- Option Chain

- Daily Reports

- Press Releases

05-Apr-2024 15:30

12-Apr-2024 | 83.3400

05-Apr-2024 17:00

Lac Crs 396.26 | Tn $ 4.75

05-Apr-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Announcements

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %), deals today --> block deals.

- For Block Deals - Morning Block Deal Window (first session): This window shall operate between 08:45 AM to 09:00 AM.

- Afternoon Block Deal Window (second session): This window shall operate between 02:05 PM to 2:20 PM.

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

- Sector: Tourism & Hospi...

- Industry: Hotels & Resorts

India Tourism Development Corporation Share Price

- 686.45 12.91 ( 1.92 %)

- Volume: 1,31,014

- 691.00 16.30 ( 2.41 %)

- Volume: 14,898

- Last Updated On: 05 Apr, 2024, 03:58 PM IST

- Last Updated On: 05 Apr, 2024, 03:51 PM IST

India Tourism Developme...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

India Tourism share price insights

Company has spent less than 1% of its operating revenues towards interest expenses and 24.19% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

Stock gave a 3 year return of 79.3% as compared to Nifty Smallcap 100 which gave a return of 94.94%. (as of last trading session)

India Tourism Development Corporation Ltd. share price moved up by 1.92% from its previous close of Rs 673.55. India Tourism Development Corporation Ltd. stock last traded price is 686.45

Insights India Tourism

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 86.22

- EPS - TTM (₹) 7.96

- Dividend Yield (%) 0.32

- VWAP (₹) 684.13

- PB Ratio (x) 17.42

- MCap (₹ Cr.) 5,887.64

- Face Value (₹) 10.00

- BV/Share (₹) 38.67

- Sectoral MCap Rank 12

- 52W H/L (₹) 878.95 / 298.20

- MCap/Sales 5.46

- PE Ratio (x) 86.79

- VWAP (₹) 683.56

- PB Ratio (x) 17.45

- MCap (₹ Cr.) 5,926.67

- 52W H/L (₹) 879.00 / 301.30

India Tourism Share Price Returns

Et stock screeners top score companies.

Check whether India Tourism belongs to analysts' top-rated companies list?

India Tourism News & Analysis

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations, 2018

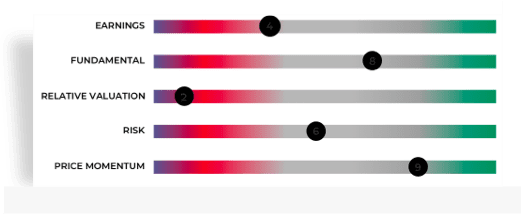

India Tourism Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

India Tourism Share Recommendations

No Recommendations details available for this stock. Check out other stock recos.

Peer Comparison

India tourism stock performance, ratio performance.

Stock Returns vs Nifty Smallcap 100

Choose from Peers

Choose from Stocks

- Oriental Hotels

- EIH Associated

- Royal Orchid

- Advani Hotels

Peers Insights India Tourism

India tourism shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, india tourism board meeting/agm, india tourism dividends.

No other corporate actions details are available.

About India Tourism

India Tourism Development Corporation Ltd., incorporated in the year 1965, is a Mid Cap company (having a market cap of Rs 5,887.64 Crore) operating in Tourism & Hospitality sector. India Tourism Development Corporation Ltd. key Products/Revenue Segments include Income (Room Rent), Sale of services, Beverages & Food, Licence Fees, Traffic Revenue, Income From Travel Operations, Wines & Spirits, Income from Project Development, Other Operating Revenue, Soft Drinks (Traded), Commission, Other Sales- Publications, Service Charges, Miscellaneous Sales for the year ending 31-Mar-2023. For the quarter ended 31-12-2023, the company has reported a Consolidated Total Income of Rs 139.59 Crore, up 4.10 % from last quarter Total Income of Rs 134.10 Crore and up 12.39 % from last year same quarter Total Income of Rs 124.21 Crore. Company has reported net profit after tax of Rs 17.90 Crore in latest quarter. The company’s top management includes Dr.Sambit Patra, Mr.Lokesh Kumar Aggarwal, Mr.Ranjana Chopra, Dr.Anju Bajpai, Dr.Manan Kaushal, Mr.V K Jain. Company has J K Sarawgi & Co. as its auditors. As on 31-12-2023, the company has a total of 8.58 Crore shares outstanding. Show More

Sambit Patra

Lokesh Kumar Aggarwal

Ranjana Chopra

Anju Bajpai

Manan Kaushal

- Doogar & Associates JKSS & Associates J K Sarawgi & Co. Agiwal & Associates

Hotels & Resorts

Key Indices Listed on

S&P BSE SmallCap, S&P BSE CPSE, S&P BSE Consumer Discretionary, + 3 more

Scope Complex,Core 8, 6th Floor,7 Lodhi Road,New Delhi, Delhi - 110003

http://www.itdc.co.in

More Details

- Chairman's Speech

- Company History

- Directors Report

- Background information

- Company Management

- Listing Information

- Finished Products

FAQs about India Tourism share

- 1 Week: India Tourism share price moved up by 8.69%

- 1 Month: India Tourism share price moved down by 9.62%

- 3 Month: India Tourism share price moved up by 47.18%

- 6 Month: India Tourism share price moved up by 79.25%

- 2. Who are the peers for India Tourism in Tourism & Hospitality sector? Within Tourism & Hospitality sector India Tourism, Samhi Hotels Ltd., Apeejay Surrendra Park Hotels Ltd., Mahindra Holidays & Resorts India Ltd., Taj GVK Hotels & Resorts Ltd., EIH Associated Hotels Ltd., Oriental Hotels Ltd., HLV Ltd., Royal Orchid Hotels Ltd., Lemon Tree Hotels Ltd. and Kamat Hotels (India) Ltd. are usually compared together by investors for analysis.

- Stock's PE is 86.22

- Price to Book Ratio of 17.42

- Dividend Yield of 0.32

- EPS (trailing 12 month) of India Tourism share is 7.96

- 4. Is the India Tourism profitable ? On Consoldiated basis, India Tourism reported a total income and profit of Rs 139.59 Cr and Rs 17.90 respectively for quarter ending 2023-12-31. Total Income and profit for the year ending 2023-03-31 was Rs 480.54 Cr and Rs 59.16 Cr.

- Promoter holding has not changed in last 9 months and holds 87.03 stake as on 31 Dec 2023

- Domestic Institutional Investors holding have gone down from 2.17 (31 Mar 2023) to 1.86 (31 Dec 2023)

- Foreign Institutional Investors holding have gone down from 0.02 (31 Mar 2023) to 0.0 (31 Dec 2023)

- Other investor holding has gone up from 10.78 (31 Mar 2023) to 11.11 (31 Dec 2023)

- 6. What is the market cap of India Tourism? India Tourism share has a market capitalization of Rs 5,887.64 Cr. Within Tourism & Hospitality sector, it's market cap rank is 12.

- 7. What is 52 week high/low of India Tourism share price? 52 Week high of India Tourism share is Rs 878.95 while 52 week low is Rs 298.20

Trending in Markets

- Sensex Today

- RBI Monetary Policy Live Updates

- F&O Ban List

- Krystal Integrated Services IPO Allotment

- F&O stocks to buy today

- Popular Vehicles and Services Share Price

- Signoria Creation Share Price

- Royal Sense Stock Listing Price

- US Fed Meet

India Tourism Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- Share Market News

- e-ATM Order

- FindYourMojo

- Relax For Tax

- Budget 2024

- Live Webinar

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

Tourism Finance Corporation of India Ltd

Tourism finance corporation of india ltd share price today.

Apr 05, 2024 04:11 PM

SECTOR : Finance | BSE :526650 | NSE : TFCILTD

0.35 (0.20 %)

Company details

- SWOT Analysis

- Information

- Tourism Finance Corporation of India Ltd: 171.65 0.35 (0.20 %)

Open Free Trading Account Online with ICICIDIRECT

Tourism finance corporation of india ltd shares swot analysis.

- SHAREHOLDING

Strengths (10)

- Stock passes majority of CANSLIM Investment criteria

- Company with high TTM EPS Growth

- Efficient in managing Assets to generate Profits - ROA improving since last 2 year

Weakness (3)

- Inefficient use of shareholder funds - ROE declining in the last 2 years

- Declining Net Cash Flow : Companies not able to generate net cash

- Weak performer : Stock lost more than 20% in 1 month

Opportunity (3)

- Negative to Positive growth in Sales and Profit with Strong Price momentum

- Highest Recovery from 52 Week Low

- Decrease in Provision in recent results

Threats (3)

- Promoter decreasing their shareholding

- Increasing Trend in Non-Core Income

- RSI indicating price weakness

Discover More

Resistance and support.

- Public 68.44%

- Promoter 17.67%

- Other Institutions 0%

- PROFIT AND LOSS STATEMENT

- BALANCE SHEET

- QUARTERLY RESULT

Tourism Finance Corporation of India Ltd Stocks COMPARISON

Equity Capital: 1,017.10 Cr FV: 10.00

- ANNOUNCEMENT

- CORPORATE ACTION

Apr 05, 2024 l NSE Announcement

Apr 01, 2024 l NSE Announcement

Tourism Finance Corporation of India Ltd Information

- ABOUT COMPANY

- COMPANY INFO

- LISTING INFO

Tourism Finance Corporation of India Ltd was incorporated on January 27, 1989 as a public limited company. The company became operational with effect from February 1, 1989 on receipt of certificate of the commencement of business from the Registrar of Companies. The company was promoted by IFCI Ltd along with other All-India Financial/ Investment Institutions and Nationalised Banks. Tourism Finance Corporation of India Ltd is a Government of India Enterprises. The company is engaged in the business of financing tourism-related projects. They provide financial assistance to enterprises for setting up and/ or development of tourism-related projects, facilities and services, such as hotels, restaurants, holiday resorts, amusement parks, multiplexes and entertainment centers, education and sports, safari parks, rope-ways, cultural centers, convention halls, transport, travel and tour operating agencies, air service, tourism emporia, and sports facilities. The forms of financial assistance include rupee loan, underwriting of public issues of shares/debentures and direct subscription to such securities, guarantee of deferred payments and credit raised abroad, equipment finance, equipment leasing, assistance under suppliers` credit, working-capital financing, takeover financing and advances against credit-card receivables. The company also provides high-quality research and Consultancy services to the tourism industry in general and to the investors in tourism industry in particular. In line with this, TFCI has been providing Consultancy services to different central and state agencies by undertaking broad-based assignments to cover macro & micro level tourism-related studies/ exercises to facilitate identification, conceptualization, promotion/ implementation of specific tourism-related projects & for taking policy level decisions with respect to investment and infrastructure augmentation etc. Besides, TFCI has been providing specific project-related services to various clients. It has also undertaken appraisal of individual projects for various state government agencies/individual clients. The company was set up as a specialized All India Financial Institution to cater to the financing requirements of the Tourism Industry at the instance of Government of India arising from the recommendation of National Committee on Tourism. It pioneered and innovated various products in financing the diverse needs of the industry such as the first Amusement-cum-Water Park at Mumbai, the first Water Sports Complex at Goa, the Palace on Wheels, the highly acclaimed spa The Ananda at Himalayas, the restoration of heritage resorts namely the Devigarh Palace at Udaipur, conversion of Umaid Bhawan Palace into a resort hotel etc. In the year 1994, the company made a public issue of 1,70,00,000 Nos of equity shares of Rs 10 each at a premium of Rs 20 per share. In the year 1999, the company had gone towards the setting up of non-conventional tourism projects like restaurants, highway facilities, travel agencies, amusement parks, dolphinarium, ropeways, car rental services, ferries for inland water transport, airport facilitation centre, training institute for hotel personnel etc. In the year 2000, Tourism Advisory & Financial Services Corporation of India Ltd was amalgamated with the company. During the year 2008-09, the company took possession of 3 hotels located at Mukundgarh, Bikaner & Jaisalmer under the SRFAESI Act. In 2009-10, it ventured into infrastructure project financing business viz., power, ports, airports, roads and bridges etc., The company in 2021-22, pursued to expand its portfolio not only by extending facilities to existing hotel properties for renovation, upgradation and setting up of new projects, but also has actively pursued consultancy assignments for various state governments in drafting the tourism policy and other projects for tourism/ circuit development etc.

Tourism Finance Corporation of India share price as on 06 Apr 2024 is Rs. 171.65. Over the past 6 months, the Tourism Finance Corporation of India share price has increased by 80.4% and in the last one year, it has increased by 132.27%. The 52-week low for Tourism Finance Corporation of India share price was Rs. 70.4 and 52-week high was Rs. 267.55.

4th Floor Tower-1 NBCC Plaza, Puship Vihar Sector-5 Saket, New Delhi, New Delhi, 110017

FAQ’s on Tourism Finance Corporation of India Ltd Shares

How can i buy tourism finance corporation of india ltd share.

You can buy Tourism Finance Corporation of India Ltd shares through a brokerage firm. ICICIdirect is a registered broker through which you can place orders to buy Tourism Finance Corporation of India Ltd Share.

What is the share price of Tourism Finance Corporation of India Ltd?

Company share prices and volatile and keep changing according to the market conditions. As of Apr 05, 2024 04:11 PM the closing price of Tourism Finance Corporation of India Ltd was ₹ 171.65.

What is the market cap of Tourism Finance Corporation of India Ltd ?

Market capitalization or market cap is determined by multiplying the current market price of a company’s shares with the total number of shares outstanding. As of Apr 05, 2024 04:11 PM, the market cap of Tourism Finance Corporation of India Ltd stood at ₹ 1,551.24.

What is the PE ratio of Tourism Finance Corporation of India Ltd ?

What is the pb ratio of tourism finance corporation of india ltd .

The latest PB ratio of Tourism Finance Corporation of India Ltd as of Apr 05, 2024 04:11 PM is 0.61

What is the 52 - week high and low of Tourism Finance Corporation of India Ltd Share Price?

The 52-week high of Tourism Finance Corporation of India Ltd share price is ₹ 267.55 while the 52-week low is ₹ 70.40

Download Our

- Kotak Mahindra Bank share price

- ₹ 1,785.25 2.09 %

- Bajaj Finserv share price

- ₹ 1,681.00 1.56 %

- HDFC Bank share price

- ₹ 1,549.40 1.41 %

- ITC share price

- ₹ 427.85 1.21 %

- State Bank Of India share price

- ₹ 764.35 0.67 %

- Tata Steel share price

- ₹ 163.35 -0.03 %

- Indian Oil Corporation share price

- ₹ 168.00 -1.03 %

- Bandhan Bank share price

- ₹ 197.40 -0.35 %

- Hindalco Industries share price

- ₹ 569.90 -1.38 %

- Vedanta share price

- ₹ 318.90 2.79 %

India Tourism Development Corp share price

Open Instant Demat Account with Angel One

Start Investing in Stocks, Mutual Funds, IPOs, and more

- Delhi Andaman and Nicobar Islands Andhra Pradesh Arunachal Pradesh Assam Bihar Chandigarh Chhattisgarh Dadra and Nagar Haveli Daman and Diu Delhi Goa Gujarat Haryana Himachal Pradesh Jammu Jharkhand Karnataka Kashmir Kerala Ladakh Lakshadweep Madhya Pradesh Maharashtra Manipur Meghalaya Mizoram Nagaland Odisha Puducherry Punjab Rajasthan Sikkim Tamil Nadu Telangana Tripura Uttarakhand Uttar Pradesh West Bengal

India Tourism Development Corp is trading 2.42 % upper at Rs 691.00 as compared to its last closing price. India Tourism Development Corp has been trading in the price range of 699.95 & 665.15 . India Tourism Development Corp has given 49.30 % in this year & 7.42 % in the last 5 days.

India Tourism Development Corp has TTM P/E ratio 55.14 as compared to the sector P/E of 40.19 .

The company posted a net profit of 18.03 Crores in its last quarter.

Listed peers of India Tourism Development Corp include Chalet Hotels ( 0.05 %) , Lemon Tree Hotels ( -0.46 %) , India Tourism Development Corp ( 2.42 %) etc .

India Tourism Development Corp has a 87.03 % promoter holding & 12.97 % public holding . The Mutual Fund holding in India Tourism Development Corp was at 1.86 % in 31 Dec 2023 . The MF holding has decreased from the last quarter. The FII holding in India Tourism Development Corp was at 0.02 % in 30 Sep 2023 . The FII holding has decreased from the last quarter.

India Tourism Development Corp share price range

India tourism development corp share key metrics, india tourism development corp stock analysis.

- 67 % Extreme risk

Technical Trends

Long term considers price movement over the last 6 months, short term considers price movement over the last 1-2 weeks.

- Moderately Bearish

- Moderately Bullish

Insight: Trends unavailable at the moment.

India Tourism Development Corp share price news

Snowfall predicted in these areas around New Year 2024

IRCTC Calls Out Jairam Ramesh; ‘Adani Takeover’ Remark ‘Misleading’ | Details

Himachal summer getaways: Tourists flock to THIS hill resort ditching Shimla

India tourism development corp financials.

- BALANCE SHEET

India Tourism Development Corp forecast

India tourism development corp technical, india tourism development corp shareholding, shareholding pattern, india tourism development corp corporate actions.

- Board Meetings

India Tourism Development Corp Company profile

About india tourism development corp.

- Industry Hotels & Motels

- ISIN INE353K01014

- BSE Code 532189

- NSE Code ITDC

India Tourism Development Corporation Limited operates hotels, restaurants at various places for tourists. It also provides transport facilities. The Company is engaged in production, distribution, and sale of tourist publicity literature, providing entertainment, engineering related consultancy services, duty free shopping facilities to tourists, hospitality and tourism management of the Company imparting training and education in the field of tourism and hospitality. It operates various divisions, including Hotels Division, Ashok Events Division (AED), Ashok International Trade Division (AITD), Ashok Travels and Tours Division (ATT), Ashok Institute of Hospitality & Tourism Management (AIH&TM), Ashok Consultancy & Engineering Services Division (ACES), and Sound & Light Show (SEL). The Hotels division includes hotels, such as Hotel Samrat, Hyderabad House, and Vigyan Bhawan. The Ashok Events Division manages events, conferences, and exhibitions. The AITD division focuses on seaports.

India Tourism Development Corp Management

- Lokesh Aggarwal Chief Financial Officer, Director - Finance, Director (C&M), Executive Director

- Mebanshailang Synrem Managing Director, Director

- Virendra Jain Compliance Officer, Company Secretary

FAQs about India Tourism Development Corp share price

India Tourism Development Corp is trading at 691.00 as on Fri Apr 05 2024 09:59:42 . This is 2.42 % upper as compared to its previous closing price of 674.70 .

The market capitalization of India Tourism Development Corp is 5926.67 Cr as on Fri Apr 05 2024 09:59:42 .

The 52 wk high for India Tourism Development Corp is 879.00 whereas the 52 wk low is 296.95

India Tourism Development Corp can be analyzed on the following key metrics -

- TTM P/E: 55.14

- Sector P/E: 40.19

- Dividend Yield: 0.33 %

- D/E ratio: -

India Tourism Development Corp reported a net profit of 59.16 Cr in 2023 .

India Tourism Development Corp Quick Links

India Tourism Development Corp Dividend | India Tourism Development Corp Bonus | India Tourism Development Corp News | India Tourism Development Corp AGM | India Tourism Development Corp Rights | India Tourism Development Corp Splits | India Tourism Development Corp Board Meetings | India Tourism Development Corp Key Metrics | India Tourism Development Corp Shareholdings | India Tourism Development Corp Profit Loss | India Tourism Development Corp Balance Sheet | India Tourism Development Corp Cashflow | India Tourism Development Corp Q1 Results | India Tourism Development Corp Q2 Results | India Tourism Development Corp Q3 Results | India Tourism Development Corp Q4 Results

Equity Quick Links

Top Gainers | Top Losers | Indian Indices | BSE Active Stocks | NSE Active Stocks

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

TOURISM FIN CORP

Tfciltd chart, about tourism fin corp.

See all ideas

Frequently Asked Questions

- Tourism Finance Corporation of India

Tourism Finance Corporation of India Share Price

Company overview, fundamentals, what’s in news.

Moneycontrol • 2w

HFT Scan: Algo traders zoom in on Tourism Finance Corp, Foods and Inns

Moneycontrol • 3w

HFT Scan: Which shares saw action?

Moneycontrol • 1mo

HFT Scan: Tourism Finance Corp, Tarmat Limited attract algo traders

Livemint • 1mo

Tourism Finance Corp share price locked at 5% upper circuit!

Bulk deals: Tourism Finance Corporation sees buying activity

Tourism Finance Corporation hit 5% upper circuit amid block deal

Tourism Finance Corp gains 5% after Rs 248-crore block deals

Moneycontrol • 2mo

HFT Scan: Citadel Securities net buyer in Tourism Fin Corp and SBC Exports

Moneycontrol • 4mo

Tourism Finance Standalone September 2023 Net Sales at Rs 57.80 crore!

Tourism Finance Corporation of India Key indicators

Featured in, financial ratios, profitability, operational, tourism finance corporation of india shareholder returns, revenue statement.

No data available at the moment

Balance sheet

Tourism finance corporation of india share price history, shareholding info, similar stocks.

GUJARAT STATE FINANCIAL CORPOR

Satin Credit Net

Ujjivan Financial Services

MAS Financial

Indian Railway Finance Corp

People also bought

Tata Motors

Vodafone Idea

Indian Railway Tourism Corp

Steel Authority of India

Investment calculators

Brokerage Calculator

Margin Calculator

MF Return Calculator

SIP Calculator

NPV Calculator

Future Value Calculator

SWP Calculator

ELSS Calculator

Option Value Calculator

NPS Calculator

PPF Calculator

Compound Annual

National Savings

Sukanya Samriddhi Yojana

Compound Interest Calculator

Atal Pension Yojana Calculator

Gratuity calculator

Simple Interest Calculator

Fixed Deposit Calculator

GST Calculator

HRA Calculator

Lumpsum Calculator

Upcoming IPOs

Key indices.

Nifty Next 50

Nifty Midcap 50

NIFTY SMLCAP 50

Frequently asked questions

What is the tourism finance corporation of india share price today, what is today’s high & low stock price of tourism finance corporation of india, what is the market capital of tourism finance corporation of india shares today, what is the tourism finance corporation of india stock price high and low in the last 52 weeks on the nse, what is the tourism finance corporation of india stock symbol, can i buy tourism finance corporation of india shares on holidays, can i do stock trading on my phone.

By signing up, you agree to receive transaction updates from Upstox.

- Trending Stocks

- Indian Renew INE202E01016, IREDA, 544026

- HDFC Bank INE040A01034, HDFCBANK, 500180

- Jio Financial INE758E01017, JIOFIN, 543940

- Yes Bank INE528G01035, YESBANK, 532648

- Suzlon Energy INE040H01021, SUZLON, 532667

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Remove Ads Get Premium Content Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Personal Finance

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Fractional Ownership Trade like Experts

- AU SFB Badlaav Humse Hai Pharma Industry Conclave

- Unlocking opportunities in Metal and Mining Pitchcraft

- International

- Go pro @₹99

- Elections 2024

- Moneycontrol /

- Share/Stock Price /

- Miscellaneous

International Travel House Ltd.

As on 05 Apr, 2024 | 04:01

* BSE Market Depth (05 Apr 2024)

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Stock with consistent financial performance, quality management, and strong

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 19.15% away from 52 week high

- Market Cap - Low in industry

- Promoters holding remains unchanged at 61.69% in Dec 2023 qtr

BIG SHARK INVESTORS

- Dheeraj Kumar Lohia and Associates 1.65%

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Price and Volume

Intl travel standalone december 2023 net sales at rs 53.70 crore, up 16.89% y-o-y.

Intl Travel Standalone September 2023 Net Sales at Rs 53.02 crore, up 16.82% Y-o-Y Oct 19 2023 10:27 AM

Intl Travel Standalone June 2023 Net Sales at Rs 51.94 crore, up 22.73% Y-o-Y Jul 26 2023 10:49 AM

Intl Travel Standalone March 2023 Net Sales at Rs 50.39 crore, up 83.03% Y-o-Y Apr 21 2023 09:25 AM

Intl Travel Standalone December 2022 Net Sales at Rs 45.94 crore, up 42.31% Y-o-Y Jan 20 2023 12:46 PM

Community Sentiments

Data not available.

What's your call on today?

Read 0 investor views

Thank you for your vote

You are already voted!

Great future as it would become ITC Hotels subsidiary post demerger. ITC Hotels itself is no 2 Hotel chain after TAJ and once it comes out ITC it would be free bird to fly. ITHL has alraedy good business and profits and after becoming part ...  View more | 2

Posted by : gnmalu1951

Repost this message

Great future as it would become ITC Hotels subsidiary post demerger. ITC Hotels itself is no 2 Hotel chain after TAJ and once it comes out ITC it would be free bird to fly. ITHL has alraedy good business and profits and after becoming part ...

Soldier_Invests

what is the future of this stock View more | 2

Posted by : Soldier_Invests

what is the future of this stock

Further its floating stock is very less and price goes up with increase in volume Stock is cornered by few HNIs and hence there is no liquidity Management should split 10 FC into 1 FC so that it would be affordable to small investors and it...  View more | 2

Further its floating stock is very less and price goes up with increase in volume Stock is cornered by few HNIs and hence there is no liquidity Management should split 10 FC into 1 FC so that it would be affordable to small investors and it...

- Broker Research

Firstcall Research

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

RUSSEL INVESTMENTS LIMITED

Peninsular investments ltd.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

PANGHAT BARTER PRIVATE LIMITED

Rajasthan global securities private limited, nitesh arjun thakkar.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

International Travel House - Closure of Trading Window

International travel house - disclosures under reg. 10(6) of sebi (sast) regulations, 2011.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

No Data For Institutional Holder Analysis.

- Institutional Investors holding remains unchanged at 0.00% in Dec 2023 qtr

About the Company

Company overview, registered office.

''Travel House',', T-2, Community Centre,, Sheikh Sarai, Phase-I,

011-26017808

011-26015113

http://www.internationaltravelhouse.in

F-65, Ist Floor, Okhla Industrial Area, Phase-I,,

New Delhi 110020

011-41406149

011-41709881

http://www.mcsregistrars.com

Designation

Chairman & Non-Exe.Director

Managing Director

Non Executive Director

Included In

INE262B01016

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

Access your Detailed Credit Report - absolutely free

Tourism Finance Corporation of India Ltd

Tourism Finance Corporation of India Ltd provides financial assistance to the tourism sector comprising hotels, resorts, restaurants, food courts, amusement parks, ropeways, multiplexes, etc. [1]

Offerings The Company provides Rupee Term Loans, Project Loans, Corporate Loans, Loans Against Securities, Bridge Loan, Take our Financing, Subscription in Equity Shares/Debentures, etc. to its clients. [1]

- Market Cap ₹ 1,551 Cr.

- Current Price ₹ 172

- High / Low ₹ 268 / 69.5

- Stock P/E 16.2

- Book Value ₹ 105

- Dividend Yield 1.40 %

- ROCE 9.46 %

- Face Value ₹ 10.0

- Sales & Margin

- EV / EBITDA

- Price to Book

- Market Cap / Sales

- The company has delivered a poor sales growth of 0.68% over past five years.

- Promoter holding is low: 17.7%

- Company has a low return on equity of 9.71% over last 3 years.

- Promoter holding has decreased over last 3 years: -9.58%

* The pros and cons are machine generated. Pros / cons are based on a checklist to highlight important points. Please exercise caution and do your own analysis.

Peer comparison

Sector: Finance Industry: Finance - Term-Lending Institutions

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

Profit & Loss

Balance sheet, shareholding pattern.

Numbers in percentages

* The classifications might have changed from Sep'2022 onwards. The new XBRL format added more details from Sep'22 onwards. Classifications such as banks and foreign portfolio investors were not available earlier. The sudden changes in FII or DII can be because of these changes. Click on the line-items to see the names of individual entities.

Announcements

- Announcement under Regulation 30 (LODR)-Change in Directorate 4h

- Announcement under Regulation 30 (LODR)-Resignation of Director 4h

- Announcement under Regulation 30 (LODR)-Preferential Issue 4h

- Board Meeting Outcome for Allotment Of Equity Shares And Change In Director 4h

- Compliances-Half Yearly Report (SEBI Circular No. CIR/IMD/DF-1/67/2017) 1d

Annual reports

- Financial Year 2023 from bse

- Financial Year 2022 from bse

- Financial Year 2021 from bse

- Financial Year 2020 from bse

- Financial Year 2019 from bse

- Financial Year 2018 from bse

- Financial Year 2017 from bse

- Financial Year 2016 from bse

- Financial Year 2015 from bse

- Financial Year 2014 from bse

- Financial Year 2013 from bse

- Financial Year 2012 from bse

- Financial Year 2012 from nse

- Financial Year 2011 from bse

- Financial Year 2010 from bse

Credit ratings

- Rating update 24 Aug 2023 from care

- Rating update 23 Aug 2023 from smera

- Rating update 31 Jul 2023 from brickwork

- Rating update 7 Feb 2023 from smera

- Rating update 1 Sep 2022 from care

- Rating update 24 Aug 2022 from brickwork

- Feb 2024 Transcript Notes PPT

- Aug 2023 Transcript Notes PPT

- May 2023 Transcript Notes PPT

- Nov 2022 Transcript Notes PPT

- Aug 2022 Transcript Notes PPT

- May 2022 Transcript Notes PPT

- Feb 2022 Transcript Notes PPT

- Nov 2021 Transcript Notes PPT

- Aug 2021 Transcript Notes PPT

- Jun 2021 Transcript Notes PPT

- Feb 2021 Transcript Notes PPT

- Nov 2020 Transcript Notes PPT

- Aug 2020 Transcript Notes PPT

- Jun 2020 Transcript Notes PPT

- Feb 2020 Transcript Notes PPT

- Nov 2019 Transcript Notes PPT

- Sep 2019 Transcript Notes PPT

- Jun 2019 Transcript Notes PPT

Largest travel companies by market cap

This is the list of the largest travel companies by market capitalization. Only the top travel companies are shown in this list and travel companies that are not publicly traded are excluded. The ranking and the market cap data shown on this page are updated daily.

What is the market capitalization of a company?

The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares.

CompaniesMarketCap is receiving financial compensation for Delta App installs. CompaniesMarketCap is not associated in any way with CoinMarketCap.com Stock prices are delayed, the delay can range from a few minutes to several hours. Company logos are from the CompaniesLogo.com logo database and belong to their respective copyright holders. Companies Marketcap displays them for editorial purposes only.

- Privacy policy

- Terms and conditions

© 2024 CompaniesMarketcap.com

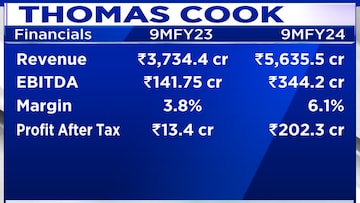

Thomas Cook India expects leisure travel to grow despite higher prices

Madhavan menon, the executive chairman of the omni-channel travel company, said there is a notable surge in domestic and short-haul travel, spanning central asia, the middle east, and southeast asia..

By Nigel D'Souza | Sonia Shenoy | Prashant Nair April 3, 2024, 4:22:37 PM IST (Published)

- Super Investors

- Account

Travel Services

The one that takes you to your favourite holidays. Get the latest information about companies present in Travel Services sector.

Today's Gainer / Loser Gainer Loser

Top performer companies (based on ttm profit), top return companies 1m 3m 6m 1yr.

IMAGES

VIDEO

COMMENTS

The best travel and tourism stocks do share some traits, though -- namely, strong brand recognition, an easy-to-use website or app, and a loyal customer following. ... price comparison, and travel ...

Performance of Tourism & Hospitality for NSE and BSE. Stock Market News: Latest Stock news and updates on The Economic Times. ... Top Searched Companies. ... Share Price Adani Power Share Price Ambuja Cements Share Price Tata Power Share Price Zomato Ltd Share Price Adani Wilmar Ltd Share Price Tata Steel Share Price. MORE. Top Videos.

Mr Manturov says the travel market is expected to grow by 14% between 2022 and 2026, translating into a value worth $451 billion (£374 billion): "With travelling becoming easier compared to a ...

Company has sufficient cash reserves to pay off its contingent liabilities. (Source: Standalone Financials) ... Tourism Finance share price was Rs 171.30 as on 04 Apr, 2024, 03:59 PM IST. Tourism Finance share price was down by 5.00% based on previous share price of Rs. 180.3. In last 1 Month, Tourism Finance share price moved down by 24.75%.

Tourism Finance Corporation of India Limited Share Price Today, Live NSE Stock Price: Get the latest Tourism Finance Corporation of India Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account, research, results and ...

India Tourism Development Corporation Share Price Today (03 Apr, 2024) Live NSE/BSE updates on The Economic Times. Check out why India Tourism Development Corporation share price is down today. ... Company has spent less than 1% of its operating revenues towards interest expenses and 24.19% towards employee cost in the year ending 31 Mar, 2023 ...

Find the latest Travel + Leisure Co. (TNL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Liberty TripAdvisor Holdings Inc. Series A. -2.84%. $161.58M. TRIP | Complete Tripadvisor Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

Company's earnings for a period net of operating costs, taxes, and interest. 180.27M. -20.31%. Net profit margin. Measures how much net income or profit is generated as a percentage of revenue ...

Book Value. 105.0296. ROCE. 9.47%. ROE. 9%. Description. Tourism Finance Corporation of India Ltd was incorporated on January 27, 1989 as a public limited company. The company became operational with effect from February 1, 1989 on receipt of certificate of the commencement of business from the Registrar of Companies.

India Tourism Development Corp Share Price Today - 14 Mar 2024: Find India Tourism Development Corp Stock Price Live updates on Mint. Check out India Tourism Development Corp share price and NSE ...

India Tourism D Share Price: Find the latest news on India Tourism D Stock Price. Get all the information on India Tourism D with historic price charts for NSE / BSE. Experts & Broker view also ...

Get the latest Tourism Finance Corporation of India Ltd (TFCILTD) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and ...

Tourism Finance Corporation Simple Price Action Bullish 3 Reasons Why NSE:TFCILTD can be a Swing Long trade. 1. Price is in Uptrend and creating continuous HHs and HLs on the chart. 2. Price has revisited the uptrend line and this can send the price up. 3. Last but not least, the Price is standing at a Bullish Trap Zone which should send the ...

Sep 27, 1999. Headquarters. New Delhi, Delhi. India. Website. irctc.com. Employees. 1,400. Get the latest Indian Railway Ctrng nd Trsm Corp Ltd (IRCTC) real-time quote, historical performance ...

Top Travel Services Stocks in India by Market Capitalisation: Get the List of Top Travel Services Companies in India (BSE) based on Market Capitalisation

Tourism Finance Corporation of India Share Price - Get NSE / BSE Tourism Finance Corporation of India Stock Price with Fundamentals, Company details, Market Cap, Financial ratio & more at Upstox.com.

International Travel House Ltd. is a miscellaneous company that offers travel and tourism services. Find out its latest share price, news, analysis, and expert views on Moneycontrol. Compare it ...

Tourism Finance Corporation of India Ltd provides financial assistance to the tourism ... Bridge Loan, Take our Financing, Subscription in Equity Shares/Debentures, etc. to its clients. Read More . Website BSE NSE Market Cap ₹ 1,643 Cr . Current Price ... Company has a low return on equity of 9.71% over last 3 years. ...

AZUL. $0.89 B. $7.77. 8.91%. 🇧🇷 Brazil. This is the list of the largest travel companies by market capitalization. Only the top travel companies are shown in this list and travel companies that are not publicly traded are excluded. The ranking and the market cap data shown on this page are updated daily.

TFCI Share Price - Get TFCI Ltd LIVE BSE/NSE stock price with Performance, Fundamentals, Market Cap, Share holding, financial report, company profile, annual report, quarterly results, profit and loss ... Tourism Finance Corporation of India Limited is an India-based financial institution. The Company provides financial assistance by way of ...

Thomas Cook (India), the omni-channel travel company based in Mumbai, expects the strong growth in leisure travel to continue, undeterred by the rising costs. In an interview with CNBC-TV18, Madhavan Menon, CMD of Thomas Cook (India), said the company is experiencing demand across all travel categories. He also noted a significant improvement ...

Get the latest Tourism Holdings Ltd (THL) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Get the complete list of stocks/shares, companies listed on NSE & BSE of Travel services Sector with current market price & details. Get the complete list of stocks/shares, companies listed on NSE & BSE of Travel services Sector with current market price & details. ... Company price Rs. Change % Autoriders Intl: 59.41 +4.98%: Mega Corporation ...

Get the latest Tourism Enterprise Company SJSC (4170) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.