Tax Refund: How to Get for Foreigners in Indonesia?

Nora Setiawan

June 2, 2020

Table of Contents

If you are a foreign tourist and want to shop around the country, it is good news that the Indonesian government has provided a facility for tax refund. As there are many stores to explore, and they offer you good stuff that you haven’t found in your home country, or you just want to shop around the country.

Additionally, in an effort to encourage tourist spending and empower small and medium enterprises (SMEs), the government had revised a regulation related to Value Added Tax (VAT) that would allow foreign tourists to get a tax refund for their spending. It is also boosting the Indonesian tourism amongst international travellers.

The Finance Ministry’s director general for taxation, Robert Pakpahan, said the new regulation would allow foreign tourists to apply for VAT refund with multiple invoices, as long as the total value of the VAT is a minimum of Rp500.000 (US$36). The invoices could have different purchase dates.

The implementation of this regulation, foreign tourists are now able to collect their purchase receipts with a minimum value of Rp500.000 each from several days and various stores, and if the total transaction amount has reached Rp5 million, they can ask for a VAT refund.

According to Jakarta Post , last August 2019, 55 corporate taxpayers (PKP) which own 501 retail stores, were participating in the refund scheme, tax office data revealed. The flowing of tourists visiting Indonesia had affected the amount of VAT refunds. Tax office had refunded Rp11.2 billion in VAT to tourists in 2019. Meanwhile, during that time, Indonesia welcomed 15.8 million international tourists.

It was an increase from Rp6.4 billion in VAT refunds that recorded in 2017, when the country welcomed 14.03 million foreign tourists.

With this new regulation, now your visit to Indonesia can be more enjoyable. You can do a tax refund for purchase goods in any shop (retailer) with VAT Refund for Tourists logo.

You may ask yourself, what is VAT Refund for Tourists? Or who is eligible to get VAT refund? However, it is a facility given by the Indonesian government which allows foreign tourists to claim back Value Added Tax (VAT) on goods purchased in any store registered as a “VAT Refund for Tourist” participant.

VAT Refund can be claimed by a foreign passport holder, who lives or stays in Indonesia no longer than 2 months since their arrival in Indonesia. You cannot claim it, if you are a cabin crew, Indonesian citizen, and Permanent Resident of Indonesia.

After knowing the regulation and requirement, you may ask yourself how and where to claim the refund. Don’t worry, we will give you guidance that you need to know!

How To Claim The Tax Refund?

1. Accompanied Baggage (Goods)

To be eligible for the tax refund:

- You must purchase goods from shops with “Tax Refund for Tourists” logo across Indonesia and don’t forget to show your passport. You also must have a valid tax invoice (a tax invoice attached with one payment receipt) from the shop.

- Minimum Tax payment is Rp50.000 per transaction and the sum of tax from several receipts should comply with a minimum of Rp500.000.

- Goods are purchased within 1 month before departing Indonesia.

- Goods must be carried out of Indonesia as accompanied baggage within 1 month of the date of purchase.

2. VAT Refund Payment Options

VAT refund can be given in cash or by transfer payment

a. Given in cash with Indonesian Rupiah (IDR) currency.

VAT refund is given in cash, only if the amount does not exceed Rp5.000.000.

b. Through transfer payment

When the VAT refund is in excess of Rp5.000.000, the refund will be made by transfer. The foreign tourist should provide a bank account number, account name, address, bank routing number, designated bank for the transfer and requested currency for the VAT refund. The transfer will be done within 1 month of receipt of the application for VAT refund.

c. Exceptional circumstances

If the amount of VAT refund is more than Rp5.000.000, however, the foreign tourist does not want to be refunded by transfer, then the amount of Rp5.000.000 will be refunded in cash, and the balance of VAT is not refundable.

d. Claim procedure

The VAT refund can only be claimed at the airport on the date of your departure and you must follow these steps below.

Option 1: Claim VAT Refund before Check-In counter

- Submit the application for VAT refund to the Directorate General of Taxes (DGT) officer at the airport.

- Submit both copies of the original valid tax invoice. A tax invoice must be attached with one payment receipt.

- Show your passport, airline ticket, and goods purchased.

- Receive VAT refund in cash or through transfer to your bank account.

Option 2: Claim VAT Refund after Check-In counter

The same steps are applied for this option. However, instead of showing an airline ticket, you need to show your international boarding pass to the DGT officer.

This option is applied for the passenger who carries on their purchased goods as hand baggage. If the goods are oversized or aviation security measures prevent you from taking your goods on board the aircraft, then you have to claim your VAT refund at VAT Refund counter before Check-In counter as stated on option number 1.

The claims procedure is easy if you have enough time to complete the steps. However, you need to allow enough time on the day of your departure, to ensure the claims process is going smoothly. It is better to prepare the receipts before your arrival at the airport, so you can claim it as soon as you reach the VAT Refund counter.

3. Where Are The Tax Refund Counters Located?

Tax refund counters are located in selected Indonesian International Airports. They are available at Soekarno-Hatta Airport (Jakarta), Ngurah Rai Airport (Bali), Adisutjipto Airport (Yogyakarta), Juanda Airport (Surabaya), and Kualanamu Airport (Medan).

The claims procedure is uncomplicated, you can now enjoy more travelling and exploring in Indonesia, and visit stores as much as you want. Remember, the stores that have VAT Refund are the ones with the “VAT Refund for Tourists” logo. Please enjoy your shopping while you can pay less and get the best. If you need any help, you can contact us anytime .

Related posts

Public holidays in asean countries (part 4 – indonesia), how coronavirus could reshape education in indonesia, is it the right time to invest in a property, how to get a bpom certificate for your food products in indonesia, download our latest ebook about real estate and property.

Tải cuốn ebook mới nhất về nền kinh tế số Việt Nam!

The digital economy of Vietnam has been fueled and accelerated by the global digital trends and the pandemic Covid-19. The movement of digital transformation is underway in every corner of Vietnamese life, strongly influencing the way people do things. Digital economy is the future of the Vietnam economy. Realizing the potential of the digital economy, the Vietnam government has issued policies, guidelines and created legal frameworks to support and further enhance this economy. In this ebook edition, the digital economy is looked at from different angles. Perspectives from the key elements comprising Vietnam digital economy are examined and discovered.

Our Happy Clients

Subscribe to our insights to look at the critical issue that your business is facing and stay ahead of the competition in a rapidly changing world.

- Terms of service

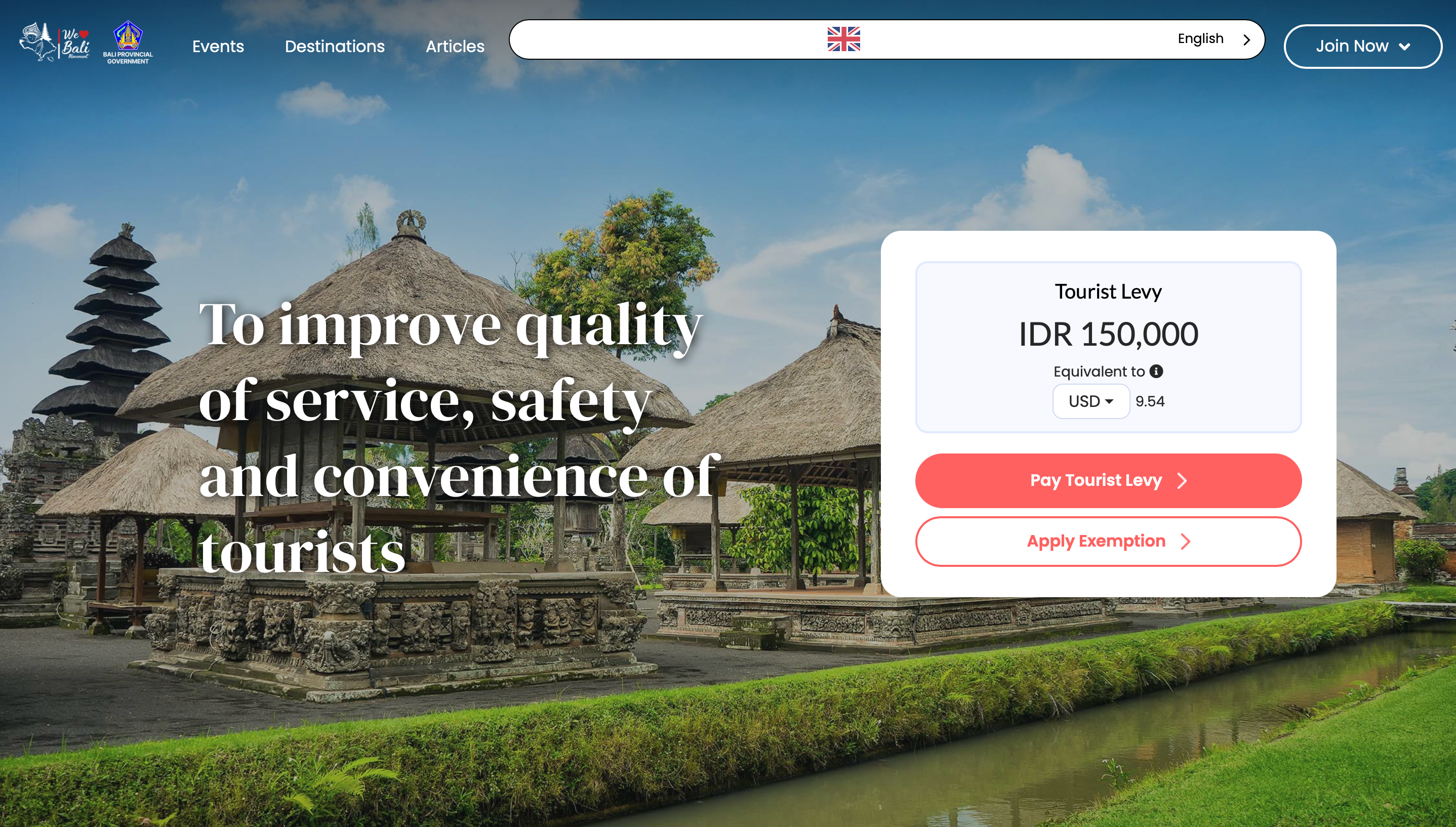

Bali’s new tourist tax launches — here’s how to pay it

From Feb. 14, foreign travelers visiting Bali in Indonesia will be required to pay a new tourist tax upon entry or before visiting the region.

The fee costs 150,000 rupiahs (around $9.50) and is in addition to any other visa fees. The tax aims to combat overtourism on the popular island.

Although the fee will not currently be enforced in other parts of Indonesia, travelers must pay it during each visit to Bali. This includes leaving Bali to visit another Indonesian island and returning during the same trip.

Related: 15 dream-worthy Bali hotels to book now

While the fee will apply to visiting tourists — including children — international travelers who have Kartu Izin Tinggal Tetap (Indonesia's permanent stay permit card); family unification, golden or student visas; or other specific non-tourist visas will be exempt from paying the tax.

According to officials, the tax will fund tourism management and help maintain Balinese culture. It will also be used for environmental cleanup efforts and disaster management.

How to pay the new Bali tourist tax in advance of your trip

To pay the tax, you have two options.

Desktop users can visit the Love Bali website for additional information about the charge and payment options. Mobile users can also download the Love Bali app ( IOS / Android ) to learn more about the tax.

Both options will provide several ways to pay the tax, including with credit cards like Visa, Mastercard and American Express, before confirming your details (name, email, passport number and arrival date).

From there, you should be able to process your payment, which will be confirmed by email.

Bottom line

Bali launched a new tourist tax for international travelers that's now in effect. The fee must be paid every time you visit Bali and will cost around $9.50. You can find out more information at the Love Bali website .

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

- SIMCards / eSIMS

Staying in Bali for more than just a holiday

Bali AI ART Artificial Intelligence Bali Paintings - inspired by the Great Masters

- Animal Welfare

- Green Traveling

Get your Bali.com Digital Discount Card

Amazing partners - handpicked selection .

Villas, Hotels, Car Rental, Rafting, Canyoning, e-Biking, Trekking & Sightseeing Tours, Spa & Fitness, Restaurants, ATV, Swings, Scuba Diving, Waterpark, Dance Shows, Cooking Class, Airport Transfer....

FREE 1GB eSIM included!

Book & Purchase Online

Discount Card & Tourist Pass

Hotels, Villas & Resorts

Internat. Driving License

Bali SIMcard & eSIM Cards

Car Rental with Driver & Tours

Private Airport Transfer

Guided Tours & Sightseeing

Scooters & Motorbike Rental

Medical & Health Insurance

Flights to Bali & Beyond

Hotels, Resorts, Villas & Holiday Rentals

Bali's no. 1 Travel Guide

Nyepi - Bali's unique & fascinating New Year.

Don't Forget:

Things to Do in Bali

With our BaliCard, Bali's Digital Discount Card & Tourist Pass, you save 10% and more

What's on Bali

Events at W Bali Seminyak

Events at Desa Potato Head

Events at AYANA Bali

- Bali Tourist Tax

for International Travelers

Bali tourist tax / bali tourist levy.

The Tourist Tax for international visitors to Bali is a tax charged by Bali’s provincial government. This is all you need to know to get ready to come to Bali. Make sure you are only using the links mentioned tha guide you to the official website of the Bali government.

Planning your trip to Bali?

In the FAQ Section below we will answer your questions about the tourist tax.

Equally important for your travel planning:

Don’t miss to check the updated Visa Regulations and general Travel Regulations to ensure a smooth arrival in Bali.

Want to rent a scooter?

International Driving License is Mandatory (online purchase)

More Essentials

Get your SIM and internet connection Book your Hotel / Villa Discounts and Things to do

Bali Tourist Tax Regulations

Faq - must know about the tourist tax (levy), the tourist tax will have to be paid by international travelers coming to bali, the tax applies to foreigners coming to bali..

For arrivals to Bali from outside Indonesia and also if you arrive coming from another province to Bali.

The Bali Tourist Tax costs IDR 150,000 per person (ca. USD 10 and AUD 15). Regardless of the age of the traveler.

It seems, that for the online payment there is also a surcharge of Rp 4,500

You can pay the tax online on the official Bali Tourism Website ( ONLY use that website, don't pay the tax anywhere else, there might be websites run by scammers).

Official website to pay the bali tourist tax lovebali.baliprov.go.id/.

You will also be able to pay the tax upon arrival (airports and harbours). We strongly suggest however you pay already online before you arrive.

Travelers with following Visas are exemption from paying the Bali Tourist Tax, without having to apply for the exemption online (automatic exemption)

- Holders of Diplomatic Visas and Official Visas

- Crew Members of Conveyances are exempted

- KITAS & KITAP Holders (Holders of Temporary and permanent stay permits)

- Family unification visa holders

- Student Visa Holders

Foreigners can apply for an exemption on the official website . Apply at least 5 days before your arrival

- Golden Visa Holders

- Any other Visa issued by the immigration office, that do not have the travel purpose tourism ,. In other words, travelers with any visas that is issued with the travel purpose "tourism" will have to pay the tax.

On the official website the government states:

We are not the government, so unfortunately we cannot help you with this issue.

First we would check the Spam / Junk Folder, to be sure you did not receive it.

You can also write a message to the support on

lovebali.baliprov.go.id/

It seems that the official site from the bali government still has problems from time to time. since we are not representing the government and are not charging any taxes or fees, we cannot assist you in this matter. we suggest you keep trying opening the website. worse case, you can pay the tourist tax upon arrival..

Only use the official Bali Tax Website:

The tourist tax (levy) is a local tax that the Bali administration is implementing, it is only related to Bali and not to Indonesia

The bali administration has issued following statement:, the levy is paid only 1 (one) time while traveling in bali, before the person leaves the territory of the republic of indonesia., how they will control this is not yet clear to us, but it seems that if you travel to bali, pay the tax, then go to lombok, return to bali, you would not have to pay the tourist tax again., the bali administration has announced that they want to use the income of the tourist tax for the following initiatives (official statement from the bali administration):, preserve heritage, protecting balinese customs, traditions, arts and local wisdom, ensuring the sustainable culture of bali island., nurture nature, contribute to the nobility and preservation of bali's unique culture and natural environment, making it an even more beautiful destination., elevate your experience, improve the quality of service and balinese cultural tourism management, promising you a safe and enjoyable travel adventure in bali., bali and the indonesian tourism officials have discussed over the last few years how they can protect the environment better, handle mass tourism, improve infrastructure and handle the growing trash problem, increase income for the local population who do not yet benefit from the growing tourism sector. they wish to encourage travelers to respect and participate the local culture more and overall have a better experience when they visit the island of gods., for the moment it seems, yes, but we expect the local administration to clarify at some point., 14th february 2024, essentials for your bali vacation.

- Digital Discount Card - The BaliCard

- SIMcards & e-Sims online (NEW)

- International Driving License (mandatory)

- Hotels, Resorts and Villas in Bali

- Trekking Tours & Sightseeing

- Car Rental with Driver (half- & full day)

- Airport Transfer DPS

- Bali Scooter & Motor Bike Rental

- Medical Travel Insurance (incl. Covid coverage)

- Golf Tee Time

- Visa & Entry Regulations

- Bali DISCOUNT Card

- Hotels, Resorts, Villas

- Buy SIMCards & eSim

- Int. Driving License (mandatory)

- Airport Shuttle

- Scooter & Bike Rental

- Car Rental & Driver

- Reliable Medical Insurance

- Destinations | Where to Stay

- Going Out & Nightlife

- Weather & Seasons

- Complete Travel Guide

- Weddings & Getting Married

- Things to Do

- What’s-On Calendar

- Events @ W Bali

- Events @ Potato Head

- Events @ Rock Bar

- Living in Bali

No products in the cart.

Return to shop

Username or email address *

Password *

Remember me Log in

Change Location

Find awesome listings near you.

ORIGINAL ART PAINTINGS GALLERY IN BALI

Item added to your cart

A comprehensive guide to obtaining a tax refund for tourists in bali.

Understanding law and regulations in Indonesia is really good for you, especially when you're traveling in Bali. Bali, with its breathtaking landscapes, vibrant culture, and warm hospitality, has become a sought-after destination for tourists from around the globe. For travelers exploring the enchanting island, understanding the process of obtaining a tax refund can add an extra layer of convenience and financial benefit to their journey. This guide aims to provide a step-by-step overview of how tourists can navigate the tax refund process in Bali, ensuring a smooth and rewarding experience.

Understanding the VAT (Value Added Tax) System:

Bali, like many other tourist destinations, imposes a Value Added Tax (VAT) on various goods and services. The standard VAT rate in Indonesia is 11% (PPN). However, tourists may be eligible for a refund on certain purchases made during their stay.

Eligibility Criteria:

To qualify for a tax refund, tourists need to meet specific criteria. Generally, these include:

- Being a non-resident of Indonesia.

- Making purchases from participating retailers that offer tax-free shopping.

Identifying Participating Retailers:

Look for shops and stores displaying the "Tax-Free Shopping" or "VAT Refund" signs. Many larger retailers catering to tourists, especially in popular areas like Kuta, Seminyak, and Ubud, participate in the VAT refund program. At Feliz'Eye Art Painting Gallery , we offer Tax Refund for our customers that bring the paintings back to their country.

Making Qualifying Purchases:

When making purchases, ensure that each receipt clearly indicates the amount of VAT paid, the business's name and address, and the details of the items bought. Only goods that are taken out of Indonesia within a certain period are eligible for a refund.

Requesting a Tax Invoice:

Ask the retailer for a tax invoice, which is crucial for the refund process. This document should explicitly state the VAT amount paid.

Filling Out the VAT Refund Form:

Complete the VAT refund form provided by the retailer. This form typically requires personal details, passport information, and a declaration of your intent to take the purchased goods out of the country.

Customs Validation:

Before departing from Bali, visit the Customs Office at the airport to get the VAT refund form stamped. Ensure that you have the purchased items with you, as customs officers may ask to inspect them.

Refund Processing:

Depending on the refund service provider used by the retailer, tourists may receive their refund in various ways, such as credit card reimbursement or cash. Some services may have a desk at the airport where tourists can claim their refund on the spot.

Keep Documentation:

Retain all receipts, tax invoices, and the stamped VAT refund form until you have successfully received the refund. These documents may be required for any follow-up inquiries.

Be Aware of Fees and Conditions:

Some refund services may charge a processing fee or have specific conditions for eligibility. Familiarize yourself with these terms to avoid any surprises.

Conclusion:

By understanding and navigating the tax refund process in Bali, tourists can make the most of their shopping experiences and enjoy additional savings on their travel expenses. This guide serves as a roadmap to help visitors effortlessly reclaim the VAT on eligible purchases, ensuring a rewarding and financially savvy stay on the Island of the Gods.

For tourists seeking a hassle-free experience in obtaining their tax refund in Bali, Feliz'Eye Art Painting Gallery is here to assist you every step of the way. Our dedicated staff is well-versed in the intricacies of the VAT refund process and is committed to ensuring that your documentation is handled with precision and care. When you make a purchase at Feliz'Eye, our team will guide you through the process of filling out the necessary forms, provide you with the required tax invoices, and facilitate the customs validation procedure. With Feliz'Eye Art Painting Gallery, you can shop for unique and exquisite artworks while our staff takes care of the paperwork, making your Bali experience even more enjoyable and stress-free. Explore the beauty of Bali, and let us handle the details of your tax refund for a seamless and rewarding shopping adventure.

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Media Komunitas Perpajakan Indonesia

- Apa itu Value Added?

- Legal Character PPN

- Saat dan Tempat Terutang PPN

- Pengusaha Kena Pajak

- Tata Cara Pengisian Faktur

- Kode dan Nomor Seri Faktur

- Faktur Pajak Gabungan

- Faktur Pajak Pengganti

- Pembatalan Faktur Pajak

- Dokumen Tertentu yang Kedudukannya Dipersamakan dengan Faktur Pajak

- Faktur Pajak Pedagang Eceran

- Pengkreditan Pajak Masukan bagi PKP Belum Berproduksi

- Pedoman Pengkreditan Pajak Masukan PKP Peredaran Usaha Tertentu

- Penghitungan Kembali Pajak Masukan

- Pengujian dan Konfirmasi Pajak Masukan

- Syarat Pengkreditan Pajak Masukan

- Pajak Masukan yang Tidak Dapat Dikreditkan

- PPN Ditanggung Pemerintah

- Kompensasi PPN

- Pengembalian Pendahuluan PPN

- Tata Cara Restitusi PPN

- PPN Tidak Dipungut

- PPN Dibebaskan

- Pengembalian Pajak yang Seharusnya Tidak Terutang

- PPN atas Perdagangan Melalui Sistem Elektronik

- PPN atas Penyerahan Hasil Tembakau

- PPN atas Penyerahan Hasil Pertanian Tertentu

- PPN atas Penyerahan Kendaraan Bermotor Bekas

- PPN atas Penyerahan Pupuk Bersubsidi untuk Sektor Pertanian

- PPN atas Penyerahan LPG Tertentu

- PPN atas Penyelenggaraan Teknologi Finansial

- PPN atas Kegiatan Membangun Sendiri

- PPN atas Penjualan Aktiva Perusahaan

- PPN Pemakaian Sendiri

- PPN Konsinyasi

- PPN atas Transaksi Pengadaan Barang dan Jasa

- PPN atas Jasa Agen dan Pialang Asuransi

- Pajak Penjualan atas Barang Mewah (PPnBM)

- Tanggung Renteng PPN

- Fasilitas PPN

- Pengenaan PPN atas Jasa Event Organizer

- Makanan/Minuman dan Jasa yang Dikecualikan dari PPN

- PPN atas Aset Kripto

VAT Refund: Syarat, Ketentuan, dan Prosedur Pengajuannya

- Alifatu Mazidah

- 29 November 2023

Melalui Peraturan Menteri Keuangan Nomor 120/PMK-03/2019 tentang Tata Cara Pengajuan dan Penyelesaian Permintaan Kembali Pajak Pertambahan Nilai Barang Bawaan Orang Pribadi Pemegang Paspor Luar Negeri secara resmi Tax Refund diberlakukan mulai 1 Oktober 2019. Tax refund ini sendiri merupakan fasilitas yang diberikan pemerintah Indonesia kepada wisatawan asing yang datang ke Indonesia untuk mengklaim kembali Pajak Pertambahan Nilai (PPN) atau Value Added Tax (VAT) atas barang yang sudah dibeli di toko-toko yang terdaftar sebagai peserta “ Tax Refund for Tourists “ saat mereka kembali ke negara asalnya dalam jangka waktu tertentu.

Pengajuan Permintaan VAT Refund

Untuk mendapat VAT refund , berikut adalah syarat-syarat yang harus dipenuhi:

- Barang dibeli dari penjual yang terdaftar sebagai peserta “Tax Refund for Tourist” dan memiliki invoice/bukti pembelian

- PPN yang dapat diminta kembali paling sedikit Rp500.000, dan minimum Rp50.000 per transaksi

- Pembelian dilakukan dalam jangka waktu 1 bulan sebelum keberangkatan ke luar negeri

Untuk memperoleh Tax Refund, wisatawan dapat mengikuti langkah-langkah berikut ini:

- Klaim diajukan dengan menunjukkan faktur pembelian melalui Tax Refund Counter

- Tunjukkan paspor, boarding pass , dan barang yang dibeli sebagai barang bawaan

- Tax refund akan diberikan dalam bentuk cash jika jumlah refund tidak lebih dari Rp5.000.000. Refund akan diberikan melalui transfer ke rekening bank jika nominal melebihi Rp5.000.000. Transfer akan dilakukan dalam waktu paling lama 1 bulan.

Baca Juga :

Penerimaan Pajak Januari 2024: Tumbuh Positif, Ditopang PPh 21 dan PPN

Permintaan vat refund secara elektronik.

Dalam hal masa pandemi COVID-19 yang melanda seluruh dunia, Pemerintah Indonesia memperbarui sistem pengajuan Tax Refund secara online melalui Pengumuman Nomor PENG – 43/PJ/2020 bahwa Unit Pelaksana Restitusi Pajak Pertambahan Nilai Bandar Udara (UPRPPN Bandara) tidak memberikan pelayanan secara tatap muka kepada Turis Asing yang hendak mengajukan permintaan kembali PPN atas pembelian Barang Bawaan melainkan terintegrasi secara online.

Pengajuan Refund

Turis asing mengirimkan surat elektronik dengan subject “VAT Refund”, menyampaikan nomor rekening dan nama bank tujuan transfer atas nama Turis Asing yang bersangkutan, dan melampirkan scan dokumen yang dipersyaratkan antara lain:

- foto halaman identitas paspor luar negeri;

- pas naik (boarding pass) ke luar Indonesia;

- invoice dan Faktur Pajak atas pembelian Barang Bawaan; dan

- foto Barang Bawaan yang dibeli,

ke alamat surat elektronik UPRPPN Bandara sesuai tempat keberangkatan Turis Asing ke luar Indonesia.

Sesuai Pengumuman Direktur Jenderal Pajak Nomor PENG-4/PJ/2022, mulai 1 Januari 2023 pelayanan VAT Refund telah dilakukan secara normal (tatap muka) .

Lokasi Pengajuan VAT Refund

Wisatawan hanya dapat mengajukan VAT Refund di enam lokasi berikut ini:

- Tagged: pajak_turis , PPN , tax_refund , Topik PPN Lainnya , value_added_tax

Artikel Terkait

Menentukan ptkp untuk karyawati, siap-siap kp3skp adakan uskp a bulan april 2024, bagaimana regulasi pajak minuman berpemanis di asia tenggara, buat billing pph final umkm kini pakai npwp pemotong, daftar dokumen yang perlu dilampirkan dalam spt tahunan pph badan, issn : 1978-5844, mitra resmi djp, terdaftar dan diawasi oleh djp.

- Copyright 2021 PT INTEGRAL DATA PRIMA

About Ortax

- Kebijakan Privacy

- Pedoman Media Siber

- Kontak Kami

Ortax Tax Solutions Center

- Tax and Accounting Services

- Payroll and PPh 21 Services

- Transfer Pricing

- Tax Manual & SOP

- Tax Training

- Tax Technology Solutions

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

Please allow a few minutes for this process to complete.

VAT Refund for Tourist in Indonesia

- Post published: 14 June 2023

After the subsiding of the Covid-19 pandemic in Indonesia, the government has been actively promoting the tourism sector in several regions of the country. The tourism sector significantly contributes to increasing foreign exchange reserves and drives national economic growth. Therefore, the government has implemented various measures to attract foreign tourists to visit Indonesia. One of these efforts is providing tax incentives in the form of VAT Refund for tourists.

VAT Refund for tourists is a tax incentive given to foreign individuals holding foreign passports, allowing them to claim a refund of Value Added Tax (VAT) paid on taxable goods purchased in Indonesia, which are subsequently taken out of the customs territory or abroad (DJP, 2019).

The VAT Refund for tourists has been regulated by the government through the Minister of Finance Regulation No. 120/PMK.03/2019 concerning the Procedures for Requesting and Resolving Requests for the Return of VAT on Personal Carried Goods by Foreign Passport Holders. Tourists who shop in Indonesia for a minimum amount of Rp 500,000 at designated stores, with a maximum purchase amount of Rp 5,000,000, are eligible to receive a VAT refund.

The requirements for applying for Tax Refund are stated in the Minister of Finance Regulation No. 120/PMK.03/2019 Article 2, as follows:

- Foreign tourists can request a refund of the paid VAT on carried goods.

- The VAT eligible for refund as mentioned in paragraph (1) must fulfill the following criteria: a. The minimum VAT value is Rp 500,000.00 (five hundred thousand rupiahs). b. The purchase of carried goods is made within one month before departure from the customs territory.

- The request for VAT refund on carried goods can be made by the respective foreign tourist.

- The request for VAT refund should be made when the foreign tourist is leaving Indonesia and should be submitted to the Director-General of Tax through the Tax Directorate General Office at the airport.

- The foreign tourist requesting a VAT refund should not be an Indonesian citizen or a permanent resident of Indonesia, and their stay in Indonesia should not exceed 60 (sixty) days from the date of arrival.

During the process, tourists can choose the following options for receiving the tax refund:

- Cash refund in Indonesian Rupiah if the amount does not exceed Rp 5,000,000.

- Refund via bank transfer in Indonesian Rupiah to the tourist’s bank account if the amount exceeds Rp 5,000,000. However, the tourist needs to provide complete information such as bank account number, account name, and address. The transfer will be made within one month from the receipt of the tax refund request.

That concludes the explanation regarding VAT Refund for Tourists. Let us all support the government’s efforts to advance tourism destinations in Indonesia.

Author: Ratih Mayaningrum Picture: Karolina Grabowska, Pexels

You Might Also Like

Understanding and Calculating Expatriate Income Tax in Indonesia: Article 21

Tax Consultation : Are Foreign Citizens subject to tax in Indonesia?

- International edition

- Australia edition

- Europe edition

Indonesia considers tourist tax to curb bad behaviour in Bali

Business groups fear cost could damage tourism sector still recovering from effects of pandemic

Indonesia is considering imposing a tax for tourists after a series of incidents in which badly behaved foreigners have violated laws or customs, according to local media.

The tourism and creative economy minister, Sandiaga Uno, told reporters this week that the possibility of a tourism tax was “currently being studied”.

“We expect the study to wrap up in the coming weeks so we can discuss and decide [the issue],” he said, according to a report by the Jakarta Post .

However, business groups fear a tax would deter people from visiting, damaging the tourism sector at a time when it is still recovering from the pandemic, the outlet said.

Earlier this month, the coordinating maritime affairs and investment minister, Luhut Pandjaitan, called for a tourism tax, saying Bali was one of the world’s cheapest tourist destinations and that this had “encouraged many low-income foreign visitors to come to Bali, leading to a rise in unruly behaviour”. The island should shift away from mass tourism and focus on becoming a quality tourism destination, he said.

Before the pandemic, Bali, known for its surfing spots, emerald green rice terraces and nightlife, drew 6.2 million foreign visitors a year, and tourism was estimated to contribute about 60% of the island’s economy.

Local people have grown increasingly frustrated with disrespectful or unlawful behaviour by tourists – from foreigners posing naked for social media photos at sacred sites, to bad driving on the roads.

Bali’s governor, Wayan Koster, said last month that the island planned to ban tourists from renting motorbikes because they were flouting traffic regulations, including driving without a helmet or a licence.

When calling for a tourism tax, Luhut cited a video in which a tourist, who had been stopped by police for driving a motorbike without a helmet or shirt, shouted at officers, accusing them of trying to steal money.

Sandiaga and Luhut have both suggested that funds collected through the tax could be used to support the development of the local tourism industry.

- Asia Pacific

- Indonesia holidays

- Bali holidays

Most viewed

- Hubungi Sales

- Pakai Gratis (top right corner)

Buat dan kelola faktur pajak lebih mudah dengan e-Faktur Klikpajak

Buat ID Billing dan bayarkan pajak dalam satu fitur e-Billing Klikpajak

Laporkan pajak Anda lebih mudah dengan e-Filing Klikpajak

Buat dan lapor bukti potong lebih mudah dengan eBupot unifikasi

Tingkatkan keamanan data perpajakan Anda dengan User Management Klikpajak

Simpan dan kelola data perpajakan Anda lebih aman dengan Klikpajak

Automasi proses persiapan hingga pelaporan faktur pajak

Automasi proses persiapan hingga pelaporan bukti potong pajak

Automasi Buat Banyak ID Billing Sekaligus

Kelola pajak Badan Anda dengan mudah dalam satu aplikasi

Kelola pajak lebih mudah dengan terhubung ke software keuangan

Automasi proses kelola pajak dan terhubung sistem akuntansi

Daftar live demo dengan Mekari Klikpajak untuk kelola urusan perpajakan lebih mudah dan cepat melalui aplikasi terintegrasi dari Mekari Klikpajak

Kelola pajak untuk customer dan supplier lebih mudah

Urusan pajak Bisnis Manufaktur Selesai dalam Hitungan Klik

Lebih Mudah Kelola Pajak Transaksi Penjualan dengan Automasi

Urusan Pajak Bisnis Multicabang Lebih Cepat dan Akurat

Hitung, setor & lapor faktur pajak lebih mudah dan cepat

Kelola pajak perusahaan lebih mudah dan fleksibel bersama tim

Pelajari bagaimana Mekari Klikpajak memudahkan urusan perpajakan berbagai perusahaan

Download beragam ebook peraturan dan panduan pajak bisnis terbaru

Hindari telat bayar & lapor pajak dengan download kalender pajak di sini

Pusat informasi berita dan webinar dengan DJP seputar perpajakan

Temukan daftar lokasi kantor pajak terdekat di sekitar Anda

Periksa dan pastikan NPWP Anda telah terdaftar dengan valid

Dapatkan bantuan informasi seputar aplikasi Klikpajak

Akses berbagai kelas pajak online gratis yang dilengkapi sertifikat

Ribuan bisnis telah berkembang bersama Mekari Klikpajak

Semua solusi dirancang khusus untuk meningkatkan produktivitas perusahaan

Referensikan rekan bisnis dan dapatkan reward Klikpajak

Rekomendasikan klien dan dapatkan reward dari Klikpajak

Berikan nilai tambah pada sistem Anda dan dapatkan reward

Promosikan Klikpajak dan dapatkan reward dari Klikpajak

Prosedur Tax Refund Indonesia secara Online

Tax refund adalah fasilitas yang diberikan kepada wisatawan pemegang paspor asing di Indonesia untuk mengklaim kembali Pajak Pertambahan Nilai (PPN) atau Value Added Tax (VAT) atas barang yang dibeli di toko mana pun yang terdaftar sebagai peserta “ Tax Refund for Tourists “.

Pemerintah memberlakukan tax refund sejak 1 Oktober 2019 dengan meresmikan Peraturan Menteri Keuangan No. 120/PMK/03/2019 tentang Tata Cara Pengajuan dan Penyelesaian Permintaan Kembali Pajak Pertambahan.

Yang berhak atas fasilitas tax refund ini adalah pemegang paspor asing yang bukan warga negara Indonesia atau bukan penduduk tetap Indonesia, yang tinggal atau tinggal di Indonesia tidak lebih dari 60 hari setelah kedatangannya.

Syarat Tax Refund

Berikut adalah persyaratan tax refund yang harus dipenuhi:

- Barang harus dibeli dari toko dengan logo “ Tax Refund for Tourists ” ditunjukkan dengan faktur pajak yang valid (faktur pajak dengan lampiran kuitansi pembayaran terkait) dari toko,

- Pembayaran pajak minimum adalah Rp50.000,00/ transaksi dan total pajak dari beberapa kuitansi yang diajukan harus memenuhi minimal Rp 500.000,00,

- Barang dibeli dalam waktu 1 (satu) bulan sebelum meninggalkan Indonesia,

- Barang harus dibawa keluar dari Indonesia sebagai bagasi tambahan dalam waktu 1 (satu) bulan sejak tanggal pembelian.

- Layanan pengembalian pajak hanya berlaku bagi transaksi barang, bukan jasa. Jadi, transaksi restoran atau hotel tidak dapat diberlakukan.

Pengembalian pajak tersebut dapat diberikan secara tunai dalam mata uang rupiah atau transfer jika jumlah pengembalian pajak melebihi Rp5.000.000,00. Transfer akan dilakukan dalam waktu satu bulan sejak diterimanya permohonan pengembalian pajak.

Jika jumlah pengembalian Pajak melebihi Rp5.000.000 (lima juta rupiah) dan penumpang tidak ingin dikembalikan melalui transfer, maka jumlah Rp5.000.000 (lima juta rupiah akan dikembalikan secara tunai dan sisa sisa Pajak adalah tidak dapat dikembalikan.

Note: Ingin tahu apa saja situs resmi DJP? Ini dia Berbagai Situs Resmi yang Dimiliki Direktorat Jenderal Pajak

Prosedur Tax Refund

Pengembalian pajak atau tax refund hanya dapat diklaim di bandara pada tanggal keberangkatan Anda dan Anda harus mengikuti langkah-langkah ini:

- Faktur pajak asli yang valid (faktur pajak terlampir dengan satu kwitansi pembayaran) diserahkan kepada petugas Direktorat Jenderal Pajak (DJP) di loket Pengembalian Pajak (UPRPPN Bandara). Faktur pajak yang valid ini juga berfungsi sebagai aplikasi Pengembalian Pajak ke DJP,

- Tunjukkan paspor, boarding pass, dan barang yang dibeli sebagai bagasi yang disertakan,

- Terima pengembalian pajak dengan uang tunai atau transfer ke rekening bank Anda.

Baca juga: Bagaimana Cara Pembulatan PPN di e-Faktur yang Benar?

Prosedur Tax Refund Online

Berkenaan dengan wabah virus Corona, DJP sudah tidak memberikan pelayanan secara tatap muka di loket Pengembalian Pajak Bandara. Untuk melayani wisatawan yang ingin mengklaim PPN atau VAT-nya, maka DJP memberlakukan proses tax refund secara online mulai 26 Maret 2020.

Prosedur tax refund secara online dilakukan dengan mengirim surat elektronik ke alamat email UPRPPN Bandara sesuai tempat keberangkatan turis asing ke luar Indonesia dengan mencantumkan subjek ‘VAT Refund’.

Email tersebut harus disertai dengan informasi dan beberapa dokumen elektronik sebagai berikut:

- Informasi tentang ama turis asing, nomor rekening serta tujuan bank transfer atas nama turis asing yang bersangkutan,

- Scan atau foto halaman identitas paspor luar negeri,

- Boarding pass ke luar Indonesia,

- Invoice dan Faktur Pajak atas pembelian barang bawaan,

- Foto barang bawaan yang dibeli.

Selanjutnya, setelah persyaratan telah diterima secara lengkap maka petugas UPRPPN akan memproses permintaan tax refund tersebut.

Berikut alamat surat elektronik UPRPPN Bandara yang tercantum dalam pengumuman DJP Kementerian Keuangan:

- Bandara Soekarno Hatta, Cengkareng, Tangerang: [email protected]

- Bandara Ngurah Rai, Denpasar: [email protected]

- Bandara Juanda Surabaya di Sidoarjo: [email protected]

- Bandara Internasional Yogyakarta, Kulon Progo: [email protected]

- Bandara Kuala Namu, Medan, Sumatera Utara: [email protected]

Informasi terkait perpajakan memang penting. Terlebih apabila Anda adalah pelaku usaha di Indonesia. Untuk mempermudah administrasi perpajakan pribadi maupun badan usaha, Anda dapat menggunakan aplikasi perpajakan digital KlikPajak yang merupakan mitra resmi dari DJP. Informasi lebih lanjut tentang aplikasi Klikpajak, dapat Anda peroleh pada website resmi Klikpajak .

SEO Intern di Mekari Klikpajak

Terima kasih, tim kami akan segera menghubungi Anda. Jika ingin berdiskusi langsung dengan tim kami, silahkan chat kami via Whatsapp

Bali's $10 Tourism Tax For Foreigners Comes Into Effect: Here's What To Know

The indonesian government said that this move aims to preserve the culture and environment of the "island of gods"..

The tourist tax came into effect from Wednesday.

Foreign tourists must now pay a $10 tax to enter Bali, one of the world's most popular tourist destinations. According to the BBC , the tourist tax, which was first announced last year, came into effect from Wednesday. The Indonesian government said that this move aims to preserve the culture and environment of the "Island of Gods". It applies to foreign tourists entering the province from abroad or other parts of the country. But domestic tourists, diplomatic visa holders and ASEAN nationals are exempted from the tax, officials said.

"This levy is aimed at the protection of the culture and the environment in Bali," Bali's acting governor Sang Made Mahendra Jaya said, as per AFP .

The tax applies to all international travellers, regardless of their age and gender, including children. Tourists will have to pay the tax each time they arrive in Bali. The fee will have to be paid electronically via the "Love Bali" online portal and will apply to foreign tourists entering Bali from abroad or from other parts of Indonesia, the BBC reported.

Tourists who do not want to pay online can also pay at arrival points, such as airports and seaports through multiple payment methods, including credit cards, bank transfers, virtual accounts or QRIS, which is a QR code standard developed by Bank Indonesia and Indonesian Payment System Association for cashless payments in the nation.

Bali is known for its pristine beaches and beautiful landscapes. It is one of the most popular destinations among tourists. According to official data, almost 4.8 million tourists visited the province between January and November last year. The BBC reported that tourism also contributed some 60% to Bali's annual GPD before the pandemic.

Also Read | Delta Flight Returns To Amsterdam After Maggots Fall On Passengers From Overhead Bin

Promoted Listen to the latest songs, only on JioSaavn.com

Citing the province's statistics bureau, the outlet said that Australia was the largest contributor of foreign tourists to Bali in November 2023 with more than 100,000 arrivals. This was followed by tourists from India, China and Singapore.

However, misbehaving tourists in Bali have sparked outrage among locals in recent years. Last year, a Russian man was deported from Bali after stripping off at a sacred site. The same year, the Indonesian government also announced plans to ban foreign tourists from using motorbikes, after a spate of cases involving people breaking traffic laws. Last year, the local government also published an etiquette guide for tourists who wish to visit Bali.

Track Budget 2023 and get Latest News Live on NDTV.com.

Track Latest News Live on NDTV.com and get news updates from India and around the world .

Track Latest News and Election Results Coverage Live on NDTV.com and get news updates from India and around the world.

Watch Live News:

Username or E-Mail

Forget Password?

Do not have an account?

Already a member.

- Testimonial

- Photo Gallery

- Terms & Conditions

- Indonesian Cruises Shore Excursion

- Indonesia Tour Discovery

- Bird Watching Indonesia

- Flight & Hotel Reservation

- Jakarta Car Rental

- Makassar Car Rental

- Car Rental Quotation Request

- Car Rental Reservation

- Car Rental Terms & Conditions

- Private Indonesia Tour

- Flight Ticket to Toraja

Bus Ticket to Toraja Land

- Toraja Trekking Tour

- Toraja Backpacker Tour

- Toraja Budget Tour

- Toraja Rafting

- Travel Insurance

- Sample of Package Tours in Indonesia

- Bali Island

- Sulawesi / Celebes Island

- Borneo / Kalimantan

- West Papua Tour

- Sumatra Island

- Flores & Komodo

- Maluku Island

- Special Offer 2019

VAT Refund Indonesia

How to claim your vat refund in indonesia.

Note: The VAT REFUND is not valid for any of Indonesia Tour Package purchase.

What is "VAT Refund for Tourist"?

VAT Refund for Tourists is a facility given by the Indonesian government which allows tourist (foreign passport holders) to claim back Value Added Tax (VAT) on goods purchased in any store registered as a “VAT Refund for Tourists” participant.

INDONESIA TOUR DESTINATION

4 Days Komodo Tour

Shore Excursion: Jakarta City Tour

Shore Excursion: Bromo Tour from Surabaya

Mount Batur Sunrise Trekking Tour

2 Days Orangutan Tour

Bali Tour: Uluwatu and Beach Dinner

Shore Excursion: Toraja Tour from Palopo Port

Shore Excursion: Makassar City Tour

4 Days Takabonerate Diving Tour

4 Days Tanjung Puting Orangutan Tour

Bali Tour: Bedugul and Tanah Lot Tour

Bali Tour: Ubud and Denpasar City

Daily Tangkoko Tour

4 Days Raja Ampat Tour

Shore Excursion: Semarang Borobudur Tour

Baliem Valley Festival 2020

Bali Tour: Ubud and Kintamani Highland

23 days java bali overland tour.

Bali Tour: Ancient and Traditional Village Tour

5 Days Orangutan Tour Borneo Exploration

3 Days Borneo Orangutan Tour

4 days toraja tour package.

5 Days Toraja Trekking Tour

MotoGP Malaysia 2019 – Sepang International Circuit

Bali Tour: Dolphin Watching Waterfall and Temple

21 Days Trans Sulawesi Tour Package

12 Days Trans Sulawesi Tour with Togian Island

Who is eligible for a vat refund.

Any foreign passport holder who is:

- Not an Indonesia citizen or not a Permanent Resident of Indonesia, who lives or stays in Indonesia no longer than 2 (two) calendar months since he.she arrived in Indonesia;

- Not a crew of an airlines.

How to claim the VAT Refund

1. accompanied baggage (goods).

To be eligible for the VAT refund:

- goods must be purchased from shop with “VAT Refund for Tourists” label across Indonesia by showing your passport, and you must have a valid tax invoice (a tax invoice attached with one payment receipt) from the shop.

- food, beverage, tobacco products;

- guns and any explosive goods (materials);

- any goods that are prohibited to be taken onto an aircraft

- minimum VAT payment is Rp500.000 (five hundred thousand rupiah) in one valid tax invoice from one shop with the same purchasing date.

- goods are purchased within 1 (one) month before departing Indonesia.

- goods must be carried out of Indonesia as accompanied baggage within 1 (one) month of the date of purchase.

2. VAT refund payment options

- Given in cash with Indonesian Rupiah (IDR) currency. VAT refund is given in cash only if the amount does not exceed Rp 5,000,000 (five million rupiah);

- Through transfer payment When the VAT refund is in excess of Rp 5,000,000 (five million rupiah), the refund will be made by transfer. The passenger should provide bank account number, account name, address, bank routing number, designated bank for transfer and requested currency for the VAT refund. The transfer will be done within 1 (one) month of receipt of application for VAT refund.

- Exceptional circumstances If the amount of VAT refund is more than Rp 5,000,000 (five million rupiah), however, the passenger does not want to be refunded by transfer, then the amount of Rp 5,000,000 (five million rupiah) will be refunded in cash and the balance of VAT is not refundable.

- Claim procedure The VAT refund can only be claimed at the airport on the date of your departure and you must follow these steps:

Option # 1 : Claim VAT Refund before Check-In counter

- Submit the application for VAT refund to the Directorate General of Taxes (DGT) officer at the airport;

- Submit both copies of the original valid tax invoice (a tax invoice attached with one payment receipt);

- Show passport, airline ticket and goods purchased;

- Receive VAT refund in cash or through transfer to your bank account.

Option # 2 : Claim VAT Refund after Check-In counter

Attention To help provide you a better service, please ensure that you allow enough time to complete your VAT Refund claims procedure on the day of your departure.

Where are the VAT Refund counters located?

Privacy Overview

Proceed booking, already a member.

Username or E-mail

Don't have an account? Create one.

Or continue as guest.

Awesome, you're subscribed!

Thanks for subscribing! Look out for your first newsletter in your inbox soon!

The best things in life are free.

Sign up for our email to enjoy your city without spending a thing (as well as some options when you’re feeling flush).

Déjà vu! We already have this email. Try another?

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from Time Out about news, events, offers and partner promotions.

- Things to Do

- Food & Drink

- Arts & Culture

- Time Out Market

- Coca-Cola Foodmarks

- Los Angeles

Get us in your inbox

🙌 Awesome, you're subscribed!

These are all the destinations you’ll need to pay extra to visit this year

More and more popular travel destinations are introducing tourist taxes to tackle problems caused by overtourism – here’s what you’ll have to pay

This year, international travel is forecast to bounce back to the highest levels since 2019 – and while that’s great news for the tourism industry in general, many cities, attractions and entire regions are suffering under the weight of overtourism .

The potential for damage to historic sites, unhinged tourist behaviour and the simple issue of overcrowding are all common consequences of overtourism. That’s why a growing list of popular travel destinations have introduced a tourist tax, with the hopes of controlling visitor numbers and improving local infrastructure to better cater to higher visitor capacity.

Many countries and cities introduced a tourist tax in 2023, and many more are due to launch theirs in 2024. Tourist taxes aren’t a new thing – you’ve probably paid one before, tied in with the cost of a plane ticket or the taxes you pay at a hotel.

However, more destinations than ever before are creating this fee for tourists, and many places have increased the cost of existing ones. Here’s a full list of all the destinations charging a tourist tax in 2024, including all the recently introduced and upcoming tourist taxes you need to know about.

Austria charges visitors a nightly accommodation tax which differs depending on province. In Vienna or Salzburg , you could pay 3.02 percent per person on top of the hotel bill.

Belgium , like Austria, has a nightly fee. Some hotels include it in the rate of the room and add it separately to your bill, so read it carefully.

The rate in Brussels is charged per room, and varies depending on the size and rating of your hotel, but is usually around €7.50. Antwerp also charges per room.

Bhutan has always been known for its steep tourist taxes and charges. In 2022, the Himalayan kingdom tripled the amount it charged visitors in tax to a minimum of $200 per day , but that amount has since been lowered. In 2024, the daily fee for the majority of visitors is $ 100, and that is due to continue until August 31, 2027.

Bulgaria applies a fee to overnight stays, but it reaches a maximum of only €1.50.

Caribbean Islands

The following Caribbean Islands charge a tourist tax, ranging from between €13 to €45: Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, Bonaire, the British Virgin Islands, the Cayman Islands, Dominica, the Dominican Republic , Grenada, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Maarten, St. Vincent and the Grenadines, Trinidad and Tobago, and the US Virgin Islands.

The tax tends to be tied into the cost of a hotel or a departure fee.

Croatia only charges its visitors a fee of 10 kuna (€1.33) per night during peak season.

Czechia (also known as Czech Republic)

Czechia only applies a fee to those travelling to Prague . It doesn’t apply to those under the age of 18, and is less than €1 per person, per night.

France ’s ‘taxe de séjour’ varies depending on city, and tends to be added to your hotel bill. It varies from €0.20 to €4 per person, per night.

Earlier this month, Paris announced it would be increasing its fee by up to 200 percent for those staying in hotels, Airbnbs, and campsites, but that it plans to put the funds towards improving the city’s services and infrastructure.

READ MORE: The cost of visiting Paris will soar this summer – here’s why

Germany charges visitors a ‘culture tax’ (kulturförderabgabe) and a ‘bed tax’ (bettensteuer) in certain cities, including Frankfurt , Hamburg and Berlin , which tends to be around five percent of your hotel bill.

Greece ’s tourist tax is based on numbers. Specifically, how many stars a hotel has, and the number of rooms you’re renting. The fee was introduced by the Greek Ministry of tourism to help pay off the country’s debt, and can be anything from €4 per room.

Hungary charges visitors four percent of the price of their room, but only in Budapest .

Iceland is introducing a tourist tax to protect its ‘unspoilt nature’ this year, which will cost between €4 to €7 per night. It comes after annual tourist numbers reached an estimated 2.3 million per year.

In Indonesia , the only destination which charges a tourist tax is Bali , and the fee is set to increase this February to $10 (£7.70, €8.90, IDR 150,000) – but is a one-time entry fee, not a nightly tax. It apparently goes towards protecting the island’s ‘environment and culture.’

Much like in France, Italy ’s tourist tax varies depending on your location. Rome ’s fee is usually between €3 to €7 per night, but some smaller Italian towns charge more.

Venice finally announced in September that its tourist tax, a €5 (£4.30, $5.40) fee which will be applicable on various days during high season, will launch in 2024. It only applies to day-trippers rather than those staying overnight, though.

Japan has a departure tax of around 1,000 yen (€8).

Malaysia has a flat-rate tax which it applies to each night you stay, of around €4 a night.

New Zealand

New Zealand ’s tax comes in the from of an International Visitor Conservation and Tourism Levy of around €21 which much be paid upon arrival, but that does not apply to people from Australia.

Netherlands

The Netherlands has both a land and water tax. Amsterdam is set to increase its fee by 12.5 percent in 2024, making it the highest tourist tax in the European Union.

Portugal has a low tourist tax of €2, which applies to all those over the age of 13. It’s only applicable on the first seven nights of your visit and applies in 13 Portuguese municipalities, including Faro, Lisbon and Porto.

Olhão became the latest area to start charging the fee between April and October. Outside of this period, it gets reduced to €1 and is capped at five nights all year round. The money goes towards minimising the impact of tourism in the Algarve town.

Slovenia also bases its tax on location and hotel rating. In larger cities and resorts, such as Ljubljana and Bled, the fee is higher, but still only around €3 per night.

Spain

Spain applies its Sustainable Tourism Tax to holiday accommodation in the Balearic Islands to each visitor over the age of sixteen. Tourists can be charged up to €4 per night during high season.

Barcelona ’s city authorities announced they plan to increase the city’s tourist tax over the next two years – the fee is set to rise to €3.25 on April 1, 2024. The council said the money would go towards improving infrastructure and services. This is in addition to regional Catalan tax.

Switzerland

Switzerland ’s tax varies depending on location, but the per person, per night cost is around €2.20. It tends to be specified as a separate amount on your accommodation bill.

Thailand

Thailand introduced a tourist tax to the price of flights in April 2022, in a similar effort to the Balinese aim of moving away from its rep as a ‘cheap’ holiday destination. The fee for all international visitors is 300 baht (£6.60, $9).

The US has an ‘occupancy tax’ which applies across most of the country to travellers renting accommodation such as hotels, motels and inns. Houston is estimated to be the highest, where they charge you an extra 17 percent of your hotel bill.

Hawaii could be imposing a ‘green fee’ – initially set at $50 but since lowered to $25 – which would apply to every tourist over the age of 15. It still needs to be passed by lawmakers, but if approved, it wouldn’t be instated until 2025.

The European Union

Finally, the European Union is planning on introducing a tourist visa , due to start in 2024. The €7 application will have to be filled out by all non-Schengen visitors between the ages of 18 and 70, including Brits and Americans.

READ MORE: Why sustainable tourism isn’t enough anymore

Stay in the loop: sign up to our free Time Out Travel newsletter for all the latest travel news.

- Liv Kelly Contributing Writer

Share the story

An email you’ll actually love

Discover Time Out original video

- Press office

- Investor relations

- Work for Time Out

- Editorial guidelines

- Privacy notice

- Do not sell my information

- Cookie policy

- Accessibility statement

- Terms of use

- Modern slavery statement

- Manage cookies

- Advertising

Time Out Worldwide

- All Time Out Locations

- North America

- South America

- South Pacific

TheJakartaPost

Please Update your browser

Your browser is out of date, and may not be compatible with our website. A list of the most popular web browsers can be found below. Just click on the icons to get to the download page.

- Destinations

- Jakpost Guide to

- Newsletter New

- Mobile Apps

- Tenggara Strategics

- B/NDL Studios

- Archipelago

- Election 2024

- Regulations

- Asia & Pacific

- Middle East & Africa

- Entertainment

- Arts & Culture

- Environment

- Work it Right

- Quick Dispatch

- Longform Biz

Indonesia to relax VAT refund requirements for tourists

Share this article, change size.

he Indonesian government is preparing a regulation to relax the value added tax (VAT) refund requirements for foreign tourists to support efforts to achieve this year’s target to attract 20 million tourist arrivals.

“We have prepared a foreign ministerial regulation,” said Finance Ministry Taxation Director General Robert Pakpahan in Jakarta on Tuesday, adding that the new policy was expected to help small and medium enterprises to boost sales among foreign tourists.

Under the current regulation, a tourist is entitled to a VAT refund if they spend at least Rp 500,000 (US$35.59) at one shop on the same date and on one receipt. Under the planned regulation, a tourist will be entitled to a refund of 10 percent of the value added tax (VAT) paid on spending of more than Rp 500,000 during their stay in Indonesia.

“With the new regulation, tourists will be able to refund the VAT for a minimum spending of Rp 500,000 on different receipts from different shops and on different dates,” Robert said.

He said the Finance Ministry was still discussing the draft regulation and that it was expected to be completed in one month. It will be a revision of Finance Ministerial Regulation (PMK) No 76/PMK.03/2010 on the VAT refund procedure for foreigners.

Indonesian Employers Association (Apindo) chairman Hariyadi Sukamdani welcomed the proposed relaxation of the VAT refund requirements and expressed hope it would benefit retailers through increasing the number of tourist arrivals.

“What we want is for tourists to get forms for refunding their VAT at each retail outlet,” he added as quoted by kontan.co.id . (bbn)

Indonesia sustainable taxonomy: Pathway to attain sustainable development

Dali, the Singapore-flagged ship that brought down Baltimore bridge

Malaysia mini-mart executives charged over 'Allah' socks

Related articles, tax administration 3.0: post-core tax digitalization challenges, directorate general of taxation objects, opposing new tax amnesty, indonesians skeptical about transparency of taxation system: survey, fiscal deficit expected to widen this year, related article, more in news.

Analysis: Govt adopts mandatory B35 biodiesel program as CPO prices tumble

Global chip crunch stunts Indonesia car sales recovery

XL profit falls in Q3 as tower sale income dries

Gibran’s candidacy in focus at court

Justice for all candidates

Indonesia's business environment ranking slips as others improve

Indonesia's taiwan conundrum: why we should do more to maintain the status quo, psi to nominate jokowi's son for jakarta governor, how to ensure a peaceful outcome to the election, for both winners and losers, considering the joy of easter and our democracy, navigating challenges, strategies in indonesia’s rice market, prabowo to display yudhoyono's painting at new presidential palace, milky way's black hole surrounded by strong magnetic fields, asian markets mixed after fed official floats rate cut delay.

- Jakpost Guide To

- Art & Culture

- Today's Paper

- Southeast Asia

- Cyber Media Guidelines

- Paper Subscription

- Privacy Policy

- Discussion Guideline

- Term of Use

© 2016 - 2024 PT. Bina Media Tenggara

Your Opinion Matters

Share your experiences, suggestions, and any issues you've encountered on The Jakarta Post. We're here to listen.

Thank you for sharing your thoughts. We appreciate your feedback.

- Indonesia Tourism

- Indonesia Hotels

- Indonesia Bed and Breakfast

- Indonesia Vacation Rentals

- Flights to Indonesia

- Indonesia Restaurants

- Things to Do in Indonesia

- Indonesia Travel Forum

- Indonesia Photos

- All Indonesia Hotels

- Indonesia Hotel Deals

- Last Minute Hotels in Indonesia

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Tax Refund for Shopping Tourists - Indonesia Forum

- Asia

- Indonesia

Tax Refund for Shopping Tourists

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Asia forums

- Indonesia forum

Bali News: Tax Refund for Shopping Tourists

(4/5/2010) The Indonesian Directorate General of Taxation have appointed eight retail companies to help introduce the first phases of the new value-added-tax (VAT) refund scheme available to Indonesian visitors effective April 1, 2010.

The first companies designated to extend tax refunds are comprised of only five companies in Jakarta and three in Bali, with plans to eventually extend the facility to more retail outlets across the country.

The companies now extending VAT refunds to travelers are:

• Pasaraya Blok M - Jakarta

• Sarinah – Jakarta

• Metro Pondok Indah Mal – Jakarta

• Metro Plaza Senayan – Jakarta

• Keris Gallery, Terminal III, Soekarno-Hatta Airport, Jakarta

• Batik Keris, Discovery Shopping Mall , Bali

• UC Silver, Batubulan, Gianyar - Bali

• Mayan Bali, Kuta Square, Block A, Number 12 – Bali

The VAT tax refund scheme is intended to stimulate purchases and spending by foreign tourist visiting Indonesia .

The participating merchants will grow in number over time will display a "VAT Refund for Tourist Sign."

The refunds are not available to Indonesian citizens or permanent residents, defined in this instance as anyone staying more than 2 months in Indonesia. The refund program is also not available to foreign airline crews.

Those wishing to take advantage of the offered refund must present their passport at the time of purchase, shop at a participating merchant, and spend a minimum of Rp. 5 million (US$532). Proof of purchase, a VAT refund form and the items purchased must be presented at the tax refund counters in operation at the Jakarta and Bali's airports set up to receive refund claims.

Source: http://www.balidiscovery.com/messages/message.asp?Id=5927

This topic has been closed to new posts due to inactivity.

- Gili Meno weather now 3:04 am

- Two nights in Jakarta 3:03 am

- chat with imigrasi about evoa etc.... 2:38 am

- Foreign Scammers in Nusa Dua ali 2:06 am

- Card hacked 1:34 am

- Another e-VOA question 1:31 am

- Bromo Foreign tourist fee 1:28 am

- REQUEST Car with driver Surabaya - cemero lawang and return 1:19 am

- balinese statue store 12:53 am

- 11 Day Itinerary in Bali with 60 year olds 12:22 am

- Changes to Sanur beach front restaurants 12:16 am

- Construction Jl Duyong 12:14 am

- Bluebird!!! 11:57 pm

- Denpasar airport 11:53 pm

- Groupon Bali voucher 41 replies

- lion air online booking 2 replies

- What is the best beach in Lombok for swimming? 2 replies

- Booking Flights with Ticket2 3 replies

- Tour from Jogja to Bromo 8 replies

- Lion Air Website 7 replies

- getting from bali to the Banda Islands 4 replies

- villas Indonesia property company or villas international 106 replies

- Garuda Airlines online booking 2 replies

- Departure tax 2 replies

Indonesia Hotels and Places to Stay

- This is the official Indonesian E visa website

- Carrying medications for personal use into Indonesia

- Warning: all marijuana, and many ADHD meds, are 100% illegal

- Official online customs form for Indonesia

- Questions about the E Visa On Arrival forms

- Advertise With Us

25 Countries Where You Will Pay a Tourist Tax in 2022

In the wake of struggling tourism sectors across the globe during the pandemic, including travel restrictions and closed borders, a number of countries are planning tourist tax policies for 2022.

1. thailand, 3. european union (eu), 4. austria , 5. belgium , 7. bulgaria , 8. caribbean islands, 9. croatia , 10. the czech republic , 12. germany, 13. greece , 14. hungary , 15. indonesia, 18. malaysia , 19. new zealand, 20. the netherlands, 21. portugal, 22. slovenia , 24. switzerland, related posts, explore jakarta with the mrt and transjakarta, halal park to be launched at jakarta airport to welcome ramadan, a staycation in surabaya: part 2, full swing in indonesia, discover and explore bali with aryaduta bali, foreign environmental journalist arrested in indonesia.

IMAGES

COMMENTS

VAT refund can be given in cash or by transfer payment. a. Given in cash with Indonesian Rupiah (IDR) currency. VAT refund is given in cash, only if the amount does not exceed Rp5.000.000. b. Through transfer payment. When the VAT refund is in excess of Rp5.000.000, the refund will be made by transfer.

The term " tax refund " means that any excess amount paid in taxes to the government can be reimbursed by the taxpayer. In companies/businesses, it often happens when employers withhold too much or more than the required amount of tax from the salary of the employees. In Indonesia, the tax system operates on the basis of tax deductions made ...

From Feb. 14, foreign travelers visiting Bali in Indonesia will be required to pay a new tourist tax upon entry or before visiting the region. The fee costs 150,000 rupiahs (around $9.50) and is in addition to any other visa fees. The tax aims to combat overtourism on the popular island. Although the fee will not currently be enforced in other ...

B. ali began imposing a Rp 150,000 ($10) tax on arriving tourists Wednesday to preserve the culture of the "Island of Gods", officials said. Tourist-dependent Bali attracts millions of foreign ...

The tax office has handed out VAT refunds amounting to Rp 11.2 billion last year, bumped up by the influx of 15.8 million international tourists. The figure is nearly double of that in 2017, where Rp 6.4 billion in VAT refunds were processed when the country welcomed 14 million tourists.

Bali Tourist Tax / Bali Tourist Levy. The Tourist Tax for international visitors to Bali is a tax charged by Bali's provincial government. This is all you need to know to get ready to come to Bali. Make sure you are only using the links mentioned tha guide you to the official website of the Bali government.

The Indonesian government will be relaxing its value-added tax (VAT) policy that will enable tourists to get tax refunds on a lower minimum retail spend, a move that aims to spur tourist spend at small and medium enterprises (SMEs). The revised regulation will enable foreign tourists to apply for VAT refunds on purchases of more than Rp 500,000 ...

Understanding the VAT (Value Added Tax) System: Bali, like many other tourist destinations, imposes a Value Added Tax (VAT) on various goods and services. The standard VAT rate in Indonesia is 11% (PPN). However, tourists may be eligible for a refund on certain purchases made during their stay.

The Finance Ministry's director general for taxation, Robert Pakpahan, said a new regulation, which will revise Finance Ministerial Regulation No. 76/2010, would allow foreign tourists to apply ...

Pengajuan Permintaan VAT Refund. Untuk mendapat VAT refund, berikut adalah syarat-syarat yang harus dipenuhi: Barang dibeli dari penjual yang terdaftar sebagai peserta "Tax Refund for Tourist" dan memiliki invoice/bukti pembelian. PPN yang dapat diminta kembali paling sedikit Rp500.000, dan minimum Rp50.000 per transaksi.

Refund via bank transfer in Indonesian Rupiah to the tourist's bank account if the amount exceeds Rp 5,000,000. However, the tourist needs to provide complete information such as bank account number, account name, and address. The transfer will be made within one month from the receipt of the tax refund request.

Bali's tourist tax comes into force. The province began imposing a 150,000-rupiah tax on arriving tourists Wednesday to preserve the culture of the island, officials said. AFP. Denpasar, Bali ...

22 January 2024 21:36 WIB. TEMPO.CO, Jakarta - The Bali Provincial Government has decided to introduce an international tourism tax that will require foreign tourists to pay a one-time fee of Rp150,000, or about US$10, in addition to the visa fee, when entering the island. The tax policy will enter into force starting February 14, 2024.

Indonesia is considering imposing a tax for tourists after a series of incidents in which badly behaved foreigners have violated laws or customs, according to local media. The tourism and creative ...

VAT Refund for Tourist Service or refund of Value Added Tax (VAT) of goods for tourists shopping in Indonesia will promote Indonesia image in foreign eyes. Director General of Tax Ministry of Finance, Fuad Rahmany said that after the VAT refund up to Rp5 million tourists spending on goods, Indonesia will impose a VAT tax refund with platfon ...

Berikut adalah persyaratan tax refund yang harus dipenuhi:. Barang harus dibeli dari toko dengan logo " Tax Refund for Tourists" ditunjukkan dengan faktur pajak yang valid (faktur pajak dengan lampiran kuitansi pembayaran terkait) dari toko, Pembayaran pajak minimum adalah Rp50.000,00/ transaksi dan total pajak dari beberapa kuitansi yang diajukan harus memenuhi minimal Rp 500.000,00,

The influx of tourists visiting Indonesia has affected the amount of VAT refund. The tax office refunded Rp 11.2 billion in VAT to tourists last year, during which - according to Statistics ...

The tourist tax came into effect from Wednesday. Foreign tourists must now pay a $10 tax to enter Bali, one of the world's most popular tourist destinations. According to the BBC, the tourist tax ...

The Indonesian government has provided a facility for VAT Refund or Tax Refund in Indonesia Airport +62-21-22321567 +62-812-12290001 info(at)indoglobaltours.com. Login. Login. Username or E-Mail. Password. Forget Password? ... VAT Refund for Tourists is a facility given by the Indonesian government which allows tourist ...

In Indonesia, the only destination which charges a tourist tax is Bali, and the fee is set to increase this February to $10 (£7.70, €8.90, IDR 150,000) - but is a one-time entry fee, not a ...

Under the planned regulation, a tourist will be entitled to a refund of 10 percent of the value added tax (VAT) paid on spending of more than Rp 500,000 during their stay in Indonesia.

The VAT tax refund scheme is intended to stimulate purchases and spending by foreign tourist visiting Indonesia. The participating merchants will grow in number over time will display a "VAT Refund for Tourist Sign." The refunds are not available to Indonesian citizens or permanent residents, defined in this instance as anyone staying more than ...

15. Indonesia. Tourist tax in Indonesia only applies in Bali. In 2019, a new law stated that foreign tourists must pay a fee starting from €9 or around Rp146,517. The income from this tax is used for programmes that help preserve the environment and Balinese culture. 16. Italy The tourist tax in Italy depends on where the tourist visits.