How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

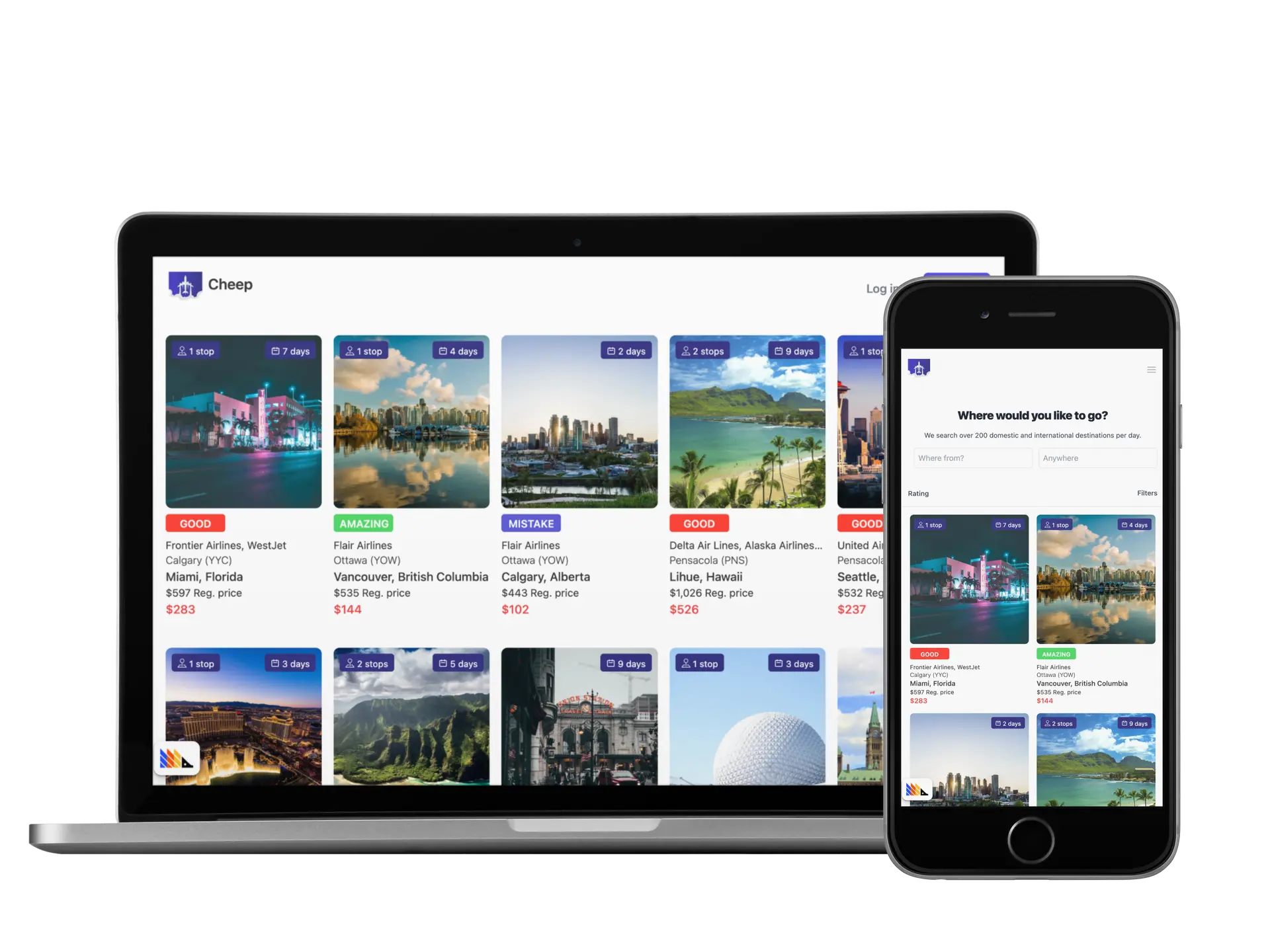

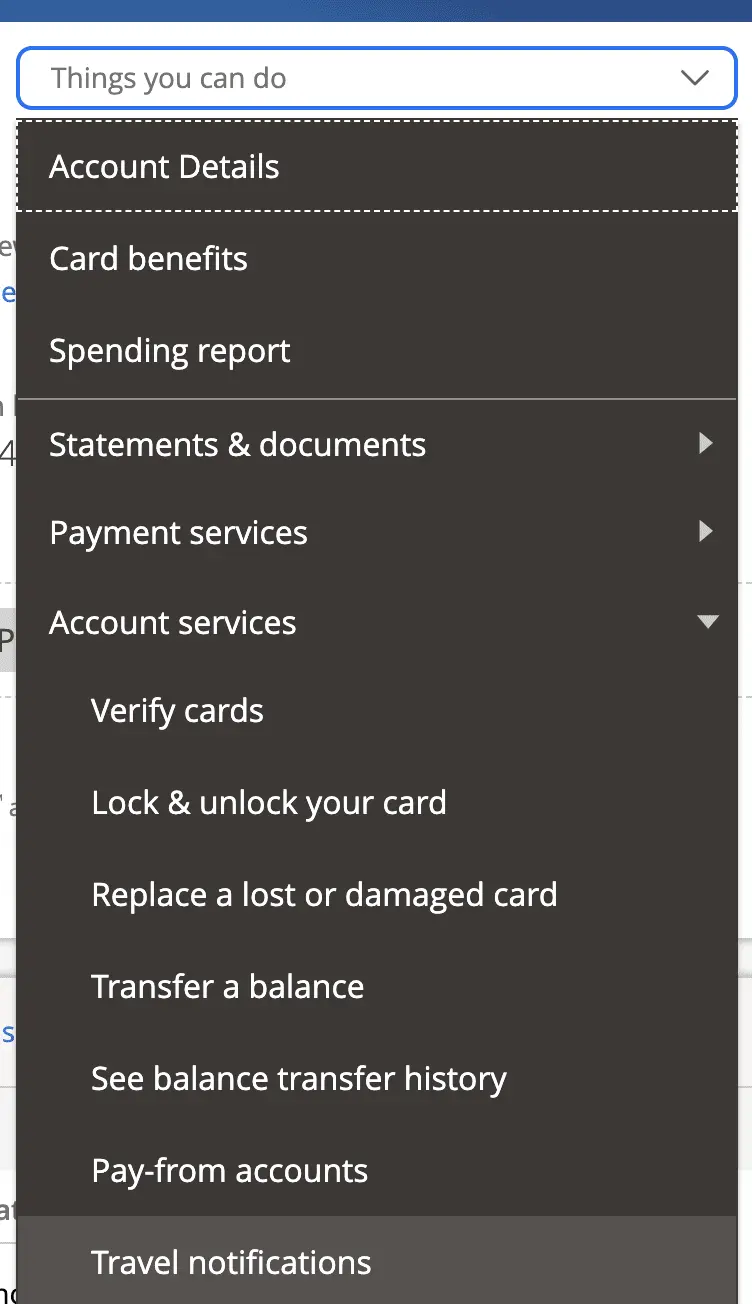

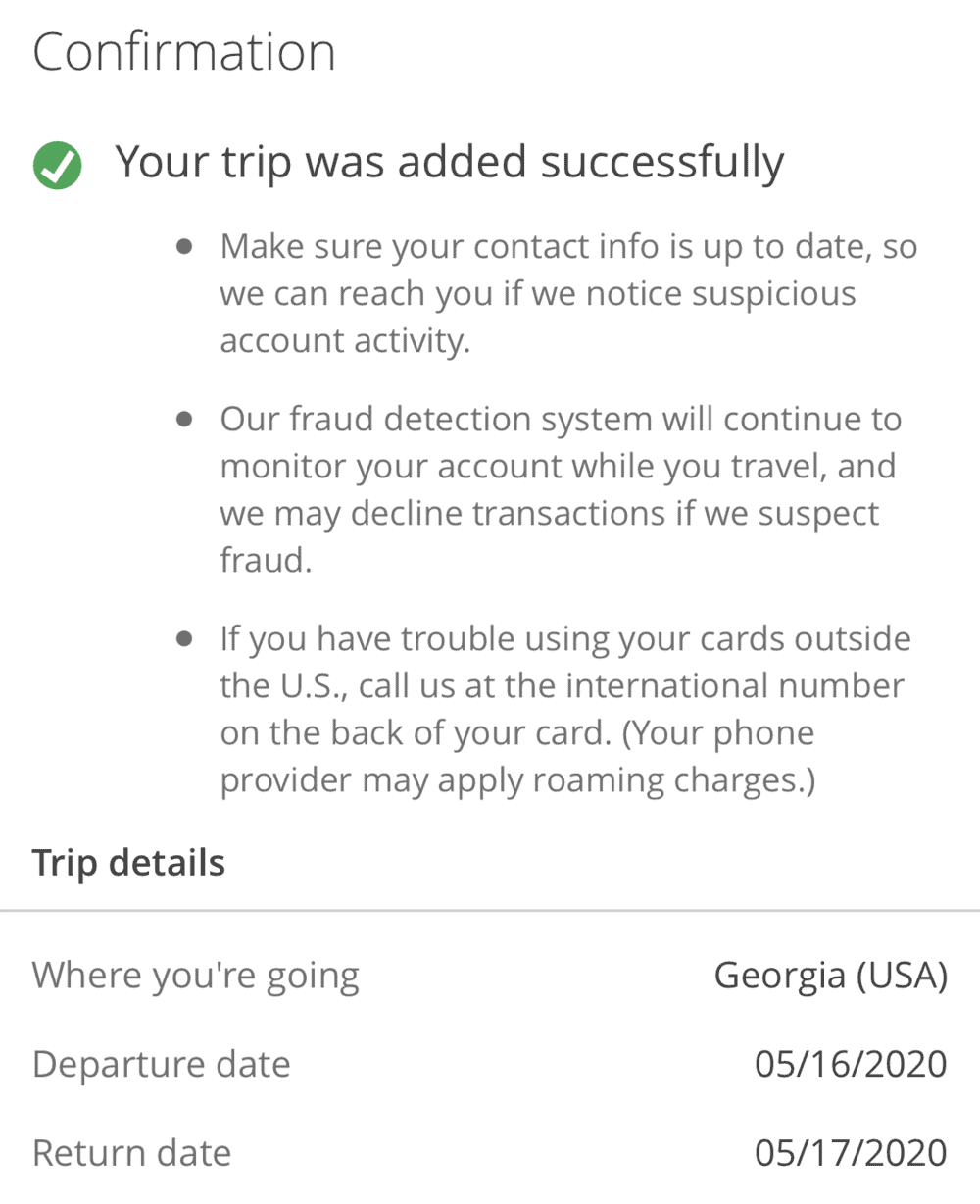

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

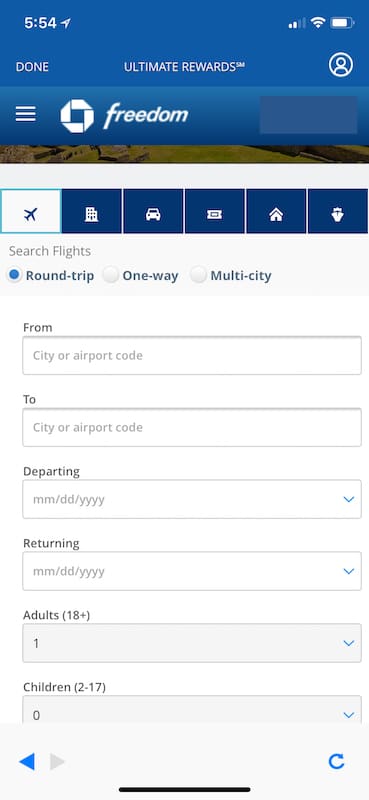

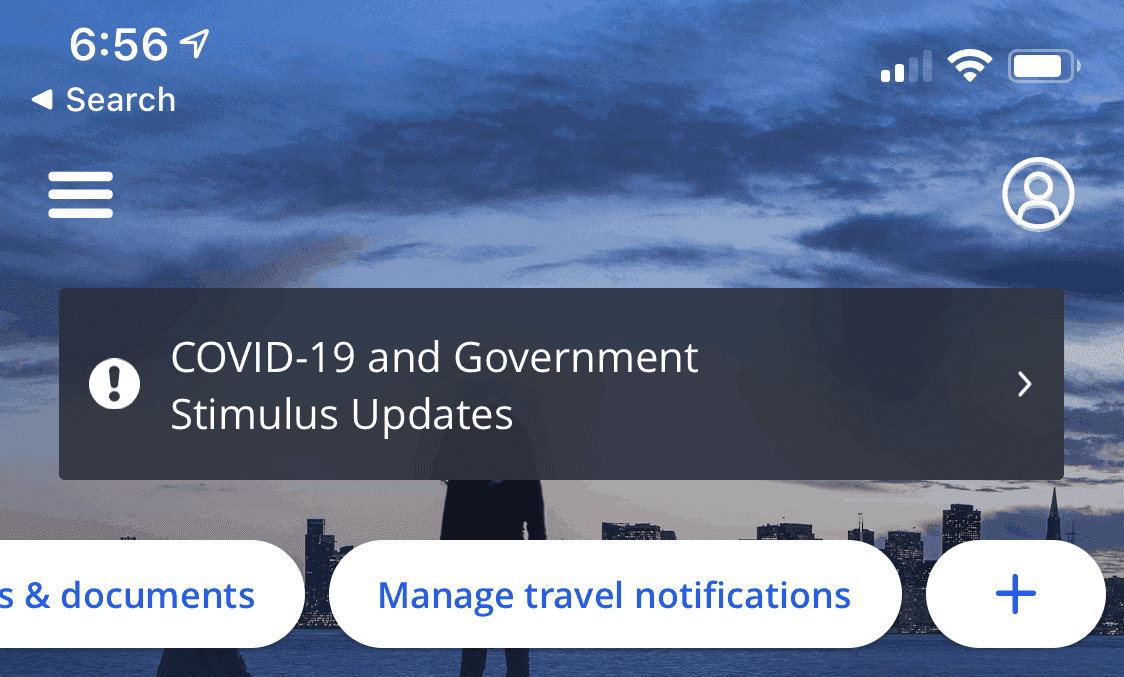

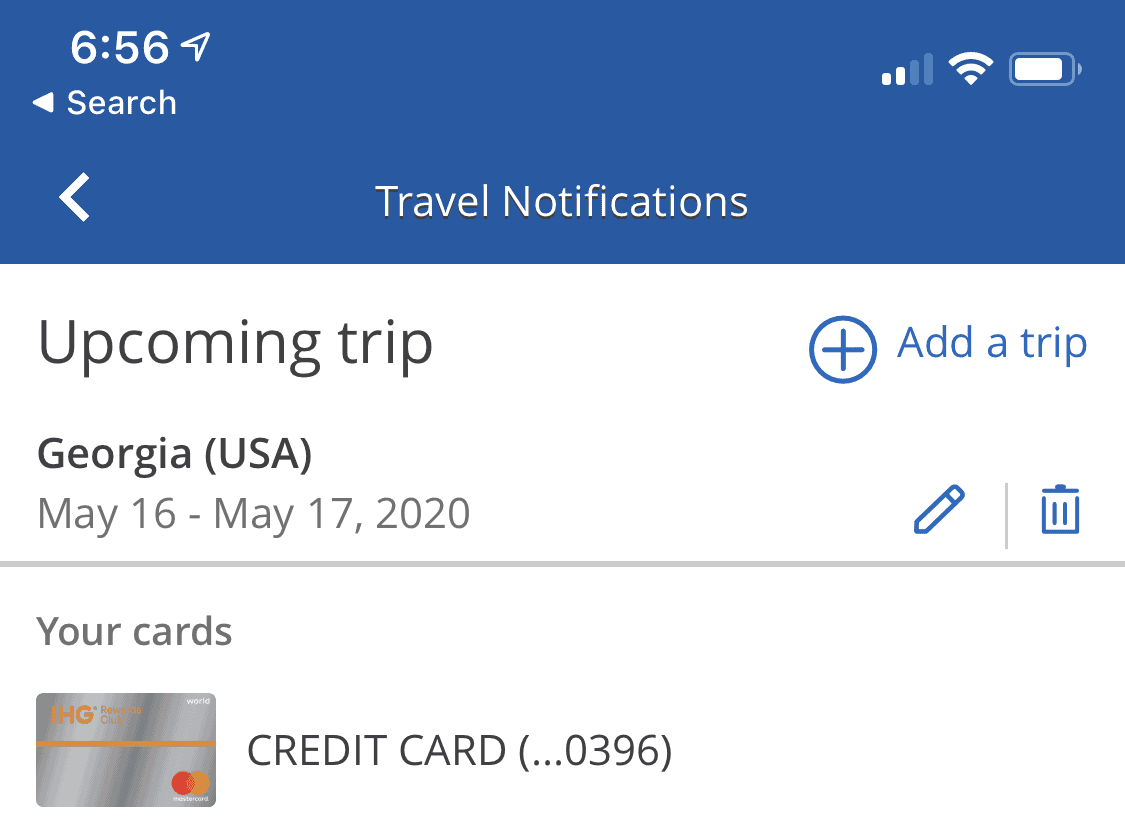

Setting up a travel notice with the Chase bank app

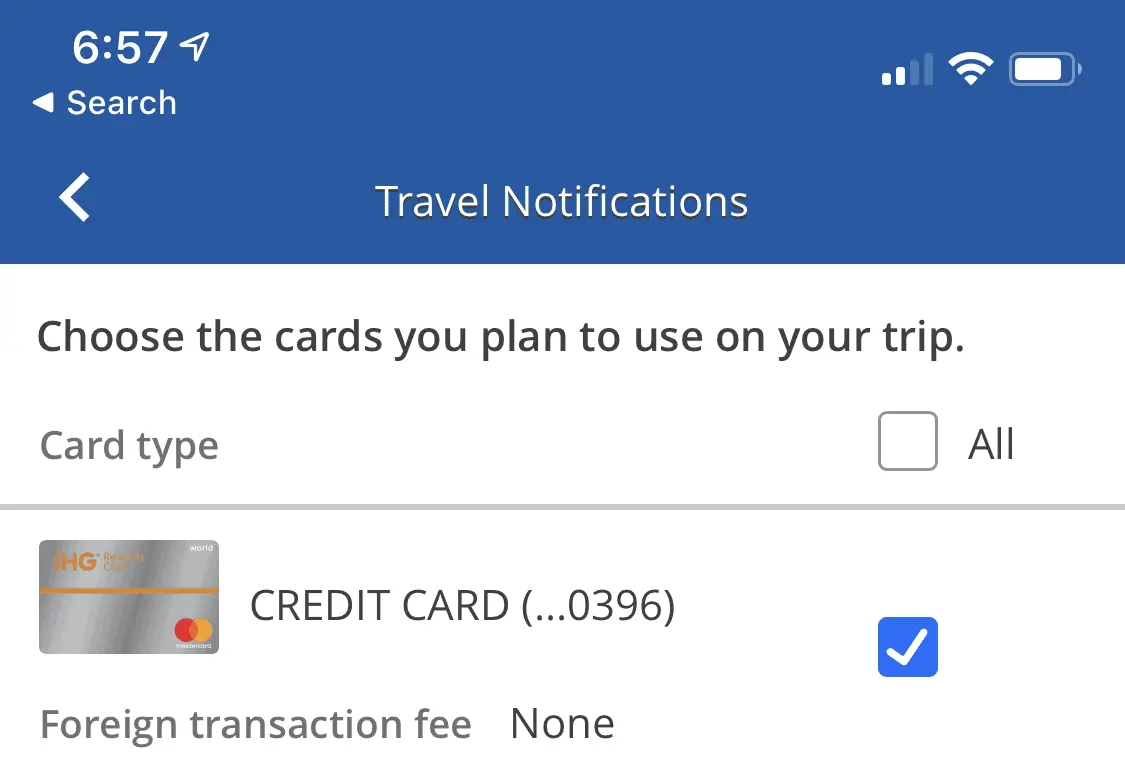

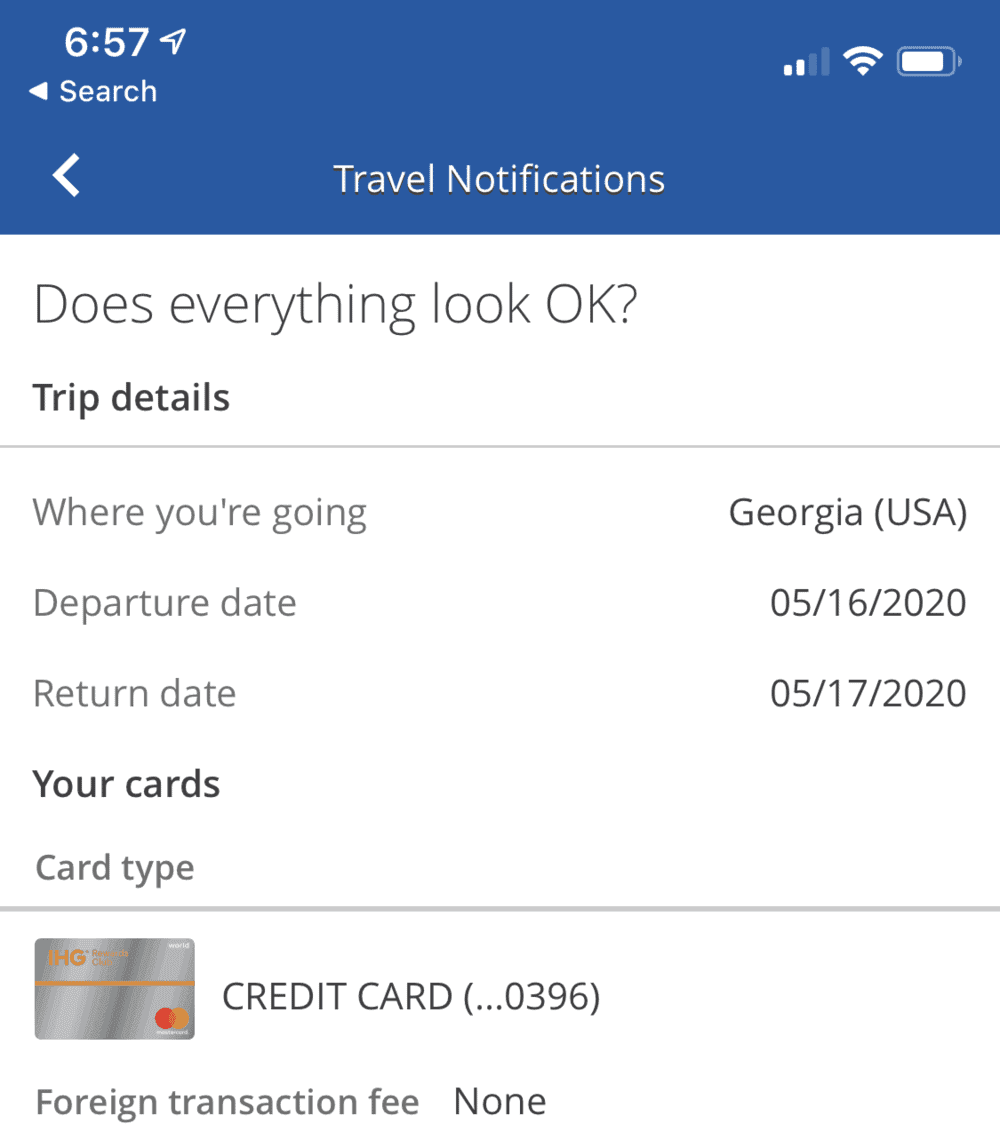

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

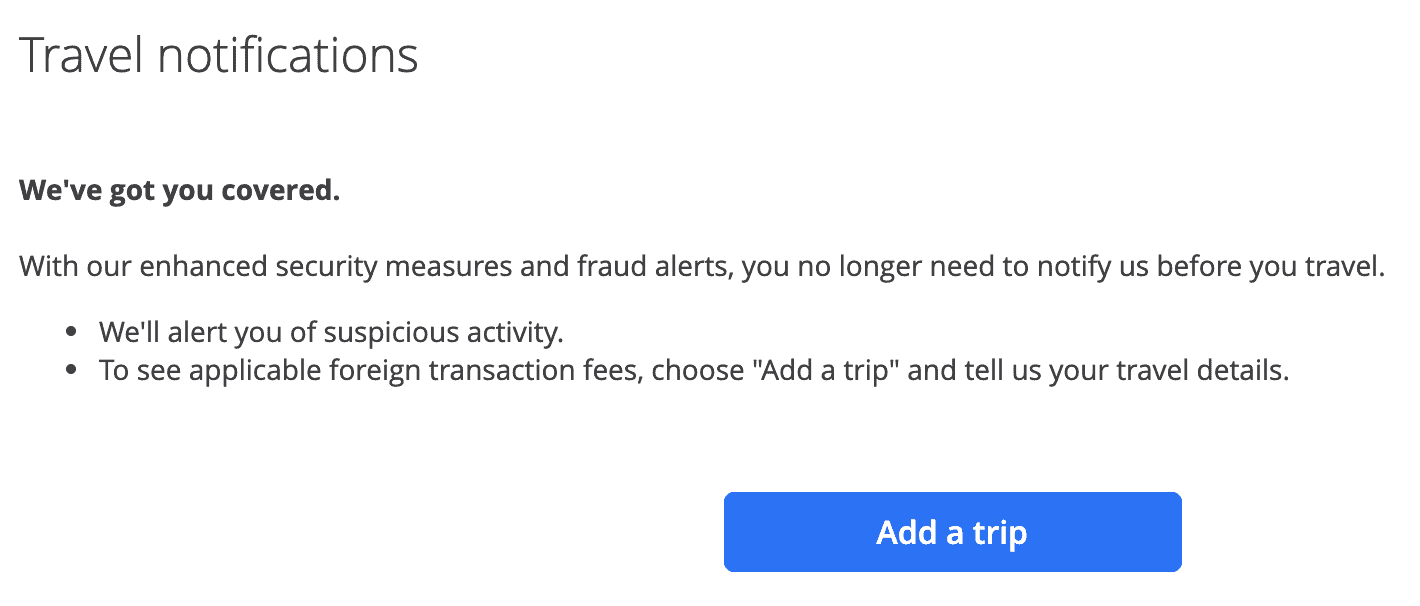

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

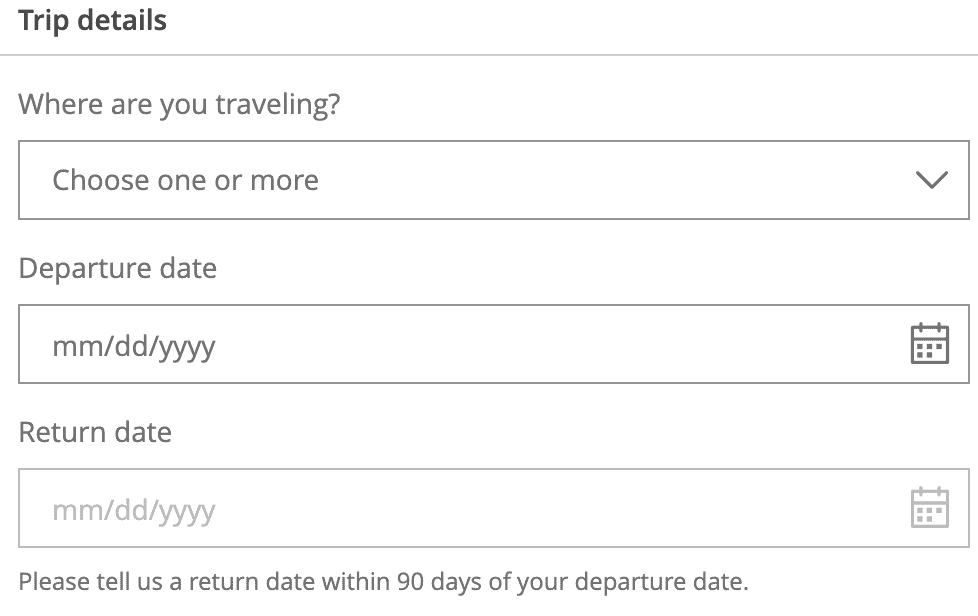

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

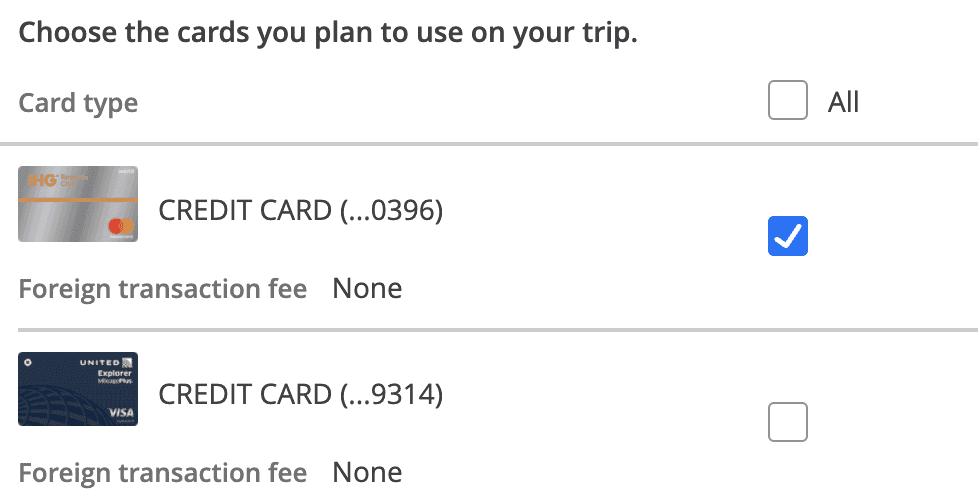

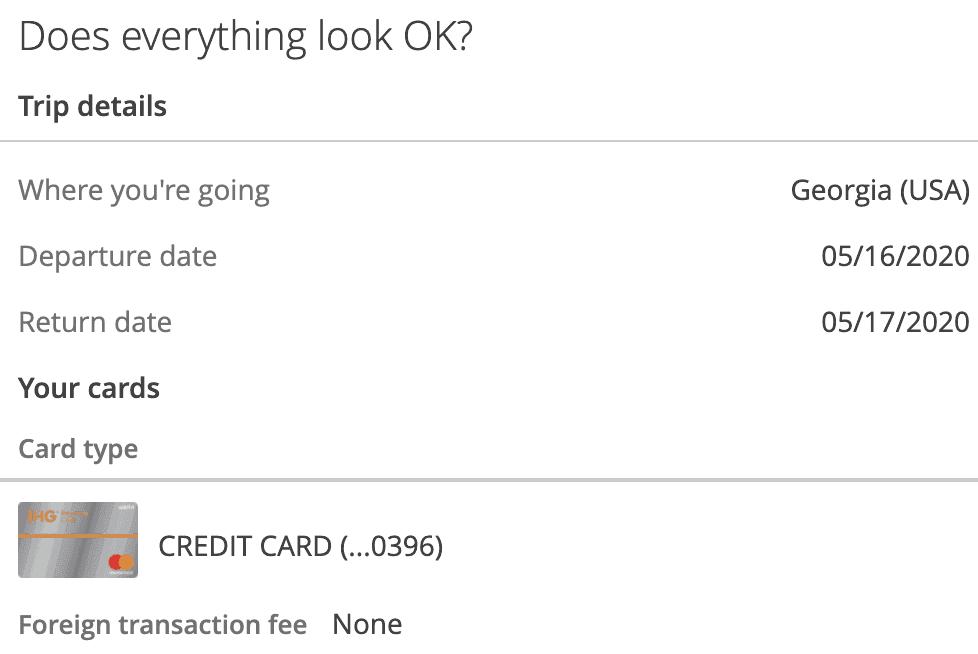

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Here’s How to Quickly Notify the Bank About Your Travel Plans to Avoid a Declined Card Overseas!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s usually a good idea to notify your bank about any international travel plans . This way, the bank won’t be surprised to see unusual charges on your account.

Million Mile Secrets team member Scott calls the number on the back of his Chase Sapphire Preferred Card to set travel alerts . Because a human picks up the phone right away. But now he’ll consider doing it online this way instead.

It can be a headache if your account is frozen by the bank (unable to make purchases) while attempting to pay for a souvenir or meal in a foreign country.

If you have a Chase debit or credit card, you can quickly set up travel notifications online .

You can also notify banks about international travel by calling the number on the back of your card. But some folks might prefer the convenience of doing it online!

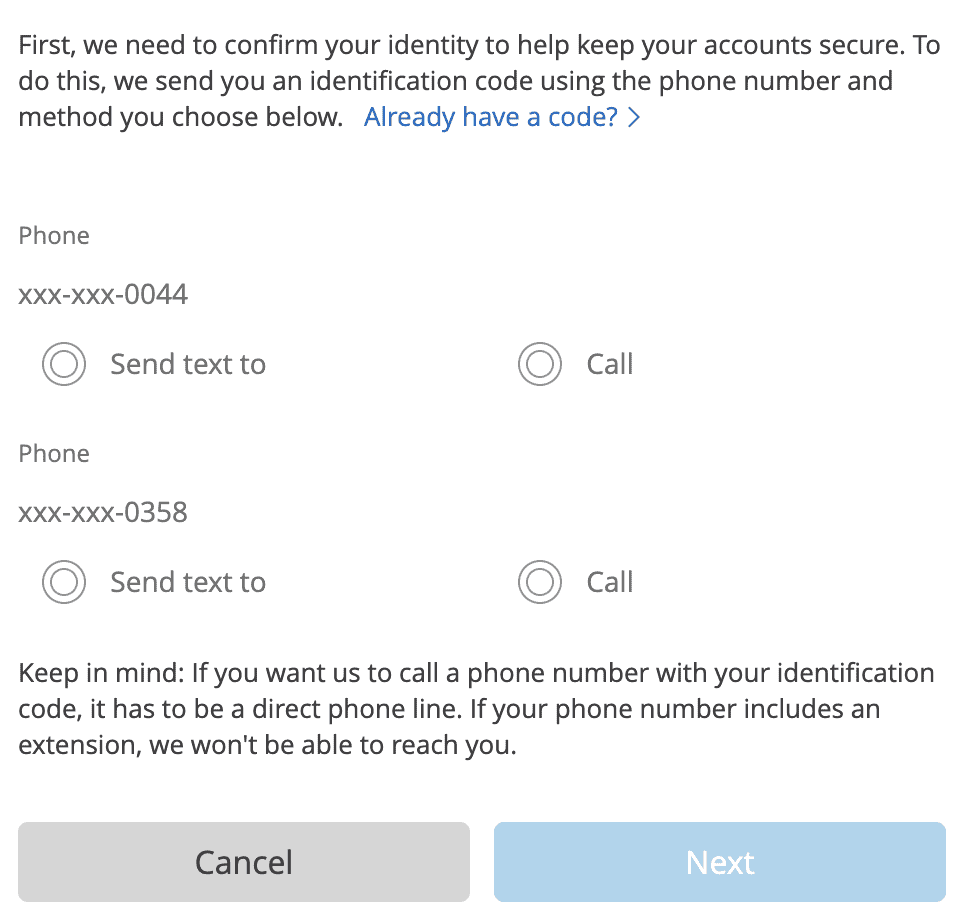

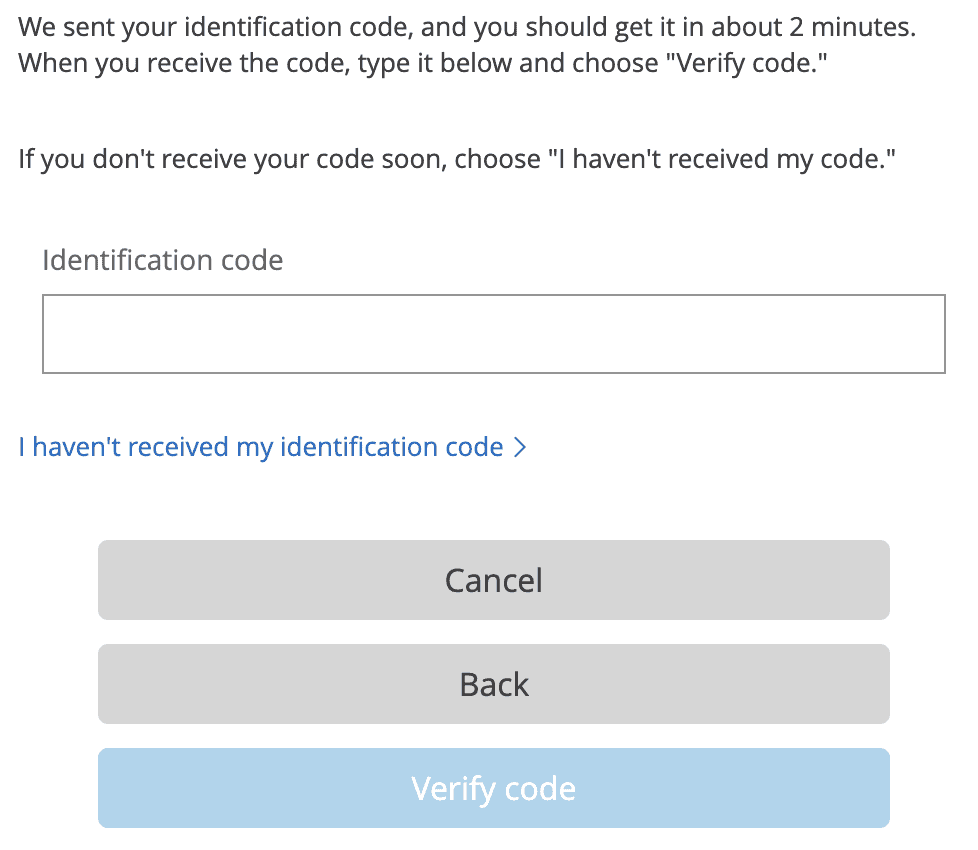

Easy 4-Step Guide to Set up Travel Notifications for Chase Card Accounts

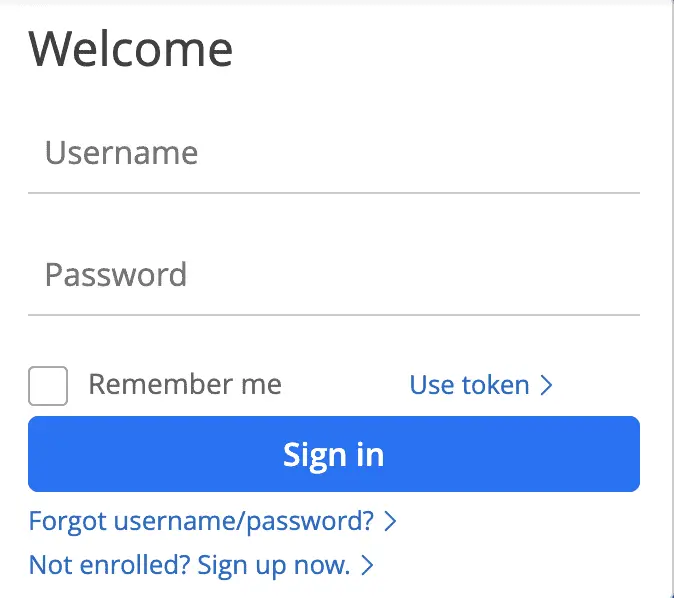

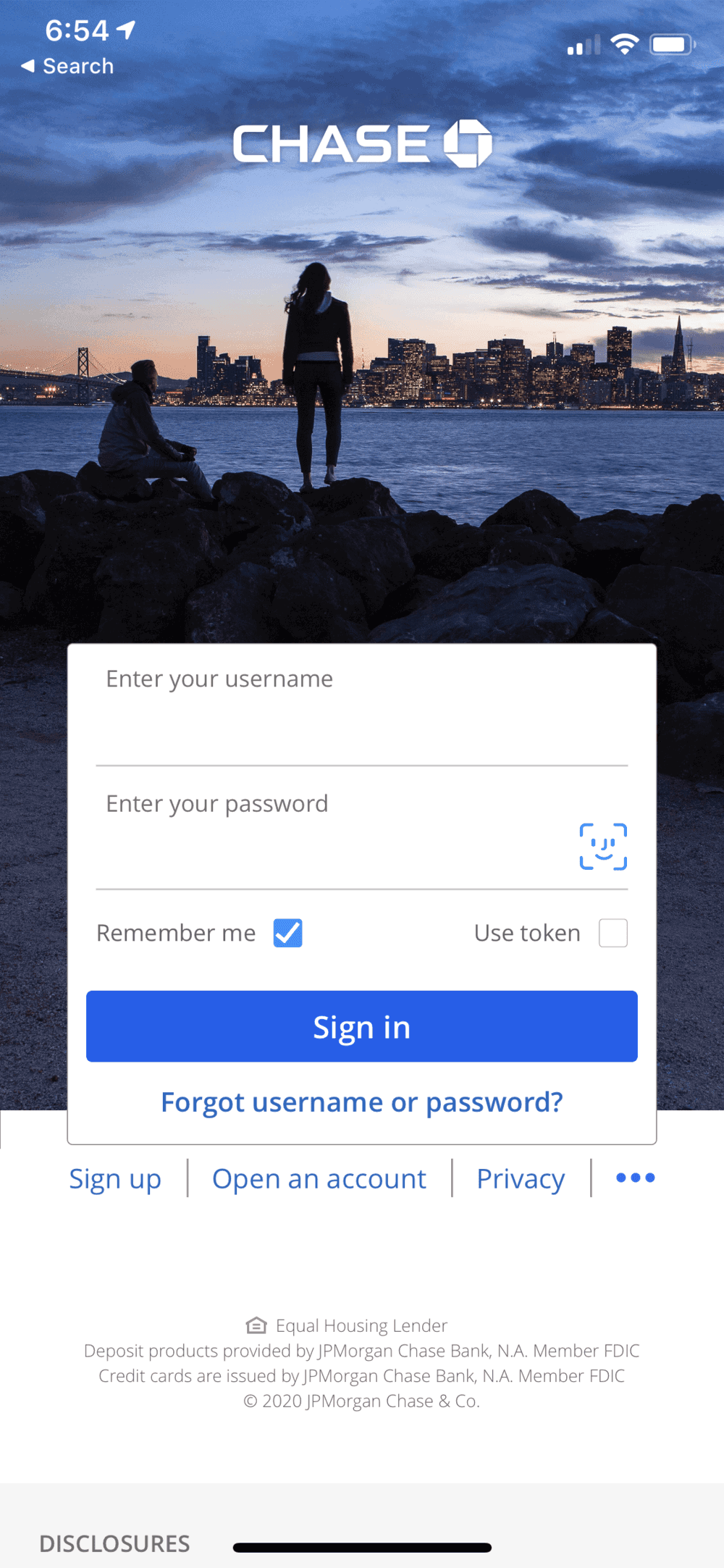

Step 1. log-in to your chase account.

First, log-in to your Chase account .

Keep in mind, you can NOT set up travel notices using the Chase mobile app. So you’ll have to log-in on your desktop or on mobile web browser.

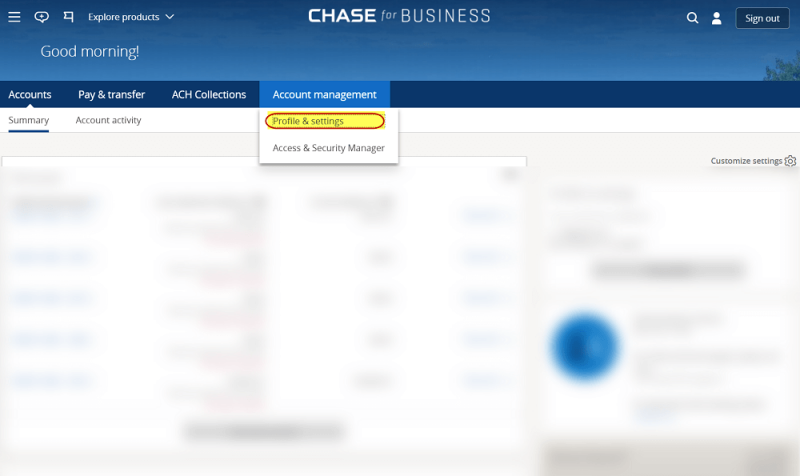

Step 2. Go to the “Profile & Settings” Under the Account Management Tab

Once you log-in, you can click on “ Account Management ” in the top navigation bar, and then click “ Profile & Settings “ .

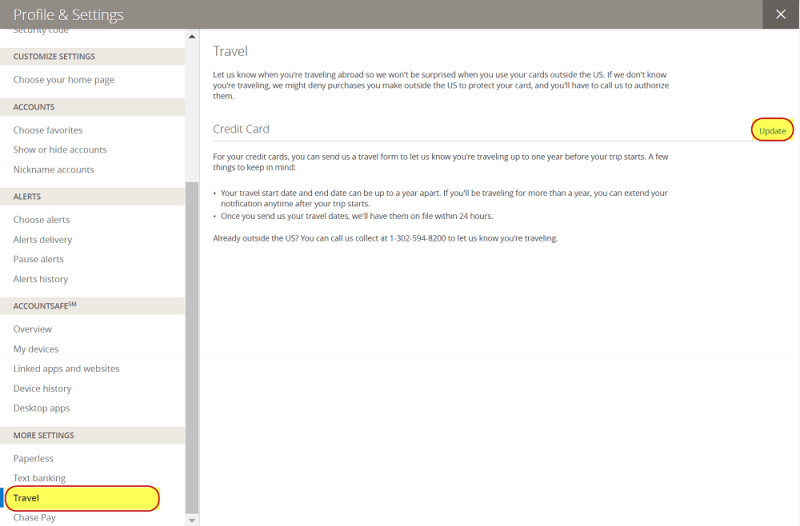

Step 3. Click “Travel” at the Bottom of the Left Menu

Scroll to the bottom of the menu on the left to find the “ Travel ” tab. Click it, and, you’ll see an “ Update ” link to the right of the page, where you can inform Chase about your upcoming globetrottery.

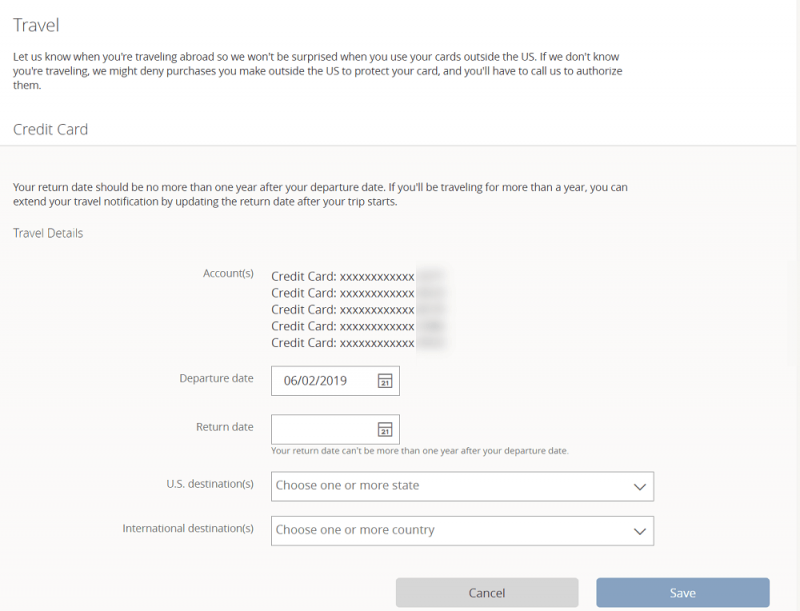

Step 4. Enter Your International Trip Details

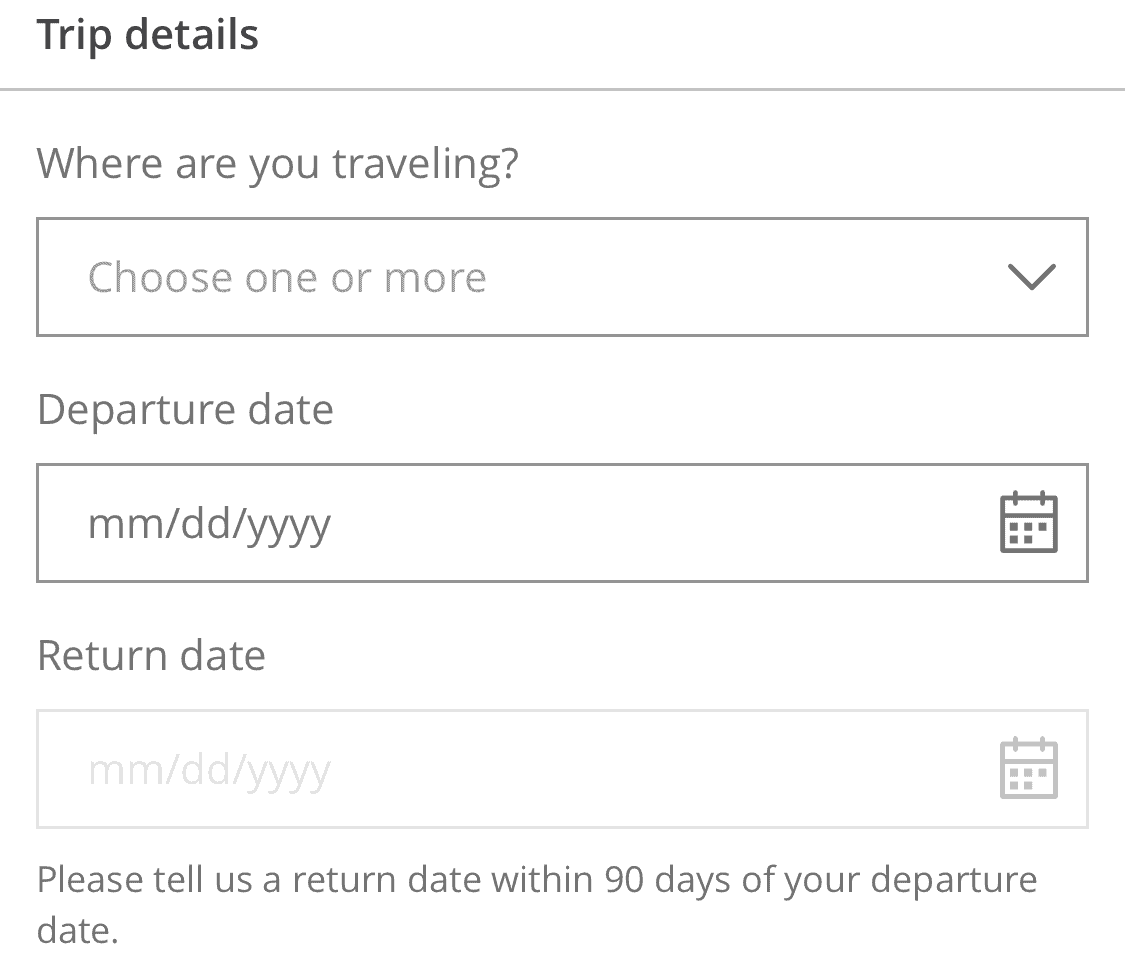

Now, it’s time to enter your trip details.

If you’re creating a travel notification for your credit card account, simply enter your travel dates and destinations .

You can create a travel notification for your credit card accounts 1 year before your departure. That’s great for folks who like to plan ahead. 😉

It’s a similar process to set up an alert if you have a Chase debit card. One minor difference is you have to manually select the debit card or checking account you’d like to establish the notification for.

Keep in mind, you can only create a notification for debit cards 14 days prior to your travel dates.

Use These Chase Cards to Save Money on Transaction Fees!

Lots of credit cards charge up to 3 % when you use them for transactions in a foreign country. But many Chase cards have NO foreign transaction fees !

So not only is it easy to set up travel notifications with your Chase cards, but you can save money too. If you’re traveling overseas, you’ll want to use a Chase card like:

- Chase Sapphire Preferred® Card (our favorite card for beginners using travel miles and points)

- Ink Business Preferred Credit Card (our favorite card for small business owners!)

- IHG® Rewards Premier Credit Card (a fantastic hotel credit card)

We also really like this travel credit card for international trips:

- Capital One® Venture® Rewards Credit Card (our #1 card for easy-to-use miles)

Here’s our post with the best travel credit cards !

Here’s our post with the best no-foreign-transaction fee credit cards!

Bottom Line

When you’re traveling internationally, you can call Chase to notify them about your plans so your credit cards and debit cards don’t get declined. But it’s just as easy to set up a travel notification online .

You can do it in 4 quick steps . Simply log-in to your Chase account . Then, create separate notifications for your debit and credit card accounts.

While abroad, don’t forget to use a Chase card with no foreign transaction fees , like the Chase Sapphire Preferred!

Other Popular Million Mile Secrets Articles to Read

- Earn more rewards with the best credit cards for eBay sellers !

- Make of the most of your rewards with our Ultimate Guide to American Airlines miles !

- Unlock the freedom to travel with AMEX Membership Rewards points !

- This is the best way to book JetBlue Mint Class with points!

- Southwest doesn’t have change or cancellation fees , here’s how to make changes when you need to

Don’t forget to subscribe to the Million Mile Secrets daily email newsletter for more tips, tricks, and insights into traveling for free.

Million Mile Secrets

Contributor

Million Mile Secrets features a team of points and miles experts who have traveled to over 80 countries and have used 60+ credit cards responsibly to accumulate loyalty points and travel the world on the cheap! The Million Mile Secrets team has been featured on The Points Guy, TIME, Yahoo Finance and many other leading points & miles media outlets.

More Topics

Credit Cards

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

UponArriving

Chase Travel Portal Review: (Airlines, Hotels, Car Rentals, Cruises) [2021]

The Chase Travel Portal can be one of the best ways to utilize your hard-earned reward points.

But how exactly does the Chase Travel Portal work and is it worth using?

This review article will walk you through step-by-step on how to use the portal for all forms of travel (airlines, hotels, rental cars, cruises) and I’ll also look at if travel through the portal is more expensive.

But most importantly, I’ll show you when to use and NOT use the Chase Travel Portal in order to maximize the value of your points!

Table of Contents

What is the Chase Travel Portal?

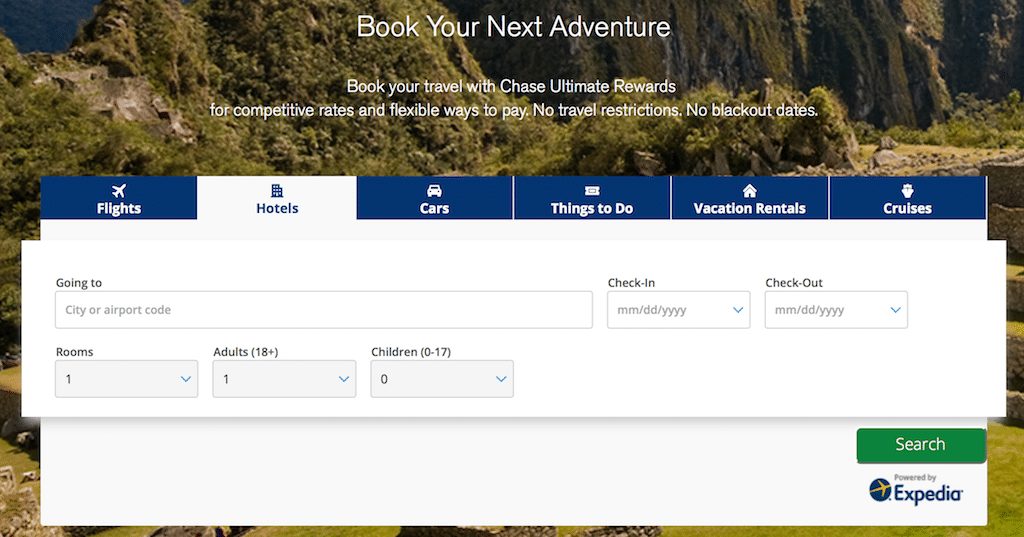

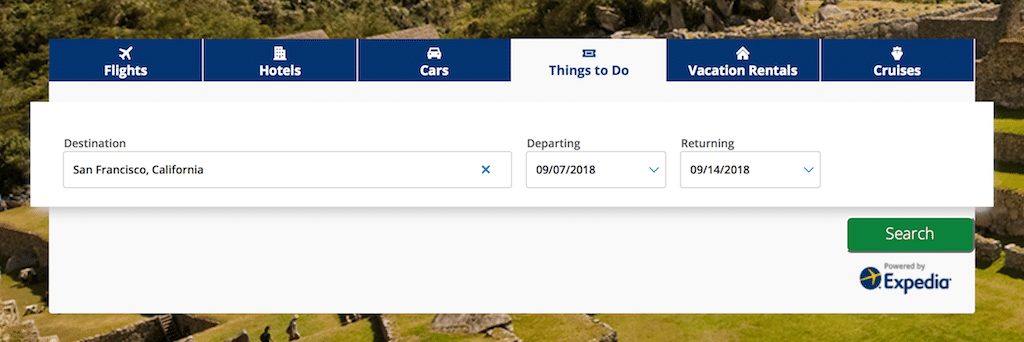

The Chase Travel Portal is an exclusive online travel agency (OTA) powered by Expedia that allows select Chase cardholders to book travel with their Ultimate Rewards or by paying via a credit card.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How do I get access to the Chase Travel Portal

This travel portal is only for Individuals with Ultimate Rewards earning Chase cards. So if you had a card like a Chase Southwest credit card you would not get access. Instead, you would need one of the following cards:

- Chase Freedom

- Chase Freedom Unlimited

- Chase Ink Cash

- Chase Ink Business Preferred

- Chase Ink Unlimited

- Chase Sapphire Preferred

- Chase Sapphire Reserve

Chase Travel Portal redemption values

When you use your Ultimate Rewards points to book travel you’ll get different levels of value from your Chase Ultimate Rewards earning credit cards, depending on the type of card that is used.

Take a look at how each point is valued based on the card you are using:

- Chase Freedom : 1 cent per point

- Chase Freedom Unlimited: 1 cent per point

- Chase Ink Cash: 1 cent per point

- Chase Ink Unlimited: 1 cent per point

- Chase Ink Business Preferred: 1.25 cents per point

- Chase Sapphire Preferred: 1.25 cents per point

- Chase Sapphire Reserve: 1.5 cents per point

Keep in mind that you can transfer Ultimate Rewards between spouses and household members so you can also use the card between you and others that has the best redemption rates for your travels.

The Sapphire Reserve with the 1.5 cents per point redemption rate is one of the top benefits of the Sapphire Reserve. It makes it much more tempting (and worthwhile) to use your points for travel redemptions when using the Chase Travel Portal.

But the Sapphire Reserve comes with a number of other stout perks including:

- $300 travel credit

- DoorDash $60 Credit

- 3X on dining and travel

- Priority Pass (with restaurant credits )

- TSA Pre-Check / Global Entry $100 credit

- Primary rental car insurance

- Annual fee: $550 (not waived first year)

All of these perks make the Sapphire Reserve one of the top travel credit cards on the market without a doubt.

Point values compared to to other programs (Amex)

You can get a sense of how great the value is with the Sapphire Reserve’s portal redemption rate by comparing its rate to other programs.

Just take a look at the Amex Travel porta l. For airfare you can redeem Amex Membership Rewards at a rate of 1 cent per point but things aren’t as good for other travel redemptions. For hotels, vacations, and cruises you’ll be redeeming at 0.7 cent per point.

So as you can see, redeeming points through the Chase Travel Portal with the Sapphire Reserve is much more lucrative than utilizing points with some other travel portals.

Chase Travel partners

Chase allows you to use your points to travel in different ways. You can either use the Chase Travel Portal or you can transfer your points out to transfer partners.

Chase travel partners

Chase has a great line-up of airlines and also has the best hotel selection out of any other major transferrable points program, in my opinion.

Here are all of the current Chase transfer partners:

Chase Ultimate Rewards Airlines

- British Airways Executive Club

- Flying Blue (Air France/KLM)

- Iberia Airways

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Chase Ultimate Rewards Hotels

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Whether or not you should transfer points to these partners depends on a few factors and I will discuss those below when giving advice on when to use and not use the travel portal.

How do I use the Chase Travel Portal?

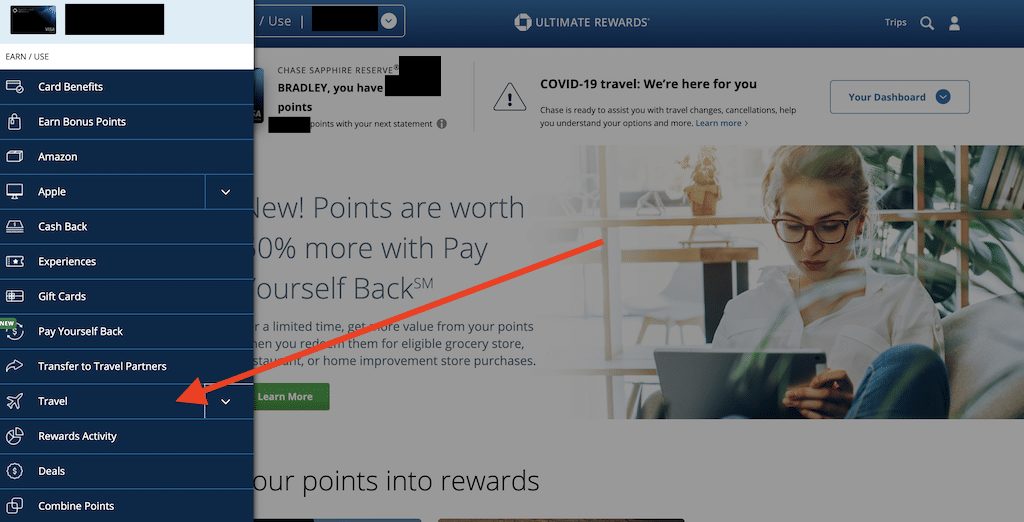

- Log-in to your Chase Ultimate Rewards dashboard

- Click on the travel button on the side panel

- Select your type of travel

- Book and enjoy!

Log-in to your Chase account

The first step to access the travel portal is to simply log-in to your Ultimate Rewards dashboard. You can log-in to the travel portal here .

Click on the travel button on the side bar

Once you are in the Ultimate Rewards dashboard you need to pull up the Chase Travel Portal by selecting travel. Simply navigate to the side panel and you will see the travel menu button.

Select for your type of travel

Once you are in the travel portal, you will need to select the type of travel that you were interested in booking. Here are the different types of travel that you can choose from:

- Flights

- Cruises

Things to do

Vacation rentals.

The last step is to simply book your travel.

Keep reading below for more details on how to get to that step.

When to NOT use the Chase Travel Portal

There are a number of reasons why you might not want to use the portal.

Outsized value

One of the biggest reasons to NOT use the Chase Travel Portal is because you can get so much more value when transferring points to travel partners.

When you book through the Chase Travel Portal you are limited to the point value of the credit card account that you are using for the portal.

So if you have the Chase Sapphire Reserve, you’re only going to get 1.5 cents per point out of your redemptions. That sounds impressive until you realize that if you transfer your points out to travel partners you could be getting redemptions at well over 10 cents per point.

So the benefit of transferring points is that you can receive amazing outsized value for your points that’s just not possible with the Chase Travel Portal.

Unforgettable travel experiences

And it’s just not about the monetary value, transferring points out to airlines allows you to experience some truly unforgettable flying experiences.

That’s because you’re able to fly in business class and first class cabins in some of the top airlines. You can experience your own private suites and live the high life rather than being stuck in economy.

These tickets can also get you access into some of the top airline lounges in the world for an unforgettable luxury experience. I’ve had some of my most memorable flights because of Chase Ultimate Rewards and some of the experiences that stick out are:

- First Class on the Korean Air A380

- First Class on the new Singapore Airlines A380

- Upper Class on the Virgin Atlantic 787

- First Class on the British Airways 747

If I would have used my points to book travel through the Chase Travel Portal, I would have never gotten a chance to experience those amazing flights.

Hotels can offer cases of outsized value, too. I recently finished a stay at the Park Hyatt Paris-Vedome and received over 3 cents per point in value.

I would have been limited to 1.5 cents per point with the Chase Travel Portal so transferring points would have made a lot more sense.

Hotel perks

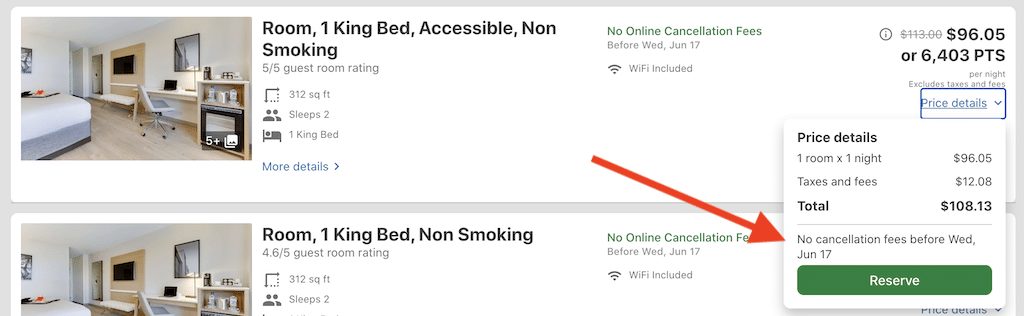

One of the main reasons why you’d want to avoid the travel portal is when booking hotel stays.

That’s because when you use an OTA, there’s a chance that you won’t receive all of your elite benefits/credits and you won’t earn hotel points for the stay.

So if you’re a Hilton Gold member for example you might not receive your free breakfast and potential upgrade that you would have had. Some programs won’t even allow you to get complimentary wifi unless you book directly.

The good news is that sometimes you can still get these perks.

You just need to call into the hotel beforehand and give them your elite information. If you do that and work a little charm at check-in you might be surprised to receive your elite benefits.

When to use the Chase Travel Portal

There are sometimes when it really makes sense to use the Chase Travel Portal.

Cheap domestic flights

Sometimes flights are pretty cheap and it makes way more sense to just use the portal to book them.

For example, if you wanted to fly on United Airlines from Houston to Orlando, you may have to transfer 25,000 Chase Ultimate Rewards for a roundtrip flight in economy.

But if you used the travel portal, you’d be able to book that Orlando flight for much cheaper during many times of the year and potentially save thousands of points.

You will still earn your frequent flyer miles, too, so there’s no loss in value there.

Cheaper hotels

The same principle applies to hotel stays as well. Sometimes it will just be cheaper to book through the portal than to transfer your reward points.

The major exception to this is Hyatt which often has point redemptions worth over 1.5 cents per point.

You’ve also got to really think about the value you might be losing out on if you don’t receive your elite benefits. It’s not hard for two free breakfasts to add up quick on a trip and if you’re giving that up, it might be more worthwhile to ditch the portal for that booking.

Not good with points

The thing about transferring points is that you need to aware of how the process works. You need to know how to transfer your points and how to use those points efficiently once you have them.

Then you’ve got to deal with finding award inventory, black-out dates, and the actual booking process which can be tricky with some foreign airlines.

Not everybody has the time to learn how to do that (or even the desire to do it). And for those people, the Chase Travel Portal is often a much better suited option.

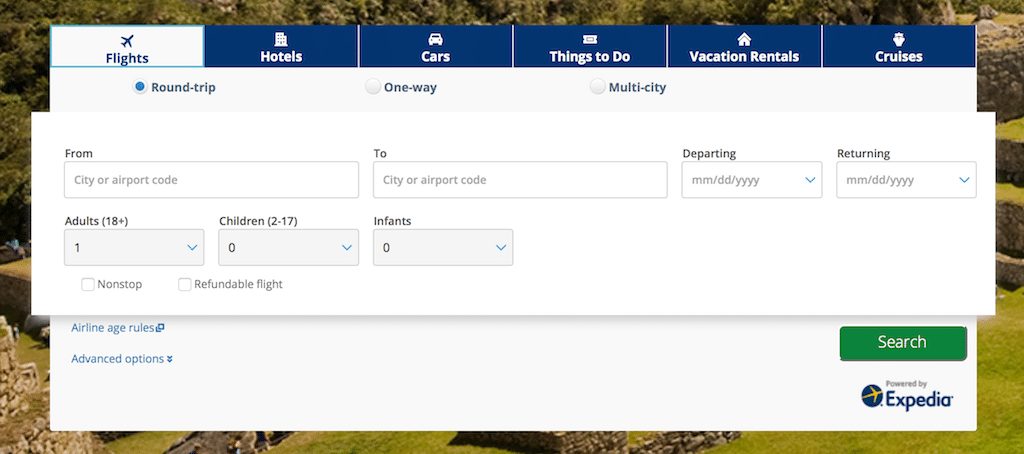

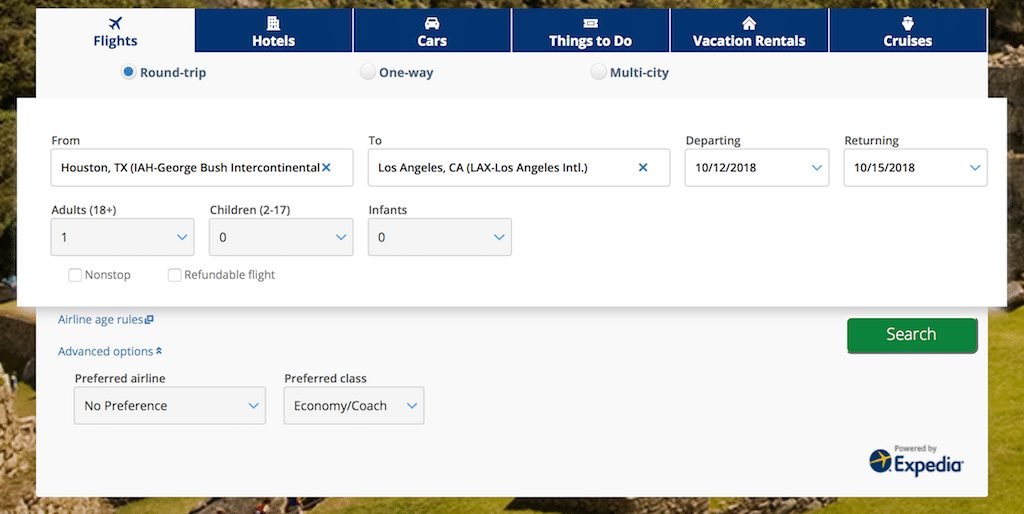

Booking different travel types

Since this is powered by Expedia , you’ll find robust filters for searching and filtering your particular type of travel. But just to give you an idea of all the possibilities, I’ve broken down some example search filters below for the different types of travel.

Chase Travel Portal Flights

The Chase Travel Portal allows you to easily search for flights.

Simply input your departure location and your destination, along with dates and passengers. You can also choose to search with your preferred airline or preferred class by using the “Advanced options.”

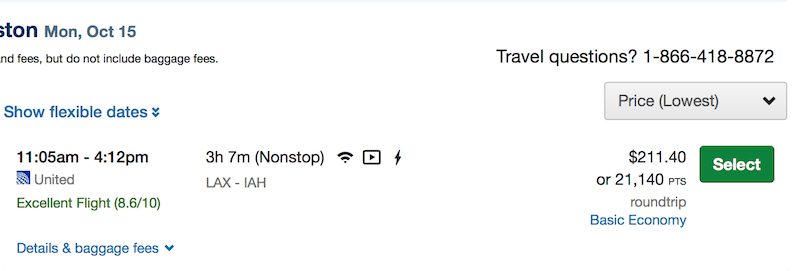

When I searched, the Chase Travel Portal pulled prices listed from the cheapest flights (which was directly on par with the lowest prices found in Google Flights).

I should note that many people complain about the pricing found on the portal and claim that many flights are also missing. So I would always double check the pricing with Google Flights and if I still had questions then I would just call the Chase Travel Portal number at 1-866-418-8872.

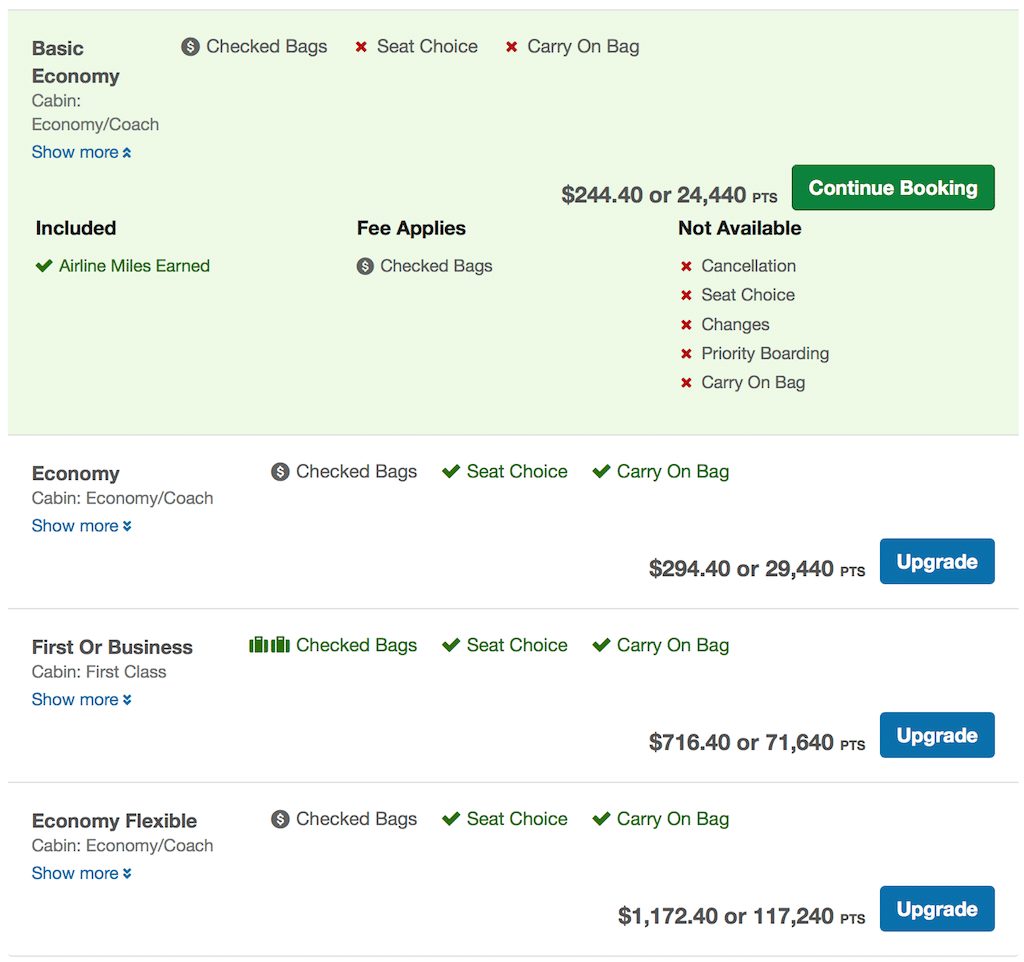

Also, be on the lookout for basic economy fares like the one below which state “Basic Economy” under Select.

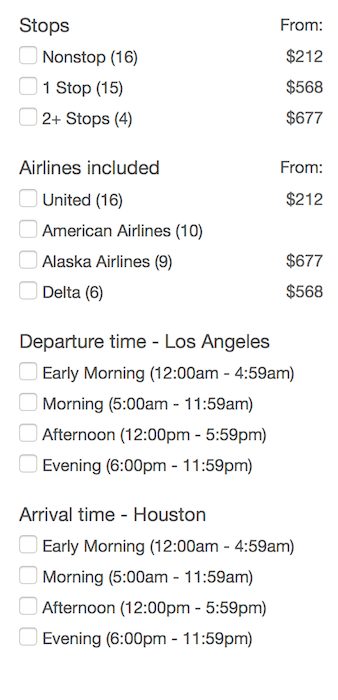

You can utilize several filters to narrow down the results including nonstop flights and also by airlines and preferences for departure time and arrival time.

You can also search the prices with the flexible dates feature. I prefer this search feature as it’s easy to spot the cheapest roundtrip prices and compare them to other websites.

Once you select your flights, you’ll be taken to another screen where you’ll need to confirm or upgrade your fare class. You’ll see the prices for upgrades and be able to confirm the options that your fare has or doesn’t have, such as seat choice.

At the next screen you’ll need to enter the names of the travelers and you’ll have a chance to enter in credentials for things like TSA Pre-Check and frequent flyer information.

You’ll also be able to choose how you want to pay for the travel. You can choose to pay with points, credit card, or a combination of the two. You’ll then confirm your booking on that screen.

Note that all booked flights can be canceled within 24 hours.

Booking flights on Southwest

Southwest flights do not show up on the Chase Travel Portal. However, you can call in to request a booking with Southwest Airlines if you’d like.

Where can I view my flight booking confirmation?

- Go to My Trips to view, email, or print your itinerary or receipt.

- View your confirmation email.

How to change your seat

For most flights, you can choose your seat during booking. Chase should send your seat selection to the airline at the time of booking, but they note that they cannot guarantee your seat assignment.

You can access your seat assignment for most flights in your itinerary , or when you view your flight booking confirmation .

Your seat selection may not be confirmed if you:

- Booked a fare with an airline that assigns seats at the gate

- Booked a Basic Economy fare which doesn’t allow seat selection

Chase Travel Portal Hotels

The search feature for hotels is pretty standard as well.

There are a lot of helpful filters that you can apply to help you efficiently search for the right hotel.

Some of these include:

Property Class

This allows you to sort by star ratings.

Price Per Night

Sort properties based on price.

Vacation Rental Bedrooms

- Bedrooms 4+ Bedrooms

Guest Rating

- Exceptional!

Neighborhood

Sort through many local neighborhoods.

- High-speed Internet

- Air conditioning

- Swimming pool

- Breakfast Included

- Babysitting service

- Business services

- Childcare Children’s club

- Fitness equipment

- Airport Transportation

- Included Newspaper

- Included Parking

- Included Hair dryer

- Kitchenette

- Laundry facilities

- Dry cleaning/laundry service

- Pets allowed(conditions apply)

- Restaurant in hotel

- Room service

- Spa services on site

Property Type

- Apartment Hotel

- Private vacation home

- Guest house

- Bed & Breakfast Hostel/Backpacker accommodation

- Apart-hotel

- Country House

- Chalet Hotel resort

- Hostel (Budget Hotel)

Popular Locations

You can even search based on popular locations. Here are some examples from London that I found when searching for a hotel.

- Tower of London

- University of London

- London Bridge

- London Dungeon

- Buckingham Palace

- St. Paul’s Cathedral

- Olympic Stadium

- University College London

- East London Mosque

- Museum of London

- Natural History Museum

- Wembley Stadium

- London Stock Exchange

- Chessington World of Adventures

Accessibility

Accessible bathroom In-room accessibility roll-in shower.

Hotel pricing might be on the cheaper side sometimes or it may not.

For the most part, I’ve always found competitive prices but I would highly recommend that you check the prices with other OTAs before booking. Just like with airfare, there are plenty of reports of the portal not displaying the best prices for hotels.

Whenever you finally find the hotel you were interested in, be sure to view the cancellation policy. You should find it in green next to the room description and also under “price details.”

Chase Travel Portal Rental Cars

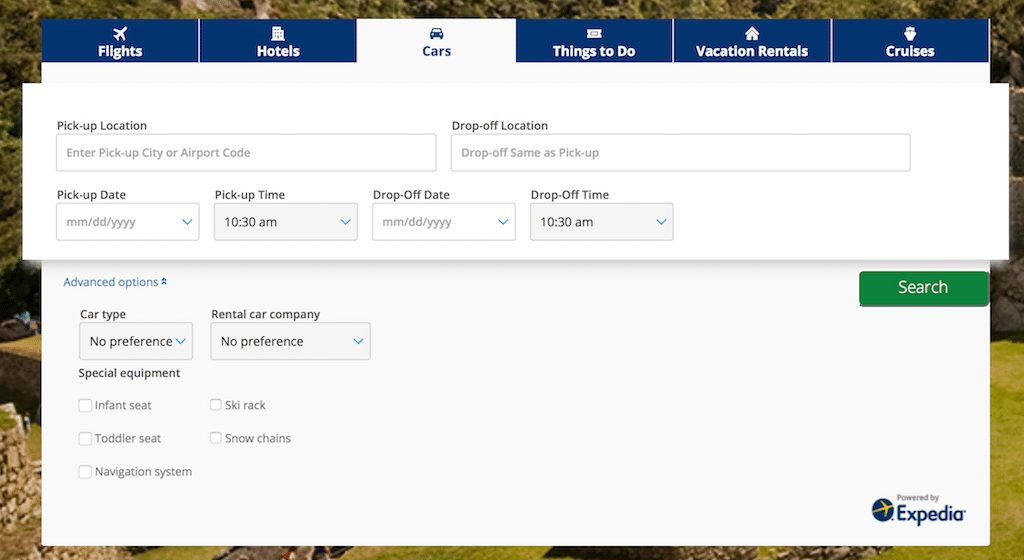

Searching for rental cars is pretty straightforward as well.

There are advanced search options for searching for car by type and by rental company. You can also filter for special equipment for things like infant seats, snow chains, navigation system, etc.

You can also find things to do in the Chase Travel Portal. You’ll find many of the major tourist options in the search results but there will be some unique things to do like craft beer tours.

What’s cool about these activities is that you can truly travel for free if you use your points. It’s pretty easy to cover hotels and airfare with points but it’s much more difficult to cover an entire trip with points (including activities).

With the Travel Portal, this is a possibility though.

What kind of activities show up?

When I searched for San Francisco, it pulled “154 things to do.”

Some examples of the things to do that popped up were:

- Golden Gate Bridge Tour

- Alcatraz Tour

- San Francisco Mega Pass

- Yosemite National Park tour

- Napa Valley wine tasting tour

- San Francisco Museum of Modern Art

You can then sort the activities based on certain criteria.

Recommendations

- Local Expert Picks

- Family Friendly

- Likely To Sell Out

- New on Chase Travel

- Tours & Sightseeing

- Walking & Bike Tours

- Day Trips & Excursions

- Cruises & Water Tours

- Air, Balloon & Helicopter Tours

- Hop-on Hop-off

- Private Tours

- Attractions

- Food & Drink

- Sightseeing Passes

- Multi-Day & Extended Tours

- Water Activities

Transportation

- Shared transportation

You can also book vacation rentals through the portal.

Chase Travel Portal Cruises

You can book cruises with points, your Chase card, or both. Here are some examples of cruise lines and cruise ships you can find in the Chase Travel Portal.

- Celebrity Cruises Celebrity Equinox

- Norwegian Cruise Line Norwegian Jade

- Norwegian Cruise Line Norwegian Gem

- Norwegian Cruise Line Norwegian Pearl

- Princess Cruises Regal Princess

- Royal Caribbean International Allure of the Seas

- Royal Caribbean’s Anthem of the Seas

- Royal Caribbean International Harmony of the Seas

- Royal Caribbean International Oasis of the Seas

For cruise information, call 1-866-951-6592 .

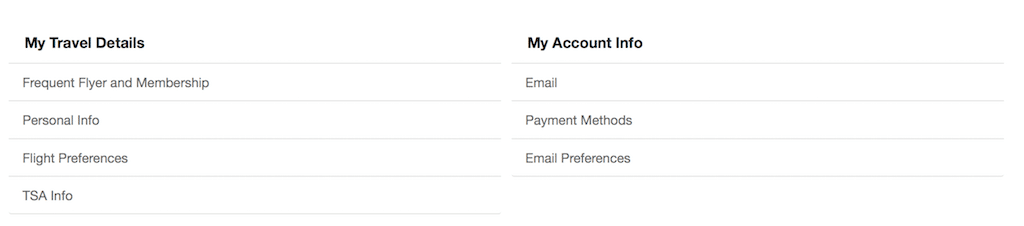

Travel profile

Under your Travel profile you can edit your travel details including:

Frequent Flyer Membership

This is where you’ll enter your frequent flyer numbers for various programs like United, Delta, American Airlines, etc.

Personal Info

This is where you can enter your personal contact information.

Flight Preferences

You can set your flight presences for things like window or aisle seats (sorry, no preference available for the middle seat).

Known Traveler Number and Redress Number . The Known Traveler Number will allow you to receive benefits like TSA Pre-Check or Global Entry if you are signed up for them.

Chase Travel Portal Promo code

Chase will sometimes send out emails with special promo codes for the Chase Travel Portal.

For example, there once was a code for $100 off $300.

However, it’s not clear who exactly gets targeted for these offers and they seem to be pretty rare so I wouldn’t go around expecting them to arrive in your inbox.

I’m not aware of publicly available promo codes.

If you do get a code it can be entered at checkout.

Price match

Others have tried their luck with seeking a price match from Chase but they haven’t been successful.

If you have any luck report back with your data points!

Chase Travel Portal (in the App)

You can use the Chase Mobile App to search and book travel through the Chase Travel Portal.

First, you just need to log-in to your Chase app on your mobile device.

Then select the “…” next to the card that you’d like to use and select “Redeem rewards.”

Next hit the three bars at the top of the screen and then select “”Travel” and that will take you right to the Chase Travel Portal on the mobile app.

Refunds and Cancellations

There are always a lot of non-refundable options when dealing with booking travel through an OTA so you always want to be on the lookout for any bookings that won’t allow you to collect a refund.

You can cancel most flight bookings online.

Keep in mind that for airfare if you cancel within 24 hours, there are usually no cancellation fees.

If you cancel a non-refundable flight reservation, the airline may issue you a flight credit for a future booking instead of a refund.

But note that some flight reservations are not eligible for a flight credit after cancellation. Canceling one of these will force you to lose the value of your ticket.

To cancel your flight booking online

- Go to My Trips to view your bookings.

- In Upcoming, select the itinerary you wish to cancel.

- Select Cancel Flight under Manage Booking

Chase allows you to cancel most hotel bookings online.

If your hotel’s free cancellation deadline has passed, you will have to pay a cancel fee and if you booked a non-refundable hotel, you will have to pay the entire cost of your stay.

To cancel your hotel booking

- In Manage Booking, select Cancel Room and follow the instructions.

Chase Travel Portal Phone Number

To speak to a Chase Travel Specialist, call 1-866-418-8872 .

Advisors specializing in flights, hotels, car rentals and activities are available 24 hours a day, 7 days a week, 365 days a year.

Advisors specializing in cruises are available Monday to Friday, 9 a.m. to 9 p.m. ET, and Saturday 9 a.m. to 5 p.m. ET.

The Chase Travel Portal is just one of the many type of OTAs that you can find online. Here are some other OTAs and OTA aggregators you might consider trying out:

1. Bonwi 2. Expedia 3. Booking.com 4. Hotels.com 5. Orbitz 6. HotelTonight 7. Priceline 8. Hostelworld 9. Kayak.com 10. Hotwire.com 11. Hotelscombined.com 12. Agoda.com 13. Trivago

You can read more about these OTAs here .

Since the Chase Travel Portal is powered by Expedia you’d expect their results to be identical but I know from experience that things can get tricky on OTAs so I’d always double check the prices elsewhere before booking.

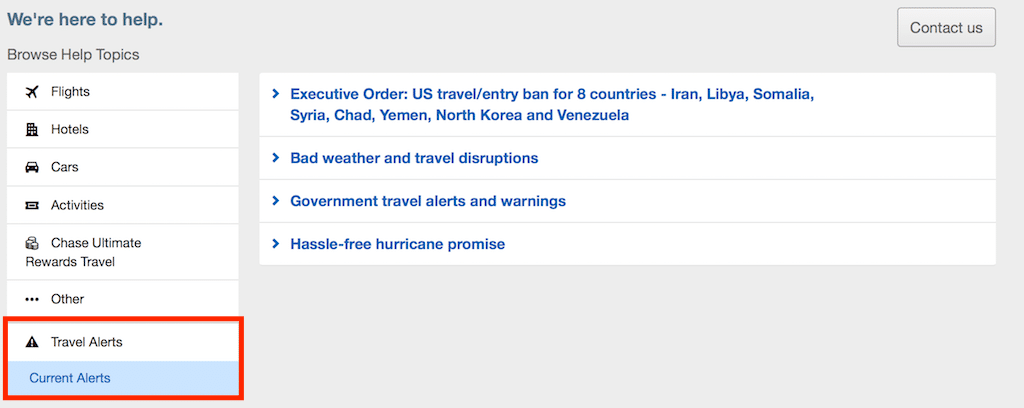

Chase travel notifications/alerts

The Chase Travel Portal will have travel notifications for certain countries if applicable and you should be able to see those when you log-in.

You should obviously do follow-up research with the US State Department and Centers for Disease Control and Prevention (CDC) to ensure there are no travel advisories even if the Chase travel portal doesn’t mention these.

Also, if you’re wanting to set Chase travel notifications so that your debit card or credit card won’t have issues abroad, you can read how to do that here .

Chase Shopping portal

If you’d like to utilize Ultimate Rewards to shop you can use your points at Amazon or to purchase gift cards. But if you’d like to earn more Ultimate Rewards via your shopping then consider trying out the Chase Shopping Portal where you can earn points when you shop at retailers including:

- American Eagle

- Under Armour

- Neiman Marcus

- And many, many more…

Read more about the portal here.

Chase Travel Portal not working?

For the longest time I though that the Chase Travel Portal was down but it turns out that there was caching issue with my computer.

All I had to do was clear out my browsing history (or use an Incognito browser) and I was able to log-in and search for travel.

The portal might not be working from time to time but I’d also try to clear your browsing history/cache and see if that works if you ever run into performance issues.

The Chase Travel Portal is a great way to truly travel for free and in many instances it can be a much more valuable use of points.

The key is to be aware of what benefits you might be missing out on and to always compare prices across OTAs so make sure you’re getting a great deal.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

I regularly buy airline tickets through the Chase Travel Portal, because airfares tend to be identical on all sites, and the Chase portal gives me 5x points for using my Sapphire Preferred card. However, when it comes to hotels, I have found Chase’s room rates to be higher than on other OTAs, or the hotel websites. Part of this is because Chase does not honor AARP, AAA, or other discounts, but even the standard base rates are a few dollars higher at Chase. Also, you do not earn Hilton or Marriott points when you book through Chase. To book hotels, I go directly to the hotel website, and use my Chase Ink card, where I earn 3x points for ALL travel. The additional 2x points I could earn on the Chase site are not worth the higher rates and reduction in benefits.

Follow up to a June 19, 2022 post. I previously explained why I would not use the Chase Travel Portal for hotels or car rentals, though I would use it for flights. That is no longer the case, and I will not use Chase for anything. I recently bought my daughter a $1,900 ticket for a trip to Africa with a charity, which was canceled due to an ebola outbreak. The purchase confirmation email clearly indicated that the fare was refundable. After watching my statements for two cycles, there was no refund, so I had to call customer service. They had no record of the cancellation, even though I had an email confirmation of it. After more than an hour on the phone, they told me that I would only get a credit, not a refund. The credit cannot be used on line, so I will have to call them to use it, just like in the 1980s. Worse still, the credit must be used all at once. This was an unusual case to purchase an international flight, and it will be impossible to spend the entire $1,900 credit on a domestic flight. So, I will effectively be screwed out of $1,000+ dollars. Had I purchased the ticket directly from United, I would have gotten a refund, or at least a credit that could be used in increments toward several future flights. Chase is using deceptive practices and stealing money from customers.

The attraction to Chase Travel of the 5x reward points isn’t out weighing the poor offerings of flight schedules, the overall portal features, like travel itinerary data made available. But worst of all is the customer service provided when you call in and the lack of notice on critical schduled changes. An upcoming international trip was my first booking with Chase Travel. I’m in shock that Chase would provide or sub-contract this highly valued benefit/service with such a low level of professionalizm and such a poor portal, when compared to other well known sites. I’ve reported my experiences (which was difficult in itself) to Chase, but with little expectation that they cared. I don’t plan to use the offering again until improvements are made.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Chase Credit Cards Mobile App Review

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Navigating through the Chase app isn’t always intuitive simply because you can do so much on it. Overall, much of what you can do on Chase.com, you can also do on the app. With so many Chase card offerings, it’s hard to beat the convenience of being able to manage all your accounts together in one place, from anywhere.

» MORE: See NerdWallet’s best Chase credit cards

The Chase mobile app includes basically everything but the kitchen sink. You can complete typical tasks like paying bills and reviewing statements, as well as manage your points in the complicated Chase Ultimate Rewards ® program, opt in to pay-over-time deals for certain purchases and more.

Secure login

You can either manually enter your username and password, or opt to use facial recognition or a fingerprint for a faster login. The app will log you out after a period of inactivity.

Monitoring transactions and trends

The app makes it easy to see where your money goes and keep an eye out for suspicious charges. You can see up to 24 months of transactions and up to seven years of credit card statements. Plus, get a breakdown of your spending by category to track trends and see if it's in line with your budget.

Staying secure

If you misplaced your card, you can lock it in the app, which will block new purchases, balance transfers and cash advances from your account. You can unlock your card if it was between your couch cushions all along.

The app allows you to dispute a charge with Chase if you were incorrectly charged for a purchase, or if you tried to cancel a recurring charge but were charged anyway. If you notice a transaction that you didn’t make (or an authorized user didn’t make), Chase recommends that you call the number on the back of the card to report fraudulent activity.

Access to all your Chase cards

If you carry multiple Chase cards, you’ll have access to all of them in the app. Holders of both business and consumer cards can toggle between those lists of cards on the home screen. If you have Chase checking, savings, mortgage, auto loan or personal loan accounts, they'll also show up on your dashboard when you sign in.

Customized navigation

You can add and remove “quick actions” on the home screen, making it possible to partially customize the app and speed up access to specific features. Options include shortcut buttons to bill payment, bill activities, statements and documents, Chase Ultimate Rewards®, ATM or bank branch locations, travel notifications, lost card replacement, showing or hiding accounts, and managing user security features.

Paying bills

Pay your credit card bills in the app, either manually or by setting up automatic recurring payments. You can connect bank accounts as payment methods through the app as well. Plus, set up push notifications to get an alert when a payment due date is coming up or when your checking account is overdrawn.

Chase Ultimate Rewards®

Check your rewards balances and redeem points in the app. If one or more of your cards earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card or the Chase Freedom Flex℠ , you can also use those points to book travel right in the app, and combine Ultimate Rewards® points earned across multiple cards.

My Chase Plan

Select a purchase of $100 or more to divide into equal monthly payments with My Chase Plan. You won’t pay interest, but there is a fixed monthly fee associated with using this service. In the app, you can choose between several payment plan options.

Chase Offers

Easily opt in to Chase Offers for each of your cards to automatically save on an upcoming purchase with participating merchants. Chase Offers change over time, so check the app on a regular basis to see where you can save.

Credit score monitoring

Chase Credit Journey can help you keep tabs on your credit score for free, whether or not you’re a current Chase customer. It also includes credit monitoring, identity theft insurance, alerts when there are changes in your credit report, and resources to help you build credit. The credit score through this tool is a VantageScore 3.0 credit score based on TransUnion data. Because lenders use different credit scoring models when evaluating loan applications, the credit score you see here may differ from your score when applying for various financial products.

The Chase mobile app isn’t equipped with in-app customer service messaging, so there’s no message or chat option. You can visit the Secure Message Center, but you’ll be connected with a bot that leads you to helpful links rather than connecting directly with a representative.

Since the app offers so many features, some users find it a bit overwhelming and hard to navigate.

Desktop vs. mobile

When it comes to managing your accounts, credit card rewards and more, most tasks can be done on both the mobile app and your desktop. You can even open new checking and savings accounts, certificates of deposit and credit cards through the app. For other actions, like applying for a mortgage or auto loan, the app will redirect you to the mobile version of Chase.com. So there are still some banking tasks that need to be completed on the desktop version.

When you visit the Chase website you can send a secure message to customer service, but you can’t send messages from the app.

Because there are slight design variations between Chase.com and the Chase app, it’s just a matter of familiarizing yourself with them both.

Ranked third out of 11 major credit card issuers — J.D. Power 2020 U.S. Credit Card Mobile App Satisfaction Study.

4.8/5 — Apple's App Store (rating as of March 2021).

4.4/5 — Google Play Store (rating as of March 2021).

on Chase's website

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Chase app review: Everything you need to know

The largest bank in the u.s. has a robust mobile app to boot — including a customized budget and daily spending insights.

Tom's Guide Verdict

The Chase app is more than just an account management tool. It's packed with many bonus features to help you improve your finances — from a built-in budget planner to a daily snapshot tool that gives you spending insights at a glance.

Easy and free to use

- Manage all your Chase accounts in one place

Free credit monitoring

Tools to help you build good financial habits

No in-app chat feature

Most features only available to Chase customers

Can't switch app to dark mode

Why you can trust Tom's Guide Our writers and editors spend hours analyzing and reviewing products, services, and apps to help find what's best for you. Find out more about how we test, analyze, and rate.

Calling all Chase users! If you have a bank account, credit card, loan, investment account, or anything else with Chase, this is THE app for you.

It’s packed with many features to help you manage all your Chase accounts, redeem rewards, track spending, pay bills, and more. It’s one of the top-rated finance apps for both Android and iOS users.

Chase app review: Features

Here’s a quick rundown of some of the things you can do with the Chase app.

- Apply for other accounts

- Track spending and spot ways to save money

- Send and receive payments with Zelle

- Pay bills and Chase credit card payments

- Transfer money between accounts

- Lock and unlock cards

- Deposit checks in the mobile app with Chase QuickDeposit

- Redeem rewards and Chase offers

- Find ATMs and branches

- Relax with 24/7 fraud monitoring

But where does it shine? Here’s a closer look at Chase’s top features:

Manage accounts and investments

As the largest bank in the U.S., Chase has a lot of accounts you can open — checking and savings accounts, credit cards, loans, investments, and more.

One cool thing about the Chase app is that no matter how many accounts you have, they’re all consolidated into one easy-to-use interface. You can see your account balances, review recent transactions, and even set up custom alerts.

It’s essentially a centralized hub to help you stay organized and on top of your finances.

Track your credit journey

These days, most banking apps have credit score monitoring. But what makes Chase so different? In a nutshell, the Chase app does a better job of helping you understand your credit score and the factors that affect it.

With its Credit Journey tool, you can:

- View your VantageScore (updated weekly)

- See how your credit score stacks up against others

- Use the Score Simulator to see how certain activities would impact your credit score

- Track your total credit balance, credit card utilization, and late payments

- View a complete history of your credit score since signing up for Credit Journey

- Get customized insights on how to improve your score

Tip: Anyone can use the Credit Journey tool for free — even if you’re not a Chase customer.

Redeem rewards, offers, and deals

Credit cards are Chase’s bread and butter. So there’s no doubt this section of its app is on point.

You can review your credit card benefits inside the app, as well as transfer and redeem rewards. Simply choose what you want to redeem your points for — cash, travel, gift cards, or Chase offers — and the app will take care of the rest.

Use the budget planner to save and monitor spending

Chase’s budget planner tool is one of the best we’ve seen among traditional banks. While most banking apps let you track purchases, the Chase app takes it a step further by allowing you to create a customized budget based on your monthly income, recurring bills, and savings goals.

As you spend money throughout the month, it’s all consolidated into a pie chart so you can see how close you are to going over budget.

And if you want even more guidance, you can turn on the “daily pacing” tool to estimate how much you should spend per day to be under budget at the end of the month. This takes away the need to use a separate budgeting app like Mint.

Get spending insights with today’s snapshot

One of my favorite features inside the Chase app is Today’s Snapshot. It’s a snazzy tool that gives you daily insights into your finances so you can build better habits.

For instance, say you have a Chase credit card. Each time you log into the app, Today’s Snapshot will show you:

- A line graph of your credit and debit card usage (like the one pictured above)

- A breakdown of your spending by category (think shopping, food and drink, travel, and groceries)

- The number of rewards points you’ve earned this week

- Your credit card usage

- How many times you’ve checked in with Snapshot this week

Knowledge is power. And together, these insights go a long way in helping you better your finances.

Get your questions answered with a Chase banker

Most of the time, you only call customer service if you’re having an issue with your account. But what if you want a financial health check-up or advice on your savings plan? It turns out you can do that inside the app too.

With the Chase app’s “Schedule a meeting” feature, you can set up a phone call or in-person meeting with a Chase banker. During this call, you can:

- Open or upgrade your account

- Apply for a credit card

- Get a financial health checkup

- Discuss a savings plan

- Get help with your accounts

Chase app review: Pricing

The Chase app is free to use. It’s available on Android and iOS devices.

Chase app review: Ease of use

Overall, the Chase app is a solid banking app with millions of users. I’ve been using it for my credit cards for nearly a decade. And honestly, I really like it.

While the app used to feel clunky and dated a few years ago, the development team has made strides in modernizing and streamlining it. Now it’s clean and easy to navigate. And I really like all the financial insights I can see as I scroll through my accounts.

If there’s one negative about the Chase app, it’s that it can sometimes feel cluttered with product advertisements — after all, Chase wants you to have as many accounts with them as possible.

More recently, users are upset that Chase took away the app’s dark mode function — so now the app uses light mode by default.

Chase app review: Support

The Chase app doesn’t have a built-in chat function for live support, but you can still contact customer support in one of four ways:

- Chat with the in-app digital assistant

- Schedule a phone call or in-person meeting with a Chase banker

- Visit a local Chase branch

- Call 1-800-935-9935 to speak with a representative

MY EXPERIENCE: I called Chase customer service on July 14, 2022, and was on hold for two minutes. The representative I spoke to was an absolute delight and did a thorough job answering all of my questions. As big as Chase is, I was amazed at how quickly I was put through to someone.

One quick tip — When you call customer service, you’ll be asked to enter your debit or credit card number before you can speak to someone. If you don’t have this info, just press 0 when you hear this prompt. It’ll redirect you straight to customer service.

How the Chase app stacks up against the competition

The four largest banks in the U.S. are Chase, Bank of America, Citibank, and Wells Fargo. So how does the Chase app stack up against its top competitors?

To start, all the apps have the same standard features you'd find with any banking app. You can manage accounts, transfer money, pay friends with Zelle, and monitor your credit score.

Beyond that, Chase stands out because it lets you create a personalized budget inside the app and set up recurring savings goals. The "Today's Snapshot" feature also gives you custom spending insights at a glance.

These features push Chase to the top, making it the highest-ranking app on the App Store and Google Play out of all four banks.

Chase app review: Verdict

As the largest bank in the U.S., Chase didn’t have to go out of its way to make an amazing banking app. But it did it anyway.

The Chase mobile app will blow you away with all of its bonus features. Two of our faves are the built-in budget planner (where you can set savings goals, monitor bills, and track your income), and the Daily Snapshot tool, where you get insights at a glance (such as your daily card usage and a breakdown of your spending by category).

Really, the Chase app is as good as it gets if you’re banking with a traditional institution. It’s clear the company has poured extra time into adding financial wellness features to help you develop smart habits.

And the cool part is, anyone can use the Credit Journey tool to monitor and build their credit — even if you’re not a Chase customer. Usually, you have to bank with an institution to get access to tools like this.

So if you’re already a Chase customer — or simply want to use Credit Journey to improve your financial health — there’s really no reason not to sign up. The Chase app has virtually everything you need.

Frequently Asked Questions (FAQs)

How do i check my bank statement on the chase app.

Follow these steps to review your bank statement:

- Log in to the Chase app

- Select the account you want to see a statement for

- Select the three dots next to your account balance. (This pulls up a separate menu)

- Click on " see statements"

Is the Chase app safe?

Yes, the Chase app comes with all the latest security features. 128-bit encryption helps keep you safe from potential hackers, and two-factor authentication helps verify it’s you signing in. You can also log in with a fingerprint or facial ID if your device supports it.

Inside the app, your account has 24/7 fraud monitoring for unusual activity. Plus, you can set up custom alerts and lock and unlock accounts with the tap of a button.

Does the Chase app have a fee?

No, the Chase app does not have a fee. It’s free to use and download.

How do I log out of the Chase mobile app?

The Chase app should automatically log you out after you exit the app or are inactive for a few minutes. That said, you can manually log out using these steps:

- Select the profile icon on the top right corner of your screen. (This pulls up a separate menu)

- Click on " sign out"

Cassidy Horton is a finance writer who specializes in insurance and banking. She has an MBA and a bachelor's degree in public relations, as well as hundreds of articles published online by Forbes Advisor, The Balance, Finder.com, Money Under 30, and more. Outside of work, she enjoys reading and hiking.

Boulies Ninja Pro review

Dragon’s Dogma 2 is the most engrossing RPG I've played since Elden Ring

I've been covering deals for 17 years — and these are the best Amazon Big Spring Sales right now

Most Popular

By Hunter Fenollol March 14, 2024

By Richard Priday March 14, 2024

By Jackie Dove March 14, 2024

By Dave Meikleham March 14, 2024

By Tony Polanco March 14, 2024

By Hunter Fenollol March 13, 2024

By Jason England March 13, 2024

By Jackie Dove March 12, 2024

By Camilla Sharman March 11, 2024

By Shaun Prescott March 11, 2024

By Nate Ralph March 07, 2024

- What is the Chase Travel Portal?

Benefits of Using the Chase Travel Portal

Chase ultimate rewards credit cards.

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Ultimate Rewards travel portal works just like an online travel agency.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

The Chase travel portal is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an Online Travel Agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Chase Ultimate Rewards is one of the most flexible and lucrative credit card rewards programs, and its benefits can be even greater depending on the Chase cards you have. With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase added lucrative new bonus categories to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, including certain types of travel booked through the portal.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What Is the Chase Travel Portal?

The Chase travel portal works like any other Online Travel Agency (such as Travelocity or Priceline), and the searches you do for hotels, airfare, and more will produce similar results to what you see on that OTA.

You must be a Chase credit card customer to use Chase travel to book with cash or with points. In fact, you'll only access the Chase travel portal when you log into your account management page with Chase.

Chase travel lets you book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two. This is one of the main benefits of using Chase travel — you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs.

There are a few other key benefits to know:

- You'll still earn airline miles and work toward elite airline status: You won't earn points or elite night credits when you book a hotel stay with Chase travel because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights you book as long as your frequent flyer number is attached to the reservation.

- Your points are worth more with certain Chase credit cards: Also be aware that some Chase credit cards give you more than the standard rate of 1 cent per point when you redeem your rewards for travel through Chase. We'll go into more detail on the cards that offer this perk below.

- The Chase travel portal is easy to use: If you don't want to deal with a bunch of hotel and airline award charts, booking through Chase travel can help keep your rewards game simple. You'll always be able to use your points for any booking you want without having to worry about blackout dates or capacity controls you would normally encounter with loyalty programs.

To be eligible to use the Chase travel portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase cards open to new applicants (points are worth 1 cent each through the Chase travel portal):

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Chase Freedom® Student credit card (read our Chase Freedom Student review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Chase travel rewards cards open to new applicants (points are worth more with Chase travel, plus these cards allow you to transfer points to airline and hotel partners):

- Chase Sapphire Reserve® (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card (read our Chase Ink Business Preferred review )

If you have more than one Chase card, you can transfer your Chase Ultimate Rewards points between accounts. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Sapphire Reserve account will increase the value of your points when you redeem through the Chase travel portal.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increments you want.

Points Value in the Chase Ultimate Rewards Travel Portal

Some Chase credit cards give you a bonus when you redeem points through the Chase travel portal. Here's a summary of how much your points are worth with each Chase card:

It's important to note that Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Personal Finance Insider's points and miles valuations . That's because it's possible to get outsized value when you transfer points to partners for award travel.

How to Use the Chase Travel Portal

Using the Chase travel portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once you are logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" in order to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click to "Select" a flight option, you'll get a rundown of what is and isn't included in the fare you selected. You may also get a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.