Sorry, we’re working on our website.

We’ll be back up and running shortly..

Code: AKM-CYB-WEB-1

Error: 18.85341060.1712328277.552b50b

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

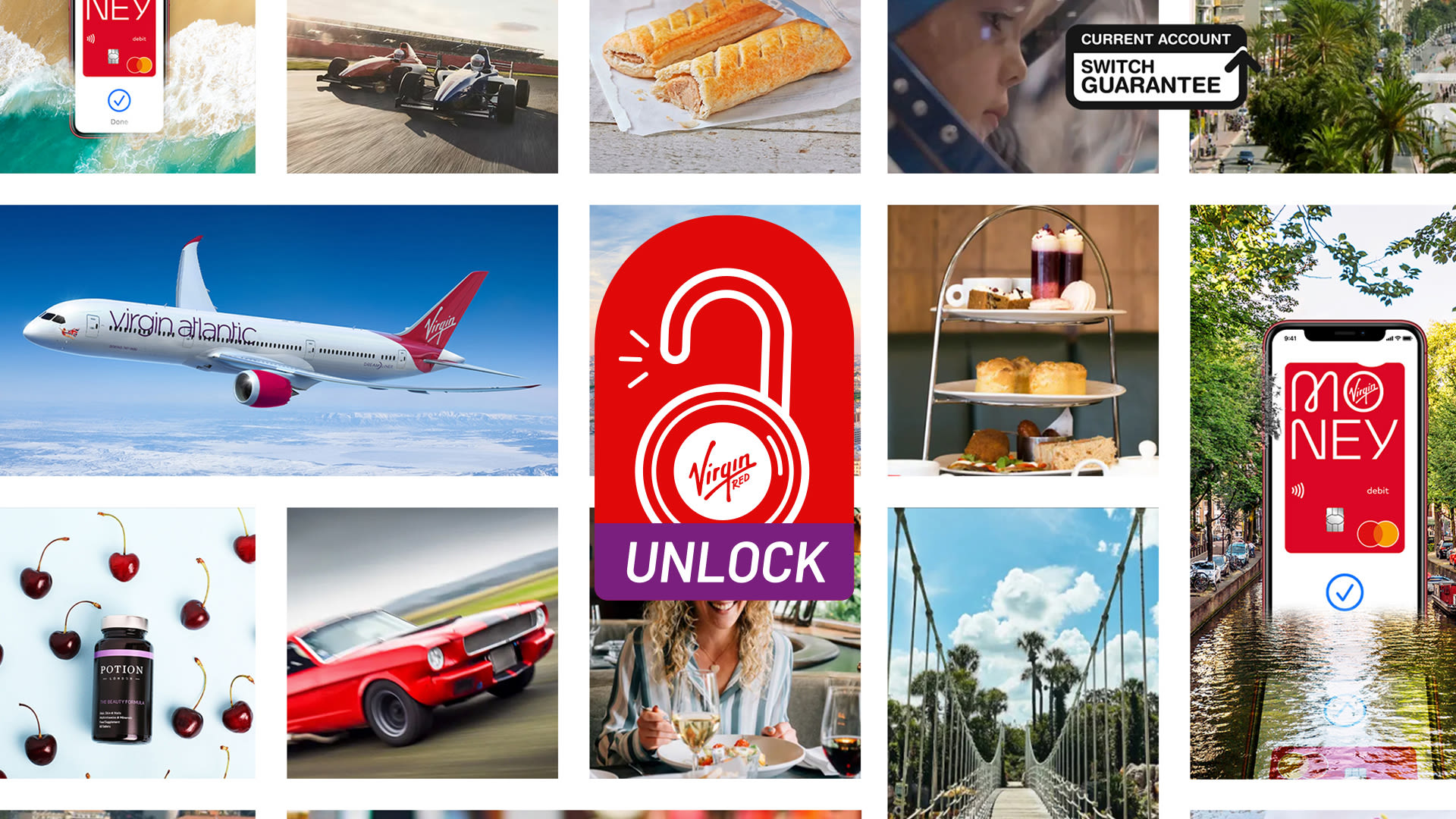

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

- " id="mainPhoneNumber">

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- Budget Direct

- Fast Cover Travel Insurance

- Insure4Less

- InsureandGo

- Simply Travel Insurance

- Ski-Insurance

- Travel Insurance Saver

- Travel Insuranz

- Wise Traveller

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Tips

- Covid-19 Help

- Read Reviews

- Write a Review

Need Quotes?

Use our travel insurance comparision to help you save time, worry & loads of money!

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

Virgin Money Travel Insurance Reviews

Virgin Money Travel Insurance is all you need to pack for peace of mind. They’ll help to protect what matters and put your adventure back on the map, pronto. Policies are available to those under 74 years. Dependants travel for free with parent or grandparent. They offer 24/7 emergency assistance no matter where you are in the world. Underwritten by Allianz Australia Insurance Limited.

Customer Experience

Claims experience, value for money.

They do not pay out

Avoid at all costs. I had to cancel my holiday because of the first covid lockdown. The holiday was b... Read more

Avoid at all costs. I had to cancel my holiday because of the first covid lockdown. The holiday was booked before anyone was even aware of Covid. My family who used different insurance providers were refunded within a month. It has been 7 months and there is still no progress. They just send a standard email every 40 days to say how it is being processed - with nothing actually happening. And yet they managed to find the time to process my renewal. It is criminal in my opinion that they are able to take money for a service they are clearly not providing.

0 comment on this review

Your comment text is too long. Max is 700 characters including linebreaks.

Terrible service - still awaiting a decision on a claim made almost 6 months ago...

I have annual travel insurance with Virgin, easy to take out but a TERRIBLE SERVICE if you need to ma... Read more

I have annual travel insurance with Virgin, easy to take out but a TERRIBLE SERVICE if you need to make a claim. I still don't have a decision on a claim made almost 6 months ago. They fob you off with promises to get back to you in 45 days and after sending documents by recorded post and email they say they cannot find them. This is the worst company I have ever dealt with and I have made a complaint to the financial ombudsman. I would advise to avoid this company, quick to take your money by not backed by the customer service and ability to deal effectively with claims.

Can’t be trusted

My wife and I took out an annual travel insurance policy with them. They then introduced a coronavir... Read more

My wife and I took out an annual travel insurance policy with them. They then introduced a coronavirus exemption. No option to adjust policy, leaving us with no other option to take out insurance with another provider. Getting a refund was so difficult it was as though they were doing it deliberately to put us off. No email option and long waits to get through on the telephone with promises to call back which never happened. To round it all off they sent us an email to say that coronavirus cover was reinstalled after we had taken out the policy with an alternate policy. In the end we were only able to get a partial refund on a policy we were never able to use. My impression is that as a company they just don’t care once they have your money. My only comfort is the knowledge that I am not having to rely on them paying out if I needed to make a claim. From my experience I would expect them to make it as difficult and time consuming as possible and they would do everything they could do to avoid paying. There are much better companies out there.

Doesn’t cover lost or stolen

They don’t cover anything stolen or lost if it was not on you at the time. If it was on me... I would... Read more

They don’t cover anything stolen or lost if it was not on you at the time. If it was on me... I wouldn’t need travel insurance because it wouldn’t be stolen or lost! Definitely read to product disclosure closely: “Unsupervised means leaving your luggage and personal effects: • with a person who is not named on your Certificate of Insurance or who is not a travelling companion or who is not a relative; or • with a person who is named on your Certificate of Insurance or who is a travelling companion or who is a relative but who fails to keep your luggage and personal effects under close supervision; or • where they can be taken without your knowledge; or • at such a distance from you that you are unable to prevent them being taken; and includes forgetting or misplacing items of your luggage and personal effects, leaving them behind or walking away“

Waste of time and money

Plane diverted to Honolulu (Auckland to San Fran) because it was leaking oil, airline was unable to r... Read more

Plane diverted to Honolulu (Auckland to San Fran) because it was leaking oil, airline was unable to rebook us at the time so we booked new flights to get us to San Francisco in time for a wedding. Virgin refused to cover the cost because they wont cover rescheduling due to mechanical faults. What if the plane had crashed because of mechanical faults and we ended up in hospital, would they not cover that either?! Out of pocket almost $500 for the extra flight plus the cost of the policy that is apparently useless. Plus the time it took to submit their epic claim process.

1 comment on this review

weaseled out of paying my claim

my flight was cancelled by an airline in canada so I missed my connections (I had another week of my ... Read more

my flight was cancelled by an airline in canada so I missed my connections (I had another week of my holiday to continue). To rebook the connections was going to cost an insane amount so I booked a comparatively cheap flight straight home. But because the airline put on a rescue flight the next day my cancelled flight didn't count as "cancelled" but "rescheduled" so now I'm out of pocket $1200! Thanks virgin money..

They don't cover the basics.

They don't cover bookings. The highest, most expensive comprehensive cover does not cover an esse... Read more

They don't cover bookings. The highest, most expensive comprehensive cover does not cover an essential item of travel... bookings.

Filed a claim because I had my holiday shortened by customs

I was stopped by the U.S customs and was meant to be travelling for 3 months, the customs officer was... Read more

I was stopped by the U.S customs and was meant to be travelling for 3 months, the customs officer was really aggressive and for some reason said I could only travel for two weeks. The policy covers unforeseen circumstances to travel plans but they are refusing to reimburse me for the flights that I had to cancel. Pieces of trash - do not use this company - STA Travel are 1000% better I should have stuck with them

7 comments on this review

terrible customer service

Called Virgin money in regards to travel insurance today at 12.30. Had several questions in regards t... Read more

Called Virgin money in regards to travel insurance today at 12.30. Had several questions in regards to what is covered...the woman I spoke to was very rude and argumentative... Her advice was to go to page 20 of the PDS and read it myself, wouldn't tell me what is or isn't covered. I then attempted to talk to her about the other quote I had from Woolworths insurance... Mid sentence she cut me off and rudely said I don't work for them.... No shit...it was a question, do I need to talk to someone else there that can answer my question. I also asked about layovers without leaving airport during journey... She again was very rude with answer.... Needless to say I hung up on here and purchased Woolworths insurance

3 comments on this review

Absolutely wonderful service

Virgin Australia's travel insurance was the best coverage for the best price, especially when it came... Read more

Virgin Australia's travel insurance was the best coverage for the best price, especially when it came to electrical equipment coverage. I experienced an incident on my return journey to Australia, where my camera was damaged. I contacted Virgin and they had a positive can-do attitude, were helpful with my claim and the repair/ replacement went through effortlessly and speedily. I can't recommend their services highly enough. Well done Virgin.

Virgin Money is good value for money

Virgin were hassle free and easy to deal with. They emailed me immediately with the forms required fo... Read more

Virgin were hassle free and easy to deal with. They emailed me immediately with the forms required for a claim and we had the full reimbursement within 2 weeks, which included them having to send it to their medical officers for review. The price was also a bonus and was the cheapest by a long way. I would definitely recommend Virgin Money Travel Insurance to anyone and I will be sure to use them again next time I head overseas.

Helpful and patient customer service

I was in a hurry to get insurance before my trip to Bali, I hopped on to their website and got a poli... Read more

I was in a hurry to get insurance before my trip to Bali, I hopped on to their website and got a policy within minutes. I later called them up for some clarification on the policy. The customer service officer was helpful and patient. No claims this trip, but I will go back with them again.

Virgin Money FAQ

How many people can i include in my policy.

You can only purchase insurance for two adults and 10 children online. Call up Virgin Money to see how many additional people can be added to your policy.

Am I covered if I go on a cruise?

Am i covered for skiing and my equipment.

Yes you are covered for skiing and your ski equipment if you purchase the ‘Sports Cover’ option with Plan A or B.

Can I pay to reduce or cancel my excess?

You can remove the standard excess by paying an additional premium. Contact Virgin Money for further information.

What additional extras are there?

Dependent under 25 travel for free if they travel with you on the journey and emergency medical assistance is available 24/7.

Am I covered if my tour company collapses?

No, Virgin Money does not cover the financial collapse of any transport, tour or accommodation provider.

I'm not an Australian resident- can I buy cover?

This policy is only available to travellers who are permanent residents of Australia unless otherwise agreed.

What size moped or motorbike am I covered to ride overseas?

You are covered to ride a motorcycle with an engine capacity of 50cc or less. You must also hold a current Australian Motor Cycle Licence and a valid license for the country you are travelling in to be covered.

How long is their single trip cover for?

Can i extend my policy from overseas.

If you decide to lengthen you trip you can do so for up to 12 months. Call Virgin Money on 1800 134 419.

Do they cover for my rental vehicle excess?

Virgin Money includes cover of up to $3,000 for the excess of a rental vehicle in case of collision, damage or theft.

Who underwrites them?

Virgin Money (Australia) Pty Limited ABN 75 103 478 897

What's their cooling off period?

Where are they based, our travel insurance comparision helps you, save time, worry and loads of money.

Stay up to date with our latest news, deals and special offers.

Your privacy is important to us.

Comparetravelinsurance.com.au is Australia’s leading comparison site solely focused on travel insurance.

Our comparison is a free service that allows users to compare quotes in a few simple steps based on limited personal criteria. Comparisons supplied are not a recommendation or opinion about the suitability of a policy for a user. Comparisons are default ranked according to price and users have the ability to sort by popular cover levels. Whilst we compare a vast range of policies, we do not compare all providers in the market. This site compares the following brands: 1Cover, AllClear, Budget Direct, Downunder, Fast Cover Travel Insurance, Insure4Less, InsureandGo, iTrek, Simply Travel Insurance, Ski-Insurance, Travel Insurance Saver, Travel Insuranz, Wise Traveller, Zoom Travel Insurance . The directors and shareholders are common with companies i-Trek Pty Ltd, Zoom Travel Insurance and 1Cover Pty Ltd including it’s subsidiary brand Ski-insurance. CoverDirect takes all reasonable care when preparing this information but does not warrant its accuracy. Pricing information is supplied by the providers who participate on this site and should be verified with the insurer before you purchase. This site links users to the website of the provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase.

CoverDirect Pty Ltd owns and operates this website under AFS Licence 383590. Located at Level 12, 338 Pitt Street, Sydney, NSW 2000 Australia.

For further information view our FSG and Terms of Use . Contact us by calling 1300 659 411.

Loading Quotes...

Please login or register to continue. It'll only take a minute.

Login with Facebook

Login with Google

- There was an error logging in, please try again.

Enter your email and password

- There was an error on your registration, please try again.

Don't you have an account?

Just checking you are a human

- United States

- United Kingdom

Virgin Money credit card complimentary travel insurance

A virgin money credit card that offers complimentary travel insurance can help you save on the cost of overseas trips – so how much cover can you get.

In this guide

What Virgin Money cards have complimentary travel insurance?

What's covered by virgin money complimentary international travel insurance, what's not covered, what do i need to do to use virgin money credit card complimentary travel insurance, pre-existing medical conditions, how to make a claim, other types of virgin money complimentary credit card travel insurance, virgin money credit card complimentary insurance for shopping.

Virgin Money offers complimentary insurance on Virgin Australia Velocity High Flyer and Flyer credit cards, including complimentary international travel insurance on the Velocity High Flyer.

These policies are underwritten by Allianz Global Assistance (Allianz) and there are different conditions to get cover and make claims. That's why it's always best to read insurance policy documents. But if you just want an overview, here we have pulled out the key details for this cover.

Have a question or need to make a claim now? Call Allianz on 1800 072 791 (Australia) or +61 7 3305 7499 (overseas).

The Velocity High Flyer and Flyer credit cards offer different types of complimentary insurance. Here's a summary of what you can get with each card.

This insurance includes emergency medical cover, luggage and some cancellations. The actual cover you get is broken down into "benefits" based on what you can and can't claim. For some claims, you'll need to pay an excess before you'll get any money back if it's approved.

Here, we've broken down the key options for different types of benefits, with basic examples of when you might make a claim. But remember: you should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover

Cancellation, delays and transport, luggage and personal items cover, death, funerals and personal liability.

All insurance policies have details of when you will and won't get cover, so check the insurance booklet before you book a trip or make a claim. With Virgin Money credit card complimentary international travel insurance, some of the key situations that aren't covered include:

- If you don't follow advice from any government, official body or mass media announcements

- If the purpose of your trip includes getting medical treatment

- Participation in criminal or illegal acts

- Acts of war

- Dangerous activities, including rock climbing, white water rafting, bungee jumping, skydiving, water skiing, off-piste snow skiing or snowboarding, or for any professional sports

These are only a few examples of when you won't get cover under this policy. Check the Virgin Money credit card insurance policy booklet or call Allianz on 1800 072 791 for more details about the exclusions.

Does Virgin Money credit card international travel insurance cover COVID-19?

Yes, for claims made on or after 1 November 2023 there is some cover related to COVID-19. This includes:

- Overseas emergency assistance

- Overseas emergency medical

- Cancellation

- Additional expenses

To make a claim, you need to be positively diagnosed with COVID-19 (or another pandemic/epidemic disease) and meet all the other requirements for a claim. This also extends to an eligible spouse or dependants travelling with you – but won’t apply if you’re travelling against government advice. As there are lots of conditions to meet for this type of cover, make sure you read the policy booklet or call Allianz on 1800 072 791 before you travel.

If you need cover for a skiing trip, bungee jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions.

If you're planning a trip and want cover through your Virgin Money credit card, you'll need to meet the following requirements:

- Spend at least $500 on your prepaid travel costs using your Virgin Money Velocity High Flyer Card.

- Use Velocity Points to book your overseas travel ticket.

- Redeem a Virgin Australia Gift Voucher for the overseas travel ticket.

- Length of travel. This cover is available if your trip is for 6 consecutive months or less.

- Account status. You need to have an active, eligible Virgin Money credit card in your name at the time of your booking.

Does Virgin Money credit card travel insurance cover family members?

Yes, your spouse and eligible dependants (i.e. your children) can also get cover when you meet the eligibility requirements for international travel insurance. For them, the key requirements to get cover are:

- They need to be an Australian resident or a holder of a visa issued under the Migration Act 1958 (Cth)

- They need to travel with you for at least 50% of the trip that you've got cover for

- They need to have a return overseas travel ticket before leaving Australia

- They need to be under 81 years of age at the time they became eligible for the cover

They also need to meet the other conditions of the insurance policy. Keep in mind that some claims have different limits for a spouse or dependants compared to what you (as the primary cardholder) get.

A pre-existing medical condition can affect your travel insurance cover and usually refers to health conditions you've recently been treated for or manage on an ongoing basis.

With Virgin Money's complimentary international travel insurance, you can only get cover for a pre-existing medical condition if you apply and get written confirmation from Allianz Global Assistance.

You can do this online or by calling Allianz on 1800 072 791 before you go overseas. If your request is approved, you’ll need to pay a $75 administration fee and will then be sent written confirmation that your pre-existing condition is covered.

Pregnancy cover

This policy offers limited cover for pregnancies, but the amount and type of cover varies.

For example, if you become pregnant after booking your trip and meeting the eligibility requirements for this cover, you’ll be able to get cover for any complications of your pregnancy that arise from injury or sickness.

There is no cover for childbirth, except if it is the result of injury or sickness. If you are pregnant or planning for pregnancy, make sure you check the insurance policy or contact Allianz directly for full details on cover.

First, contact Allianz as soon as anything happens by calling +617 3305 7499 from overseas or 1800 072 791 from Australia. They will be able to advise you on the claim or claims you want to make at the time.

You can then submit a claim online by following these steps:

- Go to the Allianz online claim portal at https://claimmanager.com.au/aga/agreement

- Confirm you agree with the terms and conditions, then click "Create new claim"

- Select the "Credit card insurance" option and provide details of your card

- Fill in the details on the claim form and upload your supporting documentation

You will hear back about your claim within 10 business days.

What to include in your claim

With insurance claims, including as much detail as possible makes it easier for the insurer to consider the claim and your eligibility for a payout.

So when you're travelling with this cover, aim to get as much written or photo evidence as you can for any claims you need to make. This could include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Official medical reports

- Police reports

- Photos of damaged items

- Emails or letters from airlines that relate to a claim

- Receipts or other proof of purchase

Tip: Use a travel wallet or create an online folder to keep all your important documents together. This could include your passport, itinerary, printed tickets, a copy of the Virgin Money card insurance policy booklet – plus anything that could become supporting documentation for future claims.

Domestic travel insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. This can include costs relating to cancelled return flights, flight delays of 4 hours or more and delayed or lost luggage.

- When can I use it? You'll get cover for up to 28 days in a row if you have paid for the entire trip with your Virgin Australia Velocity High Flyer credit card, Velocity Points, a Virgin Australia Gift Voucher or a combination of these options. Your spouse and any dependants can also get cover if you use the same payment method for their return travel of 28 days or less and they will be with you for at least half the trip.

- Is there an excess cost? There is a $75 excess for claims that relate to additional expenses. There are no excess costs for other claims but there are maximum claim amounts, which vary depending on the type of claim.

Rental vehicle excess insurance in Australia

- What is it? Cover for damage or theft of a hire car, up to a maximum total of $10,000.

- When can I use it? When you’ve used your eligible Virgin Money credit card to pay for the full cost of the car hire.

- Is there an excess cost? $100 per claim.

To make a claim under one of these policies, download a claim form online at https://claims.agaassistance.com.au/ or call Allianz on 1800 072 791.

Virgin Money credit cards give you access to other types of insurance, which are also provided by Allianz. Here’s a basic explainer of each one:

- Purchase protection insurance: Offers cover for up to 90 days when you purchase new items with your eligible Virgin Money credit card and they are then stolen, accidentally damaged or lost. It covers household and personal items such as shoes, jewellery, glasses and new works of art.

- Extended warranty insurance: This cover doubles a manufacturer's warranty, up to a maximum period of 12 months, for eligible items bought with your card in Australia.

Don't have complimentary insurance on your credit card yet? Compare Virgin Money credit cards or check out other cards that offer insurance .

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald.

More guides on Finder

Get up to 60,000 bonus Velocity Points, a yearly $129 Virgin Australia gift voucher and points per $1 on all eligible spending.

The Virgin Australia Velocity High Flyer has a bonus Velocity Points offer, lounge passes and a yearly flight benefit. So is it worth the $329 annual fee?

This Virgin Australia Velocity Flyer offer gives you 0% interest on a balance transfer for 24 months and a $0 annual fee for the first year.

As well as a competitive variable purchase rate, the Virgin Money Low rate card has a balance transfer offer that can help you save on existing debts.

Take advantage of no annual fee and up to 55 interest-free days on purchases with the Virgin No Annual Fee Credit Card.

Earn Velocity Points as you spend and save with 0% interest on purchases and balance transfers for 14 months with the Virgin Australia Velocity Flyer Card.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

10 Responses

Two questions. I am planning on an overseas trip beginning in February 2024 with my companion , paid in full with my Virgin Credit Card , is she covered by my Card

Hi Anthony, Yes, if your companion is considered as your spouse, they would get access to this cover when you meet the eligibility requirements. Here’s the definition of “spouse” in the policy document booklet: “a partner of the cardholder who is permanently living with the cardholder at the time the journey or trip starts”. If you have further questions about eligibility for cover or any other details of the insurance, you can contact Allianz (the insurance provider) 1800 072 791. I hope this helps.

I have a High Flyer Card and have booked a one-way cruise ship trip. We used our Velicity points to book the flights to the embarkation port (Hawaii). Does my High Flyer Card complementary insurance cover us fully on the cruise ship?

Hi Steve, You can check your eligibility and cover with the insurance provider, Allianz, by calling 1800 072 791. For reference, booking an overseas travel ticket with Velocity Points is listed as an option in the eligibility section of the insurance policy document. But there are other requirements and details about cruises so it’s a good idea to double-check with the insurer. I hope this helps.

I have purchased an overseas holiday with full payment being made through a travel company. The travel company has made the flight bookings on our behalf so I need to know if the travel insurance on my credit card will provide my wife and I with cover

Hi Tony, According to the terms and conditions, if you have a current, valid Virgin Australia High Flyer credit card, “charging the cost of the overseas travel ticket to the account holder’s card account” is one way to get cover for a trip of up to 6 months. As there are other eligibility requirements and conditions around pre-existing conditions, you may want to call the insurance provider, Allianz, on 1800 072 791 for full details of the cover. I hope this helps.

I do not know what type my Velocity credit card is, and I am 81 years old, so can I get travel insurance on it?

Hi Wendy, You can call Virgin Money on 13 37 39 to find out what type of credit card you have and if it offers travel insurance. Alternatively, you can compare travel insurance for people aged over 80 , including prices and what’s covered. I hope this helps.

Could you please forward a copy of the policy for complimentary travel insurance for use with Virgin High Flyer credit card. I’m assuming it is with Alliance Insurance.

Hi Deborah,

Here’s a link to the complimentary insurance terms and conditions document (pdf) effective 1 June 2022. That’s the version currently available on the Virgin Money website (at the time of writing).

Just keep in mind that they do get updated periodically. So if you need to reference it in the future, check the Virgin Money credit card forms and T&Cs webpage for updates to it. Hope that helps!

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

Virgin Money: Travel Insurance reviews

No new 5 star reviews, 250% increase in 1 star reviews, latest highest rating:.

Latest lowest rating:

About the Travel Insurance

Review virgin money: travel insurance now, virgin money travel insurance reviews ( 90 ), this is like not taking any insurance, if you think your cover you are so wrong ..

Do NOT use Virgin

2 MONTHS STILL NO CAR!

Showing 4 of 90

Do you have a different Virgin Money product?

There's still more to see!

Join smart money people.

Keep up to date on ratings of your favourite businesses. Find out about our awards and write new reviews with ease

News, guides and insight from our team

How customer reviews can help with SEO

Get your finances in shape: Ten things to check in 2024

The cost of having a baby in 2024

How to share customer feedback with senior managers

- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Selecting Allianz Travel Insurance at checkout is the easiest way to protect your investment, giving you more freedom to embrace your entire travel experience.

If you've already booked your flights, you can still find a plan to protect your trip.

Provides reimbursement for your prepaid, non-refundable travel expenses if your trip is cancelled, interrupted or extended due to a covered reason.

Provides benefits for losses due to covered medical and dental emergencies that occur during your trip.

Arranges and pays for medically necessary transportation following a covered injury or illness to an appropriate medical facility, return of dependents and more.

Provides reimbursement for eligible meals, accommodations and more when your trip is delayed for 6 or more consecutive hours for a covered reason.

Provies reimbursement for covered losses due to damaged, stolen or lost luggage and personal effects.

Provides reimbursement for the purchase of covered essential items during your trip if your luggage is delayed for 24 hours or more.

Award-winning, multilingual, travel experts here to help you deal with unexpected travel hiccups around the clock. We can help you find local medical and legal professionals, help with missed connections or lost/stolen travel documents, and more.

Free Look period

If you are not completely satisfied, you have 15 days (or more depending on your state of residence) to request a refund of your plan, provided you haven't started your trip or initiated a claim. Premiums are non-refundable after this period.

File a claim

Upload documents, track your claim status, and more through the convenient online portal .

Money blog: Streaming platform copies Netflix in crackdown on password-sharing

We've enlisted expert help to investigate whether it's more difficult to secure a mortgage if you're self-employed. Read this and more in the Money blog, your place for personal finance news. Leave a comment on stories we've covered, or a question for our experts, in the form below.

Friday 5 April 2024 15:00, UK

- Disney+ to crack down on password-sharing

- How much harder is it to get a mortgage if you're self-employed?

- Your guide to buying healthier fruit juice for your children - without breaking the bank

- Uber users to get new alert when they get in car

- British Savings Bonds announced in the budget go on sale - but experts aren't convinced

- What makes up the cost of a £6 pint - and how much is profit?

- How to make your money work harder while it's sitting in your current account

- All the places kids can eat cheap or free this Easter break

Ask a question or make a comment

British billionaire Joe Lewis has avoided a jail sentence after admitting he orchestrated an insider trading scheme that helped those around him make millions.

The former Tottenham Hotspur owner, who lives in the Bahamas, tipped off his girlfriend, friends, and two of his private pilots with inside information on four publicly-traded companies, which they used to get rich, prosecutors in New York said.

In January, he pleaded guilty to one count of conspiracy to commit securities fraud and two counts of securities fraud, admitting in court he had known he was breaking the law.

Read more here...

Savers wishing to use their annual ISA allowance have until the end of today to do so.

The tax year runs from 6 April to 5 April, so those wishing to maximise their tax-free savings must deposit £20,000 by the deadline.

An ISA, or individual savings accounts, allows you to save money without having to pay tax on any interest gained.

If you are unsure about whether you have any ISA allowance left for this tax year, check with your provider.

A new allowance will begin tomorrow for the tax year 2024-25.

You cannot roll over any unused allowance so it is important to utilise your full yearly allowance if you can.

Want to know more? Read on here...

It can be hard to balance getting nutritious foods that make you feel good without emptying your wallet.

In this series over the coming months, we're trying to find the cheapest ways to identify the healthiest options in the supermarket.

We've asked Sunna Van Kampen, founder of Tonic Health , who went viral on social media for reviewing supermarket products in the search of healthier choices, for his input.

The series does not aim to identify the outright healthiest option, rather how to get better nutritional value for as little money as possible.

This week we're having a look at juices - the staple of the lunchbox.

The NHS recommends children between the ages of four and six should have no more than 19g of sugar a day and ages seven to 10 no more than 24g.

"But would you believe a standard apple juice carton (200ml) contains over 22g of sugar," Sunna says - equal to five teaspoons.

That's nearly a child's daily intake in a single carton.

"It might seem like the healthier option at a glance, because it’s just fruit juice and sure, it's natural fruit sugar, but remember those are concentrated doses without the fibre of whole fruit," Sunna says.

Many reach for juice cartons labelled "no added sugar" or "sugar-free" - but here's where we hit a speed bump.

"These options contain the same artificial sweeteners as diet soft drinks, which, while cutting down on sugar, introduce their own set of concerns for parents," Sunna says.

"From affecting taste preferences to unnecessary chemicals, they're not the golden ticket to healthy hydration we might hope for."

The alternative

"I look for juice cartons that strike a balance without breaking the bank," Sunna says.

He suggests aiming for options with lower natural sugar content that are diluted with water to keep the sweetness in check without resorting to additives.

"This way, you're not just quenching thirst - you're also fostering healthier hydration habits," he says.

"The secret I've discovered upon my many journeys down the supermarket aisles is Cawston Press."

The company offer a "pressed fruit shaken with water" range that is as low as 45% juice.

"That makes a 200ml carton 8.8g of sugar - over a 50% reduction in their standard juice carton sugar intake."

The nutritionist's view - from Dr Laura Brown , senior lecturer in nutrition, food, and health sciences at Teesside University...

There are some accurate suggestions here.

Additionally, the message should be to stay away from these juices as they are undoubtedly contributing to the tooth decay and obesity issues.

It's difficult, though, to achieve especially with children so, as suggested, look for the lowest sugar content with nothing artificial added as stated.

This range of Cawston Press is 32p per 100ml or £1.90 for a pack of three in Tesco.

Slightly more expensive are Innocent smoothies at 47p per 100ml or £7 for a 10 pack.

Fruit Shoot, which uses Sucralose and Acesulfame K as sweeteners, comes in cheaper at 22p per 100ml or £3.60 for an eight pack.

Working that over the course of a year with a juice carton a day:

- Fruit Shoot is £164.25 a year

- Cawston Press is £231.16

- Innocent is £255.50

Even though there are cheaper alternatives, Sunna suggests that the extra cost is an investment in your health.

By picking Cawston Press over Innocent you can save nearly £25 a year and reduce your kids' sugar intake by 3kg every 12 months.

"Good for your wallet and great for their health," Sunna says.

In response to our article, Innocent told us: "We're on a mission to make it easier to live well through the delicious goodness of fruit and veg.

"We know that most of us need to get more of it into our diets and our juices and smoothies are packed full of fruity goodness. We don't add sugar - we never have, and we never will - so our products only contain the same natural sugar as you’ll find in fresh fruit and veg.

"Our 'innocent kids' range of juices and smoothies are made from 100% crushed fruit and veg, contain at least one micro-nutrient, and count towards one of your five a day.

"All our kids' smoothies are available in the recommended 150ml portion and are less than 100kcals per wedge allowing our customers to enjoy the drinks in moderation."

A Fruit Shoot spokesperson told us: "Fruit Shoot is all about offering healthier consumer choices, which is why over the years we've worked to reformulate Fruit Shoot to reduce calories without compromising on taste."

"Fruit Shoot contains sugar from real fruit complemented by permitted sweeteners - providing the taste consumers love."

Cawston Press said: “Our Cawston Press Fruit Waters are a blend of not-from-concentrate fruit juice shaken with still water and made with natural ingredients, meticulously crafted to meet the high standards of school approval.

"As with all Cawston Press juices, our Fruit Waters are made simply with pressed fruit, and are free from artificial sweeteners, colours or preservatives with no added sugars - what we call No Jiggery Pokery. The sweetness of Cawston Press' Fruit Waters comes solely from the pure juices of the pressed fruit, nothing else."

Disney+ is set to crack down on password-sharing.

Chief executive Bob Iger told CNBC the streaming platform would start taking action against the behaviour from June in some countries, before a "full rollout" in September.

Password sharing refers to users who share their log-in details with family and friends who are not in the same household, enabling them to access content without paying for it.

The crackdown would be "our first real foray into password sharing" to "turn this business into a business that we feel really good about", Mr Iger said.

Disney's decision comes after fellow streaming giant Netflix attributed a recent jump in subscribers to its own action on password sharing.

"Netflix is the gold standard in streaming," Mr Iger said.

"They've done a phenomenal job and a lot of different directions.

"I actually have very, very high regard for what they've accomplished. If we can only accomplish what they've accomplished, that would be great."

By Daniel Binns, business reporter

The price of oil has continued to shoot up this morning - meaning the cost of petrol at the pumps in Britain is at risk of rising further in the coming weeks.

A barrel of Brent crude topped $91 (£72.10) at one point this morning - its highest level since October.

The price has since eased back slightly to $90 (£71.30) a barrel, but that is still the highest it has been in months.

It comes as tensions ramp up in the Middle East amid fears of a wider escalation of the Israel-Hamas war.

Investors have also been growing increasingly jittery about global supplies after another Ukrainian drone strike on a Russian oil refinery earlier this week.

Meanwhile, London's FTSE 100 is down 1% this morning amid the geopolitical tensions - though oil and gas stocks have risen 0.3% (no surprise there).

On the currency markets, £1 will buy you $1.26 US or €1.16, down slightly on yesterday's rates.

By Ollie Cooper, Money team

We've all heard consumer advice that's repeated so often it almost becomes cliché. So, every Friday the Money team get to the bottom of a different "fact" and decide whether it's a myth or must.

This week it is...

'It's harder to get a mortgage if you're self-employed'

We've enlisted the help of Pete Mugleston , managing director and mortgage expert Online Mortgage Advisor, and to help us get to the bottom of this one, he's outlined two examples.

"By looking at the two hypothetical individuals, Person A and Person B, I aim to outline the differences and nuances of securing a mortgage under two very different circumstances," he says.

Person A: Self-employed - annual income £60,000

Person A is a self-employed professional with an annual income of £60,000.

They run their own business, providing services directly to clients and managing their finances independently.

"In the realm of mortgage applications, self-employed individuals like Person A face a unique set of challenges, especially if they do not have the required proof of accounts readily available," Pete says.

When it comes to securing a mortgage, lenders typically rely on financial documents to assess an applicant's income stability and affordability.

"For self-employed individuals without the necessary proof of accounts, the road to mortgage approval can indeed become more arduous."

Without the required documents such as two to three years of certified accounts, SA302 forms and business accounts, Person A might find themselves facing several obstacles...

"One potential hurdle is the possibility of a larger deposit requirement - lenders often view self-employed applicants without sufficient financial documentation as higher risk," Pete says.

"To mitigate this risk, they may request a more substantial deposit, possibly ranging from 20% to 25% of the property's value."

For the average UK property, with the value sitting at around £263,600, that deposit could range between £52,700 and £65,900 - a far cry from the more reasonable 5-10% deposit.

However, in some cases, lenders may consider Person A's past and projected future earnings.

If they can demonstrate a history of consistent income through bank statements, contracts of future work or other evidence, this may strengthen their case.

"However, this process can be complex and may not guarantee approval," Pete says.

Lenders also assess the stability of income for self-employed individuals.

Unlike salaried employees with predictable monthly earnings, self-employed individuals may experience fluctuations in income due to seasonality, market changes or other factors.

"This variability can raise concerns for lenders, who want assurance that the borrower can consistently meet mortgage repayments," Pete says.

"Without the required proof of accounts, Person A's journey to securing a mortgage may involve more stringent requirements, additional scrutiny of income, and a potential need for a larger deposit."

Person B: Employed full-time - annual income £40,000

Now let's turn our attention to Person B, who is employed full-time with an annual income of £40,000.

Person B holds a traditional job, receiving regular payslips and tax deductions through the PAYE system.

"In the eyes of mortgage lenders, Person B represents a more straightforward case compared to Person A, despite earning £20,000 less per annum," Pete says.

"For employed individuals like Person B, the process of obtaining a mortgage tends to be smoother.

"Person B can easily provide payslips, P60 forms and other employment-related documents to verify their income."

These documents offer a clear and consistent picture of earnings, making it easier for lenders to assess affordability.

"With a reliable income stream and documented financial history, Person B may qualify for standard deposit requirements, typically ranging from 5% to 20% of the property's value."

Lenders can conduct a straightforward affordability assessment for Person B based on their documented income. The process usually involves multiplying their annual salary by a standard factor (often four to 4.5 times) to determine the maximum mortgage amount.

"In comparison to the self-employed Person A, Person B's path to mortgage approval is generally smoother, with fewer hurdles related to income verification and deposit requirements," Pete says.

While employed individuals like Person B benefit from easily verifiable income and standard procedures, self-employed individuals such as Person A face a more challenging path, particularly in circumstances where they have less than the required proof of accounts.

In summary...

This one is no myth.

"For self-employed individuals, the key lies in meticulous financial preparation, including maintaining accurate accounts, saving for a potentially larger deposit and providing additional evidence of income stability," Pete says.

You can also seek professional help if required.

With all that in mind, the money must here if you are self-employed is to be well-prepared!

The next time you order an Uber, you might notice something different.

The company is introducing a new safety feature that will remind you to put your seatbelt on.

When your trip starts, the driver's Uber app may sound an alert so you don't forget.

At the same time, your own Uber app will receive a push notification, with another reminder to buckle up.

"You can expect to receive these reminders on a regular basis," Uber says.

"Wearing a seat belt is one of the simplest ways to help keep you and any fellow riders safe. We understand that some riders may have medical exemptions from wearing a seat belt."

Carers will be entitled to unpaid leave under a new law hailed as a "huge step forward" for more than two million people.

Under the Carer's Leave Act, which comes into force on Saturday, employees who are carers can take up to a week of unpaid leave every 12 months - equating to five days for most people.

They will be entitled to this leave to give or arrange care for a dependent (who has a physical or mental illness or injury meaning they will need care for more than three months), who has a disability, or who needs care due to old age.

Charity Carers UK has said past research found about 600 people a day give up work so they can care due to a lack of flexibility and support.

The new law is aimed at giving people more flexibility to balance work and caring.

Helen Walker, chief executive of Carers UK, said too many "skilled and valued workers are leaving employment due to the stress of balancing work and unpaid care".

Tens of thousands of people are facing crippling tax demands from HMRC for taxes their employers failed to pay.

It's a campaign that has driven people to the brink of bankruptcy and devastated families.

At least 23 victims have taken - or attempted to take - their own lives.

For the first time, two people who tried to end their lives have shared their story with Sky News.

The following article contains references to suicide that readers may find distressing.

We've all found ourselves stuck on a delayed train and wished we'd chosen any other route to get home. You might even be on one right now.

Well, thanks to a new study you can at least take note of routes you might want to avoid.

It has listed the worst offending companies on the UK's rail network by looking at official data from the Office of Rail and Road between January 2021 and September 2023.

It looked at trains that were cancelled or delayed by 15 minutes or more during that time period.

The research found Avanti West Coast had 15.36% of its services delayed or cancelled.

The study's second worst offender, with 12.32% of all trains either cancelled or seriously late, is Grand Central Rail .

And CrossCountry was the third least reliable operator, with 12.26% of trains arriving 15 minutes or more late, or being cancelled altogether.

Axel Hernborg, founder of Tripplo , which conducted the study, said: " It's no secret that the UK's rail network is a far shout from those within mainland Europe in terms of efficiency and reliability, and these findings simply underscore that."

Look at the table below for the full list of the 10 least reliable train operators, as ranked by the travel website. The column on the right shows the number of minutes customers lost in delays.

Be the first to get Breaking News

Install the Sky News app for free

COMMENTS

The core elements of Virgin Money Travel Insurance are underwritten by ERGO Travel Insurance Services Ltd (ETI) on behalf of Great Lakes Insurance UK Ltd. Great Lakes Insurance UK Limited is a company incorporated in England and Wales with company number 13436330 and whose registered office address is 10 Fenchurch Avenue, London, United Kingdom ...

If you're in one of the countries listed on our emergency contact list, simply dial the number shown for that country. ... (Virgin Money or we) arranges this insurance as authorised representative for Virgin Money Financial Services Pty Ltd ABN 51 113 285 395 AFSL 286869. ... The 10% discount applies to the initial premium for new Virgin Travel ...

Travel insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177 AFSL 245631 trading as Allianz Global Assistance on behalf of the insurer, Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708. Virgin Money does not provide any advice based on any consideration of your objectives, financial situation or needs.

If you are a permanent resident you must earn at least $25,000 p.a. for the Virgin Money No Annual Fee Card, $35,000 p.a. for the Virgin Money Low Rate Card and Virgin Australia Velocity Flyer Card or $75,000 p.a. for the Virgin Australia Velocity High Flyer Card. Approval is subject to our credit criteria.

You're one click away from talking to the people at Virgin Money about your Virgin Car Insurance, Virgin Home Loans and Virgin Super. ... Contact our partner, Lifebroker : Monday to Friday 9am - 5:30pm (AEST) ... Travel Insurance. Policy general enquiries; Emergency help overseas; Make a claim; Complaints;

Travel Insurance Holidays are back and so are we. If travel's on the horizon, or you're setting off soon, don't leave without getting a quote from us first. ... Virgin Money customers are tackling the cost of living crisis - here's how you can too Money on your mind. ... However you decide to ask for support, it's free and secure. You'll ...

Virgin Money travel insurance key features. Cover if your baggage is lost, stolen or delayed. Trip cancellation cover. Coronavirus cover. Gadget cover as standard but enhanced options are available. Pre-existing conditions cover (some serious conditions may not be covered) 24/7 emergency medical helpline.

17th March, 2022. Travel insurance policies include option to add enhanced Covid-19 cover. Features Covid-19 pre departure and overseas cover as standard. Fully digital which means policy holders can buy, update and track claims online. As confidence in overseas travel beings to build, Virgin Money has today launched a new range of travel ...

For full details about what you will be charged when using your credit card on holiday, please see the 'Key facts about your card' on your statement, under 'foreign usage'. If you'd like to talk to us about your credit card while you're abroad, you can find our contact number here. Please call the 'From outside UK' number.

Virgin Money. by Katie Fiddaman. 1 June 2022. We know taking travel insurance out can be one of the least exciting 'To Dos' when planning for a trip, but that's all about to change with Virgin Red and Virgin Money. Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Travel Insurance Reviews. Virgin Money Travel Insurance is all you need to pack for peace of mind. They'll help to protect what matters and put your adventure back on the map, pronto. Policies are available to those under 74 years. Dependants travel for free with parent or grandparent. They offer 24/7 emergency assistance no ...

Nov 23, 2023. Fact checked. Virgin Money offers complimentary insurance on Virgin Australia Velocity High Flyer and Flyer credit cards, including complimentary international travel insurance on ...

Cover yourself, your family and any other travel companions with our comprehensive travel insurance policy. Our travel insurance is available exclusively to UK residents with up to £15,000,000 cover for medical expenses and up to £5,000 per person for cancellations. Get insured. If you are a British national travelling to a country where the ...

Do NOT use Virgin. 1. I was knocked off my motorcycle by an out of control car whilst on holiday. It broke my femur in three places. Virgin Travel Insurance were contacted within 20 minutes of arriving in hospital. It took them eight days to turn down my claim.

Virgin Atlantic COVID-19 Cover policy details This policy covers every existing Virgin Atlantic booking, as well as new reservations made for travel between Aug. 24, 2020 to Mar. 31, 2021.

Provides reimbursement for the purchase of covered essential items during your trip if your luggage is delayed for 24 hours or more. 24/7 Assistance. Award-winning, multilingual, travel experts here to help you deal with unexpected travel hiccups around the clock. We can help you find local medical and legal professionals, help with missed ...

1800 662 884. Roadside assistance. Get help. Available 24 hours a day, 7 days a week. 1800 788 692. Call to add it to your policy. Mon to Fri 8am to 10:30 pm, Sat 8am to 5pm (AEST) 1800 724 678. Complaints relating to your Car Insurance.

The cost of draught lager has gone up nearly 30% since January 2019, according to the Office for National Statistics. The ONS says the cost of the average pint in Britain is £4.70 (it was £3.67 ...