- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

The Military Wallet

The Platinum Card® from American Express

Advertiser Disclosure: The Military Wallet and Three Creeks Media, LLC, its parent and affiliate companies, may receive compensation through advertising placements on The Military Wallet. For any rankings or lists on this site, The Military Wallet may receive compensation from the companies being ranked; however, this compensation does not affect how, where, and in what order products and companies appear in the rankings and lists. If a ranking or list has a company noted to be a “partner,” the indicated company is a corporate affiliate of The Military Wallet. No tables, rankings, or lists are fully comprehensive and do not include all companies or available products.

The Military Wallet and Three Creeks Media have partnered with CardRatings for our coverage of credit card products. The Military Wallet and CardRatings may receive a commission from card issuers.

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more information, please see our Advertising Policy .

American Express is an advertiser on The Military Wallet. Terms Apply to American Express benefits and offers.

The rewards are plentiful, and the travel perks are outstanding, but a hefty annual fee means you’ll need to weigh your decision carefully before applying for The Platinum Card® from American Express . However, if you spend a lot of money as a frequent and constant traveler and expect a lot of perks in return, then a platinum card may be the perfect choice for you.

Under The Servicemembers Civil Rights Act (SCRA) , American Express gives active-duty military personnel and their spouses an annual fee waiver .

The Platinum Card Benefits

Service members will be hard-pressed to find a card that offers more travel and lodging benefits than the Amex Platinum Card . Not only will you rack up multiples of points with restaurants, airfare, and hotels, but you’ll also enjoy access to airport lounges and unlock huge upgrades at major hotel chains such as Marriott, Hilton and others.

One of the biggest reasons active-duty service members use the Amex Platinum card is for the CLEAR+, TSA PreCheck, and Global Access benefits while on TDY, saving time and money for frequent travelers. There’s no foreign transaction fees either, which is a big bonus if you’re stationed outside the United States.

Under the SCRA, American Express also waives the annual fees for its credit cards – including its platinum card – for active service members and their spouses. So, now that you know you can get the annual fee waived, what are some of the biggest perks to check out?

Travel and Lodging Perks

- Introductory Offer:

- Earn 5x points on airfare. Book directly with your favorite airline or on amextravel.com – up to $500,000 per calendar year.

- Earn 5x points on prepaid hotels at amextravel.com and a $200 annual hotel credit on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card.

- $200 Airline Fee Credit in statement credits per calendar year in baggage fees, in-flight refreshments, and more at qualifying airlines. It does not include airfare or upgrades and applies to a single airline you choose when you enroll, with the option of changing airlines once a year.

- Amex’s Centurion Lounges and International American Express lounges.

- Delta Sky Clubs, when flying Delta.

- Priority Pass Select lounges (enrollment required).

- Lounges in the Plaza Premium, Escape, and Airspace networks.

- Upgrade to Gold Elite status in Marriott’s Bonvoy rewards program without meeting any stay requirements.

- Automatic Gold status in the Hilton Honors loyalty program when you enroll.

- Book a stay of at least two nights at The Hotel Collection properties, and you’ll get an automatic upgrade – if available – and a $100 credit for dining, spa, resort or other activities at the hotel.

- Book a stay at one of Fine Hotels & Resorts’ ultra-high-end properties and get upgrades and amenities worth an average of $550 per stay. These include automatic room upgrades, early check-in, late checkout, complimentary breakfast, free Wi-Fi and amenities unique to each property.

- 24-hour concierge services by phone.

- Global Dining Access by Resy gives you special access to reservations and events, like chef meet-and-greets at high-end restaurants, when you add your card to your Resy profile.

- A $189 CLEAR Credit to help you speed through airport security and get into stadiums more quickly.

- Fee credit for TSA Precheck or Global Entry.

- No foreign transaction fees while you’re out of the country.

Shopping and Entertainment Benefits

The rewards don’t stop there. Service members can access a wide range of other perks as well. You can get more out of your entertainment and shopping dollars thanks to American Express partnerships with leaders such as Uber, Walmart, Saks Fifth Avenue and others.

One of the coolest and most exclusive of these are the Invitation Only member VIP experiences and preferred seating that lets you hop to the front of the line for the hottest events and concerts.

- $240 in Digital Entertainment Credits in the form of $20 in monthly statement credits when you use your Platinum card to pay for streaming and news services such as Peacock, Audible, Sirius, and the New York Times. Enrollment is required for most statement credits.

- Uber VIP status and up to $200 in Uber Cash savings. Credits are issued monthly — $15 each month and $35 in December — good for rides or Uber Eats orders in the U.S.

- A $155 Walmart+ Credit covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card.

- A $100 Saks Fifth Avenue annual credit. You get $50 worth of credit for in-store or online purchases from January through June and another $50 for purchases from July through December.

- $300 annually for select eligible Equinox memberships , including Equinox All Access, Destination, E by Equinox memberships or the on-demand fitness app Equinox+.

- By Invitation Only offers members-only VIP experiences such as Wimbledon, the Kentucky Derby and others.

- Preferred Seating lets you jump the line to buy tickets for select sports or cultural events.

- Cell phone protection. This increasingly popular benefit joins the card’s already robust return and purchase protections and extended warranties. Coverage goes up to $800 per claim or $1,600 (two claims) per 12-month period. Each approved claim carries a $50 deductible.

American Express Membership Rewards

One of the ways American Express encourages card usage is by attaching many of its cards to the American Express Membership Rewards program, including the Platinum Card .

You can use points for travel when you book through the Amex travel portal or transfer the points to airline, hotel, or car rental partners. You can also get a statement credit, shop through the American Express site by redeeming points at affiliate partners, redeem points for gift cards or donate points to charity through American Express’s partnership with JustGiving.com.

Here are some of the specific membership rewards you’ll get with the American Express Platinum Card:

- Enjoy Uber VIP status and up to $200 Uber savings on rides and Uber Eats purchases in the U.S. annually.

- Earn 5X membership rewards points on flights booked directly with airlines or American Express travel (up to $500,000 spent on these purchases per calendar year) and on prepaid hotels booked on amextravel.com.

- Receive an annual $200 airline fee credit with a pre-selected airline and up to $100 in statement credits annually for purchases at Saks Fifth Avenue (enrollment required).

- Enjoy complimentary airport lounge access through the Global Lounge Collection.

- Take advantage of more than $1,400 worth of benefits during your first year as a cardholder.

Rewards Point Structure

Every time you spend your Platinum Card , you earn points. For every dollar you spend, you’ll earn one point. You can redeem them for cash, but you can also redeem them for travel on the Amex travel portal, or transfer them to one of American Express’s airline or hotel partners.

You can also redeem your points for gift cards and online shopping, but you typically get less than a penny per point. However, you may receive a penny per point when you redeem travel, or more if you redeem it with an American Express travel partner.

Rewards points can be worth more than the standard cash from cashback credit cards if you’re strategic about how you redeem them.

There are also a few ways to rack up points faster:

- Add an authorized user to your credit card. When more than one user spends money on the card, the points add up faster

- Take advantage of American Express membership rewards offers. If you go to the “Amex Offers” tab in your American Express app or your online account, you’ll see “Amex Offers,” which are targeted and limited in duration and can add multiple points.

- Use Rakuten. You get points using Rakuten, a cashback website and shopping app . You’ll receive one membership rewards point for every 1% cash back you earn, and you’ll still earn your regular points through your American Express credit card.

Your points don’t expire unless you close your card account with points still left in it, you return a purchase or you make a payment late.

Pros and Cons of the Platinum Card from American Express

- Generous introductory offer

- Extensive travel benefits and bonuses

- Numerous other entertainment, dining, retail, and wellness rewards

- 18 airlines and three hotel partners

- Membership rewards points

- Lounge membership

- Best for high-end lifestyle cardholders

- A high annual fee

- Complicated rewards; you’ll need to sign up for multiple programs to activate your benefits

- You will earn up to one point per dollar, except for certain travel spending. Other cards are more generous in this area.

- Although the full list of annual statement credits is worth more than the yearly fee, you must use them to get any benefit.

- Good to excellent credit score of at least 690 required

The Platinum Card Annual Fee

The annual fee is $695 – but servicemembers can benefit from the card’s perks without paying the annual fee .

How to request a waived fee and SCRA benefits from American Express

Once you apply for The Platinum Card® from American Express and are approved, you can contact American Express by phone or online to request a waiver of your card’s annual fee , as well as the other SCRA protections for your card.

Submit Request Online

Submitting your request for SCRA relief online is the quickest way to apply for SCRA relief.

Once you enroll your card in American Express online services, you can submit relevant documents via the document center.

Documents may include:

- Active duty orders

- Change of Station Orders

- DD-214 Forms

- Letters from Commanding Officers

Submit Request by Phone

If you wish to request SCRA benefits and the annual fee waiver by phone, you can contact the number on the back of your card or call American Express at 1-800-253-1720. Service members stationed outside of the U.S. can contact American Express collect at 1-336-393-1111, however, collect calling fees may apply.

Submit Request by Mail

If you are unable to submit your request online or over the phone, then you can mail a copy of your documents to American Express. Be sure to include the American Express account numbers you wish to have benefits applied to, as well as a detailed note outlining your request.

You can send documents to:

American Express Attn: Servicemembers Civil Relief Act PO Box 981535 El Paso, TX 79998-1535

Learn How to Apply for The Platinum Card from American Express

The Military Wallet has partnered with CardRatings for our coverage of credit card products. The Military Wallet and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on The Military Wallet are from advertisers. Compensation may impact how and where card products appear, but does not affect our editors’ opinions or evaluations. The Military Wallet does not include all card companies or all available card offers.

About Post Author

See author's posts

Posted In: Credit Cards

More From Us

The Best Military Credit Cards – A Guide to Finding The Top Cards by Category

U.S. Bank Cash+ Visa Signature Card

Disney® Visa® Card for Military Members

Reader interactions, leave a comment: cancel reply.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

As Featured In:

The Military Wallet is a property of Three Creeks Media. Neither The Military Wallet nor Three Creeks Media are associated with or endorsed by the U.S. Departments of Defense or Veterans Affairs. The content on The Military Wallet is produced by Three Creeks Media, its partners, affiliates and contractors, any opinions or statements on The Military Wallet should not be attributed to the Dept. of Veterans Affairs, the Dept. of Defense or any governmental entity. If you have questions about Veteran programs offered through or by the Dept. of Veterans Affairs, please visit their website at va.gov. The content offered on The Military Wallet is for general informational purposes only and may not be relevant to any consumer’s specific situation, this content should not be construed as legal or financial advice. If you have questions of a specific nature consider consulting a financial professional, accountant or attorney to discuss. References to third-party products, rates and offers may change without notice.

Editorial Disclosure: Editorial content on The Military Wallet may include opinions. Any opinions are those of the author alone, and not those of an advertiser to the site nor of The Military Wallet.

Information from your device can be used to personalize your ad experience.

Why the Amex Platinum is a great card for active duty military

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Business grants

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Active duty military members, their spouses and dependents are eligible to have the annual fee waived for The Platinum Card® from American Express.

- The Platinum Card offers a variety of benefits that include airport lounge access, airline fee credit and Uber Cash.

- American Express also offers other travel credit cards that may be a great fit for military members.

Active military members and their families face many challenges, such as lengthy separation from loved ones and financial stress. To help navigate these challenges, the federal government and many businesses offer special benefits.

The Platinum Card® from American Express is a great example. This is one of the best travel rewards cards , loaded with premium benefits like airport lounge membership and elite status with select hotels. The card also comes with thousands of dollars worth of credits, including hotel and airline fee credits, Uber Cash and complimentary Walmart+ membership credit.

Let’s take a look at why the Amex Platinum is a great card for active duty military members and their families.

Is the American Express Platinum Card free for military members?

The American Express Platinum Card usually comes with a high $695 annual fee for the primary cardholder and $195 annual fee for additional cardholders. But that fee is waived for active military members, their spouses and child dependents. So if you’re on active duty, you can enjoy all the generous benefits this card has to offer for no annual fee.

This is true whether you choose to be a primary cardholder or an authorized user on another person’s account. For example, an active duty service member could also become an authorized user on another person’s account for $0 per year, instead of the $195 per card that’s normally charged.

How do active duty military members get the Amex military fee waiver?

The fact that military members can avoid this fee is mostly due to 2003’s Servicemembers Civil Relief Act (SCRA) and the 2006’s Military Lending Act (MLA). These two acts provide important consumer protections to military members and their families, such as caps on the amount of interest they’re required to pay.

Benefits from SCRA generally apply to credit acquired prior to active duty, whereas MLA benefits apply to credit acquired during active duty. No action is needed to qualify for MLA relief, but you must submit a request for SCRA relief online or by phone, fax or mail. Fortunately, American Express offers a military relief resource page on how both the SCRA and the MLA work.

While American Express is not required to waive fees for military applications due to either of these acts, they choose to go the extra mile to help military members save money while using their products.

Does American Express waive annual fees for veterans?

While active duty military members can have their annual fee for American Express credit cards waived entirely, the same isn’t true for military veterans. Once you’re no longer active, the SCRA and MLA benefits come to an end — including waived fees for service members.

The annual fee for the AmexPlatinum Card may still be worth it . If you can take advantage of enough credits and avoid credit card mistakes , you can offset the annual fee while enjoying premium features.

What credit score do you need for the Amex Platinum card?

Like other premium travel credit cards, the Platinum Card requires very good or excellent credit. This typically means a FICO score of 740 or higher, although American Express does not advertise specific minimum credit score requirements.

Before applying, check your credit score . If you’re not eligible yet, the best ways to improve your credit include paying your bills early or on time and paying down debt to decrease your credit utilization ratio. You can also refrain from opening or closing new accounts until you’re ready to apply.

Benefits of the Amex Platinum

The Amex military fee waiver gives you access to popular premium benefits without paying an annual fee.

Amex Membership rewards

Among the best perks is the American Express Membership Rewards program , known for its value and flexibility. This program lets you book travel directly through American Express, but you can also travel with American Express transfer partners, which typically gets the most value for your rewards. You can also redeem points for gift cards, merchandise and statement credits, but these options typically come with a lower redemption value .

Airport lounge access

The Platinum Card comes with Priority Pass Select membership that extends access to more than 1,400 airport lounges across 140 countries. You can access several other lounge networks, including Amex Centurion Lounges and Delta Sky Clubs (when you fly with Delta Air Lines). While airport lounges can be hit or miss in terms of the food, drink and relaxation potential, it’s an amazing deal to get this benefit for free.

$200 airline fee credit

You also get up to $200 in statement credits each calendar year toward airline incidental purchases, though these credits are only good for a single airline you select ahead of time. Also, you can’t use these credits for airfare — only for incidental fees charged to your card’s account.

$200 in Uber credits

You get up to $200 in Uber Cash a year (Terms Apply), although these credits are doled out on a monthly basis — $15 for each month (except for December, when you get $20). These credits can help you save a considerable amount if you use Uber every month, but they do not roll over to the next month if you don’t use them.

Elite hotel status

The Amex Platinum gets you automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. This level of status may help you get free breakfast in some Hilton properties, whereas you’re more likely to benefit from a room upgrade with the Marriott Bonvoy program.

With either program, you’ll earn more points on paid stays due to your elite status. You’ll also have the ability to quickly climb the elite status ladder with paid stays since you’re getting a head start as a Gold member.

$100 credit for Global Entry or TSA PreCheck

You can use your credit card to cover the cost of TSA PreCheck membership or Global Entry, which normally set you back from $85 to $100. Since Global Entry includes TSA PreCheck, however, this membership is easily the better deal.

5X points on most travel

Rack up 5X points on flights booked with airlines as well as flights and prepaid hotels booked with American Express Travel on up to $500,000 in spending per year. If you’re someone who frequently travels for work or leisure, being able to earn such a high rate for each purchase can help you quickly grow your rewards balance.

Other American Express military credit cards

While the Platinum Card is an obvious choice for active duty military members, other American Express credit cards may be more attractive, depending on how you spend and like to redeem rewards.

The bottom line

If you’re an active duty military member and can get an American Express credit card minus the annual fee, you might as well go for one of the most premium Amex cards available. Read Bankrate’s detailed Platinum Card from American Express review for more information on the card’s benefits, rates and more.

Information about the Hilton Honors American Express Aspire Card and American Express® Green Card has been collected independently by Bankrate. Card details have not been reviewed or approved by the card issuer.

Related Articles

Why I love the Amex Business Gold Card

Amex Business Platinum benefits guide

Why I love the Amex Gold

Why I love the Amex Business Platinum Card

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). These offers do not represent all available deposit, investment, loan or credit products.

Why Active-Duty Service Members Should Get the American Express Platinum Military Card

Active duty service members can take advantage of many credit card benefits and perks the offers. The Servicemembers Civil Relief Act provides qualifying active military members financial protections and benefits. Moreover, some credit card issuers like American Express offer active duty service members additional perks.

Here’s a look at some of the benefits that the American Express Platinum Card extends to those considered active military.

Membership Rewards Points

The American Express Platinum Card gives active military members access to its Membership Rewards program. This allows them to earn five times the points for every dollar spent on flights and hotels booked through American Express’ travel portal. They can also earn one point for every dollar spent on eligible purchases.

Points rack up quickly and can be used on shopping, dining and entertainment purchases. They can also be used to book travel.

How American Express Platinum Card Military Card Members Earn Points

Like an average Card Member, American Express Platinum Military Card Members also earn five times the points on up to $500,000 annually on flights they book with American Express Travel or directly with airlines. When Card Members book and pre-pay hotel stays on AmexTravel.com, they also earn five times the points. On all other purchases, military Card Members earn a point for every dollar spent.

Entertainment, Dining and Shopping Rewards

Annual credit and cash rewards can make the American Express Platinum Card appealing to active duty military service members . Here’s a closer look at some of these benefits.

$240 Digital Entertainment Credit

American Express Platinum Card Members receive up to $20 per month in statement credit — that’s $240 annually — for making eligible purchases through SiriusXM, Audible, The New York Times or Peacock entertainment. American Express® Card Members must enroll to receive this credit.

$155 Walmart+ Credit

Walmart+ is a subscription membership that costs $98 a year, or $12.95 a month. Members can buy just about everything Walmart sells online or in-store. Card Members can use their card to pay for their monthly Walmart+ membership and redeem the full monthly cost back as a statement credit.

$200 Uber Cash

American Express Platinum military Card Members who ride Uber and order food through Uber Eats can get $15 in Uber Cash each month in addition to a $20 bonus every December. This benefit only applies to Uber rides and food orders for Basic Uber card members in the United States, though.

$300 With Equinox

The military is known for physical fitness. Active duty service members with an American Express Platinum Card can receive up to $300 in cash back savings each year if they use the Equinox+ digital fitness app or work out as a member at eligible Equinox clubs.

$100 at Saks

With the American Express Platinum Card, military Card Members can get up to $100 annually in statement credits, up to $50 twice a year, for purchases at Saks Fifth Avenue stores. They must enroll to take advantage of this perk.

$189 With CLEAR

Getting through security quickly at airports isn’t very easy. But American Express Platinum military Card Members can breeze through using the CLEAR app. CLEAR is a touchless program that uses biometrics to securely verify a person’s identity. American Express Platinum gives Card Members up to $189 back annually when they use their card to pay for CLEAR membership.

Exclusive Dining With Resy

Military service members who enjoy dining out can use their American Express Platinum Card to discover and access exclusive tables at restaurants and events when they add their card to their Resy profile.

Travel Rewards and Credits

Amex’s Platinum card has been lauded for all the travel perks it offers. Here are a few.

$200 Hotel Credit

Platinum Card Members can get $200 back in credits on their statement annually when they prepay a 2-night minimum stay through The Hotel Collection booking page with American Express or with Fine Hotels and Resort.

TSA Global Entry or PreCheck Credit

American Express Platinum Card Members can receive either a $100 statement credit for TSA’s Global Entry or up to $85 on a five-year TSA PreCheck plan from any Authorized TSA PreCheck Enrollment Provider.

$200 Airline Fee Credit

When incidental travel fees are charged to American Express Platinum Card military members, they can earn up to $200 in statement credits annually. Qualifying purchases include fees for checked bags as well as in-flight snacks and beverages.

Additional Member Services

Platinum military Card Members can add a no annual fee American Express Gold Card to their Platinum account and earn Membership Rewards points on any eligible purchases made on the Gold card by additional Card members.

American Express Platinum Military Application

Applying for the American Express Platinum card is simple and applicants can receive an approval decision in under a minute. Applicants can select their card design before entering all of the required personal information. Upon approval, applicants can opt to receive a one-time text message to their mobile phone with a link to download the American Express App.

No American Express Platinum Annual Fee for Military Members

Under the Servicemembers Civil Relief Act and the Military Lending Act, active duty military members may be eligible to not pay their American Express Platinum annual membership fee of .

SCRA protects active duty service members, and in many cases their spouses, by reducing some of their financial obligations while serving. In addition to no annual fee, these members may have their interest rate reduced up to 6%. State laws may apply and the service member must have acquired the American Express Platinum Card before being placed on active duty. They may request SCRA relief up to 180 days after leaving active duty service.

Similarly, the MLA protects active duty service members and their dependents in consumer credit matters, extending a military APR that’s capped at 36%. No enrollment in MLA is required and a military member’s American Express Platinum Card is eligible on the date they open the account.

All information about the American Express Platinum Card has been collected independently by GOBankingrates. American Express Platinum Card is not available through GOBankingRates.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy .

- Credit Karma. 2021. "The 5 Best Credit Cards for Military Personnel for 2022."

- NBC News. 2021. "What Is Walmart Plus? Membership Benefits, Prices and More."

- Forbes. 2020. "Everything You Need to Know About Amex's Generous Military Benefits."

Share This Article:

Related Content

Credit Cards

Suze Orman: 5 Smart Steps To Take When You Have Credit Card Debt

March 12, 2024

Rachel Cruze: Is Having a Store Credit Card a Good Idea?

March 08, 2024

Your Guide To U.S. Bank Rewards

March 18, 2024

Why Your Credit Matters for Big Purchases in 2024

March 01, 2024

4 Reasons Why Millennials Miss Credit Card Payments

February 29, 2024

4 Reasons Why Maximizing Your Credit Card Rewards Is More Important Than Ever

I'm a Self-Made Millionaire: 3 Reasons I Only Use Credit Cards

February 26, 2024

Debit Cards vs. Credit Cards: What Mark Cuban and Other Famous Finance Pros Advise

February 23, 2024

These People Pay For Everything With Credit To Reap Rewards: You Should Too

February 15, 2024

Can Someone Else Make a Payment on Your Credit Card?

How To Request a Capital One Credit Line Increase

Do Minimum Payments on Credit Cards Actually Cost You More

February 12, 2024

Why Warren Buffett Doesn't Trust Credit Cards

Watch Out for This Gas Station Scam: Credit Card Skimmers and How To Avoid Them

February 09, 2024

Warren Buffett Hates Credit Cards: Here's How To Realistically Ditch Yours

February 06, 2024

How Baby Boomers Stay Free of Credit Card Debt

February 02, 2024

Sign Up For Our Free Newsletter!

Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy . You can click on the 'unsubscribe' link in the email at anytime.

Thank you for signing up!

BEFORE YOU GO

See today's best banking offers.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here .

Mark Edward Atkinson / Tracey Lee / Getty Images

Advertiser Disclosure

Active duty service members can have American Express Platinum annual fee waived

Enjoy benefits like travel credits and lounge access at no cost as thanks for your service

Published: August 12, 2021

Author: Emily Sherman

Author: Dan Rafter

Editor: Ana Staples

Reviewer: Brady Porche

How we Choose

The Platinum Card from American Express offers a wide range of perks for active duty service members – including a waived annual fee.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

American Express is known for offering some of the most generous perks for active-duty military members, in accordance with the Servicemembers Civil Relief Act of 2003 (SCRA), a federal law that provides certain rights and protections to military members who are entering service and those who are on active duty. Most notably, Amex military benefits include waiving the annual fee for qualifying service members – even on its priciest card.

If you are an active-duty military member who travels frequently, The Platinum Card® from American Express is loaded with high-value perks that can save you money and make your next trip easier. Plus, you can have the high $695 annual fee waived completely. That means you can take advantage of benefits like Priority Pass lounge access and up to $1,400 in statement credit benefits each year for free.

Who qualifies for Amex SCRA benefits?

On the American Express website , SCRA eligibility is defined as follows:

- Any member of the U.S. Armed Forces on active duty (Army, Navy, Air Force, Marine Corps and Coast Guard) or a reserve component called to active duty (Reserve, National Guard and Air National Guard)

- National Guard personnel under a call or order to active duty for more than 30 consecutive days (for purposes of responding to a national emergency declared by the president and supported by federal funds)

- Public Health Service and National Oceanic and Atmospheric Administration Commissioned Officers

- Citizens serving with the forces of a nation with which the U.S. is allied in the prosecution of a war or military action

- Spouses of active-duty servicemembers listed above where credit is extended to a servicemember and spouse jointly

If you meet these qualifications, you can enroll in Amex military benefits by calling the number on the back of your card or filling out a request online . Your status will be confirmed based on any documentation you provide and reports from the Department of Defense.

What do SCRA benefits cover on Amex cards?

American Express waives the annual fee for all SCRA-eligible cardholders across the Amex suite of rewards cards. In addition, some users have reported having other fees waived, including late payment , returned payment and over-limit fees. However, even if late and returned payment fees are waived, you should be careful to make payments on time to avoid damaging your credit score .

SCRA also comes with perks that are not unique to American Express. Lenders, including credit card providers, can’t charge more than 6% interest on any amount cardholders owed before entering active-duty military service. To qualify for this lower rate, service members must inform their credit card providers – including American Express – of their active military status and must submit a copy of their orders to deploy.

Service members have up to 180 days after being released from active duty to update their lenders about their active military status.

Remember that the SCRA does not require credit card providers to charge only 6% interest on any new purchases that servicemembers make while on active duty. Card providers are only required to lower the interest rate on debt that military members acquired and owed before they entered active service.

Reasons to carry the Amex Platinum

The American Express Platinum card comes with a bevy of great perks for users who travel frequently . So, if you can score the card with the annual fee waived for being in the military, it should be a no-brainer. Here’s a quick look at some of our favorite perks of the Platinum card:

Lounge access

The Amex Platinum card offers the most comprehensive lounge access of any rewards card , ensuring you’ll have a plush lounge to escape to while on trips to a variety of destinations. The card includes access to all Priority Pass lounges (more than 1,200 locations), Delta Sky Club, Centurion lounges and more.

Up to $1,400 in annual statement credits

The Amex Platinum is generous with its statement credit benefits, which can save you money on both travel and everyday expenses.

Currently, the list of such benefits includes:

- Up to $200 in hotel credits each year on prepaid bookings with Amex Travel at Fine Hotels + Resorts or The Hotel Collection properties (minimum two night stay required)

- Up to $200 in airline incidental credits each year on one selected airline to cover things like baggage fees and seat selection fees (you can pick your selected airline each calendar year in January)

- Global Entry or TSA PreCheck credits: $100 credit for Global Entry (every four years) or $85 for TSA PreCheck credit (every four and a half years)

- $179 Clear credit

- $200 Uber Cash credit

- Up to $240 digital entertainment credit each year that can be used for eligible purchases from Peacock, Audible, Sirius XM and the New York Times (up to $20 in statement credits each month, upon enrollment)

- Up to $100 Saks Fifth Avenue credit ($50 twice a year, enrollment required)

- Up to $300 in statement credits each year on eligible Equinox memberships (enrollment required)

Hilton Honors gold status

Just by carrying a Platinum card, you can receive automatic gold elite status with Hilton Honors . This comes with perks including free Wi-Fi, late checkout and room upgrades (upon availability) while staying at participating Hilton properties.

No foreign transaction fees

While using your Platinum card in a foreign country, you won’t have to worry about paying a foreign transaction fee on your purchase. Just keep in mind that American Express cards are not accepted by as many merchants abroad as they are in the U.S.

Bottom line

With a waived annual fee for active-duty service members, it is clear that American Express is dedicated to giving back to those who serve. If you qualify for SCRA benefits, it might be worth looking into American Express cards with valuable perks, such as the Platinum card. You can enjoy travel credits, hotel elite status and more – at no cost to you.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a biweekly series of financial advice by women, for women. When she's not writing about credit cards, she's putting her own points and miles to use planning her next big vacation.

Dan Rafter has covered personal finance for more than 15 years for publications ranging from The Washington Post and Chicago Tribune to Wise Bread, HSH.com and MoneyRates.com. His work has also appeared online at the Motley Fool, Fox Business, Huffington Post, Christian Science Monitor and Time.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

7 ways to earn American Express points

Here’s how you can use your everyday spending to rack up American Express points faster.

What you need to know about American Express credit card benefits

American Express credit cards offer cardholders stand-out benefits in travel protection and retail protections. Plus, the issuer grants cardholders access to pre-sale tickets, unique experiences and valuable offers with partner merchants and services.

Best ways to spend American Express points

Earn up to 120,000 bonus points with the Platinum cards from American Express

Is the Blue Business Plus card from American Express worth it?

How to add an authorized user to an American Express card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

The best credit cards for active duty military: Get waived annual fees

Update: Some offers mentioned below are no longer available. View the current offers here.

There are plenty of discounts and benefits available to members of the military while on active duty. Some are highly advertised, while others are hidden in plain sight. On top of all the travel perks and discounts offered to those in the military, the ability to hold some of the best credit cards on the market without paying annual fees has been my favorite perk.

After several years in the military, neither I nor my colleagues had any idea what the Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA) were. I wish I had then the knowledge I have now during all of my years of service. That way I could have leveraged those programs and other benefits available to me from the day that I entered active duty.

Whether you're just starting out on active duty, are getting called up on active orders in the National Guard or Reserves, or have been on active duty for years, you can benefit from this information. This guide will review the best military credit cards and will also explain how to maximize the SCRA and MLA benefits for yourself and your family.

The best credit cards for military members in 2022

- The Platinum Card® from American Express: Best for travel benefits and lounge access.

- Chase Sapphire Reserve: Best for annual travel credit.

- Marriott Bonvoy Brilliant® American Express® Card: Best for Marriott stays.

- Delta SkyMiles® Reserve American Express Card: Best for flying Delta.

- Hilton Honors American Express Aspire Card: Best for Hilton stays.

The information for the Hilton Aspire Amex card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

SCRA and MLA basics

In addition to determining which credit card is right for you, you'll need to know some SCRA and MLA basics to better understand the financial coverage and benefits for yourself and for your family.

The SCRA was designed to provide service members relief from financial burdens while serving on active duty in the U.S. military. Of note, the SCRA puts a 6% cap on interest rates charged to service members on debts incurred prior to entering active duty. An in-depth look at everything the SCRA covers can be found here .

The MLA protects service members as well as their dependents from certain lending practices. The highlight of the MLA is the Military Annual Percentage Rate (MAPR) regulation. This prevents creditors from exceeding 36% annually in total credit-related charges to covered borrowers under the MLA.

The MLA has been amended multiple times since it was enacted in 2006, which expanded which credit services were covered in an attempt to prevent credit agencies from shifting and hiding fees. This expansion of covered services prompted many credit card companies to waive annual fees in order to avoid complications. You can find an in-depth explanation of the MLA here .

So, who is covered by the SCRA and MLA?

- Active-duty soldiers of all military branches.

- Reserve soldiers on federal active duty.

- National Guard soldiers on Title 32 (federal) orders exceeding 30 days.

- Coast Guard personnel on Title 14 orders exceeding 30 days.

Additionally, any dependent of the above including:

- Children under the age of 21.

- Children under the age of 23 who are enrolled full-time at an approved institution of higher learning and dependent (or dependent at the time of the member's or former member's death) on a covered member for over one-half of their support.

Lastly, for these regulations to apply you must meet the above conditions at the time that you become obligated on a credit transaction or open an account. And once you no longer meet the above conditions, your accounts will no longer be covered and annual fees will resume.

Some credit card companies, such as American Express, have chosen to go above and beyond the requirements of the SCRA and MLA by waiving annual fees on cards. There was a recent change in the way American Express processes annual fee waivers and benefits for military card members. You need to request the right relief — either MLA or SCRA — based on the account opening date and your entry date into service. More info on requesting relief under the SCRA or MLA is covered at the bottom of this article.

Related: How to maximize credit card annual credits from home

Now, let's take a closer look at some of the incredible benefits and built-in perks these cards have to offer, along with the relevant details for active duty service members. Of course, there are more credit cards that are beneficial to U.S. service members than just those I have highlighted in this article. These are just a sample of the premium credit cards you should consider looking into if you're eligible for waived annual fees and other perks.

The Platinum Card from American Express

- Waived $695 annual fee and authorized user fee for those covered under SCRA or MLA. (See rates and fees)

- The card is offering a welcome bonus of 80,000 Membership Rewards points after you spend $6,000 on purchases in your first six months of card membership — or as many as 125,000 points to targeted individuals through the CardMatch Tool (targeted offers, subject to change at any time).

- Up to $200 annual airline fee credit.

- Up to $100 annual Saks Fifth Avenue credit

- Up to $200 annual Uber Cash on U.S. services.

- Amex Centurion Lounge access for the cardholder and up to two included guests.

- Unlimited Priority Pass Lounge access.

- Delta Sky Club access (when flying a same-day, Delta-operated flight).

- Spouses get annual fees waived for their own accounts.

- Enrollment is required for select benefits.

- Terms apply.

For more information on the Amex Platinum, read our card review.

Chase Sapphire Reserve

- Waived $550 annual fee for those covered under MLA (this means dependents, too!) as long as you opened the account after Sept. 20, 2017.*

- The card is offering a sign-up bonus of 80,000 Chase Ultimate Rewards points after you use your new card to make $4,000 in purchases within the first three months of account opening.

- $300 annual travel credit .

- Unlimited Priority Pass airport lounge and eligible airport restaurant access .

*If you opened the account before Sept. 20, 2017, you will have to close the account before reapplying for the MLA benefits. Additional help can be provided by calling Chase's military specialist line at 1-800-235-9978.

Related: The best Chase credit cards

For more information on the Chase Sapphire Reserve, read our card review .

Marriott Bonvoy Brilliant American Express Card

- Waived $650 annual fee (See rates and fees) with the same stipulations as the Amex Platinum.

- The card is offering a welcome offer of 150,000 bonus points after you spend $5,000 in purchases within the first three months of card membership.

- Automatic Marriott Bonvoy Platinum Elite status.

- Earn up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

- Unlimited Priority Pass airport lounge access.

For more information on the Bonvoy Brilliant, read our card review.

Delta SkyMiles Reserve American Express Card

- Waived $550 annual fee (See rates and fees) with the same stipulations as the Amex Platinum and the Bonvoy Brilliant.

- Earn 50,000 bonus miles and 10,000 Medallion Qualification Miles after you spend $5,000 in purchases on your new card in your first six months of card membership.

- With most official government travel being on Delta, you could earn Delta elite status faster by holding this card and adding your TDY trip miles to your SkyMiles account.

- Delta Sky Club and Centurion Lounge access (when flying on same-day, Delta-operated flights).

- Annual companion pass valid on select flights in economy or first class at each renewal.

- 20% off inflight purchases on Delta.

For more information on the Delta Reserve Card, read our review.

Hilton Honors Aspire Card from American Express

- Waived $450 annual fee (See rates and fees) with the same stipulations as the Amex Platinum and the Bonvoy Brilliant.

- The card is offering a generous welcome offer of 150,000 Hilton points after you use your new card to make $4,000 in purchases within the first three months.

- Automatic Hilton Honors Diamond elite status.

- Up to $250 annual airline fee credit.

- Up to $250 annual resort credit.

For more information, read our card review.

Related: Best rewards credit cards

Getting your SCRA and MLA benefits right

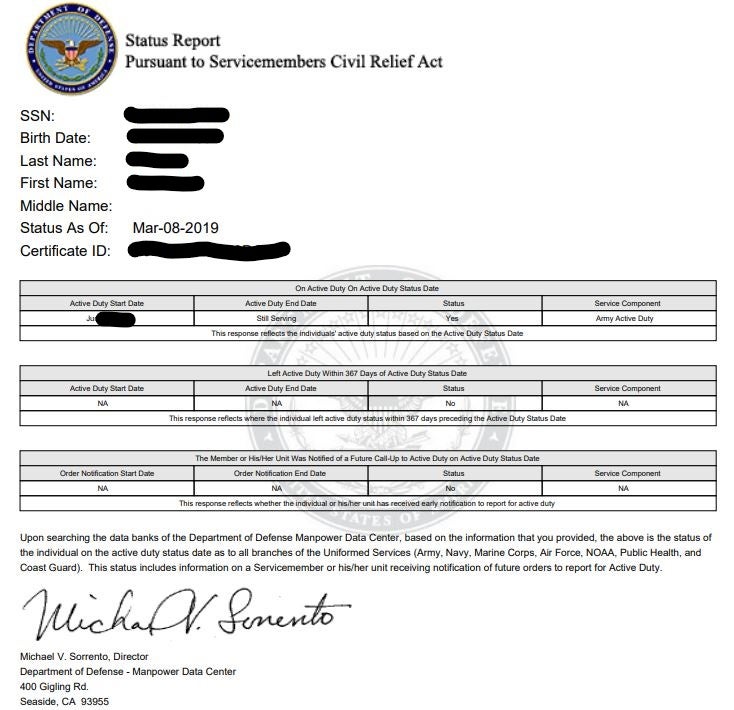

It can be confusing to make sure you are eligible for and requesting the right benefits under the right law. If you are still unsure if you or your dependents are eligible, you can check out the SCRA and MLA websites to verify eligibility. Note that dependents only fall under the MLA and will not appear under SCRA searches.

These services are completely free of charge, so do not pay an online service to verify eligibility . Below is what you should see if you are eligible.

Once your dependent is verified on the MLA record search, you can refer them to a credit card you have and potentially end up with:

- A referral bonus.

- A minimum spending bonus.

- Two waived annual fees.

- Well over $1,000 saved, depending on the credit card.

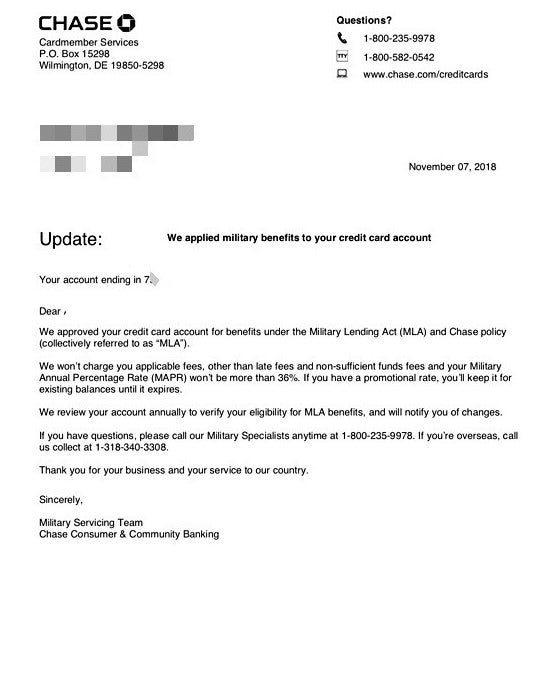

Some service members have stated that no action was required of them once they opened a new account in order to get the waived annual fee. Below is an example of the letter you or your dependent may receive from Chase if you are covered under the MLA. Additionally, there are links and phone numbers listed with the credit cards below that will lead you to your benefits.

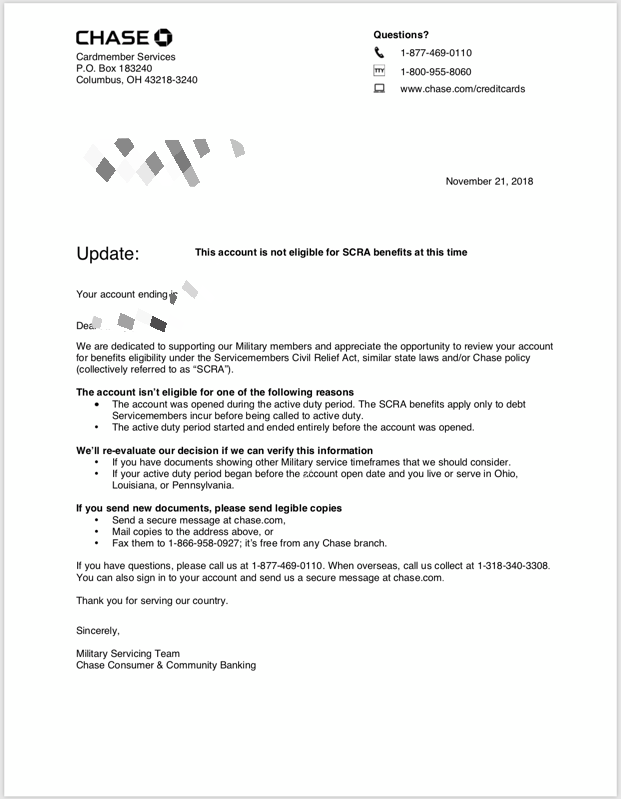

If you aren't eligible under the SCRA and have a Chase account, you may receive a letter like this:

Bottom line

There are very generous benefits available to the military community. However, you must be a responsible borrower and have the credit score to support opening new accounts.

Military life can be stressful and tracking finances while changing addresses every two to three years can be difficult. If you can manage it and keep your credit journey organized, there's no reason you shouldn't take advantage of these rewards while on active duty.

Additional reporting by Richard Kerr, Benét J. Wilson, Christina Ly and Matt Moffitt.

TSA Pre-Check fees are waived for Chase Sapphire Reserve cardholders.

Sorting through the cards in your wallet should be an annual chore. You want to double down on the most rewarding perks — which can change from year to year — while omitting other cards that have drifted into mediocrity. It’s a tedious process that can significantly boost your points and miles balances and pave the way for free and upgraded travel.

Let us do the heavy lifting for you. Changes to major credit cards offerings that happen in the yearend cycle are now inked in place, and we’ve been busy sifting the fine print so you don’t have to.

There are a few caveats: Sign-up bonuses come and go, and it is always wise to scour the internet for the best offer. Don’t assume that you need to go with the most prominent, highest-fee cards for hefty rewards. These days, some options with lower annual fees pack a solid punch, too.

Here are the best travel credit cards on the market right now, plus more affordable alternatives well worth considering.

Best overall

American express platinum card.

Annual fee: $695

The quick sell: Even with patchy acceptance of Amex cards abroad, the Platinum card continues to reign supreme for its excellent airport lounge access and instant VIP status at hotels. You can milk its pricey fee for some $1,800 in value before you redeem a single point.

New fine print for 2024: Effective February 2025, cardholders can access Delta Sky Clubs only 10 times a year; previously, there were no such limits. Meanwhile, a new partnership offers cardholders free access to Points.me, a clever tool that makes it easy to compare points-redemption options across a wide variety of airline and hotel programs.

The perks: Access to 40+ Centurion airport lounges is always a draw, though now you’ll have to pay $50 to bring a guest unless you spend more than $75,000 on your card annually. Cardholders also benefit from partnerships with other lounge networks, including Priority Pass (which offers no-cost access to its 1,300+ locations), Plaza Premium, Escape, Lufthansa and Delta Sky Club (when flying Delta). For now, Sky Club use is unlimited; in 2025, it will be restricted to 10 visits per year.

A rendering of plans for the new American Express Centurion Lounge at Newark Airport.

The card comes with a slew of valuable credits. These include $200 for such incidental airline fees as seat assignments and bag surcharges, $200 toward hotel reservations made via Fine Hotels + Resorts program, and monthly credits for Uber and media subscriptions (including Disney+, SiriusXM and the New York Times). You can also score a $155 Walmart+ credit and $100 for Saks Fifth Avenue — not to mention instant gold status with both Marriott Bonvoy and Hilton Honors loyalty programs.

Points (1 point equals 1 cent) can be redeemed like cash via the Membership Rewards portal or transferred to such airline and hotel loyalty programs as Air France/KLM, Delta and Virgin Atlantic. You get five times the points when booking travel via American Express or its Fine Hotels + Resorts program, which confers free breakfasts, room upgrades and late checkout at such hotels as the Hotel Plaza Athénée Paris or the Four Seasons Bali at Jimbaran Bay.

Cheaper alternatives: The Blue Business Plus Card from American Express offers unrivaled points-earning potential among no-annual-fee cards — two points per dollar. If you value airport lounge access, the $395-annual fee Capital One Venture X card is a better deal that offers similar earnings, plus access to Priority Pass, Plaza Premium and a growing number of Capital One lounges.

Best return on points

Chase sapphire reserve.

Annual Fee: $550

The quick sell: This card provides the most value when it comes to redeeming points for free travel. Its built-in credits are great, too.

New fine print for 2024: Here, it’s business as usual.

The perks: Chase Ultimate Rewards points can be redeemed like cash or transferred to airline and hotel partners. You’ll get 10 of those per dollar spent on hotels, rental cars and dining booked through Chase, and 5 points per dollar on flights. You also get 10 points per dollar on Lyft rides and 3 points per dollar on other travel and dining purchases made outside Chase’s ecosystem. All other purchases earn 1 point per $1.

These points come with mega value: One point is akin to 1.5 cents, making a $1,400 flight in premium economy from New York to Paris and back roughly 90,000 points.

As with Amex, you can quickly earn back the annual fee. A $300 annual credit wipes away travel charges, and you get $100 toward TSA PreCheck or Global Entry applications, plus free Priority Pass membership. Book via Chase’s own Luxury Hotel & Resort Collection program, and you’ll get perks like free breakfast and room upgrades, too. Then come such smaller benefits as a $5 monthly credit to DoorDash (plus free DashPass membership) and the free bike rentals, discounts and priority pickups that come with Lyft Pink All Access membership.

Cheaper alternative: The Chase Sapphire Preferred offers excellent points earning and solid redemption values — 1 point for 1.25 cents — but nixes Priority Pass and some other perks in exchange for a lower $95 annual fee.

Best for Star Alliance travelers

United club infinite card.

Annual Fee: $525

The quick sell: Why pay the $650 annual fee to join the United Club as a member when you can get access—for $125 via this card — along with greater access to United MileagePlus award-redemption availability just for holding the card?

New fine print for 2024: You can now earn 10,000 status-qualifying points by swiping this card — up from 8,000 last year. That’s enough to earn Premier Gold status all on its own.

The perks: United’s miles may have lost value over the years, particularly since the airline ditched award charts and raised prices on partners, but it’s the most transparent of the three biggest US carriers. (For one thing, it still shows award availability for most partners on its website and app.) With this card, MileagePlus earnings pile up fast, thanks to 4 miles per dollar on United purchases, 2 miles on dining and other travel and 1 mile on everything else. The path to elite status—measured via Premier Qualifying Points or PQPs — accelerates, thanks to 25 PQPs awarded per $500 spent (up to 10,000 PQPs a year), making most loyalty tiers (including Platinum) relatively attainable, even for non-business travelers.

This is not just about earning potential. You’ll get upgraded on eligible domestic and Caribbean award tickets just for holding the card, and if you redeem miles for a saver economy ticket, you’ll get 10% off in rebate form. Hotel benefits come via a partnership with IHG Hotels & Resorts: Cardholders get a $75 credit to apply toward on-site expenses whenever they stay at these properties, plus automatic Platinum Elite status with IHG One Rewards. (The latter gets guaranteed late checkouts, bonus points and free room upgrades.) When it comes to lounges, unlimited access is included, not just to United Clubs but to those of many Star Alliance partners as well.

Other benefits include a TSA PreCheck or Global Entry credit, two complimentary checked bags per flight, 25% discounts on in-flight purchases and standard travel insurance.

Cheaper alternative: The $95 annual fee for the United Explorer Card nets many of the most important perks, such as upgrades on United award tickets; two miles per dollar spent on United flights, dining and hotels; and two United Club passes.

Best for Delta loyalists

Delta skymiles reserve credit card.

Annual Fee: $650

The quick sell: SkyMiles has seen Zimbabwe-like currency devaluation entailing inflated redemption prices and scant partner availability. That makes this card — which isn’t a great option by most conventional measures — especially valuable to Delta loyalists. It offers an unparalleled three miles per dollar on Delta purchases (or one mile for every other purchase), and holding it bumps you up the upgrade list if you also have Medallion status.

New fine print for 2024: Pay attention to that annual fee; it costs $100 more than it did last year. But new travel credits offset that price hike, and your annual companion certificate can now be used on international flights to Mexico, Central America and the Caribbean.

The perks: In a bid to convert users toward booking hotels on Delta Stays, its own nascent platform, the airline is extending a $200 annual accommodations credit to cardholders. That’s in addition to $20 monthly Resy credits, $10 monthly ride-sharing credits and top Hertz elite status. But lounge access will soon be cut back. Starting on Feb. 1, 2025, cardholders will be limited to 15 day passes per year, rather than four free passes per trip on an otherwise unlimited basis. Additional visits will cost $50 unless you spend $75,000 per calendar year to unlock unlimited access.

The Delta Air Lines SkyLounge at LaGuardia Airport.

Also noteworthy, a free status-qualifying “boost” for cardholders nets you $2,500 Medallion Qualifying Dollars (MQD) at the beginning of the year — getting you halfway to silver under the airline’s new qualification scheme. (You’ll also get 1 MQD for each $10 spent on the card; you’d earn Diamond status with some $280,000 in annual spending at that rate.)

That’s not to mention the more standard travel benefits: free checked bags, a 20% discount on in-flight purchases, a 15% mileage discount on award flights, priority boarding, travel insurance coverage and a credit for either Global Entry or TSA PreCheck.

Cheaper alternative: If lounge access is not important, the Delta SkyMiles Platinum Card offers a happy medium with a lower $350 fee yet fewer benefits. These include a $150 Delta Stays credit, $10 per month for both Resy and ride-sharing services, mid-tier Hertz status, and the same expanded companion certificate perks. In addition to the $2,500 MQD bonus each year, the card earns 1 MQD per $20 spent, plus further basic travel benefits.

Best for American Airlines flyers

Citi/aadvantage executive world elite mastercard.

Annual fee: $595

The quick sell: While American now lets you buy status with credit card spending on everyday purchases with any of its co-branded credit cards, only this one adds complimentary Admirals Club lounge membership. This ordinarily costs $850 — more than this card’s annual fee.

New fine print for 2024: The accrual period for AAdvantage points now stretches from March through February rather than from January through December.

The perks: Airport lounge access is where you extract value from this card; you’ll maximize it by adding up to three authorized users to your account. Setting this up comes with a $175 fee, but it extends your Admirals Club access to those users — and gives them the ability to bring two guests into the lounge as well. It’s great for family members you trust and travel with; lounge membership for four individuals could otherwise cost $3,400.

The Intercontinental Paris Le Grand hotel, one of many IHG properties that extend benefits to United Club Infinite cardholders.

Moreover, handy credits include $10 per month to use with Lyft and Grubhub, $120 toward Avis or Budget car rentals annually, and 20,000 bonus points when you spend some $90,000 on eligible purchases.

Cheaper alternative: While the unique ability to exchange points for AAdvantage miles with the no-annual-fee Bilt Mastercard will end on June 30, 2024, a new partnership with Alaska Mileage Plan makes this option appealing to Oneworld flyers at large.

Bilt has quickly shaken up the industry by offering one point on everything, including rent and mortgage payments (typically not payable with other credit cards). This can help college-age consumers and young adults build credit while earning points.

Monthly promotions can help you earn and spend those points more efficiently, and the card has points-transfer partnerships with more than a dozen loyalty programs, including World of Hyatt and Air France-KLM Flying Blue.

- Latest Issue

- Arts & Entertainment

- Banking & Finance

- Latest Commentary

- Letters to the Editor

- Health Care

- Politics & Policy

- Restaurants

- Sports & Recreation

- Transportation

- Latest News

- Commercial Real Estate

- Residential Real Estate

- Deals of the Day

- Who Owns the Block

- Real Estate Families of New York

- Health Pulse

- Top Earners

- Who's News

- On Politics

- Crain's Forum

- Chasing Giants

- Economic Outlook

- 20 in Their 20s

- 40 Under 40

- Best Places to Work

- Diversity & Inclusion Awards

- Hall of Fame

- Women of Influence

- 2023 Empire Whole Health Heroes Awards (sponsored)

- 2023 New York ORBIE Awards (sponsored)

- Nominations

- Data Center

- Highest-Paid CEOs

- Highest-Paid Hospital Execs & Doctors

- Largest Private Companies

- Largest Public Companies

- Largest Residential Sales

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Amex Gold Card Benefits for Active-duty U.S. Military Members

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3062 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1166 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

How Do the SCRA and MLA Acts Work?

Why we like this card for active-duty military, welcome offer — value of $600+, annual fee — value of $250, earnings on everyday purchases — value of $1,000, earnings on travel — value of $90, access to hotel and airline partner transfers — value varies, uber cash — value of $120, dining statement credits — value of $120, access to american express hotel collection benefits — value of $100, car rental loss and damage waiver — value of $100, purchase protection and extended warranty — value varies, amex offers — value of $100+, american express auto purchasing program — value of $500, no foreign transaction fees — value of $30, who qualifies for amex’s active-duty military benefits, how to request benefits, everything else you need to know, the platinum card ® from american express, the business platinum card ® from american express, hilton honors american express aspire card, delta skymiles ® reserve american express card, marriott bonvoy brilliant ® american express ® card, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Serving on active duty in the U.S. military comes with a lot of sacrifices, including potential financial challenges. But there are ways to save money and create value for your military household with benefits such as those offered to military members by the American Express ® Gold Card .

The Servicemembers Civil Relief Act (SCRA) established in 2003, and the Military Lending Act (MLA) established in 2006, have helped make financial transactions less costly for service members. These relief acts help reduce financial burdens and provide consumer credit protection for qualifying military members who have secured credit prior to, or during, military service.

Some credit card issuers not only adhere to the requirements of these acts but expand the benefits to include eliminating fees on select credit cards.

Because American Express is one of those card issuers, we’re looking at military benefits for the popular Amex Gold card today. We’ll share how the card earns rewards, some of your options at redemption time, and benefits that could be helpful for active-duty military members .

The SCRA applies to credit established prior to active duty and provides a cap of a 6% interest rate, including fees, on many financial obligations incurred prior to military service.

The MLA applies to credit established during military service and limits interest to 36% Military Annual Percentage Rate (MAPR) on certain loans and credit products. While 36% may seem high, the MLA applies to a variety of loans including payday loans, which are known to have high interest rates. The 36% includes all fees, credit insurance premiums, and finance charges.

Credit card issuer American Express, while adhering closely to the requirements of these acts, goes beyond the mandatory fundamentals as eligible active military members won’t be charged the annual fee, and other fees, on select credit card products.

The absence of annual fees can offer significant savings for a military member while providing a long list of valuable benefits.

Let’s look at a snapshot of the Amex Gold card and the benefits you’ll realize as an active-military cardholder. No doubt, the Amex Gold is one of the best credit cards for military members.

Amex Gold Card Overview

American Express ® Gold Card

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel