Report Description

Table of content, competitive landscape, methodology.

- Consumer Goods

- Travel & Luxury Travel

- Tours and Activities Reservations Market Size, Analysis 2032

Tours and Activities Reservations Market

Segments - by Destination (Domestic and International), Booking Options (Couple, Group, and Solo), Booking Mode (Offline and Online), End-user (Corporate, Pilgrimage, and Recreational), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Global Industry Analysis, Growth, Share, Size, Trends, and Forecast 2024–2032

Debadatta Patel

Fact-checked by:

Partha Paul

Tours and Activities Reservations Market Outlook 2032

The global tours and activities reservations market size was USD 173.0 Billion in 2023 and is projected to reach USD 326.2 Billion by 2032 , expanding at a CAGR of 7.3% during 2024–2032 . The market growth is attributed to the rising demand for online arrangements for traveling. The tours and activities reservation market is experiencing a significant surge, driven by the increasing consumer demand for unique and personalized travel experiences. This sector's growth is further fueled by the rising adoption of digital platforms for booking and managing travel arrangements.

The growing penetration of smartphones and the internet is revolutionizing the way consumers plan and book their travel. Digital platforms are becoming the go-to source for researching, comparing, and booking tours and activities. This trend is expected to continue, providing a significant growth impetus to the market.

Impact of Artificial Intelligence (AI) in Tours and Activities Reservations Market

Artificial Intelligence has a positive impact on the tours and activities reservations market, by transforming the way businesses operate and engage with customers. AI-powered chatbots, for instance, offer 24/7 customer service, handling inquiries and bookings efficiently, reducing operational costs, and enhancing customer experience. Predictive analytics, another AI application, enables businesses to forecast demand accurately, optimize pricing, and manage inventory effectively. Furthermore, AI-driven personalization tools help companies tailor offerings to individual customer preferences, boosting customer satisfaction and loyalty.

Tours and Activities Reservations Market Dynamics

Major drivers.

High demand for online travel arrangements is driving the market. The convenience of online bookings, coupled with the ability to compare prices and read reviews, has made it a preferred method for planning and booking travel. This trend is expected to continue, with more travelers turning to online platforms for their travel needs. Growing urbanization and increasing disposable income are also significant contributors to the growth of the market. With more people moving to cities and having more money to spend, they are anticipated to spend more on travel and experiences. This is particularly true in emerging economies, where the middle class is expanding rapidly. Increasing interest in experiential travel is another driver of the market. More travelers are seeking unique, local experiences rather than traditional sightseeing. This shift in traveler preferences is projected to continue, leading to further growth in the market.

Existing Restraints

The lack of online presence among small and medium-sized enterprises (SMEs) in the market is projected to hamper growth. Many SMEs lack the resources and knowledge to establish an effective online presence, which is increasingly important in today's digital age. This lack of online visibility can limit their reach and potential customer base, thus restraining the overall market growth. The high cost of implementing advanced booking systems is anticipated to restrain the market. Many tour operators, especially those in developing regions, may find it financially challenging to adopt these systems. The high costs not only include the initial purchase and installation but also ongoing maintenance and updates. This financial burden can impede their ability to compete with larger, more technologically advanced companies.

Emerging Opportunities

Increasing usage of social media for travel inspiration creates new opportunities in the market. Travelers are increasingly turning to platforms like Instagram and Pinterest to discover new destinations and experiences. This trend is projected to continue, providing an opportunity for tour and activity providers to reach a larger audience. The growing trend of solo travel is creating opportunities in the market. As more people choose to travel alone, they are likely to book guided tours and activities to meet other travelers and enhance their travel experience. This trend is expected to continue, driving further growth in the market.

Scope of the Tours and Activities Reservations Market Report

The market report includes an assessment of the market trends, segments, and regional markets. Overview and dynamics are included in the report.

Regional Outlook

In terms of region , the global tours and activities reservations market is classified as Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. North America held a major market share in 2023 due to the presence of various tourist attractions, including natural wonders, historical landmarks, and theme parks, which continually attract both domestic and international tourists in the region. The high penetration of internet and smartphone usage in the region has facilitated the growth of online booking platforms, making it easier for consumers to make reservations. Moreover, the robust economy of the U.S. has led to increased disposable income, allowing consumers to spend more on leisure activities. The market in Asia Pacific is projected to grow at a significant pace in the years to come, owing to the rapid urbanization and economic development in China are leading to an increase in disposable income, thereby boosting the demand for tours and activities. The growing digital literacy and smartphone penetration in the region are projected to facilitate the use of online booking platforms. Additionally, the Chinese government's initiatives to promote tourism, such as easing visa policies and investing in infrastructure development, are likely to attract more tourists, both domestically and internationally, thereby fueling the growth of the market in the region.

Tours and Activities Reservations Market Segment Insights

Destination segment analysis.

Based on destination , the tours and activities reservations market is divided into domestic and international. The domestics segment held the major share of the market in 2023, due to the rise in local tourism and the increasing preference for staycations among consumers. The trend of exploring local destinations, coupled with the convenience of booking through digital platforms, significantly contributed to the growth of this segment. Moreover, the surge in domestic travel was further fueled by the restrictions on international travel due to the global pandemic, which encouraged people to discover and appreciate local attractions. The international segment is expected to expand at a significant growth rate in the coming years, owing to the easing of travel restrictions and the pent-up demand for overseas travel. As more people are expected to venture abroad for leisure and experiences, the demand for tours and activities reservations is likely to increase significantly. The growing trend of experiential travel, where tourists seek authentic and immersive experiences in foreign destinations, is also expected to boost the growth of this segment. The increasing use of technology, particularly mobile applications for booking tours and activities, is another factor that is estimated to contribute to the growth of the segment.

Booking Option Segment Analysis

On the basis of booking option , the global market is segregated into couple, group, and solo. The booking option segment held the largest market share in 2023, due to the rise in group travel and the increasing preference for shared experiences among consumers. The trend of exploring destinations with friends, family, or colleagues, coupled with the convenience of booking through digital platforms, significantly contributed to the growth of this segment. The surge in group travel was further fueled by the affordability and the opportunity to share costs, which encouraged people to opt for group bookings. The solo segment is anticipated to grow at a substantial CAGR during the forecast period, owing to the increasing trend of solo travel and the desire for personalized experiences. The demand for solo booking options in tours and activities reservations is likely to increase, as more people are expected to venture out alone for leisure and self-exploration. The growing trend of experiential travel, where tourists seek authentic and immersive experiences, is also expected to boost the growth of this segment. The increasing use of technology, particularly mobile applications for booking tours and activities, is another factor that is estimated to contribute to the growth of the segment.

Booking Mode Segment Analysis

Based on booking mode , the tours and activities reservations market is segmented into offline and online. The online segment led the market in terms of revenue in 2023, owing to the rise in digital literacy and the increasing preference for online transactions among consumers. The trend of booking tours and activities through digital platforms, coupled with the convenience and time-saving aspect of online bookings, significantly contributed to the growth of this segment. The surge in online bookings was further fueled by the global pandemic, which encouraged people to opt for contactless transactions and plan their travel from the safety of their homes. The online booking segment is projected to continue its dominance in the market in the coming years. This growth is anticipated to be driven by the increasing penetration of smartphones and the internet, along with the growing comfort of consumers with online transactions. The demand for online booking options for tours and activities reservations is likely to increase, as more people are expected to opt for digital solutions for their travel needs. Additionally, the growing trend of instant bookings and last-minute travel plans is also expected to boost the growth of this segment.

End-user Segment Analysis

On the basis of end-user , the market is divided into corporate, pilgrimage, and recreational. The corporate segment generated a major revenue share of the market in 2023, due to the rise in corporate travel for business meetings, conferences, and team-building activities. The trend of companies investing in travel experiences for their employees, coupled with the convenience of booking through digital platforms, significantly contributed to the growth of this segment. The recreational segment is expected to lead the market in terms of revenue during the projection period, owing to the increasing disposable income and the growing trend of experiential travel. Additionally, the growing trend of adventure tourism and eco-tourism, where tourists seek unique and sustainable experiences, is also expected to boost the growth of this segment.

Destination

- International

Booking Option

Booking mode.

- Recreational

- Asia Pacific

- North America

- Latin America

- Middle East & Africa

Key Players

- AbodeBookingLimited

- Adventure Office

- Arctic Refrigerations

- BookingBuddy

- Embed, A Helix Leisure Company

Key players competing in the global tours and activities reservations market are AbodeBookingLimited; ACIS; Adventure Office; Apptha; Arctic Refrigerations; Avvio; BookingBuddy; bookingkit, BookIt Ltd, and Embed, A Helix Leisure Company These companies use development strategies including mergers, acquisitions, partnerships, collaboration, and product launches to expand their consumer base worldwide.

Purchase Premium Report

- Single User $4200

- Multi User $5500

- Corporate User $6600

- Online License $2999

- Excel Data Pack $2599

Customize This Report

- Ask for Research To Be Focused On Specific Regions or Segments

- Receive Data As Per Your Format and Definition

- Companies Profiled based on Your Requirements

- Breaking Down Competitive Landscape as per Your Requirements

- Any Level of Customization

Our Clients

We needed a highly accurate and precise report, which delivered promptly. The company compiled information from a wide array of reliable agencies and sourcess.It is extremely satisfactory to be working with you. Strategy Head of Major Tech Company

We were very pleased to contact as they tailored reports precisely as per our requirements. As we are dealing with the aerospace and defense industry, we need reports of high accuracy and substantial quality. Major Player in Defense Industry

Extremely delighted to have a well-crafted report on “Global Packaging Solutions Market Research Report” from your team. Thank you for providing me with all our requirements and for incorporating our suggestions. CMO of Leading Packaging Company from USA

I had a good experience working with as they were very open to all constructive changes in the report. I found that the report had its charm embedded with ample of data. Founder and Managing Partner of Major Korean Company

Our company has been working with for some years now and we are very happy with the quality of the reports provided by the company.I, on behalf of my organization, would like to thank you for offering professional reports. Global Consulting Firm

Quick Contact

+1 909 414 1393

Certified By

Related Reports

Some other reports from this category!

Camping Sleeping Bags Market Report | Global Forecast From 2023 To 2032

Cruise Liners Market Report | Global Forecast From 2023 To 2032

Duty-Free and Travel Retail Market Report | Global Forecast From 2023 To 2032

Duty Free & Travel Retail Market Report | Global Forecast From 2023 To 2032

Business Travel Market Report | Global Forecast From 2023 To 2032

Travel Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Adventure Tourism Market Report | Global Forecast From 2023 To 2032

Cooler Bags Market Report | Global Forecast From 2023 To 2032

Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Leather Luggage Market Research Report 2032

- Free Sample

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

Future of Tours and Activities Tech and Marketing

Related reports, executive summary.

The tours and activities sector remains one of the digital travel industry’s greatest untapped markets. Consumers spend somewhere between $100 billion to $200 billion annually on tours and activities according to some estimates. Now the sector’s huge potential has caught the eye of the travel industry’s biggest companies like TripAdvisor, Expedia and Airbnb, which are ramping up investment, acquisitions and innovation.

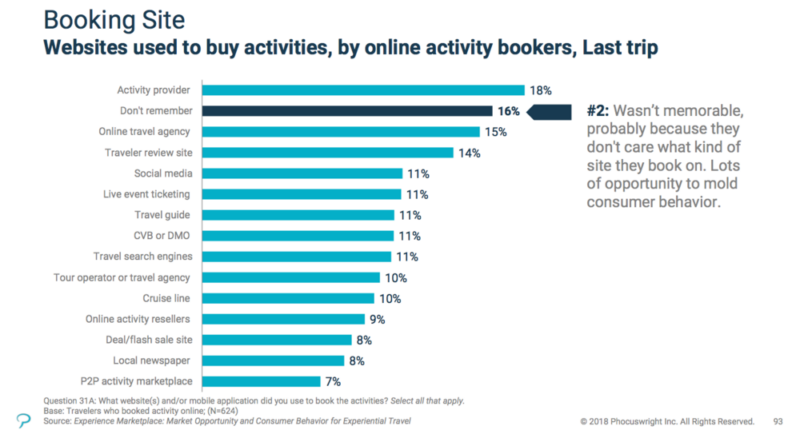

Yet even as competition in the online tours and activities sector ramps up, the market faces a range of challenges. The biggest obstacle is making more tour products available digitally. Research suggests as many as four out of 10 tour operators don’t sell their products online, and one in five don’t have a website. Another issue is consumer behavior. Many travelers wait until they arrive in-destination to make tour purchases, and increasing consumer reliance on mobile devices is putting greater emphasis on tour operators to build mobile-friendly experiences. Trying to standardize products in a highly fragmented tour category is yet another challenge. Tour suppliers sell everything from group trips to theme park admission tickets to airport transfers, complicating efforts to properly merchandize products and help customers comparison shop.

Despite these challenges, a number of new tour business models, strategies and technologies offer potential solutions. A growing number of peer-to-peer tour business models are helping small entrepreneurs bring inventory into the digital age, while more tour operators are figuring out clever ways to use mobile to help improve the tour experience for travelers. Perhaps the biggest insight is that tour operators are finding success selling tours to in-destination locals, not just to travelers.

Skift’s “Future of Tours and Activities Marketing” report reviews the potential size of this growing industry, evaluates the primary obstacles facing tour companies as the industry consolidates and offers a variety of examples of how tour operators are thriving in this dynamic sector.

Introduction

The tours and activities sector has long been a huge opportunity for travel’s biggest digital competitors, representing upwards of $100 billion of spending globally according to some estimates. Now a range of industry consolidation, including TripAdvisor’s $200 million acquisition of online tours and activities booking platform Viator, entries by new players like Airbnb and moves by category giant Expedia, suggest competition and innovation in the space is heating up. Increasingly it seems that the tours and activities business, a sector once dominated by small business owners taking reservations by phone and using pen and paper records, is undergoing an accelerating wave of innovation, driven by new efforts to bring inventory online, new types of tour experiences and new types of tour business models.

TripAdvisor’s $200 million acquisition of Viator in 2014 offers a sign of growing consolidation moves in the tours and activities sector (Viator).

But despite the industry-wide enthusiasm created by the entrance of big players like TripAdvisor and Expedia, the tours and activities operators that form the backbone of the industry still face a range of challenges. Perhaps the biggest is bringing more tour operators online. Even with all the talk of tour consolidation and digital innovation, a significant majority of tour businesses continue to operate under the “pen and paper paradigm,” hindering attempts to make tour inventory more available online. This problem is growing more acute by the day as more and more travel shoppers make their purchases online and with mobile devices, frequently doing so in real-time or within a short window before they travel. In addition, the tours and activities sector represents a huge range of different types of products, from multi-day tours to single-day courses to tickets and live events, creating challenges for effective merchandising and distribution of products in the digital realm.

Even with these obstacles, a number of new tour businesses strategies, tour products and technologies are helping provide solutions. Peer-to-peer tour marketplaces offer new opportunities for budding tour entrepreneurs to quickly get their inventory online, while new styles of geolocation-powered tour experiences let travelers skip intermediaries altogether. Other tour operators are cracking the code on how and when to use mobile to add value to the tour experience. Some tour operators are even finding the biggest opportunity of all is promoting their products not just to travelers, but to locals too.

Skift’s “Future of Tours and Activities Marketing” report examines the opportunities and challenges facing operators in tours and activities sector, reviewing key marketing strategies industry players are using to stay competitive, and tracks the emerging innovations that may impact the digital tours and activities market in the years to come.

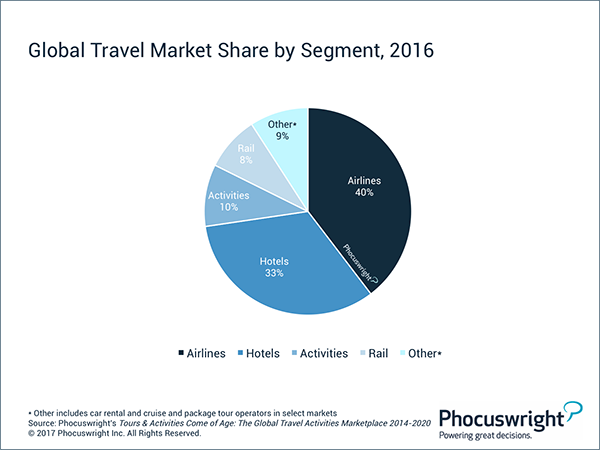

Sizing The Tours and Activities Opportunity

How big is the tours and activities market? Executives close to the sector are quick to remark on its huge untapped potential, and several third-party sources seem to back up the assertion. Take for instance 2011 research by Phocuswright, which suggested the U.S. tours and activities sector represented $27 billion in annual spending 1 . Phocuswright’s assessment of the European tour sector in 2014, by way of comparison, put the region’s annual spending at $41 billion 2 . When examining this number globally, sources suggest the global tours and activities sector tops out somewhere between $100 billion and $200 billion annually.

T.J. Sassani, the CEO of Zozi, a leading online booking marketplace for tours and activities, estimates the U.S. market is worth around $33 billion, while the global industry accounts for $125 billion annually 3 . According to Sassani, his company’s own independent research on the U.S. market’s size suggests the Phocuswright estimate is accurate. “We came up with almost precisely the same number that Phocuswright did,” said Sassani.

But as the conflicting data above suggest, it can be difficult to find up-to-date statistics on the category. This is not only because comprehensive research on the sector is scarce, but also because there is wide discrepancy as to which types of purchases fall under the definition of “tours and activities.” In some cases, the number used by many sources may actually be underestimating the total size of the market.

Take for example one recent investigation by Euromonitor, which examined the wide variety of purchases travelers make while visiting destinations, covering such spending categories as diverse as shopping, food, entertainment and excursions. According to Euromonitor’s research, the “excursions” category accounted for somewhere between $100 billion and $200 billion in global spending in 2015.

Source: Euromonito

However, more interesting was the fact that purchases for shopping, food and entertainment, activities which are increasingly bundled as tour products by some operators, often dwarf spending on purchases traditionally categorized as “excursions,” suggesting a much larger opportunity than may currently be acknowledged.

Consolidation and New Business Models Transform The Industry

Another sign of the growing interest in spending on tours and activities is the increasing wave of industry acquisitions and investment impacting the sector’s main players. The biggest such move may have been TripAdvisor’s $200 million purchase of tours and activities marketplace Viator in 2014 4 . More recently, GetYourGuide, a Berlin-based tours and activities marketplace, announced in 2015 it had received a new $50 million dollar round of investment to help bankroll the company’s continued global expansion 5 . Yet another example is the 2013 acquisition of Isango, a tours and activities startup, by European tour operator TUI Travel 6 .

“Expedia has been in the activities market for a long while and I think they are finally realizing its incredible potential,” said Johannes Reck, CEO of GetYourGuide, in an interview with Skift. “They are putting a lot of resources behind it. We definitely welcome them as a viable player and I think they’ve done a very good job over the past months 8 .”

Perhaps an ever bigger entry is yet to come. Online travel agency Expedia has been making a number of behind-the-scenes business moves, launching a tool to enable real-time tour reviews and repositioning tour products more prominently on its homepage, suggesting the company is planning an entry into the market. As further evidence, Expedia spent an estimated $6.4 million on a national TV advertising campaign in fall 2015 touting the company’s tours and activities offerings 7 . “Expedia has been in the activities market for a long while and I think they are finally realizing its incredible potential,” said Johannes Reck, CEO of GetYourGuide, in an interview with Skift. “They are putting a lot of resources behind it. We definitely welcome them as a viable player and I think they’ve done a very good job over the past months 8 .”

On top of the merger and market moves coming from well-known industry players, other new entrants into the tours and activities space are expanding the overall market for this category of services. Whereas in the past, most tours were led by licensed guides working in concert with a destination’s tourism board, many tour marketplaces increasingly let anyone with a good idea and local expertise set up their own tour business.

Peer-to-peer travel platforms, which for many in the industry currently means car- and accommodation-sharing, are also increasingly eyeing new ways to incorporate tours and activities into their business models. “We’re seeing vacation rental companies looking to beef up their marketing and provide services that their customers want by adding tours and activities,” said Jamie Wong, founder and CEO of tour platform Vayable. “We’re also finding companies that are offering tours and activities and entertainment adding on accommodations. And that’s coming from the business side as well as the consumer side and the supplier side.”

Airbnb’s new experiences marketplace for San Francisco (Airbnb)

The best example of the phenomenon is from Airbnb, which quietly started testing its own peer-to-peer tours marketplace called “Experiences” in 2014, enabling the platform’s hosts to offer local tours to guests in San Francisco 9 . In addition, other market players like Vayable and EatWith are building entirely new platforms to connect local experts directly with travelers, offering a model for anyone with access to destination-specific expertise to sell directly to consumers, rather than selling through traditional tour distribution channels.

Key Challenges For Tour and Activity Operators

For all the evidence of the spending potential and expansion of the tours and activities sector, it faces a number of challenges, Factors like the resistance of some tour operators to selling their products online, travelers’ desire to book in-the-moment purchases on mobile devices and a lack of standardization around different types of tour products still remain to be solved.

Bringing Tours and Activities Online

As it turns out, simply making tour-supplier inventory, which for many years has been sold offline via channels like phone calls, travel agents and hotel concierges, available to more online travel buyers has been difficult. “On the supply side, we haven’t really made all that much progress,” said Stephen Joyce, founder and CEO of Rezgo, a Canadian software company that designs online booking and management software for tour operators. “From an access to supply standpoint we’ve made a little bit of a dent, but there’s still nowhere near the level of [digital] penetration on the supply side that we should be seeing.”

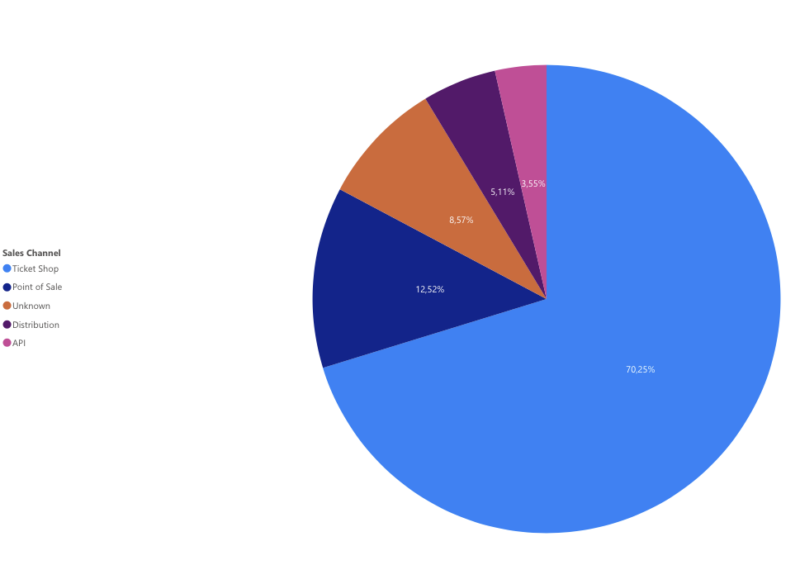

However this isn’t because travel customers don’t want to buy tours online. According to a survey of the most effective booking channels for American and Australian tour operators, conducted by tour technology firm Rezdy, 60 percent of operators reported that their “own website” was the most effective booking channel for their products.

Source: Rezdy, “The Best Tour Operator Booking Channels in 2014”

But despite these effectiveness statistics, many operators haven’t yet taken the digital plunge. According to Phocuswright research on digital penetration of tour operator inventory in North America, a significant number of suppliers are not yet operating online. “Fewer than four in 10 activity operators offer bookings on their websites, and one in five don’t have websites at all,” said Joyce. In addition, the number who use third-party tools to sell their products via an online travel agency or tour marketplace is even lower. “Implementation of CRM or reservation systems is less than 15 percent.”

“Fewer than four in 10 activity operators offer bookings on their websites, and one in five don’t have websites at all,” said Joyce. In addition, the number who use third-party tools to sell their products via an online travel agency or tour marketplace is even lower. “Implementation of CRM or reservation systems is less than 15 percent.”

Other executives from leading online tour platforms companies like Viator acknowledge the enormous challenges, and opportunities, that lie ahead. “It’s one thing getting the content, it’s another to really ensure that this business is automated, so that we can enable last-minute bookings, making it easier for consumers to book online or via their mobile device, as well as being scalable for suppliers to do so,” said Barrie Seidenberg, CEO of Viator, in a November 2015 interview with Eye for Travel 10 .

Why have so many tour operators have resisted going digital for so long? One reason is that tour inventory isn’t as perishable as other travel products like flights or hotel rooms, meaning there’s less need to sell last-minute. “Unlike a hotel which has lots of rooms, which cost money if they’re [not occupied], if tour suppliers don’t have a trip, they’ve got no overhead,” said Jon Fauver, CEO of Trekksoft, a Swiss software firm that provides online booking and payment tools for tour suppliers.

The other reason is it hasn’t been all that lucrative up to now to sell online. “Digital distribution on the tours and activities side only accounts for 8 percent of [tour operators’] online revenues, and online revenues make up 26 percent of their total revenue,” said Joyce. “We’re talking about 8 percent of 26 percent, which is not very much. From an in-destination supplier’s perspective…where’s the pain? Why would I switch over to an electronic system just so I can access maybe an additional 2 percent of revenue?”

For the time being, industry-wide challenges with digital distribution have become a “chicken-and-egg” scenario. Tour operators seem reluctant to invest more on digital commerce until online purchases account for a greater share of their overall revenues. But travelers also seem hesitant to purchase tours online because there’s simply no market-wide leader yet. This may change as players like Expedia with the necessary market clout, consumer awareness and technology infrastructure get more involved in the space. “Viator and GetYourGuide, because they’re very tours and activities-focused, have probably been the best at it. But when you look at the brand penetration of those two companies versus someone like an Expedia, [it’s just not as high],” said Joyce.

Mobile and Last-Minute Booking

Another challenge when it comes to tours is that consumers don’t always book them in advance, making it difficult for operators to keep track of inventory and scheduling. One 2012 study, published by Tourism Australia, looking at the proportion of customers that booked tours before versus after arriving at their destination, found that only 32 percent booked before they arrived, compared to 52 percent who booked on arrival 11 .

Source: Tourism Australia, Distribution 2020: Situational Analysis

Other executives confirm that last-minute mobile booking of tours is increasingly the norm. “For the U.S. and most of the world, the majority of activities are now booked in-destination, last-minute,” said Zozi’s Sassani. “We’re seeing a trend really heavily towards mobile, and we’re seeing with our bookings that greater than half are now booked with mobile.” This represents a significant obstacle for operators selling lower-priced, single-day tours who want to better manage inventory and yields.

The push towards more last-minute purchases also has particular urgency for the tours and activities sector, thanks to the growing consumer comfort with “on-demand” mobile booking services like Uber and HotelTonight. “It’s going to be very difficult to stop the activities booking window moving forward,” said Travis Pittman, founder & CEO of online tour marketplace TourRadar, speaking on a panel about the tours and activities business at the 2015 World Travel Market conference in London. “Everyone is short of time. It’s going to get worse because people will get more spontaneous, they will want to ‘Uberize’ things 12 .”

“It’s going to be very difficult to stop the activities booking window moving forward,” said Travis Pittman, founder & CEO of online tour marketplace TourRadar, speaking on a panel about the tours and activities business at the 2015 World Travel Market conference in London. “Everyone is short of time. It’s going to get worse because people will get more spontaneous, they will want to ‘Uberize’ things 12 .”

So far the digital marketplaces serving the sector have done a decent job building consumer-friendly mobile functionality for tour operators. A look at the mobile apps offered by Viator, Peek and GetYourGuide provide good examples. In addition to using the phone’s location features to suggest locally relevant tour options, many of these apps also focus on the immediacy of travelers searching in a destination at any given moment, offering real-time booking and recommending tours for the same day or within the next several days. “It’s really just about taking that functionality we’ve taken for granted with something like OpenTable and bringing it into this space,” said Ruzwana Bashir, CEO of Peek, an online tours and activities marketplace in a conversation with Re/code 13 .

But as for individual tour operators (many of whom aren’t all that digitally savvy to begin with), developing and launching these types of mobile services is costly and technically challenging. Instead, many are choosing to leave last-minute mobile sales to other players, focusing on building mobile apps and mobile-friendly websites that add additional value to travelers during their trips. “For us, both the app and the mobile-enabled sites have been about improving access and ease of use for travelers, rather than a straight ROI,” said Steve Born, senior vice president of marketing for Globus, one of the world’s largest tour operators, in an interview with Travel Weekly. “Our evaluation of these tools has been as gateways to further research rather than revenue production 14 .”

Industry Fragmentation

Yet another challenge facing the tours and activities sector as it looks to bring its product inventory online is the huge variation in the items sold by different tour operators. For other travel industry categories like hotel rooms and flights, selling their products online is relatively simple because the number of variables involved are limited. “Airfare, hotels and car rentals have been commoditized to the point where consumers can do direct comparisons,” said Rezgo’s Joyce. “All that data is available so it’s much easier to be able to do searches and comparisons on those products.”

With tours and activities, a travel purchase covering everything from multi-day group tours to cooking classes to entrance tickets at amusement parks, trying to explain product distinctions in a consistent way across different websites and operators is challenging. “There are tens of thousands of small operators, and they don’t think collectively at all,” said Rod Cuthbert, the founder of Viator and now CEO of Rome2Rio, a transportation search engine, speaking with Skift in 2013. “The owners of hotels and other businesses in the travel industry are often principally business people, but tour operators are often close to their offering.”

This lack of a collective tours and activities mindset extends to how different types of tour products are merchandised and sold. While a traveler may have very specific criteria in mind when booking a tour (for example, the tour’s price, expertise of its guide, its location or good reviews) the subtleties of these different types of factors can get lost on larger tours and activity booking sites. “Most online intermediaries offer a hodgepodge of options in the ‘things to do’ search results: museums, amusement parks, tours, spa gift cards and airport transfers can all appear in the same result set, usually with no contextualization,” said Douglas Quinby, vp of research for Phocuswright, writing about the tours and activities sector. “Why should a museum tour and an airport transfer appear side by side? 15 ”

A chart illustrating some of the many specialized tour and activity marketplaces that focus on different products offered by Viator (Tnooz)

One solution may be more specialized tour marketplaces that focus only on specific types of tour experiences. For example, a marketplace that just sells transport options, “Experiences are in 20-plus separate verticals, and we should stop treating them like one,” said David Litwak, founder and CEO of transport marketplace Mozio, writing a POV for industry news site Tnooz. “We should be conquering them one vertical at a time, with custom solutions for each vertical. 16 ”

“Experiences are in 20-plus separate verticals, and we should stop treating them like one,” said David Litwak, founder and CEO of transport marketplace Mozio, writing a POV for industry news site Tnooz. “We should be conquering them one vertical at a time, with custom solutions for each vertical.”

Another solution that may fall into place is a more widely agreed-upon set of supply-side APIs, allowing tour operators to easily plug their inventory into distribution sites en masse rather than completing the process manually or piecemeal across multiple competitors. Tour operators mention Viator as one company that’s done a good job pioneering a consistent back-end process to upload products. “Viator is starting to fix this problem, and we link with Viator’s application programming interface [API] now since they show us our live inventory, but I’m not aware of other sites that do that,” said David Naczycz, founder of Urban Oyster Tours 17 .

More important, however, will be the influence of other large online travel industry players who have the market clout and resources to handle all the variables involved. “If you think about that $125 billion global pie, there are lots of slices of that pie you need to solve for with regards to the booking platform,” said Zozi’s Sassani. “Tours, activities, daily rentals, hourly rentals, nightly rentals, lodging components, multi-day operators, ticketing, events, payments, mobile payments, scaling internationally…in order to go about this in a way that scales the industry, it takes a significant amount of capital.”

Emerging Opportunities For Tours and Activities Companies

A number of fundamental challenges remain to be solved before the multi-billion dollar tours and activities market can truly thrive in the increasingly digital world of travel commerce. But that’s not to say innovation and experimentation is not already under way. A number of new business strategies, like promoting tour offerings to locals, and focusing on ever-more-specialized tour products, appear to be working for some tour operators. In addition, new types of tours and new ways of using mobile devices to improve the tour experience are helping operators gain new clients and attract more travel customers.

Catering To Locals and Travelers Alike

Tours are traditionally thought of as any activity for travelers visiting a destination from elsewhere. But as a number of tour industry executives are realizing, there’s an equally large opportunity to cater to in-destination residents as well. “I think the tours and activities market is actually many multiples larger than anybody realizes,” said Sassani. “There’s this whole untapped opportunity to market to not just the people that are looking for a tour or attraction…but really engaging and activating the local consumer [as well].”

“I think the tours and activities market is actually many multiples larger than anybody realizes,” said Sassani. “There’s this whole untapped opportunity to market to not just the people that are looking for a tour or attraction…but really engaging and activating the local consumer [as well].”

From a simple numbers perspective, this approach makes sense. Whereas a traveler might only be in a destination for a single week out of the year, a local customer lives in the destination year-round, offering fifty times the number of purchase opportunities.

Indeed, other executives suggest that locals represent an increasingly important revenue stream for their business. “Today our business is half travelers, half locals,” said Guy Michlin, co-founder and CEO of EatWith. That said, catering to this group creates a new set of marketing challenges. “It’s relatively easy to explain to travelers what [our company] is, it’s the locals that sometimes become challenging in terms of how you explain the value.”

Tour products need not cater exclusively to visitors. Many tour operators are finding that savvy marketing can attract curious locals too. (Flickr)

For the walking tours sector, explaining their value to locals relies on being consistent in product positioning and messaging. “We present ourselves the same regardless of who the client is, but the key is to understand the differences locals and tourists have,” said Seth Kamil, founder of Big Onion Tours in New York City. “Don’t assume base knowledge, don’t over patronize and don’t oversimplify. The key is consistency.” Rather than being one-time customers, Kamil now reports that his tour patrons return four to five times on average, and 40 percent live within 40 miles of Manhattan.

Perhaps more importantly though, tour operators may need to reposition their products beyond the typical tour distribution channels in order to succeed with locals. Whereas a traveler is probably using TripAdvisor to look up potential activities, locals rely on review platforms like Yelp and Google to find local businesses. Some tour industry executives believe the solution lies in ignoring the longstanding marketing wall that exists between “travelers” and locals and simply selling wherever potential customers might be. “Yelp has developed themselves as a local brand, and TripAdvisor has developed themselves as a travel brand. I think that plays into the challenge to capture the local in the tours and activities market,” said Sassani. “In order to do that, your brand has to be positioned towards locals. That’s really our strategy and the way we approach it.”

Empowering DIY Tour Experiences

The peer-to-peer economy has already upended the markets for taxis and accommodations. Now, according to some tour industry executives, it’s increasingly becoming a new business model for aspiring tour entrepreneurs. “We operate in a slightly different space than traditionally what’s been [offered] in the market. Our focus is really on the amateur provider,” said Jamie Wong of Vayable, which offers custom experiences to locals and travelers alike. “The everyday person that’s joining our community and offering a unique experience, which is very distinct from tour operators.”

While these emerging companies offer a wide variety of different experiences or marketplaces, all have been empowered by the technological innovations upending the world of entrepreneurship. Easier-to-use payment processing tools like Square and PayPal, plus more more widely available ticketing services like Zerve and Eventbrite, are making it easier than ever to get started. Some tour operators report younger millennials and more sophisticated travelers are also driving demand for less “cookie-cutter” tour experiences. “It’s also the customer culture,” confirmed Nick Gray, founder of Museum Hack, which offers unexpected guided tours of popular New York museums like the Metropolitan Museum of Art. “I think more people, especially young people, want a non-traditional, boutique, locals-only experience. 18 ”

Another company prospering in this emerging category of DIY, peer-to-peer tour products is EatWith. The company, which connects travelers and locals with chefs for intimate in-home dining experiences, was inspired by an unexpected local dinner experience the founder had while visiting the Mediterranean island of Crete. “I started to think there was an opportunity to create a marketplace to empower home cooks to essentially turn their home into a restaurant,” said EatWith’s Michlin. “We don’t have as many opportunities as we used to in the past to interact with people that are not from our closed circle, and this a new way to meet other people that you otherwise would never have met.”

EatWith connects travelers and locals with chefs for one-of-a-kind dining experiences (EatWith)

Smartphones are yet another tool empowering a new generation of entrepreneurs to create new types of tour experiences. Detour, an interactive audio guide company started by former Groupon CEO Andrew Mason, is one such example. For Mason, the idea for Detour came from a desire for more personalized, customizable tours that went beyond typical pre-packaged experiences. “I want to explore places with the people I’m traveling with, on our terms… but I also want something that’s translating what I’m experiencing and giving me that added layer of context,” said Mason. “When the iPhone came out, it became so clear that it could be a platform for creating that layer of context that plugs people into the world and brings history and culture to life.”

Mason is quick to dispel notions that his company is offering a variation on a traditional audio tour, suggesting that Detour empowers travelers to build their own tour experiences on their own terms. “Not to be overly dramatic, but Detour is like a phoenix rising from the ashes of the guidebook industry for the mobile generation,” said Mason. “We’re not just repackaging guidebooks into the app. Detour is an entirely new user experience.”

Embracing Mobile To Improve The Tour Experience

As more travelers look to book tours last-minute and engage with their devices while traveling, figuring out ways to incorporate mobile into the tour experience has been tough. The biggest challenge for many operators is knowing how to pull off such a feat given the restrictions of budget and technology. “If you want to do something that is really adding value, if you don’t want to only show flight and accommodation, if you want to go further in terms of planning and guidance, there is a technology barrier,” said Frederic de Pardieu, CEO of mTrip, a company that designs mobile products for tour operators. 14

For Trafalgar USA, a tour operator that decided to take the plunge by launching its own app for tour guests, the benefits have been numerous. The company’s app was designed to help participants more quickly form friendships and connections during the tour, and more easily record memories of their experience via an integrated journaling and image sharing feature. “One of the common sentiments expressed by guests is how much they appreciated meeting new people within their travel group and the shared experience within a destination,” said Paul Wiseman, president of Trafalgar USA in an interview with Travel Weekly. “The app enables easy connectivity to new friends even sooner, rather than waiting for the trip to end, and encourages social engagement with family and friends through image sharing and journaling. 14 ”

Trafalgar USA’s myTrafalgar app lets travelers easily create journals and share pictures from their tour with fellow participants (source)

For other other operators, mobile has enabled new opportunities to evolve the way they offer tour experiences. Urban Oyster, a walking tours company in New York, uses a third-party mapping app to share tour routes, dispensing with the usual paper documents that typically get lost or thrown away. “Last year we stopped printing paper maps, and started using an app called Citymaps, and we created maps for all our tours on this app,” said Naczycz. “We found that people always wanted to have a map and wanted it for later to know how to get around. Half the people on our tours actually download it, and particularly millennials use it. 17 ”

Going Niche Rather Than Mass

In a world where travelers have access to more information than ever before, and it can be hard to stand out in online tour marketplaces, many tour operators are finding success by focusing on more one-of-a-kind tour products. This has meant a growing trend toward ever-more specialized tour experiences over more mass-market packaged trips. “In order to stay relevant in today’s marketplace, tour operators do need to offer experiential travel focused on the local people and culture,” said Terry Dale, president and CEO of U.S. Tour Operators Association, in an interview with Travel Weekly. 14

For Whole Journeys, a food-focused tour operator that links travelers with local farmers and food producers on trips around the globe, the company’s approach has evolved along with shifts in the broader consumer mindset around food and cooking. “We were really ahead of ourselves in trying to figure out what active adventure travel was,” said Kathy Dragon, CEO of Whole Journeys. As Dragon notes, the company’s focus has evolved as the trends around the food world have evolved as well. “The last three years that’s changed from traveling with celebrity chefs and learning to cook to traveling to meet the farmers and producers. Everything’s shifting into this mindset of ‘I want to meet the people that are actually making [my food],” said Dragon.

Still, creating these experiences and integrating them into the rigorous schedules of a tour is sometimes easier said than done. As the term implies, “one-of-a-kind” travel experiences are hard to discover and even harder to scale across multiple tour groups and visits. “They’re harder, because you can’t really manufacture them like you can a bike ride,” said Dragon. This is particularly true for visits with farmers, a group that isn’t often known as the most charismatic of performers. “The hardest thing is to see if that person is actually what I call a ‘passionate character,’ because if they’re not, it’s not even interesting to go to.”

For Liesa Bissett, a product development director for Europe and Britain at Trafalgar tours, coordinating these types of experiences requires more work, but is ultimately worth it. “We do as much research as possible before hitting the ground in a destination and knocking on doors and speaking with locals,” said Bissett in an interview with Travel Weekly. “Our connections, which have been built up over the years, have been invaluable with putting us in touch with the right people and finding these rich experiences. Word of mouth is definitely a powerful thing.” 14

Interview – T.J. Sassani, CEO of Zozi

T.J. Sassani is CEO, Chairman and Founder of Zozi, a company that offers a backend reservation management and payments platform for tour operators, plus a consumer-facing tour marketplace. Below are the highlights of Sassani’s conversation with Skift about key challenges faced by the tours sector, how his company is addressing some of the challenges, and how tour operators should think about effective mobile experiences for consumers.

Where does Zozi’s business fit in the tours and activities ecosystem?

Our model has evolved quite a bit over the years. What we’re focusing on now, and what’s really catching a lot of steam, is a two part model similar to OpenTable. We focus first on getting businesses on our SaaS (Software as a Service) platform, and we call that “Zozi Advance.” Online bookings, payments, reservations, mobile payments, etc…We’ve got several thousand businesses using the system now across about 90 countries. [There’s] about a billion dollars going through [our] platform. So we’re the largest in market and we’ve raised about $45 million in funding so far.

We also have Zozi.com, which is our consumer marketplace. We started there, and then put that on autopilot while we were focusing on the reservations platform. We’re now putting a lot more attention back on the consumer piece…So we have both the [consumer] side and the supplier, software side, and we plug that into some of the good distribution channels in the market. We have a partnership with Viator that we’re now integrating and we’re looking at one or two other places that may be able to do some volume for our merchants.

When does the tours and activities industry look like today, at the end of 2015?

If you look back 10 or even just five years ago, the market was really challenged. The reason it was challenged was that merchants were not coming online. They were very slow to adopt technology. You think about the adoption curve across other small business segments that use software. Restaurants adopted software, mind and body [businesses] adopted it and then the fitness market came online.

Now the tours and activities market is really ramping up as well. Interestingly enough, when a lot of the distribution channels started to open up–Viator started getting more steam, TripAdvisor coming into the market–what merchants saw is they now started to have more distribution points, and it went from being a “nice to have” to [needing] a centralized reservations platform to connect to the channels. Otherwise it really made it hard to provide a good customer experience. As of today, only 35 percent of operators have a booking capability on their website and only around 15-20 percent have a sophisticated reservation platform in place.

The second challenge is that because there’s no real centralized reservation system, becoming a marketplace that is truly bookable in real time with on-demand activities is something that’s quite challenging. Viator solved some of that by providing inventory and plugging into some of the systems [already] in the market, but even so, the market is still very fragmented. There’s still a lot of work to do there, but that’s being solved as well.

The third challenge is from the consumer perspective. If you went and polled a hundred people on the street, I don’t think anybody could give you an answer about where they go to book activities. People like Viator do a really fantastic job in their segment focusing on tourists. That’s a fine business to focus on the top five to 10 attractions in any given market, but as a result they’re only focusing on those customers that buy the product once a year. By the time the next occasion comes up, they don’t remember the brand.

How does Zozi hope to address some of these challenges?

The first is own the booking the system and become the de facto platform for these merchants. That’s the hardest challenge. The second is on the consumer side, we believe we should focus on capturing the hearts and minds of the locals first and developing a really strong brand. Because if you can offer it to tourists once a year, you can offer it to locals 51 times a year on the weekends when they’re not traveling.

As a result, when they travel, they already know your brand and you don’t have to reacquire them through ads, they just come to your site. On our consumer site, 90 percent of our sales come from the locals. We haven’t done a whole lot of tourist booking yet, surprisingly. That’s something we’re going to move more into now.

The key thing is having availability. The market can’t sustain 25 or 30 small booking systems all trying to build this giant web of connectivity to each other. There’s just not enough resource for everybody to do that. Our strategy has been raising capital and we’re investing heavily in the technology to bring these merchants online.

How important is mobile for tour operators as an engagement and distribution tool?

It’s incredibly important. We think about mobile through two lenses. One is the merchant lens, where we built a mobile app for them to manage their whole business and access our product through the mobile devices. The reason that was the first thing we did is it helps get more of the merchants online and keeps track of inventory availability in real time and encourages more compliance to adopt a system.

I see a lot of companies in the tours and activities sector launching mobile apps, but we don’t pay any attention because it’s just noise. You can’t just launch a mobile app for activities and have it function like the website and say ‘maybe this stuff is available, maybe it’s not.’

I think the mobile strategy for consumers needs to be entirely different and match with consumer mobile booking behaviors. Now that we have tens of thousands of activities that we have availability on, as we launch our consumer mobile web strategy next year, we will be able to very specifically target consumers with product that we know is available. We’ll also be able to allow merchants to do yield management and say ‘Hey, I’ve got a couple products available this weekend with some extra spots. I want to publish some discounts, I want to drive more volume fill that perishable inventory.’ They can do that through our platform.

There’s a unique value proposition for the mobile strategy, and it’s something people have been going after for a long time. But they’re coming at it from the wrong direction, saying they want to do in-destination marketing and last-minute mobile bookings, but they don’t know the availability and it never ends up getting steam with consumers. You have to build the infrastructure first.

Key Actionable Strategies

Go digital to boost distribution. As obvious as it may seem to suggest selling tour products online in 2015, a significant number of operators still haven’t taken the plunge. The debate is still underway as to which third-party tour marketplace has the best ROI, but at a minimum all operators should set up a bare-bones website to ensure visibility in search to generate more leads.

Move beyond the middle ground. Mass-market tour packages aren’t enough for travelers in today’s hyper-competitive environment. This will be increasingly the case as more inventory becomes available digitally, making it easier for travelers to make direct comparisons of tour packages much like they would a hotel room or flight. Although it will require more legwork to set up, these unique experiences can pay off big thanks to more word of mouth from tour participants and better differentiation versus competitors.

Empower tour partners and customers. As a companion to the previous point, travelers are already demanding more authentic, unexpected experiences when taking tours. Think about how to make it easier for your tour partners to suggest new unexpected tour activities that distinguish your product from your competition. On the flip side, consider how digital tools like mobile can help travelers more easily customize their own tour experiences as they travel.

Think beyond the traveler. Travelers aren’t the only customers who want to have unique experiences. Locals like them too, and they offer a potentially much larger year-round market for tour products. Consider how your tour product might appeal to locals and adjust positioning, distribution and marketing efforts accordingly.

Use mobile to augment the tour experience. Think about how mobile can help add value to the in-destination experience of your tour offering, providing ways for travelers to connect with fellow tour guests, get more information about activities or add context to trip activities. Not every tour operator has the financial or technological savvy to create a branded tour app, but at the very least providers can make their inventory available via mobile by adding products to tour marketplaces like Peek, Viator and GetYourGuide.

Endnotes and Further Reading

- “Special Report: Why the tours and activities market is more hype than the next big thing,” Skift (February 2013)

- “The Best Ways to Find Vacation Tours Online,” The Wall Street Journal (May 2015)

- “The Future of Travel is Local,” The Huffington Post (November 2015)

- “TripAdvisor to buy Viator for $200m,” Travel Weekly (July 2014)

- “GetYourGuide Bags $50M to Grow Its Travel Activities Booking Platform,” TechCrunch (November 2015)

- “TUI Travel makes a bet on tour services with Isango buy,” Skift (February 2013)

- “Expedia Makes a $6.4 Million Bet on Tours and Activities in New TV Advertising,” Skift (October 2015)

- “Expedia Says It’s Serious About Tours and Activities This Time Around,” Skift (August 2015)

- “Airbnb Experiments With ‘Experiences,’ Offering Everything From Bike Tours to Home-Cooked Meals,” TechCrunch (May 2014)

- “The Trouble with Tours, Activities and Ticketing,” Eye for Travel (November 2015)

- “Distribution 2020: Situational Analysis,” Tourism Australia (March 2013)

- “WTM 2015: Tours and activities has seen switch from direct to B2B sales focus,” Travolution (November 2015)

- “Peek Acts as Mobile Concierge to Help You Book Adventures on the Go,” Re/Code (May 2014)

- “Apps and ops: Tour operators step up mobile efforts,” Travel Weekly (August 2015)

- “Three (of Many) Reasons Why Travelers Don’t Book Activities Online,” Phocuswright (October 2015)

- “The tours and activities sector will be carved up,” Tnooz (December 2014)

- “Walking Tours Turn Locals Into Tourists in New York City,” Skift (November 2014)

- “New York Becomes Fertile Hub for Tours Entrepreneurship,” Skift (November 2014)

- “Tour operators respond to the hunger for authenticity,” Travel Weekly (May 2014)

The Global Tours & Activities Market

Delivered june 7th, 2022 . contributors: kej a., key takeaways.

- The global size of the tours and activities reservations market in the year 2020 is $158.5 trillion .

- The global domestic tourism market, as of 2020, had a market size of $1.22 trillion .

- The global travel activities market has an estimated size of $66.84 billion.

Introduction

Global tours and activities reservations market.

- The global tours and activities reservations market was estimated at $158.5 trillion in 2020.

- The market is expected to grow at a CAGR of 7.7% from 2020 to 2027. At this rate, the market will reach an estimated size of $266.7 trillion by 2027.

- The US alone represents about 27% of the global figure, with an annual size of $42.8 trillion .

- China holds the second position, with an estimated market size of $27.6 trillion in 2020. It is expected to continue at a CAGR of 11.7% and reach $59.9 trillion by 2027.

- The following are other key markets and their f o r e c a s t e d CAGR from 2020 to 2027;

- Japan: 4.2%

- Germany: 5%

- Canada: 6.9%

Calculations

Local experiences market (domestic tourism).

- The market size of the global domestic tourism market as of 2020 is $1.22 trillion .

- At a projected CAGR of 13.4% , the market is expected to reach $6.73 trillion by 2030.

- The Asia-Pacific region accounts for the largest share of the domestic tourism market with a 40% market share and is projected to hold this position until 2030.

- Latin America, the Middle East, and Africa (LAMEA) is the fastest-growing region and is expected to grow at a CAGR of 15.7% from 2021 to 2030.

Travel Activities Market

- According to a 2021 report by Research and Markets, the global travel market is expected to grow by $451.19 billion during the forecast period of 2022-2026 at a CAGR of 13.86% .

- Based on these figures , the 2022 market size of the global travel market is estimated to be $668.4 billion.

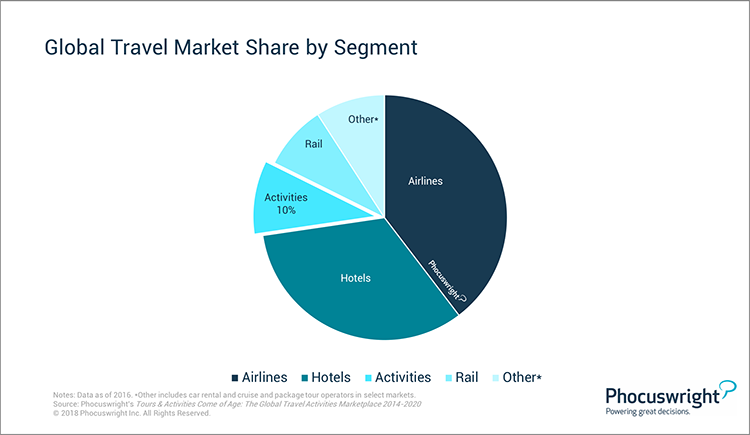

- In 2016, the travel activities market accounted for 10% of the global travel market.

- Assuming that the 10% market share remains constant, the travel activities market has a current size of $66.84 billion.

- The Global Travel Activities Report by Market Reports World is a 126-page p a y w a l l e d research report on the travel activities market, including key players, demographic profile, size, other quantitative information, and distribution by activity and geography.

- Market size 2022 = 1

- Market size 2023 = (1 + 13.86/100) =1.1386

- Market size 2024 = 1.1386 * (1+13.86/100) = 1.296

- Market size 2025 = 1.296 * (1+13.86/100) = 1.473

- Market size 2026 = 1.473 * (1+13.86/100) = 1.675

Research Strategy

Did this report spark your curiosity, global tours and activities reservations industry (2020 to 2027) - market trajectory & analytics, global domestic tourism market to reach $6.73 trillion by 2030: allied market research, global travel market growth outlook 2022-2026: compound annual growth of 13% is forecast during 2022-2026 - researchandmarkets.com, travel activities market to reach $183 billion by 2020: phocuswright.

- Consumer Goods and Services /

- Travel and Tourism

Tours and Activities Reservations: Global Strategic Business Report

- Region: Global

- Global Industry Analysts, Inc

- ID: 5310766

- Description

Table of Contents

Companies mentioned, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Global Tours and Activities Reservations Market to Reach $264.4 Billion by 2030

The u.s. market is estimated at $42.3 billion, while china is forecast to grow at 11.2% cagr, select competitors (total 12 featured) -.

- AbodeBooking

- Adventure Office

- Arctic Refrigerations

- Booking Boss Pty Ltd

- BookingBuddy

What's New?

- Special coverage on Russia-Ukraine war; global inflation; easing of zero-Covid policy in China and its `bumpy` reopening; supply chain disruptions, global trade tensions; and risk of recession.

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies - Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Access to digital archives and the publisher's Research Platform

- Complimentary updates for one year

What is the estimated value of the Global Market for Tours and Activities Reservations?

What is the growth rate of the global market for tours and activities reservations, what is the forecasted size of the global market for tours and activities reservations, who are the key companies in the global market for tours and activities reservations.

- Influencer Market Insights

- World Market Trajectories

- Impact of Covid-19 and a Looming Global Recession

- Tours and Activities Reservations - Global Key Competitors Percentage Market Share in 2022 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2022 (E)

- Table 1: World Tours and Activities Reservations Market Analysis of Annual Sales in US$ Million for Years 2014 through 2030

- Table 2: World Recent Past, Current & Future Analysis for Tours and Activities Reservations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- Table 3: World Historic Review for Tours and Activities Reservations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 4: World 16-Year Perspective for Tours and Activities Reservations by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets for Years 2014, 2023 & 2030

- UNITED STATES

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2023 (E)

- Table 5: USA Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 6: USA Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 7: Canada Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 8: Canada Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2023 (E)

- Table 9: Japan Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 10: Japan Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2023 (E)

- Table 11: China Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 12: China Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2023 (E)

- Table 13: Europe Recent Past, Current & Future Analysis for Tours and Activities Reservations by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- Table 14: Europe Historic Review for Tours and Activities Reservations by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 15: Europe 16-Year Perspective for Tours and Activities Reservations by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets for Years 2014, 2023 & 2030

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2023 (E)

- Table 16: France Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 17: France Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2023 (E)

- Table 18: Germany Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 19: Germany Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 20: Italy Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 21: Italy Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- UNITED KINGDOM

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2023 (E)

- Table 22: UK Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 23: UK Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 24: Spain Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 25: Spain Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 26: Russia Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 27: Russia Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- REST OF EUROPE

- Table 28: Rest of Europe Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 29: Rest of Europe Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- ASIA-PACIFIC

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2023 (E)

- Table 30: Asia-Pacific Recent Past, Current & Future Analysis for Tours and Activities Reservations by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- Table 31: Asia-Pacific Historic Review for Tours and Activities Reservations by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 32: Asia-Pacific 16-Year Perspective for Tours and Activities Reservations by Geographic Region - Percentage Breakdown of Value Sales for Australia, India, South Korea and Rest of Asia-Pacific Markets for Years 2014, 2023 & 2030

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Australia for 2023 (E)

- Table 33: Australia Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 34: Australia Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in India for 2023 (E)

- Table 35: India Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 36: India Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- SOUTH KOREA

- Table 37: South Korea Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 38: South Korea Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- REST OF ASIA-PACIFIC

- Table 39: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- Table 40: Rest of Asia-Pacific Historic Review for Tours and Activities Reservations by Segment - Tours and Activities Reservations Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- LATIN AMERICA

- Tours and Activities Reservations Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Latin America for 2023 (E)

- Table 41: Latin America Recent Past, Current & Future Analysis for Tours and Activities Reservations by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- Table 42: Latin America Historic Review for Tours and Activities Reservations by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- Table 43: Latin America 16-Year Perspective for Tours and Activities Reservations by Geographic Region - Percentage Breakdown of Value Sales for Argentina, Brazil, Mexico and Rest of Latin America Markets for Years 2014, 2023 & 2030

- Table 44: Argentina Recent Past, Current & Future Analysis for Tours and Activities Reservations by Segment - Tours and Activities Reservations - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR