Travel Insurance For Schengen From India

Travel insurance for schengen visa from india.

Travelling to a Schengen country this year? Make sure to get travel insurance for Europe and travel insurance for a Schengen visa before you embark on the journey!

Expert's Guide to Schengen Visa Process

Schengen travel insurance.

Schengen travel insurance is insurance for travelling to Schengen countries. Schengen countries are those 26 countries that signed the Schengen agreement in 1985 in Luxembourg, Europe. The Schengen agreement makes it easy for tourists and travellers travelling to the European subcontinent to move unrestricted in any of the 26 countries during their stay. These counties include France, Switzerland, Austria, Germany, Belgium, Denmark, Greece, among others. Travellers arriving in a Schengen country can only stay up to 90 days within a 3-month window. Moreover, they need a Schengen visa and mandatory travel insurance for Schengen before they set foot in any of the listed Schengen countries.

Schengen travel insurance is a mandatory insurance cover for travellers that protects them from unforeseen eventualities that can threaten their trip by providing financial support in various scenarios. These include medical emergencies, hospitalization expenses, accidents, lost/ delayed baggage, misplaced passport, flight delays and cancellations, and even third-party damage, among several other travel-related scenarios.

Schengen travel insurance covers the costs arising from these eventualities to protect you from financial loss and getting overwhelmed during a trip to a foreign country. Once you get travel insurance for Schengen countries, you get secured for everything that could go wrong as long as it is mentioned and explicitly covered in the travel insurance for Schengen document. When you buy online on tataaig.com, you can choose between various plans. By using the Compare Travel Insurance Feature you can pick the plan the offers the best coverage amount & premium for you. Tata AIG’s Schengen travel insurance starts at an amount as little as ₹40.82 per day*. Moreover, you invest in rupees and receive coverage in Euros.

Why do You Need Schengen Travel Insurance?

Schengen travel insurance and a Schengen visa are mandatory for travelling to any of the listed Schengen countries. But besides travel insurance for a Schengen visa being mandatory for Indians, it is crucial to get Schengen travel insurance to secure yourself and your finances from anything that could go wrong during your trip.

Here are a few reasons why you need Schengen travel insurance from Tata AIG:

To cover the expenses of medical emergencies Imagine you are all excited about your trip to Europe. You can’t wait to explore the cafes, walk through the historic lanes, and taste the eclectic cuisine. But suddenly, you become sick and require immediate medical care.

Here is where your Tata AIG Schengen travel insurance will come to your rescue. It will cover the cost of hospitalization, accidents, and even emergency dental treatment.

To cover the things that could go wrong during the journey Nothing is worse than looking forward to a trip, but something unexpected causing a complete dent in your plans. While we can’t control what happens, we want to be there to take care of the consequences.

No matter the situation – flight delays, trip cancellation, missed flights, lost passport, and even bounced bookings – Schengen travel insurance will have your back and refund the amount as per the set limits in the insurance policy document.

To support what you cherish back home Imagine you have already started your journey, but you get the sudden news of a family member falling sick. Or if someone reported a theft in your empty house. At such a time, you would not be able to enjoy the vacation awaiting you. Plus, you would definitely need financial assistance. Not only does travel insurance for a Schengen visa from India reimburse your booking and flight costs, but it also refunds the damage done to your home.

Benefits of Schengen Travel Insurance

Tata AIG has one of the most comprehensive and best travel insurance for Schengen visas that provide you with:

- Medical Cover :

The medical cover in the travel insurance for Schengen provides immediate financial assistance if you develop any illness, face an accident, and even the worst-case scenarios of any fatalities. In the scenario you need to continue your treatment in India, it will also cover the costs of evacuating you back.

- Baggage Cover :

Tata AIG’s travel insurance Schengen visa, India, also covers any delay or misdirection in your baggage by the airline you are flying in. If your baggage gets lost, stolen, or misplaced by any carrier or delivery, we will cover the costs of your personal belongings for a hassle-free stay.

- Journey Cover :

For any eventuality that takes place during your journey and derails it, our Schengen travel insurance India will cover the financial loss caused by them. These include flight delays and cancellations, trip cancellations, bounced bookings, passport loss, trip curtailments, among other harrowing scenarios.

- Covid Cover :

At present, the threat of COVID-19 is still looming at large. While you might take all the necessary precautions, it is possible to contract the virus. Not only can this cause a big dent in your travel plans, but it can pose an immediate threat to your life. With travel insurance for Schengen, you get coverage for medical expenses, trip cancellation, and refunds of amounts spent on bookings, accommodation, and travel.

Which are the Schengen Countries?

The Schengen countries are 26 countries in Europe that signed an agreement called the Schengen agreement. This agreement allows travellers coming to the continent to move freely within any of the 26 countries. So, people travelling within Europe do not have to apply for separate visas, insurance, and travel documents.

Before you get travel medical insurance for Europe, it is wise to know about the Schengen countries.

The countries include:

What are the Requirements of Schengen Visa Insurance?

To apply for travel insurance for a Schengen visa, you must know the basic Schengen visa travel insurance requirements:

- The travel insurance for Schengen visa coverage value must be a minimum of 30,000 euros. However, Tata AIG provides a coverage amount up to approximate 4,31,000 euros at premium prices as less as ₹40.82 per day.

- It must cover all medical emergencies, medical repatriation, and accident hospitalization costs at the very least. Tata AIG’s Schengen travel insurance is holistic, covering everything from medical emergencies to travel delays.

- Your Schengen travel insurance policy must be valid for the entire duration of your trip and in all 26 counties.

- You have to show your Schengen visa, the type of Schengen visa you have taken, and other relevant documents while obtaining a Schengen travel insurance policy.

- You have to state your purpose of travelling to a Schengen country and your expected time frame of staying in the continent, whether that is leisure travel, business travel, study travel, family and friend visitation travel, or any other reason.

Types of Schengen Visas

Before you get travel insurance for a Schengen visa in India, it is vital to know what type of Schengen visa will align with your purpose of travelling:

Uniform Schengen Visa A Uniform Schengen visa consists of two types of visas

- Type A Schengen Visa that is for anyone travelling through a Schengen country by air and only in-transit for a period of up to 24 hours.

- A type C Schengen Visa is for a short-term stay in a Schengen country for up to 90 days. Here there are single-entry, double-entry, and multiple entry Schengen visas.

National Schengen Visa A National Schengen Visa is for those travellers who intend to stay in a Schengen country for an academic course, research or pedagogical work, any professionals, international students, and any individual stuck in a Schengen country due to a medical emergency and other related reasons.

Documents Required for a Schengen Visa

Before you apply for a Schengen visa in India with the consulate or embassy of the Schengen country you plan to visit, you have to buy travel insurance for the Schengen visas. You can find a consulate or embassy near where you live for maximum convenience.

It is ideal to apply for a Schengen visa up to 6 months before your take-off date. The latest you can apply is 15 days before the scheduled trip, but since the visa approval takes around 10 to 15 days, it is not recommended to take such last-minute risks.

Here are all the documents required for Schengen Visa :

- A duly filled and signed printed copy of the visa application form

- Two passport-sized photographs with a light background clicked recently

- An active Indian passport that is not older than ten years and is valid for at least three months from your intended travel date to the chosen Schengen country

- Proof of accommodation during your stay in the chosen Schengen country and area

- The Schengen travel insurance is availed in India with a coverage of at least 30,000 euros.

Plus, there must be the base coverage of unforeseen medical emergencies, accidents, and medical evacuation and repatriation

- Flight tickets and flight itinerary to and from the Schengen country and area

- A cover letter stating the reason for your visit to the chosen Schengen country

- Proof of your civil status including but not limited to:

- Your marriage certificate

- Income tax return proof of the last 3 years

- Bank statement of the last 6 months

- Birth certificate of children

- Ration Card

- Proof of your capacity to finance your stay in the chosen Schengen country

- Proof of admission if you are travelling as an international student

- Letter of employment if you are travelling for work purposes

Moreover, while applying for a Schengen Visa, you will have to state your purpose of visiting the Schengen Area in the application form and during the interview at the embassy. Tata AIG provides one of the cheapest travel insurance for a Schengen visa at premium rates as little as ₹40.82 per day!

What is Schengen Visa Procedure?

Once you get offline or online travel insurance for a Schengen visa, you can apply for the Schengen visa. It is ideal to apply for your Schengen visa at least 30 to 60 days before the date of your trip, even though the cut-off date is 15 days before the trip. This is because the embassy or consulate where you apply for a Schengen visa might take anywhere between two weeks to two months to process your visa application. Here is how you can go about it:

Step 1 - Decide what purpose you are visiting the Schengen country for and select the Schengen visa type applicable These include:

- Transit Visa

- Tourist Visa

- Family and friends’ visitation visa

- Business visa

- Visa for cultural and sport activities

- Visa for official visits

- Medical visa

Step 2 - Apply to the embassy of the Schengen country you will visit. If you are visiting more than one Schengen country, apply to the consulate or embassy of the core destination country you plan to visit. Step 3 - Pick a suitable time frame to apply where the earliest date is 6 months before the trip, and the latest is 15 days. Step 4 - Book an appointment with the consulate/ embassy/ visa centre of the Schengen country. Most applications are online, but if your chosen Schengen country specifies an in-person booking, then you have to abide by that. Step 5 - You will receive the Schengen visa application form, where you will have to input details, including your personal information, background information, the purpose of visiting, and other relevant details. Before you fill the form, read the instructions on how to do so in its entirety. Step 6 - Once you fill the application form, gather all the relevant documents (mentioned above) and attach them while submitting. After that, you will receive a notification for a Schengen visa interview and get an appointment date. The interview will last around 15 minutes. Step 7 - The travel insurance for Schengen visa costs differ from insurer to insurer. At Tata AIG, we strive to provide the most holistic of coverages at affordable prices. That is why we offer comprehensive Schengen travel insurance at prices as little as ₹40.82 per day.

Best Time to Visit Schengen Countries

You can visit Schengen countries anytime during the year as the maximum temperature doesn’t exceed 23 to 25 degrees Celsius. As most of India hits hotter temperatures than those in Schengen countries, even 24-degree weather can seem pleasant. Schengen countries have four seasons:

- Summer where the temperature is between 14 to 24-degree Celsius (December – February)

- Autumn where the temperature is between 7 to 14-degree Celsius (September – November)

- Spring where the temperature is between 2 to 18-degree Celsius (June – August)

- Winter where the temperature is between -10 to 10-degree Celsius (March-May)

Each season has a unique experience to offer, and the local weather is different in different Schengen countries.

Things to Do in Schengen Countries

There are plenty of things to do in Schengen countries. You could visit popular destinations like France and visit the Eiffel tower at sunset. You could visit destinations blooming with history on every by-lane like Greece and Vienna. You could visit cultural heritages and rich architectural havens like the Czech Republic, Hungary, and Austria. You could soak in the eclectic cuisines of Italy and Spain, shopping in Germany and Belgium. And of course, there is everyone’s dream destination – Switzerland, where you could soak in amidst the luscious greenery and indulge in the world’s best chocolates. The list is never-ending, and the possibilities are countless.

What does the Schengen Travel Insurance Policy from Tata AIG Cover?

Before you buy travel insurance for a Schengen visa in India, it is necessary to know what the travel insurance coverage for Schengen visa from Tata AIG includes:

Accident & Medical Illness Treatment : Our Schengen travel insurance covers all medical costs arising due to an accident or any illness (excluding a pre-existing disease), including hospitalization, intensive care unit hospitalization, surgery, room rent expenses, and miscellaneous expenses.

Personal Accident Treatment : Our Schengen travel insurance covers all medical costs arising out of any unforeseen accident, including hospitalization, intensive care unit hospitalization, surgery, diagnostic tests, ambulance costs, room rent expenses, and miscellaneous expenses.

Medical Evacuation : Our Schengen travel insurance covers immediate evacuation expenses needed due to an unforeseen medical emergency at the nearest hospital available in the Schengen country where the eventuality occurs. If the need is, the travel insurance will also cover the costs of medical evacuation back to India.

Emergency Dental Treatment : Believe it or not, our Schengen travel insurance also covers emergency dental treatment expenses. We provide a monetary dental benefit for reasons including a medically necessary filling of a tooth/ teeth, surgical treatment required, and any other services or supplies needed to treat the tooth. However, all the dental benefits shall be limited to the treatment given only to sound natural teeth, i.e., no artificial teeth.

Trip Delay/Curtailment : Our Schengen travel insurance covers trip delays and curtailments caused due to loss of travel or accommodation due to cancellation by the other party. Even for unused travel and accommodation expenses due to a personal reason, we will refund all the unused expenses.

Baggage Loss and Delay : Our Schengen travel insurance covers the costs of all personal items due to delayed, misdirected, or lost baggage caused by the airline’s negligence. It also covers the personal belonging costs if the carrier or delivery personnel misplaces your entire baggage. Even incidents of theft are covered.

Flight Delays/Cancellation : We know how frustrating flight delays and cancellations can be for no fault of your own. That is why we cover the additional expenses incurred in securing an extra night or two of hotel stays and further bookings. You also receive coverage in case of missed or cancelled flights.

Repatriation Cover : If any case of unforeseen fatality, where the worst possible scenario plays out, we at least wish to ensure that your loved ones receive the financial support they deserve in the tough time caused by your demise. Moreover, we ensure your loved ones get to give a final goodbye by transporting remains back to India.

Hijack Risk Cover : We hate to even imagine this, but in the terrible eventuality of your flight getting hijacked, we wish to provide financial assistance as much as we can. In such a time, we hope to lessen the impact of your trauma with a distress allowance that will at least take care of your financial liabilities.

Personal Liability : In the unlikely eventuality of you causing damage to someone else, we would like to assume financial responsibility for the same. In the case of you and a third party being involved in an accident and the third party getting hurt, we will cover all the damage caused to the third party.

COVID-19 Cover : If at any time during your trip you contract COVID-19, we’re right here to ease the strain of recovery. We will take care of all the medical expenses incurred due to the disease, reimburse you for the unused and non-refundable amount of your bookings/ accommodations, and automatically extend your travel insurance by seven days if there is a lockdown imposed in your Schengen country/ city.

What does the Schengen Travel Insurance Policy Not Cover?

While we would love to secure you for every possible catastrophe, there are some scenarios where our travel insurance would not be able to help. These include:

Cosmetic treatment : We do not cover the costs of elective, cosmetic, or plastic surgery, except as a result of an injury caused by a covered accident while our travel insurance policy is in force.

War & civil unrest : We do not cover any losses arising out of war, civil war, invasion, insurrection, revolution, an act of a foreign enemy, hostilities (declared or undeclared), rebellion, mutiny, use of military power, usurpation of government/ military power, or civil unrest

Adventure sports : We do not provide financial support in the case of any damage or injury caused due to engaging in adventure sports of any kind. These include scuba diving, paragliding, bungee jumping, river rafting, among other life-threatening sports.

Mental disorders : We do not cover any mental disorders, any sexually transmitted diseases (including but not limited to HIV/ AIDS), and any pre-existing diseases.

Alternative Treatment : We do not cover any alternate treatments of any type that are prevalent in India, including but not limited to Homeopathy, Ayurveda, Unani, and other alternative medicinal practices.

Journey Exclusions : We do not cover charges incurred for diagnostic, x-ray, and laboratory examinations that are not related to the illness/ injury. We do not cover any charges for treatment rendered by a doctor that is outside his/ her medical professional or doctor’s fees charged by an immediate relative or sharing the same residence.

We do not cover the costs of any personal comfort and convenience items like television, telephone calls, internet, food, cosmetics, hygiene items, and other body care/ comfort products.

- Baggage Exclusions : We do not cover any damage or loss to a partial amount of your baggage. We only cover losses and reimburse the cost of personal belongings due to the whole loss of baggage.

Other Destinations

Disclaimer / tnc.

Your policy is subjected to terms and conditions & inclusions and exclusions mentioned in your policy wording. Please go through the documents carefully.

Related Articles

Going for a vacation. Here are five reasons you need travel insurance

5 Myths Travel Insurance

Why senior citizens travel insurance is must?

1. why do i need a schengen travel insurance policy.

You need a Schengen Travel Insurance Policy as it is mandatory if you want to travel in any of the 26 countries constituting the Schengen continent. Moreover, it is always better to have financial security in case of an emergency that threatens to drain your savings.

2. Can Business Travellers Buy a Schengen Travel Insurance Policy?

Yes, of course. Business travellers can and have to buy a Schengen Travel Insurance Policy. One of the main Schengen visas is business visas. And those travelling for professional or work-related purposes must avail of a Schengen travel insurance policy to avoid any kind of hassle

3. What is Not Covered Under a Schengen Travel Insurance Policy?

A Schengen Travel Insurance Policy, especially from Tata AIG, covers a wide range of unforeseen scenarios, including dental treatment and fatalities. But there are some things beyond the scope of coverage, including costs incurred due to cosmetic treatment, war and civil unrest, alternative treatments, injury caused due to adventure sports, mental disorders, pre-existing diseases, and others. You should always read the travel insurance policy document in detail to know about all its exclusions.

4. What is the Eligibility Criterion to Apply for a Schengen Visa?

To be eligible to apply for a Schengen visa, you must:

- Fill the visa application form within the desired time frame

- Be clear about your purpose of visiting the Schengen country

- Have all your relevant documents in place

- Have enough financial and civil status

- Have your itinerary, accommodation, and mode of travel sorted

- Have Schengen travel insurance in place

5. Is It Possible to Travel to Multiple Schengen Countries with the Same Schengen Visa?

Yes, it is possible to travel to multiple Schengen countries with the same Schengen visa. However, there is a specific type of visa that allows for multiple travels within different countries. It is the multiple-entry or type C uniform Schengen visa or the Multiple-entry or type-D Schengen visa.

6. How Does a Single-Entry Schengen Visa Differ from a Multiple-Entry Schengen Visa

A single-entry Schengen visa allows you to enter a Schengen country only at one given time during a period of 180 days and for a maximum of 90 days. Once you exit the Schengen country, you are not allowed to return and have to apply for a new visa altogether.

A multiple-entry Schengen visa allows you to enter multiple Schengen countries within the same span of 180 days and for a maximum of 90 days. It saves you the effort of doing paperwork again and again.

7. How Much Time Does It Take to Process for a Schengen Visa

It usually takes around two weeks to process a Schengen visa if the embassy/consulate finds everything in the right place and is satisfied with your application form. In some specific cases, the embassy/ consulate takes around 30 days to process a Schengen visa. In some unusual cases, it takes around 60 days to process the visa.

Disclaimer :

All the information provided above has been well-researched and sourced from reliable sources. Since this information is subject to change, it is advisable to check the latest travel guidelines and other location-specific information before planning a trip to any location. *Subject to change based on the nature and extent of coverage.

Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

2008, Tata AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CINNumber : U85110MH2000PLC128425. Registered with IRDA of India Regn. No. 108. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] .

Let's Get You A Customized Travel Insurance Plan

*COVID-19 covered for International Travel Policy Only, T&C Apply.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

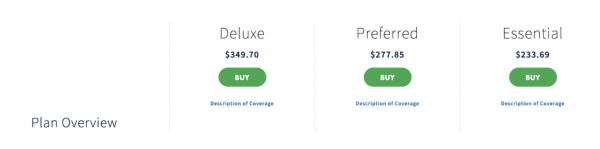

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

TATA TRAVEL

INSURANCE AGENCY

A dvisor Code: AIG2311020000

Call us today for a quote

INDIA 91- 9810794545

Fill out this form

Get a quote.

Even though many people may think that buying traveller insurance is a waste of money, the fact is, it’s an essential part of international trips. If you wish to save your time as well as money when travelling abroad, it’s prudent to buy travel insurance from a reputed insurer.

Every traveller’s needs and circumstances are different. If you need to travel out of the country for work more than once a year, you will have a few set expectations from a travel insurance policy. So, you need to choose a plan that would offer extensive coverage against medical as well as personal liabilities. Let’s find out what exactly is an annual multi-trip insurance plan.

Annual Travel Insurance Policy

If you are fond of travelling or if you need to travel outside the country more than once yearly, then you need to opt for a travel insurance policy without fail. An annual travel insurance policy will not only safeguard your finances during the trip but will also ensure that you are away from unnecessary expenses related to health and safety.

An annual international travel insurance plan, also known as annual multi-trip travel insurance, is specifically designed for frequent flyers. These insurance policies cover several trip-related exigencies. So, if you plan to travel out of the country more than once a year, instead of buying separate traveller insurance, it’s better to opt for a multi-trip policy.

So, if you are a business owner or work in a multinational company that needs you to travel outside the country pretty often, or if you are simply fond of travelling out of the country often, Tata AIG’s annual travel insurance policy can secure your trips and provide unmatched financial coverage against different kinds of trip-related emergencies.

Features of Annual Multi Trip Travel Insurance

If you are thinking about buying an annual travel insurance policy, you need to be aware of its features. Let’s learn about a few of them below-

Unlimited Trips in a Year: With annual multi-trip travel insurance, you can get coverage for an unlimited number of trips in a single year, with each trip having a duration of 30-45 days. This way, it will be cost-saving on your part to just pay the premium for one single policy rather than paying for multiple policies yearly.

Trip Assistance: Suppose you need to cancel or postpone or prepone your trip abroad due to some reason, the policy will compensate for the loss. Also, your flight may get delayed or cancelled and hence, you will be reimbursed for the unused and non-refundable amount of all your bookings like hotels, trips, flights, etc.

Flight delay or cancellation: You might miss a flight because of delays or because your first flight got canceled. With a multi-trip travel insurance plan, you will be compensated if your flight is canceled or delayed.

Unmatched Medical Support: When travelling abroad, you may fall ill and therefore, you might have to visit a doctor or get admitted to a hospital. You may even meet with an accident that may require you to get treated in a local hospital. And as we all know, medical costs abroad are expensive and hence, you may end up blowing off your entire budget on paying for your medical bills. But with an annual travel policy, your medical treatment costs will be taken care of by the insurer.

Loss of Baggage and Passport Coverage: If you end up losing the passport of your luggage during the trip, you can make a travel insurance claim and the insurer will cover all the costs of a replacement for your lost belonging. For your lost checked-in luggage, your total cost would be compensated by the travel plan.

Repatriation and Death Coverage: In case of the traveller’s (policyholder’s) sudden death or permanent disability during the trip, the repatriation of the body or the treatment expenses would be covered under the annual travel insurance policy.

Hijack Cover: If in case your plane gets hijacked, according to the policy terms and conditions, you’d be compensated for the distress caused to you during such an unfortunate incident.

Advantages of Annual Travel Insurance

There has been a rise in people travelling abroad for work and leisure. Most of the countries, keeping in mind the current post-pandemic scenario, expects their travellers to have a valid traveller insurance plan in hand. So, if you need to travel outside India more than once a year, it’s advisable for you to buy an annual travel insurance policy. If you are still not sure whether you’d need one or not, here is a simple list of great advantages that you will get with an annual multi-trip travel insurance policy in hand –

One single policy will provide you extensive coverage against several exigencies that may occur to you during multiple trips abroad in a single year.

Such policies come with an automatic cancellation cover that will allow you to claim reimbursement for a missed flight or cancelled hotel bookings.

You will not have to worry about buying a travel insurance plan every time you book your ticket for a trip abroad during a single year.

Such policies offer easy renewability options and you can also choose different cover plans along with the main insurance policy to make the policy more robust.

From medical emergencies to any other personal liability, an annual travel insurance policy will cover it all.

At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you.

Eligibility Criteria

The eligibility criteria to opt for multi-trip travel insurance varies from one insurer to another. However, the basic requirement of being able to buy one such policy is that you need to be between the age of 3 months to 70 years.

Travel Insurance

Thanks for submitting!

HOURS & LOCATION

World Trade Center .

Connaught Place, New Delhi-110001 [email protected]

T : 91.11.41090545

M : 9810794545

Monday - Friday

10:00 am to 5:00 pm

Saturday

10:00 am to 1:00 pm

Evenings by Appointment

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The world looks best in a portrait mode. So does our website :) Please tilt and enjoy the experience.

to give you a better experience. By using our website you agree to our policies .

Tata AIG General Insurance Company is a joint venture between the Tata Sons and the American International Group (AIG).

Tata AIG General Insurance Company Limited is a joint venture between the Tata group and the American International Group (AIG). Tata AIG celebrated 21 years of service as on 2021, since it commenced operations on January 22, 2001. The company has made a mark in the industry by launching several innovative products and services over the years.

Under its two main business verticals - Consumer Lines and Commercial Lines, Tata AIG offers an extensive range of General Insurance covers that cater to various individual and business insurance needs.

The products range from Home insurance, Motor Insurance, Travel Insurance, Health Insurance, Rural-Agriculture Insurance etc for individuals under the Consumer Line vertical, and Property & Business Interruption insurance; D&O, Professional and General Liability Insurance; and special products like Reps & Warranties and Environmental Insurance under the Commercial Lines vertical. Each product offering is backed by professional expertise to help the customer along the entire relationship period. Tata AIG has an empowered claims team, with a in-house capability of 400 plus experts spread across 90 office in India. The customer service team too, which is the face of the company to the customer, comprises of 450 team members, operating from various offices across India.

Today Tata AIG’s core strength lies in 3 product categories - Travel Insurance, Marine Insurance and Liability and the company aims to be the most preferred General Insurance Company in the industry. In order to achieve its vision of being the most preferred general insurance company, Tata AIG is increasing its general insurance penetration in India with various significant partnerships with leading business names from varied industries.

Tata AIG has an Asset Under Management (AUM) of approximate Rs. 18,835 Cr (as of March 2022) and a workforce of about 7,941 employees present in 200 branches across India. The company’s products are available through various channels of distribution such as Agency which has a combined strength of 65,262+ licensed agents and a very strong Broking channel of 534 licensed brokers. The Bancassurance & Affinity team is responsible for initiating and tapping partnerships with Banks, NBFC's, HFC's and other affinity partners. Tata AIG is also increasing its online presence and has a strategic initiative called ‘Go Digital’ that facilitates ease of buying Insurance products in the digital world. It makes the process from sale to policy issuance effortless.

To help its distributors significantly increase their insurance knowledge, the company had established the ‘Tata AIG Academy’ in May 2014 with a vision to be a centre of excellence in learning in the General Insurance domain. Its mission is to align the training programs with the strategic business and developmental needs of Tata AIG as well as to empower employees and partners to succeed in a fast-changing competitive environment.

Serving Up Convenience

Building Insights at Tata

Subscribe to newsletters from tata.com.

The Digital Gene

- Main Menu ×

- Search Flights

- Corporate Travel Programme

- Group Booking

- Special Offers

- Travel Insurance

- Flight Schedule

- Check In Online

- Manage Booking

- Seat Selection & Upgrades

- Self-Service Re-accommodation

- Request Refund

- Flight Status

- Nonstop International Flights

- Popular Flights

- Partner Airlines

- Baggage Guidelines

- Airport Information

- Visas, Documents and Travel Tips

- First-time Travellers, Children and Pets

- Health and Medical Assistance

- At the Airport

- The Air India Fleet

- About Flying Returns

- Sign In/Sign Up

- Our Partners

- Family Pool

- Earn Points

- Spend Points

- Upgrade Cabin Class

- Points Calculator

- Customer Support

What are you looking for?

Eligibility and Benefits

Check your eligibility and benefits, hide view who can purchase travel insurance who can purchase travel insurance -->.

- THE WEEK TV

- ENTERTAINMENT

- WEB STORIES

- JOBS & CAREER

- Home Home -->

- wire updates wire updates -->

- BUSINESS BUSINESS -->

TATA AIG Introduces 'Travel Guard Plus' - A Comprehensive Travel Insurance Solution with Enhanced Features

Mumbai, Maharashtra, India (NewsVoir) • Includes Medical Expenses - Injury and /or illness, Accidental Death and Disablement (Overseas), emergency medical evacuation coverage. • Also covers non-medical contingencies like Delay / Loss of Checked-in Baggage, Loss of personal baggage, Loss of Passport, Compassionate Travel/ Stay, Accommodation extension, Up-gradation to Business Class and many more. • It also provides instant gratification in case of flight delay or flight cancellation. • Assistance services like medical assistance, lost luggage or lost passport etc. • Geographical Scope includes Schengen, worldwide including USA/Canada and Worldwide excluding USA/Canada geo-scopes. • Option for Single Trip insurance cover up to 365 days. • Offers add-on bundles like Cruise bundle, Travel Plus bundle, Accident bundle. TATA AIG General Insurance Company Limited, a leading general insurance provider, has launched “Travel Guard Plus”, a comprehensive travel insurance product that redefines complete coverage for travellers with an array of bundle plans. TATA AIG’s Travel Guard Plus has been meticulously designed to meet people’s diverse travel needs with a wide range of plans where 41 different types of covers has been packaged to meet the need of customers. TATA AIG’s Travel Guard Plus provides coverage for a range of situations including Loss of Personal Baggage, Compassionate Travel / Stay, Accommodation extension, Up-gradation to Business class, Personal Accident in India, and Instant Gratification that allows travellers to get instant money in case of any flight delays or cancellation on real-time basis. These enhancements aim to elevate the overall travel experience and setting new standards in a travel protection, ensuring travellers have access to extensive coverage tailored to their needs with the ease of claims. Amongst the many product enhancements, one significant transformation is the customization of plans. Customer can choose from 3 add-on bundles - Cruise Bundle, Travel Plus Bundle, Accident Bundle which caters to cruise related contingencies, frequent flyer cover, coma cover, adventure sports cover. The plans have been customised in addition to the base plans. Moreover, the policy also provides optional assistance services which allows travellers to customize their coverage even further. Speaking about the new TATA AIG Travel Guard Plus, Mr. Saurav Jaiswal, President & Chief Operating Officer, TATA AIG General Insurance Co. Ltd. said, “At TATA AIG we are excited to announce the launch of Travel Guard Plus, which demonstrates the company’s unwavering commitment to its customers’ needs by providing all-encompassing insurance solutions. With our Travel Guard Plus policy, travellers can embark on their adventures with a sense of assurance, as they have a safeguard against unexpected circumstances. Our emphasis is on ensuring a stress-free experience tailored to each traveller’s specific requirements.” Key Additions in Travel Guard Plus: • Annual Multi Trip cover with higher single per trip duration of up to 180 days • Single Trip with an option of single policy up to 365 days. • Optional Assistance Services such as Care at Home, Baggage tracking, Lost Passport tracking to enhance convenience. • Non-medical coverage only plan that suits several travellers who requires cover for non-medical covers only - such as for students who travel abroad for study or young travellers travelling for short duration preferring only non-medical travel insurance. • Separate plan for Schengen geo-scope. • New age covers such as adventure sports, instant gratification for flight cancellation/flight delay, loss of Personal Baggage, Personal Accident in India and pandemic coverage. • Senior Plus plan (71 – 80 years) for higher medical sum inured up to $100000. • Super Senior plan (> 80 years) for higher medical sum insured up to $50000. (Disclaimer: The above press release comes to you under an arrangement with Newsvoir and PTI takes no editorial responsibility for the same.). PTI PWR PWR

(This story has not been edited by THE WEEK and is auto-generated from PTI)

Kerala: High Court judge’s driver beaten to death over pet dog’s barking

Possession of cannabis legalised in Germany

When Paris decided to honour 'Dr Sócrates'

Kartik Aaryan begins shooting for second schedule of 'Bhool Bhulaiyaa 3'

Why is specialised coating essential for the delayed NISAR mission’s antenna?

TATA AIG Introduces 'Travel Guard Plus' - A Comprehensive Travel Insurance Solution with Enhanced Features

Mumbai (Maharashtra) [India], April 1: TATA AIG General Insurance Company Limited , a leading general insurance provider, has launched " Travel Guard Plus ", a comprehensive travel insurance product that redefines complete coverage for travellers with an array of bundle plans. TATA AIG's Travel Guard Plus has been meticulously designed to meet people's diverse travel needs with a wide range of plans where 41 different types of covers has been packaged to meet the need of customers.

TATA AIG's Travel Guard Plus provides coverage for a range of situations including Loss of Personal Baggage, Compassionate Travel / Stay, Accommodation extension, Up-gradation to Business class, Personal Accident in India, and Instant Gratification that allows travellers to get instant money in case of any flight delays or cancellation on real-time basis. These enhancements aim to elevate the overall travel experience and setting new standards in a travel protection, ensuring travellers have access to extensive coverage tailored to their needs with the ease of claims.

Amongst the many product enhancements, one significant transformation is the customization of plans. Customer can choose from 3 add-on bundles - Cruise Bundle, Travel Plus Bundle, Accident Bundle which caters to cruise related contingencies, frequent flyer cover, coma cover, adventure sports cover. The plans have been customised in addition to the base plans. Moreover, the policy also provides optional assistance services which allows travellers to customize their coverage even further.

Speaking about the new TATA AIG Travel Guard Plus , Mr. Saurav Jaiswal, President & Chief Operating Officer, TATA AIG General Insurance Co. Ltd. said, "At TATA AIG we are excited to announce the launch of Travel Guard Plus , which demonstrates the company's unwavering commitment to its customers' needs by providing all-encompassing insurance solutions. With our Travel Guard Plus policy, travellers can embark on their adventures with a sense of assurance, as they have a safeguard against unexpected circumstances. Our emphasis is on ensuring a stress-free experience tailored to each traveller's specific requirements."

Key Additions in Travel Guard Plus :

* Annual Multi Trip cover with higher single per trip duration of up to 180 days

* Single Trip with an option of single policy up to 365 days.

* Optional Assistance Services such as Care at Home, Baggage tracking, Lost Passport tracking to enhance convenience.

* Non-medical coverage only plan that suits several travellers who requires cover for non-medical covers only - such as for students who travel abroad for study or young travellers travelling for short duration preferring only non-medical travel insurance.

* Separate plan for Schengen geo-scope.

* New age covers such as adventure sports, instant gratification for flight cancellation/flight delay, loss of Personal Baggage, Personal Accident in India and pandemic coverage.

* Senior Plus plan (71 - 80 years) for higher medical sum inured up to $100000.

* Super Senior plan (> 80 years) for higher medical sum insured up to $50000.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir . ANI will not be responsible in any way for the content of the same)

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

- Tata Steel share price

- 163.35 -0.03%

- HDFC Bank share price

- 1,549.40 1.41%

- ITC share price

- 427.85 1.21%

- Mahindra & Mahindra share price

- 2,012.15 0.48%

- NTPC share price

- 354.40 -0.10%

Tata AIG General Insurance introduces a frictionless and real-time digital process for travel insurance claims

Tata aig general insurance launches a quick and effective online claims process via a digital fast-track method for travel insurance claims..

Tata AIG General Insurance Company, a prominent insurance provider in India, has unveiled an expedited and efficient online claims system for travel insurance. This digital fast-track process offers customers a hassle-free and user-friendly platform. They can effortlessly initiate their claims directly on the tataaig.com website, submit necessary documents, and monitor their claim's progress, reducing the reliance on call centres or email correspondence. With Tata AIG's innovative approach, customers can now file claims easily through a user-friendly digital platform, even while on the go.

The company's streamlined digital claims process empowers travel insurance policyholders to submit various types of claims, including those related to accident and sickness medical expenses , and other eligible claims as specified in the policy coverage.

With this innovative addition, policyholders will gain access to a smooth digital platform that presents essential claim information throughout the claims process.

Speaking about the digital claim process, Rajagopal Rudraraju, Executive Vice President and National Head, Accident and Health Claims- Tata AIG General Insurance Company , said, " Travel insurance is the most effective guard one can have in case of an emergency while travelling. We recognise the importance of enabling our policyholders to be more digitally connected and have an accessible and straightforward claims process. It is an essential and a must-have when you are facing any unexpected event. Digital claim journey is important for our travel insurance policyholders that will help them to file their claims and have access to real-time status updates from any part of the world."

Tata AIG travel insurance policyholders now have the convenience of visiting the company's website to independently register their claims, upload all necessary documents online without requiring an intermediary, agent, or direct selling agent, and easily track the status of their claims.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

IMAGES

VIDEO

COMMENTS

Our international travel insurance policies start at just INR 40.82 per day! That's a small price to pay for care-free travel! 4. Instant Policy Purchase. You can buy a TATA AIG international travel insurance policy online with just a few easy clicks. We don't need extensive paperwork on a health check-up!

To apply for travel insurance for a Schengen visa, you must know the basic Schengen visa travel insurance requirements: The travel insurance for Schengen visa coverage value must be a minimum of 30,000 euros. However, Tata AIG provides a coverage amount up to approximate 4,31,000 euros at premium prices as less as ₹40.82 per day.

Get Plan. *COVID-19 covered for International Travel Policy Only, T&C Apply. 1 Cr + Policies Issued Last Year. 5 Cr + Customers Served Since Inception. On-the-Spot Travel Insurance. 190+ Destinations Covered. Buy travel insurance online with instant online travel insurance policy quotes & price from Tata AIG General insurance.

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

Top features of Tata AIG Travel Insurance. Depending on your policy, Tata AIG travel insurance has the following features: Round-the-clock assistance. Hassle-free claim procedure. Covers. Medical coverage. Passport loss. Travel disruptions. Baggage issues.

Exploring the diverse beauty of India is made more secure with Tata AIG's domestic travel insurance policies. You can get coverage for your travels within India for as low as INR 26 per day. 4. Instant Policy Purchase: With Tata AIG, you can purchase your travel insurance policy online in just a few clicks.

An annual international travel insurance plan, also known as annual multi-trip travel insurance, is specifically designed for frequent flyers. These insurance policies cover several trip-related exigencies. ... At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you. Eligibility Criteria.

Product-Intl. Travel Insurance: TATA AIG General Insurance Company Limited. Benefits. Maximum coverage. Deductible. Accidental Death and Dismemberment Benefit (24 Hrs) $15,000. Accident & Sickness Medical Expenses Reimbursement. $200,000.

This travel insurance policy may be a good fit for family vacations and international travel. AIG Travel Guard Essential: This budget travel insurance option includes coverage for trip ...

Tata AIG travel insurance only includes the coverages mentioned in your insurance certificate. For more information, you may refer to the set of exclusions as mentioned in the policy wording. ... Your travel policy will cover claims for unforeseen circumstances only during the period of your international travel. Your trip ends when you return ...

Why Tata AIG's Travel Insurance Ranks at No. 1 for Schengen Visa? When it comes to purchasing international travel insurance for Schengen visas, Tata AIG is regarded as a reliable insurance partner.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Like the Preferred, you'll get 100% coverage for trip cancellation and 150% of the cost of your insured trip ...

Tata AIG General Insurance Company Limited is a joint venture between the Tata group and the American International Group (AIG). Tata AIG celebrated 21 years of service as on 2021, since it commenced operations on January 22, 2001. The company has made a mark in the industry by launching several innovative products and services over the years ...

Who can purchase travel insurance? Residents of India buying flight tickets directly from Air India can also purchase our travel insurance. The coverage is provided under a group travel insurance policy underwritten by Tata AIG General Insurance Company Limited (Tata AIG). Please make sure that your trip starts from India.

The TATA AIG Travel Guard insurance policy is available as a single-trip and multi-trip policy for international travel. Robust coverage for accidental death and dismemberment, medical expenses ...

TATA AIG Introduces 'Travel Guard Plus' - A Comprehensive Travel ...

Indian travel insurer TATA AIG General Insurance Company has unveiled its new Travel Guard Plus "comprehensive travel solution". The product offers a range of travel medical coverage, including for injury, illness, disablement, and accidental death while overseas. Additionally, it has protection for "non-medical contingencies" such as ...

In the event of any service-related queries on cancellation/refund, endorsement and claim reimbursement, customers should contact TATA - AIG General Insurance through the below-mentioned option: Toll-Free: 1800-266-7780; Tolled: 022-66939500; For detailed policy wordings of International travel, please refer to the link.

The Tata AIG travel insurance is the best with good number of benefits like the premiums are low and the returns are high. The policy coverage is high and the claims are even better. The luggage and the accidental cases are inbuilt recoverable in the policy. Good future investment, Good work.

TATA AIG General Insurance Company Limited, a leading general insurance provider, has launched "Travel Guard Plus", a comprehensive travel insurance product that redefines complete coverage for travellers with an array of bundle plans. ... TATA AIG's Travel Guard Plus provides coverage for a range of situations including Loss of Personal ...

Mumbai (Maharashtra) [India], April 1: TATA AIG General Insurance Company Limited, a leading general insurance provider, has launched "Travel Guard Plus", a comprehensive travel insurance product ...

Tata AIG General Insurance introduces a frictionless and real-time digital process for travel insurance claims 1 min read 11 Oct 2023, 03:00 PM IST Abeer Ray , MintGenie Team

ANI News