- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

15 Best Travel Credit Cards of April 2024

ALSO CONSIDER: Best credit cards of 2024 || Best rewards credit cards || Best airline credit cards || Best hotel credit cards

A travel rewards credit card brings your next trip a little closer every time you use it. Each purchase earns points or miles that you can redeem for travel expenses. If you're loyal to a specific airline or hotel chain, consider getting one of that company's branded credit cards. Otherwise, check out the general-purpose travel cards on this page, which give you flexible rewards that you can use without the restrictions and blackout dates of branded cards.

Some of our selections for the best travel credit cards can be applied for through NerdWallet, and some cannot. Below, you'll find application links for the credit cards from our partners that are available through NerdWallet, followed by the full list of our picks.

250+ credit cards reviewed and rated by our team of experts

80+ years of combined experience covering credit cards and personal finance

100+ categories of best credit card selections ( See our top picks )

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of April 2024

Chase Sapphire Preferred® Card : Best for Flexibility + point transfers + big sign-up bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate travel rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

Chase Freedom Flex℠ : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers — bonus rewards + big sign-up offer

Citi Premier® Card : Best for Triple points on multiple categories

Bank of America® Travel Rewards credit card : Best for Flat-rate rewards + no annual fee, and for balance transfers

Chase Sapphire Reserve® : Best for Bonus travel rewards + high-end perks

World of Hyatt Credit Card : Best for Hotel credit card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments + no annual fee

United℠ Explorer Card : Best for Airline card

Best Travel Credit Cards From Our Partners

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Flexibility + point transfers + big sign-up bonus

Flat-rate travel rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers — bonus rewards + big sign-up offer, triple points on multiple categories, flat-rate rewards + no annual fee, and for balance transfers, bonus travel rewards + high-end perks, hotel credit card, travel rewards for rent payments + no annual fee, airline card, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

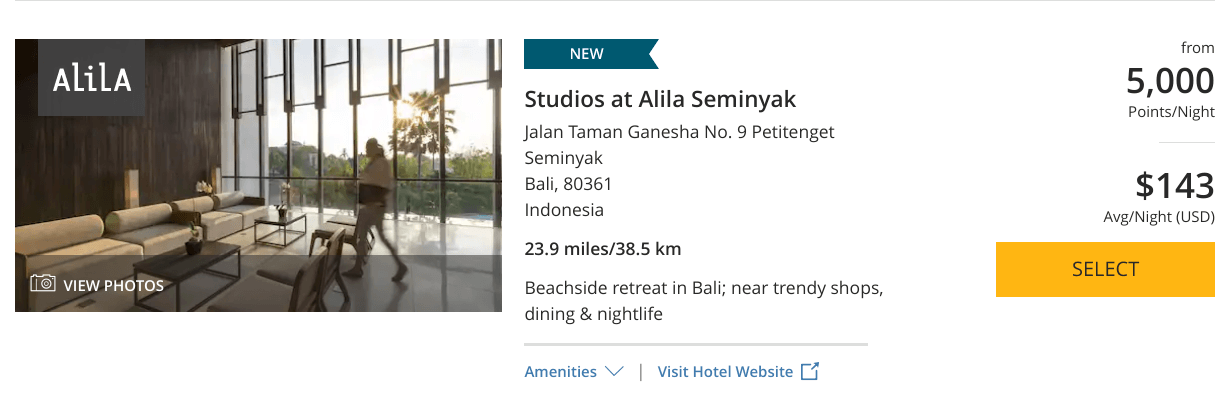

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Bank of America® Travel Rewards credit card

Our pick for: Flat-rate rewards + no annual fee, and for balance transfers

One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus travel rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Flexibility + point transfers + big sign-up bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Premier® Card

Our pick for: Triple points in multiple categories

The Citi Premier® Card earns bonus points on airfare, hotels, supermarkets, dining and gas stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

Chase Freedom Flex℠

The Chase Freedom Flex℠ offers bonus cash back in quarterly categories that you activate, as well as on travel booked through Chase, at restaurants and at drugstores. Category activation can be a hassle, but if your spending matches the categories — and for a lot of people, it will — you can rack up hundreds of dollars a year. There's a fantastic bonus offer for new cardholders and an intro APR offer, too. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: United Airlines + best domestic airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Hotel credit card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Small business — bonus categories + big sign-up offer

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

Are you in Canada?

See NerdWallet's best travel cards for Canada.

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

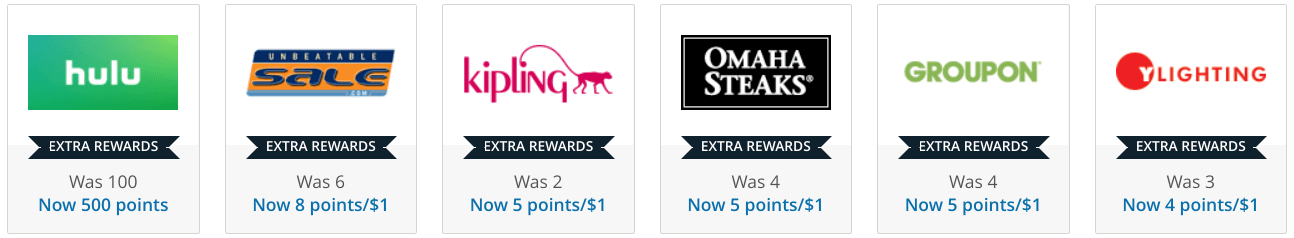

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on March 27 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions

Travel credit cards earn points (sometimes called miles) each time you buy something. The standard earning rate is 1 to 2 points per dollar spent, and many cards give you extra points for certain purchases, particularly travel expenses. The value of a point depends on the card that earned it and how you redeem it, but a good rule of thumb is to assume each point is worth an average of about 1 cent.

Your points accumulate in a rewards account, where you can use them to pay for travel. Most cards let you book travel directly using a portal similar to those at online travel agencies or on airline and hotel websites, but instead of paying cash, you pay with your points. Depending on the card, you may also have the option of booking travel any way you want, paying for it with the card and then cashing in your points for a credit against those expenses.

Points and miles are just different names for the same thing: the currency used in a travel rewards program. Some travel credit cards call them points, some call them miles.

Airline frequent flyer programs have long used the term “miles” to refer to the rewards you earn for flying. That’s because at one time, you really did earn rewards according to how many miles you flew — the longer the flight, the more miles you earned. Nowadays, most domestic airlines give out “miles” based on how much you spend, not how far you fly, so they’re really just points. (There are a few exceptions, though, notably Alaska Airlines.)

Especially when it comes to redeeming your rewards, there’s no difference between points and miles. The number of points or miles you need is based mostly on the cost of what you’re redeeming them for. It takes more than 500 miles (value about: $5) to get a free 500-mile flight!

The value of a point or mile depends on the card you earned it with and how you redeem it. A common rule of thumb is to assume that each point or mile is worth an average of 1 cent, although you can certainly get a much higher (or lower) redemption value. See our travel loyalty roundup page for NerdWallet’s current valuations for airline miles and hotel points.

Travel credit cards fall into two main categories: co-branded and general-purpose.

• Co-branded travel cards carry the name of an airline or hotel chain. The rewards you earn on the card can typically be redeemed only with that brand (or maybe its partners). Co-branded cards limit your flexibility, but because they are issued in partnership with an airline or hotel, they can give you special perks, like free checked bags or room upgrades.

• General-purpose travel cards are issued by a credit card company and are not directly tied to any particular airline or hotel. They earn points in the issuer's own program, such as American Express Membership Rewards, Chase Ultimate Rewards® or Citi ThankYou. These points are a lot more flexible, as you can use them to pay for a range of travel expenses, including flights on any airline or stays at any hotel. However, they don’t offer the airline- or hotel-specific perks of co-branded cards.

Travel cards — like rewards cards in general — typically require good to excellent credit for approval. Good credit is generally defined as a credit score of 690 or better. However, credit scores alone do not guarantee approval. Every issuer has its own criteria for evaluating applications.

About the author

Sara Rathner

14 best travel credit cards of March 2024

The best travel credit cards offer an array of premium perks and benefits. For both occasional travelers and frequent flyers, adding a travel credit card to your wallet is a great way to earn rewards and save money on every trip you take. At The Points Guy, our team has done the legwork and curated a selection of the best travel credit cards for any globe-trotter, whether you prefer to backpack through mountains or settle into a luxury villa for some relaxation. From generous travel credits to premium lounge access, we’ve chosen the cards packed with the best benefits to elevate your next travel experience.

Check out our list below and discover which travel credit card from our partners makes the best addition to your wallet for all of your adventures.

- The Platinum Card® from American Express : Best for lounge access

- Capital One Venture Rewards Credit Card : Best for earning miles

- Capital One Venture X Rewards Credit Card : Best for premium travel

- Chase Sapphire Preferred® Card : Best for beginner travelers

- American Express® Gold Card : Best for dining at restaurants

- Ink Business Preferred® Credit Card : Best for maximizing business purchases

- Alaska Airlines Visa® credit card : Best for Alaska Airlines miles

- Capital One VentureOne Rewards Credit Card : Best for no annual fee

- Citi Premier® Card : Best for starter travel

- The Business Platinum Card® from American Express : Best for business travel

- Wells Fargo Autograph℠ Card : Best for variety of bonus categories

- American Express® Business Gold Card : Best for flexible rewards earning

- Chase Sapphire Reserve® : Best for travel credits

- Bank of America® Travel Rewards credit card : Best for travel rewards beginners

Browse by card categories

- Airport Lounge Access

- Global Entry

- No Foreign Fee

- Best Overall

- Find your CardMatch™

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative. TPG values it at $1,600.

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and more than $1,400 in assorted annual statement credits and so much more. (enrollment required)

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway.

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost.

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories.

- The annual airline fee credit and other monthly statement credits can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Capital One Venture Rewards Credit Card

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. You’ll earn earns 2 miles per dollar on every purchase with no bonus categories to memorize, making it an ideal card for those with busy lives. Read our full review of the Capital One Venture Rewards Credit Card .

- This flexible rewards card delivers a solid sign-up bonus of 75,000 miles, worth $1,388 based on TPG valuations and not provided by the issuer.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories.

- Rewards earned are versatile as they can be redeemed for any hotel or airline purchase for a statement credit or transferred to 15+ travel partners.

- A couple of partners' transfer ratios are mediocre at a less than 1:1 ratio.

- Capital One airline partners do not include any large U.S. airlines.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Capital One Venture X Rewards Credit Card

If you can maximize the $300 credit toward Capital One Travel, the Venture X’s annual fee effectively comes down to $95, the same annual fee pegged to the Capital One Venture Rewards Credit Card (see rates and fees ). Add in a 10,000-mile bonus every account anniversary (worth $185, according to TPG valuations ) and lounge access, and the card may become the strongest option out there for a lot of travelers. Read our full review of the Capital One Venture X Rewards Credit Card .

- 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- 10,000 bonus miles every account anniversary

- $395 annual fee

- $300 credit annually, only applicable for bookings made through Capital One Travel portal

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase’s 14 valuable airline and hotel partners. Read our full review of the Chase Sapphire Preferred Card .

- You’ll earn 5 points per dollar on travel purchased through Chase Travel, 3 points per dollar on dining, select streaming services and online grocery store purchases, 2 points per dollar on all other travel and 1 point per dollar on everything else.

- Annual $50 hotel statement credit when booked through Ultimate Rewards

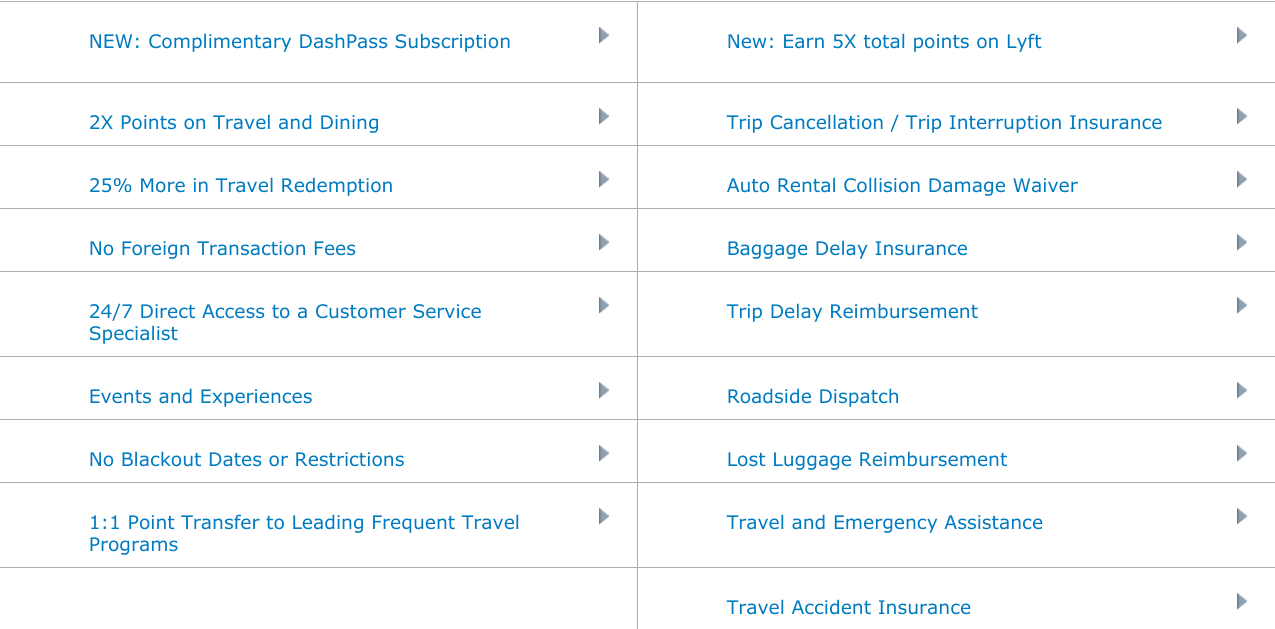

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance.

- The card comes with a $95 annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards®.

- Enjoy benefits such as 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Ultimate Rewards Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

American Express® Gold Card

This isn’t just a card that’s nice to look at. It packs a real punch, offering 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar). There’s also an up to $120 annual dining credit at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar, and select Shake Shack locations, plus it added an up to $120 annually ($10 per month) in Uber Cash, which can be used on Uber Eats orders or Uber rides in the U.S. All this make it a very strong contender for all food purchases, which has become a popular spending category. Enrollment is required for select benefits. Read our full review of the Amex Gold .

- 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar)

- 3 points per dollar on flights booked directly with the airline or with Amex Travel.

- Welcome bonus of 60,000 points after spending $6,000 in the first six months of account opening.

- Weak on travel and everyday spending bonus categories.

- Not as effective for those living outside the U.S.

- Some may have trouble using Uber/food credits.

- Few travel perks and protections.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- See Rates & Fees

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card’s sign-up bonus is among the highest we’ve seen from Chase. Plus earn points across the four bonus categories (travel, shipping, advertising and telecommunication providers) that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. Read our full review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening.

- Access to the Chase Ultimate Rewards portal for points redemption.

- Reasonable $95 annual fee.

- Bonus categories that are most relevant to business owners; primary car insurance.

- Perks including cellphone and purchase protection; extended warranty; trip cancellation/interruption insurance; trip delay reimbursement.

- Yearly cap on bonus categories.

- No travel perks.

- Subject to Chase's 5/24 rule on card applications.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Alaska Airlines Visa® credit card

There’s a lot to love about the Alaska Airlines credit card, in part due to its highly valuable loyalty program: Alaska Airlines MileagePlan. Whether you’re a loyal Alaska flyer or a points maximizer looking to diversify your rewards portfolio, this card has a lot to offer. For starters, you’ll receive Alaska’s Famous Companion Pass each year from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year, free checked bags for you and up to six guests on your itinerary, 20% back on in-flight purchases and more. Plus, Alaska has joined the oneworld alliance, opening up endless redemption opportunities. Read our full review of the Alaska Airline credit card.

- Free checked bag for you and up to six guests on your reservation.

- Alaska discounts, including 20% back on in-flight purchases.

- No foreign transaction fees.

- $95 annual fee.

- Limited Time Online Offer – 70,000 Bonus Miles!

- Get 70,000 bonus miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

- Get Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Valid on all Alaska Airlines flights booked on alaskaair.com.

- Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases. And earn unlimited 1 mile per $1 spent on all other purchases. And, your miles don't expire on active accounts.

- Earn a 10% rewards bonus on all miles earned from card purchases if you have an eligible Bank of America® account.

- Free checked bag and enjoy priority boarding for you and up to 6 guests on the same reservation, when you pay for your flight with your card - Also available for authorized users when they book a reservation too!

- With oneworld® Alliance member airlines and Alaska's Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

- Plus, no foreign transaction fees and a low $95 annual fee.

- This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

Capital One VentureOne Rewards Credit Card

If you’re looking to dip your toes into the world of travel rewards, the Capital One VentureOne Rewards Credit Card is a great way to get started. With no annual fee and a simple 1.25 miles per dollar on all your purchases, you won’t have to keep up with multiple bonus categories — just earn rewards on everything you purchase! Coupled with the 20,000-mile sign-up bonus, you can use your rewards to book travel, transfer to Capital One’s loyalty partners and more. Read our full review of the Capital One VentureOne Rewards Credit Card .

- No annual fee.

- Earn a bonus of 20,000 bonus miles once you spend $500 within the first three months from account opening.

- Use your miles to book or pay for travel at a 1-cent value, or transfer your miles to loyalty programs to gain potentially even greater value for your rewards.

- Earn 1.25 miles per dollar on all purchases.

- Other credit cards can offer you higher rewards for your common purchase categories.

- Capital One airline transfer partners do not include any large U.S. airlines.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Citi Premier® Card

The Citi Premier is a solid travel card choice with a plethora of travel partners and solid earning rates. Since the card earns the same number of points at gas stations, restaurants, supermarkets, airlines and hotels, it’s a great pick for beginner travel cardholders who want a simplified point system. Read our full review of the Citi Premier .

- For a limited time earn 10 points per $1 dollar spent on hotels, car rentals, attractions (excluding air travel) when book through Citi Travel portal through June 30, 2024

- Earns 3 points per dollar on restaurants, supermarkets, gas stations, air travel and other hotels.

- $100 annual hotel savings benefit (on single hotel stay bookings of $500 or more, excluding taxes and fees, booked through thankyou.com)

- $95 annual fee

- Lacks travel protections that other travel rewards cards come with

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. While the card does come with a high annual fee, you’re also getting a ton of valuable benefits in return. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review on The Business Platinum Card from American Express .

- Up to $100 statement credit for Global Entry every 4 years or $85 TSA PreCheck credit every 4.5 years (enrollment is required)

- Up to $400 annual statement credit for U.S. Dell purchases (enrollment required)

- Gold status at Marriott and Hilton hotels; access to the Fine Hotels & Resorts program and Hotel Collection (enrollment required)

- Steep $695 annual fee.

- Difficulty meeting $15,000 minimum spend for smaller businesses.

- Limited high bonus categories outside of travel.

- Welcome Offer: Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in annual statement credits on a curation of business purchases, including select purchases made with Dell Technologies, Indeed, Adobe, and U.S. wireless service providers.

- $200 Airline Fee Credit: Get up to $200 in statement credits per calendar year for incidental fees charged by your one selected, qualifying airline to your Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use your Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

Wells Fargo Autograph℠ Card

The Wells Fargo Autograph card packs a punch for a no-annual-fee product, with an array of bonus categories plus solid perks and straightforward redemption options. Read our full review of the Wells Fargo Autograph here .

- This card offers 3 points per dollar on various everyday purchases with no annual fee. It also comes with a 20,000-point welcome bonus and an introductory APR offer on purchases. Plus, you'll enjoy up to $600 in cellphone protection when you pay your monthly bill with the card. Subject to a $25 deductible.

- Despite the lucrative earning structure, Wells Fargo doesn't offer any ways to maximize your redemptions — you're limited to fixed-value rewards like gift cards and statement credits.

- Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

American Express® Business Gold Card

The Amex Business Gold card is a solid choice for high-spending small businesses with the flexibility to earn 4 points per dollar in the two categories where you spend the most. The card is ideal for businesses who value simplicity above all. Read our full review of the American Express Business Gold Card .

- You'll earn 4 Membership Rewards points per dollar in the top 2 spending categories each month (on the first $150,000 in combined purchases each calendar year).

- Hefty $375 annual fee.

- There may be better options for small businesses who don't spend a lot.

- Welcome Offer: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes.

- Your Card – Your Choice. Choose from Gold or Rose Gold.

- *Terms Apply

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, bonus points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve card .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access to Chase Ultimate Rewards hotel and airline travel partners.

- 10 points per dollar on hotels, car rentals and Chase Dining purchases through the Ultimate Rewards portal, 5 points per dollar on flights booked through the Chase Travel portal, 3 points per dollar on all other travel and dining, 1 point per dollar on everything else

- 50% more value when you redeem your points for travel directly through Chase Travel

- Steep initial $550 annual fee.

- May not make sense for people that don't travel frequently.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

Bank of America® Travel Rewards credit card

The Bank of America Travel Rewards credit card is a great starter card thanks to its no annual fee and no foreign transaction fees when you travel internationally. Earning and redeeming is effortless, with no confusing bonus categories to keep track of and the ability to redeem your points for all of your travel needs. Read our full review of the Bank of America Travel Rewards card.

- 1.5 points per dollar on all purchases

- No annual fee

- No foreign transaction fees

- Bank of America does not offer airline or hotel transfer partners like other banks such as American Express, Chase or Capital One.

- No travel and purchase protections.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Comparing the best travel cards

More details on the best credit cards.

The Amex Platinum is a stellar premium travel card that can provide amazing redemptions . Besides the welcome offer, it comes with more than $1,400 in credits each year and various lounge access options. Enrollment is required for select benefits.

Anyone looking for luxury travel benefits will find that the ton of annual statement credits make the annual fee worth it. Plus, you’ll get unparalleled lounge access , automatic Gold status with Hilton and Marriott, and extra perks with Avis Preferred , Hertz Gold Plus Rewards and National Car Rental Emerald Club . Enrollment is required for select benefits.

“While this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights on this card to earn 5 points per dollar spent and trip protection insurance. I make sure to take full advantage of the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear credits (enrollment is required). And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” — Matt Moffitt , senior credit cards editor

The Capital One Venture X Rewards Credit Card can be a great alternative to the Amex Platinum, with a notably lower annual fee, similar perks and a more rewarding earning rate on everyday purchases.