- You are here:

- Home »

- Blog »

- Starting A Computer Repair Business »

How to Effectively Charge Customers for Travel Time

Tackling any topic related to rates is likely one of the most debatable areas to touch with a ten foot pole. Technicians are stoutly protective of their pricing structures when the discussion comes up. However, I’m admittedly adventurous in this realm and believe that the more open we are with effective ways to address travel costs, the better we can serve our customers in settings fees that are appropriate for both sides. I took a chance to address proper self-worth valuation when it comes to pricing a little while back, but let’s see if we can tackle travel costs this time around. My goal here is not to say that my methodology is necessarily better; it works for my computer repair company FireLogic and I’m open to sharing it fully with fellow techs. The overarching goal with this article is to merely establish a friendly debate on all of the available methods for charging on travel, and weighing the pros/cons of each. There is no single method or rate that fits all technicians. We’re all disparate in our own ways: serving different communities, working with different customers, and operating within distinct socioeconomic regions.

The Technibble forums are generally host to some interesting discussion on travel fees and how to determine them. A few particular threads hosted some great insight like this one, a thread related to call out charges, and this discussion on how to charge for visits that are out of area. I’m going to admittedly pull a mixture of ideas from various forum postings below to give people an idea of what various techs have concocted to meet this growing need. Let’s take a look at the different ways you can charge your own customers for travel time.

The flat hourly rate

I’ll cover this one first since this is how FireLogic handles travel costs. I like this model because it’s simple for a customer to understand and doesn’t require any extensive tracking/recording besides time. My view is that if someone is willing to pay for us to travel out to visit them, a flat hourly travel rate properly compensates the tech that needs to make the trip and covers gas expenses. Our travel rate is currently $20USD/hr (about 1/4 of what our hourly onsite rate is) and has proven to be a happy medium for our customers and techs. We do not charge for return travel, as the notion goes that the next customer being visited will pick up the subsequent trip as their visit charge. Some forum goers admit to charging their full hourly rate for travel, which is understandable depending on your situation. Do your research before establishing anything, but for the Park Ridge and suburban Chicago area (USA) this system has been very successful for us with little customer pushback.

Enforcing minimum onsite service fees

This is an roundabout to charging outright travel fees or an hourly trip rate. In this method, you notify your customer that they will be paying, for example, a one hour minimum of service for the visit. More than a few techs on the forums prefer this approach as it keeps travel fees out of the customer’s sight, and also cuts back on excessive abuse of onsite labor for small tasks. From the consensus I could gather, it seems that rural techs tend to like this method as travel fees are frowned upon in such locales but customers take positively to this approach. I don’t think it would be a bad idea to use a hybrid approach of a travel rate with an onsite minimum. Again, your circumstances and competition’s methods will have a big bearing on your own attitude towards this model.

Staggered travel flat-rate fee

Yet another way to charge for travel is to create a graduated, or staggered, trip charge schedule that is based upon the number of miles from your home base to the customer location. The benefit of this model is that it directly segregates shorter trips from longer ones, and gives the customer an easy way to estimate their final total. However, the downside is that if traffic catches a technician, even a short 4 mile trip in an urban area could turn out to take just as much, if not more time, than a 10 mile journey in the countryside. I personally frown upon this model since I service the suburban Park Ridge region of Chicago, and traffic can be dicey depending on time of day and the direction of a customer location. For rural techs, this may be more appealing.

Charging “by the mile” based on a standard rate

A similar method as the staggered model above, but this one ties exact mileage or distance traveled to a standardized rate “per mile” or “per kilometer.” For the United States, I have heard of many techs tie their rate to correlate directly with the mileage rate used by the federal government. As with the staggered method, I don’t believe it fully takes into account the time spent traveling to a customer in busy, traffic-drenched areas. But for techs that want a simpler, streamlined way to present their travel rates to customers, this is about as clean cut as it gets. Tying your travel rate to the same as the government uses cuts down on arguments from clients because you can merely point them to the higher authority for why you charge what you do.

Utilizing different onsite vs offsite service rates

My company uses this notion for how our prices are set. For our case, it’s not directly to take into account travel costs. We differentiate hourly rates moreso because of the simple fact that when I am onsite, I am dedicated solely to that single customer. I cannot multi-task in any way like one can do in-shop or from their home office. For this reason, a different price is justified. But some techs claim that merely forgoing a separate travel fee and charging an inflated 20-30% of their regular rate is effective. The benefit is that you can mask your travel costs to the customer. The downside is that such a massive difference in rate may sway more customers than you wish to use your services at the “discounted” rate and stick to remote support or the like. Good or bad, it’s up to you to decide how this may work out.

Whichever method you ultimately decide to use, remember that doing some competitive analysis is always key to a rate structure that customers will be open to. You don’t want to blindly change your travel fee methodology without sniffing around to see what your local techs are charging, and how they are structuring their fees. Systems that may work well for rural areas are not always suitable for urban areas as I described above. Do your homework, reach out to some customers for their feelings, and make an informed decision. How you publicly account for travel expenses using any of the methods above may be just as important as what amount you charge a customer.

Feel free to post your own ideas or comments on what you think is the best way to charge for travel. What works? What doesn’t? Let us know!

Related Posts

Personal Security When You’re an On-Site Technician

My 7 Point Approach to Every Support Call

Become A Computer Technician: Starting Out On Your Own

This was a sticking point for me for a while. Because there is a major interstate that runs right past me, 20 miles north or south can take only 20 minutes to drive, while 20 miles east or west can take 45 minutes or more.

For that reason, the easiest way for me to do this was to charge a flat “travel fee” for any work done outside of my county. This is flexible, and depends on the work being done as well. If it’s a long-time client that I get a lot of work from, I may waive the fee. But I usually charge first time customers the travel fee just to make sure they’re serious about the job.

This is a very situational issue, and you seem to have covered most of the scenarios. Great read!

Matt http://www.yfncg.com

Thanks Derrick, good article.

One idea I thought was not directly stated in your article about the difference between bench rate and outside or the on-site consulting call is that they often require different levels of training thus have different levels of service in addition to the convince to the customer and different levels of cost to the provider. I can often schedule our bench with a brand new, out of tech school tech with minimal additional training and experience which we call a Jr. Tech who also BTW, makes minimal wages. I would never send this person to someone’s business or home not knowing exactly what he was walking into. On the other end I cannot send a senior tech to Cisco routing or Windows Server active directory/permissions issues. So there are at least three levels of training and experience required for these three types of service. We also have a fourth level tech which I pay on contract when things get above my head and I bill him out at $200 per hour.

At Computer Fix-It we have four levels of tech. Jr bench tech, senior tech that can do all sorts of calls everything short of heavy networking/server permissions and a Consultant who does the network design and maintenance. We get three rates. $59.99 bench rate, also that is our most profitable as you stated we can work on three or more computers at the same time. This level is supervised by a manager or Senior tech or senior consultant. Our senior tech bills out at $99.99 per hour on site to your home or small office. We also charge one way travel within the county (about 20 mile radius). Then we have a Consultant who can do minor routing, server permissions or active Directory type issues at $120 per hour also one way travel. If travel is outside our county we have a one way travel added and a 2 hr minimum billing. Finally, we have a 25 year Novell CNE and senior consultant who we bill out at $200 per hour when we need him. He is a contract employee as most of my clients do not require his level of skills.

With regards to travel, I inquired with one friend who owns a business in NYC “how you handle peak traffic and get across town which could be 1 hr or more travel?” He said that they schedule first of the day appointments which is during rush hour and they just show up at the clients site same as they would show up at their office so there was no additional travel and by the time they finished the first job it was no longer peak traffic so they go to the next appointment. Likewise for evening peak traffic they would schedule a job no later than 3pm so that they would be onsite working when peak travel began in the afternoons and then would just travel home same as if they left their office at 4 or 5pm. One thing they do is bill 2 hr minimum call no matter what time of work day which helps offset some of the additional travel expenses and they charge parking which is easily $25 per call.

Derrick, I hope to see an article on how to set adjust your prices. I believe most members could benefit from that. When initially setting your prices, one should be careful and not give too much attention to the lowest priced competition. At least not pay attention to the small or new competition which have not taken care to professionally setup their operations. It seems every tech how has the idea to start his own company thinks he is going to undercut the market and steal always all the customers. I have seen many small startups price themselves out of business. I mean they are too cheap and even if they get the requisite business, cannot get enough revenues to sustain their company. Then new companies come in and also practice the art of followership thus set their prices at what they perceive is the going cheap rate and they all go off a cliff together like a stampeding herd of buffaloes.

I live in a semi-rural area – in the city I can be anywhere within 1/2 hour, even during our “rush hour”. I have several rural clients, which, as I live near the edge of town, I can get to just as quickly as I can to clients living cross-town. I charge a flat hourly rate, minimum 1 hour and charge in 1/2 hour increments, and include travel time (which is usually not a factor). For example, if I spend 15 minutes traveling and 1 hour on site, then I charge 1.5 hours; if I spend 15 minutes travel and 1/2 hour on site, I charge for an hour. However, if I spend 10 minutes travelling and 55 minutes on site, I only charge for one hour (one does need to use some discretion). In the end, it all evens out – I don’t even mention travel charges unless the time will be 1/2 hour or more.

I add half hour at my hourly rate as long as the drive doesn’t last longer than 1 hour for the two way trip.

Interesting to hear about the different ways you all handle travel. I could never have covered every possible method, so good to see people chiming in with their own personalized styles!

I think customers prefer to see a price breakdown for every cent charged. I like using the gas price to mileage formula. I feel that charging for traffic is unnecessary and traffic should be calculated and dealt with personally. Our customers should not have to pay for traffic. Calculate your routes according to traffic and time a day.

I charge a minimum 1 hour fee per visit. All my traveling across the city (Toronto) is by bicycle. Any job that it takes me less than 30 minutes to get to from my home I don’t charge a travel fee. Over than and I charge roughly half my hourly rate for the whole travel time (including return trip). All my customers are totally fine with this.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Cherry Picked!

Hand-selected articles, guides, and more from the makers of Check Cherry, designed to help your business grow and flourish.

Charging Your Clients Travel Fees [Beginners Guide]

If you travel to provide services to your clients, there is a good chance you've considered implementing travel fees. In this article, we'll cover everything you need to know about travel fees and provide some actionable advice to ensure you're doing it right.

What is a travel fee?

A travel fee is an additional fee added to your standard pricing. Often, travel fees vary based on the distance one travels. The further one travels, the higher the travel fee.

👉 Use a quality online booking system with travel fees built-in, like Check Cherry, so you can automatically calculate and charge clients travel fees. It saves a lot of time and ensures accurate billing.

Why do people charge travel fees?

If you package your services, there is a good chance you've factored some travel into your pricing. However, if a client needs you to drive 62 miles, your standard pricing may no longer be profitable. Travel fees allow you to service a larger geographic area by offering clients the option to compensate you for travel.

Should I charge travel fees?

If you're open to traveling further distances to work and leveraging packages to sell your services, you should charge travel fees because they will ensure you are operating profitably.

If you are unwilling to travel outside a smaller area or send proposals with custom pricing to each client, you might want to lump all costs into one price to ensure each booking is profitable.

👉 Travel fees give more people the opportunity to hire you because it expands the geographic area you are willing to serve.

Distance-Based Travel Fees

We often see our customers include a free travel range with all packages. For example, the first 30 miles are free, and if they must drive more than 30 miles, it's $2.00 per mile. Distance-based travel fees are outstanding because they are granular and account for time and fuel costs best.

Flat Rate Travel Fees Tiers

Some people like to charge a flat fee for travel. For example, one's travel fee structure might look like this:

0-25 miles - FREE

25-50 miles - $35 Flat Fee

50-100 miles - $125 Flat Fee

This option is much less popular. One positive aspect is you can make one tier meaningfully more expensive than another.

Round-trip or one-way?

The majority of Check Cherry customers charge one-way travel fees. If a wedding venue is 55 miles away, they charge a travel fee based on 55 miles (single trip). Another option is calculating based on the length of getting to and from the service address (round trip).

One-way calculations make it easier for the client to understand your fee structure because most clients will not think to double the distance. If you opt to charge on a one-way basis, consider increasing your per-mile fee to account for the trip back home.

On the other hand, the round trip calculation will make the per-mile fee appear lower than a single trip fee. This may be helpful during the initial sales process. Round-trip is also a more accurate representation of actual costs associated with you traveling on behalf of a client.

Should I just use the rates provided by the IRS?

Each year, the IRS releases Standard Mileage Rates . In 2022, the amount was 58.5 cents per mile. Check with the IRS or your tax professional each year and track mileage for any business purposes. Regardless if you charge travel fees or not, you can deduct the cost per mile that you travel for business. Talk to your accountant about how to do it right.

Remember that the number provided by the IRS each year is based on an annual study of the fixed and variable costs of operating an automobile. It's probably a mistake to charge clients based on rates set by the IRS.

How much should I charge my clients for mileage?

This answer will vary by market, service type, and ideal customer profile. Here are three factors to consider when calculating a travel fee:

Travel time

One of the more significant expenses is your time, and travel will effectively increase the time you need to dedicate to complete your service. If you have staff, you probably want to pay them for travel time to ensure they want to work a booking or event.

Gas prices are outrageous. Do a rough calculation to see what it goes to drive 15, 25, or 50 miles based on your fully-loaded vehicle.

Vehicle wear and tear

The more you drive a vehicle, the more it costs to own due to depreciation, interest on your loan, insurance premiums, maintenance, and repairs. Estimates can be as low as $0.21 per mile and more than $0.62 per mile. You can use this handy calculator to get an estimate for your vehicle.

Example Travel Fee Calculation

Here is an example of how one might estimate the true costs of travel.

Fuel - $0.206 per mile

Cost per gallon of fuel: $4.33

Miles per gallon of fuel: 21

Fuel cost per mile = $0.206 cents per mile ($4.33 / 21)

Wear & Tear - $0.66 per mile

5 Year Vehicle Wear and Tear = $49,515

Vehicle Wear and Tear Per Year = $ 9903 ($49,515/ 5)

Per Mile Wear and Tear = $0.66 ($9903 / 15,000 miles)

Staff Costs - $0.517 per mile

Distance to Venue: 38.7 Miles

Travel Time: 1 Hour

Hourly Rate: $20

Cost per mile = $0.517 ($20 / 38.7 miles)

Estimated Travel Fee

$1.38 per mile ($0.206 + $0.66 + $0.517)

Automatic Travel Fee Calculations

Watch how Check Cherry makes it easy to calculate and charge travel fees . You can create multiple travel zones, limit bookings outside your service area, and more.

People will ❤️ how easy it is to book you online.

Try Check Cherry free for 14 days, no credit card required.

⭐⭐⭐⭐⭐ "I love it!"

"I found Check Cherry when doing a search for something to schedule mini sessions for my photography business. It's the perfect end to end online booking and payment solution. I has made my work so much easier, and its convenient for my clients to click to select their session, sign the contract, and pay. I love it! Not to mention, their customer service is on point. Quick response time and open to suggestions. Fantastic!"

Like What You’re Reading?

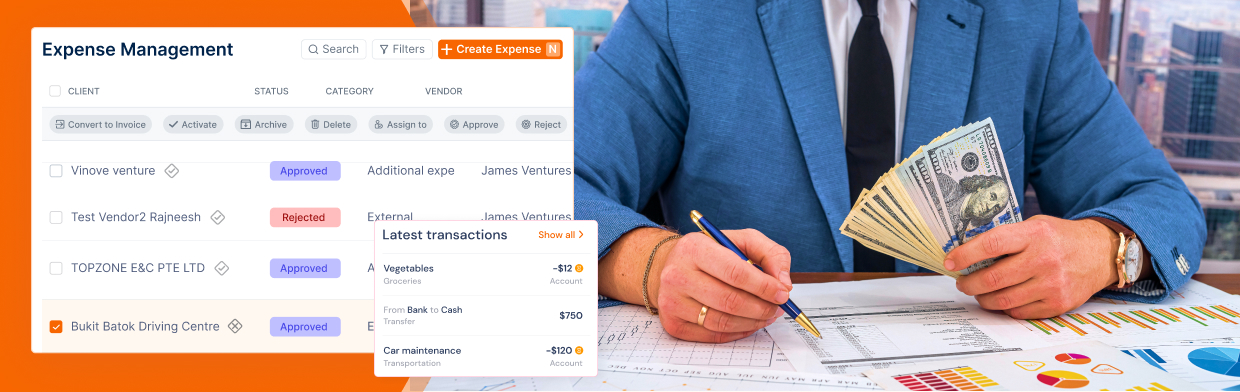

Precise tracking and billing made easy with our comprehensive solution.

How Much To Charge Clients For Travel Time?

- Written by Varun Bhagat

- Published November 30, 2023

Table of Contents (Hide) (Show)

#ezw_tco-2 .ez-toc-widget-container ul.ez-toc-list li.active{ background-color: #ededed; } table of contents toggle table of content toggle.

Subscribe to our blog

Table of Contents

Do you ever wonder how much time you spend on travelling?

According to the Corporate Travel Index compiled by Business Travel News, a businessman on average spends $319 traveling per meeting . For any small business, Travel Time is an important aspect and must be taken care of with utmost sincerity. Once you understand the true worth of your services it will help you get paid for them more appropriately. While you take steps to make a lot of your cost bearing services easier for clients, it is also important to realize the worth of money being spent on it. There are various methods that can be adopted while charging for travel time and one can choose the most appropriate one depending on the business requirements.

Every business owner has a variety of clients and one can understand the needs and requirements of each one properly, before choosing how much to charge them.

Here are some popular methods you can adapt to know how much to charge the clients for the travel time.

Onsite Fees

One can charge the client a visiting fee for each of the onsite visits. This fee does not mention travel costs or costs of tasks per sec. It just mentions a price that will be charged for each onsite visit. This sort of fee leaves little room for confusion for the client. It gives a clear idea to the client, with respect to the visiting fee. As an alternative, one can use a combination of travel expenses and the cost of service, depending on the situation.

Hourly Rate

How much to charge for travel time? A flat hourly rate is a simple way to charge the client for an onsite visit. It can be a separate rate for traveling to a client site for work. Again, this type of model is simple for the client to understand. Return travel prices can be avoided in this case for making the client feel more comfortable with this model.

Progressive Rate

A progressive rate for time and distance of travel can be a very useful method as well. Lesser price for shorter distances and lesser time on the site and more price for longer distance and more time on the site is what is most appropriate. The client may not have a problem with this method because the more effort put in, the more will be the price. The only exception where the client may find it uncomfortable is where that time was taken is longer due to an unprecedented traffic jam where no real value is being added.

—————————————————————————————————————————————————

Also Read: 5 Tips For Your Travel and Expense Policy

Mile Based Fee

The mileage-based rate can be a useful way to charge clients. This can be sufficient to recover the costs of fuel along with the cost of the time spent while traveling and the onsite visit. One can create a suitable mile based fee so one can recover both the costs.

Create a Different Rate for On-Site

Creating a higher rate for onsite can be justified because it includes the cost of travel as well. One charges normal hourly pricing when working offsite. On the other hand, while working on-site, one can keep the hourly rate at 30% higher than the general rate. Some clients may object that the differential pricing is on the higher side. One has to make the client understand that the price is higher because it includes travel costs.

Use The Right Tools

Still, facing issues with calculating exact travel time? Manual calculations can be confusing and error-prone. Choosing the right tools can help you track your time accurately by minutes and convert them into invoices that look professional. Invoicera, the cloud-based time tracking software and an Invoicing tool that helps you in accurately calculating travel time charges and converting them into invoices instantly.

It is one of the most preferred time tracking and billing tool for small businesses .

Whichever method you choose, remember to analyze its rate structure that clients will be open competitively. Make an informed decision on how you charge travel expenses using any of the methods above. Let’s work with the effective support of online invoicing tool .

Frequently Asked Question

Ques: how can i track my billable hours from clients.

Ans: Invoicera offers time tracking with its invoicing software to help businesses track every minute accurately they’re investing in a project. Simply activate time tracking in your device (PC or mobile app) while you’re working on a project to help your client be clearly aware of the time invested. Such precisely calculated invested time leads to perfectly calculated invoices, free from any dispute.

Ques: Does Invoicera includes time tracking to invoices automatically?

Ans: Yes, Invoicera lets you simply add pre-set values in monetary denominations of hours and minutes tracked in invoices. The automatically generated invoices can later be sent to clients directly via mail without the hassle of manual calculations.

Ques: Can I Directly invoice tracked time with Invoicera?

Ans: To directly invoice project hours, you can simply add values to the minutes and send them to clients. Sending billable hours with Invoicera is a one-step job Invoicera.

Ques: H ow to charge a travel fee ?

Ans: The two methods of charging clients for business travel is-

- Charges based on time

- Charges based on miles.

In both these cases, you can set pre-defined rates and include them in invoices to your clients with proper charge proof.

Ques: Do you charge clients for travel time?

Ans: yes, if you’re traveling on the behalf of your clients then you can raise receipts for reimbursement. make sure to discuss this as a pre-requisite in your contract., ques: do lawyers charge travel time.

Ans: Yes, if you’re traveling on the behalf of your clients to any site or court then you are eligible for charging travel charges from the client.

Ques: Is Travel considered work time?

Ans: Yes, for all work-related travels, it is considered work time.

Related Stories

Petty Cash Management 101: Tips And Techniques

Top Payment Solution Software For Growing Your Small Business

How To Ensure Your Project’s Schedule Boosts Profitability

Get 2x Faster Payments With Automated Invoicing

Boost your productivity with automated invoicing. Save time and resources - receive timely payments.

- Find a Firm

Travel Time: To Bill or Not?

By tim o'brien, apr, november 2020.

Whether you work on the agency or the consulting side, or if you hire consultants, one issue that can vary from firm to firm is how to account for and bill travel time.

Most PR professionals I’ve talked with agree that you need to bill for the time if a specific client requires the travel and prevents the consultant from serving other people.

However, what rate do you use? While the pandemic has greatly reduced travel time, it remains a thorny billing issue, and one worth addressing as more people will be heading out on the road again in the months ahead. I spoke with three veteran communicators for their thoughts.

Michael Grimaldi is a strategic initiatives coordinator for KC Water in Kansas City. Prior to that, he spent two decades working on the agency side.

“For a trip across town for a client meeting, we’d bill the driving time if we discussed the project en route,” he said. “If not, then we would bill the travel time one way only. If we had to travel a long distance or take a flight, we billed the travel time one way.

“Generally, if we conducted client business along the way or on the return trip, we’d bill it,” he added. “This may have involved discussing the client needs and plans, and planning for the meeting itself.”

He said that clients tended to be comfortable with these practices since they expect consultants to deliver value.

“At the end of the day, good clients expect to pay a fair and reasonable price for value, regardless of where the consultant was when the work was done, in the office or on the road,” Grimaldi said.

A half-rate for travel

Helen Patterson, APR, president of King Knight Communications in western North Carolina, worked for other firms before starting her own. In her prior experience, it was common to bill “full time” for travel. One former employer followed an eight-hour-day billing policy.

“Even if we spent 12-15 hours working that day, including a cross-country airline trip, only eight hours were billed to the client,” she said.

Today, Patterson says her policy is to bill distant travel at half of the actual time. In other words, a four-hour drive would be invoiced to the client as two hours. She does not bill clients for travel within her geographic market.

She says her clients haven’t objected to her travel time policies, though she admits that these days, she doesn’t travel for clients quite as often, and didn’t even during the pre-pandemic period.

“Most of my recent work has been accomplished through phone email, and video conference calls — with an occasional trip to a conference that clients have attended,” she said.

Blake Lewis, APR, Fellow PRSA, founder of Three Box Strategic Communications in Dallas, says that when traveling from one point to another for a client, he generally has billed 50 percent of the billable rate.

“A half-rate for travel strikes a balance between loss of productivity for other client work, while recognizing that clients generally view travel as a lower-value, yet necessary expense,” he said. “If material client work is done during the travel, that activity has been invoiced at the full rate.”

There are times when Lewis said it was appropriate to detail special travel considerations, such as not charging for travel from offices to the client office. These decisions have been made in consultation with the client.

“We once worked an assignment where I traveled from Dallas to their headquarters in another state part of every week, consulting on restructuring the client’s corporate communications function,” Lewis said. “Aside from airfare reimbursement, my time wasn’t billed because we knew going into the project travel was all a part of it. I used that time for administrative tasks or for just enjoying the break.” In the end, Blake said, “It can be challenging to find the boundaries. Reviewing what was planned, proposed and agreed to by the client helps make the lines more obvious.”

Tim O'Brien, APR

Tim O’Brien, APR, owns O’Brien Communications, an independent corporate communications practice in Pittsburgh, and hosts the “Shaping Opinion” podcast. His firm is a certified Disability Owned Business Enterprise (DOBE) by Disability:IN. Email: [email protected] . Twitter: @OBrienPR .

- Publications & News

- Strategies & Tactics

- Writers Guidelines

- Editorial Calendar

- Previous Issues

Subscribe to Strategies & Tactics

*strategies & tactics is included with a prsa membership.

Charge Clients for Travel Expenses: A Guide for SME Service Providers

As a service provider, striking the right balance between covering your business travel expenses and maintaining client satisfaction can be challenging. How can you ensure that your company remains profitable while providing transparent and fair pricing to your clients?

This comprehensive guide on “how to charge clients for travel expenses” will walk you through the essential steps while keeping their satisfaction in mind. From establishing a travel expense policy to understanding legal and tax implications, this blog post has you covered.

Key Takeaways

- Establish a travel expense policy to ensure consistency and transparency in the billing process.

- Consider factors such as distance, type of transportation used, duration of travel, and accommodation expenses when charging clients for travel expenses.

- Utilize strategies that focus on transparency, fairness & flexibility to balance client satisfaction with associated costs.

Establishing a Travel Expense Policy

A smooth billing process is supported by a comprehensive travel expense policy. This policy, detailing what types of expenses will be charged and how they will be calculated, imbues consistency and transparency into the process of charging clients for travel expenses. Key coverage areas for the policy should include:

- Mode of transportation

- Traveling time

- Accommodation costs

Your travel expense policy should be tailored to your specific business needs, especially when it comes to business travel. For example, consulting firms might decide to charge clients for travel costs separately from their billable hours. A well-defined policy not only provides a fair and consistent framework for charging clients but also helps maintain customer satisfaction and trust.

Factors to Consider When Charging Clients for Travel Expenses

When determining how much to charge clients for travel expenses, several factors come into play. These factors include:

- The distance traveled

- The type of transportation used

- The duration of travel

- Accommodation expenses

All of these factors should be taken into account based on your own company’s policies and industry standards.

Let’s delve deeper into these factors and explore how they impact your travel expenses.

Distance and Mode of Transportation

The cost of travel expenses can be greatly affected by the distance and mode of transportation involved. As the distance traveled increases, so do the monetary costs associated with travel, such as toll roads or public transport fees. Hence, it is necessary to set fair travel fees for clients, taking these factors into consideration.

A possible way to calculate travel expenses considering distance and mode of transportation can be by multiplying the number of miles traveled by a per-mile reimbursement rate, set by your organization or according to government guidelines. An alternative could be using online travel cost calculators that estimate costs based on factors like distance and mode of transportation.

Time Spent Traveling

Time spent traveling should be accounted for when charging clients, as it impacts the overall cost of providing services. Employees should be compensated at their regular hourly rate for travel time during normal business hours. However, it’s valid for an employer to pay a lower hourly rate for travel time outside of normal work hours.

In calculating travel time for billing purposes, the actual time spent traveling from the starting point to the destination is used, excluding any personal breaks or unrelated activities. The method of calculating travel time may differ depending on the company’s policies or industry practices, but it’s often billed at a reduced rate, such as half of the actual time spent traveling.

Accommodation Costs

Accommodation costs, such as hotel room stays and meals , should be factored into travel expenses charged to clients. These costs can vary depending on the industry, location, and specific circumstances, but clients are typically billed for the actual cost of the hotel stay and meals, which may include room charges, taxes, and any additional services used during the stay.

These accommodation costs need to be reasonable, justifiable, and discussed with the client for approval before any expenditure. Providing a breakdown of these costs and offering documentation with receipts or invoices can help maintain transparency and accountability to the client.

Different Methods for Charging Travel Expenses

There are various methods available for charging travel expenses. Flat fees, tiered pricing, and mileage-based charges are all options to consider, depending on your business model and client preferences.

Examining the advantages and disadvantages of each method will aid in determining the optimal choice for your business.

Flat fees simplify the process of charging for travel expenses by providing a fixed, predetermined amount for travel-related services, regardless of the actual expenses incurred during the travel. For example, a moving company might charge a flat fee of $50 for travel expenses within a specific radius.

Clients often appreciate the simplicity and straightforwardness of flat fees, as they can easily understand and budget for them. Nevertheless, it is vital that the flat fee charged mirrors the actual travel cost and remains fair to both the service provider and the client, ensuring the customer pays a fair amount.

Tiered Pricing

Tiered pricing allows for flexibility in charging for travel expenses based on factors such as distance and time spent traveling. With tiered pricing, clients can choose from different pricing tiers that best meet their needs and budgets.

For instance, a pest control company might offer tiered pricing based on the distance traveled to the client’s location. This approach enables customization according to individual requirements, while still covering the costs associated with travel.

Mileage-Based Charges

Mileage-based charges provide a more accurate reflection of the actual costs associated with traveling for a specific client. By calculating travel expenses based on the number of miles traveled and the standard irs mileage rate set by the Internal Revenue Service (IRS), businesses can charge clients precisely for the distance traveled.

This method can be particularly useful for businesses that frequently travel long distances, as it ensures that clients are charged fairly and accurately for the travel expenses incurred.

Communicating Travel Expenses to Clients

Maintaining client satisfaction when billing for travel expenses hinges on clear and transparent communication. Clients should be informed prior to travel about any associated expenses, which can be itemized on a separate line in the invoice . By providing a concise breakdown of fee and expense types, clients can make informed decisions about the services they are purchasing.

Discussing travel expenses and site visits upfront and involving clients in the decision-making process helps build trust and reduces the likelihood of misunderstandings or disputes. This transparency and openness in all company processes create trust and satisfaction, leading to lasting client relationships.

Handling Reimbursements and Receipts

Accurate billing and proper record-keeping for tax purposes rely heavily on efficient tracking of reimbursements and receipts. One way to streamline this process is by utilizing receipt-tracking apps or software like Hiveage that can scan, digitize, categorize, and generate expense reports for travel receipts.

Using these tools not only facilitates the reimbursement process but also allows businesses to conveniently monitor their travel expenses and ensure compliance with tax regulations. This can ultimately save time, reduce errors, and provide a more efficient and organized approach to managing travel expenses.

Balancing Travel Expenses and Client Satisfaction

For service providers, it is crucial to achieve a balance between billing for travel expenses and ensuring client satisfaction. Implementing strategies such as streamlining expense tracking and reimbursement processes, scheduling meetings strategically to reduce costs, and focusing on customer feedback can help achieve this balance.

In the end, the key to balancing travel expenses and client satisfaction lies in being transparent, fair, and flexible in your approach. This will not only help maintain the profitability of your business but also foster long-lasting and mutually beneficial relationships with your clients.

Legal and Tax Implications of Charging for Travel Expenses

Any service provider must grasp the legal and tax implications of billing clients for travel expenses. For instance, lawyers must not bill clients for more time than what is actually spent on travel or other tasks, and charges for travel expenses should be reasonable and directly related to the services provided to the client.

When it comes to tax compliance, the Internal Revenue Service (IRS) has guidelines for travel expense deductions that businesses should be aware of. To ensure compliance with relevant regulations, it’s advisable to consult with a professional, such as an accountant or tax attorney, who can provide guidance on the legal and tax implications of charging for travel expenses.

In conclusion, charging clients for travel expenses is a delicate balancing act that requires careful planning, clear policies, and effective communication. By establishing a travel expense policy, considering factors such as distance and time spent traveling, and exploring different methods for charging travel expenses, businesses can ensure they remain profitable while maintaining client satisfaction.

Remember, transparency, fairness, and flexibility are key to fostering trusting relationships with clients. By following the strategies outlined in this guide, businesses can successfully navigate the complexities of charging for travel expenses and create a win-win situation for both the service provider and the client.

Frequently Asked Questions

How much should i charge for travel per mile.

For travel per mile, the IRS has announced a rate of 65.5 cents per mile for business-related driving and 22 cents per mile for moving and medical purposes.

Do you bill clients for travel time?

Most consultants bill for travel time, either at their full hourly rate or half their hourly rate, with a maximum of 8-10 hours per day.

How can I create a clear travel expense policy for my business?

Clearly define types of expenses, methods for calculating them, objectives, goals, rules and guidelines, reimbursement process, and compliance with applicable laws and taxes in order to create an effective travel expense policy for your business.

What factors should I consider when determining travel expenses for clients?

When determining travel expenses for clients, take into account the distance traveled, mode of transportation, length of stay, and cost of lodging.

What tools can help me track and organize travel receipts for accurate billing and tax compliance?

For accurate billing and tax compliance, make use of receipt-tracking apps or software that can scan, digitize, categorize, and generate expense reports.

Join thousands of business-savvy entrepreneurs on our mailing list.

Curated emails that’ll help you manage your finances better.

Filed under

I’ve been using Hiveage’s predecessor Curdbee for years, and Hiveage improves on Curdbee in every way . The interface is polished, fast, fluid and intuitive, and the amount of features available are pretty amazing. It will be my project management software for the foreseeable future, and the only one I recommend to clients and colleagues. Jesse Couch Creative Director & Front-End Developer, www.designcouch.com

Between Curdbee & their new version, Hiveage, I’ve brought in more than $310,000 than I would otherwise not have . If I ever need to send an invoice, I know it’s gonna work, and I know they’re gonna get it, and I’ll know when they’ve seen it and paid or not paid it. At least if everything else gets hard, I know I’ve got a system there that’ll let me get paid. Micah Rich Creative Director and Owner, www.weareagoodcompany.com

Since switching to Hiveage my productivity has soared . The intuitive interface allows me to quickly send invoices on the go as well as offering outstanding reporting tools - I love it! Shaun Preece Creative Director & Entrepreneur, www.shaunpreece.com

With Hiveage I’m able to spend more time on the tasks that will actually grow my business without getting bogged down by non-billable administrative activities. Chad Cox www.buzzrocketmedia.com

Start loving invoicing — with Hiveage!

Start your 14-day free trial and see for yourself. No credit card required.

Grab $25 simply by signing up!

Join thousands of business-savvy entrepreneurs on our mailing list—and also receive a gift from us.

Privacy Policy: We hate spam and promise to keep your email address safe.

How to Charge for Travel Time: Strategies and Best Practices

How to Charge for Travel Time?

To charge for travel time, service providers typically add a separate fee to the standard pricing for their services.

This fee can be variable, based on the distance traveled, or a flat rate.

Charging one-way travel fees is more common, but round-trip fees can also be used.

It is not recommended to use the rates provided by the IRS for travel time.

When determining the travel fee, factors such as travel time, fuel costs, and vehicle wear and tear should be considered.

A recommended tool for simplifying travel fee calculations is Check Cherry.

Additionally, consultants often charge a reduced rate for travel time outside their local area and premium rates for emergencies on weekends and holidays.

To ensure all expenses are covered and consultants are paid for their time, it is advisable to have a rate card showing hourly rates, emergency rates, and travel charges.

A comprehensive example calculation with estimations for fuel, wear and tear, and staff costs can help determine the appropriate travel fee, such as the estimated $1.38 per mile provided in the example.

Key Points:

- Service providers often add a separate fee to their standard pricing for travel time

- The fee can be variable based on distance or a flat rate

- One-way travel fees are more common, but round-trip fees can also be used

- IRS rates for travel time are not recommended to be used

- Factors such as travel time, fuel costs, and vehicle wear and tear should be considered when determining the travel fee

- Check Cherry is a recommended tool for simplifying travel fee calculations.

Did You Know?

1. In ancient Rome, charioteers were known to charge extra for the time it took to travel from the stables to the racing arena. This practice not only accounted for their time but also for the excitement and suspense generated from the spectators’ anticipation.

2. The concept of charging for travel time not only exists in the service industry but also in the transportation of delicate goods. For example, art couriers often factor in travel time when calculating the cost of transporting valuable paintings or sculptures to ensure their safe arrival.

3. Did you know that some professions charge for travel time based on the mode of transportation used? For instance, taxi drivers may charge differently depending on whether they are driving through heavy traffic or utilizing a faster route such as a highway.

4. Paradoxically, there are situations where charging for travel time may prove to be less profitable. Certain repair technicians, such as those specializing in high-end watches or electronics, might offer free travel time to attract more clients and establish a reputation for excellent service.

5. Charging for travel time can sometimes lead to creative solutions for efficiency. For instance, some innovative businesses incentivize customers by turning the travel time into a productive experience. They offer services like mobile workstations on buses or provide engaging content during the journey, making the travel time seem enjoyable and productive rather than a mere cost.

Introduction To Travel Fees

Travel fees are an essential aspect of service-based industries that require professionals to travel to their clients’ locations. These fees serve as an additional charge, above the standard pricing for services, to compensate for the time and expenses associated with travel. The purpose of implementing travel fees is to ensure that service providers can maintain profitability when traveling longer distances, as travel time and costs can significantly impact their overall business operations.

Factors To Consider In Travel Fee Calculation

When determining the appropriate travel fees to charge, there are several factors that need to be taken into consideration.

Distance traveled is the primary determinant of most travel fees. Typically, the fee would increase proportionately with the distance covered, acknowledging the additional time and resources required for longer journeys.

In addition to distance, fuel costs and vehicle wear and tear should also be considered when calculating travel fees. These expenses can vary depending on the type of vehicle used and the prevailing fuel prices.

Another important factor to consider is the consultant’s time spent on travel. This time is valuable and should be compensated accordingly.

By thoroughly considering these elements, service providers can ensure that their travel fees accurately reflect the costs involved.

- Distance traveled: primary determinant of travel fees

- Fuel costs and vehicle wear and tear: additional expenses to consider

- Consultant’s time: valuable and should be compensated

“By thoroughly considering these elements, service providers can ensure that their travel fees accurately reflect the costs involved.”

Different Models For Charging Travel Fees

There are two main models commonly used for charging travel fees: the distance-based model and the flat rate model .

In the distance-based model , the fee is determined by calculating the distance between the service provider’s location and the client’s location. The rate per mile traveled is then multiplied by the total distance to obtain the travel fee. This method provides a straightforward and transparent approach, allowing clients to understand how the fee is calculated.

On the other hand, the flat rate model involves charging a fixed fee for travel irrespective of the distance. This model simplifies the billing process for both the service provider and the client, as it eliminates the need for distance calculations. However, it may result in discrepancies for clients located significantly farther away, as their travel costs may be higher than those located closer. Service providers must carefully consider their target market and business needs when deciding which model to adopt.

Recommendations For Calculating Travel Fees

To calculate travel fees accurately, avoid using the rates provided by the Internal Revenue Service (IRS) for travel time and expenses . These rates are intended for tax purposes and may not reflect the true costs incurred by service providers . Instead, perform a detailed calculation by considering factors such as estimated fuel costs, wear and tear on the vehicle, and staff costs. By incorporating these variables, a more accurate and fair travel fee can be determined .

For instance , an example calculation could consider an estimated fuel cost of $0.12 per mile, vehicle wear and tear at $0.08 per mile, and staff costs at $0.18 per mile. Based on these estimations, the travel fee per mile would be approximately $0.38 . Taking into account the distance traveled, service providers can then determine an appropriate overall travel fee.

Charging For Travel Time As An IT Consultant

Charging for travel time is particularly relevant for IT consultants who often need to visit clients’ locations for installations, troubleshooting, or consulting services. When these consultants are required to travel outside their local areas, it is common practice to charge a reduced rate for travel time . This accounts for the additional time and effort spent on traveling, as well as the potential impact on other business activities.

Moreover, IT consultants should be mindful of scope creep , which refers to unexpected additions to a project that may arise during travel or on-site visits. To ensure profitability, consultants should clearly define the scope of work and clearly communicate any additional charges that may be incurred due to scope creep. Clear communication and documentation of such changes will help protect consultants from potential losses associated with unaccounted for work.

– To charge for travel time:

- IT consultants should consider charging a reduced rate for travel time, especially when required to travel outside their local areas.

- This compensates for the extra time and effort spent on traveling, as well as any potential impact on other business activities.

– Scope creep and its impact:

- Consultants should be aware of scope creep, which refers to unexpected project additions that may arise during travel or on-site visits.

- Properly defining and communicating the scope of work can help manage and control scope creep.

- Consultants should clearly communicate any additional charges that may arise due to scope creep, ensuring profitability and avoiding losses.

“Clear communication and documentation of changes is key to protecting consultants from potential losses associated with unaccounted for work.”

Tips For Ensuring Adequate Compensation For Travel Time

To ensure consultants are adequately compensated for travel time , it is recommended to have a rate card that clearly outlines various rates, including regular hourly rates, emergency rates, and travel charges. By providing transparency in pricing, clients can be aware of the costs associated with travel time and can make informed decisions regarding their service provider.

Additionally, it is crucial to charge premium rates for emergencies that occur on weekends and holidays. These situations require consultants to be readily available and interrupt their personal time, thus warranting higher compensation. Establishing clear policies and rates for such instances will avoid any misunderstandings and ensure consultants are fairly rewarded for their dedication and flexibility.

In summary , charging for travel time is an important aspect of service-based industries. By implementing travel fees and carefully considering factors such as distance, fuel costs, and vehicle wear and tear, service providers can accurately calculate travel fees. IT consultants specifically should take into account reduced rates for travel outside their local area and be mindful of scope creep. By adopting best practices and providing transparent pricing, consultants can ensure adequate compensation for travel time while maintaining profitability and client satisfaction.

Additional Considerations:

- Clearly define the different hourly rates in the rate card

- Specify the travel charges based on distance or other applicable factors

- Use pricing brackets for emergency rates and clearly outline the additional charges

- Communicate the policies regarding travel time compensation to clients

- Have a mechanism in place for documenting and tracking travel time for accurate billing.

Frequently Asked Questions

How do you calculate travel time cost.

Calculating travel time cost involves multiplying the duration of travel, measured in minutes or hours, by the unit costs, measured in cents per minute or dollars per hour. The total travel time costs are determined by considering factors such as the type of trip, travel conditions, and individual traveler preferences. These variables contribute to the variation in travel time unit costs, ultimately affecting the overall cost estimation. By multiplying the time spent traveling with the appropriate unit cost, one can effectively calculate the travel time cost for a given journey.

How do consultants charge for travel time?

Consultants typically charge for travel time by incorporating it into their pricing structure. Instead of billing separately for travel, they may include it as part of their overall service fee. This approach allows consultants to account for the time and expenses associated with travel without specifically itemizing it for clients. However, if consultants fail to accurately estimate the impact of travel time on their hourly rate, they may inadvertently end up losing money by including it in their pricing. For instance, if they miscalculate the overall time spent on a project due to extensive travel, they might not be adequately compensated for the additional hours invested.

How much should you charge for a travel day?

Determining the appropriate charge for a travel day depends on various factors, but a common method is to charge around 50% of the basic shoot rate. Let’s take an example: if your fee is $1200, it would be reasonable to charge $600 for travel days. To calculate this, you can consider that a day typically consists of 8 working hours and work out a proportional rate. By aligning the travel cost with half of the shoot rate, you can ensure a fair compensation for your travel time and expenses while maintaining a balanced pricing approach.

How do you bill a client for travel?

When it comes to billing a client for travel, it is important to establish clear guidelines. While bigger corporations tend to have their own documented policies, individual consultants often have different approaches. One common method is to bill for travel time, with some consultants charging their full hourly rate and others opting for half their hourly rate. However, it is common practice to set a daily limit of 8-10 hours for billing, regardless of the actual duration of the travel. This ensures that the client is charged fairly, while also accounting for potential delays or unforeseen circumstances during the journey.

References: 1 , 2 , 3 , 4

Sign up for exclusive DIY tips, home renovation secrets, decor trends, special discounts, and seasonal maintenance reminders delivered straight to your inbox.

Thanks, I’m not interested

- Create an Account

- Become an Insider BOH Insiders unlock access to weekly designer classes and exclusive Insider-only workshops Learn more »

- To the Trade

- New Showrooms

- 50 States Project

- Business Advice

- Trade Tales

- Sustainability Resources

- Retail Watch

- Supply Chain

- Comings & Goings

- High Point Market

- News Digest

- Mergers & Acquisitions

- The Tearsheet

- Latest Debuts

- Meet the Makers

- Collections

- Accessories

- Wallcovering

- Architecture

- Graphic Design

- Interior Design

- Landscape Design

- Office Management

- Public Relations

- Product Design

- Sales & Marketing

- Writing & Editing

- Resume Board

- Classifieds

- Upcoming Events

- People & Parties

- Launch Workshops

- Course Archive

- Business Services

- Accounting & Bookkeeping

- Art Advisors

- Authors & Copywriters

- Book Packagers

- Business Consultants

- Legal Services

- Licensing Consultants

- M&A and Investment Advisors

- Marketing & PR

- Photographers

- Purchasing Agents

- Sales & Independent Rep Firms

- Specialty Shops & Showrooms

- Web & Graphic Designers

- Skilled Trades

- 3D & Hand Renderers

- Cleaning Crews

- Contractors

- Decorative Artists & Painters

- Fabricators

- Lighting & Lampshade Makers

- Master Carpenters

- Painters & Wallpaper Installers

- Plaster Workers

- Shippers and Receivers

- Textile Printers & Mills

- Upholstery Workrooms

- Window Treatments

- The BOH Podcast

- Current Issue

- Past Issues

Mobile Nav Bar

Mobile menu.

- Future of Home

- 6c8585ure of Home

- Newsletter Sign-up

- BECOME AN INSIDER BOH Insiders unlock access to weekly designer classes and exclusive Insider-only workshops

How do you charge for travel time?

When it comes to charging strategies, designers are notoriously hush-hush, and whether billing a flat fee or hourly, there’s a less-talked-about expense that definitely cuts into workflow: travel time. We asked five designers— Veronica Solomon , Mindy O’Connor , Anelle Gandelman , Alicia Cheung Lichtenstein and Dennese Guadeloupe Rojas —how they charge for time spent out of the office but still on the clock.

Half-and-Half “As we outline the scope of work, travel time is factored into the minimum estimated hours and billed upfront, payable in two increments: 50 percent at acceptance of contract and 50 percent at the presentation meeting. Time is tracked throughout the project (including travel time), and any overage beyond the initial minimum estimated hours is billed.” —Veronica Solomon, Casa Vilora Interiors, Katy, Texas

No Surprises “Transparently. I am clear upfront in my contracts and bill travel at cost, with any discretionary travel approved in advance. In general, virtual appointments and accessibility have certainly cut down on travel expenses overall.” —Mindy O’Connor, Melinda Kelson O’Connor Architecture & Interiors, Philadelphia

No Strings Attached “We present clients with an all-inclusive design fee when we initially give them a proposal to work with our firm. We know how many site visits, meetings and sourcing trips we need and simply factor those expenses into the fixed fee. With this approach, I have more freedom to stay at nicer hotels when a project is out of town, and the client doesn’t feel like we are constantly billing them for extras. We like to keep our billing and our entire client process as streamlined as possible.” —Anelle Gandelman, A-List Interiors, New York

Half-Full “We bill half our hourly rate for travel time.” —Alicia Cheung Lichtenstein, StudioHeimat, San Francisco

Perfect Cents “We have a set per diem that we implement when traveling to ‘away’ projects that require a flight. While on the road, we expense for flight costs, hotels and meals as well. Our clients are always comfortable with these charges, as we’ve discussed the costs upfront in our initial meetings. And for any local travel by our design team, we simply factor that into the initial fee.” —Dennese Guadeloupe Rojas, Interiors by Design, Washington, D.C.

Homepage image: A New York living room designed by Anelle Gandelman | Brittany Ambridge

- trade tales

Top Stories

Pirch halts operations, a groundbreaking real estate settlement, meghan markle launches a lifestyle brand, and more, are furniture stores dying, or just changing, want your own show here’s how one creator built a media company on youtube, must-see releases from kelly wearstler, industry west’s collab with clare, and more, 5 mistakes that are limiting your growth, and how to fix them, what happened to pirch, market week inefficiencies underscore the difference between housewares and home textiles, april’s can’t-miss design events.

Consultant, Experience & D... BSH Home Appliances Corporation New York, NY

Interior Designer Circa Interiors & Antiques CHARLOTTE, NC

Interior Designer Jenny Wolf Interiors x The Huntress New York Pound Ridge, NY

Assistant to the Editor-In... Luxe Interiors + Design Remote

Interior Design Assistant Anyon LLC San Francisco, CA

Senior Interior Designer Anyon LLC San Francisco, CA

Related articles

How do you manage out-of-state projects?

Which fellow designers inspire you?

How do you deal with project delays?

How do you stay in touch with old clients?

How does your firm practice sustainability?

How did your first design job shape your career?

Business of Home mission Statement

Newsletter and social, magazine subscribe, footer navigation.

Request a Demo

Successfully submitted.

How to Charge Mileage to Customers?

For companies whose operations depend on employee travel, efficient mileage tracking and charging are crucial. How you calculate and set mileage rates determines your financial success.

If your company requires staff to travel for work, appropriately billing clients for mileage ensures that your team is adequately reimbursed. As a result, figuring out how to charge for miles is critical.

In this article, we’ll look at why charging mileage to customers is important, the challenges you might face while doing so, and the different approaches to doing it. We’ll also cover how Timeero’s features can simplify tracking and charging mileage, saving your company both time and money.

Accurately Track and Charge Mileage to Customers.

Learn how Timeero can help you out.

Why is Charging Mileage to Customers Important?

Every mile matters when it comes to operating a business. The significance of charging mileage goes beyond a collection of numbers on a receipt. Here are some reasons why this is a necessity for companies with employees on the move:

1. Fair Compensation

A fair way of compensating staff members for using their personal cars for business travel is to charge mileage to clients.

Expenses associated with fuel, maintenance, and vehicle wear and tear are incurred by employees who travel for work. Accurately billing customers ensures these mileage expenses are covered, eliminating disputes.

2. Accurate Cost Recovery

Accurate mileage billing enables precise recovery of costs for companies with field-based teams. It guarantees that the organization is accounting for indirect expenses such as vehicle depreciation.

This is in addition to the direct costs related to travel. In order to avoid financial losses, accuracy is essential.

3. Compliance and Tax Benefits

Compliance with tax requirements requires accurate mileage recording and billing. The ability to offer precise mileage records can assist organizations in taking advantage of tax deductions for business travel.

Challenges Businesses Face in Charging Mileage

While charging mileage to customers is fairly simple, it comes with its own set of challenges.

1. Transparency Is Lacking

Workers may feel that their actual expenses are not being compensated appropriately if no unified and transparent process is in place. The working relationship between employers and employees may suffer as a result of this lack of transparency.

To ensure everyone agrees, you can create a policy to improve accountability. Use our free mileage reimbursement policy template to safeguard both your interests as a small business and those of your staff.

2. Inaccurate Record-Keeping

Errors and disputes can arise from the use of paper records, manual tracking, and complicated reimbursement methods. This could be the result of accidental human error, deliberate manipulation, or just wrong estimations.

Undependable records can lead to disagreements between employees and employers.

3. Time-Consuming Processes

Traditional methods of tracking and charging mileage are time-consuming. Employees spend valuable time manually logging their travel details.

Managers must then review and process these records, which eats up even more time. This can result in increased labor costs and decreased productivity.

What Is the Best Way to Calculate and Charge Customers for Mileage?

Using the conventional odometer is no longer sufficient for calculating mileage costs for businesses. Developing an elaborate and practical mileage-based pricing strategy is the only viable solution.

When deciding how to charge clients for business mileage, you have a few methods to choose from:

Charging a Flat Rate

Charging a flat rate for miles entails charging a set cost for each business trip, regardless of distance or time spent. This strategy provides both businesses and customers with a sense of predictability. It is ideal for companies with standardized services or consistent travel patterns.

- Flat rate charging is simple and uncomplicated for both businesses and clients.

- Clients know exactly what prices to expect, allowing them to budget more accurately.

- Flat rates may not correctly represent real mileage expenses, resulting in either undercharging or overcharging.

Per Mile Charging

This method involves assigning a specific cost for each mile traveled. It aims to directly correlate charges with the actual distance covered, more accurately reflecting the travel costs incurred.

It’s most suitable for businesses with variable travel distances or those where the actual distance traveled is a key factor in determining costs. In order to charge your customers fairly, don't forget to keep track of your miles. Consider your car expenses and industry when determining your rate.

- Charging per mile is more precise, aligning charges with the actual distance traveled.

- Employees are compensated based on the actual usage of their vehicles, promoting fairness.

- Calculating mileage charges might be more difficult than using a fixed rate.

- Clients may find it difficult to forecast prices, especially if mileage varies significantly.

Charging Per Hour

When you charge by the hour, you have to figure out how much each hour of travel for work costs. This method considers time rather than distance traveled, providing an alternate viewpoint on payment.

Assume your employee travels for two hours to a customer location. If you charge $25 per hour, the client would be charged $50 for travel time.

- This method offers simplicity for clients who may find it easier to budget based on time.

- It does not directly account for the distance traveled, which may lead to overcharging or undercharging.

- Managing and explaining hourly charges may be more complex than other methods.

Hybrid Approach

This method combines aspects of flat rate, per mile, and per hour charging to create a customized and flexible pricing structure. It enables companies to tailor charges according to project specifications or customer agreements.

- It offers businesses the flexibility to charge based on the unique needs of each client or project.

- This approach can adapt to different scenarios, allowing businesses to use a combination of methods.

- This strategy may be more difficult for business owners to understand than the others.

How to Charge for Mileage Using The IRS Rate

Charging at the IRS mileage rate entails applying the Internal Revenue Service's (IRS) standard mileage rate for business-related travel. You can utilize the CRA mileage rate if you are in Canada.

For 2024, the IRS standard mileage rate is 67 cents. For instance, if an employee drives 100 miles for work, the company can charge $67 (100 miles x 67 cents).

Customers are likely to accept charging mileage at the IRS standard rate since it is not too expensive. However, please note that it may not cover all of your travel expenses. This is particularly true if your business incurs additional charges such as tolls or parking fees.

This mileage rate is optional; you may choose to use it or another alternative rate.

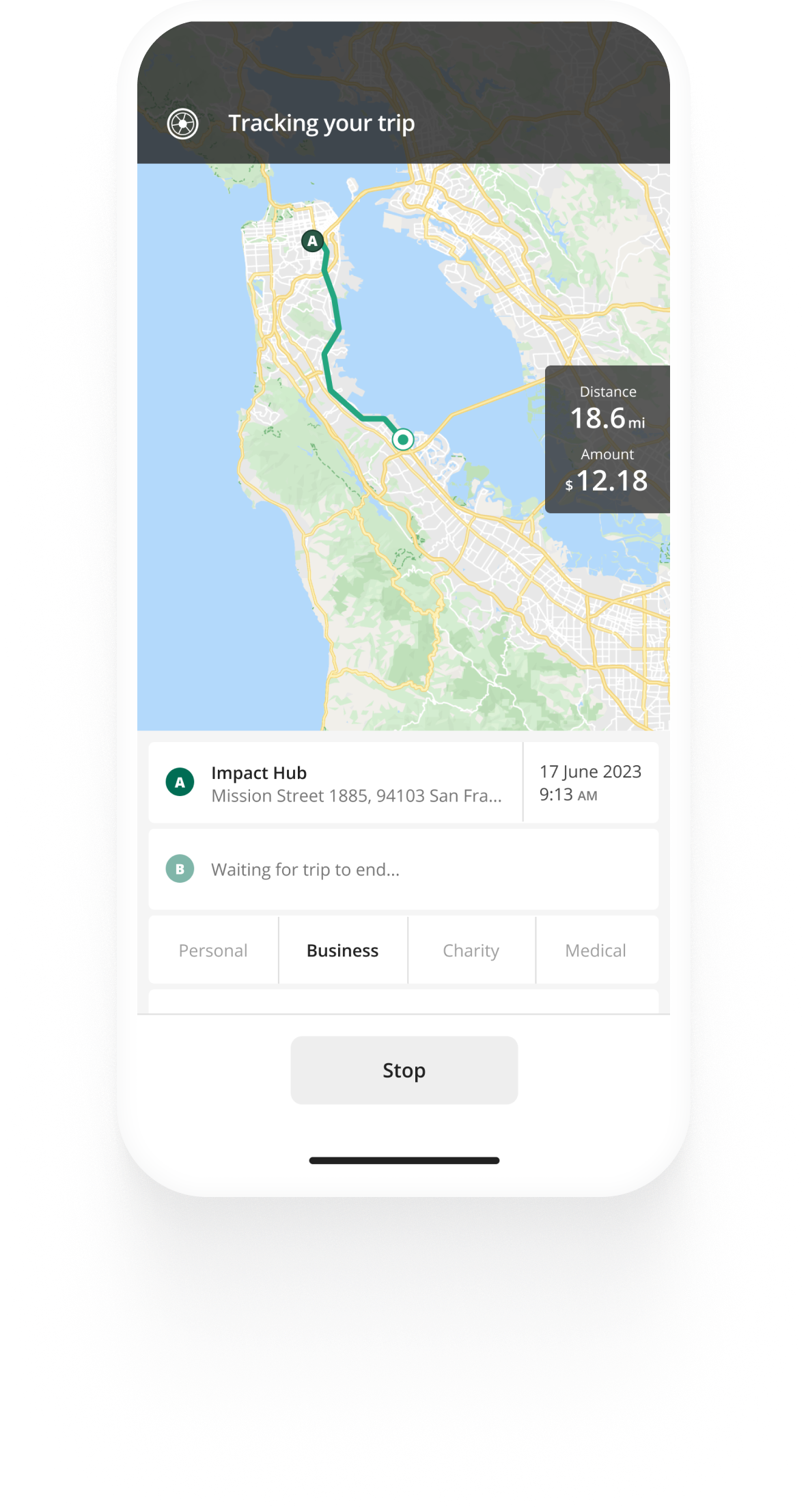

How Does Mileage Tracking and Charging Work on Timeero?

On Timeero, your employees' mileage tracking begins the moment they clock in. It continues up until they clock out.

When an employee moves above a set speed threshold, the motion-based mileage tracker app perceives it as driving. The software has a breadcrumbs feature that offers a comprehensive breakdown of the employee's journey. Each breadcrumb serves as a location marker and when you hover over it, you will see a timestamp and the speed at that particular point.

This offers insights into an employee's movements throughout the workday. The visual representation allows employers to track the exact path or route taken by the worker and verify mileage.

When determining mileage, any speed exceeding 4.5 miles per hour is taken into consideration. This guarantees that walking or time spent stuck in traffic won't be factored into mileage estimates. Administrators can also set the desired speed threshold in their accounts because it is customizabl e.

If an employee forgets to track mileage , they can manually enter their travel distance. You’ll just have to enable this functionality in your company account settings.

It’s clear that Timeero makes tracking mileage for work a breeze, but what about charging for these business miles?

Timeero allows you to set a mileage cost per mile in your account settings. This per-mile charging method simplifies the process, as you don’t have to carry out any extra mileage calculations. The app takes care of that for you. Even better, by selecting the currency in your area, you may adapt this to your company's exact location.

Benefits of Using Timeero for Mileage Charging

Timeero offers a range of features that simplify mileage tracking for business purposes and enhance efficiency in charging customers. Let’s explore the benefits of using Timeero for mileage charging.

Automated Mileage Tracking and Charging

Timeero's automated mileage tracking feature eliminates the need for manual entry. The software uses GPS technology to precisely record and compute mileage based on real distance traveled.

You can avoid manually calculating mileage expenses at the end of each journey by setting the cost per mile in your account. This decreases the possibility of mistakes. It also saves both employees and administrators time. You won't have to worry about how to charge for mileage anymore.

Real-Time Visibility

With Timeero, businesses gain real-time visibility into their employees' travel activities, whether they are driving to client meetings, making deliveries, or attending offsite events. You'll be able to monitor your team members' movements as they drive from one site to the next.

This openness guarantees that mileage records are error-free. Employees and employers may get the correct information at any moment, promoting confidence and responsibility inside the business.

Time and Attendance Information

Every employer's desire is for operations to run as smoothly as possible, and Timeero strives to make that a reality. Mileage tracking, as well as time and attendance functions, are smoothly incorporated into the software.

This enables businesses to link mileage data directly with employee work hours, providing a holistic view of work-related activities. Each timesheet has information about the times the employee clocked in and out, total hours worked, breaks taken, overtime, and covered mileage.

You get an overview of how the employee spent their workday. This ensures that mileage charges are associated with the appropriate work hours, enhancing accuracy in compensation.

Customizable Mileage Rates

Timeero allows businesses to customize mileage rates based on their preferred rate. Once you enter your preferred cost per mile, the app will calculate total costs for you.

This guarantees that businesses can appropriately charge clients, reflecting the actual costs of travel. This comes in handy when independent contractors and self-employed individuals are charging travel expenses for their own vehicles for business use.

Mobile Accessibility

Timeero's mobile app allows employees to track their mileage on the go. This mobile accessibility guarantees that no trips are missed, which is especially important for staff that's outside the office.

It also makes it quick for employees to claim mileage and managers to review and process it, simplifying the whole process even more.

All mileage records are centralized by Timeero on a secure, user-friendly platform. Due to this record-keeping, admins can review, approve, and process mileage claims more easily.

A historical record of all travel-related activities is also provided. In addition to timesheets, you receive mileage tracking reports and other valuable reports for your company.

These reports can also be exported in PDF, Excel, or CSV format. Businesses can get the particular information they want owing to the option to build customizable reports. This is very helpful for internal audits or external reporting for mileage deductions.

Integrations

Once you get the total mileage cost for your customers, the next step is to reimburse your employees for their business expenses. With Timeero, you can eliminate time-consuming, repetitive tasks by automating employee mileage reimbursement.

The software simplifies payroll calculations by integrating multiple payroll and invoicing platforms. These include Paychex, Gusto, Xero, ADP, Rippling, Zapier, Vieventium, and Paylocity.

.webp)

Use Timeero to Simplify Charging Mileage

Transforming how to charge for mileage allows you to stay competitive in today's market and get compensated fairly for your incurred expenses. The traditional way of doing it is time-consuming and, without a doubt, highly prone to errors.

Choosing the right charging method can significantly impact cost recovery and client satisfaction. Using Timeero’s mileage tracking features can be a game changer for your company. The app's flexibility in customization allows businesses to implement a straightforward charging method.

Adopt Timeero today to streamline your mileage charging processes.

Timeero: Your Solution for Accurately Tracking and Charging Mileage

Emily Maina is a tech-savvy writer with a passion for creating content. With years of experience in the industry, she is well-versed in the latest trends and developments in the tech industry. When she’s not working, Emily enjoys exploring the great outdoors or watching her favorite shows.

Related Articles

Looking for the best app for painting contractors? Read our guide to find the four best software apps for painting contractors of all sizes.

Managing employee travel expenses can be a headache. In this guide, we’ll explore gas card vs. mileage reimbursement, helping you make the right choices.

This guide provides a closer look into the policies, practices, and IRS guidelines surrounding nonprofit mileage reimbursement.

Track mileage automatically

How to charge mileage to customers, in this article, when and how to charge mileage to customers, how much to charge for mileage, charging mileage to customers at the irs rate, deducting car expenses at tax time.