TravelNursing

Enjoy Your New Home but Don’t Forget the One Year Rule

By Joseph Smith EA / MTax, contributor

One great benefit to travel assignments is the opportunity to experience a community for a longer stretch of time and absorb the local culture. Week-long vacations never provide the intimate knowledge of an area that a three-month assignment does, and if a traveler enjoys the work at the facility and the community, there is often an opportunity to extend.

Additionally, if the traveler has a tax residence, he or she can continue to enjoy the benefits of tax-free travel reimbursements. As great as that sounds, the party cannot continue forever, as tax regulations prohibit a traveler from receiving tax-free housing or reimbursements for more than a year in one geographical area.

The One Year Rule

Tax-free travel benefits like provided housing, per diems, tax advantage programs and allowances are only available to those that are working away from their tax home temporarily . Temporary is defined as an assignment not to exceed 12 months in one metropolitan area. This was not the case prior to 1992. Prior to 1992 and the legislative provisions that changed the rule, temporary was defined as work away from home for less than 2 years, regardless of the location of the assignment. The focus shifted to the location rather than the length of transitory job sites.

Applied to travel nurses and other healthcare travelers

The One Year Rule has a broad application. Tax homes are defined as where an individual earns the majority of their income unless they fall under the exceptions for temporary assignments and the engagement does not exceed a year in one location. The 12-month measurement focuses on the continual income in the area to avoid creating a tax home at the temporary job site. Working on a different floor, with a different agency, a different facility across town or taking up another temporary residence within the same metropolitan area does not change the fact that the taxpayer is receiving a continual stream of income in the same area. Additionally, the fact that each contract is for a term less than twelve months, does not “restart the clock”. All assignment extensions in the same area are considered a continuation of the first.

The rationale that Congress had when establishing this benchmark is that it would be unreasonable to expect someone to move their residence to work only for a year. Even though one year may seem short term, a line had to be drawn to prevent abuse of the benefit.

Agency due diligence

A staffing agency is required to question a traveler about their work history to determine if there is a possibility that the one year rule will be broken during the engagement. In addition to the work history that a traveler submits to the agency, many Tax Home Declaration statements will contain a question about the traveler’s work history. Failing to review this could result in some harsh penalties assessed on the agency by the IRS in an audit.

Occasionally, a traveler works multiple contracts that orbit a particular area. For example, if a traveler works in Thousand Oaks, Calif., then Long Beach and Pomona, even though these towns may be construed as different areas, they are still considered the same tax base as one could live in the middle of the assignments and have a reasonable commute. Additionally, if a traveler continues to do this multiple years, the business necessity of maintaining a home in another part of the country ceases as it would be more reasonable for the taxpayer to move their residence closer to the long-term source of income since it was all earned in the same region.

After a year

Once the 12-month time is reached, all reimbursements are to be treated as taxable income subject to Social Security and Medicare taxes. This includes the fair market value of any housing provided by the agency. Just because the agency pays for the lodging, it is still a constructive receipt of income to the recipient/beneficiary as it is a substitute for wages.

What restarts the clock?

In our next article, we will explore the break-in-service rules and what is necessary to restart the clock.

About the author: Joseph Smith is an IRS Enrolled Agent (EA) and former travel respiratory therapist whose firm, TravelTax, provides tax preparation and audit representation for the mobile professional.

© 2013. AMN Healthcare, Inc. All Rights Reserved.

.png)

- Jun 30, 2021

Travel Nurse Tax-Free Stipend and the IRS One-Year Rule

Updated: Nov 13, 2021

"I have been working as a travel AND staff nurse in the same metropolitan area for almost a year. Even though I have taken over 2 months of work off in between travel contracts my company is saying my stipends will now be taxed due to staying in the same area for so long. Can anyone clarify this? (My taxable home is in the same area however I am duplicating expenses while traveling)"

Travel nurses know that the best part of being a travel nurse is receiving a tax-free stipend as part of your compensation. Depending on how you structure your living expenses, it can really make the difference with the amount of income you get to take home.

Unfortunately, maintaining a qualified status to receive the stipend is riddled with unofficial rules of thumbs and just some plain old bad peer-to-peer advice from other travel nurses.

But failing to understand how to not only qualify, but maintain your qualification for the tax-free stipend, can land you in some hot water with the IRS.

You might hear other nurses say, “oh don’t worry about it”. “I’ve been doing it like this and I haven’t been audited yet” or “I’ll deal with it when it’s a problem”.

Here’s the truth.

When you’re standing in front of “the man” because you didn’t pay attention, none of these other nurses will be standing there with you or will be there to help you if things go south. Get the facts and follow the law.

As a refresher, let’s establish what a tax home is.

The IRS 2020 Publication 463 states your Tax Home as generally being “your regular place of business or post of duty, regardless of where you maintain your family home. It includes the entire city or general area in which your business or work is located.”

As travel nurse, it can be difficult to determine what your “main place of duty” is, especially if you’ve had 3-4 assignments in any given year. For reasons just like this, the IRS created a three-part test to determine tax home status:

You perform part of your business in the area of your main home and use that home for lodging while doing business in the area.

You have living expenses at your main home that you duplicate because your business requires you to be away from that home.

You haven’t abandoned the area in which both your historical place of lodging and your claimed main home are located; you have a member or members of your family living at your main home; or you often use that home for lodging.

If you satisfy two out of three items in the test, you generally will be eligible to receive a tax-free stipend as part of your travel assignment compensation.

Here’s the kicker.

After establishing eligibility for your tax-free stipend, you can subsequently lose that eligibility if you no longer can show that you have a “main place of duty” at your claimed tax home location.

The IRS makes it clear that a work assignment that lasts more than 1 year is no longer considered “temporary”, even if you “take time off”.

It does not matter if the months are sequential or not.

Think about it this way. If you’ve worked a travel assignment for 12 months and then take two months off, and then return to the location of your previous assignment for another 13 weeks. That is still a full 15 months of work at that location. In that case, it is apparent that your main place of duty is the location of that travel assignment.

You would not be eligible for the tax-free stipend.

I worked with a nurse with this same question. She came to me because she was confused about all the tax-home rules, as well as concerned that her fellow traveler’s advice was less than accurate.

After meeting with her, I helped her not only straighten out her taxes, but also helped her create a comprehensive action plan for her finances that included, retirement planning and investment management.

Now, she not only knows that she’s on the right side of the IRS, she’s also confident that her travel pay will go to work for her and create the life she wants to live.

Everyday we’re talking to nurses like yourself who are tired of missing out on the opportunity to transform their financial lives. Schedule your complimentary Explore call today.

Marlon is a licensed financial advisor at weshfinancial.com and is known as " The Travel Nurse Financial Advisor ". Marlon specializes in helping travel nurses crush their financial goals by helping them optimize taxes, accelerate retirement savings, and maximize their investments.

Recent Posts

The #1 Mistake Travel Nurses Make—and How to Avoid It

Don't Know How to Create a Financial Plan? Try Managing Your Risks Instead

How Travel Nurses Can Save for Retirement Without Access to a 401k

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Webcast and events

Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Overview of U.S. taxes on foreign income for individuals

How to navigate accounting assumptions

Navigating change management: How CPAs can master the art of adaptation

How Long Can a Travel Nurse Stay in One Place?

by Trusted Nurse Staffing | Jan 5, 2024 | News

One of the perks of being a travel nurse is getting to travel the world.

But what happens when you love a nursing assignment so much you decide you’d like to extend the date of your contract?

You might be wondering, “How long do travel nurses stay in one place?”

Can contracts only be one length? Can you work in one facility more than once or for a longer term? Can you extend your contract if you love where you’re working?

We’ll fill you in on the answers to those questions plus everything you need to know about travel nurse contract extensions, stipend and tax implications, and more so you can make the decision that is right for you.

Table of Contents

How long are travel nurse contracts, 4 reasons you may want to extend your travel nurse contract, faqs about the length of travel nurse assignments, get started on your travel nurse assignments today with trusted nurse staffing.

The length of a travel nursing assignment can vary depending on the type of assignment you apply for and what contract lengths your travel nursing agency offers.

A travel nurse assignment can be as short as six or eight weeks or as long as a year, but 13-week positions are the most common.

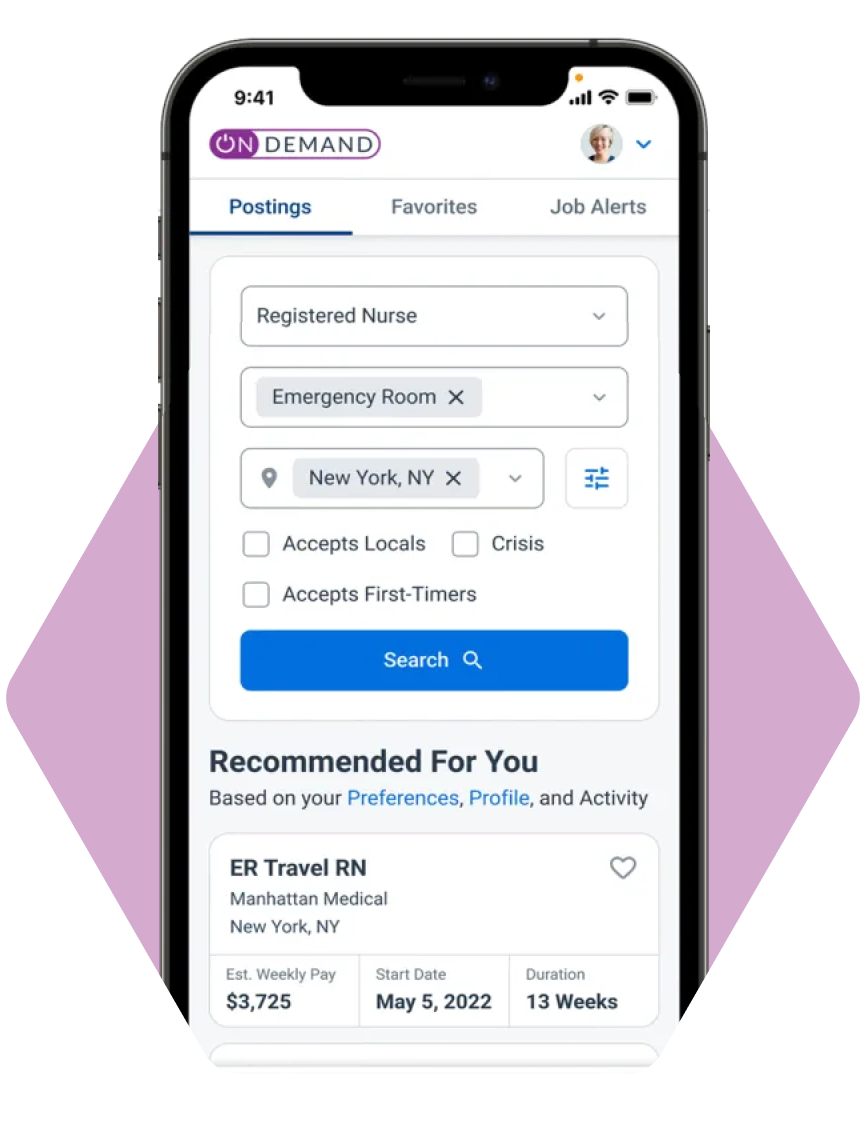

Trusted Nurse Staffing works with nurses and facilities to find the assignment length that works best for everyone involved. Once you sign up with our Pronto app, you can get key information pulled from thousands of available jobs and pick the travel nursing positions that are just right for you.

With our services, you can choose a contract that is six, eight, or 13 weeks long. If you decide you’d like to stay in one location a little longer, our team can help you extend your contract.

Why Is the Typical Travel Nursing Assignment 13 Weeks Long?

There are many possible reasons 13 has become the “magic number” for a travel nursing assignment length.

One big reason is that, as the New York Times reported, the past few decades have seen hospitals following a staffing model to match the number of occupied beds. Since this number constantly changes, flexibility is required.

Enter travel nurses. Over time, as they were being integrated into these staffing ratios, the 13-week contract became popular.

Other suggested reasons for this contract length being the most common include:

- It helps fill positions as new permanent staff members complete orientation.

- It allows travel nurses to cover for full-time staff members taking advantage of the Family and Medical Leave Act (FMLA).

- It matches many standard apartment contracts.

- It’s long enough for travel nurses to become familiar with the area and visit desired destinations.

- It’s long enough to pick up new skills or learn more about a specialty.

- It’s short enough to allow nurses to move on to a new adventure.

#1: Convenience

One of the best parts of extending a travel nurse contract is all the “nos” that come along with it.

We’re talking about no:

- Application to fill out

- Phone interview

- Orientation at a new facility

- House hunting

- Getting acclimated to a new city; or

- Trying to make new friends

It is also convenient for the travel nurse agency and the nursing facility since they will be able to avoid extra paperwork and additional staff needed for orientation.

As every travel nurse knows, not every location or position pays the same.

If you are hoping to pay off some school loans or pad your bank account, seeking an extension in a high-paying position is a great option. You may even be able to extend your contract to 52 weeks and really bank some cash!

Some of the highest-paying travel nurse positions and their salaries include:

- NICU nurse: $2,426 per week

- PACU nurse: $2,520 per week

- Oncology nurse: $2,438 per week

- ICU nurse: $2,426

#3: Facility

Maybe you feel like the hospital or clinic you are working in is the perfect fit for you.

The longer you stay, the more familiar you may become with the hospital and its policies/procedures. You may have even cultivated the ideal working relationship with the staff or have always wanted a position in this specialty, and the hours are exactly what you had hoped for.

If you feel at home in your current facility, why not stay a little longer?

#4: Location

Whether it’s the view of the mountains, the salty scent of the sea, or the energy of city life, location is everything.

You might still have a bucket list of places you’re hoping to explore. Or maybe you would like to stick around for a local festival or experience a different season of the year.

Loving your current location is a great reason to look into a travel nurse contract extension.

How Do You Extend a Travel Nursing Contract?

Communication is the key.

If you’re interested in extending your travel nursing assignment, reach out to your Travel Nurse Staffing recruiter three to four weeks before your contract’s end date.

Trusted Nurse Staffing takes care of the rest.

Your recruiter will get in touch with your current facility to inquire about the possibility of extending your assignment. If the facility okays an extension, you will be able to stay on for as long as they agree to extend your contract.

The earlier you can communicate with your recruiter, the better chance you’ll have of landing a contract extension. Our recruiters can be available for you 24/7 to answer any questions and help you meet all your contract needs.

Can a Travel Nurse Choose to Stay in One Place Even After Their Contract Is Over?

Your current travel nursing assignment has been so fulfilling, and you’re wondering, “How long can a travel nurse stay in one place?”

Is there a possibility of extending your contract?

Great news. As long as your current facility agrees, the answer is yes.

You will simply need to get in touch with your Trusted Nurse Staffing recruiter and they’ll work out all the details.

Since opportunities for contract extensions aren’t always a possibility, you should contact your recruiter as soon as possible so they can get the ball rolling on your behalf.

If You Choose Not To Extend Your Contract but Would Like to Return to a Healthcare Facility as a Travel Nurse in the Future, Is That Possible?

It sure is.

Have you loved your work at your current facility, formed good relationships with the staff, and done exemplary work during your contract assignment? If so, they’ll be happy to have you back when Trusted Nurse Staffing mentions your name again.

How Long Can a Travel Nurse Work in One State?

A travel nurse may work in one state for as long as they like.

However, for tax purposes, they will want to move to a different facility to avoid spending more than 12 months working in the same location in any consecutive 24-month period.

Can a Travel Nurse Stay in the Same Place for Too Long?

Yes, working in one place for longer than a year means you will lose your stipends and increase your taxes.

From the viewpoint of the IRS , travel nurses receive reimbursement due to duplicate expenses. So if you stay in one place for more than a year, the IRS assumes you have moved there and will start taxing you on both your permanent and travel locations.

Can I Take Time Off Between Travel Nurse Assignments?

Perhaps you’re really enjoying staying in one location but are coming close to your one-year mark. You don’t want to lose your stipends and tax benefits, but you’d like to stick around for a while.

Feel free to take some downtime between travel nurse assignments and enjoy a vacation before you decide where you’re headed next.

Taking time off between travel nurse assignments is also beneficial if you would like to:

- Spend more time with friends and family

- Plan a wedding

- Go back to school

Does Staying In One Place as a Travel Nurse Affect Your Stipends?

It does, but only after 12 months.

A travel nurse who remains in the same location for more than 12 months will lose their stipends.

Why is this?

For a travel nurse to maintain non-taxed stipends, they must be viewed by the IRS as a temporary employee. The IRS defines temporary employees as, “time-limited appointment to a competitive service position for a specific period not to exceed one year.”

Losing your temporary employee state could result in your tax home shifting. If you tax home shifts, then your stipends lose their tax-free status.

Does Extending a Travel Nursing Contract Impact Your Taxes?

In the words of Albert Einstein, “The hardest thing in the world to understand is the income tax.”

While this may be the case, the following information should make travel nursing taxes a bit easier to understand.

The IRS has set specific guidelines for those temporarily traveling away from home. However, they have not created hard-and-fast rules for the traveling healthcare industry due to the unusual scenarios found in this line of work.

We highly recommend that you seek advice from a certified tax professional to maintain tax compliance as a travel nurse.

You will want to ask them several questions to ensure that they are familiar with:

- Temporary travel nurse assignments

- Travel taxation rules

- Multi-state taxation; and

- Your specific situation

In the meantime, here are some of the basic things you will want to know about travel nursing contracts and income taxes.

What Tax Form Do Travel Nurses Fill Out?

Travel nurses may be required to file a 1099 or a W-2, it just depends on whether the travel nurse agency considers travel nurses as employees of the agency or contractors.

As a travel nurse, you can choose to file your taxes on your own or through a tax accountant. Trusted Nurse Staffing encourages its nurses to choose a trusted tax representative to help them navigate taxes as a travel nurse.

Be sure to keep the following documents to help make filing your taxes as a travel nurse easier:

- Mileage log

- Copies of your travel contracts

- Continuing education expenses

A tax specialist will be able to tell you what you may use for tax breaks like credits and deductions.

How To Create a Tax Home To Help With Tax Relief

A tax home is defined by the IRS as “the entire city or general area in which your business or work is located, regardless of where you maintain your family home.”

To prove your tax home you will need to show that you:

- Perform a portion of your business near your home

- Use your home for lodging while you are doing business in the area

- Incur living expenses such as rent, mortgage, and utilities at that home

This means your tax home refers less to where you call home and is more about where you work.

Here is the bottom line — If your tax home changes, you will be required to pay taxes on any and all tax-free reimbursements you collected for the entire time you lived there.

And since this occurs retroactively, you could wind up with a huge unexpected expense.

This is why it’s a big deal for travel nurses to remember they need to have a permanent tax home to continue to enjoy the benefits of the untaxed portion of their income.

Do Travel Nurses Have To File a Tax Return in Each State They Work In?

Yes, travel nurses must file a tax return in each state they work in.

You will also want to claim tax credits on your home state tax return, to avoid being taxed twice. You should ensure that the available tax credits you take on your home state income tax return are equal to the tax credits you take in the other states. If they are not, you could potentially be double-taxed.

How To Deal With Tax Compliance Questions

Taxes are not something to mess around with.

Your Trusted Nurse Staffing recruiter can help answer your compliance questions.

Ultimately, however, you must find an experienced tax accountant who understands the nuances of travel nurse contracts and your specific tax situation.

A tax professional will be able to guide you through the tax process to get the best return and avoid potential tax penalties.

Is There a Minimum Number of Contracts You Must Accept as a Travel Nurse?

There is no set minimum number of contracts a travel nurse has to work. Take as many as you can fit in or stay an entire year in each location to see how you like it.

Trusted Nurse Staffing helps travel nurses find as many contracts as they would like in a year. Simply use Pronto to view a variety of travel nursing assignments across the nation. Sign up and get started today.

Whether you are looking to get started on your first travel nurse assignment or are hoping to extend the one you currently have, Trusted Nurse Staffing is here for you.

Our goal is to help you reach YOUR goals, both personal and professional.

Trusted Nurse Staffing offers top pay rates and the best benefits packages in the industry.

Use the Pronto app to fill in your search terms and find the travel nurse assignment of your dreams. Your adventure begins with Trusted Nurse Staffing.

Recent Posts

- Career Changes for Nurses Who Want To Transition Away From a Clinical Setting

- 10 Time Management Tips for Travel Nurses: How To Master Your Schedule

- Pursuing Excellence: The What, Why, and How of SMART Goals in Nursing

- Growing Your Career as a Travel Nurse: Developing Skills That Will Support Your Nursing Career From Start To Finish

- Trusted Gives Celebrates Monumental Success at Its Inaugural Gala Event

Travel Nurse + Allied Health Tax Guide

Navigating the world of taxes when you take your first travel nurse job or allied health assignment can feel like a daunting task. With unique income structures, tax homes, and multi-state tax filing, it's no wonder that tax season can feel overwhelming.

But don't worry! This comprehensive guide will help you understand the ins and outs of travel nurse taxes, travel nurse stipend rules, travel nurse tax homes and tax deductions, and other tax rules you should be aware of while traveling! Keep in mind that individual circumstances can greatly impact your taxes and stipend eligibility, so be sure to connect with a tax professional for personalized advice!

Let’s get started!

- Understanding Your Income

- Contract Types

- Qualifying for Stipends

- State Taxes

Lower Taxable Income Considerations

- Audits and Travel Nurse Taxes

Travel Nurse + Allied Health Taxes: Understanding Your Income

Travel nurses and allied health professionals have a unique income structure compared to traditional staff. You can read our blog on how much travel nurses make to learn more details, but we’ll go ahead and provide a quick overview!

Travelers receive a portion of their pay that is taxed and “per diems”, or stipend payments, that are not taxed. Stipends can be a huge advantage of travel nursing because if the full amount is not used on your travel and living expenses, that leftover ends up as extra cash in your pocket! You can think of stipends as an allowance for lodging, meals, and incidental expenses while you’re working away from home. It’s important to remember, though, that you must meet certain criteria to be eligible for stipends and avoid any issues with the IRS! We’ll get into those details soon.

Contract Types: Travel vs Local Contracts

It’s also important to understand that you don’t have to qualify for stipends, or choose to receive stipends, in order to take travel assignments . There are some circumstances in which someone may prefer for their income to be fully taxed. This may be because they don’t qualify for stipends due to location or because they’re anticipating a loan, social security, or anything else that is based on taxable income. In these cases, you can still take a travel assignment, but choose to take a contract where your hourly rate is higher and your pay is fully taxed. This is referred to as a local contract . If this is the case for you, be sure to let your Nurse Advocate know!

Travel Nurse + Allied Health Stipend Rules: Qualifying for Non-Taxable Income

To qualify for tax-free stipend payments, you need to be able to show the IRS that you have a "tax home". The IRS defines a tax home as “the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. ” This may sound a little bit confusing, so let’s break it down.

You can qualify for a tax home in two main ways:

- Your primary area of residence is also your main area of income. This typically does not apply to travel nurses, but would be applicable for a staff nurse who is working at their local hospital because they are living within the same geographical area where they are making most of their money throughout the year.

- You visit your primary residence at least once every 12 months and can prove that you are paying for expenses to maintain your primary home. This is more common for travel nurses and allied health professionals. Generally this is where you have lived and have worked a staff job that has been your “main place of business”. You should be able to show that you still regularly return to this location and incur expenses such as a rent or mortgage, even while you’re working on a travel assignment.

In general, travel nurses and allied health professionals can take these steps to maintain a tax home:

- Keep proof of payments that show that you’re incurring expenses at this location. This may include invoices for a house sitter, mortgage, rent, utilities, etc.

- Maintain your driver’s license and car registration in your home state.

- Keep a per-diem job, if possible, in your home state.

- Return to your home at least once a year for about 30 days.

- File a residence tax return with your home state.

It’s important that you’re able to show that you’re duplicating expenses by traveling, meaning you’re paying for the same types of expenses at your tax home and while on assignment in your new location. This means that if you rent out your home while you’re gone, you cannot classify it as a tax home, because you’re not duplicating your expenses.

Travel Nurse + Allied Health Tax Rules: State Taxes

It’s important to know that as a travel nurse or allied health professional, you need to file taxes in every state you work in, as well as the state that serves as your permanent tax home. Keep in mind that working a travel assignment (under 12 months in one location) does not mean that you have moved your primary state of residence in the eyes of the IRS. Instead, you’re just away from your home temporarily, which is the important distinction noted above in regard to maintaining a tax home.

In 2022, tax reform laws did away with many deductions at the federal level, but some states do still allow you to deduct job expenses on your state tax return. It’s a good idea to keep receipts for things like:

- Housing and lodging expenses while traveling

- Mileage to and from assignment and to and from work while on assignment

- Uniform and scrub expenses

- Work-related expenses such as CEU’s or certifications

- Meals while on assignment

Keeping record of these expenses can help make tax preparation easier. It’s a great idea to snap a picture of these on your phone or use a document scanner app to keep these organized as PDF files, ready to submit with your taxes.

One of the appeals of travel nursing is that you have the potential to make a high income, especially through non-taxed stipends if you qualify. However, because the additional stipends you receive as a travel nurse are not taxed, they are not considered income, and will not be reflected in your annual income.

So what does that mean, exactly? If you’re anticipating that you may need to get a loan or mortgage, or nearing the age when you’ll collect social security, you may want to consider taking a fully-taxed pay package. All of these items are calculated based on your taxable income. The lower your taxable income, the lower the loan amount you will qualify for. Similarly, the lower your taxable income, the less you are contributing to Social Security, and the less you’ll be able to collect when you’re ready to retire.

You still have options in these cases, though. Some lenders are familiar with working with travel nurse pay structures and can be helpful in planning for your loan or mortgage. Another option is to declare that you are not eligible for stipends, or do not have a tax home, and receive your full pay as taxable income. You should speak with your personal tax consultant to see what will be best for your situation.

Because of the low taxable income you receive in addition to stipends, the travel nursing industry tends to be scrutinized closely by the IRS. As a travel nurse or allied health professional, you may be more at risk for an audit if you're displaying high expenses and low income.

We say this not to worry you, only to highlight the importance of working with a trusted tax professional. You can reduce your risk of an audit, or increase your chances of getting through an audit favorably, by always making sure to work with a certified tax professional who is familiar with traveling healthcare professionals.

How do I receive stipends?

As long as you indicate that you are eligible for stipends when you sign your contract, you will automatically receive stipends as part of your paycheck each week. They're considered expense reimbursements that cover expenses like meals, housing, and work-related costs, but you do not need to submit receipts in order to receive the payment. Be sure to read the section above and check in with your tax consultant for eligibility!

Do I need to file taxes in every state I work in?

Yes, you'll likely need to file a non-resident tax return in every state you've worked in within the past year, as well as the state that you consider your permanent tax home.

What happens if I work in a state with no income tax?

If you work in a state with no income tax, you won't owe state income tax for that state. However, you may still owe income tax to your home state, unless your home state also has no income tax.

Am I more likely to get audited as a travel nurse?

The travel nursing industry tends to be scrutinized closely by the IRS, so you may be more at risk for an audit. Working with a certified tax professional can help you navigate this risk.

What happens if I extend in one location for greater than 12 months?

It's best to consult your tax professional as to how you handle your contract as you approach the one year mark! The answer to this question will depend on your unique circumstances. We do offer local (fully taxed) contracts, or some nurses choose to take some time off between contracts, then extend. Since everyone's situation is different, your tax advisor would be the best person to consult. Once you do so, let your Nurse Advocate know how we can help!

Can I handle my taxes myself, or should I hire a professional?

While you can handle your taxes yourself, it's often beneficial to work with a tax professional who is familiar with the unique tax situation of travel nurses. They can help ensure you're meeting all tax obligations and taking advantage of any potential deductions.

Are there specific tax deductions for traveling healthcare professionals?

Travel nurses and allied health pros can take advantage of numerous tax breaks and deductions related to their assignments. Tax deductions reduce your taxable income to help you save money on your tax bill. Read more on this topic in our blog on tax deductions for traveling healthcare professionals .

What records should I keep for tax purposes?

You should keep records of all your income, including your pay stubs and W-2 or 1099 forms, as well as receipts for any tax-deductible expenses. This can include receipts for travel, housing, meals, uniforms, continuing education, and any expenses related to maintaining your tax home. You’ll also want to make sure that you save a copy of each assignment you take, showing your contract dates and pay breakdown.

Final Thoughts

Stay informed, stay prepared, and you'll be able to focus on what you do best - providing exceptional care to those who need it most. Remember, this guide is meant to provide general information and should not be considered tax advice. Always consult with a tax professional to ensure you're meeting all tax obligations and taking advantage of any potential deductions.

At Trusted Health, we're here to support you every step of the way. From finding the perfect assignment to helping you navigate the complexities of travel nurse taxes, we're committed to making your travel nursing journey as smooth and rewarding as possible.

Sign up with Trusted Health today and join a community of healthcare professionals who are transforming the future of healthcare. Let's navigate this journey together!

Let's start building the life you want.

We're here to help, find your first travel nursing job with trusted, travel nursing basics, travel nursing in detail, browse high paying travel nursing jobs.

Understanding taxes as a travel nurse

It’s April, which means that tax season is upon us. If you’re like me, filing for taxes has been the last thing on your mind given the impact of the COVID-19 crisis , but fortunately, the IRS has pushed the deadline to file back to July 15. Hopefully this provides some much-needed breathing room for all of you who are focused on other priorities at the moment. When you are ready to file, this post will offer some useful information, especially for those of you who are new to travel nursing.

Before I get to the advice, I want to note that while I’ll be going over travel nurse tax basics in this article, it’s important to include the disclaimer that I am not a tax professional (just a nurse!).This article is for general educational purposes only. For questions on your unique circumstances, I recommend you reach out to the IRS or a tax professional directly.

One of the most important concepts to familiarize yourself with as a traveler is a tax home. The IRS defines a tax home as “the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home.” For most people, their tax home and their permanent home are the same place, but travelers fall into a small category of people, like professional athletes and truck drivers, who earn money outside of their tax home.

As a travel nurse working outside of your tax home, you are eligible for tax-free stipends, in addition to the hourly wages you earn. It’s also worth really familiarizing yourself with the tax implications of working in a different state, as the wage component of the total compensation package will translate differently as take-home pay from one state to the next.

There are a few different scenarios that will determine where your tax home is, and this guide provides a comprehensive explanation of some of the most common cases. It’s important to note that you run the risk of the IRS considering a new tax home if you spend too much time in any one geographical location. So if you continue to renew a contract in another state, that could eventually become your tax home. To avoid this, a general rule of thumb, though not an explicit rule, is to avoid staying in any one tax region for more than 12 out of every 24 months while ensuring you’re maintaining (or re-assessing) your tax home.

You should also try to return to your permanent residence between contracts, or whenever possible. The IRS isn’t explicit about how much time they expect for you to spend in your permanent residence. Based on a previous ruling, around 30 days a year was found acceptable to maintain a permanent residence.

Tax Advantages

There are a handful of important tax advantages to be aware of as a travel nurse, primarily in the form of stipends and reimbursements. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. This is typically done in the form of an expense report. You incur expenses, save all receipts, submit it to your employer, and the money you’re reimbursed is tax-free. Conversely, stipends are lump sums paid to you periodically in order to cover expenses while on an assignment. For travelers, stipends are tax-free when they are used to cover duplicated expenses, such as lodging and meals, and do not have to be reported as taxable income.

Under the new 2018 tax laws, deductions or write-offs are no longer an option for travel nurses. This means travel nurses can no longer deduct travel-related expenses such as food, mileage, gas, and license fees, and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually incurred.

Audits & How To Handle Them

While the chances of any one person being audited are relatively low, it’s always important to be prepared. The best way to do this is to document everything (something that as a nurse, you’re probably already quite good at!). As a traveler, the most important thing to keep track of is proof that you are maintaining a permanent home and duplicating living expenses. Be sure to maintain documents for as many of the following things as possible:

- Mortgage or rent payments

- Gas, electric and cable bills

- Receipts for rental cars, flights, or public transportation to/from assignments

- Mileage logs to and from your assignments

- Copies of all your assignment contracts

To help make this easy, there are several apps and websites for organization in expenses and record keeping. A few that we recommend are Expensify , Genius Scan , Google Drive , and Turbo Tax .

One of the benefits of being a travel nurse is the ability to maximize your income . However, it’s really important to understand the tax implications and filing requirements that come along with it. It can be intimidating at first, but once you get the hang of it, taxes as a traveler can become almost second nature. That said, you should always consult an accountant or other tax professional, especially if it’s your first time filing your taxes as a traveler to be sure that you are doing everything correctly.

Sarah is the Founding Clinician at Trusted Health , the career platform for the modern nurse. Sarah is a graduate of the University of Pennsylvania’s Nursing School and began her nursing career at UCSF Benioff Children’s Hospital. Prior to moving away from the bedside, she was a Clinical Nurse III and an Evidence Based Practice Fellow, and served on multiple hospital-wide committee boards. At Trusted, she utilizes her clinical insight and passion for innovation to change how nurses manage their careers and solve for inefficiencies within healthcare staffing.

You can connect with Sarah on Instagram , LinkedIn , and Twitter .

The views and opinions expressed by My Nurse Influencer contributors are those of the author and do not necessarily reflect the opinions or recommendations of the American Nurses Association, the Editorial Advisory Board members, or the Publisher, Editors and staff of American Nurse Journal . These are opinion pieces and are not peer reviewed.

2 Comments .

First year as a traveler and was consented about the stipend. Thank you and I will have my taxes done by an accountant.

Thanks Sarah this was really beneficial to me as a first time traveler

Comments are closed.

NurseLine Newsletter

- First Name *

- Last Name *

- Hidden Referrer

*By submitting your e-mail, you are opting in to receiving information from Healthcom Media and Affiliates. The details, including your email address/mobile number, may be used to keep you informed about future products and services.

Test Your Knowledge

More nurse influencers.

Listening to messages

Nursing innovation and the diversity innovation paradox

Finding Your Connection

ChatGPT and aging

Driving innovation in healthcare settings through academic/practice partnerships

A year of finding center

A nurse’s nudge for a better year, more or less

On Health and the Holidays

A betrayal of patients’ trust

Self-care and team-care intervention of connection: Gratitude

How being grateful is good for healthcare

Placebo, nocebo, and nursing care

A Quest to Human-centered AI

Mrs. Bunge or The Curious Nurse

Travel Nurse Tax Guide 2023

Navigating travel nurse taxes can be a challenge, especially because travel nurse tax amounts can be a bit different depending on what state or states you worked in. In general, however, taxes are very different for travel nurses compared to traditional staff nurses. From choosing a tax home to keeping your receipts to knowing exactly how your income will affect your long-term financial goals, here is the information you need to know about travel nurse taxes.

RN’s can earn up to $2,300 per week as a travel nurse. Speak to a recruiter today!

Travel Nurse Taxes + Income Breakdown

Travel nurses are paid differently than staff nurses because they receive both a base hourly pay that is taxed and additional “payments” that are non-taxed to make up their “total” pay. When you sign up to commit to a travel nurse position you’ll receive a pay package that will detail all of the different aspects of what will make up your actual compensation.

Essentially it’s in the travel nursing agency’s best interest to keep the base rate of a travel nurse’s pay package low, so many travel nurses have a modest base pay but will receive additional stipends. In a technical and legal sense, those additional stipends — which typically cover things like meals, housing , and work-related expenses — are expense reimbursements for doing your job as a travel nurse, which is why they aren’t considered income and are non-taxable.

Travel agencies offer “standardized” bill rates. This means that there is one rate for all workers with any given license covered by the contract. For example, all Registered Nurses have the same bill rate, all Physical Therapists have the same bill rate, and so on. It’s also possible for the licenses to be broken down by specialty and every so often by level of experience. For example, Medical Surgical and Telemetry Registered Nurses have one rate while all other Registered Nurses have another. Registered Nurses with 1-3 years of experience get one rate, while those with more than 3 years of experience get a slightly higher rate. The important thing to understand is that standardized bill rates are set in stone by the contract for all intents and purposes. There is no possibility of negotiating a higher bill rate based on a particular travel nurse’s salary history or work experience.

Joseph Smith, EA/MS Tax, an international “taxation master” and founder of Travel Tax , explains that in addition to their base pay, most travel nurses can reasonably expect to see $20,000-$30,000 of non-tax reimbursement payments in a typical year working as a travel nurse.

Find travel nurse credit cards to earn points or miles while traveling.

Qualifying For Non-Taxable Income

In order to avoid being taxed on those reimbursement payments, however, you need to clearly prove that you have what’s called a “tax home” to the IRS. The IRS defines a tax home as “the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home.”

Smith explains that you can qualify for a tax home in two main ways:

- If your primary area of residence is also your main area of income, which typically does not apply to travel nurses.

- You visit your primary residence at least once every 12 months and can prove that you are paying for expenses to maintain your primary home.

If you can’t prove that you have a tax home, or don’t meet the qualifications for having a tax home, you will be taxed on the stipend payments you receive as part of your travel nurse pay package. Additionally, Smith cautions that most travel nursing agencies will not verify that you qualify for a tax home, so it’s up to you, the travel nurse, to ensure that you are meeting all requirements for establishing a tax home in order to collect your non-taxable stipends.

Joseph Smith, EA/MS Tax, an international “taxation master” and founder of Travel Tax, explains that in addition to their base pay, most travel nurses can reasonably expect to see $20,000-$30,000 of non-tax reimbursement payments in a typical year working as a travel nurse.

While many people commonly believe that you must have your tax home at least 50 miles away from where you work as a travel nurse, there’s actually no specific distance requirement . The only real requirement is that you must prove that it’s farther away than a reasonable commute and requires rest and sleep before going back and forth.

You should always check with a tax professional, but in general, travel nurses can take the following steps to help ensure that they qualify for a tax home in the eyes of the IRS:

- Keep proof of any payments you are making to show that someone else is maintaining your primary residence, such as receipts for a house sitter, mortgage, rent, utilities, or home maintenance expenses.

- Maintain your driver’s license and voter registration in your home state.

- Keep your car registered in your home state.

- Keep a per-diem position, if possible, in your home state.

- Return to your permanent home at least once every 13 months.

- File a Residence Tax Return with your home state.

To file taxes correctly, it’s very important to maintain your tax home and prove that you have to actually pay for “double” of everything—for both your tax home and your new living situation as a travel nurse. That means that if you rent out your home temporarily while you’re gone, you no longer can classify it as a tax home.

What About State Taxes?

Travel nurses should plan on filing their taxes by the April 15th deadline, just like everyone else in the United States, although there may be a little wiggle room for extensions due to the nature of being a multi-state professional as a travel nurse, according to Smith. Every state has different laws for filing taxes, but travel nurses may need to file a non-resident tax return in every state they have worked in, as well as the state that they consider their permanent tax home.

Travel Nurse Tax Tips

Smith advises travel nurses to keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one place. Although digital receipts may be more convenient or “modern” for younger nurses, keeping paper copies as a backup is always recommended. Your receipts can include things like:

- Housing and lodging expenses while traveling

- Mileage travel

- Uniform and scrub expenses

- Work-related expenses, such as continuing education courses or certifications you must maintain to keep your position

- Costs for Internet and phone providers

The 2022 tax reform laws did away with many job expenses at the federal level , which means that travel nurses can’t deduct certain travel-related expenses such as food, mileage, and gas on their federal return. You can still get a stipend or reimbursement from your travel agency for those expenses, but they may not count as deductions.

That being said, a handful of states still allow job expense deductions on your state tax return, such as New York , California , Alabama, Hawaii , and Arkansas, so there may be additional tax deductions you can make if you’ve worked in a qualifying state.

Smith also adds to be careful when filling out residency on your tax return, as he sees many travel nurses make the mistake that working a travel assignment means they have moved. However, working a temporary (under 12 months) travel nursing position does not qualify as a move of your permanent residence — instead, they are just away from home temporarily and that’s an important distinction to make come tax time.

Keep your tax home as a permanent residence address, and don’t change it unless you actually move permanently!

Explore Online BSN Programs

Explore Online MSN Programs

Can You Get Audited As A Travel Nurse?

The travel nursing industry as a whole does tend to be scrutinized closely, says Smith. As a travel nurse, you may be more at risk for an audit if you’re displaying high expenses and low income. For instance, if your mortgage is $10,000 a month, but your overall income with your base pay as a travel nurse is only $20,000 annually, the IRS may be puzzled as to how you’re actually affording your lifestyle.

You can reduce your risk of an audit, or increase your risk of getting through an audit favorably by always making sure to work with a certified tax professional who is familiar with traveling healthcare professionals and not solely relying on your nurse recruiter or travel staffing agency for tax advice.

Lower Taxable Income Considerations

One of the appeals of travel nursing is that you have the potential to make a high income, especially through non-taxed stipends. And although at first glance, having non-tax stipends for things like housing may sound like a great deal for you as a travel nurse, it does come with a catch: because the additional stipends you receive as a travel nurse are not taxed, they are not considered income, and as such, will not be reflected in your annual income.

That may not sound like that big of a deal unless you find yourself in need of a loan, mortgage, or disability payment, or are nearing the age to collect Social Security. All of the aforementioned items are calculated based on your income. The lower your income, the lower the loan amount you will qualify for, and the less you are contributing to Social Security and therefore will be eligible to collect when you’re ready for retirement.

If you know that you will be needing a loan or a mortgage in the near future, Smith suggests talking to your lender as far in advance as possible to explain your situation and plan ahead. Working with a lender who is familiar with the pay structure for travel nurses can also be helpful.

In some circumstances, such as for nurses who are nearing Social Security’s retirement age, it may also be helpful to legally declare that you don’t have a tax home on your tax return, and instead, pay taxes on all of your stipends, so you can count it as taxable income.

And remember – you should use this guide as information to help you learn more about filing taxes as a travel nurse but remember that it is not tax advice. You should always consult your own CPA or tax professional before filing your tax return.

Travel Nurse Tax FAQs

Yes, all travel nurses must pay taxes on all income that they earned. They will need to file a tax return for every state that they worked in, as well as their home state where they have permanent residence.

If possible, it’s always beneficial to work with a tax professional, such as a Certified Public Accountant who can help you file and pay taxes that you owe as a travel nurse. An accountant can provide you with the physical paperwork that you can use to mail your tax payment in or help you set up an online account if digital payments are acceptable. If you file your own taxes using TurboTax or another software, you will be provided with the exact mailing address and instructions to submit payment. If you don’t have one already, you may need a book of checks in order to pay your taxes. The most important thing you need to know about paying taxes as a travel nurse is that you will need to both pay taxes and file a tax return in every single state you have worked in. If you’ve worked in many different states, that’s where hiring a CPA can be very helpful to help you navigate all that paperwork and payment.

It depends. American Traveler explains that you may end up paying taxes in every state you worked in as a travel nurse, depending on which states those are. Some states have what’s called a “reciprocity” agreement, which means that they have agreed that travel nurses working in those states will only be responsible for paying taxes to one state in total. You will have to check with your accountant or look into the tax rules for each state that you’ve worked in to determine exactly how much you owe in taxes. You should also check with your travel nursing agency if this is your situation because you will most likely need to file tax exemption paperwork through them as well. You will also need to pay taxes in both your home state and any state you worked in. That means that all income you make will be ultimately taxed through your home state taxes as well as the state where you earned the money. That might look like getting taxed twice, but the good news is, your home state will deduct the difference if the percentage rate of your home state is higher. And if it’s the other way around, you will generally only pay the higher state rate. This can get a little confusing, which is why we recommend hiring a tax professional.

Some states do not have an income tax , including Alaska , Washington , Wyoming, Nevada, South Dakota, Tennessee, Texas , Florida , New Hampshire, USVI, and the District of Columbia (if you don’t live there.) If you live in one of these states, you will still need to pay any set income tax rate in the state where you work. If you don’t live in those states but you do work in those states, you will still pay your home state tax rate, so be sure you keep that in mind with your total earnings so you can have enough to pay your taxes come tax time.

This depends on if you’re considered a W2 employee or a 1099 contractor, but in general, travel nurses may be able to deduct the following expenses: – Mileage or the cost of gas – A rental car – Uniform and equipment costs – Continuing education – Licensing fees – Travel expenses – Some meals – Retirement and insurance contributions – Expenses that go into paying for your tax home

You may also like

8 Best Places For Travel Nursing In The Summer

Current Nursing Compact States 2023

Travel Nurse Insurance Guide

10 Ways To Earn Rewards For Travel Nurses

Join the many nurses already traveling.

Don't miss out on your adventure..

Travel Nursing Pay – Qualifying for Tax-Free Stipends and Tax Deductions: Part 2: Maintaining Temporary Status

In our previous blog post we laid out the criteria under which individual tax payers can qualify to receive tax-free money to cover their expenses while traveling away from their tax home. We pointed out that for the vast majority of travel nurses, the first consideration is to maintain status as a temporary worker. In this blog post, we’ll discuss what that takes.

Travel nursing tax home versus family home

Starting at the beginning, let’s recall that, “your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home.” Take note of the distinction between “your tax home” and “your family home.” This is important because it’s possible to have both!

Discover your next travel healthcare job on BluePipes!

For example, I have a friend who had a permanent job in San Jose, CA. He married his college sweetheart who was from Fresno, CA and they purchased a home in Fresno which is a 3 hour drive from San Jose. He kept his job and apartment in San Jose for nearly 3 years before he was able to find a comparable job in Fresno and move there permanently. For that 3 year period, he was not entitled to tax write-offs or stipends. Purchasing the home in Fresno was a personal matter, not a business matter. His tax home was in San Jose where he worked, and his family home was in Fresno.

The important distinction between my friend’s example and a travel nurse is that my friend’s job was a permanent job and travel nursing jobs are temporary short term assignments.

However, I offer this example and stress the difference between tax home and family home for a reason. While the IRS employs a different set of principles when dealing with temporary assignments, namely the 3 factor threshold test or the more subjective facts and circumstances test ( which we discussed in Part 1 of this 4 part series ), the spirit of the original definition is certainly at play. Authorities have ruled that declared tax homes were “personal in nature” rather than business related when deciding cases involving taxpayers engaged in temporary assignments.

Temporary assignments versus permanent employment

With that in mind let’s discuss the difference between temporary assignments and permanent jobs, or “indefinite employment” as it is commonly referred to by the IRS. This is a very important distinction to make because if a travel nurse’s employment away from their declared tax home is considered indefinite, then they no longer qualify for tax-free stipends.

Free: Universal Job Application and Credential Management for travelers.

In defining temporary work, IRS Publication 463 states, “If you expect an assignment or job to last for 1 year or less, it is temporary unless there are facts and circumstances that indicate otherwise. An assignment or job that is initially temporary may become indefinite due to changed circumstances. A series of assignments to the same location, all for short periods but that together cover a long period, may be considered an indefinite assignment.”

In this regard, one of the great things about travel nursing jobs is that you receive a contract which designates a start date and an end date. This provides proof that your employment is temporary without question. You must keep copies of your contracts! I cannot stress this enough. However, if you sign multiple contracts in one location for a total consecutive time-frame of 1 year or more, then you may run afoul of the rule. This is why you will consistently hear about the “1 year rule.”

Two employment scenarios to watch out for as a travel nurse

You’ll want to be careful with this rule in order to maintain your temporary status as a travel nurse. There are two scenarios under which I believe travelers get into trouble. First, they sometimes take consecutive travel nursing jobs in the same metropolitan region.

Negotiate travel nursing pay like a PRO with our free eBook.

For example, I’ve worked with travelers who worked in Los Angeles, California for 9 months, and then worked 30 miles away in West Hills, California for 6 months consecutively. The IRS may claim that this travel nurse is exceeding the 1 year limit because they are essentially in the same general area. Obviously, the same would be true if a traveler continued to work in the same city repeatedly.

The key to avoiding this is to ensure that you maintain what the IRS refers to as “breaks in service.” Unfortunately, the IRS does not provide an exact time-frame defining a break in service. However, there are some very clear guidelines. It’s important to note that the IRS considers employment history in 24 month increments when determining breaks in service. Various IRS cases indicate that a 3 week break is not considered significant, a 7 month break may be significant, and a 12 month break is definitely significant. A safe rule of thumb is to never work in one location for more than 12 months in a 24 month period ( traveltax.com ).

However, it’s very important to remember that your approach to this rule should be dependent on which two of the three factors in the 3 factor threshold test that you’re aiming to satisfy. Remember, the 3 factors of the test are:

- Whether the taxpayer performs a portion of their business within the vicinity of the declared tax home and uses the declared tax home for lodging purposes while performing business there.

- Whether the taxpayer’s living expenses are duplicated as a result of their traveling for work.

- Whether the taxpayer has not abandoned the declared tax home. This is typically determined by how frequently the taxpayer uses the declared tax home for their own personal lodging and personal business, and whether or not the taxpayer has direct family members living in the declared tax home ( Blum and Coppage ).

If you are incurring duplicative expenses, and therefore satisfying factor 2, then the advice in the preceding paragraph is sound. However, if you are seeking to avoid paying duplicative expenses and instead satisfy factors 1 and 3, then you may need to move around much more. We’ll discuss this in detail in Part 4 of this four part series .

Tired of filling out skills checklists? They’re free on BluePipes.

The second way that travelers can jeopardize their status as a temporary worker is to sign on for PRN with either a local agency or directly with a hospital in the same area as their travel nursing job. Travel nurses see this as an opportunity to supplement their hours and earn extra money. It can certainly be a very attractive option. For example, some hospitals in California will pay their direct PRN nurses over $70 per hour, and making $60 per hour or more is quite common. However, the IRS may view these positions as “indefinite” and reject your claim for tax-free stipends. Sure, you may have a travel nursing job in the area, but you just accepted another job that has an indefinite end date.

You can try to avoid this pitfall by requesting a contract to work the PRN shifts with clearly defined starting and ending dates. However, you’ll likely find that only agencies are willing to do this.

Join thousands of travel nurses on BluePipes.

Hospitals on the other hand are looking for people who want to keep the PRN positions long-term. They’ll have no problem finding them because these nursing jobs pay so well and are typically highly coveted. In any case, I strongly advise that you seek the advice of a tax adviser who has experience specifically with travel nursing and temporary workers on these or similar issues.

As you can see, there are many pitfalls to avoid when seeking to maintain your status as a temporary worker. Moreover, you’ll also need qualify under the 3 Factor Threshold Test in order to receive tax-free reimbursements as part of your pay package. We’ll discuss this in our next two blog post s.

It’s important to note that we are not tax advisers, Certified Public Accountants, or Lawyers. We are not in any way providing any tax advice. All information regarding taxes is informational and intended as a jumping off point. You must seek the help of professional tax advisers to gain a clear understanding of your unique circumstances. We recommend the folks at traveltax.com .

Related posts:

- Travel Nursing Pay – Qualifying for Tax-Free Stipends: Part 3: The 3 Factor Threshold Test Now that we have made the distinction between indefinite work...

- Travel Nursing Pay – Qualifying for Tax-Free Stipends: Part 4: The 3 Factor Threshold Test In our previous blog post, we discussed how to qualify...

- 6 Things Travel Nurses Should Know About GSA Rates Understandably, there is a lot of confusion about GSA rates...

Popular on BluePipes Blog

Discover Jobs

- Travel Nursing Jobs

- Travel Therapy and Tech Jobs

© Copyright 2012-2022 BluePipes, Inc

Answers to the Most Asked Travel Nurse Tax Questions

- June 14, 2022

Navigating taxes can be slightly different for travel nurses compared to traditional nursing staff. In the travel nursing industry, travelers are paid differently than staff nurses because they receive both a taxed base hourly pay and additional “payments” that are non-taxed to make up their “total” pay. When you agree to commit to a travel nurse position, you’ll receive a pay package, which will detail all of the different aspects of what will make up your actual compensation.

To ensure you receive the most out of travel nursing and combat a combination of anxiety, confusion, and any lack of resources, we’ll cover a few tax topics to answer the questions you may have below. Taxes are tricky enough to maneuver through, especially travel nurse state taxes , so we’re here to make it easier. If you still have questions about where to start, remember that you can always talk to a tax professional.

Tax Homes vs. Permanent Homes

They say home is where the heart is, but the IRS needs a little more than that. To benefit from tax-free income from your travel nurse assignments , you must establish a tax home, which usually differs from your permanent residence. For most people, their tax home and permanent home are the same places, but travel nurses fall into a small category, like professional athletes and truck drivers, who earn money outside their homes.

A general rule for travel nurses is not to stay at one travel nurse assignment for more than 12 months to maintain eligibility for tax-free stipends. To ensure you qualify for a tax home in the eyes of the IRS:

- Keep proof of any payments you make to show that someone else maintains your primary residence. (I.e., receipts for a house sitter, mortgage, rent, utilities, or home maintenance expenses).

- Maintain your driver’s license and voter registration in your home state.

- Keep your car registered in your home state.

- Return to your permanent home between every contract.

- File a Residence Tax Return with your home state.

Tax Advantages

There are a handful of significant tax advantages to be aware of as a travel nurse, primarily stipends and reimbursements.

Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. You incur expenses, save all receipts, submit them to your employer, and the money you’re reimbursed is tax-free. This is typically done in the form of an expense report. Conversely, stipends are fixed amounts of money (lump sums) paid periodically to cover expenses. For travel nurses, stipends are tax-free when they are used to cover duplicated costs. They do not have to be reported as taxable income if you can prove this duplication of living expenses.

Under the new 2018 tax laws, travel nurse tax deductions or write-offs are no longer an option. This means travel nurses can no longer deduct travel-related expenses—food, mileage, gas, and license fees—and the only way to recover these funds is either through a stipend from your travel nurse agency or in the form of reimbursements for expenses you actually sustained.

While the chances of any one person being audited are relatively low, it’s always important to be prepared and have documentation for everything. In travel nursing, it is essential to keep a paper trail of permanent home maintenance and duplicating living expenses—documentation is everything. If you claim shared expenses, always have proof of the gas, electric, cable bills, etc., under your name.

As a travel nurse, you may be more at risk for an audit if you display high expenses and low income. For instance, if your mortgage is $10,000 a month, but your overall income with your base pay as a travel nurse is only $20,000 annually, the IRS may have a few questions about how you’re actually affording your lifestyle. To get through or avoid an audit altogether, find a certified tax professional familiar with traveling healthcare professionals and do not solely rely on your travel nurse advocate or travel nursing agency for tax advice.

One of the benefits of being a travel nurse is maximizing your income. It can be intimidating at first, but travel nurse taxes can almost become second nature once you get the hang of it. If you have more questions about the travel nursing industry, take a look at our blog . If you’re ready to begin your journey check out our job board for the latest travel nurse jobs !

From a Staff Nurse to Travel Nurse: Everything You Need to Know to Expand Your Career

Travel nursing has been an in-demand career for years now, but the pandemic pushed demand for travel nurses to an all-time high. If you’re considering making the move to travel nursing, you’re bound to have certain questions. How does travel

3 Tips To Help Travel Nurses Stay Safe During The Pandemic

Nurses have been on the front lines of the pandemic since the start. Whether in traditional nursing roles, in emergency rooms, administering vaccines, or traveling, nurses have been first responders to the COVID-19 pandemic. Though the pandemic is nearing an

5 Tips On How To Make Your First Assignment As A Travel Nurse Easier

Getting ready for your first assignment as a travel nurse? Congratulations! It’s an exciting time in your career and travel nursing will open up so many doors for you. If you’re already packed, have your housing situation settled, and have

By continuing to use our website, you are consenting to Cookies being placed on your device. If you do not want Cookies placed on your device, we suggest you exit our website

Debunking 5 Common Travel Nursing Myths

Table of Contents

If you’re considering travel nursing for the first time, you’ll likely turn to co-workers and friends for information. While these people can often give you an excellent glimpse into the world of travel nursing, especially if they have travel experience themselves, there are unfortunate situations where myths are spread. Travel nursing is ever-evolving, and one RN’s personal experience as a traveler may be completely different from another’s simply because the two nurses worked with different agencies or at different facilities.

{{cta-color-with-image}}

To clear up these misconceptions about travel nursing and help you make educated decisions, our team of recruiters is here to bust five common myths!

2022 Travel Nursing Trends

Over the past several years, the world of travel nursing has grown tremendously, and so have travel nursing companies. Due to the high demand for nurses nationwide, travel nursing pay packages have increased profit margins for travel nurses, along with tax free money (stipends) and higher net pay.

There has been a slight decrease in the demand for travel nurses, but travel nursing companies still have many contracts with varying pay rates. Some contracts have low taxable base rates with higher stipends (tax free money), which means higher net pay and profit margins.

What You Should Know for Travel Nursing

Before we get into the most common travel nursing myths , first let’s discuss some basics that you should know about travel nursing.

Usually, to apply for a travel nursing job, you must have at least 1-2 years of nursing experience. This depends on your specialty and hospital needs. Travel nurse assignments are usually about 13 weeks, ranging from six weeks to one year. Healthcare facilities work with travel nursing agencies to pay you a contracted amount of work hours per week. Typically, you will receive a weekly paycheck from your agency. You will receive a contract with your assignment details as a travel nurse. Details will include the healthcare facility, length of your assignment, start date, hourly rate, housing and meal stipends, etc. It’s crucial to understand the ins and outs of your pay package before signing.

Research the locations you are interested in before speaking to a recruiter. Once you’ve found the perfect location, look around for activities and interests to do on your days off. Social media chats and groups have great ideas. On the other hand, sometimes a location seems great because of the pay, but there aren’t many activities or places to visit on your off days.

As mentioned, always review your contract and the entire pay package before signing. If you have any questions, ask your travel nurse recruiter. If you aim to make a minimum profit margin for your assignment, total your entire travel nursing pay package. Consider the cost of travel nurse housing, taxable base rate, and any other stipends, as this can vary. Assignments with low taxable base rates will most likely bring higher take-home pay in your travel nursing pay package.

Also, make sure your travel nursing licenses are in order and up-to-date. If you need any CEUs, there are many free continued education program courses online.

COMMON TRAVEL NURSING MYTHS

Starting a career in travel nursing is exciting and nerve-racking at the same time. Above, we visited current travel nursing trends and things you should know about travel nursing. Now, let’s debunk some travel nurse myths.

Myth #1: You won’t have important benefits like health insurance or retirement plans.

Completely false! Reputable travel nursing companies offer quality health insurance plans and things like dental and vision coverage and mental health resources. Because of the popularity of travel nursing, top agencies are now also providing 401(k), retirement plans, paid vacation time (PTO), and mental health resources. Some agencies even offer reimbursement for travel nursing licenses and free continued education program credits. You are traveling to hospitals with high-priority needs and should be rewarded for your hard work! Some nurses fall in love with traveling and experiencing new locations, so they decide to make travel nursing a long-term career. Because of the excellent benefits and travel nursing pay packages now offered, traveling is now a lucrative option for those who love to explore.

Myth #2: Working a lot of temporary travel assignments looks bad on a resumé.

Exactly the opposite! Having a variety of nursing experiences is always an asset. Travel nursing actually makes you more marketable because it highlights your adaptability. Nurses are known for their ability to “work anywhere,” and those who travel actually do! Potential employers like candidates who utilize their expertise and have a quality, meaningful experience in the field. Working in a wide range of facilities can give nurses invaluable experience that can be taken with them anywhere! Additionally, working several travel nursing assignments in different places can help the nurse better understand what they really want in a permanent position.

Myth #3: Travel nurses have to move every 13 weeks.

Not necessarily. 13 weeks is generally the standard length of a travel contract but can be shorter or longer, depending on the need. Sometimes, however, travel nurses are given the option to extend their contract if the hospital/facility is a good fit and the need remains. One of the best perks of being a travel nurse is flexibility. If their personal life and finances permit it, a travel nurse can take paid vacation or time off between contracts. Planning ahead with your recruiter is important to figure out how to best meet your goals.

Myth #4: You don’t have much control over where you go.

The beauty of travel nursing is that you are in control. While getting a contract within your preferences cannot be guaranteed, most recruiters work diligently to match you with the best available options. That being said, you always have the option of accepting an offer or not. The more flexible you are with shift preference and location, the more likely you are to find a job that meets your needs quickly. A travel nursing agency cannot force you to take on an assignment! You can choose your assignments and make the best decisions for your lifestyle and goals.

Myth #5: There are only travel nursing jobs in big cities.