- Share full article

Advertisement

Supported by

The Cruise Industry Stages a Comeback

After watching thousands of passengers get ill and more than a year of devastating financial losses, the global cruise industry is coming back to life. And it says it knows how to deal with the coronavirus.

By Ceylan Yeginsu and Niraj Chokshi

Nothing quite demonstrated the horrors of the coronavirus contagion in the early stages of the pandemic like the major outbreaks onboard cruise ships , when vacation selfies and videos abruptly turned into grim journals of endless days spent confined to cabins as the virus raged through the behemoth vessels, eventually infecting thousands of people, and killing more than 100.

Passengers on the Diamond Princess and Grand Princess, two of the worst-hit ships, were forced to quarantine inside their small staterooms — some without windows — as infections on board spiraled out of control. Every day anxiety and fear mounted as the captains of the ships announced new cases, which continued to spread rapidly through ventilation systems and among crew members, who slept in shared quarters and worked tirelessly throughout the day to deliver food to guests.

At the time, it was difficult to imagine how the ships, which carry millions of passengers around the world each year, would be able to sail safely again. Even after the vaccination rollout gained momentum in the United States in April, allowing most travel sectors to restart operations, cruise ships remained docked in ports, costing the industry billions of dollars in losses each month.

Together, Carnival , the world’s largest cruise company, and the two other biggest cruise operators, Royal Caribbean and Norwegian Cruise Line , lost nearly $900 million each month during the pandemic, according to Moody’s, the credit rating agency. The industry carried 80 percent fewer passengers last year compared to 2019, according to the Cruise Lines International Association, a trade group. Third-quarter revenues for Carnival showed a year-to-year decline of 99.5 percent — to $31 million in 2020, down from $6.5 billion in 2019.

And yet in June, Richard D. Fain, chairman and chief executive of Royal Caribbean Cruises, was beaming with excitement as he sat sipping his morning coffee onboard Celebrity Edge, which became the first major cruise ship to restart U.S. operations, with a sailing out of Fort Lauderdale, Fla. “At the beginning we didn’t have testing capabilities, treatments, vaccines or a real understanding of how the virus spread, so we were forced to shut down because we didn’t know how to prevent it,” he said.

Several epidemiologists questioned whether cruise ships, with their high capacities, close quarters and forced physical proximity, could restart during the pandemic, or whether they would be able to win back the trust of travelers traumatized from the initial outbreaks.

Now, said Mr. Fain, the opposite has proved true. “The ship environment is no longer a disadvantage, it’s an advantage because unlike anywhere else, we are able to control our environment, which eliminates the risks of a big outbreak.”

Cruise companies restarted operations in Europe and Asia late last year, and, after months of preparations to meet stringent health and safety guidelines set by the Centers for Disease Control and Prevention, cruise lines have started to welcome back passengers for U.S. sailings, where demand is outweighing supply, with many itineraries fully booked throughout the summer.

Carnival said bookings for upcoming cruises soared by 45 percent during March, April and May as compared to the three previous months, while Royal Caribbean recently announced that all sailings from Florida in July and August are fully booked.

Several coronavirus cases have been identified on cruise ships since U.S. operations restarted in June, including six passengers who tested positive on Royal Caribbean’s Adventure of the Seas recently, testing the cruise lines’ new Covid-19 protocols, which include isolating, contact tracing and testing passengers to prevent the virus from spreading. Most ships were able to complete their itineraries without issues, but American Cruise Lines, a small ship company, cut short an Alaska sailing earlier this month after three people tested positive for the virus.

The industry’s turnaround is far from guaranteed. The highly contagious Delta variant, which is causing surges of the virus around the world, could stymie the industry’s recovery, especially if large outbreaks occur on board. But analysts are generally optimistic about its prospects and the potential for passenger numbers to recover to prepandemic levels, perhaps as soon as next year. That optimism is fueled by what may be the industry’s best asset: an unshakably loyal customer base.

Even during the pandemic, huge numbers of people who had booked opted against taking refunds , instead converting payments already made into credit for future travel, which the companies often offered at a higher value as an incentive. Last fall, Carnival reported that about 45 percent of customers with canceled trips had opted for credit instead of cash back. About half of customers in a similar position with Royal Caribbean Cruises did the same by the end of last year, the company said at the time.

“The demand is there,” said Jaime Katz, an analyst with Morningstar. “You know that there have been 15 months of people who have had cruises booked that have been canceled.”

No U.S. bailout for the cruise companies

By April 2020, the industry was in crisis. Cruises were halted around the world after the alarming outbreaks on ships, leading to sailing bans from the C.D.C. and other global authorities.

While they employ many Americans, the major cruise companies are all incorporated abroad and were ultimately left out of the $2 trillion federal stimulus known as the CARES Act, with lawmakers chafing at the prospect of bailing out foreign corporations largely exempt from income taxes. Environmentalists lobbied against the aid, citing the industry’s poor track record on climate issues. And criticism over how the companies handled early virus outbreaks on board ships sapped any remaining political will to help. Huge losses mounted as questions swirled about whether cruise lines could avoid bankruptcy.

“All our conversations here were, ‘At this cash burn rate for each of these companies, how long can they survive?’” said Pete Trombetta, an analyst focused on lodging and cruises at Moody’s.

Cruise lines were forced to send most cruise workers home, keeping small skeleton crews on board to maintain their ships. After months without work or an income, many of the workers, who are frequently drawn from countries like the Philippines, Bangladesh and India, fell into debt and struggled to provide for their families.

The timing couldn’t have been worse for Virgin Voyages , the new cruise company founded by the British billionaire Richard Branson, which had planned to launch its inaugural ship, Scarlet Lady, with a sailing from Miami in March 2020. The ship’s official U.S. debut has been delayed until October, but a series of short sailings will take place in August out of Portsmouth, England, for British residents.

“It’s been a very difficult 15 months and we had to make some very tough cuts along the way like the rest of the industry,” said Tom McAlpin, president and chief officer of Virgin Voyages.

In the end, most cruise companies made it through the pandemic intact, but only after receiving help. That came in the form of assistance from governments abroad or money raised from investors emboldened by efforts to backstop the economy from the Federal Reserve and others. The cash wasn’t cheap, though. When Carnival Corp. sold $4 billion in bonds in April 2020, it agreed to interest on those bonds of 11.5 percent — more than half of which it recently refinanced at a more reasonable rate of 4 percent.

Carnival, which operates under nine brands globally, has lost more than $13 billion since the pandemic began and said in a securities filing last month that it expects those losses to continue at least through August. The company amassed more than $9 billion in cash and short-term investments as of the end of May — enough, it said last month, to pay its obligations for at least another year. It says it expects to have at least 42 ships carrying passengers by the end of November, representing just over half of its global fleet.

The industry faces a long road back to normal. Moodys downgraded ratings for each of the big three cruise companies during the pandemic and says it will probably take until 2023 for the major cruise operators to start substantially reducing their debt, which had nearly doubled during the pandemic.

The companies have also been caught up in a series of legal battles in Florida, the biggest base of operations in the United States, that has them sometimes allied with the administration of Gov. Ron DeSantis, and sometimes opposing it.

In June, Florida sued the C.D.C., saying the agency’s guidelines for how cruising could restart were burdensome and harmed the multi-billion-dollar industry that provides about 159,000 jobs for the state. The C.D.C. guidelines require 98 percent of crew and 95 percent of passengers to be fully vaccinated before a cruise ship can set sail, otherwise the cruise company must carry out test voyages and wait for approval.

So far, the state has prevailed in the courts, with a ruling from a federal judge that prevented the C.D.C.’s vaccine requirements from going into effect after July 18. A federal appeals court upheld that ruling on July 23.

Despite the court’s decision, Cruise Lines International Association, the trade group, said cruise companies will continue to operate in accordance with the C.D.C. requirements. The cruise lines found the C.D.C.’s initial guidance too onerous, but once the agency made revisions to factor in the U.S. immunization program, the companies agreed to comply and said they preferred passengers to be vaccinated, because it simplifies the onboard experience.

As that suit was making its way through the courts, Norwegian filed suit on July 13 against the state of Florida, saying that a law banning business from requiring proof of immunization from people seeking to use their services prevented the company from “safely and soundly resuming passenger cruise operations.”

There has yet to be a ruling in the case.

Hurdles remain

Several other hurdles could also derail the rebound of the industry. While cruising has resumed, operators still have to contend with a patchwork of domestic and international rules, some of which impose strict conditions on passengers who go on shore excursions. A serious and widespread outbreak aboard a ship, or a broader communitywide surge in virus infections, could drive away potential customers and stall the momentum of the cruise comeback.

But despite the delays and potential for further disruptions, Virgin Voyages is hopeful for a successful launch of its new brand. Virgin’s Scarlet Lady adult-only ship, which was inspired by a superyacht design, aims to attract a hip and younger crowd, offering 20 different buffet-free dining options and a range of entertainment, including D.J. sets and immersive experiences.

“We have a fantastic set of investors behind us, and I think we are well positioned to make a big comeback because people are ready to travel and cruise again and we are launching a very attractive new onboard product right in the middle of it all,” Mr. McAlpin said.

Two new cruise ships, Carnival’s Mardi Gras and Royal Caribbean’s Odyssey of the Seas are set to launch in the U.S. this week.

And cruise workers, many of whom burned through savings and went into debt during their enforced layoff, are thrilled to be back. “I can’t believe the day has come when I have been called back to work,” said Alvin Villorente, a wine steward for Norwegian Cruise Line, who spent the last year at home in the Philippines, carrying out odd jobs to pay his bills.

“It felt too good to be true,” he continued. “I made my wife read the email to make sure I understood correctly and when I saw her smile everything suddenly went from black to bright colors. I could look after my family again.”

At a time when airports are busy and chaotic and hotels and holiday rentals are expensive and booked up, cruise companies hope to appeal to people who wouldn’t normally consider a cruise vacation.

“I’m still on the fence about booking any travel because of the constantly changing rules around the world, but an adult-only cruise with some friends could be fun, especially if it meant not having to fly anywhere,” said Crystal Marks, a 37-year-old personal trainer from Miami who went on a cruise once as a child and has been looking at Virgin sailings for early next year after a friend sent her a promotional video.

“Yoga classes at sunrise, fitness throughout the day, city-style restaurants, spa treatments, it sounds pretty perfect to me,” she added with a laugh. “If everyone on board is vaccinated and tested regularly it’s probably one of the safer options for international travel.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places list for 2021 .

Ceylan Yeginsu is a London-based reporter. She joined The Times in 2013, and was previously a correspondent in Turkey covering politics, the migrant crisis, the Kurdish conflict, and the rise of Islamic State extremism in Syria and the region. More about Ceylan Yeginsu

Niraj Chokshi covers the business of transportation, with a focus on autonomous vehicles, airlines and logistics. More about Niraj Chokshi

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

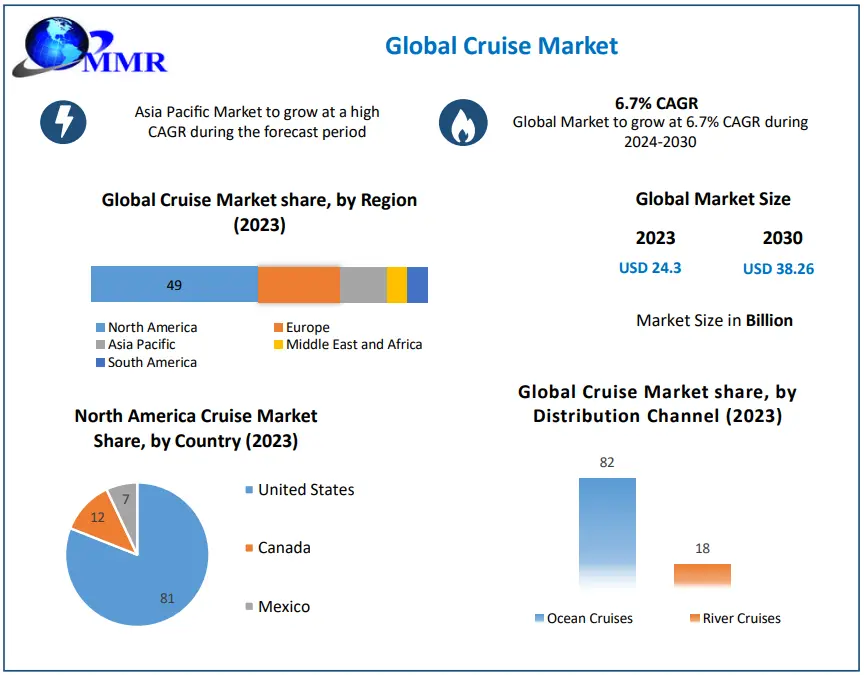

Cruise Outlook: Can rebounding demand keep up with increases in supply?

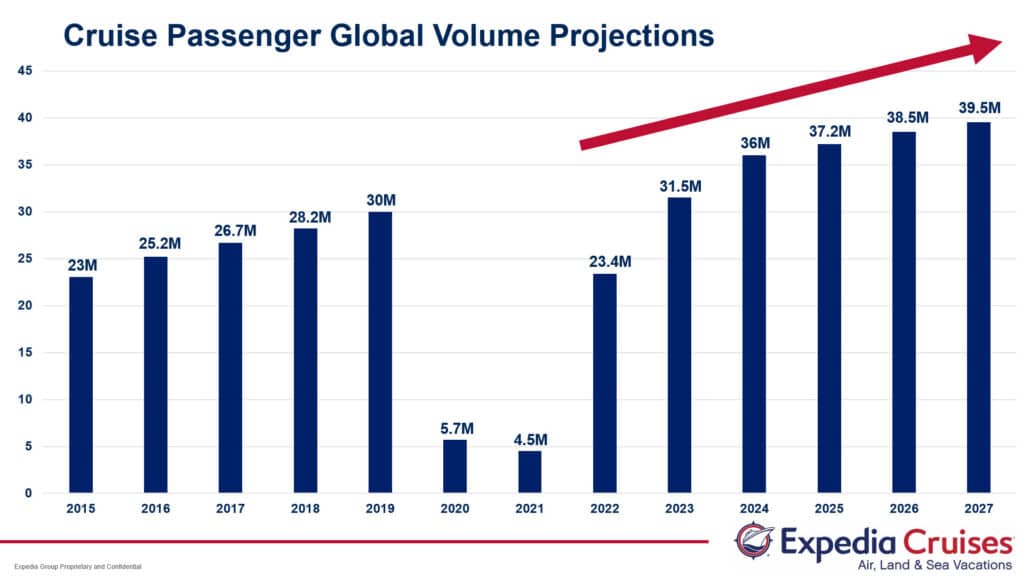

Cruise operating capacity is on pace to exceed its 2019 level by 16% in 2024. The cruise industry entered the global shutdown in March 2020 with a new vessel orderbook near record levels. Even with pandemic-related delays, many of these ships will be completed and deployed in 2023 and 2024. New capacity growth will be only partly offset by cruise ship retirements. Supply growth is anticipated to slow in 2025 but capacity should grow by roughly one-quarter into the medium-term.

What you will learn:

- Recent bookings activity has eased near term concerns, showing a strong trajectory for demand recovery. As cruise lines have resumed operations a record pace of new bookings has been reported early in the 2023 wave season, which is a key step towards filling planned sailings.

- Economic deceleration is underway, with many advanced economies in a mild recession in 2023 which risks slowing the demand recovery. However, travel demand currently remains resilient as pent-up demand and savings continue to support activity.

- Supply may outpace demand, placing pressure on occupancy rates and pricing. The supply growth cycle means that the cruise sector faces not only the challenge of re-igniting cruise demand post-pandemic among experienced cruisers but must also attract substantial numbers of new cruisers to absorb new capacity.

- Cruise lines face key choices in regional capacity deployment, with risks of over-supply in some markets. The Caribbean, Mediterranean and Alaska are anticipated to experience the largest capacity increases in 2023.

- New mega-ships have limited options for turnaround calls, pointing to a need for close coordination by ports and cruise lines to diversify activity. 49% of mega-ship turnaround activity this year is anticipated to occur at just five ports.

- New ships on the orderbook will further change the mix of operating vessels and itineraries.

Related Resouces

Leisure travel expected to continue outperforming amid signs of more even tourism growth

According to findings from Tourism Economics’ latest Travel Industry Monitor (TIM), which tracks the views of tourism professionals every quarter, leisure tourism is expected to continue to spearhead travel global travel growth in 2024, especially for domestic and short-haul destinations.

Will Chinese Traveller Behaviour Change?

As Consumer and Business Spending Slows, Which Sectors Will Grow in 2024?

Concerned about the lingering effects of inflation, rising interest rates, and the impact of geopolitical turmoil, many consumers are tapping the brakes on spending while businesses reconsider their investment strategies. Despite this slowdown, certain industries will continue to offer growth opportunities in the coming year.

Select to close video modal

Select to close video modal Play Video Select to play video

Switch language:

Cruise in 2022: the state of the industry

Using the latest thematic insights from GlobalData, Peter Nilson looks at the state of the cruise industry.

- Share on Linkedin

- Share on Facebook

At the beginning of the year, many companies, governments, and travel authorities had predicted a stronger recovery for the cruise market in 2021. Unfortunately, that was not the case.

The pandemic has proven unpredictable, with many cruise destinations going into second and third lockdowns during 2021 after a global surge in Covid-19 cases .

Go deeper with GlobalData

Innovation in Ship: Anti-fouling Ship Hull Coatings

Environmental sustainability in ship: bio-fuel propulsion marine ve..., premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

The walt disney co, carnival corporation & plc, expedia group inc, norwegian cruise line holdings ltd.

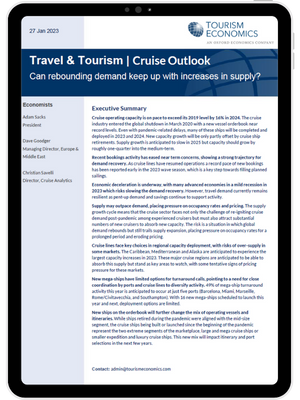

While the cruise industry has experienced a 96% Year-on-Year (YoY) increase of passengers, reaching 13.9 million, it still does not compare to the pre-pandemic levels of 2019, where there were 29.7 million passengers globally. It has been an even worse year for travel intermediaries specializing in cruise holidays.

These companies are the primary selling points for cruise trips and are often responsible for selling upgrades, premium drinks packages and excursions. Global spending across 60 major cruise markets increased by 65% YoY, resulting in total revenues of $19.4bn. Nevertheless, this was still far from pre-pandemic levels in 2019, which were approximately $29.8bn, 35% higher than 2021’s figure.

To reduce costs, many ships were retired between 2019 and 2021. Cruise ships are the most expensive assets, making this practice a necessity for many firms to stay afloat.

However, more optimistic times lie ahead for the sector. During the pandemic, the cruise industry has witnessed new innovative cruise ships and a brand-new competitor in the form of Virgin Voyages . Many cruise liners have come good with orders for new cruise ships built before the pandemic, resulting in an exciting time for loyal cruise holidaymakers to try new ships, services, and onboard experiences.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Global cruise passengers and revenue

2021 provided a tough lesson for the cruise industry, with businesses aiming to make a swifter recovery from the latest round of lockdowns.

The cruise industry’s recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels. In 2021, only 13.9 million passengers went on a cruise, 53% lower than the pre-pandemic levels of 2019.

With the fluctuations of global passengers, revenues will generally follow a similar pattern unless there is a substantial shift in consumer behaviour. Usually, the most significant impacts on a travel company’s revenues, aside from passenger flows, are an economic recession, foreign exchange, or a change in booking trends.

During the pandemic, it has become clear that the latter affected cruise intermediary revenues. In 2021, revenue generated for cruises from intermediaries reached $19.5bn, a 65% YoY increase from $11.8bn. However, cruise passenger flows increased by 95% YoY, which is a significantly higher rate of improvement.

According to the CEO of the Royal Caribbean Group, Richard Fain, this was not unexpected. The world’s fourth-largest cruise company has seen intermediaries such as online travel agencies (OTAs) and high street agencies lose a proportion of their market share, with customers opting to book directly with the cruise operator rather than a third party.

The same sentiment was echoed by Norwegian Cruise Lines CEO Frank Del Rio, who said the company had witnessed a similar booking pattern. The result is not surprising. Many agencies have had to cut back on their workforce due to poor revenue performance in 2020, resulting in fewer sales agents to capture the rising demand in 2021. This has led to more customers booking directly with cruise companies.

Research from GlobalData also supports this, when comparing two consumer surveys from 2019 and 2021. In 2019, 44% of respondents said they typically book via an OTA. However, in a Q4 2021 survey, only 24% of respondents said they booked their last holiday via this booking method. In addition, respondents who said they booked directly increased from 32% to 36%.

New cruise ships and trends for 2022

There are many new cruise ships scheduled to set sail in 2022. Many of these boast a more contemporary feel to their décor and interior, moving away from the traditional looks of the past cruise ships and moving to a more fashionable boutique hotel design.

The motivation for this stems from the fact that cruise operators need to attract a younger market. This evolution is necessary for making cruise businesses more resilient in the future by drawing the next generation of cruise tourists.

According to a 2020 GlobalData survey, 37% of Gen Z and Millennials said that they ‘strongly’ or ‘slightly’ agreed with the notion that they would book an international trip this year. In comparison, only 22% of those older than 35 responded with the same sentiment, highlighting that the younger generation may be more likely to travel in today’s travel climate.

Furthermore, cruising has also become more popular with younger adults. In GlobalData’s Q3 2019 and 2021 global consumer surveys, the percentage of Gen Z and Millennial respondents who typically take a cruise holiday increased from 17% to 21%, indicating changes in consumer tastes.

The importance of Covid-19 safety protocols on cruise ships has never been more critical. According to GlobalData, there is a demand from consumers to receive information about Covid-19 initiatives. This data shows that consumers need substantial levels of communication from cruise providers, and that cruise companies will need to develop robust communication strategies, which need to be scaled over the next few years.

Many travellers are opting to book directly with the operator rather than via an intermediary such as an OTA. According to a Q3 2019 GlobalData survey, 44% of consumers said they typically book via an OTA.

However, this has fallen substantially over the last two years. In a Q4 2021 survey, only 24% of respondents said they booked their previous holiday via an OTA.

In addition, respondents who said they booked directly with a travel supplier increased from 32% to 36%, showing that booking directly with the supplier is becoming more trustworthy and popular.

Nevertheless, this booking behaviour could well be a temporary result, with some cruise operators expecting intermediary trade to pick up again in 2022.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Leading cybersecurity companies for the shipping industry

Marine propulsion systems, transmission and ship engine room equipment for the shipping industry, australian industry group voices concern over strategic fleet proposal, the top 10 biggest cruise ships in the world, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Ship Technology In Brief

Ship Technology Global : Ship Technology Focus (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount

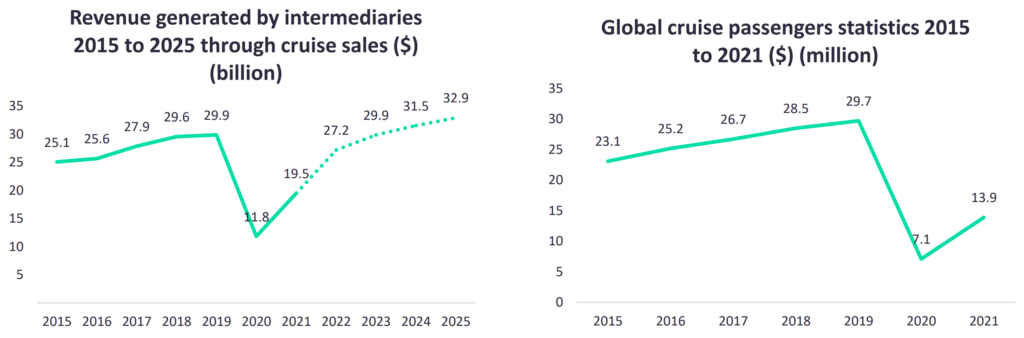

Cruise Market: Global Industry Analysis and Forecast (2024-2030)

“ Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount ”

- Request Sample

- Customization

Cruise Market Overview and Scope

Cruise Market Dynamics

Global cruise market segment analysis, regional analysis, global cruise market competitive analysis, cruise market scope : inquire before buying, cruise market, by region, cruise key players, about this report.

- INQUIRE BEFORE BUYING

Related Reports

Our clients, report payment, get call back from us.

- IT & Telecommunication

- Electronics

- Chemical & Material

- Energy & Power

- Food & Beverages

- Automotive & Transportation

- Aerospace & Defense

- Life Science

- Biotechnology

- Automation & Process Control

- Mining & Metals

- Engineering Equipment

- Medical Devices

- Consumer Goods & Services

- Subscription Model

- Competitive Intelligence

- Advance Analytics

- Technologies

- Go-To-Market Strategy

- Market Potential

- Mergers and Acquisitions

- Pricing Analysis

- Supply Chain Consultation

- Press Releases

Cruises - Worldwide

- By 2024, the Cruises market is projected to generate a revenue of US$30.11bn worldwide.

- The revenue is expected to grow annually at a rate of 5.05% (CAGR 2024-2028), which will lead to a projected market volume of US$36.67bn by 2028.

- Moreover, the number of users in this market is expected to rise to 33.43m users by 2028.

- The user penetration, which is currently at 0.37%, is expected to increase to 0.42% by 2028.

- The average revenue per user (ARPU) is projected to reach US$1.05k .

- It is noteworthy that in the Cruises market, 25% of the total revenue is expected to be generated through online sales by 2028.

- In terms of revenue generated, United States will have the highest share, with a total of US$15,160m in 2024.

- Despite the challenging times for the cruise industry, the demand for luxury cruises in the United States remains strong.

Key regions: Germany , Singapore , Indonesia , India , Vietnam

Definition:

Additional Information:

The main performance indicators of the Cruises market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues. Users represent the aggregated number of guests. Each user is only counted once per year.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

For further information on the data displayed, refer to the info button right next to each box.

- Multi-day cruises

- Ocean cruises and river cruises

out-of-scope

- Trips by ferry (including trips with overnight stay)

- Trips by ferry mainly for transport purposes

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

The Cruises market worldwide continues to experience steady growth and evolution, driven by changing customer preferences, emerging trends, local special circumstances, and underlying macroeconomic factors. Customer preferences: Customers worldwide are increasingly seeking unique and personalized cruise experiences, leading to a rise in demand for themed cruises, expedition cruises, and luxury cruises. Passengers are looking for more than just a traditional cruise vacation, opting for immersive cultural experiences, adventure activities, and wellness offerings onboard. Additionally, there is a growing interest in sustainable and eco-friendly cruises, with passengers prioritizing environmentally conscious travel options. Trends in the market: In the United States, the Cruises market is witnessing a surge in demand for river cruises, particularly along the Mississippi River and Alaska's Inside Passage. These cruises offer passengers a chance to explore inland waterways and experience the natural beauty of these regions up close. Moreover, themed cruises centered around food and wine, music festivals, and wellness retreats are gaining popularity among American travelers, catering to diverse interests and preferences. Local special circumstances: In Europe, the Cruises market is influenced by the continent's rich history, diverse cultures, and scenic waterways. European cruises often include stops at iconic cities like Venice, Barcelona, and Amsterdam, allowing passengers to immerse themselves in the region's art, architecture, and culinary delights. The Mediterranean remains a top destination for cruise travelers, offering a blend of sun-soaked beaches, ancient ruins, and vibrant coastal towns along the way. Underlying macroeconomic factors: The Asia-Pacific region is experiencing a boom in the Cruises market, driven by rising disposable incomes, expanding middle-class population, and increasing interest in luxury travel experiences. Countries like China, Japan, and Australia are seeing a growing number of cruise passengers, leading to investments in new cruise ship terminals, infrastructure development, and strategic partnerships with international cruise lines. The region's diverse landscapes, cultural heritage, and culinary offerings make it a compelling destination for both domestic and international cruisers.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Key Players

- Sales Channels

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Unlimited access to our Market Insights

- Statistics and reports

- Usage and publication rights

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Cruise Tourism Market

An Analysis of the Cruise Tourism Market by Adventure Cruises, Classic Cruises, Luxury Cruises, River Cruises, and Others

Cruise tourism is becoming increasingly popular since it is an opulent mode of transportation that incorporates an all-inclusive vacation aboard a ship for at least 24 hours.

- Report Preview

- Request Methodology

Cruise Tourism Market Snapshot (2023 to 2033)

The cruise tourism industry held a market worth of US$ 5.3 billion in 2022, and it is anticipated that it will reach a market value of US$ 17.8 billion by 2033, growing at a CAGR of 12.1% from 2023 to 2033.

Cruise tourism is a huge business industry, according to a certain study, prior to the COVID-19 pandemic in 2020; the cruise industry across the world hosted 29.7 billion passengers. This generated jobs for nearly 1.8 billion individuals across the globe and gave approximately US$ 150 billion to the world’s economy.

The cruise tourism market has become the swiftest growing segment in the entire travel industry across the globe and there is plenty of variety of cruises on offer these days. Cruise tourism is fundamentally a form of enclave tourism, and it incorporates all the aspects of the tourism industry such as transportation, accommodation, attractions, and hospitality

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Cruise Tourism Market Historical Analysis (2018 to 2022) Vs. Forecast Outlook (2023 to 2033)

The global demand for cruise tourism market is projected to increase at a CAGR over 12% during the forecast period between 2023 and 2033, reaching a total of US$ 4.6 billion in 2018, according to a report from Future Market Insights (FMI). From 2018 to 2022, sales witnessed significant growth in the global cruise tourism Market, registering a CAGR of 8.3%.

The global cruise tourism market is said to grow exponentially during the forecast period due to the increasing disposable income of individuals along with the latest development in the cruises’ facilities and offers onboard.

More pioneering services, themes, amenities, etc., that are offered in many cruise liners nowadays are anticipated to propel the demand for the cruise tourism market during the forecast period. Several cruise companies these days are offering services such as in-room spa treatments, skydiving simulators, adventurous activities, water coasters, etc., these activities are said to attract tourists and are anticipated to escalate the share of footfalls in the future.

What is primarily driving the Global Market for Cruise Tourism Market?

Remarkable Expansion of the Cruise Industry in Emerging Areas

One of the key aspects influencing the cruise tourism business is the expanding cruise industry. Several businesses are emerging, offering a range of amenities to draw clients to meet the need for maritime cross-border travel. The infographic claims that in December 2022, 239 ships entered commercial service, a 15-fold increase over December 2021.

The top 10 cruise brands account for 105 of the 239 cruise vessels that will depart in December. MSC Cruises, having 13 active ships along with 50,326 beds, is ranked first on the list, followed by Carnival Cruise Line having 17 ships along with 54,364 berths, and Royal Caribbean International having 20 sailing ships along with 71,800 berths. Immense growth in the sector as these is anticipated to open up new opportunities in the market in the years to come.

Others Factors that can have a Positive Impact on the Growth Curve

There is an increasing demand for cruise tours amongst individuals of all age groups, as there are multiple fun activities for every age group. New inventive ships are being launched with the latest technologies coupled with more onboard fun for travelers to attract larger crowd. These factors positively impact the cruise tourism market growth.

A sudden increase in the popularity of cruise tourism in emerging countries is anticipated to generate robust opportunities for all cruise service providers worldwide during the forecast period. Several cruise companies are planning to expand their business in these regions in order to capture untapped markets of developing economies. These companies launch exclusive offers and attractive discounts to drive the sales of their cruise businesses.

The cruise tourism sectors’ trends are significant as they are said to experience complete power go-ahead mode distinguished by trends such as group-oriented cruises, advancements in cruise ships, generating novel experiences, culinary delights, etc.

One of the largest growing sectors in the tourism industry is the cruise industry. Even during the time of economic recession in the 2000s, the cruise industry steadily grew. The demand for cruise tourism continues to expand and growth into new destinations. There is a considerable increase in repositioning cruises, meaning moving a cruise ship from one destination to another. The tourists’ interest in such repositioning inculcates exploration of new destinations and their price advantage as compared to regular cruising. Cruising is extremely popular across all generations, it is no longer meant just for the adult population.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What can hinder the Growth of the Global Cruise Tourism Market?

Severe Weather Conditions may have a Serious Impact on the Market

The cruise tourism segment is inspired by several macroeconomic factors, i.e., the consumer’s sureness is affected by the financial crisis. There are many natural disasters that cannot be controlled by us, humans. These factors pose a threat to the global cruise tourism market. A possible reason which affects the growth of this market is the presence of pirates in the Gulf of Aden and several other areas.

Another crucial factor that affects the cruise tourism market is the condition of the crew members. Passengers are given best privileges and facilities at the crew members’ expense. This leads to low social security, and low salaries for the crew onboard a cruise ship.

Category-wise Insights

Which tourism type is likely to gain traction during the forecast period.

River Cruises are anticipated to hold a Significant Market Share in 2023

In 2022, the river cruises segment by tourism type was estimated to hold over 35% market share. It is projected that river cruising, which allows passengers to take in the landscape along the banks, would have a beneficial effect on the market during the course of the projection period.

Onboard features on river cruises are many. Staterooms are often river-facing and have hotel-style beds, private bathrooms, refrigerators, individual climate controls, safes, and TVs. Higher cabin grades may have French balconies, verandas, and separate bedroom and sitting rooms. A room can range in size from 150 to 600 square feet. The crew members onboard deliver exceptional, customized service to visitors. Additionally, ships provide free WiFi, eating options, pubs, and lounges. There are stores, sun decks, swimming pools, and libraries on certain ships. The aforementioned amenities draw a sizable number of visitors, fueling the market expansion of the river cruise segment.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Comparative View of the Adjacent Markets

Cruise Tourism Market:

Alaskan Cruises Market:

European Cruises Market:

Region-wise Analysis

What is likely to drive the sales in the north american market for cruise tourism.

Rising Middle-Class Families to Boost the Sales in the Cruise Tourism Market

In the global cruise tourism market, North America is responsible for the dominant market share owing to the luxury taste of the population and the constantly increasing economy. The North American region is likely to hold a 33.5% market share of the global cruise tourism market.

Increasingly more people are choosing to cruise as a holiday choice in North America. The ease, comfort, and elegance of cruising have drawn a lot of interest, which has helped the sector expand. The baby boomer group is prevalent in North America, and they are more likely than younger generations to go on cruises. Demand has also been boosted by the increasing middle class families in North America, which has increased the number of individuals who can afford to go on cruises. Cruise ships can visit a variety of locations in North America, including the Caribbean, Alaska, Mexico, and Canada.

What can be expected from the European Market for Cruise Tourism from 2023 to 2033?

Rising Cases of River Cruising along with Increased Cruise Capacity to Boost Growth

In 2022, the European market cruise tourism was estimated to have acquired a 28.9% revenue share. Europe’s low market penetration strategy renders several opportunities for ship cruising. In Europe, countries like Ireland and the United Kingdom are the two biggest source markets for cruises. Spain, France, and Italy are also some of the other large source markets in Europe.

The cruise tourism market will be expanding at a considerable rate during the forecast period owing to the rise in river cruising in this region. The Netherlands has portrayed rising demand for cruise ships due to more interest in people. Every year, the river cruises segment is growing exponentially, especially in Germany. The capacity of the passengers on the main European rivers is also increasing, with the emergence of new operators while the existing operators regularly renovate or expand their fleets by constructing next-generation boats.

Market Competition

The key players in this market include:

- AmaWaterways LLC

- Ambassador Cruise Holidays Ltd.

- American Cruise Lines, Carnival Corp., and Plc

- Compagnie du Ponant

- Cosmos Tours Ltd.

- Genting Hong Kong Ltd.

- Kerala Shipping and Inland Navigation Corp. Ltd.

- LaVista Travel

- MSC Mediterranean Shipping Co. SA

- Norwegian Cruise Line Holdings Ltd.

Key players operating the cruise tourism market are adopting innovative growth strategies and some of the key developments in the cruise tourism market are:

- In March 2019, Italian shipbuilding giant Fincantieri launched the Costa Venezia, a massive new cruise ship with a capacity of over 5,200 guests. With 135,500 tons and 323 meters in length, the Costa Venezia will be the largest-ever ship introduced by Costa to the Chinese market.

- In June 2022, Carnival Corp.’s Carnival Cruise Line collaborated with Costa Cruises, which is Italy’s favorite cruise line by creating a novel concept for Carnival’s North American guests when COSTA® by CARNIVAL® debuts in the spring of 2023 and Costa Venezia TM joins the Carnival fleet sailing from New York. Costa Venezia will be followed by Costa Firenze TM arriving in the spring of 2024 to sail from Long Beach.

- In November 2022, the prestigious Ganga Vilas project in India was unveiled. It calls for the launch of a cruise service with a 4,000-kilometer travel route. Starting in 2023, the luxury vessel will travel from Varanasi in Uttar Pradesh via Dibrugarh in Assam through Bangladesh.

- In 2022, the India-based business Cordelia Cruises said that it would spend more than US$ 1 billion by 2025 to buy at least three cruise ships in order to focus on the Indian market, which boasts the third-longest coastline in the world at 7,500 km. The government's prediction of a 10-fold increase in the sector over the following ten years is consistent with Cordelia Brand's optimistic view.

Report Scope

Key segments profiled in the cruise tourism market, by cruise type:.

- Adventure Cruises

- Classic Cruises

- Luxury Cruises

- River Cruises

By Tourist Type:

- Independent Traveller

- Package Traveller

- North America

- Latin America

- Western Europe

- Eastern Europe

- South Asia and Pacific

- Middle East and Africa

Frequently Asked Questions

How big is the cruise tourism market.

The market is valued at US$ 7.1 billion in 2023.

Who are the Key Cruise Tourism Market Players?

Carnival Corporation, Royal Caribbean Group, and MSC Cruises are key market players.

Which are the Key Asian Countries in the Cruise Tourism Market?

India, Japan, and China dominate the Asian market.

How Big Will the Cruise Tourism Market by 2033?

The market is estimated to reach US$ 17.8 billion by 2033.

Which Region holds high Lucrativeness?

North America is projected to emerge as a lucrative market.

Table of Content

List of tables, list of charts.

Recommendations

Travel and Tourism

Tourism Industry Big Data Analytics Market

Published : July 2023

Casino Hotel Market

Published : June 2023

Hawaii Tourism Market

Published : February 2023

Tourism Market

Published : November 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

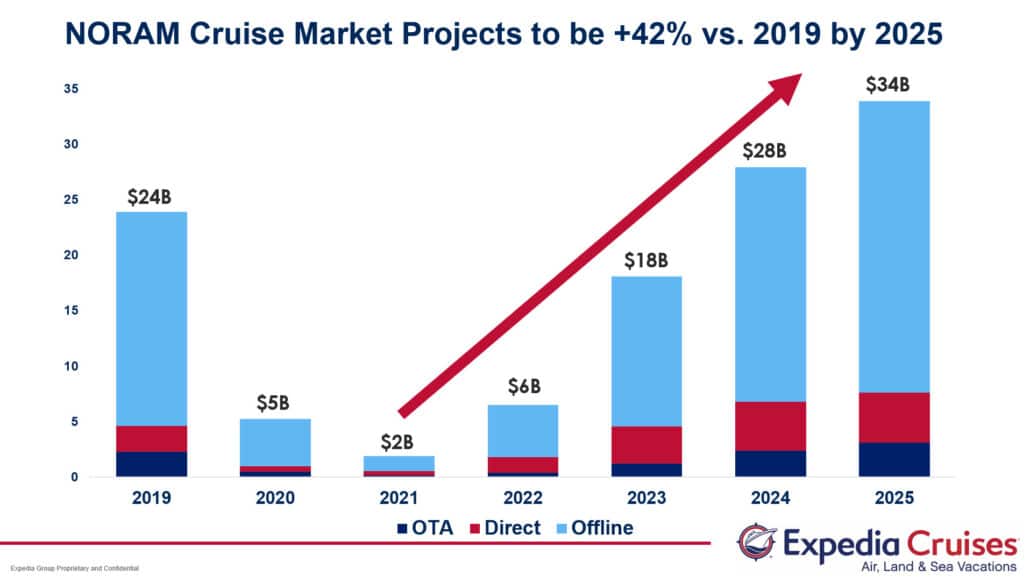

Cruise Industry Update

Last updated on September 18th, 2023

Cruise Industry Present Day & Forecast

There’s no denying that the past few years have collectively been difficult for much of the world, and the cruise industry was no different as it was one of the hardest hit industries during the pandemic. As the rest of the world recovers and life goes back to normal, the same can be said for cruise! With 31.5 million passengers expected to cruise in 2023, it’s safe to say that the cruise industry is booming once again. Cruise is a resilient industry, and it continues to be one of the fastest-growing sectors of tourism.

Cruise Industry Overview Quick Facts ( CLIA ):

- 31.5 million cruise passengers expected to sail in 2023

- 70+ new cruise ships on order between now and 2027

- 65% of cruisers work with a traditional travel agent

- 85% of travelers who have cruised before say they will cruise again

- 75% of the U.S. population is within driving distance of a cruise port

- 88% of Millennials and 86% of Gen-X travelers say they will cruise again

- Solo cruise travel is on the rise

- Younger cruise travelers—from Gen Z to Millennials to Gen X—turn to travel advisors to book their cruises more so than any other generation

- North America remains the largest cruise market

- Caribbean remains the top destination for cruisers

- Average age of a cruiser is now 46 years old

- Cruise industry is expected to reach $25.1B in revenue by the end of 2023

- Cruise industry supports over 1M jobs

Cruise Industry Investment

The cruise industry has invested over $50 billion dollars towards driving innovation and transformations over the next 4 years. In pursuit of a more responsible, efficient, inclusive, and enjoyable vacation experience, cruise lines are investing in LNG-powered ships, eco-friendly cruise travel, enhanced use of technology onboard, more onboard entertainment and activities, multi-generational experiences, and much more!

One of the main areas that cruise lines have, and will continue to, invest heavily in is their ships! A fleet of brand-new cruise ships will set sail, bringing with them a wave of excitement, relaxation, and unforgettable experiences. Cruisers will have the opportunity to immerse themselves in a world of advanced technology and unparalleled comfort, indulging in luxury as they soak up the local culture, or embark on thrilling adventures. To read more about the new ships of 2023, head over to our blog: The 12 Most-Anticipated Cruise Ships of 2023 .

Private Islands

The private islands of cruise lines have always been some of the top destinations for travelers sailing to the Caribbean or Panama Canal. These exclusive retreats have something for everyone, from eco-tours and water excursions to theme park thrills and beach side lounging. With the rise of popularity of these private islands, cruise lines have invested billions of dollars into enhancing and expanding their private islands; creating over-the-top experiences to all those who visit. Here are a few cruise lines and their private islands:

- Royal Caribbean International – Perfect Day at CocoCay, Bahamas

- Royal Caribbean International & Azamara Club Cruises – Labadee, Haiti

- Princess Cruises & Carnival Cruise Line – Princess Cays, Bahamas

- Disney Cruise Line – Castaway Cay, Bahamas

- Holland America Line & Carnival Cruise Line – Half Moon Cay, Bahamas

- Norwegian Cruise Line & Regent Seven Seas Cruises – Great Stirrup Cay, Bahamas

- Norwegian Cruise Line, Regent Seven Seas Cruises, Oceania Cruises – Harvest Caye

- MSC Cruises – Ocean Cay MSC Marine Reserve, Bahamas

- Virgin Voyages – The Beach Club at Bimini

New Ports/Port Enhancements

Is there a better sign of a booming cruise industry than cruise lines adding/enhancing their embarkation and disembarkation ports? Royal Caribbean Group is a great example of how cruise lines are investing in the future by partnering with large infrastructure companies to withstand the volume of cruise passengers expected in the next few years.

“Our partnership with iCON is a unique opportunity to catapult us into the coming decades of port investments, build further financial strength, and provide exceptional cruising experiences, responsibility, to our guests at the best destinations in the world” – Jason Liberty, President and CEO of Royal Caribbean Group ( cruisehive )

Several other cruise lines including, Carnival Corporation, Virgin Voyages, MSC Cruises, and Norwegian Cruise Line have invested, or are committed to invest, hundreds of millions of dollars in the coming years to enhance their port presence.

Industry Trends

Each year new trends emerge in the cruising industry that pave the way for the future of cruising. In 2019, we saw an increased demand for off the beaten path destinations, tech-driven features on ships, and an increase in working nomads – to name a few. In 2020, a big focal point of the industry was on decreasing the generational gap in cruisers and more options for solo travelers. Fast forward to 2023, cruising trends today include a focus on sustainable and responsible tourism, the use of tech onboard, younger generations being the future of cruise, the rise of expedition cruising, longer and more luxurious cruises for the seasoned travelers, and shorter cruises for first timers.

Environmental Sustainability

With a goal of net carbon neutral cruising by 2050, cruise lines are pursing innovative solutions, and investing billions, into sustainable cruising. But what exactly does this mean? For starters, almost all cruise lines are opting to use LNG for all new ships being built in the future. Liquified Natural Gas (LNG) are natural gasses that are drawn from the earth’s core and then are super cooled to become liquified natural gas. This liquified state makes the gas odorless, colorless, non-toxic, and non-corrosive. The advantages of adopting LNG are impressive as it creates a cheaper, more efficient, and more environmentally friendly gas. LNG releases zero sulfur, has 99% less particulate emissions, 85% less nitrogen oxide emissions, and 25% less greenhouse gas emissions. Using LNG will also result in a longer lifespan with less wear and tear on the engine, low maintenance costs, and cleaner emissions. For existing ships, the cost of converting to LNG would be too substantial so cruise lines are looking to other methods for these ships, such as exhaust gas cleaning systems.

An exhaust gas cleaning system, also known as a scrubber, allows ships to continue using heavy fueled oil, while reducing their Sulphur oxide and particulate matter emissions. In short, this scrubber will literally scrub away harmful sulfur oxides from exhaust gases. Adopting ECGS will allows ships to reduce their sulfur oxide levels by 98%, reduce total particulate matter by 50%, and reduce nitrogen oxides by 12%.

Furthermore, more and more ships are being fitted with advanced wastewater treatment systems, to ensure the quality of treated wastewater and equipped with the ability to receive shoreside power connectivity which allows ships to turn off their engines and tap into cleaner energy available at ports, cutting emissions and harmful toxins.

For more details on what cruise lines are doing to lessen their impact on the environment, here are a few cruise line sustainability websites:

- https://carnivalsustainability.com/

- https://www.celebritycruises.com/ca/about-us/sustainability-efforts/environmental-Initiatives

- https://disneyparksnews.com/uploads/sites/4/2019/07/DCL_Env_Fact_July-2019.pdf

- https://www.msccruisesusa.com/en-us/About-Msc/MSC-Sustainability.aspx

- https://www.ncl.com/about/environmental-commitment

- http://sustainability.rclcorporate.com/

Responsible Tourism

Responsible, or sustainable tourism, is just as important as environmental sustainability, as these practices often go hand in hand. As economically advantageous as it to draw hundreds, if not thousands, of visitors to a destination, the disadvantages of overcrowding, and careless behaviors by tourists, are a detriment to the unique heritage, landscape, and way of life of the places visited. As the demand for cruising increases steadily with each passing year, cruise lines are aware of their responsibility to not only preserve the physical land they allow passengers to traverse, but also to respect, protect, and value the culture and environment of the places they visit.

Cruise lines are working with local communities to brainstorm creative ways to manage the flow of tourists they bring to shore, as well as implementing the highest standards of responsible tourism ( CLIA ). For example, Princess Cruises embodies a concept of “ socially conscious ” cruising.

“It’s about creating a small group that have immersive training onboard, and then when they go ashore, it’s about doing things that are good for the local communities,” Vice President of North American Sales for Carnival Corp. and Princess John Chernesky said.

Other examples include how CLIA Cruise Lines, in collaboration with the Mayor’s office and the City Council, developed new measures to alleviate tourism flow issues in Dubrovnik; in Santorini, the cruise industry worked with local authorities on a new ship arrival management system to spread the flow of tourists visiting the system; and in Alaska cruise lines have implemented more stringent waste water requirements than even the communities on land ( CLIA ). Royal Caribbean International also offers more than 3,500 shore excursions that are GSTC-certified. To be certified by the Global Sustainable Tourism Council (GSTC), a shore excursion must be a one-of-a-kind experience that respects local culture and its surroundings.

Technology Onboard

From digital/AI check-in and boarding passes to touchless room entry and geo-locators for children on ships, cruise lines have fully embraced the new age of technology. Today’s cruisers expect a personalized and seamless experience, from embarkation to disembarkation, and everything in between, the modern cruiser will look to their phones or onboard technology for almost every aspect of their cruise experience.

Want a quick and seamless check-in to get onboard faster? You got it – just take a selfie and upload it to the app. Want to make reservations at your favorite restaurant? Easy – book it on your cruise app! Need to open your stateroom? No problem – tap your wristband to the door sensor! Want to know where your kids are on the ship? They’ve got you covered – your wristband also serves as a GPS locator onboard! And these are just a few of the incredible technological advancements fitted on ships these days. See below for a few more!

- “Zoe” on MSC’s newest ships serves as your own personal “Alexa or Siri”. Zoe is programmed to answer 800+ questions about excurions, onboard restaurants, and much more!

- On Virgin Voyages cruises you can shake the Virgin Voyages app ( Shake for Champagne™ ) for a secret button to appear. With just one press of the button a bottle of champagne will be delivered to your stateroom.

- Locate your loved ones with the MedallionClass App on Princess Cruises

- Book a virtual balcony! It’s an inside stateroom with a floor-to-ceiling, wall-to-wall, high-definition LED screen that feeds live footage of the view your would have had in a balcony room (without the price tag!)

- Geo-locate your children with trackable bracelets such as those on Carnival Cruise Lines

Catering to Younger Generations

Retirees, empty-nesters, and old couples – this is what most people considered to be the cruiser demographic in the past. But not anymore! The cruising world has drastically changed as younger generations are favoring experiences and adventures over material goods. And the numbers don’t lie – cruising demographic has changed over the last few years with the average age of a cruiser dropping down to 46! Gen-X and Millennials are the most enthusiastic about planning a cruise vacation with 86% of Gen-X and 88% of Millennials planning to cruise again ( CLIA ). As the preference for experiences becomes an increasing trend, cruise lines are adapting by creating innovative, cutting-edge, and entertaining ships, as well as itineraries that cater to a younger crowd. These include, but are not limited to, music festivals at sea, remote destination itineraries, tech-inspired ships, and endless activities onboard.

It’s important to note that with all this attention given to younger generations, cruise lines have NOT forgotten about the older generations; their bread and butter that brought cruising to the forefront of vacation planning. There are still plenty of cruise lines, ships, and itineraries that cater to a more refined taste and traditional way of cruising, with elegantly designed staterooms, traditional dining rooms, and culture-rich onboard and off-shore experiences.

Rise of Expedition Cruising

Who says you can’t have adventure AND luxury?! Small-ship expedition cruising is a hot trend that has slowly gained popularity over the past few years. Although these cruises come with a higher price tag, more and more cruisers are flocking to these itineraries that offer once-in-a-lifetime experiences. From the Arctic to the Galapagos Islands, expedition cruising allows adventure enthusiasts the perfect opportunity for eco-discovery in exotic lands, along with luxurious accommodations. Seabourn, Viking, Silversea, Hurtigruten, and Scenic Luxury Cruises & Tours are just a few of the cruise lines offering expedition cruising.

Longer, More Luxurious Cruises

With the increase in remote work, more and more cruisers have shown interest in longer, grander voyages. Longer cruises can range anywhere from 30 days to world cruises that are upwards of 200 days! These lengthy cruises allow travel aficionados the ability to visit several ports on their bucket list, all while unpacking once.

Shorter Cruises

Longer, more luxurious cruises aren’t the only one’s trending – shorter cruises have also picked up steam! Shorter cruises are under 7 days and allow travelers the opportunity to recharge over a few days, or sometimes just a weekend, at sea. The convenience of these “micro-cations” is a main selling point for cruise lines and travel agencies. Less planning, more affordable, and less paid time off required from work – what’s not to love?!

Solo Cruising

Solo cabins, although much smaller than double-occupancy cabins, are the answer solo travelers have been waiting for. The ability to unpack once, have all your meals included, and explore multiple destinations, all without paying a single-supplement fee, has made cruising a much more affordable and exciting vacation option for those opting to travel alone.

Here is a list of a few of the major cruise lines doing their part to assist solo travelers:

- Royal Caribbean International

- Norwegian Cruise Line

- Holland America Line

- Costa Cruises

- Cunard Line

- AmaWaterways.

If you’ve still got questions about why investing in a retail travel agency franchise is a great decision, we’d be happy to answer them! For more details about the Expedia Franchise opportunity fill out our request form or take a look at this six-step overview of our retail travel agency franchise opportunity here .

Carnival rides on record cruise demand to lift annual profit forecast

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Granth Vanaik in Bengaluru and Doyinsola Oladipo in New York; Editing by Sriraj Kalluvila

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Granth reports on the North American Consumer and Retail sector, covering a broad range of companies from consumer packaged goods and restaurants to department stores and apparel retailers. Granth's work on the website usually appears on the Retail & Consumer page of Reuters Business section. He holds a post-graduate degree in international relations and area studies and has previously worked as a research analyst.

Spirit Airlines gets credit from IAE that will boost liquidity

Spirit Airlines' said on Friday it will get a monthly credit from International Aero Engines through the end of 2024 as compensation for Spirit being unable to use aircraft with engine issues.

Tupperware Brands flagged doubts about the ability to continue as a going concern for at least a year and forecast inadequate liquidity to fund operations, the seller of plastic airtight food storage containers said in a filing with the SEC on Friday.

More From Forbes

3 cruise trends for 2023.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Celebrity Beyond hits the high seas.

COVID challenged the cruise industry in unprecedented ways. But the industry proved resilient. Pent-up demand caused cruise bookings to bounce back in 2022, a trend that should continue in the near future: according to Cruiseline.com and Shipmate’s 2022 Member Survey, 91.4 percent of respondents reported they plan to take a cruise within the next year.

To find out what to expect from the cruise world in 2023, we turned to Lisa Lutoff-Perlo, a 37-year industry veteran. Since 2014, she’s served as president and CEO of Celebrity Cruises , whose new Celebrity Beyond — the third ship in the modern-luxe Edge Series — set out on its inaugural U.S. sailing earlier this month featuring decorated chef Daniel Boulud’s first fine-dining restaurant at sea, Le Voyage; new AquaClass SkySuites with floor-to-ceiling ocean vistas, balconies and wellness amenities; and Simone Biles, the most decorated American gymnast in history, as the vessel’s godmother.

As we close out 2022, Lutoff-Perlo shared three cruise trends that she predicts will be big in the coming year:

There Will Be a Demand for Bucket-List Destinations

“We saw ‘revenge travel’ happening in our data before the term was coined,” Lutoff-Perlo said. “From the moment we returned to service, it was clear to us consumers had a renewed propensity to travel and to experience their bucket list destinations. They also identified the compelling value proposition that a cruise vacation offers for their return to experiencing the world — that when seeing the world there is real value in unpacking once and waking up to explore a new destination every day. Based on the ongoing data, I believe consumers will continue to seek out places they have never been and only previously dreamed of going and that they will be looking to make a deeper connection with the places they visit. Travel brands need to rethink what a destination experience really means to today’s traveler.”

Cruises will have to find ways to be sustainable.

Best Travel Insurance Companies

Best covid-19 travel insurance plans.

Sustainability Will Be a Focus

“The world is thinking about sustainability and the travel industry should continue striving for progress when it comes to ESG,” she said. “This needs to be reflected not only in the infrastructure that enables the vacation — cruise ships, planes, trains, etc. — but also throughout the entire travel experience. How are we being responsible destination partners? Taking care of the planet and each other? The cruise industry, like many others, already does so much, but we must continue to innovate and share all that we are doing.”

Wellness will go beyond the spa.

Wellness Experiences Will Evolve

“Our health instantly became top of mind pre-pandemic, and I believe it’s even more important now and into the future through a broader, more holistic lens,” she said. “We’re seeing in our research that self-care, forming stronger connections with family and friends and living a healthier lifestyle are top consumer goals for the coming years. And, with the definition of ‘wellbeing’ continuing to expand, travel brands need to think about it in terms of everything from mind to body and spirit.”

“At Celebrity Cruises, we continue to weave wellbeing into the entire guest experience from the design and spaciousness of all areas onboard, to leveraging the restorative power of the ocean, to spa and culinary experiences, to simplifying transactions for our guests.”

- Editorial Standards

- Reprints & Permissions

Carnival Corporation’s Weinstein: Creating Broad-Based Demand for Cruise Travel

- March 28, 2024

Carnival Corporation’s record-breaking results were not achieved by chance, said President and CEO Josh Weinstein.

Instead, they come as a result of broader work to increase demand and customer base, he added during Carnival’s first quarter earning calls on Wednesday.

“Our record booked position and activity did not just happen, and it is not the result of pent-up demand for repeat guests built up during the pause,” Weinstein said, noting that this situation is now “years in the rear-view mirror.”

“It is because we have been creating more consideration and broad-based demand for cruise travel in all of our source markets across our well-balanced portfolio,” he explained.

As a result, Weinstein added, Carnival Corporation brands are now capturing more new passengers than ever before which, coupled with a growing base of repeat guests, drives greater overall demand.

“Our brands are delivering sustainable revenue growth that hit the bottom line. At the same time, our brands are continuing to pull the booking curve forward,” he said.

To sustain momentum and capitalize on this untapped revenue opportunity, Carnival Corporation has “more in the pipeline,” Weinstein noted.

“We have three fantastic new ships driving increased consideration and demand to their respective brands,” he said, mentioning the Carnival Jubilee, the Sun Princess and Cunard’s Queen Anne.

Carnival Corporation is also investing in a modernization program for AIDA Cruises fleet and a new private destination for Carnival Cruise Line in the Bahamas, Celebration Key.

“Our exclusive destination, purpose-built for that brand’s target guests, is really starting to capture the imagination as they launched a new marketing campaign right in the heart of wave season,” Weinstein said.

“Although early days, Celebration Key has already delivered initial halo for bookings in the second half of 2025 across 18 Carnival Cruise Line ships departing from 10 homeports,” he said.

“We expect ticket revenue uplift from this incredible destination as the guest experience delivers unmatched fun as well as incremental in-port spending.”

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

51 Ships | 109,838 Berths | $35 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

Cruise operator Carnival lifts 2024 profit forecast on record demand

(Corrects to say adjusted net loss per share of 14 cents, not 15 cents, in paragraph 12)

By Granth Vanaik and Doyinsola Oladipo

(Reuters) -Carnival Corp raised its annual profit forecast on Wednesday, betting on a record year of bookings for its cruises as the industry has its "revenge travel" moment.

Cruise companies are experiencing all-time high booking rates as travelers switch to cheaper sea-borne experiences over expensive land-based alternatives such as booking hotels or flights, allowing operators to hike prices.

However, U.S.-listed shares of the company, which owns the Cunard and Holland America Line cruise lines, reversed course from premarket and were last down about 3%. They have risen about 94% in the last 12 months.

"This has been a fantastic start to the year," CEO Josh Weinstein said in a statement.

"We delivered another strong quarter that outperformed guidance on every measure, while concluding a monumental wave season that achieved all-time high booking volumes at considerably higher prices."

The company's first-quarter revenue rose to $5.41 billion, roughly in line with analysts' expectations.

Bookings for the rest of 2024 remain the best year on record with total customer deposits reaching a first-quarter all-time high of $7 billion, the company said.

Carnival has estimated an impact of up to $10 million on both adjusted EBITDA and adjusted net income for the full year following the Baltimore's Francis Scott Key Bridge collapse on Tuesday.

The company said in January that strong demand trends during the year were expected to offset the impact it was seeing due to the re-routing of ships in the Red Sea region.

The cruise operator now expects adjusted profit per share of 98 cents in 2024, compared with its prior forecast of 93 cents. Analysts on average were expecting a profit of $1 per share, according to LSEG data.

Adjusted cruise costs, excluding fuel in constant currency, were up 7.3% in the first quarter, compared with the same period a year earlier.

Carnival posted an adjusted net loss per share of 14 cents, compared to analysts' expectations of 18 cents.

The company projected an adjusted loss per share of 3 cents in the second quarter, in line with expectations.

(Reporting by Granth Vanaik in Bengaluru and Doyinsola Oladipo in New York; Editing by Sriraj Kalluvila)

You are using an outdated browser. Please upgrade your browser to improve your experience.

Cruise operator Carnival lifts 2024 profit forecast on record demand

(Reuters) -Carnival Corp raised its annual profit forecast on Wednesday, betting on record demand for cruise vacations as well as higher prices.

Cruise companies are now experiencing an all-time high booking rates as travelers switch to cheaper sea-borne experiences over expensive land-based alternatives such as booking hotels or flights, allowing operators to hike prices.

However, U.S.-listed shares of the company, which owns the Cunard and Holland America Line cruise lines, reversed course and were last down about 3% in early trading. They have risen about 94% in the last 12 months.

“This has been a fantastic start to the year,” CEO Josh Weinstein said in a statement.

“We delivered another strong quarter that outperformed guidance on every measure, while concluding a monumental wave season that achieved all-time high booking volumes at considerably higher prices.”

The company’s first-quarter revenue rose to $5.41 billion, roughly in line with analysts’ expectations, according to LSEG data.

Bookings for the rest of 2024 remain the best year on record with total customer deposits reaching a first-quarter all-time high of $7 billion, the company said.

To attract more bookings, firms also offered special deals and discounts during the all-important wave season – between January and March – on their tickets and itineraries for the year.

In January, Carnival said that the first half of 2024 was almost fully booked, adding that strong demand trends during the year were expected to offset the impact it was seeing due to re-routing of ships in the Red Sea region.

The cruise operator now expects adjusted profit per share of 98 cents in 2024, compared with its prior forecast of 93 cents. Analysts on average were expecting a profit of $1 per share, according to LSEG data.

(Reporting by Granth Vanaik in Bengaluru; Editing by Sriraj Kalluvila)

Leave a Reply Cancel reply

You must be logged in to post a comment.

Current Weather

Cruise Ship Industry:

Europe Cruise Industry Eyes Green Investment With Emissions Plan

Tourists queue for onward travel at a cruise terminal in Barcelona.

Europe’s cruise lines are arguing that some of the cash from emissions reduction programs should be plowed back into infrastructure investments, as the industry prepares to electrify ports and ships.

With cruise operators set to start contributing to the European Union’s emissions trading program, the global Cruise Lines International Association, or CLIA, wants “countries to be able to reinvest all, or at least some, of this extra revenue into infrastructure,” Europe Director General Marie-Caroline Laurent said in an interview.

IMAGES

COMMENTS

THE STATE OF THE CRUISE INDUSTRY 2023 CRUISE UPDATE & FORECAST Cruise tourism is rebounding faster than international tourism arrivals Source: CLIA Cruise Forecast/Tourism Economics (December 2022) Projected global cruise passenger volume (numbers represent an index of volume relative to 2019 (2019=100)) Projected global cruise passenger volume

Premium Statistic. Revenue of the cruise industry in leading countries 2025-2028. Revenue of the cruise industry in leading countries 2025-2028. Leading countries in the cruise industry revenue ...

Intro Statement. Like many businesses, the cruise industry has been challenged by the COVID pandemic of 2020. So much has happened in the nine months since cruising's pause in service first ...

United States. Over the last ten years, the popularity of cruise trips has increased significantly among travelers worldwide. However, while the number of global ocean cruise passengers peaked at ...

Dec 4, 2021. As travel begins to return in greater numbers following the COVID-19 pandemic, the future of cruise will continue to evolve in 2022 and beyond. Pent-up demand already has led to a ...

Luxury and Premium Market Uptick. Of the 14 new cruise ships entering service in 2024, eight are being introduced by premium and luxury brands. Among the luxury cruise lines receiving new vessels is Viking, with the 998-guest Viking Vela, and Explora Journeys, with the 920-guest Explora II. The Ritz-Carlton Yacht Collection is also getting a ...

The cruise industry is a major player in the global tourism industry, and it continues to grow year after year. The global cruise market was valued at $7.25 billion in 2021 and is expected to grow ...

Cruise Industry News selected some of the key destination and deployment trends for the cruise market in 2024 and beyond.. More Ships to Florida . With strong demand in North America, more ships are set to homeport in Florida than ever before. Carnival Cruise Line is repositioning the Carnival Venezia to Port Canaveral for the 2024-25 season.. Norwegian Cruise Line is replacing Norwegian Epic ...

The Royal Caribbean cruise ship Serenade of the Seas docked in Juneau, Alaska. It was the first big ship to arrive at the port this summer, as cruising tentatively restarts.Credit...

Cruise operating capacity is on pace to exceed its 2019 level by 16% in 2024. The cruise industry entered the global shutdown in March 2020 with a new vessel orderbook near record levels. Even with pandemic-related delays, many of these ships will be completed and deployed in 2023 and 2024. New capacity growth will be only partly offset by ...

The cruise industry's recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels. In 2021, only 13.9 million passengers went on a cruise, 53% lower than the pre-pandemic levels of 2019. ... According to GlobalData, there is a demand from consumers to receive information about ...