish Marine Region trends are based on GVA at 2017 prices. The % change in GVA is reported. Changes of less than 5% are considered as not substantial changes. In addition, trend arrows are not calculated on small values (GVA of less the 20 million in 2017) due to the volatility of the source Scottish Annual Business Statistics sample data. Confidence is three stars as based on published national statistics. The detailed table of results is shown as Table g in the Extended economic section above.

This Legend block contains the key for the status and trend assessment, the confidence assessment and the assessment regions (SMRs and OMRs or other regions used). More information on the various regions used in SMA2020 is available on the Assessment processes and methods page.

Status and trend assessment

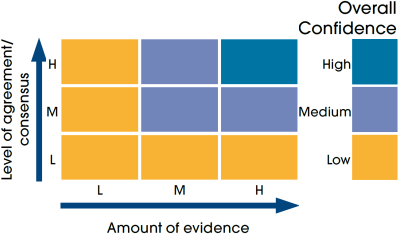

Confidence assessment.

Assessment regions

Key: S1, Forth and Tay; S2, North East; S3, Moray Firth; S4 Orkney Islands, S5, Shetland Isles; S6, North Coast; S7, West Highlands; S8, Outer Hebrides; S9, Argyll; S10, Clyde; S11, Solway; O1, Long Forties, O2, Fladen and Moray Firth Offshore; O3, East Shetland Shelf; O4, North and West Shetland Shelf; O5, Faroe-Shetland Channel; O6, North Scotland Shelf; O7, Hebrides Shelf; O8, Bailey; O9, Rockall; O10, Hatton.

Links and resources

- Literature and Data sources

To view full details of the literature source, click the title. Where literature has a DOI, you can click on the DOI link to be taken directly to the source material.

IMAGES

COMMENTS

Due to the scale of this work, we typically conduct a comprehensive Scotland Visitor Survey every three or four years. This includes a sample of both domestic (UK overnight visitors) as well as international visitors. The last survey undertaken was in 2015/2016, with the planned 2020 survey postponed due to the pandemic.

Office for National Statistics (ONS) Visits and visitors to the UK, the reasons for visiting and the amount of money they spent here. Also UK residents travelling abroad, their reasons for travel and the amount of money they spent. The statistics on UK residents travelling abroad are an informal indicator of living standards.

Scotland's international tourism continues to bounce back according to the latest quarterly International Passenger Survey figures which were released at the end of January. The figures show there were 1,438,000 visits to Scotland from international visitors, an increase of six per cent on the same period in 2022 and a rise of more than a 14 ...

Welcome to Scotland. Scotland is a place of epic natural landscapes, engaging cities and rich cultural heritage. Start your adventure and discover our hidden gems to create memories with friends and family. But don't just take our word for it. National Geographic has just included Scotland in their Best of the World 2024 list, and Far North ...

Data and analyses for tourism in Scotland. The Scottish Tourism Observatory aims to make tourism data for Scotland easy to find and use, and to enrich the data available. New content and updates will be added throughout the year, so please browse, and please check back as our content grows. Using the site.

The GBTS collects data on overnight trips (including holidays, business, or visiting friends and relatives). It measures the volume and value of overnight domestic trips taken by residents and provides detailed information about the trip and the visitor characteristics. The GBDVS collects information on "day visits" as defined by the survey.

Data for 2022 from the Tourism Survey, which gathers data on overnight trips, will be published in September. ... This large-scale survey of visitors in Scotland, conducted in normal times every 2-3 years, had to be cancelled in 2020 due to the COVID restrictions. It has been restarted, with fieldwork running through the main seasons in 2023 ...

A 2015/2016 visitor survey conducted by VisitScotland across 19 regions in Scotland over two summer periods (May to September) concluded that 1 in 2 people visit Scotland for the scenery and landscape. ... In 2021, 209,000, people were employed in the Scotland tourism sector, an 8.7% drop from 2019. [VisitScotland] Before the Coronavirus ...

About VisitScotland. VisitScotland is Scotland's national tourist board. We provide advice, information and inspiration to visitors who are planning a trip to Scotland. We do this in many ways, including through this website.

The trips in Great Britain lasted on average 3.5 nights. During the comparable period of 2022, April to December, British residents spent £268 on their domestic trip (16% increase on the comparable period of 2021), with spend per night reaching £87 (33% increase on 2021). Their trip lasted on average. 3.1 nights, which is a 12% decline on ...

• An overview of the Scotland Visitor Survey 2011/12, including our methodology, sampling considerations, and the questionnaire we used. • Guidelines for commissioning a visitor survey, including what to include in your brief, research design, methodology and sample. • An overview of how to conduct and manage a visitor survey in-house.

The 2015/2016 Scotland Visitor Survey is a 2 year research programme covering 19 regions of Scotland. The 2 year programme is required to gain robust sample sizes for reporting at a regional level. The Scotland Visitor Survey is a summer only survey, and due to the scale of the project , it is not carried out for the full year.

Future Outlook & Possible Diminishing Returns. The results of the 2022/23 Scottish Association Survey, albeit influenced by the Covid-19 pandemic and the ongoing recovery of the events and travel markets, show another year of reducing event numbers. In 2018/19 Scotland hosted 447 association events which has dropped year-on-year to 282 in 2022/23.

Volume and value of domestic and international tourism to glasgow in 2019. In 2019, Glasgow welcomed 2.5 million domestic and international visitors, generating £774 million for the city's economy. This represents an 8% increase in trips and a 17% increase in spend year-on-year.

Economic figures show that marine tourism accounted for around 14% of all tourism in 2017. While figures from the study of Scottish residents found that the vast majority (89%) of the Scottish public surveyed have visited the Scottish sea or coast in the past year. (Scottish Government, 2020). The Scottish Marine Recreation Tourism Survey ...

LGBT TRAVEL IN SCOTLAND When compared to Visit Scotland data1, our research shows that many of the factors influencing the decision to holiday in Scotland are similar for LGBT visitors and non-LGBT visitors alike. Making a repeat trip (29%), visiting particular attractions (29%), visiting friends and family/Scottish ancestry