The complete guide to corporate travel policies

The business travel policy guide you’ve been waiting for .

Creating a business travel policy for employees can feel really daunting. You don’t want to just throw something together and hope for the best, but it feels impossible to anticipate every possible scenario. The truth is your policy serves as more than a rule book; it's a guide to better decision-making about your corporate travel program and can save you a world of headaches down the road.

Introduction

What is a travel policy .

- Why do you need a travel policy?

- How to create a travel policy

What to include in a travel policy

- Travel policy best practices

- How to promote travel policy compliance

- When to review and update your travel policy

- Final thoughts

When it comes to company travel, a travel policy brings it all to one place. It acts as an influencer for travelers to make the most cost-effective choices, an important visibility tool for your managers and HR department, and it protects your people if it’s done right.

If you’re new to business travel or haven’t looked at your travel policy in a while, we’ll start with the basics and then move into the nitty gritty of corporate travel policies. We’ll touch on a few best practices for writing a travel policy, what to include, and offer plenty of resources along the way.

Ready to get cracking? Let’s go!

A travel policy is a guide for business travelers to follow that outlines:

- How, where, and when to book

- Approved technology for travel management

- Preferred suppliers for air travel, land travel, and accommodations

- Approvals process for out-of-policy bookings

- Trip extensions and personal travel

- Expenses and what is covered or not covered

- Reimbursement processes

- Business travel insurance information

- Emergency procedures and contacts

Your company’s travel policy should reflect your company culture and values, be supportive of your travelers and their needs, and protect your company from unforeseen circumstances. It acts as a central document that guides your team to the processes of embarking on company business travel, from start to finish!

While you might hear a few grumbles and groans around the words “policy” or “process,” don’t worry! A travel policy does not need to be rigid and inflexible.

Do your travelers prefer to book on their own? Don’t take away their autonomy. They can still self-book, you’ll just provide them with a better tool and way to do it more efficiently.

Do your people feel prepared for any event that can cause a travel hiccup? With a travel policy, you can give them clarity and help them feel more prepared when traveling for business purposes.

Why do you need a travel policy?

Your travel policy is an extension of your travel program and company culture. It’s the glue that holds your travel program together – from approvals, expenses, booking processes, and emergency contacts.

Having a travel policy helps you:

- Control travel costs

- Determine how reimbursement works

- Compile a list of trusted and approved travel vendors

- Manage an employee’s travel experience and safety

- Cut rogue bookings – and simplify approvals

- Budget, report on travel expenses and activity and reconcile bookings

It’s a roadmap or guidebook that your travelers can reference when they’re booking their own travel if they run into a tricky situation abroad, and it helps provide clarity around processes.

As a company though, your travel policy helps centralize your travel program, makes data and tracking more accurate and easier to navigate, and it saves time and money (including on expense management). Plus, if you take the time to craft your policy in an intentional and inclusive way, you’ll have a policy your travelers are happier to follow.

How to create a travel policy for employees

- Determine business travel guidelines

- Create a travel policy that puts your people first

- Set reasonable budget limits

- Simplify the process of expense claims

- Adopt a user-friendly all-in-one travel platform

Once you’ve read through our tips, be sure to download our free travel policy template so you can get started on creating a travel policy of your own!

1) Determine corporate travel guidelines

When you take the time to create a policy that meets the needs of your business, you are making sure that your travelers are safe, costs are controlled, and you’ve made every business trip count.

Start by looking at what types of travel are allowed and the reason for each trip.

If you have team members traveling all over the globe, you might want to set some extra safety measures. You should also decide if there will be restrictions on the type of ground transportation used or where employees can stay.

Create a process for booking flights, hotels, and other ground transportation needs. How far in advance should they be booking? Do different rules apply based on the traveler’s position? Who is the point of contact for bookings and other travel questions?

Making sure to include your company’s travel insurance info is also important. Make sure to note if your policy covers medical expenses and/or any losses due to cancellations or delays in transportation services due to factors outside an employee’s control.

Do you have a policy for reporting and documenting expenses? This includes having a system in place for claims (like meal expenses) and a reimbursement process, so your team can easily get their money!

2) Create a travel policy that puts your people first

You’ve heard the term “duty of care” before, so it’s important to create a corporate travel policy that puts traveler safety and accessibility needs first. You’ll need to define and assign the roles and responsibilities of everyone involved, including a travel manager, if you have one.

Set up an emergency plan and provide access to traveler safety information. Determine who is the emergency contact (your TMC?) and how to get in touch. Do they have 24/7 emergency support available by phone or chat? What about email support?

Invite your HR department, the travelers themselves, and your DE&I manager into a discussion to find out what needs your team has as individuals, what hiccups they face when traveling, and what holes exist in your travel program that make it difficult to navigate.

Working with a TMC is a great way to ensure travelers are kept safe before and during their trip.

3) Set reasonable budget limits for business travel

You have a budget you need to adhere to, but is it realistic? Setting reasonable budget limits is key to an effective policy.

Your budget should account for all travel-related expenses, including airfare, accommodation, meals, and ground transportation. And once you’ve set your budget, you can determine reasonable costs for hotels and accommodation, ground transport, flights, and more. Build these caps into your travel booking software to help travelers stay within the set parameters, which will later help with accountability.

It's important to set clear rules on what the company can pay back and what types of expenses are out-of-pocket.

If you’ve set a maximum daily rate for meals on work trips, it's crucial that travelers understand the limit before racking up additional charges. Requiring receipts can also help keep track of employee spending and make sure they're not going over budget.

By working with a travel management company like Corporate Traveler, you can review your previous year’s expenses and find where you can optimize or make changes based on market changes.

4) Simplify the process of expense claims

If you're unfamiliar with how to write a travel expense policy, creating a simple process for claiming expenses is key to getting your team on the same page. Do you have access to a payment system that pays for the majority of expenses at the time of booking? This could be a good way to save time and stress down the road.

The more you can pay for before your travelers get to their destination, the easier everything is to reconcile after they get home.

If you have a person in charge of reviewing expense reports and watching pre-trip approvals, make sure to set criteria for claim approvals and look at automating processes to make approvals simple!

5) Adopt a user-friendly all-in-one travel platform

Finding the right corporate travel platform is essential. The right booking platform can provide travelers with an easy-to-use experience, giving them access to the best fares and availability.

For example, at Corporate Traveler, we use Melon . It’s a booking tool, reporting suite, travel policy pusher, traveler profile manager, and so much more. Melon features a “recommended spend” function, which helps keep travelers booking in policy. Hello, visual guilt!

Melon’s simple user interface, combined with dedicated travel consultants and expert 24/7 support, makes it simple to book, manage, and keep track of your business travel. You’ll be able to access Melon-exclusive deals and perks (alongside many negotiated contracts and online deals) and take care of all your travel needs from one place.

From the get-go, you’ll be able to work closely with our team to ensure that all of your needs are met. We'll help you customize your travel program to meet specific business needs, build your travel policy into the platform, and offer training to staff to help them along the way.

Putting it all together

Wow! You’ve reached the end and should have a better idea of how to write a corporate travel policy. High five! Now it’s time to put it all together and get it on paper.

Maybe you already have something in place that needs some work or an entire overhaul. Check out our easy-to-use template and start checking those boxes!

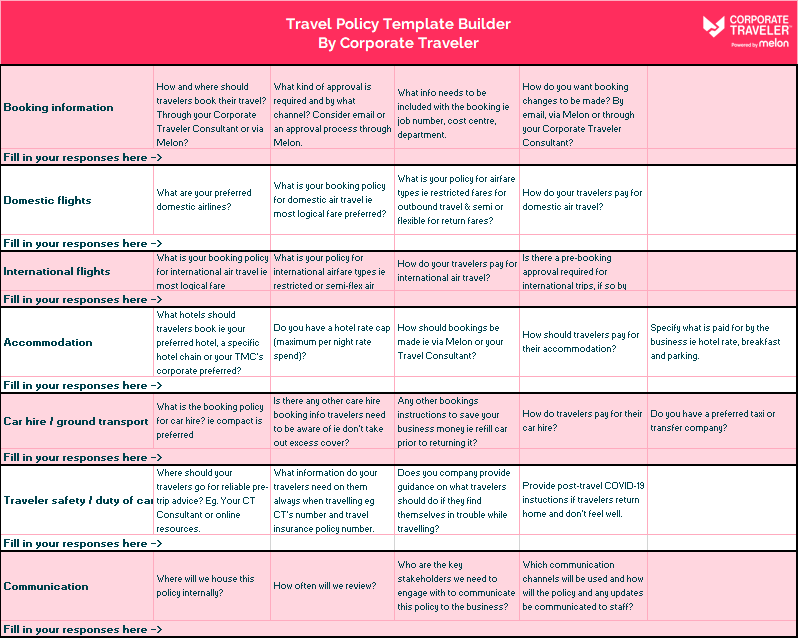

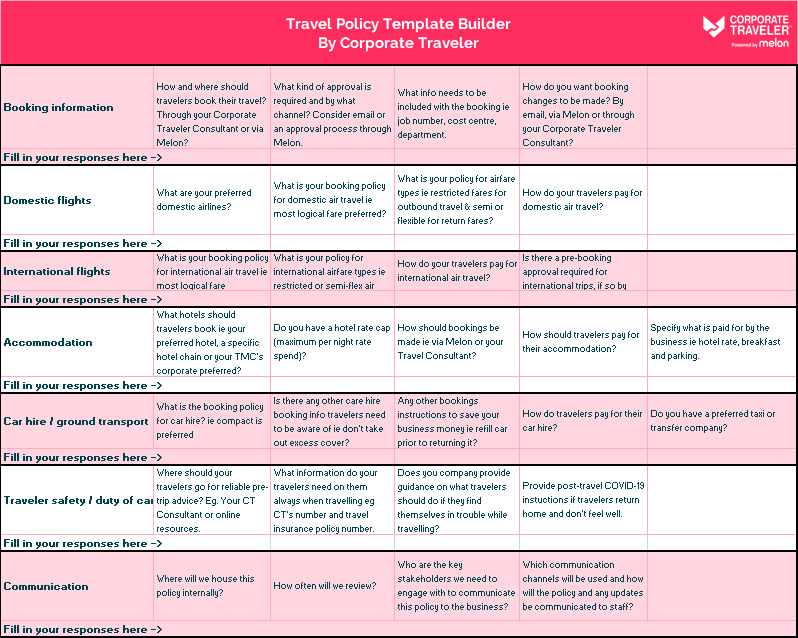

Grab our corporate travel policy template builder

Not sure where to start? No worries! We’ve got you. Here’s how to streamline your process with a travel policy template!

While there’s no one-size-fits-all travel policy for every company, following the set guidelines helps you nail a perfect-for-you policy that can see you through an ever-changing travel climate.

Travel policy template

When you’re crafting your business travel policy, there are so many considerations to be made. Things might come up that you never even thought of, but not to worry. We have loads of resources to help you see this through.

Starting out, it might be looking a little drab and wordy, but depending on your travel program size, a visual travel policy might be just what you need. You can search for examples online or take a look at an example of a visual travel policy we’ve created.

When building your policy, it’s important to include:

1. International or foreign travel policies

When you’ve got travelers all over the globe, you need to build out a policy for international or foreign travel. This is a protects them (and you) on anything from travel safety, to expenses, and everywhere in between.

Whether your travelers are individuals or entire teams, your international travel policy needs to cover:

- How and where to book – is that with a travel manager, online booking tool, a travel management company (TMC) ?

- Travel insurance coverages and contact info – international numbers and policy information

- Emergency contacts – how to reach them and the process of in-destination emergencies

- Travel expenses – limits and how to file for reimbursement

- Travel documentation – who to contact with questions

- Advance booking timelines – when should they be booking for international travel?

- Travel extensions – are these allowed and what are travelers expected to cover if they choose to extend their trip for leisure?

By outlining all of this information in your policy, you’ll streamline the process for your finance teams, travel managers, and your travelers. And really, who doesn’t want to make travel a smoother experience?

2. Corporate travel policy for business class travel

Does your corporate travel program have different rules, limits, or allowances for different levels of seniority? Are some junior members expected to travel in economy class, while some executives are allowed to book in business class?

If some certain exceptions and situations might allow for an employee to book business class, regardless of their position, you should include that in your policy as well.

Making this as clear as possible will avoid an approvals nightmare down the road.

3. Corporate meal allowance policy

It’s great if you’ve already centralized most of your business travel expenses like flights, accommodation, transportation, and car rentals, but your people gotta eat! It’s super important to include a meal allowance policy that clearly outlines which meals (and how much) you’ll cover.

Some of your team might be traveling with corporate credit cards, while others might need to be reimbursed. The guidelines and procedures for submitting expenses or asking for reimbursement need to be crystal clear!

Make sure to outline if you have a corporate travel policy for alcohol, too! You don’t want murky policies when it comes to footing the bill for drinks.

Some things to consider for your meal allowance and alcohol travel policy:

- Which meals are covered and for how much?

- Who is footing the bill for an alcoholic beverage with dinner?

- If entertaining clients, what is the budget, and how flexible is it?

- What is the process of submitting company card expenses?

- What is the process for requesting reimbursement?

Your team will always have questions about the policy on food and drinks, so make sure they can find the info easily and have a point of contact for whoever can offer more clarity.

4. Executive travel policy

We briefly touched on executive travel when we talked about traveling in business class, but there is certainly more to the top dogs traveling.

Executive travel can be a touchy subject if there are more lenient policies in place than there is for less senior team members. Your executives also may need to know the guidelines in place for their own travel, so they don’t accidently go overboard, which could be an accounting nightmare!

You’ll need to make sure you deliver a guide for approvals, procedures, booking deadlines, meals, accommodation, basically everything.

Lay it all out. Make your policy as digestible as possible, and for a busy exec, consider bullet points and titles in bold so they can easily skim to the areas they need to know.

5. Natural disaster or COVID-19 business travel policy

We can all agree that COVID-19 caused business travel to come to a screeching halt. Across most industries, the pandemic impacted client relationships, the ability to gain new clients and caused budgets to get slashed pretty dramatically.

While this was only one event, many businesses have begun to consider the “what-ifs” of their travel programs should another outbreak of COVID or something else happen. Crossing our fingers and toes doesn’t cut it, unfortunately.

There is also the chance of their travel being impacted by a natural disaster. We’ve seen it before – earthquakes, tsunamis, volcano eruptions, hurricanes. Do you have a plan or policy to aid your team and guide them through the unthinkable?

In 2022, we surveyed 120 employees across various industries and businesses. More than half, 51% of respondents said their companies didn’t provide resources or tips for safety on their trips. Duty of care isn’t something to put on the back burner, it’s your legal obligation to make sure your team is informed.

So, what’s the solution, you ask?

Working with a TMC gives you the backup you need if anything ever happens and you have people traveling abroad. At Corporate Traveler, our travel management software, Melon, is a central place to house your policy for quick and easy access. Plus, our travel experts can help you paint the big picture of what to do, who to call, and how to get your team home safely as quickly as possible.

Is there anything missing from your travel policy?

Let’s break it down. If you think of your policy like a sandwich, it should include:

The bread and butter

- Where and why: Are there any restrictions on who travels domestically or internationally? Or guidelines around reasons for travel?

- When: Are there any restrictions on when business travel is a no-no, like during an auditing period or financial downturn?

- How? How should travel arrangements be booked? Through your corporate travel booking software or with a preferred Travel Management Company (TMC)? How far in advance should domestic and international trips be booked?

- Preferred suppliers: Do you have preferred partners for air travel, accommodation, ground transport or travel insurance?

- Approvals: Who’s responsible for giving the green light on trips?

- Show me the money: What’s the process for managing/submitting expenses, paying for travel and reimbursements?

- Uh-oh: How will you prevent or deal with non-compliance to the travel policy?

- Noise level: Getting loads of ‘noise’ and questions about things in your policy? This means it’s not clear and it’s time to review why and where the stumbling block is for travelers (or your finance team!)

The filling

- Classy, baby: Who gets to fly business class, book 5-star properties or order UberLUX? And how does your business handle upgrades or airport lounge access for long-haul flights?

- All work, some play: What are the conditions if someone wants to extend their business trip to take personal leave? Are you happy for them to enjoy a bleisure trip, and if so, who foots the bill and for what?

- Loyalty: Are there any travel rewards or business loyalty programs that can be used during booking?

- Spending money: Do your business travelers have a daily allowance for meals, snacks, and drinks? How much is it, what does it include – and what’s not covered? Can they order room service, drink from the mini-bar, or use the in-house laundry service?

The not-so-secret sauce

- Safety first: your policy should support air, accommodation and ground transport suppliers that have been safety and security vetted. Guidelines or information on travel insurance for work trips is also helpful.

- Now what: What’s the plan of action in the case of Acts of God or Force Majeure events? Does your team know who to call for help?

- What’s next: Who is responsible for updating and reviewing your travel policy, and how often?

Corporate travel policy best practices

- Write for skim readers

- Guide travelers to the right resources

- Automate your policies

- Stipulate a timeframe for expense claims

- Be prepared for the unexpected

1. Write for skim readers

One of the first steps towards writing a people-first travel policy is understanding how your travelers will read it. And the truth is…

They probably won’t.

Research has shown that adults get distracted every 47 seconds . So if a business traveler is looking at your policy, they’re most likely just searching for a specific answer – and they want it fast. So what can you do?

First, make sure the document is easy to navigate. That means including things like:

- A table of contents

- Visual elements to help guide the eye toward crucial information, like flow charts and tables

- Clear headings and important details in bold

- Bulleted lists (see what we did here?)

And even though it’s a technical document, don’t make it sound like one. An effective travel policy should be clear, concise, and easily comprehended. So skip the long, complex sentence structures and technical jargon, and write in plain, simple English. It helps to pretend like you’re writing it so an eighth-grader can understand it.

2. Guide travelers to the right resources

Remember when we said travelers will only read your policy to find a solution for a specific need? Whether it’s a link, a phone number, or a step-by-step tutorial – a well-managed travel policy should provide them with the right resources.

Instead of treating a travel policy as a list of rules, treat it like a resource sheet. Here are some key pieces of information travelers might need to pull up easily:

Your approved online booking tool (and steps on how to use it)

- QR codes to download your mobile travel app

- Preferred airlines, including class, budgets, and other limits

- Permissible hotels, including guidelines on star-class and incidental expenses

- Guidelines on ground transportation (trains, ride-sharing services, rental cars, and personal car usage)

- How to get travel support

- Travel insurance carrier

- Clarification on the reimbursement process (more on this later)

You can also include other factors specific to your company, but this should at least be the necessary groundwork to help employees make the right choices on their own.

3. Automate your policies

Let’s face it: even with the best communication efforts, there’s always a chance that an employee may violate policy, even unintentionally. So, what can you do?

Build policy into booking.

By building your travel policy into your travel management software, it becomes unavoidably embedded in the booking process, so even the most easily confused employees end up following by default.

Automation tools can sound the alarm on out-of-policy bookings and even provide an audit trail. This can be especially helpful for employees who may struggle to remember procedures and policies, especially after big changes to your travel program.

4. Stipulate a timeframe for expense claims

No one wants to get stuck waiting on the money they’re owed – or worse – find out they’re not getting reimbursed for an expenditure they thought would be covered.

Having a clear and well-defined expense claim process is critical in any travel policy. Employees need to know how to claim their travel expenses, how soon they need to submit an expense report, and when to expect reimbursement.

The policy should also be clear about what expenses are and are not reimbursable, including any limits or exceptions. For example, if an employee needs to book a different seat class to accommodate a disability , the policy should include the process for requesting and approving this expense.

Plus, a submission deadline reduces cash flow issues and provides more accurate and complete expense data for that period (your finance team will thank you later).

5. Be prepared for the unexpected

As a company, you have a duty-of-care responsibility. When it comes to business trips, you need to be prepared for the unexpected. No matter how much effort you put into planning, there will always be a few hiccups along the way.

For instance, lost luggage, canceled or delayed flights, and sudden weather or political emergencies in unfamiliar destinations could all leave your employee stranded.

“Companies need to be prepared to plan for the particular, not just the universal. Every aspect of the travel program needs to be able to fit each of your travelers like a glove, from adaptable plans and experts on call, to technology that makes the journey seamless.” - Emese Graham, DE&I Manager @ FCTG

Don’t let unexpected situations blindside you. Have processes in place to ensure travel safety and security. Make sure they know what to do, where to go, and who to get a hold of if something goes wrong. Taking a proactive and prepared approach to your policy can minimize the impact of emergencies and take care of your team’s well-being while they’re on the road.

BONUS TIP: Update your policy regularly

Here’s a free business travel policy best practice just for you! It isn’t just a “one and done” deal – it’s a living document.

What’s that mean? As your company grows and travel conditions change, so should your travel policy. Revisit your expense policy at least once a year to keep it relevant and effective – and lead you towards new cost-saving solutions.

Data is going to be your best friend here. Here are a few key factors you should look into when updating your travel policy:

- Analyze travel spend patterns – are you throwing a lot of company money at certain suppliers? You might want to see if you can negotiate a new deal or find better rates elsewhere.

- Identify areas of overspending or inefficiency – are employees accruing high parking or travel costs? See if you can get season tickets or other accommodations.

- Evaluate the overall performance of your policy – are you still compliant with any new regulations that have come into play since the policy was established? How can traveler experience be improved?

You may even want to consider enlisting the help of professionals, such as a travel management company with experience in expense management, to give advice on how to optimize your travel policy to better meet the needs of your employees and your business as a whole.

Building a travel policy that's good for business and travelers and meets their needs is no small feat. But whether you're looking to retain your team, attract new talent, or make life a little easier for your travelers, investing in a well-designed travel policy is definitely worth the effort and great for company culture.

By following these travel policy best practices and ensuring your policy meets all travelers' needs, you’ll be on your way to smoother, safer, and more enjoyable travel experiences for all.

How to promote travel policy compliance

Whether compliance is a big or small issue in your company, it takes a little bit of investigating to figure out why it’s an issue at all.

Maybe your policy meets the needs of only a few of your team members. Maybe it’s too difficult to navigate your policy. Or maybe, your policy is written in legalese and makes your travelers vision blur before they go rogue and book how they want.

It could be that your travelers prefer a bit of freedom in booking and would rather do it on their own. Or, maybe they have specific needs that aren’t being met by the options provided.

Whatever their reasons, it’s your job to figure out why they aren’t following and what you can do to build better compliance.

Here are a few tips to improve travel policy compliance:

- Make your policy easy to navigate, understand, and find

- Use an online booking tool (OBT) for travelers who prefer to self-book

- Allow a bit of flexibility so travelers feel they have some autonomy

- Include a category for last-minute bookings so it doesn’t mess up your data

- Understand your traveler needs and build an inclusive policy

Read the full guide:

You've researched, gathered the necessary resources, and communicated your travel and expense (T&E) policy to your employees. But now, you're not so sure they're actually following it.

Read the full guide: How to Improve Corporate Travel Policy Compliance

When to review and update your travel policy

If the last time you reviewed or upgraded your travel policy was more than a year ago, it’s outdated and needs a refresher. If your company is small and has low turnover, you could probably get away with making small tweaks and optimizations.

But if you have a larger company with multiple departments and higher turnover, you probably need to do an overhaul and review it more regularly. We’re not saying you have to change it every time someone is hired or leaves the company, but making sure it’s relevant to the people who are there and are traveling matters!

Corporate Traveler conducted a survey in 2022, which showed that 48% of respondents didn’t know if their company had resources for specific traveler profiles, while 41% said their company didn’t provide resources for specific traveler profiles. This really goes to show that there’s room for improvement in how policies are built to support their people and their businesses.

A people-first travel program and policy have become necessary as the world grows and begins to understand neurodiversity, disabilities, and cultural differences. When we learn about our team members’ diverse needs, we can better understand how to support them when they venture abroad for our businesses.

GUIDE: Download the How to design a people-first travel program guide

We recommend policy reviews every 3-6 months, but at the minimum, once per year.

Final thoughts

Business travel is so unpredictable, as we’ve seen in recent years. There will always be circumstances you can’t avoid as a company, but making sure that you have the necessary checks and balances in place can help to make things just a little easier. If you have groups traveling, VIPS, or people heading to high-risk destinations, it’s important that your policy is relevant.

Don’t forget that travel policies shouldn’t be written and forgotten about – these are living documents that must be regularly updated to make sure they best protect your people.

Remember these best practices when writing your travel policy:

- Keep it simple and make it pop with visuals, bullet points, and bold headings.

- Answer any and every question possible – think of all the eventualities

- Always put your people first

- Implement a quick and simple approval process

- Automate as much as you can

- Use technology that’s supports your policy

- Be flexible with due reason

- Be clear about what’s not allowed

- Update your travel policy at least once a year

- Keep it somewhere easy to find

And finally, it doesn’t hurt to have a couple of different formats. Consider a visual version and an extended version so the message is delivered best depending on the person reading. For some, it might be easier to digest one over the other.

Looking for a policy review? We’d be happy to work with you.

Let’s chat .

for Shared Services

Thresholds for business class travel, peeriosity insights: recent research findings summarized insights. to view detailed research results, contact us to inquire about membership..

With the move to control discretionary spending in recent years, many companies have significantly reduced their travel budgets. One opportunity to secure large gains in this space is by restricting business class travel, where the price difference for a single trip can be $4,000 or more. Given that the most powerful executives are often frequent travelers, setting the policy can be difficult, and there often is a threshold when an employee can book their trip in business class. And, since the majority of companies have a mix of local and global travel policies , creating policies that are consistently applied globally can be difficult.

Recently, a Peeriosity member from a large global company that didn’t permit business class travel wanted to understand the approach followed by peer companies, and also understand the mix of global and local policies for the travel process. To find out, the member created an iPolling TM question and within 48 hours they had their answer.

The poll results indicated that 78% of member companies allow travelers to book in business class with certain restrictions. For 22% it is simply a matter of job level, and for 56% an approval threshold is set based on either the trip duration or the distance traveled. Here are the details:

Results to the question about the scope of the travel policy were surprising, with 57% reporting that they have a mix of global and local policies, and just 35% reporting that travel policy is set and managed only on a global basis. Creating a consistent travel policy not only improves the efficiency of the travel process, but it can also reduce complexity for the traveler, as well as ensure a proper balance between business need for travel perks and the cost of the premium services.

Here are examples of some of the additional comments from Peeriosity members that were added when they responded to these questions:

- Previously, business class was open to all employees, regardless of status for flights longer than 9 hours. This policy has recently changed to be based on the employee job level , plus the flight needs to be longer than 9 hours.

- Business class travel is allowed when the total flight time of all segments of a one-way trip is at least 6 hours.

- Approval for business class travel is based on the employee’s job level and the frequency of international trips.

- Employees may use business class when the combined intercontinental flight connection exceeds 5,500 miles, or if the circumstances of the itinerary (e.g. multiple business stops) result in a fare equal to or lower than a coach.

- Officers may fly first class where offered and, if not, business class. All other employees must fly economy unless the flight exceeds a certain amount of time.

- Business Class is permitted for flights exceeding 5 hours, except when traveling within North America (the U.S., Canada, and Alaska), Mexico and Central America, or between the U.S. and the Caribbean.

- Business travel is permitted for VP-level employees traveling on international nonstop flights lasting 10 hours or more.

- We allow business class for travel over 8 hours. For trips over 12 hours in length, we allow travelers to downgrade to economy class for a one-time cash payment to the employee of $1,500 (before taxes).

Under what circumstances does your company allow employees to book airline tickets in business class? How consistent and how global is your company’s travel policy?

Who are your peers and how are you collaborating with them?

_____________________________________________________________________

“iPolling TM ” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated e-mail system, Peer Mail TM , members can easily communicate at any time with others who participate in iPolling.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here .

- Travel Advisory

- Travel Podcasts for Covid Times

Corporate Travel Management Blogs

7 corporate travel policy templates to help you define.

Sajit Chacko Co-Founder

A corporate travel policy template can be a valuable tool to help companies define their policies and ensure that all employees are compliant with the company’s expectations. With a template, companies can quickly create a customized document that will ensure their travel policy meets all legal requirements as well as any other specific needs of the business.

For a business to implement a trip, it must first select and purchase the most economically viable choices for flights and accommodations. Apart from flight tickets and stay, incidental expenses commonly include trip aspects such as food, gifts to customers, newspapers, laundry services, value-added hotel services, dining charges, events tickets, local commutes, room service, and long-distance calls.

By 2022, global corporate travel spending was expected to amount to over US $930 billion, emphasizing how expensive it can be to secure these expenses and successfully conduct a feasible business trip.

Additionally, it is worth noting that planning and implementing these trips through traditional expense management systems makes it more expensive, tedious, and time-consuming than it needs to be. Due to the lack of transparency and restrictions of these systems, it is often a challenge for companies to track these non-budgeted expenses until post-trip reconciliation.

By this time, it’s too late, and the employee already charges the costs to the enterprise. For a company to maintain a trip’s economic feasibility, it is crucial to establish the appropriate cost-cutting measures well before the trip’s planning phase takes place.

A well-written company travel policy can be instrumental in achieving this by providing businesses and travel stakeholders the means to reduce, streamline and curb associated corporate travel costs.

Studying the approaches leading organizations have taken to address their corporate travel and employee needs is an excellent way for aspiring businesses to devise their corporate travel strategies.

Make sure to emphasize the perks of following your policy for travelers, like keeping them safe and providing support, so they understand why it’s important.

This article aims to provide businesses with seven market-tested robust templates that they may leverage as inspiration to create a winning corporate travel policy.

Before you begin, it is essential to understand what a business travel policy is and what it can help your business achieve.

What is a corporate travel policy?

A business’s travel policy is a set of regulations and parameters set by business leaders to effectively manage travel bookings and expenditures when employees travel to visit partners, sites, prospects, clients, colleagues, and conferences.

This crucial document contains information on the extent of expense coverage and considerations that travelers must follow when making flights, accommodation bookings, and incidental expenses during all travel phases.

For an employee to secure timely T&E reimbursements, it is an absolute must to abide by the rules and guidelines this policy sets.

Best Corporate Travel Policy Templates

To help you understand these policies better, let us take a look at seven well-established organizations and their take on corporate travel:

Netflix, the world-renowned streaming platform’s travel policy, is a reflection of its organizational work culture and merely states, ‘Act in Netflix’s best interest .’ These five worded simplistic travel policies provide employees an elevated level of freedom, control, and responsibility over planning and implementing their corporate travel than most other companies.

Instead of restricting employees with a stringent corporate travel policy, Netflix enables its employees to make their own travel decisions how they see fit as long as they conduct themselves in the company’s best interest and continue to drive value to the organization. Employees are free to take vacations without restrictions on the number of days a year.

The goal here is to give employees the freedom to use their best judgment and make wise decisions by understanding the context of what management considers appropriate and inappropriate without imposing strict guidelines.

This policy is enforced by a lead-by-example approach where Netflix’s leadership takes vacations that are also productive for the company.

Although this famous policy may not be suitable for all organizational types, it is still worth studying to gauge if any aspects of it may benefit you.

While Basecamp’s policy follows a similar approach to Netflix’s, it is not nearly as simple. Basecamp instead takes it one step further by providing all employees with an American Express card that they can use without restrictions or approvals.

The only criterion this highly trust-based approach expects from its employees is to be reasonable regarding the expenses they charge to the company account. It is a tricky system for businesses to implement as it requires high transparency of documented transactions for finance departments to ensure that expenses are justifiable.

Basecamp additionally offers its employees perks such as monthly capital allowances for recreational and fitness activities such as massages, yoga, and gyms.

The British Broadcasting Corporation (BBC) follows a traditional travel policy that provides its employees with informative and simplistic documentation of its policy coverage. This travel policy provides guidelines on all travel categories and transparent information on what expenses qualify for reimbursements.

Being a sustainable corporate travel policy, it encourages employees to prioritize public transport, preferably rail, to reduce the company’s environmental impact. The expense policy also dictates using communication tools such as Telepresence, Skype, and other video conferencing options as an alternative means to conduct business to travel whenever possible.

When air travel is unavoidable, the expense policy asks employees to make all flight bookings through BBC Travel & Delivery. The policy also requires travelers to obtain formal pre-approvals from the Divisional Finance Director for all bookings.

If group bookings exceed ten travelers, the tickets must be procured well in advance with the BBC’s preferred suppliers and vendors. The company allows personal travel to be combined with business travel only if it reduces the cost of travel to the company.

Employees must book the lowest-priced economy-class tickets regardless of the airline. Travelers may book premium economy tickets if their flight duration exceeds six hours and are expected to work immediately upon arrival.

Business-class tickets are reserved only for employees that have to travel over eight hours and are required to work immediately upon arrival. First-class tickets are entirely out of the question for employees and not covered under the company’s travel policy without any exceptions.

The company vigorously enforces these rules and carefully monitors upgraded tickets. Employees are encouraged to stay in private accommodations, for which they can claim £20 per day, including food. Employees can claim reimbursement of incidental expenses such as personal calls and basic laundry when their official stay duration exceeds seven nights.

The expense policy for meals states that employees may claim up to a contribution of £6 per meal inclusive of taxes within working hours and £16 for any meals for work conducted after 8 pm. Employees must produce receipts for every meal and detail them individually in the Concur claim form.

The BBC also allows employees to visit theatres and other cultural locations, provided they can assess talent and generate potentially lucrative ideas for the company.

In such instances, the employee may purchase a single ticket reserved for themselves. They must also provide appropriate reasoning for their visit in the claims form to get reimbursed.

For local commutes, the BBC’s corporate travel dictates that the usage of cabs is permissible only for business purposes if it is the cheapest available mode of transport. When such a requirement arises, the ride cost should not exceed £100, including all waiting time, booking fees, trip costs, and miscellaneous costs, unless it is the cheapest transportation option available.

Employees traveling by cab must prove that they are commuting for work by filling out a passenger declaration form. When a cab ride for official work exceeds a distance of forty miles, the company will deduct it from the employee’s salary.

If it is the cheapest option, employees may engage in personal commuting for official business purposes. Their travel policy allows employees to acquire reimbursements for any fuel consumed during the commute, provided the traveler submits the appropriate receipts to the company detailing the business purpose of the journey.

The BBC also allows employees to submit claims for car parking and toll costs as long as they are reasonable and if they occurred while conducting official business.

Federal Express, a global air freight network, provides reliable, prompt, time-definite delivery to over 200 countries and territories around the globe. As an international company that conducts its operations in numerous geographical locations, it formulated an iron-clad corporate travel and expense policy template that leaves no room for doubt for its employees on its coverage.

All business travel ticketing, including airline tickets, rail tickets, hotels, and rental cars, must be booked through FedEx’s authorized travel agency or tools. Traveling employees are permitted to use only economy class, although travelers are allowed to use Business-class if the total travel time exceeds six hours.

Flying First-class is reserved only for the company’s President and Vice Presidents.

FedEx Corporation has a preapproved list of hotels offering discounted corporate rates for their traveling employees across the globe. Employees may book a stay at a non-preferred hotel only when preferred hotels are busy or unavailable.

The corporate policy dictates that all employees must use the least expensive transportation option available such as public transportation, free shuttles, or personal vehicles, with the use of rental cars reserved only when it is cheaper than public transport and economically viable.

Upon using a rental car, travelers must utilize it optimally with other team members to reduce the overall transportation cost to the company. Upon trip completion, the original receipts and rental agreements must be submitted to the finance team at FedEx for approval.

Its corporate policy requires employees to carefully retain all receipts and submit expense reports trip-wise or weekly basis. FedEx remains clear that non-adherence to its corporate policy can lead to employee termination, depending on the circumstance.

Dartmouth College

Dartmouth College’s corporate policy template is a comprehensive document that clearly defines all allowed and disallowed expenses to keep employees clear on their expense limitations.

It details the penalties one might face when one fails to abide by the policy. It may not be a simple playbook, but it was designed specifically for the educational institution and its employees.

Dartmouth College recommends that all traveling employees who travel at least once a year obtain a corporate card for their travel expenses. Its policy dictates that employees book airway tickets through the Dartmouth travel portal.

Employees not possessing a corporate card may acquire advances to cover incidental costs for a maximum daily limit of US$50 as long as they provide a valid justification for it accompanied by proper receipts. These advances must be requested at least ten business days from the travel date and under no circumstances should be used to cover personal expenses or activities.

Non-compliance or abusing the Dartmouth travel policy will result in the Dartmouth Controller’s Office revoking the traveler’s advance privileges.

The educational institution’s policy requires employees to choose the least expensive flight tickets, factoring in reasonable comfort and convenience requirements. It also encourages employees to leverage Dartmouth College’s contract with Travel Leaders to ensure they book the lowest fares.

A significant employee benefit of the T&E policy is that travelers can personally retain the frequent flier points they accumulate through the corporate travels they can redeem for personal benefit. These benefits do not include any membership fees the employee may pay to join the frequent flier club.

Employees are allowed to book business class tickets when the travel time exceeds five consecutive hours in duration or during exceptional circumstances subject to the approval of the Dean, President, Vice President, Board of Trustees, or Provost.

Value-add-ons such as preferred seat selection and baggage fees are deemed acceptable per the policy, provided they are reasonable.

This company has a simple, transparent, and easily adaptable policy template that businesses can use as a starting point for writing their corporate travel policy. Businesses must download the customizable policy template from Workable’s company website and alter it based on their unique organizational travel requirements.

The policy requires employees to contact the office manager, HR generalist, or finance manager for travel-related bookings. The robust approach requires employees to utilize their best judgment while on their trips and submit all travel-related invoices post-trip completion.

In their policy, a ‘business trip’ is any trip whereby an employee travels to a city different from where they typically work to conduct official business. The policy recognizes employee travel for client meetings, lectures, presentations, events, conferences, off-site company locations, and research trips as reimbursable.

In such instances, all car, bus, or train commutes employees take that exceed an hour in travel time are also considered reimbursable business trip expenses. The policy does not consider daily work commutes of employees as a business trip regardless of how far they have to travel to get to the office.

It dictates that traveling employees are eligible to book a premium economy ticket, while Executives can book business class. Employees who utilize alternative means of air transport, such as boats, coaches, and trains, are eligible to reserve premium seats to and from their destination.

Although, Workable’s travel policy does not cover any value-added services or extra baggage. The policy mandates that employees seek written approvals from their respective managers and book travel tickets and accommodation at least two weeks before the travel date.

However, the policy facilitates flexibility for unforeseeable circumstances where the need for travel is unexpected.

Traveling employees are allowed to travel by their personal vehicles or taxis for their business trips. In the case of the former, fuel and toll bills, and for the latter, the cab fares, are reimbursable provided the employee provides the appropriate receipts. A rental car is a third option per the policy for trips permissible when employees travel to multiple destinations to conduct official business.

In such instances, the employee must book a basic two-four-door, compact, automatic transmission and petrol-powered automobile.

Employees are entitled to stay in three-star hotels or the best available accommodation available in the area, which will be paid for by the company. They are further encouraged to leverage business partnerships with hotels for discounted rates.

Pending approval from the manager, employees can upgrade rooms or stay at higher prices if they pay the price difference. The policy stipulates that the company will not pay for upgrades or value-added services.

Employees are also permitted to travel with a friend, partner, or family member if the extra member does not increase the travel cost to the company. In such cases, the policy requires the employee to pay in full for all additional expenses incurred that may arise due to the non-employee.

Workable’s policy allows employees to claim up to US$20 for meals, including lunch and dinner, during business trips. Client dinners also come under the policy’s coverage for up to US$150.

The traveling employee must acquire approval from Workable’s Chief Finance Officer (CFO) if the bill exceeds that amount.

Corporate Traveler

Although it’s not a readily usable travel policy template, it serves as a guide for businesses to deploy their T&E policy . It dictates the steps and important considerations when devising a robust policy for unique business travel demands. It focuses on streamlining the corporate travel process to reduce costs and keep travelers safe.

Employees are encouraged to use preferred suppliers and always opt for travel insurance. It motivates employees to avoid using business class or premium economy unless the flight time exceeds 10 hours.

Additionally, the policy encourages businesses to outline clearly and precisely to employees on all reimbursable and non-reimbursable expenses, including meals, per diems, and ground transport, amongst others.

Create and enforce your travel policy with Tripeur

Tripeur is a state-of-the-art travel management platform that simplifies the burden and responsibility of creating, updating, and enforcing your corporate travel policy.

Once you write your policy, our system eliminates compliance issues by logging all business travel expenditures in real-time. These logs actively give employees T&E visibility to inform them precisely on what travel expenses they are entitled to and their limitations.

Tripeur’s platform aims to help businesses overcome compliance issues by providing managers with the functionality of delivering WhatsApp and email approvals accompanied by automated expense reports. Through our system, management can instantly identify and mitigate any non-compliance in real time and enforce preventive measures to prevent future occurrences.

Our innovative and user-friendly product could be the solution to create a robust travel policy that can effectively handle the re-emergence of international corporate travel. Every tool you need to maintain compliance is readily available within Tripeur’s powerful platform.

Trying to figure out how to get better compliance with corporate travel policies? When you get Tripeur to book your business trips, it’ll link in with your travel policy. This makes it easier to spot when something isn’t following the rules and enables employees to make smarter decisions quickly.

For CFOs Consistent YoY savings by changing user behavior

For Travelers Superior experience for travelers with a virtual travel assistant

About Us Passionate about bringing the much needed change in Business Travel

It’s three-in-a-box corporate travel experience solution . Check it out

The Complete Guide to Business Travel Policy (With Free Downloadable Template)

Business trips may be unavoidable if you have overseas clients or offices in multiple locations. Or there may be international conferences that you want your employees to attend. With travel comes the hassle of booking transport, accommodation, paying for meals, and managing aspects related to the trip.

Well, the norm is for companies to pay for any business-related expenses and business travel is one such major expense. To make budgeting and paying for corporate travel easy, it is advisable to have a business travel policy in place.

What is a business travel policy?

A business travel policy or a corporate travel policy is a formal document that sets rules, guidelines, travel reimbursement process and other aspects related to business travel. It sets the tone for how employees should book, manage and apply for reimbursement for travel expenses related to a business trip. It must also include details on how managers should approve business travel.

A company travel policy will include a purpose statement, scope, authorization and reimbursement processes, and travel arrangements. It will include details on transportation including airfare, per diem meal allowance, accommodation, incidental expenses and any miscellaneous expenses that may arise on a business trip.

Usually, you may have a finance manager or a travel manager taking care of corporate travel. You could also hire an external travel agency. Irrespective of whether you manage business travel in-house or outsource it, having a comprehensive company travel policy regarding domestic and international travel can ease the process.

The objective of having a business travel policy

The objective of having a travel policy for employees in a company is to establish specific standards for corporate travel. It is essential to be prudent. A company-wide business travel policy will set the expectations for booking business travel for different levels of employees. It will provide the basis for employees claiming reimbursements, set a process for the same and make it easy for both travellers and travel approvers.

A travel and expense (T&E) policy is also required to help employees understand the legalities of business travel. It will also help with expense reporting and explaining to authorities how you budget and spend travel expenses as a business.

With a T&E policy in place, you will be able to budget better, monitor employee spending, and ensure that employees have a safe trip. It is also a good way to reduce overspending and limit fraud.

Scope of a travel and expense policy

A comprehensive T&E policy should ideally cover all regular employees of the company. That should include top management and percolate down to interns, depending on who may need to travel. It could also include contractors, seasonal employees, part-time employees and all others who may need to travel.

The scope should include:

- Transportation including airfare, trains and buses

- Private transportation

- On-ground or local travel

Accommodation

- Incidental expenses such as WiFi, parking charges, etc.

- Miscellaneous expenses such as cost of vaccinations and boosters required for Covid

- Helpline numbers

The repercussions of non-adherence to the company travel policy should be stringent for all.

Why do you need a business travel policy?

If you are a company that has employees who need to travel regularly, then it is optimal for you to have a T&E policy for employees. It has a range of benefits, not just for the business but also for your employees.

A corporate travel policy will ensure employee safety

There is a Duty of Care that all employers owe to their employees. If your employees are on business travel, you must ensure their safety and protection. Having a travel policy for employees with clear guidelines can make travel safe. For instance, you may mandate that employees fly with a carrier with the highest safety standards. Or, you may permit employees to use private transport late at night. That is a reliable place to work.

It saves costs

One of the biggest reasons to have a business T&E policy is to regulate costs. Research suggests that business travel expenses could grow to $1.7 billion by the end of the year. Businesses usually spend an average of 10% of their annual expenses on corporate travel. Without guidelines that tell your employees what an acceptable level of spending is, your business travel expenses could shoot up considerably. Employees may be tempted to go in for the most expensive option without appropriate guidelines in place. You don't want your employees spending on presidential suites and ordering caviar at company expense. In that case, you should consider enforcing a corporate travel policy that sets per diem limits on how much employees can spend on food, accommodation, local travel, client expenses, etc.

It makes travel management easier

Having a clear set of guidelines on what is acceptable and what isn't when travelling for work makes the process easier for both employees and the company. Imagine if your employees had to clarify every small detail regarding their travel – what airline class is permitted, whether airport parking is a claimable expense or not, are Uber fares refundable, etc. A business travel policy makes it easier for your employees and saves time answering repetitive questions.

It reduces fraud

When you have a company-wise detailed business travel policy, the chances of employees taking you for a ride are lower. Since you set the upper limit on how much they are allowed to spend on each aspect of business travel, such as food or accommodation, they will be forced to stick to the budget or pay for the difference themselves. When you put the onus on the employee, they are less likely to overspend, on purpose or otherwise.

It increases fairness and transparency

A well-designed and properly communicated T&E policy fosters an environment of fairness in the company. Managers can show no favouritism. The policy will set out the budget for employees and arrangements will be made according to that. When employees see that everyone is getting equitable treatment, it will foster a positive company culture.

Makes reimbursement process smoother

A business travel policy will clearly state the budget for business travel. It will require employees to submit receipts and invoices to support their expenses. These can then be reconciled and settled accordingly. Having a T&E platform to settle business travel expenses will make the reimbursement process seamless.

Who should consider creating a business travel policy?

Whether you are a big business or a startup, you should consider having a company travel policy if:

- You have factories in multiple locations. Managers and employees may need to travel to different sites for educational or training purposes.

- Your business is rapidly expanding across geographies. This may require senior management or other employees to travel to other locations for business purposes. Having a travel policy will make it easier to monitor and budget for these trips.

- Your business has clients spread across the country, or in international locations, then having a corporate travel policy is a must. Employees will need to travel frequently to liaise with clients. A travel policy will make business travel fair for all.

- You are a company that outsources a good portion of your business to offshore vendors, you may need to visit them from time to time for quality checks and supervision. Getting a travel policy will make corporate travel hassle-free.

- You send employees for training, conferences and seminars to other locations. This will make bulk bookings easier to manage and budget.

What to include in your business travel policy?

When drafting your business travel policy, there are many aspects to consider. Your T&E policy needs to reflect your unique needs, including your company's and employees' needs. Some of the fundamental elements to cover are:

Overall guidelines

Set the basic standard of your T&E policy for business travel. Section your outline to include domestic and international travel separately. Budgets for different destinations will differ. Clearly outline who will be responsible for executing the policy at different levels. Will the travel manager handle sanctioning for everyone, or will other team managers be accountable for authorising business travel? Also, mention the timeline for making bookings. Encourage your employees to make bookings early to take advantage of cheaper rates. Apart from budgetary considerations, also look into business travel safety and security aspects. It will put your employees at ease while travelling for work.

Transportation

You need to consider how your employees will travel for a business trip. For short domestic travel, you could consider trains or road travel. If an employee is taking their vehicle, outline whether you will be paying only for fuel or a driver. International travel may require sanctioning airline budgets. You should specify the budget for flight expenses or outline whether they are permitted to travel by business class or economy. Even while travelling locally at the destination they are at, you should specify whether employees are allowed to take cabs or whether they should stick to public transport. Even minute details such as what form of transport is acceptable while travelling to the airport or train station should be mentioned so that there is no ambiguity later on. In general, you should encourage your employees to minimise travel expenses.

If your employees need to stay overnight during business travel, you will need to provide accommodation. In the T&E policy, you must clearly state what accommodation you can provide. If your budget is large enough, you may be able to provide accommodation in a star hotel. As a startup, your accommodation may be within a budget stay. If you have your guesthouses, you could put up your employees there. Depending on your means as a company, you should define the accommodation arrangements in the corporate travel policy and communicate them to your employees.

Travel insurance

To increase business travel safety, you may choose to insure your employees on business trips. If you have partnered with an insurance company, disclose this in your T&E policy so that employees only avail the services of the vendor you have sanctioned. If there is any aspect of travel you do not insure, disclose it in your policy.

In case of group travel, you may be able to arrange food for all employees through a caterer or a fixed menu. Setting a budget per meal or day makes sense for solo travellers who may be dining on their own. Having a per diem allocation for meals can be economical. This section should also include details about whose meals employees are allowed to pay for. For instance, if an employee is going to a business meeting, you may enable them to pay for the client. However, a personal meeting not sanctioned by the manager may not fall under the company travel expense. You must outline these clearly so that there is no confusion.

Travel by designation

You may have a blanket policy for everyone, or you may choose to provide upgraded services to executive employees. For instance, you may allow senior management to travel by business class and book accommodation in star hotels. While this may seem like additional expenditure, it can also be a way to motivate your employees. If you plan on providing differential travel arrangements for employees, you should mention this in your T&E policy. It will make it easier for your budgeting team to allocate resources accordingly.

Reimbursements

You cannot prepay all expenses. There may be expenses that might arise while on the business trip, such as sudden meetings with clients, an add-on fee at a conference, etc. You need to state what expenses can be reimbursed and what cannot. You could issue a corporate credit card to your travelling employees to make the process easy. Even while giving the credit card, you need to be specific about which expenses they will be able to claim. Aspire provides unlimited corporate cards that you can issue to teams that help reduce or avoid forex charges, integrates seamlessly with your accounting software and makes it easy to track expenses. We also have specialised reimbursement software that is a delight for employees, accounting teams and the entire organization.

Non-reimbursable expenses

It may be prudent to include a section on non-reimbursable expenses. For instance, if you don't specify that entertainment expenses are excluded from business travel budgets, your employees may assume it is allowed. That could lead to confusion later on. You may not reimburse costs such as using a hotel's spa, swimming pool, gym, minibar, room service, etc. Mention this in the T&E policy.

Non-employee travel guidelines

For extended business trips, you may allow your employee to travel with their spouse or children. However, you may require them to stay in the same room or accommodation you have provided. Suppose you are allowing your employees to travel with their families. In that case, you need to specify which family members they are allowed to take with them and whether you will be paying for their travel or sanction any additional expenses.

Miscellaneous expenses

If your employees are going to attend a conference and there are registration fees involved, your T&E policy should specify whether you will be covering the expenses. Any other miscellaneous costs such as parking fees at an airport, excess baggage, laundry services while staying for extended durations, gifts for clients, tests and vaccinations required for travel under Covid-19 protocol, etc., should also be specified in the T&E policy. Leaving any expense uncovered could create room for doubt and increase your travel budget.

Special Circumstances and exceptions

It is essential to outline a section dedicated to special circumstances such as missed flights, trains or buses, double bookings, lost tickets, surcharge fare on public transport, etc. You should outline every possibility and have a backup plan for employees to follow. Having these in your guidelines will eliminate ambiguity and a possible overcharging by employees.

Approved list of agents and partners

Your business travel policy should include a list of pre-approved agents, vendors and partners you have tied up with for different purposes. For instance, you may have partnered with a group of hotels to avail corporate discounts. This should be stated in the company travel policy. You should also provide contact details, customer care numbers, discount codes, etc. wherever applicable.

Reimbursement process

For expenses that are not prepaid, you need to have a reimbursement process in place. This includes the reimbursement timeline, instructions on how to submit receipts and vouchers, which software to use while applying for reimbursement, who issues reimbursements, how long the reimbursement process will take, etc.

Escalations and emergencies

Your T&E policy should also include details regarding what to do in case of emergencies. You should provide a company helpline number as well as a local person of contact to lean on in case of emergency. For other issues and escalations too, you should provide a separate point of contact. Not equipping your employees with these details could leave them lost and confused in unexpected circumstances.

Things to consider before drafting a business travel policy

As you can see, there's a lot of detail to drafting your business travel policy. Here are some steps to keep in mind while creating a comprehensive business travel policy:

Identify your objectives

Before drafting your travel policy for employees, outline what the objectives are. You should be considering employee safety, cost management and a streamlined process; if you want your employees to have a self-serve option, you must design your T&E policy accordingly.

Consider your employees' needs

A business travel policy should not be solely from the company's point of view. You should also consider your employees' needs. Ask questions like whether your employee will be comfortable in the accommodation you are approving, whether the meals budget will be sufficient, is it safe to take public transport in the location they are travelling to, etc. You could employ a professional travel manager to make these decisions.

Set clear guidelines

An ambiguous T&E policy will do as much harm as not having a policy. Make sure to set clear guidelines on what is acceptable during business travel. From transportation-related expenses to paying for clients and gifting policies, outline every detail, so there is no room for doubts.

Put it in writing and circulate it

Write down your company travel policy in complete detail and make sure that every employee is aware of its existence. Doing this will ensure that they stick to the regulations. If you think an employee will need to travel, send the business travel policy across to them anyway. Also, make it accessible on your employee or HR portals so that employees can refer to it at any time.

Travel and expense policy best practices

Follow these travel and expense policy best practices to ensure you have an easy-to-follow T&E policy:

Keep it simple

Your business travel policy should be comprehensive, but it should also be easy to understand. Avoid jargon and legalese in your corporate travel policy. If you have a lot of terms that are difficult to understand, include an index. That will make it easy for your employees to follow the travel policy and stick to it. If your policy is too complex, your employees may have difficulty keeping up and disregard the guidelines.

Be clear with your rules

When drafting your travel policy, be clear and definite with the guidelines. Providing room for ambiguity can lead to your employees taking advantage, even if unintentional. If you have a comprehensive company travel policy that covers every aspect of travel, you are more likely to succeed with its implementation. Emphasise the importance of your employees sticking to your business travel policy and specify the repercussions of not adhering to the guidelines. To make the process smoother for your employees, you could create a detailed section with frequently asked questions. That will help make your business travel policy airtight.

Make your policy visible

For your corporate travel policy to be successful, you need to communicate it to your employees. Instead of burying your T&E policy inside another policy such as employee guidelines or HR rules, make it standalone. Integrate it with your travel booking process so that there is no chance they miss it. The policy should be easily accessible on your employee portals.

Look into employees' needs

Don't limit your T&E policy to budgetary objectives alone. Frame your business travel policy keeping your employees' safety, requirements and preferences in mind. It is possible to arrive at a solution that answers all of these. For instance, you could permit business class air travel for business trips that exceed 12 hours. It will make your employees more comfortable and improve their productivity on the business trip.

Include a care plan

A travel policy should always include a care plan. If your employees fall sick during the trip or meet with an accident, you should have a healthcare option available easily. The health insurance you provide may not cover healthcare expenses in specific destinations. Evaluate what is covered under the health insurance policy and see how you can top it up for travel. Travel insurance is also a must to ensure a safe and comfortable trip.

Incorporate flexibility

Whether you are a startup, a small-sized or a medium-sized company, you should consider making your business travel policy flexible. As long as you put broader rules in place, giving your employees some freedom to decide their travel plans can make them feel more at ease. Giving your employees the option to book their travel, choose from a range of accommodation choices, different insurance providers, multiple means of transport, etc. are ways to make your corporate travel policy more flexible.

Look for feedback

Feedback and suggestions can go a long way in helping you improve your business travel policy. Make it a point to collect employee feedback on the positives and negatives of business travel at regular intervals. You could consider monthly, quarterly or half-yearly feedback, depending on how frequently you employees travel. If you notice similar problems recurring among employees, you could consider changing that aspect of your travel policy.

Review your T&E policy frequently

To keep up with the times, you should review and edit your travel policy from time to time. Consider the different issues that have cropped up with business travel and incorporate the changes diligently to make your procedure more effective.

You can use Aspire's Spend Management tool to track your travel expenses and employee reimbursements. Spend management will help you track all your company's business travel expenses in one place, all in real-time. Our one-click reimbursement process makes it simple to claim any expense, set limits on spending, store all receipts in one place and much more. By segregating your business travel expense spend from other reimbursement expenses, you can make travel expense management more accessible and streamlined.

Want to implement a Corporate Travel Expense Policy but still not sure where to start? Download our free travel policy template and begin your journey to create a robust business travel system!

Bonus: Travel expense reporting best practices

Travel expense reporting is just as important as creating a comprehensive business travel policy. Following travel and expense reporting best practices can help you control your T&E spending. It has many advantages. You can understand how the travel expense budget is split. You can identify spending patterns and understand where most of the money is going. You can generate reports based on these analyses and involve the senior management to figure out how to handle the budget better.

Here are some travel expense reporting best practices to follow:

- Create a mechanism to report total spending at a company and department level.

- Report expenses both in international and your company's local currencies for an international trip.

- Issuing corporate credit cards can help you track expenses better since you can set up a system where you get real-time updates on spends.

- Use an expense management software that makes tracking easier.

- Ensure you use an expense management software that automatic categorizes expenses and syncs it with your accounting software for faster closure of books.

Conclusion

To scale your business and take advantage of new opportunities, you may need to send your employees on business trips. It would be best if you could put a business travel policy in place. A business travel policy will ensure that you have clear guidelines for travel, making business trips productive for you and effortless for your employees. It is also a way to ensure employee safety and at the same time, help you save costs.

If you are unsure how to create a company travel policy, use available pre-existing business travel expense policy templates and customise it to meet your requirements. Keep travel and expense policy best practices in mind before creating your business travel policy. Aspire's Spend Management tool can help you track your T&E budget and keep an eye on your travel and expense policy.

Frequently Asked Questions

Some articles you may like

🚀 Subscribe to content

How to create a best-in-class business travel policy

A conversation with Kelly Ellis, Global Practice Area Lead, Traveler Engagement

Your travel policy is the bedrock of your business travel program, and it needs to be practical and relevant.

With so much change in the industry, it’s more important than ever to build a gold standard travel policy to make your program the best it can be.

To help, we asked Kelly Ellis, Global Traveler Engagement Practice Lead for her guidance.