- Tax Pro Center | Intuit

- Blog Post Archive

- Tax Law and News

Business Meals Deduction for 2020: 100% Fully Deductible Meals

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Written by Jackie Meyer, CPA, CTC

- Modified Jun 10, 2021

While the Tax Cuts and Jobs Act clearly changed entertainment expense to make it 100% not deductible, Congress did not actually change as much on the rules revolving around meals (that have a business benefit), yet. There has been little guidance and much speculation, but in October 2020, the IRS finally gave us some final regulations to provide some insight.

There is concern that if a meal is provided solely for the purpose of entertainment, it would become nondeductible as well. I would argue that meeting the IRS’ minimum standards for a meal still allows the deduction. The standards include the following:

- The meal is not lavish/extravagant.

- A substantial business discussion took place before, during, or after the meal

- There was a business purpose for the meal.

- The cost of the meal was not included in an entertainment-type ticket.

- An owner of the business attended the meal.

Therefore, meals can be deducted as a business expense if they are directly related or associated with the active conduct of a trade or business (with a valid purpose and documentation). Once this test is established, the expense falls into two categories: 50 percent deductible or 100 percent deductible. There is an additional caveat that if a meal is considered “lavish and extravagant” under the circumstances, the extra portion attributable to extravagance is not deductible at all. Meals with employees or business partners are only deductible if there is a direct or indirect business purpose. I’ve listed out common items that fall into each category to press down your taxable income!

100 percent deductible meals (no change):

- Meal expenses for a social or recreational event such as company picnic, holiday party, employee recognition, or career development. This is for the employee’s benefit only and is not on the company’s premise, so the employees work more. If there is any benefit for the employer, it becomes limited to 50% as stated below.

- Food made available to the public for free, usually as part of a promotional campaign.

- If the meal’s expense is included as taxable compensation to the employee and included on the W-2, then the expense is fully deductible to the employer.

- If a professional firm bills actual meal expenses separately when invoicing the client and is reimbursed by the client, the actual meal expenses for that engagement are fully deductible. However, if the meal’s expense is included in the invoice, but is not separately stated at actual cost, then those meal expenses are only 50 percent deductible.

- Meals and food that are part of a charity sporting event are fully deductible. To qualify, the event must be organized for the primary purpose of benefiting a 501(c)(3) organization (nonprofit), contribute 100 percent of net proceeds to the organization, and use volunteers for substantially all the work performed in carrying out the event.

- At an entertainment venue where food or beverages are provided to the public, not just employees, for advertising purposes or a sales presentation.

- If the business sells food, employers can still deduct 100% of meals given to employees between, before, or after shifts.

Potentially limited to 50 Percent, per October 2020 final IRS regulations (formerly 100% deductible):

- Office Snacks, including coffee, soft drinks, bottled water, donuts, and similar snacks or beverages provided to employees on the business premises.

- Any meals provided on the employer’s premises for the convenience of the employer. For example, if you are providing meals to employees in order to keep them working late, in your break room, working weekends, or being on call, it is for your convenience to have them at work and the meal is a means of enticement.

50 percent deductible meals (no change):

- Meal expenses for a business meeting of employees, stockholders, agents, and directors. Office meetings and partner meetings fall into this category. If there is no business function to the meal, it is completely nondeductible for tax purposes.

- Generally, any meals during business travel. If a portion of a business trip can be considered personal and not related to the business function of the trip, then a portion of the meals expense should also be considered personal and not deductible.

- Meals at a convention, seminar, or any type of meeting, even if the cost of the meals is not separately stated from the cost of the event. If not separately stated, it must be calculated by the taxpayer based on reasonableness, or per diem rates for that location.

- Meals with people related to the business, such as clients, customers, and vendors, provided that there is a business purpose or some benefit to the business will result.

- Meal expenses by an employee during a business trip, and reimbursed to that employee, are still only deductible at 50 percent, even though the employee was reimbursed 100 percent for the cost of the meals.

- Reimbursements using per diem rates are always only 50 percent deductible. However, if you are reimbursing an independent contractor, it will be added to their 1099 income; therefore, they will be fully deductible and should fall under the general ledger account of Contract Services instead of Meals and Entertainment.

- At an entertainment venue, if a meal was separately charged from any activity that could be considered an entertaining expense (a sporting event, for example), the amount charged for food or beverages on a bill, invoice, or receipt must reflect the venue’s usual selling cost for those items if they were to be purchased separately from the entertainment, or must approximate the reasonable value of those items.

Insider tip from Jackie: It is best to set up three General Ledger accounts for Meals and Entertainment: one for 50 percent deductible meals, one for 100 percent deductible meals, and one for nondeductible entertainment. Focus on industries that can benefit the most from 100% deductions, including food services, ones that provide many public events, or provide social activities that do not benefit the employer.

If this list seems daunting, use this handy flowchart we created at TaxPlanIQ to help guide you and your business clients (subject to change at any time!). In addition, let’s continue the discussion in my Accounting Firm Influencers ‘ Facebook group.

Editor’s note: This article was updated with new information on Dec. 2, 2020.

Previous Post

December 2020 tax and compliance deadlines

Opportunity Zone investments offer potential tax savings

Jackie Meyer, CPA, CTC, is president and founder of Meyer Tax Consulting, LLC, in Southlake, Texas. Her team works with executives on strategic tax planning while also consulting on industry best practices as a speaker and thought leader. More from Jackie Meyer, CPA, CTC

7 responses to “Business Meals Deduction for 2020: 100% Fully Deductible Meals”

I think your flowchart is wrong based on your summary above. “Was the mea lprovided as part of a charity-sporting event” if yes its 50% deductible. Whereas above you have stated “Meals and food that are part of a charity sporting event are fully deductible. To qualify, the event must be organized for the primary purpose of benefiting a 501(c)(3) organization (nonprofit), contribute 100 percent of net proceeds to the organization, and use volunteers for substantially all the work performed in carrying out the event.” under the 100% deductible? Is the flowchart considering other circumstances, for example the company is sending a single employee to a charitable gala to represent them?

Thanks Jackie

Hi Mike – thanks for your comment. Yes, the flowchart was outdated on that specific line item. It is 100% deductible. We will update for our records and any future posted articles. Thanks!

Question- I sell restaurant supplies and when I visit the locations, I try to give my customers business at that location. Can deduct those expenses?

Hi Kim – you should check with your tax professional for guidance. Thanks.

This is a fantastic article for all involved in Office People Ops & Facility Management. Curious whether 1) where it says “potentially” on the two items changing ie. snacks and employee enticement — has it become official? and 2) with today’s (12/22) legislative announcement of 100% deductible business meals through 2022, are all categories now 100%? Perhaps a follow-up article once the COVID legislation is signed and clarified, thanks for the great info Jackie!

Thank you for your question; the author will respond very soon.

From Jackie Meyer: According to CNN Business, the “Covid relief package signed into law allows companies to deduct 100% of business meals with clients for 2021 and 2022. The bill’s language does not specify whether the deduction applies only to dining in or if catered, delivered, or takeout qualifies as well. It may come down to interpretation and guidance from Treasury.”

Here is the language from the bill allowing 100% deduction of meals in 2021/2022: SEC. 210. TEMPORARY ALLOWANCE OF FULL DEDUCTION FOR BUSINESS MEALS (a) IN GENERAL.—Section 274(n)(2) of the Internal Revenue Code of 1986 is amended by striking ‘‘or’’ at the end of subparagraph (B), by striking the period at the end of subparagraph (C)(iv) and inserting ‘‘, or’’, and by inserting after subparagraph (C) the following new sub11 paragraph: ‘‘(D) such expense is— ‘‘(i) for food or beverages provided by a restaurant, and ‘‘(ii) paid or incurred before January 1, 2023.’’. (b) EFFECTIVE DATE.—The amendments made by this section shall apply to amounts paid or incurred after December 31, 2020.

Browse Related Articles

IRS Issues Guidance on TCJA Changes to Business Expense…

Tax Reform Makes Changes to the Meals and Entertainment…

IRS Updates Per-Diem Guidance for Business Travelers an…

15 must-see tax breaks for small business owners in 202…

How to deduct business expenses while on vacation

IRS Updates Per Diem Rates for Lodging and Meals

Travel-Related Tax Tips for Your Self-Employed Clients

What is a Tax Home, and How Does it Impact Travel Expen…

Tax Benefits of Company In-Home Holiday Parties

Top Tax Tips for Clients in the Commercial Fishing Indu…

Tax deadline is April 15 - Our experts can help with your taxes, or do them for you as soon as today. Get started

Tax Deductions for Business Travelers

When you are self-employed, you generally can deduct the ordinary and necessary expenses of traveling away from home for business from your income. But before you start listing travel deductions, make sure you understand what the Internal Revenue Service (IRS) means by "home," "business," and "ordinary and necessary expenses."

Ordinary vs. necessary expenses

Business home, not home sweet home, transportation expenses on a business trip are deductible, fees for getting around are deductible, lodging, meals and tips are deductible.

Key Takeaways

- Typically, you can deduct travel expenses if they are ordinary (common and accepted in your industry) and necessary (helpful and appropriate for your business).

- You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home).

- Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

- You can also deduct 50% of either the actual cost of meals or the standard meal allowance, which is based on the federal meals and incidental expense per diem rate.

The IRS defines expense ordinary and necessary expenses this way:

- An expense is ordinary if it is common and accepted in your industry

- An expense is necessary if it is helpful and appropriate for your business

You can claim business travel expenses when you're away from home but "home" doesn't always mean where your family lives. You also have a tax home—the city where your main place of business is located—which may not be the same as the location of your family home.

For example, if you live in Petaluma, California but your permanent work location is in San Jose where you stay in hotels and eat out during the work week, you typically can't deduct your expenses in San Jose or your transportation home on weekends.

- In this situation San Jose is your tax home , so no deductions are permitted for ordinary and necessary expenses there.

- Your trips to your home in Petaluma are not mandated by business.

Go by plane, train or bus—the actual cost of the ticket to ride is deductible, as well as any baggage fees. If you have to pay top dollar for a last-minute flight, the high-priced ticket is a business expense, but if you use frequent-flyer miles for a free ticket, the deduction is zero.

If you decide to rent a car to go on a business trip, the car rental is deductible. If you drive your own vehicle, you can usually take actual costs or the IRS standard mileage rate. For 2023 the rate is 65.5 cents per mile. You also can add tolls and parking costs onto your deduction. This amount increases to 67 cents per mile for 2024.

TurboTax Tip: Even if you use the federal meals and incidental expense per diem rates to calculate your deductions, be sure to keep receipts from all your meals and incidental expenses.

Fares for taxis or shuttles can be deducted as business travel expenses. For example, you can deduct the fare or other costs to go to:

- Airport or train station

- Hotel from the airport or train station

- Between your hotel and the work location

- Between clients in the area

If you rent a car when you arrive at your destination, the expense is deductible as long as the car is used exclusively for business. If you use it both for business and personal purposes, you can only deduct the portion of the rental used for business.

The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstances—not lavish or extravagant.

You would have to eat if you were home, so this might explain why the IRS limits meal deductions to 50% of either the:

- Actual cost of the meal

- Standard meal allowance

This allowance is based on the federal meals and incidental expense per diem rate that depends on where and when you travel.

Generally, you can deduct 50% of the cost of meals. Alternatively, if you do not incur any meal expenses nor claim the standard meal allowance, you can deduct the amount of $5 per day for incidental expenses. You can also deduct incidental expenses, such as:

- Fees and tips given to hotel staff

- Fees for porters and baggage carriers

But don't forget to keep track of the actual costs.

Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service . Your expert will uncover industry-specific deductions for more tax breaks and file your taxes for you. Backed by our Full Service Guarantee . You can also file taxes on your own with TurboTax Premium . We’ll search over 500 deductions and credits so you don’t miss a thing.

Get unlimited advice, an expert final review and your maximum refund, guaranteed .

~37% of taxpayers qualify. Form 1040 + limited credits only .

Looking for more information?

Related articles, more in jobs and career.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

TaxCaster Tax Calculator

Estimate your tax refund and where you stand

I’m a TurboTax customer

I’m a new user

Tax Bracket Calculator

Easily calculate your tax rate to make smart financial decisions

Get started

W-4 Withholding Calculator

Know how much to withhold from your paycheck to get a bigger refund

Self-Employed Tax Calculator

Estimate your self-employment tax and eliminate any surprises

Crypto Calculator

Estimate capital gains, losses, and taxes for cryptocurrency sales

Self-Employed Tax Deductions Calculator

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

ItsDeductible™

See how much your charitable donations are worth

Read why our customers love Intuit TurboTax

Rated 4.5 out of 5 stars by our customers.

(116526 reviews of TurboTax Online)

Star ratings are from 2023

Your security. Built into everything we do.

File faster and easier with the free turbotax app.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible. If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Situations not covered:

- Itemized deductions claimed on Schedule A

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales (including crypto investments)

- Rental property income

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

Turbotax online guarantees.

TurboTax Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current 2023 tax year and for individual, non-business returns for the past two tax years (2022, 2021). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

TurboTax Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Audit Support Guarantee – Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your 2023 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current 2023 tax year. Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals for this question-and-answer support, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. Additional terms and limitations apply. See Terms of Service for details.

TURBOTAX ONLINE/MOBILE PRICING:

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year 2023.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form 1040 and limited credits only, as detailed in the TurboTax Free Edition disclosures. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state(s) and one (1) federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after 11:59pm EST, March 31, 2024, you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here.

- Full Service $100 Back Offer: Credit applies only to federal filing fees for TurboTax Full Service and not returns filed using other TurboTax products or returns filed by Intuit TurboTax Verified Pros. Excludes TurboTax Live Full Service Business and TurboTax Canada products . Credit does not apply to state tax filing fees or other additional services. If federal filing fees are less than $100, the remaining credit will be provided via electronic gift card. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Must file by April 10, 2024 11:59 PM ET.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

- Pays for itself (TurboTax Premium, formerly Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2022. Actual results will vary based on your tax situation.

TURBOTAX ONLINE/MOBILE:

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund up to 5 days early: Individual taxes only. When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

- For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.

- Pay for TurboTax out of your federal refund or state refund (if applicable): Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details.

- Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live Assisted or as an upgrade from another version, and available through December 31, 2024. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not limited to multiple sources of business income, large amounts of cryptocurrency transactions, taxable foreign assets and/or significant foreign investment income. Offer details subject to change at any time without notice. Intuit, in its sole discretion and at any time, may determine that certain tax topics, forms and/or situations are not included as part of TurboTax Live Full Service. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. See Terms of Service for details.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare 2023 tax returns starting January 8, 2024. Based on completion time for the majority of customers and may vary based on expert availability. The tax preparation assistant will validate the customer’s tax situation during the welcome call and review uploaded documents to assess readiness. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service -- Verified Pro -- “Local” and “In-Person”: Not all feature combinations are available for all locations. "Local" experts are defined as being located within the same state as the consumer’s zip code for virtual meetings. "Local" Pros for the purpose of in-person meetings are defined as being located within 50 miles of the consumer's zip code. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through 11/1/2024. Terms and conditions may vary and are subject to change without notice.

- My Docs features: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Easy Online Amend: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits. Make changes to your 2023 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10/31/2026. Terms and conditions may vary and are subject to change without notice. For TurboTax Live Full Service, your tax expert will amend your 2023 tax return for you through 11/15/2024. After 11/15/2024, TurboTax Live Full Service customers will be able to amend their 2023 tax return themselves using the Easy Online Amend process described above.

- #1 best-selling tax software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2023, tax year 2022. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2022.

- CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees . Limitations apply. See Terms of Service for details.

- TurboTax Premium Pricing Comparison: Cost savings based on a comparison of TurboTax product prices to average prices set forth in the 2020-2021 NSA Fees-Acct-Tax Practices Survey Report.

- 1099-K Snap and Autofill: Available in mobile app and mobile web only.

- 1099-NEC Snap and Autofill: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). Available in mobile app only. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

- Year-Round Tax Estimator: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). This product feature is only available after you finish and file in a self-employed TurboTax product.

- **Refer a Friend: Rewards good for up to 20 friends, or $500 - see official terms and conditions for more details.

- Refer your Expert (Intuit’s own experts): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details.

- Refer your Expert (TurboTax Verified Independent Pro): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 2/17/23 and may not reflect actual refund amount received.

- Average Deduction Amount: Based on the average amount of deductions/expenses found by TurboTax Self Employed customers who filed expenses on Schedule C in Tax Year 2022 and may not reflect actual deductions found.

- More self-employed deductions based on the median amount of expenses found by TurboTax Premium (formerly Self Employed) customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary.

- TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business, we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits, Entities electing to be treated as a C-Corp, Schedule C Sole proprietorship, Payroll, Sales tax, Quarterly filings, and Foreign Income. TurboTax Live Assisted Business is currently available only in AK, AZ, CA, CO, FL, GA, IL, MI, MO, NC, NV, NY, OH, PA, SD, TX, UT, VA, WA, and WY.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state software license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current 2023 tax year and, for individual, non-business returns, for the past two tax years (2021, 2022). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt.

TurboTax Desktop Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See License Agreement for details.

- Maximum Tax Savings Guarantee – Business Returns: If you get a smaller tax due (or larger business tax refund) from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Additional terms and limitations apply. See License Agreement for details.

TURBOTAX DESKTOP

- Installation Requirements: Product download, installation and activation requires an Intuit Account and internet connection. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers.

- TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details . Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity.

- Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 02/17/23 and may not reflect actual refund amount received.

- TurboTax Product Support: Customer service and product support hours and options vary by time of year.

- #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- Deduct From Your Federal or State Refund (if applicable): A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- Data Import: Imports financial data from participating companies; Requires Intuit Account. Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken (2021 and higher) and QuickBooks Desktop (2021 and higher); both Windows only. Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc., Quicken import subject to change.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Compare TurboTax products

All online tax preparation software

TurboTax online guarantees

TurboTax security and fraud protection

Tax forms included with TurboTax

TurboTax en español

TurboTax Live en español

Self-employed tax center

Tax law and stimulus updates

Tax Refund Advance

Unemployment benefits and taxes

File your own taxes

TurboTax crypto taxes

Credit Karma Money

Investment tax tips

Online software products

TurboTax login

Free Edition tax filing

Deluxe to maximize tax deductions

TurboTax self-employed & investor taxes

Free military tax filing discount

TurboTax Live tax expert products

TurboTax Live Premium

TurboTax Live Full Service Pricing

TurboTax Live Full Service Business Taxes

TurboTax Live Assisted Business Taxes

TurboTax Business Tax Online

Desktop products

TurboTax Desktop login

All Desktop products

Install TurboTax Desktop

Check order status

TurboTax Advantage

TurboTax Desktop Business for corps

Products for previous tax years

Tax tips and video homepage

Browse all tax tips

Married filing jointly vs separately

Guide to head of household

Rules for claiming dependents

File taxes with no income

About form 1099-NEC

Crypto taxes

About form 1099-K

Small business taxes

Amended tax return

Capital gains tax rate

File back taxes

Find your AGI

Help and support

TurboTax support

Where's my refund

File an IRS tax extension

Tax calculators and tools

TaxCaster tax calculator

Tax bracket calculator

Check e-file status refund tracker

W-4 tax withholding calculator

ItsDeductible donation tracker

Self-employed tax calculator

Crypto tax calculator

Capital gains tax calculator

Bonus tax calculator

Tax documents checklist

Social and customer reviews

TurboTax customer reviews

TurboTax blog

TurboTax Super Bowl commercial

TurboTax vs H&R Block reviews

TurboTax vs TaxSlayer reviews

TurboTax vs TaxAct reviews

TurboTax vs Jackson Hewitt reviews

More products from Intuit

TurboTax Canada

Accounting software

QuickBooks Payments

Professional tax software

Professional accounting software

Credit Karma credit score

More from Intuit

©1997-2024 Intuit, Inc. All rights reserved. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Security Certification of the TurboTax Online application has been performed by C-Level Security.

By accessing and using this page you agree to the Terms of Use .

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

Deducting Meals as a Business Expense

How the Rules Can Affect Your Business Taxes

:max_bytes(150000):strip_icc():format(webp)/SuzannesheadshotforTheBalance-0b592dc446d1453f8508704143c9a5a1.jpg)

- Business Meal Expense Deductions

- Deducting Meals for Employees

Meals for Employees As Fringe Benefits

- How to Take Meal Deductions

Frequently Asked Questions (FAQs)

Theresa Chiechi / The Balance

Taking your customers, vendors, or potential employees out for a meal and maybe some entertainment is a great way to build your business, and meals and entertainment for business purposes are a legitimate business tax deduction. But there are limits to what you can deduct. Entertainment costs aren't deductible, while some meal expenses are taxable to employees.

Key Takeaways

- Most meals are deductible at 50% after Dec. 31, 2022.

- Entertainment expenses are generally not deductible.

- The business owner must be present, and the meal can't be "lavish or extravagant."

- The cost of some meals provided to your employees can be taxable to them if they're considered to be fringe benefits.

What Are Business Meal Expense Deductions?

Business meals are deductible business expenses , and most meals are deductible at 50% of the cost. But entertainment expenses are not deductible as a business tax expense.

There was a temporary exception to the 50% limit on deductions for food or beverages from Jan. 1, 2021 through Dec. 31, 2022, Your business could deduct business meals at restaurants and bars at 100% during this time. The facility must have prepared and sold food or beverages to retail customers for dining in or take-out, and the business owner or an employee had to be present.

This increased deduction couldn't be taken for grocery stores and convenience stores. or at employer-operated eating facilities.

The 50% limit applies to your customers, clients, vendors, and employees, including meals that are part of business travel or at business conventions or professional meetings .

Qualifying for Meal Expense Deductions

Your business can generally deduct the cost of business meals at 50% beginning in 2023 or for tax years prior to 2021 if:

- The business owner or employee is present.

- The cost of the meal or beverages isn't "lavish or extravagant."

- The meal is with a business contact (such as a customer, employee, vendor, or consultant).

- The meal has an "ordinary and necessary" business purpose.

Entertainment is not deductible, so you can only deduct meal costs at entertainment events if the cost can be separated, like a catered meal delivered to a skybox at a sporting event and invoiced separately.

Meals Deductible at 100%

Some meal and entertainment expenses can be fully deducted. Your deduction doesn't have to be limited to 50% on these activities:

- An event to promote goodwill in the community, like sponsoring a community event (considered to be advertising or marketing)

- An event at which the proceeds go to a charitable organization (check to be sure the charity meets Internal Revenue Service (IRS) qualifications )

- The meal is an essential part of your business function, (such as if you're a restaurant critic, food blogger, or sports reporter)

Meal Expenses You Can't Deduct

You may not deduct the cost of meals for personal reasons, even while traveling . But most expenses will be considered business expenses if the trip is "primarily" business. Only those costs directly related to the business you conduct may be deductible if the trip is "primarily" personal and you conduct just minimal business.

Deducting Some Business Meals for Employees

Your business can deduct the cost of meals for employees while traveling and for meals with clients or customers at 50%, but you can take a 100% deduction for some meals provided to employees, including:

- Meals with value that you include in an employee's wages

- Meals as part of social events, such as a holiday party or an annual picnic

- Meals for employees at your location, such as your company's cafeteria or break room

Some meals you give to your employees are considered benefits, so they're taxable to the employees. You must report these benefits on their W-2 forms. Some of these meal benefits must be included in the wages of key employees or highly compensated employees (5% share owners or individuals paid more than $125,000) unless the benefits are available to all employees or a group of employees that doesn't favor the highly compensated individuals.

De Minimis Rules

You don't have to include the cost of meals to employees if these costs are small or " de minimis " in tax terminology. This would be the case with coffee and donuts provided at a meeting or an occasional meal for an employee who is working overtime. The de minimis rule also applies for employee meals at your company cafeteria if the annual revenue of the facility is equal to or greater than the costs.

Other Meals for Employees

Employees aren't taxed on the value of meals your company furnishes at your business location and for your business convenience. For example, the meal cost may not be taxable to them if you give meals at your cafeteria to employees who must be available for emergency calls.

"At your convenience" means that your business has a substantial business reason for providing the meals. A written statement in a contract or employee handbook isn't enough to establish business convenience. You may be required to give the IRS specific reasons and documentation.

How To Take Meal Expense Deductions

Taking these meal expense deductions is a three-step process:

- You must verify that these expenses are legitimate business expenses. Some of these expenses are deductible , while others may not be.

- You must have documentation to back up the deduction. You don't have to include these documents with your business tax return, but you'll need them in case of an audit .

- You must determine if you can take the full amount as a deduction or if the amounts are subject to the 50% rule. Remember that meals at restaurants, bars, and other eating establishments were temporarily deductible at 100% through 2021 and 2022.

You can determine meal costs in one of two ways:

- Using actual costs for meals

- Using a standard IRS meal allowance

You must keep receipts and track actual costs with either method.

Sole proprietors and single-member LLCs show these expenses in the Expenses section of Schedule C on line 24b.

Partnerships and multiple-member LLCs report them in the Deductions section of Form 1065, the partnership tax return.

C corporations enter them in the Deductions section of Form 1120, the corporate tax return. S corporations show these expenses in the Deductions section of Form 1120S.

You can use per diem rates for figuring travel expenses within the U.S. The General Services Administration (GSA) updates per diem rates each year. This US-GSA page provides each year's rates.

What documents do I need to prove a business meal expense?

You must have what the IRS calls " adequate evidence ." This means a receipt from the place where the meal took place. A canceled check isn't enough. Make sure the receipt includes the name and address of the establishment, the date of the meal, the number of people served, and the amount of the expense. Add the names of everyone dining with you and their relationship to your business and business purpose to the bottom of the receipt.

What if I don't have the documents to prove a meal expense?

You may need to give an oral or written statement with specific information in addition to other supporting evidence if you don't have complete records. You may also be able to get acceptable proof by sampling, with records for part of the year used to prove similar situations for other parts of the year. For example, you might not have to show every receipt for the whole year if you take a specific client to lunch every month. You may be able to prove a deduction by reconstructing your records or expenses if your records were lost or damaged in circumstances beyond your control, such as in a disaster .

What's a reasonable amount for a business meal deduction?

The IRS doesn't restrict the cost of a business meal to a specific amount, even if it's at a deluxe restaurant or a resort. But meals can't be " lavish or extravagant. " This is taken on a case-by-case basis looking at whether the meal cost is reasonable based on the facts and circumstances.

IRS. " Publication 535: Business Expenses ."

IRS. " Treasury, IRS Provide Guidance on Tax Relief for Deductions for Food or Beverages From Restaurants ."

IRS. " Publication 463 Business Travel, Gifts, and Car Expenses ."

IRS. " Publication 15-B: Employer's Tax Guide to Fringe Benefits ."

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips

The allocation of travel expenses on foreign trips is slightly different from the rules above. Round-trip transportation for foreign trips must be allocated to business and personal based on the number of business vs personal days on the trip. This is different from the “all or nothing” rule for the cost of domestic round-trip travel.

If your spouse joins you on a business trip, you usually cannot deduct any of their expenses. However, if your spouse’s trip satisfies a business purpose, then expenses must be otherwise deductible by the spouse.

Generally, for the travel costs of a spouse, dependent, or any other person to be tax-deductible, they must work for the business or be a co-owner.

Frequently Asked Questions (FAQs)

Are travel expenses tax deductible for business.

Yes, roundtrip travel is 100% tax deductible as long as the primary purpose of the trip is business. Once at your destination, expenses must be allocated between business and personal. However, all meals are deductible as long as the reason for your continued stay is business.

Can I deduct travel expenses for my employees?

Yes, you can generally deduct travel expenses for your employees as long as the expenses are ordinary and necessary, directly related to your business, and properly substantiated.

Is there a limit to the amount of travel expenses I can deduct?

Yes, there are some such as business travel on a cruise ship, where the expense is limited to $2,000 per year. Also, your expenses are limited to the non-lavish or extravagant cost of the trip, so you may want to be careful before booking a 5-star hotel.

Travel expenses are ordinary and necessary expenses you incur while you are temporarily away from home, so these expenses cannot be lavish in nature. To determine if a travel expense is deductible, it must be directly related to your trade or business.

When it comes to travel expenses, having well-organized records makes it much simpler to complete your tax return. Keep track of any records that may be used to substantiate a deduction, such as receipts, canceled checks, and other documentation.

About the Author

Find Timothy On LinkedIn

Tim Yoder, Ph.D., CPA

Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

The Business Meal Deduction: A Freelancer's Guide

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

Many freelancers and small business owners believe that, in order for a lunch to count as a "business meal", it needs to come with a white tablecloth and a French waiter serving you le plat du jour . Not true.

All types of self-employed people — not just consultants and salespeople — should be claiming business lunches. The key is to know what counts.

In this guide, we’ll cover everything you need to know about writing off meals — what to claim, what to avoid, and how to keep records.

What counts as a "business meal"?

The 2017 Tax Cuts and Jobs Act has left some folks confused about the rules of deducting business meals. The truth is, there are no new restrictions on business meals.

What got cut was client entertainment expenses — think concert tickets, or a round of golf. Meals are still tax-deductible. (50% of their cost can be deducted.)

Now that we've gotten that out of the way, let's talk about how to take that deduction. The IRS guidance on business meals notes that “the food and beverages" must be "provided to a current or potential business customer, client, consultant, or similar business contact.”

There's some ambiguity in the phrase “similar business contact”. So we'll breaking down what counts — and what doesn't.

✓ Taking a client out for lunch

This one’s obvious. If you go out for lunch with a client, work will come up in the discussion. You don’t even need to pay for the other person’s meal.

✓ Wooing a prospective client

Building and maintaining your network is critical to maintaining your business. Past coworkers and friends in similar industries could all eventually turn into prospective clients -- or introduce you to one.

You don’t need to sign contracts at the table for lunch with them to count as a business meal.

{upsell_block}

✓ Business meal with a coworker

Going out with a business colleague with the express goal of discussing business is deductible. Just make sure to keep notes of your conversation.

✓ A networking opportunity

Don't miss out on this one! It's very important to stay on top of the latest news and trends in your industry.

Meeting with other professionals to network or swap tips is a great way to grow your business. After all, most people get referrals from someone they already know! Just make sure to keep notes of your conversation.

In case of an audit , you'll want to make sure to keep some record of what was discussed. A follow-up email or notes will do.

{email_capture}

What doesn't count as a business meal?

Unfortunately, you can't deduct all the food that you consume on the job. These examples may seem like no-brainers, but they're not actually qualified deductions.

✘ Snacking while working

Rule of thumb: if eating on the job is not a requirement for employment, then it's not a deduction.

Say you’re a security guard on a 1099 contract, and you’re not supposed to leave your post all day. In that case, the snacks you buy are tax-deductible.

If you’re merely a busy professional trying to save time between meetings, consider it a personal expense.

✘ Stocking your home office with groceries

Sorry, folks. It’s very unlikely that your grocery bill is a tax deduction — even if you're outfitting a home office .

✘ Grabbing a solo lunch

Getting lunch by yourself doesn't count as a business meal, even if you hop on a call at the cafe. This includes getting a coffee while working at your local coffee shop.

Rule of thumb: If you’re alone, it’s not deductible.

{write_off_block}

Keeping records for your business meals

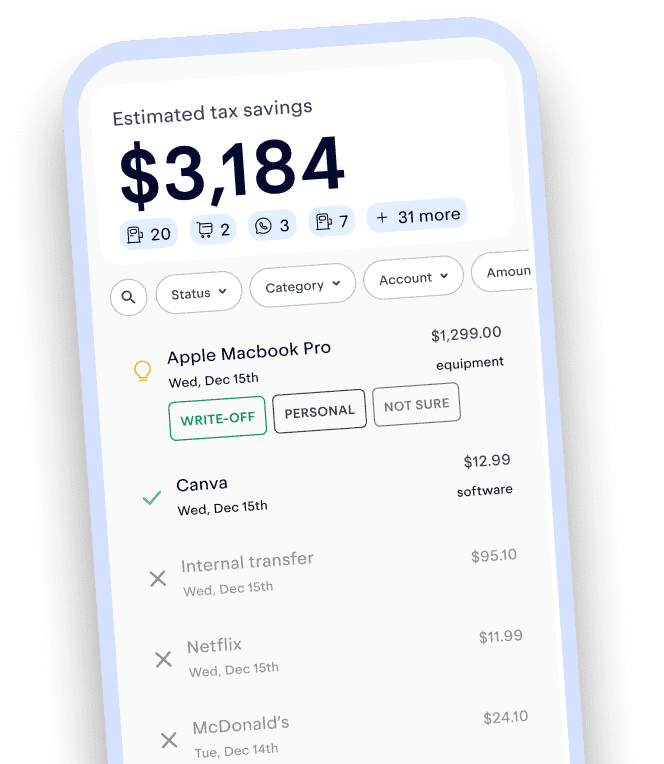

It's good to keep records of your business meals in case of audit. This is an expense category often scrutinized by the IRS, so it's best to keep notes on your business meals using a platform like Keeper .

.jpeg)

Justin W. Jones, EA, JD

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

Managing business travel expenses

Best practices for travel expense management, what exactly are business travel expenses, need to get better control of your business travel spend, what business travel expenses can employees claim.

- The actual costs of the travel (the flight, train ticket, hotel cost, etc)

- The subsistence expenditure (your food and drink consumed during the time you travel)

- Any other costs that came about because you made the journey such as entertainment.

What is not a legitimate travel expense

- Commuting to and from your usual office

- Any travel taken for private reasons.

How to manage the travel & expense process

1. decide on the employee payment method.

- Ask employees to pay them upfront using personal card/bank account/cash and then have them submit expense claims.

- Pay expenses directly from a company bank account or company card.

1. The company credit/spending card

2. pay with personal cards and submit expense claims, 2. set out a clear process for expense submission & reimbursement.

- Pre-trip expense projection - ask employees to complete a projection prior to their trip, this will force them to consider their spend.

- Receipt and invoice types - Be sure to state in what format you expect evidence to be provided (e.g. tax invoice in PDF/ physical receipt)

- Expense claim submission timeline - Ensure that expense claims are all made within 5 working days of the business trip finishing.

- Expense reimbursement period - The company commits to reimburse staff within 15- 30 days of the expense claim, during which period the company can query expenses.

3. Communicate the expense policy

- Company-wide emails every quarter - Send an email with the policy every quarter, this may not be necessary if you are a small team.

- Talk about it at all-hands meetings - Your job is important and saves the company money , and people need to know the rules. At the next meeting ask to speak for a few minutes giving examples (not naming names) of good and bad expense claims

- Post it on your company intranet - Make sure it is a live document and easily accessible. Link it to a Google doc or whatever tool you use, this means updates don’t require you to ask employees to delete or disregard previous versions,

How to calculate and track business travel expenses like a pro

1. record everything and tag each expense.

- By trip type (existing client, sales, corporate event)

- By department

- By expense type

2. Calculate every trip

- Travel cost - plane, train, car hire, this includes the petrol you put in the car

- Accommodation - Hotel, Airbnb, or wherever you stayed

- Food & drink

- Entertainment - either for clients or if permitted in policy

- Wi-Fi connections , or anything else you needed to get your business done on the road.

3. Categorize your spend

Project your travel expenses, need more tips on managing business travel, how to reduce travel expenses for small businesses, 1. do you have to stay the night, 2. get the point(s), 3. cut the taxis, 4. get corporate rates, 5. get the per diem right, 6. recover the tax, travelperk makes calculating your recoverable vat simple, 7. get cashback.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

All You Need To Know About Business Travel Meal Expenses

Home » Corporate Travel » All You Need To Know About Business Travel Meal Expenses

When planning to send an employee on a business-oriented trip or to an event for company exposure, one overlooked aspect of travel planning is business travel meal expenses. Yes, it is quite easy to forget to plan for a traveling employee’s meal allowances amongst all the other tasks like hotel bookings and flight check-ins. However it is an essential component of the overall travel. Therefore, let’s see how to plan for this important and inevitable expense of business travel.

How do we define business meal expenses?

Meal expenses can occur in many different circumstances. Travel managers should be vigilant while mentioning the expenses that will paid by the company and that which are not. They should communicate the same with the employee as well.

1. Meal allowance for business travel

When an employee has to travel for a meeting with prospective clients or with representatives of a stakeholding company, business meals will make up for an important expense. These expenses should be paid by the company or should be reimbursed if the employee is paying for it out of their pockets.

2. Dining with a client or prospect