Tune Protect and AirAsia Unveil Enhanced AirAsia Travel Insurance

Tune Protect Group Berhad (“Tune Protect”) and AirAsia Aviation Group Limited (“AirAsia”) have announced the launch of their newly enhanced AirAsia travel insurance with additional features to ensure a hassle-free experience for travellers seeking medical assistance abroad . The enhanced AirAsia Comprehensive Travel PLUS features the practical addition of Cashless Hospital Admission services for policies issued by Tune Protect Malaysia and Tune Protect Thailand, available from 19th October 2023.

AirAsia Travel Insurance enhancements

The AirAsia Comprehensive Travel PLUS, inclusive of the Cashless Hospital Admission services is offered with premiums starting at RM 74 for a return trip plan. This option is open for purchase to travellers departing from Malaysia and Thailand and can be accessed through all AirAsia online and offline booking platforms, as well as Manage My Booking and Online Check-in in the airasia MOVE app.

Most importantly, the additional benefit does not impact the insurance premium, or any other benefits and sum limits stated in the policy. In addition, AirAsia passengers who have purchased the return trip plan of the Travel Insurance for flights departing from Malaysia or Thailand will automatically gain access to these features.

…. The AirAsia Comprehensive Travel PLUS is a practical feature for travellers. With this newly added proposition, we are removing the hassle of paying for hospital admissions during overseas travel… Janet Chin, Chief Partnership Officer of Tune Protect

In addition to the addition of the Cashless Hospital Admission services, the AirAsia Comprehensive Travel PLUS includes other benefits including:

- trip cancellation

- flight delay

- loss or damaged baggage

- loss of personal money and travel documents

…. At AirAsia, we believe in continuous improvement of our customers’ travel experience. We are dedicated to offering value-added product benefits and services that provide our guests convenience and peace of mind throughout their journeys. Karen Chan, AirAsia Group Chief Commercial Officer

Activating the Cashless Hospital Admission services while abroad

The steps seem quite straightforward:

- AirAsia Emergency Hotline at +603 2302 0033

- Provide flight booking number for verification.

- If necessary, transportation will be arranged.

- To ensure uninterrupted medical attention.

- This eliminates the need for claim submissions.

The AirAsia Comprehensive Travel PLUS offers healthcare access to over 5,000 hospitals worldwide in collaboration with the globally renowned care and mobility provider, Europ Assistance. This added feature eliminates unexpected out-of-pocket expenses, and providing peace of mind for worry-free travel.

For more information on AirAsia Comprehensive Travel PLUS with Cashless Hospital Admission Services, please visit Tune Protect Comprehensive travel insurance plus

To compare inclusions and pricing with similar providers, check out our stories on post-covid travel insurance options , what to look for when choosing travel insurance and Is it worth it? .

AirAsia links all Asean countries as Kuala Lumpur-Vientiane returns

Grab airasia’s low fares sale flights from australia and malaysia, new airasia cambodia launches three domestic destinations, fly the airasia a231neo to perth aircraft.

Claiming your GST refund as you leave Australia

Best economy seat on a Qantas 747

Claiming your GST Refund as you leave Malaysia (TRS)

Malindo Air cancels some Australian flights

Malindo Air revises free baggage allowance

Using your AirAsia X travel vouchers

No comments, this post has 0 comments, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Lesley on Which Indonesian visa do I need for Bali?

- Kaveh on Which Indonesian visa do I need for Bali?

- Lesley on Arrival/transit/transfer in Bali: 10 things to know

Economy Traveller is your well-travelled friend, having flown hundreds of flights and hundreds of thousands of miles. We hope to share what we have found to make economy class travel not only bearable, but safe, comfortable and fun!

We strive to remain independent and unbiased so that you know you can trust us. All travel is self-funded unless otherwise noted in our reviews.

- previous post: AirAsia’s Santan & ZUS Coffee join forces inflight & on ground

- next post: Free Wi-Fi for all on selected Malaysia Airlines flights

- Net Zero 2050

- Editor’s Choice

- Entrepreneur

- Environment

- Human Resource

- Travel & Dining

Tune Protect, AirAsia Launch Travel Insurance For As Low As RM74

- Contact the Tune Protect – AirAsia Emergency Hotline at +603 2302 0033 and provide their flight booking number for verification.

- Upon verification, a Medical Agent will notify a nearby Medical Provider and, if necessary, arrange transportation.

- A Guarantee Letter will be issued directly to the Medical Provider to ensure uninterrupted medical attention.

- Policyholders can be rest assured that their medical bills will be taken care of, eliminating the need for claim submissions.

RELATED ARTICLES MORE FROM AUTHOR

2 more deaths reported over japan’s cholesterol lowering supplements, gamuda’s 1h revenue nearly doubles to rm6.2 billion as overseas jobs kick in, ram closely monitoring renikola’s legal disputes with its contractors, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Gamuda’s 1H Revenue Nearly Doubles To RM6.2 Billion As Overseas Jobs...

Is padu at a tipping point.

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.

- Trip delay reimbursement: up to $500 per ticket if you're delayed more than six hours or require an overnight stay.

- Trip cancellation and interruption protection: up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Medical evacuation benefit: up to $100,000 for necessary emergency evacuation and transportation when on a trip of five to 60 days and traveling more than 100 miles from home.

- Travel accident insurance: accidental death or dismemberment coverage of up to $100,000 (up to $1,000,000 for common carrier travel).

- Emergency medical and dental benefits: up to $2,500 for medical expenses (subject to a $50 deductible) when on a trip arranged by a travel agency and traveling more than 100 miles from home.

- Rental car coverage: primary coverage for damages caused by theft or collision up to $75,000 on rentals of 31 days or fewer

More protections are included with cards with an annual fee, but there are exceptions. The no-annual-fee Chase Freedom Flex , for instance, includes up to $1,500 per person (and up to $6,000 per trip) in trip cancellation and trip interruption coverage.

However, there are some differences between credit card travel coverage and obtaining coverage from a third party.

"Credit card coverage does not typically provide travel medical benefits," Borden says. "For protection if you get sick or hurt while traveling, you'll want a travel insurance plan with medical coverage."

Whether you get your travel insurance in a standalone policy or through a credit card, it's important to review your plan details carefully. In either case, there may be exclusions and other requirements such as deadlines when filing a claim, Borden notes.

What travel insurance coverage do you need to pay more for?

Knowing what travel insurance doesn't cover is as important as knowing what it does cover.

"Travelers should understand that travel insurance benefits come into play only if a covered reason occurs," Borden says. Most standard travel insurance plans won't reimburse you for the following:

Cancel for any reason (CFAR)

Cancel-for-any-reason travel insurance covers a trip cancellation for any reason, not just a covered event. your standard benefits won't kick in unless it's a covered event. For instance, you'll be reimbursed simply for changing your mind about taking a trip.

That said, CFAR travel insurance is not without its downsides. For one, it's more expensive than traditional insurance, and most CFAR policies will only reimburse you for a percentage of your travel expenses. Additionally, CFAR policies aren't available for annual travel insurance .

You can find our guide on the best CFAR travel insurance here.

Foreseen weather events

Sudden storms or unforeseen weather events are typically covered by standard travel insurance plans. There are exceptions to be aware of. For example, an anticipated and named hurricane will not be covered.

Medical tourism

If you're going to travel internationally for a medical procedure or doctor's visit, your travel insurance plan will not cover the procedure itself. Most medical travel plans also won't cover you if something goes wrong with your procedure.

Pre-existing conditions and pregnancy

Those with specific pre-existing conditions, such as someone with diabetes and needing more insulin, will not be covered by most plans. In addition, pregnancy-related expenses will likely not be covered under most plans.

That said, you can obtain a pre-existing condition waiver for stable conditions. In order to obtain a wavier, you will need to purchase travel insurance within a certain time frame from when you booked your trip, usually two to three weeks, depending on your policy.

Extreme sports and activities

Accidents occurring while participating in extreme sports like skydiving and paragliding will typically not be covered under most plans. However, many plans offer the ability to upgrade to a higher-priced version with extended coverage.

Navigating claims and assistance

When a trip goes awry, the first thing you should do is document everything and be as specific as possible with documentation. This will make the claims process easier, as you can substantiate and quantify your financial losses due to the delay.

For example, your flight home has been delayed long enough to be covered under your policy, you'll want to keep any receipts from purchases made while waiting. For instances where your luggage is lost, you will need to file a report with local authorities and document all the items you packed.

Cancellation protection also requires meticulous attention to detail. If you're too sick to fly, you may need to see a doctor to prove your eligibility. If an airline cancels a flight, you'll also need to document any refunds you received as travel insurance isn't going to reimburse you for money you've already gotten back.

Part of the benefit of CFAR insurance is the reduced paperwork necessary to file a claim. You'll still need to document your nonrefundable losses, but you won't have to substantiate why you're canceling a trip.

Choosing the right travel insurance

Each plan should be personalized to meet the insured party's needs. Some travelers prefer to stick to the bare minimum (flight cancellation benefits through the airline). Others want a comprehensive plan with every coverage possible. Before you buy anything, set your destination. Are there any travel restrictions or changes pending? Does your destination country require emergency or other medical coverage?

If the destination airport is known for lost or delayed luggage, travelers should keep important items in carry-ons. Lost or delayed luggage coverage protects insured parties in the event of a significant delay or total loss.

Second, check current credit card travel benefits to avoid redundancies. Savvy travelers don't need to pay for the same coverage twice.

Finally, consider your individual needs. Do you have a chronic medical condition, or do you feel safe with emergency-only medical coverage? Keep in mind, this does not include coverage for cosmetic surgery or other medical tourism. Do you have a budget limit for travel insurance? Asking and answering these important questions will help every traveler find the right product.

Most travel insurance plans are simple, and Business Insider's guide to the best travel insurance companies outlines our top picks. Remember, read your policy and its specifics closely to ensure it includes the items you need coverage for.

No one likes to dwell on how a trip might not go as planned before even leaving. However, at its core, travel insurance provides peace of mind as you go about your trip. While the upfront cost may seem significant, when you compare it to the potential expenses of a canceled flight, emergency evacuation, or a hefty medical bill, it's a small price to pay in the grand scheme of things.

Get Travel Insurance Quotes Online

Protect your trip with the best travel insurance . Compare travel insurance quotes from multiple providers with Squaremouth.

What does travel insurance cover frequently asked questions

Does travel insurance cover trip cancellations due to a pandemic like covid-19.

Coverage for pandemics vary from policy to policy. Some travel insurance companies have specific provisions for pandemic-related cancellations, while others may exclude them entirely.

Are sports injuries covered under travel insurance?

Sports injuries are often covered under travel insurance, but high-risk or adventure sports might require additional coverage or a special policy.

Can travel insurance provide coverage for travel advisories or warnings?

Travel advisories have different effects on your travel insurance depending on your policy. Traveling to a country already under travel advisory may invalidate your coverage, but if you're already traveling when a travel advisory is announced, you may be covered.

How does travel insurance handle emergency medical evacuations?

Travel insurance usually covers the cost of emergency medical evacuations to the nearest suitable medical facility, and sometimes back to your home country, if necessary.

Are lost or stolen passports covered by travel insurance?

Many travel insurance policies provide coverage for the cost of replacing lost or stolen passports during a trip.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

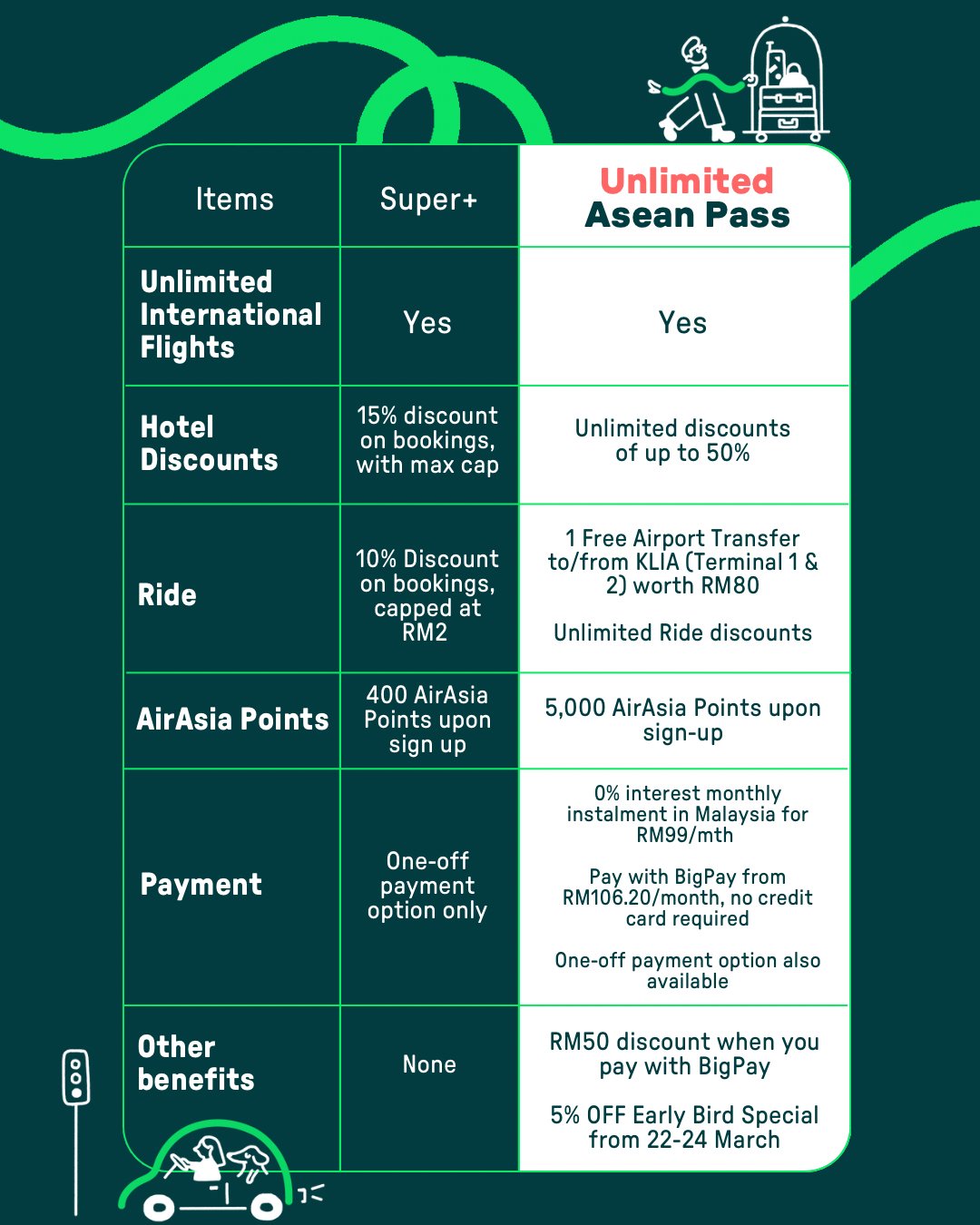

Travel UNLIMITED with AirAsia MOVE’s All New Travel Pass

Unlimited* International Flights up for grabs Exclusive discounts on hotels and rides New 0% monthly installment plan for Malaysian users at RM99* per month

KUALA LUMPUR - March 25, 2024 —

AirAsia MOVE (formerly airasia Superapp) today unveiled the reimagined travel pass - the Unlimited - Asean International Pass . This new travel pass offers passholders a variety of exclusive discount offerings, including flights, hotels and rides.

AirAsia MOVE draws from its past success with airasia Super+ back in December 2022, which saw more than 80,000 total flight seats redeemed for both its Lite and Premium options. The average passholders also enjoyed savings of more than RM1,500 throughout their pass period in terms of redeemed flights, underscoring the immense value offered.

For the Unlimited - Asean International Pass, passholders will not only enjoy unlimited* international Asean flights provided by the AirAsia airline group, but also unlimited use of an exclusive promo code to provide up to 50% discounts on overseas hotel bookings, as well as a free AirAsia Ride trip from Kuala Lumpur International Airports (Terminal 1 & 2), plus RM2 off all trips on AirAsia Ride. Upon signing-up, each passholder will also receive 5,000 AirAsia Points, which could be used to redeem flights, rides and hotels.

Malaysian passholders with a Maybank, Public Bank, Ambank or HSBC card will also be able to purchase the Unlimited - Asean International Pass at RM99* per month for 12 months. BigPay users are also eligible for a loan financing of RM106 per month for 12 months, exclusively on the BigPay app.

Those interested are encouraged to purchase now as only limited passes are available and can be purchased from today until 2359hrs (GMT+8) on 31 March 2024. Download the AirAsia MOVE app today and click on the “Unlimited” icon to purchase.

The Pass is priced at:

- RM 1,188 in Malaysia

- THB 8,888 in Thailand

- PHP 14,888 in the Philippines

- IDR 3.988,888 in Indonesia

- SGD388 in Singapore

- USD288 in other countries

Those paying with their BigPay card will also receive RM50 off. All prices above are inclusive of taxes.

Nadia Omer, CEO of AirAsia MOVE , said, “We are happy to finally bring back a new version of the popular travel pass - with a refreshed name, Unlimited - Asean International Pass - ensuring travellers a seamless and affordable travel pass while exploring Asean. This offering reaffirms our commitment to providing travellers with one convenient travel solution, encompassing AirAsia flights and AirAsia MOVE's offerings under one Unlimited pass."

For more information on how to purchase the Unlimited - Asean International Pass , click here .

Unlimited - Asean International Pass passholders can redeem their flights for one year* from the pass purchase date (eg: 25 March 2024 - 25 March 2025) and travel from 1 May 2024 onwards.

Flights redeemed via Unlimited - Asean International Pass are subject to government taxes, fees, add-ons, and other applicable charges. Flight bookings must be made at least 14 days before departure and are subject to the embargo period and other terms and conditions. Availability of the free seats is dependent on supply and demand on a particular route.

Stay updated with everything from the AirAsia MOVE by following @airasiamove on Instagram, Threads, @airasiasuperapp on TikTok or @airasia on Twitter for the latest updates.

For a seamless and enhanced experience, download your AirAsia MOVE from the Apple App Store , Google Play Store , or Huawei AppGallery.

Terms and conditions apply. Read the Frequently Asked Questions page to find out more.

*Embargo Period applies

** Seats available for Unlimited Flights dependent on supply and demand on particular route

Release ID: 89125373

In case of detection of errors, concerns, or irregularities in the content provided in this press release, or if there is a need for a press release takedown, we strongly encourage you to reach out promptly by contacting [email protected]. Our efficient team will be at your disposal for immediate assistance within 8 hours – resolving identified issues diligently or guiding you through the removal process. We take great pride in delivering reliable and precise information to our valued readers.

Articles airasia Flights: Flight Delay Insurance 24%* off for AirAsia Free Seats Campaign

Explore other articles and discussions on this topic.

08/01/2024 • FAQs

Information.

FAQs

1. What is Flight Delay Insurance? Flight Delay Insurance is a protection that provides guests an inconvenience allowance of MYR 200 (or currency equivalent) if the flight is delayed for more than 2 hours from the departure time due to factors that are controllable by the airline, and that the delay notification is received at least 24 hours before departure. By having this product as a standalone protection, it proves that we are committed to ensure the On-Time Performance of our airlines is always at its best. Our commitment to all AirAsia Guests is to continue with our effort to constantly better our services. The Insurance will be offered at a discounted price of 24% as an add-on during the AirAsia Free Seats campaign happening between 8 Jan – 14 Jan 2024 for travel period between 22 Jan - 30 Sept 2024 . 2. Who is eligible for this insurance? This is eligible to AirAsia Guests who made a successful purchase of flight booking WITH an add-on of Flight Delay Insurance during the Campaign and received a Thank You email with Certificate of Insurance (COI) from Tune Protect upon successful purchase. 3. Is it applicable to all Airasia Network Flights? Yes, the Campaign is applicable to all AirAsia Network Flights (Carrier codes: AK, D7, QZ, Z2) except for Thai AirAsia (FD) and Thai AirAsia X (XJ) flights. 4. What are the benefits and advantages of this product? Guests will be eligible to claim a compensation allowance which can help to minimise consequential losses incurred by the guests due to flight delay. The Insurance DOES NOT provide coverage for any other travel-related incidents such as medical expenses, personal accident, property losses or damages, as well as emergency evacuation and repatriation. 5. How can I purchase this Insurance during the Campaign? The Insurance will be only available during your initial flight booking. 6. How much is the premium? During the Campaign, the Insurance will be offered at a 24% discount. The premium will be as follows:

*Subject to any local taxes, if applicable. *Amount in respective country currency equivalent.

7. How do I make the claim if my scheduled flight is delayed? In the event of a flight delay, the claim can be triggered via a Claim button which is embedded in the Thank You email upon completion of the booking. 8. What will happen to this insurance if my flight is changed to a new date? If your flight is rescheduled to a new date by AirAsia, the coverage will be automatically carried forward to your new booking itinerary. The same terms and conditions will apply to the coverage for the new travel date. 9. Who is the insurance provider for AirAsia Flight Delay Insurance? During the campaign, this Insurance will be underwritten by Tune Protect Malaysia. 10. Who can I contact for assistance? Please reach out to [email protected] should you need further assistance. To find out more about the coverage, general exclusion and conditions of this product, please click here: https://s3.ap-southeast-1.amazonaws.com/tuneprotect.com/airasia/tpaa/PW_Standalone_OTG_MY_normal.pdf

Tune Protect Malaysia (Tune Insurance Malaysia Berhad 30686-K) Level 9, Wisma Tune, No.19, Lorong Dungun, Damansara Heights, 50490 Kuala Lumpur Tel: 1-800-88-5753 Fax: 03-2094 1366

General Exclusions We do not cover: 1. Payment which would violate a government prohibition or regulation; 2. Delay, seizure, confiscation, destruction, requisition, retention or detention by customs or any other government or public authority or official; 3. Any violation or attempt of violation of laws or resistance to arrest by the appropriate authority; 4. Any person who is below the age of 2 years; 5. The Insured Person’s late arrival at the airport for the Scheduled Flight after the official check-in time; 6. Any loss, injury, damage or legal liability arising directly or indirectly from travel in, to or through Afghanistan, Belarus, Cuba, Democratic Republic of Congo, Iran, Iraq, Israel, North Korea, Russian Federation (including Crimea), Somalia, Sudan, Syria, Ukraine and Zimbabwe; 7. Any loss, injury, damage or legal liability suffered or sustained directly or indirectly by the Insured Person if the Insured Person is:

8. any loss resulting directly and indirectly (in whole or in part) from:

9. any loss, damage, liability, expense, fines, penalties directly or indirectly caused by, in connection with, involving or arising out of any of the following – including any fear thereat, whether actual or perceived:

If the Insurer alleges that, by reason of this exclusion, any amount is not covered by this insurance plan, the burden of proving the contrary shall rest on the Insured.

For T&Cs, please click here .

IMAGES

COMMENTS

Accidents Happen. Get Travel Insurance Protection. Worldwide Coverage. Compare Plans. Consumer Voice Provides Best & Most Updated Reviews to Help You Make an Informed Decision!

It's Not Too Late To Buy Travel Insurance After You Booked Your Airfare. Buy Now. There's About A 1 In 5 Chance That A U.S. Flight Is Delayed Or Canceled. Get A Quote.

5,000. 5,000. International Return. Compassionate Visit. Get reimbursed for one relative or one friend's return AirAsia flight and hotel accommodation expenses if you are hospitalized during your trip due to COVID-19 and their presence is required. up to 5,000. up to 5,000. International Return. Trip Cancellation.

airasia Flights: Flight Delay Insurance 24%* off for AirAsia Free Seats Campaign; airasia Flights: Tune Protect Insurance: Premium Flex, Premium Flatbed, and Value Pack; What is AirAsia Travel Protection? airasia Superapp: Travel Insurance; airasia Flights: I have purchased Tune Protect Travel AirAsia. How do I make a claim?

AirAsia Travel Protection has been designed to protect you and give you peace of mind while traveling with Asia's largest low fare airline, AirAsia. For more information, please visit this link and select your departure country. However, if you are traveling with AirAsia X or Thai AirAsia X, your AirAsia Travel Protection policy can be amended ...

Tune Protect Travel - AirAsia is exclusively designed to offer peace of mind for guests who have purchased a one-way or return flight from AirAsia Berhad or AirAsia X Sdn Bhd online on airasia.com. This plan is underwritten by Tune Protect Malaysia (Tune Insurance Malaysia Berhad 30686-K) Domestic - One Way: Domestic - Return: International ...

Click on your preferred 'Low Fare' and select 'Add Now' under Value Pack / Premium Flex or click on your preferred 'Premium Flatbed' flight (for AirAsiaX flights only - except D7 flights). Proceed with normal booking steps. Any further details on the travel insurance policy can be obtained from the Certificate of Insurance from ...

Under Tune Protect Travel - AirAsia, air travel coverage is only limited to AirAsia flights. For the Return Cover Plans, the coverage for the period commencing upon arrival until departure only applies within the original country of destination on an AirAsia flight.

KUALA LUMPUR, 30 October 2023 - Tune Protect Group Berhad ("Tune Protect") and AirAsia Aviation Group Limited ("AirAsia") announce the launch of the newly enhanced AirAsia travel insurance, the AirAsia Comprehensive Travel PLUS, featuring the practical addition of Cashless Hospital Admission services for policies issued by Tune Protect Malaysia and Tune Protect Thailand.

KUALA LUMPUR, 17 November 2021 - In an industry first, Tune Protect and AirAsia today launched the Covid Travel Pass as an added convenience for air travellers to meet the mandatory insurance coverage set by the governments for fully vaccinated international travellers flying into the countries.Kicking off with Langkawi, Malaysia and various tourist destinations in Thailand, the service will ...

Bought your AirAsia flight without travel insurance? Don't risk your holiday, get your plan today All Airline . From RM56/Year. Tune Protect Travel - AirAsia (Annual Plan) ... Worry-Free & Get RM200 for more than 2 hours AirAsia flight delay* Read More > Buy Now Submit Claim.

Via the BigPay app, BigPay users are able to apply for TravelEasy insurance in five easy steps: Step 1: Open the BigPay app and tap "Insurance" under "Utilities". Step 2: Tap "TravelEasy - Individual". Step 3: Tap "Get a quote". Step 4: Fill in your travel details. Step 5: Pick your plan and check out. For more information about ...

Tune Protect Group Berhad ("Tune Protect") and AirAsia Aviation Group Limited ("AirAsia") have announced the launch of their newly enhanced AirAsia travel insurance with additional features to ensure a hassle-free experience for travellers seeking medical assistance abroad.The enhanced AirAsia Comprehensive Travel PLUS features the practical addition of Cashless Hospital Admission ...

Get reimbursed for one relative or one friend's return AirAsia flight and hotel accommodation expenses if you are hospitalized during your trip due to COVID-19 and their presence is required. Up to RM5,000 for International Plans. Up to RM1,000 for Domestic Plan. *Terms and conditions apply. Please refer to the Policy Wording for the full ...

The eligibility for medical expenses reimbursement due to COVID-19 are: Travelers must be between 2 to 75 years old. Applicable for return flights only. One-way flights are not covered. Flights departing from Malaysia to these 7 countries: Singapore, Indonesia, Thailand, Brunei, Vietnam, Cambodia, and Myanmar.

Yes, it is only applicable to Tune Protect Travel - AirAsia Domestic (i.e. Tune Protect Travel - AirAsia, AirAsia Lifestyle Travel Protection, Annual Plans, Flight Delay Insurance, Covid Travel Pass & Baggage Delay, On Time Guarantee & Trip Cancellation) at the prevailing rate as determined by the government from time to time.

AirAsia Travel Protection comes with benefits that cover COVID-19 so you can focus on your health, while we take care of the rest. Benefits. Description. Sum Insured. Medical Expenses. Covers medical treatment and hospitalization costs should you contract COVID-19. This plan fulfils the mandatory insurance requirement by the Singapore ...

Tune Protect and AirAsia announced the launch of the newly enhanced AirAsia travel insurance, the AirAsia Comprehensive Travel PLUS, featuring the practical addition of Cashless Hospital Admission services for policies issued by Tune Protect Malaysia and Tune Protect Thailand. Commencing 19 October 2023, this innovative feature offers travellers a seamless…

Book online with AirAsia to enjoy flights at the lowest fares to 150+ destinations, and choice of 500k+ hotels and 10k+ activities to perfect your trips! menu. home Home. app App. play Play. ... Travel Insurance by Tune Protect 2 1 Hour On Time Guarantee and Baggage Delay. airasia points

AirAsia MOVE is an all-in one travel app with a wide range of offerings, which include OTA services such as flight bookings from over 700 airlines, including the World's Best Low-Cost Carrier AirAsia and 900,000 hotels world-wide plus ride-hailing, dining experiences, travel insurance, more, underpinned by integrated financial services by BigPay and a strong loyalty programme, airasia rewards.

Kindly chat with Bo via airasia.com, AirAsia MOVE app or support page for further assistance by following the steps below: Chat with Bo and Click on 'Travel'. Choose 'AirAsia Flights'. Choose 'Insurance' under Add-ons and select the list option that matches your inquiry. 9.

Travel insurance is intended to cover risks and financial losses associated with traveling. Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

PHP 58,600. Flight Cancellation. Get reimbursed for your non-refundable air ticket if you are located in a country with a pandemic lockdown or if you or your immediate family test positive for COVID-19. Up to original AirAsia flight cost for Domestic. Up to PHP 60,000 for International. Daily Hospital Allowance.

This offering reaffirms our commitment to providing travelers with one convenient travel solution, encompassing AirAsia flights and AirAsia MOVE's offerings under one unlimited plan." Asean Pass members can use their flight redemptions for travel beginning on 8 March 2024, and for a year after the subscription date.

AirAsia MOVE draws from its past success with airasia Super+ back in December 2022, which saw more than 80,000 total flight seats redeemed for both its Lite and Premium options. The average passholders also enjoyed savings of more than RM1,500 throughout their pass period in terms of redeemed flights, underscoring the immense value offered.

Yes, it is only applicable to Tune Protect Travel - AirAsia Domestic (i.e. Tune Protect Travel - AirAsia, AirAsia Lifestyle Travel Protection, Annual Plans, Flight Delay Insurance, Covid Travel Pass & Baggage Delay, On Time Guarantee & Trip Cancellation) at the prevailing rate as determined by the government from time to time.

Unlimited - Asean International Pass passholders can redeem their flights for one year* from the pass purchase date (eg: 25 March 2024 - 25 March 2025) and travel from 1 May 2024 onwards.. Flights ...

Our commitment to all AirAsia Guests is to continue with our effort to constantly better our services. The Insurance will be offered at a discounted price of 24% as an add-on during the AirAsia Free Seats campaign happening between 8 Jan - 14 Jan 2024 for travel period between 22 Jan - 30 Sept 2024. 2.

Thank you for purchasing Tune Protect Travel - AirAsia. We can help find the policy you are looking for. Just fill in your details below to download your Certificate of Insurance. ... Flight Delay Insurance. COVID Travel Pass. Travel Pass. Tune Protect Travel - AirAsia (Annual Plan) Baggage Delay, On-time Guarantee & *New! Trip Cancellation.