- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Travel Tips

16 Airlines That Let You Book Flights Now and Pay Later

Planning a trip but don't want to pay for it all at once? These sites offer book-now, pay-later flights.

Orbon Alija/Getty Images

If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now and pay for it over time.

Affirm, PayPal, Uplift, and Klarna are among the book-now, pay-later services travel companies and airlines offer. Here, we break down the basics of these and airlines' own "BNPL" options so you can secure flights when the prices are lowest, even if you don't want to pay for them in full upfront.

Airlines Offering Book-now, Pay-later Flights

AeroMexico connects major U.S. cities to Latin American destinations like Guadalajara and Puerto Vallarta. The airline partners with Uplift to provide a monthly payment option. When you go to book a flight, you'll see an option to pay in monthly installments. Click through and you'll be asked for any personal information Uplift needs to process the loan.

You can also pay in installments through Klarna. Download the Klarna extension for Chrome or the app and you should see a pink "K" icon that will show you financing options. AeroMexico takes PayPal, which means you can use PayPal Credit to split up payments if you're approved.

Pay monthly for Air Canada flights and Air Canada Vacations packages with Uplift or PayPal Credit.

Alaska Airlines

Alaska Airlines partners with Uplift and Klarna to offer financing for flights.

Allegiant also uses Uplift and Klarna to provide payment plans. Select the Allegiant Pay option at checkout to choose financing through Uplift.

American Airlines

American Airlines offers several ways to buy now and pay later, including Klarna; PayPal Credit; Citi Flex Pay for select Citi cardholders; and Affirm, which has biweekly, monthly, and interest-free options but doesn't cover the cost of any flight extras, like luggage. American Airlines Vacations also gives you the option to pay monthly with Uplift.

Azul Airlines is a low-cost Brazilian airline that accepts payments through Uplift and PayPal.

Delta Air Lines

Delta offers PayPal Credit as a payment option, and you can pay using Affirm if you book your trip through Delta Vacations , a service for SkyMiles members that bundles flights, hotels, transportation, and activities.

One of the United Arab Emirates' two flag carriers, this airline partners with financing institutions Uplift and Klarna. You can also pay with PayPal Credit.

Frontier Airlines

Budget carrier Frontier Airlines lets you pay monthly installments through Uplift on purchases of $49 or more. If eligible, you will see the option at checkout. Frontier is also a Klarna retail partner.

KLM offers customers the option of holding a fare for 72 hours for a non-refundable fee. This is great if you find a fare that you want to book but need a few days to think about it. In addition, the airline takes PayPal Credit. This service is shown on the payment page as a "Bill Me Later" option, but directs you to your PayPal wallet.

Lufthansa has a list of payment methods on its website . Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website .

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit . As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

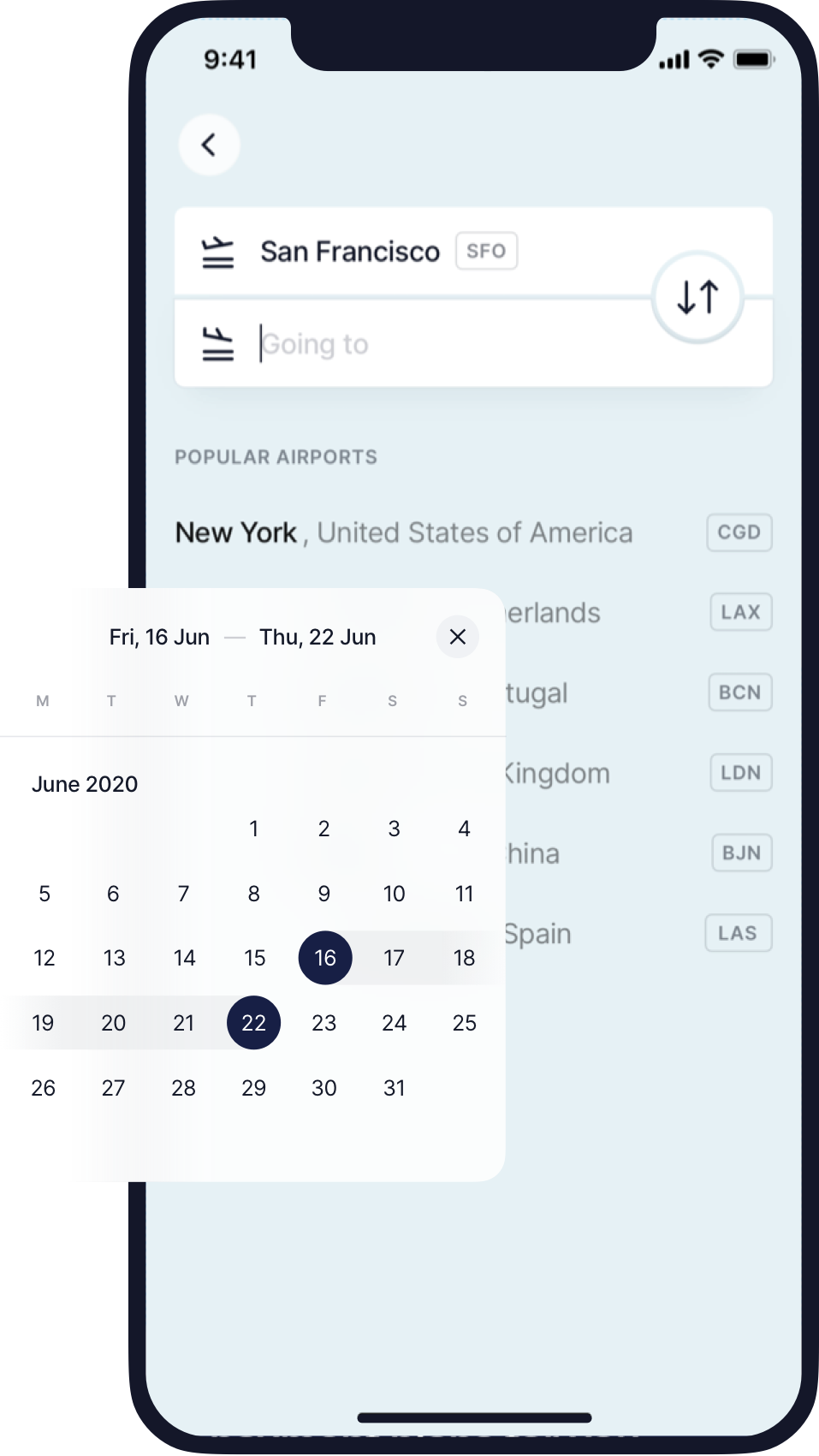

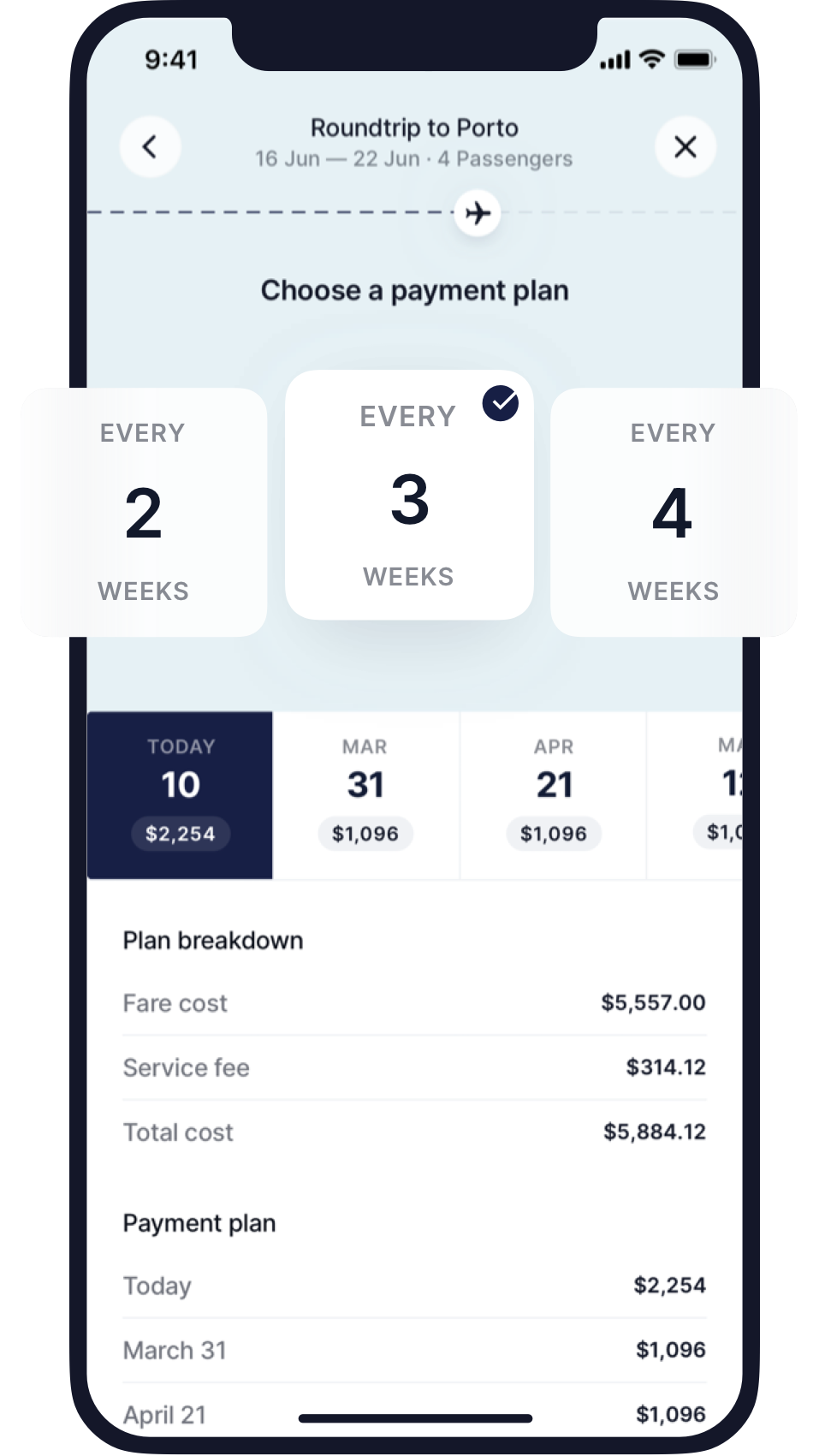

Images below are for illustrative purposes only

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

*Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses .

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

- How we work

- Hotel owners

- Advertise with us

- Airline fees

- Low fare tips

- Badges & Certificates

- Terms & Conditions

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

*0% APR offer available on 3 month terms between 4/1/2024-4/14/2024 for approved applicants purchasing Wanna Get Away Plus®, Anytime, and Business Select® tickets. Based on a purchase price of $200, you could pay a down payment of just $50 today, followed by 3 monthly payments of $50 at 0% APR. APRs range from 0%-36%, not everyone is eligible to receive a 0% APR offer. Minimum $49 purchase required. Actual terms are based on your credit score and other factors and may vary. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

No credit check, no interest

Just a transparent one-time service fee

Flexible payment plan

Choose the plan that works for you

Lock in your fare now

Don't miss out on a great deal

24/7 customer support

Focus on the fun of travel - not the stress

Scan to download

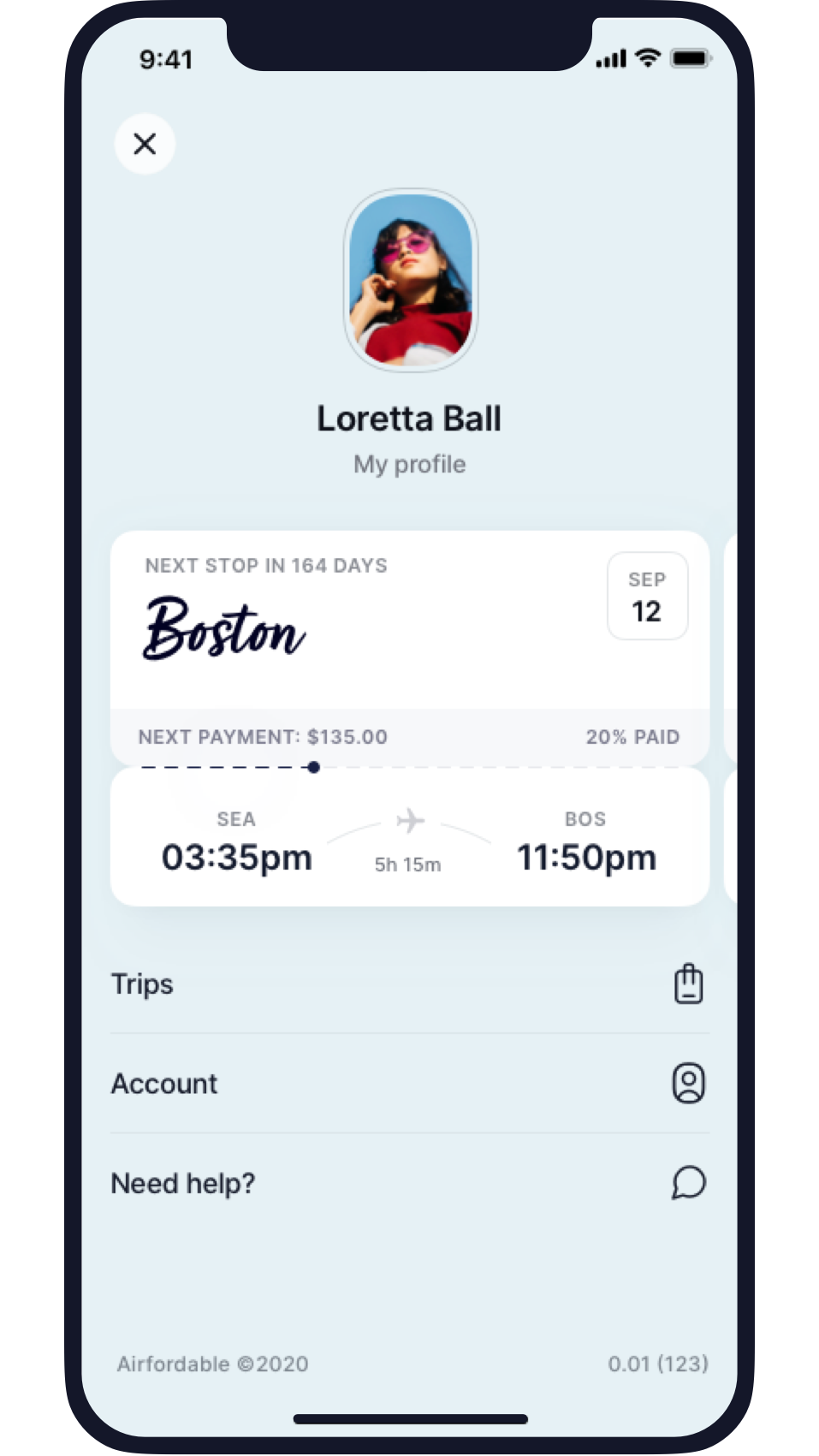

Accessible. Flexible. Easy. And done!

Fraction upfront

Book your flight for a fraction now, pay the rest later

Payment options

Pick what works best for your wallet

Progress tracking

Track all your payments and trips in one place

Discover the Airfordable difference

Planning your trip doesn’t need to feel like a chore. We put in the work so you don’t have to!

Book your favorite airlines

Complete control over your payment schedule

Manage multiple trips

Airfordable is the way to go!

Trusted by 500,000+ satisfied travelers, each with their unique stories and incredible adventures to share. Read real Airfordable traveler reviews.

What makes us different

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Price protection

When you book with us, you can secure your airfare well in advance when prices are cheaper. Protect yourself from the notorious airline price hikes no one likes.

Amazing community

Our travelers are a diverse group looking for creative ways to travel and budget. Airfordable is the bond that brings them together.

In good hands

The Airfordable team's sole mission is to help you travel more, but in an easy and financially responsible way. We're here for you.

Flexible and guaranteed

Pay only a fraction upfront for your flights. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Just accessible travel for your needs.

Safe and secure

Every interaction with Airfordable uses bank-level security and encryption. Your sensitive data is safe with us.

Great support at your fingertips

Dealing with airlines can be a hassle. Our team does the legwork for you, so you can focus on the fun — not the stress.

Available 24/7

We're always here to help you, day or night, with any support you need to book your perfect trip.

Reach us by email

Have a question, comment, or review? Our team can always be reached by email at [email protected].

Talk to support

Our in-app chat will send you directly to a member of our team for the one-on-one support you need.

Approved by the press

“Airfordable's value comes at the intersection of volatile ticket prices.... By locking in a ticket price up front, users can benefit by securing a better price on airfare while demand stays low and the date of departure is still far away.”

“A service like Airfordable could mean the difference between someone being able to take a trip or not – turning it into a priceless service.”

“The best part about Airfordable is that your ticket is paid off before your trip, so you don’t have to deal with debt once you return home. For someone who doesn’t want to miss out on a trip to see family and friends, a vacation or a life milestone, this can be a really great service.”

“Airfare is usually cheaper when you buy further in advance, but what if you haven't planned for a trip, or saved up the cash yet? One new solution is Airfordable.”

Book Your travel & enjoy a flexible payment plan that’s great for you

Flexible repayments, fast and easy, safe & secure, do you live in the uk, are you over 18, do you have a mobile, do you have a uk debit card, choose your next flight, go to the checkout, sign up & pay, frequently asked questions, when will i receive my flight tickets if i book fly now pay later flights, is there a credit check, are there any charges if my application is declined, can i book multi-city trips on a fly now pay later plan, can i change my repayment date, what could my repayment plan look like, legal statement, regulatory statement, travel made simple with our easy to use app.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Make a Flight Payment Plan with No Credit Check

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you need to buy a plane ticket but don’t want to pay the full amount upfront, an option to consider is purchasing your flight using a flight payment plan that doesn’t require a credit check.

This can be a valuable option for travelers who can’t or don’t want to pay the total amount of the flight right away but who also don’t want to put the travel on a credit card — which may carry a sizable interest rate.

If you’re considering this option, keep reading to learn how to find a flight payment plan.

What is a flight payment plan?

A flight payment plan is a buy now, pay later option for booking flights. While the specifics vary based on your particular plan and other factors, a flight payment plan involves paying for the flight over time in equal installments. Usually, you can find these payment plans as a checkout option on the airline or online travel agency's website. Look for buy now, pay later plans from companies like Uplift, Affirm, Klarna or PayPal Credit.

Here’s an example of how a flight payment plan works:

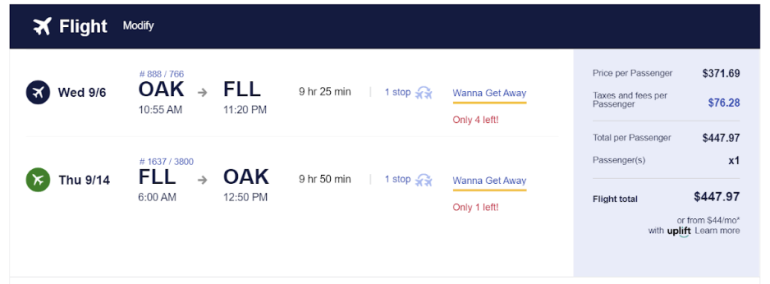

Say you want to buy a round-trip ticket on Southwest Airlines, flying from Oakland, Calif., to Fort Lauderdale, Fla. You find a ticket that departs on Sept. 6, 2023, and returns on Sept. 14 for $447.97.

Southwest allows you to pay in full or spread out your payments at checkout using Uplift. Uplift is a company that will enable qualifying customers to pay $47.34 at booking and then pay an additional $47.34 each month for the following nine months. Using the Uplift option, you’d pay $473.40 for your flight — $25.43 more than if you paid directly.

Although you’ll end up paying slightly more for the flight using Uplift than you would if you paid in full right away, this can be a great option for travelers who don’t have a credit card or who want to avoid using a credit card, especially if the card has a high interest rate.

» Learn more: 5 ways credit cards can beat buy now, pay later plans

Why look for flight payment plans with no credit checks?

Before signing up for a flight payment plan, check to see if you’ll be subject to a hard credit check for approval. Many buy now, pay later services only do a "soft credit inquiry." The main difference between a soft and a hard credit check is that a soft credit check doesn’t affect your credit score, whereas a hard credit check will.

Your credit score is essential for several reasons, including getting preferential interest rates for car loans or home mortgages, which is why you should favor flight payment plans that don’t require hard credit checks.

» Learn more: 6 tips for traveling without a credit card

Making a flight payment plan with no credit check

If you’re looking to use a flight payment plan to buy a plane ticket, the next step is to book your travel with either an airline or a booking website that offers flight payment plan options — and be sure to look for one that doesn’t require a hard credit check.

Airlines and booking websites that offer flight payment plans with no hard credit checks include:

United Airlines.

Southwest Airlines.

American Airlines.

Alaska Airlines.

While the exact steps will vary based on who you’re booking with, you’ll typically take the following steps to book your flight and secure your payment plan:

Search for and select the flight you want to book. Indicate that you’d like to use a buy now, pay later plan.

Fill in the information required to set up your payment plan, which may include your name, birthday, Social Security number and phone number.

If you’re approved, select the payment option you want to use.

After you find a plan that works for you, accept the plan. You’ll usually also have to make an initial deposit.

If you want to book a flight with an airline or booking site that doesn’t allow you to set up a flight payment plan at checkout, you may be able to set up a plan directly with a buy now, pay later company. For instance, Zip.co allows you to set up a flight payment plan with Booking.com or Delta with no hard credit check.

» Learn more: The problems with using buy now, pay later to fund travel

Flight payment plans with no credit check recapped

If you’re purchasing a flight and don’t have the funds available to pay for it in full upfront — or if you’d rather spread out your payments over time — it’s worth considering a flight payment plan.

However, finding a plan that doesn’t require a hard credit check is best since that can lower your credit score.

To secure a flight payment plan with no credit check, you should first look into airlines and booking websites that offer that option, such as Alaska Airlines, United and Priceline.

After you find a flight you like, fill in the relevant information and review your payment options. If the plan looks good to you, accept the terms, including paying an initial deposit.

Middle East GCC

- Iran English ایران فارسی

- Iraq English العراق العربيّة

- Jordan English الأردن العربيّة

- Kuwait English الكويت العربيّة

- Lebanon English لبنان العربيّة Liban Français

- Oman English عُمان العربيّة

- Qatar English قطر العربيّة

- Saudi Arabia English المملكة العربِيّة السعودية العربِيّة

- United Arab Emirates English الإمارات العربِيّة المتحدة العربِيّة

- Bahrain English البحرين العربية

Discover your next journey

- Before you fly

- At the airport

- Hamad International Airport

- Oryx Airport Hotel

- Qatar Duty Free

- Checking in

Meet & assist services

- Privilege Club

- Claim missing Avios

- Buy, gift & transfer

- Buy Qpoints

- My Calculator

- Cash + Avios

- Student Club

- Family Programme

Enjoy exclusive benefits

- Flight Status

- Search Search

- Popular searches

Choose your region

Get more on our app.

Make the most out of your trips!

Your upcoming trip

- Dashboard Edit profile Logout

- Earn Avios on every booking

- Enjoy award flights & upgrades

- Pay with Cash + Avios & save

- Not fully vaccinated

- Fully vaccinated

This information is provided by Qatar Airways as a courtesy, and although updated regularly, we recommended you frequently check back due to the rapid changes in travel conditions, and that you verify travel and entry requirements through independent enquiries before your trip.

Buy Now, Pay Later

- Departure airport is missing

- Invalid departure airport

- Destination airport is missing

- Invalid destination airport

- Departure date is missing

- Return date is missing.

- Departure airport for flight 1 is missing

- Destination airport for flight 1 is missing

- Departure date for flight 1 is missing

- Departure airport for flight 2 is missing

- Destination airport for flight 2 is missing

- Departure date for flight 2 is missing

- Departure airport for flight 3 is missing

- Destination airport for flight 3 is missing

- Departure date for flight 3 is missing

- Departure airport for flight 4 is missing

- Destination airport for flight 4 is missing

- Departure date for flight 4 is missing

- Departure airport for flight 5 is missing

- Destination airport for flight 5 is missing

- Departure date for flight 5 is missing

- Departure airport for flight 6 is missing

- Destination airport for flight 6 is missing

- Departure date for flight 6 is missing

- Please select the number of passengers.

- Departure date should not be greater than the return date

- Invalid entry for departure airport field for Flight 1

- Invalid entry for destination airport field for flight 1

- Invalid entry for departure airport field for Flight 2

- Invalid entry for destination airport field for flight 2

- Invalid entry for departure airport field for Flight 3

- Invalid entry for destination airport field for flight 3

- Invalid entry for departure airport field for Flight 4

- Invalid entry for destination airport field for flight 4

- Invalid entry for departure airport field for Flight 5

- Invalid entry for destination airport field for flight 5

- multicity.field.depart.error6

- Invalid entry for destination airport field for flight 6

- Two of your consecutive flights are same. Please update your flight details.

- Minimum two segments needs to be selected for multi-city search

- Qatar Stopover packages are not available to book from 3 Oct – 8 Oct 2023 due to the F1® Qatar Airways Qatar Grand Prix

Experience Doha on stopover

Qatar stopover is not currently available for the below route. You can proceed with a regular search to book your flight

- Premium (Business/First)

When would you like to add a stop in Doha during your journey?

How many days would you like to stay in Qatar?

- Use Avios to pay up to 50% and save

- Cash + Avios brings you double rewards

You have enough Avios to book an award flight.

still interested in travelling to {destination}?

There is a limited number of seats available. Complete your booking to secure yours.

Qatar Airways has partnered with PayPal Credit to help expand your world while easing the strain on your wallet.

From the ancient pyramids of Egypt to the colorful streets of Thailand, the possibilities are endless with Qatar Airways and PayPal Credit. Enjoy the flexibility of paying for your next trip in low, monthly installments, interest free.* Simply choose the “Pay Later” payment option when booking on qatarairways.com.

Start checking off the destinations on your bucket list. Book now, and pay when you can.

Discover the world with Qatar Airways

Explore the world with Cash + Avios

Benefit from great savings, when paying with a combination of cash and Avios on your next flight booking.

Experience more on a Qatar stopover

Turn one vacation into two with a stopover in Qatar, the perfect destination for a taste of local culture, desert adventures, world-class shopping, fine dining, and much more.

Al Maha Services

Designed with your time and comfort in mind, our personalized meet and assist service aims to ensure a comfortable and seamless experience when arriving, departing or transferring through Hamad International Airport.

Turn one vacation into two with incredible stopover packages to Qatar, the perfect destination for a taste of local culture, desert adventures, world-class shopping, fine dining, and much more.

Economy Class

Whether you wish to dine, sleep or immerse yourself in the vast selection of entertainment options on offer, our spacious seats give your more than enough room to enjoy your journey.

Business Class

Experience the world’s most memorable destinations with an unforgettable journey in the World’s Best Business Class, as recognized by the 2023 Skytrax World Airline Awards.

Become a Privilege Club member

This is your chance to unlock exclusive rewards with the World's Best Airline. Join Privilege Club using the code PCAMER23 and travel by July 31, 2024, to earn up to 5,000 bonus Avios after your first flight as a member.*

One-time pin

Add an extra layer of security to your account with a one-time pin (OTP).

Secure your account with an OTP:

Receive your otp via:.

Enter a mobile number

login.otp.mobile.calling.code.emptyerrormessage

Please enter email address

Mobile number and email address should not be empty

Please enter valid email address

Placeholder for service error message

Your account is less secure without an OTP

Your OTP preferences have been updated.

A verification link will be sent to your newly amended email address. You will now logged out of your Privilege Club account. Do you wish to continue

Please enter the one-time pin (OTP) sent to your registered mobile number {0}.

A new OTP was sent successfully.

Please enter the one-time password received in your registered email, {0}.

one-time password has been re-sent. Please enter the one-time password received in your registered email, {0}.

Please enter the one-time pin (OTP) sent to your registered email address {1} and mobile number {0}.

A new OTP has been sent to your registered email address {1} and mobile number {0}. Please enter it below.

Please enter the valid one-time password

OTP should not be empty

Your account has been temporarily locked as the maximum number of daily attempts has been reached. Please try again by resetting your password after 24 hours. Back

The OTP has been successfully verified.

Your contact details have been successfully changed..

A guide to using buy now, pay later for travel

PayPal Editorial Staff

January 5, 2024

Planning a vacation? Buy now, pay later (BNPL) may be offered as a payment option when booking flights, hotels, or other travel accommodations.

Discover how BNPL options work for travel, from potential pros and cons to responsible practices and strategies if considering using it.

What is buy now, pay later for travel?

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares.

If BNPL is an available payment option for an airline, hotel, or travel retailer, individuals can opt for a payment plan at checkout. Normally, they would select the BNPL provider and apply in the checkout, but some providers may redirect applicants to their website to create an account and apply. Typically, applicants receive a near-instant decision, which may mean those looking to use buy now, pay later for travel can book their travel or vacation without a significant delay.

Depending on the BNPL provider , there may be interest fees and other charges, though some providers may offer plans with no interest. Be sure to review any terms before applying.

While application and approval requirements may vary depending on provider, here’s a breakdown of the general eligibility requirements and approval process:

- Meet the eligibility requirements: These can vary based on the provider. People typically need to be at least 18 years old and provide personal details like their social security number and home address. Some BNPL providers may also assess income, payment history, and credit score.

- Agree to the terms: Individuals must agree to the terms and conditions of a BNPL plan, including an installment schedule and any associated fees or interest charges.

- Receive a decision and book travel: People usually receive a BNPL approval decision in seconds. If approved, they can book their travel using BNPL as their payment method.

Potential benefits of using buy now, pay later for travel

Before using buy now, pay later for a trip, consider the potential advantages:

- Flexibility: BNPL may offer flexibility to spread the cost of a trip over time, allowing travelers to manage their budget and avoid a significant upfront expense.

- Interest-free options: Some BNPL services may provide interest-free payment plans. For example, PayPal’s Pay in 4 allows people to split eligible purchases into four interest-free, bi-weekly installments. 1

- Accessibility: Buy now, pay later may help make travel accessible to those with limited credit histories or low credit scores.

Potential downsides of using buy now, pay later for travel

There are some potential disadvantages to using buy now, pay later for travel expenses. Some examples include:

- Interest and fees: Some BNPL providers may charge interest or fees if travelers miss payments or choose longer repayment terms, potentially increasing the overall cost of their trip.

- Overspending: While BNPL offers flexibility, it can also lead to overspending if travelers don't carefully budget for their installment payments. It also may tempt some to book more expensive trips than they can comfortably afford.

- Credit impact: Although certain buy now, pay later providers may not conduct hard credit checks initially, missed payments or defaults may negatively impact credit scores in the long run.

- Limited booking options: Not all travel providers or agencies accept BNPL as a payment option.

Using buy now, pay later for travel responsibly

Here are some factors to consider when signing up for a BNPL plan for travel:

- Budget and plan: Establish a personal budget for travel plans that includes not only the upfront trip cost but also the future installment payments to ensure the overall expense remains manageable and within budget.

- Read the fine print: Carefully read and understand the terms and conditions. Pay close attention to any interest rates, fees for missed payments, and the total cost of a trip when opting for BNPL.

- Responsible spending: Avoid the temptation to overspend just because BNPL offers flexibility. It’s important to only buy on credit responsibly .

- Ensure timely payments : Commit to making payments on schedule to avoid late fees or interest charges. Setting up automatic payments can help prevent missed deadlines.

Using BNPL for travel may offer convenience and flexibility for those looking to travel or book a vacation, but it should be done with careful consideration. Be sure to consider any fees or interest that may apply and keep track of when payments need to be made.

Learn about PayPal Pay Later .

BNPL for travel FAQ

What is buy now, pay later.

Buy now, pay later is a type of short-term financing method that allows people to split a purchase into several smaller installments over weeks or months. Some BNPL plans may be interest free, while others may include interest and fees.

Can buy now, pay later be used for flights?

Buy now, pay later can often be used for flights. Many airlines and travel booking platforms offer BNPL as a payment option at checkout. Travelers should budget and plan their payments accordingly before committing to a payment plan.

Can I book a vacation with buy now, pay later?

Individuals may be able to book a vacation using buy now, pay later. BNPL options are increasingly available for vacation planning, including flights, accommodations, and activities. Travelers can opt for BNPL at checkout and split the total cost into smaller installments. However, be sure to budget carefully and be aware of any potential interest or fees.

Was this content helpful?

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies

Book a flight for only a fraction upfront

Purchase your flight in installments before your departure date.

Elisa Ticket $1,100.00 Purchased @ $407.00 upfront

Jessica Ticket $820.00 Purchased @ $303.40 upfront

Patrick & Sarah Ticket $1,500.00 Purchased @ $555.00 upfront

Los Angeles

Dan Ticket $402.00 Purchased @ $148.74 upfront

How it works

The easy and convenient way to lift off

Submit your ticket

Find a flight from your favorite travel site, take and upload a screenshot of your flight details.

Book your flight for a fraction of the cost upfront and pay the remaining balance in installments before your departure date.

Receive e-ticket

Receive your e-ticket after your last payment. Pack light.

Why people love us

Price protection.

Book with us and we'll secure your airfare in advance when prices are cheaper. Protect yourself from price hikes no one likes.

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Flexible and guaranteed

Now you have the option to not pay the full cost upfront for your ticket. With Airfordable you pay for your flight for a fraction upfront and the rest in installments before you travel. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle.

Safe, secure and guaranteed

Every interaction with Airfordable uses bank-level security and encryption. Sensitive data is safe with Airfordable.

Amazing community

Our travelers are diverse and smart spenders looking for creative ways to travel. Airfordable is the bond that brings them together.

In good hands

Airfordable is a humane technology company whose sole mission is to help you travel more, but in an easy and financially responsible way.

Join the AF community

Over 10,000 travelers look to Airfordable for traveling in a responsible and systematic way

Elaine Jane Abesames

I'm really happy to have found Airfordable! They offer flexible installments which I love! It's truly a dream come true! Thank you for helping me book my dream vacation to the Bahamas!!!

I was able to book a flight to Madrid, Spain for me and my girlfriend this summer through Airfordable. Being that this is my first Euro trip, I'm super excited.

Autumn Dowis

I chose to book with Airfordable because it was simple, quick, easy, and affordable of course! As a full-time college student who also works full-time, Airfordable helped to ease the burden of a large up-front payment.

Catrina Banks

I decided to utilize Airfordable, because it gave me the opportunity to lock in the price on plane tickets while making payments that was convenient for my family. This was the best decision that I could have made!!

Frequently asked questions

Below are a few questions you might be itching to ask. If you don’t find what you’re looking for, email us at [email protected]

What is Airfordable?

Airfordable allows you to book a flight for a fraction of the cost upfront and pay the remaining balance in installments before your departure date.

Does Airfordable check my credit?

No. You are so much more than your credit score, so we don’t turn you into a three digit number.

Do you charge a service fee?

Yes, we do. Airfordable charges a one-time service fee. Sign in and use the installment calculator to determine your fee.

What happens if the price changes after I book?

Our crystal ball hasn’t arrived yet. Until it does, we cannot predict any price changes. With Airfordable, you are paying to protect your airfare from increasing in price which can be a lot more costly than price drops.

Airfordable

Fly the smart way.

Airfordable is on a mission to democratize travel

7 Million+ miles and counting...

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

'buy now, pay later' can help fund your next trip but here's what you need to know about these loans, select walks you through what you need to know if you're considering a point-of-sale loan to finance your next trip.

With summer in full swing, and many countries easing travel restrictions, you might be eager to plan a post-pandemic trip. Even if you managed to save some money ahead of time, travel expenses can quickly add up, and you might be tempted to choose the 'buy now, pay later' option that's offered at checkout on many travel websites, including Carnival or Expedia.

These point-of-sale loans are seductive to consumers who don't want to pay for their post-pandemic vacations with one lump-sum payment, allowing people to make payments over a fixed period of time, sometimes without high interest rates.

But is using the 'buy now, pay later' option to pay for your flights or hotel stays too good to be true?

Select explores some of the benefits and drawbacks of using 'buy now, pay later' for travel.

What are point-of-sale loans?

How do point-of-sale loans work, should you use point-of-sale loans for travel, bottom line.

'Buy now, pay later' providers (also known as point-of-sale loans) offer consumers the option to sign up for a payment plan either when they're buying something on a retailer's website or directly through the loan provider's website ahead of purchase

Point-of-sale loans give consumers the ability to make installment payments over a fixed period of time until they completely pay off their purchase. This means that you'll make payments toward your purchases bi-monthly or monthly depending on the plan and/ or provider.

These payments can typically be automated by providing your debit card or bank account information. While many providers boast 0% interest rates, some point-of-sale loans can have interest rates upwards of 30%, higher than the APRs on many credit cards.

Some of the most popular providers are Afterpay , Affirm , Klarna and Uplift . Klarna offers point-of-sale loans, some with 0% APR, that allow you to make four payments every two weeks and require a deposit at checkout, while Afterpay allows you to pay over six weeks. Afterpay, Uplift, Klarna and Affirm also offer consumers longer payment periods of up to one, two or even three years.

When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or point-of-sale loan . You'll be redirected to the POS provider website where you can enter your personal information.

Some companies won't perform a credit check while others will perform either a soft or hard credit inquiry . Soft credit checks don't negatively impact your credit score , but hard inquiries will temporarily decrease your score. Based on the information you enter, you'll either be approved or denied for the loan.

Afterpay doesn't do any credit checks while Klarna does soft and hard credit checks, depending on the loan.

The impact a point-of-sale one has on your credit score depends on whether the provider reports your payment history to the credit bureaus . For example, Affirm only reports your credit history to Experian for some loans and not others. For the loans that Affirm does report to Experian, your payment history, the length of your credit history with Affirm, the amount of your loan and your late payments can all show up on your credit report.

Make sure to read the terms and conditions of your POS loan to see if your negative payment history is reported to the credit bureaus.

Travel expenses might seem like the perfect opportunity to use a point-of-sale loan because it's oftentimes a big purchase that you might not have the immediate cash on hand to cover.

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. Affirm has partnerships with Delta Vacations, Priceline, StubHub and Alternative Airlines, a flight booking website. Uplift is exclusively focused on providing point-of-sale loans for travel, with around 200 travel partners , including United Airlines, Kayak , Southwest Airlines and Royal Caribbean.

Uplift will help you cover transactions costing anywhere from $100 to $25,000. Interest rates range from 7% to 30%, but there are a few travel partners such as Carnival Cruise Line and Atlantis that have a 0% APR, according to Tom Botts, chief commercial officer at Uplift. The average APR for an Uplift point-of-sale loan is 15%, which is similar to the average APR for credit cards .

"We use a variety of factors to determine eligibility," Botts says. "Interest rates are based on a number of factors including credit history, transaction amount and time to travel."

Uplift also only performs a soft credit check which won't negatively impact your credit score.

If you're able to secure a loan with 0% APR and make your payments on time, a point-of-sale loan could be a good choice for funding a trip. But if those monthly payments won't easily fit within your budget, be wary of a POS loan and read the fine print beforehand to determine how much you'll end up paying in interest.

For example, if you use Affirm to finance your purchases on Alternative Airlines , you can only get a 0% APR on your point-of-sale loan if you buy a flight that costs less than $500. If your ticket costs more than $500 , you could incur an interest rate of up to 30%, depending on your creditworthiness.

If you spend $1,000 on a flight and choose a 12-month payment plan with Affirm, you'll have to cough up nearly $100 in interest if you have a 20% APR on your loan. One perk of using Affirm over a credit card is that you'll have a longer payment period (of 3, 6, 12 or 18 months) which helps to spread the expenses over time into more manageable payments. And with an installment loan from Affirm or Uplift, the interest doesn't compound month over month, so your payment stays the same over the loan's term.

But a big drawback of using point-of-sale loans for travel is having to deal with unexpected problems, like trip cancellations or delays, says Priya Malani, the CEO and founder of Stash Wealth.

"If a trip is canceled or delayed with unexpected fees, your loan is still due. You're on the hook for the agreed upon total. Even though you may have checked out in one fluid process, you're still working with two separate entities — the travel provider and the POS loan provider," Malani says.

When it comes to funding your resort stay in Cancun or your flight to the Maldives, there are other options for financing your trip.

Travel rewards credit cards offer higher rewards rates for money spent on travel and the points you earn can go toward booking flights or hotels. While travel credit cards typically come with an annual fee, some offer a 0% introductory period, so you won't have to worry about high interest rates kicking in for 12 months or longer. If you go the 0% APR route, make sure you set up a repayment plan and pay the minimum each month so you don't end up paying late fees or big interest charges.

The Chase Sapphire Preferred® Card is currently offering a welcome bonus offer where new cardholders can earn 60,000 points after they spend $4,000 on purchases in the first three months from account opening. Points can be redeemed for $750 worth of travel when booked through Chase Travel℠.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card (see rates and fees ) is also a solid choice but comes with a smaller welcome bonus and higher rewards rate than the Preferred, giving 2X miles per dollar on every purchase and a welcome offer of 75,000 bonus miles if you spend $4,000 within three months of account opening.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

See rates and fees . Terms apply.

Travel cards also often come with additional perks such as car rental insurance, trip cancellation insurance and purchase protection. You won't get any of these perks when you use a POS loan for travel.

If you worry about putting a big expense on your credit card or you're only eligible for a POS loan with high APR, you should also consider creating a travel fund instead.

By saving your money in a high-yield savings account , you'll be earning more (thanks to compound interest ) than you would be if you put your money in either a checking account or a traditional savings account. Creating a separate fund for travel can also give you a money goal to strive for and setting up automatic monthly transfers can help you avoid spending money on other short-term, more frivolous purchases.

Point-of-sale loans are attractive because of how easy they are to use — you simply provide some basic information about yourself to the loan provider before checking out and you can instantaneously get a loan that will allow you to spread the cost of your trip over a few months. If you're not diligent about reading the fine print, however, there can be a lot of caveats to using the 'buy now, pay later' option, including high interest rates and late fees.

- How a CLUE report affects your insurance rates Ryley Amond

- What to do if your homeowners insurance claim is denied Liz Knueven

- Best car insurance companies in Illinois based on price, customer service and coverage Liz Knueven

Single Powerball ticket wins $1.3 billion jackpot

- Updated: Apr. 07, 2024, 6:16 a.m. |

- Published: Apr. 07, 2024, 5:30 a.m.

- National Desk

DES MOINES, Iowa (AP) — A Powerball player in Oregon won a jackpot worth more than $1.3 billion on Sunday, ending a winless streak that had stretched more than three months.

The single ticket matched all six numbers drawn to win the jackpot worth $1.326 billion, Powerball said in a statement.

The jackpot has a cash value of $621 million if the winner chooses to take a lump sum rather than an annuity paid over 30 years, with an immediate payout followed by 29 annual installments. The prize is subject to federal taxes, while many states also tax lottery winnings.

The winning numbers drawn early Sunday morning were: 22, 27, 44, 52, 69 and the red Powerball 9.

Until the latest drawing, no one had won Powerball’s top prize since New Year’s Day, amounting to 41 consecutive drawings without a jackpot winner, tying a streak set twice before in 2022 and 2021.

The $1.326 billion prize ranks as the eighth largest in U.S. lottery history . As the prizes grow, the drawings attract more ticket sales and the jackpots subsequently become harder to hit. The game’s long odds for the weekend drawing were 1 in 292.2 million .

Saturday night’s scheduled drawing was held up and took place in the Florida Lottery studio just before 2:30 a.m. Sunday to enable one of the organizers to complete required procedures before the scheduled time of 10:59 p.m., Powerball said in a statement.

“Powerball game rules require that every single ticket sold nationwide be checked and verified against two different computer systems before the winning numbers are drawn,” the statement said. “This is done to ensure that every ticket sold for the Powerball drawing has been accounted for and has an equal chance to win. Tonight, we have one jurisdiction that needs extra time to complete that pre-draw process.”

Powerball is played in 45 states plus Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

IMAGES

COMMENTS

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and ...

Uplift is the leader in Buy Now, Pay Later for. travel. . When you pay monthly for a flight, a cruise, a hotel, or vacation package - you're giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say "yes" to all those ...

Other Buy Now Pay Later plans we offer with 3-6 month repayment periods include Klarna (UK only) and Affirm (US only). If 3-6 months isn't enough time for you to make payments for your flights, you can opt for longer repayment periods lasting up to 12 or 18 months. At Alternative Airlines, you can spread the cost of your flights over 12 or 18 ...

This is also described as paying monthly or installments for flight tickets. The whole booking process is done online. ... You can use our Buy Now Pay Later plans on any of the 600+ airlines we ticket. Other travel-related needs on top of a flight booking, such as adding seats and baggage, ...

Step 5 - Review your final payment plan. Review the payment options for your booking and complete your reservation by paying with Affirm. *Rates from 10-36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending ...

Travel Now. Pay Later. Interest Free. Get 0% APR on a Wanna Get Away Plus ®, Anytime, or Business Select ® ticket when you pay overtime through Uplift* Book Flight. Flight. Round Trip. ... Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free.

With Affirm, you can create an account and use their app to manage payments across a range of vendors. The company has a system called "Affirm Pay in 4," whereby you can make four interest-free payments every two weeks once you've clicked "Buy.". For larger costs, you also have the option to pay monthly. This can be split across as ...

Buy your flight with Airfordable for only a fraction upfront and pay the rest in easy, flexible installments before your departure date ... help you travel more, but in an easy and financially responsible way. We're here for you. Flexible and guaranteed. Pay only a fraction upfront for your flights. You will receive your e-ticket once the final ...

Credit accounts are provided by Pay Later Financial Services Limited (t/a Fly Now Pay Later) who are authorised and regulated by the Financial Conduct Authority under registration number 672306. Pay Later Financial Services Limited registered office: 4th floor, 33 Cannon Street, London, EC4M 5SB, United Kingdom.

Pay $800 by paying for your travel upfront. Pay $866.52 by using pay later travel ($72.21 per month times 12 months). Because paying later on travel can end up costing you more, unless you're ...

Search and book any flight tickets from over 600 airlines with Alternative Airlines and pay in installments with Affirm. Affirm is a great way to split the cost of your flights over time. For smaller purchases, you'll be able to make 4 interest-free payments every 2 weeks with Pay in 4. For larger purchases, you'll have the option to make 3, 6 ...

After you are approved, Fly Now Pay Later will pay for the travel upfront and charge you monthly installments. You can choose to split up the cost of your trip over a time period of up to 12 ...

Search for and select the flight you want to book. Indicate that you'd like to use a buy now, pay later plan. Fill in the information required to set up your payment plan, which may include your ...

Lock-in today's price & pay in up to 26 weekly payments. No interest, no credit checks & no hidden fees. ... Spread the cost over weekly or bi-weekly payments before you travel. ... Travel with confidence. Once all your payments are made you'll receive your e-ticket within 24 hours. Our Happy Customers. Join our growing community! Check out ...

you can pay for your ticket using Cash + Avios. Use Avios to pay up to 50% and save; ... monthly installments, interest free.* ... Join Privilege Club using the code PCAMER23 and travel by July 31, 2024, to earn up to 5,000 bonus Avios after your first flight as a member.*

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares. If BNPL is an available payment option for an airline ...

Now you have the option to not pay the full cost upfront for your ticket. With Airfordable you pay for your flight for a fraction upfront and the rest in installments before you travel. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Safe, secure and guaranteed. Every interaction with Airfordable uses bank ...

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. ... If your ticket costs more than $500, ... And with an installment loan from Affirm or ...

Here's how it works: 1. Submit your ticket. Find a flight from your favorite travel site, and then take and upload a screenshot of your flight details. 2. Lock in. Book your flight for a fraction of the cost upfront and pay the remaining balance in installments before your departure date. According to my buddy Grant Martin over at Forbes ...

Lock-in today's price & pay in up to 26 weekly payments. No interest, no credit checks & no hidden fees. ... Pay weekly or fortnightly for up to 26 weeks before you travel. No interest. ... Once all your payments are made you'll receive your e-ticket within 24 hours. Our Happy Customers. Join our growing community! Check out where customers ...

Using Alternative Airlines and PayBright is one of the only ways that Canadian travellers can book flights online now and pay later. PayBrights offers travel loans of between 6-12 months, which can be used to purchase flights with a maximum value of $15,000 CAD. All you need to do is select PayBright (now Affirm) at checkout and follow its ...

Powerball says the single ticket matched all six numbers drawn early Sunday to win a jackpot worth $1.326 billion. The jackpot has a cash value of $621 million if the winner chooses to take a lump ...

Lock-in today's price & pay in up to 26 weekly payments. No interest, no credit checks & no hidden fees. ... Pay weekly or fortnightly for up to 26 weeks before you travel. No interest. ... No credit checks. Travel with confidence. Once all your payments are made you'll receive your e-ticket within 24 hours. Our Happy Customers. Join our ...