June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; (North) Korea, Democratic People's Rep; Russian Federation; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

How to Calculate Trip Cost for Travel Insurance: The Simple Guide

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Search Search Please fill out this field.

- Tax Planning

What Are Travel Expenses for Tax Purposes?

How travel expenses work, how to calculate and file travel expenses, what tax-deductible travel costs mean for individuals, frequently asked questions (faqs).

Marko Geber / Getty Images

Travel expenses are certain travel-related business costs that you can deduct for tax purposes.

Key Takeaways

- Travel expenses are tax-deductible costs associated with traveling for business, away from your main workplace.

- Travel expenses eligible for tax deduction need to be “ordinary and necessary” and have a business purpose

- You generally can’t deduct costs such as those incurred for a personal vacation.

- Only businesses, including self-employed individuals, can typically deduct travel expenses.

When filing taxes, your travel expenses are the costs associated with travel that a business can generally deduct. The Internal Revenue Service (IRS) defines these costs as “ordinary and necessary expenses of traveling away from home for your business, profession, or job.”

For example, a business owner might drive to a client’s office a few hours away and stay at a hotel overnight before driving home the next day. In that case, the business owner can often deduct travel expenses such as gas (or they might use the standard mileage rate rather than adding up actual car expenses ) and lodging.

However, not all travel costs are tax-deductible travel expenses. For one, traveling to and from your home to your main office wouldn’t count as travel, because that would just be commuting, which isn’t deductible. Also, tax-deductible travel expenses can’t be “lavish or extravagant,” per the IRS.

While these terms can be somewhat subjective, it helps to refer back to the “ordinary and necessary” guidelines. If your business is centered around blogging about luxury resorts, then perhaps staying at some higher-end hotels could be considered an ordinary part of doing your job. Yet, if you’re a self-employed graphic designer and you travel to another city to see a client, it might not be considered ordinary to stay at a $1,000-per-night hotel when plenty of other reasonable options exist at around a $200 price point.

In addition to being ordinary and necessary, travel expenses also need to be for business use to be deductible, rather than personal use. So you generally can’t deduct the cost of a family vacation as travel expenses just because you’re a business owner.

Travel expenses are reported by businesses on relevant forms when filing taxes, which can reduce taxable income. For example, a self-employed individual often uses Schedule C to report their business income and business expenses , with travel being a line item within the “Expenses” section.

Adding up travel costs can differ a bit based on the taxpayer’s preferences. For example, when it comes to accounting for travel expenses related to driving, you can use either the standard mileage rate (58.5 cents per mile for tax year 2022) or add up actual costs, such as gas, depreciation, insurance, etc. Also keep in mind that someone who has a vehicle that they drive for both business and personal use can only deduct the portion used for business.

Other nuances include the cost of meals while traveling. Generally, only 50% of business meals can be deducted, although certain exceptions apply. However, business owners might decide instead to take the standard meal allowance , which is a daily amount that covers food and incidental expenses, with the exact amount depending on where the travel takes place.

By taking generalized deductions such as the standard meal allowance when counting up travel expenses, a business owner doesn’t necessarily need to save receipts from every food purchase while on the road.

You still need to keep records to prove the business travel took place. Otherwise, if your business gets audited and has insufficient records to justify travel expenses, you could potentially face penalties.

Understanding travel expenses can be helpful for individuals who have their own businesses, including those who freelance or do gig work, thus filling out tax forms such as Schedule C . By accounting for these costs, you can reduce your taxable income, meaning you pay less in taxes than you would if you didn’t deduct these expenses. Consulting with a tax professional or other relevant expert could help you fully and accurately take advantage of these tax-saving opportunities.

However, individuals who do not have business income, such as those who are W-2 employees, generally can’t take any travel expenses on their personal returns. So, even if your employer doesn’t pay you back for business travel, you typically can’t deduct these expenses.

Which business travel expenses are tax deductible?

Expenses incurred when you travel away from your home for your job may be tax deductible. These expenses include costs of travel by airplane, train, bus or car. Transportation fare between hotel and work on the trip and cost of baggage. Eligible expenses may also include lodging, meals, drying cleaning, laundry, cost of business communication and any tips paid out while on the business trip.

What percentage of business travel expenses are tax deductible?

You can deduct 100% of your business travel expenses if they meet certain criteria. The expenses should be "ordinary and necessary" expenses incurred while traveling away form home for your job and must not be "lavish or extravagant." You cannot deduct expenses incurred in your commute to work as travel expenses. If you drive a car for both personal and business trips, only the business part of the usage is deductible. You may also be able to deduct up to 50% of your meals while traveling as business expense.

IRS. " Topic No. 511 Business Travel Expenses ."

IRS. " Schedule C (Form 1040) Profit or Loss From Business ."

IRS. " IRS Issues Standard Mileage Rates for 2022 ."

IRS. " Here’s what taxpayers need to know about business related travel deductions ."

- Travel Planning Guide

Estimating Travel Costs

As we have mentioned many times throughout this website, there are many factors that contribute to the cost of your trip. Every traveler and every trip is different. If you're on a longer trip, some people will tell you it's not possible to predict how much your trip will cost. This simply isn't true. While there are many variables that will affect how much you spend, budgeting a trip is like budgeting anything else in life. You have to account for your own personal variations and preferences. Having a budget is crucial to making sure your trip doesn't financially spin out of control. That being said, it can be hard to exactly predict a specific cost, but it is possible to get fairly close. Naturally, the shorter the trip, the easier this is, but this process is catered towards people that are planning longer trips.

How much should a trip cost?

There are too many factors that affect a travel budget , so there is no simple way give a rough estimate of cost, especially if your trip is more than just a few days or weeks. What type of hotels are you staying in? How will you get from place to place? Transportation and accommodation are two of the most expensive areas that travelers spend money on, but there are many more.

Factors that affect a travel budget:

Where you choose to visit will have the biggest impact on your budget. Europe and the U.S. are expensive, while India and Cambodia are very inexpensive. Naturally, spending a longer period of time in cheaper locations will allow you to stretch your budget and travel longer. There are some surprisingly expensive destinations that you should be aware of. Brazil and Argentina are much more expensive than some of their nearby South American neighbors. West Africa is also quite expensive due to limited hotel and restaurant options (those that are available are overpriced and of low quality). Eastern Europe remains cheaper than most of Western Europe, but prices continue to rise and Eastern Europe is no longer the extreme budget destination it once was. This is particularly true for places like Greece and Croatia, that have long been discovered by travelers and vacationers alike. Asia is a mixed bag, with more developed countries costing more, and many developing countries (particularly in Southeast Asia) being much cheaper.

Your travel style can have a significant effect on your budget. If you're on a truly tight budget then you will likely have to sacrifice some level of comfort and luxury during your trip. Using public transportation is cheaper than hiring taxis or renting cars, but often not as efficient or relaxing. Staying in hostels or budget hotels is probably the most effective way to save money. You'll need to figure out your priorities, though. Are you willing to share a bathroom, or even sleep in a shared room in order to travel for a longer time period? But with these sacrifices come some rewards. In many places, locals take public transportation so you'll have a chance to interact with the people of the community and you'll get to experience what daily life is really like. Although hostels offer less privacy, they also give you the chance to meet other travelers, many of whom are also on long term trips. These travelers are an excellent source of information and travel tips. It's also fun to have the company, particularly if you've been traveling by yourself for a while.

The time of year you travel to some places can also make a difference in cost. Traveling in the low season or shoulder season can often land you significant discounts. These discounts are not nearly as large as the savings you will get from staying in hostels or budget hotels, however. Also, be aware that some travel destinations essentially close down during the low season. This is particularly true in areas with extreme weather fluctuations. If most of the area's hotels and restaurants are closed, then those few that remain open will likely raise their price significantly. Also, if you're traveling somewhere specifically to experience the outdoor activities, then make sure you go during the best season. Places like Nepal or Patagonia are obvious trekking destinations. There are very specific seasons when it is best to travel there, and you are better off if you arrange your trip around these times, but the prices are also highest during these periods.

How quickly you travel from place to place will significantly affect your budget as well. Transportation is expensive, especially if you fly often. Taking local overland transportation tends to be the cheapest way to go, but it's not as cheap as just staying put for awhile. Besides, taking a longer time to get to know a place is when you open yourself up to the most interesting experiences. Another benefit to traveling slowly is that it gives you time to simply walk around a place. If you're only in town for a few days, then you'll likely try to visit all the museums and attractions that you can within those few days. This will dramatically increase your daily budget and, in turn, raise the total cost of your trip. Take your time and soak up the local atmosphere if you're on a tight budget. You never know what you might discover, as you will have time to get off of the beaten path.

Tours and guides are another expensive part of traveling. Often you can see the same places on your own and learn from a guide book instead of a person. While the quality of the information you might learn from a book versus a person is debatable, there's no arguing that some tours can be extremely expensive. Many tours also include transportation and meals, so it may be worthwhile to consider this before making a final decision. If you do decide to take a tour, ask other travelers who they would recommend. Personal recommendations mean a lot more than any suggestion in a guide book or on the internet.

Children will add considerable expenses to your budget. You'll probably want to travel with a little more comfort and stability if you have kids. That's understandable. Don't let that stop you though! Your entire family will benefit from the experience.

Working while you travel is always an interesting debate. Many people believe that they can work and travel at the same time so that they can offset their expenses. Some believe they can get jobs in certain countries, and while this is possible, it is not always practical or guaranteed. Also, the jobs avaialbe may or may not pay the amount that is needed to travel. Be realistic about your expectations!

Some people also believe they can be digital nomads and make money while blogging, being an influencer, or a freelancer. Make sure that you have already established yourself as such before you just take off, as many travelers attempt to do these things and are then sadly dissapointed in the financial results during their trip.

One very reliable way to make money abroad is to teach English as a second language. Many countries have frequent opportunities for native English speakers to teach at schools or companies. For more information, read this great article about the best places to teach English abroad .

Research is Key

If you want to create a detailed breakdown of how much your trip will cost, you'll need to gather some resources. Keep in mind that it is impossible to foresee every expense. Remember, long term travel is about staying flexible. If you plan out your expenses to the very last detail, then you're probably going to have to plan your actual trip to this detail, and that is definitely not "staying flexible". Instead, allow for conservative estimates. It's better to budget too much money for something than not enough. Then, if things do go as planned, you'll have a little extra cash for when you get home, or even to spend when you extend your trip.

It is possible and advisable to create a general plan. The most basic steps include:

Determine an average daily total for each country you plan to visit. Consider accommodation, food, entertainment and transportation expenses.

Reality check that total. Approximate the cost for a hotel, food, entrance fees (museums, shows, etc), and local transportation. Consult guidebooks, other travelers, and booking websites to ensure that your budget is realistic for your travel style.

Think about how many places you plan to visit. How much will each section of the trip cost? Price out as many plane and long distance train tickets as you can. Transportation costs can be a significant part of your budget, and it is relatively easy find a good estimate for these costs. Be realistic though. If you don't think you'll take night buses, then budget enough for the more comfortable and efficient option. Don't assume you'll find that once in a lifetime deal on a plane ticket. If you're traveling in peak season, expect to pay peak season prices.

Add in costs for visas, vaccinations, and new gear. Don't forget to consider health insurance and other forms of insurance. These expenses can quickly add up. If you're planning to book an around the world plane ticket then make sure you budget for any unexpected changes. Each change will likely incur a fee.

Add at least 10% to your total, probably more. This is your budget. Reality check it one more time and make sure you've leaned on the side of conservative.

Finding realistic costs for all of these items can be tricky. Sometimes you can rely on other travelers, but sometimes not. Every traveler has their own style and priorities and just because somebody else spent one amount, doesn't mean that you'll spend the same. Prices poste online are generally a good bet, but remember that prices can change and vary by date, supply & demand, and other factors. Online prices are can often vary by the website, too. Some guidebooks may be reliable, others less so. Prices rise quickly and many guidebooks are at least a few years old. Hotels that are listed in guidebooks are also known to raise their prices quickly. The recommendation of Lonely Planet or other books can put a hotel or hostel in high demand, so don't expect to pay the price that is listed in the book. With that disclaimer aside, we've outlined a few resources below to help you plan your daily travel budget.

Budget Your Trip's travel cost search allows you to find out what other travelers are spending. You can search by city, country, and budget type (more options are coming soon!).

Guidebooks and online travel guides often give you an idea of how much specific hotels, hostels, or food will cost in a city. It's important to remember that printed guidebooks are often slightly outdated. Expect to spend a little more than a price that's quoted in a book. Online prices also vary by season and demand. If you go ahead and book something, then you can lock in your price, but you still need to be prepared to pay a little extra for tips, fees, and other random costs that might creep in.

Travel forums such as Lonely Planet's Thorntree or Nomadic Matt's travel forum offer a great resource to discuss expected expenses in a area. Find a forum that stays active and you can usually expect prompt, although varied, responses.

Hotel and airline booking websites have up-to-date pricing that is usually reliable. Make sure you are confirming a price during the season you plan to travel as seasonal price variations can be significant.

Travel websites such as Seat61.com offer a fair estimate of costs for intercity public transportation. You can often check public transportation costs on a city's government transportation website (such as the NYC subway website, or Paris' Metro website).

Budget Your Trip

Share This Article

Subscribe to our newsletter.

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Pin This Page

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

- Cambridge Dictionary +Plus

Meaning of travel expenses in English

Your browser doesn't support HTML5 audio

- anti-subsidy

- cost-of-living allowance

- dearness allowance

- fringe benefit

- parachute payments

- personal allowance

- redundancy payment

- unemployment benefit

You can also find related words, phrases, and synonyms in the topics:

Examples of travel expenses

Translations of travel expenses.

Get a quick, free translation!

Word of the Day

throw your voice

to make something that is not real, such as a toy, seem to be speaking

Paying attention and listening intently: talking about concentration

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- English Noun

- Translations

- All translations

Add travel expenses to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

- Search Search Please fill out this field.

What Are Transportation Expenses?

- How They Work

Special Considerations

- Supply Chain

Transportation Expenses: Definition, How They Work, and Taxation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

The term transportation expense refers to specific costs incurred by an employee or self-employed taxpayer who travels for business purposes. Transportation expenses are a subset of travel expenses, which include all of the costs associated with business travel such as taxi fare, fuel, parking fees, lodging, meals, tips, cleaning, shipping, and telephone charges that employees may incur and claim for reimbursement from their employers. Some transportation expenses may be eligible for a tax deduction on an employee's tax return .

Key Takeaways

- Transportation expenses are a subset of travel expenses that refer specifically to the cost of business transportation by car, plane, train, etc.

- Expenses such as fuel, parking fees, lodging, meals, and telephone charges incurred by employees can be claimed as transportation expenses.

- These expenses may be deducted for tax purposes subject to the appropriate restrictions and guidelines.

How Transportation Expenses Work

Transportation expenses are any costs related to business travel by company employees. An employee who travels for a business trip is generally able to claim the cost of travel, hotel, food, and any other related expense as a transportation expense. These costs may also include those associated with traveling to a temporary workplace from home under some circumstances. For instance, an employee whose travel area is not limited to their tax home can generally claim that travel as a transportation expense.

These expenses, though, are narrower in scope. They only refer to the use of or cost of maintaining a car used for business or transport by rail, air, bus, taxi, or any other means of conveyance for business purposes. These expenses may also refer to deductions for businesses and self-employed individuals when filing tax returns . Commuting to and from the office, however, does not count as a transportation expense.

The cost of commuting is not considered a deductible transportation expense.

Transportation expenses may only qualify for tax deductions if they are directly related to the primary business for which an individual works. For example, if a traveler works in the same business or trade at one or more regular work locations that are away from home such as a construction worker, it is considered a transportation expense.

Similarly, if a traveler has no set workplace but mostly works in the same metropolitan area they live in, they may claim a travel expense if they travel to a worksite outside of their metro area. On the other hand, claiming transportation costs when you have not actually done any traveling for the business is not allowed and can be viewed as a form of tax fraud .

Taxpayers must keep good records in order to claim travel expenses. Receipts and other evidence must be submitted when claiming travel-related reimbursable or tax-deductible expenses.

According to the Internal Revenue Service (IRS) travel or transportation expenses are defined as being: "...the ordinary and necessary expenses of traveling away from home for your business, profession, or job." And it further defines "traveling away from home" as duties that "...require you to be away from the general area of your tax home substantially longer than an ordinary day's work, and you need to sleep or rest to meet the demands of your work while away from home."

The IRS provides guidelines for transportation expenses, deductibility, depreciation, conditions, exceptions , reimbursement rates, and more in Publication 463 . The publication sets the per-mile reimbursement rate for operating your personal car for business. Travelers who use their vehicles for work can claim 58.5 cents per mile for the 2022 tax year , increasing to 62.5 cents for the remaining six months. That's up from 56 cents eligible for 2021. The IRS' determined rate treated as depreciation for the business standard mileage is 26 cents as of Jan. 1, 2021.

Internal Revenue Service. " Topic No. 511 Business Travel Expenses ."

Internal Revenue Service. " 2022 Standard Mileage Rates ," Pages 3-4.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1191193147-f73d762717fe4c1f9bb08e74f532925b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Blog | 10 Sep 2021

Why the era of low-cost travel is not necessarily over

Senior Economist, Tourism Economics

The cost of travel has fallen over the past two decades, with global average spending per international trip across all destinations down 17% in 2019 from its 2000 level in real prices. This has been enabled in part by cheaper air fares that have resulted in an increase in not only the volume of trips but also the proportion of shorter trips and weekend city breaks. But in the midst of a pandemic, with fewer travelers and rising costs, could the era of low-cost travel be over?

The most notable argument in support of this is that airlines will inevitably need to charge higher fares to survive. As McKinsey notes, carriers that were not bailed-out by governments have had to borrow heavily; those repayments will be made more challenging by declining credit ratings and higher financing costs. Meanwhile, the increased share accounted for by short-haul leisure—at the expense of business and premium class—will eat into profits and leave airlines little choice but to raise prices.

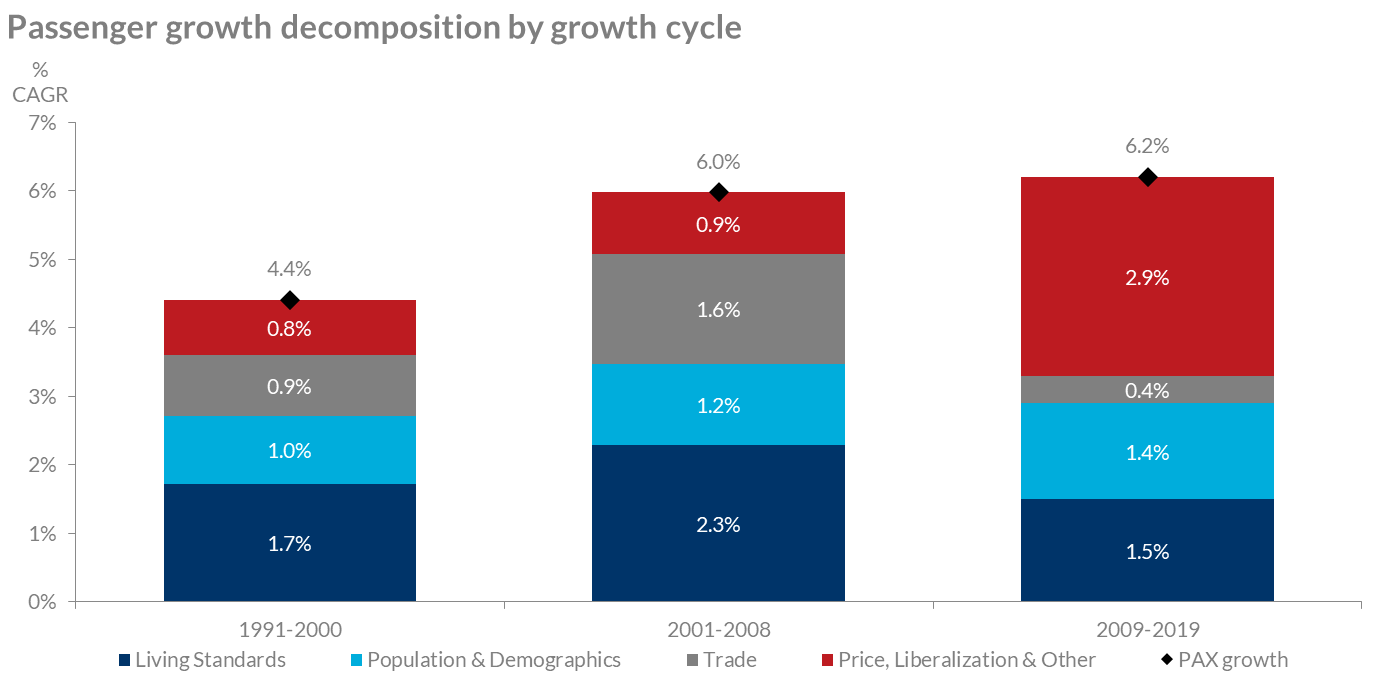

Prices have been declining since the dawn of the commercial air travel industry, alongside changes in products, markets becoming more liberalised and destination country visa regimes less stringent. Over the past three decades low-cost carriers have transformed business models, especially for shorter-haul air journeys. Discounting and market liberalization have driven the most recent growth cycle, accounting for nearly half of the passenger growth in the decade to 2019 with a notably weaker share from both living standards growth and trade than in previous cycles—see Tourism Economics/IATA’s Air Passenger Forecasts . This in part included some modal shift to air as well as growth in short-haul travel at the expense of domestic travel.

Given the significant role of discounting in the past decade, the key question is whether airlines will increase their fares to compensate for recent losses. The logic supporting an increase in prices might sound convincing, but so far the evidence is limited. Government support has covered some losses by airlines. Although this has been weighted strongly in favour of national flag carriers, even low-cost carriers have tended to survive and are planning “business as usual.” Comparatively normal flight schedules are returning, including some notable transatlantic announcements (such as from Jet Blue ), meaning that competition should remain healthy, limiting price increases. However, there is greater uncertainty about the market and price environment outside intra-European and transatlantic routes, with longer-haul travel generally expected to recover more slowly.

Concerns about environmental sustainability are also a consideration. New taxes, restrictions (such as limits on internal flights when a suitable rail alternative is available) and consumer preferences for cleaner travel could put upward pressure on prices, as could new requirements around cleaner fuels and operating activities. However, it is striking that there remain very few examples of new restrictions or higher fees of this sort.

While there are plenty of reasons why travel prices may increase, the evidence is not definitive. Lower prices may not stimulate growth to the same extent as in the past ten years, but it appears unlikely that the age of low-cost travel is fully over.

You may be interested in

Leisure travel expected to continue outperforming amid signs of more even tourism growth

According to findings from Tourism Economics’ latest Travel Industry Monitor (TIM), which tracks the views of tourism professionals every quarter, leisure tourism is expected to continue to spearhead travel global travel growth in 2024, especially for domestic and short-haul destinations.

Will Chinese Traveller Behaviour Change?

Growing confidence and easing perceptions of challenges in tourism

Tourism Economics’ latest Travel Industry Monitor (TIM), a quarterly survey among tourism professionals conducted in Q4 2023, identified strong expectations of growth in 2024 and beyond.

Select to close video modal

Select to close video modal Play Video Select to play video

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Who should use this publication.

Users of employer-provided vehicles.

Who doesn’t need to use this publication.

Volunteers.

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Travel expenses defined.

Members of the Armed Forces.

Main place of business or work.

No main place of business or work.

Factors used to determine tax home.

Tax Home Different From Family Home

Temporary assignment vs. indefinite assignment.

Exception for federal crime investigations or prosecutions.

Determining temporary or indefinite.

Going home on days off.

Probationary work period.

Separating costs.

Travel expenses for another individual.

Business associate.

Bona fide business purpose.

Lavish or extravagant.

50% limit on meals.

Actual Cost

Incidental expenses.

Incidental-expenses-only method.

50% limit may apply.

Who can use the standard meal allowance.

Use of the standard meal allowance for other travel.

Amount of standard meal allowance.

Federal government's fiscal year.

Standard meal allowance for areas outside the continental United States.

Special rate for transportation workers.

Travel for days you depart and return.

Trip Primarily for Business

Trip primarily for personal reasons.

Public transportation.

Private car.

Travel entirely for business.

Travel considered entirely for business.

Exception 1—No substantial control.

Exception 2—Outside United States no more than a week.

Exception 3—Less than 25% of time on personal activities.

Exception 4—Vacation not a major consideration.

Travel allocation rules.

Counting business days.

Transportation day.

Presence required.

Day spent on business.

Certain weekends and holidays.

Nonbusiness activity on the way to or from your business destination.

Nonbusiness activity at, near, or beyond business destination.

Other methods.

Travel Primarily for Personal Reasons

Daily limit on luxury water travel.

Meals and entertainment.

Not separately stated.

Convention agenda.

North American area.

Reasonableness test.

Cruise Ships

Deduction may depend on your type of business.

Exceptions to the Rules

Entertainment events.

Entertainment facilities.

Club dues and membership fees.

Gift or entertainment.

Other rules for meals and entertainment expenses.

Costs to include or exclude.

Application of 50% limit.

When to apply the 50% limit.

Taking turns paying for meals.

1—Expenses treated as compensation.

2—Employee's reimbursed expenses.

3—Self-employed reimbursed expenses.

4—Recreational expenses for employees.

5—Advertising expenses.

6—Sale of meals.

Individuals subject to “hours of service” limits.

Incidental costs.

Exceptions.

- Illustration of transportation expenses.

Temporary work location.

No regular place of work.

Two places of work.

Armed Forces reservists.

Commuting expenses.

Parking fees.

Advertising display on car.

Hauling tools or instruments.

Union members' trips from a union hall.

Office in the home.

Examples of deductible transportation.

Choosing the standard mileage rate.

Standard mileage rate not allowed.

Five or more cars.

Personal property taxes.

Parking fees and tolls.

Sale, trade-in, or other disposition.

Business and personal use.

Employer-provided vehicle.

Interest on car loans.

Taxes paid on your car.

Sales taxes.

Fines and collateral.

Casualty and theft losses.

Depreciation and section 179 deductions.

Car defined.

Qualified nonpersonal use vehicles.

More information.

More than 50% business use requirement.

Limit on the amount of the section 179 deduction.

Limit for sport utility and certain other vehicles.

Limit on total section 179 deduction, special depreciation allowance, and depreciation deduction.

Cost of car.

Basis of car for depreciation.

When to elect.

How to elect.

Revoking an election.

Recapture of section 179 deduction.

Dispositions.

Combined depreciation.

Qualified car.

Election not to claim the special depreciation allowance.

Placed in service.

Car placed in service and disposed of in the same year.

Methods of depreciation.

More-than-50%-use test.

Qualified business use.

Use of your car by another person.

Business use changes.

Use for more than one purpose.

Change from personal to business use.

Unadjusted basis.

Improvements.

Car trade-in.

Effect of trade-in on basis.

Traded car used only for business.

Traded car used partly in business.

Modified Accelerated Cost Recovery System (MACRS).

Recovery period.

Depreciation methods.

MACRS depreciation chart.

Depreciation in future years.

Disposition of car during recovery period.

How to use the 2023 chart.

Trucks and vans.

Car used less than full year.

Reduction for personal use.

Section 179 deduction.

Deductions in years after the recovery period.

Unrecovered basis.

The recovery period.

How to treat unrecovered basis.

- Table 4-1. 2023 MACRS Depreciation Chart (Use To Figure Depreciation for 2023)

Qualified business use 50% or less in year placed in service.

Qualified business use 50% or less in a later year.

Excess depreciation.

Deductible payments.

Fair market value.

Figuring the inclusion amount.

Leased car changed from business to personal use.

Leased car changed from personal to business use.

Reporting inclusion amounts.

Casualty or theft.

Depreciation adjustment when you used the standard mileage rate.

Depreciation deduction for the year of disposition.

Documentary evidence.

Adequate evidence.

Canceled check.

Duplicate information.

Timely kept records.

Proving business purpose.

Confidential information.

Exceptional circumstances.

Destroyed records.

Separating expenses.

Combining items.

Car expenses.

Gift expenses.

Allocating total cost.

If your return is examined.

Reimbursed for expenses.

Examples of Records

Self-employed.

Both self-employed and an employee.

Statutory employees.

Reimbursement for personal expenses.

Income-producing property.

Value reported on Form W-2.

Full value included in your income.

Less than full value included in your income.

No reimbursement.

Reimbursement, allowance, or advance.

Reasonable period of time.

Employee meets accountable plan rules.

Accountable plan rules not met.

Failure to return excess reimbursements.

Reimbursement of nondeductible expenses.

Adequate Accounting

Related to employer.

The federal rate.

Regular federal per diem rate.

The standard meal allowance.

High-low rate.

Prorating the standard meal allowance on partial days of travel.

The standard mileage rate.

Fixed and variable rate (FAVR).

Reporting your expenses with a per diem or car allowance.

Allowance less than or equal to the federal rate.

Allowance more than the federal rate.

Travel advance.

Unproven amounts.

Per diem allowance more than federal rate.

Reporting your expenses under a nonaccountable plan.

Adequate accounting.

How to report.

Contractor adequately accounts.

Contractor doesn’t adequately account.

High-low method.

Regular federal per diem rate method.

Federal per diem rate method.

Information on use of cars.

Standard mileage rate.

Actual expenses.

Car rentals.

Transportation expenses.

Employee business expenses other than nonentertainment meals.

Non-entertainment-related meal expenses.

“Hours of service” limits.

Reimbursements.

Allocating your reimbursement.

After you complete the form.

Limits on employee business expenses.

1. Limit on meals and entertainment.

2. Limit on total itemized deductions.

Member of a reserve component.

Officials Paid on a Fee Basis

Special rules for married persons.

Where to report.

Impairment-Related Work Expenses of Disabled Employees

Preparing and filing your tax return.

Free options for tax preparation.

Using online tools to help prepare your return.

Need someone to prepare your tax return?

Employers can register to use Business Services Online.

IRS social media.

Watching IRS videos.

Online tax information in other languages.

Free Over-the-Phone Interpreter (OPI) Service.

Accessibility Helpline available for taxpayers with disabilities.

Getting tax forms and publications.

Getting tax publications and instructions in eBook format.

Access your online account (individual taxpayers only).

Get a transcript of your return.

Tax Pro Account.

Using direct deposit.

Reporting and resolving your tax-related identity theft issues.

Ways to check on the status of your refund.

Making a tax payment.

What if I can’t pay now?

Filing an amended return.

Checking the status of your amended return.

Understanding an IRS notice or letter you’ve received.

Responding to an IRS notice or letter.

Contacting your local TAC.

What Is TAS?

How can you learn about your taxpayer rights, what can tas do for you, how can you reach tas, how else does tas help taxpayers, low income taxpayer clinics (litcs), appendix a-1. inclusion amounts for passenger automobiles first leased in 2018, appendix a-2. inclusion amounts for passenger automobiles first leased in 2019, appendix a-3. inclusion amounts for passenger automobiles first leased in 2020, appendix a-4. inclusion amounts for passenger automobiles first leased in 2021, appendix a-5. inclusion amounts for passenger automobiles first leased in 2022, appendix a-6. inclusion amounts for passenger automobiles first leased in 2023, publication 463 - additional material, publication 463 (2023), travel, gift, and car expenses.

For use in preparing 2023 Returns

Publication 463 - Introductory Material

For the latest information about developments related to Pub. 463, such as legislation enacted after it was published, go to IRS.gov/Pub463 .

Standard mileage rate. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Car expenses and use of the standard mileage rate are explained in chapter 4.

Depreciation limits on cars, trucks, and vans. The first-year limit on the depreciation deduction, special depreciation allowance, and section 179 deduction for vehicles acquired before September 28, 2017, and placed in service during 2023, is $12,200. The first-year limit on depreciation, special depreciation allowance, and section 179 deduction for vehicles acquired after September 27, 2017, and placed in service during 2023 increases to $20,200. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2023, the amount increases to $12,200. Depreciation limits are explained in chapter 4.

Section 179 deduction. The maximum amount you can elect to deduct for section 179 property (including cars, trucks, and vans) you placed in service in tax years beginning in 2023 is $1,160,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000. Section 179 deduction is explained in chapter 4.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2023 is $28,900.

Temporary deduction of 100% business meals. The 100% deduction on certain business meals expenses as amended under the Taxpayer Certainty and Disaster Tax Relief Act of 2020, and enacted by the Consolidated Appropriations Act, 2021, has expired. Generally, the cost of business meals remains deductible, subject to the 50% limitation. See 50% Limit in chapter 2 for more information.

Photographs of missing children. The IRS is a proud partner with the National Center for Missing & Exploited Children® (NCMEC) . Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 800-THE-LOST (800-843-5678) if you recognize a child.

Per diem rates. Current and prior per diem rates may be found on the U.S. General Services Administration (GSA) website at GSA.gov/travel/plan-book/per-diem-rates .

Introduction

You may be able to deduct the ordinary and necessary business-related expenses you have for:

Non-entertainment-related meals,

Transportation.

This publication explains:

What expenses are deductible,

How to report them on your return,

What records you need to prove your expenses, and

How to treat any expense reimbursements you may receive.

You should read this publication if you are an employee or a sole proprietor who has business-related travel, non-entertainment-related meals, gift, or transportation expenses.

If an employer-provided vehicle was available for your use, you received a fringe benefit. Generally, your employer must include the value of the use or availability of the vehicle in your income. However, there are exceptions if the use of the vehicle qualifies as a working condition fringe benefit (such as the use of a qualified nonpersonal use vehicle).

A working condition fringe benefit is any property or service provided to you by your employer, the cost of which would be allowable as an employee business expense deduction if you had paid for it.

A qualified nonpersonal use vehicle is one that isn’t likely to be used more than minimally for personal purposes because of its design. See Qualified nonpersonal use vehicles under Actual Car Expenses in chapter 4.

For information on how to report your car expenses that your employer didn’t provide or reimburse you for (such as when you pay for gas and maintenance for a car your employer provides), see Vehicle Provided by Your Employer in chapter 6.

Partnerships, corporations, trusts, and employers who reimburse their employees for business expenses should refer to the instructions for their required tax forms, for information on deducting travel, meals, and entertainment expenses.

If you are an employee, you won’t need to read this publication if all of the following are true.

You fully accounted to your employer for your work-related expenses.

You received full reimbursement for your expenses.

Your employer required you to return any excess reimbursement and you did so.

There is no amount shown with a code L in box 12 of your Form W-2, Wage and Tax Statement.

If you perform services as a volunteer worker for a qualified charity, you may be able to deduct some of your costs as a charitable contribution. See Out-of-Pocket Expenses in Giving Services in Pub. 526, Charitable Contributions, for information on the expenses you can deduct.

We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRS.gov/FormComments . Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Useful Items

Publication

946 How To Depreciate Property

Form (and Instructions)

Schedule A (Form 1040) Itemized Deductions

Schedule C (Form 1040) Profit or Loss From Business (Sole Proprietorship)

Schedule F (Form 1040) Profit or Loss From Farming

2106 Employee Business Expenses

4562 Depreciation and Amortization (Including Information on Listed Property)

See How To Get Tax Help for information about getting these publications and forms.

If you temporarily travel away from your tax home, you can use this chapter to determine if you have deductible travel expenses.

This chapter discusses:

Traveling away from home,

Temporary assignment or job, and

What travel expenses are deductible.

For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business. An expense doesn’t have to be required to be considered necessary.

You will find examples of deductible travel expenses in Table 1-1 .

Traveling Away From Home

You are traveling away from home if:

Your duties require you to be away from the general area of your tax home (defined later) substantially longer than an ordinary day's work, and

You need to sleep or rest to meet the demands of your work while away from home.

You are a railroad conductor. You leave your home terminal on a regularly scheduled round-trip run between two cities and return home 16 hours later. During the run, you have 6 hours off at your turnaround point where you eat two meals and rent a hotel room to get necessary sleep before starting the return trip. You are considered to be away from home.

You are a truck driver. You leave your terminal and return to it later the same day. You get an hour off at your turnaround point to eat. Because you aren’t off to get necessary sleep and the brief time off isn’t an adequate rest period, you aren’t traveling away from home.

If you are a member of the U.S. Armed Forces on a permanent duty assignment overseas, you aren’t traveling away from home. You can’t deduct your expenses for meals and lodging. You can’t deduct these expenses even if you have to maintain a home in the United States for your family members who aren’t allowed to accompany you overseas. If you are transferred from one permanent duty station to another, you may have deductible moving expenses, which are explained in Pub. 3, Armed Forces' Tax Guide.

A naval officer assigned to permanent duty aboard a ship that has regular eating and living facilities has a tax home (explained next) aboard the ship for travel expense purposes.

To determine whether you are traveling away from home, you must first determine the location of your tax home.

Generally, your tax home is your regular place of business or post of duty, regardless of where you maintain your family home. It includes the entire city or general area in which your business or work is located.

If you have more than one regular place of business, your tax home is your main place of business. See Main place of business or work , later.

If you don’t have a regular or a main place of business because of the nature of your work, then your tax home may be the place where you regularly live. See No main place of business or work , later.

If you don’t have a regular or main place of business or post of duty and there is no place where you regularly live, you are considered an itinerant (a transient) and your tax home is wherever you work. As an itinerant, you can’t claim a travel expense deduction because you are never considered to be traveling away from home.

If you have more than one place of work, consider the following when determining which one is your main place of business or work.

The total time you ordinarily spend in each place.

The level of your business activity in each place.

Whether your income from each place is significant or insignificant.

You live in Cincinnati where you have a seasonal job for 8 months each year and earn $40,000. You work the other 4 months in Miami, also at a seasonal job, and earn $15,000. Cincinnati is your main place of work because you spend most of your time there and earn most of your income there.

You may have a tax home even if you don’t have a regular or main place of work. Your tax home may be the home where you regularly live.

If you don’t have a regular or main place of business or work, use the following three factors to determine where your tax home is.

You perform part of your business in the area of your main home and use that home for lodging while doing business in the area.

You have living expenses at your main home that you duplicate because your business requires you to be away from that home.

You haven’t abandoned the area in which both your historical place of lodging and your claimed main home are located; you have a member or members of your family living at your main home; or you often use that home for lodging.

If you satisfy all three factors, your tax home is the home where you regularly live. If you satisfy only two factors, you may have a tax home depending on all the facts and circumstances. If you satisfy only one factor, you are an itinerant; your tax home is wherever you work and you can’t deduct travel expenses.

You are single and live in Boston in an apartment you rent. You have worked for your employer in Boston for a number of years. Your employer enrolls you in a 12-month executive training program. You don’t expect to return to work in Boston after you complete your training.

During your training, you don’t do any work in Boston. Instead, you receive classroom and on-the-job training throughout the United States. You keep your apartment in Boston and return to it frequently. You use your apartment to conduct your personal business. You also keep up your community contacts in Boston. When you complete your training, you are transferred to Los Angeles.

You don’t satisfy factor (1) because you didn’t work in Boston. You satisfy factor (2) because you had duplicate living expenses. You also satisfy factor (3) because you didn’t abandon your apartment in Boston as your main home, you kept your community contacts, and you frequently returned to live in your apartment. Therefore, you have a tax home in Boston.

You are an outside salesperson with a sales territory covering several states. Your employer's main office is in Newark, but you don’t conduct any business there. Your work assignments are temporary, and you have no way of knowing where your future assignments will be located. You have a room in your married sister's house in Dayton. You stay there for one or two weekends a year, but you do no work in the area. You don’t pay your sister for the use of the room.

You don’t satisfy any of the three factors listed earlier. You are an itinerant and have no tax home.

If you (and your family) don’t live at your tax home (defined earlier), you can’t deduct the cost of traveling between your tax home and your family home. You also can’t deduct the cost of meals and lodging while at your tax home. See Example 1 , later.

If you are working temporarily in the same city where you and your family live, you may be considered as traveling away from home. See Example 2 , later.

You are a truck driver and you and your family live in Tucson. You are employed by a trucking firm that has its terminal in Phoenix. At the end of your long runs, you return to your home terminal in Phoenix and spend one night there before returning home. You can’t deduct any expenses you have for meals and lodging in Phoenix or the cost of traveling from Phoenix to Tucson. This is because Phoenix is your tax home.

Your family home is in Pittsburgh, where you work 12 weeks a year. The rest of the year you work for the same employer in Baltimore. In Baltimore, you eat in restaurants and sleep in a rooming house. Your salary is the same whether you are in Pittsburgh or Baltimore.

Because you spend most of your working time and earn most of your salary in Baltimore, that city is your tax home. You can’t deduct any expenses you have for meals and lodging there. However, when you return to work in Pittsburgh, you are away from your tax home even though you stay at your family home. You can deduct the cost of your round trip between Baltimore and Pittsburgh. You can also deduct your part of your family's living expenses for non-entertainment-related meals and lodging while you are living and working in Pittsburgh.

Temporary Assignment or Job

You may regularly work at your tax home and also work at another location. It may not be practical to return to your tax home from this other location at the end of each workday.

If your assignment or job away from your main place of work is temporary, your tax home doesn’t change. You are considered to be away from home for the whole period you are away from your main place of work. You can deduct your travel expenses if they otherwise qualify for deduction. Generally, a temporary assignment in a single location is one that is realistically expected to last (and does in fact last) for 1 year or less.

However, if your assignment or job is indefinite, the location of the assignment or job becomes your new tax home and you can’t deduct your travel expenses while there. An assignment or job in a single location is considered indefinite if it is realistically expected to last for more than 1 year, whether or not it actually lasts for more than 1 year.

If your assignment is indefinite, you must include in your income any amounts you receive from your employer for living expenses, even if they are called “travel allowances” and you account to your employer for them. You may be able to deduct the cost of relocating to your new tax home as a moving expense. See Pub. 3 for more information.

If you are a federal employee participating in a federal crime investigation or prosecution, you aren’t subject to the 1-year rule. This means you may be able to deduct travel expenses even if you are away from your tax home for more than 1 year provided you meet the other requirements for deductibility.

For you to qualify, the Attorney General (or their designee) must certify that you are traveling:

For the federal government;

In a temporary duty status; and

To investigate, prosecute, or provide support services for the investigation or prosecution of a federal crime.

You must determine whether your assignment is temporary or indefinite when you start work. If you expect an assignment or job to last for 1 year or less, it is temporary unless there are facts and circumstances that indicate otherwise. An assignment or job that is initially temporary may become indefinite due to changed circumstances. A series of assignments to the same location, all for short periods but that together cover a long period, may be considered an indefinite assignment.

The following examples illustrate whether an assignment or job is temporary or indefinite.

You are a construction worker. You live and regularly work in Los Angeles. You are a member of a trade union in Los Angeles that helps you get work in the Los Angeles area. Your tax home is Los Angeles. Because of a shortage of work, you took a job on a construction project in Fresno. Your job was scheduled to end in 8 months. The job actually lasted 10 months.

You realistically expected the job in Fresno to last 8 months. The job actually did last less than 1 year. The job is temporary and your tax home is still in Los Angeles.

The facts are the same as in Example 1 , except that you realistically expected the work in Fresno to last 18 months. The job was actually completed in 10 months.

Your job in Fresno is indefinite because you realistically expected the work to last longer than 1 year, even though it actually lasted less than 1 year. You can’t deduct any travel expenses you had in Fresno because Fresno became your tax home.

The facts are the same as in Example 1 , except that you realistically expected the work in Fresno to last 9 months. After 8 months, however, you were asked to remain for 7 more months (for a total actual stay of 15 months).

Initially, you realistically expected the job in Fresno to last for only 9 months. However, due to changed circumstances occurring after 8 months, it was no longer realistic for you to expect that the job in Fresno would last for 1 year or less. You can deduct only your travel expenses for the first 8 months. You can’t deduct any travel expenses you had after that time because Fresno became your tax home when the job became indefinite.

If you go back to your tax home from a temporary assignment on your days off, you aren’t considered away from home while you are in your hometown. You can’t deduct the cost of your meals and lodging there. However, you can deduct your travel expenses, including meals and lodging, while traveling between your temporary place of work and your tax home. You can claim these expenses up to the amount it would have cost you to stay at your temporary place of work.

If you keep your hotel room during your visit home, you can deduct the cost of your hotel room. In addition, you can deduct your expenses of returning home up to the amount you would have spent for meals had you stayed at your temporary place of work.

If you take a job that requires you to move, with the understanding that you will keep the job if your work is satisfactory during a probationary period, the job is indefinite. You can’t deduct any of your expenses for meals and lodging during the probationary period.

What Travel Expenses Are Deductible?

Once you have determined that you are traveling away from your tax home, you can determine what travel expenses are deductible.

You can deduct ordinary and necessary expenses you have when you travel away from home on business. The type of expense you can deduct depends on the facts and your circumstances.

Table 1-1 summarizes travel expenses you may be able to deduct. You may have other deductible travel expenses that aren’t covered there, depending on the facts and your circumstances.

If you have one expense that includes the costs of non-entertainment-related meals, entertainment, and other services (such as lodging or transportation), you must allocate that expense between the cost of non-entertainment-related meals, and entertainment and the cost of other services. You must have a reasonable basis for making this allocation. For example, you must allocate your expenses if a hotel includes one or more meals in its room charge.

If a spouse, dependent, or other individual goes with you (or your employee) on a business trip or to a business convention, you generally can’t deduct their travel expenses.

You can deduct the travel expenses of someone who goes with you if that person:

Is your employee,

Has a bona fide business purpose for the travel, and

Would otherwise be allowed to deduct the travel expenses.

If a business associate travels with you and meets the conditions in (2) and (3) above, you can deduct the travel expenses you have for that person. A business associate is someone with whom you could reasonably expect to actively conduct business. A business associate can be a current or prospective (likely to become) customer, client, supplier, employee, agent, partner, or professional advisor.

Table 1-1. Travel Expenses You Can Deduct

A bona fide business purpose exists if you can prove a real business purpose for the individual's presence. Incidental services, such as typing notes or assisting in entertaining customers, aren’t enough to make the expenses deductible.

You drive to Chicago on business and take your spouse with you. Your spouse isn’t your employee. Your spouse occasionally types notes, performs similar services, and accompanies you to luncheons and dinners. The performance of these services doesn’t establish that your spouse’s presence on the trip is necessary to the conduct of your business. Your spouse’s expenses aren’t deductible.

You pay $199 a day for a double room. A single room costs $149 a day. You can deduct the total cost of driving your car to and from Chicago, but only $149 a day for your hotel room. If both you and your spouse use public transportation, you can only deduct your fare.

You can deduct a portion of the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on business. Meal and entertainment expenses are discussed in chapter 2 .

You can't deduct expenses for meals that are lavish or extravagant. An expense isn't considered lavish or extravagant if it is reasonable based on the facts and circumstances. Meal expenses won't be disallowed merely because they are more than a fixed dollar amount or because the meals take place at deluxe restaurants, hotels, or resorts.

You can figure your meal expenses using either of the following methods.

Actual cost.

If you are reimbursed for the cost of your meals, how you apply the 50% limit depends on whether your employer's reimbursement plan was accountable or nonaccountable. If you aren’t reimbursed, the 50% limit applies even if the unreimbursed meal expense is for business travel. Chapter 2 discusses the 50% Limit in more detail, and chapter 6 discusses accountable and nonaccountable plans.

You can use the actual cost of your meals to figure the amount of your expense before reimbursement and application of the 50% deduction limit. If you use this method, you must keep records of your actual cost.

Standard Meal Allowance

Generally, you can use the “standard meal allowance” method as an alternative to the actual cost method. It allows you to use a set amount for your daily meals and incidental expenses (M&IE), instead of keeping records of your actual costs. The set amount varies depending on where and when you travel. In this publication, “standard meal allowance” refers to the federal rate for M&IE, discussed later under Amount of standard meal allowance . If you use the standard meal allowance, you must still keep records to prove the time, place, and business purpose of your travel. See the recordkeeping rules for travel in chapter 5 .

The term “incidental expenses” means fees and tips given to porters, baggage carriers, hotel staff, and staff on ships.

Incidental expenses don’t include expenses for laundry, cleaning and pressing of clothing, lodging taxes, costs of telegrams or telephone calls, transportation between places of lodging or business and places where meals are taken, or the mailing cost of filing travel vouchers and paying employer-sponsored charge card billings.

You can use an optional method (instead of actual cost) for deducting incidental expenses only. The amount of the deduction is $5 a day. You can use this method only if you didn’t pay or incur any meal expenses. You can’t use this method on any day that you use the standard meal allowance. This method is subject to the proration rules for partial days. See Travel for days you depart and return , later, in this chapter.

The incidental-expenses-only method isn’t subject to the 50% limit discussed below.

If you use the standard meal allowance method for non-entertainment-related meal expenses and you aren’t reimbursed or you are reimbursed under a nonaccountable plan, you can generally deduct only 50% of the standard meal allowance. If you are reimbursed under an accountable plan and you are deducting amounts that are more than your reimbursements, you can deduct only 50% of the excess amount. The 50% Limit is discussed in more detail in chapter 2, and accountable and nonaccountable plans are discussed in chapter 6.

You can use the standard meal allowance whether you are an employee or self-employed, and whether or not you are reimbursed for your traveling expenses.

You can use the standard meal allowance to figure your meal expenses when you travel in connection with investment and other income-producing property. You can also use it to figure your meal expenses when you travel for qualifying educational purposes. You can’t use the standard meal allowance to figure the cost of your meals when you travel for medical or charitable purposes.

The standard meal allowance is the federal M&IE rate. For travel in 2023, the rate for most small localities in the United States is $59 per day.

Most major cities and many other localities in the United States are designated as high-cost areas, qualifying for higher standard meal allowances.

If you travel to more than one location in one day, use the rate in effect for the area where you stop for sleep or rest. If you work in the transportation industry, however, see Special rate for transportation workers , later.

Per diem rates are listed by the federal government's fiscal year, which runs from October 1 to September 30. You can choose to use the rates from the 2022 fiscal year per diem tables or the rates from the 2023 fiscal year tables, but you must consistently use the same tables for all travel you are reporting on your income tax return for the year. See Transition Rules , later.

The standard meal allowance rates above don’t apply to travel in Alaska, Hawaii, or any other location outside the continental United States. The Department of Defense establishes per diem rates for Alaska, Hawaii, Puerto Rico, American Samoa, Guam, Midway, the Northern Mariana Islands, the U.S. Virgin Islands, Wake Island, and other non-foreign areas outside the continental United States. The Department of State establishes per diem rates for all other foreign areas.

You can use a special standard meal allowance if you work in the transportation industry. You are in the transportation industry if your work:

Directly involves moving people or goods by airplane, barge, bus, ship, train, or truck; and

Regularly requires you to travel away from home and, during any single trip, usually involves travel to areas eligible for different standard meal allowance rates.

Using the special rate for transportation workers eliminates the need for you to determine the standard meal allowance for every area where you stop for sleep or rest. If you choose to use the special rate for any trip, you must use the special rate (and not use the regular standard meal allowance rates) for all trips you take that year.

For both the day you depart for and the day you return from a business trip, you must prorate the standard meal allowance (figure a reduced amount for each day). You can do so by one of two methods.

Method 1: You can claim 3 / 4 of the standard meal allowance.

Method 2: You can prorate using any method that you consistently apply and that is in accordance with reasonable business practice.

You are employed in New Orleans as a convention planner. In March, your employer sent you on a 3-day trip to Washington, DC, to attend a planning seminar. You left your home in New Orleans at 10 a.m. on Wednesday and arrived in Washington, DC, at 5:30 p.m. After spending 2 nights there, you flew back to New Orleans on Friday and arrived back home at 8 p.m. Your employer gave you a flat amount to cover your expenses and included it with your wages.

Under Method 1 , you can claim 2½ days of the standard meal allowance for Washington, DC: 3 / 4 of the daily rate for Wednesday and Friday (the days you departed and returned), and the full daily rate for Thursday.

Under Method 2 , you could also use any method that you apply consistently and that is in accordance with reasonable business practice. For example, you could claim 3 days of the standard meal allowance even though a federal employee would have to use Method 1 and be limited to only 2½ days.

Travel in the United States

The following discussion applies to travel in the United States. For this purpose, the United States includes the 50 states and the District of Columbia. The treatment of your travel expenses depends on how much of your trip was business related and on how much of your trip occurred within the United States. See Part of Trip Outside the United States , later.

You can deduct all of your travel expenses if your trip was entirely business related. If your trip was primarily for business and, while at your business destination, you extended your stay for a vacation, made a personal side trip, or had other personal activities, you can deduct only your business-related travel expenses. These expenses include the travel costs of getting to and from your business destination and any business-related expenses at your business destination.

You work in Atlanta and take a business trip to New Orleans in May. Your business travel totals 900 miles round trip. On your way home, you stop in Mobile to visit your parents. You spend $2,165 for the 9 days you are away from home for travel, non-entertainment-related meals, lodging, and other travel expenses. If you hadn’t stopped in Mobile, you would have been gone only 6 days, and your total cost would have been $1,633.50. You can deduct $1,633.50 for your trip, including the cost of round-trip transportation to and from New Orleans. The deduction for your non-entertainment-related meals is subject to the 50% limit on meals mentioned earlier.

If your trip was primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense. However, you can deduct any expenses you have while at your destination that are directly related to your business.

A trip to a resort or on a cruise ship may be a vacation even if the promoter advertises that it is primarily for business. The scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, won’t change what is really a vacation into a business trip.

Part of Trip Outside the United States