- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IMG Travel Insurance: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

IMG travel insurance plans and costs

Which img travel insurance plan is best for me, can you buy img travel insurance online, what isn’t covered by img travel insurance, covid-19 considerations, is img travel insurance worth it.

- Annual or single-trip policies are available.

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

Are you planning to travel soon? We don’t blame you — spending the last few years dealing with country shutdowns, testing requirements and travel restrictions has considerably impacted everyone.

If you’ve booked a vacation, you may wonder if you should purchase travel insurance. Among a variety of providers from which to choose, IMG insurance offers several different insurance plans. These include both short- and long-term policies, some of which include coverage for issues arising from COVID-19 illness.

Let’s look at IMG travel insurance, its different plans, and how to choose one that’s right for you.

» Learn more: Common myths about travel insurance and what it covers

The type of travel insurance you’ll want to purchase will depend on what kind of travel you’re doing. Are you looking specifically for medical coverage? How about trip insurance in case your plans go awry? You can be reimbursed in various circumstances if you have the proper insurance.

Single-trip plans

Single-trip plans are intended for those going on a trip for a predetermined period and returning home. This is compared to those who intend to take multiple trips within a year or those who will be abroad for a long time.

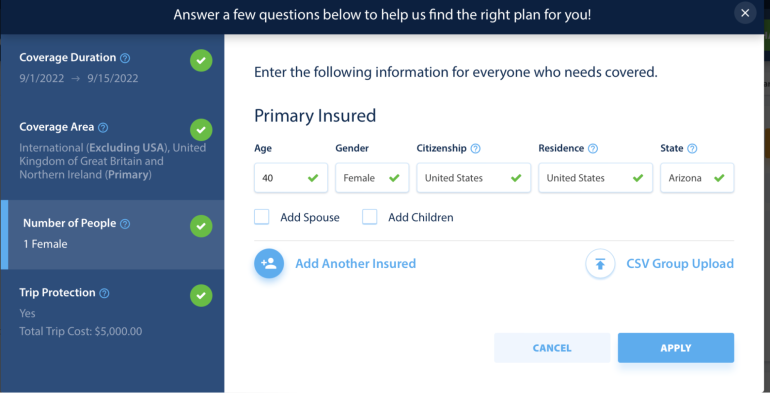

To get an idea of the options, we input a search for a 40-year-old female from Arizona traveling for two weeks to the U.K. on a $5,000 vacation.

IMG returned a total of 12 different plans. The cheapest plan, at $37.31, was limited strictly to health insurance. This includes coverage of up to $1,000,000 for unexpected illnesses and accidents.

The most expensive option, meanwhile, included medical insurance, trip cancellation insurance, and trip delay insurance. The total cost for this plan came out to $343.96.

Many travel credit cards offer complimentary trip insurance as long as you pay for the trip with your card, though coverage levels may vary.

Annual plans

Annual plans are built for those types of folks who travel often. This can be on many short trips or for longer-term absences from home.

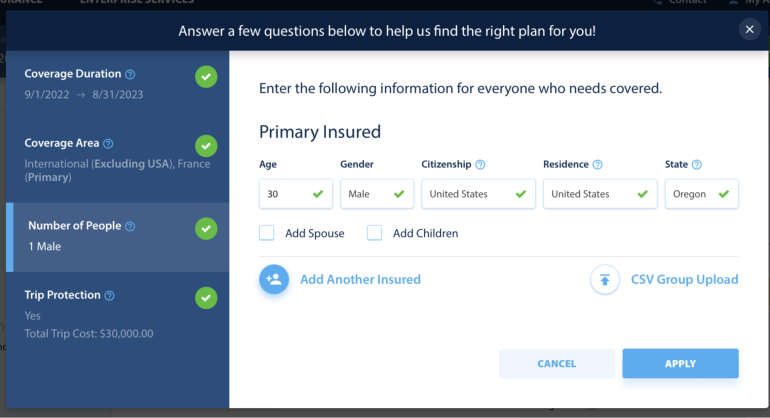

For an idea of the annual plan coverage IMG offers, we put in a search for a 32-year-old man from Oregon, traveling for a year with a budget of $30,000.

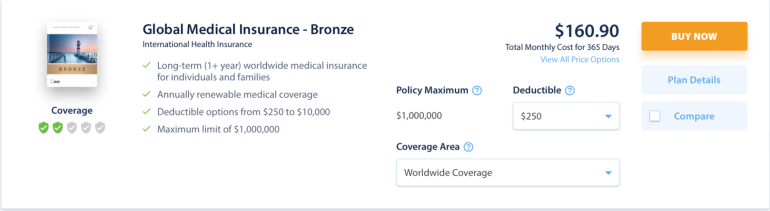

In this case, IMG returned a total of 19 different plans. The cheapest plan cost $160.90 for the year and included worldwide health insurance and a deductible of $250.

It’s worth noting that you can alter the deductible amount — upping the deductible to $10,000 dropped the annual cost of the insurance down to just $65.60.

The most expensive option, meanwhile, cost $816.69 and included 24/7 telehealth access for non-emergency medical questions. Maximum coverage limits for the policy range from $2,000,000 to $8,000,000.

» Learn more: How much is travel insurance?

The type of plan you’ll need will vary based on your travel habits. Here are some things you’ll want to think about when choosing your plan:

Look at coverage details

Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.

Think long-term

If you’re planning on traveling multiple times within the year, compare the cost of purchasing several different single-trip policies to buying a year-long plan, which may save you money.

Use existing coverage

If you hold a credit card with trip insurance, you may want to skip purchasing insurance entirely. Depending on your card, you may already have emergency medical insurance, trip interruption insurance, rental car insurance, trip delay insurance and more.

» Learn more: How to find the best travel insurance

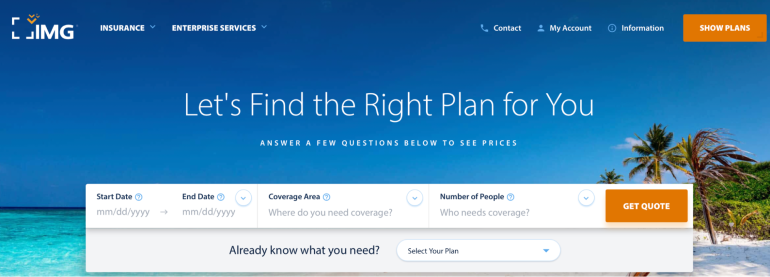

If you’re looking to purchase IMG travel insurance, you’ll first want to navigate its website: imglobal.com .

From there, you’ll be able to enter the details of your trip, including how many travelers you have, where you’re going and how long you’ll be gone. You’ll then be presented with various insurance plans to fit your needs.

We mentioned above that different plans have different levels of coverage. Still, in general, there are some things that you shouldn’t expect to be covered, including high-risk activities, intentional acts of harm and other designated events.

» Learn more: Does travel insurance cover medical expenses?

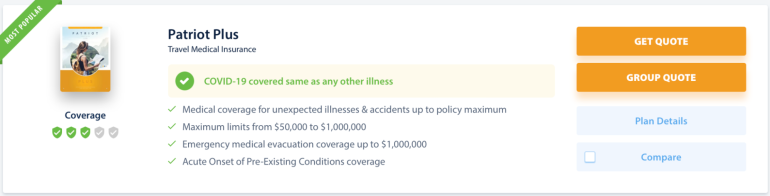

You’ll want to be aware that not all insurance plans cover instances of coronavirus. This is also true for IMG travel insurance; different plans have different levels of coverage and not all of these include COVID-19 protection.

If coronavirus is something you’d be covered for, you’ll want to double-check your plan before purchasing. Those that include coverage for COVID-19 will specify so like this:

» Learn more: Is there travel insurance that covers COVID quarantine?

The cost of your travel insurance will vary based on your coverage levels. Things that may bump up the price of your policy may include trip reimbursement insurance, cancel for any reason insurance and pre-existing condition coverage.

Yes, IMG offers international travel insurance. When getting a quote, you’ll be able to select the countries to which you’re traveling, though if you’re looking for a long-term plan, you can expect worldwide coverage.

Whether or not travel insurance is worthwhile will depend entirely upon your needs. If you have a credit card that provides complimentary insurance, that may suffice. Otherwise, purchasing a plan could help bring you peace of mind on your vacation and help you manage an unforeseen challenge if one occurs.

Some IMG travel insurance plans offer Cancel For Any Reason as an add-on. This benefit covers 75% of your nonrefundable trip cost and must be purchased within a specific time frame from your initial trip deposit. For example, for IMG’s iTravelInsured Travel LX plan you need to purchase CFAR within 20 days of trip deposit.

The cost of your travel insurance will vary based on your coverage levels. Things that may bump up the price of your policy may include trip reimbursement insurance,

cancel for any reason insurance

and pre-existing condition coverage.

Travel insurance can be a good option for those wanting coverage while away from home. The cost of your policy will vary based on the coverage you want — the better the plan, the more you can expect to pay.

Choosing whether or not to purchase travel insurance from IMG is a personal decision. However, if you’re heading out of town and want to be sure you’re covered, do your research and select a plan that suits your needs.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

International Medical Group (IMG) Travel Insurance Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3077 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Why Purchase Travel Insurance

Why purchase travel insurance from img, travel insurance and covid-19, types of policies offered by img, how to get a quote, the value of travel insurance comparison websites, to credit card travel insurance, to other travel insurance companies, to point-of-sale coverage, how to file a claim with img, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

It’s been especially important to protect our travel investments recently. You’ve likely had to cancel at least 1 trip in the past couple of years, and there’s still the uncertainty of whether future trips could face the same fate.

As a result, seeking out travel insurance that’s both affordable and provides the right combination of coverage has become an essential element of the trip-planning process versus a mere afterthought.

When it comes to purchasing travel insurance , it can be difficult to know where to start. Whether you conveniently buy the coverage offered when you purchase your trip, compare travel insurance companies and policies in-depth, or rely on your credit card with travel insurance , having as much information as possible can be helpful in making a decision on travel insurance.

Today we’re going to focus on 1 specific travel insurance company, International Medical Group, Inc. (known as IMG or IMGlobal). We’re also going to talk briefly about travel insurance in general, give you some tips on finding the best travel insurance value, and provide some direction when faced with the decision of whether you need to purchase coverage.

We’ll get to our review of IMG in short order, but let’s start by briefly discussing why you’d want to consider purchasing travel insurance.

Travel insurance provides protection for economic loss should unexpected covered events occur prior to and during your travels. The more money you have at risk, the greater the need to consider travel insurance.

If you’re simply purchasing a domestic flight and hotel for a weekend away, you may not need to purchase travel insurance.

However, if your trip includes a lot of non-refundable expenses or your itinerary is complex (increasing the chances that something could go wrong), you’ll want to be fully protected.

In addition, if your trip includes potentially dangerous sports activities , you’re visiting remote locations, or if you will not have medical insurance during your travels, you’ll also want to strongly consider travel insurance.

Here are some sample situations where travel insurance could provide protection:

- You’re on safari, become seriously ill, and need to be evacuated to the nearest hospital.

- There is severe weather, your flights are canceled and you must stay at a hotel overnight before continuing your trip.

- An immediate family member passes away causing you to cancel your trip.

- You’re skiing, fall, and break your leg.

- There is a flood, your home becomes uninhabitable, and you must cancel your trip.

Bottom Line: If your trip is expensive, has a complex itinerary, you’re visiting a remote location, or you need medical coverage during your travels, you should consider a comprehensive travel insurance policy.

There are a lot of companies from which to select when purchasing travel insurance. The bottom line, however, is whether the company is financially sound, can pay its claims, offers a policy that is affordable, and has coverage matching your needs.

IMG checks all those boxes as a leading provider of international health insurance, travel medical insurance , and comprehensive travel insurance. The company’s parent company, SiriusPoint America Insurance Company, is rated A- (Excellent) by prominent insurance financial rating company A.M. Best . Additionally, IMG has been around for over 25 years, so you know you’re dealing with an established company.

IMG has also been accredited by the Better Business Bureau since 2005 and has an A- rating. The company has had 59 complaints in the past 3 years, the majority of which were concerns with products/services typical of other insurance company complaints, including claims processing.

Whether IMG has the exact policy that matches your needs and is affordable for you requires more research. We’ll be digging deeper into examples of its policies and pricing later in this article.

First, however, let’s talk about COVID-19 and how IMG may provide related coverage.

In the light of the pandemic, we’ve all become more aware of the need for travel insurance. Perhaps you’ve had to cancel a trip due to the fear of getting ill while traveling, or borders were shut down, making it impossible to travel to your destination.

Unfortunately, travel insurance does not cover these situations unless you have purchased Cancel for Any Reason insurance . This add-on to your travel insurance policy offers protection when you feel the need to cancel for any reason . The coverage can be expensive and only 50% to 75% of your trip expenditure will be covered.

Many travel insurance companies include coverage for COVID-19 for medical coverage, trip cancellation, trip interruption, and trip delay. Some companies exclude COVID-19.

IMG treats COVID-19 as any other illness on the company’s iTravelInsured travel protection plans. It also offers a Cancel for Any Reason insurance add-on, depending on the policy you select. IMG may exclude coverage from some of its medical plans if your destination is designated as having a Level 3 warning by the Department of State (DOS) or the Center for Disease Control (CDC).

Bottom Line: Travel insurance does not cover voluntary trip cancellations due to fear of getting ill or cancellations for borders that have been shut down due to COVID-19. You would need to purchase Cancel for Any Reason insurance to have coverage. IMG offers this add-on option with some of its plans.

IMG offers 25 different insurance plans, ranging from basic travel medical insurance, comprehensive travel insurance, cruise and sports coverage, international medical insurance, and more.

The company is known for its international medical insurance offerings , including plans for visitors to the U.S. (including non-U.S. citizens, students, and exchange visitors). U.S. citizens traveling abroad will find several comprehensive travel insurance plans that include medical coverage or plans that have strong medical coverage with ancillary travel insurance.

The company also offers insurance that complies with Schengen visa requirements, specialized plans for government service workers, for marine captains/crew, and for those doing mission work.

Let’s look at a comparison snapshot of a few of the most popular plans offered by IMG and some of the coverage combinations you can expect to find.

This is just an overview of the core coverage offered by 3 of IMG’s travel insurance plans. Descriptions are abbreviated and are meant for comparison only.

Bottom Line: IMG offers a large variety of plans that allow you to select the type and level of coverage you prefer. In addition to comprehensive travel insurance plans, the company offers travel medical plans for visitors to the U.S. and plans for U.S. citizens when traveling both internationally and in the U.S.

Obtaining a quote from IMG for your trip is simple. You’ll need to provide your age, where you reside, and your primary trip destination. You’ll also need to provide the dates of your trip and the total cost of your trip.

Once you hit submit, you’ll receive an instant quote for several different plan options. You can compare coverages, pricing, and then select the plan that fits what you’re looking for.

You can then purchase the plan and coverage will start on the date you selected.

You will have 10 days to review the plan. If you’re not satisfied, you will receive a full refund.

Bottom Line: You can receive an instant quote on the IMG website by providing minimal information. You can also immediately purchase the policy and be covered for the date you selected.

Chances are we wouldn’t purchase a new vehicle without shopping around to find the best value. Fortunately, comparing travel insurance policies to find the best value requires a lot less effort.

Travel insurance comparison websites simplify the process making it easy to compare dozens of companies and hundreds of policies, all in a few minutes.

You’ll need to input your trip and traveler information including where you reside, the cost and dates of the trip, whether you want an annual multi-trip policy, and the date you wish coverage to begin.

Also, all of these comparison sites offer click-through links to COVID-19 coverage information for each featured company.

Here are some of the best travel insurance comparison websites to get you started:

- Squaremouth — Squaremouth compares a wide variety of policies, including annual plans that cover every trip you take within a 1-year period, medical travel insurance, single-trip coverage, and plans that cover sports/special activities.

- Insure My Trip — Insure My Trip is a good source for comparing comprehensive single- or multi-trip plans that include medical coverage.

- TravelInsurance.com — While the site does not compare medical-only plans, it offers comparisons of comprehensive travel insurance plans.

- AARDY.com — We like AARDY as it does a great job of comparing dozens of highly rated travel insurance companies. We don’t like having to provide our email in order to obtain a quote, however.

Bottom Line: Travel insurance comparison websites help you compare the best companies and policy options in a minimal amount of time. You can also purchase the policy after your search and receive immediate coverage.

How IMG Compares

Let’s look now at how IMG compares to the complimentary travel insurance coverage on your credit cards, to other travel insurance companies, and to the point-of-sale travel insurance offerings you might find when purchasing flights or travel packages.

Here’s how IMG compares:

If your trip is simply a flight and a short hotel stay, the travel insurance that comes with your credit card could provide you with all the coverage you need.

Once your trip becomes more complex, or more expensive, the need for travel insurance becomes greater. In either of these situations, or if you need medical coverage for your trip, the coverage that comes on your credit card will not be sufficient.

One important element is that most of the coverage provided on your credit card is secondary , meaning you must file a claim with other insurance first. You could potentially have to deal with the travel provider, the credit card company, any other insurance that may cover the loss, and the claims administrator.

Having a comprehensive travel insurance policy, like those sold by IMG, could simplify the process, especially for a complex trip involving several providers.

To learn more about the best credit cards for travel insurance , we invite you to check out our informative article.

Bottom Line: The travel insurance that comes complimentary on your credit card may be sufficient enough to cover a simple trip, perhaps just consisting of a flight and hotel. Expensive, more complex trips, or those requiring medical coverage, will be better served by purchasing a comprehensive travel insurance policy.

Using a travel comparison website like the ones mentioned previously allows you to compare companies and policies quickly .

While plans and prices will vary widely depending on your trip and personal criteria, we created a quote based on a single-trip, 1 week in length, involving a traveler 40 years of age, with a total trip cost of $2,000.

The above quote does include CFAR insurance. But even without it, IMG came out higher than most competitors. Policy coverage was identical in most cases but IMG did offer $1,000,000 evacuation coverage, $10,000 in search-and-rescue coverage, and coverage for rented sporting equipment.

When we look at travel medical coverage plans, IMG becomes more competitive (using our limited example). You will find some travel insurance coverages are also provided, making this option a consideration if you’re looking for a medical-specific plan.

Your criteria could change the comparisons entirely. That’s why a travel insurance comparison website is an essential tool when seeking out the best value in travel insurance.

Bottom Line: While our limited comparisons showed IMG plans as being higher than the competitors, this may not be the case for your specific trip and policy preferences. Plans that focused on medical coverage tended to be more competitive. Always compare options to find the best value for you.

The coverage options provided at checkout when you purchase a flight, vacation package, or other travel, can be limited. Additionally, the coverage is focused on cancellation and interruption coverage and only for the specific reasons listed.

To illustrate how IMG would stack up against point-of-sale coverage, we looked at the coverage and cost of insuring the same flight as the point-of-sale coverage above. For just a few dollars more, with IMG you would have emergency medical and evacuation coverage, and trip delay coverage. The point-of-sale plan covers just trip cancellation/interruption for up to 100% of the trip cost.

Bottom Line: In our limited example, even a budget policy purchased from IMG offers more coverage than a point-of-sale policy of a similar price. Always compare prior to purchasing, as rates will vary based on trip criteria.

If you need medical treatment during your travels, in many cases IMG can work directly with the medical provider. But if you also need to file a medical claim, the best way to get started is to complete the online claim form .

As the filing of a claim for a baggage delay can be quite different than filing a medical claim, and the documentation required will certainly differ, you’ll want to begin by using a claim form designed for your specific type of loss.

You can select the associated form on the company’s claim center website . Each individual claim form lists the unique required documentation you will need to submit for that type of claim.

You can also contact the company by calling 866-243-7524, 317- 655-4500, or 317-655-9796. On each claim form, there is also an address, phone number, fax number, and email that may differ depending on the type of claim.

Be aware that there are deadlines for reporting claims and submitting all of the required documentation and these timeframes can differ depending on the type of claim.

Bottom Line: The best way to submit a claim is by completing the online claim form specific to the type of claim, which is available on the company’s claim center website. On the claim form you will find the associated phone number, address, email address, and fax number to help facilitate your claim should you need this additional information.

Be aware that some of the plans IMG offers may provide secondary coverage versus primary coverage. This means that you must first file a claim with any other insurance that may apply.

You can feel comfortable purchasing a policy from IMG as you’ll have 10 days from the date of purchase to review the plan and get a full refund if you’re not satisfied.

We were able to obtain a quote for travelers up to and including age 99. Coverage levels and pricing vary by age.

While we have focused on individual travel and medical insurance in this article, IMG does have an Enterprise division that provides services to corporations and other organizations.

IMG is a good choice as a travel insurance company due to its financial stability and the fact it has been in business so long. However, you’ll need to compare plans and pricing with competitors to make sure the company provides the best value for you personally when purchasing a comprehensive travel insurance plan.

If you’re looking at insuring a single trip of short duration, the company can provide solid value over point-of-sale policies by delivering more coverage for similar economic outlay.

Additionally, the company’s travel medical insurance plans with primary coverage could provide you with solid medical coverage during your travels for minimal cost.

For more information on the basics of purchasing travel insurance , the best travel insurance companies , and how travel insurance works with COVID-19, visit our additional articles on these topics.

Frequently Asked Questions

Is img a good travel insurance company.

Yes. IMG is an established company backed by highly rated companies. The company is accredited by the Better Business Bureau with an A- rating.

Does IMG sell Cancel for Any Reason Insurance?

Yes. Cancel for Any Reason insurance is available as an add-on to some of the plans offered by IMG. However, just like other travel insurance providers, there’s a limited window of time to purchase the coverage. There are also limits on the percentage of trip costs that are covered.

What is IMG visitors insurance?

IMG offers several levels of medical plans for visitors to the U.S. These plans can cover students and visitors traveling on J-1 and J-2 visas, including non-U.S. citizens.

How can I contact IMG?

You can reach IMG by calling 866-243-7524, 317- 655-4500, or 317-655-9796. If you are out of the U.S., you can call collect.

You can also reach the company via email at [email protected] or by mail at International Medical Group, Inc., P.O. Box 88500, Indianapolis, IN, 46208.

Does IMG cover COVID-19?

IMG treats COVID-19 the same way it treats any other illness on many coverages including medical, trip interruption, trip cancellation, and trip delay.

You may also have the option to purchase Cancel for Any Reason insurance on some of its plans.

Be sure to check the specific policy prior to purchasing for related COVID-19 coverage.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

IMG Travel Insurance Review: Flexible Options For Your Next Trip

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

In this IMG Travel and Travel Medical Insurance review, we’ll explore what plans they offer, how they compare with each other, and which plan is best for different situations. Enjoy!

When planning a trip, it’s crucial to consider protecting your financial and physical well-being. If you’ve put down expensive, non-refundable deposits, it’s smart to protect those investments with a travel insurance policy. You might tell yourself you can’t afford it, but it’s more likely that you can’t afford to skip it .

The other major consideration is the cost of medical care outside your home country. No one likes to think about it, but what if you get injured or fall ill during your trip? Travel medical insurance covers the cost of emergency care so you can focus on getting better without worrying about the expense.

Today I’ll review IMG travel insurance and travel medical insurance. IMG offers a ton of products to meet the needs of almost any traveler. While I don’t have space to get into the nitty-gritty off all the options, I’ll focus on the main travel insurance and travel medical insurance plans to give you an idea of how they work and what’s included.

Here we go!

IMG at a Glance

- Customizable, renewable travel medical insurance

- Multi-trip travel medical plan for frequent travelers

- Travel insurance featuring trip cancellation, trip interruption, and emergency medical coverage

- Specialty travel medical plans for seniors, missionaries, U.S. visitors, and expats

IMG Travel Insurance Products

IMG offers two broad types of products: travel insurance and travel medical insurance.

Travel insurance (sometimes called trip protection) protects the investment you make in your trip. Its main features are trip cancellation and trip interruption, but it includes other benefits, too.

Trip cancellation gives you money back on your non-refundable trip costs when you need to cancel your trip for a covered reason. Trip interruption reimburses your non-refundable costs if you need to return home suddenly once your trip has started.

Travel insurance plans also typically cover some of the inconveniences that might come up when you travel. Think things like delayed flights and delayed or lost baggage. Travel insurance plans often include emergency medical coverage as well, making them well-rounded options for many travelers.

IMG offers the following travel insurance plans:

iTravelInsured Travel Lite Insurance

Itravelinsured travel se insurance, itravelinsured travel lx insurance.

The other main type of insurance IMG sells is called travel medical insurance. These policies provide temporary medical coverage when you’re traveling outside of your home country. They cover the cost of emergency medical treatment in the unfortunate event you get injured or sick during your trip.

IMG offers the following travel medical plans for coverage outside the U.S.:

- Patriot Travel International Medical Insurance

Patriot Platinum International Travel Medical Insurance

Patriot multi-trip travel medical insurance.

They also offer three travel medical plans for non-U.S. residents who need short-term medical coverage while visiting the U.S.:

- Patriot Travel America

- Patriot Plus America

- Patriot Platinum America

Although it is beyond the scope of this review to include details on these, be aware that IMG also offers specialty plans targeting international students, expats, seniors, and missionaries. Check out their website to learn more .

IMG Travel Insurance: What’s Included?

First, let’s take a closer look at the benefits included with IMG’s travel insurance plans.

Travel Lite is IMG’s entry-level plan. It offers secondary coverage, which means you have to exhaust other forms of insurance before IMG will pay a claim. Even though it’s a budget pick, it boasts impressive coverage.

Travel SE is IMG’s most popular plan. It’s suitable for domestic or international travel , including cruises. It includes all the benefits of the Travel Lite plan, but with higher levels of coverage, plus a few extra perks.

Travel LX is IMG’s deluxe travel insurance plan, providing the broadest range of benefits with the highest levels of coverage. It includes everything the Travel SE offers and more.

The biggest perks are the cancel and interrupt for any reason coverage. With the other plans, these benefits only apply when you cancel or interrupt your trip for a covered reason. The covered reasons are fairly inclusive, but you can’t beat the flexibility of being able to change your plans for any reason.

The Travel LX plan will appeal to adventure travelers, since it covers the sports and recreation activities excluded under the other plans. Those types might also be more likely to rent sporting equipment, so they might appreciate being covered for that, too.

IMG Travel Medical Insurance: What’s Included?

Now let’s take a closer look at the benefits included with IMG’s travel medical insurance plans.

Patriot Travel International Travel Medical Insurance

The Patriot Travel International plan is IMG’s most popular travel medical insurance product. It offers short-term medical coverage when traveling outside your home country and is renewable up to 24 continuous months. Maximum limits and the deductible you pay are customizable, so you can design a plan that meets your needs and your budget.

As you can see, it includes a slew of medical benefits. Be sure to visit the website to review a comprehensive list (spoiler alert: It’s long).

The Patriot Platinum plan offers the highest level of coverage of any of IMG’s international travel medical plans. It includes the same benefit categories as the Patriot plan, but in many cases, more coverage. It also adds:

- Remote transportation

- Supplemental accident

- The ability to extend coverage to up to 36 months

Note that you can add additional coverage for adventure sports to any of IMG’s travel medical plans.

The Patriot Multi-Trip plan is an ideal solution for frequent travelers . It covers all trips lasting up to 30 or 45 days in a 12-month period and is renewable for up to 36 months. Unlike the other travel medical plans, the coverage limits and benefits are not customizable.

Benefits include but are not limited to:

- Medical expenses

- Emergency dental

- Emergency and political evacuation

- Emergency reunion

- Return of mortal remains

- Return of minor children

- Accidental death and dismemberment

- Trip interruption

- Lost luggage

A Note About the Patriot America Plans

IMG offers three plans for non-U.S. residents visiting America . The Patriot Travel America, Patriot Plus America, and Patriot Platinum America offer similar benefits to the Patriot International plans, with some distinct features. Consult the certificate of insurance for specifics.

How Much Do They Cost?

The price of IMG’s plans will depend on:

- The plan you select

- The duration of coverage

- Your destination

- The value of your trip (for the travel insurance plans)

- Your desired coverage limit and deductible (for the travel medical insurance plans)

For accurate pricing, it’s best to get a quote directly from IMG. Don’t worry – it’s fast and easy on their website.

Just for fun, I tested out the system and grabbed a fast quote for a hypothetical family of four from Alabama spending a week in sunny Dominican Republic. Their ages are 38, 36, 10, and 8. Their trip costs $5,000. These are their quotes:

- iTravelInsured Travel Lite: $172

- iTravelInsured Travel SE: $196

- iTravelInsured Travel LX: $392

- Patriot Travel International: $35.02

- Patriot Platinum: $49

As you can see from those quotes, the travel insurance plans are much more expensive than the travel medical plans. That’s because the travel insurance plans include trip cancellation coverage for $5,000, which is an expensive benefit. The Travel LX plan, which is the most expensive on the bunch, includes cancellation for any reason, which is part of what drives up the cost.

IMG: What Isn’t Covered?

Certain sporting and recreational activities (except travel lx).

With the exception of the iTravelInsured Travel LX plan, IMG’s travel insurance plans don’t cover losses related to certain sporting and recreation activities that are considered adventurous. The travel medical plans come with the option of adding coverage for an extra charge, but they don’t include it by default. Consult your specific plan to see which activities are excluded. (Pssst: For incredibly inclusive adventure sport coverage, check out World Nomads ).

Anyone Who Is Pregnant, HIV+, or Disabled

The Patriot Travel Medical plans won’t cover anyone who is HIV+, pregnant, hospitalized, or disabled on the plan’s effective date. While it’s a given that people in the hospital won’t be traveling, it’s important for pregnant women and HIV+ travelers to be aware of this exclusion and look elsewhere.

> Read More: Best Travel Insurance Companies This Year

Losses Related to War

Like most travel insurance and travel medical insurance providers, IMG will not cover losses related to war, civil unrest, hostilities between nations, riots, and the like.

Pre-Existing Medical Conditions (With Some Caveats)

Generally speaking, IMG’s plans cover losses related to pre-existing medical conditions, but there are some caveats.

The definition of pre-existing medical condition varies by plan. IMG’s iTravelInsured travel insurance plans define it as a condition for which you sought care, treatment, testing, or medication in the 60 days before your plan effective date. The Patriot travel medical insurance plans define it as a condition that required treatment, testing, or medication (including a change in medication) in the 30 days before the plan effective date.

The iTravelInsured travel plans do not cover pre-existing medical conditions. However, a pre-existing condition exclusion waiver is available with the Travel SE and LX plans if you purchase it within 20 days of your initial trip payment.

The Patriot single-trip plans cover acute onset of pre-existing conditions for travelers under age 70. That means that if a condition is stable for 30 days before your policy comes into effect, but something unexpected comes up when you’re traveling, you’re covered. The Patriot Multi-Trip plan covers sudden and unexpected recurrence of a pre-existing medical condition.

Who Can Be Covered?

To be eligible for IMG’s Patriot single-trip travel medical insurance plans, you must be at least 14 days old and cannot be pregnant, HIV+, hospitalized, or disabled on the date your coverage begins. Only non-U.S. residents are eligible for the Patriot America travel medical plans. Travelers under age 76 with their own domestic health insurance policies are eligible to purchase the Patriot Multi-Trip plan.

IMG’s iTravelInsured travel plans cover travelers up to age 99 who are medically able to travel on their plan effective date.

Pros and Cons of IMG Travel and Travel Medical Insurance

Who should buy it.

- Seniors: IMG’s travel insurance plans cover travelers up to age 99, so age won’t prevent seniors from securing the protection they need. IMG also offers a product specifically for seniors that is worth checking out.

- Groups: IMG offers group rates, which means your travel posse might be eligible for a discount. Get a quote today to find out .

- Travelers Looking for One Product to Cover All Their Needs: IMG’s travel insurance plans bundle trip protection, emergency medical coverage, and convenience features. For many travelers, this is a simple solution that covers all their needs.

- Travelers Seeking Customizable Coverage: Travelers seeking to customize their medical coverage and deductible can select a travel medical plan that suits their needs and budget. The Patriot plans offer high levels of coverage that will satisfy even the most discerning traveler.

- Long-Term Travelers: IMG’s travel medical plans are renewable up to 24 or 36 months, depending on the plan. That means travelers with a case of wanderlust won’t find themselves without protection if they decide to extend their trip.

- Frequent Travelers: People who travel several times per year might benefit from IMG’s Patriot Multi-Trip Travel Medical Insurance. Rather than buying a policy for each individual trip, getting the multi-trip plan means you’ll be covered for all trips within a year.

Who Should Skip IMG?

- Anyone Who Is Pregnant or HIV+: IMG’s travel medical plans won’t cover travelers who are pregnant or HIV+ on the plan effective date. While most travel medical insurance providers will not cover claims related to routine care during pregnancy, most of the ones I have reviewed do not refuse to cover pregnant women altogether. So even if you’re trying to get pregnant, I would look elsewhere. Similarly, while many providers do not cover pre-existing medical conditions, most do not exclude people completely based on HIV status.

- Anyone Looking for Travel Insurance Lasting Longer Than 90 Days: IMG’s travel insurance (as opposed to the travel medical) plans cover trips lasting up to 90 days. If you’re planning to be away for an extended period, the travel medical plans might work for you, since they are extendable up to 24 or 36 months. Of course, the travel medical plans don’t include the same benefits as the travel insurance plans. Notably, they don’t provide trip cancellation. You might want to check out SafetyWing Travel Insurance instead.

- Travelers Looking to Bundle Trip Cancellation With Customizable Medical Coverage: When you shop IMG, you basically have to choose between two key benefits: trip cancellation and customizable medical coverage. You can get either, but not both on the same plan. If you opt for a travel insurance plan, you get trip cancellation and one-size-fits-most emergency medical coverage. If you opt for a travel medical plan, you get to choose your level of medical coverage and the deductible you’re comfortable paying, but you forfeit trip cancellation. This is the case with many providers, but it can still be a difficult decision.

How to Buy IMG Travel Insurance or Travel Medical Insurance

The easiest way to buy IMG travel insurance or travel medical insurance is on their website . Start by entering information about yourself, your traveling companions, and your trip. You’ll get a quote for all the plans that meet your needs. From there, choose the one that works best for you and purchase it online. If you need help, you can always contact IMG.

How to Make a Claim

If you need to file a claim, you can log into MyIMG to complete and submit claim forms online. Alternatively, you can mail claim forms and original itemized bills to IMG’s claims department. IMG needs to receive all relevant documents within 90 days of the service you’re claiming.

IMG Travel Insurance Plans: Are They a Good Buy?

IMG offers so many options that one is bound to suit your needs. The travel insurance plans are good all-in-one options for people who need trip cancellation coverage. Even the iTravelInsured Travel Lite, which is the entry-level offering, has solid trip protection and medical coverage. For anyone who doesn’t need customizable medical coverage or deductibles and wants to protect their trip, IMG travel insurance plans are a good buy.

Travelers who don’t need trip cancellation or trip delay can save some money and gain more control over their medical coverage by opting for travel medical insurance.

Sandra Parsons is a professional freelance writer and personal finance expert who writes about all things money. Her work has been featured on sites like MoneyTips, Credit Knocks, Women Who Money, and CreditCards.org. She also adores travel (preferably paid for with credit card rewards) and routinely reviews sightseeing passes and travel insurance solutions. Prior to focusing on her writing career, Sandra spent five years working in banking. She also holds master’s degrees in employment relations and psychology. Learn more about Sandra here.

Similar Posts

RoamRight Travel Insurance Review: Multiple Plans to Fit Your Needs

RoamRight Travel Insurance is a good option for covering your next trip. We’ll explore their plans, what they cover, and if they are right for you.

Seven Corners Travel Insurance Review: Is It Worth It?

Seven Corners offers several travel insurance options for travelers of all ages, including seniors. Learn if they’re right for your trip in this review.

Travelex Insurance Review: A Great Value for Families

Travelex Insurance offers travel insurance to tourists of all ages, including seniors. In this review, we’ll explore if it’s a good value for your family.

World Nomads Travel Insurance Review: Is It Worth It?

In this World Nomads travel insurance review, we’ll explore what their plans cover, who is eligible, and whether the plans are worth it for you.

AllClear Travel Insurance Review: Is It Worth It?

AllClear Travel Insurance offers single and multi-trip medical insurance plans (including pre-existing conditions) for all ages. Learn more in this review.

AXA Travel Insurance Review: Solid Trip Insurance for Families

AXA Travel Insurance offers 4 plans for your next trip. In this review, we’ll cover what the plans include, how much they cost, and who they’re good for.

Pin It on Pinterest

Enter your ZIP Code!

Get a quote today., img travel insurance: plans, costs, reputation, and services.

IMG specializes in providing travel medical insurance to individuals, families, and groups who are traveling, studying abroad, or even living abroad.

Its customer service is multilingual and available 24/7.

It has an A+ rating from the Better Business Bureau (BBB) and offers the ability to insure as an individual, family, group, or all three, helping you to minimize coverage gaps.

IMG Travel Insurance Coverage & Plans

Though IMG has three coverage selections for trip insurance, it really shines when it comes to travel medical insurance.

IMG offers medical coverage for vacations or other trips as well as international health insurance.

The company is a great option to consider for groups, students, or others who will be working or studying abroad for extended periods of time.

Available Plans:

- Comprehensive

- Trip Cancellation/Interruption

- Accidental Death

Travel Insurance Plans

IMG’s iTravelInsured product line has three different policy options covering a number of potential financial losses including trip cancellation, baggage delay, and emergency medical evacuation.

These plans cover you throughout your entire trip, and some even provide Cancel For Any Reason (CFAR) benefits.

iTravelInsured Travel Lite Insurance

- As IMG’s lowest-priced travel insurance program, the iTravelInsured Travel Lite insurance plan is designed for people who want to protect themselves against trip cancellations or trip interruptions.

- It also provides coverage for travel and baggage delay, as well as access to IMG’s non-insurance emergency travel assistance.

iTravelInsured Travel SE Insurance

- The Travel SE plan is IMG’s most popular travel insurance plan for both domestic and international destinations.

- This plan includes coverage for extra expenses your family could incur due to travel delays such as movie rentals, internet usage fees, and additional kennel fees for pets.

iTravelInsured Travel LX Insurance

- For travelers willing to pay a little extra for peace of mind, IMG’s Travel LX plan provides the highest level of benefits, including Cancel for Any Reason and Interruption for Any Reason coverage.

- This plan is a good choice for those considering adventurous activities or those planning a trip to remote or exotic locations.

Medical Insurance Plans

IMG offers a variety of medical insurance plans that cover visits to doctors, hospitals, or other licensed providers , including dentists.

In the event of a severe health issue, you may need emergency medical coverage to insure things such as evacuation and repatriation.

Medical coverage is even available for those with preexisting conditions, and there is no age limit for coverage.

Patriot Travel Medical Insurance

- IMG’s most popular plan, it provides coverage for individuals, families, and groups who need temporary medical insurance while traveling for business or pleasure anywhere outside of their home country.

Patriot America Plus

- This plan is for non-U.S. residents who need temporary medical coverage when traveling to the United States for a minimum of five days.

- There are a wide variety of plan limits and deductible options.

Patriot Exchange Program

- As its name indicates, this plan is specifically designed for students or groups studying abroad.

- IMG states that most plan options are designed to meet the U.S. J1 and J2 visa travel insurance requirements.

Visitors Care

- This plan for non-U.S. citizens offers a selection of scheduled benefits for those traveling or temporarily living outside their home country for at least five days.

- It can be renewed for up to 24 months.

Patriot Platinum Travel Medical Insurance

- This IMG medical travel insurance plan provides maximum coverage for short-term trips and vacations.

- It allows you to choose from an extensive range of deductibles and maximum limits and includes exclusive access to IMG’s Global Concierge and Assistance Services.

Global Mission Medical Insurance

- Global Mission medical insurance from IMG is a long-term plan that can be renewed each year and provides worldwide medical insurance coverage specifically for missionaries.

Student Health Advantage

- This plan is for individual or groups of five or more students participating in sponsored, study abroad programs who need a comprehensive plan that can be renewed yearly.

- IMG claims that this plan meets student visa requirements and includes benefits for maternity, mental health, organized sports, and international emergency care.

Outreach Travel Mission Advantage

- This plan is specifically designed for U.S. citizens and non-U.S. nationals who need short-term medical insurance while traveling for international outreach anywhere outside of their home country.

GlobeHopper Senior Travel Medical Insurance

- This plan is for U.S. citizens and U.S. permanent residents over the age of 65 and who need temporary medical insurance for trips outside the United States.

- It has both single-trip and multi-trip coverage options.

Student Health Advantage Platinum

- This plan is for individuals and groups of five or more students or scholars that participate in sponsored study abroad programs and who need an annually-renewable plan.

- It meets student visa requirements and includes maternity, mental health, organized sports, and international emergency care benefits.

Patriot Multi-Trip

- For those who take multiple trips abroad each year, the Patriot Multi-Trip plan could be a cost-effective option.

- Coverage choices are available for both U.S. citizens and non-citizens.

IMG Travel Insurance Costs

Though it can be challenging when you are tallying up expenses for your upcoming vacation, it’s wise to plan for the cost of travel insurance.

When programming your trip, you should budget between four to eight percent of the total cost of the trip for travel insurance.

The price is generally based on three factors: the length of the trip, the destination, and the age of the policyholder.

In general, longer trips cost more than shorter ones, international destinations are more expensive to cover than domestic ones, and older policyholders will usually pay more than younger ones.

IMG also offers annual or renewable plans for frequent travelers and, for most plans, dependents under the age of 18 are covered along with their parents.

Check out the IMG website for a quote based on your specific details.

If for some reason you don’t wind up needing IMG’s travel insurance, you may submit a cancellation request and receive a full refund within ten days of the effective date of your coverage.

IMG Travel Insurance Reviews & Reputation

When it comes to IMG travel insurance’s reputation, reviews are somewhat mixed.

While IMG has earned an A+ rating from the Better Business Bureau (BBB), customer reviews on the BBB website average less than two out of five stars.

However, IMG has been accredited by the BBB since 2005, and only has 15 customer complaints lodged against it within the past three years. Most of the complaints are categorized as billing issues.

Trustpilot gives IMG three out of five stars, which is an average score.

As is typical for insurance companies, many of the negative reviews come from customers who had billing or coverage disputes.

Customer Assistance Services

IMG prides itself on its 24/7 customer service and multilingual staff.

The IMG website lets you browse through policy options so you can choose what plan works best for you, your family, or your group.

The website also lets you build an instant quote, compare policies, and buy your choice of packages online.

IMG’s online support service, MyIMGSM, provides online access to local providers, explanation of benefits, claims status, ID cards, and certificate documents.

There is a paperless submission option for claims, though faxing or mailing is also permitted.

IMG also offers a convenient mobile app.

IMG Travel Insurance Financial Stability

When you decide to purchase insurance, you want to know the company is reliable.

To that end, IMG has the financial stability of an established international insurance company, providing peace of mind for the consumer.

IMG is underwritten by Sirius International Insurance Corporation, a wholly-owned subsidiary of CM International Holding Pte. Ltd, which is rated A (excellent) by A.M. Best and A- by Standard & Poor’s.

These high ratings should make potential purchasers very comfortable.

IMG Travel Insurance Phone Number and Contact Information

Homepage URL : https://www.imglobal.com

Company Phone : 1-800-428-4664

Headquarters Address : 2960 North Meridian Street, Indianapolis, IN 46208-4715

Year Founded : 1989

Best Alternatives to IMG Travel Insurance

Not satisfied with what IMG has to offer? These companies provide great travel insurance alternatives:

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

International Medical Group

IMG Global: Insurance Plans for Expats and Travelers

IMG Insurance has a broad array of offerings and a robust network of providers to support them. They have a large PPO (preferred provider organization) in the US as well as their IPA (international provider access) network of over 17,000 providers and facilities around the world. IMG services members in over 190 countries and has built a staff that can help you in an emergency 24 hours a day, 7 days a week, 365 days a year.

Through their subsidiaries IMG Europe, Akeso Care Management, IMG-Stop Loss, and iTravelInsured, they provide around-the-clock medical management services, trip cancellation programs, stop-loss insurance to reduce employer risk, and an internationally based service center. They've set the benchmark for industry service levels by integrating independent credentialing services with in-house, wholly owned and operated service divisions.

Since 1990, International Medical Group Insurance (IMG) has risen to become one of the world's leading providers of global travel and medical insurance. Whether you are an individual traveler, an expatriate, a missionary, a student or scholar, a business or a maritime worker, IMG has a plan that will work for you. They can service your every travel need, whether you're looking for simple trip cancellation insurance or a medical plan that will follow you on a year-long trip around the globe.

Why Choose IMG?

Extensive provider network.

IMG has a large network of international providers as well as its robust PPO network within the United States.

24/7/365 Service

Staff are available every minute of the day, whenever you have an emergency. And if you want to file a claim, search for providers or manage your account, their web portal is always available.

A Plan for Every Need

Whether you're going abroad for a week or a year, for work or for pleasure, IMG has plans that are tailor-made for your needs.

Global Reach

With offices around the world and a staff that speaks 18 languages, IMG can help you wherever you are.

IMG Global Products

IMG Global has created international travel insurance plans, global medical insurance plans and expat insurance as well as insurance for students and scholars , insurance for missionary groups and volunteer groups as well as people from many other walks of life. Here is an overview of IMG Insurance's most popular plans. Click on any plan to get more details.

IMG Global Medical Plan

IMG Global Medical Insurance provides anyone living and working outside of their home company with a reliable, full-featured medical plan that will cover them wherever they are in the world.

- Four plan options and additional optional coverages

- Choice of the coverage area to reflect your geographical area of need

- Freedom to choose your health care provider wherever you are in the world

IMG Patriot Platinum Travel Insurance

The IMG Patriot Plan provides first-class travel medical insurance for international trips with customized deductibles and maximum limits. Enjoy extra benefits like IMG's Global Concierge and Assistance Services and access to over 17,000 providers through their International Provider Access.

Patriot Platinum Travel Insurance

- Maximum limits up to $8,000,000

- IMG pays 100% of medical expenses in-network

- Evacuation due to Natural Disasters & Political Unrest

IMG Student Health Advantage Plan

If you are a student or scholar traveling abroad and looking for IMG international student insurance , then the Student Health Advantage plan is for you. This plan meets all US student, scholar, and cultural exchange visa requirements.

- Standard and Platinum level benefits available.

- Coverage for individuals and groups and their dependents.

- Freedom to seek treatment with hospital or doctor of your choice.

IMG Short-Term Student Health Insurance

IMG Patriot Exchange Program insurance is a streamlined and budget-friendly plan that provides medical coverage for students, families, and groups of two or more people while studying abroad. It also covers cultural exchange program participants. It is available for a minimum of 30 days and can be renewed up to a length of 48 continuous months. Most coverage options satisfy J1 and J2 visa requirements. The Patriot Exchange health insurance program provides effective coverage 24 hours a day while you are away from home.

IMG Multi-Trip Insurance

Patriot Multi-Trip is designed for individuals and families who travel frequently outside their home country throughout the year. The plan offers the ease and convenience of purchasing an affordable single annual premium plan that provides coverage for trips up to 30 or 45 days in length for each trip taken during a period of 12 months. The plan provides up to $1,000,000 of medical coverage and services.

IMG Insurance for US Seniors

GlobeHopper Senior addresses the insurance needs of seniors who are U.S. citizens and U.S. permanent residents and need temporary medical insurance while traveling outside the USA. In addition to medical benefits, the plan includes coverage for emergency medical and political evacuation, repatriation, and a choice of deductibles and plan maximums up to $1,000,000.

See our comparison of Senior Travel Insurance Plans .

Group Options from IMG

IMG offers several group plans for employers, including several different travel and global medical insurance plans.

Global Benefits for Organizations

- Offering group plans for international health, life and travel

- Request a quote from the leading insurers around the globe

- A licensed agent will provide quotes and expert advice

Review your options - Group International Benefits

IMG Insurance for Europe

- Global Prima Medical Insurance from IMG is a comprehensive, annually renewable global medical plan for individuals and families living and working abroad. Designed specifically for the European market, it includes an option to purchase coverage in Europe only, so subscribers do not have to pay for coverage in areas of the world that they will not be going to. Request a free online quote now!

- GlobeHopper Platinum is a flexible travel medical plan designed for travel to and from European countries. Subscribers may purchase this plan for any length of time from 30 days to 36 months – and, so long as they are covered, they may extend until they reach the 36 month limit. The GlobeHopper Platinum plan is extremely flexible, offering three different coverage maximums and five coverage add-on options. Subscribers may pay in USD, GBP or Euro. Request a quote online here .

IMG is listed as a Top 10 Travel Insurance Company and one of the Best Health Insurance Companies .

International Medical Group Insurance Provider Network

IMG's extensive global network of doctors, facilities and care providers can provide you with exceptional medical treatment wherever you are in the world. The company provides easy-to-use tools that help subscribers quickly find the right healthcare provider to fit their needs.

IMG Global International Doctors Network (Outside of the USA)

IMG provides a helpful online database of providers for anyone outside of the USA who needs care and has purchased an IMG Travel Insurance Plan , an IMG Global Medical Plan , or any other IMG insurance product. The International Provider Access database allows subscribers to search for medical, dental, and other care providers by facility, country, city, physician, and specialty worldwide. Note: U.S. providers are not included in this database.

Search IMG’s International Provider Access

IMG’s PPO Network in the USA

If you have purchased coverage within the United States, your plan gives you access to a preferred provider organization (PPO) network. While you can see any doctor, using a provider within the PPO network is likely to reduce your out-of-pocket expenses. Your insurance card should include a logo that shows whether your plan uses the First Health PPO network or the UnitedHealthcare PPO network. To access a list of providers in that network, click on the link related to your network below.

The PPO directory is updated regularly but changes may be made between updates. Contact the physician’s office to confirm his/her participation in your PPO network.

You can narrow your provider results by providing more criteria, such as location and specialty. If you cannot find a provider in your city or country, please contact IMG’s Customer Service Department via their contact form here .

First Health : Search PPO

UnitedHealthcare : Search PPO

International Medical Group Insurance Services

International Medical Group (IMG) is your plan administrator for assistance and customer care. They offer a number of online tools to allow subscribers to complete routine tasks as well as phone and email points of contact for customer service.

My IMG Client Zone

Through My IMG you have immediate access to a wealth of information about your account and can manage routine areas to help you save time when you may need it most. Some features include:

- Get explanation of benefits Initiate pre-certification

- Obtain certificate documents

- Locate a provider

- Recommend a provider/facility

- Request or print ID cards

Go to MyIMG Client Zone

IMG Claims Processing

Log onto My IMG SM to submit claims using their online claims form.

If you have an IMG Global plan, you may also use the following address to send any information to IMG's Claims department.

International Medical Group Claims Department PO Box 88500 Indianapolis, IN 46208-0500

If you have an IMG Europe plan, you may use the following contact information to send information to the IMG Europe claims department.

International Medical Group Claims Department Kingsgate, High Street, Redhill, Surrey RH1 1SH, United Kingdom

IMG Customer Service Contact Information

Postal Mail:

IMG Global International Medical Group (IMG) 2960 North Meridian Street Indianapolis, IN 46208

IMG Europe International Medical Group (IMG) Kingsgate, High Street, Redhill, Surrey RH1 1SH, United Kingdom

IMG Global C [email protected]

IMG Europe [email protected]

IMG Global Within the USA: 800-628-4664 Outside the USA: 317-655-4500 (call collect and indicate that you have a medical emergency)

IMG provides on-site, multi-lingual claims administrators and customer service representatives who process tens of thousands of claims each year. IMG also has international service and assistance centers around the world, so that when you call you can speak to someone in a nearby time zone.

+44 2920 474 236

International Medical Group FAQs

Is img insurance good.

IMG is a respected name in the international medical insurance industry, with products geared toward travelers, global citizens, and people living in a country not their own. They are one of our top-rated insurance companies and consistently place in the list of top international travel and best health insurance companies worldwide.

The company has been in operation since January 1990. with more than 30 years of serving the global community, IMG provides complete plan administration expertise. Its globally recognized underwriter, SiriusPoint, offers the financial security and reputation demanded by international consumers. Rated A- (Excellent) by A.M. Best and A- by Standard & Poor's*, SiriusPoint shares IMG's vision of the international marketplace and offers the stability of a well-established insurance company.

Who is the underwriter for IMG insurance plans?

IMG's globally recognized partner, Sirius Specialty Insurance Corporation (SSIC), offers the financial security and reputation demanded by international consumers. As the underwriter, Sirius is Rated A (Excellent) by A.M. Best and A- by Standard and Poor's, offering the stability of a well-established insurance company.

What are adventure sports for IMG insurance?

IMG offers optional add-on insurance to their patriot travel insurance plan that covers the following adventure sports, so long as they are being participated in at an amateur level: abseiling, BMX, bobsledding, bungee jumping, canyoning, caving, hot air ballooning, jungle zip lining, parachuting, paragliding, parascending, rappelling, skydiving; spelunking, whitewater kayaking, wildlife safaris, and windsurfing.

If you’re a thrill-seeking traveler who enjoys life’s more adventurous activities, you may want to consider adding supplemental coverage to your plan. The Adventure Sports Rider provides coverage for injuries sustained during certain extreme sports that would otherwise be excluded from your insurance policy.

How do I extend IMG insurance?

Before the end of your term of coverage, IMG will email you at the address you provided them when you began your coverage. This email will include a link that will allow you to extend your coverage. You must extend your coverage before your current plan expires.

More to Read:

Best International Health Insurance Companies

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .