You are using an outdated browser. Please upgrade your browser to improve your experience.

The nuts and bolts of hybrid working: Expenses and compensation

Lucie Mitchell explores the ins and outs of hybrid and remote working, from travel expenses to other costs.

- Vote

- You already voted!

The pandemic has led to huge increases in the numbers of remote and hybrid workers and the trend looks set to continue. A 2021 report by McKinsey revealed that nine out of 10 executives plan to embrace hybrid working post-pandemic.

Yet with many people continuing to work remotely – and possibly living far away from the office – employers must now consider whether their approach to employee compensation and expenses needs to change.

“Expense costs for hybrid workers might include things like travel to attend the workplace or other sites, telephone, broadband, heating and lighting costs and any increased insurance premiums,” comments Anna Schiavetta, employment law solicitor at Howarths.

“So, employers need to consider what expenses they are willing to reimburse, if any. They may choose to contribute a specific sum towards an employee’s homeworking expenses or reimburse actual reasonable expenses incurred. Alternatively, they might decide not to provide a contribution or make any reimbursement at all.”

Make it clear

Whatever employers decide, it’s vital they create or update their hybrid working policies to ensure the rules for claiming expenses and business travel are set out clearly. When developing these policies, there are a number of key ramifications for employers to consider, such as whether employees need to have a designated office as their base, even if they spend the majority of their time working remotely; and how this may impact expense claims when either travelling to the office; or travelling for work when starting from home and not their designated workplace.

“To be legally compliant, employers are required to specify the employee’s place of work in their contract of employment,” advises Schiavetta. “Whether it’s the employer’s address the employee’s home address, or even both, employees need to have a specific place of work, so this must be considered when implementing home or hybrid working.”

Kate Palmer, HR advice and consultancy director at Peninsula, adds that employees who work from home but have to travel as part of their duties and responsibilities, for example, to visit a client, should be expensed from their first location – home – to their work-required destination.

“That being said, where hybrid workers spend part of their time at home and part in the workplace, travel to and from each is unlikely to be included in any expenses. Instead, the travel would be considered as part of an employee’s normal commute, so any costs incurred would be their own.”

However, Schiavetta warns: “If an employee’s place of work is their home address, they could theoretically claim for the commute to and from an employer’s office as part of a hybrid working agreement, and any other commute required for business purposes. Whether or not they are entitled to do this will depend on the wording of the employee’s contract and the employer’s expenses policy.”

It’s therefore important to ensure employment contracts and expenses policies specify which travel expenses the employee can claim when working from home as part of a hybrid working arrangement, to avoid any uncertainty or errors, she adds.

From remote to very remote

One other implication to consider is when an organisation decides to widen its geographical net for recruitment, and how this impacts the expenses they can claim if they don’t live anywhere near their designated workplace.

“Employees can be based from home if there is no work base in close proximity, but employers must carefully think through the impact of employing someone who is located far away from the office, and what the implications might be for travelling should the employee be required to visit offices regularly,” remarks Hannah Copeland, HR Business Partner at WorkNest.

“It will be best to agree the terms of the employment up front and put everything in writing, so both the employee and employer are clear on what they can and can’t claim.”

Andrew Mawson, founder and managing director of Advanced Workplace Associates, adds: “We can see a time when a contract would simply state that if the employee wants to be a home worker, then the salary negotiated should include all expenses associated with working at home. An infrequent visit to a central office – say once a month – may be a small cost compared to the savings in time, cost, and wear and tear for the employee.”

Another issue may arise if an existing employee decides to move a long way from their base office. In this instance, does their entitlement to expenses for visits to the office and for business travel change?

“Given that this would essentially be the decision of the employee – and unless agreed otherwise with the employer – the employee would continue to be bound by their existing terms and conditions of employment,” comments Copeland. “Entitlement to expenses and business travel would not change and any additional costs created by the move would be borne by the employee, given their choice to move.”

Policies are better than a case by case approach

With the sudden changes to remote and hybrid working, borne out by the pandemic, it would appear that employers are currently dealing with these issues on a case-by-case basis. “This is not necessarily the best approach, however, and leaves the door open to potential employee relations issues,” warns Copeland.

Palmer envisages some amendments to expenses policies going forward, to account for all these changes. “There will likely be an increase in demand for bespoke expenses policies, so there are clear terms and conditions relating to the ever-growing number of remote and hybrid workers.”

Communication is key, adds Schiavetta. “Communicate your company’s position on reimbursement of expenses from the outset and ensure that this is consistent with any written policies or provisions in contracts. This will avoid any uncertainty for employees, later down the line.”

Post a comment Cancel reply

Your email address will not be published. Required fields are marked *

By: Lucie Mitchell

Published: 11th January 2022

Can I be the only one excluded from a pay rise if I am on maternity leave?

Whilst on maternity leave, an employee’s terms and conditions continue as normal. The... read more

How will rising pay rates affect working parents?

In April, statutory payments will rise as they do year upon year. For workers who earn... read more

Search jobs

Search here for jobs

Search here for Franchise Opportunities, Top Employers, Returner Programmes, Events and Articles

For Jobseekers

- Top Employers

- Work for a smaller organisation

- Ask the expert

- Flexible Working

- Career Advice

- Career Progression

- Returning To Work

- Return To Work Week

- Employment Rights

- Maternity & Parental Leave

- Tax Credits & Benefits

- Mental Health

For Employers

- Flexible Working Practices

- Gender Equality

- Older Workers

- Recruitment

- Managing Staff

- Returner Programmes

Work for yourself

- Start a franchise

- Franchise Opportunities

- Home Business

- Self-Employment

- Freelancing

- Top Employer Awards

- National Older Workers Week

- Set up Job Alerts

Your Franchise Selection

Click the button below to register your interest with all the franchises in your selection

Request FREE Information Now

This franchise opportunity has been added to your franchise selection

You may be interested in these similar franchises

Add these franchises to your selection

Privacy Overview

- Rest Of The World

- Attractions

- FDE Merchandise

UK Remote Workers – How To Manage Your Taxes While Travelling

Imagine trying to unravel a complex crossword puzzle with no clues or hints provided; this is how the tax system for UK remote workers travelling across borders can feel like.

A real-life story of Sam, a digital nomad hailing from Manchester, adds layers to this baffling prospect. He once found himself staring at a monumental tax bill after his six-month Spanish escapade. If, like Sam, you’re navigating the uncertain waters of remote employment while globetrotting, it’s crucial to understand how to manage your taxes aptly and avert such costly surprises. This blog post serves as your comprehensive guide on “UK Remote Workers: How to Manage Your Taxes While Travelling”.

Faris Khatib from Ideal Tax, a tax relief firm further explains that working remotely while travelling overseas can have significant tax implications for both UK workers and their employers. Depending on various factors such as double taxation agreements and tax residency status, the income earned by non-resident workers could be taxable in the UK, taxable in an overseas country, or not taxable at all. To ensure compliance with tax laws and regulations, it is important for remote workers to understand their tax residency status, potential withholding obligations, and the applicable tax rules in both the UK and the country where they are working. Seeking professional advice or consulting with relevant tax authorities may also be necessary to avoid unexpected liabilities and penalties.

Understanding Tax Residency As A UK Remote Worker

As a UK remote worker, you might find the concept of tax residency to be quite confusing. However, it is important to understand it to avoid any unintended tax liabilities. Tax residency refers to the country where you are considered liable to pay taxes on your income. If you are a UK resident for tax purposes, then you will need to pay tax on your global income in the UK, regardless of where the money was earned. Understanding your tax residency status involves considering several factors such as the amount of time spent in the UK or overseas, your connexions with both countries, and whether or not you have a permanent residence in another country. For example, if you spend more than 183 days in the UK per year, then you are likely to be considered a UK tax resident. To illustrate further, let’s say that Tom is a freelancer who has been living and working remotely from Thailand for eight months out of the year. He also has a rented flat back in London but doesn’t spend enough time there during the year to maintain it as his primary residence. In this case, Tom would likely be considered non-resident since he hasn’t spent more than 183 days in the UK during that tax year. It’s important to determine your tax residency status accurately because it affects how much tax you’ll pay and whether or not you’re eligible for certain benefits. As such, identifying if you’re resident or non-resident can help you avoid potential penalties for failing to pay taxes correctly. Now that we’ve established what it means to be a UK resident for tax purposes let’s examine how to acquire or break residency certificates as a remote worker.

Acquiring And Breaking UK Tax Residency

Acquiring or breaking UK tax residency can lead to potential changes in taxation. It’s an essential factor that remote workers should consider before deciding to work abroad. To acquire or break UK tax residency, you should understand how the UK government determines your status. For example, suppose you’re planning to move abroad for a longer period and want to break ties with the UK to avoid paying taxes there. In that case, you need to prove to HMRC that you have severed all significant ties to the country, such as disposing of your UK property and bank accounts or terminating your business affairs. You may also need to provide evidence of your permanent residence in a foreign country. On the other hand, if you are planning on returning to the UK after working abroad, it’s important to become familiar with the criteria for being considered a resident again. In general, you would usually regain UK residency if you spend more than 183 days in the UK during any given tax year or if you maintain be significant economic ties with the United Kingdom e.g., having investments, ownership or employment. Changing residency status is like switching from one boat to another; it can be very choppy waters, and mistakes can be costly if not orchestrated properly. Therefore, a good starting point is always consulting with a qualified tax advisor who can guide you through the complexities involved. Understanding how and when to acquire or break residency is essential for managing your finances while travelling overseas. Misunderstanding your residency status can lead to unnecessary taxation and legal issues in both the home and host countries. Now that we’ve established how tax residency works let’s now examine how working overseas affects your taxes as a UK remote worker.

- It is crucial for remote workers to understand the process of acquiring or breaking UK tax residency as it can have significant implications on their taxation. To break ties with the UK and avoid taxes, one needs to sever all significant ties with the country and provide evidence of permanent residency in a foreign country. If planning on returning to the UK, one should become familiar with the criteria for regaining residency. Changing residency status is complex, and consulting with a qualified tax advisor is highly recommended. Misunderstanding your residency status can lead to unnecessary taxation and legal issues in both home and host countries.

Implications Of Overseas Work On Taxation

As a UK remote worker travelling abroad, it is important to understand the tax implications of working overseas. When you work in another country, you may be subject to income tax in that country as well as in the UK. This means that you may have to pay taxes on your income twice if there is no double taxation agreement in place between the UK and the country where you are working. It is important to note that tax laws vary from country to country, and therefore, it is essential to research the local tax laws of the country you plan to work in. In some countries, you may be able to deduct some expenses related to your work, such as travel or accommodation costs. However, in other countries, you may not be entitled to any deductions or credits. For instance, let’s say that you are a freelance writer working remotely for a UK-based company and temporarily staying in France. You will need to report your income from your employer in the UK and file a tax return for this income with HM Revenue & Customs (HMRC). Additionally, you will need to report your earnings from clients based in France and file an income tax return with the French tax authorities. It can get complicated when working for multiple employers or clients based in different countries while travelling overseas. Thus, staying informed about local regulations will help you avoid possible legal consequences. Knowing all of this information makes it clear that one should always aim at asserting their tax status and avoid any penalizations arising from ignorance regarding foreign tax statutory laws.

Double Tax Agreements And Their Role

Double taxation agreements (DTAs) provide relief for individuals who are subject to taxation in two countries on the same income. These agreements aim at enabling residents of one country who earn income from another country exempted from being taxed on the same income twice. DTAs also help reduce overall taxation on the residents of each party. Understanding DTAs can be compared to a society’s recycling policies. Just as how countries have local tax laws that vary from others, local waste management regulations similarly differ from one area of the world to another. However, like how waste management firms in some areas provide recycling dumpsters while other regions don’t have such a facility accessible. Likewise, some countries may have DTAs agreements with others, while others won’t allow this convenience. There are particular eligibility criteria for obtaining DTA advantages. Requirements include and are not limited to individuals being a tax resident in one country, earning taxable income or deemed taxable income from sources outside of the country of residence, among other stipulations. For instance, the UK has over 130 double taxation agreements that cover issues including taxes on income, corporation taxes, inheritance taxes, and pensions. Understanding these treaties is essential for any UK remote worker intending to perform work duties abroad. Knowing how a Double Taxation Agreement can benefit you makes it imperative that you acquaint yourself with whether your work destination has one signed into law with the UK.

- A recent survey conducted in 2021, revealed that nearly 60% of UK employers have experienced tax compliance issues due to their employees working abroad.

- PwC research shows that prior to the pandemic, less than 20% of workers were considered ‘remote’. In 2023, this figure has risen to over 40%, increasing the complexity of cross-border tax implications for both employees and employers.

- According to an Office of Tax Simplification report (OTS), around 75% of UK companies are unprepared for the tax responsibilities associated with overseas remote working by their employees.

How Travel Influences Taxes For UK Remote Workers

As a remote worker, it’s easy to blur the lines between work and travel. However, when it comes to taxes, there are certain rules you need to follow. When you’re travelling overseas, your tax situation will depend on your tax residency status in the UK and whether or not you’re considered to be earning income from foreign sources. If you remain UK tax resident while travelling overseas, any foreign earnings will still be taxable in the UK. On the other hand, if you become a tax resident of another country while abroad, different rules may apply. Additionally, double taxation treaties between the UK and other countries may impact how your income is treated for tax purposes. For instance, let’s say you’re a writer living in Thailand for three months out of the year to find inspiration for your work. During this time, you continue writing articles for your UK-based employer and earning an income. Since you’re spending less than six months in Thailand, you won’t be considered a Thai tax resident. Therefore, your income should still be taxable in the UK, as long as you maintain your UK tax residency. If that’s not the case and your tax residency changes while you’re travelling or living abroad, then what expenses can be deducted from your taxes?

Deducible Expenses For Global Nomads

When working remotely or living abroad , there are specific expenses related to travel that can be deducted from your taxes. However, knowing which expenses qualify as deductible can be complex since some rules vary by country. For example, if you find yourself travelling frequently for business purposes, such as attending conferences or meeting with clients face-to-face in other countries, these expenses may qualify as deductible. Flights, hotels, meals, and other necessary business-related expenses incurred during qualifying trips can generally be written off against your taxable income. An example of a qualifying expense would be if you’re a freelance web developer tasked with attending a conference in San Francisco to promote your services. Since this trip is directly related to your business, the airfare, hotel costs and meals during your stay can all be deducted against your UK taxable income. However, it’s important to note the “necessary” part. You cannot deduct expenses that are deemed unnecessary or personal in nature such as sightseeing trips. Additionally, self-employed individuals have different rules when it comes to what they can and cannot claim as business-related expenses. It can be tempting to write off all travel expenses when working remotely or living abroad. Still, keeping proper records and understanding which deductions are available will benefit you in avoiding any mistakes that could lead to more substantial tax liabilities.

Filing Tax Returns: Tips For UK’s Outbound Remote Workers

Filing tax returns can be a daunting task, especially if you’re an outbound remote worker. To ensure compliance and avoid potential issues with the tax authorities, it’s important to stay informed of all the applicable rules and regulations. Here are some tips to help you file your tax returns as a UK remote worker travelling overseas. Firstly, it’s crucial that you keep detailed records of your income and expenses throughout the year. This includes documenting all earnings from your employer, any freelance work you may do, as well as any eligible business expenses such as travel, accommodation or office supplies. By keeping these records organised, you’ll have a clear understanding of what needs to be reported and will be able to file accurately and efficiently. Secondly, make sure you’re fully aware of the deadlines for submitting your tax forms. As an outbound remote worker, you may have different filing requirements depending on where you are in the world. It’s essential that you research this in advance and make sure you adhere to all relevant deadlines to avoid penalties. Thirdly, don’t forget about potential deductions when filing your tax returns. Expenses for global nomads can quickly add up, from flights to visas to insurance costs; it’s important you document all eligible expenses to claim them back later. However, be sure to review what is considered admissible by HMRC; this means that while some costs may seem logical for your work abroad – like sightseeing – HMRC often does not accept them as legitimate business expenses. In addition to the previous points above; think about consulting with a UK-based accountant who specialises in international tax. They can provide guidance on specific country requirements and advise on how best to maximise deductions available to remote workers travelling abroad. Think of it like this: going to an accountant is like having a personal trainer, you can do your taxes yourself without them, but they save you from costly mistakes and ensure your affairs are in the best form. Filing tax returns correctly is critically important for outbound remote workers. By developing a proactive approach and staying informed of all relevant requirements, you can manage your taxes while travelling with confidence. Remember to stay organised throughout the year with records of your expenses, keep abreast of deadlines that may be different depending on where you are, claim admissible expenses back but do not stretch them too far. And finally, consider consulting with a specialist accountant who knows international tax to help maximise deductions and minimise any potential liabilities.

Mr and Mrs W

Marcus and Mellissa, a married couple who love travel and adventure but now require a bit more luxury during their trips. Blogging and vlogging around the world, sharing hints, tips and stories. Enjoying the ride, having a laugh and even the odd argument.

You Might Also Like

Preparing For A Stress-Free Flight

Visiting The UK – 30 Essential Things To Know Before You Go

Tips For Your First Caravan Trip

The latest from instagram.

- Responsible Business

Funding Advisory Hub

Our Funding Advisory Hub, curates insights and expertise together in one place, to assist your company in raising finance.

- Charities and Not for Profit

- Energy, Renewables and Natural Resources

Food and Drink

Hospitality and leisure.

- Housing Associations

Manufacturing

- Private Client

- Professional Services

- Public Sector

- Real Estate and Construction

Technology, Media and Telecommunications

- Transport and Logistics

Our dedicated Technology team can support your business locally, nationally, and internationally.

- External Audit

- Internal Audit and Risk Assurance

- Business Strategy and Advisory

- Company Secretarial

- Management Information and Cloud Accounting

Payroll by IRIS

- Tax Compliance

- Capital Tax

Corporate Tax

Employer solutions.

- Independent Financial Advice

International Tax

- Making Tax Digital

Personal Tax

- Real Estate Tax

- R&D and Innovation

- Transactions

- Trusts and Probate

- VAT and Indirect Tax

- Corporate Finance and Deals

- Forensic Accounting Services

- Funding Advisory

- Restructuring

- Valuation Services

- Owner Managed Businesses Specialised accounting and advisory services tailored to owner-managed business clients.

- Family Business Proactive advice and support to help family businesses grow and protect their future.

- Private Equity Backing Meeting the diverse needs of businesses involved in private equity transactions.

- Private Client Practical advice on all aspects of your individual and personal tax and financial needs.

- Public Sector and Education Comprehensive advisory services for public sector, local government and education organisations.

Attract and retain talent for your business, with Bishop Fleming's Employer Solutions.

What are the tax implications of employees working remotely?

The recent COVID-19 pandemic and introduction of national and international restrictions has had a significant and unprecedented impact on employees’ working patterns and arrangements.

These changes have triggered a shift to more flexible remote working arrangements and resulted in more and more employees performing their duties away from their normal place of work.

It is therefore important for employers to be aware of their employee’s remote working arrangements (especially overseas working arrangements) and the potential tax and compliance implications these arrangements create.

Homeworking Expenses

The tax-exempt payment limit available to employees from employers to cover additional household expenses (e.g. electricity, heating or broadband) increased on 6 April 2020 from £4 to £6 per week.

This is usually available where the employee works under a homeworking arrangement. However, during the pandemic, this is also available to employees who must work from home due to COVID-19 (ie. so not working at home by choice).

No records are needed to be retained to support the above payment.

If the employer makes payments that exceed this limit, these payments may still be exempt from tax, but the employer will need to obtain and keep records to support the payment made.

The records should cover the increased costs specifically relating to heating, lighting, or electricity. Mortgage interest or rent payments are not included.

If the employer does not wish to make the payments to their employee, the employee can only personally claim tax relief on their additional household expenses if the homeworking is not voluntary (ie they do not have a personal choice).

The can do this through HM Revenue and Custom’s online service or their Self-Assessment tax return.

Home Office Equipment

New tax legislation was introduced last year to ensure there is no tax charge on an amount reimbursed to an employee in respect of home office equipment obtained for the sole purpose of enabling the employee to work from home during the pandemic.

This exemption was due to end on 6 April 2021, but has now been extended to cover the 2021/22 tax year. Please note that, for the exemption to qualify, there must be no significant private use of the equipment.

Use of Assets

Where an employer lends an asset to one of their employees and the asset is used for private purposes and not solely for business use, a taxable benefit will arise. The benefit will need to be recorded via a form P11D and will be subject to tax and Class 1A National Insurance.

The taxable value of the benefit can be reduced where the asset is used for business purposes or the employee makes a contribution for their private usage of the asset. This is also known as “making good” the chargeable benefit.

The latest date for making good for all non-payrolled taxable benefits is 6 July following the end of the tax year in which the benefit is provided (so 6 July 2021 for 2020/21 benefits).

Travel Expenses

If the employee will attend the office or other workplace on occasion, it is important to consider if they can get any relief on their travel between their home and the other workplace.

The general rule for tax relief on travel expenses is that any travel from an employee’s home to their ‘permanent workplace’ will be deemed as ‘ordinary commuting’.

Therefore no tax relief will be available to the employee nor would any costs reimbursed by the employer be exempt from tax or National Insurance.

There are options to consider such as whether the other workplace is a permanent workplace as well or if there is any scope for the other workplace to be regarded as a ‘temporary workplace’ (broadly somewhere that an employee will spend less than 40% of their working time and their attendance at this workplace is self-contained).

Please see our separate blog which regards more details on this.

Working Remotely Overseas

Working overseas can cause many tax, social security and compliance challenges for both the employee and employer and should all be considered separately.

These include but are not limited to:

- Dual payroll reporting – The employer will need to consider their payroll reporting and tax withholding requirements in the UK and overseas country.

- Immigration Law and Visas – Does the employee have a right to work in the overseas country? Do they need a visa to work there?

- Employment Law – The employer and employee must consider the foreign labour laws and what legal rights the employee is entitled to in the other country as well as working time requirements.

- COVID-19 Travel Restrictions – Are there any COVID19 border restrictions in the overseas country? Will the employee be allowed back into the UK? Will they need to quarantine on their return?

- Permanent establishment issues.

- Increased tax and social security costs.

Please see our article on employees working overseas .

If you require assistance with any of the above matters, please do not hesitate to contact a member of our Employer Solutions team.

How can we help?

As the national and international COVID-19 restrictions relax and employee working arrangements are reviewed, we urge employers to thoroughly consider the implications of the shift to remote work arrangements and ensure they remain tax compliant at all times.

Our Employer Solutions team here at Bishop Fleming can assist you with any queries you may have in respect to the above and can help employers review their employee’s current domestic or overseas remote working arrangements and advise on the risks and implications of such arrangements.

Our Employer Solutions Knowledge Hub contains more information on how our team can help you attract and retain talent for your business.

Keep up to date

Ideas are just the beginning.

Stay informed about all our latest updates and services, and sign up to our email newsletter.

Key contacts

Adele Clapp

- 01392 448828

- Email Adele Clapp

Related insights

Sending an employee to work overseas, are you hiring a foreign national to work in the uk, employer solutions knowledge hub, covid and internationally mobile workers, tax free allowance for working from home, related services.

Related sectors

- Central & Eastern Europe

- Central & South America

- Middle East & Asia Pacific

- North America

- Western Europe

- Argentina Bruchou & Funes de Rioja Bruchou & Funes de Rioja

- Australia Corrs Chambers Westgarth Corrs Chambers Westgarth

- Austria Schima Mayer Starlinger Schima Mayer Starlinger

- Bahrain Al Tamimi & Co (Bahrain) Al Tamimi & Co (Bahrain)

- Belgium Claeys & Engels Claeys & Engels

- Brazil Veirano Advogados Veirano Advogados

- Bulgaria BOYANOV & Co. BOYANOV & Co.

- Canada Mathews Dinsdale Mathews Dinsdale

- Chile Munita & Olavarría Munita & Olavarría

- China Fangda Partners Fangda Partners

- Colombia Brigard Urrutia Brigard Urrutia

- Bahtijarević & Krka" data-country="31"> Croatia Divjak Topić Bahtijarević & Krka Divjak Topić Bahtijarević & Krka

- & Associates LLC" data-country="30"> Cyprus George Z. Georgiou & Associates LLC George Z. Georgiou & Associates LLC

- Czech Republic Randl Partners, advokátní kancelář, s.r.o. Randl Partners, advokátní kancelář, s.r.o.

- Denmark Norrbom Vinding Norrbom Vinding

- Estonia COBALT (Estonia) COBALT (Estonia)

- Finland Dittmar & Indrenius Dittmar & Indrenius

- France Capstan Avocats Capstan Avocats

- Germany Kliemt.HR Lawyers Kliemt.HR Lawyers

- Greece KREMALIS LAW FIRM KREMALIS LAW FIRM

- Hong Kong Lewis Silkin (Hong Kong) Lewis Silkin (Hong Kong)

- Hungary Bozsonyik-Fodor Legal Bozsonyik-Fodor Legal

- India Kochhar & Co. Kochhar & Co.

- Ireland Lewis Silkin (Ireland) Lewis Silkin (Ireland)

- Israel Herzog Fox & Neeman Herzog Fox & Neeman

- Italy Toffoletto De Luca Tamajo Toffoletto De Luca Tamajo

- Japan Anderson Mori & Tomotsune Anderson Mori & Tomotsune

- Kazakhstan AEQUITAS Law Firm AEQUITAS Law Firm

- Latvia COBALT (Latvia) COBALT (Latvia)

- Lithuania COBALT (Lithuania) COBALT (Lithuania)

- Luxembourg CASTEGNARO CASTEGNARO

- Malta Ganado Advocates Ganado Advocates

- Mexico Basham, Ringe y Correa S.C. Basham, Ringe y Correa S.C.

- Netherlands Blom Veugelers Zuiderman Advocaten Blom Veugelers Zuiderman Advocaten

- Netherlands Bronsgeest Deur Advocaten Bronsgeest Deur Advocaten

- New Zealand Kiely Thompson Caisley Kiely Thompson Caisley

- Norway Advokatfirmaet Hjort DA Advokatfirmaet Hjort DA

- Peru Vinatea y Toyama Vinatea y Toyama

- Poland Raczkowski Raczkowski

- Portugal pbbr pbbr

- Romania Nestor Nestor Diculescu Kingston Petersen (NNDKP) Nestor Nestor Diculescu Kingston Petersen (NNDKP)

- Saudi Arabia Al Tamimi & Co (Saudi Arabia) Al Tamimi & Co (Saudi Arabia)

- Serbia Karanovic & Partners Karanovic & Partners

- Singapore Rajah & Tann Singapore Rajah & Tann Singapore

- Slovakia NITSCHNEIDER & PARTNERS NITSCHNEIDER & PARTNERS

- Slovenia ŠELIH & PARTNERJI Law Firm ŠELIH & PARTNERJI Law Firm

- South Korea Yulchon LLC Yulchon LLC

- Spain Sagardoy Abogados Sagardoy Abogados

- Sweden Elmzell Advokatbyrå Elmzell Advokatbyrå

- Switzerland Blesi & Papa Blesi & Papa

- Thailand Rajah & Tann Thailand Rajah & Tann Thailand

- Turkiye Bener Law Office Bener Law Office

- Ukraine Vasil Kisil & Partners Vasil Kisil & Partners

- United Arab Emirates Al Tamimi & Co (UAE) Al Tamimi & Co (UAE)

- United Kingdom Sackers Sackers

- United Kingdom Lewis Silkin Lewis Silkin

- Venezuela D'Empaire D'Empaire

- Our Lawyers

- Learn & Connect

- Global HR Law Guide

Hybrid working arrangements in the UK: what you need to know

General questions.

With the government encouraging a return to the workplace as the COVID-19 pandemic is brought under control, many employers are taking the opportunity to reconsider their working arrangements. Reflecting on their experience of remote working during the pandemic, they are looking at ‘hybrid’ arrangements that combine office-based and remote work. According to an Acas survey , over half of businesses expect an increase in staff working from home or remotely for part of the week. Nearly half expect an increase in staff who only work remotely.

In this article, ‘hybrid working’ refers to arrangements in which employees split their time between a workplace such as an office and working remotely, for example, at home or at a local co-working space.

Whether hybrid working is practicable and, if so, how it will work will depend on the context – the nature of the organisation, the role and the individual’s personal circumstances. Some jobs can be carried out remotely. Others, particularly those based on direct ‘in-person’ presence (e.g. waiter, security guard, dentist) would be inappropriate for hybrid working.

Whether an individual can work remotely in an effective way is likely to depend on the nature of their home, the space and facilities available to them, childcare and other caring responsibilities, and the nature of their relations with other occupiers. To facilitate hybrid working and avoid over-dependence on individuals’ personal arrangements, some employers are looking to set up local hubs from which several employees might work.

Before setting up hybrid working arrangements, you should give careful thought to what you are trying to achieve and why:

- Are you actively encouraging hybrid working or just agreeing to it if staff push for it?

- How flexible should the arrangements be?

- How will you maintain team culture and cohesion?

- What arrangements will you make for supervision, particularly with inexperienced junior staff?

You should, of course also, consider what your employees want. Some may value the extra time that working from home gives them. Others may prefer to be in an office because they live in a small bedsit, or it enables them to meet colleagues and make friends.

The advantages of successfully introducing hybrid working may include increased productivity and job satisfaction, attracting and retaining a more diverse workforce, greater loyalty, lower turnover and improved working relationships. In the longer term, you may be able to reduce your premises costs.

It may be helpful to consider the following:

- what work really needs to be carried out in the workplace and what can be done elsewhere;

- to what extent improved technology may help, identifying any specific requirements;

- how teams will communicate and work together;

- any core times when employees need to be available;

- how often a team should meet in person;

- whether customers or other stakeholders expect particular tasks to be carried out at specific times;

- how to introduce new recruits to the organisation.

Introducing hybrid working

What is the best approach if you are proposing to introduce hybrid working? In theory, employees might be encouraged to make a statutory request to work flexibly, and many employers may have a policy on such formal requests. But the statutory scheme is not designed for changes initiated by an employer and is also quite formulaic and restrictive.

If you want an open discussion about hybrid working arrangements, both to understand the numbers that might be interested and the type of arrangements that employees would value, it is better to take a more open approach. For example:

- produce a paper on possible hybrid working arrangements with proposals for how they might work;

- circulate it to staff and any representatives for comments and organise team discussions;

- in light of comments and discussions, develop a policy;

- ask for specific proposals by individuals on their working arrangements, then consider and seek to agree these.

Be aware that a discussion may become a more formal request for reasonable adjustments by someone with a disability, or a statutory request to work flexibly due to caring responsibilities or for other reasons. In either case, you should clarify the request with the employee and deal with it under your usual policies.

Contractual and policy arrangements

You will need to review your employment contracts and make appropriate changes to reflect the new working arrangements.

As well as outlining the scheme for hybrid working, you should consider whether you need a right to require an employee to attend the office for specific purposes. This might include, for example, requiring employees to attend the office for training, appraisals or disciplinary issues, together with how expenses for travel to and from the office should be met. The usefulness of such a right in practice may depend on where the individual is living and how much notice you are able to give of a change to normal arrangements.

If an employee moves home, this may mean higher travel expense claims or a practical barrier to attending work at the office, so you could consider placing limits on how far an employee can move from a particular location.

You should also develop a hybrid working policy that sits alongside the contract. This might set out the organisation’s commitment to encouraging hybrid working, how such arrangements will operate and the expectations of employees and managers. The policy is likely to be non-contractual, meaning you can make changes without employees’ agreement.

Unless you are confident you have identified ‘the way’ for your organisation to deal with hybrid working, it would be sensible to build in a trial period and review – both of the arrangements as a whole and of any individual’s personal working situation. Contracts should include both a trial period and a level of flexibility, with a specific (contractual) right to unpick arrangements if they do not work out as expected. You may want to retain the flexibility to alter the arrangement temporarily and/or make agreement to homeworking conditional on certain conditions being met (such as satisfactory performance being maintained).

You may need to modify other policies such as IT, homeworking, expenses and data protection to reflect the fact that employees may be working on a hybrid basis. There are, for example, likely to be specific requirements related to IT and data security (see below).

Management and supervision

Consider how staff working remotely will be managed and supervised. It will be important to ensure effective engagement and to arrange regular one-to-one meetings to discuss what the individual is doing and their performance. In the early days of remote working during the pandemic, it was not unusual for managers to express concern that employees might not work properly at home. Although experience has suggested that employees at home are likely to work as effectively as they would in an office (and perhaps more so), such concerns may linger.

Managers may need to focus less on what employees are actually doing (are they sitting at their desk, when did they get back from lunch?) than on the outcomes of what they do and the results. This may depend on the specific tasks employees are performing and the evidence available as to what they have been doing. A different approach to management and assessment is likely to be required and there may be a need for manager training. You should also consider whether appraisal objectives need to be modified to fit with hybrid working.

Inclusion and fairness

It is important to treat all staff fairly and equally when introducing hybrid working. Everyone should be given the same access to work, support and opportunities for training and promotion. For example, you will need to ensure that the career advancement of those who work on a hybrid basis does not suffer, perhaps because they have less personal contact with significant managers. Meetings should be scheduled to so that all staff can take part in conversations and activities.

Although one would expect hybrid working arrangements to promote diversity, rules and practices that limit hybrid working may amount to unlawful indirect discrimination unless they are for a good business reason and proportionate. Making changes to arrangements, such as requiring more office-based work, may risk allegations of indirect discrimination by employees who face difficulties for reasons such as caring commitments or disability.

You should also consider whether new joiners can work on a hybrid basis, or whether they need to be in the office for a period to facilitate training and supervision. Although such rules may give rise to age discrimination issues (i.e. if new joiners are likely to be younger), employers may be able to justify them as a proportionate means of achieving a legitimate business aim.

In general terms, the best line to take is to be flexible and open to different approaches, ensuring there is are sound business reasons for any restrictions imposed.

Legal and practical issues

If hybrid working is to be a success, it is important that employees have the equipment they need to perform their role. Although specific requirements will depend on the job, most employees will need suitable IT equipment and devices, an ergonomical chair and desk, and effective lighting. They may also require a shredder to ensure confidentiality.

Employers may wish to produce a list of recommended equipment for hybrid working and collaboration and should consider either providing equipment themselves or meeting the costs of employees setting up a ‘home office’. Under health and safety legislation, employers are required to pay for certain equipment required by the regulations including, for example, display screens and chairs. You should also ensure that your IT department is able to provide remote support for any issues that arise.

Disabled employees may be entitled to auxiliary aids as a reasonable adjustment. If such an aid is reasonably needed, you should make sure it is provided to the individual when working from home at your organisation’s expense.

It is generally more tax efficient for employers to provide home office equipment to their employees rather than reimbursing employees’ costs. The provision of home office equipment by an employer is generally exempt from tax and National Insurance contributions (NICs) provided certain conditions are satisfied, whereas sums paid to reimburse employees who have purchased their own equipment are subject to income tax and NICs. As part of HMRC’s efforts to help employers during the COVID-19 pandemic, a temporary exemption was introduced allowing employers to reimburse employees for the costs they incur on home office equipment without any tax and NICs, but this is due to expire on 5 April 2022.

Property and insurance

Employers are required to have employers’ liability insurance. You should tell your insurers that you have employees working from home. You may also want to check that your business insurance covers your property when in employees’ homes (for example, laptops and other equipment provided to support homeworking).

If employees have home insurance or a mortgage, they should be advised to tell their insurer or lender that they are working from home in case it affects their cover.

Although an employer has no legal obligation to reimburse expenses incurred by an employee working from home, it is not uncommon to meet actual expenses or to contribute a specific sum on account of expenses. Employees working at home may incur additional expenses on items such as heating and lighting, metered water, business phone calls and perhaps increased insurance premiums. You should consider your approach to this, taking account of the tax consequences.

Payments by employers to reimburse employees for reasonable additional household expenses incurred while working under homeworking arrangements are exempt from income tax and NICs provided the employee works at home regularly by agreement. HMRC will accept a payment of GBP 6 per week without requiring supporting evidence and may approve a greater amount if there is supporting evidence of the cost.

If the employer does not reimburse an employee’s additional household expenses, the employee may be able to claim tax relief for those expenses. In practice, aside from the concessions introduced for tax years 2020-21 and 2021-22 in response to the pandemic, the rules are strict and it is unusual for employees to receive such tax relief.

Health and safety

Employers have duties relating to the health and safety of employees which apply even if they are working from their own home. In particular, there is a duty to provide a working environment that is, ‘so far as is reasonably practicable, safe, without risks to health, and adequate as regards facilities and arrangements for their welfare at work’.

You must conduct a risk assessment of all work activities including those of hybrid workers with a view to identifying hazards and assessing the degree of risk. While the Health and Safety Executive (HSE) took a relatively relaxed approach to this during the pandemic, it is likely to expect stricter compliance once arrangements become more prevalent and longer-term.

In the context of hybrid working, you need to give special consideration to the following issues:

Stress and mental health . Some employees may find the conflation of work and home life leads to an increased risk of stress. You should encourage clear boundaries and the taking of adequate rest breaks. Contact between those working at home and their colleagues is likely to be less frequent which may make supervision of work more challenging for managers, especially in relation to new starters or junior employees. It may also make it harder for managers and colleagues to recognise someone who is struggling.

Addressing this may require more proactive steps than in a face-to-face environment. The government recently published guidance for employers on how to address loneliness. This suggests setting up a comprehensive wellbeing programme, promoting personal and work-related networks, and training managers in having difficult and emotional conversations. The guidance also advises the creation of space, time and opportunities for connection.

Equipment. Equipment supplied by employers must be suitable, in good working order and inspected regularly. There must be suitable and sufficient lighting.

Employers have various duties in relation to computers and display screen equipment (DSE) including laptops, tablets and touch screens. These include ensuring that workstations meet specific requirements in the Health and Safety (Display Screen Equipment) Regulations on equipment and the environment. These also include provisions on breaks, changes in activity and eye tests, together with provision of information and training. The HSE has produced a DSE workstation checklist .

Other aspects . There are duties to ensure that electrical equipment (such as a laptop or scanner) are safe and to supply appropriate first-aid provisions. In practice, homeworking is likely to be low risk and a simple first-aid kit should be sufficient. Accidents and injuries when working at home should be reported to the employer.

Data privacy and security

As an employer, you have a duty under data protection legislation to use appropriate technical and organisational measures to ensure security of personal data and to protect it from unauthorised processing and loss. This applies to personal data in an individual’s home. You should carry out a data privacy impact assessment of the implications of employees working from home or otherwise remotely.

Measures that you might decide to take include:

- Ensuring that only the employee has access to personal data on the device and that other members of the household do not have access. In practice, the best approach is for the employer to provide the device.

- Encrypting the device so that if it is stolen, for example, no-one can access the data.

- Centrally controlled updates to software, security, password changes and the capacity to wipe the device remotely.

- Ensuring that when the device is moved from the office to home or vice versa it is secure. (The best protection will probably be encryption.)

- Rules on retention of personal data and their secure deletion or destruction. You should consider providing a shredder for paper-based records.

- Guidance and training on responsibilities

The Information Commissioner’s Office has produced guidance on data protection and working from home.

Related Insights

KPMG Personalisation

- Hybrid and remote working within the UK – what next?

The Office of Tax Simplification is preparing its report and recommendations – what might this mean for employers?

The Office of Tax Simplification is preparing its report and recommendations – what..

- KPMG in the UK ›

- Insights ›

Hybrid and distance working – previously the exception – has become the rule for many employees. Crucially in the competition for talent, it’s now a key expectation of the labour market. The Office of Tax Simplification (OTS) previously announced a review looking at the tax and social security implications of both domestic and international hybrid and remote working arrangements, with its findings and recommendations to the Government expected by the end of the year. KPMG in the UK has responded to the OTS’s call for evidence, putting forward a number of suggestions as to where improvements could be made for the benefit of employees, employers, and HMRC. This article discusses our response in respect of hybrid and remote working within the UK, and what action employers should consider taking to confirm they have complied with their associated employment tax obligations. It may be read in conjunction with our related article on the international aspects of the OTS review.

Why is this important?

An increasing number of employers now offer hybrid and remote working within the UK. However, implementing such arrangements carries some employment tax risks.

In our response to the OTS’s call for evidence, we highlighted areas where employers report challenges with domestic employment tax compliance (see our separate article discussing international considerations ). Our key submissions are summarised below.

Home working equipment

Under current rules, an employer can provide employees with home working equipment and services without tax or NIC charges arising provided certain conditions are met, but cannot (since the temporary COVID-19 easement ended) reimburse an employee for home working equipment or services they purchase themselves. This distinction can be confusing for some employers, who might inadvertently trigger employment tax charges when reimbursing employees for the costs of necessary equipment or supplies.

We suggest a permanent exemption be considered for employer reimbursed homeworking equipment and services, in line with that which was introduced as a temporary measure during lockdown, or that HMRC clarify in guidance when, and in what circumstances, they would accept an employee acquires home working equipment or services as agent for and on behalf of their employer, which would allow reimbursement to be made without income tax or NIC charges arising.

Employers providing home working equipment must retrieve and store this when employees leave, or administer a benefit in kind charge on the secondhand value of equipment they allow leavers to retain. The costs of either course of action are often disproportionate to the low value of the equipment. We consider that the introduction of a de minimis tax exemption could be appropriate here to reduce administration for both employers and HMRC in respect of equipment leavers are allowed to retain because its retrieval is not cost effective for the employer.

Home working expenses

Employers can make payments to meet or reimburse reasonable additional household expenses free of tax and NIC to employees carrying out duties of their employment at home under a homeworking arrangement. However, employers can be uncertain as to whether they have implemented arrangements which qualify for the relief, and we suggest that HMRC improve their guidance in this area. The rate that can be paid for such expenses on an unreceipted basis is currently £6 per week or £26 per month, which has only changed marginally in previous years, despite increases in the cost-of-living. We suggest this rate be reviewed by HMRC in order for the easement to remain meaningful.

Permanent workplaces and travel expenses

Determining an employee’s ‘permanent workplace’ is necessary to ascertain whether travel expenses that they incur can be reimbursed free of tax and NIC. In 2014, the OTS reported that the legislation and guidance in this area lacked clarity in respect of what travel and subsistence expenses could be reimbursed, including for employees who are office-based but allowed to work at home some of the time.

Since this report was published, the number of remote and hybrid working employees has increased. Whilst HMRC have published additional examples in their guidance, employers may remain unsure of the correct position in some circumstances. For example, where employers have reduced office facilities and can no longer accommodate all employees on site every day, so there is a practical requirement to work from home, could the employee’s home then be considered a ‘workplace’ with travel to the employer’s site eligible for tax free reimbursement?

We suggest that the OTS’s earlier report and recommendations be revisited in light of hybrid and remote working patterns.

Availability of exemptions on certain benefits-in-kind

Where an exemption or relief is linked to an employee’s location or workplace, the availability of these may be affected for employees working on a hybrid or remote basis. For example, for there to be no charge to tax on the provision of a bicycle or cyclist safety equipment, one of the conditions that must be met is that the employee uses the cycle or equipment for ‘qualifying journeys’. This means that the cycle must be mainly used by the employee for the whole or part of the journey between their home and workplace or for business travel. Remote and hybrid workers may no longer meet this condition, however from a public health and environmental perspective (and in line with their Environmental, Social and Governance agendas) many employers will consider that encouraging employees to use a bicycle should be viewed positively.

We suggest that tax reliefs with some link to an employer’s premises be reviewed to ensure that hybrid and remote workers are not discouraged from accessing certain benefits due to a loss of tax advantages.

What should employers do now?

The OTS expects to publish its report on hybrid and remote working later this year and we will provide a further update once this is available. In the meantime, employers should review their employment tax compliance and consider whether any unexpected tax or NIC exposures may have arisen in connection with employees’ hybrid or remote working arrangements.

To talk through how KPMG in the UK can assist you with reviewing your tax compliance and benefits offering, please speak to the authors below or to your usual KPMG in the UK contact.

For further information please contact:

- Paul Moreels

- Chloe Boyle

Tax Matters Digest

Read KPMG's bi-weekly newsletter which covers the latest issues in taxation and government announcements relating to tax matters.

NEW : Run fairer and faster compensation reviews - learn how here

Say Hello To The Future of Filing

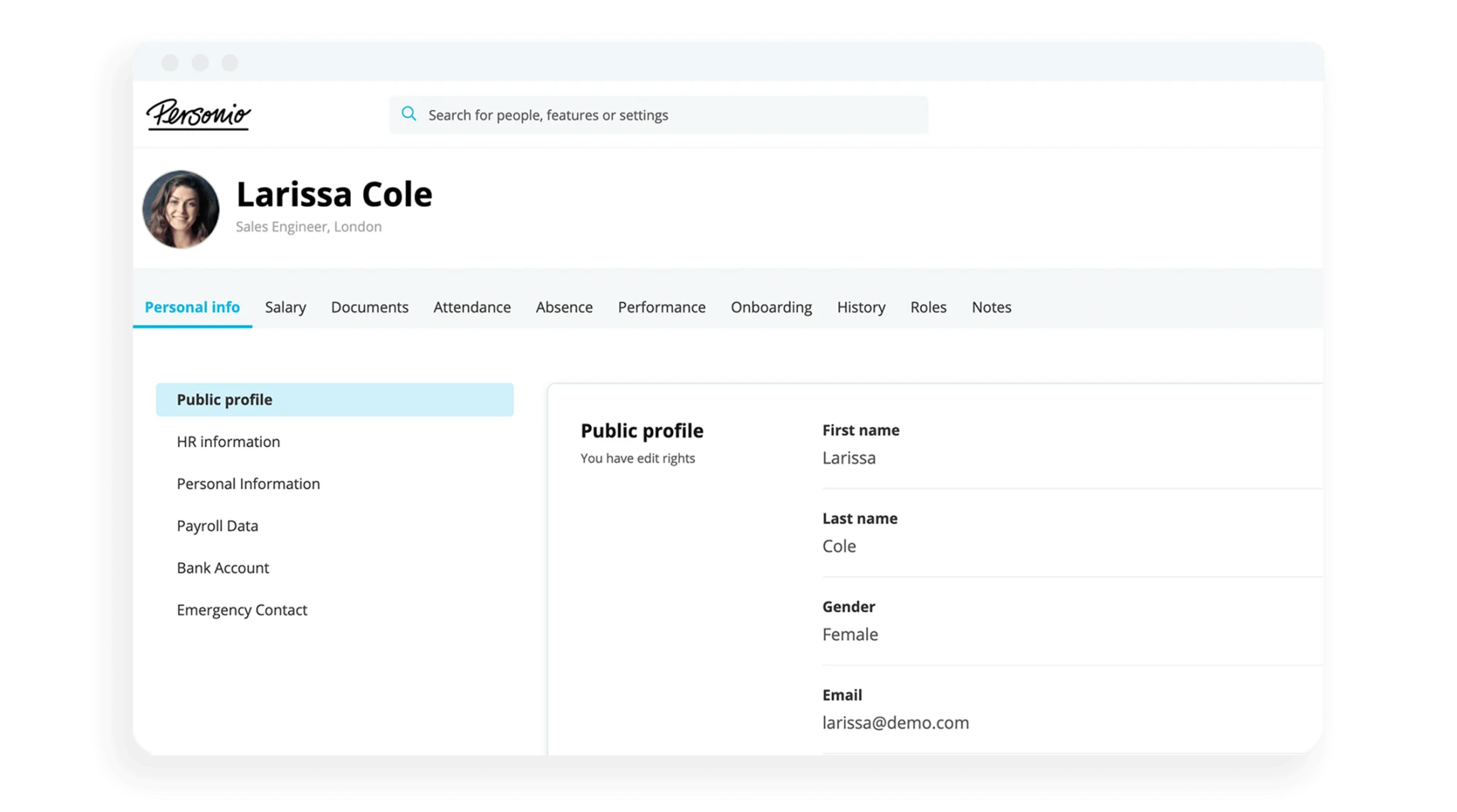

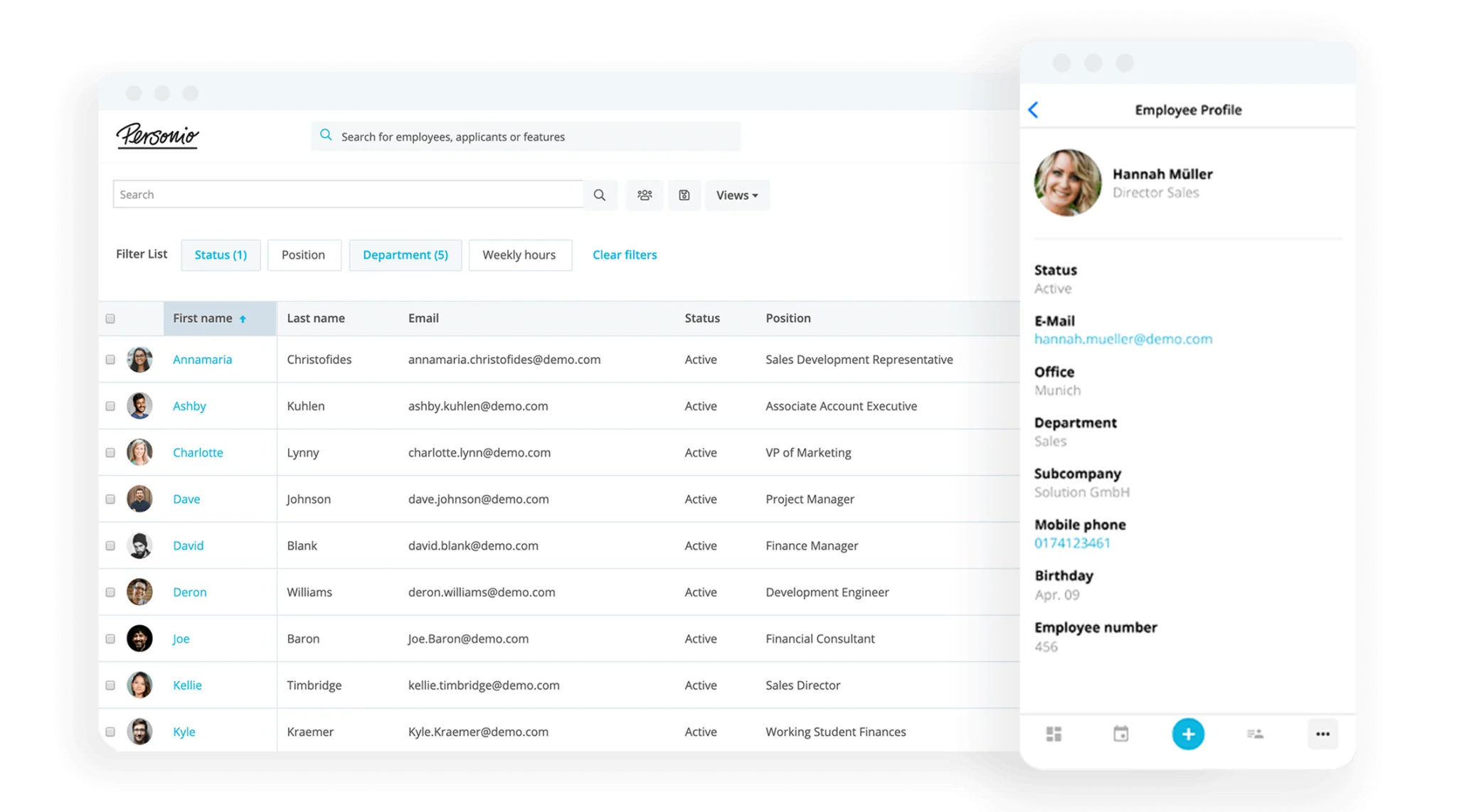

Organise your employee data.

Latest blog posts, travel expenses in 2024: a guide to claims and definitions.

We all acknowledge that handling travel expenses can be a headache. However, the process isn't as complex as it initially appears. This guide demystifies travel expenses for UK employers.

- 1 What are travel expenses?

- 2 What are the requirements for travel expense claims?

- 3 One source for all your employee information

What are travel expenses?

Travel expenses cover the costs an employee is likely to incur during business travel. These can include travel fares (be it car, train, or plane), accommodation, additional meal costs and other miscellaneous expenses.

Who is responsible for covering travel expenses?

As the employer, organisations are responsible for reimbursing your employees for business travel expenses. These expenses are tax-deductible for the company.

In instances where the business activity is closer to an employee’s home than their regular office, the employee might be eligible to claim these costs as income-related expenses against their own taxes.

Remember, however, that in the UK, specific rules and criteria apply. It's crucial to retain all relevant receipts and logs.

What are the requirements for travel expense claims?

In the UK, there aren't formal requirements concerning the format of a travel expense claim. However, having a standardised form facilitates the verification process and minimises errors.

For companies where business travel is frequent, automated expense tracking systems can streamline the process. In smaller operations, a well-designed Excel template suffices.

When is a travel expense report necessary?

A travel expense report is essential when an employee travels on company business. However, not all travel is classified as 'business travel.'

For instance, an employee visiting a client within the same city isn’t necessarily on a 'business trip' and may not be eligible for all travel reimbursements.

Common reasons for business travel:

Meetings with clients outside the local area

Engaging with external business partners

Visiting other branches of the company

Attending trade shows, courses, or conferences

Which costs are reimbursable?

To reimburse your employees, you'll need invoices, receipts or other valid proof of expense. These can include:

Transport costs: car, train, plane, including public transport, tolls, and parking fees

Accommodation costs

Meal allowances

Incidental costs: phone and internet

Other business-related expenses

Reimbursement procedures for different travel modes

When employees travel by car, a standard mileage rate can simplify reimbursements. In the UK, the mileage rate tends to fluctuate, so ensure you're up to date. Alternatively, a detailed logbook can be used to calculate actual expenses.

Accommodation and meal expenses

For overnight stays, you generally cover the costs within a pre-agreed budget. Keep in mind, meal expenses are often capped or may require valid proof for reimbursement.

Overseas travel expenses

For international travel, meal and accommodation allowances vary based on the destination. Always consult the HMRC guidelines or specific country allowances when planning international business trips.

Don't forget incidental costs

Additional costs such as parking, business-related calls, or currency exchange losses should also be considered. Always require your employees to provide receipts.

One source for all your employee information

And there you have it. Managing travel expenses need not be a convoluted process. With a consistent system and clear understanding of UK regulations, you can streamline the process for both the company and your employees.

With Personio, you can rely on an all-in-one HR software solution to help centralise all of your important employee data. Ditch the spreadsheets and emails, and go with a system that houses data in a compliant fashion. Speak with one of our experts today.

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness. Die Inhalte unserer Internetseite – vor allem die Rechtsbeiträge – werden mit größter Sorgfalt recherchiert. Dennoch kann der Anbieter keine Haftung für die Richtigkeit, Vollständigkeit und Aktualität der bereitgestellten Informationen übernehmen. Die Informationen sind insbesondere auch allgemeiner Art und stellen keine Rechtsberatung im Einzelfall dar. Zur Lösung von konkreten Rechtsfällen konsultieren Sie bitte unbedingt einen Rechtsanwalt.

Keep Vital Data At Your Fingertips

The HMRC 24 month rule: what, why, & how it works

Published on August 18, 2023

)

Travel between offices and worksites is a normal cost of doing business for some workers. But the cost and inconvenience of leaving your usual surroundings can quickly add up.

To reflect this, HMRC offers tax relief on travel expenses to a non-permanent place of work. But it’s not available in certain circumstances - specifically when the famous “24 month rule” applies.

As with all things tax, the regulations are a little murky and hard to understand. So in this article, we’ll explain the fundamentals of the 24 month rule, when it applies, and what to do if you think it affects you.

Let’s dive in.

The HMRC 24 month rule

The 24 month rule is a specific condition that lets you claim travel expenses for trips between your home and your client’s offices or a “temporary workplace”. The idea behind it is that visiting a client’s workspace - as opposed to your own HQ - requires special travel and can lead to undue costs.

This travel should not be part of your standard commute; HMRC sees travel to a temporary workplace to be a business expense, unlike commuting.

The rule exists to help define what is (and isn’t) a temporary workplace. In order to set clear guidelines and limit abuse of this tax exemption, HMRC created a (relatively) simple test to figure out whether a site is temporary or not.

Put simply: if the conditions of the 24 month rule are met, you’re dealing with a permanent workplace .

So what are those conditions?

How the 24 month rule works

The 24 month rule has two key conditions. In order for the rule to apply - and for a business to NOT be able to claim this travel expense - both of these must be met:

The employee must have spent or be likely to spend more than 40% of their working time at a workplace , AND;

They must attend it or be likely to attend it over a period lasting more than 24 months .

If you meet both of these criteria, you cannot claim tax relief on your travel expenses to and from a workspace. In other words, if you spend 40% of your time in an office or onsite for more than 24 months, this is a permanent place of work .

Important extras to factor in

Here are a few key considerations to keep in mind as you apply for tax relief:

As soon as you become aware that a contract will last longer than 24 months , you must stop claiming relief. So if you know on day one that this will be a two-year contract, you’ll never be able to claim.

24 months is the total calendar period in question, and not the actual amount of time you spend working with a client. So if you work two days a week with them starting January 1, or if you work six months on and then six months off, you’ll reach 24 months on January 1 two years from now. This is the case even if you sign new contracts along the way .

The 40% rule (above) applies, however. So a 15-month break (60% of any two-year period) would be enough to ensure that the 24 month rule doesn’t apply.

If the length of the contract is unclear, you can claim tax relief if it’s assumed that the agreement won’t last 24 months or more.

It’s possible to have more than one permanent workplace. If the 24 month rule is met, the workplace is permanent, even if the rule can also be met in other workplaces.

Tax relief is not available for private travel . That is travel to any place that an employee doesn’t need to be for work purposes.

Examples from HMRC

HMRC itself has published a very helpful (but very long) guide to employee travel . In its section on the 24 month rule, you’ll find good examples to illustrate the rules:

As Chris’ attendance at the temporary workplace in Wigan is expected to last less than 24 months, tax relief is available for the full cost of her travel between home and the temporary workplace.

Duncan has worked for his employer in Sheffield for 10 years and is sent to help out at the employer’s Rotherham branch for 28 months. There is no tax relief for the cost of travel to and from the workplace. This is because he will be spending more than 40% of his working time there and his attendance is known from the outset to be for more than 24 months so the workplace is a permanent workplace. His home to work travel is therefore ordinary commuting for which no relief is available.

Richard has worked for his employer for 3 years. He is sent to perform full-time duties at a workplace for 18 months. After 10 months the posting is extended to 28 months. Tax relief is available for the full cost of travel to and from the workplace during the first 10 months (while his attendance is expected to be for less than 24 months), but not after that (once his attendance is expected to exceed 24 months).

Sarah has worked for her employer for 7 years and is sent to perform full-time duties at a workplace for 28 months. After 10 months the posting is shortened to 18 months. No tax relief is available for the cost of travel to and from the workplace during the first 10 months (while her attendance is expected to exceed 24 months), but tax relief is available for the full cost of travel during the final 8 months (once her attendance is no longer expected to exceed 24 months).

The HMRC guide contains plenty more excellent examples - read chapter 3!

What is a travel expense?

Remember, the 24 month rule prevents employees from receiving tax relief on travel expenses related to temporary workplaces. That means, in order to claim such relief, you need to actually have incurred travel expenses.

We’ve already written a guide to defining reimbursable expenses for employees . But in this case, we’re talking more about expenses that are not reimbursed by an employer.

To help, here’s a breakdown:

Travel expenses in the UK

Travel expenses for employees are tax-deductible when certain conditions are met, for example:

The employee personally pays their own expenses without reimbursement from their employer;

The employer reimburses travel expenses paid for by the employee;

The employer pays the costs directly on the employee’s behalf;

The cost is met by vouchers, e.g. travel tickets, or credit tokens are provided to the employee; or

The travel facilities, such as accommodation, are provided directly to the employee.

Travel expenses include not only the actual cost of the business journey but all other associated costs, such as food and accommodation, toll fees, car parking and vehicle hire charges.

Manage travel expenses the smarter way

Manoeuvring HMRC's 24 month rule, mileage rates, and trivial benefits (as just a few examples) takes practice, patience, and know-how. But keeping track of your team's travel costs and receipts only requires good tools.

Spendesk makes on-the-go expenses simple, and our smart cards and even smarter software are best-in-class. Learn more about how we fix company spending here .

And if you're not quite ready for that, here's a great (free!) guide to help you manage travel expenses on your next work trip, near or far:

More articles dealing with HMRC's rules and regulations:

How HMRC meal allowance rates work

HMRC mileage allowance: How to manage employee car travel

What is a valid proof of purchase for business expenses?

e-Receipts: How to store digital receipts for your business expenses

How HMRC advisory fuel rates work for UK businesses

HMRC Employment Allowance 2023: the rules & how to claim

How to claim HMRC research & development (R&D) tax credits easily

More reads on Product Updates

)

Expense receipt recovery made easy with Spendesk

)

A brief guide to Irish VAT rates & easier returns

)

Effortless bookkeeping with our new "Payment Inbox" feature

Get started with spendesk.

Close the books 4x faster , collect over 95% of receipts on time , and get 100% visibility over company spending.

- [email protected]

Home » Hot Topics » Remote working across borders arrangements: key issues for international employers and home working employees post-Brexit

Remote working across borders arrangements: key issues for international employers and home working employees post-Brexit

- 21 February 2021

There is no doubt that remote working and home working arrangements were already a growing trend prior to the Covid-19 pandemic.

A recent study published by PwC in the US into attitudes towards home working shows that the unintentional mass experiment which forced most of us to work from home has largely been a success.

Although, it is fair to say that few companies are planning to abandon office space completely, according to an article published on FlexJobs , it is also estimated that 22% of the total American workforce will be working remotely by 2025.

To put this number into perspective, that would mean a pre-pandemic increase of nearly 90%!

For both employers and employees, there are clearly many win-win factors which contribute to this staggering increase and change of workplace attitude.

However, for international employers and employees alike, long term working from home arrangements also represent some challenges and risks which should not be over-looked.

Table of Contents Main considerations for both employer and employee when working remotely across borders Immigration implications of remote working temporarily abroad Social security implications for cross-border remote workers Income tax and payroll issues when working remotely across borders 3 reasons why is this important for a remote worker across borders AND their employer? Cross-border remote work Corporate Tax and Permanent Establishment considerations

Main considerations for both employer and employee when working remotely across borders

Employers who have put in place or are planning to put in place home working arrangements with their remote workers working from home (but with “home” meaning one or more overseas locations), should be mindful of a variety of potential tax implications and other key issues.

The arrangement could in fact have repercussions for both employer and employee in terms of immigration, social security, tax, payroll requirements, employment law and other important aspects.

Brexit has also thrown an additional spanner in the works and in this article we will discuss in more details why that’s the case and how to best deal with it.

Immigration implications of remote working temporarily abroad

Whilst little has changed with Brexit for countries already outside of the EU-EEA and Switzerland as the usual requirements of Visa sponsorship for employers and work permits for employees continue to apply, Brexit has changed the immigration landscape for Brits who wish to remote work in the EU-EEA and Switzerland or for EU-EEA and Swiss citizens who might like the idea of smart working in the UK.

The end of free movement of people between the UK and the EU-EEA and Switzerland, as reported on the UK Government website , has translated into a maximum period of 90 days in any 180-day period in which an individual can work remotely without the need to apply for a Visa.

This means that unless an EU-EEA and Swiss citizen can obtain settled status in the UK (which would enable them to continue to live and work in the UK as before Brexit) or a UK Visa, they would no longer be able to work remotely from the UK for their EU employer say for 4 consecutive months until their partner completes their UK master degree.

Similarly, let us look at the example of a UK national seeking an arrangement with their employer whereby they work remotely from home and who, because of their personal circumstances, decide Switzerland will be their home for a period exceeding 90 days in any 180-day period.

In this scenario, they will be subject to the standard stricter criteria contained in the Federal Act on Foreigners & Integration applicable to non-EU nationals in Switzerland.

Social security implications for cross-border remote workers

The good news here is that Brexit has not overhauled existing arrangements between EU countries and there therefore no real possibility of a remote worker being asked to pay social security contributions in two jurisdictions.

The social security arrangements from 1 January 2021 are regulated by the detached worker protocol .

As part of this new UK/EU protocol on social security coordination, each EU Member State had until 1 February to decide whether or not to adopt the rules for detached workers (which effectively replicate the previous posted workers rules ).

It has now been confirmed that all EU Member States have decided to adopt the detached worker rules with the main significant difference being that the 24 month period cannot be extended the same way that it could before.

The only exceptions being:

- Norway (where employees can remain in their home country social security system for up to 3 years provided they apply within 4 months of the start of the posting)

- Liechtenstein (where there are no special provisions in place and therefore the remote working employees may genuinely find it that they have to pay social security contributions in both countries)

- Iceland (where employees can remain in their home country social security system for up to 1 year, if employed and non-UK / non-EEA national, with the possibility of extending for 1 more year provided they agree the extension before the end of the first year)

- Switzerland (where employees can remain in their home country social security system for up to 2 year)