- Customer Service

- En Español

Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N.A. or any of its affiliates; and, may be subject to investment risk, including possible loss of value.

SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD BANK, N.A. OR ANY OF ITS AFFILIATES; AND, MAY BE SUBJECT TO INVESTMENT RISK, INCLUDING POSSIBLE LOSS OF VALUE.

Data as of March 2018. Comparison of longest average store hours in the regions (MSAs) in which TD Bank operates compared to major banks. Major banks include our top 20 national competitors by MSA, our top five competitors in store share by MSA and any bank with greater or equal store share than TD Bank in the MSA. Major banks do not include banks that operate in retail stores such as grocery stores, or banks that do not fall in an MSA.

©2022 TD Bank, N.A. All Rights Reserved.

- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

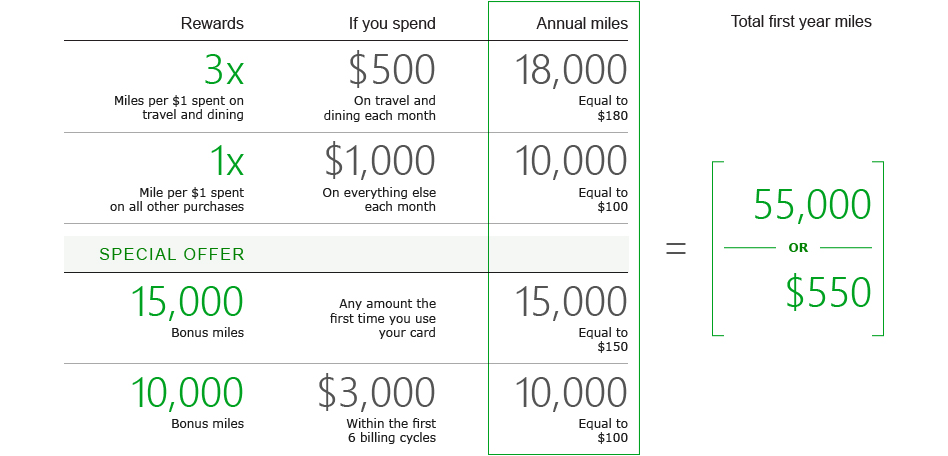

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Small Business

- Investing & Wealth

Double up and cash in.

Earn a sweet $150 bonus and unlimited 2% Cash Back with TD Double Up. SM

TD Bank Credit Cards

Check out our special offers and find the credit card that meets your needs and has the benefits you want – like Cash Back Rewards, balance transfer offers and a credit card with a predictable minimum payment.

Check if you're prequalified

See if you're prequalified for a credit card offer – with no impact to your credit score

Choose the card with the perks you want

Filter by card feature to find the card that works for you or browse all cards below.

Balance Transfer

Points Rewards and Cash Back

No Annual fee

Low Intro APR

Points Rewards and Cash Back Credit Cards

Choose the TD credit card where you can earn points rewards for your purchases that can be redeemed for cash back, gift cards, travel, and more. Remember, the TD Business Solutions Credit Card is available for business and commercial purposes only.

TD Cash Credit Card

SPECIAL OFFER

Earn 3% and 2% Cash Back on your choice of Spend Categories. Plus, you can switch your categories quarterly. Earn 1% Cash Back on all other eligible purchases

Special Offer: Earn $200 Cash Back when you spend $500 within the first 90 days after opening your account 2

Balance transfer: 0% intro APR for the first 15 billing cycles after account opening. After that, 20.24%–30.24% variable APR based on your creditworthiness*

No annual fee*

*Terms and conditions

TD Double Up SM Credit Card

Earn 2% unlimited Cash Back – no rotating Spend Categories, no caps or limits

Special offer: Earn $150 Cash Back in the form of a statement credit when you spend $1,000 within the first 90 days after account opening 1

No annual fee *

TD First Class SM Visa Signature® Credit Card

Earn up to 25,000 bonus miles when you spend $3,000 in your first 6 billing cycles 3

Earn 3X miles on travel and dining

$89 annual fee (waived the first year)*

TD Cash Secured Credit Card

Helps you build your credit

Earn 1% Cash Back on everyday purchases*

Your savings account works as a security deposit*

$29 annual fee*

TD Business Solutions Credit Card

Limited Time Offer : Earn Up to $750 Cash Back value

5% Cash Back on all eligible purchases for 6 months or up to $10,000 in spend, that’s up to $500 Cash Back value* 4

Plus, Earn $250 Cash Back in the form of a statement credit when you spend $1,500 within the first 90 days after account opening 5

After 5% promotional period, earn unlimited 2% Cash Back on all eligible purchases - no rotating Spend Categories, no caps, or limits*

Points Rewards and Cash Back credit card FAQs

What are points rewards on a credit card.

Credit card points are a type of reward that can be earned in exchange for eligible credit card spending. These points can be redeemed for statement credits, travel purchases, online retail purchases and other redemptions depending on the credit card issuer's rewards program and criteria for point redemption. Some credit cards, like the TD First Class SM Visa Signature® Credit Card, offer miles rewards on eligible purchases.

How do rewards credit cards work?

Rewards credit cards provide an added advantage by offering different types of rewards for eligible purchases made using the rewards credit card. Some card issuers may offer more points or cash back on certain types of purchases or spend categories. They may also offer a welcome bonus of a specified amount of points for new customers with a minimum spending amount.

Depending on the credit card issuer, once you have enough rewards points to redeem then you can redeem for a variety of things such as cash back, statement credit, merchandise, gift cards, and travel.

What types of credit card rewards can you get?

Credit card rewards can be redeemed for a variety of options such as cash back, statement credit, merchandise, gift cards and travel.

How can I redeem my points rewards?

In many cases, you can redeem your cash back or points rewards for your credit card by visiting your bank's website or logging in to your credit cards online banking portal. For TD Bank credit cards, points can be redeemed through our Online Banking portal or by logging in to your TD Bank app. Access your rewards earnings details and choose the best redemption option for you.

Which categories are eligible for cash back on TD credit cards?

For TD Double Up, you earn 2% cash back on all eligible purchases. For TD Cash, you earn 3% cash back on your favorite spend category and 2% cash back on your second favorite spend category. Spend categories include dining, entertainment, gas stations, travel and grocery stores. If it isn't a favorite spend category, you'll still earn 1% in rewards on all other eligible purchases. You have the ability to select your 3% and 2% cash back spend categories each calendar quarter, based on your spend preferences. For TD Cash Secured, you earn 1% cash back on all eligible purchases. TD First Class SM Visa Signature provides different offerings for cash back.

For business and commercial use, with TD Business Solutions you earn 2% cash back on all eligible purchases with no rotating spend categories, caps or limits.

Already have a TD Credit Card?

See what your td credit card can do.

Manage your card, redeem rewards and use our digital tools to get the most out of your card

TD Bank Visa® Credit Card Benefits

Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more

Understanding Your Credit Score and Report

Learn about your credit score and what steps you can take to improve it

Log in to manage your card

View your balance, pay your bill and more with Online Banking and the TD Bank app

Important Disclosures

View Credit Card Agreements for TD Bank Credit Cards . View TD Bank Credit Card Applications for Cross-Border Clients .

TD Double Up Credit Card * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and rewards program details. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, 20.24%, 25.24% or 30.24% variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “Payment to Avoid Purchase Interest” amount shown within the ‘Payment Information’ box on your account statement.

1 Eligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards. If you are approved for an Account in response to this specific offer, you are eligible to earn a One-Time Bonus Offer ("One Time Bonus Offer") of 15,000 Bonus Points, equal to $150 in the form of a statement credit. To qualify for the $150 statement credit, you must spend $1,000 in total Purchases using the Account within 90 days of the Account opening date. Provided your Account is open and in good standing, the 15,000 Bonus Points, equal to a $150 statement credit will be reflected on your Account within 6 to 8 weeks after you have met the eligibility criteria. This One-Time Bonus Offer is not available if you open an account in response to a different offer that you may receive from us or if you previously received a One-Time Bonus Offer on this account or any other account with us.

TD Cash Credit Card * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and rewards program details. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, 20.24%, 25.24% or 30.24% variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “Payment to Avoid Purchase Interest” amount shown within the ‘Payment Information’ box on your account statement.

2 Eligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards. For the TD Cash credit cards, maximum bonus accumulation for this promotional offer is 20,000 points which can be redeemed for $200 Cash Back rewards. Provided your TD Cash Credit Card account is open and in good standing, the $200 Cash Back rewards will be reflected in the Points Summary of your Credit Card statement in 6 to 8 weeks after you spend $500 in total net purchases within the first 90 days of account opening. This offer only applies to new TD Cash Credit Card accounts during the promotional period and is non-transferable. This One-Time Bonus Offer is not available if you open an account in response to a different offer that you may receive from us or if you previously received a One-Time Bonus Offer on this account or any other account with us.

TD FlexPay Credit Card * Read important terms and conditions for details about your account including APRs, fees, and balance transfers. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, 19.24%, 21.24%, 24.24%, 27.24% or 29.24% variable APR based on your creditworthiness. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within the introductory offer. After that: Either $5 or 5% of the amount of each transfer, whichever is greater. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “Payment to Avoid Purchase Interest” amount shown within the ‘Payment Information’ box on your account statement.

‡ Late fee forgiveness does not change your monthly payment requirement. Past due payments will be reported to credit bureaus subject to applicable law and standard practices. This may affect your credit score.

TD Clear Visa Platinum Credit Card with a $1,000 Credit Limit * Read important terms and conditions for account details. The Clear Platinum Visa Credit Card with $1,000 Credit Limit has a $10 monthly membership fee. The monthly membership fee will be added to your monthly billing statement each month as a charge, whether or not you use your account, and applied against your available credit like other charges.

TD Clear Visa Platinum Credit Card with a $2,000 Credit Limit † Read important terms and conditions for account details. The Clear Platinum Visa Credit Card with $2,000 credit limit has a $20 monthly membership fee. The monthly membership fee will be added to your monthly billing statement each month as a charge, whether or not you use your account, and applied against your available credit like other charges.

TD First Class Visa Signature Credit Card * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and rewards program details. Balance transfer 0% introductory APR for first 12 billing cycles after account opening. After that, 18.49% variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “Payment to Avoid Purchase Interest” amount shown within the ‘Payment Information’ box on your account statement. Eligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards. Groceries purchased from superstores and/or warehouse clubs may only earn 1 mile for each dollar spent.

3 Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net eligible purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This One-Time Bonus Offer is not available if you open an account in response to a different offer that you may receive from us or if you previously received a One-Time Bonus Offer on this account or any other account with us.

TD Cash Secured Credit Card * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details. Eligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards.

TD Business Solutions Credit Card * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and rewards program details.

4 If you are approved for an Account in response to this specific offer, you can earn 5% on all eligible purchases for 6 months from your account open date, or up to $10,000 in spend, whichever comes first. This translates to 50,000 bonus points which can be redeemed for $500 Cash Back rewards. Provided your TD Business Solutions Credit Card account is open and in good standing, the Cash Back rewards will be reflected in the Points Summary of your Credit Card statement after each individual purchase. This offer only applies to new TD Business Solutions Credit Card accounts during the promotional period and is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us.

5 Eligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards. us. If you are approved for an Account in response to this specific offer, you are eligible to earn a One-Time Bonus Offer ("One Time Bonus Offer") of 25,000 Bonus Points, equal to $250 in the form of a statement credit. To qualify for the $250 statement credit, you must spend $1,500 in total Purchases using the Account within 90 days of the Account opening date. Provided your Account is open and in good standing, the 25,000 Bonus Points, equal to a $250 statement credit will be reflected on your Account within 6 to 8 weeks after you have met the eligibility criteria. This One-Time Bonus Offer is not available if you open an account in response to a different offer that you may receive from us or if you previously received a One-Time Bonus Offer on this Account or any other account with us.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC.

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

Compare up to 3 cards

Compare up to 2 cards

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank US Holding Company. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

How to use TD Rewards points to reduce travel costs

by Anne Betts | Mar 21, 2024 | Travel Hacking | 5 comments

Updated March 21, 2024

Is the TD Rewards program worth it? How does the program work? What are the various ways to use TD Rewards points to reduce travel costs ? What qualifies as a travel cost?

After several years of earning and redeeming TD Rewards points for travel, I’ve found the program to be beneficial. Here is my review.

Table of Contents

What are TD Rewards Points?

Td rewards credit cards, td first class travel visa infinite card, what are td rewards worth, (i) expedia for td, (ii) book any way, what qualifies as book any way travel, (i) expedia for td, is the td first class travel visa infinite worth it, what i like, what i don’t like.

TD refers to the Toronto-Dominion Bank. TD’s propriety loyalty program is called TD Rewards. The rewards currency is TD Rewards Points. To improve readability, I’ll refer to the points as ‘TD Rewards.’

TD Rewards can’t be converted to any other loyalty currency, or transferred to another loyalty program. It used to be possible to convert TD Rewards to Aeroplan on a product switch to a TD Aeroplan-branded card at a rate of 4:1. However, since April 2019, this is no longer the case.

Points don’t expire as long as your TD Rewards-earning credit card account is in good standing. If you close your credit card account (and don’t have another TD Rewards-earning credit card), you’ll have 90 days to redeem any points left in the account. But, if you lose access to Expedia For TD, they’ll be redeemable at the lower ‘book any way’ value.

As a general rule, points in any in-house program should be redeemed or transferred to another credit card earning the same rewards currency before cancelling or product switching a card.

How to earn TD Rewards

TD Rewards can be earned from a credit card sign-up bonus, through everyday spend on the credit card, and the occasional promotion.

TD offers four credit cards earning TD Rewards:

- TD Platinum Travel Visa Card

- TD Rewards Visa Card

- TD Business Travel Visa Card

TD offers very few points-earning promotions.

The best way to stay abreast of these opportunities is via promotional emails from TD.

For travellers, the best of the three personal credit cards is the First Class Travel Visa Infinite, last overhauled on October 30, 2022.

TD offers promotions on the TD First Class Travel Visa Infinite with elevated sign-up bonuses. For example a promotion ending March 4, 2024 included an annual fee waiver ($139) in the first year and a sign-up bonus of up to 135,000 points. The current promotion ending June 4, 2024 has a sign-up bonus of up to 100,000 points:

- 20,000 points after the first purchase

- 80000 points after spending $5,000 within 180 days of account opening

According to the terms and conditions, the offer isn’t available to customers who have activated and/or closed a TD First Class Travel Visa Infinite Account in the last 12 months. However, this may or may not be enforced. Also, a product switch from a lower-tier card may be eligible for the full promotional benefits.

The TD First Class Travel Visa Infinite also includes:

- a birthday bonus of 10% of the points earned in the 12 months preceding the primary cardholder’s birthday (up to a maximum of 10,000 points)

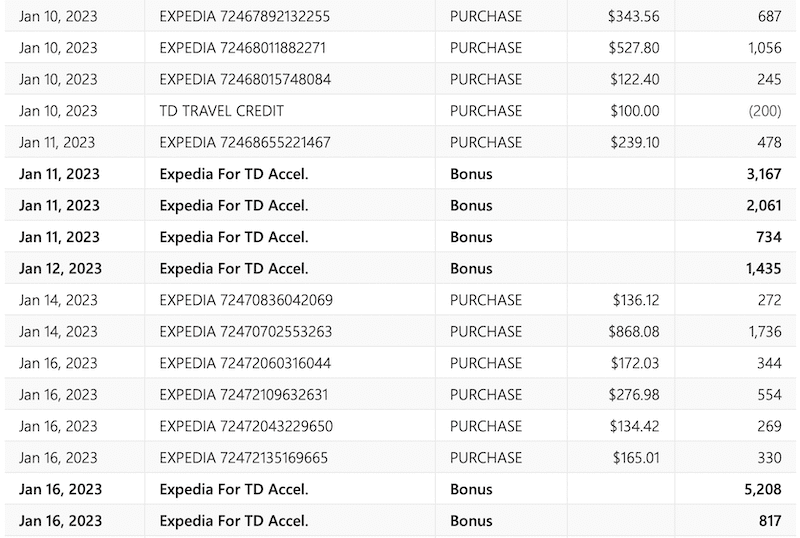

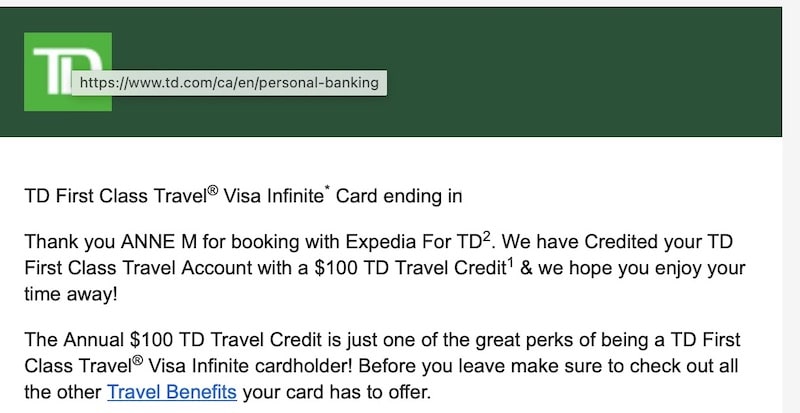

- an annual TD Travel Credit of $100 each calendar year on certain bookings (hotel, motel, lodging, vacation rental, or vacation package) of $500 or more at Expedia for TD in cash, points, or a combination of points and cash.

- a free Uber One membership for 12 months

The earning rate on the TD First Class Travel Visa Infinite is:

- 8 points per dollar for travel booked online or by phone at Expedia for TD

- 6 points per dollar spent on groceries and at restaurants

- 4 points per dollar on regular recurring payments

- 2 points per dollar on all other purchases

There’s a $25,000 cap on spending at the accelerated rates. After that threshold is reached, the earning rate decreases to the base rate of 2 points per dollar.

At first glance, the earning rate on the TD First Class Visa Infinite looks very attractive. That’s because many reward programs can be redeemed at one cent per point (e.g., 10,000 points = $100). With TD Rewards, the best possible redemption rate is 0.5 cents per point (e.g., 10,000 points = $50).

TD’s in-house travel portal is called Expedia For TD, operated by Expedia.

There are two ways to redeem TD Rewards for travel purchases:

- Expedia for TD

- ‘Book Any Way’

Each has a different redemption value.

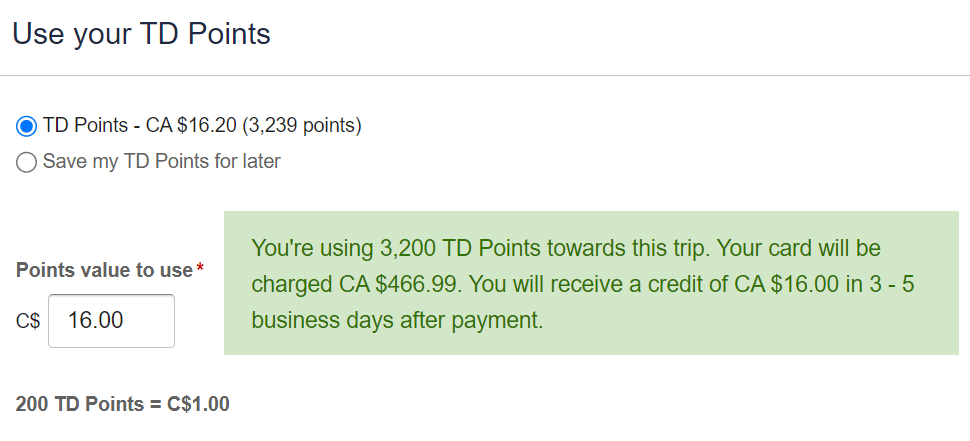

For travel booked through Expedia For TD, points are valued at $0.05 (200 points = $1).

For the most part, Expedia for TD mirrors what’s available on Expedia. However, there are gaps in the inventory. Also, some folks have reported higher prices on Expedia for TD, compared to what’s posted on Expedia.

For what it’s worth, that hasn’t been my experience. For example, a search for a specific hotel in Halifax revealed the best price at Expedia when compared with other booking sites.

The (almost) same price for the same property appeared at Expedia for TD.

‘Book Any Way’ covers travel purchased from travel providers other than Expedia For TD. This allows you to book and redeem points for travel products that don’t appear on Expedia. This includes the option to book last-minute deals or discounted travel at prices that are cheaper than what’s listed at Expedia.

However, TD Rewards are valued at $0.04 (250 = $1) on the first $1,200 of a Book Any Way travel purchase. The value increases to $0.05 (200 = $1) for any amount that is over $1,200 on the same purchase. This is useful for ‘big-ticket’ bookings such as vacation packages or apartment rentals.

Keep in mind that when purchasing from a provider other than Expedia For TD:

- you’re earning x2 TD Rewards Points (instead of x8 at Expedia for TD); and

- you’re redeeming at a lower value of $0.04 (instead of $0.05).

The program has a broad view of what qualifies as travel. Flights, accommodation, cruises, vacation packages (usual stuff) are eligible. Expenses such as theatre tickets, golf fees, resort excursions, restaurant bills, gasoline, taxi fares, and parking may qualify if they’re incurred while travelling.

How to redeem TD Rewards for travel

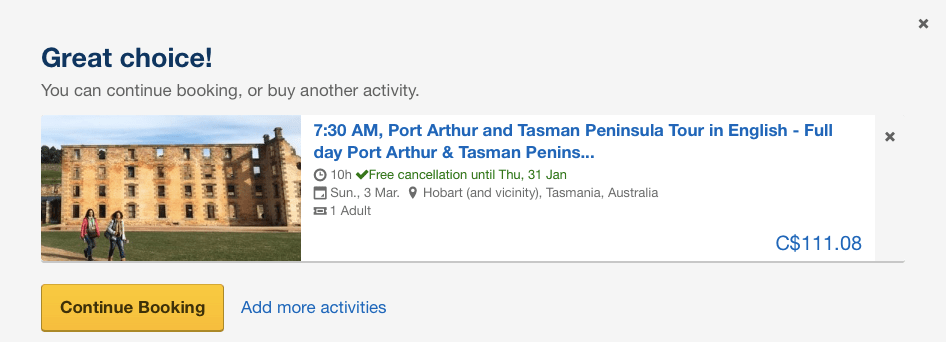

The most convenient way is to book online by signing in to TD Rewards, and entering the Expedia For TD portal to shop for travel.

When you’re ready to make a decision, one click takes you to your chosen travel product.

Another click takes you to the payment page with helpful pre-populated fields showing the name of the cardholder, credit card, TD Rewards account balance, and its monetary value.

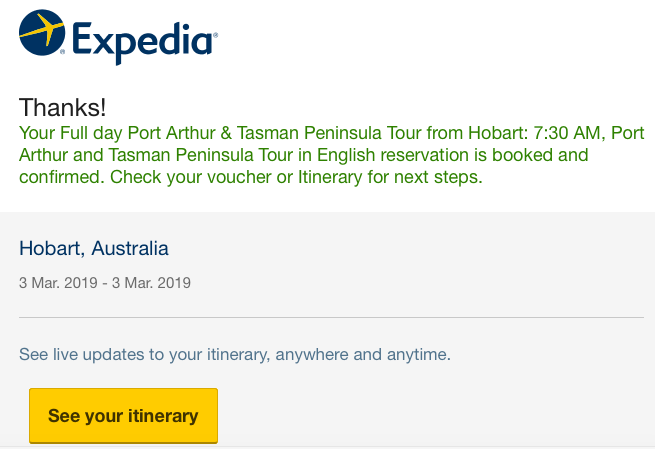

Within moments, an email arrives from Expedia for TD with the booking confirmation and details.

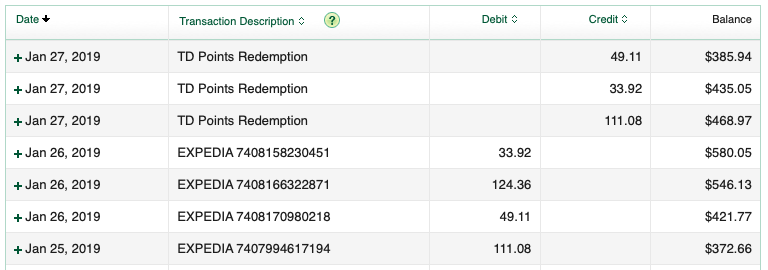

With the “use points” option, the entire travel purchase, including taxes and fees, will be charged to your credit card. But, because you used TD Rewards Points, you’ll receive a credit on your credit card statement within 5 days after the charge, equal to the number of points used.

For the best return, anything appearing at Expedia should be booked online through Expedia For TD and redeemed in this way. Another option is to book by telephone (at Expedia for TD). The points multiplier of x8 for using Expedia For TD will be earned on each booking. Travel purchases and their respective statement credits will appear as separate line items.

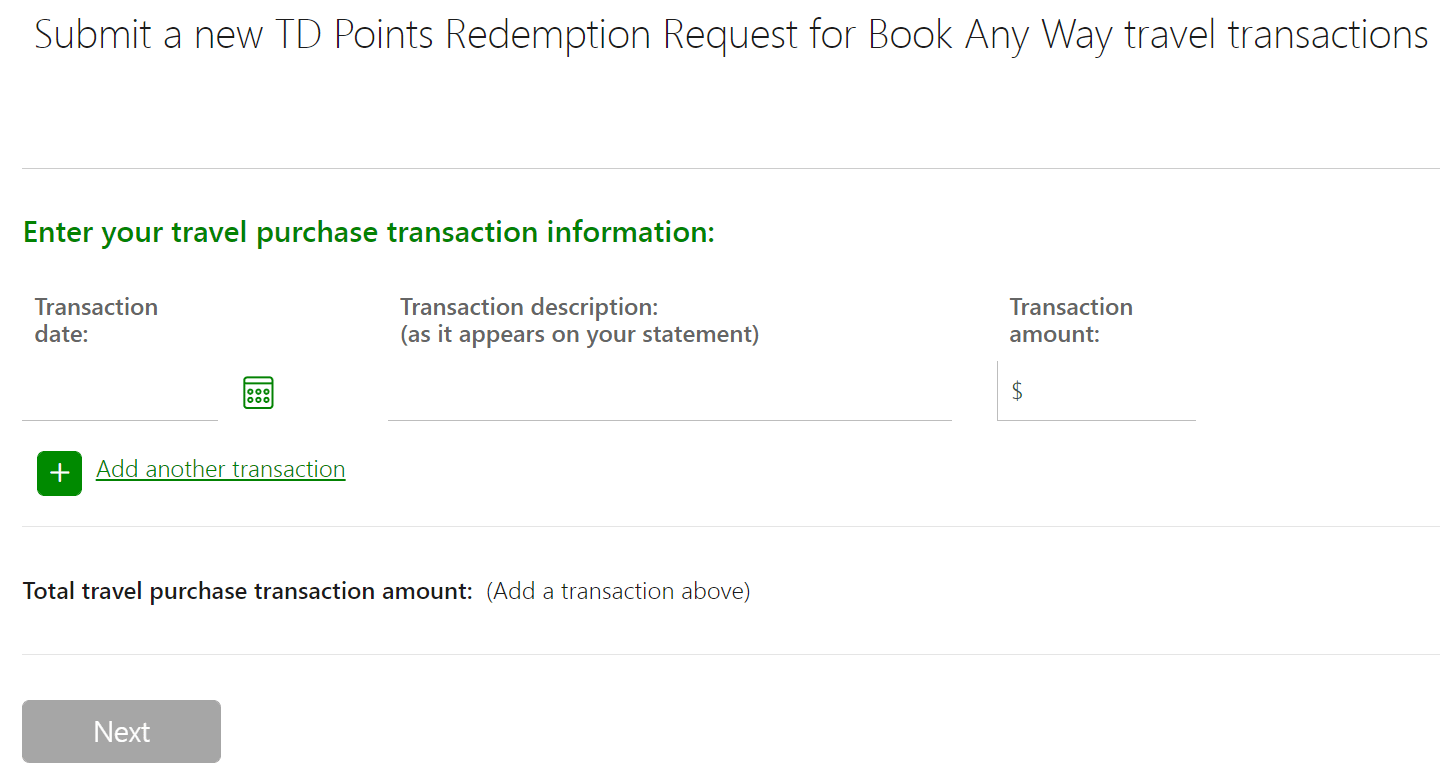

- Make a travel-related purchase using the credit card earning TD Rewards.

- Wait until the charge posts to your credit card account.

- Call TD Rewards within 90 days of the transaction date of the purchase, and ask to have points applied.

- The points will be deducted from your points balance available at the time the points are redeemed, not the transaction date of the purchase.

- The amount credited towards the purchase will be equal to the value of the points redeemed. If there are insufficient points available to cover the entire amount, the remaining cost will be posted on the account for payment.

Both redemption routes (Expedia For TD and Book Any Way) allow payment in any combination of points and cash.

Note: Travel usually delivers the best rate of return. However, TD Rewards can be redeemed for merchandise (at an average of 0.23 cents per point), gift cards (0.25), tuition, or paying down a student loan debt (0.4), or as a credit against your credit card account (0.25). These redemption values are shared with thanks to Credit Card Genius for their research and analysis.

If the following applies to you, I say YES :

- You purchase a considerable amount of travel through Expedia (for TD).

- You’re likely to make a single purchase of $500 or more at Expedia for TD to earn the annual travel credit of $100.

- You like the idea of offsetting a variety of travel costs with various rewards programs.

- You’re not loyal to any particular hotel brand and you use a variety of accommodation that’s bookable through Expedia (for TD).

- You’re able to tap into a fee waiver and decent sign-up bonus.

- You have a TD All-Inclusive Banking Package. This requires a minimum daily balance of $5,000 in your account. It entitles you to a $29.95 monthly fee rebate ($22.45 for seniors aged 60 or older). It includes an annual fee rebate of your choice of one of five select TD credit cards. The TD First Class Travel Visa Infinite is one of the cards. The rebate covers the fees for the primary cardholder and one supplementary cardholder.

- You can make use of the travel insurance benefits.

- You use Expedia sparingly. You don’t use it enough to justify paying the annual fee of $139 (beginning in the second year under a -first-year-free promotion).

- Most of your flights are award bookings using frequent flyer miles or points. When you do purchase a revenue ticket, you book flights directly with an airline because of better service in the event of booking irregularities, flight cancellations, and overbooked flights.

- You’re a member of one or more hotel loyalty programs. You book directly with the respective program to earn loyalty points, status credits, and other benefits.

- The other credit cards in your wallet have superior earning power on everyday-spend categories such as groceries, gas, transit, and dining, and/or earn flexible points that are convertible to other reward programs offering better redemption values.

Is the TD Rewards program worth it?

The TD Rewards program shouldn’t be viewed as a frequent flyer program but one where it’s possible to cut trip costs by redeeming points for miscellaneous travel expenses.

For a personal credit card, I believe the best of the bunch is the TD First Class Travel Visa Infinite Card. What did I think of TD Rewards and the TD First Class Travel Visa Infinite Card?

- When used exclusively for travel bookings at Expedia for TD, the TD First Class Travel Visa Infinite Card offers an appealing return of 4%. Otherwise, a mixture of earn rates puts the return somewhere between 1% and 4%.

- For the most part, Expedia has a solid reputation. The company carries some weight in the travel world and could be a useful ally if things don’t go as planned with a small, independent tour operator. However, I’d never use Expedia for expensive long-haul flights. Overbooked flights, delays, cancellations, and other disruptions can put passengers in a zone where neither the airline nor the OTA (Online Travel Agency) will provide assistance.

- I like Expedia For TD’s large inventory of accommodation options, including hostels and apartments, at a variety of price points. I’ve also been impressed by the attractiveness of refundable bookings. For example, the same property at Booking might be refundable up to a month out, whereas at Expedia, it might be refundable up until the day before arrival. This limits reliance on trip cancellation insurance.

- TD’s recent overhaul of the TD First Class Travel Visa Infinite that included a $100 annual travel credit is a welcome benefit. It requires a purchase of $500 or more at Expedia for TD once in a calendar year (that is relatively easy to accomplish when booking accommodation). Triggering the credit requires no intervention on a cardholder’s part as as an email and secure message from TD arrives within 48 hours. This effectively reduces the annual fee of $139 to $39, a compelling reason to keep the card.

- There’s also the option to book tours and experiences. Other propriety programs (e.g., AMEX Travel) don’t offer a similar range and variety of travel products.

- I love the online system for booking travel at Expedia For TD, and redeeming points against the purchase. It involves inserting a minimal amount of information, and a few clicks to complete the process. Within seconds, the booking confirmation arrives by email.

- Anything appearing at Expedia for TD is bookable online from anywhere in the world. Expedia For TD’s online booking process is convenient, user-friendly, and efficient.

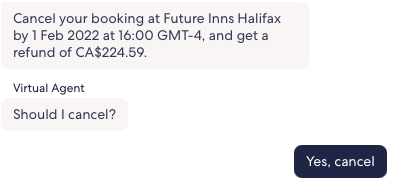

- The same applies to the online process for changing a reservation or using Expedia for TD’s Virtual Assistant to cancel refundable bookings. Sign in, select the booking, hit the cancel button, and receive notification that the refund will be sent within 48 hours.

- The range of travel expenses redeemable as Book any Way travel is impressive.

- With the accelerated earn rate of 6 points per dollar resulting in a 3% return on groceries and dining, I’ve appreciated having the TD First Class Travel Visa Infinite Card in my wallet at restaurants that don’t accept American Express (Cobalt and Scotiabank Gold cards that both earn x5 points on dining).

- TD has a no-fee credit card (TD Rewards Visa Card) that earns TD Rewards. This presents an option to product switch from the TD First Class Travel Visa Infinite (or any other credit card earning TD Rewards) to protect your points and keep a TD Rewards account active.

- TD has a generous approach to product switches that encourage clients to try different credit card products. Some switches provide access to full promotional benefits. In addition, there are cases where clients have been able to hold more than one TD First Class Travel Visa Infinite Card at the same time.

- For credit card cancellations and product switches, TD offers prorated refunds of annual fees.

- The TD All-Inclusive Banking Package presents an option to obtain an annual fee rebate.

- TD’s EasyWeb account management system is efficient and user friendly. After product switching or applying for a new TD credit card, I’ve had the card, with the credit card number, appear in my account within a few hours. On a product switch, the ‘switched-from’ card can be used the following business day to earn points in the ‘switched-to’ card’s rewards program. This is handy to start working on the new card’s Minimum Spend Requirement without having to wait for the new card to arrive by mail.

- There will be others who don’t agree but in my opinion, of the ‘big five,’ TD has the best customer service. For the most part, I’ve found Customer Service Representatives to be helpful, patient, and well informed. Those I’ve dealt with have been more than willing to follow up on requests, listen to, and consider, my interpretation of terms and conditions when it differs from theirs, and seek information from advisors and supervisors.

- To extract maximum value on travel purchases and redemptions, customers need to use Expedia For TD. When purchasing travel from other providers (at an earn rate of 2 points per dollar), and redeeming points using ‘Book any Way’ at the lower redemption value, each point is valued at only 0.8 cents (or 0.8% return).

- At the present time, the program doesn’t have a flight rewards chart where it could be possible, as with other reward programs, for members to extract greater value when redeeming points for flights. For example, the CIBC Rewards (Aventura) Flight Reward Chart offers the potential of a 2.2% return.

- For more information on the CIBC Rewards program, see When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Expedia for TD’s Virtual Assistant works well on uncomplicated bookings such as obtaining a refund before the fully refundable date. However, in the case of complications, the Virtual Assistant is hopeless. For example, in Warsaw, the guide on a scooter tour was a no-show on the day of the tour (so it was past the refundable period) and trying to get the Virtual Assistant to retrieve the booking was impossible, despite inserting my answers to each question asked.

- As a rewards currency, TD Rewards has limited value. It’s not convertible to any other program, and it has a fixed maximum value of $0.05 per point.

- While obtaining a fee rebate is an attractive proposition, doing so on a TD Aeroplan-branded credit card might make more sense for Aeroplan account holders. Aeroplan is capable of delivering much greater value than TD’s fixed-value system.

- I’m not fond of having two-tiered redemption values for travel purchases. Other in-house programs such as Scene+ make no distinction between travel booked through the program’s travel portal, and that from another provider. Redemption values are the same.

- For more information on the Scene+ program, see What’s the best use of Scene+ when travelling the world on miles and points?

- If a customer has two credit cards earning TD Rewards, it’s possible to merge the points into one account but it must be done by an agent. Unlike other programs such as RBC Avion, it can’t be done online. And disappointingly, fewer than 10,000 TD Rewards cannot be moved from one account to the other.

- The TD First Class Travel Visa Infinite Card doesn’t stand out among its competitors. It’s competing with travel credit cards that offer lounge membership and complimentary passes, companion/buddy passes, NEXUS fee rebates, free checked baggage, concierge services, and no FX (foreign exchange) fees. However, as mentioned earlier, the annual $100 travel credit helps fill a much-needed gap in its attractiveness as a travel credit card.

- The insurance benefits are on par with other premium credit cards. Personally, I’ll never use them. For emergency medical insurance, an annual multi-trip plan from an insurer of my choice is a better fit for my age and travel style. The trip cancellation/interruption doesn’t apply because a covered trip is one where “the full cost has been charged to Your Account and/or using Your TD Points.” Like many other travellers, my trips are funded from a variety of sources using a mixture of miles, points, and cash.

- It’s both a blessing and a curse but I’ve been surprised by the types of charges flagged by TD’s fraud detection program. This results in a rejection of the charge and a freezing of my credit card until it’s sorted.

The fact that TD has hitched its rewards wagon to Expedia makes it an interesting proposition. I’m impressed with Expedia For TD’s online portal for booking and redeeming points for travel (and changing a reservation or cancelling via the Virtual Assistant), and the First Class Travel Visa Infinite’s x8 points multiplier on Expedia for TD bookings. For heavy Expedia users, it’s an attractive addition to a credit card portfolio.

I’ve been impressed by recent promotional offers with annual fee waivers and sign-up bonuses of up to 135,000 points. It demonstrates that TD is interested in attracting new customers. To keep them, TD could be more creative with additional travel benefits. Reinstating the option for cardholders to convert TD Rewards to Aeroplan would be a welcome start.

TD needs to increase the value of Book-any-Way redemptions, and introduce an online system for applying points against those purchases. While the Scene+ coding system for travel purchased from other providers isn’t perfect, their system is capable of presenting the vast majority of travel purchases to users for redeeming points online. TD needs to craft an online redemption system that’s as user-friendly as their booking system.

As a fixed value program, TD Rewards can’t match the value achievable with programs such as Aeroplan, British Airways’ Avios, and other frequent flyer programs. But, with the extensive inventory of travel products bookable at Expedia For TD, and the range of travel expenses redeemable as Book any Way travel, it can certainly occupy a very useful secondary corner of a diversified miles-and-points portfolio.

If you found this post helpful, please share it by choosing one of the social media buttons. Also, what do you think of the TD Rewards program? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- What’s the best use of Scene+ if travelling the world on miles and points

- When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Is a no-FOREX-fee credit card always the best choice for international travel?

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

- Lounge and flight review of United Airlines’ Polaris experience

- Why the Best Western loyalty program is good for travellers

- Is the BMO Air Miles World Elite MasterCard a good deal?

- Finding Aeroplan flights: a step-by-step guide

- Travel the world on miles and points by meeting Minimum Spend Requirements

Pin for later?

I’m curious if the prices are jacked a bit through the TD Expedia site. For example, I looked at the Park Lane Hotel in Manhattan. For a five night stay in a 1 Queen Bed City View room, , TD Rewards Expedia site said it would be $2222.97, all taxes, fees all in. Looking at the same room through hotels.com or Trivago, I got the same room, all in price of $1723.72/$1743 respectively. When I apply my current Rewards amount of $836 against the $2222.97, I’m left paying $1386.97, which is only around $336 less, even though I used $836! Is Expedia always more expensive? I looked at more than a few other hotels and they are all much cheaper on hotels.com and Trivago.

Thanks for dropping by. While I never experienced price differences between Expedia and Expedia For TD, some people have reported differences, both in inventory and prices. I’ve just done a search for a five-night stay at the Park Lane Hotel in Manhattan (October 12 to 17) and found the same price at Expedia, Hotels and Booking. I couldn’t access Expedia for TD as I no longer have a TD Rewards credit card. Each of the three sites showed a regular price of $466/$468 and a discounted price of $372 for a total price of $1860. It sounds as though Expedia for TD hasn’t adjusted the regular price yet. What I would do is call Expedia for TD and ask them to match the Expedia price (if that’s what you find for your dates on expedia.ca). Good luck!

Excelent article!

Can you clarify when you got the $100 credit? The “in a calendar year” part confuses me. If I booked accommodations via ExpediaForTD over $500 for the first time this year (March 2023), will I get the $100 travel credit right away? within this year? or Jan 2024?

Trackbacks/Pingbacks

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What’s the best use of Scotia Rewards? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Lounge and flight review of United Airlines’ Polaris experience - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] Travelling the world on miles and points. Is the TD Rewards program worth it? […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

TD Travel Rewards Review [2024]: The Credit Cards Worth It?

![t d travel rewards TD Travel Rewards Review [2024]: The Credit Cards Worth It?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/6414daa0c0987a635e5c9a5e_td_for_expedia.jpg)

Looking to earn cashback on your next travel adventure? See if TD's set of travel credit cards are worth the wait! From first class cash back visa cards to travel points, find out if TD travel rewards are worth investing in.

Booking travel is easier than ever, now that everything can be done online, and deals on hotels and flights are in more demand daily. But, to simplify things, whether you want to jet set to Europe or backpack Southeast Asia, TD Travel Rewards can help get you there.

With the vast number of travel rewards programs on the market, it can be confusing to determine which ones you should sign up for and which ones to avoid. How do you know if TD Travel Rewards is right for you? Read on to learn the ins and outs of TD Travel Rewards in this handy guide!

Suppose you are a Canadian resident who holds a TD credit card. In that case, you might be eligible for the TD Travel Rewards program. Even if you aren't a TD customer, applying online and getting started is very easy.

Customers with an eligible TD card can earn points and redeem them for travel through their online portal, partnered with Expedia. Are TD travel points worth it, and are they right for you? Find all your answers and more in this all-inclusive guide!

What Are TD Travel Rewards?

TD Travel Rewards is a rewards program that allows credit card holders to earn points on every purchase. Some TD credit cards specifically earn travel rewards, while some earn cash-back points that can be used for almost anything. Each set of cards has its own travel-specific benefits as well.

Can Non-Canadian Citizens Apply for a TD Travel Rewards Card?

TD Travel Rewards Credit Cards and cash-back cards are only available to Canadian residents and citizens over the age of 18. If you aren't a Canadian resident or citizen, there are plenty of US travel credit cards to choose from!

Some US travel cards require you to be a US citizen or resident. However, American Express Travel Cards allow applicants from selected foreign countries, making it a flexible option, perfect for digital nomads.

How Do TD Travel Points Work?

TD Travel Rewards points are easy to use and redeem online for exciting and unique travel benefits. Here is a breakdown of how the travel and cash-back rewards cards work.

- Apply online for a TD Travel Rewards credit card or the cash-back credit card you choose.

- Earn rewards or cash back on all your everyday purchases, from your morning latte to your weekly groceries shop.

- Once you have earned enough points, you can redeem them online for flights or hotels with TD-specific deals on Expedia.

- Points can also be used at any travel agency or website.

How Much Are the Points Worth?

TD Travel Rewards points can be used instead of cash and can only be redeemed online in increments of 200. 200 travel rewards points are worth $1.

How Do I Book A Trip?

The best way to redeem TD Travel Reward Points is by booking through Expedia. Using Expedia gives you 0.5 cents per point, one of the best value for redeeming rewards. Here is how to redeem TD Travel Rewards using Expedia.

- Head to Expedia for TD 's portal.

- Sign in to your account.

- Choose which travel rewards you want, like hotels, flights, or cruises.

- Book as usual and pay with your points!

What About Cash-Back Credit Cards?

TD cash-back dollars are earned with every purchase using your TD cash-back credit card. Depending on which card you have, you can earn between 1-3% cash back on your everyday purchases.

Your cash-back dollars can be used for any purchase through the TD app or online, including travel-related purchases! You could also splurge and get a new Monos luggage set or help fund the flight for your Europe trip .

How Can I Redeem TD Cash-Back Dollars?

If you have a credit card that gives you cash-back dollars, you can also redeem those for travel rewards! Cash-back dollars can be redeemed online in increments of $25. Here's how to redeem TD cash-back dollars.

- Log in to your My TD Rewards in the app or online.

- Select the Pay With Rewards page.

- Start shopping!

- Enter the amount you want to redeem.

- Confirm and pay for your purchase.

Travel Rewards Credit Cards

TD has 4 Travel Rewards credit cards with different reward levels to choose from. Here's a breakdown of each card.

TD First Class Travel Visa Infinite Card

This is the highest level of Travel Rewards credit cards that TD has to offer. It's an excellent option for those looking for a card with luxury and regular travel benefits.

Annual Fee: $139

Interest: 20.99%

Cash Advance Interest: 22.99%

Additional Cardholder Fee: $50

Minimum Income to Apply: Single income of 60K or household income of 100k

- Bonus 20,000 TD Rewards Points after your first purchase.

- Birthday bonus of up to 10,000 points.

- Points can be redeemed for eGift cards, education credits, or cash credits.

- 8 points for every $1 when booking through Expedia.

- 6 points for every $1 spent on groceries and restaurants.

- 4 points for every $1 spent on recurring bills.

- 2 points for every $1 spent on all other purchases.

Travel Benefits

- $100 travel credit when booking through Expedia.

- No travel blackouts or limitations whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent-a-Car.

Exclusive Travel Benefits

- Exclusive benefits when booking with Visa Infinite Luxury Hotel Collection.

- Access to special events with The Visa Infinite Dining Series.

- Benefits at over 95 participating wineries in famous wine regions of Canada and the US.

- Golf and entertainment benefits.

Insurance Coverage

- Emergency travel assistance.

- Lost baggage.

- Car rentals.

- Flight delay or cancellation.

- Medical travel.

- Trip delay or cancellation.

TD Business Travel Visa Card

This travel card is perfect for business-minded travelers, with great perks for running your business.

Annual Fee: $149

Interest: 19.99%

Additional Cardholder Fee: $49

Minimum Income to Apply: None

- Welcome bonus of 30,000 points after your first purchase.

- 60,000 points if you spend $2,500 in monthly purchases for the first year.

- Annual fee rebate after the first year.

- Points can be redeemed for anything, like eGift cards or cash credits.

- TD card management access helps you manage business expenses.

- 6 points for every $1 spent on foreign currency, restaurant, and recurring bill payments.

- Earn 9 points when you book travel through Expedia.

- No travel blackouts or limitations, whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

- Travel medical.

- Trip delay or cancellation.

- Auto insurance.

TD Platinum Travel Visa Card

This TD travel card is excellent for travelers who only need some of the luxury perks of the top-tier travel card or the business-focused perks.

Annual Fee: $89

Additional Cardholder Card Holder Fee: $35

- Welcome bonus of 15,000 points after your first purchase.

- 35,000 points when you spend $1,000 within 90 days of opening an account.

- 6 points for every $1 when booking through Expedia.

- 4.5 points for every $1 spent on groceries and restaurants.

- 3 points for every $1 spent on recurring bills.

- 1.5 points for every $1 spent on all other purchases.

TD Rewards Visa Card

This lowest-tier travel card is an excellent way to budget yet still earn travel points, even on a budget!

Annual Fee: $0

Interest: 19.9%

Additional Cardholder Fee: $0

- Cellphone insurance of up to $1000 if you lose or damage your phone.

- 4 points for every $1 when booking through Expedia.

- 3 points for every $1 spent on groceries and restaurants.

- 2 points for every $1 spent on recurring bills.

- 1 point for every $1 spent on all other purchases.

Cash-Back Credit Cards

TD has 2 cash-back credit cards, each with distinct advantages and different levels to choose from. Here's a breakdown of each card.

TD Cash Back Visa Infinite Card

Additional Cardholder Card Holder Fee: $50

- No annual fee for the first year.

- Cellphone insurance.

- 3% cash-back on groceries and gas.

- 1% cash-back on all other purchases.

- Cash-back dollars can be used for any purchases.

- Emergency Road Services with Deluxe TD Auto Club Membership.

TD Cash Back Visa Card

Cash Advance Interest: 29.99%

Additional Cardholder Card Holder Fee: $0

- 1% cash-back on groceries and gas.

- 0.5% cash-back on all other purchases.

- Cash-back dollars can be used on any purchases.

Is TD Travel Rewards Worth It?

For travelers looking to earn fantastic points and significant cash-back percentages with TD's top-tier travel cards, it's definitely worth it! The top-tier TD Travel Rewards card gives an important point-to-spending ratio, and insurance coverage that's handy on the road. This card also has attractive luxury travel benefits.

Travelers looking to save money and still get great benefits might want to weigh their other options and compare TD with other travel cards. Although the lower tier cards have $0 in annual fees, they give less than a point-to-point spending ratio. That said, any travel card earning points is better than no points at all.

Our Rating: 4.1/5

- Lots of price point options for different card levels.

- Budget cards are available.

- Top-tier cards have excellent insurance coverage.

- Low-tier cards only have a few benefits and only give a few points.

- Minimum income required for top-tier cards.

- Top-tier cards need a high minimum spend to earn bonus points.

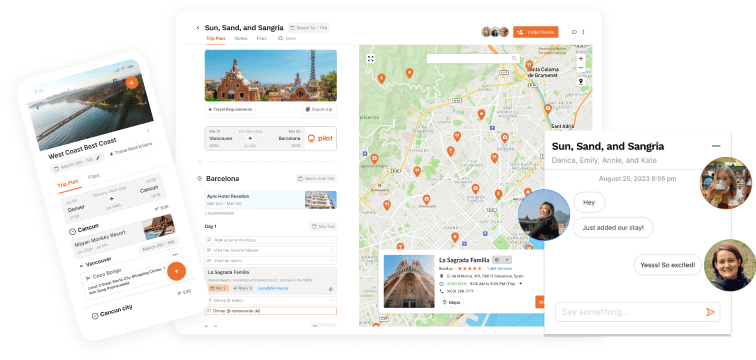

Plan Your Next Trip With Pilot!

Now that you've learned how to save and earn travel points with TD Travel Rewards cards, let Pilot help you figure out the rest of the journey!

Disclosure : Pilot is supported by our community. We may earn a small commission fee with affiliate links on our website. All reviews and recommendations are independent and do not reflect the official view of Pilot.

Satisfy your wanderlust

Get Pilot. The travel planner that takes fun and convenience to a whole other level. Try it out yourself.

Trending Travel Stories

Discover new places and be inspired by stories from our traveller community.

Related Travel Guides

The Points Guy Review: Are His Tips Still Relevant Today?

View From the Wing: Gary Leff's Credit Churning Strategy!

Make the most of every trip.

You won’t want to plan trips any other way!

The trip planner that puts everything in one place, making planning your trip easier, quicker, and more fun.

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

TD Rewards Points are the primary currency touted by the largest bank in Canada, Toronto-Dominion Bank. TD Rewards are a proprietary currency, belonging solely to TD and tied exclusively to TD credit cards .

TD Rewards is a fixed-value points currency, meaning that points can be redeemed in a number of ways at a fixed value. TD Rewards Points are particularly useful to offset the cost of incidental travel purchases, such as independent hotels, short-term rentals, and vacations, to further minimize your out-of-pocket travel expenses.

Earning Points via Signup Bonuses

The only way to earn TD Rewards is from the bank itself, via its suite of personal TD Rewards-earning credit cards.

- The TD Rewards Visa* Card is the no-fee card, which typically comes with a small signup bonus.

- The TD Platinum Travel Visa* Card is the entry-level product among the TD Rewards cards. The card frequently puts on first-year annual fee rebate promotions along with a modest welcome bonus, which typically ranges between 15,000–50,000 TD Rewards Points.

- The TD First Class Travel® Visa Infinite* Card is the flagship TD Rewards product from TD. The card frequently offers first-year annual fee rebates, along with a sizeable welcome bonus of 20,000–135,000 TD Rewards Points.

Earning Points via Daily Spending

Beyond signup offers, you can earn TD Rewards Points through daily spending on the above credit cards. The earning rates are as follows:

- 4 TD Rewards Points† per dollar spent on eligible Expedia® for TD purchases†

- 3 TD Rewards Points† per dollar spent on eligible groceries and dining purchases†

- 2 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1 TD Rewards Point† per dollar spent on all other eligible purchases†

- 6 TD Rewards Points† per dollar spent on eligible Expedia® for TD†

- 4.5 TD Rewards Points† per dollar spent on eligible groceries and dining†

- 3 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1.5 TD Rewards Points† per dollar spent on all other eligible purchases†

- 8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD†

- 6 TD Rewards Points† per dollar spent on eligible groceries and restaurant purchases†

- 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 2 TD Rewards Points† per dollar spent on all other eligible purchases†

Purely from an earning perspective, the TD First Class Travel® Visa Infinite* Card stands out as the strongest card.

This is especially true for anyone who books a significant component of their trips on Expedia, as you can earn an effective 4% return on your purchases.

Redeeming TD Rewards Points

The TD Rewards program offers various redemption possibilities, with different levels of value attached to each one.

Expedia® for TD

The best redemption value for TD Rewards comes by redeeming them on the dedicated redemption portal Expedia® for TD. By redeeming points this way, you’ll get 0.5 cents per point (cpp), which is the best way to use TD Rewards Points.

Expedia® for TD is essentially the same platform as the regular Expedia, except you log in with your TD credentials so you can redeem points.

Simply sign in to your TD Rewards account, click “Expedia for TD” under the “Redeem” tab, and then click through to the Expedia for TD portal.

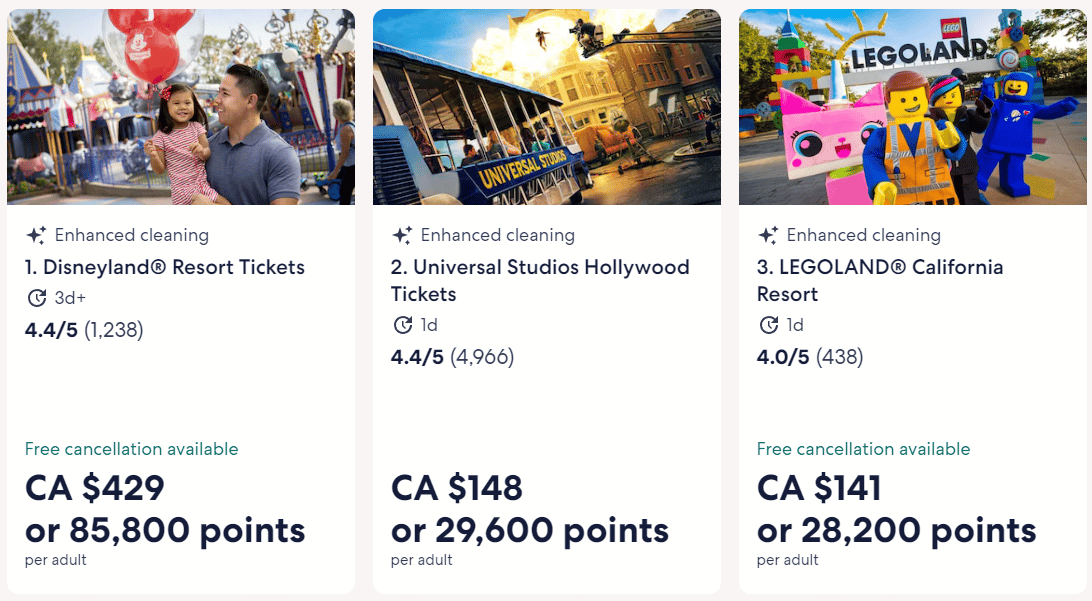

As with regular Expedia purchases, you can book flights, hotels, car rentals, and other travel purchases. Importantly, Expedia also offers cruises, tours, and Disney tickets, among other things.

As these travel expenses are typically quite difficult to book with points, using TD Rewards Points at a fixed value of 0.5 cents per point is an excellent redemption opportunity, and could end up saving you a significant amount of cash out-of-pocket.

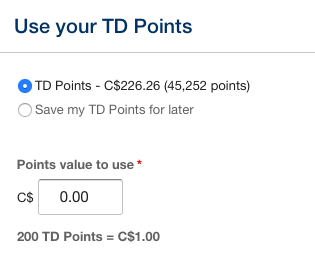

The minimum redemption is 200 points ($1), and you can choose to redeem your points in $50 increments. You’re able to make purchases in any combination of points and cash.

Once you’ve chosen your desired purchase on Expedia for TD, look for “Use your TD Points” on the checkout page. Just select the number of points you’d like to redeem at 0.5cpp, and then proceed with your purchase.

The credit posts in three to five days after the purchase, so be patient and keep an eye on your account.

If you’re using your TD Rewards Points on Expedia® For TD to redeem for hotels, or car rentals, the usual warnings of using an online travel agency apply.

You won’t earn any hotel status benefits or accrue elite qualifying nights at hotels. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

This doesn’t apply to airfare, though, as you’ll still accrue the same amount of elite qualifying miles, segments, and dollars. As long as you have your frequent flyer number attached to your booking or add it in at the check-in counter, your travel should count towards elite status qualification.

One major thing to note about using Expedia to book airfare is that any and all changes and cancellations must be pursued through the third-party booking agency, and can’t be done through the airline.

Book Any Way

The second-best way to redeem TD points is for non-Expedia travel, where you can redeem at a respectable 0.4 cents per point. The minimum redemption is 250 points ($1).

This ratio is maintained for the first $1,200 of a single travel purchase, and will be 0.5 cents per point (200 points = $1) thereafter.

Booking non-Expedia travel using TD points is called “Book Any Way Travel” and can be booked by using the TD Rewards website or by calling 1-800-983-8472.

Calling has a few distinct advantages, such as the ability to redeem your points for non-conventional travel items, such as gas, attractions, various hotel expenses, RV rentals, and even Airbnbs.

To redeem TD Rewards points through “Book Any Way Travel”, select “Book Any Way Travel” from the “Redeem” tab on the TD Rewards website.

On the next screen, fill in the information about the transaction against which you’d like to redeem points. Note that you can only redeem TD Rewards points for “Book Any Way Travel” after the purchase has posted on your account.

You’ll need to note down the transaction date, its description, and the amount before proceeding. You can submit multiple transactions at once.

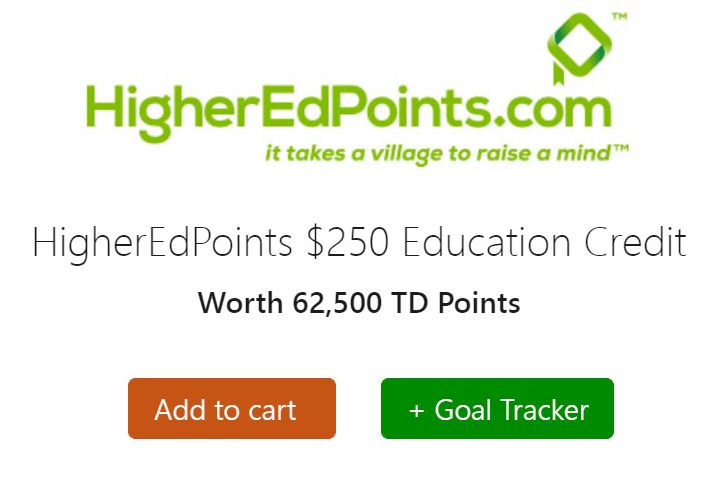

Higher Education

Using TD Rewards Points towards higher education is also a decent option, at a redemption value of 0.4 cents per point (250 points = $1). You’re able to use your TD Rewards Points to pay for tuition and/or student loans, in increments of $250 (62,500 points).

First, check if your institution participates on the TD website , and then you can buy HigherEdPoints Education Credits with your TD Rewards Points.

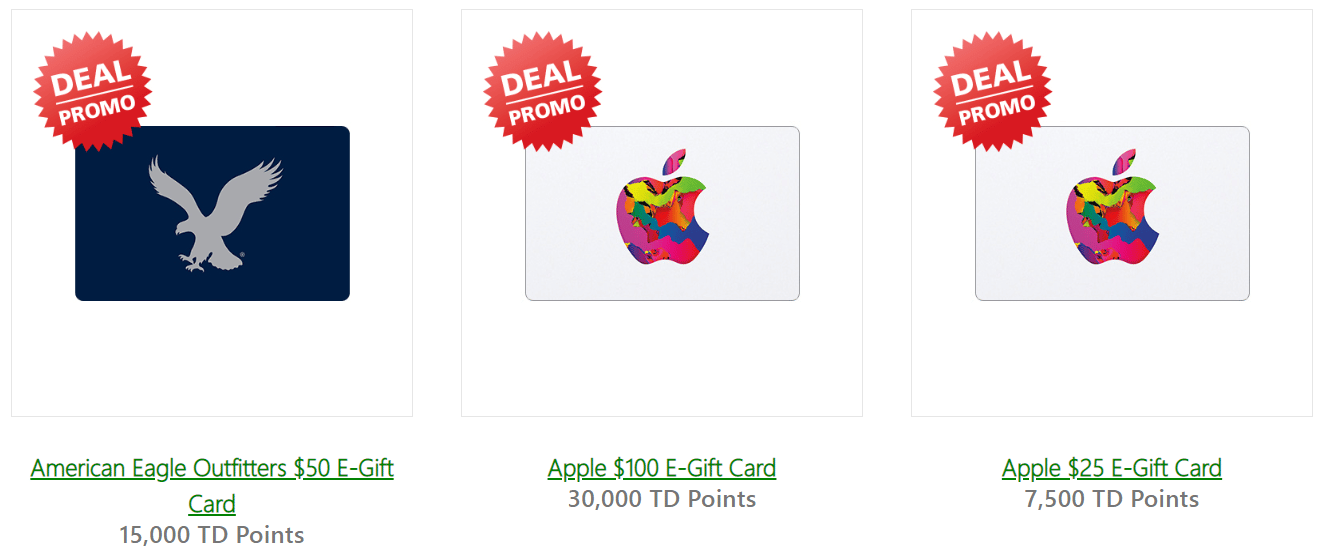

If you want to use your TD Rewards Points towards shopping expenses, you can redeem your points towards gift cards at a flat value of 0.25 cents per point (400 points = $1).

This is objectively a lower-value redemption than travel; however, as long as you’re redeeming points for higher value than your costs (which is usually the annual fee), you’re keeping cash in your pocket.

Gift Cards & Merchandise

There are sometimes discounts which offer gift cards for 25% off, so you can redeem at 0.33 cents per point. If you plan on redeeming TD Rewards for gift cards, it’s best to wait for one of these promotions prior to doing so.

The same value of 0.25 cents per point is offered for merchandise purchases, which are listed on the TD Rewards website . As with gift cards, there are sometimes sales where you can redeem for up to 0.3–0.4 cents per point.

As always, check if the item you’re redeeming for is on sale for a lower price on another platform to calculate your redemption value.

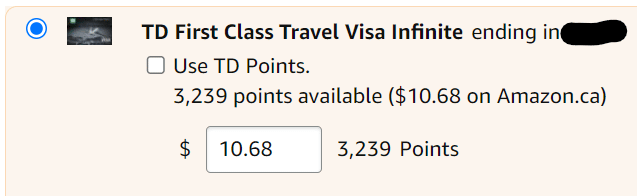

There’s also the option of redeeming TD Rewards Points at 0.33 cents per point through a partnership with Amazon.ca.

First, you’ll have to enroll by linking your TD Rewards-earning credit card with your Amazon account. Once you’ve done this, you can apply TD Rewards Points.

At the check-out page on Amazon, change the payment method to your linked TD Rewards credit card, where you’ll see the balance of points available. You can cover the rest of the purchase with your credit card.

Statement Credit

Finally, the last way to use your TD Rewards Points is to redeem for statement credit directly, also at a rate of 0.25 cents per point.

It sounds like the same rate as gift cards and merchandise, but keep in mind that those have occasional sales, while statement credits always remain at 0.25 cents per point.

This makes it the lowest-value way of redeeming your TD Rewards Points, and if you plan to use your points towards a statement credit, you’re better off with a cash back card .

Without a doubt, using Expedia® For TD at a rate of 0.5 cents per point (200 points = $1) is the best value redemption for TD Rewards Points.

For most travellers, this should suffice just fine, as Expedia offers tours, Disney park tickets, and a plethora of other travel possibilities aside from the usual flights, hotels, and car rentals.

TD Rewards Points are a great way to save money on miscellaneous travel expenses, and the regular high signup bonuses and respectable earning rates make it quite easy to rack up the points.

† Terms and conditions apply. Refer to the TD website for the most current information.

Hi, is it possible to sell my TD points to someone in exchange for cash? I am getting older and I doubt I will ever use it for travel. I have a lot of points. Any help would be appreciated. Thanks

Hi Judy. I don’t think TD points are transferable to other people, however you CAN redeem them for a cash (statement credit). You will get 0.25 cents per point, so for example if you have 100,000 TD points, that should be a credit of $250 . You may also be able to redeem them for non-travel rewards that will give you more value for your points. If you do decide on the statement credit, this can be done from TD Easyweb when viewing your TD Visa details. You might have to sign up or sign-in to ‘TD Rewards’ for the other options. Hope this helps!

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 100,000 Points Earn up to 100,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of up to 10,000 TD Rewards Points†. Account must be approved by June 3, 2024.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

- Option to purchase TD Auto Club Membership†: and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.