- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate can be good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Travel FX Foreign Currency Exchange Rates in 2023

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Travel FX is a well-known British retailer that offers foreign currency exchange for travel money, which you can pick up at their stores or have it delivered to you.

Understanding Travel FX exchange rates is important for anyone who is planning to travel abroad because they do not often offer the best rates. In this article, you'll see how to find the Travel FX exchange rate and how to calculate the hidden fees.

We also provide a list of some of the best Travel FX alternatives, such as Starling Bank , Revolut and Wise , that exist in 2023.

Our highlights for the best travel money exchange rates:

- Revolut : Get a starling and euro account, plus hold and exchange over 30 foreign currencies with no fees for the first £1,000 per month exchange during the week. | Read our Revolut review .

- Starling Bank : Get a free GBP and EUR bank account and access both currencies with the Starling debit card, which waives all foreign transaction fees and charges no ATM fees. | Read our Starling Bank review .

Everything You Need to Know About Travel FX Exchange Rates

- 01. What is the Travel FX exchange rate today? scroll down

- 02. Comparison table of Travel FX exchange rates scroll down

- 03. Travel FX travel money limits and fees scroll down

- 04. Factors that affect Travel FX exchange rates scroll down

- 05. Get the best Travel FX alternatives scroll down

What is the Travel FX Exchange Rate in 2023?

The most important thing to note as a Travel FX customer is that their exchange rates are always weaker than the real mid-market rate . This is also known as the spread. Exchange rate margins are used by Travel FX to cover their costs and make a profit.

We recorded the Travel FX exchange rate on their website from the British Pound to the Euro at 9:25 on 14 September 2023 . For example, if you had exchanged £1,000 at the mid-market rate, you would have gotten around €1,162. With Travel FX, you get only €1,144.

- Real Mid-Market Exchange Rate: £1 = 1.162 EUR

- Travel FX Exchange Rate: £1 = 1.1446 EUR

Due to the hidden exchange rate margin fee in this example, you would lose £18 to Travel FX if you exchanged £1,000 for Euros:

- Hidden Exchange Rate Margin Fee: £18

While mid-market exchange rates are subject to fluctuate constantly from second to second, be aware that the Travel FX exchange rate will fluctuate along with it at a weaker rate.

Compare the Travel FX Exchange Rate in 2023

In the graph below, we compare several travel money exchangers across the UK. See how Travel FX's rates compare against other providers.

You'll notice that many providers advertise themselves as commission-free. However, commissions are not the only important factor to take into account when finding the best deal. The hidden exchange rate margin, card surcharges, and cash delivery fees will all affect how much currency you'll receive at the end of the transaction.

The hidden exchange rate margin fee that we recorded below is not guaranteed. However, we calculated the margin and by recording both the real mid-market exchange rate and the provider's exchange rates at the same time, at 9:25 CEST on September 14th, 2023. In this comparison test, we requested a £1,000 conversion into Euros at each provider:

Travel FX vs Other UK Bureau de Change Euro Rates

Check out this table to compare Travel FX's euro rate margins, commission, and other fees to those of other UK travel money bureau de change.

Data quoted: 14 September 2023 *Calculated on 9:25 CEST on September 14th, 2023 for a £1,000 conversion into Euros (margin may vary depending on the foreign currency)

Travel FX Travel Money Limits and Fees

In addition to hidden exchange rate margins and commission fees, bureau de change in the UK may impose some transaction limits, cash delivery fees, and surcharges when paying by debit or credit card.

Travel FX Travel Money for In-Store Pick-Up

Travel FX sets £300 minimums and £5,000 maximums for travel money bought in-store.

- Minimum order amount: £300

- Maximum order amount: £5,000

- Surcharge for payment by debit card: 0.299%

- Surcharge for payment by credit card: 0.299%

Travel FX Travel Money for Home Cash Delivery

For online travel money orders, the minimum order amount is £300 and the maximum is £5,000. Orders over £700 enjoy free delivery. Otherwise, Travel FX will charge a £5.00 delivery fee to send the cash to your door.

- Maximum order amount: £5,000

- Minimum order amount for free delivery: £700

- Delivery charge for orders under free delivery amount: £5.00

- Surcharge for payment by debit card: 0.299%

- Surcharge for payment by credit card: 0.299%

Factors That Affect Travel FX Exchange Rates

Exchange rates are influenced by a variety of complex factors, including inflation, interest rates, international trade flows, government intervention, and much more. The unpredictability of exchange rate fluctuations is due in large part to the combined influence that all of these factors have at once on the value of a given currency.

In regards to foreign exchange for travel money, customers should take heed on one crucial fact: bureau de change and providers like Travel FX will often automate their exchange rates so that they fluctuates in sync with the market, but at a weaker rate.

Before you exchange your British pounds for Euros, US Dollars, or any other currency for your travels, make sure to compare Travel FX's exchange rate to the real mid-market rate.

Get the Best Exchange Rates with Travel FX Alternatives

With the introduction of travel debit cards and the development of multi-currency accounts , there are now limited benefits to getting travel currency in the UK through a travel money provider (such as those found on platforms like MoneySuperMarket).

Traditionally, getting physical bills of foreign cash from a travel money exchange in the UK served as a convenient option before your journey. Nevertheless, it has become significantly more cost-effective to simply withdraw cash at an ATM during your overseas trip. Additionally, the majority of retailers and merchants abroad now readily accept card payments. Moreover, there are travel cards available that exempt you from foreign transaction fees . Their virtual cards also reduce the risks associated with carrying substantial amounts of cash while traveling.

In the following list, we will compare three companies for getting travel currency while in the UK . Let's explore these options:

Revolut is our top choice for travel money in the UK because it charges zero fees for first £1,000 per month that you exchange (only on weekdays, since weekend surcharges apply). The platform works entirely by desktop or smartphone, and they send you a debit card to access your travel money. After the fair usage limit, Revolut charges 1% of the total for Standard plan customers.

What's just as impressive is Revolut's exchange rate fees. While markups vary by currency and increase on the weekends, the average margin is a minuscule 0.2%. For euros (€), the most popular currency used for travel money in the UK, Revolut sometimes applies an exchange rate that is actually stronger than the European Central Bank's mid-market rate. While not guaranteed, this means you can gain when you exchange your GBP to EUR for your next holiday in the Eurozone.

You can use Revolut's debit card to use at ATMs for local cash. As a Standard customer, you'd get £200 per month of fee-free withdrawals, though third-party ATM withdrawal fees may still apply.

Learn more: Read our in-depth Revolut review or visit their website .

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Starling Bank

Starling Bank stands out as one of the premier debit cards for international travel for customers in the UK, thanks to its absence of foreign transaction fees. If you solely have their GBP account, your Starling Bank card will apply the live exchange rate used by MasterCard, which closely aligns with the mid-market exchange rate.

Starling Bank also provides EUR accounts for no additional cost, making it an ideal choice for traveling to countries that accept euros. In such instances, your Starling Bank debit card will access these account balances, allowing it to be recognised as a local Eurozone card.

One of the most compelling features of Starling Bank is its complete exemption from ATM fees, both domestically and internationally. Irrespective of the amount of cash withdrawn or the frequency of withdrawals, Starling Bank never imposes any fees for ATM transactions. While third-party fees may still apply, as determined by the ATM owner, this travel benefit solidifies Starling Bank's position as the top debit card for international travel for UK residents and citizens.

More info: Read our in-depth Starling Bank review or visit their website .

- Trust & Credibility 9.3

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

Wise Account

The power of the Wise multi-currency account comes from never charging hidden exchange rate margin fees . No matter which foreign currency you want, Wise will always apply the real mid-market exchange rate to your British pounds. Instead, it charges a transparent service fee that ranges from 0.3% to around 2% depending on the currency.

The Wise account lets you exchange, hold, and spend over 50 foreign currencies with its debit card. It even comes with checking account details for 10 countries, including a UK sort code, US account number, EU IBAN, and more. This means you can receive money locally from those countries with direct debits, SEPA payments, and other methods.

For holiday cash, you can use the Wise debit card for 2 free ATM withdrawals for a total of £200 per month.

Learn more: Read our in-depth Wise review or visit their website .

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

References Used In This Guide

Convert GBP to EUR. XE.com . Accessed 14 September 2023. Currency Conversion. John Lewis Finance . Accessed 14 September 2023. Travel Money. Tesco Bank . Accessed 14 September 2023. Buy Euro Travel Money. Marks and Spencer Bank . Accessed 14 September 2023. Travel Money. Halifax.co.uk . Accessed 14 September 2023. Foreign Currency Conversion Terms & Conditions. UK Post Office . Accessed 14 September 2023. Post Office Travel Money. Wise.com . Accessed 14 September 2023. Travel Money Help. Travel FX . Accessed 14 September 2023. Travel Money FAQ. Sainsbury's Bank . Accessed 14 September 2023. Travelex FAQs. Travelex . Accessed 14 September 2023. Travel Money. Thomas Cook . Accessed 14 September 2023. Send Money. Wise . Accessed 14 September 2023. Send Money to Europe. Starling Bank . Accessed 14 September 2023. Currency Converter. Revolut . Accessed 14 September 2023.

From the United Kingdom? Revolut is not licensed as a bank in the UK. The content found on this page relating to its products and services is not intended exclusively for a UK readership and may therefore contain inaccuracies from the perspective of UK customers.

Travel Money Comparisons of Travel FX Exchange Rates

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Suggested companies

The currency club, sterling fx, covent garden fx.

Travel FX Reviews

In the Currency exchange service category

Visit this website

Company activity See all

Write a review

Reviews 4.9.

20,742 total

Most relevant

Myself and my sister in law purchased…

Myself and my sister in law purchased our Aus$ from TravelFX. An excellent rate of exchange and quick delivery to door by R Mail Special Delivery. So very easy, not having to go to banks, travel agents or stores to purchase. Can highly recommend this company.

Date of experience : 28 March 2024

The service is great

The service is great, the exchange rate I got was also great. The first time I used this service, was to sell my US dollars, everywhere else but back rate, was very poor, Travel FX was the best rate, having had a brilliant, I then also bought my Euros from them as well, knowing the TV the buy back policy they have, will also be very favourable. Would definitely recommend Travel FX.

Date of experience : 14 March 2024

Travel money purchase online

Made a purchase for travel money on this site because even with the delivery fee it worked out a better exchange rate than anywhere else and the money didn’t take long to be sent either. Easy site to use and place an order. Excellent experience

Date of experience : 26 March 2024

Best travel exchange

We have used Travel fx for several years now. They offer the best exchange rate delivered straight to your door on your preferred date. They always keep you updated when delivery is due .service is excellent and so easy to use

Date of experience : 02 April 2024

Used this service many a time

Used this service many a time. ALWAYS the best rate, efficient and on time. Cannot fault this service and its refereshing in this day and age, rather than the lies most companies promise, and deliver nothing.

Good rate great service and delivered straight to your door

Ordered Euros and got a good exchange rate . My Euros were delivered free of charge and I was kept updated throughout as to when they would be delivered. Great service. I accidentally typed in a wrong number on my address and emailed to say that I had made a mistake this was delt with efficiently and very quickly with no hassle whatsoever. I have used this service before and will do in the future as easy and convenient.

A great way to purchase euros!

Have used this service twice now, great rates and euros delivered to my home via recorded delivery within 48 hours. Good selection of notes provided too. Will be using again in the future.

In my experience Travel FX offer the…

In my experience Travel FX offer the best rates for currency exchange. I have used them a few times and their service is fast ,professional and safe. I have never used their buy back wervice so I don't know what rates they offer.

Date of experience : 20 March 2024

Have used this company for allot of…

Have used this company for allot of years. Always had excellent service. From ordering to receiving. Kept informed every step of the way. Would never use anyone else

Date of experience : 29 March 2024

Pretty good

I have used TravelFX a few times now and always had good service and rates. The only annoyance I have is with delivery times. You are asked to give a preferred day for delivery, but the money nearly always arrives a day or two early which is absolutely useless if you work.

Date of experience : 03 April 2024

Wouldn't go anywhere else for foreign currency.

Always get the best rate of exchange. Money arrives when expected and I feel that it is safe. I also use Travel Fx to return unused foreign currency, again because I get the same great service.

Prompt service

Prompt service. Does exactly what it says on the tin. Nothing hidden. Web page easy to use. Currency delivered by Royal Mail Special Delivery and you are kept informed of progress. Delivery date estimate was accurate. I have used Travel FX for a few years now and intend to use them again in the future.

Date of experience : 06 March 2024

Reliable service

Have used TravelFX to obtain our foreign currency for the last few years. Usually the best rate on the market, simple process to purchase and reliable delivery.

I always use Travel FX for my holiday…

I always use Travel FX for my holiday money.They offer excellent rates and always deliver safely on time .I would not hesitate to use them for my foreign currency.

Date of experience : 16 April 2024

Used this company many times and it’s…

Used this company many times and it’s now even easier to order and pay safely. Never had any issues with service or delivery- and have always found them to have best rates .

Date of experience : 04 April 2024

TravelFX for buying and selling…

I've used TravelFX for years for buying currency, perfect service. I wanted to sell US dollars and other currencies and their buying service is also brilliant. They give an indicative quote (competitive) and emailed transaction details to be printed and enclosed with the currency. Post Office next day guaranteed delivery envelopes worked perfectly. On receipt (next day) TravelFX emailed confirmation giving the live market priced amount that had been transferred to my bank. The rising £ actually gave me more for my USD than originally quoted. Money was always in my bank by the time the email was received. I recommend this service.

Date of experience : 15 April 2024

Great Experience Buying Currency via TravelFX

I found buying the required Foreign Currencies from TravelFX easy, straight forward & very safe. so, I would recommend TravelFX for all foreign travel.

Date of experience : 22 March 2024

Excellent and professional money service

Best exchange rate for US dollars, and my order arrived securely as promised. My go-to foreign currency provider of choice. Totally excellent and professional money service.

Best out there

Always use Travel FX, Best rates, quick and easy to order, super fast and secure delivery with a date of your choice. They also give you a good variety of currency notes. Thank you!

Found Overall a very good efficient and quick service.this company to give the best…

Found this company to give the best rates time and time before. Very easy transaction and quick delivery. Would recommend to those who have yet to try them.

Date of experience : 25 March 2024

- Home ›

- Exchange Rates ›

Travel FX exchange rates

Today's latest Travel FX travel money exchange rates, updated 4 minutes ago at 4:40am

Travel FX have 45 currencies in stock and ready to order now. Buy online and get your currency delivered securely to your door.

Jump to section:

- View today's latest Travel FX rates

- Compare Travel FX's rates

Travel money order limits and fees

- Travel FX reviews

Travel FX travel money rates

These are the latest Travel FX exchange rates available right now. You must buy or reserve your currency online to guarantee these rates or you may be given a lower rate in-store.

Compare Travel FX's exchange rates

We compare hundreds of exchange rates from dozens of currency suppliers across the UK. Select a currency below to see how Travel FX's rates compare against other providers. Bear in mind that exchange rates aren't the only important factor when it comes to getting the best deal; commission, card surcharges and delivery costs can all affect the final amount of currency you'll receive. You can see the full range of currency deals on offer right now on our travel money comparisons .

The minimum order amount for travel money is £300. There is no maximum order amount, although larger orders will be subject to identity and compliance checks. Delivery is free for orders over £700, otherwise a £5.00 delivery charge will apply. Travel FX treat each currency as a separate order, even when bought together at the same time. This means you'll have to pay £5.00 for any currencies on your order that fall below the £700 free delivery threshold.

Latest Travel FX reviews

Our users have rated Travel FX Excellent in 1888 reviews. Read more on our Travel FX reviews page.

Paul Hutson

Another great service, delivered within 3 days, have been using for several years, keep up the great service, would recommend TFX

Read the full review

This is the third time that I have used Travel Fx and they are extremely reliable and efficient. Best rates and the euros arrived at exactly the time stated with the order.

Jill McLean

Ordered £750 of euros ( not my first transaction with Travelfx) but on this occasion the currency never arrived. I realize the fault lies at the door of the Royal Mail who acknowledge it has gone missing but my problem is that Travelfx will not reim [...]

The euro rate at Travel FX right now is 1.1537. You'll need to buy or reserve your euros online to guarantee this rate; the euro rate offered in your local store may be lower if you don't order online beforehand.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Personal Finance Accounts Best Credit Cards Best Financial Advisors Best Savings Accounts Apps Best Banking Apps Best Stock Trading Software Robinhood Alternatives TurboTax Alternatives Brokers Brokerage Account Taxes Brokers for Bonds Brokers for Index Funds Brokers for Options Trading Brokers for Short Selling Compare Online Brokers Forex Brokers Futures Brokers High-Leverage Forex Brokers MetaTrader 5 Brokers Stock Brokers Stock Brokers For Beginners

- Insurance Car Best Car Insurance Rental Car Insurance Motorcycle Best Motorcycle Insurance Seasonal Insurance Vision Best Vision Insurance Types of Vision Insurance Vision Insurance For Kids Vision Insurance For Seniors Health Affordable Health Insurance Best Health Insurance Companies Individual Health Insurance Self-employed Health Insurance House Earthquake Insurance Flood Insurance Homeowners Insurance Mobile Homes Moving Insurance Renters Insurance Sewer Line Dental Affordable Dental Insurance Best Dental Insurance Dental Insurance With No Annual Maximum Dental Insurance With No Waiting Period Kids Dental Insurance Medicare Compare Medicare Plans Cost of Hospital Stays Life Term Life Insurance Business Best Business Insurance Pet Best Pet Insurance

- Investing Penny Stocks Best EV Penny Stocks Best Penny Stocks Penny Stocks Under 10 Cents Penny Stocks With Dividends Futures Best Futures Trading Software Futures to Trade Futures Trading Courses Strategies Trading Platforms for E-Mini Futures Stocks Best Stock Charts Best Stocks Under $50 Best Stocks Under $100 Best Swing Trade Stocks Best Time to Trade Cash App Stocks How to Invest Stock Market Scanners Stock Market Simulators Stocks to Day Trade Forex Forex Demo Accounts Forex Robots Forex Signals Forex Trading Apps Forex Trading Software How to Trade Forex Making Money Trading Forex Trading Courses Trading Strategies Options Options to Buy Options Trading Apps Options Trading Books Options Trading Courses Paper Trading Swing Trading Options Trading Examples Trading Simulators Trading Software Trading Day Trading Apps Day Trading Books Day Trading Courses Day Trading Software Day Trading Taxes Prop Trading Firms Trading Chat Rooms Trading Strategies Alternative investing Alternative Investment Platforms Best REITs Best Alternative Investments Best Cards to Collect Best Gold IRAs Investing in Precious Metals Investing in Startups Real Estate Crowdfunding ETFs Commercial Real Estate ETFs International ETFs Monthly Dividing ETFs

- Mortgage Best Mortgage Companies FHA Lenders First Time Buyers HELOC & Refinancing Lenders for Self-Employed People Lenders That Do Not Require Tax Returns Online Mortgage Lenders

- Crypto Best Crypto Apps Business Crypto Accounts Crypto Day Trading Crypto Exchanges Crypto Scanners Crypto Screeners Earning Interest on Crypto Get Free Crypto How to Trade Crypto Is Bitcoin a Good Investment?

Best Forex Card for International Travel

A forex card is one of the most convenient and safe ways to carry cash and exchange money for your travels abroad. It's a widely accepted payment and is simple to use, like a credit or debit card. When selecting a type of forex card, you need to consider the countries you are traveling to. Find out more about the best forex card for international travel, their benefits and how to use them.

5 Best Forex Cards for International Travel

Wise travel card, axis bank forex card, indusind bank multi-currency forex card, travelex money card, hsbc everyday global travel card, what is a forex card, how to choose a forex card for international travel, low exchange rates, ability to hold multi-currency, ability to reload online.

- EVM Chip-enabled

Special Perks

Cut down on international travel expenses using forex cards.

- Frequently Asked Questions

Quick look: Best Forex Cards

- Best for Exchange Rate: Wise Travel Card

- Best for Discounts and Exclusive Rewards: Axis Bank Forex Card

- Best for Low Fees: Travelex Money Card

- Best for Convenience: IndusInd Bank Multi-Currency Forex Card

- Best for No International Transaction Fees: HSBC Everyday Global Travel Card

The following are among the best five forex cards and their features:

With the Wise Travel forex card, you can enjoy a better exchange rate and lower fees than your bank. The Wise Travel Card is ideal for purchasing goods online from other countries, and it charges no transaction fees. The Wise card is accepted across the MasterCard network.

Best for: Frequent travelers

Card Validity: The validity of your card is stated on the front of the card. Wise will notify you when it's time to order a new one.

Number of Currencies : 50+

Fees and Charges:

- After making two withdrawals of up to $100 each month for free, you'll be charged $1.50 per withdrawal.

- There's a 2% fee on any amount you withdraw above $100.

- Wise charges a fee of $9 when you order a card.

- Best exchange rates globally

- One of the lowest conversion fees on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Cons:

- If you require a replacement card, it may take up to two to three weeks to arrive.

- You can only top up your account online or in the app.

- There are no cash or check payment options.

- There are no credit facilities.

Axis Bank provides four different types of forex cards. Each card has unique perks and disadvantages, so you can select which suits your requirements. The Axis Bank forex card offers emergency assistance and a miles program. Using Mastercard's contactless technology, the card offers quick and secure payments.

Best for: Students

Card Validity: 5 years

Number of Currencies : 16

- Issuance Fee – 300 Indian rupees (INR)

- Reload Fee – 100 INR

- Add-on Card Fee – 100 INR

- Cash withdrawal: $2.25

- Balance inquiry: $0.5

- Replacement card fee (Domestic): $3

- Replacement card fee (International): $15

- Cross Currency Fee – 3.5%

- 24-hour emergency assistance

- Locked exchange rate: Your money on the card is unaffected by the fluctuation in the dollar exchange rate.

- The Axis Bank Forex Card is widely accepted in all retail outlets and online retailers that accept MasterCard or Visa credit and debit cards.

- Charges fees for signing up, reloading and cash withdrawals from ATMs other than those operated by Axis Bank.

- If the card is not used for longer than 36 months, there is an inactivity fee of $5 or the indicated fee for each currency.

- Axis bank forex cards only support a limited amount of currencies.

The IndusInd Bank multi-currency forex card has an embedded chip, which makes transactions secure and simple. Indusind forex card provides currency withdrawals from all VISA ATMs and currency fluctuation protection. IndusInd Multi Currency Forex card also provides add-on features, such as zero foreign markup rates.

Best for: Frequent international travelers

Card Validity: 3 years

Number of Currencies : 14

Fees and Charges:

- Issuance fee – 300 INR

- Cross currency fee – 3.5% markup

- Re-issuance of card fee – 100 INR

- ATM cash withdrawal fee- $2

- Reload fee – 100 INR

- Inactivity fee – $3 per quarter after 18 months of inactivity

- Two free ATM withdrawals each month per currency

- There is no extra charge on International bookings and payments for hotels, restaurants, flights, retailers and gas stations made with the travel card.

- It offers protection given against currency fluctuations.

- You cannot reload the card at foreign locations.

The Travelex Money Card is a contactless prepaid forex card. Pre-loading your Travelex Money Card before a trip allows you to manage your travel budget better. You can pay for goods and services online and at physical stores worldwide. Travelex Money Card does not charge fees for international ATMs withdrawal or purchases.

Card Validity: The validity of your card is stated on the front of the card.

Number of Currencies : 10

- Currency transfer fee - Foreign exchange rate applies; varies each day.

- Foreign exchange fee - If you use your card for a transaction in a currency that is not listed on it you will be charged a 5.75% fee. This fee also applies if there is not enough money on the card to cover the transaction in the local currency, and the rest is taken from another currency.

- Individuals can use it anywhere Mastercard is accepted.

- Travelex doesn't charge ATM fees.

- If your card is lost or stolen, you can withdraw funds from your account through Western Union or Moneygram agents.

- The currency rates are less favorable than those offered by other international travel forex cards.

- It only supports a limited amount of currencies.

The HSBC Everyday Global Travel Card provides an excellent conversion rate for U.S. dollars. When you use HSBC ATMs, you can withdraw cash without paying the 10% withdrawal fee. HSBC forex card does not charge a foreign transaction fee. When you tap and pay with payWave, Apple Pay or Google Pay, you can receive 2% cash back for transactions under $100.

Best for: Individuals traveling to or within the United States and Australia, and transferring overseas.

Card Validity: The validity of your card is stated on the front of the card. HSBC will notify you when it's time to order a new one.

- HSBC does not charge ATM fees, but local operators may charge additional fees or set limits.

- Foreign currency conversion fees are calculated in different scenarios based on HSBC real-time or VISA exchange rates.

- Excellent USD exchange rate.

- There are no ATM fees, foreign transactions, currency conversion costs or monthly fees.

- Multiple currencies can be managed in a single account online or via the HSBC mobile banking app.

A forex card is a prepaid travel card that you can preload with the foreign currency of your choice before embarking on your trip. A forex card can be used to pay for shopping and lodging expenses or to get cash from an ATM in your travel destination's local currency.

When you use a forex card, you do not have to pay a conversion fee every time you swipe the card. Forex cards provide better exchange rates than cash purchases of foreign currency. Currency fluctuations do not impact forex cards because they are preloaded at fixed exchange rates. It is a secure and simple means of holding and transacting foreign currencies.

The following are factors to consider when selecting a forex card for international travel.

When you purchase a forex card and load it with the currency of your choice, it is not affected by currency fluctuations. When selecting a forex card, find out about its exchange rate and fees, as these might significantly increase your expenses. Read the exchange rate fees listed for each forex card and choose the most affordable ones that meet your requirements.

A multi-currency forex card is a card that can hold several currencies. This feature is essential if you plan to visit several countries during your trip. Choose a forex card that supports the currencies of the countries you visit. This way, you won't need to plan for cash each time you pass a border or worry about exchange rate changes.

The forex card you select should have an online reload feature, allowing you to instantly transfer funds from your bank account. This function may come in handy if you run out of money while traveling and cannot visit a bank or wait for a fund transfer.

EVM Chip-enabled

The most important factor to consider when getting a forex card is its security features. Magnetic-stripe cards are vulnerable to card skimming, which allows hackers to clone and abuse them. Ensure that your currency card has an EVM chip for security. The chip's encryptions prevent attackers from using data-reading devices and technology to obtain your card information.

Some forex card issuers provide you with special perks, like discounts, cash back, miles and access to airport services. Find out if a forex card offers additional benefits before choosing one because doing so could help you save money and cut down on travel costs.

Most forex card issuers have mobile apps that allow you to monitor your transactions online and easily reload your card when your funds run out. Forex Cards are one of the most efficient, safe and cost-effective ways to carry money when traveling internationally. Select one of the best forex cards and get easy access to making international transactions at affordable rates.

Frequently Asked Questions

Is a forex card worth it.

Forex cards offer better exchange rates, discounts and additional features that make financing international travel easy.

Do forex cards work?

Yes. After signing up and activating your forex card, you can use it to make purchases and payments.

Is a forex card better than a debit card?

For international travel, a forex card is recommended because they have a better exchange rate and do not charge a conversion fee on every international transaction.

Get a Forex Pro on Your Side

FOREX.com , registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.2 with fixed $5 commissions per 100,000

- Powerful, purpose-built currency trading platforms

- Monthly cash rebates of up to $9 per million dollars traded with FOREX.com’s Active Trader Program

Learn more about FOREX.com ’s low pricing and how you can get started trading with FOREX.com.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel FX Euro Exchange Rates Compared

- buy Currency

What Currency do you want to buy?

How much do you want to spend.

↓ Scroll down for results ↓

Travel FX Does not currently offer this currency, the best Euros on offer right now can be found below

Our review on travel fx: pros and cons, pros: what we like :.

✔ They are one of our most competitive currency suppliers, often showing the best exchange rates for travel money

✔ Option to pay by debit card or bank transfer

✔ Hassle-free home delivery of travel money

✔ Their services are safe, secure and regulated

✔ Travel FX reviews are very positive on popular consumer review sites and often report five star, excellent service

Cons: What we like less:

✓No options for money collection, you can't order currency and pickup at a local branch or bureau de change

Questions about Travel FX

As Travel FX are a foreign currency broker they access wholesale rates that are updated every minute. Most banks and brokers, especially in high street branches, set their rate in the morning and do not move it throughout the day. If there is a major exchange rate movement during the day you will only benefit from it through Travel FX.

Travel FX makes most of their money on the difference between the exchange rate they offer to customers and the base exchange rate.

You can see all today's best exchange rates and easily compare all the providers with our holiday money comparison tool.

Travel FX holiday money is a delivery service only. They do not have a physical branch or bureau de change where you can collect currency.

See the latest Travel FX travel money exchange rates here or go here to compare the best tourist rates for all the travel money providers.

The minimum order is £300, with a minimum of £100 per currency.

If you request more than £10,000, Travel FX will need to carry out additional identity checks. in those cases you will need to provide a copy of your passport, driving license or officially recognized photo I.D. You will also need to provide a copy of a utility bill (not mobile phone) or bank statement dated within the last three months that shows your home address.

If you want to order travel money for home delivery, you just need to visit Travel FX’s website and you can place an order online.

You just need to enter the following information into a simple form:

- ✓ Your personal details

- ✓ The amount of pounds you’re exchanging into the foreign currency

- ✓ Select the currency you’re exchanging your pounds into and select how you want to pay. With Travel FX this has to be bank transfer.

Then, once you have made the bank transfer and Travel FX have received the payment, they will send you your travel money.

Yes, subject to minimum order values. Individual or combined orders below £700 attract a £5.00 handling fee. Any individual currency order below £300.00 will attract a £2 additional currency fee.

You can pay by bank transfer, internet or telephone banking, BACS or CHAPS. Travel FX does not accept cash payments into our accounts, card payments or Cheques under any circumstances.

Your travel money will be mailed to the delivery address you specify on your order, usually using Royal Mail Special Delivery Service.

If your order is above £700 there are no commission or postage charges to pay on your order. If your order total is below £700, a £5.00 handling fee will occur. Any individual currency order below £300.00 will attract a £2.00 handling fee.

If you specifically require a particular note denomination or a delivery time outside of the Royal Mail standard schedule then a charge may apply.

Travel FX only offer buyback for currency they have sold you. However, their partner company The FX Company do offer a buyback service on leftover travel money from any travel money provider . Click here to use our holiday money buy back comparison tool .

What is the Travel FX Euro rate?

The Travel FX Euro rate is currently .

The best pound to euro exchange rate now is 1.1575, which is available from Covent Garden FX.

The worst exchange rate is 1.1133. The difference between the highest and the lowest is 3.82%. This means that if you are buying £750 worth of euros you will get €33.15 more euros by buying with the best euro provider.

This shows you it pays to shop around and get the best rates on travel money!

Euro exchange rate over the last week.

This shows you the best pound to euro exchange rate recorded daily from our UK suppliers over the last week.

In the last 7 days, the rate for Euros has fallen by 0.39%.

If you were to order £1,000 today you would get €4.50 less euros for your money than last week.

How do we source the data above? We receive rate feeds travel money suppliers and aggreate the data each evening we save the average rate that occured during the day, and also include the current best rate

How to get the best euro exchange rate.

We compare the pound to euro exchange rates from many of the UK’s biggest travel money providers including exclusively online providers as well as some of the well-known high street banks and supermarket travel money services. Our clever algorithms ensure you get the latest euro rates and see who is offering the best euro to pound currency deals .

Compare Travel cash is a free service that takes the pain and effort out of finding the best exchange rates for buying euro online . Don't forget the price we quote is the price you pay, we calculate the amount including any fees and delivery costs!

Buying Euros online FAQs

Hundreds of customers safely buy euros through online travel money providers sites every day and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transferring money to any company. Compare Travel Cash undertake comprehensive checks on all of our online travel money providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

Its simple! Choose the travel money provider you would like to buys euros from, then: 1. Fill in your details. 2. Select your preferred payment option and make the payment. - Each currency supplier will have different payment options, but the options are usually bank transfer, debit card, with some suppliers offering payment by Apple Pay and Android pay. 3.Enter your delivery preferences whether you want your currency delivered to your door or collection (depending on the supplier). 4.Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next day delivery.

Not Usually! We constantly update our exchange rates as they change for each supplier, we try to do this in almost real-time, (in normal circumstances not more than 1 minute difference). Also we sometimes have exclusive offers that you won't find by going direct.

Of course! If you want to exchange euros into pounds you can see the best buy back rate on euros and many other currencies using our buy back comparison tool .

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency Online Group

- Covent Garden FX

- The Currency Club

- Sterling FX

- Sainsburys Bank

- Post Office

- Marks and Spencer

- Hays Travel

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registrtion Number 12065287

- Buy US Dollars

- Buy travel money

- sell unused travel cash

CompareTravelCash.co.uk is a price comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Log in | Support

Making FX International Payments

American Express® FX International Payments offers you a quick, secure and cost-effective solution for making payments as wire transfers or drafts. Here we’ll take you through foreign exchange payment methods, payment processing and payment solutions, and provide you with useful tips and insights into forex trading.

What you’ll need to get started:

1 The link to FX International Payments .

2 Your login details. If you haven’t logged in before, go to the Logging In tutorial.

3 Payment details, including the currency and amount you’d like to send.

4 Payee information, including their name, address and bank information.

Useful Terms

Visit our Glossary to familiarize yourself with terms and processes referred to throughout this site and the FX International Payments online platform.

Creating a Payment

Go to Create & Manage Payments > Create a Spot Payment ,then:

1 Choose Outgoing Wire or Outgoing Draft from the Product drop-down menu.

2 Select the currency you want to send from the Payment Currency drop-down menu, then enter the Amount you want to send.

3 Select whether the Amount is in Foreign Currency or Local Equivalent . For example, if you would like to send 1,000 EURO, select Foreign Currency . If you would like to send $1,000 worth of EURO, select USD Equivalent .

4 You can now choose how you want to pay for the transaction from the Settlement Method drop-down menu. If you select Wire Funds, you’ll need to click the Pay to American Express info button to view receiving bank information. If you select ACH (Automated Clearing House) transfer as the Settlement Method , the debit will normally be sent to your checking account two business days before the selected Value Date .

5 To batch same-currency wires, check the Hold for Batch box. Once batched payments are created, they can be viewed under Batch Management . Payments sent to Batch Management will not be processed until you go to Batch Managementand accept the payments. For more details, view the Batch Management tutorial.

6 Once you have entered all the mandatory information, click Quote . The Current Transaction Quote box will then appear with a summary of the transaction details, including the Rate , Fee and Total Cost .

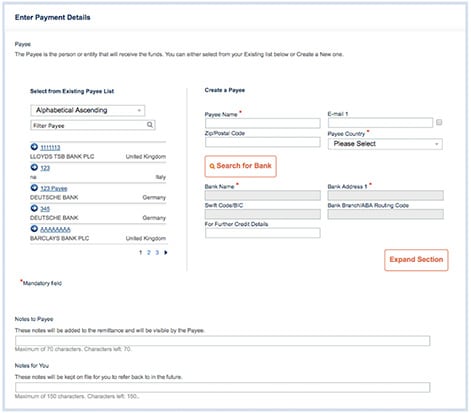

Entering Payee Information

You must enter the information for the payee receiving the payment. To do so, either Select from Existing Payee List or Create a New Payee .

- If you choose to Create a New Payee , manually enter the information in the fields on the right.

- To complete the Bank Details , use the Bank Search button – there’s more on this below.

- If you wish to add a note, Notes to Payee will be sent with the payment instruction. Notes for You/Internal comments are for your use only – they will not be viewable by your payee.

Searching for a Bank

For wire transfers, the payee section will display the Search for Bank option, as well as the related bank information fields. To search:

1 Click the magnifying glass icon. A new overlay window will appear.

2 Enter the country of the bank you are sending to and provide the required details as indicated.

3 Once the correct IBAN , SWIFT or Routing Code has been entered, the bank information will show in the box below. See the Glossary for an explanation of unfamiliar terms.

4 Click on the correct bank name, and the bank details will autofill.

Completing your Payment

Once you have entered all the mandatory information, you have three options:

1 Click Accept to execute the transaction immediately.

2 Click Send to modify queue to save the transaction for editing before final approval. The transaction can be accessed in Modify a Payment . For more details, view the Modifying a Payment tutorial.

3 Click Send for Approval if you do not have the required authorization level to approve the transaction. With this option, you can notify an approver by email by checking the appropriate box. The transaction will be sent to Approve a Payment . For more details, view the Approving a Payment tutorial.

With any of the options above, you will be able to Print details of the transaction or Save as PDF .

Related Tutorials

Logging Into Your Account

Creating and Managing Payees - Global Payments

Managing Users - International Payments

Creating Payment Reports

Existing members

Our Customer Service team is available 24 hours a day, Monday through Friday. 1 888 391 9971.

New members

New to American Express? Give us a call on 1 833 319 7265. Our Customer Service team is available 24 hours a day, Monday through Friday.

Make International Payments

1 833 319 7265

Existing FX International Payments customers log in here

Terms and Conditions

FX International Payments is a service of American Express Travel Related Services Company, Inc. (" American Express "). This service is not available to consumers. To enroll in this service, your business will be required to complete an application, which is subject to review and approval by American Express . 1. FX International Payments incorporates encryption, both for stored data (such as account information) and for payments created and transmitted in real-time. The FX International Payments platform is deployed within American Express’ state of the art data center that features advanced online and offline security and monitoring against internet attacks. FX International Payments implements American Express standards relating to information integrity, transaction security and information security. 2. American Express makes money from currency exchange. 3. Transfer times for Outgoing Wire Transfers, typically 1-4 business days (delivery times depend on currency and country). 4. Forward contracts are not suitable for every business. American Express is not providing you with legal, tax or financial advice. We recommend that you consult your own advisers to determine whether Forward Contracts are suitable for you. Eligibility requirements apply. 5. One (1) Membership Rewards ® point will be awarded for every USD $30 your business wires internationally using the FX International Payments (“FXIP”) service. The maximum award per transaction is 4,000 points. Not valid for same currency wire transactions (e.g. US Dollar to US Dollar). For a designated Card Member to be eligible to receive Membership Rewards points, your business must first enroll in the FXIP service. Your business must also complete and submit to us a form designating an American Express Card Member who is already enrolled in the individual Membership Rewards program to whom points will be credited. With respect to a company enrolled in the Corporate Membership Rewards program, any earned points will be credited to the relevant Program Administrator Corporate Card linked to the company’s Membership Rewards program. If you select a basic personal American Express Card Member or a basic small business American Express Card Member (e.g., OPEN from American Express ) to receive the award of Membership Rewards points, please note that the designated Card Member for that personal or small business account is authorized to determine how and when to redeem those points. You agree not to make any claims against American Express with regard to the manner in which the basic Card Member redeems such points. The American Express Card Member you select to receive the award of points, or in the case of Corporate Membership Rewards, the company, must be current and enrolled in the Membership Rewards program at the time the transaction is initiated. FXIP must have a completed registration on file for the Card Member’s Card account or company’s Program Administrator Card Corporate Card account, and there must be no unpaid FXIP obligations of your business or other violation of or defaults under the FXIP Terms and Conditions at the time of point fulfillment. No points will be awarded retroactively for transactions processed prior to the enrollment of the business in the FXIP service and the processing of the Membership Rewards program registration form. In the event a registered Card is lost, stolen or renewed, you must register the new Card by submitting an updated form to FXIP with the new Card information. Processing of the registration form takes approximately 2-4 weeks. To obtain a registration form, call 1-833-319-7265. Points will be credited to the Card Member’s Membership Rewards program account or Corporate Membership Rewards account, if applicable, within 10-12 weeks after the eligible transaction is completed. Membership Rewards points that are awarded for transactions with FXIP are subject to the terms and conditions of the Membership Rewards program, including rules regarding forfeiture of Membership Rewards points. Note that the rewards available in the Membership Rewards program vary depending on the type of American Express Card enrolled in Membership Rewards. The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to Membership Rewards . Participating partners and available rewards are subject to change without notice. See Membership Rewards Terms or call 1-800-AXP-EARN (297-3276) for more information. A company that is enrolled in Corporate Membership Rewards, and points earned under that program, are subject to the terms of the Corporate Membership Rewards program (see Membership Rewards – Corporate TnC ). Transactions by university or financial institution clients are not eligible for this offer. FXIP reserves the right to change, limit, modify or cancel this offer at any time. Bonus ID A9PE It is your responsibility to find out if you are liable for any federal, state or local taxes as a result of earning or using points. FX International Payments is a service of American Express Travel Related Services Company, Inc. (" American Express "). This service is not available to consumers. To enroll in this service, your business will be required to complete an application, which is subject to review and approval by American Express . Click here for information about addressing complaints regarding our money services business, lists of our money services business licenses and other disclosures. NMLS ID # 913828

Buy Currency

Top up card.

Enter the currency you need, or if you don't know what currency you need for your trip, simply enter the country that you're travelling to

Rate last updated Friday, 19 April 2024 19:32:02 BST

[fromExchangeAmount] [fromCurrencyCode] British Pound

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

You can choose to receive cash via home delivery or pick up from store.

Enter the card number of the prepaid card you would like to top up

Card validated

Select the currency you would like to load or top up to your card

Enter how much you'd like to load or top up, either in Pounds Sterling, or in the foreign currency amount for the currency you have selected

How do we compare? Every day we check the exchange rates of major banks and high street retailers and adjust our rates accordingly to ensure that we give you a highly competitive overall price on your foreign currency.

- [name] [amount]

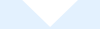

You can now add your Travelex Money Card, powered by Mastercard ® to the Apple Wallet

Get started in a few easy steps

- Travel Money Card

Secure spending abroad made easy.

- Safe and secure

- Choice of 22 currencies

- Seamless spending with Apple Pay and Google Pay

- Manage your travel money effortlessly via the Travelex Money App

- In case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you

Buy foreign currency

Order the currency you need online for our best rates. Pick up in store (including airports) or get it delivered to your home.

- Store Finder

Locate your nearest UK Travelex store. Order your currency online and collect in-store.

Join our Mailing List

Be the first to know about exclusive sales, competitions, product news and more.

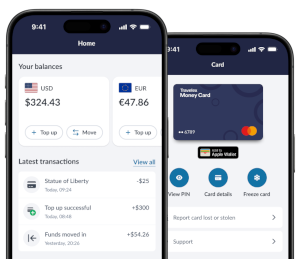

Find your foreign currency now

Whether you're going to Australia or Thailand, we've got you covered. With a choice of over 40 currencies and our Travelex Money Card, we make it easy for you to get your travel money. Have it delivered straight to your door next day or pick it up from any of our UK stores at major airports, ports and retail locations.

How it Works

Choose from 40+ currencies

Select to have your currency delivered to your home or collect at one of our stores across the UK

Relax knowing that your travel money has been taken care of by the world's leading foreign exchange specialist

The Travel Hub: Tips & Guides

Discover top tips, indulgent guides and no end of travel inspiration at The Travel Hub! From the hottest destinations to last minute travel and family fun, here's to making your next trip the best one yet.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

Do you want an early hotel check-in? Here's what is happening behind the scenes.

Joy Felicitas’ bed-making skills are an artform.

Moving swiftly, Felicitas pinched the pillows in half with her forearm so they slid smoothly into the pillowcase. She flung the double-sized mattress up as if it didn’t weigh over 50 pounds and tucked the sheet under. She folded the topsheet at the foot of the bed, allowing extra room for taller people. She slipped the comforter into the duvet cover without a hitch. The final touch was a few hot water spritzes to smooth out any wrinkles. It was over in the blink of an eye.

Then again, Felicitas has made hundreds of beds in her lifetime. As one of over 100 housekeepers at the Four Seasons Resort Oahu at Ko Olina , Felicitas is part of what is often a hotel’s biggest – and arguably, most important – department.

Most people know housekeepers to spruce up our room daily, sometimes even at night for a turndown service. But behind the scenes, housekeepers do much more to ensure guests have the seamlessly luxurious experience expected on vacation through grueling labor.

Housekeepers not only accommodate specific guest requests, like using eco-friendly cleaning products, as they clean, they also anticipate unexpressed needs, like providing extra towels if there’s a family with young children, according to Felicitas. They are also the ones responsible for cleaning any trace of a previous guest before the next one arrives.

Learn more: Best travel insurance

Their work touches every single department in a hotel, from washing coats for the chefs to keeping public areas immaculate. And they do this all without guests noticing.

“We’re the silent team people never see,” said Terry Marks, Senior Director of Housekeeping at the Four Seasons Resort Oahu at Ko Olina. “We’re able to communicate with the guests through our work, our actions.”

Ever wanted to ride an airport bag belt? You can't, but we can show you where they go.

How intensive is housekeeping?

Felicitas makes bed-making look easy, but housekeeping is back-breaking – and often unappreciated – work.

To get rooms to pristine condition, not only are housekeepers cleaning everything – from the shower curtain to each window shutter – they’re also making sure the pillows stand up nicely and phone-charging cords are neatly coiled. Then there’s pushing the supplies cart that can easily weigh over 60 pounds from room to room. (The Four Seasons replaced the heavy carts in 2016 with smaller wagons that are lighter and easier to maneuver and don’t damage the carpets.)

“Hello, the amount of steps they get each day, having to lift the beds and the mattresses, going back and forth to the bathroom, you have to get down on your hands and knees to scrub the floor, the showers and they do it right … You give them the time to take care of these, but yeah, it’s a very tough job,” Marks said.

What many people don’t know is housekeepers are also strategizers.

“Housekeeping, we would clean rooms, and so they weren’t considered a skilled worker,” Marks said. “COVID is really one of the areas that brought to light how important housekeeping is, and they need to be intelligent.”

Typically, housekeepers are assigned a specific timeframe to clean each check-out room to prepare for a new guest, based on data gathered by each resort. At the Four Seasons Resort Oahu at Ko Olina, a guest room featuring double beds is granted 73 minutes for turnover.

Since housekeepers manage the same sets of rooms, they take ownership. If check-out is the following day, they can prep the room as best they can the day before, so turning over the room is a little faster, Marks said. They also make sure their carts are properly supplied so they can avoid going back and forth to the linen closet, filled with fresh linens and amenities, on each floor to avoid running back to the housekeeping department.

However, things don’t always run smoothly. If there’s a family with kids versus a couple or an early check-in, it can be a time crunch to get the room cleaned to standard. “Expect the unexpected,” said Sonia Hara, a housekeeper of 18 years at the Hilton Hawaiian Village, Oahu’s largest resort with 700 workers in the housekeeping department and part of the Local 5 union, which advocates for better working conditions and equitable pay.

At the start of each day, Hara does mental math to see how many linens and new shower curtains she has to add to her cart to be efficient, although that can result in a heavy cart. To finish her 12 rooms in time, Hara often ends up skipping lunch. “Sometimes it’s a really hard job,” she said.

The demanding labor can also take its toll. Hara has gotten injured while working, like when a guest turned off the bathroom lights and she slipped on spray-on sunscreen that was all over the floor. She also went to physical therapy for six months after pushing the heavy cart caused her back to “become crooked.”

Despite the physically taxing work, Hara is proud. “I take pride in my work and I love what I’m doing.”

Do housekeepers pay attention to guests’ behavior?

Housekeepers also read their guests. They take mental notes of a guest’s behavior, like if someone typically sleeps in, they’ll start coming to clean their room later. They also look at “visual signals,” as Marks puts it. “So this gentleman, every time you know, I put the hairdryer back, they move it back over to the right, so I'm going to start leaving it on the right, and increase his consistency.”

At the Four Seasons, housekeepers cater to guest needs before they even realize it. It can be as small as leaving distilled water in a room if someone uses a CPAP to sleep or slipping a bookmark into an open book. “We go into the rooms a lot of the times without seeing the actual guests, we're being invited into their home away from home,” Marks said.

How is the hotel kept clean without guests noticing too much?

To keep an entire resort with 370 guest rooms, for example, and multiple public areas looking unblemished, the behind-the scenes at a resort like the Four Seasons Resort Oahu at Ko Olina is a massive operation. Over 100 housekeepers are managed by a team of three supervisors, who worked their way up from housekeeper. Public attendants take care of common areas, like lobby restrooms. House attendants help run items for housekeepers or to guests rooms, like an extra toothbrush.

Down the service elevator, the basement of the Four Seasons is where the office for the housekeeping coordinators. The team of three coordinators are on until 11 p.m. They’re the ones who answer when you call for an extra pillow and manage the cleaning schedule for all the housekeepers, including figuring out late check-out and early check-in. Housekeepers are in constant communication with the coordinators. At the Four Seasons, the coordinators use iPod-like devices to stay in touch and heat sensors to tell if a guest is in the room or not.

“In my humble opinion, (housekeeping) is the most important department,” Marks said. “You can’t check guests into rooms if they’re not clean ... We’ve got to be on our game, making sure we’re communicating properly.”

Turning the corner of the Four Seasons’ downstairs housekeeping department are towering stacks of boxes containing hundreds of linens. The tremendous amount of linens the resort goes through are outsourced to a third-party washer and returned the next morning. There are also shelves of linens washed in hypo-allergenic detergent.

Then there’s a giant chute that the dirty towels and bedsheets changed out by housekeepers from each floor empties into. One worker sorts through the hulking pile all day, wearing heavy duty gloves in case something sharp is caught in the sheets.

How can we be better hotel guests?

Besides trying to keep their room somewhat orderly, there are a few ways hotel guests can help make their housekeeper’s role easier. Hara prefers her guests opt into daily housekeeping to make her check-out days faster, and that the “Do not disturb” sign can sometimes throw her schedule off.

Communication is also key. Letting the hotel know a preferred time for daily housekeeping and turndown service can help housekeepers stick to their schedules. It can also give guests the best chance for early check-in and late check-out.

Hotels try their best to accommodate late check-out and early check-in, even turning over a room in 60 minutes or less at the Four Seasons (which may include a supervisor or second housekeeper being called in to help). The more information guests can give the hotel before arrival, the better, Marks said, to allow the coordinators to go through arrival times and prioritize cleaning schedules. Sometimes, if there are too many check-ins, it just isn't possible.

Taking the time to get to know the housekeeper also goes a long way, not only in making their job easier but also because of the pride they take in their work. Hara loves it when her guests interact with her or leave thank-you notes. Some guests even request certain housekeepers or rooms because of the housekeepers. (On that note, consider sending a quick email to the hotel to give kudos to the housekeeper, which Hara said is “very uplifting.”)

“That's really the thing; the people who are here really care about the guests,” said Marks. “And it amazes me just how much they do interact, and the comments that I get from the guests that’s ‘I felt like family... Joy, or whoever it was, you know, really took care of us.’”

Kathleen Wong is a travel reporter for USA TODAY based in Hawaii. You can reach her at [email protected] .

- Share full article

Advertisement

How to Fly Your Kid Solo, Free of Stress

By Alexander Nazaryan

For many parents and guardians, putting a child on a flight alone may seem terrifying. Belligerent passengers, delays, turbulence: All loom large in a caregiver’s imagination.

Life sometimes leaves no other option. Hudson Crites , 17, of Marshall, Va., was 10 when he started flying unaccompanied to visit his father in Kansas and later Georgia, said his mother, Chelsea Tippett. But the extra attention from airline staff made Hudson “feel special,” Ms. Tippett recalls. Other than a single tarmac delay, he has had no problems.

On rare occasions, children have had troubling experiences. In December, Spirit Airlines accidentally flew a 6-year-old to Orlando, Fla., instead of the intended destination of Fort Myers. Spirit apologized, fired the gate agent responsible and offered reimbursement to the boy’s grandmother for her travel to Orlando. But while the boy was unharmed, his grandmother expressed worry that he had been kidnapped .

If you decide to fly your child unaccompanied, you’ll discover that each airline has its own procedures, fees and routes open to children. While some may find the process complicated, flying alone may be exciting for your child, instilling some independence. Here’s what you need to know.

Before you book, know the process

Regardless of the airline or route, flying an unaccompanied minor differs from an adult or a family catching a flight. Airlines require a trusted pre-authorized adult to be at the departure and arrival gates, and will ask you at booking to provide contact information for those adults. They will also need to present identification at the terminals.

The journey begins at the originating airport’s airline ticket counter. There, airline staff will check your identification and check in the child, perhaps handing them a lanyard or wristband to wear. The agents will provide you with a pass to get through security with your child. You will accompany them to the gate, where you will hand them off to a gate agent. You must stay at the gate until the plane takes off.

In the air, the flight crew will keep watch — but will not babysit, or sit with, your child. If the flight has a connection, a crew member will walk your child off the plane and a gate agent will take him or her to the next gate.