- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Home > Travel Insurance > Go Travel Insurance Review

Go Travel Insurance Review

Learn more about Go Insurance’s travel policies to find out about their coverage and fees and compare them with other insurers today.

Fact checked

Go Insurance is a Brisbane-based company founded by a couple of Australian insurance specialists who wanted to give their customers more policy options. Its travel insurance policies are underwritten by Lloyd’s of London, one of the world’s largest providers of protection for holidaymakers.

If you’re doing some holiday homework and want to see how Go Insurance's travel policies stack up against the competition, comparing with Savvy can help you make the choice easier. You can find a policy which best suits your next getaway by considering your options with us.

Compare Go Insurance’s policies and other offers with Savvy today before buying your travel insurance.

*Please note that Savvy doesn’t represent Go Insurance for its travel products.

More about Go Insurance's travel policies

What travel policies does go insurance offer.

Go Insurance offers a few standalone travel insurance policies, including:

- Go Basic: this is Go Insurance’s most base-level coverage and provides you with unlimited medical and hospital cover on your international holiday, as well as some limited protection for cancellation and your personal items. You’re also given 24/7 emergency support and some limited coverage for cancellation due to COVID-19.

- Go Plus: this type of coverage falls between a basic and comprehensive policy. The claim limits are larger on this policy than the Go Basic option, and you’re covered for disruptions to your travel plans such as if your mode of transport is hijacked or your airline goes bankrupt.

- Go Elite: Go Insurance’s top-tier policy, the Go Elite plan offers you the same coverage as the Go Plus policy however you’re able to claim more if something goes wrong on your holiday. For example, while the Go Plus policy offers $2. 5 million in personal liability cover, the Go Elite option offers double that amount.

- Corporate travel: technically a business travel insurance plan, this option covers you and your employees for any loss, theft or damage to equipment or belongings while you’re on a corporate trip. It also covers the renting of any necessary equipment, theft of your company’s money and cover for important papers if they’re lost or stolen.

- Already overseas: if you’ve already reached your international destination but forgot to take out travel insurance, Go provides the chance to purchase a policy. However, there is a cooling off period of 48 hours in which you won’t be able to make any claims and those over 75 aren’t eligible to take out this type of insurance.

Whether you’re heading to Antarctica's freezing temperatures or lapping up some sun in Ayers Rock, comparing your options with Savvy will help you find the best policy on the market for your needs.

What optional extras are available through Go Insurance?

Go Insurance offers a few optional extras that you can tack onto your standalone travel policy. These include:

- Snow sports cover: if you’re going skiing or snowboarding on your holiday, Go Insurance offers winter sports cover as an optional extra. It offers protection against the loss or robbery of, or damage to, any hired or personal equipment, including winter sports gear. Additionally included are the costs of renting replacement equipment for the length of your trip as well as the replacement cost of lost or stolen ski tickets or lesson vouchers. Even if avalanches, lack of snow or piste closures prevent you from skiing, you will still get compensation.

- Golf cover: this golf option covers your own or rented golf gear in case it’s lost, stolen, or broken. If you have to cancel or shorten your vacation, Go Insurance will also cover the rental cost of new equipment and you can be paid for unused green fees.

- Cruise cover: if you’re taking a domestic or international trip on a cruise liner, this optional extra covers you if you miss out on pre-paid excursions, visits to shore, port connections or lose your formal attire. You’re also covered for cabin confinement, so long as the claim isn’t directly related to COVID-19.

- Water sports cover: Go Insurance will pay you if you can't go on a pre-planned boat trip because of an accident, illness or bad weather. Equipment for water activities that are lost, stolen, damaged or have to be replaced can all be covered. Additionally, you'll be compensated for items such as water sports passes and tuition fees that you couldn't utilise because of things like cancellation, loss, theft or bad weather.

What exclusions should I be aware of when buying through Go Insurance?

In the case of Go Insurance, some of the exclusions are:

- Any losses or incidents outside of your travel insurance period

- Claims relating to loss or damage from war or rebellions

- Losing your bags or personal items due to carelessness

- Treatment for unapproved pre-existing medical conditions

- Accidents caused by alcohol consumption or drug use

- Intentionally injuring yourself

- Travelling to partake in a competitive sport

- Expenses you can’t provide sufficient evidence for

If you’ve found a travel insurance policy that draws your eye, make sure you review the Product Disclosure Statement (PDS) before you set your decision in stone.

What we think of Go Insurance's travel policies

What we like, plenty of cover options.

One of the main benefits of Go Insurance is that it offers a wide variety of policy options, ranging from business or leisure policies to optional extras such as water or snow sports.

Internal claims handling

Go Insurance is one of the few providers who handle claims themselves without handballing them to their underwriter. This allows you to deal with the same person from the start of the process to the end.

Generous claim limits

Some of the claimable limits Go Insurance offer on their policies are hefty. For example, if you have cash stolen, you can claim up to $1, 000, whereas other insurers will only allow you $250 worth of cover.

What we don't like

Restricted seniors cover.

While some insurers on the market allow senior travellers of any age to buy a policy, Go Insurance draws the line at those over 75 being able to purchase coverage.

Reduced coverage for pregnancies

Go Insurance offers considerably less coverage for pregnant travellers than some of their competitors, with coverage only up to the 20th week of gestation.

Limited car hire cover

Unlike some insurers who let you claim back up to $8, 000 if you need to pay the excess on your hire car, Go Insurance only lets you claim up to $4, 000.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Frequently asked questions about Go Insurance's travel cover

Yes – Go Insurance covers a slew of COVID-19-related expenses, such as:

- Overseas medical costs: this includes hospital expenses, ambulances, doctors' fees and the cost of medication.

- Trip cancellation: you’re covered if you or your travel partner need to cancel your holiday because one or both of you have tested positive for COVID-19.

- Post-departure curtailment: if you or your travelling companion are suffering from COVID-19 and need to go into mandatory quarantine, the additional expenses can be covered by Go Insurance.

If you want to make a claim through Go Insurance, you can do it online. The claims process is handled internally and not by Lloyd’s of London, the company’s underwriter. To make an insurance claim, you’ll need to:

- Start the process within 30 days of your return home

- Complete the claim form with ample detail

- Submit any relevant documentation, such as medical or police reports. You can also include photographs

- Submit your form and await a response

Once you’ve lodged your claim, you’ll generally hear back from your insurance company within ten working days. Claims are paid out in Australian dollars and paid into your nominated bank account.

The cost of travel insurance varies from person to person, so there’s no such thing as an average cost when it comes to purchasing a policy. Some of the factors which determine what you’ll pay include:

- Destination (for example, if you travel to Bermuda , where health cover can be expensive)

- Level of coverage

- Optional extras you choose

- Pre-existing medical conditions

- Chosen policy excess

- Type of insurer and insurance policy you purchase

Unlike annual multi-trip policies which cover you for multiple holidays, single-trip policies only cover you for taking one trip away. Annual policies, including those offered by Go Travel Insurance, allow you to take an unlimited number of holidays so long as they aren’t any longer than 45 days each. On the flip side, one-way travel insurance only covers you if you don’t have a return ticket home booked.

More travel insurance reviews

CHI Travel Insurance Review

Learn more about CHI’s travel insurance to find out about their coverage and fees and compare them with other insurers …

RACT Travel Insurance Review

Read Savvy’s review of RACT’s travel insurance offers to find out about their overseas coverage and fees and compare them …

CFMEU Travel Insurance Review

Learn more about CFMEU’s travel insurance policies to find out about their coverage and fees and compare them with other …

Real Insurance Travel Insurance Review

Learn more about Real Insurance’s travel policies to find out about their coverage and fees and compare them with other …

Australian Unity Travel Insurance Review

Learn more about Australian Unity’s travel insurance policies to find out about their coverage and fees and compare them with …

COTA Travel Insurance Review

Learn more about COTA’s travel insurance policies to find out about their coverage and fees and compare them with other …

Helpful travel insurance guides

Best Multi-Trip Travel Insurance Australia

Compare your multi-trip travel insurance options with Savvy to help you find the best. Compare Travel Insurance Quotes in 30...

Compare Domestic Travel Insurance

Exploring your own backyard? Compare and find the best domestic travel insurance with Savvy. Compare Travel Insurance Quotes in 30...

Cheap Domestic Travel Insurance

Compare with Savvy and find a cheap travel insurance deal for your next domestic holiday. Compare Travel Insurance Quotes in...

What is a Travel Insurance Excess?

Find out what a travel insurance excess is and how you should compare them here. Compare Travel Insurance Quotes in...

Travel Insurance for Heart Conditions

Looking for travel insurance that covers heart conditions? Compare with Savvy to help you get the cover you need today....

Best Travel Insurance for Cruises

If you’re chasing travel insurance for your next cruise, compare with Savvy and get the best policy today. Compare Travel...

Asking yourself why you need travel insurance for your holiday? Compare with Savvy and understand the benefits. Compare Travel Insurance...

Best International Travel Insurance

Travelling abroad? Compare policies and find your international travel insurance here with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

Benefits of Travel Insurance

Understand more about the benefits of travel insurance by comparing your options with Savvy. Compare Travel Insurance Quotes in 30...

Travel Insurance Broker

Find out how a broker may be able to help you and compare travel insurance options with Savvy. Compare Travel...

Explore your travel insurance options for your next destination

Travel Insurance for Malta

Travel Insurance for Switzerland

Travel Insurance for the Seychelles

Travel Insurance for Canada

Travel Insurance for Phuket

Travel Insurance for the Himalayas

Travel Insurance for Costa Rica

Travel Insurance for China

Travel Insurance for Hungary

Travel Insurance for Saudi Arabia

Travel Insurance for Romania

Travel Insurance for Prague

Travel Insurance for the Czech Republic

Travel Insurance for the Philippines

Travel Insurance for Indonesia

Travel Insurance for Japan

Travel Insurance for Hong Kong

Travel Insurance for the UAE

Travel Insurance for South Africa

Travel Insurance for Singapore

Travel Insurance for Dublin

Travel Insurance for New Zealand

Travel Insurance for Southeast Asia

Travel Insurance for Asia

Travel Insurance for Africa

Travel Insurance for Bangladesh

Travel Insurance for Bhutan

Travel Insurance for Azerbaijan

Travel Insurance for Belgium

Travel Insurance for Serbia

Disclaimer: We do not compare all travel insurance brands currently operating in the market. Any advice presented above or on other pages is general in nature and does not consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy.

Savvy earns a commission from our partners each time a customer buys a travel insurance policy via our website. We don’t arrange for products to be purchased from these brands directly, as all purchases are conducted via their websites.

Before purchasing your policy, we recommend you refer to the provider’s PDS for any further information on the terms, inclusions and exclusions.

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

- Join CHOICE

Travel insurance

Go Insurance Go Plus review

One trip policy..

This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how common it is for consumers to bring a travel insurance dispute to AFCA about them.

In years (up to and including the number stated). For policies listed as '100+', there is no age limit.

Maximum age for dependants listed on the policy. In years (up to and including the number stated).

Does the policy list pre-existing medical conditions that are automatically covered.

Does the policy cover pre-existing medical conditions that are not listed as automatic cover on the policy (on application and subject to approval)

The lower the number, the better. It's the time period before booking your trip that a medical condition would be covered if you've had no symptoms, medication or treatment (as long as that condition isn't specifically excluded). If for example, your condition last showed symptoms 18 months ago, but the time period here is 12 months, then you'll be covered subject to the other conditions of the policy.

Are claims covered that arise from pregnancy or pregnancy complications?

Until which stage pregnancy is covered for single births (up to and including).

Are medical costs covered for the mother if childbirth occurs up to the maximum pregancy stage

Limit for medical and emergency evacuation and repatriation expenses for illness or injury.

Expenses for an accompanying person such as a member of the travelling party, a friend or a close relative (not necessarily listed as insured on the certificate of insurance) to travel to the sick policyholder overseas, remain with them in hospital and accompany them home during an emergency repatriation.

Daily hospital cash allowance per person.

Minimum number of hours the insured must be continuously hospitalised before receiving the hospital cash allowance.

Limit for dental as a result of an accident.

Limit for dental as a result of sudden and acute pain.

Limit for overseas funeral costs and the return of mortal remains per deceased person, in the event of the death of the policy holder. There may be a separate limit for 'return of mortal remains' and 'overseas funeral costs', so check the policy terms for more details.

Limit for additional accommodation and travel expenses if the policy holder cannot travel due to injury or sickness.

The limit for additional travel expenses per person if travel is interrupted by an insured event (not including injury or sickness as that is covered separately under 'Additional travel expenses for injury or sickness'). Cover is assessed on individual circumstances.

Whether the policy covers you for additional travel expenses per person if travel is interrupted due to a lost or stolen passport or travel documents. Cover is assessed on individual circumstances.

Whether or not the policy covers you for additional accommodation and travel expenses if you need to curtail travel due to the serious illness or injury of a relative at home. May be subject to assessment of pre-existing conditions for the relative.

Limit for resumption of a journey interrupted due to the serious illness, injury or death of a relative. May be subject to assessment of pre-existing conditions for the relative. Check the policy terms for more details. 'Cancellation cover chosen' means variable cover options are available.

Whether the policy covers you for cancellation or amendment expenses.

Limit for cancellation or amendment expenses. 'Cover chosen' means variable cover options are available.

Limit for cancellation expenses for transportation bought using frequent flyer points.

Limit for travel agent cancellation fees.

Whether the policy covers you for losses arising out of insolvency of a travel services provider (e.g. airline, accomodation provider, bus line, shipping line, railway company, motor vehicle rental agency). Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to insolvency of a travel agent. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to unexpected/involuntary retrenchment. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to cancellation of pre-arranged leave from work for members of the Defence Force and Federal, State or Territory Emergency Services. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to cancellation of pre-arranged leave from work for non-emergency services occupations. Cover is assessed on individual circumstances.

Are stolen or damaged personal belongings covered

The overall limit for stolen or damaged personal belongings.

Limit for a single unspecified item.

Limit per item for a video or photo camera. Cover is assessed on individual circumstances.

Limit for a laptop or tablet. Cover is assessed on individual circumstances.

Limit for a smartphone. Cover is assessed on individual circumstances.

Limit for any prescribed medications. Cover is assessed on individual circumstances.

Overall limit for specified items, available for an extra premium. Cover is assessed on individual circumstances.

Cover for belongings locked in a luggage compartment of a car out of sight during the day. Cover is assessed on individual circumstances.

Cover for belongings locked in a luggage compartment of a car out of sight overnight. Cover is assessed on individual circumstances.

Cover for valuables such as laptops, tablets, mobile phones, jewellery or cameras locked in the luggage compartment of a car. Cover is assessed on individual circumstances.

Cover limit per person for lost or stolen cash. Cover is assessed on individual circumstances.

Overall limit for a single person for baggage lost temporarily. Cover is assessed on individual circumstances.

The minimum period of time in hours before which cover applies for temporarily lost baggage. Cover is assessed on individual circumstances.

Limit for additional travel expenses to reach a special event such as a wedding, conference or sporting event on time if the scheduled transport is cancelled or delayed.

Limit for additional travel expenses to reach pre-paid travel arrangements on time if the scheduled transport is cancelled or delayed. Cover is assessed on individual circumstances.

Whether the policy is automatically extended if your journey is extended due to unforeseen circumstances.

Limit for additional meal and accommodation expenses if scheduled transport is delayed.

The minimum number of hours before transport delay is covered. Cover is assessed on individual circumstances.

Limit per person per 24-hour period for this transport delay. Cover is assessed on individual circumstances.

Is the collision damage excess for a hire car covered?

Limit for collision damage excess for a hire car. Cover is assessed on individual circumstances.

Does the policy cover cancellation and additional expenses for claims due to transport incidents like mechanical breakdown and accidents?

Does the policy cover cancellation and additional expenses for claims due to strikes?

Does the policy cover claims due to mental health illness experienced for the first time on the trip, and not classified as an ongoing or existing medical condition?

Does the policy cover claims due to COVID-19?

Does the policy cover claims due to pandemics other than COVID-19?

Does the policy cover claims due to natural disaster?

Does the policy cover claims due to civil unrest?

Does the policy cover claims due to terrorism?

Does the policy cover claims due to war?

Average rating

Write a review, member review.

Create an account or log in to write a review.

MouthShut.com Would Like to Send You Push Notifications. Notification may includes alerts, activities & updates.Compare International Travel Insurance 2024 | CHOICE

![]()

Concern / Feedback Form

Secure your account

Please enter your valid contact number to receive OTP.

Just one step away to protect your account with 2FA.

Protect your account by adding an extra layer of security.

Set Email Alert

Alert on more product reviews

Alert on new comments on this reviews

Read All Reviews

- Write Review

Home > Personal Finance > Insurance Companies > Go Digit General Insurance > My Experience

My Experience. Review on Go Digit General Insurance

Go Digit General Insurance

MouthShut Score

Customer Service:

Claims Settlement:

Range of Plans:

Staff Attitude:

Upload your product photo

Contact Number

The ingenuineness of this review appears doubtful. Justify your opinion.

I feel this review is:

- Question & Answer

For the last 3 years I have been with Go Digit insurance for my two Volkswagen cars, fortunately nothing happened to my cars, but recently My Jetta wiring was bitten by rats and I could not steer my car, the steering module wires were chewed by the rats. As there is insurance cover for the rat bite, I called digit for insurance coverage, and they asked me to take it to the VW service centre. In the wv service centre they have found that the wiring under the steering wheel is gone and needed a replacement. I informed the Digit insurance person, They have not sent the surveyor in time after almost 5 days he came and asked so many questions and finally they gave 7000 of 33000 spent. It is one of the worst insurance company I have seen in my 30 years of car ownership experience. Don't waste your money on them, go for some good insurance company when you choose.

- Flag This Review

- Thank You! We appreciate your effort.

Upload Photos

Upload photo files with .jpg, .png and .gif extensions. Image size per photo cannot exceed 10 MB

Comments on Go Digit General Insurance Review

fake company. Don't want to pay the claim amount. Worst Experience, Staff is not professional. At the time of purchase they promise you that they will provide 100% settlement for any miss-happening

By: DiyaBasu | Apr 22, 2022 12:36 PM

View more comments

YOUR RATING ON

Thank you for sharing the requirements with us. We'll contact you shortly.

Free MouthShut app saves money.

OTP Verification

An OTP has been sent to your email and mobile number. Please enter OTP to verify the account.

Didn't receive? Resend OTP

An OTP has been sent to your email address. Please Enter OTP to verify your email address

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AEGIS (Formerly GoReady) Travel Insurance Review: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Purchasing travel insurance can provide peace of mind on your trips, especially when you opt for a policy that covers trip delays and includes emergency medical benefits.

AEGIS insurance is a travel insurance provider with a variety of options to suit travelers. Here's a look at the company's different plans, what’s covered and how to choose a plan that works for you.

What does AEGIS travel insurance cover?

AEGIS travel insurance provides six different policies to customers with varying levels of coverage. These are called:

Pandemic Plus.

Vacation Rental.

Trip Cancellation.

Depending on your itinerary, one plan may be superior; this is especially true if you opt for something specialized like a Vacation Rental policy or Cruise policy.

Otherwise, you can expect a fairly standard coverage from AEGIS, such as:

Accidental death insurance .

Emergency evacuation insurance .

Lost luggage insurance .

Rental car insurance .

Travel medical insurance .

Trip cancellation insurance .

Trip interruption insurance .

» Learn more: How much is travel insurance?

AEGIS insurance plans

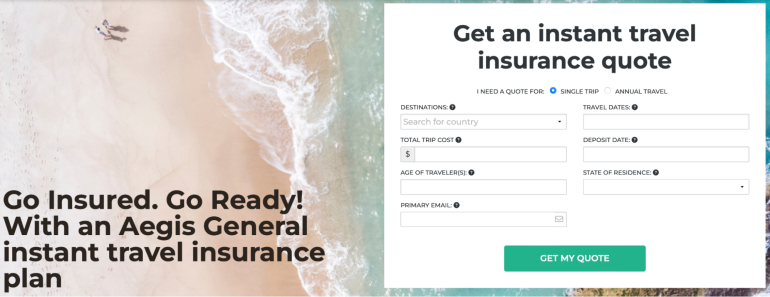

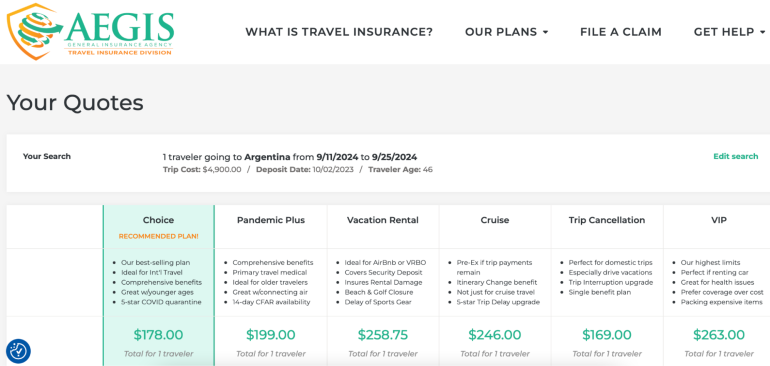

To generate quotes, we created a sample trip for one 46-year-old traveler from Colorado heading on a two-week trip to Argentina.

AEGIS offers three more "standard" travel insurance plans: Choice, Trip Cancellation and VIP. Here’s how the costs and coverage vary across these plan options.

AEGIS standard plans

The cost for our Argentina-bound traveler for the Choice plan is $178, while for Trip Cancellation and VIP, the price is $169 and $263, respectively.

AEGIS specialty plans

AEGIS also offers three travel insurance plans oriented toward specialty experiences, including for those staying in a vacation rental or going on a cruise.

Specialty plans don't always mean higher costs. The Pandemic Plus coverage will cost the sample trip traveler $199, while Vacation Rental coverage is $258.75 and Cruise coverage is $246.

» Learn more: How does travel insurance work?

What isn’t covered by AEGIS

An AEGIS insurance review wouldn't be complete without considering what types of situations aren’t covered. While these aren't included in the base package, you can consider adding this coverage by purchasing it as an add-on.

Baggage delay for sports equipment.

Cancel For Any Reason insurance .

Trip cancellation for work reasons.

There will be other situations that are excluded from your policy. To find these, review the full benefits schedule of the plan that you’re considering.

» Learn more: What to know before buying travel insurance

How to choose a AEGIS plan online

Is AEGIS insurance legitimate? It is, and purchasing a plan online is simple. To do so, go to AEGIS’s website . On the homepage, you’ll input your information to generate a quote. This includes travel destination, age and state of residence.

Once you’ve tapped “Get My Quote,” you’ll be presented with all six of AEGIS's available options, including costs and a breakdown of inclusions.

From here, you’ll be able to select the plan that suits your needs and pick any optional add-ons. Then, you’ll go through the checkout process. After you’ve paid, your plan becomes active.

» Learn more: The most common travel insurance myths

Which AEGIS plan is best for me?

Choosing the right plan for your trip involves understanding what type of coverage you need.

For cruises . The Cruise plan has the ability to include pre-existing conditions long after this option disappears with other policies. It also covers you in the event you miss prepaid events if your travel provider changes your itinerary.

For the best service . The VIP plan offers the most comprehensive suite of benefits and the highest payouts, including rental car coverage .

For vacation rental stays . The Vacation Rental plan is a superior option for those in short term rentals because of its coverage for damage, which includes up to $1,000 for security deposit loss.

For those with their own medical insurance . The Trip Cancellation plan is the least expensive option but still provides trip protections in the event that your travel is canceled.

AEGIS's travel insurance plans may make sense for you, but before purchasing a policy, check to see whether a travel credit card you hold offers its own complimentary travel insurance .

Is AEGIS travel insurance worth it?

AEGIS offers several travel insurance plans to choose from, with some levels of customization to help you get the exact coverage you're looking for.

Overall, travel insurance is worth it, but AEGIS might not give you the best deal. Shop around with other travel insurance companies to make sure you're getting the lowest price for the protections you need.

If you have a travel credit card, look at what travel insurance benefits are included to avoid duplicating your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Nationwide Travel Insurance

- AXA Assistance USA

- Seven Corners Travel Insurance

- HTH Worldwide Travel Insurance

- World Nomads Travel Insurance

Cruise Travel Insurance Tips

- Why You Should Trust Us

Best Cruise Insurance Companies of April 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best travel insurance coverage that won't leave you high and dry in an emergency.

Best Cruise Insurance Companies

- Nationwide Travel Insurance : Best Overall

- AXA Assistance USA : Best for Affordability

- Seven Corners Travel Insurance : Best for Seniors

- HTH Worldwide Travel Insurance : Best for Expensive Trips

- World Nomads Travel Insurance : Best for Exotic Locations

Compare the Top Cruise Insurance Offers

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Reasonable premiums

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR coverage available with some plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical emergency and evacuation coverage

- con icon Two crossed lines that form an 'X'. Special coverages for pets, sports equipment, etc not available

- con icon Two crossed lines that form an 'X'. Limited reviews with complaints about claims not being paid

- Trip cancellation of up to $5,000 with the Economy plan and up to $50,000 with the Preferred plan

- Cancel for any reason insurance and missed connection insurance available with the Preferred plan

- Baggage delay insurance starting after 24 or 12 hours depending on the plan

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

Cruise Insurance Reviews

Best cruise insurance overall: nationwide travel insurance.

Nationwide Travel Insurance is a long-standing and reputable brand within the insurance marketplace that offers cruise insurance plans with solid coverage and reasonable rates.

It has three cruise insurance options: Universal, Choice, and Luxury. The Nationwide Choice plan, for example, offers $100,000 in emergency medical coverage and $500,000 in emergency medical evacuation coverage.

The right plan for you depends on your budget and coverage needs. But each plan offers cruise-specific coverages like ship-based mechanical breakdowns, coverage for missed prepaid excursions if your cruise itinerary changes, and covered service disruptions aboard the cruise ship.

Read our Nationwide Travel Insurance review here.

Best Cruise Insurance for Affordability: AXA Travel Insurance

AXA Assistance USA offers three comprehensive coverage plans: Gold, Silver, and Platinum. Each of these plans offers coverage for issues like missed flights, medical emergencies, lost luggage, and more.

The highest-tier Platinum plan provides $250,000 in medical emergency coverage and $1 million in medical evacuation coverage. The baggage loss coverage is $3,000 per person, and their missed connection coverage is $1,500 per person for cruises and tours.

In addition, travelers can take advantage of AXA's concierge service, which provides an extensive network of international service providers. They'll be able to assist you with things like restaurant reservations and referrals, golf course information, and more. This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise.

The coverage limits on AXA's policies are on the higher end compared to other providers. And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence.

Read our AXA Travel Insurance review here.

Best Cruise Insurance for Seniors: Seven Corners Travel Insurance

Seven Corners Travel Insurance lets cruisers enjoy traveling in their golden years with the knowledge they're covered in the event of an accident or emergency. While other providers do offer coverage to those 80+ years old, Seven Corners is known for its affordable premiums while offering above-average medical expenses and medical evacuation coverage limits — two areas of travel insurance coverage that are even more important as we get older.

Seven Corners also offers the option of a preexisting conditions waiver and CFAR insurance at an additional cost, plus "Trip Interruption for Any Reason" coverage, which you won't find on many policies.

You can choose between the Trip Protection Basic or Trip Protection Choice plans, with the higher-tier Choice plan costing more but providing more coverage.

Read our Seven Corners Travel Insurance review here.

Best Cruise Insurance for Expensive Trips: HTH Worldwide Travel Insurance

HTH Worldwide Travel Insurance offers three levels of trip protection: TripProtector Economy, Classic, and Preferred. The higher the tier, the more coverage you'll get for things like baggage delays, trip delays & cancellations, and medical expenses. But their premiums remain reasonable even at the highest tier of coverage.

Not only does the HTH Worldwide Trip Protector Preferred plan offer higher-than-average medical emergency and evacuation coverage limits ($500,000 and $1 million, respectively), but you'll also get a baggage loss coverage limit of $2,000 per person and coverage for trip interruption of up to 200% of the trip cost. You also have the option to add CFAR coverage for an additional cost.

Read our HTH Worldwide Travel Insurance review here.

Best Cruise Insurance for Exotic Locations: World Nomads Travel Insurance

World Nomads Travel Insurance has been a top choice for comprehensive travel insurance for many years now. And it's a great option when it comes to cruise coverage, too.

Even the most basic Standard Plan comes with $100,000 in medical emergency coverage and $300,000 in emergency evacuation coverage. And you'll get higher coverage limits with their Premium Plan. Plus, unlike many other providers, World Nomads trip cancellation and emergency medical coverage include COVID-19-related issues.

What sets World Nomads apart from many other insurance companies is that its policies cover 200+ adventure sports. This can be important for adventurous cruisers who plan to take part in activities like jet skiing, scuba diving, or parasailing during their cruise.

Read our World Nomads Travel Insurance review here.

Introduction to Cruise Insurance

Cruise insurance may offer unique coverage like missed port of call and medical evacuation coverage. You might not need the flight protections of a regular travel insurance plan if you're catching a cruise at a port near you, but medical and cancel for any reason coverage could be critical.

Understanding the Basics of Cruise Insurance

At its core, cruise insurance is your financial lifeboat, designed to protect you from unforeseen events that could disrupt your sea voyage. Whether it's a sudden illness, adverse weather, or other unexpected occurrences, having the right insurance can make a world of difference.

Why Cruise Insurance is Important

Picture this: You're all set for your dream cruise, but a sudden family emergency means you can't set sail. Or worse, you fall ill in the middle of the ocean. Without cruise insurance, you're not just missing out on an adventure, but also facing potentially huge financial losses. That's why securing cruise insurance isn't just recommended; it's a crucial part of your cruise planning.

Types of Cruise Insurance Coverage

Cruise insurance isn't a one-size-fits-all life jacket. There are various types of coverage, each tailored to protect different aspects of your cruise experience.

Trip Cancellation and Interruption Coverage

This coverage is like your safety net, catching you financially if you need to cancel your trip last minute or cut it short due to emergencies, be it due to personal, health-related, or even certain work conflicts.

Medical Coverage

Being on a cruise shouldn't mean being adrift from medical care. Medical coverage ensures that if you fall ill or get injured, your medical expenses won't sink your finances.

Emergency Evacuation Coverage

In the rare case that you need to be evacuated from the ship due to a medical emergency or severe weather, this coverage ensures you're not left adrift in a sea of expenses.

Baggage and Personal Effects Coverage

Imagine reaching your dream destination only to find your luggage lost at sea. This coverage ensures that lost, stolen, or damaged baggage doesn't dampen your cruise experience.

Buying Cruise Insurance

Securing the best cruise insurance isn't just about finding the best price; it's about ensuring it covers all your potential needs.

When to Purchase Cruise Insurance

Timing is everything. Purchasing your insurance soon after booking your cruise can often provide additional benefits and ensure you're covered for any early surprises. As you get closer to your trip your coverage options may get more expensive, and certain providers may not be able to offer you coverage.

How to Find the Best Deals on Cruise Insurance

Keep a lookout for deals, but remember, the cheapest option isn't always the best. Balance cost with coverage, and ensure you're getting the protection you need at a price that doesn't rock your financial boat. A travel insurance comparison site like SquareMouth is a good place to compare multiple quotes from all of the major carriers at once.

How to Pick The Best Cruise Insurance for You

When buying travel insurance for a cruise, consider the additional risks that are specific to cruising. These include hurricanes and other weather-related concerns, strict cancellation terms, high pre-paid costs of a cruise, and the distance to emergency medical assistance.

To find the policy that's right for you, it's best to compare several different cruise insurance policies based on the pricing and coverage they provide. Remember too that all reputable insurance providers will offer a "free-look period." This allows you to return the policy you've purchased for any reason, within a specific time period, for a full refund.

The most important coverages to look for in cruise insurance are:

- Medical coverage — This coverage will pay for medical bills outside the US. But because treatment can be more expensive while onboard, make sure your policy offers sufficient coverage ($100,000+).

- Medical evacuation coverage — This coverage will transport you to the nearest hospital or even back home if you become sick or injured during your journey. But an evacuation from sea will be more expensive than one from land. So you'll want to make sure your coverage has sufficiently high limits ($250,000+).

- Missed connection (missed port of call) coverage — This type of coverage will help you catch up to your itinerary if you miss your port of call for a covered reason, like a delayed flight on the way to the airport.

- Coverage for hurricane warnings — With this type of coverage, you don't actually need to be affected by the hurricane. You can cancel and be reimbursed for your trip if the NOAA issues a hurricane warning. If you're cruising anywhere during (or on the tail ends) of hurricane season, this can come in handy. Just note: You can't buy travel insurance to cover a weather event once a storm or hurricane has been named.

- Cancel for any reason (CFAR) — This is the most comprehensive coverage you can get, as it allows cancellations and reimbursement for pre-paid expenses for any reason. This can be a wise add-on for cruise coverage given the often higher prepaid expenses associated with cruising. See our guide to the best CFAR travel insurance options to learn more.

- Preexisting conditions — This coverage ensures that no known health conditions are excluded from coverage. Obtaining a preexisting condition waiver usually requires purchasing your travel insurance soon after booking your trip.

- Personal possessions insurance — Because of the events and fancy dinners cruise ships hold, you might take more valuable clothing or jewelry with you on a cruise. This type of coverage will insure your belongings against loss or theft while cruising.

- Baggage loss and delay — This coverage will reimburse you up to a specified amount for essentials if your bags are delayed or if your bags get lost en route.

As a rule of thumb, you can expect to pay between 5% and 10% of your prepaid, nonrefundable trip expenses for cruise insurance coverage. The price will vary depending on factors like your age, your travel destination, and whether you require additional coverage.

If you're booking a cruise, we recommend purchasing travel insurance when you make your first trip payment. That could be for the cruise itself or an expense like airfare to get you to your cruising destination. This way, if you have to cancel your trip, you'll have the most extended coverage period possible.

You can buy your own cruise insurance that isn't offered directly through the cruise line operator. In fact, this could be a better option if you want coverage for your travel to the cruise's departure point, not just for the cruise itself.

The difference between traditional travel insurance and cruise insurance is that cruise insurance offers more specialized coverage, for situations such as missing a departure port and more coverage for medical evacuations, since it's more expensive to evacuate someone at sea than on land.

Most cruise insurance includes coverage for missing a departure port, so you should be able to claim for a missed port. Just make sure you check the details of your policy before you file a claim, and before you travel so you know what compensation you're entitled to.

Why You Should Trust Us: How We Chose the Best Cruise Travel Insurance

When comparing cruise travel insurance providers, we evaluated them based on the following criteria to come up with our list of top picks:

Customer Satisfaction

We look at ratings from JD Power and other industry giants to see where a company ranks in customer satisfaction. We also look at customer review sites like Trustpilot and SquareMouth.

Policy Types

We look at policy types and offerings, from standard travel protections to adventure sports coverage. We look at the amount of insurance offered

Average Premiums

We compare average premiums per trip. Some companies also offer annual plans, and we compare policies accordingly.

Claims Paid

How frequently do companies pay claims easily and quickly? We check customer reviews and other resources to see which companies honor policies most effectively.

We look at the company's overall behavior. Is it operating ethically? Companies can earn additional points for such behaviors.

You can read more about how Business Insider rates insurance here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Travel Insurance

- Travel Insurance Direct Review

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance Direct Review: Pros and Cons

Published: Mar 26, 2024, 1:44pm

Travel Insurance Direct is one of our highest ranking comprehensive policies, largely due to its thorough Covid-19 cover which includes both medical expenses and trip cancellations. It also includes some 43 medical conditions automatically, and covers a broad range of sports and adventure activities—some 93, in fact.

Related: Best Comprehensive Travel Insurance Providers for Australians

- Thorough Covid-19 cover for both medical and cancellations

- 93 sports and activities are automatically covered

- Lost luggage coverage up to $12,000, with the ability to increase item limits

- Online discounts are only available for multiple policies or group policies

- Certain pre-existing medical conditions cannot be covered

- Only covered up to 75 years of age

Table of Contents

About travel insurance direct, what does travel insurance direct cover, covid-19 coverage, what about pregnancy, sports and activities, customer service.

Travel Insurance Direct has been offering travel insurance policies to Australian customers since 2005, and sells policies in more than 100 countries.

The company is part of the nib group, with all insurance policies offered by Travel Insurance Direct underwritten by Pacific International Insurance Pty Ltd.

In Forbes Advisor Australia’s pick of the best comprehensive travel insurance policies , Travel Insurance Direct ranked the highest with 4.5 stars (as did Allianz and Bupa ). But it is not just Forbes Advisor Australia that has given Travel Insurance Direct a positive review: from more than 2,500 customer submissions, TID has received a star ranking of 4.2 stars on Australia’s independent consumer opinion website, ProductReview.

Related: How Much Does Travel Insurance Cost?

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

Covid Cover?

Maximum age limit?

99 years old

Lost luggage cover?

Yes, up to $15,000

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

While Travel Insurance Direct offers a comprehensive policy with significant Covid-19 cover, emergency evacuation and other features, it is only available for those aged up to 75 years old at the time of the policy being issued. This means for elderly travellers, or grandparents wishing to travel with their families, the policy may not be suitable.

However, for families looking to travel without their elderly grandparents or relatives, the policy automatically includes children up to the age of 21 provided they are working fewer than 30 hours per week and are travelling with the policyholders for the entire trip.

In terms of financial coverage, Travel Insurance Direct will cover up to $3,000 in credit card fraud and up to $2.5 million for personal liability.

Additionally, travel delays are covered up to $2,000, while missed connections are only covered for special events (and included in the $2,000 travel delay limit). Cancellations are also covered with the amount chosen by the customer, which in turn, affects the premium.

For those looking to hire a car while abroad, Travel Insurance Direct offers a car hire excess of $6,000 in coverage.

Lost luggage

Travel Insurance Direct covers lost luggage up to $12,000, but sub limits apply. If required, item limits can be increased within individual policies, but, once again, this is likely to increase the premium.

Unlimited overseas medical cover is included with the Travel Insurance Direct comprehensive policy. Within that cover, there are 43 pre-existing conditions that will automatically be accepted pending certain criteria.

These conditions include allergies, epilepsy, iron deficiency, migraines and more. Unfortunately, other conditions are not covered, nor is there a way to include them within your policy as an additional fee.

On its website, Travel Insurance Direct states that “if you have an existing medical condition that’s not listed above as an automatically accepted condition, or you don’t satisfy all criteria for any listed condition, then you can still buy a policy, but you won’t be covered for any claim that arises in relation to the existing medical condition”.

It’s worth noting that the unlimited medical cover also includes illness arising from Covid-19, which is explained in more depth below.

Is Dental Cover Included in Medical?

No, dental cover is not included in Travel Insurance Direct’s medical cover. Dental is still covered, but only to a limit of $1,000, although this is still higher than some insurers, which offer policies that top out at $500 for dental.

Travel Insurance Direct includes Covid-19 related medical expenses within its unlimited medical coverage. From our analysis, we found that Travel Insurance Direct had one of the best Covid-19 cover options on the market—which is important in this day and age.

Along with medical expenses, any additional travel expenses incurred due to Covid-19 are covered up to $2,500. Plus, cancellations due to Covid are covered for both you and your travelling party.

Travel Insurance Direct will cover pregnancy covered up until week 26 provided there are no pre-existing complications. Pre-existing complications are not covered, and cannot be covered under any circumstance.

Childbirth is not covered.

Related: Guide To Pregnancy And Travel Insurance

There are 93 automatically included sports and activities within the Travel Insurance Direct comprehensive policy, making it a great choice for customers looking to embark on an adventure-filled holiday.

The list includes quite a few thrill-seeking holiday activities, such as bungee jumping, go-karting, canoeing, mountain biking, zip lining and more.

Certain activities may come with caveats and conditions. For example, hiking and trekking is included as an activity but will only be covered to certain heights and in certain locations. Another example is motorcycle riding, which is only covered if you are riding a motorbike that is 250cc or less and are wearing a helmet.

For other specific adventure coverage—such as snow sports, cruising, or policies targeted towards backpackers—Travel Insurance Direct offers optional add-ons at an extra cost.

Travel Insurance Direct offers its policyholders 24/7 emergency assistance.

The TID Worldwide 24/7 emergency assistance team can be called on:

- +61 2 8256 1523, or

- +61 2 9234 3123

Phone enquiries are also available from Australia and overseas on Monday to Friday, 9am to 6pm AEST. These lines are:

- 1300 843 843 from Australia, or

- +61 2 8256 1537 from overseas

You can also submit online enquiries via the TID website at any time.

Frequently Asked Questions (FAQs)

Who underwrites travel insurance direct.

Travel Insurance Direct is underwritten by Pacific International Insurance Pty Ltd.

What is the best travel insurance for Australians?

The best travel insurance for Australians will depend on a multitude of factors: whether you’re travelling domestically or internationally, where you are going, what activities you have planned, your age, any pre-existing conditions, and more.

This means that the best policy for you may not be the best policy for someone else.

For ease, Forbes Advisor Australia has reviewed the comprehensive options on the market and chosen our top 10 picks. Travel Insurance Direct ranked the highest, scoring 4.5 stars.

We have also ranked our picks for the best domestic policies for Australians for those looking for local options; the best policies for senior travellers ; the best cruise policies, for travellers setting sail; and the best family-friendly policies .

Is there a promo code for Travel Insurance Direct?

No, at the time of writing, there are no active promotional codes for Travel Insurance Direct. However, you can be eligible for a discount if you purchase multiple policies at once, which can be helpful for families.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany site, Sophie has worked closely with finance experts and columnists around Australia and internationally. Sophie grew up on the Gold Coast and now lives in Melbourne.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Cruise Travel Insurance

- Best Domestic Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

More from

Our pick of the best cruise travel insurance, cover-more comprehensive travel insurance review, insureandgo travel insurance review, our guide to the best family travel insurance for australians, interest rates are high, but aussies keep travelling, annual multi-trip travel insurance explained.

Seven Corners Travel Insurance Review 2024

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Offering the right coverage is not always the same as paying claims and honoring coverage. In our experience, there's a lot of ground in between. Finding the carrier for your needs means looking at the whole picture. With nine plans and plenty of add-ons available, Seven Corners may have exactly what you need.

Competitive with some of the best travel insurance companies, see if Seven Corners travel insurance is right for you.

Seven Corners Travel Insurance Review

Over 30 years, Seven Corners , Inc. has provided travelers with a wide array of coverage options. US-based travelers can find an array of options for traveling abroad or domestically. Non-US citizens can also find options for traveling to the US. The carrier also offers supplemental riders to tailor coverage to your precise needs, such as adventure sports coverage. It is also among the best CFAR travel insurance providers.

Additionally, many of its single-trip policies can be extended up to 364 days. It also offers annual multi-trip insurance for international trips, making it onto our list of the best international travel insurance for long-term travel.

Seven Corners is reviewed positively among customers, receiving an average of 4.2 stars out of five across over 5,100 reviews on Trustpilot . Seven Corners does even better on SquareMouth, receiving 4.38 stars across 3,700 reviews.

Seven Corners Plans Available

As noted above, Seven Corners Travel Insurance offers many travel insurance plans and riders. Each features distinct benefits, inclusions, exclusions, and claim limits, so it's vital to read the plan documents thoroughly before you finalize your purchase. Here is a summary of its core products:

Trip Protection

Comprehensive coverage for US residents traveling domestically or internationally. Specific coverage benefits and services will vary by state, but the broad coverage areas are as follows:

- Trip cancellation (optional CFAR addition for qualified travelers)

- Trip interruption

- Missed connection

- Change fees

- Accident and sickness medical expenses

- Emergency dental expense

- Emergency medical evacuation/medical repatriation/return of remains

- Accidental death and dismemberment

- Baggage and personal effects

- Baggage delay

- Covid-19 coverage

Note: This plan is not available for Missouri residents.

Trip Protection Annual Multi-trip

This plan is for travelers who intend to go on multiple trips, internationally or domestically, within a 365-day period.

- Trip cancellation: $2,500 to $10,000

- Trip interruption: up to 150%

- Trip delay: up to $200 per day and $2,000 per year

- Missed connection: $1,000 per year

- Travel medical expenses: up to $250,000 or $50,000 for New Hampshire residents; $100 deductibles

- Emergency dental expenses: up to $750; no deductible

- Emergency evacuation and repatriation: up to $500,000

- Lost baggage: up to $2,000 with $500 limit per item; $100 deductible

- Baggage delay: up to $100 per day and $1,000 per year

- 24/7 travel assistance services

Trip Protection USA

This plan is for international travelers visiting the US. Its base plan offers coverage for trip cancellation and interruptions, but you can add onto your coverage with the medical bundle and air travel bundle.

- Trip cancellation: 100% of trip cost up to $20,000 per traveler

- Trip interruption: up to 125% of trip cost

Optional air travel bundle

- Trip delay over six hours: $100 per day, up to $300

- Travel inconvenience: $150 for missing work or travel diversion

- Baggage and personal effects: $250 per item, up to $500

- Baggage delay over six hours: $100 per day, $250 maximum

Optional medical bundle

- Emergency medical evacuation and repatriation of remains: up to $250,000

- Emergency accident and sickness medical expense: up to $50,000

- Emergency dental expense: up to $250

Travel Medical (Excluding/Including US)

Seven Corners offers standalone travel medical insurance plans for travelers who don't want other travel insurance coverage. It offers separate policies for travel plans including and excluding the US.

Travelers can also choose between the Basic and Choice plans, with additional add-ons. Coverage length can range from five to 364 days. Here are some of the highlights of Seven Corners' Travel Medical plan.

Travel Medical USA Visitor