Home » Online Shopping » Flights / Hotels » How to Get Travel Insurance from Expedia

How to Get Travel Insurance from Expedia

Now that you’ve learned all about booking flights, hotels, car rentals, vacations, and cruises with Expedia , you might be thinking about planning a trip. If you’re looking for a little extra peace of mind on your trip, you might be considering purchasing one of Expedia’s travel protection plans, in order to be ready for the unexpected.

Just a heads-up that some of the services we’re reviewing here have affiliate partnerships with us, so we may earn a commission if you visit one of them and buy something. You can read more about how this works at https://techboomers.com/how-to-support-techboomers .

In this article, we’ll explain how to get protection from Expedia, and what types of plans you can choose from. Read on to learn more!

How Expedia travel insurance works

Expedia travel insurance is a protection plan for your trip which will entitle you to a refund in the event that the conditions of the insurance are met. By purchasing insurance with or after your booking, you are protecting yourself if the trip is cancelled or if unfortunate circumstances occur while on your trip.

We all know vacations can be expensive. By purchasing an Expedia protection plan, essentially you are preparing for a situation out of your control, so you don’t lose all of the money you spent on your trip. Depending on the protection you purchase, you could be reimbursed for the cost of your trip for situations such as illness, bad weather, or missing your flight.

You will be given the option of adding travel insurance while booking, but this is completely optional. You will need to purchase protection plans during booking, prior to the completion of your transaction. You can however purchase the Car Rental Insurance Plan up until the day before you leave for your trip.

How do I get a Travel Protection Plan from Expedia?

You will automatically have the option to add a travel protection plan whenever you are booking an itinerary for which that plan is applicable.

Types of Travel Protection Plans that Expedia offers

Expedia package protection plan – for before, on, or after the trip..

This plan applies mainly to vacation packages, usually consisting of at least a flight and hotel booking. It is meant to protect you from elements before and during your trip, including:

- If you need to change or cancel your flight before you leave, for any reason (one time only)

- If your flight is significantly delayed

- If you need to return home mid-trip because of an emergency

- If you need to pay for any emergency medical bills

- If your baggage is lost, stolen, damaged, destroyed, or significantly delayed

- If you or someone you are travelling with is seriously injured or killed in an accident

- If you need to call someone for any other type of emergency travel or medical assistance

Expedia Vacation Waiver – for flight issues.

This is similar to the package protection plan, except that it only covers you if you need to change or cancel your flight before you leave. If you’re just worried about whether or not you’ll be able to make your flight at all, and not so much about what will happen after you’re already on it, then pick this plan.

- You can use this plan one time only, before the time you are scheduled to leave.

- You may cancel or change your flight for any reason.

- Expedia will pay for any change or cancellation fees from the airline.

- You will be given credit to use towards a flight in the future.

- The future flight must be with the same primary passenger on the same airline.

Expedia Cancellation Plan – for an emergency before the trip occurs.

Similar to the vacation waiver, this plan compensates you if you need to cancel your trip before you leave or during your trip, if you or someone closely related to you becomes critically ill or injured.

- This plan only compensates you if you wish to cancel your trip, not change it.

- It covers medical emergencies only, and requires a doctor’s note.

- It is available only for packages that include flights totally within the continental United States.

Expedia Total Protection Plan – for travel, medical, baggage, and emergencies.

This plan is sort of a mix between the cancellation plan and the package protection plan, and usually only applies to packages that have flights booked, but not hotel rooms.

- Like the cancellation plan, it allows you to be compensated if you cancel your trip before you’re scheduled to leave or after you’ve already left, though only for doctor-certified medical emergencies.

- Like the package protection plan, it also protects your luggage against loss, theft, damage, destruction, or significant delay. It also covers emergency medical bills, and can compensate you if you or a travelling partner is seriously injured or killed in an accident. Finally, it includes 24/7 emergency traveller’s assistance.

Cruise Travel Protection.

As its name implies, this plan is for packages that include cruises. It offers you protection and/or compensation:

- If you have to cancel your cruise because you or a close associate has a medical emergency

- If your cruise is significantly delayed

- If you have to pay for any emergency medical bills

- If your luggage is lost, stolen, damaged, destroyed, or significantly delayed

Car Rental Insurance.

This plan covers your expenses, above and beyond your regular car insurance, if your rental car is damaged by forces of nature (fire, flood, hail, wind, etc.) or by anything else that isn’t your fault. This is also the only insurance that can be purchased from Expedia after your booking; you can obtain it up until the day before you leave for your trip – so you have more time to decide if you’ll need it.

Is Expedia’s Travel Insurance Worth It?

The answer to this, like a lot of similar questions, is “it depends.” There are a number of factors that may make you decide that you want the extra protection or not. Here are a few things to consider.

- How well does your other insurance cover you? There are some things included in their travel insurance plans that your other insurance plans don’t cover, and there are some things that they do. Consider what things are most likely to pose a problem for you personally on your trip, and ask whether the insurance you have already covers those things or not.

- How dangerous is your trip destination? There are some places that are prone to extreme weather conditions, while others are notorious for thievery and violence. Again, consider what the biggest risks are for you when travelling when deciding on your insurance plan.

- Did you read the fine print? Again, we know that a lot of people don’t like doing it and/or don’t bother doing it. But a lot of people who complain on the Internet about the travel insurance plans being useless probably didn’t realize that there are specific situations in which they do or do not apply. For instance, some of them only reimburse you if you outright cancel your trip instead of changing it, and only for a medical emergency verified by a doctor.

- Are you getting value for money? This kind of goes hand-in-hand with the other points made so far. There are some places where you will be able to buy travel insurance at a lower rate. Also, in some places, you may be able to get travel insurance that is more expensive, but has more covered scenarios and/or doesn’t have as many restrictions in the fine print. Do a bit of shopping around to find a good balance of price versus broadness of coverage.

And that’s how Expedia’s Travel Protection Plans work. If you’re interested in learning more about what you may be entitled to when you book with Expedia, check out our article on the their cancellation policy here .

More Great Related Articles

Best Travel Apps Guide: Make Plans, Book Flights, and Find Deals

Best 9 Sites Like TripAdvisor

How to Find and Use Priceline Coupons

Best 9 Sites Like Kayak

AskMoney.com

What's Your Question?

- Credit Cards 101

- Credit Score

- Budgeting 101

- Budgeting Software & Apps

- Debt Management

- Savings & Settings Goals

- Mortgages 101

- 401(k) Plans

- Cryptocurrencies

- Investing 101

- Retirement Planning

- Brackets & Rates

- Federal and state refunds

- Car insurance

- Homeowner Insurance

- Life insurance

- Medical Insurance

- Renters insurance

What Is Expedia’s Travel Insurance Policy?

As much as we want our vacations to go according to plan — and many actually do — travel mishaps aren’t exactly uncommon. However, if you booked your trip with Expedia and took advantage of one of the company’s various travel insurance options, you won’t be left high and dry, figuring out solutions on your own. These plans are designed to protect you and your fellow travelers if something goes awry.

Insurance options include hotel, flight and vacation package coverage plans, each with different protection for the different aspects of your trip. Each insurance plan derives from a partnership between Expedia and Travel Guard insurance . Regardless of which type of plan you select, you can manage your trip, file claims (if necessary) and keep everything on track using Expedia’s accompanying online portal.

Basics of Expedia’s Travel Insurance Policy

Expedia partners with Travel Guard to provide travel protection services for your next vacation or any other trips you take. These services include flight insurance, hotel insurance, cruise insurance and even insurance for your entire vacation package. Expedia’s Package Protection Plan goes into effect once the company receives the appropriate plan payment.

Before choosing a plan, it’s important to browse through the descriptions and summaries of the different protection options to see what is covered and what isn’t. It won’t do you any good to pay for coverage you don’t need, and you also don’t want to risk any unpleasant surprises because you believe something is covered that isn’t.

You can access Expedia’s Customer Service Portal at any time after purchasing your insurance to change or manage your upcoming trip, check for government travel alerts and warnings, book a flight using airline credits, change the components in your vacation package and more. Expedia’s most current information is available through this portal.

Flight Insurance

Expedia has partnered with AIG’s Travel Guard to provide flight insurance via Flight Cancellation Plan and Flight Protection Plan insurance options. The Flight Cancellation Plan insures all domestic flights within the United States, except for Hawaii and Alaska. Under this insurance plan, you can expect to be reimbursed for the entire cost of your trip if you must cancel or shorten your trip for covered reasons. Each state has its own limitations and exclusions for residents.

The second flight insurance option is the Flight Protection Plan, which is available for all flights outside of the continental U.S., including Alaska and Hawaii. This plan includes everything you get in the Flight Cancellation Plan, plus additional benefits, such as medical assistance and coverage for any loss or theft as well as damage to your baggage or personal belongings. Accidental death is also covered under this plan.

To book flight insurance coverage, you can add the insurance to your flight during checkout or for a period up to 24 hours after your purchase. You can cancel the insurance before your trip for up to 15 days after you book the flight as long as you haven’t filed a claim. If you pay for the insurance at the same time as your flight and then cancel the flight online, your insurance purchase will also be canceled.

Hotel Insurance

Expedia also offers two Travel Guard hotel insurance options: Hotel Booking Protection (U.S. hotels only) and Hotel Booking Protection Plus (outside U.S.). The Hotel Booking Protection plan covers trip cancellation as well as trip interruption for up to the total cost of the trip. Trip delay coverage can be used if you experience a delay of six hours or more or if a delay causes you to miss a night of a hotel stay. Baggage delay insurance protection is also included in this insurance plan. If you need to cancel or shorten your trip due to covered reasons, you will be reimbursed for the total cost of your trip, up to a maximum of $3,000.

The Hotel Booking Protection Plus plan includes everything the Hotel Booking Protection plan offers along with expense coverage for accidents, sickness and certain medical conditions. You also have insurance protection in the event of an emergency evacuation. These extra coverages are only available when staying in hotels outside the U.S.

Cruise Insurance

Expedia’s Cruise Travel Protection plan covers you if your cruise is canceled or unavoidably delayed. It also provides coverage in the event of unforeseen medical expenses along with lost luggage. Make sure you read the terms carefully for limitations and exclusions.

Vacation Package Insurance

Through its partnership with Travel Guard, Expedia provides two vacation package travel insurance options: Package Protection Plan and Pre-Travel Vacation Waiver. With the Package Protection Plan , your coverage protects you when you must cancel for certain covered reasons. You also get insurance coverage for trip delays and interruptions as well as medical expenses you may incur after your departure.

Just as the name indicates, the Pre-Travel Vacation Waiver provides protection from certain costs before you travel but doesn’t provide any coverage on your trip. The waiver allows you to cancel or change your package reservation one time before your scheduled travel date without paying any fees to make these changes.

MORE FROM ASKMONEY.COM

Enter your ZIP Code!

Get a quote today., expedia travel insurance: plans, costs, reputation, & services.

Expedia markets itself as “the world’s travel platform.”

In business since 1996, the company has grown to be one of the biggest travel insurance providers in the world.

It has several plans with different coverage levels suitable for a variety of travelers, helping keep its spot as a leading travel insurance company in the industry.

Expedia’s plans can be customized with a variety of add-ons and extra benefits that let travelers make sure they get the best travel insurance for their needs and budget.

Travelers can find out more about the costs of an Expedia travel insurance plan by visiting its website and inputting their personal information, with the details of their planned trip.

The company routinely provides flights and hotels, bundling travel insurance as part of this main offering.

Expedia’s travel insurance is only available for purchase when you book your trip and accommodation with the company.

Aon Affinity Travel Practice, who administers Expedia’s travel insurance policies, has a rating of A+ from the Better Business Bureau (BBB).

This is an indicator of the efficient way this company deals with complaints that are filed against it.

While it had 49 logged complaints within the last 12 months, according to the BBB, the company’s prompt response time is reflected in its A+ rating.

Expedia provides a mobile app which gives its customers the ability to file a claim from anywhere in the world.

It also offers 24/7 telephone support.

While this is a pretty standard offering in the travel insurance industry, it’s a great relief knowing that if you need to talk to your travel insurance provider from a different time zone, you’ll be able to.

An insurance company’s financial stability is regularly overlooked by potential customers, but can often be just as important as analyzing travel insurance reviews.

Expedia’s underwriting company, Stonebridge Casualty, has received a rating of “A” by A. M. Best through its parent organization Transamerica Casualty.

Financial stability should always be something to consider when you’re looking at travel insurance providers .

Expedia Travel Insurance Coverage & Plans

Expedia travel insurance offers a wide variety of coverage plans to ensure protection across a variety of situations.

Each offering has several available levels of coverage, so there’s a big chance you can find something that’s right for you to protect you when you’re away from home.

Expedia travel insurance provides the following types of coverage:

- Comprehensive

- Trip Cancellation/ Interruption

- Accidental Death

Expedia Package Protection

This plan provides trip cancellation and interruption coverage.

It also includes reimbursement for any expenses incurred if your travel is delayed due to mechanical failure, strike, or adverse weather conditions.

This plan also protects you in the event of medical emergencies and can help with the costs of medical expenses and medical transportation.

Baggage and personal property is covered, so any lost, stolen, or damaged items during travel can be replaced.

If a hurricane warning has been issued and you need to change the specifics of your trip, the company may waive cancellation fees and liaise with its partnering companies to waive its associated fees as well.

You can also receive assistance with re-booking the entirety of your trip, including your flight and any activities you may have booked.

Though Expedia only offers one travel insurance plan, the company has a wide range of add-ons.

These include coverage for lost passport and document assistance, emergency cash, translation services, medical case management, and concierge services such as restaurant or event referrals and reservations.

While these add-ons may understandably increase the cost of your travel insurance, they also provide you with a greater degree of protection and offer added value.

Expedia Travel Insurance Costs

Travel insurance generally costs between 4 and 8 percent of the total trip.

While this is the industry standard, the actual costs of your travel insurance usually depend on the level of coverage you select and how comprehensive your plan is.

Travel insurance companies base their actuarial math on several factors.

The length of the trip is a significant determiner, as the longer you’re traveling, the more likely adverse calamities could occur. Destination dramatically impacts the price as well.

If you’re visiting an area with a high crime rates, political unrest, or poor infrastructure, to name just a few, insurance providers may view you as a higher risk. The age of the policyholder can also influence the price of the premium.

Generally, consumers aged 70 or over can expect to pay considerably more for their travel insurance.

The price of travel insurance is calculated based on risk, and the older you are, the more your risk increases in the eyes of the insurance providers.

Travelers can get a quote from Expedia by visiting its website and providing precise details of the trip that they plan on making.

Expedia doesn’t have annual options available, so it may not be possible to get a standard rate year in year out.

There’s no minimum age limit for insuring children via this company, though dependents are covered under their parents’ policy.

Expedia only refunds policies purchased ten days before the trip, provided no claims have been made.

Customer Reviews & Reputation

Before purchasing any travel insurance policy, it’s important to look at the insurer’s reviews, to gain insight into the company should you need its services on your trip.

Expedia (through Aon Affinity) has been awarded the Better Business Bureau’s highest rating of A+.

Though this rating is not uncommon, it is noteworthy that Aon Affinity has closed 49 complaints in the past 12 months.

This high volume of complaints can be attributed to the fact that this company is quite a large insurance provider.

Customer Assistance Services

When you take out a travel insurance plan with Expedia, you benefit from 24/7 support and access to its mobile app, with paperless claim filing available.

Choosing a travel insurance company that has modern interfaces is always a good choice, as instant access can significantly reduce your stress should something go wrong on your trip.

Another critical aspect to consider, and one which may not initially cross your mind, is whether the insurance company you choose has 24/7 support available.

This is particularly important for travel to far removed time zones from your own.

Expedia also provides additional concierge services such as ground transportation, up to the minute travel advice, and event or restaurant referrals and bookings.

Expedia Travel Insurance Financial Stability

Financial stability is an essential factor to consider when choosing an insurance company.

Dedicated credit rating agencies such as A.M Best, Standard and Poor’s, and Moody’s analyze insurance companies and report their findings, publishing results regularly.

Good ratings with any of these are generally indicative of a company’s ability to meet its obligations.

Expedia is underwritten by Stonebridge Casualty, a subsidiary of Transamerica Casualty, which has received a rating of A from A. M. Best.

This high rating shows that the backing company can meet its ongoing insurance obligations.

If there were any concerns with the quality of the coverage offered by this company, or of its ability to make good on claims, A. M. Best would have a lower rating.

Expedia Travel Insurance Phone Number & Contact Information

- Homepage URL : https://www.expedia.com/

- Provider Phone : (877) 227-7481

- Headquarters Address : 333 108th Ave NE Ste 300, Bellevue, WA 98004-5736

- Year Founded : 1996

Best Alternatives to Expedia Travel Insurance

Not satisfied with what Expedia has to offer? These companies provide great travel insurance alternatives:

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Expedia add travel insurance.

Traveling is an exciting experience that lets us explore new places, cultures, and people. However, it can also bring unexpected events and risks that we must face. To ensure a safe and hassle-free trip, adding travel insurance to your itinerary can make a significant difference. In this guide, we will discuss how to add travel insurance to your Expedia booking and answer some frequently asked questions.

What is Expedia?

Expedia is a popular online booking platform that offers travel deals and reservations for flights, hotels, car rentals, cruises, and vacations packages. With Expedia, travelers can compare prices, read reviews, and find exclusive discounts from various providers.

Why Add Travel Insurance to Your Expedia Booking?

Travel insurance can provide financial protection and peace of mind in case of unforeseen circumstances during your trip, such as flight cancellations, medical emergencies, lost or stolen baggage, and trip interruptions. By adding travel insurance to your Expedia booking, you can have access to a range of coverage options that suit your needs and budget.

How to Add Travel Insurance to Your Expedia Booking?

Adding travel insurance to your Expedia booking is easy and straightforward. Here are the steps to follow:

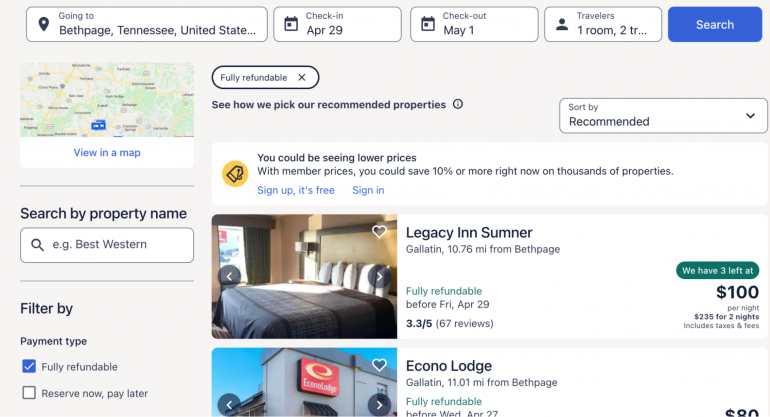

- Select the travel product you want to book on Expedia, such as a flight or a hotel.

- On the payment page, look for the “Add trip protection” section.

- Choose the travel insurance provider you prefer and select the coverage option that suits you.

- Review the details and terms of the travel insurance and click “Continue to checkout” to complete your booking.

Adding travel insurance to your Expedia booking can provide you with valuable coverage and protection during your trip. It is essential to understand the coverage options, terms, and conditions of the travel insurance policies and choose the one that suits your needs and budget. By following the steps mentioned above and the frequently asked questions, you can have a smooth and enjoyable travel experience.

- Vacation packages

- Things to do

- AARP Member Savings

- Create an Account

- List of Favorites

- Not ? Log in to your account

Create your free account

Sign in to your account, travel protection plans, vacation waiver.

Prepare for life's unexpected occurrences. With an Expedia Vacation Waiver you can cancel or change your trip—for any reason—and Expedia will pay your change fees. Go ahead, book that family vacation today, resting assured that you can change it if you need to!

- Change or cancel your trip for any reason.

- Covers you prior to the scheduled start of your trip.

- Cancelling your flight? Get a full refund of any cancellation fees and a credit for the amount of the cancelled ticket.

- Changing your flight? Get a full refund of any change fees and a credit for future travel.

- Refund Instructions

- Terms & Conditions

Change or cancel for any reason

Vacation Waiver helps protect you against life's unexpected occurrences. Your group is allowed to change or cancel your trip for any reason one (1) time prior to the scheduled start time* of your trip without being charged any change or cancellation fees. If canceling, any monies paid will be returned to the customer who booked the travel except the cost of published airfare, which may be made available as a credit for future travel.** Note: The waiver is valid once you have paid the appropriate waiver cost and your booking is confirmed. *Scheduled Start Time is defined as the originally scheduled departure time of your flight or, if you haven’t booked a flight as part of your package, the scheduled check-in time of your hotel at the time of booking. Other terms and conditions apply. Please see Terms and Conditions below. **For a published air ticket, credit may be issued per applicable airline policies less airline change fees and Expedia, Inc. will absorb the change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility. You are allowed to change or cancel your trip for any reason one (1) time prior to the start of your trip.

The Vacation Waiver is valid for redemption only by the person(s) named on the voucher. It is not transferable, has no cash value, and may be redeemed only once. The Expedia Vacation Waiver must be purchased at the time of booking; waivers cannot be purchased after booking. The Vacation Waiver excludes the price of the Expedia Vacation Waiver. If you change your trip for ANY REASON prior to the scheduled start time* of your trip, all package cancellation fees imposed by the airline, hotel, car rental company or other travel service provider will be paid by Expedia. You will be responsible for any increase in the cost of the trip as a result of fares being higher at the time of the change. The Expedia Vacation Waiver does not cover changes in fares. If you cancel your trip, you will receive a refund for all amounts paid, except for the cost of non-refundable air tickets. In most cases, the full amount of money paid for air travel will be returned in the form of a credit for future travel, subject to restrictions and limitations imposed by airlines. Airfare credits are typically limited for use by the named ticketed passenger, for use on the same airline, for a period of up to one year from the original ticketing date.

General What is the Expedia Vacation Waiver? The Expedia Vacation Waiver allows you to cancel your trip for any reason prior to the scheduled start of your trip. Any monies paid will be returned to the customer who booked the travel except the cost of published airfare, which will be made available as a credit for future travel. For a published air ticket, credit may be issued per applicable airline policies less airline change fees and Expedia, inc. will absorb change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility. Why should I get the Expedia Vacation Waiver? You've saved, you've waited, and now you're all set to go on the vacation of your life—an Expedia Vacation. Preparing for your vacation should include preparing yourself for any unfortunate occurrences. By getting the Expedia Vacation Waiver you’ll skip all cancellation fees and be refunded for your hotel cost and receive a credit for your airfare. If you’d like coverage for baggage loss, emergency medical coverage, and more consider the Expedia Package Protection Plan instead. For travelers seeking flexibility and the freedom to change your plans, this may be right for you. What does the Expedia Vacation Waiver provide? The Expedia Vacation Waiver allows you to change or cancel your trip one time prior to the start of your trip for any reason. For a published air ticket, credit may be issued per applicable airline policies less airline change fees and Expedia, inc. will absorb change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility. Is there help while I'm traveling? No, the Expedia Vacation Waiver only allows you to cancel or change your trip one time for any reason prior to the start of your trip. Your scheduled start time is defined as the originally scheduled time of your flight, or, if you haven’t booked a flight as part of your package, the scheduled check-in time of your hotel at the time of booking. If you wish to have insurance coverage while you are traveling, consider the Expedia Package Protection Plan , which includes all the benefits included here as well as insurance coverage while traveling. Who can I contact for more information? For more information about the Expedia Vacation Waiver, contact Expedia at 1-800-675-4318. How is the waiver different from the Expedia Package Protection Plan? The Expedia Package Protection Plan includes a lot more than the waiver. In addition to pre-trip coverage, the Expedia Package Protection Plan includes travel insurance provided by Berkely. This insurance includes emergency medical coverage, evacuation coverage, and much more during your trip. Find out more . Enrollment When is payment due? Payment for the Expedia Vacation Waiver is due at the time you book your package. This waiver is not available after you book your package. When does the waiver go into effect? The Expedia Vacation Waiver goes into effect the moment you book your package. You may only use the Expedia Vacation Waiver once to make changes or cancel your trip. I am not a U.S. or Canadian resident; can I get the waiver? Yes! The Expedia Vacation Waiver is available to everyone, regardless of country of residence. Request a Refund What happens if I need to cancel my vacation? If you need to cancel your vacation, contact Expedia at 1-800-675-4318 to request a refund. A travel agent can assist cancelling or changing your vacation. Exclusions Are there exclusions? No, there are no exclusions! Is there a Pre-Existing Condition Exclusion? The Expedia Vacation Waiver does not have a pre-existing condition exclusion.

Contact Information

For questions or to request a refund, contact AARP Travel Center Customer Support at 1-800-675-4318.

Can you add insurance to Expedia trip after booking?

FAQs about adding insurance to an Expedia trip after booking

1. is it possible to add insurance to my expedia trip if i already have a booking, 2. what does travel insurance cover, 3. how much does travel insurance cost, 4. can i purchase travel insurance for only part of my trip, 5. is travel insurance worth it, 6. are there any restrictions or limitations to adding insurance after booking, 7. how do i make a claim with travel insurance, 8. can i cancel travel insurance if my plans change, 9. can i upgrade my travel insurance coverage, 10. how do i select the right travel insurance for my trip, 11. can i add insurance to an expedia trip if i booked through a third-party website, 12. is it cheaper to purchase travel insurance directly from the insurance provider.

If you have already booked a trip through Expedia and are now wondering whether you can add insurance to your reservation, the answer is yes, it is possible. Expedia provides the flexibility to add insurance to your trip even after the initial booking. Travel insurance offers protection and peace of mind in case of unforeseen events such as trip cancellations, delays, or medical emergencies. It is highly recommended to consider adding insurance to your Expedia trip, as it can save you from potential financial losses and provide you with assistance when you need it the most.

Yes, Expedia allows you to add insurance to your trip even after making the initial booking. Simply log in to your Expedia account, go to your itinerary, and look for the option to add travel insurance. Follow the prompts to select the insurance coverage that suits your needs.

Travel insurance typically covers a range of scenarios, including trip cancellations or interruptions, medical emergencies, lost or delayed luggage, and emergency evacuation. The exact coverage may vary depending on the insurance provider and the plan you choose.

The cost of travel insurance depends on various factors, such as the duration of your trip, the destinations you are traveling to, your age, and the level of coverage you require. It is best to obtain quotes from different insurance providers to compare prices and coverage options.

Yes, most insurance providers offer the flexibility to purchase coverage for specific portions of your trip. For example, if you have a multi-destination trip, you can choose to only cover the duration of your stay in certain locations.

Travel insurance can provide valuable protection and peace of mind, especially if you are traveling to unfamiliar destinations or engaging in activities with potential risks. It can save you from significant financial losses in case of unforeseen events and provide assistance when you need it.

While it is generally possible to add insurance to your Expedia trip after booking, there may be certain restrictions or limitations. It is important to carefully read the terms and conditions of the insurance policy to understand any exclusions or limitations that may apply.

If you encounter an event covered by your travel insurance policy, you will typically need to contact your insurance provider as soon as possible. They will guide you through the claims process, which may require submitting documentation such as medical reports or receipts.

Most travel insurance policies offer a grace period during which you can cancel the insurance and receive a refund. However, the duration of the grace period may vary between insurance providers. It is important to review the policy terms to understand the cancellation policy.

If you find that the initial coverage you selected is inadequate, it may be possible to upgrade your travel insurance. Contact your insurance provider for guidance and to explore any available options.

Choosing the right travel insurance involves considering your specific travel needs, such as the destinations, duration, and activities planned. It is important to compare coverage options, read reviews, and understand the terms and conditions before making a decision.

In most cases, you should be able to add insurance to your Expedia trip even if you booked through a third-party website. However, it is always advisable to check with Expedia directly or consult the insurance provider to ensure compatibility.

While purchasing travel insurance directly from the insurance provider may be an option, it is often more convenient to add insurance through Expedia. Additionally, Expedia may offer bundled packages that provide competitive pricing and the convenience of managing all aspects of your trip in one place. It is recommended to compare prices and coverage options to make an informed decision.

About The Author

Abby andersen, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Travel Erudition

Can you add travel insurance after booking on expedia?

When booking a trip, many people choose to add travel insurance as an extra layer of protection. While Expedia offers a variety of travel insurance options, it is not always possible to add insurance after booking. In some cases, you may be able to add insurance within 24 hours of booking, but it is not guaranteed. If you are interested in adding travel insurance to your Expedia booking, it is best to check with the insurance provider ahead of time to see if it is possible.

No, you cannot add travel insurance after booking on Expedia. You must purchase travel insurance at the time of booking in order to be covered.

Can you add trip protection after booking Expedia?

If you’re considering adding trip insurance to your travel plans, you can usually do so after you’ve booked your trip on Expedia. In most cases, you can add trip insurance to your existing travel plans without any problems. However, it’s always a good idea to check with your insurance provider to make sure that your policy covers you for the type of travel you’re planning.

Expedia offers two different types of travel insurance for flights — the Flight Cancellation Plan and the Flight Total Protection Plan. For hotels, they offer Hotel Booking Protection and Hotel Booking Protection Plus. You can purchase an Expedia travel insurance policy before your trip to protect your investment and have peace of mind while you travel.

What does Expedia trip protection cover

The plan provides coverage for medical expenses in the event of a medical emergency while traveling, as well as coverage for emergency medical transportation. Benefits are also provided for baggage and personal effects that are lost, stolen or damaged during your flight.

If you are looking to cancel your hotel booking with Expedia, there are a few things you need to know. If you have booked a fully refundable room, you can cancel up to 48 hours before your check-in date and receive a full refund. If you have booked a non-refundable room, however, you will not be refunded for your booking. Be sure to check the cancellation policy of your hotel before booking to avoid any surprises.

Can I cancel my trip on Expedia and get a refund?

If you need to cancel your flight, you can do so within 24 hours for a full refund. If you need to change your flight, you may be charged fees by the airline.

The Expedia Cancellation Plan is a great way to protect yourself in case you need to cancel your trip before you leave or during your trip. If you or someone closely related to you becomes critically ill or injured, this plan will compensate you. This is a great way to protect yourself and your loved ones while you travel.

Does travel insurance cover booking cancellation?

Comprehensive travel insurance is a great way to protect your investment in your vacation. If you need to cancel your trip due to illness, injury, natural disasters, family emergencies, or other unforeseen circumstances, comprehensive travel insurance will reimburse you for your accommodation, flights, and other pre-paid deposits. This type of insurance is a great way to peace of mind on your next vacation.

When you buy travel insurance, you can decide whether you want it to start immediately or on a later date. If you want it to start on the day you buy it, you’re usually insured the moment you pay for the policy. So it doesn’t take long to get your insurance sorted!

Can you get flight cancellation insurance after booking

It’s always best to purchase travel insurance as early as possible, but you can still buy it after booking your trip. If you wait, you may miss out on some benefits.

Though you may pay 5 to 10 percent of your trip cost for travel insurance, travel insurance is often worth the investment for its potential to help reimburse you for hundreds of thousands of dollars of covered travel-related expenses like emergency evacuation, medical bills, and costs related to trip cancellation and.

Is it better to book through Expedia or the airline?

If you’re looking to save money on your flight tickets, booking through Expedia can be a great option. In many cases, Expedia is able to offer flight tickets at a lower price than if you were to book directly through the airline. This is because third-party services often get a bulk discount from airlines, allowing them to sell their flight deals for less than the average ticket price.

Please note that the fare is non-refundable and any change or cancellation will result in full forfeiture of the value of the ticket with no refund or credit available. Rules and restrictions as imposed by the airline(s) will be applicable to your fare should you need to change or cancel your flight(s).

What happens if I cancel a reservation on Expedia

The Expedia cancellation policy for hosts is quite simple and straightforward – if a guests cancels or changes their reservation within 24 hours of booking, they will not be charged any fees or penalties. This policy is in place across the entire Expedia site, so guests can rest assured that they can cancel or change their reservations without any hassle.

If you need to cancel your flight reservation, you can do so through Expedia. However, please be aware that the airline may charge a cancellation fee depending on the fare type that you purchased. You can find the fare rules for your particular fare type in your trip itinerary. Thanks for using Expedia!

Does Expedia insurance cover missed flights?

If your flight is delayed more than 12 hours, you will not be reimbursed for any expenses incurred as a result of the delay. This includes things like missed hotel reservations, car rental fees, and so on. You will also not be covered for any lost or stolen baggage. So if your flight is delayed, be sure to make alternate arrangements and travel insurance plans accordingly.

If you need to cancel your hotel reservation, you can do so by using the Expedia app or by calling Expedia at 1-800-397-3342. Make sure you have your reservation number handy, as you will need to enter it into an automated system when you call.

Yes, you can add travel insurance after booking on Expedia.

After booking a trip on Expedia, you can’t add travel insurance through Expedia. You would need to contact a travel insurance company directly to see if you can add insurance for your already booked trip.

Scott Johnson

Scott Johnson is passionate about traveling. He loves exploring new cultures and places, and discovering the world around him. He believes that travel can open up new perspectives and opportunities for growth and development. Scott has visited many countries in Europe, Africa, South America, and Asia, and he continues to seek out new destinations for his adventures.

Leave a Comment Cancel reply

Demystifying car rental insurance

So you’re at the car rental pick-up, raring to sit at the wheel and dash to your next destination. While you await your keys, the helpful attendant at the counter has other plans. The inevitable question pops up: ma'am, do you need insurance?

You’re sure you added Travel Guard’s collision damage insurance while booking your rental with Expedia. You tell her as much. But she has more questions; ones with legal-ey terms that you don’t fully understand: liability, supplemental liability, overseas coverage, and so on. Puzzled, you no longer know whether you have the necessary coverage to drive your rental car.

Sounds familiar? Let’s help you clear this confusion.

Collision damage protection

First things first. If you said Yes to Travel Guard’s collision damage protection while booking your car rental with Expedia, you already have collision damage protection. This protection is offered by TravelGuard and it covers you in all US states — when you drive interstate, and even when you drive overseas.

Here’s a quick link to share with the rental agency while picking up your car: Collision Damage Plan . Bookmark it. Even better, download the policy document for your state of residence and keep it handy on your phone or another device.

Keep your key insurance documents handy to make that conversation at the car rental agency easier. Gathering this information is a one-time activity that’ll serve you well whenever you travel or rent a car.

Liability insurance

Many states in the US require you to have a minimum level of liability insurance in order to lawfully drive a car. This minimum coverage varies by state and by the damages caused to others in an accident for which you have legal responsibility.

Do you already have liability coverage?

The Travel Guard Collision Damage Protection plan you bought through Expedia doesn’t include liability protection. However, you might already have liability coverage through other sources:

Included in rental price: The car rental agency might be required by law to provide a minimum level of liability insurance.

In the European Union in particular, such minimum liability coverage required by law may be significant. Ask if the price you’re paying for the rental already includes that minimum liability insurance.

Included in your existing personal auto insurance: Any personal auto insurance you have might give you liability coverage even when you’re driving a rental car.

Call your auto insurance provider in advance and check the extent of such coverage. For instance, liability protection bundled with your auto insurance may have a dollar limit to the amount you can claim. Also ask if that protection is primary or secondary.

If your auto insurance offers such coverage, keep a copy of your policy document handy.

As an add-on to your existing homeowner’s/tenant’s insurance

If you don’t have the minimum level of liability coverage mandated by the state, or if you’re apprehensive that this minimum level of coverage is too low; you can add an umbrella liability insurance rider to your auto or homeowner’s/tenant’s policy before starting on the trip. Just speak to the provider of these policies about adding such a rider. In the process, you may end up with sufficient liability coverage that’s way cheaper than the insurance you’re offered at the counter.

Personal accident insurance

Your health, life, or auto insurance may already offer a degree of personal accident coverage. Also, neither personal accident insurance nor personal effects insurance is legally required to drive a car.

If your existing insurance already provides personal accident coverage, you can say No to it at the counter.

Additional reading:

- “Paying for Coverage You May Not Need”, New York Times

- “Everything You Ever Wanted to Know About Car Insurance”, DoughRoller.net

- “Automobile Liability Insurance”, Investopedia.com

Ace the conversation at the counter

Equipped with all that we know now, let's imagine what a sample conversation with your car rental agency attendant might go like:

[…after ID verification and vehicle inspection]

Jargon:unjargon

Car rental insurance comprises several kinds of coverage. Here are the terms you should know:

covers damages to other people's person and property in accidents for which you’re legally responsible. This insurance may also cover medical expenses for other people’s injuries, legal fees if the accident results in a lawsuit against you, and related expenses. Liability insurance is also sometimes known as casualty insurance or third-party insurance .

If you don’t have liability insurance, you may be responsible for paying for damages in such accidents from your own pocket. But, most likely, you’ll have liability coverage through your existing insurance or another source.

provides coverage for any injuries or disabilities that you may sustain in an accident.

While at the car rental counter, you may also hear about primary and secondary coverage. Primary coverage is insurance that pays first and to the extent allowed in its policy document. Secondary coverage comes into play only for expenses that are not settled by primary insurance.

Get support

Still have questions? Call Travel Guard:

1-855-334-3855

- Vacation Rentals

- Restaurants

- Things to do

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Do not buy trip cancellation insurance from Expedia - Air Travel Forum

- Tripadvisor Forums

- Air Travel Forums

Do not buy trip cancellation insurance from Expedia

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Air Travel forum

Expedia's so-called Trip Protection package is a scam. It's expensive and its coverage is limited to health emergencies.

I made the mistake of buying it, and it cost me dearly.

Don't buy it!

174 replies to this topic

you bought a policy without reading what was included??

What did you expect that you did not get? Please clarify

Another case of an OP not reading what he bought and calling it a scam. Blaming someone else is the true American pastime, not baseball. Last time I bought trip insurance, it covered health, jury duty, job layoff, terrorism, environmental issues, carrier no longer providing the service, etc. Just read it again to make sure.

Expedia's policy would never be a "cancel for any reason you please" policy.

Those are VERY expensive!! Most policies cover cancelling for very specific reasons that are always listed before you buy.

I don’t doubt that the insurance provided by Expedia was very limited. The real problem is not reading the policy before purchasing the insurance.

So not a scam. Just not very good value.

A bit like champagne.

Expensive is a matter of perspective. A health emergency in a foreign country can indeed be very expensive. You would be singing quite a bit different tune if you did in fact have a health emergency and the insurance covered the health insurance.

A health emergency in a foreign country can indeed be very expensive.

----------------

It would be less expensive than in the US for sure.

They are talking about cancelling for a health emergency prior, not getting emergency medical insurance while in destination.

Unless your elderly, spending a ton of money on travel, or don't have health insurance I would recommend avoiding trip insurance. Most travel insurance is hard to get reimbursement for and they require very specific things to warrant paying out.

I have Kaiser health insurance and they cover me inside and outside the United States. My Visa travel credit card offers trip protection and baggage protection. I also travel alone, so I only have to worry about myself.

- UK Liquids Rules 3:36 pm

- Yet More BA Companion Voucher questions! 3:36 pm

- Few Questions- American Airlines/Japan Airlines codeshare 3:24 pm

- Misunderstanding with times 3:19 pm

- India to USA through Paris 3:11 pm

- Etihad A321 row numbers 2:28 pm

- LGA versus ATL 2:26 pm

- Selecting seats on Latam Airlines when booked through Delta 12:29 pm

- Schengen via Schengen transit to Non-schengen 12:16 pm

- Gay travel being banned? 11:59 am

- Beware of Wizz Air scam 11:26 am

- Ethiopian Airlines - Baggage, Transit questions 10:53 am

- United Airlines reimbursement after flight cancellation 9:20 am

- SQ check in at LAX 8:31 am

- ++++ ESTA (USA) and eTA (Canada) requirements for visa-exempt foreign nationals ++++

- ++++ TIPS - PLANNING YOUR FLIGHTS +++++++

- Buy now or later? What's with these screwy ticket prices?

- Around-the-world (RTW) tickets

- All you need to know about OPEN JAW tickets

- Beware of cheap business class tickets (sold by 3rd parties)

- ++++ TIPS - PREPARING TO FLY +++++++++

- TIPS - How to prepare for Long Haul Flights

- TIPS - Being Prepared for Cancellations and Long Delays

- TIPS - How to survive being stuck at an airport

- Flights delays and cancellations resources

- How do I effectively communicate with an airline?

- Airline, Airport, and Travel Abbreviations

- Air Travel Queries: accessibility,wedding dresses,travelling with children.

- Connecting Flights at London Heathrow Airport

- TUI Airways (formerly Thomson) Dreamliner - Movies and Seating Information

- ++++ COVID-19 CORONAVIRUS INFORMATION ++++

- Covid-19 Coronavirus Information for Air Travel

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Pros and Cons of Expedia

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When it comes to Expedia prices

When it comes to expedia travel insurance, when it comes to the expedia cancellation policy, when it comes to the expedia loyalty program, when it comes to maximizing credit card points, the pros and cons of expedia recapped.

Frequent travelers likely know that there’s something better than a dream trip: a dream trip that you booked on a bargain.

The ways to save money on travel are plentiful. You can redeem hotels and airline points, or take advantage of last-minute travel deals, to name a few. And booking through third-party online travel agencies like Expedia can sometimes yield especially big savings.

Beyond just deals, Expedia has robust search filters that make finding your perfect vacation easy. It streamlines purchasing trip insurance , which can be especially important for travel these days. Plus, the Expedia Rewards program earns you points to pay for future bookings.

But booking through an OTA like Expedia is not without its drawbacks. Here's a look at some of those to help you weigh the pros and cons of booking travel through Expedia.

Pro: Expedia has frequent sales, last-minute travel deals and bundle discounts

Expedia deals are aplenty, whether it’s a bundling discount or a sale.

Bundling: A major component of booking travel on Expedia is the practice of bundling, where you can expect additional savings for booking more than one product (e.g., flight and hotel, or hotel and attraction ticket) in one transaction. For example, when we searched for a hotel and rental car in Miami, one five-day booking option included up to three free rental car days while another offered one free night.

A perk of booking travel through Expedia is that you select your hotel, airfare and car rental in separate steps in the process. This makes it easy to bookmark the page and compare the cost of these items on Expedia versus the cost on the company’s direct website.

Expedia payment plans: If you don’t want to pay for your whole trip at the time of booking, Expedia allows you to make smaller payments through Affirm, which is a service that offers short-term loans for online purchases. If approved by Affirm , you’ll be able to pay for your trip in monthly installments.

You can also check Expedia’s Deals page and Expedia’s Last-Minute Deals page . Both tend to offer an eclectic mix of travel deals, ranging from cheap motels in tiny towns to lavish resorts in major tourist destinations. We’ve spotted deals as high as 70% off.

» Learn more: How to find cheaper last-minute flights

Con: Booking direct is sometimes still cheaper than Expedia

Sure, Expedia sales and last-minute deals are nice, but that’s not to say that you can’t find other (sometimes better) deals for booking directly with the travel provider. Many offer their own exclusive deals — and they might save you even more than booking with online travel agencies. Compare prices across both Expedia and the specific company to ensure you’re getting the best price.

And sometimes the savings go beyond just the sticker price. For example, boutique hotel chain Ovolo Hotels offers generous amenities including free laundry, happy hour refreshments and a daily breakfast buffet — but only if you book directly with them.

» Learn more: Is Expedia legit? Can it get me a good deal?

Pro: You can purchase an Expedia travel insurance policy

Expedia partners with various insurance providers, depending on your individual booking, to offer trip protection.

F or flights: Expedia offers travel insurance protection options that cover flight cancellation, medical emergencies and other covered circumstances.

For hotels: Choose hotel booking protection to reimburse your stay in the case of cancellation.

For car rentals: You can add car rental damage protection for an extra per-day fee.

Coverage varies by plan, but you can typically expect reimbursement for some (or all) trip costs if your trip is impacted by covered reasons. Covered reasons typically include delays, loss, theft or damage to one’s baggage and personal belongings. You’re also typically reimbursed for covered medical expenses, including emergency evacuation if you get sick or injured during your trip.

But there are many limitations and exclusions, so read your policy’s fine print to understand what’s covered.

Expedia 24-hour cancellation

When you book a flight on Expedia, you can cancel for a full refund as long as you do so within 24 hours of booking. The U.S. Department of Transportation requires airlines to allow you to cancel a flight for a full refund if canceled within 24 hours of booking and it was booked seven days before departure.

Con: Outside travel insurance might be more comprehensive or cheaper (and sometimes free)

You can opt out of Expedia’s travel insurance and either be completely uninsured — or simply acquire your insurance elsewhere. And there are better travel insurance policies out there.

After a comprehensive review of dozens of plans that assessed factors including price and COVID-19 coverage, here are the best travel insurance policies .

What’s more, you might not even need to pay for travel insurance at all. Many credit cards offer travel insurance benefits if you paid for your trip with that card.

Pro: Expedia offers some fully refundable options

Because airlines, hotels and other travel services set their own individual policies on Expedia, change and cancellation policies can vary significantly. While it can be tricky to parse the policies for each individual property, use Expedia’s “fully refundable” search filter to limit potential bookings to those with flexible policies.

For straightforward requests, use the Expedia service page to make changes and get a refund. If you’re unable to get help through Expedia’s self-service tools, other ways to get in touch with Expedia include live chat, a dedicated Twitter account ( @expediahelp ) and a phone line.

Con: Most cancellation policies are bad, confusing or both

Because airlines are required to give full refunds if you cancel within 24 hours of booking, Expedia lets you change or cancel your flight reservation without fees within the same time period.

For everything else, good luck. Because each travel provider sets its own policies, navigating them can be a headache. In some cases, canceling through Expedia means you’ll have to chase after the hotel or activity provider to recoup the costs.

Additionally, prepare for cancellation fees (both Expedia’s own fees as well as fees from the service provider). That’s if you’re able to cancel at all. Some bookings through Expedia are nonrefundable altogether.

Pro: It’s great for commitment-phobes

The new Expedia Rewards program, One Key Rewards, lets you earn OneKeyCash for every booking you make on the platform (plus on Vrbo and Hotels.com), which can then be used like cash toward future trips. Not only that, but Expedia users can earn status, which includes benefits like exclusive members-only discounts and extra benefits at VIP Access properties (such as free breakfast or late checkout).

For travelers who don’t like to commit to one airline or hotel company, don’t travel that frequently, or who book travel that otherwise doesn’t have its own loyalty program (like a tour or vacation rental), Expedia makes it possible to still get rewarded.

» Learn more: The guide to One Key Rewards

Con: Most hotel and airline loyalty programs are far more rewarding

While the One Key Rewards program is fine, most travel loyalty programs tied to specific hotels or airlines are almost always more rewarding. For individual point values, most other currencies of airline and hotel points are worth far more than OneKeyCash, which nets you 2% back on cruise, hotel, activity and rental car bookings but only .2% on flights. Once it's in your account, you can use it to pay for bookings just like you would cash — though you’ll need enough OneKeyCash in your account to pay for an entire flight, not just part of it.

Additionally, holding specific airline or hotel elite status is typically more lucrative than the value of elite status on One Key Rewards as most perks extend to Expedia VIP Access properties only. That said, some elite members can enjoy up to 20% discounts on hotels and free price drop protection on flights, which is a plus.

As for how to use Expedia points, OneKeyCash can be redeemed on “pay now” bookings for participating purchases priced in U.S. dollars. You can use it to pay for part of a hotel booking, but you’ll have to have enough to pay for the full cost of a flight (including taxes and fees). And while you can’t transfer rewards, you can use your OneKeyCash to book travel for others.

But depending what status you’re able to reach with individual brand loyalty programs, you can likely expect better perks. So if you’re fine committing to one brand, you’re almost always better off striving to earn its status versus with One Key Rewards. But if you only stay for a night here or there or prefer to book based on location or price, it’s a way to earn a few more rewards.

Pro: Expedia counts as a travel purchase

Many travel rewards credit cards give you a higher rewards rate on travel purchases, and booking sites like Expedia typically count as travel spending. For example, the Chase Sapphire Preferred® Card earns 2 points per dollar on travel spending, compared with 1 point per dollar on most purchases.

Con: Travel credit cards are usually better for earning and redeeming rewards

If you’re loyal to a specific hotel or airline brand — or are open to pledging allegiance — credit cards aligned with those brands typically pay more on purchases directly from the brand partner. For example:

on American Express' website

on Chase's website

• 2 miles per $1 spent on Delta purchases.

Terms apply.

• 2 miles per $1 spent on United purchases.

• 12 points per $1 spent on eligible Hilton purchases.

• 6 points per $1 spent at participating Marriott Bonvoy hotels.

• 1 mile per $1 spent.

• 3 points per $1 spent.

• 2 points per $1 spent.

Even general-purpose travel rewards cards that aren't tied to a specific airline or hotel chain will often reward you more handsomely for booking through their own portals than they would for going through a site like Expedia. Going back to the Chase Sapphire Preferred® Card : As mentioned, it earns 2 points per dollar on most travel purchases — but 5 points per dollar on travel booked through the Chase portal . Among general-purpose travel cards:

• 5 miles per $1 on hotels and car rentals booked through Capital One Travel.

• 2 miles per $1 on other purchases.

• 5 points per $1 spent on travel booked through Chase.

• 10 points per $1 spent on hotels and rental cars booked through Chase.

• 5 points per $1 on air travel booked through Chase.

• 5 points per $1 spent on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 2 miles per $1 spent.

• 1 point per $1 spent.

If you're considering booking with other online travel agencies like Priceline or Hotels.com, here are the best credit cards for online travel booking websites .

With the right deal, booking travel — including flights, hotels, cruises or car rentals — on Expedia could be worth it. It makes searching for travel relatively easy given the massive array of available listings, coupled with thoughtful search functionality to actually help you create your ideal itinerary.

But don’t automatically assume it’s a cheap way to book travel. Especially given the complicated cancellation policies, it might become among the most expensive, should an uninsured trip need to be canceled.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Expedia Flight Cancellation & Insurance (7 Important Facts)

If you want to cancel a flight that you booked through Expedia, you need to know 7 things so that you don’t get frustrated and get every penny you owe from Expedia or your airlines.

This article also talks in-depth about Expedia travel insurance. The information outlined here will help you save money on your next trip.

Can Expedia Flights be Canceled?

The US Department of Transportation requires every airline to provide a 24-hour free cancellation option upon booking an airline ticket. Expedia honors this law.

It doesn’t matter whatever type of plane ticket you purchase from Expedia; your flight can be freely canceled within 24 hours of your ticket purchase, and you can get a full refund without any fees.

However, once the 24 window passes, Expedia will apply the airline ticket cancellation policy.

If you bought a refundable ticket, airlines would allow you to cancel your flights and refund you, but they would cut the cancellation fee from your refund money.

Budget airlines such as RyanAir, Frontier, and Spirit handle all the cancellation by themselves, and most of the time, they sell non-refundable tickets. Therefore, contact your airline directly if you want to cancel these tickets.

Sometimes, they can cancel a non-refundable ticket and give you travel credits which you can use at a future date with the same airline. However, they will not refund your full money; they will charge you a cancellation fee.

Can You Get a Refund from Expedia if Your Flight is Canceled?

Expedia offers two types of airlines on its platform for booking.

- Low-Cost Airlines

- Full Service Airlines

RyanAir, Frontier, AirAsia, Spirit, EasyJet, or Jetstar are low-cost airlines. If you hold tickets from any of these airlines and it gets canceled, you have to talk to the airlines for a refund or future alternatives directly. Expedia can’t help you get a refund with these airlines.

However, if the full-service airline cancels your flight, Expedia will handle all the refunds, and you don’t have to call the airline. Expedia will refund your money in original form to your bank or credit card. It may take up to 7 days to process the refund.

Related : 8 Reasons Why Expedia Is So Cheap (In-Depth Explanation)

Does Expedia Travel Insurance Cover Cancellation?

The Expedia travel insurance will not cover your flight cancellation either by you or your airline carrier. Travel insurance has strict claim guidelines, which we discussed below.

There are two types of Expedia flight insurance:

- Flight cancellation plan

- Flight protection plan

The flight cancellation plan is for domestic flights within the USA except for Alaska and Hawaii. The flight protection plan is for international flights, including Alaska and Hawaii.

Expedia doesn’t give these insurances. A third-party company named “AIG” provides this insurance. It’s similar to the car’s extended warranty that auto dealers sell. It costs a lot of money but isn’t that helpful.

Both of these travel insurance will refund your flight cancellation money if and only if the following criteria are met:

- You or your travel companion becomes seriously sick or injured and needs hospitalization. If the Physician says that your or your travel companion’s injury is life-threatening and you can’t travel, you can file a claim with AIG. However, you must submit a certified paper from your Physician when you file a claim. AIG will call your Physician to find the authenticity of your claim. Your claim will be denied if your hospital or Physician doesn’t receive the call.

- You or your travel companion receive a jury duty subpoena, or you are required to visit court as a witness in legal action.

- If you lose your job and were employed with the same employer for the last 12 months.

- You get into an accident while going to the airport and need medical attention. When filing your claim, you must submit a police report and certified hospitalization paper.

- You lose your passport. You must submit a police report with your claim.

As you can see, the travel insurance will refund you if and only if any of these things happen to you.

Expedia flight insurance will not refund your money if you cancel for any other reason.

However, please remember that criterion 4 and 5 doesn’t apply to all state residents. For example, for Indiana residents, these two criteria don’t apply. Therefore, if you lose your passport, AIG will not refund you.

Read the flight insurance policy from AIG here .

Related : Expedia Refunds (8 Things You Must Know For Quick Refund)

Is Expedia Cancellation Plan Worth It?

The Expedia flight cancellation plan does very little to protect a consumer. The claim criteria are ridiculously challenging and apply to almost no one. For most airline passengers, the cancellation plan is a waste of money.

In five rare circumstances, Expedia travel insurance will refund your money. Those circumstances are not only rare, but you will also have a hard time filing your claim successfully because of paperwork and verification.

It is not only an expensive plan, but it’s also useless.

We highly recommend you not buy the cancellation plan because AIG will usually deny your claim outright. This is how these insurances work.

The Expedia cancellation plan isn’t worth your hard-earned money.

Is Expedia Free Cancellation Really Free?

Expedia, on their website, advertises that they offer free cancellation. However, these cancellations aren’t really free.

Expedia is saying that they don’t charge the customer for cancellation. But the airlines or hotels might charge you a cancellation fee. If they do, Expedia will pass the cancellation fee to you.

Why Did Expedia Cancel My Flight?

Airline cancellation is common due to bad weather, pilot shortage, airline maintenance, or other reasons.

Expedia doesn’t cancel flights; airlines do. If you get your flight cancellation email or notification, call Expedia immediately.

Even though you have booked your flight through Expedia, it’s better to contact the airlines and ask for a refund. Or ask them to give you another ticket for your trip.

Sometimes Expedia proactively will book another flight for you.

Remember that Expedia will not reimburse you if you need to stay extra a few days in a hotel, nor will they refund you any money if you must leave early due to flight schedule changes.

If you need hotel accommodations due to flight cancellations, you have to talk to airline customer support.

If either Expedia or your airlines refuse to give you another flight ticket or refuse you a full refund, call your credit card company and put a chargeback claim. It’s because Expedia failed to provide you with a service for which they took the money.

How to Cancel Expedia Flight Insurance?

If you purchased the flight insurance, you have 15 days to cancel it to get a full refund of your insurance premium. However, if you already filed a claim with the insurance, you can’t cancel it.

To cancel the flight insurance, follow the steps outlined below:

- Go to My Trips on the Expedia website.

- Select Cancel insurance and follow the instructions.

You can also call Expedia to cancel your flight insurance.

How to add travel insurance to your Expedia booking

Adding travel insurance to your Expedia booking is a simple process. After you have selected your travel dates and destination, click the “Add Trip Protection” link on the right side of the page. Select the type of coverage you want and proceed to checkout.

When you’re booking travel through Expedia, you can now add travel insurance to your itinerary. Travel insurance through Expedia is underwritten by Allianz Global Assistance, one of the world’s leading providers of travel insurance. Here’s how to add travel insurance to your Expedia booking:

1. Search for your trip and click “Book now.”

2. On the next page, select “Add travel insurance” under the “Optional products” section.

3. Select the number of travelers who will be covered and the length of coverage you want.

4. Click “Continue.”