- Get Benzinga Pro

- Data & APIs

- Our Services

- News Earnings Guidance Dividends M&A Buybacks Legal Interviews Management Offerings IPOs Insider Trades Biotech/FDA Politics Government Healthcare Sports

- Markets Pre-Market After Hours Movers ETFs Forex Cannabis Commodities Options Binary Options Bonds Futures CME Group Global Economics Previews Small-Cap Real Estate Cryptocurrency Penny Stocks Digital Securities Volatility

- Ratings Analyst Color Downgrades Upgrades Initiations Price Target

- Ideas Trade Ideas Covey Trade Ideas Long Ideas Short Ideas Technicals From The Press Jim Cramer Rumors Best Stocks & ETFs Best Penny Stocks Best S&P 500 ETFs Best Swing Trade Stocks Best Blue Chip Stocks Best High-Volume Penny Stocks Best Small Cap ETFs Best Stocks to Day Trade Best REITs

- Yield How to Buy Corporate Bonds How to Buy Treasury Bonds How to Invest in Real Estate Online

- Money Compare Online Brokers Stock Brokers Forex Brokers Futures Brokers Crypto Brokers Options Brokers ETF Brokers Mutual Fund Brokers Index Fund Brokers Bond Brokers Short Selling Brokers Stock Apps All Broker Reviews Insurance Auto Home Medicare Life Vision Dental Business Pet Health Motorcycle Renters Workers Comp Top Stocks Penny Stocks Stocks Under $5 Stocks Under $10 Stocks Under $20 Stocks Under $50 Stocks Under $100 Alternative Investing Invest in Art Invest in Watches Invest in Land Invest in Real Estate Invest in Wine Invest in Gold Mortgages Refinance Purchase Find a Mortgage Broker Consumer Moving Living

- Alts Alternative Investment Platforms REITs Versus Crowdfunding How to Invest in Artwork How to Invest in Jewelry Best Real Estate Crowdfunding Platforms Best Alternative Investments Best Alternative Investment Platforms

- Crypto Get Started Is Bitcoin a Good Investment? Is Ethereum a Good Investment? What is Blockchain Best Altcoins How to Buy Cryptocurrency? DeFi Crypto and DeFi 101 What is DeFi? Decentralized Exchanges Best DeFi Yield Farms Digital Securities NFTs NFT Release Calendar What is a Non-Fungible Token (NFT)? How to Buy Non-Fungible Tokens (NFTs) CryptoPunks Watchlist Are NFTs a Scam or a Digital Bubble? Best In Crypto Best Crypto Apps Best Crypto Portfolio Trackers Best Crypto Day Trading Strategies Best Crypto IRA Best Cryptocurrency Scanners Best Business Crypto Accounts Best Crypto Screeners

- Cannabis Cannabis Conference News Earnings Interviews Deals Regulations Psychedelics

Analyst Bullish On Gene Therapy-Focused Voyager Therapeutics Sees Best In Class Potential For Its Neurogenetic Medicine Platform

Zinger key points.

- The analyst writes that Voyager's TRACER capsid discovery platform has best-in-class potential for CNS-targeted in vivo gene therapies.

- Voyager's programs are expected to lead to at least four investigational new drug application filings in 2024 and 2025.

H.C. Wainwright initiated coverage on Voyager Therapeutics Inc VYGR , noting a growing franchise of novel, highly-differentiated adeno-associated virus (AAV)-based TRACER capsids with the potential to overcome limitations of central nervous system (CNS) delivery and systemic toxicity of 1st-generation AAVs.

The analyst writes that Voyager’s TRACER capsid discovery platform has best-in-class potential for developing CNS-targeted in vivo gene therapies.

Voyager is advancing its Tropism Redirection of AAV by Cell Type-Specific Expression of RNA (TRACER) capsid discovery platform to develop novel capsids, the outer viral protein shells that enclose a genetic payload that makes up the gene therapy product, with enhanced affinity, to the CNS.

H.C. Wainwright notes that while gene therapy remains its core technology, Voyager’s pipeline also includes an anti-tau monoclonal antibody (mAb) program in Alzheimer’s disease (AD), which is expected to be followed by a combination approach with potential best-in-class in vivo gene therapies.

Voyager’s wholly-owned and partnered programs are expected to lead to at least four investigational new drug application filings in 2024 and 2025, potentially generating key clinical proof-of-biology data as early as 2025.

H.C. Wainwright has initiated with a Buy rating and a price target of $30 .

Voyager had approximately $431 million in pro-forma cash as of December 31, 2023, adjusted for $100 million consideration from Novartis agreements and a $100 million public offering , providing a cash runway into 2027 .

In January, Voyager Therapeutics announced a collaboration with Novartis AG NVS to advance potential gene therapies for Huntington’s disease (HD) and spinal muscular atrophy (SMA) .

H.C. Wainwright notes that the TRACER platform has produced promising preclinical data.

This success has led to strategic partnerships with major players in neurological disease drug development, including Novartis, Neurocrine Biosciences Inc NBIX , Sangamo Therapeutics Inc SGMO , and Alexion, AstraZeneca Plc’s AZN subsidiary. These partnerships are expected to bring significant long-term value to shareholders.

Price Action: VYGR shares are up 9.57% at $9.96 on the last check Tuesday.

Illustration of Phrama lab worker created with MidJourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

- Revisions & Errata

- Get Featured

Subscriber for weekly insights

The leading business publication for the bold and ambitious.

You’re officially subscribed to our newsletter.

For Customers

- Product Manual

- Product Updates

- API Documentation

- Explore Datasets

- Thinknum Alternative Data

Industry Products

- Investor Intelligence

- Business Intelligence

- External Data Conference

Media Services

- Content Studio

- Advertising

Here comes a wave of space companies blasting off for the public markets — and the vehicle of choice is a SPAC

Space startups like Voyager and Virgin Orbit are are among the players preparing to make their public debuts, while companies like Rocket Lab and Momentus are already trading.

While the stock market has a relatively quiet period every August, the space industry has been buzzing with activity, from recent SPACs to upcoming IPOs.

Spacetech’s SPAC trend arguably began in 2019, when Virgin Galactic merged with a special purpose acquisition company that was already trading on the NYSE. Then came SPAC deals for other space companies, many of which make small satellites.

Astra Space went public in July after announcing a SPAC merger in February, bringing its valuation up to $2 billion. Spire, another small satellite company, went public in August after raising $265 million. Satellite imagery company BlackSky also took the SPAC route, raising $283 million in its NYSE debut on Monday.

There’s still plenty of SPAC skepticism among investors, who view the blank-check deals as a risky way to bypass the IPO process, which typically requires more time, money and red tape. Because SPACs are just companies that have already gone public via IPO, space startups are seeing them as a shortcut to get publicly traded.

Spacecraft maker Rocket Lab is one of spacetech’s bigger public debuts this year. The company announced a SPAC merger last month, making its public debut on the Nasdaq on August 25. Rocket Lab’s valuation soared to $4.8 billion after the deal, and it plans to use its $777 million in proceeds to build Neutron, a larger rocket comparable to a Russian Soyuz, which would position it as a worthy competitor to Elon Musk’s SpaceX.

Peter Beck, who has already been called “the New Zealand Elon Musk,” founded the company in 2006, and much like Musk’s SpaceX, Rocket Lab builds every vehicle in-house from scratch. The company is also partnering with NASA for two upcoming missions — one called CAPSTONE that will send astronauts to the lunar surface, and the other, ESCAPADE, that will send two spacecraft to explore Mars.

Virgin Orbit

Virgin Orbit, not to be confused with Richard Branson’s other space company, Virgin Galactic, announced last month that Boeing would invest in its upcoming $3.2 billion SPAC. Boeing already invests in Virgin Galactic, which deals in space tourism as opposed to Orbit’s satellite-launching focus.

One of Virgin’s unique features is its launch method: Instead of a vertical rocket launch, a converted Boeing 747 launches a rocket into orbit carrying the company’s satellites. Branson used the same launch method for his infamous spaceflight in July.

It’s not clear exactly when Virgin Orbit will go public, but the company is well on its way to becoming a rival of SpaceX, which currently dominates 30% of the $9 billion launch market.

Voyager Space

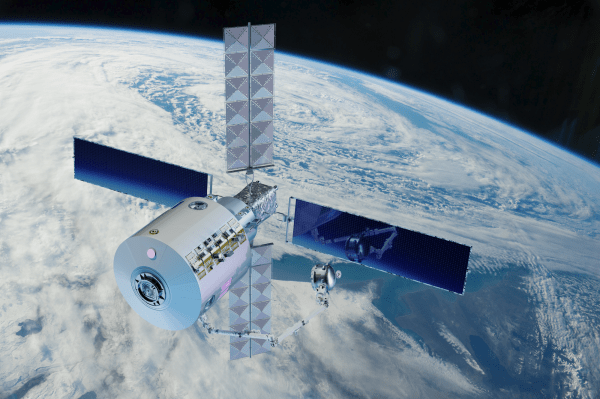

Unlike most space startups going public, Voyager is planning an IPO as opposed to a SPAC. The Denver-based company is aiming for a $1 billion valuation, and plans to make its debut in early 2022. It’s currently working on raising capital with the help of JP Morgan, according to CEO Dylan Taylor.

Voyager is also much younger than most other space companies. Founded in 2019 by Steve Ehrlich, Voyager specializes in TK. The company has also used its capital to buy up smaller space tech firms — most recently a majority stake in Nanoracks, which built the first private airlock on the International Space Station.

Not all SPAC mergers go smoothly, as was the case with Momentus, a space company that makes water-based plasma engines, among other products. Momentus completed its deal and went public in August after a year of negotiations which resulted in the departure of its founders and a new CEO, John Rood. The original founders, Mikhail Kokorich and Lev Khasis, who are both Russian, were ousted after unspecified national security concerns were raised.

But Momentus’s problems didn’t end there. Its valuation was slashed in half from $1.1 billion to $567 million, followed by an $8 million SEC fine. According to the SEC, Momentus misled investors and falsified results from a 2019 prototype test. The company posted no revenue last year or this year, and expects just $5 million in revenue in 2022.

Sign up for our Newsletter

Start your day off with our weekly digest.

Latest Articles

Who really works for opensea, twitter’s endgame in its case against elon musk, bolt and client abg bury the hatchet and become “proud partners” again, a brief history of why martin shkreli got banned from twitter, recession and bankruptcy fears are rising, corporate filings show, analysis: the sharks are circling crypto, and it’s going to take a lot to fight them off, falling down the rabbit hole — how a reporter became part of the martin shkreli story, "repulsive," "reptilian," "diseased": what john d. rockefeller had in common with martin shkreli.

.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NVIDIA CORPORATION

- NIPPON ACTIVE VALUE FUND PLC

- UNILEVER PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Undervalued stocks

- Trend-Following Stocks

- Multibaggers

- Yield stocks

- Growth stocks

- Ageing Population

- The Vegan Market

- Let's all cycle!

- The genomic revolution

- Israeli innovation

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Place your bets

- Circular economy

- The Golden Age of Video Games

- Financial Data

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

- Stock market news

- Voyager Space Is Weighing Traditional Ipo As Soon As Next Year -…

VOYAGER SPACE IS WEIGHING TRADITIONAL IPO AS SOON AS NEXT YEAR - CNBC

Wall Street: investors wait before the Fed meeting

Biggest cyberattacks in US healthcare sector

News Highlights : Top Global Markets News of the Day - Wednesday at 9 AM ET

Europe's debt collectors face reckoning as bad loans vanish

CANADA FX DEBT - Canadian dollar weakens, benchmark yield slips

Netanyahu to address U.S. Republican senators, after speech by Democrat Schumer, source says

Futures steady ahead of Fed rate decision

Pre-Fed rate nerves push FTSE 100 in red

Industry consolidation vital for European airlines - IAG CEO

Futures bide time in lead-up to Fed policy decision

ANALYST RECOMMENDATIONS : Best Buy, Wells Fargo, AMD, Netflix, Nvidia...

Every morning, find a selection of analysts' recommendations covering North America and the UK. The list only includes companies that have been the subject of a change of opinion or price target, or of a new coverage. It may be updated during the session. This information can be used to shed light on movements in certain stocks or on market sentiment towards a company.

NVIDIA CORP : Buy rating from JP Morgan

Gucci's steep sales decline throws spotlight on China

Intel prepares for $100 bln spending spree across four US states

BASF SE : From Neutral to Buy by Berenberg

Intel clinches nearly $20 bln in awards from Biden to boost US chip output

China to pass new rules for labelling of GMO crops used in food, media reports say

Kering: warning severely punished on the stock market

Asia stocks shaky ahead of Fed, yen hits 4-month low

Futures directionless on Fed day

Voyager Air shelves $200 million London IPO

Reporting by Shashwat Awasthi in Bengaluru and Clara Denina in London; Editing by Arun Koyyur

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Britain's Cameron says Gaza ceasefire crucial but 'a whole lot of conditions' to meet

Britain's Foreign Secretary David Cameron on Wednesday said it was vital for a pause in fighting between Israel and militant group Hamas to enable the release of hostages in Gaza, but a lot of conditions first needed to be met for a lasting ceasefire.

Voyager Space raises $80M as it continues development on private space station, Starlab

Voyager Space , a company developing a private space station, has raised $80.2 million in new capital. The new funding comes as Voyager continues its development of the station, Starlab, which is no doubt an enormously capital-intensive undertaking.

The funding includes participation from NewSpace Capital, Midway Venture Partners and Industrious Ventures, according to U.S. Securities and Exchange Commission filings and other documents viewed by TechCrunch. Seraphim Space also participated, TechCrunch has confirmed. The funding was filed with the SEC on January 27.

In October 2021, Voyager announced it was developing “Starlab,” a completely private space station, in partnership with Nanoracks (which is majority owned by Voyager) and Lockheed Martin. The project, which is not the only private station currently under development, is in part in response to the impending retirement of the International Space Station by the end of the decade.

NASA has already provided a large bulk of funding to Voyager, as well as two separate projects led by Blue Origin and Northrop Grumman. Starlab was awarded $160 million to further develop its plans under the agency’s Commercial low Earth orbit (LEO) Destinations program. In a recent report, NASA’s Office of Inspector General said that a habitable station in LEO was vital to conducting research needed to support human exploration missions to the moon and Mars.

TechCrunch has reached out to Voyager Space for comment and will update the story if they respond.

Voyager Space operates a space-focused holding company intended to increase vertical integration and mission capability. Voyager's long-term mission is to create a vertically integrated NewSpace company capable of delivering any space mission humans can conceive. The company centralizes core shared services and offers an alternative solution to traditional private capital models and replaces them with a longer-term approach as a provider of permanent capital, enabling commercial space companies to focus more on the development of innovative products and solutions.

Important Disclosure

As of December 9, 2020, Liberty Street Advisors, Inc. became the adviser to the Fund. The Fund’s portfolio managers did not change. Effective April 30, 2021, the Fund changed its name from the “SharesPost 100 Fund” to “The Private Shares Fund.” Effective July 7, 2021, the Fund made changes to its investment strategy. In addition to directly investing in private companies, the Fund may also invest in private investments in public equity (“PIPEs”) where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about The Private Shares Fund (the "Fund"), please download here , or call 1-855-551-5510. Read the prospectus carefully before investing.

The investment minimums are $2,500 for the Class A Share and Class L Share, and $1,000,000 for the Institutional Share

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell shares other than through the Fund's repurchase policy regardless of how the Fund performs. The Fund does not intend to list its shares on any exchange and does not expect a secondary market to develop.

All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund’s outstanding shares at NAV to be redeemed each quarter. Due to transfer restrictions and the illiquid nature of the Fund’s investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Fund’s securities, value will be based on the parameters set forth by the prospectus. As a consequence, the value of the securities, and therefore the Fund’s Net Asset Value (NAV), may vary.

There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund is a non-diversified investment company, and as such, the Fund may invest a greater percentage of its assets in the securities of a smaller number of issuers than a diversified fund. The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices. Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities.

The Fund may invest in private securities utilizing special purpose vehicles (“SPV”s), private investment funds (“Private Funds”), private investments in public equity (“PIPE”) transactions where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements. The Fund will bear its pro rata portion of expenses on investments in SPVs, Private Funds, or similar investment structures and will have no direct claim against underlying portfolio companies. PIPE transactions involve price risk, market risk, expense risk, and the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

The Fund may not be suitable for all investors. Investors are encouraged to consult with appropriate financial professionals before considering an investment in the Fund.

Companies that may be referenced on this website are privately-held companies. Shares of these privately-held companies do not trade on any national securities exchange, and there is no guarantee that the shares of these companies will ever be traded on any national securities exchange. The Fund invests primarily in equity securities of Portfolio Companies, which consists of shares of either common or a series of preferred stock of such company or convertible debt issued by such company which is convertible into shares of common or a series of preferred stock of such company (and references to “equity securities” throughout this Prospectus includes such equity-linked convertible notes).

The Private Shares Fund is distributed by FORESIDE FUND SERVICES, LLC

Private Shares Fund

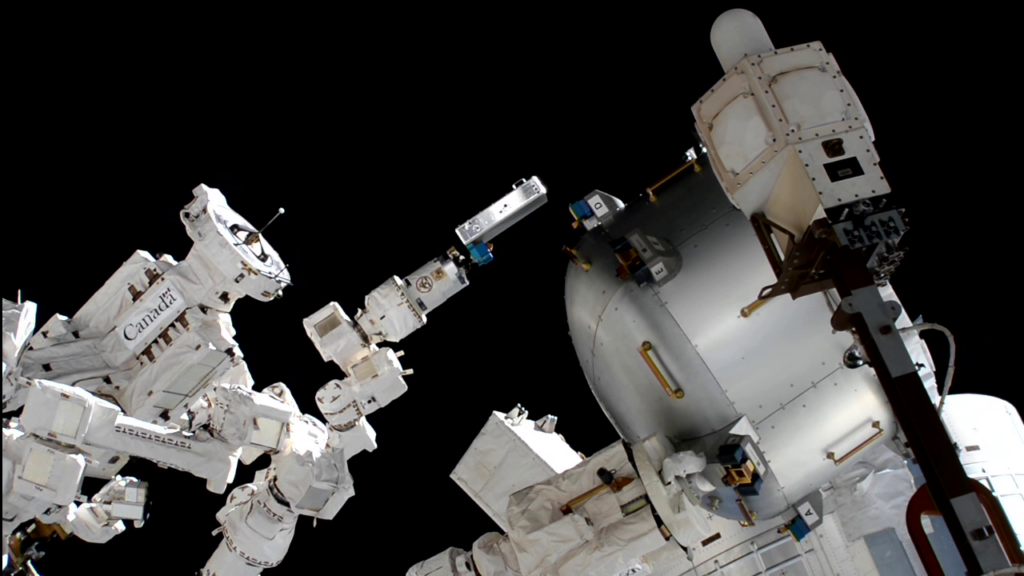

- Bishop Airlock

- Satellite Launch Services

- Astronaut Health & Medicine

- Mission Management, Ops, & Integration

- Advanced Systems

- Research & Tech Payloads

- Technical Resources

- In Space Servicing & Assembly

- Satellite and Spacecraft Subsystems

- Electro-Optics, Guidance & Navigation

- Digital Systems

- Signals Intelligence

- TALIX: Tactical Precision

- Ground Launch Support

© Copyright. All rights reserved.

Legal & Privacy Notices

Explore Space

Enabling your mission, from microgravity research to satellite deployment and commercial activities.

Innovate Forward

Pioneering space technology solutions for a sustainable future.

Protect from Ground to Space

Leading-edge defense solutions for ground, air, and space.

Expanding Frontiers

Starlab is unleashing the next generation of commercial space destinations.

Unleashing the next generation of space destinations.

Starlab, a US-led joint venture between Voyager Space and Airbus, will serve global space agencies and companies while ensuring continued human presence in low-Earth orbit and the transition of microgravity research into the new commercial era.

Airlocks, critical infrastructure for all space stations, facilitate movement between the internal station environment and the vacuum of space. From hosted payloads to robotics research and satellite deployment, learn how Bishop can advance your mission.

Our spacecraft technologies have long-standing heritage, enabling LEO, GEO and Cislunar missions since 2006 with a failure-free cumulative track record. Our solutions include rad-hardened laser and RF communications systems, electro-optical and digital systems, star trackers, space situational awareness-capable space cameras, image processors, command and data handling systems, and solutions for in-space servicing and assembly.

Our controllable solid propulsion technologies make solids perform like liquids. This technology allows for the in-flight modulation of thrust for solid fuel boosters, enabling a dramatic improvement in accuracy for both subsonic and hypersonic systems.

We are the leading provider of commercial research opportunities in low-Earth orbit. Whether you are designing your own plug-and-play payload leveraging our standardized hardware, or want our team to build a custom research platform for you – we are here to help.

We offer software and technologies that provide space-to-Earth and space-to-space visualization in support of Intelligence, Surveillance, and Reconnaissance (ISR) applications.

Our technologies help solve the medical and physiological problems of spaceflight and off-world surface exploration. We deliver a broad range of novel, non-invasive, and versatile instrumentation and hardware tailored for space mission-unique requirements.

Forging the Future.

We are Voyager Space, a leading space company dedicated to bettering humanity’s future through bold exploration, cutting-edge technologies, and an unwavering drive to protect our planet and our people.

It Takes a Planet to Explore the Universe

We’re committed to advancing humanity by driving space norms, empowering youth, and valuing sustainability from Earth to orbit, aiming for a prosperous future with a lasting, positive impact.

- The Contents

- The Making of

- Where Are They Now

- Frequently Asked Questions

- Q & A with Ed Stone

golden record

Where are they now.

- frequently asked questions

- Q&A with Ed Stone

Mission Status

Instrument status.

Where are the Voyagers now?

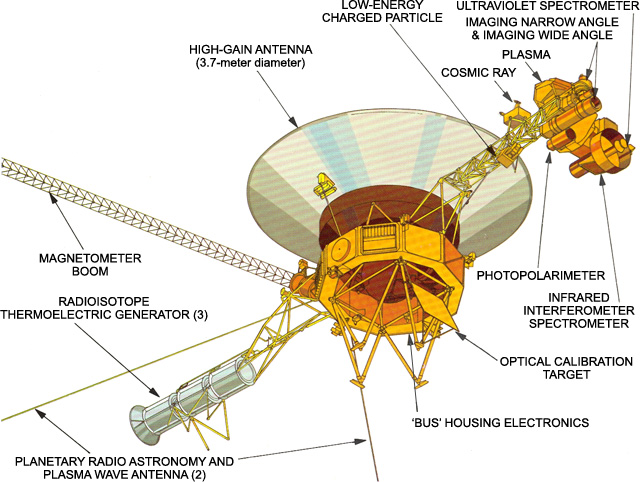

To learn more about Voyager, zoom in and give the spacecraft a spin. View the full interactive experience at Eyes on the Solar System . Credit: NASA/JPL-Caltech

View Voyager

Space Flight Operations Schedule (SFOS)

SFOS files showing Voyager activity on Deep Space Network (DSN)

2024 Tracking Schedule

2023 tracking schedule, 2022 tracking schedule, 2021 tracking schedule, 2020 tracking schedule, 2019 tracking schedule, 2018 tracking schedule, 2017 tracking schedule, 2016 tracking schedule, 2015 tracking schedule, 2014 tracking schedule, 2013 tracking schedule, 2012 tracking schedule, 2011 tracking schedule, 2010 tracking schedule, 2009 tracking schedule, 2008 tracking schedule, 2007 tracking schedule, 2006 tracking schedule, 2005 tracking schedule, 2004 tracking schedule, 2003 tracking schedule, 2002 tracking schedule, 2001 tracking schedule, 2000 tracking schedule, 1999 tracking schedule, 1998 tracking schedule, 1997 tracking schedule, 1996 tracking schedule, 1995 tracking schedule, 1994 tracking schedule.

Oh no, you're thinking, yet another cookie pop-up. Well, sorry, it's the law. We measure how many people read us, and ensure you see relevant ads, by storing cookies on your device. If you're cool with that, hit “Accept all Cookies”. For more info and to customize your settings, hit “Customize Settings”.

Review and manage your consent

Here's an overview of our use of cookies, similar technologies and how to manage them. You can also change your choices at any time, by hitting the “Your Consent Options” link on the site's footer.

Manage Cookie Preferences

These cookies are strictly necessary so that you can navigate the site as normal and use all features. Without these cookies we cannot provide you with the service that you expect.

These cookies are used to make advertising messages more relevant to you. They perform functions like preventing the same ad from continuously reappearing, ensuring that ads are properly displayed for advertisers, and in some cases selecting advertisements that are based on your interests.

These cookies collect information in aggregate form to help us understand how our websites are being used. They allow us to count visits and traffic sources so that we can measure and improve the performance of our sites. If people say no to these cookies, we do not know how many people have visited and we cannot monitor performance.

Special Features

Vendor voice.

Voyager 1 starts making sense again after months of babble

Veteran spacecraft shows signs of sanity with poke from engineers.

Engineers are hopeful the veteran spacecraft Voyager 1 has turned a corner after spending the past three months spouting gibberish at controllers.

On March 1 , the Voyager team sent a command, dubbed a "poke," to get the probe's Flight Data System (FDS) to try some other sequences in its software in the hope of circumventing whatever had become corrupted.

Readers of a certain vintage will doubtless have memories of poke sheets for various 1980s games. Not that this hack ever used a poke to get infinite lives in Jet Set Willy , of course.

While Voyager 1's lifespan is not infinite, it has endured far longer than anticipated and might be about to dodge yet another bullet. On March 3, the mission team saw something different in the stream of data returned from the spacecraft, which had been unreadable since December.

An engineer with the Deep Space Network (DSN) was able to decode it, and by March 10, the team determined that it contained a complete memory dump from the FDS.

The FDS memory read-out contains its code, variables, and science and engineering data for downlink.

Prior to NASA's announcement, Dr Suzanne Dodd, project manager for the Voyager Interstellar Mission, said in a Pasadena Star-News report that the data being transmitted from the probe was "not exactly what we would expect, but they do look like something that can show us that the FDS is at least partially working."

- Work to resolve binary babble from Voyager 1 is ongoing

- Space exploitation vs space exploration: Humanity has much to learn from the Voyager probes

- 44-year-old Voyager 2 data sheds light on solar system's magnetic personalities

- NASA engineers scratch heads as Voyager 1 starts spouting cosmic gibberish

Dodd was referring to the ones and zeroes streaming from the spacecraft. Previously, the probe's telemetry modulation unit (TMU) had begun in mid-December transmitting a repeating binary pattern as though it was somehow stuck. Engineers reckoned the issue was somewhere within the FDS.

The next step is to study the memory read-out and compare it to one transmitted before the problem arose. A solution to the issue could then be devised.

One of the original Voyager scientists, Garry Hunt, told The Register that engineers at JPL were determined to get communications with the stricken probe working again: "This requires both skills and patience with the long time between communication instructions and response."

The time lag is a problem. A command from Earth takes 22.5 hours to reach the probe, and the same period is needed again for a response. This means a 45-hour wait to see what a given command might have done.

The availability of skills is also an issue. Many of the engineers who worked on the project - Voyager 1 launched in 1977 - are no longer around, and the team that remains is faced with trawling through reams of decades-old documents to deal with unanticipated issues arising today. ®

Narrower topics

- Hubble Space Telescope

- James Webb Space Telescope

- Neil Gehrels Swift Observatory

- Perseverance

- Solar System

- Square Kilometre Array

Broader topics

- Federal government of the United States

Send us news

Other stories you might like

Nasa and japan's x-ray satellite space 'scope sends first snaps of distant galaxies, nasa's satellite pit stop project runs out of gas, swift enters safe mode over gyro issue while nasa preps patch to shake it off, reducing the cloud security overhead.

NASA missions are being delayed by oversubscribed, overburdened, and out-of-date supercomputers

Uk and us lack regulation to protect space tourists from cosmic ray dangers, nasa's fy2025 budget request means tough times ahead for chandra and hubble, japan's first private satellite launch imitates spacex's giant explosions, euclid space telescope needs de-icing, grab a helmet because retired iss batteries are hurtling back to earth, european space agency to measure earth at millimeter scale, nasa's mars sample return program struggles to get off the drawing board.

- Advertise with us

Our Websites

- The Next Platform

- Blocks and Files

Your Privacy

- Cookies Policy

- Your Consent Options

- Privacy Policy

- Ts & Cs

Copyright. All rights reserved © 1998–2024

The Most Anticipated Tech IPOs In 2023: Stripe, SpaceX Headline An Uncertain Class

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The IPO market for tech companies in 2022 was the worst in many years. Here are the startup unicorns and dark horse plodders that investors are hoping can heat it back up.

Additional reporting by Kenrick Cai, Alex Knapp and Iain Martin

T he year 2022 was largely a write-off for the tech industry when it came to IPOs, with few listings and even fewer successes. As eyes turn to 2023, investors and industry insiders aren’t expecting much more. But a few flagship companies like Stripe and SpaceX still have the capacity to change that narrative – alongside a surprise source of optimism.

A look-back at 2022 IPOs is hardly revelatory. Fewer than 80 companies went public in the U.S. for the year, down 88% from 2021, proceeds were down 95%, per data from Refinitiv, leading Axios to call it “the worst year for U.S. IPOs since 1990.”

Car rental marketplace Getaround tried to buck the trend in December, merging with a special purpose acquisition vehicle. Shares are down 90% in the past month, putting the combined company in penny stock territory. Another rare example, self-driving car company Mobileye, went public in October; it trades today up about 70% from its list price. Even so, it still trades far below where Intel, which spun out the business after acquiring it in 2017, reportedly hoped to list it.

By comparison, 2021 saw a wave of buzzy tech startups go public, including cryptocurrency exchange Coinbase, DevOps software maker GitLab, restaurant software maker Toast, data infrastructure company Confluent and dating app maker Bumble. All of those companies, like their public tech peers over the same period, now trade far below where they closed during their first days of trading.

“IPOs, we have kind-of written off for next year.”

“The goal in 2021 was to get liquid, get out there and pump up your stock and your story,” said Matt Cohen, a Wall Street public markets veteran turned venture capitalist at Toronto-based Ripple Ventures. “Now, I think we’re going to see a continued pause.”

One leader of a Bay Area-based venture firm, who asked to remain anonymous to speak freely about the market and specific companies, agreed. “IPOs, we have kind-of written off for next year,” they said. “Next year is about being heads down and trying to gain market share, and look at 2024 for exits.”

Still, some investors believe – or at least hope – that next fall, or the fourth quarter of 2023, may see tech IPOs start flowing again. With their help, Forbes reviewed the current unicorn landscape to tap who might be likely to buck the trend.

THE TRAILBLAZERS

Stripe cofounder John Collison

The online payments company valued earlier this year at $95 billion is typically first off investors’ tongues as the type of “monster” that could go public anytime. Founded in 2010 by brothers Patrick and John Collison, Stripe has the billions in revenue and restless early employees and investors to make a public offering make sense. Like others in fintech, Stripe spent the second half of 2022 in contraction, laying off more than 1,000 employees after slashing its own internal valuation by 28%. After a pandemic boom in 2021, Stripe suffered from a slowdown in e-commerce this year. If it can show a bounce-back in numbers for several quarters, it’s the company many VCs are hoping will set the table.

“Good companies don’t have to go public,” noted Villi Itchev, managing director at Two Sigma Ventures. “But I don’t subscribe to the theme that IPO windows are closed. What does happen is the valuation expectations change, and the risk appetite changes.”

While its highest-valued peers in tech were trimming their valuations, Elon Musk’s SpaceX continued to march. A recent tender offer first reported by Bloomberg will price the company at $143 billion, up about 15% from its last valuation, according to a source with knowledge of the transaction. The offer, through which employees will be able to sell shares back to SpaceX’s investors, comes as the company recently passed one million subscribers to its satellite-based Starlink internet service, the company announced in December . Launched just two years ago, and with no marketing spend behind it, Starlink has more than quadrupled its user base in the last year .

Such growth would imply annualized revenue of more than $1 billion for SpaceX from its internet satellites moving forward, not counting its fully-booked rocket launch business. But with Musk having recently acquired Twitter and taken the social media service private, it is unclear whether SpaceX will be in any rush to fully open its books – and quarterly estimates – to public market investors.

Cloud darling Databricks, valued in 2021 at $38 billion, lowered its internal valuation in October to $31 billion, according to The Information . But CEO Ali Ghodsi told Forbes in August that the company would continue to hire instead of laying people off after recently passing $1 billion in annualized revenue. “We’re not facing the pressures that come with being public,” Databricks’ cofounder said then. As the largest data infrastructure company still private, following a wave of past IPOs from the likes of Confluent and Snowflake, the Cloud 100 list fixture still carries the hopes of its area of the tech world — much like some of the buzzy, but still smaller, startup high-flyers in our next category.

THE HOTSHOTS

The big question around high-flying tech companies in the roughly $10 billion to $20 billion valuation range: Can their revenue back it up? Investors note that tech company comparisons in the public market are lucky to trade at multiples of 12x or 15x their revenue in the current environment. For companies like collaboration software businesses Airtable and Notion, that could mean a haircut from valuations of last announced funding rounds ($11.7 billion for Airtable off annual recurring revenue of more than $100 million in 2021 ; $10 billion for Notion in 2021 off annualized revenue outsiders pegged more recently at about that milestone.)

Airtable CEO Howie Liu.

The same could hold true for other Silicon Valley darlings that raised at aggressive valuations in 2020 and 2021 and now face pressure to trim costs and prioritize potentially slower, but more sustainable growth (a more difficult ask in areas such as fintech, where Chime operates, or consumer, where Discord plays). Otherwise, public market investors might have more appetite to buy shares of companies like GitLab, which has traded recently at about 11x its current sales, or Twilio, which faces more challenges but traded at just twice its sales.

“That gap will have to become more narrow,” said Cohen, the investor.

THE WOBBLERS

Klarna CEO Sebastian Siemiatkowski in 2019, in buzzier times.

A whole cohort of billion-dollar startups who talked about public listing plans but now face major issues represent another – if relatively unlikely – group that might re-approach the IPO runway in 2023. In the current market, these companies have faced major write-downs of their valuations (Klarna’s dropped 85% in July to $6.7 billion) and have conducted layoffs to try to right their ships. How effectively they could do so, and what the market would make of them, remains to be seen. But a post-Stripe or SpaceX boom could perhaps encourage their leadership to give it another try.

THE DARK HORSES

Private equity.

Should the high-flyers hold off on 2023 IPO plans, eyeing the following year, one source of hope for some tech activity could come from a surprising source: private equity firms. Thoma Bravo, Vista Equity Partners, Warburg Pincus and others were busy in past years gobbling up private and public tech company plodders that, while they lacked the rocket ship growth of others in this list, demonstrated solid financials and potential to be turned into consistent profit makers.

Gainsight CEO Nick Mehta may yet have a chance to take his company public, even after its private equity sale.

Companies like Apttus, Imperva, Gainsight, Pipedrive and Pluralsight were all taken off the board in 2021 or the preceding several years. Should their cleanup jobs have made meaningful progress, their owners may look to spin them out later in 2023, similar to Mobileye or Qualtrics, a software business SAP acquired in 2018 and took public in January 2021.

Such businesses may not be in a rush to be first out the door, either. In an interview with AdExchanger last month, Dave Clark, CEO of Vista-owned ad tech business TripleLift, poured some cold water: “We’re very lucky to be private right now and have the backers that we have in Vista. We probably won’t be thinking about [an IPO] for a few years.”

Update: This story has been updated to reflect that Starlink announced its user numbers in December 2022.

MORE FROM FORBES

- Editorial Standards

- Reprints & Permissions

- Voyager IPO is now available on Seedrs

by Nick | Jun 15, 2021 | Shareholder update | 0 comments

As I hope you are aware we have been working towards an IPO on Aquis and I am pleased to let you know that we are on target to complete that process in the coming weeks. Documentation is now substantially finalised and investor meetings are well underway. You may also have seen that our re-registration as a PLC concluded last week and that we have appointed Nikki Cooper and Jill Overland to our board. We are planning to raise up to £2 million at a valuation (prior to these new funds) of between £5 million and £6 million. That equates to a share price range of 58 – 70 pence. There is no formal right of pre-emption in our IPO fundraising but we value your support and so we do want to give all of our shareholders the opportunity to participate in our IPO, should you wish to do so. As with our previous fundraisings, new investments in Voyager continue to qualify for EIS relief.

Seedrs We are pleased to let you know that we are making participation in our IPO available on the Seedrs platform. This was announced by Seedrs earlier today and the campaign is now live . One thing to bear in mind is that although the total raise on Seedrs reflects that we are prepared to accept up to £2 million of new investment at this time, the commitments received by investors outside of the Seedrs platform are not visible on Seedrs’ campaign page (and won’t be until that element of the funding has concluded). However, we have already held numerous investor meetings and we are very pleased with the reception so far. If you have any questions either about the campaign on Seedrs or our IPO generally then please let me or Hebe ( [email protected] ) know and we will be happy to help. These are very exciting times for our Company and I thank you for your ongoing support. Kind regards Nick Tulloch CEO

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- All Aboard for Aquis!

- Proposed IPO

- Welcome to Voyager!

Recent Comments

- Shareholder update

- Entries feed

- Comments feed

- WordPress.org

Privacy Overview

IMAGES

COMMENTS

LEXINGTON, Mass., Jan. 04, 2024 (GLOBE NEWSWIRE) -- Voyager Therapeutics, Inc. (Nasdaq: VYGR), a biotechnology company dedicated to advancing neurogenetic medicines, today announced the pricing of an underwritten public offering of 7,777,778 shares of its common stock at a public offering price of $9.00 per share, and, to investors who so choose in lieu of common stock, pre-funded warrants to ...

Voyager had approximately $431 million in pro-forma cash as of December 31, 2023, adjusted for $100 million consideration from Novartis agreements and a $100 million public offering, providing a ...

Voyager Space . Unlike most space startups going public, Voyager is planning an IPO as opposed to a SPAC. The Denver-based company is aiming for a $1 billion valuation, and plans to make its debut in early 2022. It's currently working on raising capital with the help of JP Morgan, according to CEO Dylan Taylor.

Voyager is working to file paperwork for an IPO in the fourth quarter ahead of a public markets debut in early 2022. Terms of the funding round are yet to be finalized. The Denver-based company is discussing raising new equity at a valuation of at least $1 billion, which would give it so-called unicorn status, a person with knowledge of the ...

Voyager Therapeutics, Inc. ( NASDAQ: VYGR) completed its IPO in 2015, raising ~$81m via the issuance of 5.75m shares priced at $14 per share. The company's focus is on the delivery of adeno ...

Voyager Space Holdings Inc. is working with JPMorgan Chase & Co. on raising capital, its last such effort before a potential initial public offering, Chief Executive Officer Dylan Taylor said ...

Based in Cambridge, MA, Voyager Therapeutics (NASDAQ: VYGR) scheduled a $75 million IPO on the Nasdaq, with a market capitalization of $412 million, at a price range midpoint of $16, for Wednesday ...

Nanoracks was considering going public through an IPO or SPAC deal. Voyager has also acquired The Launch Company and Pioneer Astronautics this year in separate deals.

Voyager Therapeutics Inc. has debuted after pricing its initial public offering (IPO). The company sold 5 million shares at an offering price of $14.00 per share, for gross proceeds of $70 million ...

Voyager Space Is Weighing Traditional Ipo As Soon As Next Year -…. Secure and Increase the Performance of your Investments with our Team of Experts at your Side. Securing my Investments. VOYAGER SPACE IS WEIGHING TRADITIONAL IPO AS SOON AS NEXT YEAR - CNBC ... -September 29, 2023 at 05:04 pm EDT - MarketScreener.

1. Early Stage VC (Series A1) 04-Mar-2021. $56.6M. $56.6M. 00000. Completed. Generating Revenue. To view Voyager Space's complete valuation and funding history, request access ».

Funding. Voyager Therapeutics has raised a total of. $374M. in funding over 6 rounds. Their latest funding was raised on Jan 4, 2024 from a Post-IPO Equity round. Voyager Therapeutics is registered under the ticker NASDAQ:VYGR . Their stock opened with $14.00 in its Nov 11, 2015 IPO. Voyager Therapeutics is funded by 9 investors.

Voyager Air Limited <IPO-VOY.L> on Thursday put off its plans for an ... in recent weeks and intends to reactivate the IPO at a later date," it said. ... world's biggest IPO of 2019 at ...

Voyager Space, a company developing a private space station, has raised $80.2 million in new capital.The new funding comes as Voyager continues its development of the station, Starlab, which is no ...

Oct 4, 2021. A Denver company formed to consolidate space startups and small businesses is acquiring a California business developing missile defense and software technologies for the U.S ...

Aerospace | Founded: 2019 | Funding to Date: $100,000,000. Voyager Space operates a space-focused holding company intended to increase vertical integration and mission capability. Voyager's long-term mission is to create a vertically integrated NewSpace company capable of delivering any space mission humans can conceive.

With a market capitalization just north of $200 million, shares of Voyager Therapeutics (NASDAQ:VYGR) have fallen over 30% year to date. This past December shares rallied significantly after ...

Please contact [email protected] · FAQs. Private company information about Voyager Space Holdings from MarketWatch.

We deliver a broad range of novel, non-invasive, and versatile instrumentation and hardware tailored for space mission-unique requirements. the Future. We are Voyager Space, a leading space company dedicated to bettering humanity's future through bold exploration, cutting-edge technologies, and an unwavering drive to protect our planet and ...

Instrument Status. This is a real-time indicator of Voyagers' distance from Earth in astronomical units (AU) and either miles (mi) or kilometers (km). Note: Because Earth moves around the sun faster than Voyager 1 is speeding away from the inner solar system, the distance between Earth and the spacecraft actually decreases at certain times of year.

Engineers are hopeful the veteran spacecraft Voyager 1 has turned a corner after spending the past three months spouting gibberish at controllers. On March 1, ... NASA missions are being delayed by oversubscribed, overburdened, and out-of-date supercomputers. Flagship facility has just 48 GPUs. Public Sector 15 Mar 2024 | 35.

Funding. Voyager has raised a total of. $510.1M. in funding over 8 rounds. Their latest funding was raised on Jun 17, 2022 from a Post-IPO Debt round. Voyager is registered under the ticker CNSX:VYGR . Their stock opened with $0.95 in its Feb 11, 2019 IPO. Voyager is funded by 7 investors. Alameda Research and Digital Currency Group are the ...

A look-back at 2022 IPOs is hardly revelatory. Fewer than 80 companies went public in the U.S. for the year, down 88% from 2021, proceeds were down 95%, per data from Refinitiv, leading Axios to ...

Seedrs. We are pleased to let you know that we are making participation in our IPO available on the Seedrs platform. This was announced by Seedrs earlier today and the campaign is now live . One thing to bear in mind is that although the total raise on Seedrs reflects that we are prepared to accept up to £2 million of new investment at this ...