Want To Know The Journey Of Registering Your Travel Business?

How-to • Operations • August 16, 2018 • Vacation Labs

India has seen a sharp spike of startups over the last decade. Thanks to the ease of doing business through technology. According to a recent report , India is set to host 10,500 startups by 2020 making it one of the largest ecosystems for startups. Well, good luck to those who thought that the startup ecosystem is just a bubble waiting to burst. In fact, the travel and tourism industry will be adding $11,512.9 billion* to global GDP by 2027. So, everyone in the travel startup space is looking to share a part of the pie.

(*As per a 2017 report by the World Travel And Tourism Council)

Here are some stats that’ll open your eyes:.

95% of consumers search online before making a travel purchase. Now that’s an insight

Social media affects purchase decisions of 48% consumers

41% consumers make a purchase after receiving a promotional offer/discount

25% consumers make a purchase after receiving it over SMS

YOU MAY ALSO LIKE: Get Your Travel Website In One Day- No Developer Needed

Are You Missing The Point?

Though, there’s something, which is mission critical even before you get that website up. That’s actually registering your business and making it legal and operational. After all, you don’t want to make headlines in the tourism industry for all the wrong reasons.

So How Do You Start Your Travel Business ?

There are plenty of ways to start a travel company . The question is whether you want to go the traditional way or do it the smart way (more on that later). First, let’s look at the traditional way of registering a travel company. The first thing you’d do is contact your CA and set up an appointment. Then he would ask you for a bunch of documents time and again to submit and then give you an approximate date of registering your company. Then the wait starts for you. In this process, two things do not go in your favour. That’s convenience and accountability.

Remember, we mentioned a smart way for travel company registration . There are plenty of startups out there including those that would be a one-stop shop solution for all your legal and financial needs to start your travel business in India.

There are companies like:

VakilSearch

Startupwala

These companies ensure that you can start your travel company without running around to multiple places for documents. After all, you have a busy life and are on the go. Through these companies, you are saving time and money. And we all know time is money. So now that we’ve made a case for going online, here’s another important question:

That totally depends on how you want to start your travel company. A majority of travel entrepreneurs start solo, while others usually team up with family or friends to begin with. Very rarely people start with a full-fledged travel company.

Does A Sole Proprietorship Make Sense For You?

Yes, it does. In fact, it is the easiest way to start your travel company . That’s because you’d be managing the whole show as the principal decision maker and owner of your travel company. The best part is that you could have a proprietorship company up and running in a fortnight. No wonder, it is the most popular way to start a business, particularly for new entrepreneurs and establishments.

Here are some of the pros of going solo or rather with Sole Proprietorships:

Get a head start

15 days is all you need to start a travel company . That includes your GST registration. It’s fairly a straightforward process. All you need is a:

- Identity proof

- Address proof

- Shops & Establishments Act Registration

- Current Bank Account

And you’re almost done.

Less compliance. More ease.

The compliance required for running your travel business or tour operator business is uncomplicated. All you’ve got to do is file the taxes of your service or profession.

Easy on the pocket

Not only do you require less paperwork and compliances for Sole Proprietorship firms, but you have to pay less to get started. One can start with as low as Rs. 1,499 . Now, that’s even less than a meal at a restaurant in most urban cities in India.

Tax is on your side

Since you are the sole owner of a travel company, you do not need to show a distinction between your income and the company’s income. Therefore, you’d be taxed according to the rates applied to personal income tax rates, and not corporate tax. That means, no hiring expensive auditors. You can breathe easy.

How Do You Go About Registering The Company?

You must be thinking that you can do it yourself. But first, this is all that you have to go through:

- Choose possible names for your company. Here’s what you need to know about naming your company

- Apply online on with the Ministry of Corporate Affairs for the DIN (Director Identification Number)

- Register online for a DSC (Digital Signature Certificate)

- Gather your application materials

- Complete e-Form 1A

- File Form 1A online to apply for company name

- Draft the Memorandum of Association (MoA) and Articles of Association (AoA)

- Print the MoA and AoA.

- Have the MoA and AoA notarized

- Pay the registration and filing fees online

- Find the corresponding RoC office to file your application

- Gather your completed application documents

- File your application one with the RoC

- Collect the Certificate of Incorporation

- Ready to do business

It ends up something like this:

Not your idea of forming a company, right?

There’s a better way to do it by using online platforms such as Vakil Search, Venture Easy and IndiaFilings.

Let’s look at Vakil Search

A floating box with a call-to-action window

They even have a chat window powered with a Bot called TARS to assist you

The chat window is extremely user-friendly by clearly defining the special offers and options in the chat window

Apart from the initial form and chat window on the right side, there is also the option for the user to ask a question with their name and phone number.Vakil Search arranges for a call back to the user to answer their queries.

Once you choose an option, a representative from Vakil Search will send you a dashboard for all the following details.

Make sure you fill in all your details and make the payment. Next, wait for a few days and voila, you are all set to roll. Therefore, sites like these become a one-stop shop solution for starting your travel company.

Thinking About The Paid-up Capital?

There is none in the case of the Sole Proprietorship as is the case with the One Person Company or Private Limited Company which is usually Rs. 1 lakh.

Are There Any Downsides?

Though a Sole Proprietorship is fairly easy to set up, it’s not all rosy when your business suffers losses. That’s because Sole Proprietorship comes with the unlimited liability clause, which means in case the business goes into a loss, the business, as well as the personal assets of the proprietor, can be used to pay debts or recover losses. That can seriously dent a proprietor’s financial goals. That’s also one of the major reasons why it becomes difficult to raise funds or lend funds to assist sole proprietors.

What Is A One Man Company?

2013 saw a new form of business introduced according to the Companies Act. It was brought in to help sole proprietors and new entrepreneurs who would like to start a business with limited liability and yet have the business as a separate legal entity. Want to know the other features and differences between OPC and Sole Proprietorship, this will help .

What If Two People Or More Wish To Start A Travel Business Together?

That’s always a question running in an entrepreneur’s mind especially if he or she wants to start the travel business with a friend or family member. For this modus operandi, we’d suggest you register your tour operator or travel business with a Limited Liability Partnership (LLP).

What Is An LLP?

It is a legal corporate entity in which a firm enjoys the partnership with limited liability yet the business has all the features of a company. It means, the best of both worlds when it comes to a partnership and a limited company. That’s because a partner does not take responsibility for the decisions and the wrongdoings of other partners. Plus, they enjoy limited liability when it comes to their business.

What About Expansion?

Yes, we can understand a lot of entrepreneurs have registered a travel company but are looking to take the next step of expansion. After all, everyone would like to make it big when it comes to their business. For these entrepreneurs, it is time for them to register their company as a Private Limited Company.

What Is A Private Limited Company?

A private limited company is a legal corporate entity with a limited liability incorporated under the Companies Act, 2013. It should have a minimum of two directors and a maximum of 15 directors. A director can also be a shareholder. It also allows foreign nationals, foreign entities or NRIs to be the Directors as well as shareholders.

What Are The Advantages Of A Private Limited Company?

Having your own travel business private limited means you’ll get the boost and funds available to scale-up your business. That’s because, there will be shareholders as well as investors who’d take interest in your company provided on your profitability and returns. This means some serious investment and opportunities to see your travel business take-off.

OK, Now That You Have Registered, What Next?

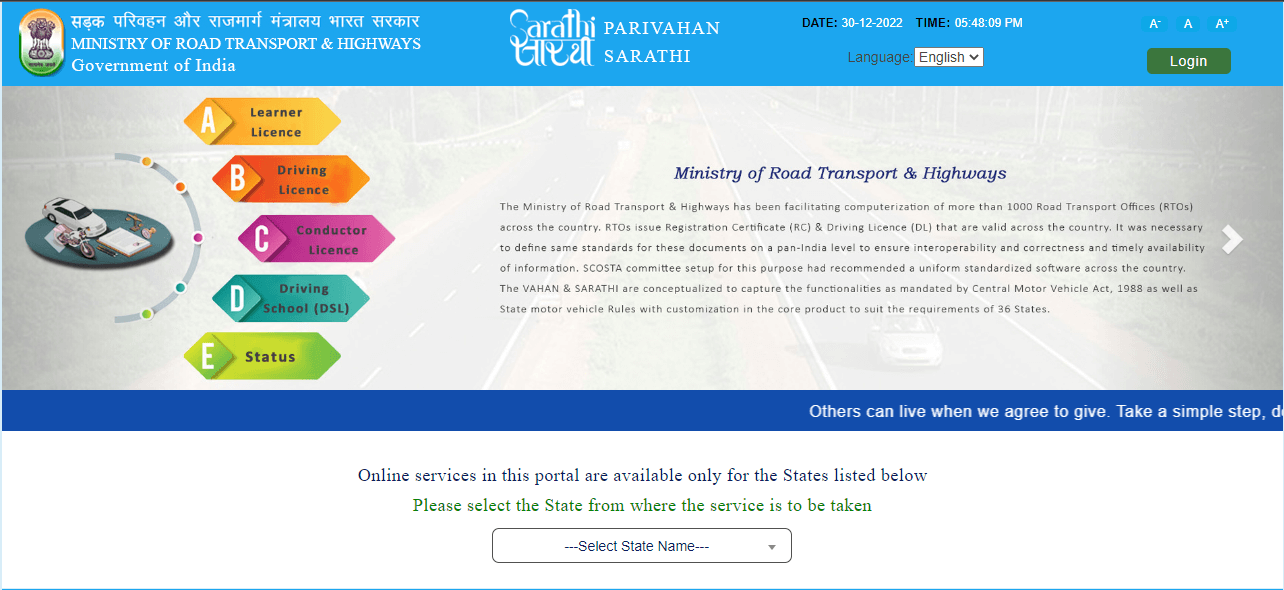

Yes, that’s a very valid question for starting a travel company in the new GST era. The Goods or Services Tax is applicable to you if you have an annual turnover of more than 20 lakhs. Since we are also talking about taking your business online, you will also require a GST number for selling travel services or products online. Again, it’s a hassle-free and paper-free process as the Government of India has made it easy to apply for GST. There is even a GST portal .

GST registration can be done via the GST portal. All you’ll need is:

- PAN card, Photo and Aadhar Card of the proprietor

- Address proof of business (Electricity bill/ rent agreement)

- A copy of your bank statement, which clearly shows your bank account number and IFSC code

Normally, the GST number is received within 3-4 days of submitting the application.

While it is not mandatory to be approved by the Government of India to be a travel agent, it has its advantages. It means you are maintaining certain checklists and quality standards. Plus, you become a credible travel business or tour operator, which is important in the eyes of the international tourist. To become an approved travel agent or tour operator, you’ll need to apply to the Ministry of Tourism with certain information like capital invested, a certain number of staff employed, maintenance of minimum office space and other stipulations.

Are There Any Guidelines From The Government For Entrepreneurs Who’d Like To Register Their Travel Business? Yes, the government has put together certain guidelines for inbound tour operators. You can view them here .

Is There Any Tour Operator Body In India That Is Helpful For A New Tour Operator Business?

Yes, there is. There is an Association of Domestic Tour Operators of India or ADTOI as it is called. While starting a tour operator business , it makes perfect sense to be a part of this organization. There is also the Indian Association of Tour Operators or IATO , which is also an apex body of inbound tour operators. Here are some of the advantages of becoming a member of IATO. And you have ATOAI , that stands for Adventure Tours Operators Association Of India. If you cater to airline ticketing getting registered with IATA (International Air Transport Association) is a must.

YOU MAY ALSO LIKE: What is a Tour Operator Software? Tour Operator Fundamentals

We have shared a step-by-step process with specific guidelines to help you get your travel start-up the initial formalities and recognition to perform business. However, one thing is clear, for any travel business to even survive, they have to get online.

How Can We Say This?

Vacation Labs has helped more than 200 tour operators and travel companies go online from scratch. That too, in a short span of time. We are a testimony to their start-up experience and success. So, once you get your company registered, don’t look further. Contact us to get your travel website up and running in no time with powerful travel commerce capabilities. One thing is clear, for any travel business to even survive, they have to get online. Here are some of the fundamentals of setting up your tour operator business online. If you’d like to get started or want to know anything else, we are waiting.

Vacation Labs has helped more than 200+ tour operators and travel companies go online from scratch.

RELATED ARTICLES

How-to • Operations

How To Run A Tour Business From Your Mobile Phone How To Run A Tour Business From Your Mobile Phone

Guide • How-to

Get Your Travel Website In One Day- No Developer Needed Get Your Travel Website In One Day- No Developer Needed

Tools you need to have a great tour operator website tools you need to have a great tour operator website.

Set-up dynamic pricing for your tours right away

Sign up today and get a free 14-day trial!

Vacation Labs

- We Are Hiring

- Affiliate Program

- Terms of Service

- Travel Website Templates

- Marketplaces

- Free Travel Website

System Modules

- Tour Operator Website

- Tour Operator Booking Engine

- Tour Operator Backoffice

- Tour Operator Agent Login

- Tour Operator Mobile App

- Itinerary Builder

Find Your Business

- Water Sports

- Nature Trails

- Bicycle Tours

- Aerial Adventures

- Knowledge Hub

- Post a Blog

- Know The Law

- Acts & Amendments

- Legal Guide

- Insolvency & Bankruptcy

- Property Related

- Registrations

- Business Advice

- Trademark Class

- Banking/Loans

- Know the Law

License required for Tour and Travel agencies for running their business

Travel and tourism industry, also known as Tour and Travel agencies is one of the major industries in India and plays a very significant role as employment generators. States like Goa and North-Eastern generate their primary revenue depending on tourism.

The licenses required to start a tour and travel agencies business in India are;

Business Entity Choices for Travel Agency

Any individual who is willing to open a Tour and Travel agency could open it under various selections of business entities, and these choices are left with the person who wants to start the business. Entrepreneurs generally select Private Limited companies as the preferred one amongst the rest, because Private Limited companies get a lot of benefits and subsidies from the government.

Also, business enterprises like Limited Liability Partnership (LLP) or One Person Company (OPC) could also be preferable for businesspersons who want to gradually build the business or carry it out on a part-time basis. As Limited Liability Partnerships have no obligation for audit unless the turnover goes beyond Rs.40 lakhs in a year, it shall be ideal for businesspersons who are getting their first-hand experience in their Tour and Travel agency venture. Then again, OPCs can also be ideal for businesspersons who are establishing their commerce as a single individual and want to avoid having broad compliance-related requirements to follow. However, a business enterprise offering limited liability status as well as separate legal entity status shall be perfect for a travel agent.

GST Registration for the Travel Business

It is important for business owners to adopt GST Registration so that they could collect GST from the customers on the service incurred through the business.

GST payable by Air Travel Agent is;

• Commission income from the airlines for booking domestic air tickets, GST at the rate of 18% on 5% of Basic fare

• Commission income from the airlines for booking international air tickets at the rate of 18% GST on 10% of basic fare

• Processing/service fee for booking of tickets for the customer, GST at the rate of 18% on invoice from Air traveller

Trademark Required for the Travel Business

If the businessperson wishes to have a unique name and symbol, he could do so by means of registering as a trademark provided under the Intellectual Property Rights laws in India.

Becoming a Government of India approved Travel Agent

By registration as a Government of India approved Travel Agent is not compulsory; it is useful and provides recognition for the travel agent. The goal and objective of the scheme for recognition of Travel Agent or Agency (TA) is to boost the quality standard and service in the tourism industry. In order to become a Government of India recognized travel agent, the travel agent is required to satisfy few requirements on capital invested, number of employees employed, maintenance of minimum office space as well as other stipulations. Furthermore, application should be made towards the Ministry of tourism in the prescribed format in order to become a Government of India approved Travel Agent.

The Travel agency is required to be approved by the International Air Transport Association (IATA). This travel Association offers several training methods and professional development services towards the travel agencies. IATA accreditation is very much preferred seal of approval recognized worldwide. It is important for a travel agency or for a travel agent availing international travel packages towards being a member of IATA, as it gives a lot of benefits in the air services across the globe.

- Share on Social :

- Visitors - 1

Leave a Comment

Previous comments, related blogs.

TRADEMARK CLASS 40

Description.

How to Register a Company in India

Check Company by Registration Number

Trademark Registration Status

All categories, get a callback, recommend links:.

Sign in with Google

Sign in with Facebook

Find Lawyers By Practice Area

Hire best Lawyers for your matters:

Personal / Family Lawyer

- Notary Lawyer

- Marriage Lawyer

- Divorce Lawyer

- Child Custody

- Family Dispute

- Motor Accident

- Wills/Trusts

- Labour & Services

- Corporate Lawyer

- Arbitration

- Banking/Finance

- Customs & Central Excise

- IPR Services

Civil Lawyer

- Cheque Bounce

- Consumer Complaints

Criminal/Property Lawyer

- Property Services

- Landlord / Tenant

- Cyber Crime

Others Lawyer

- Financial consultant

- Supreme Court

- Armed Forces Tribunal

- Immigration

- International Law

AI Summary to Minimize your effort

How to Start Tourism Business?

Updated on : Jun 17th, 2022

The tourism industry is one of the largest industries in India and a significant employment generator. Many Indian states depend on tourism to generate their primary revenue. India’s tourism industry is ranked 12th among 184 countries in GDP contribution. It is set to grow at 7.8% per year from 2013 to 2023.

The tourism market in India is estimated at USD117.7 billion in 2011, and it is estimated to boom to USD418.9 billion by 2022. Thus, starting a tourism business is a good option for new entrepreneurs in India.

Process Involved to Start a Tourism Business

- Entrepreneurs or travel businesses should identify who their target customers are and what locations they prefer to travel to.

- The travel business can cater to a niche group of customers like family vacations, educational tours for school and college students, religious tours, etc.

- It should define its geographical area of operation.

- It should obtain the required licences to operate the business.

- It should coordinate between tour guides and local vendors or outsource allied services for smooth operation.

- It should make a plan for future funding.

- It should make arrangements for booking travel through air, land or water and arranging its documentation processing.

- It should carry out marketing activities to attract customers.

- It can use referral methods and conduct loyalty programs to generate a customer base or offer discounts to repeat customers.

Types of Tourism Business in India

A travel agent can establish a small-scale or large-scale tourism business in India, thus making it one of the best businesses to start. A travel agent can operate various types of tourism businesses based on his/her niche and investments. The types of tourism business in India are as follows:

Adventure tourism

Millennials are the main target customers of adventure tourism. Adventure tourism is gaining popularity. It has the potential to grow when the travel operator approaches the business with creativity and provides unique adventure sports or activities to the youngsters.

Religious tourism

India is a religious country and home to many religious beliefs and rituals. People are looking for tour packages to visit monumental places of worship. The tour and travel business specialising in this field operates following local festivals like the Khumb Mela, Char Dham Yatra, etc.

Wellness tourism

Due to the modern-day lifestyle, people look for avenues to obtain intermittent resting of body and mind. Wellness tourism is a unique business idea that offers people an array of options for rejuvenation ranging from detox camps to rejuvenating centres.

Rural tourism

Rural tourism caters to people who want to experience the beauty of rural areas and be close to nature. The farm and vineyard visits, local cuisine, and activities for creating local crafts like pottery are some of the offerings of the rural tours and travel operators.

Heritage tourism

Indian and foreign tourists are keen to explore India’s historical monuments and buildings. Since UNESCO recognised many sites as ‘World Heritage Sites’ in India, heritage tourism is booming.

Licences Required to Start a Tourism Business in India

Tour and travel agents should obtain various required licences to start a tourism business in India. The following are the licences required for establishing a tourism business:

Business Registration

Travel agents or entrepreneurs wanting to start a tourism business should establish it as a legal entity by giving it a structure. They can choose from different structures to establish the tours and travel business, such as One Person Company (OPC), Limited Liability Partnership (LLP), private limited company, sole proprietorship or partnership firm.

Most travel agents choose to establish their business as a private limited company since it is one of the most recognised forms of business in India. A Limited Liability Partnership (LLP) or One Person Company (OPC) business structure would be ideal for entrepreneurs who plan to build the business slowly or do it part-time.

However, when entrepreneurs establish the business as a sole proprietorship or partnership firm, their liability is unlimited and can endanger personal assets in case of a financial crisis. Therefore, a public limited company, OPC or LLP, is preferred to establish a tourism business in India.

GST Registration

The tourism business needs to obtain GST registration and collect GST from the customers on the service incurred through the business. The transport and restaurant services provided by tour operators attract GST. Thus, the travel business must mandatorily register under the GST law.

Government Approved Travel Agent Registration

Travel agents and entrepreneurs establishing a tourism business can register as a Government of India approved Travel Agent. Though obtaining this registration is not mandatory, it is beneficial as it provides recognition to travel agents in India. The Ministry of Tourism started a scheme known as ‘Recognition of Tourism Service Providers by the Ministry of Tourism’ to promote the tourism sector in India.

This scheme allows travel agencies, tour operators, and travel agents to operate their business and encourages standard, service and quality in their business. The travel agents or agencies should apply to the Ministry of Tourism to be registered as recognised travel agents.

However, a travel agent should satisfy specific requirements of annual turnover, capital invested, qualification requirements for staff employed, a minimum period of operational experience, maintenance of minimum office space and other stipulations as per the guidelines for the scheme to become a Government of India recognised travel agent.

The International Air Transport Association (IATA) is responsible for the worldwide aviation travel industry, representing around 240 airlines or 84% of total air traffic. IATA offers professional development services and comprehensive training for travel agents. The IATA accreditation is a significant seal of approval recognised worldwide.

Thus, though becoming an IATA agent is not mandatory, it is recommended for a travel agency to obtain an IATA accreditation and enjoy access to a wide range of benefits. The IATA accreditation is vital for a travel firm providing international travel packages as it helps them simplify booking processes and conduct a hassle-free tour.

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Business Performance Improvement

- Legal Compliances

- Market Linkage

- Newsletters

- Professional Services

- Proposal Creation & Funding

- Research & Policy advocacy

- Yashaswi Udyojak

Registrations That Your Travel Agency Will Require

The thought of travelling brings cheers up almost everyone and travel plans are made enthusiastically and eagerly awaited by families and individuals alike. The wanderlust bug has bitten people of all ages as more and more people are seeking to travel and explore new destinations. Travelling to far off destinations or during the summer breaks is a norm now, along with which more individuals are even looking for city breaks and short get-aways. This increasing popularity for travelling has subsequently increased the demand for travel agencies and businesses dealing with travel.

A travel agency is a business that does not require much preparation beforehand and has no restrictions in terms of space and equipment. In fact, it can be started from home too. All you need is a computer, the requisite degree or licences and the zeal to arrange for travel itineraries and transportation at the earliest.

Travel Agency Registrations

A tour and travel business is one of the fastest growing businesses in recent times. It requires the business to adhere to certain compliances and register itself before it can start operations. The basic process involves the following steps in travel agency registrations-

Register The Business Entity

One of the first steps for any kind of business is to register itself. There are a number of business entities to choose from such as sole proprietorship, partnership, private limited company, limited liability company (LLP) or any other that best suits the entrepreneur and is favourable for the business. Other factors to be considered while choosing a business entity is the taxation law that applies to each business type and also the requirements and compliances for each business type.

Carry Out GST Registration

Post registering as a business entity, the next vital step is to register the travel business under the new GST laws. The GST application is a straight forward process and the GST registration documents required include-

- Identity proof

- Address proof

- Shops & Establishments Act Registration

- Current Bank Account

GST is mandatory for agencies that have an annual turnover of over Rs 20 lakhs. The air travel tickets, travel packages, etc. all have GST rates applicable to them and thus it is vital that the travel agency register itself under GST.

Register Under A Tour Operator Body

After the mandatory registrations of GST and business entity, the next step while starting a travel agency is to register under a Government approved travel body. This either means to become a Government approved travel agent or TA. This is not mandatory but is a way to ensure that travel agents provide standard and quality service everywhere. In order to be eligible for becoming a TA the entrepreneur must satisfy certain requirement such as the capital invested, the number of staff employed, maintenance of minimum office space and other stipulations. Apart from this, while starting a travel agency, entrepreneurs can even become an International Air Transport Association or IATA agent. The IATA provides training to travel agents and offers professional development services. Additionally, IATA certification is recognised worldwide.

Are You Ready To Start A Travel Agency?

Apart from the travel agency registrations, the agency does not require much in terms of equipment and setting up the business and specifically the premises but there are a few factors that need to be considered to find whether an entrepreneur is ready and prepared to start a travel agency/business.

Knowledge And Enthusiasm

Starting a business just because it seems like a profitable venture is not always a good way to move forward. A passion and enthusiasm for the field help to work with rigour and eagerness. Along with enthusiasm, knowledge about the travel industry, the registrations and compliances is a must.

Ability To Conduct Research

When embarking on a journey to a new destination, tourists look forward to visiting places of interest at the destination such as famous landmarks and architectural wonders, or popular local sites, along with staying in a conveniently located, comfortable hotel with amenities and having access to restaurants or getting homely meals. All of this is possible when the travel agency conducts a complete research about the place and makes arrangements for the tourists before-hand, to ensure a hassle free holiday. Thus entrepreneurs must be able to carry out a thorough research about all aspects of travelling.

Organisation Skills And Eye For Details

As a travel agent, entrepreneurs need to prepare detailed itineraries and organise travel plans with the greatest planning, whether it is regarding travel bookings, schedules, visa applications, transportation arrangements, etc to avoid a glitch-free travel experience for the clients. Also, they must look around for deals in airfares, hotel bookings, ticket prices to avail of benefits for the clients too.

People Skill To Connect With Customers

The travel industry is such that entrepreneurs need to constantly connect and interact with clients. For this, they need to have excellent communication skills and must be friendly and approachable for the clients to come to them repeatedly for travel bookings.

Seeking Assistance

Entrepreneurs are relatively new to the world of starting a business and might be overwhelmed with the thought of all the legalities and compliances to complete before starting the actual operations. However, deAsra can help with the details regarding all of the travel agency registrations including the GST registration processes since deAsra ’s motto is to be of assistance to entrepreneurs at every step in their journey as an entrepreneur.

Empowering Women at Home – Top 6 Work from Home Business Ideas for Housewives

In today's dynamic world, the concept of entrepreneurship has dramatically evolved, opening doors to numerous opportunities, especially for housewives looking to step into the business realm. With the...

Join the Celebration: deAsra’s Entrepreneur Excellence Awards 2024 – Support and Inspire

As the calendar flips to 2024, the entrepreneurial spirit among women in India will be celebrated grandly through deAsra Foundation's Entrepreneur Excellence Awards. This prestigious event not only sp...

Navigating ONDC: A Step-by-Step Guide for Sellers

The Open Network for Digital Commerce, or ONDC, is setting a new precedent in the e-commerce landscape of India, offering a unique platform for sellers across the country. This innovative initiative a...

The Importance of a Well-Prepared Business Plan in Securing Business Loans from Banks

Obtaining a business loan from a bank is a crucial moment for any entrepreneur. The key to unlocking this door is a well-prepared business plan. This blog isn't just a guide for where you want to take...

Balancing Act: Tips for Women Small Business Owners to Manage Work-Life Balance

Introduction In India's bustling landscape of women-owned small businesses, achieving a harmonious work-life balance is paramount for sustained success. As we commemorate International Women's Day, e...

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Step 1 of 2

All fields marked* are mandatory

To continue reading further, please provide us the below details

- Name * First Last

- Country Code *

- Facilitator Email

- External Handholder Email

- Selected Service

- EHH Engaged Consent Stay Engaged with EHH only

- LS Response

- Business Rule

- Response Message

- UTM Campaign

wrong OTP try again!!

- Get a Quote

Request to call back

- Become an Associate

- +919810602899

- +91-8882-580-580

Modal sideout small

Explore the history of the classic Lorem Ipsum passage and generate your own text using any number of characters, words, sentences or paragraphs.

- Knowledge Base

- Business Registrations

- Private Limited Company

- How to Start Online Travel and Tourism Business in India

- October 21, 2022

- Dushyant Sharma

The travel industry is one of the fastest growing industries and India is the world’s tenth largest business travel market. Unlike earlier times now, the travel and tourism agencies are being facilitated on online portals to promote ease of booking. Through this article,

We will look at the multiple rules, regulations and taxation issues for starting a travel agency business in India.

Travel agency is one of the most fruitful business activities in India with the immense increase in the number of people who love to travel. The travel agents provide a variety of services including, tour booking, activities booking, hotels and arranging flight tickets. In order to start a travel agency, the entrepreneur must understand the aspects mentioned below and make decisions about it.

Obtaining government approval

In India, it is not mandatory for all the travel agencies to obtain government approval for operating their business in India. Thus, travel agents can charge a commission to tourists even though they are not registered officially as a travel agent. However, all the travel agents are recommended to obtain government registration as the tourists, particularly foreign ones, are interested in the credentials of the agency. If a travel agency desires to get registered with the government then he is required to file an application with the Ministry of Tourism in the required format.

Acquiring tax registration

Earlier, travel agencies were taxable under service tax and so travel agents were required to obtain a service tax registration. However, small-scale travel agents were given the option of availing service tax exemption in case the aggregate turnover of taxable services does not exceed Rs 10 lakhs in a financial year. With the introduction of goods and service tax now the travel agencies are required to obtain GST registration and pay goods and service tax at 5% without availing the benefit of input tax credit. The rate of GST will be uniform for all services including package tours, hotel accommodation only, etc.

Choosing the right business structure

If the travel agency desires to gain legal identity and government approval, then it is required to form itself into a corporate structure. Today in India there are multiple business structures from which the travel agents can choose the most suitable option for them. The most preferred business that travel agents choose is the Private Limited Company as it is one of the most widely used and recognized forms of business in India, offering a host of benefits.

However, for the entrepreneurs desiring to start the business solely or on the part-time basis, the business structure like Limited Liability Partnership (LLP ) or One Person Company (OPC) would be ideal.

The trade association for world airlines is known as the International Air Transport Association (IATA).This institution offers comprehensive training and professional development services for travel agents. Being IATA accredited helps the travel agency to attain seal of approval recognized worldwide.

Registering Trademark

In today’s competitive world it is very significant to protect your brand name and logo from being exploited by competitors. Also, it helps the owner to obtain exclusive rights over the trademark.

- Share This Post

Author: Dushyant Sharma

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Registrationwala

Blog Search

- Top 10 Unicorn Companies in India

- FCRA Registration: Definition, Benefits & Criteria

- What is an LMPC Importer License?

- Opportunities and Challenges for Non-Banking Financial Companies (NBFCs)

- What is LEDGERS - Accounting Software?

- New Tax Regime vs Old Tax Regime: Which one is better in 2024?

- Certificate of Commencement of Business: Explained

- Everything you need to know about RWA

- What is a Drug Patent in India?

- Complete Guide about Provisional Patent

- What is a Regulatory Sandbox?

- BIS Certification for Electronic Products

- How to Save Income Tax for FY 2024-25

- What is Pradhan Mantri Ujjwala Yojana (PMUY)?

- Top 10 Consulting Firms in India

- IRDA Guidelines for Health Insurance

- How to apply for Newspaper Registration?

What are the rights of a shareholder in a company?

- APEDA Registration Modification Process

- What's the Difference between TDS and TCS?

- What is the Difference Between GST and VAT?

- Amendment for GST Registration: All the Details

- What is General Insurance?

What differentiates the Stakeholders from the Shareholders?

- Guidelines issued by IRDA for Motor Insurance

- Reserve Bank of India (Bharat Bill Payment System) Directions, 2024

How to Start a Coffee Shop Business in India?

- What’s the Difference Between Insurance Agents and Insurance Brokers?

- Masala (Spice) Board of India: Certification & Eligibility Criteria

- IRDAI Issues Draft Guidelines to Protect Insurance Policyholders

- What is the International Organization for Legal Metrology?

- Everything you need to know about Eating House License

- What Licenses are Needed for Starting a Cosmetic Business in India?

One Person Company (OPC): Legal Framework

- What is the Senior Citizen Savings Scheme?

- Blue Aadhaar Card: All the Details

- Why is Model Approval Certificate Necessary?

- Everything you need to know about FIFP Approval

- Why is HACCP beneficial?

- What is MCD Health Trade License?

- How to start a paper manufacturing company in India?

- What is Marine Products Export Development Authority?

- How to Start a Restaurant Business?

- 10 Things you Need to Know Before Applying for an Internet Service Provider License

- How to Become a Vehicle Insurance Agent in India?

- What is PM Surya Ghar: Muft Bijli Yojana?

- Organic Farming Certification in India

- Mutual Funds Schemes in India

- What is E-waste License?

- What do you mean by Legal Metrology?

- Filing Insurance Complaint with IRDA’s Grievance Redressal Cell

Why Should You Hire a Company Registration Consultant?

- The issue with Paytm Payments Bank: Explained

- How Can Trusted Approval Benefit Telecom Companies?

- Payments Bank License in India

How to Download FSSAI Certificate

- The Evolution of Insurance Industry in India - The Struggles & the Introduction of Laws

- Everything you need to know about Income Tax E-filing Portal

- What is the Telecommunications Act, 2023?

How to Start a Fruit Business in India

- Dual Pricing Ban in India - Reasons, Solutions and Exceptions

- Overview of Modi Government’s Interim Budget, 2024

- Highlights of Interim Budget 2024- 2025

- Benefits and Role of Insurance Web Aggregator in India

What is the FSSAI License Checklist for Importer?

- What is a Satellite ISP and How Does it Work?

- RNI Registration: Legal Obligation for Businesses

- 7 Key Factors to Consider When Applying for an NBFC License in India

- Difference Between AoP and BoI

What are the Types of NGOs in India?

- 10 Profitable Import or Export Business Ideas

- How to Check Aadhaar Card Link With PAN Card?

- Do’s and Dont’s for Corporate Agents

- What is the Difference Between Section 80C and 80CCD?

- Regulatory Framework of FFMC License in India

- Know The RBI Compliance for NBFC

- What Is Advance Tax? Here Is Step By Step Guide To Calculate

- What is Suo Moto Cancellation of Registration under GST?

- What is the Difference Between Internal and External Auditors of a Company?

- Exploring the Benefits of Medical Store Registration

- How to Open a Company in India?

- Why EPR Certificate is Important in India?

- Factors to be Considered While Obtaining a Legal Metrology Certificate

- How to Apply for DIN (Director Identification Number)?

- 5 Factors to Must Choose in New Tax Regime: Income Tax Return 2024

- What are the Benefits of Import Export Code in India?

- Impact of GST on Non-Banking Financial Companies in India

- Compliances of Partnership Firms in India

- 10 Tips for Starting a Successful Startup Business in India 2024

- Budget 2024: What is the Difference Between Interim Budget and Vote on Account

- How to Download the Udyam Registration Certificate?

- Limitation and Liability of Private Limited Company

- 10 Reasons to Choose an Internet Service Provider Business in 2024

- 5 Reasons to Start Your Insurance Company in 2024

- How to File XBRL Return for NBFC?

- Latest UIDAI News - Aadhaar Card Schemes Notifications & Circulars

- Benefits of a Legal Metrology License in India

- Bharat Net Scheme- Biggest Telecom Project for Rural India

- The Role of the TEC Certificate in the Telecom Industry

- How Does Taxation Affect an Essential Service Like the Internet?

- How Does Non-Banking Financial Companies (NBFC) Work?

- GST State Code List

- How to Start a Home Business in India 2024?

- Top Telecom Consulting Firms in India

- Impact of GST on Insurance and Banking

- How to Identify a Fake GST Bill

- Procedure of Takeover NBFC

- The Role of Trademarks in Start-Up Success: A Comprehensive Guide

- Non-Profit Organisation vs Charitable Trust

- What is the Difference Between MSME and Startup?

- A Comprehensive Guide on How to Claim GST Refund in India?

- How Telecom Companies Increase Customer Experience?

- What Licenses Required For Cloud Kitchen Business Start?

- Major Differences Between a Bank and NBFC

- Advantages of Trademark Registration in India

- Top 10 Insurance Companies in India

- Difference Between ISP and VNO License

- Benefits, Objectives, and Renewal Criteria Of Full-Fledged Money Changer

- Compliances for Web Aggregators in India

- List of Web Aggregators in India

- The Role of Insurance Web Aggregators in Simplifying Policy Comparisons and Purchases

- How to Become a Life Insurance Agent in India?

- How to Download the IRDA License Certificate Online?

- Advantages and Disadvantages of Holding an Insurance Broker License

- 5G Implementation Roadmap: How the DoT is Shaping the Future of Connectivity

- Insurance Marketing Firm vs Corporate Agent

- How Many Types of Startup Companies are in India?

- How to Start a WiFi Service Provider Business in India?

- Different Types of Financial Companies in India

- Annual Compliances of Section 8 of Companies Act, 2013

- How Exporters and Producers Can Complete Spice Board Registration?

- A Guide to Start a Payment Service Provider Business

- What is the Landscape of RBI Certified NBFC P2P Lending Platforms?

- PM Kisan Scheme and Beneficiary Status

- Company Incorporation vs. Company Registration

- Different Welfare Schemes in India and Their Objectives

- Guide to Lock or Unlock Aadhaar Biometric Online to Protect Your Money

- What Difference Between a Payment Aggregator License and a Payment Gateway License?

- Bank Account in Malaysia for Indian Entrepreneurs

- Global Categorisation of International Intellectual Property Laws

- Registration Process to Start a Software Company in India

- 52nd GST Council Meeting – GST Amnesty Scheme & Major Changes in Rates of Goods and Services

- Know All About The PM Vishwakarma Yojana

- Articles of Association and Memorandum of Association - Differentiation

- Difference Between ETA and WPC License

- What is the Calibration of Measuring Instruments?

- Exploring the Benefits of Starting an NBFC in the Current Fintech Landscape

- Different Ways for Foreign Businesses to Enter into Canada

- How to Become an Insurance PoSP?

- Guide to Form MGT-14 – Purpose, Types, and Penalties

- LUT (Letter of Undertaking ) Certificate Number in GST

- All About New Payment Wallet License Under PPI

- International Business Environment: Explore Its Types and Benefits

- What is the Difference Between FSSAI and APEDA?

- Why Insurance Audit is Important for Insurance Companies?

- Microfinance Company Registration - RBI Guidelines, Documents & Process

- How to Start a Franchise Business? - Types of Franchise and Benefits

- How Insurance Sales Person Can Become a Partner in an Insurance Marketing Firm?

- Telecom Technology Development Fund Scheme Launched by Prime Minister

- RBI Announced Top 15 NBFCs Under the Upper Layer

- Open House of IRDAI for Insurtech and Fintech Entities

- The Power of SSI Registration: Empowering Small Scale Industries

- The Effect of G20 Summits on the Global Market

- AGR-Return Filing for Telecom Companies in India

- A Guide on Why WPC License is Important to Obtain for Wireless Products

- How to Setup a Consulting Business in Dubai?

- Free Legal Aid Under the Legal Service Authority Act 1987

- The Role of Dealers in India's Weights and Measures Industry

- Visa Choices for Entrepreneurs to start a Business in U.S.A

- Importance of Business Bank Account : Why Open a Business Bank Account in Germany

- Key Functions and Responsibilities of APEDA

- About JIO Financial Services as a Second Largest NBFC Company in India

- How Does Corporate Tax Work in the USA? and Check Out Strategies to Reduce Corporate Tax in the USA

- Key Takeaways from DCIP Recommendations

- ISI Certification vs. BIS Certification: What's the Difference?

- Reward to GST Payers from September 1st, 2023 [Mera Bill Mera Adhikar]

- What is the Money Transfer Service Scheme (MTSS)?

- FAQs on the Digital Personal Data Protection Act, 2023

- How to Find an Investor for Your Business in Singapore?

- Amendment In Import Policy of Items Under HSN 8471

- New Bill on Digital Personal Data Protection 2023

- LLC vs. Corporation: Distinguishing Business Structures

- What are the Standard Products in Insurance?

- How to Register CSC Online?

- Advantages of Forming an LLC Company in the USA

- E-way Bill Registration | Step-by-Step Process and Documents

- Types of Trademark Symbols ™, Ⓡ, ⓒ - Explore their Meaning and Uses

- Advantages of New Startup Registration in India

- Penalties for Violation of FCRA Regulations

- How to Login Beneficiary Identification System PMJAY

- 52nd GST Council Meeting on October 7 on Online Gaming, Casinos and Horse Racing

- Key Steps Involved in Repackaging and Relabeling Business

- How to Register GeM Portal Online

- Mandatory e-Invoice for Businesses with Turnover More Than Rs 5 Crore

- The Evolution of Telecom Licensing: From 2G to 5G and Beyond

- Types of Business License Registration in India

- How to Convert Udyog Aadhar to Udyam?

- Sahara Refund Portal - Check How to Claim Refund?

- Step-by-Step Process to Find Perfect Trademark for Your Brand

- How to Start Agri and Food Processing Firms in India?

- Navigating Udyam Certificate Registration: Benefits, Stepwise Process, and Documentation

- Document Required for Entrepreneur Pass (EntrePass) in Singapore

- Production Linked Incentive Scheme in Telecom and Networking Products

- How to Become Internet Service Provider in India?

- Hong Kong Company Incorporation Documents Checklist

- 11 Benefits Why You Should Open a Company in Hong Kong

- Common Mistakes to Avoid During Registration of Newspapers for India

- Top 10 Finance Companies in India

- How to Start a Food Packaging Business in India?

- Understanding the Telecommunications Industry and the Role of a Telecom Consultant

- NBFC License vs. Bank License: Understanding the Differences and Similarities

- What is an offshore company and its Benefits?

- What is Mobile Virtual Network Operator (MVNO)?

- The Benefits of Operating an ISP License

- Understand the Differences between FERA and FEMA

- Who is a Mutual Fund Advisor & How to Become One

- Dubai Mainland vs. Free Zone: Which is the Best Choice for Your Company?

- Roles and Functions of IRDA in the Insurance Sector

- Apply Ayushman Bharat Card Online - Eligibility, Procedure

- Petrol Pump License - Eligibility, Procedure, Fees

- Comprehensive Checklist Of Legal Requirements For Startup Business Registration

- Steps to Follow Before Filing an ITR Return

- Company Registration in Gurgaon

- What are the Objectives of FEMA?

- How to Register a Company in Mumbai

- How Does RNI Registration Strengthen Credibility and Trust in Journalism?

- New SEBI Regulations on the Execution Only Platform (EOP) for Direct Mutual Funds

- What is FPO Mark & How to Get FPO Certification

- Appeal Against the NBFC License Cancellation in High Court

- Register a Company in Bangalore

- Understanding the Types of IRDAI License: A Comprehensive Guide

- Full Process to Register a Company in Delhi

- Navigating the Landscape of Certification Marks in India: Types and Significance

- How To Raise Funds For NGO In India?

- How to Start Your Business in Dubai with 100% Ownership?

- Which Type of Exporters and Other Entities Can Register Under MPEDA?

- Why MPEDA Catch Certificate is Important for Marine Product Exporters?

- Fair Practices Code (FPC) for NBFC- Microfinance Institutions

- RBI Guidelines for E-Commerce ISNPs

- How is Insurance Web Aggregator Different From Insurance Broker?

- The Importance of Corporate Agent License for Business

- Which Certification is Required For Packaged Commodities?

- What is the Purpose of the TEC / MTCTE Portal? and Certification Schemes Under MTCTE

- Reasons Behind NBFC License Cancellation

- The Significance Role and Advantages of IRDA Broker License Consultant

- The Importance of Obtaining a Wholesale Drug License for Pharmaceutical Businesses

- Why Register A Business Name In Ontario?

- A Comprehensive Guide to Start a Telecommunication Business in India

- IRDAI Rule and Regulations For Insurance Companies

- How a Telecom Consultant Can Help Companies Save Time and Money?

- What is a Shop and Establishment Registration Act?

- Corporate Agent License VS Individual Agent License

- How To Get Telecom Equipment Dealer License in India?- Process , Documentation and Eligibility

- Ideal Countries for Indian Entrepreneurs to Launch a Business

- What Are The Responsibilities and Duties of a Mutual Fund Distributor License Holder

- How Indian Entrepreneurs Leaving Their Mark on London ?

- What are The Benefits of Free Zones Company Incorporation in Dubai

- What's the Difference Between an Insurance Broker and an Agent?

- Categories of ISP License in India

- A Comprehensive Guide on Model Approval Certificate

- Top 5 Business Licenses and Permits in India

- What are the Different Types of NBFC Licenses Available and Their Specific Requirements?

- Choosing the Right Insurance Broker: Key Factors to Consider

- How APEDA Membership Can Help to Enhancing Export Business

- How to start a currency exchange business in India?

- The Top Strategies to Grow a Successful Insurance Marketing Firm

- The Ultimate Guide to Making Your Career as a Mutual Fund Distributor

- Setting up a Private Limited Company in the BVI: A Registration Guide for Entrepreneurs

- Monetize Your FinTech Ideas with Money Wallet License

- Top 5 manufacturing and Packing business in India

- The Role of Mutual Fund Distributors in Investment Management

- What does Agmark certification mean?

- What is ISP License and How To Get It?

- What is the difference between FSSAI and AGMARK?

- Agricultural Packaged Commodities Rule for Packers, Manufacturers and Importers

- How to Become a Mutual Fund Distributor?

- Insurance Marketing Firm: Principal Officer Eligibility Criteria

- Understanding the NBFC License Renewal Process - A Step-by-Step Guide

- How to become SEBI registered investment advisor?

- Checklist of Documents Required for GST Registration

- IRDA licence Cancellation Process Online

- What is the Process for Granting Trusted Telecom Approvals by the Authority?

- ISNP Compliance as per the IRDAI's Directives

- Get To Know the Paybacks of WPC Certification for Manufacturers and Consumers

- Duties And Responsibilities of Insurance Surveyor And Loss Assessor:

- Renewal Process of Insurance Surveyor License

- Legal Metrology Quantify Instrument's reliability

- Advantages and Disadvantages of Sole Proprietorship Registration

- Legal Metrology Product Stamping and Inspection

- Associated Models for getting Certificate from Telecommunication Engineering Centre

- Benefits of Health Insurance Broker License

- Documents required for Insurance Broker License registration in India

- Legal Metrology Act: About Dealership Certification

- IRDAI's Guidelines for an Insurance Surveyor and Loss Assessor

- Benefits of Obtaining a Network License in India

- What is a Co-Packer Company?

- Advantages of registering to a Public Limited Company in India

- What Benefits of Using IPLC License for International Business Operations?

- Extended Producer Responsibility: Plastic Waste Management Rules

- Restrictions & Provisions for FDIs from India’s bordering countries

- Which services are allowed under the PM-WANI Framework?

- LMPC Guidelines for registration of Import Licenses in India

- How do Insurance Companies work & earn their revenue?

- Benefits of registering a Nidhi Company with the Ministry of Corporate Affairs

- Top Five Businesses in Germany opted by Foreign Nationals

- IRDAI issues Commission Payment regulations for Insurers: Learn all about it

- Challenges faced by Insurance Marketing Firms & How to overcome them?

- Why must you convert your Pvt Ltd Company into an OPC?

- Understanding Dubai's Tax System for Business Owners

- Benefits of Producer Company Registration to Farmers

- Why must Foreign Nationals opt for Company Registration in BVI?

- What are the benefits of registering a Company in Singapore?

- SOP for processing FDI proposals at Foreign Investment Facilitation Portal

- Monetary Requirements for VNO Operators of Unified License

- Importance of Dealer Certification in India for Weights and Measures: An Overview

- Bharat 6G: Government's plan to implement 6G by this decade

- A Complete Guide to register a Sole Proprietorship in Canada

- Procedure for applying for Insurance Broker License in India

- Benefits of applying for a Media Gateway Approval in India

- Six Types of Company Registrations in India

- Centre for Policy Research's Foreign Contributions License has Suspended

- A Comprehensive Guide to Company Registration in Hong Kong

- MPEDA boosts India’s Seafood Export Market with Seafood Expo 2023 Participation

- Compliance Checklist for ISP-licensed Company in India

- Register your Business as a Company in Foreign Countries

- What is the Incorporation of a Company?

- Types of Company Incorporations in the USA

- APEDA and its role in promoting Agricultural and Processed Food Exports from India

- Kinds of Trademark Filing Forms

- Role of Registrar of Companies in the Incorporation Process

- A Comprehensive Guide to Legal and Regulatory Requirements for singapore companies

- Future of Nidhi Companies in India: Opportunities and Challenges

- How can Foreign Nationals register for a Company in Singapore?

- Full Fledge Money Changer: Eligibility and Documentation

- Converting a Partnership Firm into a Private Limited Company

- Best Practices for Managing & Maintaining an ISP License

- Amazon VAT Registration in Germany

- Common Mistakes to avoid when registering a Company in Dubai

- Why is the WPC Certificate Important for Electronic Products in India?

- How do I link my PAN Card with an Aadhaar card before the deadline?

- Types of Telecom Licenses in India

- Understanding the Importance of Agricultural Products License in India

- Everything you need to know about Insurance Surveyors

- How to Start Spices Export Business in India?

- Benefits of APEDA Registration for Agricultural and Processed Food Exporter

- What is the CPCB EPR Plastic E-waste Registration?

- How to get Wholesale Drug License in India?

- Discover the Step-by-Step Process of Registering a Company in Dubai

- Application Journey of Packers and Manufacturers

- Revised DOT Guidelines for IP-1 Registration

- How to Start a Fish Export Business in India?

- Understanding the Legal Requirements for Nidhi Company Registration

- Producer Company Compliance Checklist: Everything You Need to Know

- FCRA Compliance for NGOs in India

- German Trade Register

- Step by Step Procedure to Incorporate a Company in India

- Future of Company Registration in Dubai and its potential for Business Growth

- Types of Trademark Application

- What is APEDA, and why is it important for businesses?

- Nidhi Company its Process for Incorporation and Restrictions

- The Dos and Don'ts for Insurance Marketing Firms in India

- Types of Corporations for Company Registration in Canada

- Maximize Your Internet Service Provider Business Potential with ISP License

- Quantity Inspection and Error Handling of Packaged Commodities

- Benefits of working with a Telecom Consultant for Business

- Guidelines for Indian Submarine Cable Landing Station by DOT

- Corporate Structures for Company Registration in Dubai, UAE

- Effects of New Tax Regime on Insurance & Investments sectors in India

- Why must we opt for Company Registration in the USA?

- Foreign Direct Investment (FDI) in Private Limited Company

- Union Budget 2023: What's there for the Entrepreneurs, Farmers, and Middle Classes?

- Brand Name Registration Process in India

- Startup20: Initiative to boost Startup Registration in India

- More on Union Budget 2023-24: The Good, the Bad, and the Ugly

- Union Budget 2023 Key Highlights: Major Budget Announcements

- Required Documentation for Company Registration in Dubai

- Unresolved Mystery of Service Tax or VAT on Trademark Assignment

- How to start a Business in the UK ?

- Why must one apply for Trademark Infringement services in India?

- Lifting of Corporate Veil in the Company Law

- Company Registration Procedure in the USA

- How to start a Business in Malaysia for Indians?

- Exploring the Demand for a Demonstration License in showcasing Technology

- ISP License: How to start a broadband business in India?

- Complete Guide to Procedure of Filing Annual Return

- Business Registration in Canada for a Non-Residents

- What is the Difference Between Mutual Funds and Nidhi Company

- Which License (s) is required for Manufacturing Business?

- The Importance of Timely Trademark Renewal: Safeguarding Your Brand

- Company Registration in the USA for non-resident Indians

- Guidance for Indian Entrepreneurs to Register a Company in the USA

- Compliance Checklist for Investors

- TEC-Telecommunication Engineering Centre

- Logo Registration Fees | Logo Registration Process

- What Are The Benefits of Private Limited Company Registration?

- What is Offshore Company in Dubai?

- What Are The Features and Objects of Section 8 Company

- How to Appoint an Auditor in India's Private Limited Company

- How to Close a Company in India?

- What are the Steps for Filing DOT OSP Compliance

- What is the process of Import License in India?

- What is Mainland Company in Dubai?: Registration Checklist

- Investment Facilitation Portal: FDI's Eligible Investors

- Code of Conduct for Corporate Insurance Agent License holder

- Legal Metrology Rules for Packaging Commodities-2023

- Registration of Firm in Partnership Act: Complete Procedure

- What is Free Zone Company in Dubai?

- Society Registration: Purpose of setting up a Society in India

- Post-Registration DoT Compliance Checklist for Telecom Companies

- Grounds of which Examiner rejects Company Logo Registration

- Procedure of Acquiring a TAN Number for a Company

- What qualifies you to get a DOT IP-1 Registration in India?

- How Can You Differentiate Between a Service Mark and a Trademark?

- Motor Insurance Surveyor Registration Process in India

- Legal Metrology License: Quantity Declaration on Packages

- Details & Documents Submission for Company Registration

- How to open a Company in Canada?

- How to file GST returns in India?

- How to get SACFA Approval for Site Registration from SACFA committee?

- Why Should Obtain ISO 9001 for My Business?

- Business Setup in Dubai: Benefits of Free Zone Registration

- Insurance for all: GoI's Vision 2047 for the Insurance Sector

- How to file Annual Returns for a registered Company?

- What are the Consequences of Not Filing Annual Return?

- Legal Advice for Startup Company in India

- Documents required for Trademark Registration

- How to Check the Registration Status of a Company?

- General Insurance Broker License Acquiring Qualifications

- Trainee Registration on the BAP Portal

- What is the process of Trademark Registration in India?

- LMPC issued-regulations for the Dealer Certification

- What can be Patented in India?

- LLP VS. Private Limited Company

- How to Sustain Your Business?

- How Does one register for the ETA WPC Certificate with DoT?

- How to register a Logo Trademark in India?

- How to Check Company Name Availability

- Import License in India: Why was it sought during COVID?

- How to copyright a Logo or a Name in India?

- How to declare details on the packaging material?

- What is the TEC Certificate Number? How to register for it?

- What is the Procedure to Register a Private Limited Company

- Check out the Broadcasting Regulations Amendments Clauses

- Producer Company: Objectives, Registration, & Required Documents

- Telecom Consultant: for all DoT registration-related queries

- What is the Difference between TM and R Trademark Symbol in India

- Annual Compliance Checklist for Companies in India

- Transitioning from Private to Public: The Initial Public Offering Process

- Why is it imperative to timely file IRDA's ISNP Compliance?

- What is expected of an Insurance Surveyor and Loss Assessor?

- TRAI's Recommendations for Data Centres to render ISP services

- VNO License Fee Structure per the Unified License Agreement

- Documents required for Trademark Assignment In India

- Post Incorporation Compliance for a Company

- Trademark Logo: Types of Logos and their Classes in India

- How can a Demonstration License help you with Telecom world?

- Copyright for Online Environment

- Legal Metrology Packaging Registration: Amendment Rule October 2022

- Remuneration allowed to Limited Liability Partnership

- What is the licensing fee required for the IPLC Licensee?

- How to Remove a Director from the Private Limited Company?

- How to Check FSSAI License Number Online

- Depositor Protection Issues in a registered NBFC

- Holding Company and Subsidiary Company relationship in India

- Forex Trading License Requirements

- Penalty for Late Filing of Annual Return of Company

- DPL-NDPL License in India

- What is Digital Signature Certificate

- How to register a Section 8 Company in the country?

- Appointment of Women Directors for Companies

- What did the Government envision with the Startup Registration in India?

- Annual Compliance Checklist for Startups

- What cannot be a publication's title in RNI Title Registration?

- Common Reasons for Company Name Rejection

- What is Deceptively Similar Trademarks Case in India | Brief Example

- What Are The Powers Of NCLT

- DoT Regulations to be observed by the Maritime Approved Telecommunication Companies

- What Is The Liquidation Process Under IBC

- Duties & Responsibilities of a Trustee in a Trust Registration

- What is the ISO Certification Process in India?

- How to opt for Nidhi Company Registration in India?

- Raising Funds for Private Limited Company

- Reply to a Trademark Examination Report

- Checklist for Due Diligence of Company

- LLP Compliance Post Incorporation

- How to Renew Your FSSAI Food License?

- Know all about Media Gateways in India

- ISO Certification Procedure in India

- NABARD Loan for Producer Company

- Partnership Firm Formation and Registration in India

- Different NBFC Licenses for different purposes

- Business Registration in India- Is it Really Worth It

- Foreign Investment Facilitation Portal: Bringing verified FDIs to Telecom

- What is the Process or Procedure of Patent Registration in India?

- Advantages of One Person Company Registration

- Why are Trademark Investigation Services a Necessity for Businesses Today?

- Important facts of Copyright

- Payment Wallet: Financial Instrument taking over the Country

- LLP registration for NRI and Foreign Nationals

- What is the Difference Between Utility Patent and Design Patent?

- Best Practices and Regulations for legal metrology Products

- Benefits of Startup India Scheme

- Is Company Registration Now Free of Cost?

- Insurance Surveyor: What does IRDA expect a Surveyor to do?

- NLD and ILD: Points of Similarities and Differences You Need to Know

- International Copyright Registration

- Alteration to Registered Trademark

- IPLC License: Monetary requirements for IPLC registration

- Role of Promoters in Company Law

- Importance of Copyright over Trademark

- Complete Procedure for Network License Registration in India

- Assignment of Copyright in India

- Madrid Protocol an International System for Trademarks Registration

- Dealer License: How to get a Dealer's License in India?

- Ways to Close / Dissolve a Partnership Firm

- Foreign Direct Investment is a boost for Start-Ups in India

- How you can get the colour trademark registration in india

- One person company compliance in India

- Difference between Trademark Objection and Trademark Opposition

- Restoration of the Expired Trademark

- Process of Online Subsidiary Company Registration in India

- New Exemptions Granted to Private Limited Companies

- Trademark Renewal: Renew your Trademark Before its Expiry

- How to Register Right Trademark?

- How to Choose the Right Business Entity

- Steps for Inspecting Documents of a Private Limited Company

- How to Get a TAN Number for a Company?

- Registration of One Person Company(OPC) Is Good Decision

- Procedure of Changing the Name of Company under Companies Act 2013

- What are the Basic Payment Gateway License Requirements?

- Types of Insurance Brokers in India

- What are the Essentials of an LLP Agreement?

- 10 Reasons why start-ups should choose One Person Company

- Maintaining Statutory Register of the Company

- Renewal of Insurance Broker License, before License expiry

- Why is the Procedure of ISI Mark Registration Important?

- What is BEE certification and how it can enhance your business?

- How new IPR policy is start-up friendly

- RNI registration is the need of the hour that we deliver

- Procedure for change in object clause of the company

- Trademark Objection: Its Grounds and Way to File a Reply

- Compliances for Foreign Companies in India

- Tips to Start your Own Company

- How to Close a Private Limited Company?

- Why Copyright Registration is required?

- How to renew a trademark in India

- How is Animation Protected under the Copyright Laws?

- What is Copyright Infringement in India?

- Documents Required for Company Registration in India

- What is the Cost of Patent Registration in India?

- What are the Minimum and Maximum Directors of a Company

- Simplified Proforma for Incorporating Company Electronically (SPICe)

- The Procedure of Online Trademark Registration in India

- Trademark/Brand Licensing in India

- What is Patent Provisional Specification?

- Why do people need ISO Certification?

- Trademark Registration in Raipur: Apply for the Logo at Home

- Name Approval Process of Private Limited Company

- International Trademark Registration

- Step by Step Process of Copyrighting a Book

- How to start an NGO in India?

- Sound Trademark in India

- Required Documents for CDSCO Registration in India

- What is Intellectual Property Rights(IPR) and types of IPR in India?

- Start(up) Making Money

- Section 8 Company: Conversion of a Sec 8 into other models

- Know new rules of company name approval

- RNI registration: Documents required for Renewal application

- Different Types of Patent Applications in India

- Nidhi Company: Know how to register a Nidhi Company in India

- Let's Prepare Board's Report

- How to increase Authorised Share Capital

- Restrictions on Nidhi Companies

- Why trademarks are important for businesses to be successful

- NRI Shareholders Incorporating in a Pvt Ltd Company in India

- Corporate Frauds - A Nagging Issue in a Private Ltd Company

- Insurance Marketing Firms, Don’t Mis-Sell Insurance Policies

- 5 things to keep in mind before paying Advanced Tax

- Trademark Opposition in India: The Complete Guide

- Board Meeting, Annual General Meeting & Extra-ordinary general meeting

- How to calculate AMT in LLP ?

- Annual Filing Checklist

- Google to facilitate Startups in India

- Requirements for MSME Registration in India

- FSSAI Registration and the Documents Required to Obtain It

- Appointment of the Auditor

- Trademark Assignment: How to apply for Trademark Assignment?

- Difference between Import Export Code (IEC) and Import License

- Why Should People Choose Nidhi Company?

- How to Close an Inactive Company under Companies Act 2013?

- Private Limited Company Registration Requirements

- Trademark Infringement: Famous Infringement cases in India

- Trademark is not equal to Copyright

- Section 8 Company Activities

- How To Apply For Copyright Protection in India?

- Documents Required for Patent Filing or Registration in India

- Section 8 Company and Its Registration Procedure

- How to start Food business in India

- Infringement is an issue for the Tech Giant Facebook as well

- How to use Trademark correctly

- Eligibility and Process for Registering Non-governmental organization

- What is Company Compliance Requirement

- What is the Auditing Process of ISO?

- Few words of Wisdom for startups

- Benefits of Design Registration over Trademark Registration

- What is Trademark Restoration Process In India

- How to Rectify your Already Registered Trademark?

- Types of Companies under Ministry of Corporate Affairs

- Types of Registration for Foreign Contributions in India

- Benefits of ISO Certification for Your Business

- Government Suspends Registrations of 156 Different NGOS

- How to Surrender Director Identification Number (DIN)

- Trademark your Business to Make your Mark

- Procedure to Shift Registered Office from One State to Another

- Government Initiatives for Startups In India

- Documents for Section 8 Company Registration Process

- Why should entrepreneurs prefer one person company?

- How to Get ISO Certification in Bangalore?

- Compliances That You Should Do After Incorporating A Company

- Adani confirms its participation in the 5G spectrum race

- What are the Advantages of Registering a Section 8 Company

- Challenges when getting ETA License and how you can overcome them

- 7 Main Reasons behind Trademark Application Rejection

- Managing Trademark Objection

- Mandatory Company Registration

- How to Become a Paytm Seller

- Different Types of Shares In a Private Limited Company

- Difference Between Unregistered And Registered Trademarks

- How Many Directors are required in a Section 8 Company

- Relaxation to Private Limited Companies

- Tweaking in Deposit Rules to aid Startups

- A Comprehensive List of Required Documents for NGO Registration

- All about FSSAI Rules & Regulations

- What are the Documents Required For OPC Registration

- Conversion of LLP into Private Limited Company

- List of All the Major Compliance Requirements of a Company