Dark horse for an everyday card: Virgin Atlantic Mastercard credit card review

Update : Some offers mentioned below are no longer available. View the current offers here .

Virgin Atlantic World Elite Mastercard® overview

The Virgin Atlantic World Elite Mastercard® is a mid-tier airline credit card that can provide serious value to Virgin Atlantic loyalists and travelers that know how to maximize Flying Club redemptions. It's lacking some key benefits like a free checked bag and discounts on inflight purchases, but it earns 1.5 points per dollar spent on almost everything you buy, making it a potential everyday spending card for select travelers. Card Rating*: ⭐⭐⭐½

*Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

Airline credit cards aren't generally the most lucrative options on the market when it comes to travel rewards, since they don't offer flexible points and can be weak when it comes to sparse bonus categories or earning on everyday spend.

However, the Virgin Atlantic World Elite Mastercard® is a compelling option for an airline card, because it earns at least 1.5 Virgin points per dollar spent on all purchases. In addition, its points can be used very effectively on partner redemptions. I've personally used Virgin points to book a Delta-operated transcontinental flight in economy for just 12,500 points one way, and using Flying Club points to book Delta-operated flights is far from the program's only sweet spot.

So, let's dig into the earnings and benefits of the Virgin Atlantic Mastercard.

The information for the Virgin Atlantic Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

For the latest travel news, deals, and points and miles tips, subscribe to The Points Guy's daily email newsletter .

Who is the Virgin Atlantic Mastercard for?

The Virgin Atlantic Mastercard earns points in the Virgin Atlantic Flying Club and provides benefits that can useful for Virgin Atlantic flyers and loyalists. However, it's important to note that even though the card earns Virgin points, it can be worth having even if you never set foot on a Virgin Atlantic aircraft.

For travelers who can maximize Flying Club redemptions, this can be a solid everyday spending card , thanks to its ability to earn 1.5 points per dollar on non-bonus spending. Plus, you can earn bonus points when you hit spending thresholds within your anniversary year.

Sign-up bonus: As much as $450 in value

With the Virgin Atlantic Mastercard, you can earn 30,000 bonus points after spending $1,000 or more in purchases within the first 90 days of account opening. TPG's valuations peg the value of Virgin points at 1.5 cents each, so this welcome bonus is worth $450. But, depending on how you use your points, you may be able to get even more than $450 in value from them.

Plus, with this bonus offer, there are a few opportunities to earn even more Virgin points:

- 2,500 points for each of the first two authorized users added to your card, up to a total of 5,000 bonus points.

- 7,500 anniversary points after you spend a minimum of $15,000 with your card within your anniversary year.

- An additional 7,500 anniversary points after you spend a total of $25,000 with your card within your anniversary year.

So, if you add two authorized users and spend at least $25,000 with your card in the first year, you'll earn 50,000 Virgin points within your first year. And, it's important to note that these bonus points are on top of the miles you'd normally earn on your purchases.

Main benefits and perks

Although Virgin points can be useful to many travelers, the Virgin Atlantic Mastercard's benefits and perks will be most attractive to Virgin Atlantic loyalists. In particular, the card's benefits can be particularly valuable to Virgin Atlantic elites or aspiring elites.

One benefit of the card is the ability to earn tier points through spending. You can earn 25 tier points per $2,500 in purchases — up to 50 tier points per month — to help you elevate your Flying Club status.

It takes 400 tier points per year to reach Silver status and 1,000 tier points per year to reach Gold status. Since you can earn up to 600 tier points per year, you can make it to Silver Tier with the card alone and get within 400 tier points of Gold Tier. So, this card can be extremely useful if you're working toward Virgin Atlantic elite status.

Related: How to get Virgin Atlantic elite status without stepping on a plane

The card's other major benefit is the enhanced anniversary award that you can earn each cardmember year in which you spend $25,000 or more in purchases. For this benefit, you can choose either a companion award in the same cabin class when you redeem Virgin points for a Virgin Atlantic award ticket or a one-cabin upgrade from Economy to Premium class on a Virgin Atlantic award flight.

Although the companion award can be extremely valuable, there are some restrictions. First, the cabin into which you redeem points for a companion award is restricted based on your Flying Club tier at the time of booking. Red Tier (basic) members can only redeem for Economy Classic or Premium; if they choose to book a companion into Upper Class, the ticket is discounted 50% only -- it's not free. Silver Tier and Gold Tier members can redeem for Economy Classic, Premium or Upper Class.

In addition, you'll still be responsible for paying applicable taxes, fees and carrier-imposed surcharges for the companion award, which can mean a lot of cash for most Virgin Atlantic-operated awards. The terms and conditions note that "the initial ticket must be a Virgin Atlantic ticket purchased directly through Virgin Atlantic Airways," which seems to imply the companion award is limited to flights marketed and operated by Virgin Atlantic.

The Virgin Atlantic Mastercard also has some benefits that aren't related to Virgin Atlantic. In particular, you won't pay foreign transaction fees when you use your card abroad. And, you'll have access to select shopping benefits that can provide peace of mind when you make purchases with your card.

For example, most items are protected against damage or theft within the first 90 days after purchase. And, the card's extended warranty protection doubles most original manufacturer's warranties of one year or less. However, unlike the airline credit cards attached to the main U.S. airlines, this card does not offer a free checked bag , nor does it provide a discount on inflight purchases as benefits

Finally, the $90 annual fee on the card isn't waived the first year.

Related: The 8 most valuable World Elite Mastercard benefits

How to earn points

The Virgin Atlantic Mastercard offers 3 Virgin points per dollar spent on Virgin Atlantic tickets and duty free items purchased directly from Virgin Atlantic. TPG values Virgin points at 1.5 cents each , which means you can get a 4.5% return on these purchases. However, since the card doesn't offer much in the way of travel protections, you may want to purchase travel insurance to protect flights you book with this card.

However, the true value for cardholders may be on non-bonus spending. This is because the card earns 1.5 points per dollar spent on all non-Virgin Atlantic purchases, which equates to a 2.25% return. Although this rate of return isn't the best you can find for everyday spending , it's worth considering if you can maximize redemptions in the Flying Club program or are using this spending for the combined value of points plus status earning with Virgin Atlantic.

How to redeem points

You can redeem Virgin points for flights and upgrades with Virgin Atlantic and Virgin Atlantic's network of partners. However, due to high taxes and fees on Virgin Atlantic-operated flights, most points and miles collectors will want to use these points for award flights on partner airlines.

Related: How to avoid fuel surcharges on award travel

Virgin Atlantic is not a member of any of the three main airline alliances, but there are currently eight partner airlines you can book award flights on using Virgin points. Each partner has its own specific award chart when booking through Flying Club, which can be found using the following links:

- Air France (SkyTeam).

- Air New Zealand (Star Alliance).

- ANA (Star Alliance).

- Delta Air Lines (SkyTeam).

- Hawaiian Airlines .

- KLM (SkyTeam).

- Singapore Airlines (Star Alliance).

- South African Airways (Star Alliance).

- Virgin Australia .

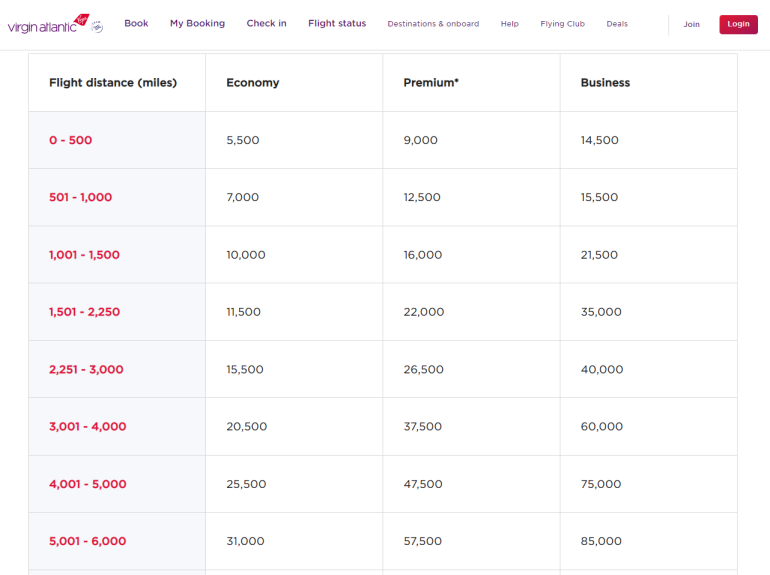

In general, you'll find the best value when using Virgin points to book award flights on Air New Zealand, ANA, Delta and South African Airways. For example, you can fly between Japan and the Western U.S. in first class on ANA for just 110,000 Virgin points round-trip (or 55,000 points each way). Domestic Delta routes within the U.S. can present good value, as well. Transcontinental routes in economy between New York-JFK and LAX cost just 15,000 points.

Previously, you could consistently obtain great value on redemptions for Delta flights. However, a January 2021 devaluation shook this up . Thus, only some Delta award bookings continue to provide good value here.

Additionally, redemptions for Air France and KLM flights can provide value on flights in off-peak periods or short-haul flights where cash prices are high.

For more details on how to search awards and other sweet spots in the Flying Club award charts, check out our guide below.

Further reading: Unlock incredible value with Virgin Atlantic Flying Club

Should I spend to the anniversary bonus each year?

The Virgin Atlantic Mastercard provides various benefits if you spend at least $25,000 on your card within your anniversary year, including an enhanced anniversary award benefit and anniversary bonus points. You can also earn tier points based on your spending with the card. All of these benefits can provide value that may justify making the Virgin Atlantic Mastercard your everyday spending card .

While it's difficult to estimate the value of tier points and the enhanced anniversary award benefit, we can estimate the value of the anniversary bonus points and calculate how it affects your return on spending with the card. In the following table, let's consider what return you could obtain if you spent $25,000 with your card within an anniversary year:

The above table doesn't take into account the 30,000-point sign-up bonus you can earn in your first 90 days after spending $1,000 on purchases, nor does it account for the bonuses you can earn for adding up to two authorized users.

So, if you earn the sign-up bonus, authorized user bonuses, anniversary bonuses and account for the points earned from $25,000 in purchases, you'll have a first-year return between 6.15% (if you only put non-bonus spending on your card) and 8.4% (if you only put Virgin Atlantic spending on your card). These returns for first year spending are much better than what's offered by most everyday spending cards .

So, should you spend $25,000 on the Virgin Atlantic Mastercard during each anniversary year? If you can get solid value from Virgin points , then the answer for you may be yes. This is particularly true if you can utilize the tier points or the choice of a companion award or a one-cabin upgrade that comes with this level of spending. How much (or how little) you maximize these perks will sway your opinion of whether this spending makes sense for you.

Which cards compete with the Virgin Atlantic Mastercard?

As an airline credit card, the Virgin Atlantic Mastercard competes with other airline credit cards. However, since you can transfer American Express Membership Rewards , Chase Ultimate Rewards , Citi ThankYou Rewards and Capital One miles to Virgin at a 1:1 ratio, this means any card earning those points can also effectively earn Virgin points.

Let's look at some comparisons to see what might be best for your wallet.

The British Airways Visa Signature Card earns Avios , which are the currency of another U.K.-based airline: British Airways . With the British Airways Visa from Chase, you can earn up to 100,000 Avios. Earn 75,000 Avios after you spend $5,000 on purchases within the first three months from account opening and earn an additional 25,000 Avios after you spend $20,000 in the the first 12 months of account opening. The card has an annual fee of $95 and offers a 3 Avios per dollar spent with British Airways, Aer Lingus , Iberia and LEVEL.

You'll do better than the Virgin Atlantic Mastercard on hotel spending (3 Avios per dollar in the first 18 months, then 2 Avios per dollar) but will earn less on everyday spending (just 1 Avios per dollar). If you're looking for a competing credit card with another airline, this is a quality option.

But what about credit cards that earn flexible points you can still use with Virgin Atlantic Flying Club?

You may not think of the Citi® Double Cash Card when it comes to airlines, but the card has no annual fee and earns 2 ThankYou Points (1 when you purchase, 1 when you pay the bill) per dollar on all purchases -- without limits or special categories. When you pair this card with a card like the Citi Premier® Card, those rewards become fully-transferable ThankYou points.

Thus, you can effectively earn 2 Virgin points per dollar on everyday spending with this card by transferring these points to your Flying Club account.

Another solid option would be the Chase Sapphire Preferred Card, which currently has an elevated bonus of 80,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening. The card comes with a number of lucrative bonus categories and better perks that the Virgin Atlantic Mastercard. And while you can transfer your points to Virgin Atlantic, you also have other valuable partners — including World of Hyatt and Aeroplan.

Read more: New 80,000-point bonus for a top travel card: Chase Sapphire Preferred credit card review

The best earning rate for ultimately putting points in your Flying Club account is with The Platinum Card® from American Express. When you book flights directly with the airlines or via American Express Travel, you'll earn 5 Membership Rewards points per dollar spent (up to $500,000 in purchases each calendar year). And those Membership Rewards points you earn can be transferred to Virgin Atlantic at a 1:1 ratio — occasionally with a transfer bonus.

Unfortunately, you'll only earn 1 point per dollar spent on all other purchases, and this card has the highest fee of the bunch: $695 (see rates and fees).

Bottom line

Although the Virgin Atlantic World Elite Mastercard can be a solid choice for many travelers, it's a particularly good fit for two types of travelers: those who can get solid value from Virgin points and those who are loyal to Virgin Atlantic and can benefit from having status with the airline.

For those travelers, using the card for everyday spending and working to hit the $5,000 in monthly spending to maximize the possible tier points each month can provide a solid rate of return — especially because this will hit the $25,000 spending threshold per anniversary year to earn the bonuses and perks detailed above.

The card is missing a few key airline credit card benefits — such as a free checked bag and a discount on inflight purchases — which lowers the value of the card a bit when compared to other airline credit cards . But if you're a regular Virgin Atlantic flyer, you should consider adding the Virgin Atlantic Mastercard to your wallet.

For rates and fees of the Amex Platinum card, click here

- Is the Virgin Atlantic Credit Card the best credit card for you?

How to earn rewards from the Virgin Atlantic card

How to use virgin points.

- Benefits and features

Fees and costs

- Virgin Atlantic card vs other Bank of America travel cards

- Frequently asked questions (FAQ)

Virgin Atlantic World Elite Mastercard review

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Virgin Atlantic World Elite Mastercard®, Alaska Airlines Visa Signature® credit card. The details for these products have not been reviewed or provided by the issuer.

The Virgin Atlantic World Elite Mastercard® often flies under the radar, as co-branded credit cards from foreign carriers tend to do. The card offers a decent welcome bonus and has a reliable set of perks that can be worth the $90 annual fee. Between a generous earning rate and annual bonuses, this card can offer hundreds of dollars in value.

17.49% to 25.49% Variable

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good welcome offer and earning rate on non-bonus categories

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Ability to earn tier points with spending

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Companion reward and bonus points after meeting spending thresholds

- con icon Two crossed lines that form an 'X'. Few travel benefits compared to similar airline credit cards

- con icon Two crossed lines that form an 'X'. The best perks require meeting a high spending requirement

- con icon Two crossed lines that form an 'X'. Annual fee

- The information related to the Virgin Atlantic World Elite Mastercard® has been collected by Business Insider and has not been reviewed by the issuer.

- Earn 30,000 bonus Virgin Points after spending $1,000 or more on purchases in the first 90 days of account opening

- Up to 15,000 bonus Virgin Points every anniversary after qualifying purchases

- Up to 5,000 bonus Virgin Points when you add additional cardholders to your account

- Get a companion reward in the same cabin class or a cabin upgrade when you book a ticket through Virgin Atlantic. Must spend $25,000 or more in purchases annually to qualify

- 3 points per dollar spent directly on Virgin Atlantic purchases

- 1.5 points per dollar spent on all other purchases

- Earn 25 tier points per $2,500 in purchases (maximum 50 per month)

- No foreign transaction fees

- Low $90 Annual Fee

Virgin Atlantic Credit Card Overview

Not only are the Virgin Atlantic World Elite Mastercard®'s benefits exceptional considering the low annual fee, but Virgin Atlantic's Flying Club program also makes award redemptions attainable. While the card's welcome bonus offer of 30,000 bonus Virgin Points after spending $1,000 or more on purchases in the first 90 days of account opening is one of the lowest credit card bonuses available right now, it's actually enough for at least one round-trip transatlantic flight.

The card and its corresponding program offer several surprising benefits that you might not know about. Here's our full review of the Virgin Atlantic World Elite Mastercard® and who it might be a good fit for.

Who should consider the Virgin Atlantic World Elite Mastercard?

The Virgin Atlantic World Elite Mastercard® is best for frequent travelers who want to supplement their rewards and accelerate their path towards elite status. The recurring benefits are also tailored towards those who fly with Virgin Atlantic, at least on occasion.

However, you don't have to be loyal to the airline to make this card worthwhile. If you're willing to familiarize yourself with the Flying Club program and how to maximize its award chart, this card can be valuable. The welcome bonus isn't as high as some other airline credit cards , but big spenders who don't want to deal with category bonuses might benefit from the 1.5x earning rate on all purchases.

Lastly, it's worth noting that Virgin Atlantic's Flying Club program is a transfer partner of Amex Membership Rewards , Chase Ultimate Rewards®, and Citi ThankYou . You can also transfer Capital One miles to Virgin Red, the loyalty program of Virgin brands (including Virgin Atlantic).

Those programs have credit cards that not only offer bigger welcome bonuses than this one but also allow you to transfer points to dozens of other programs. That way, if Flying Club ever gets devalued and awards require more points, you have other options.

The Virgin Atlantic World Elite Mastercard®'s welcome bonus offer is usually small compared to other airline credit cards, but it can still go a long way thanks to Flying Club's generous award chart. New cardholders can earn 30,000 bonus Virgin Points after spending $1,000 or more on purchases in the first 90 days of account opening. Plus, cardholders can earn up to 5,000 bonus points for adding two additional cardholders to the account.

The Virgin Atlantic World Elite Mastercard® doesn't offer much in the way of category bonuses. However, it makes up for it with an elevated earn rate on regular purchases. Cardholders earn 3 points per dollar spent directly on Virgin Atlantic purchases and 1.5 points per dollar on everything else. Considering other airline credit cards typically only earn 1 mile per dollar on non-bonus spending, this is pretty generous.

This card is a great choice for people who want to earn more than 1 mile per dollar spent on everyday purchases without having to track category bonuses. This elevated earn rate makes award flights more attainable, especially considering some of the cheap awards you can book through Virgin Atlantic Flying Club (more on that later).

The Virgin Atlantic World Elite Mastercard® will further reward your spending with up to 15,000 bonus points every anniversary. All you have to do is meet a certain spending threshold within your anniversary year to qualify for these bonuses:

- 7,500 points after you spend $15,000 within your anniversary year

- An additional 7,500 points after you spend a total of $25,000 within your anniversary year

Redeem points for flights

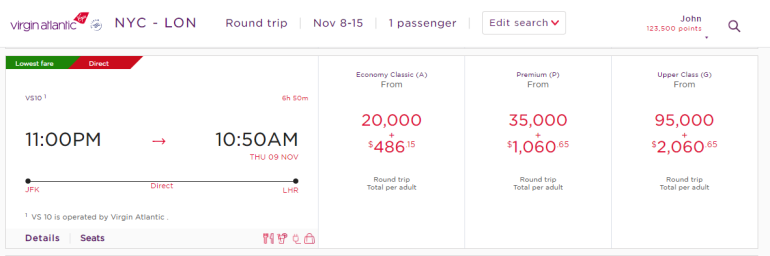

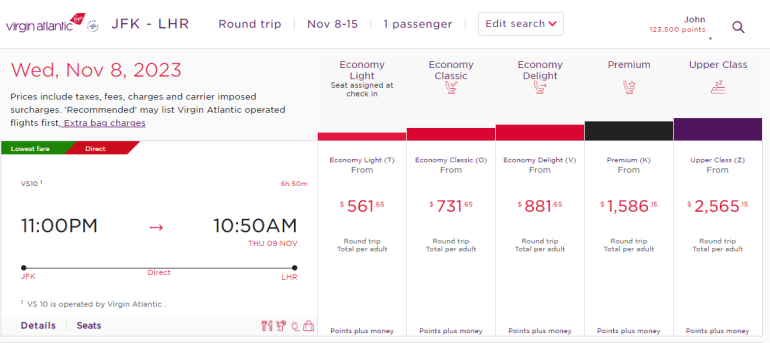

Virgin points are undervalued, considering the number of sweet spot awards you can book. Virgin Flying Club offers one of the cheapest ways to travel to Europe. An economy class ticket to London starts at just 10,000 points each way. That's less than what most frequent flyer programs charge for a domestic award ticket.

Keep in mind Virgin Atlantic adds significant fuel surcharges to some awards, so be sure to compare the cost of a flight including taxes and fees to other programs.

If you're looking for reasonable international business and first-class award tickets, Virgin Atlantic offers several sweet spots. You can fly Delta One business class to Europe for just 50,000 points each way.

If you're itching to get to Japan once it reopens to visitors, you can fly All Nippon Airways' aspirational first-class seat to Japan for just 110,000-120,000 points round-trip. This is an incredible bargain, considering Star Alliance partner United charges at least 70,000 points each way for the same award.

Virgin Atlantic is a great program if you want to redeem miles for international travel. It offers reasonable rates for both economy and premium seats. With the welcome bonus from the Virgin Atlantic World Elite Mastercard®, you can book at least one round-trip ticket to Europe.

Redeem points with upgrades and companion tickets

If you don't have enough points for a premium cabin award, you might want to book an economy fare and upgrade your seat with points. Rates vary greatly depending on your travel dates, departure city, destination, and the cabin you're booked into.

Upgrades to premium economy start at 16,000 points round-trip, while economy-to-Upper-Class upgrades start at 42,000 points. If you have many Virgin Atlantic points and dread a long-haul flight in economy class, redeeming points for an upgrade can be worthwhile. That's especially true if you booked a particularly cheap fare.

The ability to book a companion ticket for less is also a noteworthy feature of the Flying Club program. With as few as 9,000 points, you can book a companion ticket on select routes. This can be a good way to put the welcome bonus from the Virgin Atlantic World Elite Mastercard® to good use. Again, the exact number will vary by route and travel dates.

Redeem points for other travel experiences

If you don't quite have enough points for an award or seat upgrade, you can use them for spa treatments or chauffeur service to the airport. Spa treatments at Flying Club locations start at just 2,000 points for brow wax or 3,000 for a facial. You can choose from many more treatments and the rates will vary, but this is a nice way to unwind during your trip and put a small point balance to good use.

If you want to start your trip in style, you can splurge on a chauffeured ride to the airport for just 17,500 points. You must be traveling on an Upper Class ticket to qualify for this redemption and picked up within 75 miles of the airport.

Virgin Atlantic card benefits and features

Up to 15,000 bonus points every anniversary after qualifying purchases .

With a standard earning rate of 1.5 points per dollar spent, the Virgin Atlantic World Elite Mastercard® is already generous on the rewards front. However, the card offers an additional incentive when you complete a certain amount of spending every year. You can earn up to 15,000 bonus points for completing $25,000 in spending within your anniversary year:

These bonuses may not seem like much, but they can go a long way, thanks to Virgin Atlantic's generous award chart. Moreover, this bonus can help some cardholders justify keeping the card long-term and paying the annual fee.

Up to 5,000 bonus points when you add additional cardholders to your account

The Virgin Atlantic World Elite Mastercard® lets you give your Flying Club balance an easy boost by adding an authorized user. There's no additional fee and you'll earn 2,500 bonus points for adding an additional cardholder to your account. You can earn up to 5,000 bonus points this way.

While 5,000 points may not sound like much, it gets you halfway to a one-way economy class ticket between the East Coast and London. That's a terrific value for a simple action that takes just a few minutes.

Ability to earn elite status through spending

The Virgin Atlantic World Elite Mastercard® is one of the few airline cards that let you earn elite status via credit card spending. You can earn 25 Tier Points for every $2,500 made in purchases, up to 50 per month. That means you can earn Silver elite status through credit card spending alone and get more than halfway through earning top-tier Gold status via credit card spending.

Earning Silver status normally requires earning 400 Tier Points. However, the status requirements have been reduced between April 1, 2022, and March 31, 2023. Instead of completing 400 Tier Points for Silver status, you need just 300. Meanwhile, Gold status requirements have been reduced from 1,000 Tier Points to 800.

Once you achieve status with Virgin Atlantic, you have some practical benefits to look forward to.

Silver

- 30% bonus points on flights

- Premium check-in

- Free seat assignments in Economy Light

- 60% bonus points on flights

- Upper Class check-in

- Access to the Virgin Atlantic Clubhouses and London Heathrow Revival lounges

- Extra luggage allowance

Annual Companion Reward

The Virgin Atlantic World Elite Mastercard®'s Companion Reward is a unique benefit. Cardholders who spend $25,000 annually can choose between a companion reward or a one-cabin upgrade. With the companion reward, you can bring a friend or family member on the same itinerary for just the cost of taxes and fees.

If you're a standard Flying Club Red Tier member, you can book the companion ticket on an Economy Classic or Premium ticket. Red members can also upgrade the companion ticket to Upper Class at a 50% point discount.

Flying Club Silver and Gold members can use the companion ticket in any cabin class. So if you were to book yourself an Upper Class ticket, you could book your companion's seat for just the cost of taxes and fees.

Solo travelers can forego the companion ticket in favor of a one-cabin upgrade. Virgin Atlantic gives you plenty of time to decide how to use the anniversary benefit. You have two years after the issue date to redeem it.

World Elite Mastercard perks

Because the Virgin Atlantic World Elite Mastercard® is a World Elite Mastercard , it comes with additional benefits, including:

- Purchase assurance

- Extended warranty

- Travel assistance

- Emergency roadside assistance

- Travel accident insurance

- World Elite Mastercard Concierge

The Virgin Atlantic World Elite Mastercard® has a $90 annual fee, which is slightly lower than the standard $95 fee on most other airline credit cards. The yearly fee is partially offset by recurring benefits like bonus points and companion rewards.

The card has no foreign transaction fees , meaning you can use it abroad to earn 1.5 points per dollar on all your purchases without any penalties.

Unfortunately, the card doesn't currently offer an introductory APR , so you'll want to pay your card in full every month to avoid interest fees.

Compare the Virgin Atlantic card

Virgin atlantic credit card frequently asked questions (faq).

Most people who qualify for the Virgin Atlantic World Elite Mastercard® have a good or excellent credit score, which means at least a 670 FICO score or a minimum VantageScore of 700.

If you're not quite there yet, check out our guide to the top credit cards for fair credit for other options.

If you fly Virgin Atlantic or like redeeming points with the Flying Club program, the Virgin Atlantic World Elite Mastercard® could be a useful addition to your wallet. It's particularly valuable for big spenders who can unlock bonus points and the companion certificate by meeting spending thresholds.

That said, if your main objective is to earn Virgin Atlantic points from spending, you might want to look at credit cards that earn rewards in transferable points programs like Chase Ultimate Rewards or Amex Membership Rewards instead. Because you can transfer points to Virgin Atlantic at a 1:1 ratio from these programs, a card like the Chase Sapphire Preferred® Card or American Express® Gold Card could be a better fit depending on your spending and travel habits.

The Virgin Atlantic World Elite Mastercard® is issued by Bank of America.

For rates and fees of the Delta SkyMiles® Gold American Express Card, please click here.

For rates and fees of the American Express® Gold Card, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

Guide to Virgin Red

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Budgeting

- • Rewards credit cards

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Virgin Red allows you to earn points redeemable for flights, hotel stays, cruises, gift cards and unique travel experiences.

- Virgin Red is not a replacement for Virgin Flying Club.

- Members can link their Virgin Red and Flying Club accounts together to pool points.

- New Flying Club members are automatically enrolled in Virgin Red.

Frequent flyers know the value of airline rewards programs . Most, if not all, airline carriers offer a loyalty program where members can earn and redeem rewards for flights, airline upgrades and various redemptions.

For fans of Virgin, there are now two rewards programs you can earn rewards through. Virgin Red is the newest loyalty rewards program from the Virgin Group. The program was launched in the UK in 2021 and in the U.S. later that year. Virgin Atlantic already has a frequent flyer program called Flying Club . Virgin Red is not the replacement for Flying Club. Instead, the two programs pair together for more rewards-earning potential.

In this guide, we’ll dive into the Virgin Red program, how to earn and redeem points and how to link your account with your Flying Club account to pool your points.

What is Virgin Red?

In February 2021, the Virgin Group announced the arrival of Virgin Red in the UK, a new rewards club that earns points redeemable to spend on hundreds of rewards across the Virgin Group and beyond. The loyalty program was later launched in the U.S. in November 2021. The American version is not an exact copy of the UK program, though — it’s structured with American members in mind.

The Virgin Group launched Virgin Red not to replace Flying Club but to complement the popular airline loyalty program. In fact, Virgin Red gives members hundreds of other ways to earn and spend Virgin Points, which aren’t just related to travel. Members can link their Virgin Red and Flying Club accounts to pool points to use with either platform.

How to earn Virgin Points

Virgin Red members can earn Virgin Points, the universal currency used by Virgin brands going forward, in several ways. The number of points you can earn varies depending on the offer.

- Online shopping : Virgin Red members can earn points shopping through select retail partners.

- Travel : You can earn points by booking stays at Virgin Hotels, flights with Virgin Atlantic, Delta , Air France/KLM and travel booked through Booking.com and other Virgin Red travel partners.

- Unique experiences : Virgin offers distinctive experiences that can earn Virgin Points. For example, you currently can earn 55,000 points by booking a seven-night stay at Necker Island, Sir Richard Branson’s 74-acre private island in the Caribbean.

- Transfer partners : Both Virgin Red and Flying Club are transfer partners for many popular rewards programs, including Chase Ultimate Rewards , American Express Membership Rewards , Citi ThankYou Rewards and Bilt Rewards. All four programs allow you to transfer points to your Flying Club account at a 1:1 ratio.

- Credit cards : Virgin Atlantic offers a co-branded airline credit card that earns Virgin Points — the Virgin Atlantic World Elite Mastercard® *. The card earns 3X points per dollar on Virgin Atlantic purchases and 1.5 points per dollar on all other purchases for a $90 annual fee.

How to redeem Virgin Red rewards

Virgin Red offers various ways to redeem points, including some noteworthy options you won’t find anywhere else. Point values vary depending on the redemption. Virgin Points don’t expire either, so you can bank your points as long as you want if you have larger redemptions in mind.

You can redeem Virgin Points for award flights through Virgin Atlantic. Redemptions start at 18,000 for Economy Classic reward seats and go up based on when and where you travel — you only pay for any taxes and fees imposed. There are also options to use points and money toward flights or redeem your points for seat or cabin upgrades on eligible flights. Virgin Atlantic is part of the SkyTeam Airline Alliance, so you can redeem points for flights on SkyTeam partner airlines. The full list of SkyTeam airlines includes:

SkyTeam airlines

- Aerolineas Argentinas

- China Airlines

- China Eastern

- Czech Airlines

- Delta Air Lines

- Garuda Indonesia

- ITA Airways

- Kenya Airways

- Middle East Airlines

- Saudia (Saudi Arabian Airlines)

- Vietnam Airlines

- Virgin Airlines

- Xiamen Airlines

SkyTeam airlines aren’t the only airline partners of Virgin Atlantic. You can earn and redeem Virgin Points for flights with the following airline partners:

Additional airline partners

- Air New Zealand

- All Nippon Airways (ANA)

- Hawaiian Airlines

- LATAM Airlines

- SAS Scandinavian Airlines

- Singapore Airlines

- South African Airways

- Virgin Australia

There are plenty of redemption options outside of flights available through both Virgin rewards programs. Virgin Red and Flying Club members can also redeem their points for:

Other redemption options

- Virgin Atlantic Holidays

- Virgin hotel stays

- Stays at Virgin partner hotels (Marriott Bonvoy, IHG One Rewards, Hilton Honors and Kaligo)

- Transfer points to another Flying Club member

- Donate points to charity and causes

- Entertainment and experiences

- Virtual culinary masterclasses

- Live events

Not only can you earn Virgin Points for a stay on Sir Richard Branson’s private island, as mentioned earlier, but you can also redeem points for an exclusive private island getaway at Necker Island. As you might expect, you’ll need to save a significant points balance and pay cash to cover this one-of-a-kind redemption. A minimum four-night stay at Necker Island costs 540,000 points plus $5,400, which includes one free night. Each additional night runs 180,000 points plus $1,800. This redemption is only available during select Celebration weeks throughout the year. A lot of fine print is included with a redemption of this nature. Read through the offer guidelines and restrictions carefully before booking a stay at this island retreat.

Getting started with Virgin Red

Anyone over the age 18 can sign up for Virgin Red for free online or through the app. You don’t need to be an existing Virgin customer to set up an account. New Virgin Atlantic Flying Club members are automatically enrolled in Virgin Red.

One of the most unique features of Virgin Red is that it pairs with the existing Virgin Atlantic frequent flyer program, Flying Club. To link your account, navigate to the “Link accounts” section of your Virgin Red account and enter your Flying Club account number. Once linked, members can view and redeem Virgin points through either program platform.

Frequently asked questions

Do i need to spend with virgin to use virgin red, how do i link my virgin atlantic flying club account, the bottom line.

Virgin Red is a valuable rewards program that builds on the brand’s existing Flying Club program. The ability to earn points through two programs and pool your points together is unique, although many airline and credit card loyalty programs allow you to earn points beyond booking travel through their brands.

Still, signing up is a no-brainer if you fly on Virgin Atlantic or regularly shop online with any of its retail or travel partners. The program is free, and rewards never expire. Virgin Red is also an excellent option for travelers who want to redeem rewards for one-of-a-kind travel experiences.

*The information about the Virgin Atlantic World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

A guide to earning and redeeming frequent flyer miles

Guide to JetBlue TrueBlue

Guide to Virgin Atlantic Flying Club

Best United Airlines credit cards

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Virgin Money Travel Card Review - 2024

Virgin Money UK discontinued their prepaid travel card in 2020, and now has a couple of credit card options that are promoted for travel use - the Virgin Atlantic Reward Credit Card, and the Virgin Atlantic Reward+ Credit Card.

This guide covers the Virgin Atlantic Reward Credit Card features, benefits and fees in detail - with a quick look at the differences compared to the Virgin Atlantic Reward+ Credit Card, too. Plus we’ll touch on the Wise international prepaid card and the Revolut debit card as alternatives you might want to consider.

Virgin Money travel card: key features

Virgin Money UK directs customers looking for a travel card to the Virgin Atlantic Reward Credit Card and the Virgin Atlantic Reward+ Credit Card . The Virgin Atlantic Reward Credit Card has no annual fee, while the Reward+ Card has an annual charge of 160 GBP, in return for higher reward point opportunities.

This guide focuses on the Virgin Atlantic Reward Credit Card, but you can learn more about the Reward+ Card over on the Virgin Money UK desktop site.

Here are a few Virgin Atlantic Reward Credit Card pros and cons to kick off:

Travel credit cards let you spread the costs of travelling out over a few months, while earning rewards, cashback or points as you spend. However, in return you may find you have to pay interest on unpaid balances, cash advance fees, and penalties if you don’t make a minimum repayment every time.

Travel debit cards can be a cheaper way to hold, exchange and spend foreign currencies. With providers like Wise and Revolut you can hold dozens of currencies and spend with your debit card - with no interest to worry about. Just top up your account in pounds, and spend overseas with low fees and fair exchange rates.

Who is the Virgin Money travel card for?

The Virgin Atlantic Reward Credit Card has no annual fee, and you can earn 0.75 points on every pound spent, which can be redeemed against travel benefits. If you’d rather earn more points, and don’t mind paying an annual fee, there’s also the Rewards+ Card which can suit frequent travellers.

In general, travel credit cards are most economical for people who repay their bills monthly to avoid interest charges, who can also benefit from the rewards offered by the card as you spend.

What is the Virgin Money travel card?

The Virgin Atlantic Reward Credit Card Virgin Money Credit Card is a no annual fee credit card which allows you to earn points on spending that can then be redeemed against travel benefits such as upgrades on travel, lounge access when you fly, and free flights for friends.

Is the Virgin Money Card a multi-currency card?

The Virgin Atlantic Reward Credit Card is not a multi-currency card, it’s a credit card with benefits optimised for travel, including extra points on some travel spend, and rewards you can redeem against flights.

If that doesn’t suit you, you might prefer providers like Wise and Revolut which have multi-currency accounts with linked debit cards, to add money in pounds and spend internationally with low fees and the mid-market exchange rate. More on that. next.

Alternatives to Virgin Money travel card

Travel credit cards aren’t necessarily the cheapest way to spend overseas, because of interest costs and potential penalties, as well as any foreign transaction fees you face.

To help you decide if the Virgin Atlantic Reward Credit Card is right for you, let’s look at it alongside a couple of other popular alternatives:

Information taken from Virgin Money Card desktop site and Terms and conditions , Wise pricing page , Revolut international transfer fees .pdf) and Revolut UK ; correct at time of writing, 17th May 2023

There’s a pretty big choice of different types of travel money cards for UK residents - including credit cards and prepaid travel cards from providers like Wise or Revolut. Which suits you depends on how you like to manage your money. Credit cards can be handy to spread the costs of travel over a few months - but more expensive overall.

Options like Wise or Revolut cards can be cheaper and more flexible - but you’ll need to add funds in advance before you can get started. More on Wise and Revolut, next.

Read a full Wise review here

Wise accounts can hold and exchange 50+ currencies, and come with an optional linked Wise card to spend with the mid-market rate and low fees from 0.41%, in 170+ countries. You can apply, and manage your account, from your smartphone, and get extra perks like fast payments to 70+ countries, and local bank details for 9 currencies, to get paid easily from 30+ countries.

The Wise card is a debit card, not a credit card - so there are no interest costs and no late payment penalties, just top up in pounds, and you’re good to go.

Revolut accounts come with linked debit cards, and can hold 25+ currencies. You can either get a standard plan which has no monthly fees, or pay a monthly charge to access extra features and perks. Revolut currency exchange uses the mid-market exchange rate to plan limits, with fair usage fees after that. Out of hours fees may also apply if you switch currencies when the global markets are shut.

Read a full Revolut review here

Virgin Money travel card fees & spending limits

Let’s look at the costs of using the Virgin Atlantic Reward Credit Card when you’re travelling:

Information correct at time of writing - 17th May 2023

Exchange rates

When you spend overseas with the Virgin Atlantic Reward Credit Card your spending is converted back to pounds using the Mastercard exchange rate, to create your bill.

If you’re paying in EUR, RON and SEK in the UK and EEA, there’s no foreign transaction fee, so the exchange rate is made with the Mastercard rate with no additional charges. All other spending incurs a 2.99% foreign transaction fee, which is added to the rate used to convert your spending back to pounds.

How to get a Virgin Money travel card

To get a Virgin Atlantic Reward Credit Card you’ll need to complete an online eligibility and credit check.

Eligibility criteria include:

You must be a UK resident, over 18, with a UK bank or building society account

You must have good credit history and an income of at least 7,000 GBP a year

You can’t apply if you’ve recently closed a Virgin Money credit card, or if you have an active Virgin card already

To apply, simply head to the Virgin Money credit card desktop site, to complete the eligibility check and start your application.

What documents and information you’ll need

Virgin Money partners with identity verification service HooYu, to allow you to get verified and set up with your card from your phone. You’ll be guided through the verification process by on screen prompts, but you’ll usually need to upload a picture of your photo ID and a selfie. You’ll also be asked for your current address, and may need to provide proof of this to complete verification.

As the Virgin Money travel card is a credit card, a credit check may apply, and so you may also need to provide proof of income or outgoings.

How to use a Virgin Money travel card?

Use your Virgin Atlantic Reward Credit Card at home and abroad, just as you would with any other payment card. As the card is issued on the Mastercard network, all you need to do is look out for the Mastercard logo to check if the card is accepted.

How to withdraw cash with a Virgin Money travel card?

To withdraw cash with your Virgin Atlantic Reward Credit Card, just insert your card into any ATM on the Mastercard network, enter your PIN, and the amount you need to receive. Don’t forget, there’s a 5% cash advance fee, and the interest on the withdrawal amount starts to accrue immediately once you’ve made the withdrawal.

Is the card safe?

Yes. Virgin Money issues credit cards through Clydesdale Bank PLC, which is authorised and regulated in the UK by the FCA.

How to use the Virgin Money travel card overseas?

The Virgin Atlantic Reward Credit Card can be used anywhere you see the Mastercard symbol. If you’re in the UK or EEA, and spending EUR, RON or SEK, there’s no extra fee for foreign transactions. A 2.99% charge applies on all other spending overseas, though.

Conclusion: is the Virgin Money travel card worth it?

Virgin Money UK promotes the Virgin Atlantic Reward Credit Card, and the similar Reward+ Card as good options for international travellers. You can earn points on everyday spending, and extra points on travel - which can then be redeemed for free flights, upgrades and lounge access when you’re going on holiday. However, as with any credit card, you may run into interest costs, and with overseas spending outside the EEA you’ll pay a 2.99% foreign transaction fee too.

For a cheaper alternative, compare the Virgin Atlantic Reward Credit Card against a flexible multi-currency account that comes with a debit card - like the popular options from Wise and Revolut we explored earlier. Debit cards are often cheaper overall, and the option to hold and exchange currencies right in your account can also make managing your budget far easier - even when you’re working across currencies.

Virgin Money travel card review FAQ

The Virgin Atlantic Reward Credit Card is a credit card with no annual fee which offers travel rewards. Compare the benefits to a debit card designed for overseas spending, from alternative providers like Wise and Revolut, to see which suits you best.

The Virgin Atlantic Reward Credit Card can be used at home and abroad anywhere you see the Mastercard symbol. If you’re spending in the EEA you may find there’s no foreign transaction fee to pay - but elsewhere, overseas usage costs 2.99% in charges.

If the Virgin Money Credit Card isn’t right for you, there’s lots of choice out there. Compare a few travel credit cards from major UK banks against travel debit cards from a provider like Wise or Revolut to build a picture of the options available, including their features and fees.

A Full Guide of Best Travel Credit Cards for Travel Miles

Table of Contents

Best Travel Credit Cards for Travel Miles

I often get asked which credit cards I use for travel. Although I can share with you my opinion and what I use it may not be right for you. All of these cards are mainly intended for travel purposes and most of them have a hefty annual fee. If you use the benefits it is 100% worth it however if you do not travel a lot they are not.

These cards are for UK citizens. I have found that other countries such as the US have more variety of travel credit cards for travel miles available however as a UK citizen you will be unable to obtain them.

I wouldn’t recommend getting these cards for people who don’t travel a lot. I am looking at people who travel 5 times a year or more to get the full benefit. Also, take note of your annual spending. The free cards offer £20,000 annual spend to get a companion voucher while the paid cards are £10,000 spend which is a lot more doable but at a cost.

Virgin Atlantic Reward Credit Cards

These are all credit cards that are offered by Virgin. You will receive Virgin points to be used on your next Virgin Atlantic flight. Virgin also has a current account under Virgin Money however this is different than the cards below.

The Virgin Atlantic Reward+ Credit Card does offer an additional bonus at certain times of the year where you can get an additional 15,000 Virgin Points (this is on top of the welcome bonus). You need to spend £3,000 within 90 days of opening your account for an extra 15,000 points. This is a great bonus as it can take you on a round trip to destinations such as New York, Florida or the Caribbean in economy class.

If it was me I would choose the Virgin Atlantic Reward+ Credit Card especially if the limited offer with bonus points is available. If you spend £10,000 in the year and get 1.5 Virgin Points for every £1 spent, however, there is a £160 annual fee.

American Express Credit Cards

British airways american express and premium plus credit card.

These two cards are great for people who travel a lot using Avios. You will need to have a BA executive account (which is free to sign up). If you don’t travel with British Airways or any airlines that are part of OneWorld then these cards aren’t for you. British Airways is a part of the One World alliance. You can gain Avios points by travelling with any airline associated with One World.

One World Member Airlines are:

- Alaska Airlines,

- American Airlines,

- British Airways,

- Cathay Pacific,

- Japan Airlines,

- Malaysia Airlines,

- Qatar Airways,

- Royal Air Maroc,

- Royal Jordanian,

- Sri Lankan Airlines,

- Fiji Airways (Oneworld Connect member),

- Oman Air (Future Member).

Note: Although you can earn Avois through all the airlines above you can only use your Companion Voucher flying with British Airways.

American Express Rewards Credit Cards

American Express Rewards Credit Cards are great for people who want to spread out their rewards to perhaps a hotel chain or other airline alliances other than Avios. For every pound you spend, you get 1 point which can be used to convert to Nectar points, emirates or Hilton so you can get money off your shopping or gain enough points to earn free stays in a hotel. You can of course add them to Avios if you prefer but you have more options as to where your points go.

American Express Preferred Rewards Gold Credit Card is a great first card for anyone who travels even a little bit. The first year is free (you just have to remember to cancel) and you can get 2 points for airline purchases. You also get 4 free passes to air lounges that are part of Priority Pass. Do remember that you are not guaranteed entry to air lounges and you may be refused if the air lounge is full.

American Express The Platinum Card

The American Express Platinum Card has a hefty charge to it however you can add another cardholder completely free of charge. This can then allow you to share the cost of the card so £287.50 each per year which doesn’t sound so bad. This card is worth it if you travel a lot.

The air lounge perk is great however you are not guaranteed entry into any lounge and I have been refused entry as it was at full capacity. You are also only allowed in there up to three hours before your flight and no earlier. The maximum time you have in the air lounge is three hours. As for the travel insurance, it doesn’t cover people over the age of 70 something I wished I had known before signing up.

In my opinion, if you travel 4-5 times a year it is worth it for the travel insurance and the air lounge access otherwise I wouldn’t bother. If you have a partner or friend you would want to share it with it may also be worthwhile.

American Express Cashback Credit Cards

Although the credit cards listed below are not intended for use of travel miles. I would recommend these cashback cards for people who are new to credit cards or are a little short on cash (as you get cashback on your everyday spending). The cashback you can then use for when you travel.

Barclaycard Avios Credit Cards

Barclays introduced these cards only a few years ago and are therefore fairly new. The British Airways American Express Premium Plus Card was the only Avios card available until now. I prefer the Barclaycard Avios Plus Credit Card as it can be used anywhere unlike American Express where some shops don’t accept it.

Both of these cards have the same fee although Barclaycard is paid monthly while American Express is annual. They also both have a £10,000 annual spend for a companion voucher and offer 1.5 Avios for every £1 spent as well as having the same welcome bonus. The only difference is British Airways American Express offers 3 Avios for every £1 spent with British Airways or British Airways Holidays, something to consider if you pay via British Airways.

Curve Card is not associated with a bank and you cannot put money onto the card itself. It is used as an “in-between” card where you can put all your Visa, Mastercard and now Papal accounts on the card therefore only taking your Curve Card shopping with you. You can select which card you then want to pay with within the Curve App.

- American Express does not work on ANY Curve Cards

- The best feature is the go back in time feature where you can change where you spent money after you’ve spent it.

- Beware of using your Curve card abroad (in foreign currency) on weekends as it charges you an extra fee.

- For those of you who are self-employed, you can pay your Taxes with Curve (free for Curve Metal up to £3000 30-day rolling period but it is a 2.5% charge after that)

- It is also worth noting that Curve is digital therefore there are no branches. The chat in Curve can take a while for someone to get back to you if you have any issues. It took me 3 working days to get a response from the chat function on the app.

Curve card is great overseas as it uses the FX exchange rate which means you can use it as an in-between card to load your credit card to get you extra points. This service does however charge you a little for using the card on weekends however it is still worth it in my opinion.

Which Travel Credit Cards for Travel Miles do I currently use?

These are the personal credit cards I currently use.

For most of my banking in the UK and Europe, I use a Virgin Money Reward+ Credit Card . This gives me 1.5 virgin points per £1 and it is free to use in Europe. It uses the Mastercard exchange rate.

For paying on my card outside Europe I use Revolut as it uses an interbank exchange rate and has multiple currencies in the app so I can easily exchange money.

For withdrawing money abroad I always use Staling Bank as it has an unlimited withdrawal fee. Revolut is currently free for withdrawing £200 a month after that there is a fee.

I also have Curve Metal which links all my cards together.

If you are looking at getting a debit card you can find my recommendations here .

I have used American Express in the past however I have had a discrepancy with them and they refused to pay me back my money so I have cancelled my card. There bonuses for first-time users are great however I couldn’t justify having two credit cards that both have an annual fee. Always be aware with getting an American Express (Amex) card that fees are high if you do not pay the card back in full every month and not all establishments accept it.

Braintree Ice Skating – a fun activity for the whole family this Christmas

Santa claus express night train 10 things you need to know, you may also like, braintree ice skating – a fun activity for..., mrs doubtfire musical london review a must see....

3 Credit Card Mistakes to Avoid When You're Traveling

I t's common to take a credit card or two along with you when you travel. That way, you don't have to worry about running out of cash or struggling to find an ATM. But if you're going to use your credit cards while traveling, make certain to avoid these three big mistakes.

1. Not checking to see if there's a foreign transaction fee

It's not a given that your credit card will impose a foreign transaction fee. But some cards do. Always check the fine print before taking a credit card with you if you're traveling abroad, because in some cases, you may be looking at paying more than necessary for your purchases.

Featured offer: save money while you pay off debt with one of these top-rated balance transfer credit cards

Foreign transaction fees commonly amount to 1% to 3% of your purchase total. But let's say you go to Europe for a week and spend $1,000 on food and entertainment. With a 3% fee, you're looking at $30 extra.

If you have time between now and your next trip out of the country and none of your current credit cards are free from foreign transaction fees, consider applying for a new one. You may especially want to look at travel rewards credit cards , which often waive this fee and also tend to offer money-saving perks like discounts on in-flight purchases.

2. Not informing your credit card issuer that you'll be traveling

The fact that credit card companies are constantly on the lookout for fraud is a good thing. But you may run into some issues if you travel abroad or to another part of the country and you don't loop your credit card issuer in.

In that case, your card might get flagged for fraud and you may find that you're unable to use it. And while you can generally call your issuer to confirm that your charges are legitimate, thereby releasing that freeze, that hinges on you being able to place a call.

If you're abroad, you may not have an international calling plan. And if you're in a remote part of the U.S., you may not have reception. That could be a problem if you're trying to fill up your car on a country road, it's rejected at the only gas station within 80 miles, and you don't have cash.

3. Not keeping track of your credit card spending

When you're traveling, it's easy enough to spend more freely because you're in the midst of a whole new set of experiences. But don't let that spending get out of hand. If you don't track your purchases while traveling, you could end up with a costly pile of debt on your hands.

Let's say you've only budgeted for $1,000 worth of spending while on vacation outside of lodging and airfare, and your total purchases reach $1,600. That's a $600 balance you might have to pay off over six months. But on a credit card charging 20% interest, that'll mean paying an extra $35. That's money you could be putting toward a future trip instead.

A credit card can be an asset on your vacation. But do your best to avoid these mistakes, so you don't pay extra or end up having to deal with the hassle of having your credit card denied.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a disclosure policy .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Virgin Atlantic Flying Club

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

About Virgin Atlantic

How to earn virgin atlantic flying club points, how to redeem virgin atlantic flying club points for maximum value, virgin atlantic flying club redemptions to avoid, virgin atlantic flying club’s elite status program, virgin atlantic clubhouses, virgin atlantic flying club, recapped.

In 1984, Sir Richard Branson founded a quirky new airline. Named after his established Virgin Group, he dubbed the airline Virgin Atlantic. His adventurous personality came to personify what the airline was all about, including his famous "screw it, let's do it" philosophy. As it grew, Virgin Atlantic became the airline you flew if you wanted an adventure.

As it wraps up its fourth decade of flying, Virgin Atlantic is setting off on a new adventure. As of March 2, 2023, the United Kingdom-based airline joined the SkyTeam alliance — adding over a dozen new airlines to its already-long list of airline and hotel partners.

In this guide, we'll explore how to earn Virgin Atlantic points, the best ways to redeem them, and what it takes to earn elite status with the airline’s loyalty program, the Flying Club.

Here’s a quick overview of a few key features of Virgin Atlantic and its loyalty program:

Main U.S. routes: Virgin Atlantic operates flights to 12 U.S. cities, with most of its flights routing through London-Heathrow airport. Flights to New York City, Los Angeles , Orlando, Fla., and San Francisco are among the most popular. Virgin Atlantic also operates flights to the U.S. from Manchester, England and Edinburgh, Scotland.

Classes of service: Virgin Atlantic offers three classes of seats — economy , premium economy and "Upper Class" business class. Economy fares are further broken down into three categories: Delight, Classic and Light. Upper Class passengers receive complimentary access to Virgin Atlantic Clubhouse lounges.

Points currency and loyalty program: Virgin Atlantic travelers earn and redeem Virgin points through the Virgin Atlantic Flying Club. Members earn a percent of the actual miles flown multiplied by an earning rate that depends on the fare class and the traveler's level of elite status. Points can be redeemed for flights, upgrades or holiday packages, or they can be transferred to hotel partners or other members.

» Learn more: The guide to Virgin Atlantic premium economy

Earn by flying

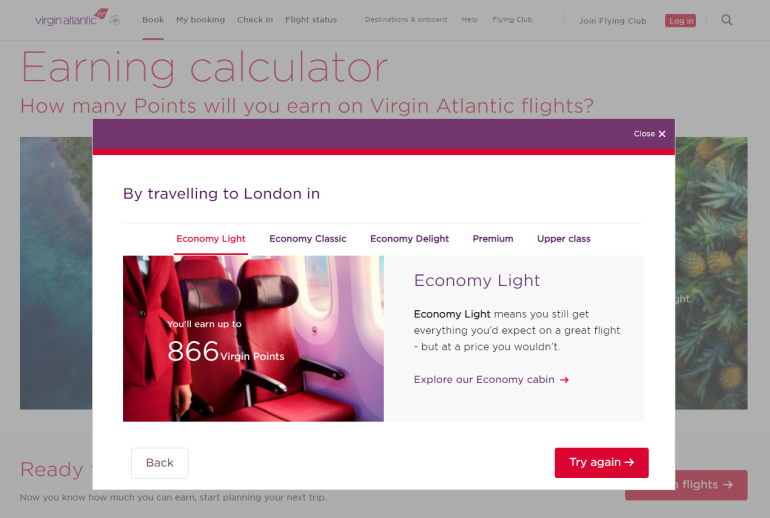

Flying Club members earn Virgin Atlantic points based on the ticket class and the number of miles flown. Economy flights earn from 25% to 150% of miles flown, while Premium flyers earn 100% to 200% and Upper Class travelers earn 200% to 400%. Here's how those earnings rates shake out:

Don't want to do the math? The good news is that Virgin Atlantic offers a handy earning calculator .

Flying Club elite status members earn a bonus on top of the base earnings. Silver members get a 30% points bonus, while Gold elites get a 60% points bonus.

» Learn more: How to know how many miles you’ll earn from a flight

Flying Club members can also earn Virgin points by crediting flights flown on any SkyTeam partner or on any of Virgin Atlantic's nine non-alliance partners. The earnings rate depends on the airline you're flying, the fare class you booked and the distance of the flight.

Earn by spending on credit cards

Another way to earn Flying Club points is by using the Virgin Atlantic World Elite Mastercard® . Cardholders earn 3 points per dollar spent on Virgin Atlantic purchases and 1.5 points per dollar on other purchases.

New applicants can earn the following sign-up bonus: For a limited time: 60,000 bonus Virgin Points after spending $2,000 or more on purchases within the first 90 days of account opening. Plus, get an additional 2,500 points for each authorized user on the account, up to a maximum of 5,000 points.

The Virgin Atlantic World Elite Mastercard® offers several bonuses for spending on the card:

Earn up to 15,000 bonus points by hitting spending thresholds on the card each cardholder anniversary year.

Receive 25 tier points (up to 50 per month) for every $2,500 in purchases on the card. That means you can achieve Silver status solely from credit card spending. Plus, you'll have an easier path to Gold by maxing out this opportunity.

After spending $25,000 on the card, you'll earn a choice of either a one-time one-cabin upgrade or a Companion Fare.

The Virgin Atlantic World Elite Mastercard® charges an annual fee of $90 but doesn't charge foreign transaction fees.

» Learn more: The best airline credit cards right now

Earn Virgin points through transfer partners

Building your Flying Club points balance is easy thanks to Virgin Atlantic's many transfer partners. Virgin Atlantic partners with the following bank and hotel loyalty programs — which travelers can use to convert rewards into Flying Club points.

If you transfer at least 60,000 Marriott Bonvoy points to Virgin Atlantic, you'll receive an additional bonus of 5,000 Virgin Atlantic points. World of Hyatt has a similar offer: You'll receive 7,500 bonus Virgin points when converting at least 50,000 Hyatt points at one time.

Earn Virgin points on lodging

Virgin Atlantic Flying Club members have a slew of ways to earn Virgin points through hotel stays, such as the following:

Virgin Limited Edition: Earn up to 55,000 Virgin points by booking a stay at one of Richard Branson's retreats.

Virgin Hotels: Earn 2,000 points per stay. Plus, Silver elites will receive complimentary upgrades, and Gold elites will get upgrades and free breakfast.

Rocketmiles: Earn at least 500 points per night — up to 10,000 points per night.

Kaligo.com: Earn up to 10,000 points per night at 550,000 hotels worldwide.

Hyatt: Earn 750 Virgin points per stay at Hyatt hotels and resorts.

IHG: Earn up to 500 Virgin points per stay at select IHG brands.

Marriott: Earn up to 2 points per dollar spent at qualifying Marriott brands.

Best Western: Earn 500 Virgin points per stay at any Best Western property worldwide.

WorldHotels Collection: Earn 500 Virgin points per qualifying stay.

Yotel: Earn 500 Virgin points on stays of three or more nights in New York and 100 points for stays at Yotel airport locations.

Earn Virgin points on car rentals

Another way to earn Flying Club points is through rental car reservations with these five partners:

Avis: Earn from 250 to 1,000 Virgin points, depending on the length of rental and the rate you use.

Alamo: Earn 1,000 Virgin points per rental in the U.S. and Canada.

Hertz: Earn up to 1,100 Virgin points per rental — 1,000 points for leisure rentals plus 100 bonus points for Hertz Gold Plus Reward members.

National: Earn 1,000 Virgin points per rental in the U.S. and Canada and up to 1,200 points in Europe.

Sixt: Earn 500 points per car rental and 3 points for every euro (about $1.09) spent on Sixt premium limousine services.

Other ways to earn Virgin points

Flying Club members can also earn Virgin points through the following methods:

Online shopping: Earn 2 Virgin points for every English pound (about $1.24) spent through the Virgin Atlantic "Retail Therapy" shopping portal.

Virgin Atlantic Holidays: Book a package through Virgin Atlantic Holidays to earn a base of 2 Virgin Points for every English pound (about $1.24) spent. Even better, Silver Flying Club elites earn 3x and Gold Flying Club elites earn 4x points on bookings.

e-Rewards: Convert e-Rewards Currency or Opinion Points to Virgin points. The transfer rate depends on where your account is registered and how many points you convert.

Purple Parking: Earn up to 500 Virgin points for airport parking bookings.

Business Traveller: Earn 400 Virgin points for a one-year subscription, up to 2,300 Virgin points for a three-year subscription.

Purchase points: Buy Virgin points for $25 per 1,000 points, plus a $22 transaction fee.

» Learn more: British Airways vs. Virgin Atlantic: Which is better?

Virgin Atlantic award flights

For award flights on Virgin Atlantic, Flying Club offers two award charts — one for the standard season and one for the peak season. Points rates depend on which regions you're flying between, which cabin of service you’re in, and whether you're flying during peak or standard dates.