Virgin Voyages Help & Support for The Band

- Help & Support

- / Before You Sail

Other topics related to "The Band"

- New Bookings

- Port Information

Need help getting the As to your Qs?

Hit the big, red button below and reach out to our sailor services crew..

Sorry, we’re working on our website.

We’ll be back up and running shortly..

Code: AKM-CYB-WEB-1

Error: 18.4d645e68.1711779602.23a3cbf7

- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Cover yourself, your family and any other travel companions with our comprehensive travel insurance policy..

Our travel insurance is available exclusively to UK residents with up to £15,000,000 cover for medical expenses and up to £5,000 per person for cancellations.

If you are a British national travelling to a country where the FCDO advise against travel at the time you are due to depart, then your insurance policy may be invalid. This could include destinations which Virgin Atlantic are flying to.

Please check here for up to date information: https://www.gov.uk/foreign-travel-advice

Covid-19 cover included

Covid-19 cover is included as standard with our travel insurance, to take care of the health and cancellation costs that arise should you fall ill or need to cancel due to Coronavirus.

Cruise cover included

Our policy includes additional benefits including cruise connection, missed port, cabin confinement and excursions cover.

Key policy terms

Providing peace of mind for your trip

- Covid-19 cover for medical expenses and cancellation if you become ill or have to quarantine due to Covid-19

- Up to £15,000,000 medical assistance cover in the event of illness or an accident while away

- Up to £5,000 cancellation cover or if you have to cut your trip short

- Up to £2,000 in the event of loss, theft or damage to your personal possessions

Please ensure this insurance is suitable for the country you're travelling to.

If you are a British national travelling to a country where the FCDO advise against travel at the time you are due to depart then your insurance policy may be invalid. This could include destinations which Virgin Atlantic are flying to.

Please check here for up to date information: https://www.gov.uk/foreign-travel-advice

Our partner, Allianz Assistance UK, is dedicated to providing answers to any questions, as well as claims information on +44 (0) 20 8239 4030 .

Where are you flying from?

- London Heathrow

- Manchester International

- Inverness Airport

- Cardiff Airport

- Norwich Airport

- Humberside Airport

- London City Apt

- Belfast International

- Leeds Bradford Airport

- Bristol Airport

- Teesside Airport

Our new direct Virgin Atlantic service commences 22nd October 2023.

Please remember when searching for your holiday to add an additional night, as we operate an overnight service on our outbound flight.

i.e. For a 7 night holiday please search for 8 nights.

Our new direct Virgin Atlantic service commences 30th October 2023.

We will operate from London Heathrow four times a week on Mondays, Tuesdays, Thursdays and Saturdays.

Our seasonal Virgin Atlantic service with up to 4 direct flights, will operate until the 19th May 2024.

Our seasonal direct service will recommence on the 28th October 2024.

Our Virgin Atlantic service operates on Mondays, Wednesdays and Sundays.

Flights include a short touchdown in Barbados.

Our Virgin Atlantic service operates on Tuesdays, Fridays and Saturdays until 29th March 2024. From the 2nd April, this service will reduce to Tuesdays and Saturdays.

Our seasonal service will recommence on the 29th October 2024, with flights operating on Tuesdays, Fridays and Saturdays

Our seasonal Virgin Atlantic service with up to 3 direct flights, will operate until the 11th May 2024. Flights will commence from 23 May 2024 - 24th October 2024 on Thursdays and include a short touchdown.

Our seasonal direct service will recommence on the 29th October 2024.

Daily direct flights from London Gatwick to New York with our partner airline, Delta, operates between 10th April and 26th October 2024.

Our Virgin Atlantic service with direct flights, will operate on Wednesdays and Sundays until the 30th March 2024.

Our direct service will operate on Tuesdays and Thursdays from the 2nd April 2024.

1 room / 2 adults

Please enter all child ages

There must be 1 adult per child under two years of age travelling, please adjust your passenger number

To book online please select a maximum of 9 passengers, to book 10 adults or more please call 0344 557 3978

Please note: Drivers must be over the age of 21 to hire a car unless otherwise specified. Drivers between 21 and 24 years of age may be subject to additional costs.

Holiday insurance tailored to your next adventure

We know it's hard to concentrate on Seizing the Holiday without first having peace of mind.

Whether you are taking the children or grandchildren to Disneyland, tying the knot in Vegas, or relaxing on a Caribbean cruise we've got a policy to cover you. Booking your travel insurance through Virgin Atlantic gives you the reassurance that we have you covered from the start to finish of your holiday.

Get your Travel Insurance Quote today

Single Trip - Travel Insurance

Need travel insurance for your family holiday? Our Single Trip Travel Insurance offers great value cover at an affordable price.

Single Trip - Cruise Insurance

Our specialist cruise policy offers additional benefits including: Cruise connection, Missed port, Cabin confinement, Excursions cover.

Providing peace of mind whilst on holiday:

- COVID-19 - cover for medical expenses and cancellation if you become ill or have to quarantine due to COVID-19

- Up to £15m medical assistance cover in the event of illness or an accident while away

- Up to £5k cancellation cover or if you have to cut your trip short

- Up to £2k in the event of loss, theft or damage to your personal possessions

You may also like...

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Destination Guide: U.S. Virgin Islands

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Best Travel Insurance for Students

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does travel insurance for students cover?

How much does travel insurance for students cost, travel guard: best for budget travelers, world nomads: best for adventurers, allianz: best for premier travel benefits at a lower cost, geoblue navigator for students: best study abroad health insurance, more tips for purchasing study abroad travel insurance.

If you’re a student who’s planning to travel internationally or study abroad, it’s a good idea to go prepared with comprehensive student travel insurance. But where do you find plans tailored to your unique needs?

These companies offer some of the best options for travel insurance for students, whether you’re globe-trotting for a week, a semester or a whole year.

Student travel insurance can vary from plan to plan. But there are a few things you should look for whether you’re an exchange student, studying abroad or simply planning an international trip between classes.

Trip cancellation insurance : This coverage reimburses you for any prepaid, nonrefundable costs of your trip should you have to cancel for any unexpected circumstances covered by your selected policy.

Travel medical coverage : If you become ill or get injured while traveling, travel medical coverage can help pay for medical expenses and even emergency travel back home.

Travel delay insurance : In the event of rescheduled or canceled flights that result in painfully long layovers, this coverage will reimburse you for personal items, food and lodging you may have to pay for as you wait for a rescheduled flight.

Delayed baggage : Just as it sounds, this coverage reimburses you for luggage (including necessities you might have to purchase while you wait for your luggage to arrive) if it’s delayed or lost by a travel provider in transit.

» Learn more: When to buy travel insurance

As with travel insurance for more general travelers, there are several factors that affect the cost of travel insurance for study abroad students and other young travelers, including:

Traveler age.

Overall trip cost.

Trip duration.

Specific coverage selected.

Because there are so many factors involved, and because every travel insurance company is different, it’s often wise to compare a number of plans to decide which is best for you and your travel plans. That said, these are some of the best student travel insurance options.

» Learn more: Best annual travel insurance this year

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

What Travel Guard covers

There are several options available from Travel Guard for travel insurance for students studying abroad or simply exploring on break: Deluxe, Preferred and Essential.

They all include trip cancellation and interruption, medical coverage, and lost or delayed baggage insurance. Bonus: They even come with dental coverage. Add-ons like car rental coverage and “cancel for any reason coverage” are also available with some plans.

There is also an annual plan available, but coverage automatically expires if any single trip lasts longer than 90 days, so it wouldn’t likely be sufficient for more than a semester abroad.

Multiple price points for a wide range of coverage options.

Dental coverage included.

24/7 emergency assistance available with all plans.

If you plan on participating in adventure sports, the Adventure Sports Bundle is only available as an add-on on some Preferred and Deluxe plans.

» Learn more: Read our full review of Travel Guard

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

What World Nomads covers

Designed for independent, often more adventurous travelers, World Nomads offers several travel insurance options for students of any age.

While plans may seem more expensive than some other options, it’s important to remember that these plans include medical treatment and evacuation if you are injured while participating in some adventure sports. Plans also cover medical expenses, trip cancellation and interruption, baggage loss and delay, and include 24/7 travel assistance.

Many adventure sports are covered.

Some plans include car rental coverage.

Dental is covered.

Pre-existing conditions aren’t covered.

» Learn more: Best adventure sports travel insurance

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

What Allianz covers

A well-known travel insurance company, Allianz offers a number of travel insurance plans that may appeal to students.

All plans include epidemic coverage, trip cancellation and interruption, medical and dental coverage, baggage loss and delay, and 24-hour assistance. And premium plans tend to offer similar coverage as other insurance companies but at a lower price.

There’s also an annual plan available called AllTrips, but it doesn’t cover individual trips longer than 45 consecutive days.

Includes epidemic coverage (including for COVID-19).

Covers 100% of prepaid costs if you cancel your trip for a covered reason.

The cost to change flights or other transportation is covered on some plans if you have to change or cancel bookings because of a covered reason.

Rental car coverage not included on any plan.

» Learn more: NerdWallet's Allianz review

- Flexible deductible options.

- Wide ranging medical coverage.

- Low prices for medical only needs.

- Lacks in traditional travel insurance coverage options such as trip Interruption, bag delays, etc.

- Better when paired with travel credit card insurance coverage.

What GeoBlue covers

Designed for students staying in one place for more than a week or even a whole semester, GeoBlue’s Navigator for Students plan is perfect for students studying abroad who are more concerned with health care coverage than travel-related benefits.

It’s designed more like traditional health insurance with deductibles, monthly payment plans and unlimited annual maximums when it comes to medical care. It covers medical care inside and outside the U.S., making it a good overall health insurance if you plan to travel back and forth. Travel vaccinations, emergency medical transportation and repatriation are even covered.

What’s not covered are more typical travel-related expenses like lost baggage, delayed flights and trip cancellation. But the medical coverage is so comprehensive that if you want travel-specific coverage, you could opt to purchase a more budget-friendly plan for each specific trip.

Unlimited annual maximum for medical benefits.

Sliding payment scale to customize your deductible-to-monthly premium payments.

Preventive care is covered.

Dental and vision benefits are extra.

Coverage for most travel-related snafus isn’t included.

» Learn more: GeoBlue travel insurance review : Is it worth the cost?

The best travel insurance for students studying abroad or traveling between semesters or even on holiday breaks is insurance that’s best suited to you and your travel plans.

Before you hit “Add to cart,” compare several plans, make sure to read the fine print and understand what’s covered (and, just as importantly, what’s not ). Select a plan that offers the coverage required to help you feel safe, secure and protected wherever you roam.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Member News AAA's Take KeeKee's Corner AAA Traveler Worldwise Foodie Finds Good Question Minute Escapes Car Reviews

WHAT’S COVERED, COSTS, AND TIPS ON FINDING THE BEST TRAVEL INSURANCE FOR YOUR NEEDS

March 28, 2024 | 3 min read.

Travel insurance can be an overwhelming expense to consider atop an already costly vacation. Admittedly, even as a seasoned travel industry professional with three decades of globe-trotting under my belt, I have a moment of pause each time I’m confronted with this. Ultimately, I almost always purchase some travel insurance coverage, especially when it’s a complex international trip. It’s primarily motivated by my aging parents—heaven forbid anything should happen to them—and wanting a safety net to return home at a moment’s notice without incurring massive out-of-pocket costs. This parental paranoia is just a small piece of the greater solace that travel insurance can provide, says AAA Tour Product Manager Randy Osborne. “Everyone can benefit from travel insurance,” he says. “The unexpected happens. It can provide peace of mind and reduce stress during a traumatic situation, as well as a contact to call when traveling abroad.” Osborne has seen it all. He works directly with AAA Travel Advisors and AAA’s preferred travel insurance provider, Allianz . It’s a vantage point that continually provides him with real-life cautionary travel tales. “I’ve never heard of anyone who needed and used travel insurance regretting having purchased it,” Osborne says. He says the biggest mistake people make is this: “Not getting it at all.” Here are some key things to keep in mind when navigating travel insurance

IT’S A FINANCIAL SAFETY NET FOR YOUR VACATION INVESTMENT There is no “one-size-fits-all” travel insurance plan, says Osborne, since available plans will be based on the trip cost, vacation destination(s) and age of the traveler(s). Most comprehensive travel insurance plans, however, will include varying degrees of coverage for the following:

- Trip Cancellation: This is a predeparture benefit that provides the ability to recoup travel costs if you cannot travel. It’s typically limited to specific reasons covered in the plan. Osborne advises understanding what these covered reasons are upfront when reviewing plan options.

- Trip Interruption: This helps if you need to cut your trip short. Covered reasons typically include an illness or injury during the trip, or a family emergency at home—which, as mentioned earlier, has always been this author’s primary motivator to purchase travel insurance.

- Travel Delays: This helps to cover expenses if your travel is delayed due to a covered reason. Osborne advises understanding what constitutes a “travel delay” within the travel insurance plans you are considering.

- Medical Expenses: This helps to cover unforeseen medical expenses while traveling to destinations where your U.S.-based health insurance may not work. “Frequently, the biggest covered amounts are for medical,” Osborne says.

- Emergency Evacuation Coverage: This typically helps to cover the cost of transportation (plus related medical services and supplies) to a medical facility if you’re seriously injured or ill. The best plans will provide up to $1 million per person for medical evacuation. This can seem high, but evacuation costs can exceed tens of thousands of dollars, especially if you’re traveling to a remote destination.

- Baggage Loss or Delays: This helps to recoup costs for lost luggage, as well as damaged or stolen baggage while you are on your trip.

COMPARE PLANS

In some cases, such as when booking a cruise or a guided group tour vacation, the travel provider may require you to purchase a certain level of travel insurance before you can join the excursion. In these situations, representatives often have options that allow you to bundle travel insurance into the cost of the vacation at the time of booking. Even if this is the case, however, Osborne says it pays to shop around and compare travel insurance plans to see if there is a policy that better suits your needs.

Most travel insurance companies, including Allianz Insurance, have easy-to-use websites that highlight several levels of travel insurance for your trip. These quotes can be used as baselines for building upon or removing elements. Gather a few online quotes, then speak over the phone with a representative to customize.

SEEK PROFESSIONAL GUIDANCE

Allow a AAA Travel Advisor to guide you through the process and identify a travel insurance policy that works for your needs, risk tolerance, and budget. The best part: This service is free.

PURCHASE EARLY FOR THE MOST BENEFITS

You’ll get the best and most comprehensive coverage if you purchase travel insurance within the first 14 days of making a trip deposit. (That clock starts ticking once you put a down payment on any part of the vacation.) The biggest benefits include:

- Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. “Often I get calls from travelers who didn’t expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going,” Osborne says.

- Better Trip Cancellation Coverage Options: Many travel insurance companies offer more covered reasons for trip cancellation if you purchase it within 14 days of making an initial trip deposit.

- Pre-Existing Medical Conditions: If you have a pre-existing medical condition, most travel insurance will not cover medical situations due to this condition that arise during your travels— that is, unless you purchase comprehensive travel insurance coverage within the first 14 days of making a trip deposit.

ASSESS MEDICAL COVERAGE CAREFULLY, ESPECIALLY IF YOU HAVE A PRE-EXISTING CONDITION

Most U.S.-based health insurance plans won’t offer medical coverage on non-U.S. soil. Even if you have outstanding health insurance, it may not be very helpful during an international vacation where unexpected medical and health issues arise. This is certainly the case if you’re traveling to more remote areas with limited medical facilities or your vacation includes high-risk excursions and activities. Osborne says it’s important to understand whether travel insurance you’re considering offer primary or secondary medical coverage, and to assess which is best for you.

If you have a pre-existing medical condition or chronic health problems, medical coverage is an especially critical piece of the policy to scrutinize, Osborne says. He recommends consulting a travel insurance specialist so that you are covered accordingly.

UNDERSTAND WHAT IS NOT COVERED IN THE POLICY It’s easy to focus on what’s included when comparing trip insurance plans. Osborne recommends paying close attention to what is excluded from coverage, too.

Case and point: I recently read about a couple who booked a return flight home after their original flight had been cancelled. When the couple filed a claim with their insurance provider to recoup this cost of this new flight, they learned that this specific scenario was not covered under the policy. (The flight was cancelled due to crew not arriving on time, and the airline was able to rebook the couple on a less-desirable flight home, which the couple declined.)

Clearly understanding the exclusions—and this could be achieved with a simple phone call to the insurance provider’s customer service—could have prevented this financial oops. BE

Find An Agent

AAA Travel Advisors can provide vacation planning guidance to make your next trip unforgettable. Find a Travel Advisor

CAREFUL RELYING ON CREDIT CARD TRAVEL INSURANCE Just as you should not rely on your U.S.-based health insurance to cover you while traveling internationally, it’s wise to not make assumptions about a credit card that offers travel insurance as one of its perks. Osborne advises reviewing the credit card’s travel insurance coverage amount; the medical coverage policy; whether all trip purchases need to be made with that credit card; and if approved claims results in a cash refund or a travel credit.

EPIDEMIC AND PANDEMIC COVERAGE IS AVAILABLE The events of 2020 turned travel on its head, and also impacted the travel insurance industry. As a result, travel insurance companies evolved and most now offer epidemic and pandemic coverage options. “Having coverage for quarantine is at the forefront of people’s minds now,” says Osborne, pointing to the out-of-pocket costs that came with many travelers having to quarantine in a vacation destination when Covid-19 was at a peak. BUDGET FOR TRAVEL INSURANCE The average cost of travel insurance is 5% – 6% of your trip costs, according to Forbes Advisors’ analysis of travel insurance rates. If you’re planning an international, bucket-list vacation—and want to protect your investment in the unfortunate event that things go sideways—it’s wise to keep this cost in mind when creating your trip budget. “As much as we don’t want to think about the unexpected, things happen and having the coverage you need when you need it can be a huge benefit,” says Osborne. “If you need it, you will never regret having it.

- facebook share

- link share Copy tooltiptextCopy1

- link share Copy tooltiptextCopy2

Discover the best London Restaurants, London Museums, and London Neighborhoods…in just two days!

When Is The Best Time To Book A Flight?

Money-Saving Strategies for Booking Airfare

Related articles.

What Does Cruise Insurance Cover?

Which Trusted Travel Program is Best For You?

How to Reduce the Chances Your Flight Will Be Canceled

Limited Time Offer!

Please wait....

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Virgin Voyages Travel Insurance - 2024 Review

Virgin voyages travel insurance - review.

- Strong Insurance Partner

- Easy To Buy At Check Out

- Poor Medical And Evacuation Cover

- Few Cancellation / Interruption Reasons

Sharing is caring!

Virgin Voyages offers cruises to adults aged 18 and up (no children allowed) that feature high tech amenities, low environmental impact, and complimentary drinks and dining. Although Virgin Voyages offers a variety of cruises, cabin types, and dining options, they only offer a single option for travel insurance, which is their Voyage Protection plan.

Arch Insurance Company, a strong insurance partner, underwrites Virgin’s Voyage Protection plan, while Aon Affinity administers policy service and handles claims.

Like most major cruise lines, the Voyage Protection plan carries dangerously low limits for Medical Insurance and Medical Evacuation. It also lacks many of the important features of quality travel insurance policies found on the wider market, such as a Pre-Existing Medical Condition Waiver and a comprehensive list of reasons for Trip Cancellation and Trip Interruption.

The one redeeming element of Virgin Voyages’ travel insurance is that you can easily purchase it at checkout when booking your cruise online. Before you buy, check out this review to find out if the Voyage Protection plan is right for you.

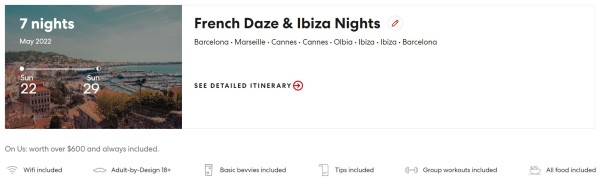

Our Cruise: French Daze & Ibiza Nights

For our review, we selected the French Daze & Ibiza Nights cruise. Our sample couple, ages 55 and 60, will be staying in The Insider suite, sailing from 5/22/22-5/29/22. The cruise begins and ends in Barcelona, with stops in Marseille, Cannes, Olbia, and Ibiza along the way. The total cost of the cruise comes to $2,600 after taxes and fees.

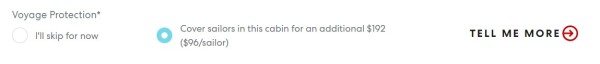

Conveniently, Virgin Voyages offers the option to purchase travel insurance at checkout.

To Virgin Voyages’ credit, their website is incredibly user friendly and easy to navigate. And obviously, it’s a simple click of “Yes” or “No” to purchase their travel insurance plan. But before you add it into your shopping cart, you need to know what your $192 is really buying - and what it’s not.

Virgin’s insurance provides travelers with $10k of medical coverage and $25k of medical evacuation coverage. Let’s see how this compares to other travel insurance in the wider travel insurance marketplace.

Comparison Quotes

When we review cruise line travel insurance plans, we always compare them to other options available on the wider travel insurance marketplace. This way, you can see what the cruise line offers, and determine whether it fits your needs or is a good value for your money.

We recommend all travelers leaving the US have ample emergency insurance in case of an overseas catastrophe. This saves you the headache and heartache of paying for medical treatment out of pocket, and a 6-figure transportation fee to return home in a worst-case scenario.

Therefore, TravelDefenders advocates carrying a minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible . This is the primary benchmark we use to determine if a cruise line’s travel insurance is suitable for travelers.

Using the details of the trip, we ran a sample quote to show you how Virgin Voyages’ travel insurance plan compares with two policies available at TravelDefenders .

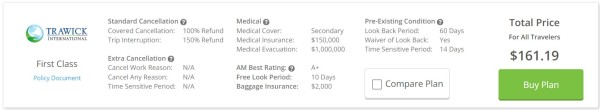

First, we’ll compare it to Trawick First Class for $161.19, because this is the least expensive comprehensive trip insurance plan that includes our recommended minimums for Medical Insurance, Medical Evacuation and Pre-Existing Condition Waiver.

Then, we’ll compare it to the least expensive plan that meets our minimum recommendations, includes a Pre-Existing Condition Waiver, and also offers Cancel For Any Reason benefits, which happens to be the John Hancock Silver (CFAR 75%) for $262.50.

How Does Virgin Voyages Compare to the Competition?

As you can see, the Voyage Protection plan offers extremely limited coverage for the $192 cost. Like many cruise line travel insurance plans, the Medical Insurance and Medical Evacuation coverage have disappointingly low limits. Furthermore, the policy does not cover Pre-Existing Conditions nor provide a Cancel For Any Reason option.

In comparison, Trawick First Class costs $30.81 less than the Voyage Protection plan on our sample quote. While this is not a significant savings, Trawick First Class provides adequate coverage for travel outside of the US, with $150k in Medical Insurance and $1m in Medical Evacuation coverage. It also covers Pre-Existing Conditions if purchased within 14 days of your initial payment or deposit towards the trip.

Our sample couple could have Cancel For Any Reason protection by purchasing the John Hancock Silver (CFAR 75%) for $70.50 more than the Voyage Protection plan. In addition to the standard cancellation coverage, our two travelers would have the option to cancel their trip for any reason and still receive a significant portion of their trip cost back. They’d also be properly protected with $100k of Medical Insurance and $500k in Medical Evacuation coverage.

We’ll discuss the importance of these coverages further below.

Trip Cancellation Reimburses You If You Can’t Travel

Travelers value Trip Cancellation benefits because the coverage allows you to get a full reimbursement of your pre-paid, non-refundable trip costs in the event you must cancel your trip for a covered reason. Of course, the more covered reasons a policy has for cancellation, the better.

Disappointingly, Virgin’s cruise insurance covers a mere 6 cancellation reasons:

- Your, a Family Member’s, a Traveling Companion’s, or a Traveling Companion’s Family Member’s death, that occurs before departure on Your Trip; or

- Your, a Family Member’s, a Traveling Companion’s or a Traveling Companion’s Family Member’s covered Sickness or Injury, that: a) occurs before departure on Your Trip; b) requires Medical Treatment at the time of cancellation; and c) as certified by a Physician, results in medical restrictions so disabling as to cause Your Trip to be cancelled;

- You or Your Traveling Companion being hijacked, quarantined, required to serve on a jury (notice of jury duty must be received after Your Effective Date), served with a court order to appear as a witness in a legal action in which You or Your Traveling Companion is not a party (except law enforcement officers);

- Your or Your Traveling Companion’s primary place of residence is made Uninhabitable and remains Uninhabitable during Your scheduled Trip, by fire, flood, or other Natural Disaster, vandalism;

- You or Your Traveling Companion being directly involved in a traffic accident, substantiated by a police report, while en route to Your scheduled point of departure;

- You or Your Traveling Companion who are military, police or fire personnel being called into emergency service to provide aid or relief for a Natural Disaster.

While covered cancellation can vary by policy, most policies cover all the above reasons and more, including but not limited to:

- A documented theft of passports or visas

- Permanent transfer of employment of 250 miles or more

- Involuntary termination or layoff

- An unannounced strike causing a complete cessation of services

- Inclement weather causing a complete cessation of services

- Revocation of previously granted military leave due to war

- Bankruptcy or default of airline, cruise line, tour operator

By comparison, both Trawick First Class and John Hancock Silver (CFAR 75%) offer 14 covered cancellation scenarios. The John Hancock Silver (CFAR 75%) also includes Cancel For Any Reason, which allows you to cancel for any reason not otherwise covered by the policy and still receive a 75% reimbursement of your trip cost.

Another important factor to consider is that the Voyage Protection plan only covers travel arrangements booked through Virgin Voyages. Any travel arrangements booked elsewhere, such as independently booked airfare and accommodations for travel time ahead of or after the cruise, would not be covered. This is typical of cruise line travel insurance plans but leaves you at risk of losing those costs if you cancel your trip.

Alternatively, third-party travel insurance plans, like Trawick First Class and John Hancock Silver (CFAR 75%), insure all of your pre-paid and non-refundable trip costs, regardless of who your travel arrangements were booked through.

Cancel For Any Reason

Cancel For Any Reason coverage is exactly what it sounds like – it allows you to cancel for any reason that’s not covered under the policy and still receive a reimbursement of your trip cost.

Many major cruise lines offer Cancel For Any Reason , which assigns a future cruise credit to the travelers if they cancel their cruise for any reason not listed on the policy. Surprisingly, Virgin Voyages doesn’t offer anything of the sort. While a future cruise credit is far from preferable, it’s better than nothing.

On the other hand, some third-party travel insurance plans, like John Hancock Silver (CFAR 75%) have Cancel For Any Reason benefits built into the policy. Instead of offering future credit, the policy gives you a cash reimbursement for a portion of the trip cost.

However, Cancel For Any Reason has a few rules. The coverage reimburses 50% -75% (depending on policy) of your pre-paid and non-refundable trip costs, provided you:

- Purchase the policy within 10-21 days (depending on the policy) of your initial payment or deposit towards the trip. For the John Hancock Silver (CFAR 75%), this timeframe, called the Time Sensitive Period, is 14 days.

- Insure 100% of your pre-paid and non-refundable trip costs, and add any subsequent payments to the policy’s trip cost within the Time Sensitive Period

- Cancel your trip no later than 48 hours prior to departure

Trip Interruption Refunds the Unused Portion of Trip

Similar to Trip Cancellation, Trip Interruption reimburses you for the missed portion of your trip if you have a covered disruption. Covered reasons for Trip Interruption mimic those of Trip Cancellation. For example, if you unexpectedly fell ill during your cruise and had to seek treatment off the ship for two days, that’s a covered Trip Interruption (along with a Medical Insurance claim).

In some cases, your Trip Interruption may allow you to return to the trip after missing a portion of it. Other times, you might have to go home early to tend to a family emergency. In the same fashion, a Trip Interruption could delay your arrival to the cruise.

In any event, travel insurance reimburses you up to your trip cost for the unused, pre-paid, non-refundable expenses for your travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate route of travel; or

- Rejoin your trip from the point where your trip was interrupted or return home early

While Virgin’s barebones policy offers only 100% trip cost refund for a covered interruption, both Trawick First Class and John Hancock Silver (CFAR 75%) cover up to a 150% refund. The extra 50% helps cover the added cost of transportation.

Trip Interruption coverage that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy.

Medical Insurance When Traveling Overseas

Sometimes travelers are more focused on Trip Cancellation and overlook the risks of traveling overseas without proper Medical Insurance .

American travelers often have the false impression that countries with socialized medicine will treat them for free, but this is not the case. In fact, countries with universal health care programs only offer those services to their residents, who pay taxes for this privilege, whereas travelers must pay full price for health care. Inpatient care at a hospital can run $3,000 to $4,000 per night, plus treatments and surgeries.

Also, Medicare does not pay for your treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, it’s a lifetime limit and you must pay a 20% co-pay out of pocket. These policies falsely lead you to believe you’re safely covered, but they leave your retirement savings exposed to the risk of a sudden, catastrophic financial loss.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas, which is why carrying adequate Medical Insurance is critical when leaving the country.

Thus TravelDefenders recommends each traveler carry at least $100k in Medical Insurance when leaving the US. This is enough coverage to assure you’re properly treated without paying off medical bills for years to come.

Getting back to Virgin Voyages’ travel insurance, the Voyage Protection plan includes only $10k of Medical Insurance. That’s simply not going to help you in an emergency.

On the other hand, Trawick First Class includes $150k Medical Insurance and John Hancock Silver (CFAR 75%) covers $100k. These levels of coverage are much better suited for seniors cruising outside of the US.

Emergency Medical Evacuation Brings You Home

Have you ever seen a helicopter land on a cruise ship to pick up a sick passenger, or heard of someone being flown home in a private medical jet? These things happen more frequently than you think.

Specifically, Medical Evacuation coverage pays for transportation from the place of injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, Medical Evacuation returns you home. If your condition is critical and you require ongoing care by a medical team to return home, an air ambulance outfitted as a flying ICU might be most appropriate.

Private air transportation such as this can cost $15k to $25k per flight hour and coming back to the US from overseas can get very expensive, very quickly.

In addition, many travelers assume their private health insurance pays for Medical Evacuation so they can get home. In fact, private health insurance plans, including Medicare supplements, do not include Medical Evacuation benefits beyond a limited amount for a ground ambulance to the hospital. So, that medical flight cost comes out of your pocket and could cost as much as a house.

For these reasons TravelDefenders recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. Travelers venturing even further from home, to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Virgin’s Voyage Protection plan only provides a minimal $25k Medical Evacuation benefit. Meanwhile, Trawick First Class has a benefit of $1m per person for Medical Evacuation and the John Hancock Silver (CFAR 75%) covers $500k per person.

Pre-Existing Medical Conditions

Pre-Existing Conditions are an understandable concern for many senior travelers.

In the world of travel insurance, a Pre-Existing Condition does not mean anything that’s ever happened to you in your entire medical history. Instead, travel insurance companies only concern themselves with your more recent medical history.

Most policies are only concerned about the 60-180 days prior to the day you purchased your policy. This means any conditions older than 60-180 days will be covered if none of the following has occurred within that timeframe:

- New conditions or change or worsening of previous conditions

- Treatment, testing, or examinations that have occurred or been recommended

- New or changes in medication, including dosage changes

If any of the above did occur during to 60-180-day window prior to purchasing travel insurance, it would be excluded from coverage.

Luckily, if you purchase your policy early in the booking process, within 14-21 days of making your initial payment or deposit towards your trip, many travel insurance policies include coverage for Pre-Existing Conditions with a Waiver. Once those 14-21 days pass, however, Pre-Existing Conditions aren’t covered. Instead, they’re subject to the Look Back period, the time between when you bought the policy and the 60-180 days prior.

To make life easier and give you peace of mind TravelDefenders recommends travelers buy travel insurance that includes a Pre-Existing Condition Waiver whenever possible. It’s simple to get, just by purchasing your travel insurance policy shortly after making a deposit. The Voyage Protection plan does not cover Pre-Existing Conditions at all. They do not offer a waiver, so regardless of when you buy their insurance, they won’t cover it. One good thing in Virgin Voyages’ favor is that their policy only looks back 60 days into your medical history, rather than 90 or 180 days.

Alternatively, both policies we compared from TravelDefenders to Virgin’s Voyage Protection plan offer a Waiver of Pre-Existing Conditions, if the policies are purchased within 14 days of your initial payment or deposit.

Virgin Voyages offers contemporary cruising experiences, but minimal travel insurance. Their policy is deficient in critical areas such as Trip Cancellation, Medical Insurance, Medical Evacuation and covering Pre-existing Conditions. It also lacks a Cancel For Any Reason option. Overall we rate it a 7 out of 10.

Trawick First Class is one of many TravelDefenders policies that provides outstanding value for the money, with a savings of $30.81 over the Voyage Protection plan, for exponentially better coverage.

While a higher tiered plan like John Hancock Silver (CFAR 75%) costs $70.50 more than the Voyage Protection plan, it offers many of the features and flexibility anyone would want in a travel insurance policy and is a better value for your money.

In addition, you cannot insure your other travel arrangements with Virgin Voyages’ policy, but you can insure them under a policy purchased in the wider travel insurance marketplace. You’ll find more value for your money working with TravelDefenders .

Did you know you won’t find lower prices on the same policy anywhere else, not even with the insurance company directly? At TravelDefenders , we take the nation’s top travel insurance carriers and bring them in our marketplace where you can shop and compare different plans.

Visit TravelDefenders first to see your options before committing to the first travel insurance policy you’re offered. Stop by and have a chat, send an email or give us a call at +1(786) 321 3723 . Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Very easy to explore options

I looked at some plans on my own and then did an online chat. The representative was very helpful.

Amanda was very helpful and informative…

Amanda was very helpful and informative about helping us with our insurance needs.

Stanley Johnson

Super job.

In addition to being very helpful and knowledgeable, they (Katrina and Nicole) were so cheerful, which means they enjoy their job. They walked me through the process and provided assistance as I had questions. They answered them all!

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.

- Trip delay reimbursement: up to $500 per ticket if you're delayed more than six hours or require an overnight stay.

- Trip cancellation and interruption protection: up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Medical evacuation benefit: up to $100,000 for necessary emergency evacuation and transportation when on a trip of five to 60 days and traveling more than 100 miles from home.

- Travel accident insurance: accidental death or dismemberment coverage of up to $100,000 (up to $1,000,000 for common carrier travel).

- Emergency medical and dental benefits: up to $2,500 for medical expenses (subject to a $50 deductible) when on a trip arranged by a travel agency and traveling more than 100 miles from home.

- Rental car coverage: primary coverage for damages caused by theft or collision up to $75,000 on rentals of 31 days or fewer

More protections are included with cards with an annual fee, but there are exceptions. The no-annual-fee Chase Freedom Flex , for instance, includes up to $1,500 per person (and up to $6,000 per trip) in trip cancellation and trip interruption coverage.

However, there are some differences between credit card travel coverage and obtaining coverage from a third party.

"Credit card coverage does not typically provide travel medical benefits," Borden says. "For protection if you get sick or hurt while traveling, you'll want a travel insurance plan with medical coverage."

Whether you get your travel insurance in a standalone policy or through a credit card, it's important to review your plan details carefully. In either case, there may be exclusions and other requirements such as deadlines when filing a claim, Borden notes.

What travel insurance coverage do you need to pay more for?

Knowing what travel insurance doesn't cover is as important as knowing what it does cover.

"Travelers should understand that travel insurance benefits come into play only if a covered reason occurs," Borden says. Most standard travel insurance plans won't reimburse you for the following:

Cancel for any reason (CFAR)

Cancel-for-any-reason travel insurance covers a trip cancellation for any reason, not just a covered event. your standard benefits won't kick in unless it's a covered event. For instance, you'll be reimbursed simply for changing your mind about taking a trip.

That said, CFAR travel insurance is not without its downsides. For one, it's more expensive than traditional insurance, and most CFAR policies will only reimburse you for a percentage of your travel expenses. Additionally, CFAR policies aren't available for annual travel insurance .

You can find our guide on the best CFAR travel insurance here.

Foreseen weather events

Sudden storms or unforeseen weather events are typically covered by standard travel insurance plans. There are exceptions to be aware of. For example, an anticipated and named hurricane will not be covered.

Medical tourism

If you're going to travel internationally for a medical procedure or doctor's visit, your travel insurance plan will not cover the procedure itself. Most medical travel plans also won't cover you if something goes wrong with your procedure.

Pre-existing conditions and pregnancy

Those with specific pre-existing conditions, such as someone with diabetes and needing more insulin, will not be covered by most plans. In addition, pregnancy-related expenses will likely not be covered under most plans.

That said, you can obtain a pre-existing condition waiver for stable conditions. In order to obtain a wavier, you will need to purchase travel insurance within a certain time frame from when you booked your trip, usually two to three weeks, depending on your policy.

Extreme sports and activities

Accidents occurring while participating in extreme sports like skydiving and paragliding will typically not be covered under most plans. However, many plans offer the ability to upgrade to a higher-priced version with extended coverage.

Navigating claims and assistance

When a trip goes awry, the first thing you should do is document everything and be as specific as possible with documentation. This will make the claims process easier, as you can substantiate and quantify your financial losses due to the delay.

For example, your flight home has been delayed long enough to be covered under your policy, you'll want to keep any receipts from purchases made while waiting. For instances where your luggage is lost, you will need to file a report with local authorities and document all the items you packed.

Cancellation protection also requires meticulous attention to detail. If you're too sick to fly, you may need to see a doctor to prove your eligibility. If an airline cancels a flight, you'll also need to document any refunds you received as travel insurance isn't going to reimburse you for money you've already gotten back.

Part of the benefit of CFAR insurance is the reduced paperwork necessary to file a claim. You'll still need to document your nonrefundable losses, but you won't have to substantiate why you're canceling a trip.

Choosing the right travel insurance

Each plan should be personalized to meet the insured party's needs. Some travelers prefer to stick to the bare minimum (flight cancellation benefits through the airline). Others want a comprehensive plan with every coverage possible. Before you buy anything, set your destination. Are there any travel restrictions or changes pending? Does your destination country require emergency or other medical coverage?

If the destination airport is known for lost or delayed luggage, travelers should keep important items in carry-ons. Lost or delayed luggage coverage protects insured parties in the event of a significant delay or total loss.

Second, check current credit card travel benefits to avoid redundancies. Savvy travelers don't need to pay for the same coverage twice.

Finally, consider your individual needs. Do you have a chronic medical condition, or do you feel safe with emergency-only medical coverage? Keep in mind, this does not include coverage for cosmetic surgery or other medical tourism. Do you have a budget limit for travel insurance? Asking and answering these important questions will help every traveler find the right product.

Most travel insurance plans are simple, and Business Insider's guide to the best travel insurance companies outlines our top picks. Remember, read your policy and its specifics closely to ensure it includes the items you need coverage for.

No one likes to dwell on how a trip might not go as planned before even leaving. However, at its core, travel insurance provides peace of mind as you go about your trip. While the upfront cost may seem significant, when you compare it to the potential expenses of a canceled flight, emergency evacuation, or a hefty medical bill, it's a small price to pay in the grand scheme of things.

Get Travel Insurance Quotes Online

Protect your trip with the best travel insurance . Compare travel insurance quotes from multiple providers with Squaremouth.

What does travel insurance cover frequently asked questions

Does travel insurance cover trip cancellations due to a pandemic like covid-19.

Coverage for pandemics vary from policy to policy. Some travel insurance companies have specific provisions for pandemic-related cancellations, while others may exclude them entirely.

Are sports injuries covered under travel insurance?

Sports injuries are often covered under travel insurance, but high-risk or adventure sports might require additional coverage or a special policy.

Can travel insurance provide coverage for travel advisories or warnings?

Travel advisories have different effects on your travel insurance depending on your policy. Traveling to a country already under travel advisory may invalidate your coverage, but if you're already traveling when a travel advisory is announced, you may be covered.

How does travel insurance handle emergency medical evacuations?

Travel insurance usually covers the cost of emergency medical evacuations to the nearest suitable medical facility, and sometimes back to your home country, if necessary.

Are lost or stolen passports covered by travel insurance?

Many travel insurance policies provide coverage for the cost of replacing lost or stolen passports during a trip.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

Money blog: Big drop in energy bills on way in summer; government urged to let some Britons retire early

A respected pension expert has called for an end to the triple lock - and for some people to get their pensions earlier. Read this and more in the Money blog - your place for consumer and personal finance news. You can leave a comment on anything we've covered in the form below.

Thursday 28 March 2024 20:33, UK

- 'Outrageous': Should the youngest British workers really be paid less?

- Government urged to drop triple lock - but let some Britons retire earlier

- Energy bills predicted to drop this summer

- Eight things that are going up in price next week - and six major boosts to Britons' pockets

- Free childcare about to be extended - here's all the support on offer to parents of young children

- ISA deadline approaching - here's what you need to know

- Tap here to follow the Ian King Business Podcast wherever you get your podcasts

Ask a question or make a comment

We'll be back with our Weekend Money features on Saturday - and will return with live consumer and personal finance updates after the Easter weekend on Tuesday.

For those who've got time off, enjoy - and thanks for following along.

By James Sillars , business reporter

High margins for fuel retailers may mean drivers are still paying over the odds at the pump, according to the competition regulator.

In a monitoring report, following its fuel market study of 2022, the Competition and Market Authority (CMA) said fuel margins - the difference between what retailers pay for their fuel and the price they sell it at - remained "concerning".

The regulator said supermarket margins, which had stood at 4% in 2017, rose to 7.8% in 2023.

Other retailers, it said, saw their margins hit 9.1% last year.

This was "not a good sign for drivers", the CMA said, though it stopped short of openly declaring that they were being overcharged.

Lobby groups representing both the supermarkets and independent retailers, the British Retail Consortium (BRC) and Petrol Retailers Association (PRA) respectively, have consistently denied ripping drivers off.

Read more on this story here ...

By Victoria Seabrook , climate reporter

Emissions of climate-heating gases from the UK continued to fall last year.

That's good news for the climate, and reinforces the fact UK has cut emissions faster than any other G20 country - by 53% since 1990.

But the reasons aren't entirely good.

While most of the fall last year was down to the UK burning less gas for electricity because it imported more from France, a large chunk was due to homes and businesses cutting back on electricity amid soaring prices.

Budgets were also "squeezed" by high interest rates, inflation and mortgages, said Glenn Rickson, who analyses the UK power sector for S&P Global Commodity Insights.

Read more on this story here ...

More than 600 Border Force officers at Heathrow Airport will go on a four-day strike from 11 April, the last weekend of the Easter school break, their union has announced.

The officers, who carry out immigration controls and passport checks, have voted to take strike action over a new roster and changes to their shift pattern.

The PCS union has warned the changes could see 250 members of staff lose their jobs by the end of April.

"Ministers have 14 days to withdraw these unfair and unnecessary proposals or our members at Heathrow will take strike action," Fran Heathcote, its general secretary, said.

"Ripping up flexible working arrangements is no way to treat staff especially as the government says their work is critical to our nation's security."

Read more on this story here :

Respected energy consultants Cornwall Insight have predicted the typical household's energy bill will fall to £1,560 a year from July.

That's more than £100 less than the price cap that comes into force on Monday, which is set at £1,690 a year.

However, the leading market researcher's latest prediction is around 7% higher than its previous forecast from around a month ago.

Ofgem changes the price cap every three months based on several factors, the most important of which is the price of energy on wholesale markets.

Wholesale prices recently hit their lowest point for a quarter of a decade, but have risen slightly in recent weeks.

The price cap does not limit a household's total bills - the figures provided are just for an average-use household.

Cornwall Insight also predicts the price cap will rise slightly from the July figure to £1,631 in October.

"With wholesale prices hitting a two-and-a-half-year low, it was only a matter of time before a slight rise occurred as the market stabilises," Dr Craig Lowrey, its principal consultant, said.

"While no household will want to see forecasts rising, it's important to recognise that these do still represent a fall from the new cap coming in from April, itself a large drop."

Uswitch has said the prediction is "another step in the right direction" for households.

Energy expert Will Owen said: "Energy prices are forecast to rise into autumn and winter, so for the many households wanting price certainty, now is a good time to consider fixing.

"We're increasingly seeing suppliers offer better value deals, but Ofgem’s steps to reform the price cap must encourage more innovation from suppliers and bring back competition on price and customer service."

Elon Musk has announced further changes to social media platform X that will see certain accounts get premium features for free.

The tech billionaire, writing on the platform formerly known as Twitter, said all accounts with more than 2,500 verified subscriber followers would be able to access features that usually cost $8 (£6.30) a month.

Premium features include the ability to edit and write longer posts, as well as reducing the number of adverts seen by the user. It also gives the account holder a blue tick next to their display name.

Read more on that story here ...

Disgraced crypto entrepreneur Sam Bankman-Fried has been sentenced to 25 years in prison after being convicted of stealing billions of dollars from his customers.

He was the chief executive of FTX, which suddenly went bankrupt in November 2022 - leaving millions of users frozen out of their accounts and unable to make withdrawals.

Read the full story here ...

Cambridge is considering introducing a tourist tax at its hotels, charging £2 per night.

The city could introduce a local charge on visitors staying in hotels, something that is common in Europe, according to a new report from Cambridge City Council.

It follows the launch of a similar scheme in Manchester last April.

Read more on that here ...

Supermarket giant Asda has apologised as its employees continue to face payroll issues.

Staff said that despite the issue being identified last week, they were still out-of-pocket, with some unable to pay their bills or even rent.

Nearly 10,000 Asda workers received incorrect payslips due to an "IT glitch", with union bosses suggesting some had been underpaid.

One employee told Retail Gazette: "Six days in and my pay has still not be sorted it's a disgrace!"

Another said: "Missing £827 from my wages. Rent direct debit has been declined. Management haven't got a clue what to do. Surely this is illegal. Cannot contact HR directly as have to go through store managers.

"I'm just going round in circles. Angry, upset and ashamed at having to tell my landlord that I can't pay my rent due to Asda not paying me!"

A spokesperson for Asda told Retail Gazette: "While the majority of Asda's 150,000 colleagues were paid correctly this month, we know there have been discrepancies for some hourly paid colleagues."

"We sincerely apologise to those affected and want to reassure them we are proactively resolving this issue by making additional payments as soon as possible."

Sky News has approached Asda for comment.

Thousands of you have left a comment in the form at the top of this page in the past two weeks.

And they fall broadly into three categories: anger, questions and people saying their bosses also swindle them out of annual holiday after this week's Money Problem...

We're going to tackle a few of the employment disputes in our Money Problem series (this runs every Monday) over the coming months and your correspondence has prompted us to write a Basically... feature on employment rights that will be published this coming Tuesday.

Turning to some of your questions , we had this...

What is Labour's position on compensation for Waspi women? Because, hand-on-heart I think if Labour won power they would play the "we haven't got the money card". Worried of Shropshire

As has been widely reported, the government has refused to commit to compensation for women born in the 1950s and affected by how changes to their pension age were brought forward.

Labour, too, has been vague, with shadow women and equalities secretary Anneliese Dodds telling the BBC on Sunday: "Those women deserve respect, that's the most important [thing].

"If I was to sit in your studio and I was to say, plucking out of the air, this is exactly how, for example, compensation should work or other elements of the response to the Waspi women… I don't think they would believe me, frankly, and nor should they."

Another question that landed in our inbox related to our Friday feature about making your supermarket shop healthier for less.

Last Friday focused on bread and concluded that sourdough may be your best option...

Interested in how to buy healthier bread as it can be confusing. I get why sourdough might be healthier because of how it's made. But the question of salt content has not been addressed here. Bread has a significant amount of salt. Does sourdough have less salt? Mrs Helene Shorter

We asked Dr Laura Brown, senior lecturer in nutrition, food and health sciences at Teesside University. She says (as the feature explained) that sourdough isn't the absolute healthiest bread - those would be breads made with whole grains.

And sourdough does have a higher salt content, she says - especially bakery bread, so reading the label and picking wholemeal sourdough are good tips. A high salt content is classed as being more than 1.5g salt per 100g.

All this said, sourdough does have a "great nutritional profile"...

"With sourdough being rich in vitamins and minerals and lower on the glycaemic index, it is a healthier alternative to regular white or whole wheat bread," she says.

Now to anger - which had a broad range of causes...

After our post about the owner of Alton Towers, Madame Tussauds, London Eye and Legoland introducing surge pricing, which makes tickets more or less expensive depending on how busy it is...

Surge pricing on everything from trains, hotels, holidays, flights and now attractions should be banned. These companies should be ashamed of themselves. 1963 stu

We also heard from dozens of pensioners pointing out that the national insurance cut wouldn't benefit them...

Pensioners are much worse off! Council tax, food shopping, house insurance & car insurance almost doubled… Tax threshold never gone up & pension increase puts pensioners into income tax bracket... Lose-lose for pensioners, win-win for this government. Julia choo

We're regularly reporting on house prices - and this week we brought you news about a new £5,000 deposit mortgage aimed at helping first-time buyers.

But will it make a big difference?

As a 23-year-old, it feels like the possibility of owning a home in the UK grows increasingly unlikely every year. Will there ever be a time period where owning your first home will be somewhat more affordable? Abbie

How am I ever going to afford to buy a house when I finish university? Islander

By Brad Young, Money team

On Summer Scholes's 16th birthday, two days after her mum died, the first thing on her mind was getting a job to keep a roof over her head.

It was 2021, and alongside her studies in Margate, Summer said she worked for £4.62 an hour (the minimum wage for under-18s at the time) just so she and her aunt could pay rent and put food in the fridge.

By the time she was 18, last September, she was spending the summer working 50 hours a week in hospitality for £375, while her colleagues aged 21 were legally entitled to at least £134 more for the same job.