Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Capital One Travel: Your Guide To Booking Flights, Hotels & Car Rentals

Carissa Rawson

Senior Content Contributor

250 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3114 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Book Travel Through Capital One Travel?

What are capital one miles worth, how to access capital one travel, how to book a flight through capital one travel, how to book a hotel through capital one travel, how to book a rental car through capital one travel, rental cars, other ways to use capital one miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Trying to figure out how to use your rewards? Whether you’re a longtime fan of Capital One Miles or you’ve just jumped on the Capital One Venture X Rewards Credit Card train, there’s a lot to love about this flexible point currency.

Although it’s possible to transfer your Capital One miles out to a variety of partners, you can also use Capital One Travel to earn and redeem rewards for your stays. Let’s take a look at Capital One Travel, how it works, and when you should use it.

Capital One is heavily pushing its customers toward its travel portal — and for good reason. There’s a lot to love about Capital One Travel, and if you’re the kind of person who values simplicity and high rewards over elite status, it could be a good match for you.

Earn Miles or Points by Paying With a Credit Card

There are 2 ways in which you’ll earn miles or points when booking through Capital One Travel.

As a Capital One cardholder, you’ll earn a varying amount of miles depending on which card you use to pay:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

The Capital One Venture X card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

The Capital One Venture card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Up to a $100 Global Entry or TSA PreCheck credit

- No foreign transaction fees

- Free employee cards

- Extended warranty coverage

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

- Business Credit Cards

- Best Capital One Business Credit Cards

- Best Ways To Redeem Capital One Miles

- Capital One Miles Program Review

- Capital One Transfer Partners

- How Much Are Capital One Miles Worth?

- Best High Limit Business Credit Cards

The Capital One Spark Miles card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Venture X Business Card*

Capital One Venture X Business Card

The Capital One Venture X Business card offers at least 2x miles on all purchases, and comes packed with premium perks.

The information regarding the Capital One Venture X Business card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The Capital One Venture X Business card is a great all-around premium rewards card that helps you rack up miles on all of your business expenses.

From 2x miles on all purchases, airport lounge access, an annual travel credit, complimentary employee cards, and more, there is plenty to love about the Capital One Venture X Business card.

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and Priority Pass lounges

- No-additional-fee employee cards ( rates and fees )

- No preset spending limit

- No foreign transaction fees ( rates and fees )

- $395 annual fee ( rates and fees )

- 10x and 5x bonus categories are limited to Capital One Travel bookings

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs. The annual fee on this card is $395

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you’ll get the best prices on thousands of options

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings through Capital One Travel

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry. Then enjoy unlimited complimentary access to Capital One Lounges and a network of 1,300+ lounges worldwide, including Priority Pass™ and Plaza Premium Group lounges

- This is a pay-in-full card, so your balance is due in full every month

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking

- APR: All charges made on this account are due and payable in full when you receive your periodic statement. The minimum payment due is the New Balance as indicated on your statement.

The Capital One Venture X Business card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else. *(Information collected independently. Not reviewed by Capital One.)

You’ll still earn points even when paying with a different credit card; cards including the Chase Sapphire Reserve ® will earn you 3 Chase Ultimate Rewards points per $1 on all travel, even when using Capital One Travel to book.

Earn Points With Your Loyalty Program

Flights booked through Capital One Travel are counted as paid tickets . This is true whether you use your Capital One miles for a redemption or use cash. Because of this, you’ll be able to earn frequent flyer miles on any flights that you book. Signing up is free and easy — there’s no reason for you to miss out on these miles!

The same can’t be said of hotel programs. Nearly all hotel chains will skip out on benefits if you don’t book your stay directly with the hotel . Not only will you miss out on your perks, but you’ll also lose the ability to earn elite night credits for your stays, which can be a real blow if you’re trying to earn elite status. Keep this in mind when you’re using Capital One Travel for hotel bookings.

Ease of Use

If you’re not a huge points and miles geek, it can make sense for you to book with Capital One Travel. This is because it’s simple; you simply log in, look for the flights/hotels/rental cars that you need, and then book. You won’t have to sift through endless programs trying to find the best rates, and it’s especially easy when you’re looking to redeem your Capital One miles. They’ll always be worth 1 cent each when used for travel via Capital One Travel , which is a solid redemption. It’s not the best, however, as you’ll see later on.

Price Match Guarantee

In a bid for your business, Capital One offers a price match guarantee on all of its hotel bookings . If you find a publicly available price within 24 hours that is better than the one you’ve booked, Capital One will match it.

Capital One also offers price-drop protection for its flights . If the Capital One price prediction tool recommends you purchase a flight and you do, the same tool will automatically keep monitoring the cost of the flight. If prices drop again, you’ll get a refund on some or all of the price difference.

Bottom Line: There are a lot of reasons to book with Capital One Travel, though you’ll want to be wary of limitations that arise from booking with a third party.

We value points and miles according to a variety of factors, including how easy they are to use and redeem. Although you can use your Capital One miles for travel on Capital One Travel, there are plenty of other ways they can be redeemed.

The most valuable use of your miles occurs when you transfer them to any one of Capital One’s hotel and airline partners. In these cases, you can get outsized value for every mile. This is why we consider Capital One miles to be worth 1.8 cents each — nearly double the amount you’ll get when redeeming them within Capital One Travel.

You need to be a Capital One cardholder in to access Capital One Travel . Once on the page, you’ll log in to your account. After logging in, you’ll be brought to the portal’s home page:

From here, you can choose to book flights, hotels, or rental cars.

Booking a flight through Capital One Travel is fairly intuitive. After you log in and reach the landing page, you’ll want to select Flights in the toolbar up top:

This will bring you to the search page for flights. You’ll want to input all your information, including departure airport, destination, and dates of travel:

Like Google Flights , Capital One Travel will give you an estimation of price within a calendar feature:

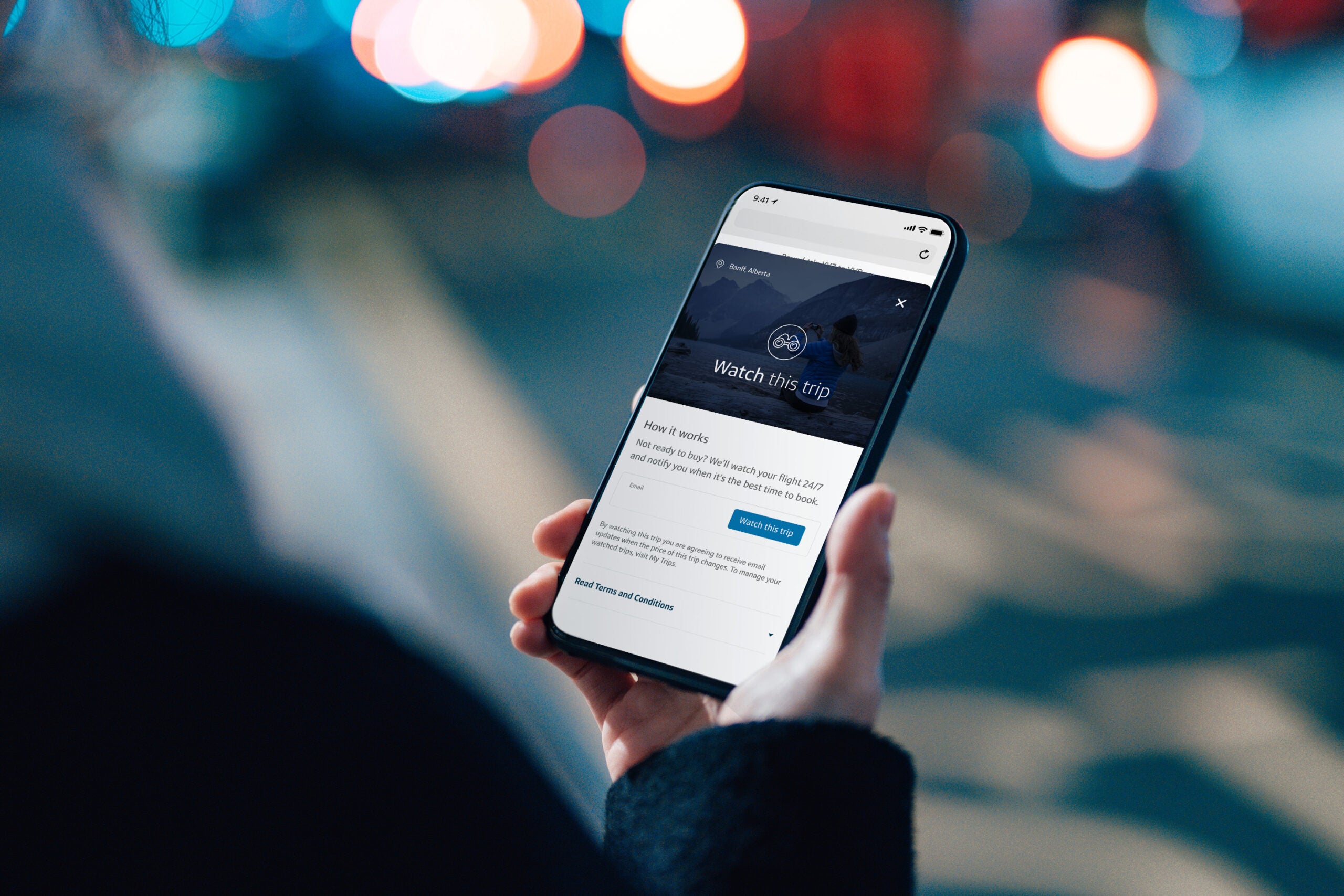

Unlike Google Flights, however, Capital One has partnered with the booking site Hopper to tell you when you should book. You’ll be presented with detailed information regarding price predictions :

As you can see in the screenshot above, you have the option to freeze your price or set a price watch alert. If you’re looking to book immediately, you’ll want to scroll down, where Capital One will give you a list of results:

When selecting a flight, Capital One Travel will also give you a breakdown of information and the ability to book economy or first class tickets:

Once you’ve selected your outbound flight, you’ll pick the return. If booking a one-way, you’ll be taken to the checkout page.

Hot Tip: Capital One’s price drop protection automatically monitors the cost of flights you purchase and refunds you if prices fall.

As is normal with checkout pages, you’ll need to fill in your passenger information and credit card information. You can also select seats and choose whether or not you’d like to redeem miles. Capital One will give you 1 cent per point of value when using your miles through Capital One Travel . While this isn’t terrible, there are much better uses of those miles — such as transferring to a partner and booking a reward seat.

Once you’ve input all your info, you’ll hit Confirm and Book . That’s it!

Bottom Line: Booking flights through Capital One Travel is both intuitive and easy. Plus, you’ll be able to earn frequent flyer points on your booking.

If you’re looking to book a hotel through Capital One Travel, the process is simple. As before, you’ll start by logging into your account. Once you’ve hit Capital One Travel’s landing page, you’ll select Hotels in the top toolbar:

You’ll be taken to Capital One’s hotel search bar, where you can put in your travel destination and dates:

Once you select Search Hotels , you’ll be taken to a results page featuring an interactive map:

Along with filtering by rating and price, Capital One offers a variety of ways to narrow down your search:

As we mentioned above, Capital One Travel offers a hotel price match guarantee , which means you won’t find cheaper prices elsewhere. If you do happen to stumble across one on a publicly available site within 24 hours of booking, you can submit a price match request and, if approved, Capital One Travel will drop the cost down to the rate you’ve found.

Selecting a hotel from the search results will open a new tab where you can alter your information:

Scrolling down, you’ll be able to select the room type you prefer:

Once you’ve picked your room, you’ll be taken to the checkout page where you’ll fill out your traveler and payment information. You can also choose to use your Capital One miles for a value of 1 cent per point towards your booking:

Hot Tip: Be aware that booking hotels through Capital One Travel counts as a third-party booking — which means you won’t receive any elite status benefits or credit towards earning elite status when booking this way.

Once everything is filled in, you simply need to select Confirm and Book .

Just as with flights and hotels, you’ll log in to your account. From the landing page, you’ll select Car Rentals from the top toolbar:

You’ll be taken to the rental car search page where you can enter your information, including dates of travel and location:

Once you’ve hit Search Cars , you’ll be taken to the results page:

You can choose from a variety of filters, including the rental car company you’ll be booking, what type of car you prefer, and the cancellation policy of your booking. After picking the car you’d like to reserve, you’ll have the chance to review your booking:

If everything is correct, you’ll hit Reserve , which will take you to the checkout page where you can enter driver information and your method of payment:

As with hotels and flights, you can apply your Capital One miles to your rental car booking at a rate of 1 cent each. Again, there are better ways to use your miles, which we’ll discuss below.

Hot Tip: Check out our handy guide on how to save money on car rentals , including options with points, upgrades, cash savings, and more!

How Do the Prices Compare to Other Sites?

Is it actually worth it to book through Capital One Travel rather than other sites? How do the prices compare? Let’s take a look.

Here’s a flight from Los Angeles (LAX) to London (LHR) in mid-May 2022:

Interestingly, Capital One Travel notes that this isn’t the best time to book. The cheapest options available are $715, and they’re all nonstop. However, Google Flights comes back with very different results:

Not only does Google suggest that prices are currently low, but it also returns an option that is nearly $200 less than what Capital One Travel is offering . A closer look reveals that although Capital One Travel has the outbound leg available of this cheap flight for $736 roundtrip, it doesn’t offer the same returns. Here’s what’s available from Google:

Meanwhile, here are the options you can get on Capital One:

Bottom Line: While Capital One allows you to book flights through its Capital One Travel portal, its prices aren’t always competitive with other offerings. Make sure to check a few other websites for flights to ensure you’re getting the best deal.

So how do hotels on Capital One fare when compared to other booking options? This is especially pertinent as Capital One has its own price guarantee.

Here’s a night at the all-inclusive Secrets the Vine Cancun in early June from Hotels.com :

Booking with Hotels.com will earn you 1 stamp towards a free night stay . After 10 stamps you’ll get a free night, which can be especially valuable when booking costly stays.

And here are the results from Priceline , an online travel agency:

Bookings with both Priceline and Hotels.com can also be stacked with shopping portals . Using Rakuten with Priceline, for example, will earn you 5% back on your booking; this can either come in the form of $25.35 or 2,535 American Express Membership Rewards .

Booking Directly

Here’s how much it costs when booking directly with the hotel:

Secrets the Vine Cancun is a member of AMR Resorts , which was recently purchased by Hyatt. Although you can’t earn or redeem points with the property until later in 2022, Hyatt is offering a promotion for its cardholders for many new all-inclusive properties, including this one. Now through May 15, 2022, eligible cardholders will receive 10 points per $1 spent at these hotels.

This means that booking and paying with your The World of Hyatt Credit Card will earn you 5,070 World of Hyatt points. We value World of Hyatt points at 1.5 cents each, which means you’ll be getting $76.05 worth of points back on this booking.

Capital One Travel

Finally, here’s the rate within Capital One Travel:

With the 3 other sites we compared charging $507, Capital One Travel is a few dollars cheaper. But saving $15 doesn’t match the benefits other options are providing, like Hotels.com’s $200 resort credit.

There is, however, one case where booking via Capital One Travel is your best option. First, you won’t want to use Capital One Travel unless you don’t care about elite status — as we’ve mentioned above — so boutique properties can be a good option to book .

Second, as we mentioned above, those who hold the Capital One Venture X card earn 10 miles per $1 spent on hotels booked through Capital One Travel. In this situation, you’d earn 4,915 Capital One miles on your booking. We value Capital One miles at 1.8 cents each, which means you’ll earn $88.47 worth of miles . All in, you’ll net $403.53, which wins out compared to most other options.

How good are rental car prices compared across multiple sites? The results are less exciting. Here’s what a 5-day rental from Los Angeles looks like at Capital One Travel:

RentalCars.com offers nearly the same price:

AutoSlash, meanwhile, saves you a full $65 on the cheapest rental car:

Bottom Line: The Capital One Venture X card offers 10 miles per $1 on rental cars booked through Capital One Travel and it comes with some nice car rental insurance coverage too.

Of course, redeeming your miles through Capital One Travel is just one way that they can be used. There is a multitude of uses for those miles.

Transfer to Travel Partners

Nearly always, the best use of your Capital One miles comes from transferring to hotel and airline partners. Capital One has many transfer partners from which to choose:

Hot Tip: Check out our guide on the best ways to redeem Capital One miles for max value .

Cover Travel Purchases

Just as when using your miles at Capital One Travel, Capital One will allow you to redeem your miles for recent travel purchases at a rate of 1 cent each .

Redeem for Cash-back

You can redeem your Capital One miles for cash-back, but this is a terrible use of miles. Capital One will only give you 0.5 cents of value per mile when redeeming to cash.

Get Gift Cards

There are a variety of gift cards available using your Capital One miles, but these still aren’t a great redemption. Your value will vary — and can even be as high as 1 cent per mile , but transferring to other partners will still give you better value.

Shop With Amazon

You can use your miles on a linked Capital One card, which will give you a value of 0.8 cents per mile .

Pay With PayPal

Paying with your Capital One miles through PayPal will net you 1 cent per mile , just the same as redeeming your miles within Capital One Travel.

Bottom Line: You can redeem your Capital One miles in a variety of ways, but only transferring them to hotel and airline partners will grant you more than 1 cent per mile in value.

Capital One Travel is robust — and can be a good option for eligible cardholders who aren’t concerned about elite status. However, you’ll find better value for your miles when transferring to one of Capital One’s many travel partners. Regardless, you can find good deals within the travel portal, and the best price guarantee, combined with price drop protection, can make this portal tempting for many travelers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Information regarding the Capital One Spark Miles for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How do i book travel with capital one.

You can go to Capital One Travel to book travel with Capital One.

What airline can I use my Capital One miles on?

Capital One miles can be used with virtually any airline, whether you’re booking through Capital One Travel or booking directly with the airline.

How do I see my trips on Capital One?

After logging in to Capital One Travel , you’ll find your trips in the My Trips section in the upper left-hand corner of the page.

Can you book Southwest through Capital One Travel?

Unfortunately, you cannot book Southwest flights through Capital One Travel . You can, however, book flights directly with Southwest and pay with your Capital One card. You can then redeem miles against your purchase within 90 days via Purchase Eraser.

Does Capital One use Expedia?

No, Capital One uses a proprietary blend of search tools for its Capital One Travel portal.

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![travel one capital Booking Travel With Orbitz – Everything You Need to Know [2023]](https://upgradedpoints.com/wp-content/uploads/2017/09/orbitz-computer.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Why Capital One Travel should be your only stop for booking (and enjoying) your next trip

No matter how often you travel or how savvy you are, planning and booking any trip can be an overwhelming task. Throw in two kids under 5 years old (like I have), and it's almost inevitable that you'll overlook something. So I'm always looking for the most efficient way to arrange my travel, including which card and program will offer me the most value.

That's where Capital One Travel comes in. It is more than just a booking platform; it has all the tools I need to help me travel smarter — which is why it's the first place I go when it's time to plan a trip.

See how Capital One Travel can transform your booking and travel experience.

In fact, Capital One Travel delivers value at all stages of travel — from the initial planning phase to the booking process to the travel experience and even back home, where all of the rewards you've earned can jumpstart your next trip. Sure, you can purchase flights, reserve rental cars and book your accommodations through Capital One Travel. But it also tells you if you're getting a good price on your flight, and if not, you can set up alerts for when it's time to book.

If you have a Capital One Venture X Rewards Credit Card , you get unlimited access to Capital One Lounges. Plus, there's a new culinary-focused airport concept — Capital One Landing — coming to Ronald Reagan Washington National Airport (DCA) and New York City's LaGuardia Airport (LGA) in partnership with legendary Chef José Andrés. And the recently-announced Premier Collection will offer luxurious accommodations and value-added benefits for Venture X cardholders.

In short, Capital One Travel makes it easy to be a smarter traveler while earning valuable rewards.

Keep reading to see everything you can enjoy with Capital One Travel .

Experience a better way to book travel

Does Capital One Travel finally answer the question, "When's the best time to book airfare?" Each situation is unique, but one thing's for sure: Capital One Travel makes sure you have all the information you need to feel confident both before and after booking your flight.

With its proprietary price prediction technology, Capital One Travel shows you a color-coded calendar as soon as you search for a flight, allowing you to see which dates have the lowest prices to fly to your desired destination. If prices are still high, there's no need to constantly monitor them yourself — you can create price alerts that'll notify you when it's time to book.

And it gets even better thanks to Capital One Travel's price drop protection , another tool automatically available to cardholders at no extra cost.

The premise is simple yet so valuable. If Capital One Travel recommends that you book a flight (or a price alert tells you to book), it will keep watching your itinerary for 10 days after booking. If the price drops during that time, Capital One Travel will automatically issue a credit for the price difference — up to $50 per ticket.

These features — price alerts and price drop protection — aren't found with any other card issuer's travel portal.

When it comes to hotels, you can trust that you're getting the best price as well. Capital One Travel utilizes proactive price matching with online travel agencies like Expedia. However, if you still somehow find a better price at the same hotel within 24 hours of booking, Capital One Travel will match the better price. This even extends to flights and car rentals.

But giving cardholders these unique, innovative insights and tools is just part of what makes Capital One Travel so valuable.

Earn extra rewards on travel

Cardholders can look forward to earning up to 10 miles per dollar when booking travel with Capital One Travel (depending on which card they hold). Capital One Venture X cardholders earn 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights. All other Capital One rewards cardholders — including the Venture, Savor, Quicksilver, Spark Business and Student product suites — earn 5 miles (or 5% cash back) per dollar on hotels and rental cars.

Once you've earned those valuable rewards, you can redeem them directly through Capital One Travel for future trips, or you can transfer them to one of over a dozen airline and hotel partners . Alternatively, Venture X and Venture cardholders can choose to cover recent travel purchases by redeeming their miles at a rate of 1 cent per mile. Even when I pay for my trip with Venture X, I could use the miles that I earned through Capital One Travel to then offset all (or part) of my travel purchases.

And then, during your trip, you can look forward to starting your vacation early — by kicking back and relaxing at a Capital One Lounge.

Start your vacation off right with special lounge access

There's no need to wait until you land at your destination for your vacation to begin. Venture X cardholders get unlimited complimentary access (plus two guests) to over 1,300 airport lounges worldwide, including Capital One Lounges and the Partner Lounge Network. Meanwhile, Venture cardholders receive two complimentary visits per year to Capital One Lounges or 100+ Plaza Premium lounge locations .

A Capital One Lounge is now open at Dallas Fort Worth International Airport (DFW), and two more locations are coming soon to Denver International Airport (DEN) and Washington, D.C.'s Dulles International Airport (IAD).

And these aren't just your run-of-the-mill airport lounges.

Boasting a contemporary, light and airy layout, a Capital One Lounge features a premium dining experience, including health-conscious food options that are plated small bites served via dining stations rather than buffet-style. All food is freshly prepared with a focus on locally sourced ingredients — including vegetarian, vegan and gluten-free options.

For travelers in a hurry, there's a whole section of grab-and-go items — including artisanal nut mixes, fresh fruits, juice shots and rotating warm selections like breakfast sandwiches in the mornings or fresh-from-the-oven cookies in the afternoons. These sustainably-packaged selections are perfect for those without long layovers who still want some terrific food while traveling.

If you can spend some time in the lounge, you'll enjoy a fully stocked bar with craft cocktails on tap, local beers and hand-selected wines. A full-service coffee and espresso bar featuring La Colombe cold brew on tap appeals to even the most discerning coffee aficionados, while a custom, six-tap system of artisanal sodas and flavored waters keeps all members of the family happy.

Beyond these extensive food and beverage offerings, travelers can also take advantage of relaxation rooms, Peloton bikes, nursing rooms and showers where they can freshen up before (or after) a long flight.

Related: 5 distinctive amenities in the Capital One Lounge that impressed me the most

But that's not all.

Last month, Capital One announced a new offering as it continues to rethink the airport experience. Capital One Landings , a new chef-driven concept, will focus on bringing an elevated dining experience to the heart of the terminal. In partnership with the award-winning José Andrés Group, Capital One Landings will offer top-notch food for travelers on their way to the gate. The first locations will debut in Terminal B at LGA and at DCA in the near future.

And while you may never want to leave the comfort of the Capital One Lounge (or Landing), the luxury travel benefits continue upon arrival at your destination.

Elevate your hotel stay with the Premier Collection

In addition to Capital One Landings, the issuer continues to raise the bar for what travelers can expect with its Premier Collection of hotels and resorts, offering cardholders premium benefits with every stay. Capital One hand-picked these properties for their unparalleled service, immersive culture and authentic character — all to deliver exceptional experiences to travelers.

The Premier Collection will be available to Venture X cardholders later this year and will include hotels from all over the world — from city stays to villas and private island retreats. Cardholders will enjoy benefits like a $100 experience credit, daily breakfast for two, complimentary Wi-Fi and more. Venture X cardholders will also earn 10 miles per dollar spent on Premier Collection properties booked through Capital One Travel .

Bottom line

The Capital One Travel ecosystem continues to grow. With top-notch credit cards, an outstanding booking experience, luxurious lounges, new airport dining options and premium hotel perks, Capital One deserves a place at the top of every traveler's mind.

You can book your flights with confidence thanks to price alerts and the color-coded calendar. And you'll get a price match guarantee on all bookings — all while earning Capital One rewards to use on future travel.

The Capital One Lounge iat DFW will be joined by two more locations in 2023 (IAD and DEN), and as a complement, the issuer will debut its culinary-focused airport experience — Capital One Landing — at LGA and DCA to provide fresh, unique and inventive food and drinks for travelers in the heart of the terminal.

Plus Venture X cardholders have even more to look forward to with the Premier Collection, Capital One's curated set of luxury hotels and resorts.

So what are you waiting for? Join the many Americans (and TPG staffers ) who are using Capital One Travel to elevate their trips — and unlock incredible value along the way.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

A complete guide to the Capital One travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:50 a.m. UTC Jan. 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

You may know Capital One as a company that offers credit cards, car loans and bank accounts, but they also have a travel portal that allows you to book flights, hotels, rental cars and luxury vacations. For eligible Capital One cardholders, booking through the Capital One travel portal can be an excellent way to earn and redeem Capital One miles. Let’s take a look at the Capital One travel portal, how it works and who has access to its perks.

- The Capital One travel portal is accessible to cardholders of more than 15 different Capital One cards.

- Eligible cards will earn extra rewards on their Capital One travel bookings.

- Features of the Capital One travel portal include price drop protection and price matching.

- Capital One miles can be earned and redeemed through the Capital One travel portal.

How to book travel through the Capital One travel portal

Booking travel through the Capital One travel portal is simple. To do so, simply navigate to the Capital One travel portal website . Then log in to your Capital One account.

Once logged in, you’ll be directed to the site’s home page.

From there, you can search for flights, hotels and rental cars for any travel you have planned. Just enter your search parameters, such as travel dates and destination, to get a list of booking options.

Your search results will vary depending on what type of travel you want to book. For example, if you’re searching for a hotel, Capital One will bring up a dynamic map and a list of properties that match your filters.

Once you’ve perused available options, you can make a selection that suits your needs. You’ll then go through the checkout process, which includes filling in your personal details and payment information. Note that you’ll need to use your eligible Capital One card to pay.

Who can use the portal?

The Capital One travel portal is accessible to those with an eligible Capital One credit card. These include:

- Capital One Venture Rewards Credit Card * The information for the Capital One Venture Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Venture X Rewards Credit Card * The information for the Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One QuicksilverOne Cash Rewards Credit Card * The information for the Capital One QuicksilverOne Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Savor Cash Rewards Credit Card * The information for the Capital One Savor Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One SavorOne Student Cash Rewards Credit Card * The information for the Capital One SavorOne Student Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Spark 2X Miles * The information for the Capital One Spark 2X Miles has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Venture X Business Card * The information for the Capital One Venture X Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

You’ll want to be aware that not all Capital One cards provide access to the travel portal. For example, the Capital One Platinum Credit Card * The information for the Capital One Platinum Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , which is designed to help build credit, does not offer this feature.

Is the portal worth using?

There are a few factors to consider when deciding whether or not to use the Capital One travel portal for a booking.

First, depending on which Capital One card you hold, you may be able to earn big rewards by booking your travel through the portal. For example, the Capital One Venture X earns 2 miles per $1 on purchases, 5 miles per $1 on flights booked through Capital One Travel and on purchases through Capital One Entertainment and 10 miles per $1 on hotels and rental cars booked via Capital One Travel.

Capital One miles can be redeemed in a variety of ways, but are worth one cent each toward travel, which means you’re effectively getting 10% back on eligible bookings.

That being said, many hotel and rental car companies limit the benefits you’ll receive if you choose to book through a third party (such as the travel portal). This can mean you lose out on perks such as bonus points and the benefits of any elite status that you’ve earned. However, this varies by hotel, so you might want to check before you book.

How to maximize your Capital One travel benefits through the portal

Capital One has built a robust portal that provides value to its customers. This is especially true when it comes to booking flights. The flight search function includes a handy calendar of prices to show you at a glance when fares are high.

Capital One has also partnered with the travel app Hopper to give customers free price prediction tools. When searching, the portal will let you know whether you should book or wait for a better price.

Even better, if you book a flight when recommended by Capital One, you’re automatically enrolled in price drop protection for 10 days. If the price goes down during that time frame, you’ll get a refund of up to $50.

You can also choose to set an alert for your flight, which will notify you when the price changes. Finally, if you’re not ready to book but are worried that the price will increase, you can pay a small fee to freeze the cost of your fare so you can return later to book.

Other benefits associated with the Capital One travel portal include access to the Lifestyle Collection and the Premier Collection. If you have an eligible Capital One card, you’ll be able to book specialty hotels with exclusive benefits such as room upgrades, late checkout and experience credits.

Quick guide to Capital One rewards

Different Capital One cards earn different types of rewards. Some cards earn cash back while others earn miles.

Capital One miles can be redeemed in a variety of ways, including transfers to Capital One hotel and airline partners. This is generally the most valuable method of redeeming miles, but you can also redeem them for statement credits against travel purchases that you’ve made. While this isn’t typically the best way to redeem Capital One rewards, it can be useful if there are no reward options available for the dates you want to travel.

Finally, Capital One miles can also be used for bookings within the Capital One travel portal. You’ll be able to redeem them at a rate of one cent each — but you’d be better off using your card to pay, then redeeming miles against your purchase. This allows you to earn rewards on your booking before wiping away the charges.

Other ways to redeem miles include gift cards, entertainment and cash, but you’ll want to be wary of doing so as you won’t get as much value from your rewards this way as you would with travel redemptions.

Frequently asked questions (FAQs)

The Capital One travel portal works with many different airlines, including Delta Air Lines, United Airlines, American Airlines, Alaska Airlines, Frontier Airlines, Spirit Airlines and JetBlue.

However, you won’t see flights from Southwest Airlines on the Capital One travel portal. Instead, you’ll want to search directly with the airline to find these tickets.

Capital One miles don’t expire as long as you have an eligible Capital One credit card open. If you plan to close a Capital One credit card account, make sure to use or transfer any accumulated miles first.

Unlike hotels and rental cars, airlines generally don’t penalize those who book through a third party. This means you’ll be able to enter your loyalty program number and earn rewards on flights booked through the Capital One travel portal.

Many of the best credit cards on the market offer a statement credit (up to $100) that will reimburse you for the cost of TSA PreCheck or Global Entry, two popular trusted traveler programs that can help you speed through the airport. This includes Capital One cards such as the Capital One Venture X rewards credit card and the Capital One Venture Rewards credit card.

Making a booking through the Capital One travel portal doesn’t automatically entitle you to entry into airport lounges. However, certain Capital One credit cards offer this as a benefit. For example, those who have the Capital One Venture X rewards credit card or the Capital One Venture X Rewards Business card receive a complimentary Priority Pass Select membership (enrollment required) and unlimited access to Capital One lounges for themselves and two guests.

*The information for the Capital One Platinum Credit Card, Capital One QuicksilverOne Cash Rewards Credit Card, Capital One Savor Cash Rewards Credit Card, Capital One SavorOne Student Cash Rewards Credit Card, Capital One Spark 2X Miles, Capital One Venture Rewards Credit Card, Capital One Venture X Business Card and Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Global Entry renewal: A how-to guide

April 18, 2024 | 4 min read

If you’ve ever traveled abroad, you may be familiar with the Global Entry Program. It’s a Trusted Traveler Program (TTP) designed to get international travelers through airport customs checkpoints faster when they reenter the U.S.

Learn how to renew your Global Entry membership before it expires, how long renewal lasts and more.

Key takeaways

- Global Entry is a TTP administered by the U.S. Customs and Border Protection (CBP).

- Membership in Global Entry lasts for five years; renewal extends it for another five years.

- You can renew your membership starting one year before it expires.

- Capital One Venture and Venture X cardholders can receive up to a $100 statement credit toward their Global Entry renewal.*

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is Global Entry?

Global Entry is a TTP run by CBP. The program is designed to help expedite airport customs screening for travelers reentering the U.S. after traveling abroad.

Benefits of Global Entry include helping members reduce wait times at security checkpoints and navigate airports more easily .

Global Entry membership is open to U.S. citizens, legal permanent U.S. residents, Mexican nationals, citizens of certain other countries and more. It’s available at dozens of airports in the U.S. and abroad.

Global Entry renewal requirements

Here are things to know about renewing your Global Entry membership.

- You can renew your membership starting one year before it expires. And if you submit a renewal application before your membership expires, you can use the program’s benefits for up to 24 months after the expiration date.

- You’ll need to submit a renewal application. You can complete your Global Entry renewal application and pay your renewal fee on the U.S. Department of Homeland Security (DHS) website.

- You may need to attend an in-person interview. An interview may be required once your renewal has been conditionally approved. But since this interview isn’t always necessary, be sure to check your account periodically for updates on next steps.

How to renew Global Entry

Here are specifics on the Global Entry renewal process.

1. Fill out the Global Entry renewal application

You can fill out your renewal application on the DHS website. Here are the steps:

- Sign in to your account on the TTP portal. If you don’t already have an account, you’ll be directed to create one.

- Select the option for Global Entry renewal and follow the prompts.

- Submit your renewal application.

2. Pay the Global Entry renewal fee

Once you’ve submitted your renewal application on the TTP portal, simply follow the prompts to pay your application fee.

When it comes to paying the renewal fee, there’s good news: Some travel credit card issuers reimburse cardholders for the fee. In fact, Capital One reimburses Venture and Venture X cardholders up to $100 for Global Entry fees every four years.

3. Complete your Global Entry renewal interview, if required

When you first apply for membership, you’ll typically be required to attend an in-person Global Entry interview with a U.S. Customs and Border Patrol officer. But an interview isn’t always required for renewal.

If you’re asked to attend a renewal interview, you can schedule it at a Global Entry enrollment center or at a major airport to coincide with your travel plans.

Global Entry renewal FAQ

Here are commonly asked questions about renewing Global Entry membership.

Can I renew my Global Entry pass online?

Yes. You can fill out your renewal application on the DHS website’s TTP portal.

How long after Global Entry expires can you renew?

You can typically renew Global Entry starting one year before your membership expiration date. If you complete a renewal application before your membership expires, you can continue using Global Entry benefits for up to 24 months.

Does Global Entry renewal require an interview?

Not always. But if you’re asked to attend an interview, you can schedule it at a Global Entry enrollment center. A program known as Enrollment on Arrival also allows you to schedule your interview at a major airport to coincide with your travel plans.

Global Entry renewal in a nutshell

Global Entry is one of several U.S. government TTPs. Its goal is to help travelers get through customs screening faster when they land in U.S. airports after traveling abroad.

Capital One Venture and Venture X cardholders can receive up to a $100 statement credit toward their application fee or renewal fee every four years.

Related Content

Global entry vs. tsa precheck®: what’s the difference.

article | September 28, 2023 | 5 min read

Known Traveler Number (KTN): What to know

article | September 28, 2023 | 6 min read

TSA PreCheck® vs. Clear®: What’s the difference?

article | September 28, 2023 | 4 min read

What the Wells Fargo Autograph Journey Visa Card offers

How other travel cards compare to the wells fargo autograph journey℠ visa® card, 3 key benefits cardholders get from the autograph journey , move over, chase sapphire preferred. this new travel credit card is turning heads.

Wells Fargo's newest card has one key advantage over the gold standard in travel cards.

Holly Johnson

Contributor

Holly Johnson is a credit card expert and writer who covers rewards and loyalty programs, budgeting, and all things personal finance. In addition to writing for publications like Bankrate, CreditCards.com, Forbes Advisor and Investopedia, Johnson owns Club Thrifty and is the co-author of "Zero Down Your Debt: Reclaim Your Income and Build a Life You'll Love."

Tiffany Connors

Tiffany Wendeln Connors is a senior editor for CNET Money with a focus on credit cards. Previously, she covered personal finance topics as a writer and editor at The Penny Hoarder. She is passionate about helping people make the best money decisions for themselves and their families. She graduated from Bowling Green State University with a bachelor's degree in journalism and has been a writer and editor for publications including the New York Post, Women's Running magazine and Soap Opera Digest. When she isn't working, you can find her enjoying life in St. Petersburg, Florida, with her husband, daughter and a very needy dog.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

The Wells Fargo Autograph Journey℠ Visa® Card * -- Wells Fargo’s latest and best travel card -- recently launched with an impressive set of features. Its competitive rewards, welcome bonus and redemption options take aim at incumbent travel credit cards from Chase, American Express and Capital One.

What gives Wells Fargo’s first foray into the point-transfer space an edge is that you don’t have to book travel in a portal to earn the highest rewards rates.

Here’s why we think the Wells Fargo Autograph Journey could go toe-to-toe with some of the best travel credit cards, plus three insider tips to help you decide if you should add it to your credit card lineup.

Here’s a quick overview of what you can expect with the Autograph Journey:

- Earn 60,000 welcome bonus rewards points after spending $4,000 in purchases within three months of account opening.

- Earn unlimited 5x points on hotels, 4x points on airlines, 3x points on other travel and dining and 1x on other purchases.

- Receive an annual statement credit with a $50 minimum airline purchase.

- No foreign transaction fees.

- Other benefits include trip cancellation and interruption insurance, lost luggage reimbursement, roadside dispatch and cell phone insurance.

- $95 annual fee.

Wells Fargo Autograph Journey℠ Card

Chase Sapphire Preferred® Card

Capital One Venture Rewards Credit Card

Here’s a rundown of four facts we discovered about the Autograph Journey that you should know when deciding whether to apply.

1. You can transfer points with Wells Fargo point-based cards

The launch of the Autograph Journey also marks the first transferable points program from Wells Fargo, which joins other card issuers like Chase and Capital One, which have their own pooling programs .

Autograph Journey will be able to do a points transfer with the no-annual-fee Wells Fargo Autograph℠ Card . This is especially notable since the Wells Fargo Autograph℠ Card offers bonus rewards in different categories than the Autograph Journey.

For example, the Autograph card earns unlimited 3x points on restaurants, travel, gas stations, transit, popular streaming services and phone plans, plus 1x points on other purchases. So you can maximize your point earning across different categories, then transfer your points to your Autograph Journey account to access premium travel redemptions.

2. It offers more options for earning bonus miles on travel than some competitors

The Autograph Journey will offer more flexibility than many travel rewards cards when it comes to earning more points on travel purchases. For example, cardholders earn unlimited 5x points on hotels booked directly with hotel brands and 4x points on airfare booked with airlines.

This helps the card stand out from other popular travel credit cards that offer the most bonus points only if you book travel through their portals. For example, the Capital One Venture Rewards Credit Card * and the Capital One Venture X Rewards Credit Card * only offer the highest bonus rewards on travel booked through Capital One Travel. The Chase Sapphire Preferred® Card also offers its highest rate of 5x points on travel booked through Chase Travel℠, whereas other travel purchases earn 2x points.

Autograph Journey cardholders also earn a minimum of 3x points on other travel purchases, which could include rental cars, cruises and travel booked through online travel agencies like Expedia and Priceline.

3. The card may grow in value as more transfer partners join

The Autograph Journey Card will earn flexible travel rewards points that transfer to a selection of airline and hotel partners, similar to Amex Membership Rewards points or Chase Ultimate Rewards . While the list of transfer partners is limited, Wells Fargo stated in its initial press release that “more partners will continue to be added throughout the year.”

Points transfers could dramatically change the value proposition of the Autograph Journey, especially if new partners include domestic airlines and popular hotel loyalty programs.

Wells Fargo point transfers will be available to new cardholders starting on April 4. For now, Wells Fargo transfer partners include the following:

Smart Money Advice on the Topics That Matter to You

CNET Money brings financial insights, trends and news to your inbox every Wednesday.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy . You may unsubscribe at any time.

Your new Subscription

Here’s all of the excitement headed to your inbox.

Recommended Articles

After writing about hundreds of credit cards, these two are still my favorite, 6 reasons the chase sapphire preferred should be your next credit card, 3 steps to take when your flight is canceled or delayed, 8 best credit card strategies to maximize earnings in 2024, as a foodie who enjoys a night out on the town, this credit card gives me plenty to savor.

* All information about the Wells Fargo Autograph Journey, Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card have been collected independently by CNET and has not been reviewed by the issuer.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

5 best credit cards that offer pre-approval or pre-qualification in 2024, pre-approval doesn't guarantee approval, but it can help you avoid an unnecessary hard pull on your credit..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more.

When you apply for a credit card, the issuer performs what is known as a hard pull or hard inquiry , which shows up on your credit report. Hard pulls temporarily lower your credit score, which isn't the end of the world, but it's better to avoid racking up unnecessary hard inquiries since they can remain on your credit report for up to two years. One way to do this is by going through a card issuer's pre-approval or pre-qualification process before applying.

Getting a pre-approved offer for a credit card doesn't guarantee you'll be approved, but it can give you a better idea of your approval odds with no hard inquiry. There is no impact to your credit score until you formally apply.

Not every card issuer offers pre-approvals. Below, CNBC Select details the top credit cards that generally offer pre-approval or pre-qualification and how they work. (See our methodology for more information on how we made this list.)

Best credit cards for pre-approval

- Best for no annual fee: Wells Fargo Active Cash® Card

- Best for balance transfers: Citi Double Cash® Card

- Best for travel rewards: American Express® Gold Card

- Best for cash-back: Discover it® Cash Back

- Best for premium perks: Capital One Venture X Rewards Credit Card (see rates & fees )

Best for no annual fee

Wells fargo active cash® card.

Unlimited 2% cash rewards on purchases

Welcome bonus