- Home ›

- Travel Money ›

- Turkish Lira

Compare Turkish lira travel money rates

Get the best Turkish lira exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best Turkish lira exchange rate

The lira has been the official currency of Turkey since 1923 after it was introduced by the newly-formed Turkish government in the aftermath of World War I. In recent times, the lira has experienced periods of extreme volatility due to economic and political instability, which have caused its value to plummet and led to a significant devaluation in the Turkish lira exchange rate.

If you're travelling to Turkey, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best Turkish lira exchange rate by comparing a wide range of UK travel money suppliers who have Turkish lira in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best Turkish lira exchange rate right now is 38.1517 from Travel FX . This is based on a comparison of 16 currency suppliers and assumes you were buying £750 worth of Turkish lira for home delivery.

The best Turkish lira exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

Turkish lira rate trend

Over the past 30 days, the Turkish lira rate is up 0.44% from 38.1517 on 28 Feb to 38.3196 today. This means one pound will buy more Turkish lira today than it would have a month ago. Right now, £750 is worth approximately ₺28,739.70 which is ₺125.93 more than you'd have got on 28 Feb.

These are the average Turkish lira rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Turkish lira currency chart .

Timing is key if you want to maximise your Turkish lira, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the Turkish lira rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the Turkish lira rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their Turkish lira as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your Turkish lira sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better Turkish lira rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your Turkish lira first before you collect them from the store so you benefit from the supplier's better online rate.

Turkish lira banknotes and coins

Turkish lira are governed and issued by the Central Bank of Turkey (Türkiye Cumhuriyet Merkez Bankası), while Turkish lira banknotes and coins are produced by the Turkish State Mint and Printing House Corporation which has facilities in Ankara and Istanbul.

One Turkish lira can be subdivded into 100 kuruş (kr). The word 'kuruş' (pronounced 'koo-roosh') means 'fraction' in Turkish.

There are six denominations of Turkish lira banknotes in frequent circulation: ₺5, ₺10, ₺20, ₺50, ₺100 and ₺200. Each denomination features a portrait of a notable Turkish figure on the obverse, and a design inspired by different periods of Turkish history or culture on the reverse.

Coins are available in six denominations: 25 kr, 50 kr and ₺1 which are used most frequently, and 1 kr, 5 kr and 10 kr which are used less-often due to their low values. Although they remain legal tender, 1-kuru coins are no longer minted because the cost of their production is more than their face value. Consequently, most cash transactions in Turkey tend to be rounded up to the nearest 5 or 10 kuruş.

The symbol for Turkish lira (₺) has an interesting history. Unlike most currency symbols which are centuries old, the lira symbol was created by a Turkish citizen after a country-wide competition in 2012. The symbol is based on the letters 'T' and 'L' crossed in the middle by two lines to form an anchor-like shape which is supposed to represent the stability of the lira. The two horizontal lines symbolise Turkey connecting to Europe in the West and Asia in the East.

There's no evidence to suggest that you'll get a better deal if you buy your Turkish lira in Turkey. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your Turkish lira in Turkey:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy Turkish lira when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Turkey

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Tips for saving money while visiting Turkey

Naturally, the cost of a holiday in Turkey will vary depending on where you go and what you do. You can expect to pay more for goods and services in major cities like Ankara and Istanbul which have a higher cost of living than many other parts of Turkey, and resorts on the Aegean Coast tend to be more expensive than those on the Black Sea, but overall Turkey is considered to be an affordable holiday destination for British travellers.

- Plan your itinerary: There are hundreds of free attractions to visit in Turkey: from the Blue Mosque, Hagia Sophia and Grand Bazaar in Istanbul, to the Pamukkale in Denizli which is known for its white terraced pools of mineral-rich hot springs, and the ancient city Ephesus in İzmir which is home to some of the best-preserved ancient structures in the world including the Odeon theater and the Temple of Artemis. Research free attractions in whatever city you're staying in and plan your itinerary around these.

- Use public transport: Local buses are the most affordable way to travel around towns and cities in Turkey, followed by metros. All major cities in Turkey have fast and reliable metros that allow you to travel around the city on a single ticket or a rechargeable card. Or, if you prefer travelling by road, consider using Dolmuş instead of hiring a private taxi or rental car. Dolmuş is a shared taxi or minibus service that operates on a fixed route. It can be a flexible and affordable way to get around, especially in smaller towns and more rural areas.

- Haggle for prices: Haggling is common practice in Turkey, so don't be afraid to haggle for a better price on goods and services. Find out the value of whatever you want to buy by looking around or asking locals, then start by offering a lower price than you're willing to pay. Be prepared to negotiate, and above all; be patient and respectful and you could end up with a bargain!

- Research your accommodation: Instead of booking a hotel, consider staying in a pension. Pensions in Turkey are small, family-run guesthouses that offer budget-friendly accommodation for travellers. They are usually located in historic neighborhoods or in the countryside and they provide an authentic experience compared to staying in a hotel. Pensions usually have basic amenities such as shared bathrooms and simple furnishings, but they provide a comfortable and clean place to stay at an affordable price.

- Eat like a local: Turkey is famous for its affordable and delicious street food. Kebab houses can be found everywhere and they serve a variety of grilled meat dishes including doner kebab, shish kebab, and adana kebab which are typically served with rice, salad, and bread. If your accommodation has a kitchen, consider shopping in the local markets and creating your own Turkish-inspired dishes.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or Turkish lira - always choose Turkish lira. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Best Travel Agencies

Search turkeytravelplanner.com, what cities.

- Aegean Coastal Cities

- Mediterranean Coastal Cities

Turkish Liras & Money in Turkey

Last Updated on June 26, 2023

The official currency as well as the unit of Turkish money is the Turkish Lira (Türk Lirası, TL or TRY) . A unique symbol (₺) was introduced by the Turkish Central Bank to denote the Turkish Lira.

Banknotes are in denominations of 5, 10, 20, 50, 100 and 200 liras.

The lira is divided into 100 Kuruş (koo-ROOSH), with coins in denominations of 10, 25 and 50 (Kuruş). Read more about the history of the Turkish lira which was used before the new Turkish Lira.

Where to Obtain Liras

It's usually best to obtain your Turkish liras in Turkey rather than before you leave home, as the exchange rates outside Turkey are generally not as good as those inside the country.

The easiest way to get cash liras is to stick your home bank card or credit card into a Turkish ATM (bancomat/cashpoint, cash machine). While withdrawing cash, choose the option to be charged in the local currency (Turkish Lira) instead of your home currency to avoid the hidden costs of dynamic currency conversion (DCC).

You can exchange foreign-currency cash at a Currency Exchange Office (Döviz Bürosu). Note that exchange rates at international airports in Turkey are usually worse than rates in city centers. In Istanbul or tourist areas, it’s easy to find places to exchange your money, but you may need to provide your passport and other details at exchange offices in order to exchange money.

Exchange Rates

Here's the current exchange rate for the Turkish Lira Currency Converter

Using Credit and Debit Cards in Turkey

Turkey is a country that happily accepts credit and debit cards , which are widely used in cities and tourist destinations. Remember to inform your bank about your travels to Turkey so that your card doesn't get blocked due to suspicious overseas transactions. Travelers Checks are a bother, and not recommended.

As digital wallets gain popularity around the globe, Turkey is no exception. Mobile payments are becoming more common, particularly in larger cities and tourist destinations. The adoption of mobile payment platforms such as Paycell and BKM Express is on the rise, offering the convenience of secure and quick transactions.

However, not all vendors may accept mobile payments or even debit and credit cards, particularly in rural areas or local markets. Hence, it's still essential to carry some cash in Turkish Lira. Apple Pay, Paypal, Google Pay, and many other global wallets are not currently in use.

Cash vs. Card

While cards are quite popular, cash is used widely in local markets, small shops, or when taking a ride in the famous Turkish dolmuş (minibuses). If you are venturing off the city or visiting smaller towns and villages, you'll definitely need cash. The good news is that ATMs are easy to find in Turkey, so you won't have trouble withdrawing cash when needed.

Tax-Free Shopping

You can benefit from tax-free shopping in Turkey if you're from outside the EU. This means you can get a refund for the VAT you pay on your purchases, but there's a process to follow. First, make sure the store you're shopping at offers Tax-Free Shopping services. When paying, ask for a Tax-Free form. Fill it out and have it stamped by the store. Before you leave Turkey, show your purchases, receipts, and your stamped form at the customs office at the airport to get your VAT refund.

Bargaining and Tipping Customs in Turkey

Don't be scared to bargain while shopping in Turkey, especially in bazaars and markets! It's part of the shopping venture. Start by suggesting a price lower than what you're willing to pay and work from there.

When it comes to tipping, it's a common practice in restaurants, cafes, and taxis. The usual amount is around 10% of the bill, but feel free to give more if you've received excellent service. A service charge might be added to your bill in some upscale restaurants or hotels, in which case extra tipping is unnecessary.

Cost of Living

The cost of living in Turkey varies greatly depending on where you are. Generally, big cities like Istanbul and Ankara are more pricey than the smaller towns and countryside.

For example, a meal at an inexpensive restaurant is quite affordable, but it’s possible to find high-end establishments whose prices mimic the cost of Europe or North America.

Note that Turkey has been facing high levels of inflation in recent years and the prices of goods and services, as well as the exchange rate for foreign currency, can change rapidly. As such, many places that cater to tourists might have a price list in a foreign currency. However, Turkish lira is the only official currency in Turkey and it is always possible to pay in Turkish lira.

Cost of Traveling in Turkey

To give you a rough idea of daily costs, a budget-conscious tourist could get by on less than $100/day. This includes meals at affordable restaurants , public transportation , and budget accommodations. You should budget more if you plan to visit museums and historical sites or enjoy the nightlife.

Tour operators and establishments that cater to tourists will often post their prices in foreign currencies such as USD, Euro, or Sterling.

Read more about the cost of traveling in Turkey.

Banks in Turkey

Banks in Turkey typically operate from 9 am to 5 pm from Monday to Friday. They're usually closed on weekends and public holidays. But don't worry, ATMs are widespread and open 24/7, allowing you to withdraw cash whenever needed. Remember that transactions might come with fees, especially if you're using a foreign bank card.

Safe Travels

Most people in Turkey are welcoming and honest, but like everywhere, a few might try to take advantage of travelers. For example, be cautious of overly friendly strangers inviting you to bars or restaurants, which can lead to abruptly high bills.

Also, be aware of the classic taxi hoaxes, where drivers take longer routes to charge more or use rigged meters. Always demand using the meter in taxis, and consider using ride-hailing apps like BiTaksi, which offer transparent pricing.

—by Tom Brosnahan , updated by Can Turan

Turkish Bills/Notes

ATMs (Auto Teller Machines)

Credit Cards

Travelers Checks

Travel Details FAQ

Quickest Transfer service in Istanbul

One of our top Agencies for tours in Turkey

Turkey: What It Costs

Currency Exchange Rates

Shopping in Turkey

Bargaining/Haggling

Visit our Facebook group:

- Maps of Turkey

- Best Guided Tours

- Travel Agents

- Private Tour Guides

- Turkish Money

- What it Costs

- Photo Gallery

- Special Interests

- Trip Consulations

- Travel Details FAQs

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Best places to buy Turkish lira in the USA

If you have a trip to Türkiye planned, you’ll need to work out the best way to get Turkish lira to pay for things while you’re there. While carrying TRY cash is a popular option, you might find using a travel card is cheaper and more convenient - and more secure than carrying a lot of cash too.

Where to buy Turkish lira in the US

When it comes to getting Turkish lira for your trip, you’ve got several different options, including taking cash in USD to exchange, converting to TRY online before you travel or at the airport, or picking up a travel money card for convenient spending and cash withdrawals in Turkish lira on arrival in Türkiye.

Each option has its own features, fees, pros and cons. Which is best for you will depend a lot on your personal preferences - this guide will help you pick the right one based on convenience, cost, availability and more.

Turkish lira travel money card

Travel money cards and international prepaid debit cards are a safe and convenient way to spend in Turkish lira - and if you pick the right one they could help you save on currency conversion, too. Top up your card balance in dollars and convert those dollars to TRY to spend in stores and restaurants, or withdraw cash from ATMs when you need it. Easy.

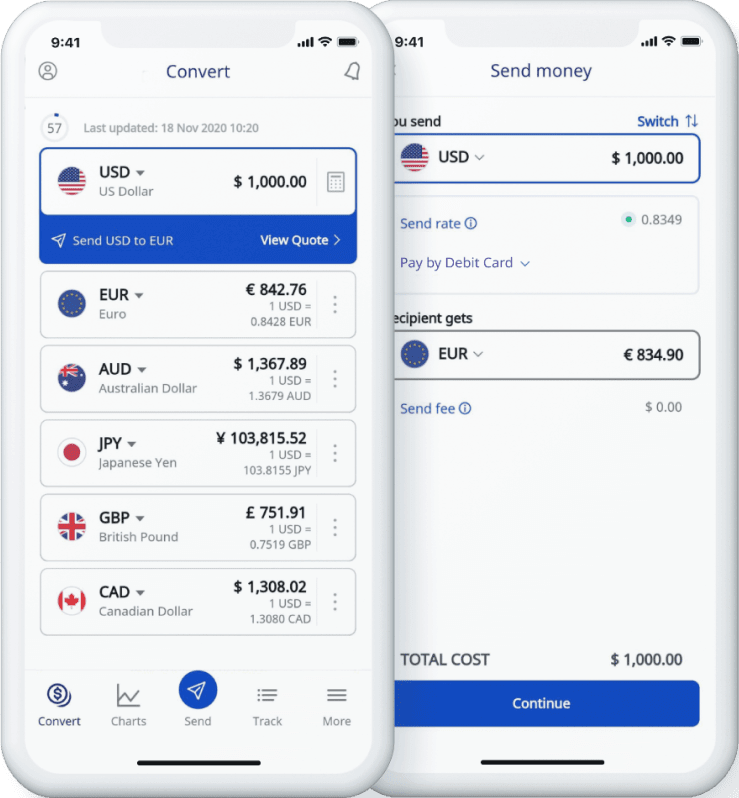

Learn more about the best Turkish lira cards in the US. Let's look at Wise card and Revolut card more in detail:

Wise debit card

With the Wise travel money card you’ll get the mid-market exchange rate whenever you need to switch from dollars to TRY. It’s free to spend Turkish lira when you have enough balance in your Wise account - or if you’d prefer, just leave your money in dollars and let your Wise card do the conversion when you make a purchase, with the mid-market exchange rate and low fees. You can also withdraw liras from an ATM whenever you need them - giving you the safety of spending with a card, and the convenience of cash.

It’s free to open a Wise account , with a one time fee of 9 USD for the Wise debit card. Switching from one currency to another costs from 0.43% with Wise - with the mid-market exchange rate , so you can see exactly what you’re spending, and how much your travel money is costing you.

You're not limited to buying and holding Turkish lira with Wise; you can hold balances in 40+ currencies , plus you can get local bank details to receive payments conveniently to Wise in a selection of global currencies.

Want to learn more? Click here to read Wise card review

Revolut debit card

Open a Revolut account online and order your travel money card, to start spending in 150+ countries . You’ll be able to choose from a Standard account which has no monthly fee to pay, or upgrade to an account with a monthly fee which also unlocks extra perks and benefits. All account tiers offer some no-fee currency conversion, and some no-fee international ATM withdrawals, with fair usage fees applied once your account plan allowances run out.

Revolut accounts can be used to hold and exchange 25+ currencies and depending on which plan you pick you could also get handy benefits like some travel insurance and airport lounge access, to make your trip more comfortable.

Buy TRY online

Often this is one of the best ways to buy Turkish lira, based on convenience and cost. You won’t even need to leave home to order your money - and the dollar to Turkish lira exchange rate might be better online , to give you more Turkish lira for your US dollars. You can reserve your order, pick it up in a store or even have it delivered to your door, depending on which provider you pick.

If you’d prefer to use a travel money card, you can also get that set up online. Open a digital multi-currency account with a provider like Wise or Revolut , get your card, and simply make an ATM withdrawal once you arrive in Turkey to get your TRY cash. That means you don’t need to collect your travel money in advance, making the process fast and easy.

Go to Wise Go to Revolut

Want to learn more? Read Wise account review and Revolut review

Currency Exchange International (CXI)

Currency Exchange International specializes in providing foreign currency exchange at great rates with superior customer service. CXI owns and operates 30+ of its own branch locations across the United States, as well as working through affiliates to extend branch services - plus you can order foreign currency online through its website.

Buying liras online for home delivery is easy with CXI. Select from more than 90 foreign currencies and receive it as soon as the next day. Available in most areas.

Want to learn more? Click here to read CXI review

You can buy TRY with dollars at major banks like Wells Fargo and Bank of America . You will need to be a bank customer already and can order Turkish lira online easily. Banks do offer a wide range of currencies that you can buy but make sure you spend your foreign currency overseas because you might not be able to convert it back to dollars when you get back home.

In some cases, you can choose to receive your order in small, large or mixed denominations but it is subject to availability. Currency exchange services offered by the bank might not offer the best TRY to US dollar rates but they are convenient, particularly if you are an existing customer.

When you buy Turkish lira from the bank you can pay with credit card, cash or from one of your bank accounts.

Foreign Currency Exchange

Money changers are another option to buy Turkish lira in cash. However, it can be hard to find them outside of the city and they may not stock less common currencies.

Often the exchange rates are on a board facing the front of the shop, so finding the USD to TRY rate is easy. Ask what transaction fees they charge for the foreign exchange and if it costs more to pay with credit cards - and bear in mind that the exchange rate you get is likely to include a markup, which is a fee added onto the mid-market rate.

It’s good to know that you’ll often find that the exchange rates are better in major cities where competition drives down overall cost - that can make it well worth going to a city center if you're exchanging high value amounts.

Yes, you can buy currency at the airport. But that doesn't mean you should. While it's convenient, it's also often very expensive , which can mean that you receive less TRY for your USD at the airport. Most airport currency exchange services accept cash and credit cards.

Ordering your Turkish lira online and picking it up at the airport can be cheaper than buying TRY on the spot when you arrive for your flight. However, because of the costs overall, if you've run out of time before your trip, it might be better to buy your Turkish lira when you get to your destination, or use your cards instead, to make an ATM withdrawal on arrival in Turkey.

What is the cheapest way to buy Turkish lira in the US?

The cheapest way to buy Turkish lira in the US is usually online. You’ll have a couple of options, depending on what suits your needs:

Choose a specialist provider which has multi-currency accounts to support international spending - like Wise or Revolut

Use an online money exchange service, and collect your foreign cash or have it delivered to you - in this case, you may pay an exchange rate markup, which is an extra fee

Your other alternatives include getting your cash at your bank, or at the airport. Banks may not have any conversion fee advertised, but that doesn’t necessarily mean the service is actually free. The costs are often simply added into the exchange rate used for conversion, which can make them harder to spot.

Of course, you also have the option to buy Turkish lira at the airport. However, this can be very expensive compared to buying your Turkish lira online before you head off, simply because airport exchange services know you have no other options until you get to your destination. That can mean high commission fees and very poor foreign exchange rates.

How to get Turkish lira in the US

There are a few different ways to get Turkish lira in the US, so you can pick the method that suits you best. Each service will have its own process, so whichever way you choose, you’ll want to check directly with the provider you choose to make sure you know exactly what’s required to get your TRY conveniently and without unnecessary delays.

Usually if you plan to get foreign currency cash through a bank or a specialist travel money service, you’ll need to visit a branch or agent location, and take along your USD in cash, or a card to pay for your Turkish lira. Assuming the bank or currency exchange office you visit has enough TRY in stock, you’ll be able to take away your travel money instantly.

However, picking up your Turkish lira in person is not necessarily the most convenient choice. In many cases, you’ll also have the option to arrange your TRY online, which means you can get everything organised without needing to take extra time out of your day to go to the bank.

How to buy Turkish lira online

Often buying foreign currency online is more convenient than visiting a branch in person. One great option is to sign up for a multi-currency account with a linked card which lets you manage your account digitally and make cash withdrawals. Specialist non-bank providers like Wise and Revolut both offer convenient ways to hold, exchange and spend in a broad selection of foreign currencies, with easy to manage accounts you can access from your phone.

To buy Turkish lira online with a specialist provider that offers multi-currency accounts or travel cards, you’ll usually need to:

Head to the provider’s website or download their app

Hit Sign Up, add your personal details and create a password

Get verified by uploading images of your ID documents - you might also need a proof of address

Add some money to your account in USD, for spending later

Depending on the provider you pick, you can order a linked international debit card to spend while you’re away, or you can convert to the currency you need to make online payments. Some providers can issue you a virtual card instantly for online spending, and once you have your physical card you can withdraw cash as you travel for convenience.

If you’re keen to have travel money in your pocket before you leave the US, you can also choose to order cash in Turkish lira online and either collect it or have it delivered to your home address. That can be a convenient option, and gives you the reassurance that you’ll have access to TRY even before you travel.

To buy Turkish lira for cash spending with an online money exchange service, you’ll usually need to:

Visit the provider’s website, and place an order for your currency

Decide if you want to have your money delivered, or collect your cash at an agent location

Make payment for your foreign currency in USD

When you collect your cash, or when it’s delivered you’ll need to show a valid ID document

Where can I exchange USD to TRY

Your options to exchange USD to TRY broadly split into two categories: ways to get Turkish lira online, and ways to get Turkish lira through a physical location.

Online, you can order foreign currency cash to collect or for delivery through a specialist service or your bank. Or you could open a multi-currency account with a specialist service like Wise or Revolut , and order a travel money card you can use to spend and make withdrawals in Turkish lira and in many other supported currencies, too.

If you’d rather set up your travel money in person you can do so by visiting a currency exchange store or bank and paying for your Turkish lira in cash or with a card. You can also exchange money at the airport before you leave the US - but this often costs more overall, so do check the exchange rates available before you get started.

Go to Wise Go to Revolut With multi-currency accounts, you can also open a bank account in Turkey . In your Wise account , you can open a TRY balance, get local account details in Türkiye, hold and exchange Turkish lira using mid-market exchange rate.

Where can I get the best exchange rate for Turkish lira?

There’s no single best provider when it comes to exchange rates. Different services set their own rates which may vary based on the currency, the amount you want to exchange, how you want to pay, and whether you’re exchanging money in a digital account or for physical cash.

Generally, looking for a service which has transparent exchange rates which are the same as - or close to - the mid-market exchange rates is a good idea. You can compare a few live exchange rates for popular providers using the Exiap tools, to see which works best based on the specific transaction you want to make.

Let’s take a look at the exchange rates you might be able to find through some different exchange services:

- Wise exchange rate : mid-market exchange rates with transparent conversion fees split out, from 0.43%

- Revolut exchange rate: all accounts have some currency conversion which uses the mid-market rate - fair usage fees apply once you’ve exhausted your plan limits

- Currency exchange international: exchange rates are likely to include a markup, but tellers in physical locations may offer to match or beat other local bank and airport exchange rates if you ask

- Banks: exchange rates usually include a variable markup which is added on to the mid-market exchange rate

- Currency exchange offices: exchange rates usually include a markup which is added on to the mid-market exchange rate - the amount of markup used does vary, so looking for a service in a city center where providers compete may mean you get a better rate

- Airports: exchange rates usually include a markup which is added on to the mid-market exchange rate - because of a lack of competition this can be a pretty high fee

Conclusion: Best ways to buy Turkish lira in the US

The good news is that you have several different options to buy Turkish lira in the US - which means that with a bit of research you’ll find the right one for your specific needs.

Generally your options will include heading to a physical location - like your bank or a currency exchange store - to buy your TRY cash; or arranging your exchange online. Ordering your foreign currency online, or opening a multi-currency account and getting a linked debit card for spending in Turkish lira means you can get everything organized without even needing to leave home. You may also get better exchange rates and lower overall costs, depending on which service you select.

Check out Wise and Revolut as good options for convenient spending in Turkish lira, with fair exchange rates and low overall fees. With Wise you can open a free online account to hold and exchange 40+ currencies, and spend with your card in 150+ countries. All currency exchange uses the mid-market exchange rate with fees from just 0.43%.

Revolut lets you hold and exchange 25+ popular currencies - and you can pick the account tier which meets your needs, depending on how often you’ll transact and which features you’ll use. All accounts offer some currency exchange which uses the mid-market exchange rate , and some no-fee ATM withdrawals, with fair usage fees once you exhaust your specific plan limits.

How to buy Turkish lira FAQs

Is it cheaper to buy turkish lira in the us or in turkey.

Whether it’s cheaper to buy Turkish lira at home or once you arrive in Türkiye depends a lot on the exchange rates you’re able to find online or in physical exchange stores locally. As an alternative, travel money cards from providers like Wise and Revolut give the convenience of using a card with the flexibility of being able to withdraw cash at an ATM in Türkiye with good exchange rates and low fees, making them a great choice for many travelers.

Should I get Turkish lira before going to Turkey?

Getting your travel money in advance means you’ll save time once you’re on your trip, but you’ll need to shop around to get a good deal. Take a look at options like Wise and Revolut which offer convenient and flexible digital accounts you can use to hold and spend in Turkish lira conveniently.

What is the best way to get Turkish lira for travel?

There’s no single best way to get your Turkish lira for your trip. Compare a few services using the handy Exiap tools, including physical exchange locations and convenient digital alternatives, like Wise and Revolut, to find the best option for your needs.

How long does it take to get Turkish lira?

If you’re ordering cash in Turkish lira you may be able to collect it instantly or on the same day, depending on the provider you pick. Home delivery of currency usually takes a few days. Getting a travel money card from a service like Wise or Revolut allows you to add USD instantly, and then spend or make withdrawals in cash in TRY as soon as you arrive, so you can access Turkish lira right away.

How to get the best exchange rate for Turkish lira?

You’ll need to shop around to get the best exchange rate for Turkish lira, including physical locations and banks, and digital and online services like Wise and Revolut. The good news is that Exiap has lots of handy comparison tools to let you see live exchange rates, fees and more. Use these to kickstart your research and get the best deal for your specific needs.

Best Place to Buy Turkish Lira in the USA Without Huge Fees

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Preparing for your travels to Turkey? You may be wondering whether you should prepare some Turkish Lira in cash prior to your departure, or if its cheaper to simple use your cards in Turkey after arrival.

In this guide, we will explore the best overall place to get Turkish Lira online in the USA, which is with a travel money card like Revolut or Wise . If you'd like to simply withdraw Turkish Lira in cash from an ATM in Turkey, we will explain how to do so without incurring unnecessary fees.

We'll cover the costs, and the pros and cons, involved for each method. By understanding your options and their fees up front, you can enjoy the peace of mind that you're getting the best deal for your situation.

We highly recommend Revolut 's travel debit card to buy Turkish Lira in the USA cheaply. Revolut is a multi-currency account that allows you to hold and exchange US Dollars, Turkish Lira, and over 30 other foreign currencies at industry-low, transparent fees and exchange rates. Best of all, you can easily do this online or straight from the app!

The Best Places to Buy Turkish Lira in the USA

- 01. Turkish Lira travel money card scroll down

- 02. ATMs abroad via travel debit card scroll down

- 03. Online foreign currency exchange scroll down

- 04. Traditional banks scroll down

- 05. Money changer kiosks scroll down

- 06. Airport kiosks scroll down

- 07. Summary: Where to buy Turkish Lira in the USA scroll down

1. Turkish Lira Travel Money Card

Travel money cards are prepaid debit cards that let you hold the local currency of your destination (TRY) so that ATMs and point-of-sale devices treat you like a local card holder. Simply top up your card balance in US Dollars and convert those balances to Turkish Lira. Then use your card to pay with peace of mind like a local.

User-friendly fintech apps like Revolut and Wise far and away offer superior rates when compared to banks and bureau de change kiosks. Since you can download the apps and use their virtual cards directly onto your smartphone, we also consider them to be more convenient. Compare the in more detail with our in-depth prepaid travel card guide .

Revolut Account

Revolut charges no foreign transaction fees on the first $1,000 spent per month and no ATM fees on the first $1,000 per month, although fair use limits and weekend surcharges may apply. This ATM policy is far more generous than other competitors such as Wise , Monzo , and Monese . If you're in a rush, you'll still be able to access Revolut's instant virtual card from the app and add it Apple Pay, Google Pay, and other third-party digital wallets.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Wise Multi-Currency Account

Unlike banks, credit unions, airport kiosks, and foreign ATMs , Wise is transparent about never charging a hidden exchange rate margin when you convert your dollars into euros (and 51 other currencies) with them. The live rate you see on Google or XE.com is the one you get with Wise . Instead, they charge an industry-low commission fee, which ranges from 0.35% to 2.85%.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

2. ATMs Abroad Using a Debit Card With No Foreign Transaction Fees

We recommend getting Turkish Lira in cash from ATMs with debit cards because credit cards with charge you cash advance fees and high APR on ATM withdrawals. Plus, debit cards will use exchange rates set by your card network (like Visa and Mastercard ), which are near the mid-market rate.

Foreign transaction fees are fixed percentage fees (usually around 2.5%) that card issuers will tack on to the purchase price. These fees pile up when you travel and spend internationally, which is why you should always travel with a card that waives foreign transaction fees .

Travel Tip: Read more about the 5 best debit cards that waives international transaction fees .

Always Pay in the Local Currency

- When the point-of-sale machine or ATM in Turkey ask you to "Pay in TRY" or "Pay in USD", always opt to pay in the local currency: Pay in TRY.

Learn more about dynamic currency conversions .

3. Online Foreign Currency Exchange

Online foreign currency exchange services are convenient and can be reasonably priced if you order a few weeks in advance. Take note to not pay with a credit card because your card provider will treat it like a cash advance, which will incur fixed fees and APR costs. When you order Turkish Lira in cash online, foreign exchange service providers will charge you two kinds of fees:

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

In-Person Cash Pick-Up

Most services allow you to visit a local branch in your neighborhood to pick up your cash. This is usually a no-cost service.

Home Delivery

For added convenience, you can pay a delivery fee to have the money sent to your designated address on a set date and time.

4. Traditional Banks

Despite commonly heard advice, banks and credit unions are outdated currency exchange providers. Many banks offer foreign exchange services online, but you may need to be a client of the bank. You can pay by cash, card, or with your existing account balances.

For illustration, we found that Bank of America was converting €1,000 EUR into $1010.60 USD even though the mid-market exchange rate was at €1,000 EUR = $1,063.60 USD*. That's a markup worth $53.

*Exchange rates recorded on 22 September 2023 12:55 CEST.

We generally recommend against getting Turkish Lira from your traditional bank or credit union.

5. Money Changer Kiosks

Money changers generally charge high exchange rate margins, like banks and online foreign exchange services. We tend to treat these providers in the same category as airport bureau de change. Even if they advertise "no commission," you will still incur the hidden cost of the exchange rate margin.

While these kiosks may be conveniently located in cities and tourist attractions, we recommend going to bank ATM instead, using a prepaid travel card or a debit card that waives foreign transaction fees .

6. Airport Bureau de Change Kiosks

While bureaux de change at airports in the USA may be convenient for last-second exchanges, they charge huge exchange rate margins and hefty commission fees. They should be avoided at all costs.

If you need cash for your trip to Turkey, we recommend that you withdraw cash from an ATM abroad, using a prepaid travel card or a debit card that waives foreign transaction fees .

Summary: Best Place to Buy Turkish Lira in the USA

Each method to get Turkish Lira in the USA will have its conveniences and drawbacks depending on your situation.

Here is a summary of the best places to buy TRY with USD:

- Prepaid Travel Money Card: Compare the best travel money cards .

- ATM with Debit Card: The top 5 that waive foreign transaction fees .

- Online Foreign Currency Exchange Service: Learn about travel money .

- Traditional Banks: Explore bank currency exchange .

- Money Changer Kiosks: Find the best way to spend money abroad .

- Airport Bureau de Change: Use ATMs abroad as better alternatives .

Frequently Asked Questions About How to Get Turkish Lira in the USA

We generally only recommend getting Turkish Lira in the USA if you open a free multi-currency account from Revolut or Wise . If you want Turkish Lira while in Turkey, then it is best to simply get cash from an ATM there.

You can use any of the 6 methods included in this article. We recommend travel money card, which let you hold TRY via a multi-currency account and spend them with a card.

Yes, you can exchange for Turkish Lira at a bank in the USA. However, it is generally expensive because they may charge commission fees and very high exchange rate margins.

- Open an account with Revolut or Wise ;

- Access your account online by desktop or by smartphone;

- Top up USD onto the multi-currency account;

- Convert the USD to TRY using their industry-low rates.

It depends on your method. If you want to get Turkish Lira in the USA, then we recommend you open an account with a multi-currency account like Revolut or Wise . If you want Turkish Lira while in Turkey, then its best to get cash from an ATM.

Currency exchange rates are constantly in flux due to market fluctuations. This is why we recommend multi-currency account like Revolut or Wise . They have features that let you lock in a desired exchange rate, which will trigger a conversion if met by the mid-market rate.

Learn More About Where to Best Buy Foreign Currency in the USA

Find the Best Places to Buy Other Foreign Currencies in the USA

Why trust monito.

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Compare turkish lira travel money rates

- buy Currency

What Currency do you want to buy?

How much do you want to spend.

- Hays Travel

Hays Travel offers 0% commission on currency and has hundreds of branches on the high street across the UK.

Order Limits and Fees

Company Name: Hays Travel

Payment Options: Bank Transfer, Debit Card

Address: Gilbridge House, Keel Square, Sunderland, Tyne and Wear SR1 3HA

Minimum Order: £200

Maximum Order: £2,500

Minimum order amount for free delivery: £500

Debit Card Charge: NA

Credit Card Charge: NA

Collection available: ✔

What is the Best Turkish Lira Exchange Rate Today?

The best place to buy turkish lira today is Natwest.

The worst exchange rate is 34.7032. The difference between the highest and the lowest exchange rate is 9.12. This means that if you are buying £750 worth of turkish lira you will get ₺2612.10 more turkish lira by buying with the best provider.

This shows you it pays to shop around and get the best turkish lira rates!

Turkish lira exchange rate over the last week.

This shows you the pound sterling to turkish lira exchange rate recorded daily from our UK suppliers over the last week.

In the last 7 days, the exchange rate for turkish lira has risen by 1.18%.

If you were to order £1,000 today you would get ₺449.20 more turkish lira for your money than last week.

How do we source the data above? We receive rate feeds travel money suppliers and aggreate the data each evening we save the average rate that occured during the day, and also include the current best rate

How to get the best turkish lira exchange rate.

We compare pound to turkish lira rates from many of the UK’s best companies including exclusively online providers as well as some of the well-known high street banks and supermarket travel money services. Our clever algorithms ensure you find the best place to buy turkish lira.

Compare Travel cash is a free compare travel money service that takes the pain and effort out of finding the best exchange rates for buying turkish lira online. Don't forget the price we quote is the price you pay, we calculate the amount including any fees and delivery costs!

Buying Turkish Lira online FAQs

Hundreds of customers safely buy turkish lira through online travel money providers sites every day and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transferring money to any company. Compare Travel Cash undertake comprehensive checks on all of our online travel money providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own research before placing an order with any company.

It's simple! Choose the travel money provider you would like to buy turkish lira from, then:

Not Usually! We constantly update our exchange rates as they change for each supplier, we try to do this in almost real-time, (in normal circumstances not more than 1-minute difference). Also, we sometimes have exclusive offers that you won't find by going direct.

Of course, most companies offer a buyback service for your unused currency! If you want to exchange your leftover turkish lira into pounds you can see the best buy back rate on turkish lira and many other currencies using our buy back comparison tool . Remember most buybacks are only possible for notes, not turkish lira coins.

You can use your Turkish lira in Turkey and also in Northern Cyprus.

Each provider will have different rules on the maximum amount of currency you can buy.

Some providers will allow you to order large amounts, but we suggest you check the terms and conditions before you place an order if you are ordering a large amount.

Also, consider that currently you are only allowed to carry 5,000 USD. If you take more than this you have a legal obligation to inform customs. Note, this amount is per person so if you are travelling with more cash than this you can distribute it to your fellow travellers. Therefore, it is important to check all of this before you convert your gbp to Turkish lira.

You will only be able to order notes, not coins.

If you require specific denominations consult with the provider first to ensure they offer this service when buying Turkish lira. Most will charge for this, but we find most providers supply a mixed selection of denominations. If a supplier does not specifically offer this service, contact them and ask them if they can provide the dollar denominations you require, they may do this for free depending on their stock levels!

Currently there are 5, 10, 20, 50, 100 and 200 lira banknotes.

Even though these sites don't supply coins, the coins you can get in Turkey are 5, 10, 25 and 50 kurus.

The short answer is, that it is very difficult to time your order of dollars correctly to attain the best exchange rate. There are so many factors affecting the lira exchange rate it is impossible to pin down a time when rates are best.

The prudent thing to do is to research to find the best Pounds to Turkish lira exchange rate using our comparison engine and obtain the best rate you can on the day you want to buy your currency. If you are short on time and need your currency on a specific date, we suggest buying with time to spare. All providers will use Royal Mail special delivery and in recent times we have seen delays in some cases, so leave as much time as you can to ensure you have your currency comfortably before your departure date.

Buying Turkish lira in Turkey is almost always more expensive.

To avoid any surprises and to ensure you have a hassle-free trip we suggest buying lira before you travel.

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency Online Group

- Covent Garden FX

- The Currency Club

- Sterling FX

- Sainsburys Bank

- Thomas Cook Money

- Post Office

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registrtion Number 12065287

- Buy US Dollars

- Buy travel money

- sell unused travel cash

CompareTravelCash.co.uk is a price comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Exchange Rates UK

Your live currency exchange rates website.

- Compare Exchange Rates

- Currency Exchange Rates

- Currency Rates Cross Table

- Exchange Rates Today

- Country Codes

- Currency Symbols

- Todays Top Movers

- Pounds to Euros

- Pounds to Dollars

- Pounds to NZ Dollars

- Pounds to AUS Dollars

- Pounds to CAD Dollars

- Pounds to Yen

- Pounds to Rands

- Euros to Pounds

- Dollars to Pounds

- Euros to Dollars

- Currency Calculator

- Historical Currency Converter

- Exchange Rate Calculator

- Market Updates (Email)

- Currency Converter App

- British Pounds

- Swiss Franc

- Australian Dollars

- Canadian Dollars

- South African Rands

- Euro Exchange

- Emigrating Overseas

- Buying Property Abroad

- Regular Overseas Payments

- International Money Transfers

- Importing High Value Assets

- Sending Money Home

- Foreign Exchange Brokers

- Money Transfer Options

- ...more in this section

- Money Transfer to Spain

- Money Transfer to Australia

- Money Transfer to Hong Kong

- Money Transfer to New Zealand

- Money Transfer to Canada

- Money Transfer to US

- Money Transfer to UK

- Money Transfer to South Africa

- Money Transfer to Germany

- Foreign Currency

- Travel Money Card

- Travellers Cheques

- Live Forex Rates

- What is forex trading?

- History of Forex

- Can I Make Money?

- Is Forex Trading Risky?

- Software or Broker?

- Live Gold Prices

- Live Silver Prices

- Live Oil Prices

- Live Currency Exchange Rates Data

- Live Crypto Currency Rates Data

- Live Commodities Data

- Currency Affiliate Program

- Live Forex Rates and Charts

- Rates Table Live

- Money Transfer To Table

- Exchange Rate Converter

- Exchange Rates Table

- Exchange Rates Table Deluxe

- Currency Charts

- Live Currency Converter

- Live Currency Rates Ticker

- Live Forex Rates Ticker

- Live Currency Toolbar

Live Turkish Lira (TRY) Exchange Rates

Welcome to the Turkish Lira exchange rate & live currency converter page. The Turkish Lira (TRY) exchange rates represented on this page are live, updated every minute within the forex market's trading hours of 22:00 Sunday through 21:00 Friday GMT. Use links provided below to drill down to your preferred currency pair; Here you can view the latest news, top 5 best UK travel money rates, historical exchange rates and historical charts.

Countries using the ISO 4217 Currency Code TRY: Money Transfer To Turkey ,

Whether you are going on holiday and after travel money rates or looking to carry out Turkish Lira exchange , it pays to keep informed. Exchange rates fluctuate constantly and this page allows you to not only check the latest exchange rates Turkish Lira today, but also the Turkish Lira exchange rate history in more detail.

The currency code for Turkish Lira is TRY .

Turkish Lira Exchange Rate Full Table (TRY):

- North/ South America

- Asia & Pacific

- Middle East/ Cen Asia

Latest TRY News From Our NewsDesk at Exchange Rates UK

Pound to lira outlook: turkish central bank stance crucial for gbp/try gains, turkish lira, polish zloty and czech koruna (cee) forecasts updated for october 2023: unicredit, dollar to lira rate outlook: usd/try depreciation to decelerate throughout 2023 say mufg, turkish lira tipped to test 2023 lows vs us dollar as cbrt hike to 19% say unicredit, pound to lira rate outlook: gbp extends recent highs vs try, us dollar to turkish lira forecasts: 28, 29 and 30 in 3, 6 and 12 months say goldman sachs, pound to lira exchange rate: gbp at ₺29.483 as try sells off, turkish lira to dollar rate: try tipped to hit new record lows vs usd, turkish lira collapse sends inflation soaring to 36%, turkish lira crashes to record low, president erdogan’s attempts to defy markets triggers huge losses.

TRY Converter

Turkish lira exchange rate.

- Copyright © 2006 - 2024 Exchange Rates UK

- Editorial and Ethics Guidelines

- Ownership/Advertising/Funding Disclosure

- Legal Disclaimer

- Language: English

- Français

- Español

- Português

- Netherlands

Travel money: How to get the best exchange rates on your holiday currency and top ways to pay abroad

A t sterling’s 21st-century peak in 2008, £1 was worth over US$2 on the foreign exchanges. During the calamitous premiership of Liz Truss , the pound sank almost to parity against the American dollar in October 2022. The UK currency has recovered slightly, but is still only worth $1.26 or so. Sterling’s fall is mirrored against other currencies that are locked to the US$, including UAE dirhams and the dollars used in many Caribbean islands.

Shortly after the euro was introduced at the start of 2002, sterling was riding high: worth €1.65. Today it has shed about 50 euro cents to around €1.15. Against the Swiss franc , the pound has fared even worse – losing half its value in 15 years, corresponding to a doubling of prices for British travellers.

Given the continued erosion in the value of the pound, it is essential to avoid further losses by managing your holiday finances well.

If you leave holiday money to the last moment and change money at the airport on your way out, you will be wasting your cash – which would be much better spent at your destination. In addition, the pandemic accelerated changes in how travellers transact, with contactless payment increasingly the norm.

These are the key questions and answers on holiday money.

Using a credit or debit card

This is a fast and easy method of paying your way, whether with a physical card or a card on a phone. We are now in an age when cards are used for the most minor transactions. Crucially, though, you could be losing a slice of cash every time you use your normal UK bank card abroad.

For most mainstream UK credit and debit cards, banks charge just under 3 per cent (usually 2.95 or 2.99 per cent) as a “foreign currency transaction fee”. Adding almost £3 to a £100 purchase represents free money for them at your expense.

Some also impose an additional “cash advance fee” – sometimes a flat £1.50 or a percentage of up to 5 per cent – for withdrawals from an ATM.

Check your card provider’s policy – which should be easily visible online – and if necessary get a new card specifically for overseas use.

How can I dodge the card fees?

If you are a First Direct customer, your Mastercard debit card is fee-free abroad. For other travellers who seek a simple solution, apply for a Halifax Clarity credit card and use it purely for spending overseas; it does not add transaction fees.

Online firms such as Revolut may offer a better exchange rate. Along with low-cost providers Monzo, Starling Bank and others, Revolut holders can expect fee-free cash withdrawals (usually subject to a monthly limit).

HSBC has an interesting Global Money account, available to most active UK current account holders. Using the bank’s mobile banking app (select “International Services” then “Global Money”) you can create an account that allows you to keep funds in up to 18 currencies, and spend abroad without transaction fees.

Note that an increasing number of ATMs apply their own, local transaction fees – typically €5 in Mediterranean nations. You should be warned of this before you commit to a withdrawal.

Is it best to take a credit or debit card?

Credit cards have several advantages over debit cards. UK-issued cards are covered by Section 75 of the Consumer Credit Act 1974, which makes the card provider jointly liable with the merchant for any purchases over £100. That means any goods you buy with the card must be of reasonable quality.

You are also protected against financial failure of a travel provider, whether an airline, tour operator or hotel – though if you book through an agent the legal position is cloudier.

A credit card also gives you something of a cushion; money does not leave the account immediately, and if you pay off the bill in full every month you should not face interest charges.

Debit cards may incur even higher charges for spending abroad. For example TSB adds a £1 “non-pounds purchase fee” outside the EU to its 2.99 per cent transaction fee for purchases made on a debit card. That inexpensive £16 Turkish lunch bill becomes £17.50 using a TSB debit card, increasing the cost by 9 per cent.

Check before you use your normal debit card abroad – unless you are with First Direct, whose debit cards are fee-free.

The Chase debit card makes an interesting offer: no fees plus 1 per cent cash back, though this applies only for the first year, with a maximum of £15 back per month.

Debit-card purchases are covered by the banks’ voluntary chargeback scheme, which does not offer the same degree of protection as credit cards.

Beware of Dynamic Currency Conversion

“Would you like to pay in sterling?” the waiter asks innocently. He is hoping that you will choose pounds, thereby boosting the restaurant’s profits. Dynamic Currency Conversion (DCC) means the merchant and a bank give you a terrible rate of exchange and split the profit – typically a margin of 5 to 6 per cent – between them.

Restaurants, shops and hotels are allowed to offer the “opportunity” so long as they make it clear that the cardholder has a choice, and cite the rate of exchange that will be used.

The EU-funded European Consumer Organisation, known as BEUC, adds: “It is almost impossible for a consumer to make an informed decision when presented with the DCC option, because of various ‘nudging’ strategies put in place by the DCC service providers and merchants.”

Always choose to pay with local currency, not “GBP”.

Could I face unexpected charges abroad?

Yes, depending on the location. I have paid credit-card surcharges in Australia and Denmark, and they may pop up elsewhere. In the UK it is illegal to charge extra for paying with a credit card, but that does not apply elsewhere.

Watch out for the ‘hold’ on a credit card

All kinds of enterprises, from car-rental firms to hoteliers concerned about their minibar, demand a credit card. Without one, you might be asked for a hefty cash deposit – or simply refused service. This is because the firm wants some comeback, and to reserve the right to extract additional funds.

If, after you have checked in the car or checked out of the hotel, they find that you have run up a charge, they want to claim it back – and the easiest way to do that is to demand “pre-authorisation” up to a certain amount.

They will exercise a “hold”, which means reserving a chunk of capacity – perhaps as much as £1,000 – from your account for contingencies.

This money will not leave your account (unless there has been some financial chicanery on your part), but it does limit your freedom of financial movement.

Pre-paid cards

These are cards which you load with currency – usually sterling, euros or dollars – and use to pay for goods and services, or to withdraw cash from ATMs. On longer trips, you can keep topping them up online from your bank account, making them good for globetrotting tourists and gap-year adventurers.

You can also hold multiple currencies on the same account – FairFX offers up to 20.

But do your homework. The key components you need to compare start with the initial fee. Some providers waive this, but often make up for it with higher charges elsewhere. Paying a fee now may actually save you more in the longer term.

Next, do you have to pay a “loading” fee to put money on the card? If so, this could prove expensive. Some companies demand 3 per cent of all the money you put on your account. Is there a flat rate or a percentage charge for using the thing? Lastly, how quickly do your funds erode if you don’t use the card for a while? The depletion of value over time is a very useful income stream for the prepaid card issuer.

Should I take cash?

Obtaining local currency locks you into an exchange rate, and therefore you can calculate precisely how much a cup of coffee or a night’s stay costs in sterling. Cash also says less about you than plastic, eliminating the risk of credit-card fraud.

Should I take out currency in the UK or abroad?

Many people use their credit or debit cards to withdraw cash abroad. But on top of any fees added by your card provider, many operators of ATMs abroad charge a Direct Access Fee (DAF). Providing a fully stocked ATM on a Greek island, with all the security and maintenance issues involved, is an expensive business, they point out – and the transaction fee reflects this reality.

So buying ahead of your trip is a good plan. Foreign currency is the ultimate commodity: the euros or dollars you get cheap from a backstreet bureau de change are worth exactly the same as the notes you buy, expensively, at your high street bank. But the only way sensibly to compare rates is to frame the question right: “how many euros will you give me for £300?” or “I need $500, how much will that cost me in sterling?”.

On your local high street, don’t expect much from banks – which now appear to regard changing money as a faff, and often restrict it to existing customers.

Travel agents often offer more competitive rates. And the Post Office is worth checking. But you are almost certain to get a better deal if you shop around online through companies such as Travelex and Moneycorp, and pick up the foreign currency at an airport or ferry port.

For the best deals, it helps to be in London. Search Thomas Exchange Global for some of the best rates. You can pay online and pick up the cash at a Thomas Exchange office.

Better still, take a stroll along Britain’s finest foreign-currency artery: Queensway in London W2. Within a few hundred metres, there are two dozen bureaux de change. It takes 10 minutes to compare rates, and with lots of tourists selling euros or dollars for sterling, there’s a willingness to turn a quick profit.

All of this applies only to the “big” currencies: the euro and dollar, and also the Swiss franc, Canadian and Australian dollars, plus the UAE dinar. You might also want to buy in advance for Scandinavian currencies or New Zealand dollars (weak competition at the destination means rates are rarely good).

But just about every other currency counts as “exotic”, and for these locations the rule is: wait until you get to the country in question. Take clean Bank of England £20 notes (with a few £5 and £10 notes in case you need to change smaller amounts towards the end of your stay).

Turkish currency

The usual advice for European holidays – buy euros in the UK at the best rate you can find – does not apply to for the Turkish lira.

First rule: do not change in large quantities in Britain; you will get a much better rate in Turkey. If you like to have a modest amount of foreign currency for incidentals when you arrive, then I suggest to go to your local post office and change £20 or so into Turkish lira. You won’t get a great rate of exchange, but it will be better than your departure airport. And it is commission-free, which is handy for small transactions like this.

Once at your destination in Turkey, you will soon be able to identify the bureau de change with the best rates for sterling. Even in small towns, there are change opportunities; ask at the tourist office or a travel agency.

Change reasonably small quantities in case there is another sudden collapse of the lira. Little and often is the best way.

When you shop around, note that some places charge commission and some don’t. The sensible question to compare rates is: “How many Turkish lira will you give me for £100?”

The Independent is the world’s most free-thinking news brand, providing global news, commentary and analysis for the independently-minded. We have grown a huge, global readership of independently minded individuals, who value our trusted voice and commitment to positive change. Our mission, making change happen, has never been as important as it is today.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

- GBP to TRY exchange rate

Pounds GBP to Turkish lira TRY exchange rate

Whether you’re going to Istanbul or Cappadocia, get your holiday cash from Post Office

Buy travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

- Order Turkish lira online and pick it up the next working day in any Post Office branch

- The more Turkish lira you buy, the better the rate

- Check the GBP to Turkish lira exchange rate for the best deal

Due to the volatility of the Turkish lira exchange rate, Post Office may withdraw the currency from sale without notice.

If it's not available on the drop-down list of currencies, please try again on another day. Turkish lira is still available to order in branch. Exchange rates shown online will differ from those available in branch.

Taking a trip to Turkey? Get your holiday money with Post Office

Turkey is one of British holidaymakers’ favourite summer destinations. With its lengthy high season and exceptionally good value, tourists can enjoy their holidays without breaking the bank.

If you want to buy Turkish lira holiday money online from the Post Office, you can enjoy great rates and 0% commission. You could pop into thousands of participating branches or get yourself a Travel Money Card .

Our click and collect service allows you to order Turkish lira online and pick up your cash at a designated branch. And, if you order before 3pm, you can pick it up the next working day or have it delivered to your home.

We’ll buy back any leftover currency notes or refund all of your currency within 28 days of purchase if your holiday gets cancelled. And don’t forget to buy your travel insurance, and check out our information on visiting Turkey .

Get our best rates online. The more you buy, the better the rate.

Buy Turkish lira with us for great rates

Voted ‘Best Foreign Exchange/Travel Money Retailer’ by the UK public at the British Travel Awards 2022

0% commission and competitive rates on more than 60 currencies

Order online by 3pm for next-working-day collection

Buy between £400 and £2,500 and enjoy better rates the more you get

Get your Turkish lira delivered the next working day using Royal Mail Special Delivery Guaranteed by 1pm

Home delivery is free for orders of more than £500 or £4.99 for less

Or get a Travel Money Card – the digital way to use holiday money

Click and collect in branch

Stop by your local branch and get your holiday money more quickly.

Home delivery

If you can order by 3pm, we can get your cash over to you the next working day.

Travel tech for Turkey

If you want to go cashless, get our Travel Money Card. Top up with our travel app, accepted anywhere you see the Mastercard® symbol and easily switch between currencies

Great value in Turkey

Our latest Post Office Holiday Money Report shows Marmaris in Turkey offers holidaymakers eye-popping value

Cup of coffee

£1.45

Three-course evening meal for two

£40.39

£6.48

Costs are for Marmaris, Turkey and based on prices at the time of our last Post Office Travel Money Holiday Money Report in 2023. Meal price is based on three courses for two people with a bottle of house wine.

How far will your Turkish lira go?

The relative value of Turkish lira has decreased over recent years, meaning excellent savings for British holidaymakers. That’s not to say the trend will definitely continue, so it’s a good idea to buy your travel money at the most favourable rate available

Many popular resorts in Turkey are cost-effective when compared with other world or European destinations, so even if it costs a little more than our nearest neighbours to get flights, the ultimate savings could be strong

As well as the low price points for many holiday makers, Turkey has some of the most appealing weather and enrapturing cultural heritage

Its long high season means that deals are possible earlier and later than other destinations

Some common questions

How do i buy turkish lira.

Order Turkish lira online (minimum order value of £400) or find your nearest participating branch .

You can collect your currency at any Post Office branch or have it delivered to your home . Online orders placed before 3pm on a working day can be delivered to your home the next working day using Royal Mail Special Delivery Guaranteed by 1pm.

Home delivery for orders of £500 or over is free, or for orders of under £500 there is a small delivery charge of £4.99.

What is Turkish lira?

Turkish lira is the national currency of Turkey. It was introduced as the Ottoman lira during the Ottoman Empire in 1844. In the early twentieth century the Ottoman lira was replaced with the Turkish lira following the Turkish War of Independence.

Ever wondered why the symbol for pounds (in terms of weight) is “lbs”? You may be surprised to learn that “pounds” and “lira” mean almost the same thing. A libra was a Latin unit of weight equivalent to the English “pound”, and we get the word lira from libra. So Turkish lira are, in a sense, Turkish pounds.