Asia Is Poised to Lead Travel’s Recovery in 2024

Rashaad Jorden , Skift

February 2nd, 2024 at 5:06 AM EST

Today's podcast looks at Asia's growth in 2024, Frontier's biz class beliefs, and Royal Caribbean's answer to Vegas and Orlando.

Rashaad Jorden

Skift Daily Briefing Podcast

Listen to the day’s top travel stories in under four minutes every weekday.

Good morning from Skift. It’s Friday, February 2. Here’s what you need to know about the business of travel today.

🎧 Subscribe

Apple Podcasts | Spotify | Overcast | Google Podcasts | Amazon Podcasts

Episode Notes

Skift Research has published its Global Travel Outlook 2024 , which sees Asia leading the travel industry’s growth while Europe’s travel boom will likely slow down.

The forecast shows Asia Pacific growing 20% over 2023. Research Analyst Saniya Zanpure writes the region has gotten a big boost from China easing its strict Covid-era regulations in January 2023. Meanwhile, Europe’s travel revenue is projected to register only a 5% increase from last year, with Zanpure noting that Europe faces challenges such as inflation and climate-related concerns.

Next, Frontier Airlines announced on Thursday that it’s launching a business fare as part of its strategy to attract corporate travelers, writes Airlines Reporter Meghna Maharishi.

Frontier said that “BizFare” would enable businesses to save on corporate travel expenses. The ticket would be available through a company’s global distribution channel. Maharishi added the new fare could help Frontier cater to travelers that wouldn’t normally fly with an ultra-low-cost carrier for business trips.

Finally, Royal Caribbean believes the new Icon of the Seas , the world’s largest cruise ship, will help the company better compete against destinations like Las Vegas and Orlando for family vacations, writes Global Tourism Reporter Dawit Habtemariam.

Royal Caribbean Group CEO Jason Liberty said during the company’s fourth-quarter earnings call that it can hold its own against longtime popular tourist destinations. The $2 billion, 20-floor ship contains eight different sections, each with a different experience for guests. Liberty added Royal Caribbean plans to innovate further to reduce the value gap between the company and land-based vacations.

Have a confidential tip for Skift? Get in touch

Tags: asia , asia pacific , business travel , coronavirus recovery , frontier airlines , royal caribbean , skift podcast , skift research

Photo credit: The Marina Bay Sands in Singapore. Dan Peltier / Skift

Outlook for China tourism 2023: Light at the end of the tunnel

China is now removing travel restrictions rapidly, both domestically and internationally. While the sudden opening may lead to uncertainty and hesitancy to travel in the short term, Chinese tourists still express a strong desire to travel. And the recent removal of quarantine requirements in January 2023 could usher in a renewed demand for trips abroad.

Domestically, there are already signs of strong travel recovery. The recent Chinese New Year holidays saw 308 million domestic trips, generating almost RMB 376 billion in tourism revenue. 1 China’s Ministry of Culture and Tourism. This upswing indicates that domestic travel volume has recovered to 90 percent of 2019 figures, and spending has bounced back to around 70 percent of pre-pandemic levels. 2 McKinsey analysis based on China’s Ministry of Culture and Tourism data.

This article paints a picture of Chinese travelers and their evolving spending behaviors and preferences—and suggests measures that tourism service providers and destinations could take to prepare for their imminent return. The analyses draw on the findings of McKinsey’s latest Survey of Chinese Tourist Attitudes, and compare the results across six waves of surveys conducted between April 2020 and November 2022, along with consumer sentiment research and recent travel data.

From pandemic to endemic

By January 8, 2023, cross-city travel restrictions, border closures, and quarantine requirements on international arrivals to China had been lifted. 3 “Graphics: China’s 20 new measures for optimizing COVID-19 response,” CGTN, November 15, 2022; “COVID-19 response further optimized with 10 new measures,” China Services Info, December 8, 2022; “China reopens borders in final farewell to zero-COVID,” Reuters, January 8, 2023. This rapid removal of domestic travel restrictions, and an increase in COVID-19 infection rates, likely knocked travel confidence for cross-city and within-city trips. Right after the first easing of measures, in-city transport saw a marked drop as people stayed home—either because they were ill, or to avoid exposure. Subway traffic in ten major cities in mainland China fell and then spiked during Chinese New Year in February. Hotel room bookings also peaked at this time.

Domestic airline seat capacity experienced a minor rebound as each set of restrictions was lifted—suggesting a rise in demand as airlines scheduled more flights. Domestic capacity fluctuated, possibly due to the accelerated COVID-19 infection rate and a temporary labor shortage. International seat capacity, however, continued to climb (Exhibit 1).

By Chinese new year, China was past its infection peak—and domestic tourism recovered strongly. For instance, Hainan drew 6.4 million visitors over Chinese New Year (up from 5.8 million in 2019) and visits to Shanghai reached 10 million (roughly double 2019 holiday figures). 4 China’s Ministry of Culture and Tourism. Overall, revenue per available room (RevPAR) during this period recovered and surpassed pre-pandemic levels, at 120 percent of 2019 figures. 5 STR data. Outbound trips are still limited, but given the pent-up demand for international travel (and the upswing in domestic tourism) the tourism industry may need to prepare to welcome back Chinese tourists.

Tourism players should be ready for this; the time to act is now.

A demand boom is around the corner—Chinese tourists are returning soon

Before the pandemic, Chinese tourists were eager travelers. Mainland China had the largest outbound travel market in the world, both in number of trips and total spend. 6 World Tourism Organization (UNWTO) Tourism dashboard, Outbound tourism ranking. In 2019, Mainland Chinese tourists took 155 million outbound trips, totaling $255 billion in travel spending. 7 China’s Ministry of Culture and Tourism. These figures indicate total outbound trips, including to Hong Kong and Macau. China is also an important source market for some major destinations. For instance, Chinese travelers made up 28 percent of inbound tourism in Thailand, 30 percent in Japan, and 16 percent of non-EU visitors to Germany. 8 United Nations World Tourism Organization (UNWTO) database.

Leisure travel was the biggest driver of China’s outbound travel, representing 65 percent of travelers in 2019. In the same year, 29 percent of travelers ventured out for business, and 6 percent journeyed to visit friends and relatives. 9 Euromonitor International database.

Our most recent Survey of Chinese Tourist Attitudes, conducted in November 2022, shows that Chinese tourists have retained their keen desire to explore international destinations. About 40 percent of respondents reported that they expect to undertake outbound travel for their next leisure trip.

Where do these travelers want to go?

The results also indicate that the top three overseas travel destinations (beyond Hong Kong and Macau) are Australia/New Zealand, Southeast Asia, and Japan. Overall, respondents show less interest in travel to Europe than in previous years, down from 7 percent to 4 percent compared to wave 5 respondents. Desire to embark on long-haul international trips to Australia/New Zealand increased from 5 percent to 7 percent, and North American trips from 3 percent to 4 percent since the last survey. The wealthier segment (monthly household income over RMB 38,000) still shows a high interest in EU destinations (13 percent).

There are stumbling blocks on the road to recovery

While travel sentiment is strong, other factors may deter travelers from taking to the skies: fear of COVID-19; the need for COVID-19 testing which can be expensive; ticket prices; risk appetite of destination countries; and getting a passport or visa.

Chinese travelers may favor domestic trips, even if all outbound travel restrictions are removed, until they feel it is safe to travel internationally. A COVID-19-safe environment in destination countries will likely boost travelers’ confidence and encourage them to book trips again. 10 “Long-haul travel barometer,” European Travel Commission, February 1, 2023.

Travel recovery is also dependent on airline capacity. Some international airlines might be slow to restore capacity as fleets were retired during COVID-19 and airlines face a shortage of crew, particularly pilots. Considering that at the time of writing, in April 2023, international airline seat capacity has only recovered to around 37 percent of pre-pandemic levels, travelers are likely to face elevated ticket prices in the coming months. For instance, ticket prices for travel in the upcoming holidays to popular overseas destinations such as Japan and Thailand are double what they were in 2019. 11 Based on Ctrip prices. Price-sensitive travelers might wait for ticket prices to level out before booking their overseas trips.

Chinese airlines, however, appear more ready to resume full service than their international counterparts —fewer pilots left the industry and aircraft are available. Chinese carriers’ widebody fleets are mostly in service or ready to be redeployed (Exhibit 2).

Moving forward, safety measures in destination countries will affect travel recovery. Most countries have dropped testing requirements on arrivals from mainland China, and Chinese outbound group travel has resumed but is still limited to selected countries.

Many Chinese travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months. 12 Steve Saxon, “ What to expect from China’s travel rebound ,” McKinsey, January 25, 2023. Furthermore, travel visas for destination countries can take some time to be processed and issued.

Taken together, these factors suggest that the returning wave of Chinese travelers may only gather momentum by the Summer of 2023 and that China’s travel recovery will likely lag Hong Kong’s by a few months.

Overall, China is opening up to travel, both inbound and outbound—all types of visas are being issued to foreign visitors, and locals are getting ready to travel abroad. 13 “China to resume issuing all types of visas for foreigners,” China Briefing, March 14, 2023.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

The returning chinese traveler is evolving.

Although Chinese travelers did not have opportunities to travel internationally over the past three years, they continued to travel domestically and explore new offerings. Annual domestic trips remained at around 50 percent of pre-pandemic levels, amounting to 8.7 billion domestic trips over the past three years. 14 China’s Ministry of Culture and Tourism. During this time, the domestic market matured, and travelers became more sophisticated as they tried new leisure experiences such as beach resorts, skiing trips, and “staycations” in home cities. Chinese travelers became more experienced as thanks to periods of low COVID-19 infection rates domestically they explored China’s vast geography and diverse experiences on offer.

Consequently, the post-COVID-19 Chinese traveler is even more digitally savvy, has high expectations, and seeks novel experiences. These are some of the characteristics of a typical traveler:

- Experience-oriented: Wave 6 of the survey shows that the rebound tourist is planning their trip around experiences. Outdoor and scenic trips remain the most popular travel theme. In survey waves 1 to 3, sightseeing and “foodie” experiences were high on the list of preferences while traveling. From waves 4 to 6, culture and history, beaches and resorts, and health and wellness gained more attention—solidifying the trend for experience-driven travel. Additionally, possibly due to the hype of the Winter Olympics, skiing and snowboarding have become popular activities.

- Hyper-digitized: While digitization is a global trend, Chinese consumers are some of the most digitally savvy in the world; mobile technologies and social media are at the core of daily life. COVID-19 drove people to spend more time online—now short-form videos and livestreaming have become the top online entertainment options in China. In the first half of 2022, Chinese consumers spent 30 percent of their mobile internet time engaging with short videos. 15 “In the first half of the year, the number of mobile netizens increased, and short videos accounted for nearly 30% of the total time spent online,” Chinadaily.com, 27 July 2022.

- Exploration enthusiasts: Chinese travelers are also keen to explore the world and embark on novel experiences in unfamiliar destinations. Survey respondents were looking forward to visiting new attractions, even when travel policies limited their travel radius. Instead of revisiting destinations, 45 percent of respondents picked short trips to new sites as their number one choice, followed by long trips to new sites as their second choice.

Consumers are optimistic, and travel spending remains resilient

McKinsey’s 2022 research on Chinese consumer sentiment shows that although economic optimism is seeing a global decline, 49 percent of Chinese respondents reported that they are optimistic about their country’s economic recovery. Optimism had dropped by 6 percentage points since an earlier iteration of the survey, but Chinese consumers continue to be more optimistic than other surveyed countries, apart from India (80 percent optimistic) and Indonesia (73 percent optimistic) (Exhibit 3). 16 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Chinese consumers are still keen to spend on travel, and travel spending is expected to be resilient. Wave 6 of the tourist attitude survey saw 87 percent of respondents claiming that they will spend more or maintain their level of travel spending. Moreover, when consumers were asked “which categories do you intend to splurge/treat yourself to,” travel ranked second, with 29 percent of respondents preferring travel over other categories. 17 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Against this context of consumer optimism, the wave 6 tourist attitude survey results shed light on how travelers plan to spend, and which segments are likely to spend more than others:

- The wealthier segment and older age groups (age 45-65) show the most resilience in terms of travel spend. Around 45 to 50 percent of travelers in these two groups will spend more on their next leisure trip.

- The wealthier segment has shown the most interest in beach and resort trips (48 percent). Instead of celebrating Chinese New Year at home with family, 30 percent of Chinese travelers in the senior age group (age 55-65) expect to take their next leisure trip during this holiday—10 percent more than the total average. And the top three trip preferences for senior travelers are culture, sightseeing, and health-themed trips.

- When it comes to where travelers plan to spend their money on their next trip, entertainment activities, food, and shopping are the most popular categories. These are also the most flexible and variable spending categories, and there are opportunities to up-sell—attractions, food and beverage, and retail players are well positioned to create unique and unexpected offerings to stimulate spending in this area (Exhibit 4).

Independent accommodation is gaining popularity

Overall, Chinese consumers have high expectations for products and services. McKinsey’s 2023 consumer report found that local brands are on the rise and consumers are choosing local products for their quality, not just for their cheaper prices. Chinese consumers are becoming savvier, and tap into online resources and social media to educate themselves about the specific details and features of product offerings. 18 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.

Furthermore, 49 percent of Chinese consumers believe that domestic brands are of “better quality” than foreign brands—only 23 percent believe the converse is true. Functionality extended its lead as the most important criterion influencing Chinese consumers, indicating that consumers are focusing more on the functional aspects of products, and less on emotional factors. Branding thus has less influence on purchasing decisions. 19 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.

These broader consumer sentiments are echoed in the travel sector. Chinese travelers pay attention to cost, but do not simply seek out the lowest prices. While 17 percent of wave 6 respondents are concerned about low prices, 33 percent are on the hunt for value-for-money offerings, and 30 percent prefer good discounts and worthwhile deals.

And consumer sentiment regarding local brands holds true for travel preferences. Independent travel accommodation continues to be the preferred choice for most respondents, increasing in share against international chain brand hotels (Exhibit 5). Almost 60 percent of respondents prefer independent accommodation such as boutique hotels, B&Bs, and Airbnb—an 8 percentage-point increase since 2020.

Local chain brand hotels remain stable, the favored accommodation for 20 percent of respondents. These hotels are seen as a more standardized option, and as most are located in urban areas, they target the budget traveler segment.

Opting for independent accommodation is not considered a trade down; Chinese travelers expect a high level of service. In particular, respondents in the wealthier segment picked independent options (57 percent) over international premium brands (27 percent).

Premium independent options for the wealthier segment are abundant, specifically in leisure travel. Setting up a premium brand hotel requires long-term construction periods and heavy capital investment. Small-scale boutique hotels or B&Bs, on the other hand, are more agile solutions that can ramp up in the short term. This may explain the abundance of premium independent offerings. For instance, in destinations such as Lijiang and Yangshuo, between seven and nine of the top-ten premium hotels listed on Ctrip are independent boutique hotels.

Premium independent accommodation’s strength lies in quality guest experience with a genuine human touch. The service level at premium independent establishments can even surpass that of chain brand accommodation thanks to the high staff-to-room ratio, which easily reaches 3:1 or even 5:1. 20 “Strategic marketing analysis of boutique hotels,” Travel Daily , June 3, 2015. For hotels in Xiamen, Lijiang, and Yangshou, Ctrip service ratings of premium independent hotels are all above 4.7, outperforming international chain brand hotels.

Travelers are becoming smarter and more realistic during hotel selection, focusing on fundamental offerings such as local features and value for money. Across all types of hotels, local features are one of the most important factors influencing hotel selection—even for chain brand hotels which have a reputation for mastering the standardized offering. On average, 34 percent of respondents report that local features and cultural elements are the key considerations affecting their choice of hotel.

Outbound Chinese tourists are evolving rapidly, becoming increasingly diverse in their travel preferences, behaviors, and spending patterns. Chinese travelers are not homogeneous, and their needs and preferences continue to evolve. Therefore, serving each group of tourists may require different product offerings, sales channels, or marketing techniques.

The path toward eco-friendly travel in China

How international travel and tourism can attract outbound chinese travelers.

China’s lifting of travel restrictions may cause some uncertainty in the short term, but a promising recovery lies ahead. Chinese tourists have maintained a strong desire to travel internationally and are willing to pay for this experience. They are also discerning and looking for high-quality accommodation, offerings, and service. As boutique hotels are becoming more popular, international hotel brands hotels could, for example, aim to stand out by leveraging their experience in service excellence.

With renewed travel demand, now may be the time for international travel and tourism businesses to invest in polishing product offerings—on an infrastructural and service level. Tourism, food and beverage, retail, and entertainment providers can start preparing for the rebound by providing unique and innovative experiences that entice the adventurous Chinese traveler.

Craft an authentically local offering that appeals to experience-driven Chinese travelers

Chinese travelers have suspended overseas trips for three years, and are now looking to enjoy high-quality experiences in destinations they have been to before. They also want to do more than shopping and sightseeing, and have expressed willingness to spend on offerings geared towards entertainment and experience. This includes activities like theme parks, snow sports, water sports, shows, and cultural activities. Authentic experiences can satisfy their desire for an immersive foreign experience, but they often want the experience to be familiar and accessible.

Designing the right product means tapping into deep customer insights to craft offerings that are accessible for Chinese travelers, within a comfortable and familiar setting, yet are still authentic and exciting.

Travel and tourism providers may also have opportunities to up-sell or cross-sell experiences and entertainment offerings.

Social media is essential

Social media is emerging as one of the most important sources of inspiration for travel. Short video now is a major influence channel across all age groups and types of consumers.

Tourist destinations have begun to leverage social media, and short video campaigns, to maximize exposure. For example, Tourism Australia recently launched a video campaign with a kangaroo character on TikTok, and overall views soon reached around 1.67 billion.

The story of Ding Zhen, a young herder from a village in Sichuan province, illustrates the power of online video in China. In 2020, a seven-second video of Ding Zhen turned him into an overnight media sensation. Soon after, he was approached to become a tourism ambassador for Litang county in Sichuan—and local tourism flourished. 21 “Tibetan herder goes viral, draws attention to his hometown in SW China,” Xinhuanet, December 11, 2020. Another Sichuan local, the director of the Culture and Tourism Bureau in Ganzi, has drawn visitors to the region through his popular cosplay videos that generated 7 million reviews. Building on the strength of these influential celebrities, visitor numbers to the region were said to reach 35 million, more than two-and-a-half times 2016 volumes. 22 “Local official promoting Sichuan tourism goes viral on internet,” China Daily, June 17, 2022; “The Director of Culture and Tourism disguises himself as a “Swordsman” knight to promote Ganzi tourism,” Travel Daily , June 17, 2022.

Online travel companies are also using social media to reach consumers. Early in the pandemic, Trip.com took advantage of the upward trend in livestreaming. The company’s co-founder and chairman of the board, James Liang, hosted weekly livestreams where he dressed up in costume or chatted to guests at various destinations. Between March and October 2020, Liang’s livestreams sold around $294 million’s worth of travel packages and hotel room reservations. 23 “Travel companies adapt to a livestreaming trend that may outlast the pandemic,” Skift, October 26, 2020.

Livestreaming is being used by tourism boards, too. For instance, the Tourism Authority of Thailand (TAT) collaborated with Trip.com to launch a new campaign to attract Chinese tourists to Thailand as cross-border travel resumed. The broadcast, joined by TAT Governor Mr Yuthasak Supasorn, recorded sales of more than 20,000 room nights amounting to a gross merchandise value of over RMB 40 million. 24 “Trip.com Group sees border reopening surge in travel bookings boosted by Lunar New Year demand,” Trip.com, January 13, 2023.

International tourism providers looking to engage Chinese travelers should keep an eye on social media channels and fully leverage key opinion leaders.

Scale with the right channel partners

Travel distribution in China has evolved into a complex, fragmented, and Chinese-dominated ecosystem, making scaling an increasingly difficult task. Travel companies need to understand the key characteristics of each channel type, including online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies as each target different customer segments, and offer different levels of control to brands. It also takes different sets of capabilities to manage each type of distribution channel.

Travel companies can prioritize the channels they wish to use and set clear roles for each. One challenge when choosing the right channel partner is to avoid ultra-low prices that may encourage volume, but could ultimately damage a brand.

Meanwhile, given the evolution of the postCOVID-19 industry landscape and rapid shifts in consumer demand, travel companies should consider direct-to-consumer (D2C) channels. The first step would be selecting the appropriate D2C positioning and strategy, according to the company’s needs. In China, D2C is a complicated market involving both public domains (such as social media and OTA platforms) and private domains (such as official brand platforms). To make the most of D2C, travel companies need a clear value proposition for their D2C strategy, whether it be focused on branding or on commercial/sales.

Create a seamless travel experience for the digitally savvy Chinese tourist

China has one of the most digitally advanced lifestyles on the planet. Chinese travelers are mobile-driven, wallet-less, and impatient—and frequently feel “digitally homesick” while abroad. Overseas destinations and tourism service providers could “spoil” tech-savvy Chinese travelers with digitally enhanced service.

China’s internet giants can provide a shortcut to getting digital services off the ground. Rather than building digital capabilities from scratch, foreign tourism providers could engage Chinese travelers through a platform that is already being used daily. For example, Amsterdam’s Schiphol Airport provides a WeChat Mini Program with four modules: duty-free shopping, flight inquiry, information transfer, and travel planning. This contains information about all aspects of the airport, including ground transportation and tax refund procedures.

Alibaba’s Alipay, a third-party mobile and online payment platform, is also innovating in this space. The service provider has cooperated with various tax refund agencies, such as Global Blue, to enable a seamless digitized tax refund experience. Travelers scan completed tax refund forms at automated kiosks in the airport, and within a few hours, the refunded amount is transferred directly to their Alipay accounts. 25 “Alipay and Global Blue to make tax refunds easy for Chinese tourists,” Alizila, June 23, 2014.

Such digital applications are likely to be the norm going forward, not a differentiator, so travel companies that do not invest in this area may be left behind.

Chinese travelers are on the cusp of returning in full force, and tourism providers can start preparing now

With China’s quarantine requirements falling away at the start of 2023, travelers are planning trips, renewing passports and visas, and readying themselves for a comeback. Chinese tourists have not lost their appetite for travel, and a boom in travel demand can be expected soon. Though airlines are slow to restore capacity, and some destination countries are more risk averse when welcoming Chinese travelers, there are still options for Chinese tourists to explore destinations abroad.

Tourism providers can expect to welcome travelers with diverse interests who are willing to spend money on travel, who are seeking out exciting experiences, and who are choosing high-quality products and services. The returning Chinese traveler is digitally savvy and favors functionality over branding—trends suggest that providers who can craft authentic, seamless, and unique offerings could be well positioned to capture this market.

Guang Chen and Jackey Yu are partners in McKinsey’s Hong Kong office, Zi Chen is a capabilities and insights specialist in the Shanghai office, and Steve Saxon is a partner in the Shenzhen office.

The authors wish to thank Cherie Zhang, Glenn Leibowitz, Na Lei, and Monique Wu for their contributions to this article.

Explore a career with us

Related articles.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Vietnam – Asia Outlook Travel

by Mary Eden | Jun 12, 2020

Asia Outlook Travel – vietnam

Our partner – asia outlook travel.

From luxury holidays to special-interest tours, Asia Outlook Travel offers authentic, hand-crafted experiences and itineraries throughout Vietnam to suit individual or group requirements. Their highly knowledgeable guides, unique products and top-notch service continue to keep clients coming back time and time again.

Market Representation

- Europe & The Americas

- Air Transport

- Defense and Space

- Business Aviation

- Aircraft & Propulsion

- Connected Aerospace

- Emerging Technologies

- Manufacturing & Supply Chain

- Advanced Air Mobility

- Commercial Space

- Sustainability

- Interiors & Connectivity

- Airports & Networks

- Airlines & Lessors

- Safety, Ops & Regulation

- Maintenance & Training

- Supply Chain

- Workforce & Training

- Sensors & Electronic Warfare

- Missile Defense & Weapons

- Budget, Policy & Operations

- Airports, FBOs & Suppliers

- Flight Deck

- Marketplace

- Advertising

- Marketing Services

- Fleet, Data & APIs

- Research & Consulting

- Network and Route Planning

Market Sector

- AWIN - Premium

- AWIN - Aerospace and Defense

- AWIN - Business Aviation

- AWIN - Commercial Aviation

- Advanced Air Mobility Report - NEW!

- Aerospace Daily & Defense Report

- Aviation Daily

- The Weekly of Business Aviation

- Air Charter Guide

- Aviation Week Marketplace

- Route Exchange

- The Engine Yearbook

- Aircraft Bluebook

- Airportdata.com

- Airport Strategy and Marketing (ASM)

- CAPA – Centre for Aviation

- Fleet Discovery Civil

- Fleet Discovery Military

- Fleet & MRO Forecast

- MRO Prospector

- Air Transport World

- Aviation Week & Space Technology

- Aviation Week & Space Technology - Inside MRO

- Business & Commercial Aviation

- CAPA - Airline Leader

- Routes magazine

- Downloadable Reports

- Recent webinars

- MRO Americas

- MRO Australasia

- MRO Baltics & Eastern Europe Region

- MRO Latin America

- MRO Middle East

- Military Aviation Logistics and Maintenance Symposium (MALMS)

- Asia Aerospace Leadership Forum & MRO Asia-Pacific Awards

- A&D Mergers and Acquisitions

- A&D Programs

- A&D Manufacturing

- A&D Raw Materials

- A&D SupplyChain

- A&D SupplyChain Europe

- Aero-Engines Americas

- Aero-Engines Europe

- Aero-Engines Asia-Pacific

- Digital Transformation Summit

- Engine Leasing Trading & Finance Europe

- Engine Leasing, Trading & Finance Americas

- Routes Americas

- Routes Europe

- Routes World

- CAPA Airline Leader Summit - Airlines in Transition

- CAPA Airline Leader Summit - Americas

- CAPA Airline Leader Summit - Latin America & Caribbean

- CAPA Airline Leader Summit - Australia Pacific

- CAPA Airline Leader Summit - Asia & Sustainability Awards

- CAPA Airline Leader Summit - World & Awards for Excellence

- GAD Americas

- A&D Mergers and Acquisitions Conference (ADMA)

- A&D Manufacturing Conference

- Aerospace Raw Materials & Manufacturers Supply Chain Conference (RMC)

- Aviation Week 20 Twenties

- Aviation Week Laureate Awards

- ATW Airline Awards

- Program Excellence Awards and Banquet

- CAPA Asia Aviation Summit & Awards for Excellence

- Content and Data Team

- Aviation Week & Space Technology 100-Year

- Subscriber Services

- Advertising, Marketing Services & List Rentals

- Content Sales

- PR & Communications

- Content Licensing and Reprints

- AWIN Access

2024 Outlook: Asia-Pacific Traffic Sees Rapid Growth

2024 Outlook: Asia-Pacific Traffic Sees Rapid Growth is part of our Air Transport World subscription.

Subscribe now to read this content, plus receive full coverage of what's next in air transport from the experts trusted by the global air transport community. Every article focuses on what airline management professionals need to run their airline, including crucial analysis and insights in financing, airframes and engines, environmental and regulatory pressures and much more.

Already a subscriber to ATW or an AWIN customer? Log in with your existing email and password.

Related Content

Stay Connected. Stay Informed. Grow Your Business.

Travel & Tourism - Asia

- It is estimated that the revenue in the Travel & Tourism market of Asia will reach US$326.20bn by 2024.

- Moreover, it is expected to grow annually at a rate of 5.36% between 2024 and 2028, resulting in a market volume projection of US$402.00bn by 2028.

- Among all the markets, Hotels is expected to be the largest with a market volume projection of US$165.40bn by 2024.

- Furthermore, the number of users in the Hotels market is expected to reach 624.30m users by 2028, while the user penetration is projected to increase from 20.3% in 2024 to 23.1% in 2028.

- The projected average revenue per user (ARPU) is expected to be US$352.90.

- It is estimated that 74% of the total revenue in the Travel & Tourism market will be generated through online sales by 2028.

- Finally, it is noteworthy that United States is projected to generate the highest revenue (US$199bn in 2024) in the Travel & Tourism market globally.

- In Japan, there has been a growing trend of "slow travel" where tourists are seeking authentic cultural experiences and staying longer in one destination.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

The Travel & Tourism market in Asia continues to experience significant growth and development, driven by a variety of factors ranging from changing customer preferences to local special circumstances and underlying macroeconomic factors. Customer preferences: Travelers in Asia are increasingly seeking unique and authentic experiences, leading to a rise in demand for personalized and experiential travel options. From cultural tours to eco-friendly adventures, customers are looking for ways to immerse themselves in the local culture and environment. Trends in the market: In Japan, there has been a noticeable trend towards rural tourism, with more travelers exploring off-the-beaten-path destinations to escape the crowds and experience the tranquility of the countryside. This shift is driven by a desire for authenticity and a break from the fast-paced city life. Local special circumstances: South Korea has seen a surge in medical tourism, with visitors flocking to the country for high-quality healthcare services combined with the opportunity to explore the rich cultural heritage. The country's advanced medical facilities and skilled professionals have positioned it as a top destination for medical travelers in Asia. Underlying macroeconomic factors: In China, the growing middle class and increasing disposable income levels have fueled the demand for luxury travel experiences. This has led to a rise in high-end hotels, fine dining establishments, and exclusive tour packages tailored to affluent Chinese travelers looking for premium services and amenities.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Unlimited access to our Market Insights

- Statistics and reports

- Usage and publication rights

Latest News

P&G Appoints Neal Reed as Senior Vice President and Managing Director, P&G Australia and New Zealand

“Thaiconic Songkran Celebration” attracts international tourists along the Chao Phraya river in Bangkok

Amara Hotels redesigns flagship Singapore properties

Sabre and InterparkTriple forge AI-driven travel partnership

Northern Territory boosts tourism with $68m investment

Halim Perdanakusuma Airport manages surge in Eid return traffic

Vietnam and Korea bolster tourism and cultural ties

Macao celebrates 25 years with grand international travel expo

Singapore unveils ‘The Dream Sphere’ Pavilion at Expo 2025 Osaka

Air Astana launches summer flight schedule with expanded services

China to dominate Asia outbound travel by 2030

Outbound Travel Demand from residents of smaller cities to outpace major Urban Centres; TripAdvisor-BCG Report Highlights strategies to reach Chinese travellers and win their loyalty.

LONDON – TripAdvisor and The Boston Consulting Group (BCG), a global management consulting firm, have jointly published a new report on the travel and tourism industry titled, Winning the Next Billion Asian Travellers – Starting with China . The report shows that by 2030, more than 50% of the growth in global traffic will come from Asia Pacific and 49% of all passenger traffic globally will be within Asia Pacific or between the region and the rest of the world.

Travellers from China will account for the lion’s share of this growth—accounting for around 40% of Asian outbound travellers by 2030. Within the same time frame, China will likely overtake the US as the world’s largest domestic travel market.

Specifically, by 2030, Chinese urban travellers will take 1.7 billion domestic and outbound trips annually, up from 500 million today, spending $1.8 trillion on travel and tourism—nearly seven times their current expenditures. The report shows that China’s outbound leisure market will grow the fastest, with its travel and tourism spending increasing by 15% year-on-year between now and 2030.

TripAdvisor revealed several important insights into the future growth direction of China’s outbound tourism market, including destinations that Chinese travellers are investigating, the cities they come from, factors that motivate their travel choices, and how businesses can better cater to their needs and preferences.

Growing Chinese Interest in Long-Haul and Exotic Destinations According to data from TripAdvisor’s official site in China, daodao.com, the number of unique visitors in July and August 2013 who researched outbound destinations has increased by more than 250% (excluding Hong Kong and Macau), compared to the same period the year before. Of those who researched outbound destinations in that time, 56% researched destinations in Asia while 44% researched destination outside of the region, with Paris, Rome, London and New York amongst the most frequently researched destinations.

Similarly, a BCG 2013 survey showed that a growing number of young affluent Chinese travellers were interested in longer-haul trips. While just 20% of the most popular destinations for the past three years were long-haul trips (to the US and France), 80% of the most desired destinations for intended travel over the next five to 10 years are outside of Asia. The top “dream” destinations include, the Maldives, US, France, Australia, Greece, the UK, New Zealand, and Italy. While sightseeing, relaxing, and shopping are popular activities amongst Chinese travellers, outdoor and adventure trips are emerging as a new trend, providing opportunities for countries such as New Zealand and Australia to increase their share of Chinese visitors.

Middle Class Segment in Smaller Cities Offers Biggest Growth Opportunities The TripAdvisor-BCG report revealed that more than 80% of China’s middle-income and affluent consumers (MAC) and potential spenders live in smaller cities outside of China’s major metropolises.

According to 2013 data from daodao.com, more than 70% of unique site visitors researching outbound destinations lived outside China’s four largest cities (Beijing, Shanghai, Guangzhou and Shenzhen), and online traffic from these visitors is growing two to three times faster than that of visitors from those four cities. The report also showed that businesses that reach beyond China’s largest cities may have to further adapt their services as well as marketing and distribution models, but they also have a better chance of gaining a first-mover advantage.

Meeting the Needs and Expectations of Chinese Travellers “China’s fast-growing outbound tourism market represents significant and unprecedented opportunities for businesses around the world. Companies that deeply understand and cater to the preferences of Chinese travellers can differentiate themselves and win market share,” said Lily Cheng , Managing Director of TripAdvisor China.

According to the report, many of these preferences are rapidly evolving—particularly for young affluent travellers. For example, Chinese travellers tend to be more spontaneous and have shorter planning timelines than their Western counterparts. This is mainly because they love bargains, but also because planning for a vacation three to six months in advance is not the cultural norm in China. When it comes to hotels, the biggest decision factors for young affluent travellers are location, cleanliness, and price. According to TripAdvisor traveller insights of hotel preferences, the most important considerations for business and leisure travellers alike were location and reputation. Furthermore, Chinese consumers continue to emphasise that they trust recommendations from people they know, as well as online opinion.

“Language barriers and cultural differences are two of the biggest obstacles that Chinese travellers face when travelling abroad. Businesses that offer various services and amenities that make Chinese travellers feel more welcome, such as Mandarin-speaking staff, travel guide information in Chinese, photos in menus, and acceptance of international cards like China UnionPay which are dominant amongst Chinese travellers, will stand a greater chance of attracting Chinese guests and winning them over,” added Ms. Cheng.

TDN Newsroom

TravelDailyNews Asia-Pacific editorial team has an experience of over 35 years in B2B travel journalism as well as in tourism & hospitality marketing and communications.

- TDN Newsroom https://www.traveldailynews.asia/author/tdn/ Where to get a job teaching english abroad

- TDN Newsroom https://www.traveldailynews.asia/author/tdn/ Anime-inspired travel itinerary for visiting Japan

- TDN Newsroom https://www.traveldailynews.asia/author/tdn/ How to plan the best glamping trip to Khao Yai, Thailand

- TDN Newsroom https://www.traveldailynews.asia/author/tdn/ Things to consider when buying car insurance in Thailand

Related posts

Previous article, next article, competition heats up in thailand's skies, the indian traveller 2014.

EaseMyTrip expands with new franchise store in Karnal, Haryana

jüSTa Hollow Oak opens in Mussoorie: A new luxury experience

Mercure opens its largest hotel in Singapore’s central business district

GenZ women lead rebound in Chinese outbound travel

Shaping Balanced Tourism: Leveraging Social Influencers, Content Creators, and Bloggers

Royal Caribbean reveals exciting 2025-2026 Australia season

Guizhou Tourism conference aims to create world-class destination

Korean Air partners with Ramco Systems to enhance engine maintenance

ICBC pledges $41 billion to boost China’s tourism sector

Vietnam ramps up global tourism promotion efforts in 2024

Jinhua delegation enhances trade and cultural ties in Africa

Sydney Seaplanes to launch direct flight from Sydney to Canberra

HKTB and Xiaohongshu strengthen partnership to boost Hong Kong tourism

Madhya Pradesh Tourism Board shines at MITT Moscow

Air India expands global customer support with new contact centers

Prague to Beijing direct flights resume, boosting tourism

Top must-visit indoor attractions in Pigeon Forge

Unveiling Travel Trends: Insights from PATA’s CEO, Noor Ahmad Hamid

Maha Songkran World Water Festival 2024 Unveiled with Epic Spectacle

Addressing Quality Assurance concerns: A critical analysis of Boeing’s production practices

Jakarta police prepare for post-Eid traffic surge, urge strategic planning

SriLankan Airlines strengthens its global reach as UATP merchant

$1 million boost for Aboriginal Tourism in Northern Territory

Ascott partners with Canopy Sands for two new properties in Cambodia

Da Nang joins Vietnam’s MICHELIN Guide culinary destinations

Yum China announces expansion and enhanced stockholder returns in 2023 annual letter

Philippines vies for seven accolades at World Travel Awards 2024

Thailand proposes single-visa scheme with Southeast Asian neighbors

WA Government boosts tourism workforce with training workshops

Courtyard by Marriott Pune Chakan welcomes new F&B Director

Taylor Swift concerts boost Singapore hotel industry records

TAT launches ‘ASEAN + India Shoppers in Thailand’ for tourist engagement

BWH Hotels expands with new SureStay in Suvarnabhumi, Bangkok

Çelebi India partners with Thai Lion Air at Cochin International Airport

Malaysia Airlines and Tourism Malaysia host events to promote to Indian travellers

Air India launches direct flights between Delhi and Ho Chi Minh City

HSMAI’S Revenue Optimization Conference (ROC)

Hsmai roc apac 2024: elevating hospitality revenue optimization.

TAT launches global Songkran festival campaign on BBC

Air Canada resumes Vancouver-Bangkok flights in partnership with TAT

Traveloka partners with Hong Kong Tourism Board to boost Southeast Asian travel

Singapore Airlines relaunches Brussels flights after 20 years

ICC Sydney unveils immersive AV projection in Darling Harbour theatre

Dean Dimitriou appointed General Manager of The Murray, Hong Kong

Ant Group launches program for International Consumer-Friendly Zones in China

Jakarta shifts Eid Holiday focus to tourist safety, enforces strict bus regulations

IT&CM China and CTW China 2024 celebrate successful in-person event

Amadeus completes acquisition of Vision-Box, enhancing traveler experience

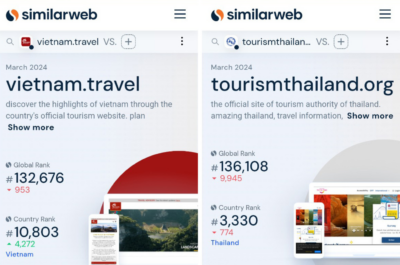

Vietnam’s Tourism website outranks regional competitors, attracting global attention

AirAsia X resumes Kuala Lumpur-Changsha flights, expanding China network

Nepal Tourism Surges with Record-Breaking March Arrivals

Hong Kong Airlines reignites student travel program with 1,000 sponsored tickets

Hotel101 Global det for US NASDAQ listing through merger

AirJapan elevates travel experience with Sabre’s Radixx technology

Western Australia celebrates local manufacturing milestone with first C-Series train journey

Air India and BIAL partner to boost Bengaluru as Southern India’s aviation hub

AirAsia launches first late-night fixed fare flights for Hari Raya to Miri

Flipkart expands into bus bookings, offering 10 lakh connections

HKTB to launch regular pyrotechnic and drone shows for festivals

Direct Mumbai to Tashkent flight launched, boosting India-Uzbekistan ties

Wyndham expands in Vietnam with first hotel in Hai Duong

Air India welcomes new Head of Global Airport Operations

I've traveled to 9 out of 10 countries in Southeast Asia. Here are the 5 biggest mistakes I made along the way.

- I've traveled solo to nine countries in Southeast Asia.

- I've made many mistakes, from traveling during monsoon season to forgetting to bring enough cash.

- Travelers should make sure they plan ahead and research each country's culture.

Over the last two years, my journey as a travel enthusiast and Business Insider's travel reporter in Singapore has brought me to almost every country in Southeast Asia.

In total, there are 10 countries in Southeast Asia , and I've traveled to nine of them — Singapore, Philippines, Malaysia, Vietnam, Thailand, Indonesia, Cambodia, Laos, and Brunei. Myanmar remains the only country in the region I have not visited, and while I am keen to explore it, I have held off on visiting because of the country's ongoing civil war.

I've watched the sun rise in Angkor Wat in Cambodia and cared for elephants in Chiang Mai, Thailand. I've explored the Bornean jungle in Brunei and crawled the Cu Chi Tunnels in southern Vietnam.

But it hasn't always been easy. I've made several mistakes traveling across the region , especially as a solo traveler. Here are five mistakes I made and how to avoid them.

1. Going during monsoon season and not planning for the weather.

In July, I traveled to Thailand on a reporting trip to cover the budding cannabis industry . There, I was met with heavy rain nearly every day. In Bangkok, I was staying in a hostel in Chakkrawat , a district with narrow, meandering streets, which made it difficult to walk anywhere in the pouring rain.

I didn't plan for the weather, so I didn't have an umbrella or poncho with me and had to rush to get one at the last minute. I also had a packed itinerary with a lot of travel between meetings, which was a hassle in the constant downpour.

Before traveling to Southeast Asia, make sure to avoid two seasons — the monsoon season, which often comes with strong typhoons in countries like the Philippines, and the burning season, where farmers burn land for fertile soil. This is a common occurrence in countries like Laos, Thailand, and the island of Borneo, which is shared between Brunei, Indonesia, and Malaysia.

When I traveled to Laos in April last year during the burning season , most of my plans — including a hot air balloon ride — were canceled because of the thick smog. I also didn't have an N95 mask with me, and I ended up with a sore throat.

If you do plan to come during these seasons, make sure to pack accordingly and plan a flexible schedule.

2. Traveling during Ramadan and expecting the same practices everywhere.

Having grown up in Singapore, I'm familiar with the practices during Ramadan , the holy month for Muslims, where they fast for most of the day. I studied Malay for seven years, and in school, I often fasted with my Muslim classmates and ate only in private.

Still, in many cities in Singapore, Malaysia, and Indonesia , non-Muslims are free to dine in public, so long as they do so respectfully. But on my trip to Brunei in April — at the height of the burning season and in the middle of Ramadan — there were more practices I needed to observe.

Most restaurants were closed, and diners weren't allowed to eat there even if they were open — only take-out was allowed. Eating in public was a major faux pas even for non-Muslims, and if you want to drink some water, you can only do so when nobody is around.

It wasn't easy, especially as Brunei was sweltering at 100 degrees Fahrenheit on some days. I made do by returning to the hotel for lunch and grabbing a big dinner with the locals at the night market after they had broken their fast.

3. Not packing enough modest outfits when visiting temples and mosques.

Southeast Asia is pretty liberal, and you can wear whatever you want in many places. In popular destinations like Phuket, Thailand, and Bali, Indonesia, lots of tourists walk around in bikini tops and shorts, and locals mostly tolerate it.

But there are certain places you do need to cover up, like places of worship, which include temples and mosques. When I visited Angkor Wat — the famed temple complex in Cambodia — in February last year, I found some tourists being told off by the local tour guides for wearing shorts and tank tops — "Tomb Raider" style.

I've learned to err on the right side of caution and bring a sarong wherever I go. It's an easy way to cover up and make an outfit more modest when you need to.

4. Forgetting to pack medication, especially when I plan to eat street food.

Southeast Asia has some of the world's most flavorful food. In every country, you can find food that is cheap and delicious, and that includes Singapore , the world's most expensive city. In countries like Malaysia and Vietnam, street food dishes can cost as little as a dollar.

I eat mostly street food when I travel in Southeast Asia, so medicine for tummy-related illnesses is a must. I've only gotten sick twice from eating street food — and it was the same dish both times— and unfortunately, those were the few times I didn't have medicine with me.

I'm a pretty adventurous eater. I've eaten everything from pufferfish stew to frog porridge and dishes made with intestines off the street. I've learned to wash the utensils provided before digging in and make sure the food is cooked to order and heated up before being served.

5. Relying on my card and not bringing enough cash with me.

In Singapore, I don't really use cash and often use Apple Pay, mobile payments, and cards. But I've found that many stores in other countries in Southeast Asia only accept cash.

For example, on my third trip to Vietnam, I spent an hour trying to make payment via bank transfer after the staff at a luxury perfume shop — which was selling items priced upwards of $200 — informed me at the last minute that they didn't accept card or contactless payment.

I've also found the majority of street vendors in the region only accept mobile payment — which is limited to local banks — or cash. I've learned to change a considerable amount of money before leaving the airport and keep whatever I didn't use for my next trip.

- Main content

Delta expects summer travel demand to produce record second-quarter revenue

- Medium Text

Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here.

Reporting by Rajesh Kumar Singh in Chicago Additional reporting by Deborah Sophia in Bengaluru Editing by Pooja Desai, Chizu Nomiyama and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

The number of people killed in plane crashes in Russia dropped to a decade low in 2023, despite Western sanctions on Russia's aviation industry which had raised concerns about flight safety, according to new data.

Business Chevron

AMD introduces AI chips for business laptops and desktops

Advanced Micro Devices unveiled a new series of semiconductors for artificial intelligence-enabled business laptops and desktops on Tuesday as the chip designer looks to expand its share of the lucrative "AI PC" market.

Outlook Travel Magazine

- Travel Guides

- Testimonials

- Meet the Team

- Work With Us

- Outlook Features

- Sign Up Today

- Middle East

Thanks for stopping by. We’re Outlook Travel, and for the past five years, we’ve been uncovering the best-kept travel secrets, destinations and recommendations with tourism boards and location experts from across the globe.

Upholding a commitment to sustainable travel that doesn’t compromise on comfort, our content caters to a new age of travellers.

In Issue 16

Tootbus : Travel Business

Iconic cities inspire our imaginations, and Tootbus is ready and waiting to offer customers the opportunity to discover iconic locations across Europe through hop-on, hop-off …

Under SXM : Creating Sustainable Underwater Experiences

As the first Caribbean artificial reef snorkelling attraction in Sint Maarten, we dive headfirst into Under SMX with Managing Director, Nick Cambden, to learn more …

Queensland Indigenous Womens Ranger Network

Larissa Hale, one of the first Indigenous women rangers in Queensland, Australia, speaks about the inspiration behind the Queensland Indigenous Women Ranger Network and the …

Jordan Banks : Behind the Lens

With vast experience capturing the essence and unparalleled characteristics of countries and landscapes across the world, Jordan Banks showcases his most recent venture into the …

Urbino : The Last Stop

Delicately nestled between the sloping foothills of the Northern Apennines and the languid breeze that carries the salty, citrus scent of the Adriatic Sea, lies …

Hidden Spots for Cherry Blossom Season : Round Up

When it comes to places to see cherry blossoms, Setouchi is truly blessed with variety. For each of the region’s prefectures, we showcase the spots …

Western Cape Travel Guide

Welcome to the Western Cape, where majestic mountains meet wild, open seas. This is a place of rolling green valleys and vast, untouched plains; a place where you can connect with a diverse group of people; a place where you can find yourself again.

Brisbane Travel Guide

With its undeniable charm and relaxed outdoor lifestyle, Brisbane invites travellers to escape the ordinary and experience its spirited inner-city precincts, unique neighbourhoods, and stunning natural surrounds.

Seychelles Travel Guide

Staggeringly seductive beaches, majestic marine life, and exquisitely distinct island culture lay in wait for explorers setting their sights on Seychelles, a truly unique utopia.

With vast experience capturing the essence and unparalleled characteristics of countries and landscapes across the world, Jordan Banks showcases his most recent venture into the icy depths of the Antarctic and discusses what has led him to this point in his career.

Iconic cities inspire our imaginations, and Tootbus is ready and waiting to offer customers the opportunity to discover iconic locations across Europe through hop-on, hop-off routes and themed tours aboard a fleet of environmentally friendly double-decker buses.

Larissa Hale, one of the first Indigenous women rangers in Queensland, Australia, speaks about the inspiration behind the Queensland Indigenous Women Ranger Network and the trailblazing work she and the organisation are doing to further both the environment and women.

As the first Caribbean artificial reef snorkelling attraction in Sint Maarten, we dive headfirst into Under SMX with Managing Director, Nick Cambden, to learn more about the immersive eco-experience that empowers communities to harness the value of the ocean.

When it comes to places to see cherry blossoms, Setouchi is truly blessed with variety. For each of the region’s prefectures, we showcase the spots to consider for cherry blossom viewing.

Sign in to your account

Username or Email Address

Remember Me

COMMENTS

Episode Notes. Skift Research has published its Global Travel Outlook 2024, which sees Asia leading the travel industry's growth while Europe's travel boom will likely slow down. The forecast ...

Asia Outlook Travel | 97 followers on LinkedIn. Asia Outlook Travel is a premium Destination Management Company.

Asia Outlook Travel. 175 likes. Local Handling Agent for over-sea tours operators (since 2005) Contact : [email protected]

By January 8, 2023, cross-city travel restrictions, border closures, and quarantine requirements on international arrivals to China had been lifted. 3 This rapid removal of domestic travel restrictions, and an increase in COVID-19 infection rates, likely knocked travel confidence for cross-city and within-city trips.

BANGKOK, May 31, 2023 -- Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA) today, show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025. Sponsored by Visa and with data and insights from Euromonitor International, this ...

Zhuang's outlook on Asia travel is shifting to more nature-based travelling, giving sample activities like cycling or destinations that have minimal use of vehicles to be more in touch with the ...

Asia-Pacific Travelers Return in 2023, With Different Tastes. By Michelle Jamrisko. March 12, 2023 at 9:50 PM PDT. Listen. 2:49. Travelers are set to come out in fuller force across the Asia ...

Our Partner - Asia Outlook Travel. From luxury holidays to special-interest tours, Asia Outlook Travel offers authentic, hand-crafted experiences and itineraries throughout Vietnam to suit individual or group requirements. Their highly knowledgeable guides, unique products and top-notch service continue to keep clients coming back time and ...

Travel is back in full swing in 2023. We are excited to present the latest edition of Travel Weekly Asia for January-March 2023, featuring exclusive content and expert insights on the latest trends and developments in the travel industry. Themed 'The Big Impact', our cover story takes a deep dive into how 2023 is shaping up for Asia's travel ...

Explore the essential places and hidden gems with our Asia Travel Guides, and discover what makes Asia the go-to place for any traveller. Magazine; Issues; Travel Guides; Outlook Recommends; Features. Features Show More. ... Subscribe to receive Outlook Travel Magazine direct to your inbox! SUBSCRIBE. Follow Us. INSTAGRAM FACEBOOK TWITTER

2024 Outlook: Asia-Pacific Traffic Sees Rapid Growth. While some of the Asia-Pacific region's main domestic markets—Australia, China and India—recovered quickly from the pandemic ...

The Travel & Tourism market in in Asia is projected to grow by 5.36% (2024-2028) resulting in a market volume of US$402.00bn in 2028.

Airfare for all destinations is averaging under $275 round trip for 2023 departures. Cancun, London, Barcelona and Punta Cana top the rankings for most booked international destinations, with airfare averaging just over $600 to the two European destinations and under $500 to the Caribbean. 2. International travel will boom, especially to Asia.

New research points to continued industry recovery, easing of supplier staffing constraints, and mixed outlook on China travel Global business travel is forecast to see an uptick in 2023 versus 2022. Companies are expected to send more employees on trips and travel suppliers anticipate an increase in corporate travel spending.…

Revenue in the third quarter of 2023 almost doubled from a year earlier; net profit in the three months to September totaled 4.6 billion yuan (about $637 million), more than 18 times the year ...

Air Travel Trends in APAC. The resurgence of the domestic market in Asia suddenly paints a promising future for the travel and tourism industry. This presentation will provide the latest data and insights into the current trends and opportunities for the region. Joanna Lu, Head of Consultancy Asia, Ascend by Cirium. 16:10 - 16:40.

Asia Pacific is back in business. AP travel trends in 2023 are influenced by those eager to explore, creating diverse opportunities for the industry. ... This year's Economic Outlook report explores the causes and effects shaping the speed and path of real economic growth, - focusing on housing prices, interest rates, inflation, consumer ...

750. 367. 337. View profile. As China's largest city, Shanghai combines both tradition and modernity. Stroll along the historic Bund waterfront, soar high in the Shanghai Tower, or experience the energy of Nanjing Road's shopping scene. Explore Shanghai with our travel guide.

SLEEP: FOR AN INDULGENT, ALLURING GETAWAY… Perched above the tree line and nestled between lush tropical gardens on a pristine cliffside, AYANA Segara Bali introduces a looser kind of luxury. Designed to allow for sweeping views of Jimbaran Bay at every moment, the rooms at AYANA Segara combine an undeniable sense of cliff top cool with a rich, natural aesthetic of clean, modern lines ...

The sheer volume of air passengers last year reflects a robust return to travel — and a shift toward tourism hotspots in Asia and the Middle East. Close to 8.5 billion passengers took a plane ...

Specifically, by 2030, Chinese urban travellers will take 1.7 billion domestic and outbound trips annually, up from 500 million today, spending $1.8 trillion on travel and tourism—nearly seven times their current expenditures. The report shows that China's outbound leisure market will grow the fastest, with its travel and tourism spending ...

China has strong trade and tourism linkages, so this is positive news for Asia, as half of the region's trade takes place between its economies. Our analysis in the latest Regional Economic Outlook for Asia and the Pacific shows that, for every percentage point of higher growth in China, output in the rest of Asia rises by around 0.3 percent.

5. Relying on my card and not bringing enough cash with me. The Café Apartments in Ho Chi Minh City, Vietnam. Marielle Descalsota/Business Insider. In Singapore, I don't really use cash and often ...

Delta Air Lines said on Wednesday it expects the highest second-quarter revenue in its history thanks to buoyant demand for spring and summer travel and what it called the "most constructive ...

China's economy made a stronger-than-expected start to the year, even as the crisis in its property sector deepened. According to official data, gross domestic product (GDP) expanded by 5.3% in ...

The US economy's enduring strength and the possibility that inflation's progress might have stalled means the central bank likely won't cut interest rates at its upcoming policy meeting just ...

Chinese shares closed lower after Fitch Ratings cut its credit-rating outlook for the country. Japan's Nikkei 225 also fell, while the Stoxx Europe 600 finished 0.2% higher.

Outlook Travel Magazine. Thanks for stopping by. We're Outlook Travel, and for the past five years, we've been uncovering the best-kept travel secrets, destinations and recommendations with tourism boards and location experts from across the globe. Upholding a commitment to sustainable travel that doesn't compromise on comfort, our ...

President Joe Biden is seeking to draw a sharp economic contrast with former President Donald Trump during a three-day swing through Pennsylvania with campaign officials framing the election as a ...