Chase Freedom Flex℠

Best for rotating categories

The Chase Freedom Flex is a great all-around card for beginners and fans of cash back. It’s easier to be approved for than many top-tier cards from Chase and Amex, and it offers a great array of benefits for a no-annual-fee card. (Partner offer)

At a glance

- 5% 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% 5% cash back on travel purchased through Chase Ultimate Rewards®, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- 1% Unlimited 1% cash back on all other purchases.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Ultimate Rewards®, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Flex℠ card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- Member FDIC

TPG Editor's Rating

The cash-back Chase Freedom Flex took the old Chase Freedom card and added new benefits and bonus categories. For a no-annual-fee credit card, it offers an impressive return across a number of spending categories, and the card becomes even more valuable when you pair it with a Chase Ultimate Rewards credit card.

- For a no-annual-fee credit card, the Chase Freedom Flex does offer additional benefits for cardholders including cell phone protection and food delivery perks.

- The card comes with an intro APR offer

- You must remember to activate your bonus categories quarterly or risk not earning 5x on select purchases

Who is this card good for?

This credit card is great for any individuals who are beginning the cashback rewards game or building history with a bank. With different earning categories every quarter, card is also great for pairing as part of a larger credit card strategy for rewards experts. If you have a Chase Ultimate Rewards credit card such as the Chase Sapphire Preferred Card , the rewards you earn with the Freedom Flex can be converted to full-fledged Ultimate Rewards points, which doubles their value in TPG’s eyes

Earning Rewards

The Chase Freedom Flex Card is packed with earning potentials that change quarterly. A quick rundown of the earning categories includes 5% on the first $1,500 spent on rotating categories each quarter (activation required), 5% on Lyft rides (through March 2025), 5% on travel booked through Chase Ultimate Rewards, 3% on dining, 3% on drug stores, and 1% on all other purchases. When paired with another Ultimate Rewards card, cashback can be transferred to Ultimate rewards points giving the card new life for those who may have moved on to higher tier rewards cards.

Advertiser Disclosure

Many of the credit card offers that appear on the website are from credit card companies from which ThePointsGuy.com receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Please view our advertising policy page for more information.

Editorial Note: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Chase Freedom Flex: Unique travel perks for a cash back card

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Chase Freedom Flex is a unique cash back credit card that doubles as a great travel rewards card for those who know how to best take advantage of it.

- With no annual fee and the ability to redeem Chase Ultimate Rewards points for travel purchases, the Chase Freedom Flex can save you money without the added cost of carrying the card.

- Pairing the Chase Freedom Flex with other Chase credit cards can help you maximize your rewards and save even more.

While the Chase Freedom Flex℠ is marketed as a cash back credit card, there are several reasons for travel lovers to take another look. Not only does it offer a generous selection of travel insurance protections, but its rewards can be redeemed directly for travel, whether you have this card alone or you pair it with a premium travel credit card from Chase.

With its rotating bonus categories and generous rewards on everyday spending, the Freedom Flex can help anyone boost their rewards haul. If you want to earn travel rewards and don’t want to pay another annual fee for a credit card, read on to learn why this card may be exactly what you need.

Why the Chase Freedom Flex is a good card for travelers

Picking up a cash back card for travel may seem strange, but the Freedom Flex works well in different scenarios. Consider the following perks and benefits before you make it part of your travel rewards plan:

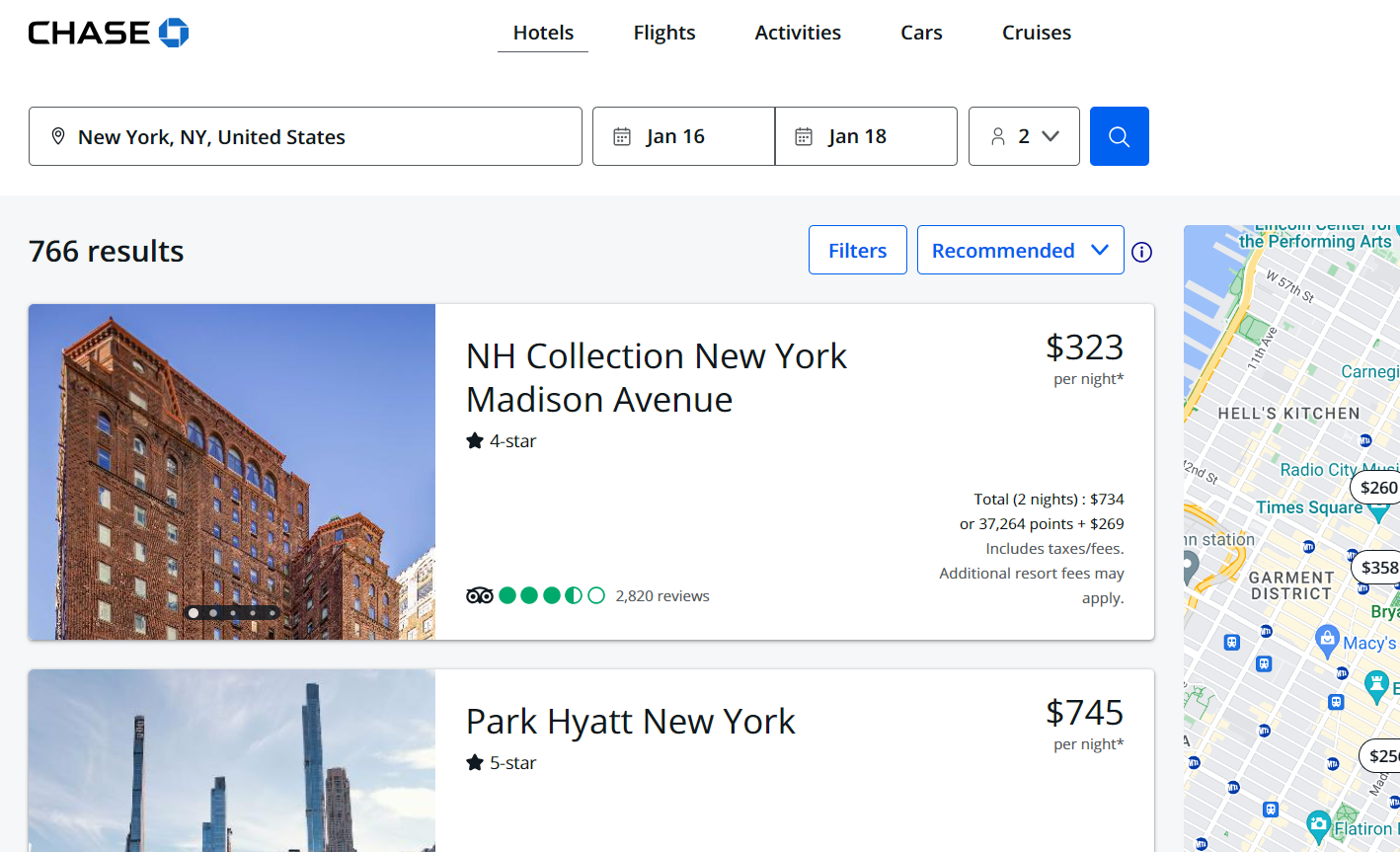

Travel rewards redemption

If you feel intimidated by the idea of redeeming your Chase points for travel, know that it’s quite simple. The Chase travel portal features buttons that take you to the booking pages for such travel categories as hotels, flights, travel activities, rental cars and cruises.

From there, Chase will show you how much your travel would cost in points. Here’s an example of how the portal displays your options if you search for a hotel in New York City for dates in January 2024.

You have the option to pay for your travel plans entirely with points, with a combination of points and credit card charges or entirely with your credit card. If you pay for all or part of your travel through Chase with your Freedom Flex card, you will earn 5 percent back on that spending.

Pairing with other Chase Ultimate Rewards cards

With the Freedom Flex, you can transfer rewards to a premium Chase travel credit card account for better travel redemptions. If you also have the Chase Sapphire Preferred® Card , for example, you could use each card for purchases in their respective bonus categories, and then move all your points to your Preferred account before you redeem.

This strategy would help you get 25 percent more value for your points if you redeem for travel through Chase. Separately, moving points to your Preferred card unlocks the option to transfer rewards to Chase’s airline and hotel partners , so you can take advantage of their rewards points or miles instead. Those programs include British Airways Avios, United Airlines MileagePlus, JetBlue TrueBlue, Marriott Bonvoy and World of Hyatt.

Pairing the Freedom Flex with a premium card should also help you avoid foreign transaction fees. Since the Freedom Flex comes with a 3 percent foreign transaction fee, you can use it to earn rewards points and use another travel card to pay for purchases while abroad.

Travel insurance

The Freedom Flex comes with a generous amount of travel insurance for a cash back credit card. Perks you’ll qualify for include trip cancellation and interruption insurance worth up to $1,500 per passenger and $6,000 per trip, secondary auto rental coverage and travel and emergency assistance services.

And remember, these benefits are offered free of charge for cardmembers.

With that said, you can get even more travel insurance protections with a premium Chase travel card. With the Chase Sapphire Reserve® , for example, you get higher-value trip cancellation and interruption insurance, primary auto rental coverage, trip delay reimbursement, emergency evacuation and transportation coverage, baggage delay insurance, travel accident insurance, roadside assistance and more.

Additional perks of the Chase Freedom Flex

In addition to being a great travel rewards card, The Chase Freedom Flex is still a popular, well-rounded cash back credit card . Not only can you earn a high rate of rewards for each dollar you spend, but you can redeem your rewards in several different ways aside from just travel.

Chase Freedom Flex

Card highlights.

- Welcome bonus: $200 cash bonus when you spend $500 within three months of account opening

- Intro APR: 0 percent intro APR on purchases and balance transfers for 15 months, followed by a variable APR of 20.49 percent to 29.24 percent

- Intro balance transfer fee: 3 percent of the amount of each transfer with a $5 minimum, followed by 5 percent of the amount of each transfer with a $5 minimum after the 60-day intro period

- Annual fee: $0

More ways to earn rewards

The Chase Freedom Flex is unique in that it offers rotating bonus categories and bonus rewards in several everyday spending categories. Here’s the card’s current rewards structure:

- 5 percent cash back on activated bonus category purchases each quarter (up to $1,500 in purchases, then 1 percent)

- 5 percent back on Chase Ultimate Rewards travel purchases

- 5 percent back on Lyft rides (through March 2025)

- 3 percent back on dining and drugstore purchases

- 1 percent back on everything else

While Chase Freedom Flex categories can change over time, they frequently include options like gas stations, home improvement stores, Walmart and PayPal purchases and more. The 5 percent category for Chase Ultimate Rewards travel purchases is also pretty broad and can include airfare, hotels, rental cars and day trip activities.

More ways to redeem rewards

While the Freedom Flex is a cash back credit card at heart, the rewards you earn are actually Chase Ultimate Rewards points . This distinction is part of what makes the Freedom Flex such a great travel rewards card. The points you earn are typically worth 1 cent each, so the $200 welcome bonus, for example, would be worth 20,000 points.

In addition to redeeming your rewards for travel through the Chase Travel portal, the program lets you redeem your rewards for cash back or statement credits. You also have the options to redeem your points for things like gift cards and merchandise.

Should you get the Chase Freedom Flex for travel purchases?

Considering the Freedom Flex offers generous rewards in everyday categories, you can’t really go wrong. If your spending lines up with the card’s highlighted categories, then you’ll be able to rack up the rewards points pretty easily.

The Freedom Flex is an even better choice for current Chase customers who have a premium travel credit card they can pair it with. When you have a few different Chase credit cards, or even better, the Chase trifecta , you get bonus rewards in more categories, all the best redemption options and the best selection of travel protections, all at once.

The bottom line

The Chase Freedom Flex is an excellent credit card for people who travel occasionally and want some basic travel protections, as well as for those who travel all the time and want a way to boost their travel rewards haul. Plus, with no annual fee , it costs nothing to add it to your wallet and take advantage of its high rewards rates.

Issuer-required disclosure statement Information about the Chase Freedom Flex℠ has been collected independently by Bankrate. Card details have not been reviewed or approved by the issuer.

Citi Double Cash vs. Chase Freedom Flex

Is the Chase Freedom Flex worth it?

Chase Freedom Flex review: Plenty of value packed into one card

Chase Freedom Flex ® Credit Card

New cardmember offer, earn a $200 bonus, at a glance, earn cash back for every purchase.

Cash Back Rewards & Benefits

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. * Opens offer details overlay

This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.

Earn 5% cash back in quarterly bonus categories

Earn 5% cash back on different categories like gas stations, grocery stores (excluding Target ® and Walmart ® ) * Opens offer details overlay and select online merchants on up to $1,500 in total combined purchases each quarter you activate. * Opens offer details overlay View the 5% cash back calendar Opens overlay.

Additional ways to earn cash back

Earn 5% on travel purchased through Chase Travel SM . * Opens offer details overlay

Earn 3% on dining at restaurants, including takeout and eligible delivery services. * Opens offer details overlay

Earn 3% on drugstore purchases. * Opens offer details overlay

Earn 1% on all other purchases. * Opens offer details overlay

Low intro APR

0% intro APR for 15 months from account opening on purchases and balance transfers. † Opens pricing and terms in new window After the intro period, a variable APR of 20.49 Min. of (8.50+11.99) and 29.99 %– 29.24 Min. of (8.50+20.74) and 29.99 %. † Opens pricing and terms in new window Balance transfer fee applies, see pricing and terms for more details. † Opens pricing and terms in new window

No annual fee

You won't have to pay an annual fee † Opens pricing and terms in new window for all the great features that come with your Chase Freedom Flex ® card.

Cash Back rewards do not expire

Cash Back rewards do not expire as long as your account is open. * Opens offer details overlay And there is no minimum to redeem for cash back.

Explore Additional Benefits

Refer friends.

if you already have a Chase Freedom Flex ® Card!

Earn up to $500 cash back per year

You can earn $50 cash back for each friend who gets any participating Chase Freedom ® credit card. Click the button below to start referring.

Is the Chase Freedom Flex credit card worth it?

The Chase Freedom Flex ® cash back credit card allows you to:

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate.

- Earn 5% cash back on travel purchased through Chase Travel SM . * Opens offer details overlay

- Earn 3% cash back on dining at restaurants, including takeout and eligible delivery services.

- Earn 3% cash back on drugstore purchases.

- Earn 1% cash back on all other purchases.

If you often dine out or anticipate frequently using your Chase Freedom Flex ® on other bonus categories such as groceries, gas, or utility services, then this card may be a good credit card choice for you.

Can you have Chase Freedom ® and Chase Freedom Flex ® ?

Yes, you can have both the Chase Freedom Flex ® and Chase Freedom ® credit cards.

Do Chase Freedom Flex ® points expire?

Your Chase Freedom Flex ® reward points will not expire as long as your account remains open. Check your Rewards Program Agreement to learn more about your reward points and possible limitations.

Does Chase Freedom Flex ® have foreign transaction fees?

The Chase Freedom Flex ® credit card charges a foreign transaction fee, which amounts to 3% on transaction charges made internationally.

Does Chase Freedom Flex ® have travel insurance?

The Chase Freedom Flex ® credit card offers Trip Cancellation/Trip Interruption Insurance. When you use your Freedom Flex ® credit card to pay for your travel, you can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, if your trip is canceled or cut short by sickness, severe weather and other covered situations.

Browse credit cards by category

MEET FREEDOM FLEX ®

Quarterly calendar, your 5 % quarterly cash back 2024 calendar.

Explore your new bonus categories every quarter and start earning 5 % . ** Same page link to footnote terms and conditions reference

January – March

Grocery Stores (excluding Walmart ® and Target ® ) ** Same page link to footnote terms and conditions reference | Fitness Clubs & Gym Memberships | Self-Care & Spa Services

Activation period closed

April – June

Amazon.com | Hotels | Restaurants

Activate by June 14, 2024

July – September

Coming Soon

Activate starting June 15, 2024

October – December

Activate starting September 15, 2024

Activate each quarter to earn 5% cash back on up to $1,500 in combined purchases in this quarter's bonus categories. * Opens offer details overlay See chase.com/freedomflex Opens in a new window for more details and exclusions on 5% categories.

** Same page link returns to footnote terms and conditions reference TERMS AND CONDITIONS

Cash Back And Points: See your Rewards Program Agreement Opens in a new window for more details. For a purchase to qualify for the 5% bonus Cash Back, the merchant must submit charges to your credit card by the last day of the relevant calendar quarter.

Third-Party Merchants: The listed merchant(s) are in no way affiliated with Chase, nor are the listed merchant(s) considered sponsors or co-sponsors of this program. All trademarks are the property of their respective owner(s).

Amazon, the Amazon.com logo, the smile logo, and all related logos are trademarks of Amazon.com , Inc. or its affiliates.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

Mastercard, the silver circles design and World Elite Mastercard are registered trademarks of Mastercard International Incorporated.

JPMorgan Chase Bank, N.A. Member FDIC

Service & protection

Zero liability protection.

Means you won't be held responsible for unauthorized charges made with your card or account information. * Opens offer details overlay

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. *** Same page link to disclaimer

Extended Warranty Protection

Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less. *** Same page link to disclaimer

Trip Cancellation/Interruption Insurance

You can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, if your trip is canceled or cut short by sickness, severe weather and other covered situations. *** Same page link to disclaimer

Cell Phone Protection

Get up to $800 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay it with your eligible credit card. Maximum of 2 claims in a 12 month period with a $50 deductible per claim. * Opens offer details overlay

24/7 Fraud Monitoring

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. * Opens offer details overlay

Auto Rental Collision Damage Waiver

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is provided for theft and collision damage for most cars in the U.S. and abroad. In the U.S., coverage is secondary to your personal insurance. *** Same page link to disclaimer

Travel and Emergency Assistance Services

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.) *** Same page link to disclaimer

*** Same page link to disclaimer reference These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Redeem Your Cash Back Rewards

Redeem your cash back rewards.

There is no minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open.

Shop with points at Amazon

Link your Chase Freedom Flex ® card to your Amazon.com account and instantly redeem your Cash Back rewards to pay for all or part of your eligible Amazon.com orders at checkout, including tax and shipping. * Opens offer details overlay

Redeem for a variety of gift cards and certificates for shopping, dining and entertainment, and more.

Book your travel with Chase Travel SM for competitive rates and flexible ways to pay.

Partner benefits

The best of your neighborhood. $0 delivery fee.

Get a complimentary 3 months of DashPass, DoorDash's membership that provides unlimited deliveries with $0 delivery fee and reduced service fees on eligible orders on DoorDash and Caviar. After that, you are automatically enrolled in DashPass at 50% off for the next 9 months. Activate by December 31, 2024. * Opens offer details overlay

5% Cash Back on Lyft Rides

Earn 5% cash back on Lyft rides through March 31, 2025. * Opens offer details overlay That's 4% cash back in addition to the 1% cash back you already earn.

Instacart+ Benefit

Free credit score with chase credit journey.

Credit Journey provides you with personalized insights to help you build, monitor and protect your credit health. Access your weekly score for free anytime, and dive into our resources like our score simulator and score factor breakdown to understand where you stand. We'll alert you of any new activity on your credit report and usage, in order to help detect any potential fraud. * Opens offer details overlay We're here for you 24/7, 365 days a year if you ever need support, and we'll work together to help you get back on your feet.

My Chase Plan

For more information, please visit chase.com/mychaseplan Opens in a new window .

Offer Details

Offers may vary depending on where you apply, for example online or in a branch, and can change over time. to take advantage of this particular offer now, apply through the method provided in this advertisement. review offer details before you apply..

$200 Cash Back After You Spend $500 On Purchases In The First 3 Months From Account Opening: This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months. You will receive 20,000 bonus points with this bonus offer, which can be redeemed for $200 cash back. To qualify and receive your bonus, you must make Purchases totaling $500 or more during the first 3 months from account opening. ("Purchases" do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for statement credit to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Cash Back And Points: Rewards Program Agreement: For more information about the Chase Freedom Flex ® rewards program, view the latest Rewards Program Agreement (PDF) Opens in a new window . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards Opens in a new window . Cash Back and Points: "Cash Back rewards" are the rewards you earn under the program. Cash Back rewards are tracked as points and each $1 in Cash Back rewards earned is equal to 100 points. You may simply see "Cash Back" in marketing materials when referring to the rewards you earn. You may also see, "points" or "Ultimate Rewards points" when referring to the points you can use. How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Chase Freedom Flex credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count and won't earn points: Balance transfers, cash advances or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, fees of any kind, including an annual fee, if applicable. 1% Cash Back: You'll earn 1% Cash Back rewards for each $1 spent. 3% Cash Back in the drugstore and dining at restaurants categories: You'll earn 3% Cash Back rewards total for each $1 spent on purchases in the following rewards categories: drugstores and dining at restaurants including takeout and eligible delivery services (2% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). 5% Cash Back on Chase Travel bookings: You'll earn 5% Cash Back rewards total for each $1 spent on purchases made using your card through Chase Travel (4% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). 5% Cash Back in quarterly bonus categories: You'll earn 5% Cash Back rewards total for each $1 spent until $1,500 is spent on combined purchases in the quarterly bonus categories each quarter that you activate the bonus (4% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). You must activate your 5% Bonus Cash Back each quarter by the activation deadline. 5% Cash Back quarterly bonus categories may include individual select merchants in addition to bonus rewards categories. After $1,500 is spent on combined purchases in the quarterly bonus categories each quarter, you go back to earning 1% Cash Back rewards for each $1 spent, with no maximum. For more information on 5% Cash Back quarterly bonus offers, please visit chase.com/freedomflex Opens in a new window and select the Chase Freedom Flex FAQs link at the bottom of the page. For a purchase to qualify for the 5% bonus Cash Back, the merchant must submit charges to your credit card by the last day of the relevant calendar quarter. 5% total Cash Back on qualifying Lyft rides through 03/2025: You'll earn an additional 4% Cash Back rewards for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees, and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional Cash Back. You may see "5% Cash Back rewards" in marketing materials to refer to the 4% Cash Back rewards earned in addition to the 1% Cash Back rewards earned on all purchases. The additional 4% Cash Back rewards will appear on your billing statement in a separate line from the 1% Cash Back rewards. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties. Redemption values for reward options vary. Points expiration/losing points: Your points don't expire as long as your account is open, however, you'll immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window .

Zero Liability: Zero Liability Protection does not apply to use of an account by an authorized user without the approval of the primary cardmember. If you think someone used your account without permission, tell us immediately by calling the Cardmember Services number on your card or billing statement.

Cell Phone Protection: Coverage is provided by New Hampshire Insurance Company, an AIG Company. Benefits are subject to terms, conditions, and limitations, including limitations on the amount of coverage. The monthly bill associated with the phone must be paid with the eligible card for coverage to be effective. Policy provides secondary coverage only. For further information, see your Mastercard Guide to Benefits or call 1-800-MASTERCARD. Visit mycardbenefits.com to file a claim.

Account Alerts: Delivery of alerts may be delayed for various reasons including technology failures and capacity limitations. There is no charge from Chase, but message and data rates may apply.

Amazon Shop With Points: When using points at checkout, each point is worth $0.008, which means that 100 points equals $0.80 in redemption value. Amazon.com Shop with Points service terms apply . Amazon, the Amazon.com logo, the smile logo, and all related logos are trademarks of Amazon.com , Inc. or its affiliates.

Complimentary 3 months of DashPass/50% Discounted DashPass for 9 months: When the membership is activated for the first time by 12/31/2024 your Chase Freedom Flex account will receive 3 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date. After your complimentary period ends, you'll be automatically enrolled for 9 months at 50% off the then current monthly DashPass rate until you cancel. After the DashPass discounted period ends, you will continue to be enrolled and charged the then current monthly DashPass rate until you cancel. You can cancel anytime on DoorDash or Caviar. Membership will be registered in the name of the primary cardmember or an authorized user, whoever activates the benefit first. Membership period for the user on the Chase credit card account referenced above will begin and end based on when the first user activates the membership on DoorDash or Caviar. The same log in credentials must be used on DoorDash and Caviar in order for the DashPass benefit to be used on both applications. To receive the membership benefits, the primary cardmember and authorized user(s) must first add their applicable Chase credit card as a default payment method on DoorDash or Caviar, and then click the activation button. Once enrolled in DashPass, you must use your Chase Freedom Flex card for payment at checkout for DashPass-eligible orders to receive DashPass benefits. Benefits of DashPass include no delivery fee on orders above the minimum subtotal (as stated in the DoorDash and Caviar apps and sites) from DashPass-eligible merchants (amounts subject to change). However, other fees (including service fee), taxes, and gratuity on orders may apply. Current value of the DashPass membership is as of 04/01/2022. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Mobile applications, websites and other information provided by DoorDash or Caviar are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, DoorDash or Caviar benefits and services. If you product change to another Chase credit card during the promotional period, your benefits may change. You may experience a delay in updating your applicable benefits in the DoorDash application; please note, once you product trade, the benefits from your previous credit card are no longer available for your use. Your applicable Chase credit card account must be open and not in default to maintain membership benefits. See full DoorDash terms and conditions at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US . All deliveries subject to availability. Must have or create a valid DoorDash account. Qualifying orders containing alcohol will be charged a $0.01 Delivery Fee. No cash value. Non-transferable. See full terms and conditions at: help.doordash.com/consumers/s/article/offer-terms-conditions .

Complimentary Instacart+ Membership: You will receive one complimentary Instacart+ membership per eligible card account for 3 months (for Freedom, Freedom Unlimited, Freedom Flex, Freedom Student, Freedom Rise, Slate, and Slate Edge cardmembers) when the membership is activated on http://www.instacart.com/chase with an eligible card between 6/15/2022 and 7/31/2024. ("You" and "your" mean you as the primary cardmember or any authorized user, depending on which user activates first). This offer is non-transferrable. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Benefits of Instacart's membership include no delivery fee on orders that total over $35 (amount subject to change – see Instacart.com for current minimum); however, other fees, taxes, and/or tips may apply. Delivery subject to availability. If you do not currently have a paid or trial Instacart+ membership, by activating your Instacart+ membership, you agree to the Instacart+ Terms and you agree that after the complimentary Instacart+ membership period ends, you will be automatically enrolled in an annual Instacart+ membership and billed at $99/year or the then current annual Instacart+ membership rate for each membership activated, unless you have not placed any orders or you cancel during your complimentary Instacart+ membership period. If you currently have a paid or trial Instacart+ membership, you agree that your existing membership will be paused for the duration of this benefit and resume upon expiration. Your existing membership will automatically renew based on the Instacart+ Terms previously agreed upon unless you cancel. Your membership fees will be billed to any active payment method on file until you cancel. You can cancel your Instacart+ membership prior to the end of your complimentary Instacart+ membership period or at any time thereafter by selecting "Cancel Membership" in your Account Settings. Cancellation goes into effect during the next billing cycle. You may cancel within the first 15 calendar days of your paid Instacart+ membership and receive a refund of the Instacart+ membership fee you paid, but only if you have not placed any orders using your Instacart+ membership. If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Your complimentary membership benefits may be removed if your eligible credit card account is closed or in default.

Statement Credit on Instacart Purchases: Earn up to $10 per calendar quarter (for Freedom, Freedom Unlimited, Freedom Flex, Freedom Student and Freedom Rise cardmembers) in statement credits on qualifying Instacart purchases from 8/1/2022 through 7/31/2024 when you activate a complimentary Chase Instacart+ membership on Instacart.com/chase with your eligible Chase credit card. Calendar quarters are Jan – March, April – June, July – September, October – December, and the partial calendar quarters at the beginning and end of the promotional period. You can check the status of your enrollment in the Chase benefit within the Instacart+ section of the Instacart mobile app. You will continue to receive statement credit benefits regardless of whether you choose to renew your Instacart+ membership at the end of your complimentary period. Qualifying Instacart purchases include only those orders purchased by you, or an authorized user, with a Chase Freedom Flex credit card through Instacart.com or the Instacart mobile application (gift cards excluded). Statement credit(s) will post to your account within 48 hours of your qualifying Instacart purchase posting to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. Statement credits will be issued for the calendar quarter in which the transaction posts to your account. For example, if you pay for an Instacart order, but Instacart does not post the transaction until after the current calendar quarter ends, the cost of the Instacart purchase will be allocated towards the next calendar quarter's maximum, or will not qualify if the promotional period has ended. If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Accounts must be open and not in default at the time the statement credit posts to your account.

My Chase Plan Eligible Purchase: An eligible purchase transaction for My Chase Plan is a purchase of at least $100, but may not include certain transactions, such as (a) cash-like transactions, (b) any fees owed to us, including Annual Membership Fees, and (c) purchases made under a separate promotion or special finance program. Eligible purchases will be identified within your transaction history on chase.com Opens in a new window or the Chase Mobile App. Chase Mobile App: Chase Mobile ® app is available for select mobile devices. Message and data rates may apply.

INSTACART ® , the Instacart Carrot logo, the Instacart Partial Carrot logo, and the Instacart Carrot Top logo are trademarks of Maplebear Inc., d/b/a Instacart. Instacart may not be available in all zip or post codes. See Instacart Terms of Service for more details.

Chase Freedom Flex credit cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Accounts subject to credit approval. Restrictions and limitations apply. Offer subject to change.

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Chase Freedom Flex benefits guide 2024

Julie Sherrier

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Published 5:26 a.m. UTC April 3, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Shavel Ludmila, Getty Images

The Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is often listed as one of the top cash-back credit cards, offering an easy-to-earn welcome bonus, a generous introductory APR on both purchases and balance transfers and the ability to earn 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% cash back on travel purchased through Chase Travel℠, 3% cash back on dining and drugstores and 1% cash back on all other purchases. Learn how to make the most of this card in our Chase Freedom Flex benefits guide.

Chase Freedom Flex overview

The Chase Freedom Flex is consistently ranked as one of the best cash-back credit cards on the market. In addition to its great rewards rates, this card comes with a generous intro APR for purchases and balance transfers as well as an easy-to-earn welcome bonus all for no annual fee. This card is best for those who don’t mind having to opt into bonus categories that change every quarter.

The Chase Freedom Flex is one of three available Freedom cards, including the Chase Freedom Unlimited® and the Chase Freedom Rise℠ * The information for the Chase Freedom Rise℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . The Freedom Flex card is the upgraded version of the old Chase Freedom card, which is no longer available to new applicants. All three cards earn cash-back rewards that are tracked as points and can be redeemed for statement credits, cash, travel or gift cards or transferred to eligible Chase Ultimate Rewards® -earning cards, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® , which both boost the value of points when redeemed for travel purchases through Chase Travel℠.

The Chase Freedom Flex earns 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% cash back on travel purchased through Chase Travel℠, 3% cash back on dining and drugstores and 1% cash back on all other purchases. Previous quarterly categories have included grocery stores, Target, gym memberships, Lowe’s, Amazon.com, gas, wholesale clubs, charities and PayPal, among others. The new categories are announced a few weeks prior to the new quarter and cardholders must opt in each time to earn that elevated rate.

Major Chase Freedom Flex benefits

The Chase Freedom Flex has many notable features. Let’s take a look.

Attainable welcome offer

With the Chase Freedom Flex, new cardholders can earn $200 bonus after spending $500 on purchases in the first three months of account opening. This is a very attainable spending requirement compared to other top credit cards that may require a minimum spend in the thousands of dollars before you can earn their welcome bonuses.

Decent intro APR offers on purchases and balance transfers

If you’re planning a big purchase that you’d like to finance for more than a year or if you need to transfer a high-APR balance , know that the Chase Freedom Flex offers 0% intro APR for the first 15 months on purchases and balance transfers, then a variable APR of 20.49% to 29.24%. There is an intro balance transfer fee of either $5 or 3% of each transfer, whichever is greater, in the first 60 days. Then the fee is the greater of $5 or 5% of each transfer.

Rewards varied spending categories

Cardholders have the ability to earn 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% cash back on travel purchased through Chase Travel℠, 3% cash back on dining and drugstores and 1% cash back on all other purchases. Each $1 in cash-back rewards is equal to 100 points. Points can be redeemed as cash, gift cards, travel or by paying with points at select merchants.

Several insurance and travel benefits

When you use your Chase Freedom Flex card for travel reservations, you’ll have access to travel insurance for trips canceled or cut short for illness, severe weather or other eligible situations. You can be reimbursed for up to $1,500 per person and $6,000 per trip for prepaid, non-refundable fares.

Cardholders also can get secondary rental car insurance against damage or theft when using their card to pay for the reservation. Finally, you’ll be able to access Chase’s travel and emergency assistance services for referrals while traveling, though you’ll have to pay for any services or medical treatment you need.

Pay over time

If you’d like to break up the cost of a purchase costing $100 or more into monthly payments, you can opt to enroll that purchase in My Chase Plan® for a fixed monthly fee of 1.72% of the amount of each eligible purchase transaction (or an amount you choose) instead of being charged interest. Your purchase amount will then be divided into equal monthly payments ranging from three months to two years based on the purchase amount.

Additional benefits worth noting

Cellphone protection.

When you use your Chase Freedom Flex to pay your monthly cellphone bill, you can qualify for up to $800 per claim and $1,000 per year in cellphone protection, which covers against theft or damage. Just know there is a maximum of two claims per 12-month period and a $50 deductible applies for each claim.

5% cash back on Lyft rides

Cardholders who pay for Lyft rides through the Lyft app with their Chase Freedom Flex will receive a total of 5% cash back on qualifying rides through March 31, 2025.

Discounts on DashPass, DoorDash and Caviar

You can get a complimentary three months of DashPass if you activate a membership for the first time by December 31, 2024 with your card as the payment method. Once that time is up, you’ll get 50% off your membership for the next nine months.

Complimentary Instacart+ membership

To receive a complimentary Instacart+ membership for three months, you’ll need to visit instacart.com/chase to sign up with your Chase Freedom Flex by July 31, 2024. Once the complimentary membership expires, you’ll be billed the regular Instacart+ membership fee of $99 a year or $9.99 a month unless you cancel. When enrolled, you’ll also earn up to $10 in statement credits each quarter through July 31, 2024 on eligible Instacart purchases with the card.

Additional protection and warranty on purchases

When using your Chase Freedom Flex, you’ll automatically get purchase protection on new purchases for 120 days against damage and theft. You can apply for up to $500 per claim and $50,000 per account.

If a purchase comes with a U.S. manufacturer’s warranty of three years or less, you’ll also get an additional year on eligible warranties, providing extra peace of mind for larger purchases.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Chase Sapphire Reserve®

Welcome bonus.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Up to $300 annual travel credit and Priority Pass Select lounge access.

- Redeem points for 50% more value to book travel through Chase Travel ℠ .

- Transfer points 1:1 to partners such as United Airlines and World of Hyatt.

- High annual fee.

- Not ideal if you aren’t interested in transferring points.

- May not qualify if you’ve applied for 5 or more credit cards in the last 24 months.

Card Details

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

Frequently asked questions (FAQs)

Yes, the Chase Freedom Flex offers trip cancellation/interruption insurance up to $1,500 per person and $6,000 per trip for non-refundable prepaid fares in case your trip is canceled or cut short by severe weather, sickness or other covered situations.

No, the Chase Freedom Flex does not have hidden fees. However, the card agreement plainly states that there is a $40 late or returned payment fee, a foreign transaction fee of 3% of each transaction in U.S. dollars, an intro balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater, in the first 60 days (then $5 or 5% of the amount of each transfer, whichever is greater) and a monthly fee of 1.72% instead of interest for eligible purchases enrolled in the My Chase Plan. It’s always wise to check the pricing and terms page before applying for a new credit card.

No, you cannot use the Chase Freedom Flex at Costco as it is a Mastercard. Costco only accepts Visa cards as well as most debit/ATM cards.

Yes, the Chase Freedom Flex offers trip cancellation/interruption insurance where you can get reimbursed for up to $1,500 per person and $6,000 per trip for a non-refundable prepaid fare in certain situations.

The Chase Freedom card was replaced by the Chase Freedom Flex and is no longer available to new applicants. That said, the original Chase Freedom card offered a similar 5% cash back in rotating categories (on up to $1,500 in combined spending each quarter), but only 1% cash back on all other purchases. There are two other Chase Freedom cards: the Chase Freedom Unlimited and the Chase Freedom Rise (for students and those new to credit). Check out our list of the best Chase cards to see which may be best fit for your budget and lifestyle.

*The information for the Chase Freedom Flex℠ and Chase Freedom Rise℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Credit Cards Jason Steele

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne

Breeze Airways releases new Breeze Easy credit card with lofty rewards, up to 10 points per $1

Credit Cards Stella Shon

6 little-known perks of the Citi Diamond Preferred Card

Guide to Wells Fargo Rewards: How to earn and redeem points for travel and other uses

Best ways to use Citi ThankYou points

Credit Cards Michael Dempster

Why the Citi/AAdvantage Platinum Select is the best card for earning elite status

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Chase Freedom Flex vs. Freedom Unlimited 2024: Pick Your Style

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Chase Freedom Flex℠ , launched in September 2020, and the older Chase Freedom Unlimited® have certain things in common. Both are cash-back credit cards with super-generous bonuses, long 0% APR periods, no annual fees and names plucked from motivational posters.

Their ongoing rewards structures share some similarities, too, but that's also where there's the most daylight between them.

Here's how to choose which one is right for you.

on Chase's website

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

5% back on quarterly bonus categories that you activate, on up to $1,500 per quarter in spending.

• 5% cash back on travel purchased through Chase Ultimate Rewards®.

• 3% cash back at restaurants, including takeout and eligible delivery services.

• 3% cash back on drugstore purchases.

1% cash back.

1.5% cash back.

As noted in the table above, both products offer these identical rewards on certain categories:

5% cash back on travel purchased through Chase Ultimate Rewards®.

3% cash back at restaurants, including takeout and eligible delivery services like Grubhub, DoorDash and Uber Eats.

3% cash back on drugstore purchases.

Plus, for new and existing cardholders through March 2025, both cards will also earn 5% back on qualifying Lyft services purchased through the Lyft app.

From there, though, the cards go their separate ways.

The Chase Freedom Flex℠ offers rotating 5% bonus categories

Aside from the ways to earn extra cash back listed above, the Chase Freedom Flex℠ also earns 5% back in bonus categories that change each quarter, on up to $1,500 in combined quarterly purchases (category activation is required every three months). All other non-bonus-category purchases earn 1% back.

In this way, the card works much like the original, decommissioned Chase Freedom® .

The Chase Freedom® still exists but is closed to new applicants. It can be product-changed to a Chase Freedom Flex℠ if you call Chase and make the request. There is also yet another rewards-earning Freedom product — the Chase Freedom Rise℠ — but unlike the other cards, it is meant for beginners to credit.

» MORE: Read more about the benefits of the Chase Freedom Flex and Chase Freedom Unlimited

The Chase Freedom Unlimited® offers a solid flat rate on 'everything else'

The Chase Freedom Unlimited® does not feature 5% rotating bonus categories.

Instead, any purchases you make outside of the card's fixed, ongoing bonus categories listed above will earn a flat 1.5% cash back.

» MORE: What is the 'Chase trifecta'?

How do you pick between the Chase Freedom Flex℠ and the Chase Freedom Unlimited® ?

The choice between these cards comes down to how you spend money and how much appetite you have for managing your rewards:

Spending habits: Do you spend enough in the Chase Freedom Flex℠ bonus categories to make the card worth the effort? Take a look at current and past categories here . If these kinds of categories represent a significant chunk of your budget, then the 5% card is a good fit. If your spending is all over the place, the Chase Freedom Unlimited® might be the better option long term.

Complexity: Beyond its fixed bonus tiers, the Chase Freedom Unlimited® doesn't require as much tracking, and you won't have to opt in to any bonus categories. But the Chase Freedom Flex℠ requires you to activate (and keep track of) quarterly categories, and it knocks down your rewards rate to 1% back once you hit the $1,500 quarterly limit.

The Freedom cards earn Chase Ultimate Rewards® points (1 point is worth 1 cent when redeemed for cash back.) But if you also have either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® , you can transfer the points you earn from your Freedom product to one of those Sapphire products. This lets you squeeze 25% or 50% more value out of them (depending on which Sapphire card you have) when you redeem for travel through Chase.

» MORE: NerdWallet's best Chase credit cards

Looking for value with less fuss? Go with the Chase Freedom Unlimited®

The Chase Freedom Unlimited® is the better choice if you want a card with simpler terms.

It's better for the budgeter. The Chase Freedom Unlimited® is more predictable. You don't need to tailor your spending to rotating bonus categories to get a good rewards rate. That makes it easier to avoid overspending.

Say the Chase Freedom Flex℠ is paying 5% back on purchases at Amazon.com. If you don't normally shop there, you might feel compelled to change your habits — and potentially spend more — to get the extra rewards.

It’s lower-maintenance. The Chase Freedom Unlimited® doesn't require you to activate categories every quarter. Basically, this card helps you earn robust rewards with less effort. It won't leave you Googling spending categories in the checkout lane.

It pairs well with other cards. The Chase Freedom Unlimited® is a great companion to the other reward cards in your wallet, such as co-branded airline cards and gas cards. Depending on the quarter, the Chase Freedom Flex℠ bonus categories might clash with the kind of spending that those other cards in your wallet reward most.

» SEE: Making the most of the Chase Freedom Flex℠

Willing to spend time to maximize rewards? Go with the Chase Freedom Flex℠

The Chase Freedom Flex℠ is your card if you like to squeeze the most value from every purchase.

It offers useful 5% categories. Let's start with its 5% bonus categories, noted here:

These broad categories make it easier to reach your quarterly maximum. For example, if the current 5% category is gas stations, you can use your card to buy a gift card for a restaurant you frequent from the gas station’s store. In effect, you're earning 5% back on restaurants, too.

You get fixed, tiered rewards on top of all that. In addition to the card’s rotating 5% categories, it rewards spending at restaurants and drugstores year-round. That's a hard combination to find.

All told, if you can reach the quarterly spending caps on the Chase Freedom Flex℠ without spending more than you normally would, it becomes much more valuable over time than the Chase Freedom Unlimited® .

» MORE: Which Chase Freedom credit card is right for you?

Why not both?

If you're having trouble choosing between the Chase Freedom Flex℠ and the Chase Freedom Unlimited® , here's a simple solution: Get both.

These cards are often treated like rivals, but they work really well together. Use the Chase Freedom Flex℠ for its 5% categories and the Chase Freedom Unlimited® to earn more than 1% back on everything else. You can even transfer your rewards between accounts and redeem them all in one go. If you do decide to get both, space out your applications by at least a few months to minimize the impact to your credit score.

Both cards offer excellent value on their own. But together, they become even more valuable.

Information related to the Chase Freedom® has been collected by NerdWallet and has not been provided or reviewed by the issuer of this card.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

The Travel Sisters

- Chase Freedom Flex 2024 2nd Quarter 5% Bonus Categories

by The Travel Sisters | Apr 1, 2024 | Credit Cards , Flexible Rewards , Ultimate Rewards | 0 comments

The Chase Freedom 5% categories for 2024 2nd quarter (April 1, 2024 – June 30, 2024) are Amazon.com, Hotels and Restaurants.