- Travel Planning Guide

Travel Budget for Gothenburg Visit Gothenburg on a Budget or Travel in Style

- Gothenburg Costs

- Gothenburg Hotel Prices

- Best Luxury Hotels in Gothenburg

- Best Family-Friendly Hotels in Gothenburg

- Best Cheap Hotels in Gothenburg

- Best Romantic Hotels for Couples in Gothenburg

- Best Hotels for First Time Visitors in Gothenburg

- Best Hotels for One Night in Gothenburg

- Best Pet-Friendly Hotels in Gothenburg

- Best Hotels for a Weekend Getaway in Gothenburg

- Best Hotels for One Week in Gothenburg

- Is Gothenburg Expensive?

- How much does a trip to Gothenburg cost?

- Sweden Costs

- How much does it cost to travel to Gothenburg? (Average Daily Cost)

- Gothenburg trip costs: one week, two weeks, one month

Is Gothenburg expensive to visit?

- How much do I need for a trip to Gothenburg?

- Accommodation, Food, Entertainment, and Transportation Costs

- Travel Guide

How much does it cost to travel to Gothenburg?

You should plan to spend around $100 (kr1,060) per day on your vacation in Gothenburg. This is the average daily price based on the expenses of other visitors.

Past travelers have spent, on average for one day:

- $39 (kr415) on meals

- $19 (kr199) on local transportation

- $82 (kr869) on hotels

A one week trip to Gothenburg for two people costs, on average, $1,404 (kr14,834) . This includes accommodation, food, local transportation, and sightseeing.

All of these average travel prices have been collected from other travelers to help you plan your own travel budget.

- Travel Style: All Budget (Cheap) Mid-Range Luxury (High-End)

- Average Daily Cost Per person, per day $ 100 kr 1,060

- One Week Per person $ 702 kr 7,417

- 2 Weeks Per person $ 1,404 kr 14,834

- One Month Per person $ 3,008 kr 31,788

- One Week For a couple $ 1,404 kr 14,834

- 2 Weeks For a couple $ 2,807 kr 29,669

- One Month For a couple $ 6,016 kr 63,576

How much does a one week, two week, or one month trip to Gothenburg cost?

A one week trip to Gothenburg usually costs around $702 (kr7,417) for one person and $1,404 (kr14,834) for two people. This includes accommodation, food, local transportation, and sightseeing.

A two week trip to Gothenburg on average costs around $1,404 (kr14,834) for one person and $2,807 (kr29,669) for two people. This cost includes accommodation, food, local transportation, and sightseeing.

Please note, prices can vary based on your travel style, speed, and other variables. If you're traveling as a family of three or four people, the price per person often goes down because kid's tickets are cheaper and hotel rooms can be shared. If you travel slower over a longer period of time then your daily budget will also go down. Two people traveling together for one month in Gothenburg will often have a lower daily budget per person than one person traveling alone for one week.

A one month trip to Gothenburg on average costs around $3,008 (kr31,788) for one person and $6,016 (kr63,576) for two people. The more places you visit, the higher the daily price will become due to increased transportation costs.

Independent Travel

Traveling Independently to Gothenburg has many benefits including affordabilty, freedom, flexibility, and the opportunity to control your own experiences.

All of the travel costs below are based on the experiences of other independent travelers.

Prices in Gothenburg are reasonable and comparable to your average travel destination. Hotels, food, and sightseeing are generally within normal price ranges.

Within Europe, which is known to be an expensive region, Gothenburg is a reasonably affordable destination compared to other places. It is in the top 25% of cities in Europe for its affordability. You can find more affordable cities such as Novi Sad, but there are also more expensive cities, such as Avignon.

For more details, and to find out if it's within your travel budget, see Is Gothenburg Expensive?

How much money do I need for a trip to Gothenburg?

The average Gothenburg trip cost is broken down by category here for independent travelers. All of these Gothenburg travel prices are calculated from the budgets of real travelers.

Accommodation Budget in Gothenburg

Average daily costs.

Calculated from travelers like you

The average price paid for one person for accommodation in Gothenburg is $41 (kr434). For two people sharing a typical double-occupancy hotel room, the average price paid for a hotel room in Gothenburg is $82 (kr869). This cost is from the reported spending of actual travelers.

- Accommodation 1 Hotel or hostel for one person $ 41 kr 434

- Accommodation 1 Typical double-occupancy room $ 82 kr 869

Hotel Prices in Gothenburg

Looking for a hotel in Gothenburg? Prices vary by location, date, season, and the level of luxury. See below for options.

Find the best hotel for your travel style.

Actual Hotel Prices The average hotel room price in Gothenburg based on data provided by Kayak for actual hotel rooms is $90. (Prices in U.S. Dollars, before taxes & fees.)

Kayak helps you find the best prices for hotels, flights, and rental cars for destinations around the world.

Recommended Properties

- Hotel Royal Gothenburg Budget Hotel - Kayak $ 94

- Dorsia Hotel & Restaurant Luxury Hotel - Kayak $ 207

Transportation Budget in Gothenburg

The cost of a taxi ride in Gothenburg is significantly more than public transportation. On average, past travelers have spent $19 (kr199) per person, per day, on local transportation in Gothenburg.

- Transportation 1 Taxis, local buses, subway, etc. $ 19 kr 199

Recommended Services

- Umea Private Transfer from Umea city centre to Umea airport Viator $ 147

- Goteborg Landvetter Airport (GOT) to Goteborg City - Round-Trip Private Transfer Viator $ 110

Flights to Gothenburg

Rental cars in gothenburg, food budget in gothenburg.

While meal prices in Gothenburg can vary, the average cost of food in Gothenburg is $39 (kr415) per day. Based on the spending habits of previous travelers, when dining out an average meal in Gothenburg should cost around $16 (kr166) per person. Breakfast prices are usually a little cheaper than lunch or dinner. The price of food in sit-down restaurants in Gothenburg is often higher than fast food prices or street food prices.

- Food 2 Meals for one day $ 39 kr 415

Entertainment Budget in Gothenburg

Entertainment and activities in Gothenburg typically cost an average of $16 (kr168) per person, per day based on the spending of previous travelers. This includes fees paid for admission tickets to museums and attractions, day tours, and other sightseeing expenses.

- Entertainment 1 Entrance tickets, shows, etc. $ 16 kr 168

The Go City Gothenburg Pass offers great discounts on attractions in Gothenburg. With the Go City Explorer pass, you can choose to visit specific sights and attractions at a discount. Or, you can visit as many included attractions as you like with a multi-day All-Inclusive Pass. The average visitor saves 30% off of the regular admission prices.

Recommended Activities

- Bike Tour Gothenburg, Guided Bicycle Tours Viator $ 115

- Historical Walking Tour in Restaurant and Bars in Central City Viator $ 43

Alcohol Budget in Gothenburg

The average person spends about $21 (kr221) on alcoholic beverages in Gothenburg per day. The more you spend on alcohol, the more fun you might be having despite your higher budget.

- Alcohol 2 Drinks for one day $ 21 kr 221

Related Articles

Gothenburg on a budget.

Neighborhoods

Food and dining, transportation, more related articles.

We've been gathering travel costs from tens of thousands of actual travelers since 2010, and we use the data to calculate average daily travel costs for destinations around the world. We also systematically analyze the prices of hotels, hostels, and tours from travel providers such as Kayak, HostelWorld, TourRadar, Viator, and others. This combination of expenses from actual travelers, combined with pricing data from major travel companies, gives us a uniqe insight into the overall cost of travel for thousands of cities in countries around the world. You can see more here: How it Works .

Subscribe to our Newsletter

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Search for Travel Costs

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

Travel Cost Data

You are welcome to reference or display our travel costs on your website as long as you provide a link back to this page .

A Simple Link

For a basic link, you can copy and paste the HTML link code or this page's address.

Travel Cost Widget

To display all of the data, copy and paste the code below to display our travel cost widget . Make sure that you keep the link back to our website intact.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

The Cost of Traveling Sweden

Sweden is one of the most beautiful destinations in the world. I fell in love with it so much, I ended up moving there for a summer.

But it’s also one of the most expensive places to visit.

Most backpackers and budget travelers skip Sweden (and Scandinavia in general) because of its cost. If they do visit, they usually just pop into Stockholm for a couple of days before retreating to more affordable destinations.

That’s understandable but also unfortunate because Sweden has a lot to offer.

While the country is expensive, there are plenty of ways to save money and visit on a budget .

Here’s a summary of one of my trips, what I spent (as well as updated costs/prices) to help you plan your trip, and ways to save money. Because it’s definitely possible to go to Sweden without breaking the bank — you just need to get creative.

How much did I spend?

I was in Sweden for 19 days, and I spent a total of 11,357 SEK (Swedish kronor) or $1,892.83 USD — roughly $100 USD per day (the exchange rate was about 6 SEK to 1 USD; it varies and now stands around 9 or 10 to $1 USD). The numbers break down this way:

- Accommodation: 2,320 SEK

- Food: 2,289 SEK

- Alcohol: 3,072 SEK

- Transportation: 1,898 SEK

- Attractions: 100 SEK

- Phone: 549 SEK

- Miscellaneous 1,129 SEK

Total: 11,537 SEK

My spending was pretty high for one simple reason: I went out a lot. My friends in Stockholm took me out most nights, so a large portion of my budget went toward that.

When every beer you have is 54 SEK ($9 USD), even having only two or three really adds up. (I should also note that most clubs have entrance fees, so about 500 SEK of my “alcohol” budget went to that.)

Moreover, while I ate cheaply, I only cooked my own meals three times during my trip. Cooking would have lowered my costs significantly, but friends were always taking me places to eat.

Lastly, I also stayed with friends for most of my trip. Had I paid for accommodation every night, my accommodation costs would have risen a lot more.

How much do you need?

If you stick to free or cheap activities, like enjoying nature and taking free walking tours, you can keep your daily spending low without missing out.

Moreover, if you Couchsurf or camp, skip the alcohol, and cook all or most of your meals, you can lower this even further!

To help you plan your trip, here are some typical prices in Sweden:

- Hostel dorm: 250 SEK<

- Camping & national parks: Free

- Casual restaurant meal: 125–250 SEK

- Cheap restaurant meal: 75-100 SEK

- Pizza: 65-99 SEK

- Cheap hot dogs and sausages: 20-35 SEK

- Fast-food combo: 85 SEK

- Beer: 65 SEK

- Bottled water: 25 SEK<

- Stockholm transit: 38 SEK one-way, 160 SEK for a 24-hour pass, 415 SEK for a 7-day pass

- Bike rentals: 200-250 SEK per day

- Ferry to Gotland: 295 SEK (one-way)

- Stockholm-Gothenburg train: 185-330 SEK (one-way)

- Museums: 80-195 SEK

- Liseberg (theme park): 95 SEK

If you’re on a backpacker budget, you’ll need around $80 USD per day for food, accommodation, and some cheap activities. If you camp, skip the booze, or Couchsurf you can lower this quite a bit.

If you’re a mid-range traveler looking to stay in a Airbnb or hotel, eat out for most meals, go out a few times, and visit some attractions, you’ll want to budget around $175 USD per day.

Budget Tips for Sweden

But if staying with strangers or cooking isn’t your thing, here are some other ways to save money:

1. Drink beer – Alcohol isn’t cheap in Sweden, as it’s heavily taxed. However, beer is quite cheap. If you stick to beer, you can save yourself a lot of money when you go to the bars.

Additionally, you can buy your own alcohol from Systembolaget (the government-run liquor store chain), which will be much cheaper than buying drinks at the bar or club.

2. Avoid clubs – Most clubs have a cover 200 SEK (or more). Don’t waste your money!

3. Limit how often you eat out – Eating out is very expensive, especially at sit-down restaurants. If you want to eat out without spending a lot of money , stick to Thai, Middle Eastern, and pizza places.

4. Refill your water – The tap water here is some of the cleanest in the world, so bring a reusable water bottle so you can ditch the single-use plastic and save money in the process. LifeStraw is my go-to bottle, since it has a built-in filter to ensure your water is always clean and safe.

5. Book in advance – Booking trains or buses 3-4 weeks in advance can get you around 40–50% off the price. Last-minute tickets are always super expensive, so don’t leave your purchase to the last minute.

The cheapest train company is MTR, while Flixbus will have the cheapest prices for buses.

6. Buy a rail pass – If you plan to do a lot of traveling around, buy a rail pass before you get to the country. You’ll end up saving a few hundred dollars off the high cost of travel.

This can be a good alternative to booking in advance if you’re like me and plan everything at the last minute.

7. Purchase a Stockholm Card – This pass gives you access to the city’s public transportation system and free entrance to 99% of the museums and canal tours, over 60 attractions. It’s well worth the money and will definitely save you a lot more than it costs if you plan to see a lot of sites while in Stockholm . It is 669 SEK for a one-day pass or 1,569 SEK for a five-day pass (which is a much better deal).

8. Get a metro card – If you don’t plan to get the Stockholm Card, make sure you get a week’s metro pass. At 415 SEK for a week’s worth of public transportation, it’s a better deal than paying per ticket (Göteborg and Malmö also offer multiday passes)

9. Avoid taxis – Public transportation is excellent in Sweden. With a little planning, you can avoid the overpriced taxis, as they will ruin your budget in a flash.

10. Enjoy the free outdoors – Hiking and camping are free in Sweden. You can pretty much pitch a tent anywhere, thanks to the country’s Freedom to Roam laws. If you’re an avid outdoorsy person, that means you can pay virtually nothing for accommodation.

11. Stick to buffets – Lunch is the best time to eat out in Sweden. Buffets and restaurants have set meals for around 105 SEK. It’s the best deal you can find and one utilized a lot by locals. (Don’t miss Hermitage in Stockholm for a cozy, home-cooked meal!)

12. Take a free walking tour – Free Tour Stockholm runs the best walking tour in the city. It covers all the highlights and lasts around two hours, so you can see everything on a budget. Just remember to tip your guide at the end!

13. Visit the free museums – The National Museum, the History Museum, and the Medieval Museum in Stockholm are free to enter, as is the Natural History Museum in Göteborg . Many museums are also free to students and people under 20, so be sure to ask if there are discounts!

Like the rest of Scandinavia, Sweden isn’t the most budget-friendly destination. But it has so much to offer, including some of the most beautiful landscapes in Europe , that you really shouldn’t pass it up.

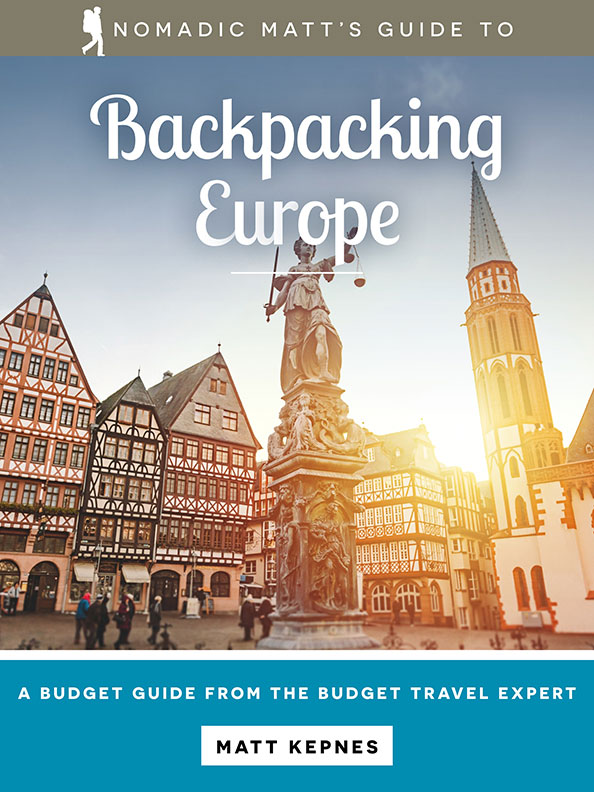

Get Your In-Depth Budget Guide to Europe!

My detailed 200+ page guidebook is made for budget travelers like you! It cuts out the fluff found in other guides and gets straight to the practical information you need to travel while in Europe. It has suggested itineraries, budgets, ways to save money, on and off the beaten path things to see and do, non-touristy restaurants, markets, bars, safety tips, and much more! Click here to learn more and get your copy today.

Book Your Trip to Sweden: Logistical Tips and Tricks

Book Your Flight Use Skyscanner to find a cheap flight. It is my favorite search engine because it searches websites and airlines around the globe, so you always know no stone is being left unturned!

Book Your Accommodation You can book your hostel with Hostelworld as it has the biggest inventory and best deals. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

If you’re looking for more places to stay, here for my favorite hostels in Stockholm .

If you’re wondering what part of town to stay in, here’s my neighborhood breakdown of Stockholm .

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it, as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- Safety Wing (for everyone below 70)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Looking for the Best Companies to Save Money With? Check out my resource page for the best companies to use when you travel. I list all the ones I use to save money when I’m on the road. They will save you money too.

Want More Information on Sweden? Be sure to visit our robust destination guide on Sweden for even more planning tips!

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

Get my best stuff sent straight to you!

Pin it on pinterest.

First-timer's guide to Gothenburg, Sweden

Nov 30, 2017 • 6 min read

The central canal (Stora Hamnkanalen) through downtown Gothenburg.

Gothenburg is Scandinavia’s largest port and sometimes lovingly referred to as Sweden’s ‘second city’. It’s best known for producing Volvos, but over the last couple of decades it has managed to reinvent itself as a modern travel destination.

Nowadays, cutting-edge design has replaced industrial grit in Gothenburg’s formerly run-down neighbourhoods. Warehouses and industrial buildings have been turned into art galleries, Michelin-starred restaurants grace the local dining scene, and independent coffee shops dot the city. Add a lively night scene and a string of peaceful islands right on its doorstep, and it’s easy to understand why Gothenburg is giving Stockholm a run for its money.

Welcome to the neighbourhood

Gothenburg is made up of a number of distinct neighbourhoods, so it helps to get your bearings early on. Its historic city centre is separated from the rest of town by a jagged moat. Vasastan is where you’ll find most of the art galleries. Gothenburg’s most important museums are found off Avenyn, the city’s main boulevard.

Trendy Magasingatan is the top spot for Swedish fashion brands, while the streets around Järntorget are filled with increasingly hip and ethnically diverse eateries. Of the city’s formerly hard-luck nooks, none have seen greater transformation than Haga, one Gothenburg’s oldest districts. Its cobbled streets are now lined with quirky shops and cafes and renovated wooden landshövdingehus houses.

Bordering Haga to the west is Linné; independent designer shops and al fresco patios are found all along Linnégatan boulevard. The adjoining ‘long streets’, such as Andra Långgatan have held onto their classic watering holes, which remain pleasantly down to earth.

Frihamnen, Gothenburg’s innermost harbour and port area, is at the forefront of the city’s rebirth. Partially derelict since 2000, it is being turned into Jubileumsparken – a new leisure park that will be a major part of Gothenburg’s 400 th anniversary in 2021. Its features will include a man-made beach, a floating pool and a spectacular sauna, designed by the award-winning architect group Raumlaborberlin.

Art and design

Stockholm gets headlines for its all-enveloping design scene, but Gothenburg is no lightweight. The city boasts a treasure trove of trendy interior design shops in a compact area in the city centre. Places like Artilleriett/Artilleriet Kitchen, Rum 21, Floramor & Krukatös and many more make for an unbeatable day of décor inspiration.

For contemporary Scandinavian art, it’s hard to beat Galleri Ferm , Galleri Thomassen and Galleri Nils Åberg . Putting a defunct power station to good use, Röda Sten art centre is the city’s top alternative art venue, staging everything from edgy Swedish photography exhibitions to live music nights. And though it’s currently closed for renovation through the fall of 2018, the Röhsska Museum is the best design and applied arts museum in Sweden.

Cutting-edge architecture is also part of Gothenburg’s appeal. Kuggen (Lindholmplatsen), resembling a red Colosseum, is a marvel of green engineering, while the distinctive red-and-white skyscraper Göteborgs-Utkiken (a.k.a. The Lipstick) towers over the harbour and offers tremendous views from the top.

City of culture

As Volvo’s home of manufacturing, Gothenburg has an enduring relationship with the car company. Visitors can both take a tour of the car factory itself and immerse themselves in all things Volvo-related at the Volvo Museum . But there is much more to the city than car culture, including several world-class museums.

Science and technology meet the rainforest at the incredible Universeum . Meanwhile, the Konstmuseum ’s art collection, spanning from the 15 th century to the present day, is one of the finest in Europe. Stadsmuseum is the only place in Sweden where you can see an original Viking longship, while Sjöfartsmuseet explores the city’s more recent maritime culture. And once you’re all museum-ed out, head to Liseberg , Sweden’s largest amusement park, to unwind.

Where to eat

Gothenburg’s dining scene is defined by the abundance of fresh fish and seafood, caught off the west coast of Sweden. Swedish oysters, seasonal smoked prawns, grilled crayfish and catch of the day dominate the menu at local institution Restaurang Gabriel inside the legendary Feskekôrka (‘fish church’) fish market.

Other good places to sample the sea’s bounty include Fiskekrogen , locally beloved for over two decades for its shellfish platters, and Strömmingsluckan, a humble food truck at Magasinsgatan 17, serving nothing but freshly grilled herring with mash and lingonberries. The creative, seasonal menu at Michelin-stared Sjömagasinet focuses heavily on seafood, as do the multi-course tasting menus of its Michelin-anointed brethren, Koka and Thörnströms kök .

Seafood aside, Gothenburg’s diverse dining scene encompasses a multitude of world cuisines, from Thai and Ethiopian to gourmet hot dogs, with numerous chefs championing Sweden’s slow food movement as well. And if you’re looking to meet local foodies, visit the splendid Saluhallen (‘The Market Hall’) with some 40 delis and restaurants.

Bring on the night

From beer halls and wine bars to nightclubs and live music, Gothenburg takes its nightlife seriously. Neither has it escaped the craft beer explosion, with some of the bars and brewpubs found along Andra and Tredje Långgatan. Haket Pub represents most of the local microbreweries, Noba Nordic Bar , branches out into Norwegian, Danish and Icelandic brews, while creaky Ölhallen 7:an (Kungstorget 7) has been serving pints since 1900.

Mexican-brothel-inspired Puta Madre ’s cocktails are as enticing as its crazy décor, while tiny Basque bar Juan Font pairs carefully selected wines with tapas. Going strong for years, Nefertiti is both a legendary jazz club and one of the city’s liveliest dance floors, while Lounge(s) has something for everyone on one of its many floors. For the underground music scene, check out illegalground.com to see what’s happening.

Island escape

If you get tired of the hustle and bustle of the city, catch tram 11 to Saltholmen boat terminal and take a boat to the southern archipelago – nine peaceful, car-free islands. Carved of granite and sparsely covered with greenery, they are ideal for long walks, bicycle rides, exploring villages and smokehouses or just sunbathing on the rocks. Brännö, Styrsö and Vrångö have guesthouses. Vrångö also has good swimming spots, as does tiny Vinga.

Practicalities

Gothenburg Airport is served by flights from numerous European cities, including London, Frankfurt, Munich, Helsinki, Amsterdam, Brussels, Copenhagen, Stockholm, Malaga, Paris, Prague and Istanbul. The city’s also reachable by train from Stockholm or Copenhagen (those rides are about three hours).

If you’re planning on doing a lot of sightseeing, it can be worth getting the Göteborg City Card, which gives you free entry to many attractions and includes bus, tram and boat travel. There’s a new Gothenburg Pass card available from 1 January 2018, though it doesn’t include public transportation.

Explore related stories

Aug 21, 2019 • 5 min read

A culturally diverse and vibrant cosmopolitan capital city, Bogotá is a fantastic starting point for any trip to Colombia. It’s a huge metropolis, so…

Jun 23, 2019 • 11 min read

Jun 18, 2019 • 3 min read

Dec 14, 2018 • 4 min read

Nov 5, 2018 • 5 min read

Apr 3, 2024 • 10 min read

Apr 3, 2024 • 15 min read

Apr 3, 2024 • 6 min read

Apr 2, 2024 • 8 min read

Book the best hotels in Gothenburg - in partnership with booking.com

Compare hotel rates in gothenburg and save up to 80%.

Hotel Vanilla

Dorsia Hotel & Restaurant

Elite Plaza Hotel

Comfort Hotel City

Scandic Europa

Hotel Flora

Gothenburg prices guide. how much does a trip to gothenburg cost the estimated travel expenses for food, public transport, attractions entrance and accommodation..

Currency in Gothenburg is Swedish Krona

If you are travelling alone to gothenburg, depending on your expectations, you will pay for an overnight stay from 52 usd (557 sek) for a hostel to 187 usd (2,000 sek) for a luxury hotel., the other daily costs you have to pay when travelling to gothenburg are:.

- Food 11 USD (114 SEK)

- Meals in restaurants 18 USD (197 SEK)

- Bottled water 1.40 USD (15 SEK)

- Local transportation 13 USD (140 SEK)

- Entrance tickets 42 USD (450 SEK)

- Alcoholic beverages 4.90 USD (52 SEK)

As you can see - a stay for a few days in Gothenburg can cost 350 USD (3,700 SEK) or 1,100 USD (12,000 SEK) , depending on whether you are a frugal tourist or you are planning to spend a luxurious holiday in Gothenburg.

How much Swedish Krona should I have for one week in Gothenburg?

If you want to spend a week in Gothenburg the cost of your stay will be:

- 817 USD (8,700 SEK) - a cheap stay for 7 days in Gothenburg

- 783 USD (8,400 SEK) - a budget travel for 7 days in Gothenburg

- 1,300 USD (14,000 SEK) for a one week of comfortable stay in Gothenburg

- 2,700 USD (30,000 SEK) for a week of luxury holidays in Gothenburg

How much money do I need per day to stay in Gothenburg?

If you are travelling alone to Gothenburg, 110 USD a day should be enough. If you choose a hotel for your stay in Gothenburg, the price will rise to 110 USD. A couple will have to pay around 200 USD for one day in Gothenburg. A family with two children should have 340 USD for one day stay in Gothenburg.

How to visit Gothenburg on a low budget? How to travel Gothenburg cheaply? How to save money while travelling in Gothenburg?

In order not to exceed reasonable expenses during a trip to Gothenburg, which we estimate at 112 USD (1,200 SEK) for a one day, you must comply with the following rules:

- Choose to stay in a hostel (52 USD (557 SEK) ) or in a cheap hotel (25 USD (273 SEK) ).

- Use public transport. The price for a one-way ticket is 3.30 USD (35 SEK) and for a monthly pass 76 USD (815 SEK) .

- Make your own breakfast and own dinner. Daily shopping cost in the shop is around 11 USD (114 SEK) in Gothenburg.

- Choose restaurants outside the city centre and close to tourist attractions. Meal in a cheap restaurant cost around 11 USD (120 SEK) in Gothenburg. McMeal at McDonalds (or equivalent meal in other fastfood restaurant) costs approximately 8.90 USD (95 SEK) .

Car-related costs are mainly fuel, road tolls and parking fees. Of course, the price depends on the purpose of the journey and energy efficiency of a vehicle.

In Gothenburg, you will pay for the fuel accordingly:

- Petrol price in Gothenburg is around: 2.00 USD (21 SEK)

- Diesel fuel price in Gothenburg is around: 1.90 USD (20 SEK)

- 1kg sausage: 20 USD (210 SEK)

- 0,5 kg bread: 2.50 USD (26 SEK)

- 10 eggs: 3.30 USD (35 SEK)

- 1kg cheese: 9.60 USD (104 SEK)

- 1 liter milk: 1.40 USD (15 SEK)

- 1 kg apples: 2.60 USD (28 SEK)

- Bottle of local beer (0,5 liter): 6.10 USD (65 SEK)

What is most famous in Gothenburg? How much does an average entrance to travel attractions in Gothenburg cost?

The most important tourist attractions in gothenburg that we recommend:, the museums worth a visit in gothenburg:, on warmer days, we recommend walking in parks in gothenburg. below is a list of the largest and most interesting parks in gothenburg. parks in gothenburg:, alcohol prices in gothenburg, gothenburg - whisky prices comparison, gothenburg - rum prices comparison, gothenburg - vodka prices comparison, gothenburg - gin prices comparison, view map of hotels and accommodation.

ProfilHotels Opera

Hotel Pigalle

Gothenburg city break: a travel guide to Sweden’s second biggest city

Gothenburg, Sweden’s second-largest city, is always an excellent idea for a city break or a long weekend. Despite having less than half a million inhabitants, there’s a variety of things to do, see and enjoy in the city. Its proximity to the sea and the numerous attractions guarantee a great escape from daily life. Therefore, in this Gothenburg city break guide , you’ll see how you can make the most out of a visit to Gothenburg for two, three, or four days.

Specifically, you’ll read the best things to do in Gothenburg (Swedish: Göteborg ) and some activities outside of town. Moreover, I’ll share the best hotels in Gothenburg and offer some budget and food tips. Last but not least, you’ll see the photos I took and a short 4K travel video. So, simply navigate through the sections of this article and find everything you need to know for your vacation.

Let’s start.

Table of Contents

*Some of the links are affiliate links. It means that if you buy something, I might earn a small commission at no additional cost to you.

Gothenburg city break: how to reach it

Located on Sweden’s west coast, Gothenburg lies at the mouth of a beautiful archipelago. Gothenburg is home to an international airport called Landvetter , and for a city its size, the airport receives quite some international traffic. Moreover, since the city has become one of the most popular destinations for city breaks in Scandinavia, Gothenburg sees an increasing number of flights on its soil.

That said, you can reach the city with direct flights from the majority of Northern European capitals like London, Berlin, or Paris. What makes the city even more attractive for a city break is that you’ll need less than two hours from Northern Europe to reach it. Here are some examples:

- A flight from London to Gothenburg takes 1 hour and 50 minutes.

- For a flight between Paris and Gothenburg, you’ll need 2 hours.

- A flight from Berlin to Gothenburg it’s just 1 hour and 25 minutes.

To find the best available flights between your hometown and Gothenburg, I recommend searching at Kiwi. Kiwi is one of the best flight aggregators comparing flights between your city and airports all around the world.

You can search for your flights on Kiwi here .

How to go from Gothenburg airport to the city

A number of private buses operate the route between Landvetter airport and downtown Gothenburg. You can pre-pay for your ticket to and from the airport, and all you have to do is present the ticket in PDF when embarking. The line is well-served, and there are 3 or 4 buses per hour during the day (but fewer at night).

You can book your bus ticket to downtown Gothenburg by heading to the Flygbussarna website . Add your dates and the nearest stop to your hotel and purchase your ticket. A one-way ticket to/from the airport currently costs 119 SEK (~12 euros).

By private transfer

If you don’t want to wait for the bus or prefer a more relaxed journey, you can also pre-book a private transfer. Your guide will pick you up at the arrivals hall and take you to your accommodation. There are a couple of drivers offering their services, and you can prebook the best private transfer here .

The best things to do in Gothenburg, Sweden

Gothenburg is a popular destination all year long. There are plenty of things to do in Gothenburg , no matter what time of the year you visit it. Of course, the summer days are long and the weather nicer, but this doesn’t mean you can’t enjoy the city during the winter or a rainy day. There are plenty of museums and indoor activities to keep you occupied any time of the year.

So, in this section, you’ll find the best things to do in Gothenburg, Sweden.

Take a Fika break

City breaks are ideal for getting a glimpse into local life. Therefore, I’ll start the list of the things to do in Gothenburg with something very local: a Fika break .

Fika in Swedish means something like “pausing the day to enjoy a coffee break with friends.” And while it might sound familiar to you, I can assure you that for the Gothenburgers, it’s important and part of their routine. In Gothenburg, you’ll find some of the most atmospheric Scandinavian cafes, and delicious sweets always accompany the coffee. Especially popular are the cinnamon buns -and in the food section, I’ll share where you can find the biggest ones you ever saw.

Fika is more than a ritual: for the locals is some sort of art and a state of mind. The word’s origin probably derives from Kafi , the word for coffee. Just invert its syllables, and you get fika . So, why not start your Gothenburg city break by immersing straight ahead into one of the most local things? Order a coffee and something sweet, and slow down.

There are loads of cafes to enjoy a fika break (you’ll read more in the following sections). However, if you’d like to learn how to do it properly, there’s a tour with a local you can join. Your guide will explain the art of fika, take you to some cafes, and offer you a tour of the city. You can check the fika tour here .

Don’t miss the Gothenburg Museum of Art

Gothenburg is home to plenty of fascinating museums. If you only have time to see one museum in Gothenburg, this should be the Museum of Art . It is assumed as one of the best museums in Scandinavia, and there’s a reason for that. It hosts many pieces of art, from internationally renowned artists but -most importantly- from Scandinavian ones. The latter is a reason by itself to visit the museum: you’ll discover fascinating artists that you never heard of before.

The museum has six floors, and each is dedicated to different eras. In my opinion, it is one of the best things to see in Gothenburg, and I wrote a separate article about it. You can read my guide to the Gothenburg Museum of Art here , and you can also read about Barbro Östlihn , an artist I discovered in the museum. If you’re an art lover, you can’t miss this museum.

Pro tip : There’s also a guided museum tour, where you’ll learn everything about the works of art. You can prebook the museum tour here .

Other museums in Gothenburg

There’s not enough time to see every museum on a Gothenburg city break. However, if you’re not that much into art, you can pick one of the following museums:

Volvo Museum . Did you know that Volvo, the iconic car company, comes from Gothenburg? There’s even a museum featuring cars and all kinds of info about Volvo. You can learn more about the Volvo Museum here .

Universeum . That’s one of the most important places in the city. Universeum is the science center of Sweden and a place for education. It has numerous halls and exhibitions, and the most impressive is an indoor (!) rainforest. Learn more about the Universeum .

Explore Haga

Haga is Gothenburg’s sweetest neighborhood. It’s the most laid-back hood in town, and people come here to relax and have a cup of coffee ( fika , anyone?). You can find some 19th-century atmosphere in Haga, and that’s not just because of the cafes. The area is full of beautiful wooden houses.

No visit to Gothenburg is complete without a stop at Haga. Established in the 17th century by Queen Christina, Haga was for years a working-class district. Although it feels gentrified nowadays, it still has lots of charm, and it’s one of the nicest walking areas in the city. Apart from the charming atmosphere, you’ll discover local shops (textiles, design, souvenirs, etc.).

If you’d like to learn more about Haga, you can book a small group tour and have a local narrate stories from the district’s past. You can book the Haga tour here .

See Gothenburg from Skansen Kronan

Skansen Kronan is the small fortress that you’ll see in Haga. You’ll have to climb dozens of steps to reach it, but the view from the top is magnificent. You can see a fantastic view of the city, and on a clear day, you can also see the archipelago. The Skansen Kronan has been in use since 1698, and its purpose was to protect the (back then) young city from a Danish invasion.

To get an idea of how Gothenburg grew throughout the centuries, Skansen Kronan was once upon a time on the city’s outskirts. Nowadays, though, you can even call its location downtown.

Gothenburg city fact : Gothenburg was founded in 1621. It’s “just” 400 years old.

Take advantage of the Gothenburg hop-on-hop-off bus

A hop-on-hop-off bus might sound ultra-touristy to some. However, the one running in Gothenburg passes several places of interest, and it’s a good alternative if you enjoy flexibility and freedom of choice. You can buy a 24-hour ticket and embark and disembark at every station.

For people on a Göteborg city break, it’s one of the easiest ways to explore the city. The 24-hour ticket costs currently 24 euros, and you can learn more about the hop-on-hop-off bus here .

Enjoy an hour with the Land & Water Amphibious bus

That’s one of the most original and fun things to do in Gothenburg . If the hop-on-off-bus is nothing for you, there’s a great alternative: an amphibious bus. This is a 10-ton bus transforming into a boat and splashing in the water! The tour lasts one hour, costs 28 euros, and here’s what to expect.

You’ll start from the Stora Teatern in downtown Gothenburg, and from there, you’ll see the statue of Poseidon, the famous Avenyn, the Liseberg amusement park, and a bunch of other attractions. The fun part, though, starts when the surface changes and the bus has to get wet. That’s when the bus transforms into a boat and enters the river. All of a sudden, you’ll be sailing on the river and have beautiful city views.

The activity is safe and fun, and a tour guide will be on board, sharing info about the city. You can book a place on the amphibious bus here .

Stroll around the Garden Society

The Garden Society is a fabulous park in downtown Gothenburg. It’s one of Europe’s best-kept 19th-century parks, and you’ll see -among other things- a Palm House dating back to 1878. During the summertime, you’ll see thousands of beautiful roses in the gardens, while the Palm House host many exotic plants.

Apart from being one of the best walks in downtown Gothenburg, you can also have a picnic with your friends (no alcohol, no dogs), and there’s also a restaurant within the Garden Society.

Feskekörka: the food-church

One of the odd things to see in Gothenburg is the Feskekörka . Don’t be fooled by its exterior: that’s not a church, even if it looks like one. The Feskekörka is an indoor fish market hosted in a building that resembles a gothic church. It dates back to 1874 and is the best place to enjoy fresh fish. You can buy fish, but there’s also a high-quality restaurant inside the Feskekörka. On a sunny day, you can grab a portion of fish or seafood and sit by the river to enjoy your meal.

Enjoy Liseberg

Liseberg is almost a synonym for Gothenburg. The famous amusement park attracts millions of visitors annually and is loved by kids and adults. The hundred-year-old Liseberg has more than 30 different rides, and it also hosts dance halls, music venues, and restaurants. Liseberg has two entrances (Örgrytevägen and Getebergsled), one of the city’s greenest areas.

As you can imagine, you can easily spend an entire day there. Therefore, visit Liseberg and enjoy either the rides or simply a walk in one of the top 10 amusement parks in the world, according to Forbes .

A day out at the Gothenburg archipelago

Enjoying a day out at the Gothenburg archipelago is probably one of the top things to do. However, since this is a full-day excursion, it’s better to do it if you have at least two full days in the city. Otherwise, you might miss pretty much everything mentioned above.

The Gothenburg archipelago features two subcomplexes of islands, the southern and the northern. They are equally beautiful, and you should see as much as possible. Apart from their geographic position, there’s also something more separating them. The Southern Islands are car-free, while the Northern Islands have more inhabitants and you can even bring your car.

Ferries to the Gothenburg archipelago depart from various places in town, and the biggest hubs are Stenpiren and Saltholmen. You can find a map with the routes to the archipelago here .

Where to stay in Gothenburg for a perfect city break

New hotels open up constantly in the city, and since Gothenburg is famous among interior design lovers, you can expect an eclectic mix of accommodations. However, not everything is about top-notch Scandinavian design. On the contrary, some of the city’s most charming hotels are old-fashioned.

Most of the hotels lie around the central train station. You’ll find plenty of four-star hotels (and some 5 stars too) in this area, which is the city’s heart. Another excellent and relatively quieter area for your Gothenburg accommodation is close to Liseberg, the Museum of Contemporary Art, and the famous Avenyn street. This is one of the most traditional areas of downtown Gothenburg, and while you’ll be a twenty-minute walk from the center, you will find lots of charm here.

Finally, as you read earlier on the best things to do in Gothenburg, Haga is probably the most beloved area for travelers. However, the charming neighborhood is preserved by its residents, and you won’t find any hotels in Haga.

Please keep in mind that prices depend on the season: most hotels will cost 50% less if you visit off-season. On the other hand, visiting Gothenburg during the summertime means that everything will be significantly pricier.

So, below you’ll find the best hotels for your Gothenburg city break.

The best hotels in Gothenburg around the train station (city center)

Hotel Royal . That’s hands down one of the most charming hotels in Sweden. I chose Hotel Royal for my Gothenburg city break, so I added it first to this list. Located just a 5-minute walk from Gothenburg Central Train Station, Hotel Royal is an exceptional hotel. Housed in a building dating back to 1852, the hotel has old-fashioned rooms with a charming atmosphere. Moreover, there’s complimentary tea, coffee, and sweets all day long. Book your room at Hotel Royal here .

* Bonus : I wrote an extensive review about the Hotel Royal Gothenburg here .

Dorsia Hotel . That’s one more excellent option for your stay at Gothenburg. Dorsia Hotel is located close to the Central Station and just steps away from the Kungsportsplatsen Tram Stop (where the airport bus also stops). Apart from the luxurious decor and the comfy beds, there’s also a restaurant at Dorsia serving high-quality French cuisine. Book your room at Dorsia Hotel .

Radisson Blu Göteborg . Finally, for lovers of timeless Scandinavian design and luxury, you also have the opportunity to stay at a Radisson. The Radisson Blu Hotel is just a few meters away from the Central Station (and close to Hotel Royal), and apart from the beautiful rooms, it also offers a spa and yoga studio. Access to the gym is free, and some rooms have a Nespresso coffee machine. Last but not least, you’ll find the elegant Atrium restaurant on the ground floor. Book your room at Radisson Blu .

The best hotels in Gothenburg close to Liseberg

Gothia Towers . Located straight opposite the famous Liseberg amusement park and featuring a 23rd-floor bar, Gothia Towers is one of the top Gothenburg accommodations. The rooms are spacious and clean, and you’ll enjoy breathtaking views. Book your room at Gothia Towers .

Hotel Lorensberg . That’s a great family run with cozy rooms and many original paintings on the walls. The hotel also has a sauna and a beautiful garden. If you’re an art lover, that’s the place to stay. See more about Hotel Lorensberg .

Hotell Onyxen . This hotel is situated in a 19th-century building and offers free WiFi and complimentary tea and coffee all day long. Book your room at Hotell Onyxen .

Elite Park Avenue Hotel . This hotel offers typical Swedish rooms on Gothenburg’s main street, Avenyn. It also has a sauna and a popular restaurant. Book your room at Elite Park Avenue Hotel .

The best hotel close to Haga

Göteborgs Mini Hotel . Located in the nearby cozy hood of Majorna, that’s the closest to Haga you can stay right now. That’s a relatively simple hotel, and there’s no en-suite bathroom in the rooms. However, the Mini Hotel is significantly cheaper than other downtown hotels, and if you are after an affordable option, it’s a real bargain. See Göteborgs Mini Hotel .

Please use the interactive map below for all other accommodation options in Gothenburg, Sweden.

How to get around Gothenburg

Gothenburg is a compact city, and you can walk its downtown area in one day. There’s no subway in Gothenburg, but you have two excellent ways to explore everything that Gothenburg has to offer.

Gothenburg by tram

The easiest way around the town is by using the trams. The tram lines are busy throughout the day, and they’ll bring you everywhere in the city. The blue and white trams of Gothenburg are (as you might expect in Scandinavia) very accurate. You can find their routes here , and the ticket costs 35 SEK (approx. 3,5 euros)

Of course, since you’ll be on a Gothenburg city break, you can also consider buying a multi-day ticket for public transport. You won’t probably need anything more than an A-Zone Ticket (there are also AB and ABC tickets). The A-Zone Gothenburg ticket currently costs 115 SEK for one day (approx. 11,5 euros), and for three days (72 hours), it costs 230 SEK (approximately 23 euros).

Gothenburg by bike

Gothenburg is a paradise for cycling. Featuring hundreds of kilometers of bikeways, the city is a dream to cycle around. You can explore downtown Gothenburg by bike, but you can also cycle outside of town. If you’re into cycling, don’t miss the chance to rent a bike and explore the city and -why not- even the region.

There are multiple bike rentals around the town, but you can use a bike-sharing app if you don’t want to deal with expensive rentals. The best option is by NextBike , operated under Styr & Ställ in Sweden. You can pick up a bike from any of the stations around the city and pay as you go. The charge is 20 SEK every thirty minutes (2 euros), but you can’t spend more than 300 SEK per day (30 euros). Therefore, even if you keep the bike for 10 or even 15 hours within the same day, you won’t pay more than 30 euros.

Last but not least, you can leave your bike in the city center wherever you want; therefore, you don’t have to bring it back to the station where you picked it up. However, leaving a bike outside the city center is costly and comes with a surcharge.

Where to eat in Gothenburg

It’s not a surprise that there are plenty of restaurants in Gothenburg. After all, that’s Sweden’s second-biggest city, and your options are countless, spanning between local joints and fancy restaurants. Traditional Swedish cuisine is delicious, and you can also taste various fish dishes. In the shortlist below, you’ll see the places I enjoyed eating in Gothenburg.

Every link in this section will forward you to the restaurant’s location on Google Maps. Therefore, you can bookmark these places and create your Gothenburg city break food itinerary.

Fiskbar 17 . This tiny restaurant doesn’t accept reservations, but it has some of the most delicious fish you can taste in town. Located at the famous Magasinsgatan, Fiskbar 17 is a joint that serves street food-like fish. I enjoyed eating here twice. Ask for the day’s fish -together with a glass of wine, it will cost approx. 35 euros. See Fiskbar 17 on the map .

Atrium (at Radisson) . The Radisson Blu Hotel hosts one of the nicest restaurants in Gothenburg. The interior is spacious, and the food is fantastic. The prices are steep, but the dinner is a culinary experience. A starter, a main course, and a dessert will cost approx. 60 euros together with a drink. See Atrium on the map .

Sjöbaren Haga . On the main street of the beautiful hood, called Haga Nygata, Sjöbaren is the place to eat fish and seafood on this side of town. The prices are between Fiskbar and Atrium, but the food is equally delicious. See Sjöbaren .

2112 . That’s the place to eat burgers in downtown Gothenburg. 2112 has a variety of burgers and offers vegan and vegetarian options too. A burger and a drink will cost you about 25-30 euros. See 2112 .

Da Matteo . That’s one of the most famous coffee places in Gothenburg. It has multiple locations around the city, but the nicest is the one at Victoriapassagen. See Da Matteo here .

Kafe Magasinet . Look no further if you’re searching for the most Instagrammable cafe in Gothenburg. Kafe Magasinet is more than a cafe: it’ll remind you of an old but stylish warehouse; it has lots of plants and serves fantastic coffee and snacks. Hands down one of the best places in the city. See Kafe Magasinet on the map .

Cafe Husaren . Last but not least, Cafe Husaren is a typical fika-place. That’s also where you’ll find the biggest cinnamon buns in the city. Don’t miss it, especially on a sunny day: it’ll have tables and chairs on the street, and you can observe Haga’s life to its fullest. See Cafe Husaren .

How to budget for a relaxed Gothenburg city break

It’s not a surprise that Gothenburg is not the cheapest city break destination in Europe. After all, Scandinavia is Europe’s more expensive region. However, compared to other neighboring cities, Gothenburg feels slightly cheaper. So, let’s break down the costs for a wonderful Gothenburg city break.

Flights . Everything goes here, and it mainly depends on how early you book. You can find very cheap flights if you book in advance: it’s actually not uncommon to find EasyJet or Ryanair itineraries for 50 euros return. So, book your flights in advance to secure a fair price.

Hotels . The hotels in Scandinavia are beautiful but also pricey. Your accommodation (together with the food) will be your main expense during your Gothenburg long weekend or city break. Staying in downtown Gothenburg is, of course, a must if you want to see as much as possible. For a double room in the city center expect to pay anything from 100 euros and up. Even in this price range, the hotels are just a few. The majority of hotels are much pricier.

Food . The food is relatively expensive in Gothenburg. Even if you go for a fast food option, you won’t be able to get food at a very low price. On the other hand, eating in a restaurant -a main dish and a drink- will cost you approximately 30-35 euros. Obviously, if you choose to have a starter and/or a dessert, receiving a 50-60 euros bill shouldn’t surprise you.

Other expenses . Museum entrances, public transportation tickets, or a Gothenburg archipelago excursion won’t be unaffordable. Therefore, for your other expenses, you should calculate European capital standards.

So, how much should I calculate per day for my Gothenburg city break?

Long story short, here’s what I’d calculate on a daily basis for an off-season city break to Gothenburg (and what I also paid).

A double room that costs 100 euros means 50 euros per person per day for two people. For a light lunch and a dinner, it’s logical to spend 50 euros per person. For all other expenses, you should calculate approximately 40 euros per day. This includes a bottle of water, a museum ticket, a rented bike for an hour, a coffee, and a random Swedish souvenir.

Therefore, a solo traveler to Gothenburg should calculate approximately 180-200 euros per day, including accommodation, food, tickets, etc. Subsequently, if you are two people traveling and sharing a room, it’ll be slightly cheaper: calculate approximately 140 euros per person per day.

Finally, if you travel during the high season, I’d say that calculating 50 euros more per day per person sounds reasonable.

Bonus Gothenburg tip: how to quickly convert Swedish krona (SEK) to USD or EUR.

Sweden’s currency is the Swedish krona (SEK). The following tip helped me convert the prices quickly. However, this is just an approximation, and it’s not totally accurate. But, if you don’t want to have constantly a calculator in hand, that’s the quickest way.

So here’s the conversation tip: whenever you see a price in SEK, all you have to do is add a decimal point before the last digit . That said, if something costs, for example, 60 SEK will be close to 6.0 euros or 6.0 USD. Of course, that’s an approximation. The exact cost will be 5,81 EUR or 6,43 USD for the record. But at least you won’t need a calculator every time you see a price.

When it’s the best time to have a city break in Gothenburg?

The winters in Scandinavia tend to be cold and snowy, while in the summertime, the days are long, and the weather is most of the time warm. On the other hand, visiting Gothenburg in winter or early spring will be significantly cheaper than in summer.

Apart from the budget issue, there are also great timeslots throughout the year. For example, Gothenburg hosts several festivals, so you can check if they fit your schedule. Attending a festival would be a great addition to your city break.

Some festival and their dates to keep in mind:

- The International Film Festival . It usually takes place in late January.

- Summerburst music Festival . It takes place in June, at Ullevi Stadium.

Long story short: if Scandinavian prices scare you, visit Gothenburg off-season. On the other hand, if you can afford the cost, visit during the summer and enjoy the long, warm days.

Gothenburg city break: final thoughts

Gothenburg is one of the liveliest and more beautiful cities in Scandinavia. After being overlooked for years, the city started receiving the attention it deserves. There are plenty of things to see and enjoy in Gothenburg, and immersing in the local lifestyle will give you peace of mind. Add the delicious food and the proximity to the sea, and you’ll have a perfect getaway. Spending three or four days in Gothenburg will refill your batteries and show you an aspect of local life.

Enjoy Gothenburg, and don’t forget the fika breaks.

More about Gothenburg: My Göteborg travelogue , The Göteborg Museum of Art

Pin it for later

Sharing is caring. Share this Gothenburg travel guide with your friends on Social Media.

Last Updated on July 23, 2022 by George Pavlopoulos

- More Options

- Share on LinkedIn

- Reddit this!

- Save in Pocket

- Save on Flipboard

- Share on Tumblr!

- Share via Telegram

- Share via WhatsApp

- Send via Viber

Related Posts

Things to do in murano: discover venice’s glass island, things to do in burano: a guide to the lace island of venice, things to do in lido, venice: a travel guide, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Privacy Overview

Cost of living and prices in Gothenburg, prices of food, rent, shopping, etc. 🇸🇪 Updated Jul 2023

Gothenburg is a city located in Northern Europe, specifically in Sweden. It's known for being a port city situated at an elevation of 10 meters above sea level. With a population of over 600,000 people, it's one of the largest cities in Sweden and the region as a whole. Gothenburg is located at 57.70887 latitude and 11.97456 longitude.

As far as the cost of living is concerned, Gothenburg is generally considered to be affordable in comparison to other major European cities. However, prices can be quite high for certain things such as alcohol, dining out, and certain types of imported goods. Fortunately, wages in Sweden tend to be high as well, so many residents find that they are able to comfortably afford the cost of living in Gothenburg.

One of the biggest expenses in Gothenburg is housing, which can be quite pricey especially in certain areas of the city. However, there are also many options for affordable housing, including student housing and communal living arrangements. Transportation is also generally affordable, and the city is known for having an excellent public transportation system. With its high quality of life and affordable cost of living, it's no wonder that Gothenburg is such a popular destination for expats, students, and professionals from around the world.

Cost of Living Estimate in Gothenburg

Total cost of living in Gothenburg for two person with average consumption for one month will be 1683.96 USD , no rent price included. Click here to calculate cost-of-living estimate in Gothenburg

You can calculate cost of living in Gothenburg by changing quantity using input near each good or service. Resulting total will appear in a floating box in the bottom of your screen.

Restaurants prices

If you're traveling to Gothenburg, you'll be pleased to know that the restaurant scene here is diverse and exciting. Whether you're a foodie seeking a fine dining experience or simply looking for a delicious casual meal, there's something for everyone. The city has an abundance of restaurants that serve international cuisines, such as Indian, Italian, Thai, and Mexican, as well as traditional Swedish cuisine. You can easily find vegan and vegetarian options as well. Many restaurants have stunning waterfront views. For those who want to grab a quick bite or enjoy a picnic-style meal, there are food trucks and street vendors all over town.

A popular attraction that many tourists enjoy is a visit to the fish market at Feskekôrka. Here, you'll be able to try some of the finest seafood in Sweden. The market has a variety of vendors that sell everything from lobster and crab to salmon and herring. You can also find a few small restaurants and cafes that offer seafood dishes. Gothenburg has a long history of fishing, and the industry is still thriving today. Eating at the fish market is an experience that's sure to please seafood lovers.

Markets prices

If you're planning a trip to Gothenburg, Sweden, you might be wondering about the market prices in this bustling city. While prices can vary depending on the specific goods or services you're looking for, in general, Gothenburg is known for being a bit pricier than some other popular tourist destinations in Europe. However, it's also a city that's full of unique and high-quality offerings, from delicious seafood to locally-made crafts and souvenirs. So if you're willing to spend a bit more to experience the best of what Gothenburg has to offer, you won't be disappointed!

One thing to keep in mind when it comes to market prices in Gothenburg is that the city is home to a strong economy and a high standard of living. This means that goods and services tend to be priced higher than they might be in other parts of the world, but that you'll also find a wide range of high-quality and innovative offerings. Additionally, the Swedish krona is used as the local currency, which can be a bit confusing if you're used to Euros or other currencies. However, most businesses in Gothenburg will accept credit cards or offer currency exchange services, so you shouldn't have any trouble paying for your purchases while you're exploring this beautiful city.

Transportation prices

Gothenburg, Sweden is a beautiful and vibrant city that offers a variety of transportation options for visitors to explore and enjoy. One of the most popular forms of transportation in Gothenburg is the tram system, which provides easy access to many of the city's top tourist attractions, including the famous Liseberg Amusement Park. The trams are convenient, easy to use, and offer a great way to see the city while traveling between destinations. Visitors can purchase tickets at machines located at the tram stops or through a mobile app, making it a hassle-free option to explore the city.

For those who prefer a more active mode of transportation, Gothenburg also offers a bike-share program that allows visitors to rent bikes and travel around the city at their own pace. The bikes are stationed throughout the city and can easily be rented using an app on your phone. Gothenburg is a bike-friendly city, with dedicated bike lanes and scenic paths that offer a unique perspective of the city. This transportation option is perfect for visitors who prefer to explore the city on their own, while getting some exercise in the process.

Utilities Per Month prices

When it comes to utilities cost in Gothenburg, visitors may find it slightly higher than what they might be used to in their home country. This includes costs such as electricity, water, and heating. However, it's important to note that the quality of the services provided is exceptional. The tap water in Gothenburg is some of the cleanest in the world, and the heating systems are highly efficient. Visitors may also find that many accommodations will include these utility costs within the rental fee, so it's worth checking beforehand to avoid any surprises.

Another important utility cost to consider while visiting Gothenburg is transportation. While the city has an excellent public transportation system, visitors may find it more expensive than they expected. However, there are several options for discounted travel, such as the Gothenburg Pass, which includes free travel on buses, trams, and boats, as well as discounts on attractions and tours. Overall, while utilities costs may be higher in Gothenburg than other places, visitors can rest assured that they are getting high-quality services and can find ways to save money on transportation costs.

Sports And Leisure prices

Gothenburg, Sweden is the perfect destination for sports enthusiasts and lovers of leisurely activities. The city has an abundance of outdoor spaces, including parks, beaches, and nature reserves, ideal for those looking to get active. With 65 km of jogging and bicycle paths, visitors can explore the city on foot or by bike. If you are a water lover, Gothenburg's many canals and harbors provide an opportunity to kayak or paddleboard.

If you prefer watching sports, Gothenburg provides you with plenty of options. Football is by far the most popular sport in the city, with two top-flight clubs battling for supremacy. Hockey and baseball fans will also find facilities that host games throughout the year. Gothenburg is also home to various sports events, including the Gothia Cup, the world's most significant youth football tournament, attracting over 1,700 teams from around the world. Whatever your sporting preference, Gothenburg has plenty to offer, from taking part in games to cheering for your favorite teams.

Salaries And Financing prices

Gothenburg, Sweden is known for its high salaries and strong economy, making it an attractive destination for job seekers and entrepreneurs alike. With a thriving tech and startup scene, the city offers plenty of opportunities for those looking to build their careers or start their own businesses. Financing options are also readily available, with a range of funding programs and venture capital firms supporting entrepreneurs in the region.

For travelers, the high salaries in Gothenburg mean that there is a wide range of high-quality services and amenities available. From luxury hotels to fine dining restaurants, visitors can expect to find top-notch experiences throughout the city. This also means that there are plenty of opportunities to indulge in the local culture and lifestyle, whether that means exploring the city's museums and galleries or enjoying the nightlife scene. Overall, Gothenburg's strong financial standing creates a vibrant and dynamic environment that visitors are sure to enjoy.

Childcare prices

Childcare prices in Gothenburg, Sweden are among the highest in the world. This is particularly true when it comes to schools and kindergartens. Families with young children can expect to pay a significant amount of money each month to ensure that their children are cared for properly. Many families are finding it difficult to afford these costs, which has led to a growing debate over the state of childcare in Gothenburg and Sweden as a whole.

Despite the high prices of childcare in Gothenburg, there is a strong basis of support for families with young children. Many kindergartens and schools offer high-quality care and education, ensuring that children get the best possible start in life. However, the high costs of these services are leading some families to consider alternative options such as staying at home to care for their children or relying on family members for support. Ultimately, childcare prices in Gothenburg are likely to remain a significant challenge for parents and policymakers alike.

Clothing And Shoes prices

Gothenburg, Sweden is a fashion-forward city with a wide range of options for clothing and shoes. Whether you're looking for high-end designer brands or affordable fashion, you're bound to find something that suits your taste and budget. From trendy boutiques to department stores, Gothenburg is a shopping paradise where you can find unique styles and one-of-a-kind pieces. In addition to the many shopping districts throughout the city, Gothenburg also offers a variety of flea markets and second-hand stores where you can score some great deals on vintage clothing and accessories.

If you're looking for the latest trends in clothing and shoes, Gothenburg has plenty of options. Some of the most popular places to shop include Nordstan, the largest shopping center in the city, and Magasinsgatan, a trendy street filled with independent boutiques and cafes. For high-end designer brands, head to Kungsgatan or Avenyn, where you'll find luxury retailers like Louis Vuitton and Prada. If you're on a budget, don't worry - Gothenburg also has plenty of affordable options, including popular fast-fashion chains like H&M and Zara. No matter your style or budget, there's something for everyone in Gothenburg's lively fashion scene.

Rent Per Month prices

If you're planning a visit to Gothenburg, Sweden, there are plenty of options for short-term rentals and stays. From cozy apartments to stylish hotels, you'll find a range of accommodations that suit your budget and preferences. Short-term rentals can be a great option for those who want more space and privacy, while hotels offer convenience and luxury. Whichever option you choose, you'll find plenty of great deals and discounts during off-seasons and holiday periods.

When it comes to prices, there are plenty of great options for budget-conscious travelers in Gothenburg. You can find small apartments or rooms for rent at affordable prices, especially if you're willing to stay a bit further from the city center. If you're looking for something more luxurious, there are plenty of high-end hotels and apartments that offer top-notch amenities and services. Whether you're looking for a cozy, value-packed stay or a luxurious retreat, Gothenburg has something for everyone.

Buy Apartment prices

If you're interested in purchasing real estate in Gothenburg, Sweden, you have a number of options to choose from. There are a variety of properties available, from apartments and townhouses to large villas and estates. Additionally, you can find homes in different neighborhoods throughout the city, each with its own unique character and charm.

The cost of purchasing real estate in Gothenburg can vary depending on a number of factors, including the location of the property, its size and amenities, and the overall state of the local real estate market. Regardless of your budget, however, it's likely that you'll be able to find a home that meets your needs and preferences in this vibrant and dynamic city.

Cost of living in the cities nearby

- Borås, Sweden

- Trollhättan, Sweden

- Varberg, Sweden

- Uddevalla, Sweden

- Smögen, Sweden

- Frederikshavn, Denmark

- Skara, Sweden

- Hjørring, Denmark

- Halmstad, Sweden

- Jönköping, Sweden

Change language

Change currency.

The Outdoor Lovers' Guide To Beautiful Places

- Work With Katiesaway

- Destinations

Europe , Gothenburg , Sweden · July 3, 2022

A Weekend in Gothenburg – The Ultimate 2 to 4 Day Itinerary

Gothenburg is the perfect city for a weekend escape, with a lot of great things to see and do cosy cafes for fika, and a beautiful archipelago. If you are visiting Gothenburg for the first time, or a return visitor, there is always something new to enjoy. Having lived in Gothenburg for 2 years, I have put together this 2 to 4 day itinerary for all my friends and family who come to visit it really shows the best for the city! The first two days are set with activities and different areas to explore, while day 3 and 4 of this Gothenburg itinerary are optional! This is the perfect opportunity to take a day trip from Gothenburg and explore the west coast or head into the archipelago. So, without further ado, here is the perfect itinerary for a weekend in Gothenburg.

Please note that this post contains affiliate links meaning that if you make a purchase through the link, I receive a small commission at no additional cost to you. I make sure to only ever promote products and brands I have used and like, and that all links are to trusted websites.

About Gothenburg

Gothenburg is Sweden ’s second-largest city. It is located on the South-West Coast of Sweden, with a large archipelago , filled with inhabited fishing villages and lovely swimming spots! In the summer, Gothenburg is a paradise for exploring the islands and getting a taste of the magic of Swedish summer. In the winter, you will find lots of super cosy cafes and Christmas markets to explore!

How to travel around Gothenburg

Gothenburg is a city with a great infrastructure. The city is easy to reach, with a private airport bus which takes you directly from Göteborg Landvetter Airport to Nils Eriksson Bus Terminal by Gothenburg Central Station. Alternatively, there are bus and train connections to most major cities, including Stockholm , Malmö, Copenhagen and Oslo.

While in Gothenburg, you can travel around using buses and trams. These run regularly and cover the entire city. You can buy this ticket from Västtrafik , either through the app or by purchasing a physical travel card. The app is the easiest and most cost-effective way to travel. You can either buy individual tickets or a day ticket. The day ticket is definitely worth it if you plan to take several trips. The individual tickets for inner-city travel (zone A) last 90 minutes and cost 35kr. This allows you to travel unlimited journeys within the city for 1 hour and a half.

A Weekend in Gothenburg – 2, 3 or 4 Day Itinerary

Gothenburg itinerary: day 1.

This guide to Gothenburg doesn’t include breakfast or brunch ideas as this is often included in most hotels! But if you want to eat out in the morning then make sure to read this post for Gothenburg’s best brunch spots !

Trädgårdsföreningen and Palmhuset

Start the day with a walk through Trädgårdsföreningen. This is the Central Park of Gothenburg, a popular spot for a summer picnic, or a short walk through the winding pathways behind the cafe. Make sure to stop at Palmhuset for a wander around the tropical palms.

Lunch in Saluhallen

Saluhallen is the biggest food hall in Gothenburg, filled with delis, speciality cheese shops, fishmongers, boutiques cafes and bakeries. There is a great restaurant on the second floor called Kajutan. They serve traditional Swedish food with a bit of a twist, and it is a great experience to sit and watch the market below.

Saluhallen is closed on Sundays so make sure to visit on another day!

Kungsparken

Following Saluhall take a walk along the canal through Kungsparken. This is one of the best spots to hang out in the summer. Make sure to stop at Gelateria Göteborg for ice cream on the way past.

Magasinsgatan

Magasinsgatan is a long road that connects the two canals, lined with shops and cafes. The most popular spot on Magasinsgatan is the courtyard where you will find Da Matteo, probably the most popular Gothenburg coffee roasters and cafe. Here there are two cafes, Magasinsgatan, a great place to study with the coffee roasters on the upper level, and Vallgatan, a smaller, cosier cafe. In the summer you can sit outside and enjoy a coffee with a bao bun from Jinx Food Truck (the best in the city!)

Nearby are the restaurants Hello Monkey, Fiskebar 17, and Tavolo, three of Gothenburg’s best eateries! Make sure to visit Grandpa’s or Artilleriet if you fancy a bit of shopping, or head round to HUMANA Second Hand for one of Gothenburg’s best second-hand shops! Round the corner, you will find Floramor och Krukatös, an incredibly picturesque flower shop with an entrance to Da Matteo Magasinsgatan through the courtyard.

Make sure to read these posts if you want to know more about Gothenburg’s best fika places , the best restaurants , or the best second-hand shops in the city !

Fiskekyrkan

Fiskekyrkan is Gothenburg’s fish market, where fishermen bring their catch of the day to sell at the fish counters. Here you will also find some great prepped food perfect to take on a little day trip from Gothenburg, and two restaurants with great Swedish fish dishes.

Make sure to add a visit to Haga to your itinerary during your three days in Gothenburg! This is one of the oldest parts of Gothenburg and is known for its cosy cafes and boutiques.

Haga is where you will find Cafe Husaren, serving the famous giant cinnamon buns. Make sure to visit early if you want a fresh one as they often sell out fast!

If you’re not a fan of cinnamon buns you will still find some of the best Swedish fika in Gothenburg on this street – make sure to try a Chokladboll or Dammsugare if you want something really traditional!

Skansen Kronan

Skansen Kronan is one of the two towers built to defend Gothenburg from invasion back in the 17th century. Today it is more of a museum and function centre located on top of a hill that looks out over Haga. The view here is one of the best in Gothenburg, especially at sunset! Make sure to stop off at the cosy little Waffle Cafe on one side of the tower!

There are a lot of great places for dinner in this area of Gothenburg! You can find all my recommendations in this post on Gothenburg’s best restaurants.

For now, I will mention Taco’s and Tequila, a really lovely taco restaurant located on Tredje Långgatan. This is a personal favourite and somewhere we visit regularly! Make sure to try the surf and turf taco and their frozen margaritas! If you are eating early, it’s always nice to sit out in the courtyard with a drink from Cafe Magasinet before heading in for dinner! Another great taco restaurant is Mucho Macho located on Övrehusargatan. Here they have great drinks and it is possible to book.

If you are on a budget then one of the best restaurants for dinner is Benne Pasta! Here they serve delicious fresh pasta and have a good selection of sauces! The dishes range from 50-100kr each and are really tasty!

Find the rest of my Gothenburg restaurant recommendations here!

Gothenburg Itinerary: Day 2