Important notice

You are leaving bank of america.

You are continuing to another website that is not affiliated with Bank of America or Merrill. Bank of America is not responsible for and does not endorse, guarantee or monitor content, products, services and level of security that are offered or expressed on other websites. Please refer to the website’s posted privacy policy and terms of use. You can click the Cancel button now to return to the previous page.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the Digital Advertising Alliance or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Preferred Rewards

Maximize your rewards earn with exclusive benefits

Members of the award-winning Bank of America Preferred Rewards® program enjoy many exclusive benefits and pricing discounts, all designed around the ways you save, spend and borrow with Bank of America and invest with Merrill. 1 When your balances work together, you can maximize the rewards you earn. On average, members increased their overall benefits to $500 a year. 2

Don't have a Bank of America checking account yet?

Open an account

*Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about Merrill pricing, visit merrilledge.com/pricing .

It's so easy to be rewarded for what you already do

There's no fee to enroll or participate in Preferred Rewards. To become a member, you'll need:

Bank of America checking account

Must be an active, eligible account

$20K 3-month average combined balance Includes balances in your Bank of America deposit and/or Merrill investment accounts

Don’t have a Bank of America account yet?

Open a checking account

Manage all your rewards in one place with Bank of America My Rewards

Track your rewards, deals and benefits throughout the year

Explore what’s available and start redeeming

Discover additional benefits so you never have to miss out

Enroll in Preferred Rewards if you're eligible

Maximize with Merrill

Your Merrill investment accounts and Bank of America deposit balances both count towards helping to maximize the Bank of America Preferred Rewards you could earn.

Awards and accolades

Best Customer Loyalty Programs List 12

Best Bank Customer Loyalty Program 13

The Ascent (a Motley Fool service)

Frequently asked questions

What is the Preferred Rewards program?

The Bank of America Preferred Rewards program offers real benefits and rewards on your everyday banking and investing. And as your qualifying Bank of America® deposit accounts and/or Merrill® investment balances grow, so do your benefits.

Your benefits are based on your tier, and your tier is based on the qualifying combined balances in your Bank of America deposit and/or Merrill investment accounts. Once you’re a Preferred Rewards member, you'll keep your program benefits for at least a full year, so no need to worry if your balances dip temporarily. In addition, your balances are reviewed monthly to see if you qualify for a higher tier. If so, you'll automatically move to the next level of rewards.

How do I qualify?

All you need to qualify is an eligible Bank of America® personal checking account and a three-month combined average daily balance of $20,000 or more in qualifying Bank of America deposit accounts and/or Merrill® investment accounts . Then you can enroll in the program.

Log in to Online Banking to see if you qualify

Are there any fees associated with the Preferred Rewards program?

No. There is no fee to join, no fee for ongoing participation, no fee to opt-out. There are no fees associated with Preferred Rewards.

What value of benefits could I potentially earn?

The value to you will be determined by all the ways you can utilize the various benefits. On average members increased their overall benefits to $500 a year with Preferred Rewards. For example, you could potentially benefit from interest rate discounts, credit card rewards bonuses, no-fee ATM transactions and Merrill Guided Investing Program discounts. To find out more, check out our Preferred Rewards calculator .

Do I have to enroll to become a Preferred Rewards member?

Yes, through Online Banking, but enrollment is simple. There are no fees to join or participate in Preferred Rewards. And once you're enrolled, as your balances qualify you for the next level of rewards, you'll receive an automatic tier upgrade.

Log in to Online Banking to get started

What happens if my program balance drops after I enroll in Preferred Rewards and I go into a grace status?

No need to worry if your balances dip temporarily; you'll keep your Preferred Rewards program status for a full year. If after a year you no longer meet the balance requirement, you'll get a three-month grace period. If you haven't met the balance requirement after those three months, you'll be moved to a lower tier or lose your Preferred Rewards benefits, if you no longer qualify.

If you meet the balance requirements again within 24 months after losing your benefits, we’ll automatically reinstate your Preferred Rewards membership. If you meet the requirements after 24 months, you’ll need to re-enroll in the program.

Learn more about how we calculate your balance and tier level

What is included in the no-fee banking services?

Here are some of the no-fee services that Preferred Rewards members are eligible for, based upon their tier:

- Monthly maintenance fees are waived on checking and savings accounts, for up to four accounts for the Gold, Platinum and Platinum Honors tiers; unlimited number of accounts for Diamond tier

- ATM/Debit card rush fees are waived for all Preferred Rewards tiers

- Non-Bank of America ATM fees are waived for withdrawals, transfers, and balance inquiries at the Platinum tier and above – one per statement cycle for Platinum; and unlimited for Platinum Honors and Diamond tiers

- ATM international transaction fees are waived for Diamond tier

- Incoming domestic wire transfer fees are waived for all Preferred Rewards tiers

- Outgoing wire transfer fees are waived (two per statement cycle), for Diamond tier

- Check image service fee is waived for all Preferred Rewards tiers

- Stop payment fee is waived for all Preferred Rewards tiers

- Small safe deposit box is available for Platinum tier and above

What is My Rewards?

My Rewards is where you can see the value of all your rewards in one convenient place , whether you’re in Online Banking or on the Bank of America Mobile Banking app. 14 It tracks your Preferred Rewards benefits, credit card rewards and BankAmeriDeals® 15 in a single location, so you can review at a glance and explore other available benefits that you may not be using. Your three-month average daily balance is also displayed in My Rewards.

Do I need to open new accounts to take advantage of Preferred Rewards benefits?

It depends on which accounts you already have. To become a Preferred Rewards member, you must have an active, eligible Bank of America® checking account. Once you enroll in Preferred Rewards, you can receive benefits on your existing eligible Bank of America banking and Merrill ® investing accounts.

To take advantage of some Preferred Rewards benefits, your existing accounts may require an account conversion, or you may want to open a new account to receive other program benefits. For example, for savings and credit card benefits, you'll need:

- A Bank of America Advantage Savings account , to receive the savings interest rate booster

- An eligible Bank of America credit card , such as the Unlimited Cash Rewards, Customized Cash Rewards, Travel Rewards, or Premium Rewards® card, to receive the credit card rewards bonus

Once you’re enrolled in Preferred Rewards, you can speak with a specialist to convert your existing savings account to a Bank of America Advantage Savings account or open a new credit card account that's eligible for the rewards bonus.

How can I move to a higher Preferred Rewards tier?

After you enroll, you can move to a higher Preferred Rewards tier — and enjoy more benefits and rewards — by increasing your qualifying Bank of America® deposit and/or Merrill® investment balances. Every month, we'll review your three-month average daily balance and if it’s high enough, you'll receive an automatic tier upgrade. To view your qualifying three-month combined average daily balance, log in to Online Banking or use our mobile app and go to My Rewards.

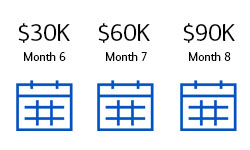

Here's an example:

You’ve been a Preferred Rewards Gold tier member for six months, with an average combined daily balance in your Bank of America and Merrill accounts of $30,000. If your average balance reached $60,000 in month seven and $90,000 in month eight, you’d qualify for the Platinum tier because your three-month average daily balance would be $60,000.*

*Your tier upgrade may take a bit longer if there are other changes to your account.

What extra benefits are available in the Preferred Rewards Diamond tier?

Diamond tier members have access to a curated suite of luxury benefits and extraordinary experiences across dining, travel, culture, and more. For more details, review the exclusive benefits available to Diamond tier members.

How can Preferred Rewards help me earn more rewards on my Bank of America credit cards?

Once you’re a Preferred Rewards member, you’ll earn 25% to 75% more rewards on every purchase made with eligible Bank of America® credit cards. For example, a purchase that typically earns $1.00 in cash rewards will earn $1.25 to $1.75, depending on your Preferred Rewards tier. Bank of America credit cards offer many different benefits to enhance what matters most to you — from cash back to dining and travel rewards. Learn more about how Preferred Rewards can boost your credit card rewards .

When will my Preferred Rewards benefits become active?

Typically, Preferred Rewards benefits become active within 30 days of your enrollment. Some benefits are automatically activated upon the effective date of your enrollment, requiring no action on your part. If you’ve opened a new account and enroll in Preferred Rewards, your benefits will become active within 30 days of account opening, unless we indicate otherwise. Note that some rewards may require you to open a new account or take other action to enjoy the complete benefits.

How can I increase my balance in order to qualify for Preferred Rewards?

To meet the minimum $20,000 combined balance requirement, you can move money over from accounts at other banks or investment firms, such as 401(k) or IRA accounts, or perhaps a vacation or rainy-day fund.

Do I need to have a Bank of America® checking account to be a Preferred Rewards member?

Yes, to enroll in Preferred Rewards you’ll need an eligible Bank of America® personal checking account and a three-month combined average daily balance of $20,000 or more in eligible Bank of America deposit accounts and/or Merrill® investment accounts.

Can I enroll in Preferred Rewards now, even though I need to open a Bank of America® checking account and maintain the qualifying balance?

Yes, we offer early enrollment if you don’t currently have an eligible Bank of America® personal checking account (or haven’t had one in 12 months or more). You’ll need to open an eligible checking account, then you’ll have the option to enroll in Preferred Rewards.

You must have the minimum combined balance of $20,000 in your eligible Bank of America deposit accounts and/or your Merrill® investment accounts within 30 days of opening the checking account. Once you meet the $20,000 balance requirement, you’ll be automatically enrolled in Preferred Rewards.

This means that you can enroll in the program early, before you’ve met the three-month combined average daily balance minimum requirement of $20,000.

How could having a Merrill® investment account help me get to a higher Preferred Rewards tier?

Merrill® investment account balances count toward Preferred Rewards tier balance requirements to help you make the most of all the program benefits and get to a higher tier.

How is Merrill related to Bank of America?

Merrill and Bank of America are both wholly-owned subsidiaries of Bank of America Corporation. The Bank of America Preferred Rewards program is designed to offer benefits based on the breadth of a client’s relationship with us, including the combined balances in their eligible Bank of America® deposit accounts and/or Merrill® investment accounts.

What types of auto loans are eligible to receive the Preferred Rewards auto loan interest rate discount?

The Preferred Rewards auto loan interest rate discount only applies to new loan applications that you submit directly to Bank of America through its website, Financial Centers, or Bank call centers. Discounts are not available for motor vehicle leases or for applications sourced from car dealerships, car manufacturers, or third-party branded/co-branded relationships.

How can I earn rewards on my Bank of America® small business accounts?

With the Preferred Rewards for Business program, you can earn valuable benefits and rewards on your everyday business banking. As your qualifying Bank of America® business deposit accounts and/or Merrill® business investment balances grow, so do your benefits.

There are three tiers in the Preferred Rewards for Business program: Gold, Platinum and Platinum Honors. Your business may be eligible to enroll if it qualifies for one of these tiers based on the combined balances in your Bank of America business deposit accounts and/or Merrill business investment accounts. Compare rewards and benefits for business

Keep in mind that your Bank of America personal accounts are not eligible to receive Preferred Rewards for Business benefits.

Does Bank of America offer deals and rewards in addition to Preferred Rewards?

Deals and rewards, including rewards credit cards like the Customized Cash Rewards card, are available in addition to Preferred Rewards. To learn more visit Rewards Central .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Bank of America Preferred Rewards: More Rewards With Every Purchase

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Bank of America® offers competitive rewards credit cards to the general public. But if you’re a banking or investment customer, the cards can become outstanding choices through the bank's Preferred Rewards program.

That’s because the bank offers accelerated points and cash back from its rewards credit cards — along with other banking goodies — as part of its loyalty program, which can be especially lucrative for high-balance customers. Credit cards that qualify for a rewards boost of 25% to 75% include:

Bank of America® Travel Rewards credit card .

Bank of America® Customized Cash Rewards credit card .

Bank of America® Premium Rewards® credit card .

Bank of America® Unlimited Cash Rewards credit card

Granted, you’ll need to keep tens of thousands of banking and investment dollars with Bank of America® to qualify for what it calls a “relationship bonus.” And credit card rewards probably aren’t the foremost factor when deciding on a financial institution for your household wealth.

Still, if Bank of America® financial products appeal to you, consider its Preferred Rewards program and the accompanying boost to credit card rewards.

» MORE: Best Bank of America® credit cards

What is the Preferred Rewards program?

With the Preferred Rewards program, Bank of America® customers get a bigger bump in credit card rewards if they stash mounds of cash at the bank or its Merrill-branded investment arms.

To qualify for the Bank of America Preferred Rewards® program, you need:

A Bank of America® personal checking account.

A three-month average balance of $20,000 or more in qualifying Bank of America® accounts, which include eligible Merrill investment accounts.

Preferred Rewards tiers are labeled Gold, Platinum, Platinum Honors, Diamond and Diamond Honors. Your combined balances determine the tier you're in, and the tier determines how much of a boost you get in your credit card rewards.

Once you reach a rewards tier, you can keep the program benefits for a total of 15 months if your balances drop below the thresholds.

Preferred Rewards offers more than extra credit card rewards. You can also get interest-rate boosts on money market accounts, no-fee ATM transactions, reduced mortgage origination fees and loan rate discounts, among other perks. For more information, see the Bank of America® website .

How card rewards add up

Rewards credit cards under the Bank of America brand qualify for Preferred Rewards. Excluded are business credit cards and such non-rewards cards as the BankAmericard® credit card , the bank’s secured cards and its non-rewards student card.

Bank of America® Travel Rewards credit card

The Bank of America® Travel Rewards credit card gives you 1.5 points per dollar spent on all purchases.

Here’s how the annual rewards rack up for a consumer charging $1,000 per month on the card.

Bank of America® Customized Cash Rewards credit card

The Bank of America® Customized Cash Rewards credit card pays 3% cash back in a spending category of your choice and 2% at grocery stores and wholesale clubs, on up to $2,500 in combined spending per quarter; all other spending earns 1%. Choices for the 3% category include gas/EV charging; online shopping (including cable, streaming, internet and phone plans); dining; travel; drugstores; or home improvement/furnishings. You can update your category for future purchases once each calendar month; do nothing, and it stays the same.

Here's how those rates translate when you take Preferred Rewards into account:

Bank of America® Premium Rewards® credit card

The Bank of America® Premium Rewards® credit card earns unlimited 2 points per dollar spend on travel and dining and 1.5 points per dollar on other purchases. With Preferred Rewards:

The Bank of America® Unlimited Cash Rewards credit card is the newest addition to the Bank of America® family of cards. It earns a flat rate of 1.5% cash back on all purchases, with no limits or expiration rules.

If you like the simplicity of earning cash and not worrying about categories, this card is a solid option for a $0 -annual fee.

Why you might avoid Preferred Rewards

Compare Bank of America® account offerings for banking and investing with other choices. Higher fees and expenses on some financial products — or lower savings rates — could reduce or wipe out bonus earnings from credit card rewards.

NerdWallet rates Bank of America® banking offerings as fair overall, although the bank excels at some aspects and not others.

Credit card rewards shouldn’t drive your decision on where to do banking and investing. But if your relationship with Bank of America® qualifies you for preferred status, be sure to reap your Preferred Rewards.

» MORE: How to choose a bank

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards > Reviews

Bank of America Preferred Rewards program 2024 review

Sarah Brady

Glen Luke Flanagan

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 2:09 p.m. UTC Feb. 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Bank of America’s Preferred Rewards program provides opportunities for the institution’s customers to boost the rewards earned on their credit cards, increase the interest earned on savings account funds and enjoy reduced interest rates and fees on certain financial products such as mortgages and auto loans.

The Preferred Rewards program charges no fees for participating, and the perks make it a no-brainer for those who qualify. But the threshold for entry might be daunting to some, as the lowest tier requires a combined average daily balance of $20,000 or more in Bank of America and Merrill accounts over the past three months.

- Bank of America® Travel Rewards credit card

Welcome Bonus

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- 15 billing cycles of intro APR financing on both new purchases and on qualifying balance transfers.

- Earn an unlimited 1.5 points per $1 on purchases.

- No foreign transaction fees so it’s a good choice to use abroad.

- Points must be redeemed towards eligible travel and dining purchases for maximum redemption value.

- You can’t transfer rewards to airline or hotel partners.

Card Details

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

What is the Bank of America Preferred Rewards program?

Bank of America Preferred Rewards is a program for customers who meet certain criteria in terms of funds in Bank of America bank accounts or investments with Merrill. It offers five tiers, and comes with a package of perks including more cash back on certain Bank of America credit cards and waived or discounted fees on various other types of accounts. The Preferred Rewards program tiers, from lowest to highest, are as follows:

- Platinum Honors

- Diamond Honors

Even at the lowest tier, the Gold level, you’ll get the following benefits:

- Elevated rewards for spending on eligible credit cards.

- Increased interest rate on savings accounts .

- Waived maintenance fees on checking and savings.

- Discount on auto loans and mortgage origination fees.

- Merrill Guided Investing Program discounts.

Customers who qualify for the Diamond and Diamond Honors tiers will also have access to “lifestyle benefits.” Not much is disclosed about these benefits upfront, but they may include exclusive travel packages, extensive golf course access and savings on certain luxury automobile brands like Mercedes.

How does the Preferred Rewards program work?

When you enroll for Preferred Rewards, your combined average account balances over the prior three months will be used to determine which Preferred Rewards tier you fall into. Any of the following accounts on which you’re an owner or co-owner will be will be considered to determine your eligibility:

- Bank of America – checking, savings, certificate of deposit and IRAs.

- Merrill – Cash Management Accounts, IRAs and 529 Plans.

Another perk of the program is that you can’t lose your tier status if you dip below the minimum balance requirement during the first year. You can, however, be automatically moved to a higher tier if your balances increase.

Preferred Rewards tiers

What credit cards are eligible for preferred rewards.

Bank of America’s web page on boosting your credit card rewards through the Preferred Rewards program lists five cards that are eligible. You can use any of the following cards with the program, as long as your account is open and has active charging privileges.

- Bank of America® Customized Cash Rewards credit card

- Bank of America® Unlimited Cash Rewards credit card

- Bank of America® Premium Rewards® credit card

- Bank of America® Premium Rewards® Elite credit card * The information for the Bank of America® Premium Rewards® Elite credit card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Note that co-branded credit cards issued by Bank of America are not eligible for the program.

Also, this program is specifically for consumer products. Thus, small business credit cards are not eligible. However, the bank also offers a similar program for business owners called Preferred Rewards for Business.

How do I join the Preferred Rewards program?

You’ll need an active and eligible Bank of America checking account in order to enroll in Bank of America’s Preferred Rewards program. Customers can enroll by logging in to their online banking account. No documents are required to complete enrollment and there’s no fee to sign up or to participate.

Benefits typically become active within 30 days of enrollment.

Frequently Asked Questions (FAQs)

Bank of America Preferred Rewards is a program that customers of the bank can enroll in, if they meet eligibility requirements, to increase their credit card rewards. The bank issues a variety of popular cash-back and points-earning credit cards, including the Customized Cash Rewards credit card and the Unlimited Cash Rewards credit card. Both of these are eligible for boosted earnings through the Preferred Rewards program.

A Preferred Rewards client is someone who is enrolled in Bank of America’s Preferred Rewards Program. You may be eligible to enroll if you have at least $20,000 in combined deposits in your Bank of America accounts and your Merrill investment accounts.

The Preferred Rewards program is worth it for eligible Bank of America customers since there are no fees or charges for enrolling, and the program can help you earn more interest on savings and more rewards on credit card spending, not to mention providing discounts on other financial products from the bank.

The value of Bank of America rewards points can vary depending on how you use them. According to Bank of America’s website, 50,000 online bonus points potentially have a value of $500.

Note that rewards points are not one of the benefits you get with the Preferred Rewards program. Rather, you earn these points by making purchases on an eligible Bank of America rewards credit card.

*The information for the Bank of America® Premium Rewards® Elite credit card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Sarah Brady is a personal finance writer and educator who's been helping individuals and entrepreneurs improve their financial wellness since 2013. Sarah's other publications include Investopedia, Experian, the National Foundation for Credit Counseling (NFCC), Credit Karma and LendingTree and her work has been syndicated by Yahoo! News and MSN. She is also a former HUD-Certified Housing Counselor and NFCC-Certified Credit Counselor.

Glen Luke Flanagan is a deputy editor on the USA TODAY Blueprint credit cards team. Prior to joining Blueprint, he served as a deputy editor on the credit cards team at Forbes Advisor, and covered credit cards, credit scoring and related topics as a senior writer at LendingTree. He’s passionate about helping people understand personal finance so they can make the best decisions possible for their wallet. Glen holds a master's degree in technical and professional communication from East Carolina University and a bachelor's degree in journalism from Radford University.

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne

Breeze Airways releases new Breeze Easy credit card with lofty rewards, up to 10 points per $1

Credit Cards Stella Shon

Chase Sapphire Preferred vs. Bank of America Travel Rewards: Which should beginner travelers get?

Editor's Note

If you're jumping into the travel rewards game, picking which credit card to start with can be overwhelming. There are a lot of competitive options, each with its own set of advantages and disadvantages.

In this guide, I will walk through two popular beginner travel credit cards — the Chase Sapphire Preferred Card and the Bank of America® Travel Rewards credit card . Both offer an entry point into earning travel rewards, but which is best for your wallet?

Chase Sapphire Preferred vs. Bank of America Travel Rewards comparison

Before we dive deeper into how these cards stack up against each other, let's run through a quick overview of each card's details.

*Point value is based on TPG calculations and is not provided or reviewed by the issuer.

Sapphire Preferred vs. BofA Travel Rewards welcome offer

The Chase Sapphire Preferred clearly has a superior bonus in terms of value. You'll receive 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth up to $1,200 according to TPG valuations .

By comparison, you'll only get 25,000 points after spending $1,000 in the first 90 days of account opening (a $250 value) from the Bank of America Travel Rewards credit card .

However, something to keep in mind here is the spending requirements. While you must spend $4,000 in the first three months to earn the Chase Sapphire Preferred bonus, you'll only need to spend $1,000 in the first 90 days with the Bank of America Travel Rewards credit card.

At the end of the day, the value of the bonus doesn't matter if you can't reasonably hit the spending requirements. For those with smaller budgets, the Bank of America Travel Rewards sign-up bonus might be the more attainable (and therefore more beneficial) option — though be sure to check out our guide on reaching minimum spending thresholds for tips on how to hit a higher requirement.

Winner : Sapphire Preferred.

Sapphire Preferred vs. BofA Travel Rewards benefits

Neither of these cards is a premium travel card , which means they offer comparatively few additional benefits.

That said, the Chase Sapphire Preferred stands ahead in this category, as it does offer cardholders at least one complimentary year of DashPass service, which gives you $0 delivery fees and reduced service fees on eligible DoorDash food delivery and takeout purchases (must activate by Dec. 31, 2024).

You'll also get a $50 annual hotel statement credit for reservations booked through the Chase travel portal, plus a solid lineup of credit card protections , including trip cancellation/interruption insurance, primary car rental coverage, baggage delay insurance, trip delay reimbursement, travel and emergency assistance services, purchase protection and extended warranty protection.

On the other hand, the Bank of America Travel Rewards card is much more limited, though — like the Sapphire Preferred — it is a Visa Signature card, so that will provide some benefits .

Earning points on the Sapphire Preferred vs. BofA Travel Rewards

Once again, the Chase Sapphire Preferred comes out ahead in the earning department. You'll earn 3 points per dollar on dining and 2 points per dollar on travel purchases, plus 5 points per dollar on Lyft purchases (through March 2025).

On the other hand, the Bank of America Travel Rewards credit card earns 1.5 points per dollar across all purchases. However, preferred cardholders can boost this earning rate significantly. If you are an existing Bank of America customer with enough money stashed away with the bank to qualify for the Preferred Rewards program , you can earn anywhere from 1.87 points per dollar to 2.62 points per dollar on all purchases.

Those who are Platinum Honors Preferred Rewards members (meaning you'll earn 2.62 points per dollar on all purchases) might end up getting more value from earning this higher flat rate across all purchases in the long term.

Winner: Sapphire Preferred.

Redeeming points on the Sapphire Preferred vs. BofA Travel Rewards

Another major difference between the two cards is the redemption options.

The Bank of America Travel Rewards credit card earns fixed-value points, like cash back on eligible purchases. You can redeem your Bank of America Travel Rewards points at a value of 1 cent apiece as a statement credit to cover travel and dining purchases. Otherwise, you'll get 0.6 cents value from each point by requesting a check or deposit from the bank.

With the Sapphire Preferred, you can redeem your points at a 25% bonus for travel when you book through the Chase travel portal, plus you get many more options when transferring points (see below).

Transferring points on the Sapphire Preferred vs. BofA Travel Rewards

The Chase Sapphire Preferred offers a lot more flexibility in its redemption options. You can transfer points at a 1:1 rate to one of Chase's 14 valuable transfer partners . At a minimum, you can get a 1.25-cent value from your points through the Chase portal, but transferring to the right partner could get you even more value.

While there's something to be said about the simplicity of Bank of America's redemption process, Chase still takes the cake with more potential value and flexibility.

Should I get the Sapphire Preferred or BofA Travel Rewards?

On paper, the Chase Sapphire Preferred is certainly the more valuable credit card. It comes with a higher sign-up bonus, a more robust earning rate (unless you are one of the few who have over $100,000 in eligible Bank of America banking or investment accounts to qualify for Platinum Honors Preferred Rewards status), more value and flexibility in redemption options and more travel protections.

However, that doesn't automatically mean it's the better card for you .

For starters, the Chase Sapphire Preferred comes with a $95 annual fee. While many will be able to easily offset that cost with the Chase Sapphire Preferred's earning rates and other benefits, beginners with small budgets may want to start with a no-annual-fee credit card like the Bank of America Travel Rewards card.

Something else to consider is that the Bank of America Travel Rewards credit card is great for beginners who do not want to worry about maximizing redemption options or varied bonus categories. You're earning a flat rewards rate across every purchase, no matter what.

And then, those rewards can be redeemed at a fixed rate as a statement credit. It's simple and easy, which may appeal to beginners who feel overwhelmed at the idea of transfer partners and travel portal redemptions.

Bottom line

While both may be considered starter travel credit cards , each appeals to a different audience. For those who hope to build a robust travel credit card strategy and learn about how to maximize transfer partners and card pairings, the Chase Sapphire Preferred is a great starting place.

But if the thought of navigating transferring points to a specific airline and juggling different bonus categories and temporary perks makes you break out into hives, the simplicity of the Bank of America Travel Rewards credit card makes it an excellent choice.

At the end of the day, it's all about deciding which type of travel credit card meets your specific wants and needs.

Official application link: Chase Sapphire Preferred

Official application link: Bank of America Travel Rewards

A dditional reporting by Madison Blancaflor.

Bank of America Travel Rewards card vs. Chase Sapphire Preferred

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- When it comes to travel-related card perks, the Chase Sapphire Preferred is an overall better choice than the Bank of America Travel Rewards credit card, but the Travel Rewards can still be the right choice for some people.

- Bank of America offers a Preferred Rewards program that boosts the rewards rates of its credit cards, so if you're already a member of this program, you'd get a lot more value out of this card

- The Sapphire Preferred also has a better welcome bonus offer and a higher overall rewards rate, but the Travel Rewards card has no annual fee and offers a 0 percent introductory APR on purchases and balance transfers.

If you’re trying to decide between the Bank of America® Travel Rewards credit card and the Chase Sapphire Preferred® Card , you have quite a bit to think about. For example, you’ll have to consider your routine spending habits, the type of rewards you want to earn and whether you’re comfortable paying an annual fee.

In the meantime, you should also consider whether you could benefit from a 0 percent APR on purchases for a limited time. Why? Because only one of these cards gives you this opportunity.

While the Bank of America Travel Rewards card and Chase Sapphire Preferred have quite a bit in common, there are some areas where one card undoubtedly beats out the other. Read on to learn which of these cards wins in the most important categories, as well as reasons to sign up for either option.

Main details

Bank of america travel rewards card vs. chase sapphire preferred highlights.

Both cards offer generous rewards for travel and let you redeem your points for flexible options. However, the Chase Sapphire Preferred beats out the Bank of America Travel Rewards card in the more important categories.

Chase Sapphire Preferred

Why it wins.

While you do have to meet a higher spending threshold ($4,000 within three months of account opening) to earn the welcome bonus on the Chase Sapphire Preferred, the spending threshold is still reasonable, and the bonus is worth significantly more.

Chase Ultimate Rewards points are worth a minimum of 1 cent each when redeemed for cash back or statement credits, so 60,000 bonus points have a baseline value of $600. However, users get 25 percent more value when they redeem for travel through the Chase Ultimate Rewards portal, so these points are worth $750 in travel when redeemed through Chase.

By contrast, the 25,000 online bonus points you can earn with the Bank of America Travel Rewards card (after spending $1,000 within the first 90 days) are only worth $250. And even with the rewards rate boost from being a Bank of America Preferred Rewards member (more on that later), the welcome bonus would only be worth $437.50, which is still less than the Sapphire Preferred’s bonus.

The Bank of America Travel Rewards card does offer a higher rate of 1.5X points on all regular spending compared to the Sapphire Preferred, and Preferred Rewards members can earn even more than that.

The Bank of America Preferred Rewards program allows cardholders who have over a certain amount of money in eligible Bank of America accounts to get special perks and rewards rates. Here’s the breakdown for each Preferred Rewards tier:

So if you were a Preferred Rewards Platinum Honors member or higher, you’d earn 2.62X points instead of just 1.5X, which is a significant boost in rewards. However, the savings threshold for a 75 percent boost is pretty high, and even with a boost like this, the Travel Rewards card has no bonus categories for customers to maximize.

On the other hand, the Chase Sapphire Preferred offers more rewards in several everyday categories. For example, Sapphire Preferred cardholders earn:

- 5X points on travel through Chase Ultimate Rewards (and on Lyft rides through March 2025)

- 3X points on dining (including eligible delivery services), select streaming services and online grocery purchases (excluding Walmart, Target and wholesale clubs)

- 2X points on general travel

- 1X points on everything else

These lucrative bonus categories can help the average family boost their rewards despite the lower rate of 1X points on non-bonus spending.

Bank of America Travel Rewards card

The Bank of America Travel Rewards credit card doesn’t charge an annual fee , so it wins in this category. With no annual fee to pay or keep track of, this Bank of America travel card is an easy option to keep for the long haul. In comparison, the Chase Sapphire Preferred charges a $95 annual fee, and it’s not waived the first year.

With the Bank of America Travel Rewards credit card , new customers are eligible for an introductory 0 percent APR on purchases and balance transfers for 18 billing cycles, followed by a variable APR of 18.24 percent to 28.24 percent. This offer can be immensely helpful for consumers who want to pay down large purchases over time, as well as those who may need to carry a balance when cash is tight. Just remember that intro balance transfers for this card must be made in the first 60 days from account opening, and a 3 percent fee ($10 minimum) applies to all balance transfers.

If you carry a balance on the Chase Sapphire Preferred, you’ll pay a variable APR of 21.49 to 28.49 percent right off the bat. Even on the lower end, the interest you’ll pay will cost significantly more than the value of the rewards you can earn with this card.

Which card earns the most?

Now for the interesting part. Which of these travel credit cards will net you the most in rewards? That really depends on how you use your card and the categories you spend the most in.

Our spending example shows how much the average family might earn with either card.

Bank of America Travel Rewards card vs. Chase Sapphire Preferred spending example

This example scenario shows the average rewards for a family of four with a man and woman under the age of 50 and two kids between the ages of 9 and 11. The average food spending for this family would work out to $1,324.30 per month (or $15,891.60 per year) on a moderate plan, according to the USDA .

Since we’re comparing cards for people who travel, let’s also estimate that this family spends $5,000 per year on airfare, hotels and other travel purchases, with half of it able to be booked through the Ultimate Rewards portal. Add onto that $300 per month ($3,600 per year) in restaurant purchases and $1,000 per month ($12,000 per year) on miscellaneous purchases.

With the Bank of America Travel Rewards credit card, earnings would total 68,420 to 95,606 points, depending on their Preferred Rewards membership status. With the Chase Sapphire Preferred credit card, earnings would total 87,973 points. As you can see, the Chase Sapphire Preferred would net more points overall — but with some caveats.

Which card will suit your spending habits?

The Chase Sapphire preferred only has boosted rewards rates on grocery purchases if you make those purchases online, and its 5X rewards rate on travel only applies to purchases made through the Chase Ultimate Rewards portal. Without shopping online or using the Chase Ultimate Rewards portal, you’d get less points.

Also, the Bank of America Travel Rewards credit card could earn more if you’re at least at the Preferred Rewards Platinum Honors member tier or higher.

If you’re already a Bank of America loyalist and plan on keeping your Platinum Honors status or higher, then the Travel Rewards card might be better off for your budget. But if you’re not a Preferred Rewards member, you’ll likely get more mileage out of your Sapphire Preferred — especially given that their points are worth much more if you transfer them to a high-value travel partner.

Why should you get the Chase Sapphire Preferred?

The spending example above shows that the Chase Sapphire Preferred can help the average family earn more rewards on their spending, but there are other reasons to sign up for this card.

Additional benefits

- Primary rental car coverage

- Trip cancellation and interruption insurance worth up to $10,000 per person and $20,000 per trip

- Baggage delay insurance

- Trip delay coverage

- Travel and emergency assistance services

- Purchase protection against damage or theft

- Extended warranties

Redemption options

- British Airways

- Southwest Rapid Rewards

- United MileagePlus

- Marriott Bonvoy

- World of Hyatt

When you transfer your rewards to partners for premium redemptions, Chase points can be worth up to 2 cents each, according to the latest valuations from Bankrate .

Recommended credit score

Why should you get the bank of america travel rewards card.

While the Chase Sapphire Preferred is hard to beat, there are some compelling reasons to choose the Bank of America Travel Rewards card instead — its lack of an annual fee among the biggest. Other reasons to sign up include a generous intro APR period and unique opportunities to boost your earnings.

- The Bank of America Preferred Rewards program. As previously stated, this program allows cardholders to earn 25 percent to 75 percent more points depending on their combined balance between eligible Bank of America or Merrill accounts.

- The BankAmeriDeals program. By activating your BankAmeriDeals offers , you can earn additional cash back with a rotating selection of retailers.

- The Museums on Us program. This program allows Bank of America cardholders to earn free entry to select cultural centers during the first week of every month.

- Trailer parks, motorhomes and recreational vehicle rentals

- Campgrounds

- Car, truck, trailer and boat rentals

- Cruise lines

- Travel agencies, tour operators and real estate agents

- Passenger trains

- Taxis, ferries and limousines

- Parking lots and garages

- Tolls and bridge fees

- Tourist attractions and amusement parks

- Art galleries and museums

- Carnivals and circuses

- Aquariums and zoos

The Travel Rewards card also lets you redeem your points for gift cards and cash back as a deposit into an eligible Bank of America or Merrill Money Management account.

The bottom line

The Chase Sapphire Preferred definitely has more to offer out of these two cards, yet the Bank of America Travel Rewards card’s lack of an annual fee and generous intro APR makes it a good option, too — especially if you already have a significant amount of money saved up in Bank of America accounts.

If you still can’t decide between these two cards, however, it never hurts to compare them to alternative travel credit cards from Chase , Bank of America and other major issuers.

Issuer-required disclosure statement

Information about the Bank of America® Travel Rewards credit card was last updated on February 7, 2024.

Article sources

We use primary sources to support our work. Bankrate’s authors, reporters and editors are subject-matter experts who thoroughly fact-check editorial content to ensure the information you’re reading is accurate, timely and relevant.

“ Official USDA Food Plans ” U.S Department of Agriculture. Accessed on February 7, 2024.

“ Museums on Us ” Bank of America. Accessed on February 7, 2024.

Related Articles

Bank of America Premium Rewards credit card vs. Chase Sapphire Preferred

Southwest Rapid Rewards Plus Credit Card vs. Chase Sapphire Preferred

Bank of America Premium Rewards vs. Bank of America Travel Rewards Credit Card

Petal 1 vs. Discover it Secured

Important notice

You are leaving bank of america.

You are continuing to another website that is not affiliated with Bank of America or Merrill. Bank of America is not responsible for and does not endorse, guarantee or monitor content, products, services and level of security that are offered or expressed on other websites. Please refer to the website’s posted privacy policy and terms of use. You can click the Cancel button now to return to the previous page.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the Digital Advertising Alliance or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Preferred Rewards

Maximize your rewards earn with exclusive benefits

Members of the award-winning Bank of America Preferred Rewards® program enjoy many exclusive benefits and pricing discounts, all designed around the ways you save, spend and borrow with Bank of America and invest with Merrill. 1 When your balances work together, you can maximize the rewards you earn. On average, members increased their overall benefits to $500 a year. 2

Don't have a Bank of America checking account yet?

Open an account

*Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about Merrill pricing, visit merrilledge.com/pricing .

It's so easy to be rewarded for what you already do

There's no fee to enroll or participate in Preferred Rewards. To become a member, you'll need:

Bank of America checking account

Must be an active, eligible account

$20K 3-month average combined balance Includes balances in your Bank of America deposit and/or Merrill investment accounts

Don’t have a Bank of America account yet?

Open a checking account

Manage all your rewards in one place with Bank of America My Rewards

Track your rewards, deals and benefits throughout the year

Explore what’s available and start redeeming

Discover additional benefits so you never have to miss out

Enroll in Preferred Rewards if you're eligible

Maximize with Merrill

Your Merrill investment accounts and Bank of America deposit balances both count towards helping to maximize the Bank of America Preferred Rewards you could earn.

Awards and accolades

Best Customer Loyalty Programs List 12

Best Bank Customer Loyalty Program 13

The Ascent (a Motley Fool service)

Frequently asked questions

What is the Preferred Rewards program?

The Bank of America Preferred Rewards program offers real benefits and rewards on your everyday banking and investing. And as your qualifying Bank of America® deposit accounts and/or Merrill® investment balances grow, so do your benefits.

Your benefits are based on your tier, and your tier is based on the qualifying combined balances in your Bank of America deposit and/or Merrill investment accounts. Once you’re a Preferred Rewards member, you'll keep your program benefits for at least a full year, so no need to worry if your balances dip temporarily. In addition, your balances are reviewed monthly to see if you qualify for a higher tier. If so, you'll automatically move to the next level of rewards.

How do I qualify?

All you need to qualify is an eligible Bank of America® personal checking account and a three-month combined average daily balance of $20,000 or more in qualifying Bank of America deposit accounts and/or Merrill® investment accounts . Then you can enroll in the program.

Log in to Online Banking to see if you qualify

Are there any fees associated with the Preferred Rewards program?

No. There is no fee to join, no fee for ongoing participation, no fee to opt-out. There are no fees associated with Preferred Rewards.

What value of benefits could I potentially earn?

The value to you will be determined by all the ways you can utilize the various benefits. On average members increased their overall benefits to $500 a year with Preferred Rewards. For example, you could potentially benefit from interest rate discounts, credit card rewards bonuses, no-fee ATM transactions and Merrill Guided Investing Program discounts. To find out more, check out our Preferred Rewards calculator .

Do I have to enroll to become a Preferred Rewards member?

Yes, through Online Banking, but enrollment is simple. There are no fees to join or participate in Preferred Rewards. And once you're enrolled, as your balances qualify you for the next level of rewards, you'll receive an automatic tier upgrade.

Log in to Online Banking to get started

What happens if my program balance drops after I enroll in Preferred Rewards and I go into a grace status?

No need to worry if your balances dip temporarily; you'll keep your Preferred Rewards program status for a full year. If after a year you no longer meet the balance requirement, you'll get a three-month grace period. If you haven't met the balance requirement after those three months, you'll be moved to a lower tier or lose your Preferred Rewards benefits, if you no longer qualify.

If you meet the balance requirements again within 24 months after losing your benefits, we’ll automatically reinstate your Preferred Rewards membership. If you meet the requirements after 24 months, you’ll need to re-enroll in the program.

Learn more about how we calculate your balance and tier level

What is included in the no-fee banking services?

Here are some of the no-fee services that Preferred Rewards members are eligible for, based upon their tier:

- Monthly maintenance fees are waived on checking and savings accounts, for up to four accounts for the Gold, Platinum and Platinum Honors tiers; unlimited number of accounts for Diamond tier

- ATM/Debit card rush fees are waived for all Preferred Rewards tiers

- Non-Bank of America ATM fees are waived for withdrawals, transfers, and balance inquiries at the Platinum tier and above – one per statement cycle for Platinum; and unlimited for Platinum Honors and Diamond tiers

- ATM international transaction fees are waived for Diamond tier

- Incoming domestic wire transfer fees are waived for all Preferred Rewards tiers

- Outgoing wire transfer fees are waived (two per statement cycle), for Diamond tier

- Check image service fee is waived for all Preferred Rewards tiers

- Stop payment fee is waived for all Preferred Rewards tiers

- Small safe deposit box is available for Platinum tier and above

What is My Rewards?

My Rewards is where you can see the value of all your rewards in one convenient place , whether you’re in Online Banking or on the Bank of America Mobile Banking app. 14 It tracks your Preferred Rewards benefits, credit card rewards and BankAmeriDeals® 15 in a single location, so you can review at a glance and explore other available benefits that you may not be using. Your three-month average daily balance is also displayed in My Rewards.

Do I need to open new accounts to take advantage of Preferred Rewards benefits?

It depends on which accounts you already have. To become a Preferred Rewards member, you must have an active, eligible Bank of America® checking account. Once you enroll in Preferred Rewards, you can receive benefits on your existing eligible Bank of America banking and Merrill ® investing accounts.

To take advantage of some Preferred Rewards benefits, your existing accounts may require an account conversion, or you may want to open a new account to receive other program benefits. For example, for savings and credit card benefits, you'll need:

- A Bank of America Advantage Savings account , to receive the savings interest rate booster

- An eligible Bank of America credit card , such as the Unlimited Cash Rewards, Customized Cash Rewards, Travel Rewards, or Premium Rewards® card, to receive the credit card rewards bonus

Once you’re enrolled in Preferred Rewards, you can speak with a specialist to convert your existing savings account to a Bank of America Advantage Savings account or open a new credit card account that's eligible for the rewards bonus.

How can I move to a higher Preferred Rewards tier?

After you enroll, you can move to a higher Preferred Rewards tier — and enjoy more benefits and rewards — by increasing your qualifying Bank of America® deposit and/or Merrill® investment balances. Every month, we'll review your three-month average daily balance and if it’s high enough, you'll receive an automatic tier upgrade. To view your qualifying three-month combined average daily balance, log in to Online Banking or use our mobile app and go to My Rewards.

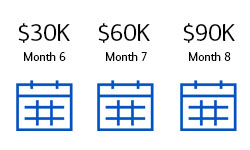

Here's an example:

You’ve been a Preferred Rewards Gold tier member for six months, with an average combined daily balance in your Bank of America and Merrill accounts of $30,000. If your average balance reached $60,000 in month seven and $90,000 in month eight, you’d qualify for the Platinum tier because your three-month average daily balance would be $60,000.*

*Your tier upgrade may take a bit longer if there are other changes to your account.

What extra benefits are available in the Preferred Rewards Diamond tier?

Diamond tier members have access to a curated suite of luxury benefits and extraordinary experiences across dining, travel, culture, and more. For more details, review the exclusive benefits available to Diamond tier members.

How can Preferred Rewards help me earn more rewards on my Bank of America credit cards?

Once you’re a Preferred Rewards member, you’ll earn 25% to 75% more rewards on every purchase made with eligible Bank of America® credit cards. For example, a purchase that typically earns $1.00 in cash rewards will earn $1.25 to $1.75, depending on your Preferred Rewards tier. Bank of America credit cards offer many different benefits to enhance what matters most to you — from cash back to dining and travel rewards. Learn more about how Preferred Rewards can boost your credit card rewards .

When will my Preferred Rewards benefits become active?

Typically, Preferred Rewards benefits become active within 30 days of your enrollment. Some benefits are automatically activated upon the effective date of your enrollment, requiring no action on your part. If you’ve opened a new account and enroll in Preferred Rewards, your benefits will become active within 30 days of account opening, unless we indicate otherwise. Note that some rewards may require you to open a new account or take other action to enjoy the complete benefits.

How can I increase my balance in order to qualify for Preferred Rewards?

To meet the minimum $20,000 combined balance requirement, you can move money over from accounts at other banks or investment firms, such as 401(k) or IRA accounts, or perhaps a vacation or rainy-day fund.

Do I need to have a Bank of America® checking account to be a Preferred Rewards member?

Yes, to enroll in Preferred Rewards you’ll need an eligible Bank of America® personal checking account and a three-month combined average daily balance of $20,000 or more in eligible Bank of America deposit accounts and/or Merrill® investment accounts.

Can I enroll in Preferred Rewards now, even though I need to open a Bank of America® checking account and maintain the qualifying balance?

Yes, we offer early enrollment if you don’t currently have an eligible Bank of America® personal checking account (or haven’t had one in 12 months or more). You’ll need to open an eligible checking account, then you’ll have the option to enroll in Preferred Rewards.

You must have the minimum combined balance of $20,000 in your eligible Bank of America deposit accounts and/or your Merrill® investment accounts within 30 days of opening the checking account. Once you meet the $20,000 balance requirement, you’ll be automatically enrolled in Preferred Rewards.

This means that you can enroll in the program early, before you’ve met the three-month combined average daily balance minimum requirement of $20,000.

How could having a Merrill® investment account help me get to a higher Preferred Rewards tier?

Merrill® investment account balances count toward Preferred Rewards tier balance requirements to help you make the most of all the program benefits and get to a higher tier.

How is Merrill related to Bank of America?

Merrill and Bank of America are both wholly-owned subsidiaries of Bank of America Corporation. The Bank of America Preferred Rewards program is designed to offer benefits based on the breadth of a client’s relationship with us, including the combined balances in their eligible Bank of America® deposit accounts and/or Merrill® investment accounts.

What types of auto loans are eligible to receive the Preferred Rewards auto loan interest rate discount?

The Preferred Rewards auto loan interest rate discount only applies to new loan applications that you submit directly to Bank of America through its website, Financial Centers, or Bank call centers. Discounts are not available for motor vehicle leases or for applications sourced from car dealerships, car manufacturers, or third-party branded/co-branded relationships.

How can I earn rewards on my Bank of America® small business accounts?