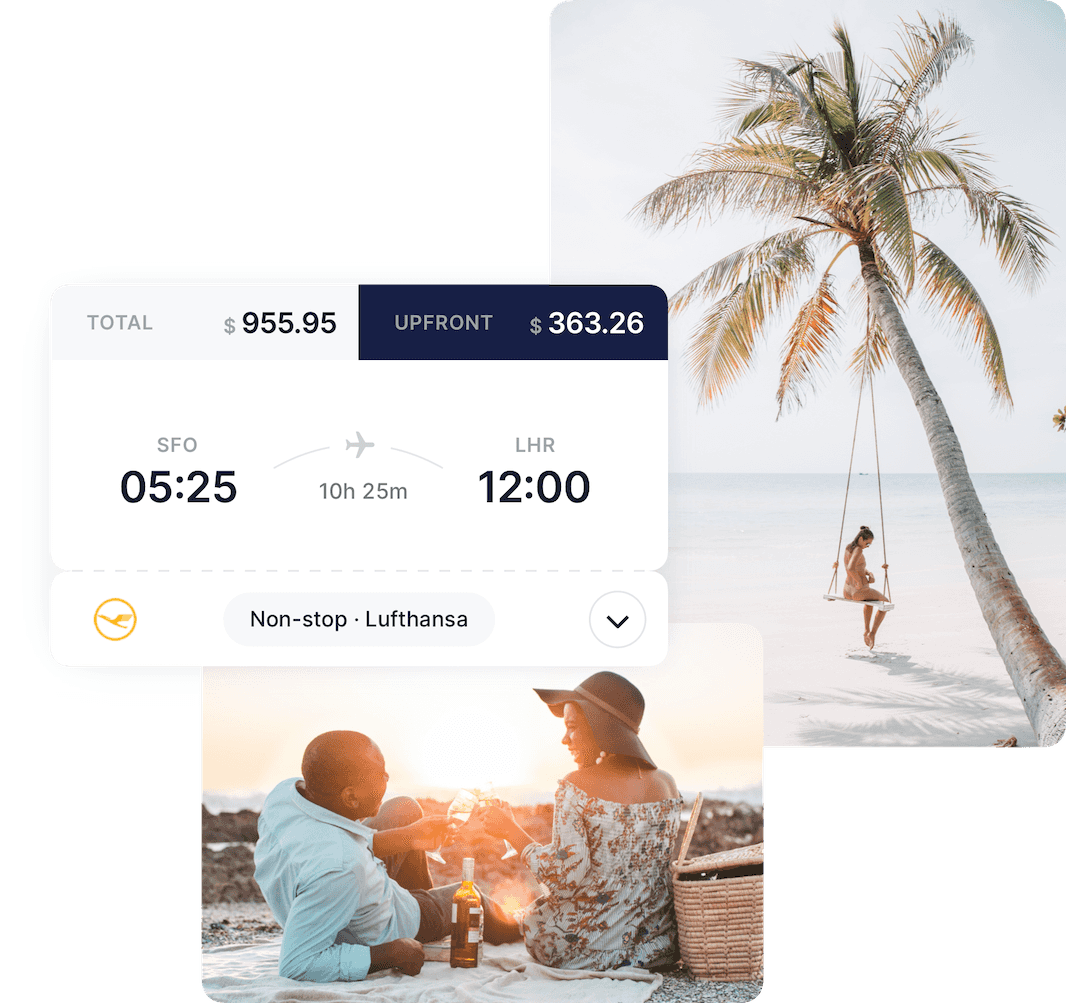

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

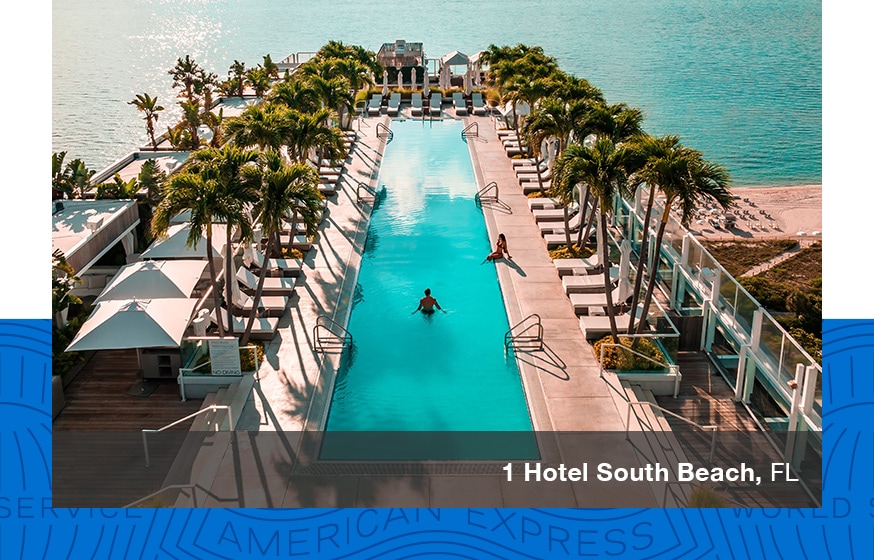

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Travel now. Pay over time.*

Through Uplift, you can book your trip today and make easy monthly payments that fit nicely within your budget. It's a fast and easy way to turn your ideal vacation into reality. Plus, you can travel before your loan is paid off.

With Uplift Pay Monthly you get:

Great rates

Affordable plans

Pay off your vacation with convenient monthly payments. To keep things simple, Uplift can automatically process your payments and notify you with a convenient email and text.

Quick and easy application

Simply select Pay Monthly at checkout, complete a short application, and you’ll receive a quick decision.

No surprises

Make the same fixed payment each month with no late fees and no prepayment penalties.

Questions? Visit the Uplift FAQ page .

*Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use . Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

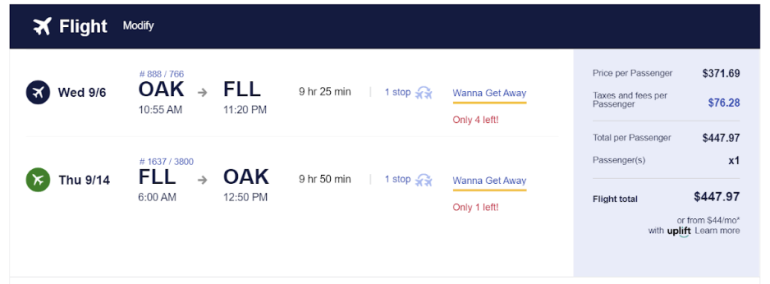

Images below are for illustrative purposes only

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

*Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses .

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

- How we work

- Hotel owners

- Advertise with us

- Airline fees

- Low fare tips

- Badges & Certificates

- Terms & Conditions

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Vacation deposit and payment plans.

- Things to do

I only need accommodations for part of my trip

What are the benefits of vacation payment plans?

Paying for your vacation in instalments can help you spread the costs and also gives you the option to plan a vacation you wouldn’t otherwise be able to afford. By booking in advance and choosing a trip payment plan you’ll give yourself plenty of time to pay for the vacation of your dreams. It can also come in handy when paying for a group booking, giving you extra time to round up money from other members of your party.

Can I book now and pay later with Expedia?

With Expedia you can filter your vacation search results by payment type, to see what options are on offer. If you know you need to spread the costs, go straight to our latest book now, pay later deals . With this option you can reserve your accommodation ahead of time, and cancel or modify your booking with no extra fees, should your plans change.

How can I find great deals on vacation packages?

To grab the best deal on your next vacation, book your accommodation, flight, and car rental as an Expedia bundle . Search the latest deals to see what’s on offer and then choose to pay monthly for your vacation on checkout.

Does Expedia have a flexible cancellation policy?

Find free cancellation and pay later options by filtering your search results by payment type, so you can rest assured that your vacation is fully flexible. Cancellation policies differ between vacation packages, so it’s always best to check at the time of booking.

Why should I book a vacation payment plan with Expedia?

At Expedia we give you easy access to a huge selection of the best vacation packages. You can then use our advanced filter options to build your ideal vacation and book it in just a few clicks. With access to loads of book now, pay later deals, as well as vacations with payment instalments , we can help you secure the vacation of your dreams.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

Explore other types of vacation packages

Update your browser

Be sure you have the most current version of your browser for the best experience on AAVacations.com. Browser requirements Opens in a new window

- Skip to global navigation

- Skip to content

- Skip to footer

- Sign up for email offers Opens in a new window

- aa.com Opens in a new window

- Destinations

- AAdvantage®

AAdvantage® login

Logout Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Enjoy now. Pay over time.

Spread the cost of your trip over low monthly payments.

Experience Buyer's Joy Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized installments while keeping yourself on a budget.

Low monthly payments Budget-friendly loan options

Easy application Quick decision

Surprise-free No late fees or prepayment penalties

Easy AutoPay No payment dates to remember

- Select Uplift at checkout Add purchases to your cart just like you normally would. When you are ready to check out, choose Uplift as your form of payment.

- Quick & easy Provide a few pieces of information and receive a quick decision.

- Enjoy now Enjoy your trip now and pay for it over time with low monthly installments.

Find vacations

Frequently Asked Questions

- What is Uplift?

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select "Uplift" as your payment method, complete a short application and receive quick decision. Choose the terms of your payment plan, finish checking out and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

- How do I apply for installment payments through Uplift?

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a U.S. resident, your Social Security Number. If you're approved, finish checking out and you're done.

- How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details and more.

- How do I make installment payments?

You can make a payment anytime at pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button.

We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com, click on the Accounts page and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime at pay.uplift.com.

Make installment payments Opens in a new window

- I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

- What is your Privacy Policy and Terms of Use?

Privacy Policy Opens in a new window

Terms of Use Opens in a new window

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $300 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders.

Uplift lenders Opens in a new window

Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

- Things to do

Explore > Company > News > Book your flight and hotel now, pay later

Book your flight and hotel now, pay later

We are always looking ahead at new payment options and technologies to help alleviate the stress of booking your dream vacation. Are you on a tight budget, or perhaps you just prefer to pay for big purchases over time? Great news, we now have you covered!

Expedia recognizes there’s no one-size-fits-all approach to budgeting for vacation so next time you’ve caught the wanderlust bug or need to get home for Christmas but are struggling to pay for those flight and hotel reservations upfront, you can now breathe a sigh of relief. We’ve recently expanded our partnership with online lender Affirm to give you the flexibility of spreading out the cost of your flight and hotel package booking over numerous payments instead of paying the full amount of your trip upfront.

Our team is incredibly passionate about making travel accessible for all—everyone deserves a vacation! We’ve received positive feedback from our customers who have used Affirm to book and pay for hotels on Expedia , and now we are excited to bring this payment offering to Expedia customers shopping for flight and hotel packages as well.

Ready to take advantage of more payment flexibility when you travel? Here’s how you can use Affirm on Expedia to book your next hotel and flight package.

1) Visit expedia.com , search for and select a flight and hotel.

Upon selecting your package, select the Monthly Payments tab .

2) Click on “Continue to Affirm”

3) Create an account or sign in to Affirm

You will be transferred to a secure Affirm sign-in page. Shoppers apply using top-of-mind information about themselves and receive a real-time decision at checkout.

4) Complete your reservation with Affirm

Now you’re ready to jet set!

Expedia also offers exclusive Book Now, Pay Later hotel deals , so there’s no reason to let the cost of accommodation keep you from your travel plans.

What’s holding you back? Plan and book your next dream vacation today!

More Articles With Company

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Travel Tips

16 Airlines That Let You Book Flights Now and Pay Later

Planning a trip but don't want to pay for it all at once? These sites offer book-now, pay-later flights.

Orbon Alija/Getty Images

If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now and pay for it over time.

Affirm, PayPal, Uplift, and Klarna are among the book-now, pay-later services travel companies and airlines offer. Here, we break down the basics of these and airlines' own "BNPL" options so you can secure flights when the prices are lowest, even if you don't want to pay for them in full upfront.

Airlines Offering Book-now, Pay-later Flights

AeroMexico connects major U.S. cities to Latin American destinations like Guadalajara and Puerto Vallarta. The airline partners with Uplift to provide a monthly payment option. When you go to book a flight, you'll see an option to pay in monthly installments. Click through and you'll be asked for any personal information Uplift needs to process the loan.

You can also pay in installments through Klarna. Download the Klarna extension for Chrome or the app and you should see a pink "K" icon that will show you financing options. AeroMexico takes PayPal, which means you can use PayPal Credit to split up payments if you're approved.

Pay monthly for Air Canada flights and Air Canada Vacations packages with Uplift or PayPal Credit.

Alaska Airlines

Alaska Airlines partners with Uplift and Klarna to offer financing for flights.

Allegiant also uses Uplift and Klarna to provide payment plans. Select the Allegiant Pay option at checkout to choose financing through Uplift.

American Airlines

American Airlines offers several ways to buy now and pay later, including Klarna; PayPal Credit; Citi Flex Pay for select Citi cardholders; and Affirm, which has biweekly, monthly, and interest-free options but doesn't cover the cost of any flight extras, like luggage. American Airlines Vacations also gives you the option to pay monthly with Uplift.

Azul Airlines is a low-cost Brazilian airline that accepts payments through Uplift and PayPal.

Delta Air Lines

Delta offers PayPal Credit as a payment option, and you can pay using Affirm if you book your trip through Delta Vacations , a service for SkyMiles members that bundles flights, hotels, transportation, and activities.

One of the United Arab Emirates' two flag carriers, this airline partners with financing institutions Uplift and Klarna. You can also pay with PayPal Credit.

Frontier Airlines

Budget carrier Frontier Airlines lets you pay monthly installments through Uplift on purchases of $49 or more. If eligible, you will see the option at checkout. Frontier is also a Klarna retail partner.

KLM offers customers the option of holding a fare for 72 hours for a non-refundable fee. This is great if you find a fare that you want to book but need a few days to think about it. In addition, the airline takes PayPal Credit. This service is shown on the payment page as a "Bill Me Later" option, but directs you to your PayPal wallet.

Lufthansa has a list of payment methods on its website . Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website .

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit . As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

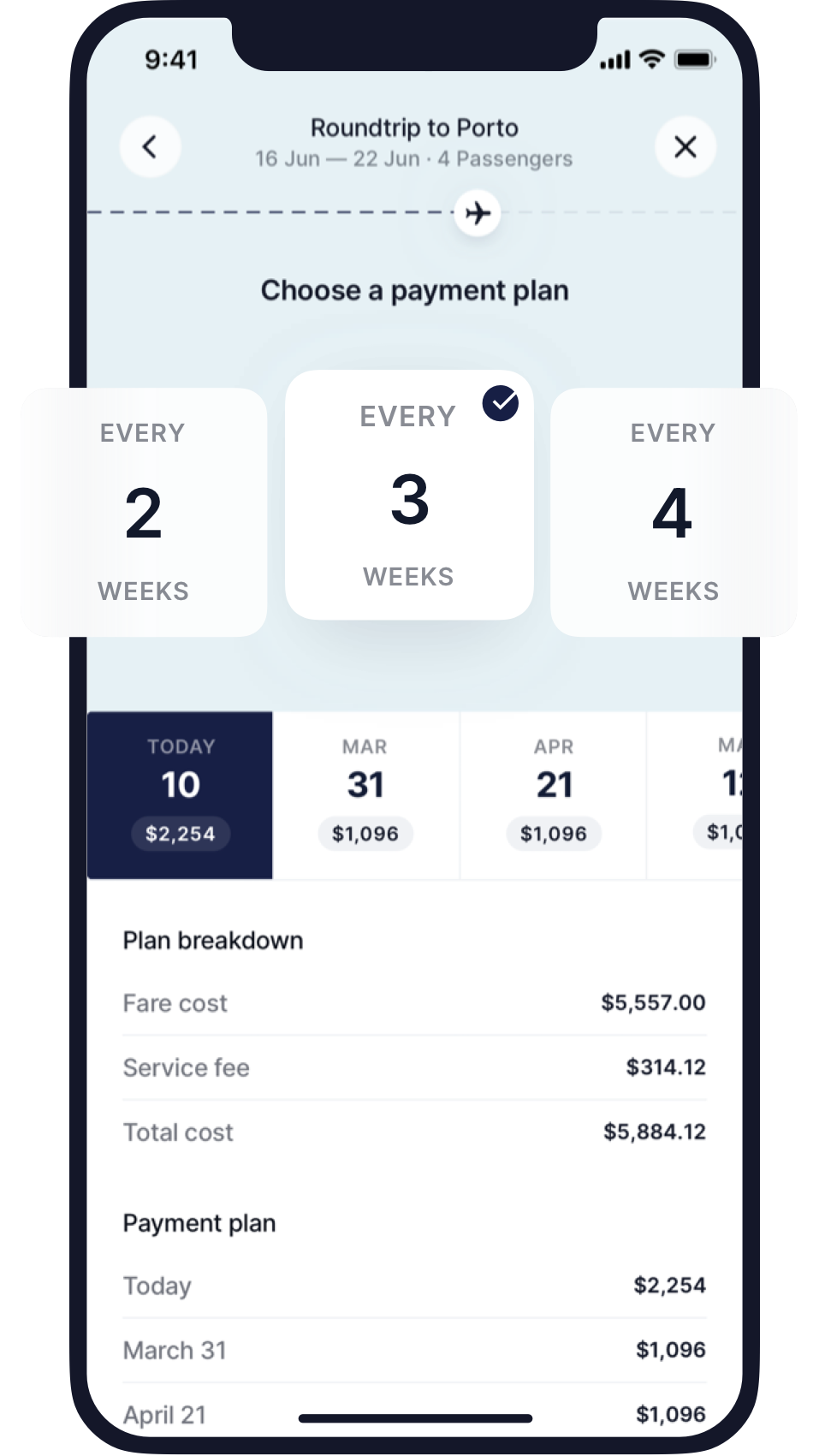

No credit check, no interest

Just a transparent one-time service fee

Flexible payment plan

Choose the plan that works for you

Lock in your fare now

Don't miss out on a great deal

24/7 customer support

Focus on the fun of travel - not the stress

Scan to download

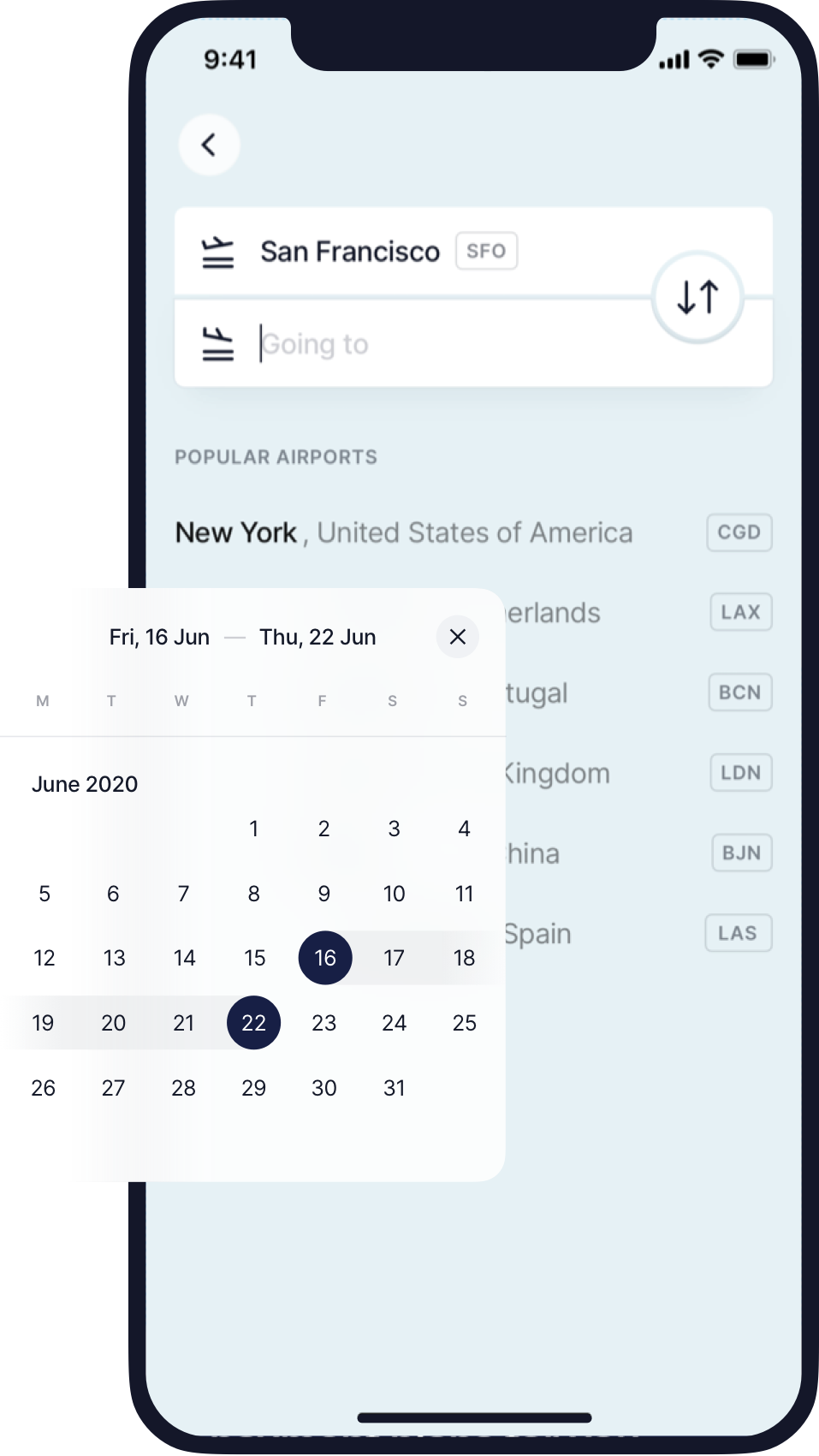

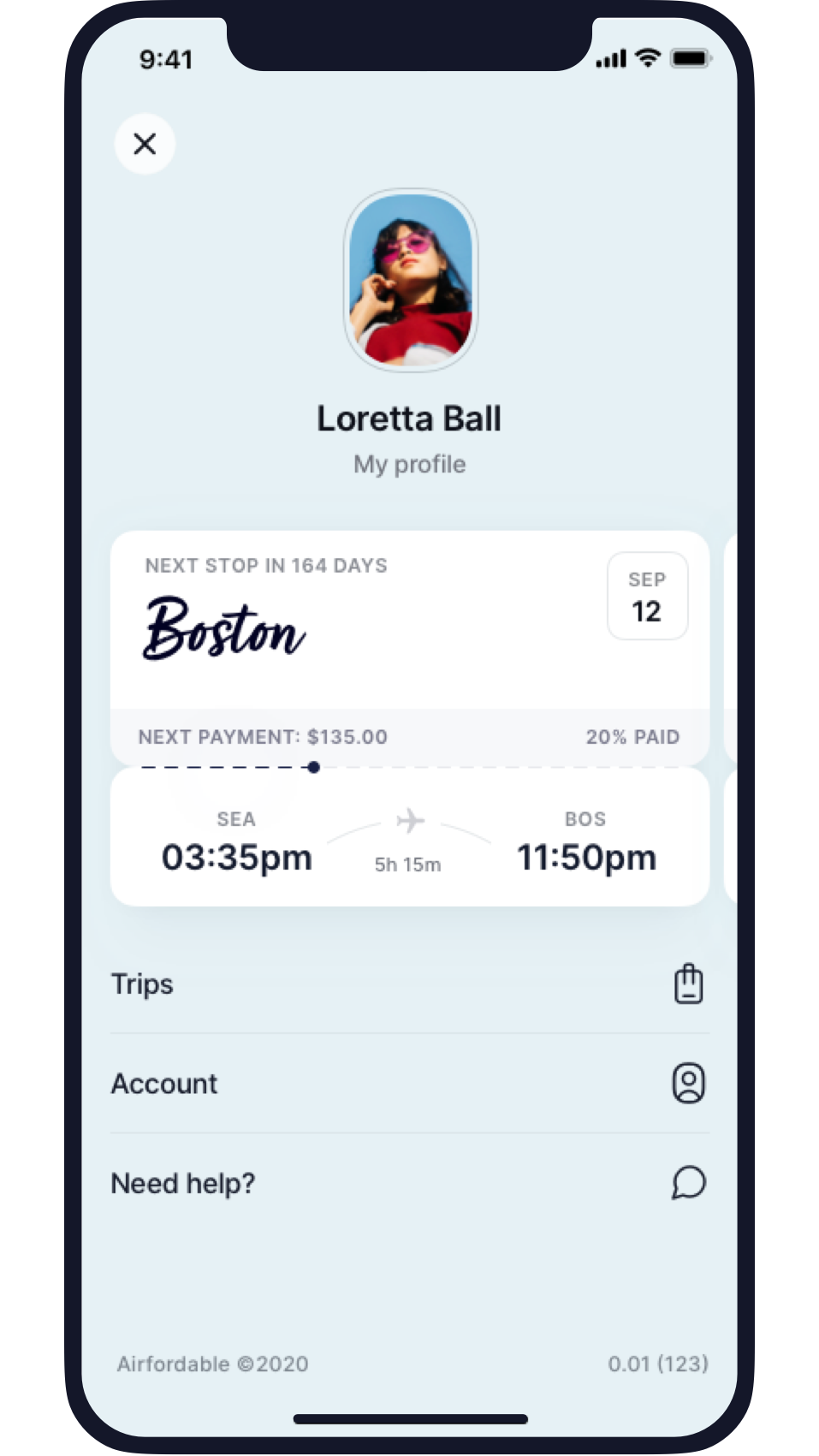

Accessible. Flexible. Easy. And done!

Fraction upfront

Book your flight for a fraction now, pay the rest later

Payment options

Pick what works best for your wallet

Progress tracking

Track all your payments and trips in one place

Discover the Airfordable difference

Planning your trip doesn’t need to feel like a chore. We put in the work so you don’t have to!

Book your favorite airlines

Complete control over your payment schedule

Manage multiple trips

Airfordable is the way to go!

Trusted by 500,000+ satisfied travelers, each with their unique stories and incredible adventures to share. Read real Airfordable traveler reviews.

What makes us different

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Price protection

When you book with us, you can secure your airfare well in advance when prices are cheaper. Protect yourself from the notorious airline price hikes no one likes.

Amazing community

Our travelers are a diverse group looking for creative ways to travel and budget. Airfordable is the bond that brings them together.

In good hands

The Airfordable team's sole mission is to help you travel more, but in an easy and financially responsible way. We're here for you.

Flexible and guaranteed

Pay only a fraction upfront for your flights. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Just accessible travel for your needs.

Safe and secure

Every interaction with Airfordable uses bank-level security and encryption. Your sensitive data is safe with us.

Great support at your fingertips

Dealing with airlines can be a hassle. Our team does the legwork for you, so you can focus on the fun — not the stress.

Available 24/7

We're always here to help you, day or night, with any support you need to book your perfect trip.

Reach us by email

Have a question, comment, or review? Our team can always be reached by email at [email protected].

Talk to support

Our in-app chat will send you directly to a member of our team for the one-on-one support you need.

Approved by the press

“Airfordable's value comes at the intersection of volatile ticket prices.... By locking in a ticket price up front, users can benefit by securing a better price on airfare while demand stays low and the date of departure is still far away.”

“A service like Airfordable could mean the difference between someone being able to take a trip or not – turning it into a priceless service.”

“The best part about Airfordable is that your ticket is paid off before your trip, so you don’t have to deal with debt once you return home. For someone who doesn’t want to miss out on a trip to see family and friends, a vacation or a life milestone, this can be a really great service.”

“Airfare is usually cheaper when you buy further in advance, but what if you haven't planned for a trip, or saved up the cash yet? One new solution is Airfordable.”

We'll Be Right Back!

How to Use ‘Travel Now, Pay Later’ Services When Planning a Trip

By Jennifer Bradley Franklin

All products featured on Condé Nast Traveler are independently selected by our editors. However, when you buy something through our retail links, we may earn an affiliate commission.

All products featured in this story are independently selected by our editors. However, when you buy something through our retail links, we may earn an affiliate commission.

After more than a year of sticking close to home, travelers are ready to budget for a vacation once again. But if the desire to travel outpaces your finances, a growing number of “travel now, pay later” services are making immediate vacations possible.

“Services such as Klarna and Afterpay are giving us the flexibility to afford that extra-nice hotel or to stay on vacation that extra day by staggering payments and slicing them into four rather than requiring one upfront payment,” says Michelle Halpern, the founder of the Live Like It's the Weekend travel blog.

Here’s how it works: If you find a trip, flight, or hotel and see the Klarna or Afterpay option, you can undergo a 30-second soft credit check, either through the apps or online, to determine the amount you qualify to pay in installments. You make the first payment—one-quarter of the total purchase—and get your trip or flight confirmation immediately. The service charges the remaining interest-free installments of the total every two weeks directly from your preferred payment method until the total is paid. You secure the deal instantly, there’s no impact on your credit score and there are no fees. However, using these services doesn’t help build credit and their charges are initiated automatically, which means that even if your linked bank account gets low or your credit card is near its limit, those charges are still going to happen.

“Afterpay saved my life on many occasions,” says Shawn Richards, a U.K.-based expedition coordinator for Ultimate Kilimanjaro, who spent years as a nomad. Richards recalls times when he’d decide spontaneously to go somewhere new, but wouldn’t have the ready funds. “Afterpay was like having a virtual father, as it gave me the kick I needed; I had to find a job in my destination very quickly to be able to pay for how I got there,” he says. Four years ago Richards used Afterpay to score the $1,400 open-ended flight to Tanzania that led to working with his current tour company.

The idea is catching on fast: Afterpay reported that it’s signed up more than 13 million users in North America as of January 2021. Different retailers have partnerships with different payment systems, so you might need accounts with multiple service providers to build the trip you want. For example, Airbnb offers payment through Zip (formerly Quadpay), while you can pay for trips on Booking.com and Expedia through Klarna. Here are some other things to consider.

Should I spring for a pricier trip?

While these services can be a great way to avoid credit card debt and the interest that can come with it, financial pros caution against spending more than your budget allows.

“Just because you have more time to spend your money doesn’t mean you have more money to spend,” says Tony Palazzo, CFA and Managing Partner at Berkeley Capital Partners & Access Private Capital in Atlanta , who notes that pay in four services may ease the psychological impact of a purchase, but that doesn’t mean you’re paying less. “You need to ask yourself, ‘If I can’t afford it now, how will I afford it within a [six]-week time period?’” he says.

Palazzo is currently seeing his financial services clients plan to take bigger trips , either because they haven’t spent money on travel during the pandemic or they’re rewarding themselves for a difficult 2020. “‘Revenge spending’ is a real thing, and travel appears to be a popular target,” he says.

When he was a nomad traveling the world , Richards tried to keep his budget conservative by thinking of Afterpay like borrowing money from a friend. “Then you are likely to only borrow what you need, and not more,” he says.

How to maximize the benefits

When you see an ultra-low price on a flight to your dream destination or an unheard-of deal on a hotel, services like Klarna and Afterpay can help you book it before it’s gone. “Time pressure to lock in a great deal is common with travel,” Palazzo says. “Offers appear at a moment’s notice and often require you to act quickly. Having quick access to the cash you might not have readily on hand, could better position you to nab that heavily discounted red-eye to Paris .”

Dolores Mason-Stokes, a Chicago-based plus-size fashion and travel blogger, used Klarna to book an upcoming trip to Catalina Island in California, and she’s planning to use it again to pay for a 2022 anniversary trip to Bali . She says that using the service strategically makes it easy to budget for a bigger trip because she’ll buy one element (like a flight) and pay it off before adding the next (like a hotel). “It doesn’t matter if it’s flights, transportation, places to stay or even excursions, you can pay through [Klarna],” Mason-Stokes says. “You could book an entire trip abroad.”

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Pay for your flight with Uplift

Feel good about where you fly and how you pay for it. With Uplift, you can book your trip now and pay for it over time with budget-friendly monthly payments.

Low monthly payments

Budget-friendly loan options.

Easy application

Receive a quick decision.

No surprises

That means no late fees, no prepayment penalties.

Automatic payments

So you don't have to remember due dates either.

How Uplift works

Step 1: Select Uplift at checkout

Shop for your trip on our website or app like you normally do and select Uplift as your payment method at checkout.

Step 2: Complete a quick application

Provide a few pieces of information and receive a quick decision without ever leaving the payment page.

Step 3: Enjoy your trip

Relax knowing you can travel now and pay for it over time with low monthly payments.

Frequently asked questions

What is uplift.

Uplift gives you the freedom to purchase travel now and pay over time with simple monthly payments. Some plans include interest while some are interest-free.

How do I apply?

Shop for your flights like you normally would. Then, select Uplift as your payment method at checkout. You’ll complete a short application and receive a quick decision letting you know if you’ve been approved. You can choose the terms of your plan before you complete checkout and enjoy your trip.

How is my loan term offer determined?

Uplift looks at a number of factors, including your credit information, purchase details and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and selecting the “Loans” tab. From there, select the "Make a Payment" button.

Uplift recommends you enable AutoPay at the time of purchase so your payments are automatically deducted from your bank account each month. You can enable AutoPay on the "Accounts" page on pay.uplift.com. You can also update your payment method here at any time.

Can I travel before paying off my trip with Uplift?

Yes! You do need to allow a few days between booking your trip and departure for things to process. Other than that, you are free to travel whenever—even before you’re all paid off.

Where can I find Uplift’s Privacy Policy and Terms of Use?

Here is the Privacy Policy and Terms of Use for Uplift.

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by their lending partners . Privacy Policy and Terms of Use . Uplift’s address: 440 N Wolfe Road, Sunnyvale, CA 94085

The 10 Best Payment Plans for Vacations

Vacations are a time to have fun, sit back, and relax. It’s a great way to let off steam that comes with the monotony of life. The only possible drawback I can think of? The meticulous planning and finances.

The good thing is, there’s an alternative. The “Book Now Pay Later” vacation payment plans option is increasingly becoming popular and for good reason!

Imagine this scenario: You need a vacation badly. You’re burnt out from working and the distinction between your work and private life has disappeared, but you don’t have enough in savings to fund your vacay. Should you wave that badly needed vacation goodbye?

Not quite. This is where payment plans come into play. Payment plan offers range from interest-free policies to low down payments and easy monthly installments.

Even if you can’t afford a vacation right now, you can still take the leap. Your dream of exploring the City of Light? Vacationing in the Maldives? Payment plans put them all within reach.

The benefits of using payment plans for vacation packages abound. With so many options in the tour and travel market, it can get a little overwhelming. Don’t fear, this article has you covered.

Top Vacation Payment Plans

1. expedia .

With their Uplift payment program , you can book a trip today and set easy monthly instalments that fit your budget. You don’t have to pay an arm and a leg every month. These monthly payments can be tailored to your budget allowing you to travel before your loan is paid off in its entirety. Southwest are a particularly good choice if you are looking for all-inclusive vacations with hundreds of resorts to choose from.

- They have customizable monthly payments.

- They offer an easy application process.

- There are no charges in the monthly payments, no late fees, and no prepayment penalties.

- Large range of all-inclusive vacations and resorts (including Mexico and Caribbean)

- Canceled flights are refunded as Southwest Airlines air credit which can be limiting.

- Canceled land travel, tours, and accommodations are refunded in the form of travel credit from Southwest Vacations.

3. Funjet (Best for All-Inclusive Packages)

Funjet has a great payment plan if you want to travel and save money at the same time. With a simple downpayment, you can secure the best deals at great rates.

You’ll have to make your vacation reservation six weeks in advance with deposit options available at checkout. You can schedule a final payment or make multiple payments at zero interest.

- Cancel any time for any reason. There are no pesky rebooking fees.

- Reserve a vacation for as little as $50.

- Reservations are subject to change.

- Deposit options are not available if you’re traveling during a holiday.

4. Luxury Escapes

Luxury Escapes’ Latitude Financing Payment plan offers a 12-month interest-free period. You’ll pay monthly installments, but after the 12-month promotional period, you’ll be charged a pretty hefty 24.99% interest rate.

Luxury Escapes offers flexible booking dates. That means you can book a limited-time deal for a certain property now and rebook it for a different date later.

- They have a seven-day refund guarantee.

- There are no hidden costs.

- If your preferred date is unavailable, you can’t get a refund. Make sure to read the terms and conditions carefully.

5. Contiki

A small layaway deposit of $99 will lock in your travel dates. Contiki accepts Visa, Mastercard, and American Express. They can accommodate all types of installment plans : weekly, monthly, two payments of 50% each – you name it, you got it. You just have to make the entire payment 45 days before departure. That’s it.

- There are no interest charges and no fees.

- They offer flexible payment plans.

- The Freedom Guarantee ensures you can reschedule travel dates, swap the tour type, or choose a different region to travel in altogether. You can avoid cancellation fees with this feature.

- Cancellation fees as high as 50% if cancellation is done within one to seven days before departure and 100% if done on the day of departure.

6. United Vacations (Best for Layaway Vacation Packages)

With United Vacations, you can finance your trip through Uplift . United have a layaway vacation option which allows you to lay down an initial $250 deposit and pay the rest at least 45 days before the departure date. The best part? You can use multiple credit cards to fund your trip.

- If you get the vacation protection package, you won’t have to deal with cancellation fees. You have the flexibility to change or cancel the plan as needed.

- You can book your entire trip through United Vacations from hotels, flights, car rentals to resorts, airport transfers, and excursion experiences.

- Airfare is non-refundable. If your flight was canceled, they’ll give you credit you can use within a year as long as your tickets were booked through American Airlines. If not, policies vary from carrier to carrier.

7. JetBlue Vacations

JetBlue’s annual percentage rate ranges from a huge 10.99% to 25.99% for a loan term of 12 to 18 months. Their partnership with MarcusPay enables them to offer top-tier package getaways.

If you want lower rates and longer terms, you’ll need to have excellent credit scores. Additionally, rates are generally higher for longer-term loans.

- They don’t require a deposit upfront.

- If you find the same package for a cheaper price within 24 hours of booking, they’ll match it and refund the difference.

- JetBlue Vacation charges a $200 cancellation fee per person plus additional penalties charged by the hotels.

8. G Adventures

Deposits for layaway vacations start at $250. If you’re unsure about a specific tour but don’t want to let the opportunity pass you by, they have a “holding an option” tool that lets you reserve a spot for 48 hours without paying a pretty penny.

The best part? If you ever have to cancel a trip, change it, or push it back, you’re not forced to use it within a year or two. It’s good for life. You can pay the full balance close to your departure date.

- They have small groups per trip. This helps you form a closer connection to the places and people you visit on your travels.

- They offer lifetime deposits.

- “Optional” activities cost you an additional fee if you decide to purchase. If you don’t want to factor in any additional costs to your budget, you can pass on these.

- Depending on the trip, guides can be a hit or miss.

9. Intrepid Travel

Intrepid Travel provides exemplary flexibility in changing travel plans. There are no change fees as long as you notify them about the changes at least 21 days in advance. You have the flexibility to choose an entirely new trip or pick new travel dates.

You only need to secure your trip with a deposit and you can pay the rest in installments whenever you like. Just make sure you’ve paid for the trip in full at least 21 days before you’re scheduled to depart.

- There are no interest and rebooking fees.

- You can hold your trip for up to 5 days without paying a deposit.

- If you’re traveling solo, you’ll have to pay a mandatory single supplement fee for certain trip types.

10. Priceline

Priceline.com comes through with terrific ways to save on travel. As long as you know how to look for deals, you’ll hit pay dirt.

Check out Priceline’s Express Deal which can save you anywhere between 10% to 40% off flights. The catch? You don’t know what time your flights will depart. It can be a red-eye for all you know.

- Priceline offers significantly lower prices.

- You can place bids for a lower price. If you get it, it’s a win. If you don’t, you lose nothing.

- Once the fee is charged, you don’t get a refund if you change your mind.

- You can’t reserve a room for more than 2 people.

Most popular destinations for vacation payment plans

If you are looking for inspiration for your next vacation then we’ve chosen 5 of the most popular destinations which are available to finance with installments.

Bonus Trip – Disney World Payment Plan

If you’re looking for family vacation payment plans then one of the best is the Disney World payment plan , we’ve written about it before and it’s a great choice if you have kids. Family vacations can be expensive and instalments are a great way to spread the cost. With Disney you can book your vacation and choose how often you want to pay. The payment plans are extremely flexible allowing you to look forward to your next family vacation without the stress of a huge amount leaving your bank account.

Wrapping It All Up

Payment plans for vacations are probably the best thing for people who don’t mind taking a chance and are flexible in their travel itineraries. With plans offering 0% interest rates and easy installments, who wouldn’t want to travel the world?

Before you settle on a payment plan, read the fine print. There are multiple “book now, pay later” options available on the market, but some have better deals than others. Always explore your options and take your time in making a decision. Most, if not all travel plans, are non-refundable. Click wisely.

Can you use Afterpay for vacations?

Yes. You can currently use Afterypay for hotels and accommodations via the website Agoda.com. Agoda is a reputable travel company and is part of the Priceline group.

Can you use Affirm for travel?

Yes. There are multiple travel companies which accept Affirm at checkout. These companies currently include Expedia, Priceline, Delta Vacations and CheapOair.

Can you finance vacations with Klarna?

Yes. It is possible to book vacations with Klarna using their ‘Pay in 4’ option which allows you to split your vacation payments into 4 payments using the Klarna app.

Related Posts

Can you buy a gift card with Afterpay?

Pay later apps like Klarna

Buy Now Pay Later Gift Cards

Pay Monthly Cruises

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Pay your way

Super-simple travel payment plans so you can choose when and how to pay for your trip.

Pay monthly or bi-weekly

Automatic payments with no interest and certainly no drama.

- Put $150 down*

- Your card or bank account is automatically charged once or twice per month

- Finish paying 30 days before your trip

* If you book your trip less than 100 days before departure, the minimum deposit will be $750. Trips booked less than 60 days before departure must be paid in full.

Pay at your own pace

No fixed schedule. Pay over time, on your own terms.

- Put $450 down*

- Pay off the balance on your own schedule

- Finish paying 99 days before your trip

* Plus a $50 service fee to cover the costs associated with processing these payments.

Pay in full

Everything up front, nothing to worry about later.

- Pay for your trip in its entirety

- Relax some more

Pay with affirm

Travel now, pay later.

- Check your eligibility during checkout

- Pay over 6, 12, or 18 months. For example, on a $1,500 purchase, you may pay $135.39 for 12 months with a 15% APR.

- Go on your trip, even if you’re still paying for it

.css-1m22qs9{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;background:none;border:0;color:inherit;display:grid;font-size:17px;font-weight:700;line-height:1.2;grid-template-columns:1fr auto;margin:0;padding:16px;text-align:left;width:100%;}.css-1m22qs9 path{stroke:#191919;} What happens if I choose monthly or bi-weekly and I miss a payment? .css-xxs3zl{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;}@media print{.css-xxs3zl{display:none;}}

If you miss one payment, the amount will be distributed evenly over your remaining payments. However, if you miss two consecutive payments, you will be withdrawn from the plan altogether. Note: there is a $35 decline fee each time you miss a payment.

Can I make a payment outside of my payment plan?

Yes, you can do this anytime from your online account under the payments tab. An additional payment does not take the place of any upcoming automatic payments. Your new balance will be distributed evenly over the remaining payments.

How do I use a Future Travel Voucher?

Future Travel Vouchers issued in 2020 or 2021 can be applied to any travel booked prior to 12/31/2022, for departures before 9/30/2024. Just book a trip like you usually would and then start a chat on our website to apply the voucher to your order.

What if I switch trips or move my trip to a later date?

All completed payments will be applied to your new trip and any remaining balance will be redistributed evenly over your new time frame.

What payment methods do you accept?

You can pay using a credit/debit card (Visa, MasterCard) or by using a checking account.

Is Affirm a loan?

Technically speaking, yes. Our financing partner, Affirm, will lend you the money to pay for your trip, and you’ll pay them back over time.

Does Affirm perform a credit check?

Affirm only performs a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. Checking your eligibility will not affect your credit score.

Can I pay for my trip in pennies?

Please don’t.

If I refer a friend, do I get a discount on my trip?

Actually, yes. We have group and referral discounts to make it even easier to afford your trip. Learn more about these discounts here.

What if I have more questions?

You’re in luck! We’re available via phone, email, live chat, and messenger pigeon. You can reach us here.

$250 down, pay later

Reserve your vacation for as little as $250 down.

United Vacations allows you to reserve your vacation from just $250 per person and pay the rest later. United Vacations offers you the flexibility to apply multiple payments over time, or even pay using multiple credit cards. The final payment is due at least 45 days prior to departure. The amount of your deposit includes a portion of your flights, your hotel stay and the full cost of any vacation add-ons, such as show tickets, excursions or travel protection.

How do I put as little as $250 down and pay later?

If you are booking your vacation more than six weeks in advance, the deposit option will appear during the booking process on step three of checkout. At this point, you can even schedule automatic final payments or set up email reminders. The actual deposit amount required varies based on the destination and hotel accommodations selected.

Scheduling automatic final payment

Select a final payment date more than 45 days before your departure date and your credit card will automatically be charged on that date. If you've entered multiple credit cards for your initial deposit, select the corresponding number in the Payment # field (a "1" in this box will charge the first credit card listed, a "2" will charge the second credit card listed, and so on).

Scheduling an email reminder

It's easy to set up an email reminder that will notify you when payment is due on your vacation. This makes it especially easy when you are making multiple payments toward the full vacation price. Just follow the instructions during step three of checkout to schedule your email reminder.

The actual deposit amount required varies based on the destination and hotel accommodations selected. Destinations outside of North America require a $350 per person deposit. Some special holiday/convention periods (or other exceptions) may apply where full payment is required at time of booking. Vacation cancellations/revisions are subject to penalties outlined in the Terms and Conditions . If you prefer, you may pay for some or your entire final vacation amount due before the final payment date (you can do this either by logging in to the account you created at time of booking or by calling us at the phone number above).

Have questions?

Call us at 1-888-854-3899 . You can also find answers to most of your questions by reviewing our Frequently Asked Questions .

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Cruise Planner

- Book a Flight

- Book a Hotel

- Check-In for My Cruise

- Required Travel Documents

- Make a Payment

- Redeem Cruise Credit

- Update Guest Information

- Beverage Packages

- Dining Packages

- Shore Excursions

- Transportation

- Royal Gifts

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

Cruise Payment Plans

Vacation financing, stop waiting to start cruising .

Booking with our payment options and methods make it easier than ever to celebrate a milestone occasion or cruise with your crew — anytime, anywhere.

✔ choose your cruise

Whether it’s beachside bliss, European wonders or anywhere in between, you can book a cruise vacation to any destination. Browse our site and select the cruise you want.

✔ SELECT PAYMENT OPTION

Once you’ve chosen your cruise, its time to book. Upon checkout, choose from different options like gift card, credit card or pay over time with Affirm.

✔COMPLETE YOUR PURCHASE

Just like that you’re ready for a vacation full of adventure or relaxation. You can manage your cruise experience by downloading the Royal Caribbean App .

PAYMENT OPTIONS

Booking a cruise has never been easier with so many payment options to choose from. Whether you need a little more time to think it over with a courtesy hold or want to pay over time, we give you the flexibility you want to score the vacation of a lifetime.

COURTESY HOLD

Need time to think it over? We’ll hold your reservation — including any promotions — for up to two days* while you coordinate vacation plans with your crew.

*The 2-day hold expires at 11 p.m. EST/EDT on the second day after booking.

scheduled payments

Book your cruise now and pay little by little. Or make a lump sum payment for the entire balance no later than the final payment date. The choice is yours.

total balance

Pay the full balance at the time of booking and start packing! This worry-free option sets you up for instant vacation mode. All that’s left to do is enjoy your upcoming adventure.

PAYMENT METHODS

Making a payment toward your upcoming cruise is a breeze with several convenient options. From Affirm to Royal Caribbean Gift Cards, we accept a variety of payment methods to snag your best vacation ever.

CREDIT CARD

Secure your cruise today with a minimum credit card deposit. Then schedule subsequent payments to be automatically charged to your card before your sail date. Or charge the full balance up front.

Need a little more time? Select Affirm during checkout for instant financing options to cruise now and pay later — even after your vacation has ended.

A Royal Caribbean Gift Card can pay for a portion of your cruise — or someone else’s. They’re easy to purchase, send, and redeem toward cruises and onboard purchases on U.S. sailings.

WHY CHOOSE AFFIRM?

From cotton-candy sunsets in Santorini to giant glaciers in Alaska and post-card pretty beaches in the Caribbean, Royal Caribbean® offers the boldest adventures on the industry’s best ships. Explore the world on your own terms with flexible payment plans through Affirm †. Book now and pay over time for as low as 0% APR with no late or hidden fees.

PAY over time

Book now and pay over time with fixed monthly installments for as low as 0% APR.

No late FEES

Affirm won't charge you late fees, hidden fees, compund interest, or penalties of any kind—ever.

see your purchasing power

Checking your eligibility at checkout won't impact your credit score.

GET ROYAL DEALS, SIGN UP TODAY

Sign up to receive information about our special offers and deals. You can unsubscribe at any time. For more details about how we use your information, view our Privacy Policy .

ROYAL CARIBBEAN GIFT CARD GIVE THE GIFT OF ADVENTURE

Max out the memories with a Royal Caribbean® Gift Card. Easy to purchase, send and redeem, Gift Cards let them choose the adventure that’s right for them — or splurge on onboard faves like specialty dining, beverage packages, spa services, shore excursions and more. All it takes is a few clicks to email a gift that’s customizable, convenient and flexible. And since the value never expires, family and friends can make bold new discoveries on their own time.

buy a gift card today

Buy a Gift Card Today

WEEKEND VS. WEEK LONG GETAWAYS

A Bolder Way to Getaway

WEEKEND GETAWAYS

explore more

Bragworthy Destinations

Week Long Vacations

CARDHOLDERS GET MORE

There’s a sea of incredible benefits to enjoy with the Royal Caribbean Visa Signature® card even when you’re not sailing. From rental car coverage and roadside assistance to price protection and purchase security, cardholders enjoy these benefits with their card.

LEARN MORE ABOUT THE ROYAL CARIBBEAN VISA SIGNATURE® CARD

LEARN MORE ABOUT THE ROYAL CARIBBEAN VISA SIGNATURE® VISA CARD

EXPLORE MORE

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

Satisfaction Rating

$150 per person, travel protection plan.

OUR FLEXIBLE PAYMENT PLAN

Flexible payment plan, at all inclusive outlet, we offer flexible payment options to ensure a stress-free shopping experience, you can book the trip of your dreams for a deposit as low as $50.00 per person* and make additional payments anytime that you wish, provided that you’ve paid in full 60 days before you travel., how it works:.

- The minimum payment required to secure your spot will show up at checkout when booking online or you can also pay over the phone if you’re working directly with one of our Travel Specialists.

- You can make follow-up payments in any amounts, using any credit or debit cards, at any time you wish! There are no auto-payment options as we don’t store credit card details for security purposes.

- From your online customer account, you’ll be able to make follow-up payments as well as view your remaining balance and payment history.

- You can choose to make small payments leading up to the final due date, or simply pay off the balance at one time.

- There are no additional fees or interest added for not paying in full as long as the required deposit amount is paid at time of booking, and the final payment is made by the due date.

- After making full payment, you’ll receive your travel documents!

Want to make a payment? Click HERE or contact us at 888.403.2822

Ready to start planning your next unforgettable getaway?

*$50 deposit is applicable to land only bookings.

- Get Exclusive Deals By Email

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

You’re a Member When Every Trip Can Be Extraordinary

Book through American Express Travel® and elevate your next journey.

Plan Your Ideal Getaway

With the inspiration, personal advice, and tools to help you make your trip perfect.

Find New Inspiration

Your new favorite destination is always a few clicks away. From adventures close to home to the farthest reaches of the globe, we can help you plan the adventure of a lifetime – and then find your next.

American Express Travel

Help yourself to more – for less. American Express Travel offers multiple ways to unlock extra savings and get the most for your travel dollar. When you book through American Express Travel, using your full suite of Card benefits is seamless. Terms apply. ‡

Ready, Set, Book

Spend fewer days dreaming about your trip and more days on it. Book directly with American Express to use benefits that could help you extend your travel.

Go Farther With Membership Rewards ® Points

Let Membership Rewards points cover this trip, or the next. From short flights to long stays, eligible Card Members can earn extra points when you book flights, prepaid hotels, prepaid car rentals, and cruises through American Express Travel using your eligible Card. Then you can use those points toward your next adventure. Terms apply. ‡

Lowest Hotel Rates Guarantee

Book with confidence, knowing you’ll always get the lowest rate through American Express Travel. If you book a qualifying hotel rate on AmexTravel.com and then find the same room, in the same hotel, for the same dates, the same number of children and adults, at a lower price online, before taxes and fees, we’ll refund you the difference. Terms apply.‡

Take Advantage of Insider Fares

Go further with fewer Membership Rewards points. With Insider Fares, it takes fewer points to get around the globe. Access select flights at AmexTravel.com if there are enough points for the entire fare. Terms apply.‡

Elevate Your Travel Experience With a Gift Card

Card Members like you are redeeming Membership Rewards ® points for Gift Cards from Delta, Uber, and other favorite travel brands. Browse from a selection of Gift Cards and use the points you've worked hard to earn.‡

Book Your Trip Now, Pay Later With Plan It®

Ready to get going? You can use Plan It to pace out your payments for purchases of $100 or more. Split the cost of your trip into equal monthly installments with a fixed fee, and still earn rewards on purchases the way you usually do. Terms apply.‡

Split Travel Expenses With Ease

Traveling with friends or a big group? Seamlessly split any pending or posted American Express purchase right from the American Express® App with any other Venmo or PayPal user and get paid back directly to your Card as a statement credit. Terms apply.‡

Coverage and Benefits Options for Your Next Trip

Help Protect Your Travels

Prepare for unexpected events with American Express® Travel Insurance◊ . Build your own insurance coverage or choose one of our packages. Fees, coverage limits, and coverage areas apply. Please read important exclusions and limitations. Enrollment required.

The Flexibility to Change Your Mind

With Trip Cancel Guard , you can cancel your flight for any reason up to two full calendar days before departure and receive up to 75% reimbursement when an airline credit or voucher is not available or expires. Available exclusively at AmexTravel.com at time of booking. Terms apply. ‡

Drive Forward With Confidence

Enroll your American Express ® Card in Premium Car Rental Protection◊ . Your Card will be charged one flat rate per rental period, not per day like rental companies may charge. Fees, coverage limits, and coverage areas apply.

Enjoy Your Adventure

From local finds to legendary favorites, take advantage of unique rewards and access at stops along your journey.

Multi-Card Carousel

Explore Local Hot Spots

Wherever your travels take you, you can find a table with Resy. Explore Resy’s curated itineraries to find beloved local restaurants along your trip.

Enhance Your Trip With Amex Offers

Whether you’re preparing for your journey, booking accommodations, or exploring your destination, Amex Offers‡ has got you covered. Simply add offers to your eligible Card and make qualifying purchases to earn rewards throughout your travel experience.

Make Every Moment More

When you’re a Member, any event is more rewarding. Experience exclusive Card Member benefits – like 10% off concessions, exclusive Card Member entrances, and more – at some of the most iconic venues around the world.‡

Unlock Savings on Great Events

Get 10% off tickets to live events, including concerts, sports events, theater shows, and more through the Tikety Live Event Site for Amex® Card Members.‡

Explore the World with GetYourGuide

Whether it’s marveling at unique scenery, appreciating local art museums, or tasting local cuisine, experience the wonders of travel by booking an activity at gyg.me/amex. Terms Apply.‡

Explore Your Options

Find the best Card, and benefits, for you.

Looking for a New Travel Card?

Explore Your Current Card Benefits

Start Your Next Adventure

You deserve the best from every journey. We’re here to help you get it.

‡ Terms and Conditions

Seller of Travel Show Details Hide Details

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms .

California CST#1022318; Washington UBI#600-469-694

Membership Rewards Show Details Hide Details

Terms and Conditions for the Membership Rewards ® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo .

Lowest Hotel Rates Guarantee Show Details Hide Details

Valid only for American Express Card Members. If you book a qualifying hotel rate on amextravel.com and then find the same room, in the same hotel, for the same dates, the same number of children and adults, the same rate type and cancellation policy at a lower price online, before taxes and fees, we'll refund you the difference. For pre-paid reservations, your claim must be submitted prior to your stay, before the date of check-in. For verification of “pay later” hotel bookings, your claim must be submitted within thirty (30) days after you have completed the hotel stay, and the customer service representative may instruct you to mail a copy of your hotel receipt to American Express within that time period. American Express will honor the lower price for verified requests. The "Lowest Hotel Rates Guarantee" policy applies only to online rates available to the general public and excludes (1) rates or discounts that are not available to the general public, including, but not limited to, corporate, group, charter, meeting/convention, AAA, government/military, and senior citizen rates/discounts; or (2) hotel rooms booked through or in combination with frequent stay, loyalty, points, coupon promotions, rooms won through contests or sweepstakes or transferred, or rooms booked on opaque websites that do not allow you to see the name of the hotel until your reservation is complete; or (3) promotional packages, deals, all-inclusive packages, or bundles that may include additional amenities such as parking, meals, or entertainment, or (4) rates booked through the Fine Hotels + Resorts® and The Hotel Collection programs.

Insider Fares Show Details Hide Details

Insider Fares are valid only for Membership Rewards ® program-enrolled Cards when a Card Member is booking through AmexTravel.com. Insider Fares will display in search results on AmexTravel.com only if an eligible Card Member is logged into his/her account and has enough Membership Rewards points for the entire fare; otherwise, publicly available fares will display. Insider Fares are fares for which less Membership Rewards points are required to purchase the flight. The entire amount of the purchase must be covered using Membership Rewards points. Insider Fares are only available on select flights. When purchasing an Insider Fare, the dollar amount of the fare will be charged to the Card Member’s account and a credit will be issued in that dollar amount on the Card Member’s statement; additionally, the number of Membership Rewards points required for the fare will be deducted from the Card Member’s Membership Rewards account balance. Participating airlines and benefits are subject to change. For more information about the Membership Rewards program visit www.membershiprewards.com/terms .

Delta Gift Card Show Details Hide Details

Once Membership Rewards points are redeemed for a Delta Gift Card, the award becomes subject to the terms and conditions of the Delta Gift Card Program. All Membership Rewards redemptions for Delta Gift Cards are final and transactions cannot be returned or reversed.Use of the gift card is subject to the below terms and conditions and, in addition, to the full terms provided at www.delta.com/giftcard . A maximum of 3 Delta Gift Cards can be used per Delta air transportation purchase.Each Delta Gift Card may only be used towards the purchase price of air transportation on Delta Air Lines marketed flights (including as part of a Delta Vacations® package) and may not be used to pay other amounts, such as baggage fees, in-flight purchases, mileage booster, premium seating (e.g., Preferred Seating or Economy Comfort™) or other ancillary products. Delta Gift Cards are not reloadable; will not be replaced by Delta for any reason; are not refundable and cannot be redeemed or exchanged for cash, check or credit except where refund or redemption is required by law; are not a credit, debit or charge card; have no implied warranties; and may only be sold by Delta and Delta-licensed vendors. Use of a Delta Gift Card is subject to applicable law. If there is a conflict between the terms and conditions and applicable law, applicable law will govern. The Delta Gift Card is issued by, and represents an obligation of, Delta Gift Cards, Inc. Call 800-221-1212 for balance information and customer service.

All Delta Gift Card terms apply. For complete terms and conditions, please visit delta.com/giftcards. Delta name and logo are registered trademarks of Delta Air Lines, Inc. and used with permission. Delta is not a sponsor of the program/promotion and is not affiliated with American Express.

Uber Gift Card Show Details Hide Details

By using this gift card, you accept the following terms and conditions: This card is redeemable via the Uber® or Uber Eats app within the U.S. in cities where Uber or Uber Eats is available. Funds do not expire. The card is non-reloadable and, except where required by law, cannot be redeemed for cash, refunded, or returned. You may be required to add a secondary payment method to use this gift card with the Uber or Uber Eats app. The card is not redeemable outside the U.S. Issuer is not responsible for lost or stolen cards, or unauthorized use. This card is issued by The Bancorp Bank, N.A. For full terms and conditions and customer service, visit uber.com/legal/gift.

Pay It Plan It ® Show Details Hide Details

Pay It ® is only available in the American Express® App for your eligible Account. With the Pay It feature, you can make a payment equal to the amount of a billed purchase less than $100. Payments made with Pay It are not applied to that billed purchase but to your outstanding balance in accordance with how we apply payments.