Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

13 Common Travel Insurance Questions and Misconceptions Answered

Travel insurance is one of the most important things you’ll buy for your trip — no matter how long you are going away for. It is a must-have and I never leave home without it.

Yet so many travelers I talk to travel without it — often because they don’t quite understand what it is and what it does. There are a lot of misconceptions about travel insurance out there and those misconceptions are putting people in danger.

Today, I want to address those questions, concerns, and misconceptions.

Personally, I always buy travel insurance when I travel. After all, we get home insurance, life insurance, health insurance, and car insurance. Why would we not cover ourselves when we’re abroad?

Travel insurance was there when I popped an eardrum in Thailand .

It was there when I broke my camera in Italy .

It was there when a friend had to go home after her father died.

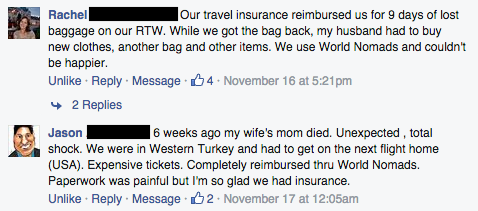

And it was there for these people too:

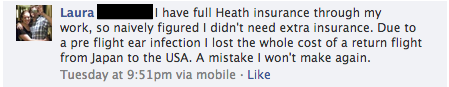

But not this person who decided not to get it:

Buying travel insurance is a must. But since it is a confusing topic (try reading New York insurance law for fun. I did. It’s not fun), today I want to answer the common questions about travel insurance. These questions pop up in my inbox all the time and are the greatest points of confusion on the subject.

Table of Contents

- What is Travel Insurance?

- Is Travel Insurance Just Health Insurance?

- Can Go See a Doctor When I Want?

- Can I Get Treated for an Illness I Already Have?

- My Credit Card Offers Some Protection. Isn’t That Good Enough?

- How Does Insurance Actually Work?

- What About Obamacare

- Why Are the Reviews Bad?

- I Got Drunk and Hurt Myself. Will I Be Covered?

- Does Travel Insurance Cover Me in My Home Country?

- I’m a Senior. What Should I Do?

- Will Travel Insurance Send Me Home If I Get Injured or Sick?

- What About COVID-19?

- My Recommended Travel Insurance Company

1. What is Travel Insurance?

Travel insurance provides support, compensation, and medical care when things go wrong on the road. Depending on your policy, it could provide support and compensation if your luggage is lost, if you slip and break a bone hiking, or if you need to return home early due to a death in the family.

It’s a financial safety net for emergencies while you’re abroad.

Contrary to popular belief, travel insurance is not a substitute for health insurance in your home country — nor is it a license to be foolish! (Also, travel insurance pretty much unilaterally excludes any mishaps that occur while you’re under the influence of alcohol or drugs.) It’s your emergency parachute should something terrible happen while you’re traveling.

2. Is Travel Insurance Just Health Insurance?

No, it’s so much more than that. While there is a medical component for sudden illnesses and accidental injuries, it can also cover all sorts of additional incidents, such as:

- Trip cancellation

- Lost/Damaged/Stolen possessions

- Emergency evacuation

- Expatriation should there be a natural disaster

- Trip interruption or delay

Travel insurance is for all-around emergencies, not just medical ones.

3. Is Travel Insurance Similar to Health Insurance? Can I Go See a Doctor When I Want?

Travel insurance is not a replacement for health insurance. It’s there for unexpected emergencies only, not regular checkups. And should you need to be sent home due to a health emergency, it will be your regular health coverage that kicks in once you’re back in your home country.

For that reason, you’ll need to make sure you have both travel insurance (for when you’re abroad) and regular health coverage (in case you get sent home with an injury)

Break a leg? Pop an eardrum? Get food poisoning or dengue? Travel insurance has you covered.

Want to go see a doctor for a physical or get a cavity filled? You’re on your own.

(If you’re a digital nomad or expat, check out SafetyWing and Insured Nomads , which both have plans that are akin to health insurance.)

4. Can I Get Treated for an Illness I Already Have?

As a general rule, most travel insurance plans don’t cover pre-existing conditions. If you get sick on the road, travel insurance is there for you. But if you need medication for an ongoing chronic disease or a medical condition you knew of before you bought the policy, you could be out of luck.

Moreover, if you get sick under one policy and then you extend it or start a new policy, most insurers will consider your illness a pre-existing condition and won’t cover it under your new policy.

In short, pre-existing conditions are generally not covered unless you find a specific plan that provides coverage for them.

5. My Credit Card Offers Some Protection. Isn’t That Good Enough?

Travel credit cards , even the very best ones, offer only limited protection. Some cards offer coverage for lost or stolen baggage, delays, and trip cancellation — but only if you booked your trip with that specific card.

In my experience (and I’ve had dozens of travel credit cards over the years) even if your card covers some things, that coverage limit is often very low. Plus, very few cards cover medical expenses, and even those that do provide limited coverage. This all means you’d have to pay out of pocket (and you’ll be surprised at just how expensive that can be!).

Bottom line: don’t rely on credit card coverage. While it’s nice to have its protection as a backup, I wouldn’t (and don’t) rely on credit cards for my primary coverage when abroad. It’s not a smart choice.

6. How Does Insurance Actually Work? Do They Mail Me a Card I Can Show the Doctor?

If you experience a major medical emergency that requires surgery, overnight hospitalization, or emergency repatriation, then you (or someone else) would contact your travel insurance company’s emergency assistance team. They can then help make arrangements and approve costs. Every insurance company has a 24-hour contact number you can call for emergencies. I always suggest travelers save this number in their phone before departure just to be safe.

For all other situations, you need to pay for the costs upfront, collect receipts, and then make a claim for reimbursement from your insurer. You’ll pay out of pocket and then submit documentation to the insurance company after the fact (so there’s no need to show a card to the doctor).

Be sure to keep all documentation, file any necessary police reports, and save all receipts. Companies don’t reimburse you based on your word. Keep documentation!

7. What About Obamacare? How Does That Affect Everything?

For Americans, the ACA, or “Obamacare,” covers you only in the United States , and since travel insurance is not a replacement for health insurance, it doesn’t get you out of any state-based requirements for health insurance.

While there is no longer a nationwide tax penalty for not having health insurance, some states still do charge one. Be sure to contact a tax accountant or the ACA hotline number for more information.

Also keep in mind that, if you need to be sent home due to an injury, travel insurance will not cover your bills upon arrival back to your country of residency.

8. I Read Reviews Online. All These Companies Suck. What’s Up With That?

I’ve talked with hundreds of travelers over the years about insurance and received thousands of emails from people who have had insurance issues. While there are some legitimate concerns, the overwhelming majority of people I interact with haven’t read the fine print of their policy. People buy a plan, don’t read the exact wording, and then make (incorrect) assumptions about their coverage.

Naturally, they scream bloody murder when their assumptions don’t match up with reality and go on a digital tirade, leaving bad review after bad review.

And, to be honest, most people don’t write good reviews when they are helped. On the Internet, we love to scream our displeasure but rarely do we go out of our way to leave a positive review of something.

So take online reviews of insurance companies with a grain of salt. I’ve read them and most of the time, I think, “You didn’t read your policy!”

I’m by no means an insurance company defender, but if you’re going in with no documentation, no proof you owned what you lost, or you want to make a claim for something that is specifically excluded on the policy, you should expect to get denied.

Is the reimbursement process fun? No. It’s a lot of paperwork and back-and-forth emails with the insurer. But when you have all your ducks in a row, you get reimbursed.

Here’s a list of my suggested insurance companies to help you get started . They’re reputable and reliable and can save you a lot of money should an accident happen.

9. I Got Drunk and Hurt Myself. Will I Be Covered?

Probably not! If you are doing something foolish (whether you’re drinking or not), insurance companies will want to know if putting yourself at unnecessary risk led to the injury. If, after investigating, they find you did, they can deny your claim. That’s not to say that they expect you to be sober your entire trip, but let’s just say you’re unlikely to get reimbursed if you’re drunk and decide that it would be a good idea to stand in the middle of the road and play chicken.

So, don’t be foolish!

10. Does Travel Insurance Cover Me in My Home Country?

Some travel insurance can cover you at home. For example, World Nomads travel insurance covers you either 100 miles from your permanent address (for U.S. residents), outside your home province (if you’re Canadian), or outside your home country (for everyone else).

It depends on your policy, and there are always conditions on when the coverage starts and ends and where you can travel to, so check this carefully first. Some companies let you be in your home country for a short period, others won’t cover you at all. So read the fine print!

11. I’m a Senior. What Should I Do?

Unfortunately, insurance companies don’t like covering seniors as they view them as high risk. Therefore, it’s a lot harder for older travelers to find comprehensive coverage. For seniors, use Insure My Trip , an online marketplace that searches over 20 different insurance companies to help you find the best policy for your needs. It’s the best place to get insurance for anyone over 65. Just expect prices to be much higher than policies for younger travelers, as older travelers pay a premium due to their age.

You can read more about travel insurance for seniors in this post .

12. Will Travel Insurance Send Me Home If I Get Injured or Sick?

Under most circumstances, travel insurance will not repatriate you to your home country. In a nutshell, travel insurance is there to make sure you get the medical assistance you need should an emergency arise. Usually, that means sending you to the nearest acceptable facility — they don’t have to send you home.

So, if you break your leg hiking you’ll be taken to the nearest suitable facility and patched up. After that, the onus is on you to get home. Your policy will likely reimburse you for any part of your trip that you cancel due to your injury but it won’t pay for you to go home early (unless you have a life-threatening injury that requires advanced medical care).

If you feel this isn’t enough coverage and want additional medical transport and repatriation coverage, use a service like Medjet . They’re a membership program with affordable annual (and short-term) policies that include medical transport coverage that’s more comprehensive than what you’d find in your average travel insurance policy.

You can learn more about the program in my Medjet review.

13. What About COVID-19 and Other Pandemics?

As many found out the hard way in 2020, travel insurance historically has not covered pandemics. While many companies have made changes to their pandemic coverage (such as SafetyWing and Medjet ), pandemic and COVID-19 coverage is not universal.

Be sure you understand exactly what COVID/pandemic coverage is offered before you book. Specifically, you’ll want to know whether you’re covered only for medical issues or if you have cancellation/trip interruption coverage as well.

For policies that give blanket coverage (i.e. “cancel for any reason” policies) check out Insure My Trip .

The #1 Travel Insurance Company for Travelers

My favorite travel insurance company is SafetyWing . SafetyWing offers convenient and affordable plans tailored to digital nomads and long-term budget travelers. They have cheap monthly plans, great customer service, and an easy-to-use claims process that makes it perfect for those on the road.

I use them because I can purchase and renew my insurance policy online in a matter of minutes, they have a very friendly and responsive staff who answer questions and help solve problems via social media, they have great customer feedback, and most importantly, they provide a lot of coverage at a super affordable price.

I’ve used travel insurance since my first round-the-world trip , and it’s helped me, my friends, and readers of this website. I can’t stress its importance enough.

I can also not stress enough that you need to read the fine print of your plan. Remember, travel insurance companies are for-profit. They will only reimburse you if your situation fits within the scope of your policy. The only way to know if it does is to read your plan.

Having had to use my insurance several times over the years, I genuinely hope you’re never put in a situation where you need to use yours. However, if something does happen and you need to make a claim you’ll be happy you spent the money.

Don’t avoid buying travel insurance because you read a bad review or think you’ll be OK. Accidents happen to the best of us.

Travel insurance is a safeguard against the unexpected. So, be prepared. You won’t regret it.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip? Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

Get my best stuff sent straight to you!

Pin it on pinterest.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Home Country Coverage Explained

What is home country coverage in an international health plan.

When purchasing international health insurance or travel medical insurance , you may notice a benefit referred to as Incidental Home Country Coverage or Incidental Trips to Home Country . International medical insurance is are designed to cover you outside of your home country (depending on the area of cover you choose), but the added benefit of incidental home country coverage will give you some coverage for emergency medical treatment if you sustain an injury or get sick while on a brief and unplanned trip back home. The Incidental Home Country benefit varies by plan. Some plans only offer a maximum of 14 consecutive days per policy period while others, like the Seven Corners Travel Medical plan, offer five days for every 30 days of coverage purchased, up to a maximum of 60 days. Also, the benefit levels might be slightly reduced for incidental trips home, but then become the same as before when you resume your trip abroad.

Home Country Coverage with International Health Plans

International health insurance plans will cover you within the select area of coverage you choose at the time of purchase. Depending on where you are from and where you will be living, your home country may not be included in that area of coverage. Many plans offer emergency coverage for specific amounts of time when visiting home for leisure, business, or pleasure. You need to assess your need for home country coverage when purchasing an international health insurance plan and check to make sure you have the coverage you need in the areas you want it.

Incidental Home Country Coverage in Travel Insurance Plans

Individuals who have been abroad for either business or pleasure know that the need to return home for brief periods of time during their coverage period sometimes occurs without warning. There is always the possibility for a work-related emergency back home to occur or an unexpected personal event of a friend or family member’s such as pregnancy, funeral, or wedding to come about that you do not want to miss due to your travels.

If you will be traveling abroad and are shopping for international travel medical insurance that will also cover you back home in the event that you need to return for a short period of time during your journey, one popular plan option is the Atlas Travel Insurance plan .

The Atlas Travel Insurance plan includes an incidental home country coverage benefit that provides 15 days of home country coverage for every three months of overseas coverage purchased. Although this benefit can’t be used for trips home that are taken specifically to receive care, it will give the covered individual protection for any eligible illness or injury that may occur while on their trip home. The 15 days of incidental home country coverage are able to be used within the three-month period that the days are earned.

The Atlas Travel Insurance plan can be purchased for a minimum of 5 days, up to 364 days with the option to extend coverage. Other benefits included in the Atlas Travel plan include emergency medical evacuation, hospitalization, emergency dental, emergency reunion, acute onset of a pre-existing condition, hazardous sports coverage, accidental death and dismemberment, natural disaster benefit, and repatriation of remains, lost checked luggage, and outpatient coverage.

If you would like to purchase international travel insurance that includes a home country coverage benefit, you can view more Atlas Plan details or contact one of our licensed agents today.

End of Trip Home Country Coverage

A different type of benefit you might be interested in is for the end of a long trip abroad, it is called End of Trip Home Country Coverage . This is important because some travelers may no longer have coverage under their domestic insurance plan and may not be able to re-enroll for a month or more. A continuation of the international health insurance plan in your home country will allow you to receive medical treatment if you sustain an injury or become sick after returning home. The length of coverage available depends on the number of months of international coverage purchased. Typically you will have had to purchase a minimum of five months of international travel insurance to be eligible for one month of Home Country Coverage. Travelers who are planning to stay abroad internationally for an extended period, whether it be for business or students who are studying abroad, should consider a travel plan with these benefits. Long-term travelers should consider this home country coverage because the possibility of sick relatives, weddings, or urgent business back home could require a trip back home on short notice. Students studying abroad should consider home coverage because of school breaks or an urgent matter that could need them to return home.

Some insurers reduce the covered expenses for Home Country Coverage. Be sure to read your policy thoroughly or ask one of our Brokers for clarification.

International Citizens Insurance offers several travel medical plans with benefits to suit your particular needs. Here is a list of benefits for each travel medical plan:

International Medical Group

Hcc tokio marine, seven corners.

If you have any questions about Home Country Coverage that we haven’t answered above, please contact our support team or request a free quote and include your question in the space provided.

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

Residency and Travel Insurance

December 11, 2018 By : Administrator

Answering Your Travel Insurance and Residency Questions

You’re shopping for a travel insurance plan, but you’re confused about how your decision could be impacted by the place where you live, your citizenship status, and your travel destination. You’re not alone. We have received many questions from clients about how their country of residence and country of citizenship affect their travel insurance purchase. We’ve provided some answers to the most common travel insurance and residency questions below to help you make the right decision.

If you’re unsure about any of this information, we urge you to contact an insurance expert at Good Neighbor Insurance. We’ll be happy to help!

Do International Insurance Plans Consider My Home Country Based on My Citizenship or Where I Live?

Some international insurance plans are based on citizenship (your passport) and others are based on residency (where you live). Many long-term health plans are based on citizenship, while short-term travel plans are generally based on residency. Of course, the country you live in may be different from your country of citizenship. It’s important you pay attention to which one the insurance plan is requesting.

How Will an Insurance Carrier Determine my Country of Residence?

Insurance carriers may determine your country of residence in different ways. Some may define your country of residence by where you have lived for the past six months, or where you live for most of the year. Other carriers may define it by where you are currently receiving mail, or by the country that you are living in when you apply for insurance.

Your country of residence will not be a country you may have visited on a short-term basis, whether for business, leisure, or visiting family. Your country of residence is usually the place where you would want to be sent back home should you need to be evacuated for medical reasons or should you interrupt your trip. For example, if you are a U.S. citizen residing in France and you decide to take a trip to Thailand, you should buy travel insurance as a French resident.

Please ask the insurance carrier for clarification, or reach out to us, and we are happy to help.

How Do I Prove That I am a U.S. Resident?

To be eligible for travel insurance coverage as a U.S. resident, you must have a residential address and unrestricted right of entry into the U.S. You must be able to provide documentation to prove your address in the United States (for example, a U.S. driver’s license, a government-issued ID or a utility bill) and agree to be repatriated, if required, back to the state of residence named on your insurance policy.

Those living in U.S. territories are for the most part regarded as U.S. citizens and residing in the U.S. when filling out forms or travel insurance applications.

What If I Am An International Student or a Foreign National Living in the U.S.?

You may purchase an insurance policy as a U.S. resident as long as you meet the requirements for U.S. residency described above. Otherwise, you should buy your travel insurance policy under your country of citizenship.

What If I’m a Digital Nomad and Change Countries Frequently?

If you are a digital nomad and change countries frequently, you should use your country of citizenship as your country of residence.

Will My Travel Insurance Plan Cover Me in the Country Where I Am Living?

Some travel insurance plans won’t cover you in your country of residence – they’ll only cover you when you travel outside of that country. Other travel insurance plans will cover you at home. It depends on your policy, and there are always conditions on when the coverage starts and ends and where you can travel to, so check this carefully first. Some companies allow you to be in your home country for a short period, others won’t cover you at all.

Can My Travel Destination Impact My Insurance Purchase?

There are fewer residency considerations when you are a citizen of the country in which you live. However, if you are not a citizen of the country in which you live, there are certain factors to consider before buying travel insurance. One factor is your travel destination. Are you traveling back to your country of citizenship? Are you traveling inside or outside the country you reside in? Those answers could make a big difference to your insurance plan, so it’s important to talk with an insurance expert before buying one.

What If I Don’t Have Legal Status in the Country Where I Live?

Insurance companies don’t care about legal status/undocumented immigrants, but only about where claims might be submitted. So illegal aliens can buy and use international travel or health insurance without worrying about questions regarding political status.

Does the State in the U.S. Where I Live Affect My Travel Insurance Plan?

As with other types of insurance policies, every state has specific rules and regulations regarding the types of travel insurance that people can receive in that state. A traveler might find that only certain types and levels of coverage are permitted for purchase in the traveler’s home state. Depending on your residence, the policy may include or exclude benefits, or have different coverages for the same benefit. This is determined by your state’s department of insurance.

For example, whether a traveler can even receive out-of-state or out-of-country medical coverage as part of a trip protection plan depends a great deal on the location of the traveler’s primary residence. As a result, a travel protection plan offered to residents of New York might not be available to residents of Georgia. Additionally, a plan offered to citizens in the United States might not be available to citizens of Canada or Mexico.

Can Residency Impact Trip Cancellation Coverage?

A traveler’s residence can be critical to a traveler that needs trip cancellation coverage. Some insurance plans cover trip costs for travelers who make a cancellation because of a natural disaster that takes place in the area of the traveler’s primary residence. Some plans also cover cancellation if a traveler must cancel after experiencing a serious life event at the primary residence, such as damage or destruction of the traveler’s home or business because of a natural disaster or accident and property theft.

What If I Am Traveling with Someone from a Different State?

If you and your traveling companion are residents of different states, it is best for you to purchase separate travel insurance policies. In the event of a loss, each traveler’s claim will be paid based on the coverage available for their individual residence.

The issue of travel insurance and residency or citizenship can be confusing. Please don’t hesitate to reach out to us with questions! We are happy to serve you.

We hope these answers to your travel insurance and residency questions are helpful to you. Please let us know if you have other questions that were not answered in this post.

Online travel insurance companies that have no physical office, or agents to call on the phone, can make this hopelessly confusing to the simple traveler. This is why we always recommend that you save yourself the headache and call us at (480) 813-9100, or Skype us at “Good Neighbor Insurance” , or click LIVE CHAT , or email us at [email protected] .

Administrator

Search results, waivers and riders – what are those.

September 23, 2009

I’ve been thinking about “waivers” and “riders” and how that might affect a young woman with a busted knee when she tries to buy health insurance. What are her options?

What is a Pre-Existing Condition and Will My Health Insurance Cover It?

Never lie on your health insurance application. You will be asked about your medical history because the insurance company is looking for pre-existing conditions. This short blog will tell you what a pre-existing condition is and how it will affect your ability to get affordable health insurance.

A Look at Healthcare Systems Around the World – England

September 18, 2023

Britain’s health care system may offer “free” health care for its citizens, but most don’t see the hidden costs of such a system.

Buying Health Insurance is Like Buying a Car

April 2, 2010

Bells and whistles on a car increase the cost. So it is with health insurance. Adding benefits only increases your premiums. One way to lower premiums is to increase your deductible and decrease the amount of benefits.

Understanding Pre-existing Medical Conditions

April 23, 2010

Don’t we all have some pre-existing condition? To quote from an unknown author, “No one is perfect…that’s why pencils have erasers.“ So what is a pre-existing condition? Imagine you contact your car insurance agent on a Monday morning to tell him you want to take out car insurance to pay car repairs. The car is now in the garage being fixed because […]

How Much Travel Insurance Do I Really Need?

October 16, 2023

Clicking the “buy insurance” button when buying an online ticket most likely will offer only very basic coverage. This may be fine if your trip doesn’t cost much and if your itinerary is not a complicated one. But if you have multiple stops over a longer period of time with expensive hotel reservations, you may want to consider Trip Cancellation insurance.

- Request a Quote

- Log In / Register

Does My Insurance Cover Me Abroad?

Insurance is, ideally, something you rarely have to think about. You did your research, and you have coverages in place that protect you, your family and your property. But have you ever considered what happens when you leave the United States? Whether it’s that spring break trip to Mexico or a long-awaited tour of Europe, it pays to know what your insurance will and won’t cover while you’re abroad.

Health Insurance

This varies widely by carrier, so you’ll want to do your homework before you leave the United States. The State Department recommends contacting your insurance company before your trip to ask about what medical services overseas are included in your coverage. You might be surprised; some activities that could be considered “risky” (like that ATV tour) may not be covered by your insurer. It pays to check!

Questions to Ask Your Health Insurer:

- If I am seriously ill, does my policy cover an emergency return to the United States?

- Does my policy cover activities like mountain climbing or scuba diving?

- What about pre-existing conditions?

- Does my insurance cover medical payments abroad?

- Will my insurance pay foreign hospitals and/or doctors directly?

What If I Have Medicare?

Medicare does not cover emergency medical services if you are travelling outside of the United States. Check with your insurer about supplemental coverage.

Vehicle Insurance

You can’t assume that the vehicle insurance you rely on in the United States will automatically apply in a different country. If you are planning on renting a car overseas, make sure you have a plan in mind before you arrive. Check with your insurance agent to confirm what is and isn’t covered by your auto insurance policy. Beyond that, you might want to consider additional coverage, which can be found through:

- Your credit card company . Some of these companies will provide rental insurance protection. Whether or not coverage is offered can depend on the company, the country and the type of vehicle you are using.

- A foreign car insurance company. Third-party insurers can be found near national borders, but their policies may not cover theft or personal accidents.

- The rental car company. Be sure you understand what is and isn’t included if you purchase coverage through the rental car company; they may or may not cover things like collision or theft.

Property Insurance

The good news is, most homeowners and renters policies cover you even when you’re not at home. If you lose your luggage or your jewelry is stolen, the coverages you have in place in the United States will typically apply overseas, as well. As always, check with your agent — if the item isn’t covered before you leave the country, you might be out of luck!

What Should I Bring?

When traveling overseas, it pays to be prepared. Consider bringing:

- Name, phone number and address of your primary care physician

- Health insurance company name, phone number and ID number

- Names and dosages of any medications you may be taking

- List of allergies

- Address and phone number of a clinic near where you’ll be staying

Protect Your World While Traveling It

Your vacation should be filled with good memories and a break from the daily grind. If the unexpected does happen, a little extra preparation can make all the difference between a vacation that’s one for the books … and one you’d rather forget. And whether you’re at home or abroad, you can enjoy the peace of mind that comes with having insurance through your Farm Bureau agent . Call your agent today to learn more about how your agent can protect what matters most in your world.

http://travel.usnews.com https://travel.state.gov/content/passports/en/go/health.html http://www.dmv.org/insurance/overseas-auto-insurance.php http://www.bankrate.com/finance/insurance/homeowners-insurance-can-leave-home-with-you-1.aspx

Want to learn more?

Contact a local FBFS agent or advisor for answers personalized to you.

You May Also Like

How to start a garden: a beginner's guide, spring cleaning can help you save money on homeowners insurance, what home improvements add the most value, reduce student loan debt while in college.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Insurance 101: How Travel Insurance Works

What is travel insurance?

Travel insurance is a plan you purchase that protects you from certain financial risks and losses that can occur while traveling. These losses can be minor, like a delayed suitcase, or significant, like a last-minute trip cancellation or a medical emergency overseas.

In addition to financial protection, the other huge benefit of travel insurance is access to assistance services , wherever you are in the world. Our elite team of travel and medical experts can arrange medical treatment in an emergency, monitor your care, serve as interpreters, help you replace lost passports and so much more. Sometimes, they even save travelers’ lives.

A few things you should know about travel insurance:

- Benefits vary by plan. It’s important to choose a plan that fits your needs, your budget and your travel plans. Here are definitions of all available travel insurance benefits.

- Travel insurance can’t cover every possible situation. Allianz Travel Insurance is named perils travel insurance, which means it covers only the specific situations, events, and losses included in your plan documents, and only under the conditions we describe.

- Travel insurance is designed to cover unforeseeable events —not things you could easily see coming, or things within your control. If, for example, you wait to buy insurance for your beach trip until after a named hurricane is hustling toward your destination, your losses wouldn’t be covered.

How does travel insurance work?

In most scenarios, travel insurance reimburses you for your covered financial losses after you file a claim and the claim is approved. Filing a claim means submitting proof of your loss to Allianz Global Assistance, so that we can verify what happened and reimburse you for your covered losses. You can file a claim online , or do it on your phone with the Allianz TravelSmart TM app .

How does this work in real life? Let’s say you purchase the OneTrip Prime Plan , which includes trip cancellation benefits, to protect your upcoming cruise to Cozumel. Two days before departure, you experience a high fever and chest pain. Your doctor diagnoses bacterial pneumonia and advises you to cancel the trip. When you notify the cruise line, they tell you it’s too late to receive a refund.

Without travel insurance, you’d lose the money you spent on your vacation. Fortunately, a serious, disabling illness can be considered a covered reason for trip cancellation , which means you can be reimbursed for your prepaid, nonrefundable trip costs. Once you’re feeling better, you gather the required documents—such as your airfare and cruise line receipts and information about any refunds you did or did not receive—and you file a claim . You can even choose to receive your reimbursement by direct deposit, to your debit card, or via check.

Sometimes, this process works a little differently. Travel insurance may pay your expenses upfront if you require emergency medical treatment or emergency transportation while traveling overseas. Or, with the OneTrip Premier and OneTrip Prime plans, you may be eligible to receive a fixed payment of $100 per day for a covered travel delay or $100 for a covered baggage delay . No receipts for purchases are required; all you need is proof of your covered delay.

Many travelers are wondering: Can COVID-19 be considered a covered reason for trip cancellation? And can travel insurance help if you become seriously ill with COVID-19 while traveling? Most of our travel insurance plans now include epidemic-related covered reasons (benefits vary by plan and are not available in all jurisdictions). The Epidemic Coverage Endorsement adds covered reasons to select benefits for certain losses related to COVID-19 and any future epidemic. To see if your plan includes this endorsement and what it covers, please look for "Epidemic Coverage Endorsement" on your Declarations of Coverage or Letter of Confirmation. Terms, conditions and exclusions apply. Benefits may not cover the full cost of your loss. All benefits are subject to maximum limits of liability, which may in some cases be subject to sublimits and daily maximums.

> Learn more: Travel Insurance and COVID-19: The Epidemic Coverage Endorsement Explained

How to choose a travel insurance plan

There’s a wide range of Allianz Travel Insurance plans, each with different benefits and benefit limits. So how do you know which is best for you? To begin, get a quote for your upcoming trip. When you enter your age, trip costs and trip dates, we can recommend a few plans for you. Then, you can compare the costs and benefits of each.

If you’re a budget-conscious traveler who’s traveling in the U.S., you may like the OneTrip Cancellation Plus Plan . It includes trip cancellation, trip interruption and trip delay benefits.

If you want protection in case of medical emergencies overseas, but you have few pre-paid trip expenses, you may consider the OneTrip Emergency Medical Plan . This affordable plan includes emergency medical and emergency transportation benefits, as well as other post-departure benefits, but not trip cancellation/interruption.

If you want the reassurance of carrying substantial travel insurance benefits, the best fit may be the OneTrip Prime Plan . This plan also covers kids 17 and under for free when traveling with a parent or grandparent (not available on policies issued to Pennsylvania residents).

If you’re planning several trips in the next 12 months, consider annual travel insurance such as the AllTrips Prime Plan . It gives you affordable protection for a full year of travel, including benefits for trip cancellation and interruption; emergency medical care; lost/stolen or delayed baggage; and Rental Car Damage and theft protection (available to residents of most states).

> Find the right travel insurance plan for you

How to get the most from your travel insurance plan

Don’t wait too long to buy travel insurance! The best time to buy travel insurance is immediately after you’ve completed your travel arrangements. The earlier you buy insurance, the bigger your coverage window. Also, you must buy your plan within 14 days of making your initial trip deposit in order to be eligible for the pre-existing medical condition benefit (not available on all plans).

Read your plan documents before you leave. If you're not completely satisfied with your plan, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven't started your trip or initiated a claim. Premiums are non-refundable after this period.

Call us when you need help. If you have questions about how travel insurance works, or how to file a claim, or which benefits you need, please contact us ! Our representatives are available 24/7. If you’re already traveling, and you’re facing a travel crisis or just need some advice, call our emergency assistance hotline .

> Read more about how we can help

Related Articles

- What Does Travel Insurance Cover?

- How Travel Insurance Covers Family Members

- Trip Delay, Trip Interruption and Trip Cancellation Insurance Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Everything you need to know about travel insurance before you book your next trip

With more and more people traveling , travel disruptions have increased. You might be ready to book your next vacation, but it's smart to consider buying a comprehensive travel insurance policy that will protect you from financial losses you may incur due to unexpected issues both before you travel and during your trip.

"Travel insurance is often an overlooked investment until the unforeseen happens," says Beth Godlin, a spokesperson with Aon Affinity Travel Practice . "It's designed to give travelers peace of mind and financial protection against the risks of travel."

While some travelers decline purchasing travel insurance because they think it will be costly, Godlin says it doesn't have to be expensive and notes "purchasing it adds an extra layer of protection and security."

Travel insurance is obviously valuable for big-ticket trips, such as a luxury cruise, safari or multi-city international vacation, but it can even be helpful when you're staying closer to home. "When deciding if travel insurance is right for you, I suggest asking yourself what you could stand to lose if you had to cancel last-minute," says Godlin.

CNBC Select spoke to experts in the travel insurance space to get their best advice on everything consumers need to know about travel insurance.

How to find an insurance carrier

Purchasing travel insurance is relatively easy, and there are lots of different options in the marketplace. If you have never purchased a travel insurance plan, a good place to start is sites like InsureMyTrip.com , CoverTrip or Squaremouth , which let you compare different carriers based on both price and coverage. You simply fill out a brief questionnaire about the trip and the traveler.

The benefit of using aggregator sites is shoppers have the ability to view the entire travel insurance marketplace and compare policies all in one place. Squaremouth also provides verified customer reviews to help travelers feel confident about the policy they are purchasing.

There is no charge to use Squaremouth, as they receive commission on every sale directly from the provider, and do not charge any type of fee to consumers.

Beyond comparison sites, you can always visit a specific travel insurance carrier's website for a quote or call the company's toll-free customer service number for information.

CNBC Select has reviewed many of the top travel insurance companies and named AXA Assistance USA Travel Insurance as the best choice overall with three tiers of coverage to choose from and a high financial strength rating. Our runner-up was Travel Guard® Travel Insurance for its offerings available online and coverage for one related child age 17 or younger.

AXA Assistance USA Travel Insurance

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

If you're using a site like Expedia , for example, to book your reservations, you usually have the option to purchase travel insurance, too, through a third-party provider. You should make sure to carefully review the full details of the policy, because the plans are based around the trip elements (hotel, flight, rental car) and could differ every time you book, and you want to make sure you understand what you're getting.

What does travel insurance cover?

Travel insurance can vary, but policies generally provide coverage for three things: protection for your financial expenses, protection for your well-being and protection for your personal belongings.

When shopping for a policy, look for these benefits:

Trip cancellation coverage

Your travel insurance policy can reimburse you for prepaid, non-refundable trip deposits if a trip is canceled for a covered reason. These outlays can include airline tickets, hotel rooms, rental cars, tours and cruises, says Daniel Durazo, spokesperson with Allianz Travel Insurance .

Examples of acceptable reasons to cancel a trip include illness, injury or death of the traveler, a close family member or a traveling companion; military deployment or civil unrest; a serious family emergency, even unplanned jury duty.

Other reasons include: your travel supplier stops offering services for 24 hours due to a natural disaster, severe weather or a strike, your home or destination becomes uninhabitable or you or a traveling companion lose your job after you purchase your policy.

You typically can't cancel your trip for any reason and expect to be reimbursed just because you have travel insurance. For example, if you have a fight with your friend and don't want to travel with her, or you change your mind about taking a long-haul flight to Hawaii, these are not covered reasons.

If you want the highest level of flexibility to make changes to your trip, consider adding "cancel for any coverage" to your policy. Cancel For Any Reason (CFAR) plans will bump up the cost of your travel insurance by about 40%, but it gives you the latitude to cancel your trip if you need to as long as you meet certain requirements like canceling no later than 48 hours before your scheduled departure.

You won't be reimbursed for 100% of your trip costs. Typically, CFAR coverage will reimburse between 50 to 75% of trip expenses.

Trip delay coverage

Should you experience a hiccup in your travel itinerary, your travel insurance policy can provide some financial relief.

"Travel delay coverage provides reimbursement if a traveler is delayed for one of the policy's covered reasons," says Megan Moncrief, a spokesperson with Squaremouth. "This benefit will typically reimburse for expenses such as food, lodging and local transportation that are incurred during the delay."

Covered reasons will generally include severe weather, airline maintenance or civil unrest.

There's often a waiting period before your benefits kick in.

"In order for a traveler to become eligible for this benefit, they must be delayed for the amount of time listed on their policy," says Moncrief. "Some policies are very lenient and provide benefits available for any length delay, while other policies will specifically list a length requirement. This typically ranges from three to 12 hours. All travel delay policies will come with a daily limit, as well as a policy limit ranging from a couple hundred to a couple thousand dollars."

Daily limits typically range from $150 to $250 per traveler, while the policy limit can range from $500 to $2,000, Moncrief says. It's very important to save all your receipts as you will be required to submit them with your reimbursement claim.

Don't miss: The best credit cards with trip delay insurance

Trip interruption coverage

Should you need to cut your trip short due to illness or injury you experience during your trip, or if there's a family emergency back home, your policy may reimburse non-refundable expenses you forfeit if you return home early.

Your policy may also cover the cost of a one-way economy airline ticket home. Not all reasons are covered, however. For example, if your beach vacation is a washout or you miss your new puppy, your trip interruption benefits won't apply.

Medical expenses and emergency-evacuation benefits

If you're traveling within the U.S., your personal health insurance should cover any illness or injury you sustain while you are on a trip. But if you're traveling to a foreign country, your U.S.-based health plan will provide zero or very little coverage, and Medicare isn't accepted abroad, so it's good to sign up for additional coverage.

"Domestic healthcare plans are usually not accepted outside the U.S., so it's especially important to get travel insurance with medical coverage and emergency medical transportation when traveling internationally," says Durazo. "If you do become ill or injured while traveling, these benefits can cover your medical costs including doctors' fees and hospital costs."

In addition, your travel carrier's customer support hotline can help. "Allianz's 24/7 assistance team can coordinate your care with the doctors treating you in your destination, as well as ensure you're at an appropriate medical facility up to U.S. standards," he says.

Even more expensive than medical treatment is an emergency medical evacuation, something the right travel insurance policy can arrange and cover. "Medical evacuation and transport costs range from $15,000 to $200,000+, depending on the traveler's health condition and their location in the world," says Durazo.

"If you're heading overseas, you'll need the additional protection of emergency medical benefits and emergency medical transportation benefits," he adds. "And if you're visiting more remote areas, there's always a chance you may need emergency medical transportation to get you to an appropriate health care facility."

Find the best credit card for you by reviewing offers in our credit card marketplace or get personalized offers via CardMatch™ .

Baggage loss

Should your checked baggage take a detour and not arrive at your destination, your travel insurance policy could be a saving grace.

"If your travel insurance plan includes baggage benefits, your insurer can reimburse you, up to the maximum shown on the Confirmation of Coverage, for covered loss, theft or damage to your baggage and personal items," says Durazo. "Every plan has specific coverage limits for each benefit, which are outlined in the plan documents."

For example, Allianz Partners' OneTrip Prime plan , covers baggage loss up to $1,000 and baggage delay up to $300 while the OneTrip Premier includes up to $2,000 in baggage loss/damage and up to $600 for baggage delay.

Your personal possessions are also covered if lost or stolen while you're traveling. "Travel insurance can reimburse you for the actual cash value, repair or replacement — whichever is less, based on the limits in your insurance policy's letter of confirmation," says Durazo.

You must report losses to your airline, airport, police or other relevant authority like a tour operator or hotel manager. You will need this documentation when you file a claim.

Not all items are covered by your travel insurance policy. For example, cash is not reimbursable, and many policies won't cover very expensive jewelry, art, antiques or heirloom items. To reduce the risk of losing irreplaceable items, don't bring these items on vacation. And make sure to read your policy carefully to see what is covered.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

What you should know about Covid-19 and travel insurance

When it comes to Covid coverage , travel insurance plans can vary from one another, so you should read your policy carefully and ask your insurance provider if you have questions, says Godlin.

Also, regulations around travel have evolved during the pandemic, with some countries requiring specific travel insurance coverage for entry. "As a result, we're seeing new policies emerge to directly meet those needs," she says.

How much is travel insurance?

Travel insurance can vary a lot depending on how much coverage you're getting and how expensive your trip is. CoverTrip advises its customers that travel insurance plans cost between 4 to 10% of the total trip cost. So if you're spending $5,000 on a European tour, your insurance could be anywhere from $200 to $500.

Of course, there are budget plans out there that could cost (and cover) less. And you could also shell out for premium coverage so you can take advantage of a "cancel for any reason" policy. Whichever plan you choose, make sure you read the fine print so you understand what you're paying for.

Your credit card may offer built-in travel protection

You may have a credit card in your wallet that offers travel insurance . "Travel insurance is a common benefit for credit cards that often comes at no additional cost to the cardholder," says Francis Hondal, president of loyalty and engagement with MasterCard. "It can also be extremely easy to take advantage of it—the key is knowing what coverage you have so you don't waste money on additional coverage you don't need."

Coverage is automatic when you make a relevant purchase, she says. "So, for instance, if you have trip cancellation insurance on a card, you're covered when you book a flight using that card. Same goes for checking your bag and activating your lost luggage protection," Hondal says.

It's important to know if and how you're covered when making travel-related purchasing decisions. Mastercard offers a digital insurance platform, mycardbenefits.com . You can usually find more information on your credit card's website.

To ensure you reap the travel insurance benefits your card offers, you must charge the trip expenses on your card.

"Where credit card travel insurance can shine is if you run into weather problems or mechanical delays, or if you get sick while traveling or even if your luggage gets lost or delayed," says Ted Rossman, senior industry analyst, Bankrate.com.

The Chase Sapphire Reserve® is an industry leader in these areas, he says. It offers up to $10,000 per person and $20,000 per trip in the form of trip cancellation/trip interruption coverage. If you run into a flight delay lasting at least six hours, you can get up to $500 per ticket to book a different flight, stay in a hotel, buy food, etc.

If your luggage is late, you can get up to $100 per day for up to five days to buy necessities.

"If something really bad happens while you're abroad, [Chase Sapphire Reserve travel insurance] will pay for up to $100,000 of emergency evacuation and transportation coverage," says Rossman. "And the Sapphire Reserve also gives primary rental car insurance benefits, meaning that you can decline the rental car company's expensive coverage, and you won't need to go through your personal car insurance if you get into an accident while renting a car."

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

Rossman says another good pick is the Chase Sapphire Preferred® Card which also has very good coverage although slightly less coverage than the Sapphire Reserve card, in line with a lower annual fee. Even the no-annual-fee Chase Freedom Flex℠ gives up to $1,500 per person and up to $6,000 per trip in trip cancellation/trip interruption coverage, Says Rossman.

For more information on cards that offer travel insurance, check out CNBC Select's round-up of the best travel credit cards .

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

21.49% - 28.49% variable on purchases and balance transfers

Either $5 or 5% of the amount of each transfer, whichever is greater

Excellent/Good

Read our Chase Sapphire Preferred® Card review .

Is travel insurance worth it?

Travel insurance can be useful in many scenarios, from a medical emergency forcing you to cut your trip short to a tropical storm ravaging your destination. If you've spent a lot of non-refundable money on your trip, you could be at a loss if something goes awry.

There are several scenarios where travel insurance could be worth it , including if:

- You're traveling internationally where your US-based health insurance won't apply

- You've spent a lot on prepaid, non-refundable expenses

- You're traveling to a remote area

- Your flight involves multiple connections or destinations

For those who have spent a good amount of money on their trip, getting trip insurance generally makes sense whether that's through a separate policy or through a credit card you booked the trip with.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- How to get the student loan interest deduction Ana Staples

- Here's how to file your taxes at the last minute Liz Knueven

- Cash App Banking offers a 4.50% APY and no fees Elizabeth Gravier

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

What does travel insurance cover?

Erica Lamberg

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 10:49 a.m. UTC Feb. 23, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Mikhail Blavatskiy, Getty Images

- Travel insurance coverage can protect you from financial losses associated with a trip.

- Most travel insurance plans include trip cancellation insurance and travel medical insurance.

- What is covered, and how much, varies by plan, so it’s important to read your policy and look for exclusions.

Compare the best travel insurance offers

Travel insured.

Via TravelInsurance.com’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

RoundTrip Basic

$500,000/$1 million

What is covered by travel insurance?

The best travel insurance plans provide comprehensive benefits to protect your travel investment, both leading up to your trip and while you’re traveling. These trip protections typically include coverages for trip cancellation, delay or interruption, emergency medical and evacuation, baggage delay or loss, and other benefits like missed connection coverage.

Trip cancellation insurance