Australia Post Travel Platinum Mastercard®

A prepaid travel card with 11 currencies to load from, giving you confidence when spending overseas.

- About Australia Post Travel Platinum Mastercard

- Fees & limits

- Get started

- Support & FAQs

The ideal prepaid card for overseas travel

Travel smarter with our Australia Post Travel Platinum Mastercard, a reloadable, multi-currency prepaid card that’s accepted wherever Mastercard is, worldwide 1 . Easily swipe or tap in-store, use online and withdraw money from ATMs 2 .

Load up to 11 currencies. Easily switch between USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD, AED and AUD on your travels.

Lock in your exchange rates. Know exactly how much you have to spend online or in-store with locked-in exchange rates 3 .

Travel safely. With no link to your bank account and Mastercard’s Zero Liability 4 protection against fraud and other unauthorised transactions.

Total control. Manage and load your prepaid travel money card on the go via ‘ My Account ’ or the Australia Post Travel Platinum Mastercard app.

24/7 global assistance. Card lost or stolen? Call for a replacement anytime. You may also be eligible for emergency funds assistance 5 .

Managing your travel money just got easier

Our Australia Post Travel Platinum Mastercard app makes managing your travel money faster and easier. Check your balance, reload in-app, track your spending and switch between currencies.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 248kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

View the Target Market Determination (PDF 88kB) for this product.

If you click on links to Australia Post Travel Platinum Mastercard you will be leaving the Australia Post site and be directed to a third-party site to place your order and complete your purchase. Please see the terms and conditions of the third-party site for further details.

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card

2 Some ATM operators may charge their own fees and set their own limits.

3 Lock in your exchange rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

4 Further information relating to Zero Liability card protection can be found at the Mastercard website .

5 T&Cs apply. Customers must contact Customer Service to report lost or stolen cards. Emergency cash can be arranged up to the balance of your Australia Post Everyday Mastercard, subject to availability of funds at the approved agent location.

For a full list of Fees & Limits, refer to the Product Disclosure Statement (PDF 258kB) .

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 248kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Travel smarter with our prepaid travel money card

Buy your Australia Post Travel Platinum Mastercard® at a participating Post Office or online .

Register / Activate

Register your prepaid travel money card online.

If you purchased your card online, you’ll need to activate it.

Load your card anytime online through ' My Account ', the Australia Post Travel Platinum Mastercard® app or at any participating Post Office .

Use your card wherever Mastercard is accepted 1 .

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card.

More information

- Product Disclosure Statement (PDF 339kB)

- Financial Services Guide (PDF 72kB)

- Target Market Determination (PDF 88kB)

Can't find an answer below? Call Card Services on 1800 549 718 within Australia or +44 207 649 9404 internationally for help 24/7.

If you have a transaction on your card that doesn't seem right, download the disputed transaction form .

Frequently asked questions

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

- Travel Money Card

Get our best rate on the award winning Travelex Money Card

Buy currency, top up card.

Rate last updated Tuesday, 26 March 2024 2:07:11 PM AEDT. Please note that these are the Travelex online sell rates.

[fromExchangeAmount] [fromCurrencyCode] Australian Dollar

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

Enter the card number of the Prepaid Card you would like to top up. The number of the Prepaid Card you are topping up must be the Primary Card Number and must have been originally purchased from Travelex.

Card number confirmed

Select the currency you would like to top up to your card

Enter how much you'd like to top up, either in Australian Dollars, or in the foreign currency amount for the currency you have selected.

This section is optional on mobile

E!am commodo accumsan scelerisque. Quisque posuere laoreet lectus a elementum. Mauris euismod, lectus sed gravida dictum, magna orci iaculis ligula, quis blandit lorem enim at magna.

Get Dollars on Us!

Load more, save more with the travelex money card.

- Save up to AUD $240! View all available discounts codes here .

- Available online, in-store, or via the Travelex Money App. Ends 28 April at 11.59pm AEST. T&C Apply.

The Travelex Money Card

Travel Card Exchange Rates & Currencies

Choose your currency, $0 currency conversion fee when spending a currency not on your travel card:.

The below calculator is a handy tool to help you estimate the applicable exchange rate for your transaction 2 :

Spend Calculator

You can use this calculator to see what your spend would look like for your trip. It will help you estimate the applicable exchange rate for your transaction.

- Netherlands

- Vatican City

- Czech Republic

Save with the Travelex Money Card

$0 Eftpos Fees

$0 atm fees 1, $0 currency conversion fees ^, $0 online shopping fees*, $0 free delivery to your home, special offer, load aud on your travelex money card and save when spending in the below currencies.

- Free Online AUD Load and Top-Ups

- $0 International ATM Fees

Features and Benefits

UNLIMITED FREE overseas ATM withdrawals 1

Highly competitive exchange rates

NO fees when you buy online $0 Currency conversion fee ^

24/7 Global Assistance

Convenient Mobile App Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online, collect in-store or get it delivered to your home

5 ☆ outstanding value award winning travel money card

Exclusive offers with Mastercard Priceless TM Cities

No account or membership required

How our Travel Card Works

Order your travel card.

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Free delivery to your home or collect from a Travelex store

Home delivery

Delivered within 1 to 3 days

Download the App

Download the app from the Google Play and Apple App stores

Register for My Account

Simply activate your card by registering your account via the app or online

Manage and check your balance online and on your mobile

Exchange leftover currency

After your trip, exchange leftover money for another currency, transfer into your bank account or withdraw in-store or at an ATM.

Fees and Limits

NO fees online $0 Currency conversion fee ^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater). • BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. - MasterCard Biller Code: 184416 - Reference No: your 16 digit Travelex Money Card number - Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE* *The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

AU$350 or currency equivalent AU$100 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and to a maximum of $10,050 top-up value over 24hrs; and to a maximum of $20,000 top-up value over 21 days.

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

- AU$ cannot be loaded or topped up onto a card online via www.travelex.com.au

Terms & Conditions

Download the travelex travel money app.

Convenience on the go

- Top up your Travelex Money Card

- Check your balance

- Quick touch log in

The app requires Android 5.0 and up or iOS 10.0 or later. Compatible with iPhone, iPad and iPod touch.

Other Ways to Get Foreign Currency

All the easy options to access foreign currencies with travelex.

About Travelex Money Card online and in-store

- Travel Insurance

Discover more of the world with travel insurance by your side

All you need to know getting foreign cash with Travelex

Get foreign cash from an ATM in Australia

About Your Destination

Browse our Destination Guides

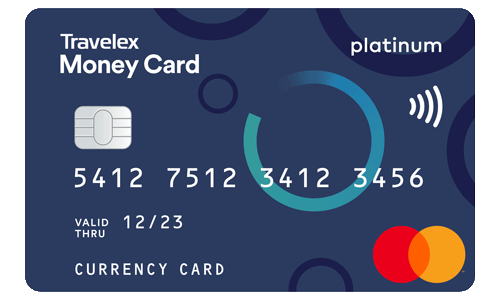

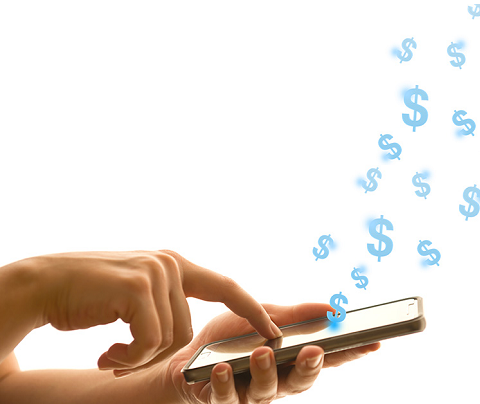

Historical Rates

Check out current and historical AUD to FX Travelex rates

Track Currency Rates

Receive an alert when your selected foreign currency has reached your desired rate

- Find a Store

Purchase cash, a Travelex Money Card or transfer money in-store

Travelex Travel Card Currency Information

Travel card faq links.

Getting Started

Using the Card

Topping up the Card

Travelex Money Card FAQ

You can only hold one card in your name at any one time.

Top-up via the Travelex website

Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

Move currencies on your card, instantly.

If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via bpay:.

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. You must make payment using your own account.

MasterCard Biller Code: 184416 Reference No: your 16 digit Travelex Money Card number

Funds will be allocated to your default currency. To check your default currency login to your account. Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

Yes, travel money cards come with a host of advantages that can save you money when travelling. These include the ability to load multiple currencies at a fixed and competitive exchange rate, and the capability to make purchases in-store, online, and at ATMs worldwide with no overseas ATM or withdrawal fees.

- Locking in fixed foreign currency exchange rates and avoiding foreign transaction fees before you travel

- The ability to load multiple currencies onto one card, similar to a travel debit card

- The ability to spend money conveniently and comfortably overseas

- No overseas ATM withdrawal fees

- No fees when making online purchases

- Travel money cards can be ordered online and collected in store next day.

- Just walk in store. Cards purchased and loaded in-store are active and ready-to-use on the spot. We will automatically transfer funds between currencies complete your card transactions.

- Home delivery within 5-7 business days.

Most common questions

The best travel money card for Australians is the one that caters to the currencies available at your destination, removes ATM withdrawal and foreign purchase fees, and has the best exchange rate. The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel card by Mozo two years in a row.

A travel money card is a global currency card that allows you to load several foreign currencies into a personal account at a prevailing exchange rate . Like debit and credit cards, a travel money card can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling. You can buy currencies and add or reload them into your travel money card account via a mobile app whilst abroad.

One of the best ways to use the Travelex Money Card is with the Travelex Money App. The Travelex Money App makes ordering, transferring, and checking currencies quick and simple on your travel card. You can also use the Travelex travel exchange rate tracker to check currencies in real time.

You can order a travel money card online or purchase one directly from a Travelex store. Find a store near you.

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Similar to any bank account, you can withdraw money from your travel money card at ATMs worldwide. When withdrawing cash, select the “credit” option on the ATM machine screen to access funds. You will not be charged credit card fees by selecting this option. If the “credit” option does not work, try selecting “debit” or “savings”. The maximum withdrawal amount is 3,000 Australian dollars each 24 hour period. Bear in mind that some ATMs may also have their own ATM fee, adding a cost to your withdrawal.

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

The initial card fee is free, subject to minimum load amounts. Please see the fees and limits section for more information. There are fees associated with the way you use your card e.g. the type of transaction, the currency you use, and when you move currencies on your card. Limits also apply to top up amounts and method of top up. Please see more information on applicable fees and limits section.

Activity on your Travelex Money Card is monitored every day to detect unusual behaviour, and if something is spotted you'll be contacted to check your transactions. There are also things you can do to help keep your travel money secure: • Sign your card as soon as you receive it • Check your transactions regularly and report anything unusual to Card Services immediately • If you print statements from the internet, keep them safe and shred them when you've finished using them • Never give your personal details to someone on the phone • Don't give out your details in response to unsolicited email • Be wary of anyone who asks for common security details like your mother's maiden name, passwords, date of birth, or information about your work • Never give your PIN to anyone, even if they claim to be from your card issuer • Don't let yourself get distracted when using cash machines or point of sale terminals - somebody may be trying to find out your PIN

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au , before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Transacting via some online merchants may incur a surcharge.

- Join our Mailing List

- Price Promise

- About Travelex

- Best Ways to Buy Foreign Currency

- Travelex Money App

- Currencies Available to Buy

- Currency Converter

- Rate Tracker

- Sell Your Currency

- Travelex Travel Hub

- Australia Post

- Become an Affiliate

- Other Services

- International SIM Cards

Travelex Info

- Business Services

- Product Disclosure Documents and Terms & Conditions

- Website Terms of Use

- Privacy Policy

- Fraud & Scams

Join the conversation

Customer support.

Online Order Queries:

- Tel.: 1800 440 039

- Email: [email protected]

- Map: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000

International Money Transfer Queries:

- Help & FAQ

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel Money Card

Travel Money Card

Lock in exchange rates and load up to 13 currencies on one account to easily access your money while you’re travelling.

Features & benefits

$0 card issue fee.

Order a Travel Money Card for free in branch or online (search 'Travel Money Card' in the CommBank app or log into NetBank ).

Lock in exchange rates

Load up to 13 currencies on one card before your trip, so you know how much you have to spend, no matter how the Australian Dollar moves.

Spend anywhere in the world

Shop online, in-store, or over the phone wherever Visa is accepted, plus get access to Visa ® travel offers .

Easily manage your travel budget

Manage your holiday money and track your spending via the CommBank app or NetBank.

Your purchases, covered

Lost or stolen personal belongings? We may be able to cover the cost to repair or replace them up to 90 days after purchase. 2

Extra card security

Lost, misplaced or stolen card? Lock it and report it in the CommBank app or NetBank.

- Currency converter

Exchange rates

Load up to 13 currencies on one account

Lock in exchange rates and load up to 13 currencies easily on one account – wherever you are in the world – through NetBank or the CommBank app:

- United States Dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Australian Dollars (AUD)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

No load or reload fees

You can load up to 13 currencies on your Travel Money Card with no load or reload fees. The exchange rate is the CommBank Retail Foreign Exchange Rate at the time of the conversion.

When you’re ready to pay for something, we will always try to complete the transaction for the country you are in. Make sure you have enough of the correct currency for the country you’re in on your card to avoid additional fees. If you don’t have enough of the local currency, we’ll use the next available currency instead, so long as there’s enough of it loaded on your card.

If you load multiple currencies on your Travel Money Card, you can change the order (the next available currency) anytime online.

Rates & fees

See all fees and charges

Who can apply

To get your Travel Money Card, you’ll need to:

- Be at least 14 years old;

- Be registered to use NetBank, or register online New to CommBank? Sign up to NetBank at your nearest branch ;

- Provide a valid email address; and

- Have an Australian residential address

How to apply

Before your trip.

- Order a Travel Money Card in the CommBank app (search 'Travel Money Card'), NetBank , or at your nearest branch .

- Load at least AUD 50 or the foreign currency equivalent to get started

- Once you’ve got your card, activate and set your PIN online in NetBank, or under Cards in the CommBank app

- Lock-in the exchange rate by loading currency on your card in NetBank or the CommBank app

How it works

During your trip.

- The local currency will be automatically applied when you pay for something, as long as it’s loaded on your card and you have sufficient funds

- Reload in real time , fee-free if your balance gets low

- Stick to daily transaction limits

- The maximum value of purchases per day is unlimited, however no more than your available balance

- The maximum amount you can withdraw from ATMs per day is AUD 2,500 or the foreign currency equivalent. Keep in mind most ATM operators have a limit on how much you can withdraw from an ATM per transaction

- The maximum amount for over-the-counter withdrawals per day is AUD 2,500 or the foreign currency equivalent.

When you’re home

- Got leftover currency? Exchange it for another currency or back into your CommBank account from NetBank or the CommBank app

- Top up your Travel Money Card (it’s valid for 4 years) in preparation for your next trip

- Donate your foreign (and local) currency to any CommBank or Bankwest branch and every cent will go to UNICEF

- How to manage your Travel Money Card

You’ve got your new card – here’s how to get the most out of it.

Find detailed info on getting started, loading and reloading currencies, setting a currency order, checking your balance and tracking your spend. Plus, info on Purchase Security Insurance Cover and access to Visa ® travel offers .

Manage your Travel Money Card

Need foreign cash? Have it ready before you travel

If you’re a CommBank customer, you can buy or sell up to 9 foreign currencies at selected CommBank branches in exchange for Australian Dollars.

You can also order foreign cash in over 30 currencies online – even if you’re not a CommBank customer.

Discover Foreign Cash

Planning an overseas trip?

Discover travel tips to help make the most of your European summer holiday.

See travel tips

Emergency support & tools

What to do if you’ve lost your card or it’s stolen.

If you’ve lost your Travel Money Card, or you think it might’ve been stolen, we can have an emergency replacement card sent to you anywhere in the world.

You may also be eligible for an Emergency Cash Advance, giving you access to cash within 24-48 hours (often on the same day).

Call us in an emergency on:

- 1300 660 700 within Australia

- +61 2 9999 3283 from overseas (reverse charges accepted).

When calling from overseas using your mobile, standard roaming charges may apply. To avoid roaming charges, call the international operator in the country you’re in from a landline and give them our reverse charges number +61 2 9999 3283.

Tools & calculators

- Saving calculator

- Budget planner

- Managing multiple currencies on your Travel Money Card

- Travelling overseas: 10-step money checklist

- Beginners guide to exchange rates

- Online banking while overseas

- Planning an overseas holiday

We can help

Your questions answered

Get in touch

Visit your nearest branch

Things you should know

1 The cash withdrawal fee will not apply to cash withdrawals made in Australia.

2 For more information relating to the complimentary Purchase Security Insurance refer to Travel Money Card Complimentary Insurance Information Booklet (PDF) .

As this advice has been prepared without considering your objectives, financial situation or needs, you should before acting on this advice, consider its appropriateness to your circumstances. The Product Disclosure Statement and Conditions of Use (PDF) issued by Commonwealth Bank of Australia ABN 48 123 123 124 for Travel Money Card should be considered before making any decision about this product. View our Financial Services Guide (PDF) .

To raise a dispute related to your Travel Money Card please complete this form for transactions (PDF) or this form for ATM disputes (PDF) .

Any withdrawal or balance enquiry fee will come from the currency for which you are using your card. If this currency is not loaded on your card, the fee will be taken from the first (or sole) currency loaded on your card. Any SMS balance alert fee will come from the first (or sole) currency loaded on your card.

The target market for this product will be found within the product’s Target Market Determination, available here .

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Prepaid Travel Cards for Australians 2024

Here is a list of the 6 best prepaid cards you can take with you on your travels and the positives and negatives for each one:

- Wise - our pick for prepaid cards

Revolut - low fees

- Citibank - good for use at home

- Travelex - no fees for ATM withdrawals

- Australia Post - lock in exchange rates

HSBC - no international transaction fees

With a prepaid travel card you’ll load money - either in AUD or the foreign currency you need - in advance, which you can then use as you travel , for spending and withdrawals. Lots of cards let you top up and manage your account through an app, which means you can always keep up with your money, even when you’re away from home.

Picking the right prepaid card can mean you get more convenient ways to spend and withdraw when you’re abroad - and lower overall costs, too. Let’s look at some of the best prepaid travel cards on offer for Australians , so you can pick your perfect match:

Wise - our pick for prepaid travel card

- Top up for free in AUD using PayID or bank transfer

- No annual fee, hidden transaction fees or exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR), Canada (CAD) and New Zealand (NZD)

- Available in the US, UK, Europe, Australia, Singapore, Japan and New Zealand

Find out more about the Wise card .

With this card:

- It's very easy to set up and order

- Available as a virtual card

- You can receive foreign currency into a multi-currency account linked to the card

- Pay with your Wise card in most places overseas where debit cards are accepted

- You can transfer money to a bank account overseas

It's not all good news though

- There is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

Go to Wise or read our review .

- No hidden fees or exchange rate mark-ups (except on weekends)

- Very easy to use app

- Free to set up account and top up

- You can use it to transfer money to a bank account overseas

Read the full review

- No purchase fee, load fee, reload fee, exchange rate margin or minimum balance requirements

- Unlike other Travel Cards, its free and easy to use the balance of your currency or convert it back to AUD

- The exchange rates are unbeatable. They use the same rate you see on XE or Google with no hidden mark-up

- For the free Standard account, there is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- The premium account costs $10.99 a month, which can really add up if you are not using it often

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

Click here to see the full list of cards and how Revolut compares

Australia Post Prepaid Travel card - lock in exchange rates

- Load up to 11 different major world currencies

- Spend and withdraw easily around the world

- Get access to extras like free wifi when you travel

- Manage your card in online and via an app

- Transfer instantly to another Travel Platinum Mastercard

- Load up to 11 different currencies for easy spending and withdrawals

- Lock in exchange rates so you know what your travel money budget is in advance

- Get extra perks like free wifi when you load 100 AUD or more

- Get fraud protections from Mastercard

- 3.5 AUD international ATM fee, or 2.95% domestic ATM fee

- Exchange rates to add money in a foreign currency or spend a currency you don’t hold are likely to include a markup

- Some fees apply depending on how you top up your account

Travelex - no fees for international ATM withdrawals

- Load up to 10 major currencies at a time

- Spend and withdraw anywhere Mastercard is accepted

- Contactless payments so you can just tap and go

- No Travelex fees for international ATM withdrawals

- Free to spend currencies you hold in your account

- Order online and have it delivered to your home - or collect in store

- Top up and hold up to 10 currencies at a time

- View and manage your account online

- Spend online and in person, and make withdrawals as you travel

- No membership or account fees to pay

- Get exclusive Mastercard discounts and perks

- Inactivity fees apply if you don’t use the card for a year

- Not all major currencies are supported for holding - double check they have the currency or currencies you need

Go to Travelex or read our review .

Citibank Saver Plus - best for use at home

- No international ATM or transaction fees

- Fee-free international money transfers to any account worldwide

- SMS notifications through Citi Alert

With this card you can:

- withdraw money for free at over 3000 ATMs Australia-wide and overseas

- take advantage of no foreign transaction fees, monthly fees, or minimum opening balance

- transfer money to friends and family anywhere in the world for free

- Cash deposits available within 24-48 hours

- Can’t have two cards active at the same time

- $5 account closure

- Hold and exchange 10 currencies: AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, and CNY

- No account opening or annual fees to pay

- No foreign transaction fee and no HSBC ATM fee at home or abroad

- Some cashback earning opportunity on local spending

- Easy online overseas transfers - 8 AUD fee and exchange rate markups apply

- Hold and exchange 10 currencies

- No account opening fee, no ongoing fees

- Get up to 2% cashback on eligible card spend

- No HSBC ATM fee

- No international transaction fee

- 8 AUD fee for sending money overseas

- Cashback on low value transactions made in Australia only

- Limits apply on how you can use CNY within your account

Read our HSBC Everyday Global Account review .

What are Prepaid Travel Cards?

Prepaid travel cards are a good international card alternatives to carrying cash. They look like credit or debit cards, but they function differently.

You're able to load the card with a set amount of money in the currency you need and can use it to make purchases online, in stores and to withdraw money at ATMs.

Most travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

Find out how our 5 best prepaid travel cards for Australians compare in our best and worst travel cards article .

Looking for something different?

Read our guides on:

- The best travel debit cards

- The best travel cards for Europe

- The Wise debit card review

- Best virtual debit cards for Aussies

How does a prepaid travel card work?

Order a prepaid travel card online, through a provider app , or - in some cases - pick one up at a physical location or store. Generally to get your card you’ll need to show or upload some ID documents for verification - this is to keep your account safe and is a legal requirement.

Once you have your card account open , you can load funds . Different cards have their own supported methods for topping up, which usually include bank transfer, PayID, credit and debit card, and which may also allow you to deposit cash in some cases. Once you have funds on your card, you can switch to the currency you need for overseas spending. In some cases you can also leave your funds in AUD and just allow the card to convert for you - but do check that no additional fees will apply in this case.

Prepaid travel cards can then be used to tap and pay , make withdrawals and shop online . You can often also add them to mobile wallets like Apple Pay for convenient spending. Because your card isn’t attached to your everyday account it’s secure, and you can only spend the funds you’ve loaded, which means there’s no chance of accidentally blowing your budget.

Advantages and disadvantages of prepaid cards

Prepaid cards can be a handy addition when you’re abroad, as they are secure and convenient to use for payments and withdrawals. However, they’re not the only option. If you’re not sure about whether a prepaid card is right for you, check out these advantages and disadvantages to help you decide:

Advantages:

- More convenient than carrying cash, with easy access to ATMs to withdraw when you need to

- Not linked to your primary day to day account, which can be more secure and make budgeting easier

- Some accounts let you buy currency in advance to lock in exchange rates when they’re good

- You may be able to access better exchange rates and lower fees compared to using a regular bank card

Disadvantages:

- Some prepaid cards have fairly high fees - including charges when you add money to the account. Read more on how to find the best travel cards with no foreign transaction fees

- Not all prepaid cards support a broad range of currencies - check the currencies you need are covered

- Prepaid cards aren’t always accepted for things like paying security deposits - so it’s safest to have a credit card as well

Who is a prepaid debit card for?

A prepaid debit card is handy for many different customer needs. For example, you may choose a prepaid debit card in the following situations:

- You’re planning travel and want to set your budget in advance with no chance of accidentally overspending

- You want to be able to hold and exchange a selection of foreign currencies all in the same account

- You want to increase security by using a payment card that’s not linked to your main everyday account when you travel

- Some cards also offer other perks like ways to receive foreign currency payments conveniently, or cashback

How can I get a prepaid travel card?

Different prepaid cards have their own order and activation processes. However, to comply with local and international law, providers will usually need to see some ID before you’re able to get a card - this verification step may be available online by uploading images of your paperwork, or in person by visiting a branch.

Here’s an outline of the basic steps you’ll take to get a prepaid travel card:

- Pick the right card for your needs

- Visit the provider’s website or app - or call into a branch if you’d prefer a face to face service

- Complete a travel card order from, which will include your personal information

- Get verified - usually this involves showing or uploading ID like a passport or driving licence

- Add money to your card, which could be in cash, with a bank card, or by bank transfer

- You can now get your card, and manage your account online or in the app

If you’re ordering a card in person you’ll be able to start using it right away. If you’ve ordered online for delivery, you’ll need to wait a few days, to a couple of weeks, depending on the provider you’ve picked, for your card to be available. You might be able to access virtual card details in the meantime, to start spending right away.

How to choose a prepaid debit card

There are many different prepaid debit cards on the Australian market - so picking the best one for you will require a bit of research. Starting with this guide, compare a few different prepaid debit cards based on features and fees. Here are a few pointers to think about:

- Make sure you know about any opening or card delivery fee which will apply once you order your card

- Check how long it’ll take to get your card if you’re ordering online for home delivery

- Make sure the card you pick can hold a broad selection of currencies, so you can use it for more than one trip away

- Check the fees for adding funds, making ATM withdrawals and converting currencies

- Look to see if there are any account close, cash out or dormancy fees that apply once you stop using the card

- Make sure the card is well rated by other users, and from a trustworthy provider

Where can I get a prepaid debit card?

Generally you can order your prepaid debit card online or by downloading your preferred provider’s app. Some cards, like the Auspost card, can also be collected in physical branch locations.

FAQ - 6 Best Prepaid Travel Cards

Are prepaid cards free.

Prepaid cards may be free to order, or you may pay a small one time fee, depending on the provider and card you pick. Once you have your card you may also pay transaction fees such as exchange rate markups when you switch currencies, and ATM withdrawal charges. Read the card’s terms and conditions carefully so you’re aware of the costs involved.

What are the best prepaid debit cards for international travel?

There’s no single best prepaid debit card - it’ll come down to your personal preferences, where you’re travelling, and the type of transaction you need to make. Pick a prepaid card which is easy to use, which supports the currency you need, and which offers a good balance of low fees and good exchange rates.

What is the best reloadable prepaid card?

There’s no single best reloadable prepaid debit card. Use this guide to compare a few options to pick the one that’s right for you, thinking about features, fees and the range of supported currencies you’ll need.

Should I use a Mastercard or Visa for overseas?

Both Visa and Mastercard are very broadly accepted globally. It’s often a good idea to have a prepaid, debit or credit card on each of these networks, so you’ll always have a backup if for some reason one network isn’t available wherever in the world you are.

Are prepaid currency cards worth it?

Picking the right prepaid currency card can help you save money on currency exchange and access low fee international transaction services. You might also get extra perks like easy ways to lock in exchange rates in advance, so you can get a good deal and fix your travel budget before you go away.

Your currency knowledge centre

5 Best Debit Cards for Australians Travelling Overseas

Travel debit cards are a good alternative to carrying cash. They also offer the convenience of a credit card, but work differently. Here is a list of the 5 best travel debit cards you can take with you on your travels and the positives and negatives for each one.

- Read more ⟶

Wise Debit Card Review

The Wise Debit card give customers an easy way to spend their balances in multiple countries. With interbank rates and low fees, this product is available in Australia for both personal and business customers.

8 Travel Traps to Avoid If You're Heading to Europe

To help you avoid spending money unnecessarily, here are some pretty important travel money traps you want to avoid if you travel to Europe.

- United States

- United Kingdom

The best travel money cards for Australian travellers

Compare prepaid travel cards, debit cards and credit cards to find the best option for your next overseas trip..

In this guide

Using your debit card overseas

Debit cards with no international transaction fees, best prepaid travel cards to load foreign currency, find a better travel money card, australian travel statistics, 1. new zealand, 2. indonesia.

- 4. The UK, Canary Islands & the Isle of Man

6. Thailand

8. singapore, 10. vietnam.

Travel Money Cards

What you need to know

- The most important features to compare are the foreign transaction fees, exchange rates and usability.

- If you want to withdraw cash, a prepaid travel card or debit card will likely be cheaper than a credit card.

- It is a good idea to have several travel money options in case of loss, damage or theft.

Debit cards allow you to spend the money you have in your bank account, instead of having to pre-load it like a prepaid travel card. There are some debit cards that don't charge any international transaction fees and even some that allow you to hold multiple currencies - like the HSBC Everyday Global Account .

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Instead of a debit card, a prepaid card lets you load up on the currency you need before you get there. There are several options for this, but the right one for you will largely depend on the currency you're going to be using.

We've looked at the top 10 most popular travel destinations for Aussies based on the Australian Bureau of Statistics overseas departure and arrivals data and rounded up the most relevant travel cards you could use in each location. From the rolling hills of New Zealand to the bustling streets of China, read on for the travel card tips you'll need for your next holiday.

Australia is a nation of travellers. According to the Australian Bureau of Statistics, there were 8,337,080 resident returns from overseas for the year 2022 - 2023. The most popular reason we travel is for a holiday, and the median trip duration is 15 days.

The land of towering snow-capped mountains, crystal blue lakes and hobbits and elves often tops Australia's list of favourite travel destinations. Conveniently, most Australian prepaid travel cards support New Zealand dollars.

See our New Zealand travel money guide for more tips to help you prep for your trip over the Tasman.

Aussies love the tropical climate, beaches and poolsides of Indonesia. Despite our close proximity to Indonesia and Australia's reputation for frequenting tourist destinations such as Bali, no Australian travel cards currently support Indonesian rupiah.

However, as Visa and Mastercard are accepted in Indonesia, you can still use an Australian travel card when you're there. You can find travel cards that don't charge a currency conversion fee when you spend in an unsupported currency.

Browse our Indonesia travel money guide for more travel money options.

The land of stars and stripes also has a soft spot in the heart of Australian travellers. So, it's probably no surprise that most Australian prepaid cards support US dollars.

See our US guide for the best travel money options for your next trip to the states.

4. The UK, Canary Islands & the Isle of Man

If you're making a Eurotrip to the UK, you'll be glad to know that most Australian prepaid travel cards support the pound sterling.

Use our UK travel guide for everything you need to plan your next trip to the UK.

The Indian rupee isn't supported by any Australian travel cards. So, if you're travelling to the hustle and bustle of India, you might want to look for travel cards that don't charge any currency conversion fees when spending in an unsupported currency.

Thailand is a popular holiday destination for many Aussies seeking sunshine and rich culture, so it's lucky that quite a few Australian travel cards support the Thai baht.

Use our Thailand travel money guide to research more travel money options for your trip.

While the white sands and crystal blue waters of Fiji are a favourite for Aussie travellers, no prepaid travel cards currently support the Fijian dollar. However, as Mastercard and Visa are widely accepted in Fiji, there are still a few options available for holidaymakers drawn to this island oasis.

See our Fiji guide for more travel money tips and tricks.

If you're taking a trip to the Garden City, there are a few travel card options to choose from.

You can find more travel money options for your trip to Singapore with this guide .

Whether you want to bask in the beauty of cherry blossom season or tear up the snowy slopes, there are plenty of travel card options if you're planning a trip to Japan.

See our Japan guide for more travel money tips for your next holiday.

A land of beautiful beaches, Buddhist pagodas and bustling cities, Vietnam makes the list of Australia's most popular travel destination. If you're planning a trip and want to spend in Vietnamese dong, there are travel card options to choose from.

You can find more travel money options for your trip to Vietnam with this guide .

While there's no single best travel money card out there, it's easier to narrow down your search when you know which cards support the local currency you'll be spending in on your trip. Once you've done this, look for any issue fees, ATM withdrawal fees and loading costs to help compare your travel money options and pick the right travel card companion for you.

Latest travel headlines

- Is it worth paying extra on Jetstar to earn Qantas Points?

- Qantas promises improved Frequent Flyer by April

- Woolworths Qantas iPhone deal is back! Get 20,000 Qantas Points

- Coles iPhone Velocity points hack: Score a free Virgin flight

- Kicking, screaming and stinking: Plane neighbours annoy millions

Sally McMullen

Sally McMullen was a creative content producer at Finder. Sally wrote about credit cards for almost 5 years, authoring almost 900 articles on Finder alone. She has also been published in Yahoo Finance, Dynamic Business, Financy and Mamamia, as well as Music Feeds and Rolling Stone. Sally has a Bachelor of Communication and Media Studies majoring in Journalism (Hons) from the University of Wollongong.

More guides on Finder

The Wise Travel Money Card supports over 40 currencies, with free loading by bank transfer and an instant, virtual card. Here’s how its other features compare.

Revolut offers virtual and physical Visa cards, support for over 30 currencies and other travel perks – plus 3-month Premium trial with this offer.

Use finder's interactive world map to learn about variations in beer prices globally. Find out where in the world you'd pay a whopping $15.10 for a pint.

Discover the travel money options available for young people and how to prepare for a trip overseas.

Want to avoid fees and charges when using your card overseas? This guide explains the most common pitfalls when using travel cards.

This guide explains how you can get back any leftover funds from your travel money card after your trip.

Use this guide to understand foreign currency exchange and discover how to get the best deal.

Spend in up to 13 major currencies, lock in exchange rates and manage your account with the CommBank app when you use the Commonwealth Bank Travel Money Card.

Spend in 11 currencies wherever Mastercard is accepted and save on currency conversion fees with the Cash Passport Platinum Mastercard.

Ask an Expert

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

11 Responses

I am going on a cruise with stops in India, Singapore, Dubai and Sri Lanka. Apart from getting cash what is the best way to take money there? I will only be in Sri Lanka for one day.

Hello there Ian,

Thank you for your inquiry.

Like the page you’re on, you have travel card alternatives for Singapore and India. However, India does not support Australian travel cards, but rather you can look at your travel card choices that don’t charge currency conversion fees.

In Dubai, you may begin looking at your travel card .

In Sri Lanka, Their Government has tight control over the national money and there are strict points of confinement on the measure of rupees you can get in and out of the nation. Aside from cash, you may look at your prepaid travel cards, debit or credit card choices on our page for Travel guide in Sri Lanka.

You may likewise jump at the chance to consider a Debit Card or Credit Card with low or no currency conversion fees.

I hope this information helped.

Cheers, Asia

Travelling to Mexico and Cuba and don’t know whether there is any card better than a Westpac Global Currency Card all things considered.

Thank you for visiting Finder.

For options in getting the most suitable travel money card for you, you may want to visit our travel money option for Mexico as well as our travel money guide for Cuba . From there you may compare cards and select which one would suit your needs. Once you have chosen a particular card, you may then click on the “Go to site” button and you will be redirected to the bank’s website where you can proceed with your application or get in touch with their representatives for further assistance.

Please ensure you review the relevant Product Disclosure Statements/Terms and Conditions before applying.

Cheers, Joanne

What about Peruvian Soles? Or Chilean Pesos? Do I have to put in USD first?

Thanks for your question.

Currently, prepaid travel money cards do not support the currencies of South American countries. You would have to load them with Australian dollars and withdraw the local currencies such as nuevo sol and peso. However, this will attract overseas ATM fees and currency conversion fees.

If you wish to avoid these fees you can use debit or credit cards. Moreover, you can consider a travel card with no currency conversion fees. Check out our Travel Money Guide to Peru to compare your options. You may also check your travel money options for South America .

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Cheers, Liezl

Travelling to Bali with a Qantas Cash card. I understand I can’t load it with rupiah, however can use it where Mastercard accepted. I’m not clear though on what the currency conversion fee is. Above it says that you can “avoid currency conversion fees when spending Indonesian rupiah with this card.” However you can’t load Rupiah in the card. Can you explain further please?

Hello Jacqui,

The currency conversion fee is when you load Australian dollars on your card and then convert them to Rupiah while you’re traveling in Indonesia. In this case, you are simply converting the currency on a “as per needed basis”, Qantas daily rate for the currency you’re spending in will apply. You can use their currency conversion tool on the website to check the exchange rate daily.

If in case you are interested, please explore different travel money options in Indonesia .

Please take time to download the Product Disclosure Statement of this product to know more about the terminologies and fees associated with use.

Hope this clarifies.

Cheers, Jonathan

What about. Europe comparison for travel cards?

Hi Suzanna,

Thanks for your inquiry.

Here is the page where you can compare Travel Cards for Europe – https://www.finder.com.au/travel-money/europe . It also has a comparison for Travel Credit Cards and Travel Debit Cards.

Hope this information helped.

Cheers, Rench

Hi Suzanne,

You may be interested to check the available option/s for travel cards in Europe on our website. Check that page and you will also find more details about how you use travel money cards in Europe.

I hope this information has helped.

cheers, Harold

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

Best travel money cards in 2024.

Travel money cards are essential when travelling overseas.

They allow you to easily make payments whilst travelling overseas. They make paying easier for shops, restaurants, hotels and ATMs.Travel money cards work in a similar way to ATM cards. They use a pin when you purchase goods or services overseas.

In this guide, we have compared travel money cards to help you make the best selection for your next trip.

Best Travel Money Cards:

- Wise Travel Card Best Exchange Rates

- Revolut Best for Low Fees

- Travelex Money Card Best All Rounder

- Bankwest Breeze Platinum Best Travel Credit Card

- Pelikin Student Traveller Card Best Student Card

- HSBC Everyday Global Travel Card Best Travel Card by Bank

- Qantas Travel Money Card Best Reward Benefits

Wise Travel Card - Great Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is great for frequent travellers as it offers over 40 currencies at the inter-market exchange rate, which is the cheapest rate globally. In addition you can buy goods online from overseas with no transaction fee plus get the best exchange rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Our Wise Travel Card Review

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Card is a good all rounder.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut Card abroad , the support network if the card is lost or stolen is very good.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- 0% p.a. on purchases and balance transfers for the first 15 months

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- 55 interest free days

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling overseas.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places around the world.

HSBC Everyday Global Debit Card

- No initial card or closure fees

- No monthly or account fees

- No international ATM fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Awarded 5 gold stars by CANSTAR in 2021 for Outstanding Value

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with Visa pay wave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Debit Card is a good option to take travelling and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees. In addition there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Finally it is one of the only travel cards that offers Chinese Yuan. To avoid ATM fees you need to find HSBC branches in Australia and only use ATMs overseas with a VISA or VISA Plus logo.

Best Student Card

Pelikin student traveller card.

- Use promo code SMONEY10 for a $10 discount

- Up to 15% off international flights

- A globally accepted virtual student ID card

- 2% cash back on food & drinks, transport and accommodation

- Over 150,000 discounts worldwide

- $30 for 12 months

- 20+ currencies available

- Split bills, pay and get paid instantly

Pelikin is one of the only travel cards in Australia specifically for students. While it has a small annual fee, the range of discounts and offers more than make up for it.

The app is relatively easy to use and card arrives in under a week.

Best Rewards Card

Qantas travel money card.

- No monthly fees, purchase fees and currency conversion fees

- No load fees if you pay by bank transfer or BPay

- Locked in exchange rates: 4%+ margin on exchange rates

- Earn 1.5 Qantas points for every AU$1 spent in foreign currency

- 10 currencies offered USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED

- Free Australia ATM withdrawals

- 0.5% fee debit card reload fee

- ATM fees overseas (USD 1.95; GBP 1.25; EUR 1.50; THB 70; NZD 2.50; SGD 2.50; HKD 15.00; CAD 2.00; JPY 160; AED 6.50)

- Minload of $50 and max of $20,000

- Available to 16 year olds, has a lower age restriction than most credit cards (18 year olds)

Qantas Travel card is a great option to spend foreign currency overseas if you are already a loyal Qantas customer and use your frequent flyer points regularly on flights, accommodation or gifts. The fees are low, the exchange rate is average however the ATM fees are expensive and will easily add up.

Other popular travel money cards

Aside of the Top 5 travel money cards, there are many more options to consider. These include well known brands such as the Commonwealth Bank and Travelex and less known services like Up Bank and Revolut.

Here is a rundown of their best features, fees and available currencies:

- 13 currencies available, including Vietnamese Dong and Chinese Yuan

- No issue fee, load fees, closure and card replacement fees

- Additional card offered

- Can be accessed through Commonwealth Bank app

Commonwealth Bank Travel Money Card

- $3.50 fee at ATMs overseas

- 13 currencies offered USD, GBP, EUR, THB , NZD, SGD, HKD, CAD, JPY, AED, AUD, VND & CNY

- Minload of $1 and max of $100,000

- Available to 14 year olds, has a lower age restriction than most credit cards (18 year olds)

- When you use your card for a purchase or withdrawal in a currency that is not loaded, or when they automatically transfer funds between the currencies on your card to enable the completion of the transaction at the Visa retail exchange rate plus 4%

- To transfer money between currencies or a transaction account, it will be at the bank rate which is normally 4% above the market value

The Commonwealth Bank travel money card is great if you are already a Commonwealth bank customer who banks online and knows exactly how much money in each country you want to spend. However if you need to transfer between currencies or make a purchase in a currency you don't have funds loaded, then you can get an additional expensive charge. Watch how many withdrawals at ATMs you make as well to keep the costs down.

- Exchange rates most competitive for USD, GBP and THB

- No fee on initial card or load (not BPay)

- No fee on reloads via bank transfers

- No monthly or inactivity fees

- Card is valid for 5 years

Travel Money Oz Currency Pass

- 1.1% reloading fee via Travel Money Oz Login or with debit or credit card