U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

6 Best Cancel for Any Reason Travel Insurance Options

Allianz Travel Insurance »

Travelex Insurance Services »

Seven Corners »

AXA Assistance USA »

IMG Travel Insurance »

Squaremouth »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cancel for Any Reason Travel Insurance Options.

Table of Contents

- Rating Details

Allianz Travel Insurance

Travelex insurance services.

Even the best travel insurance policies don't cover every "what if." "If you buy travel insurance, there are covered reasons for cancellation or interruption. If your situation doesn't fit those covered reasons, there's no coverage," explains Angela Borden, product strategist with Seven Corners .

That's why cancel for any reason coverage, or CFAR, can be a valuable add-on. With this type of policy, you can cancel your trip for any reason at all and still get a percentage of your prepaid travel expenses back (typically around 50% to 80% of what you’ve already paid; percentages vary by provider).

Read on to see the best cancel for any reason travel insurance options and the main policy details you should know about, as well as answers to common questions around this type of coverage.

Seven Corners

Axa assistance usa, img travel insurance, squaremouth, best cfar insurance options in detail.

Reimburses up to 80% of prepaid travel arrangements

Allows you to cancel trip as late as day of departure

"Cancel Anytime" coverage may not be available in every state

Can cancel trip up to 48 hours before departure

Emergency medical coverage is only $50,000

CFAR add-on offers up to 75% reimbursement for prepaid travel costs

CFAR coverage can be purchased up to 20 days after initial trip payment

Benefit not available in all states

Get up to 75% of prepaid travel expenses back when you cancel for any reason

10-day money back guarantee if dissatisfied (prior to your trip)

Must purchase CFAR coverage within 14 days of initial trip deposit

Get back up to 75% of the full cost of nonrefundable travel expenses

CFAR coverage can be purchased within up to 20 days of the initial trip deposit

CFAR coverage does not apply if the travel supplier goes out of business or refuses to provide services

Compare multiple plans with CFAR coverage in one place

Comparison tool makes it easy to price shop

CFAR coverage reimbursements and fine print vary by company

Frequently Asked Questions

Cancel for any reason insurance (also called CFAR coverage) is a type of trip cancellation insurance that lets you cancel your trip for a reason not listed as a covered reason in your plan. For example, you may decide not to travel due to an illness in your extended family or a specific financial issue you're dealing with. In either case, this time-sensitive coverage can help you get reimbursement for prepaid trip payments you have made toward airfare, hotel stays, tours and more.

CFAR coverage typically needs to be purchased within a sensitive period of time after making a trip deposit (usually ranging from 14 to 20 days after). Travelers only get back between 50% and 80% of prepaid travel expenses, depending on your policy, so this coverage won't lead to a full refund.

If you're worried how COVID-19 might affect your travel plans, you can purchase travel insurance that includes COVID-19 coverage . That said, CFAR protection can also be a good investment, particularly if you want the option to cancel based on last-minute disinclination to travel due to the coronavirus pandemic.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

Flight Insurance: The 5 Best Options for 2023

Protect your flight (and peace of mind) with the top coverage plans.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

Where to Travel During Hurricane Season

Amanda Norcross

Some destinations pose less of a risk than others.

What Is Cancel For Any Reason (CFAR) Travel Insurance? (2024)

Cancel for any reason (cfar) travel insurance typically costs 40% to 50% more than your standard travel insurance policy..

)

3 years of content writing

Bylines with leading financial publications

Alani is a freelance writer specializing in personal finance. She aims to make complex topics more approachable through fun, digestible content.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Updated October 5, 2023

)

Table of contents

- CFAR insurance

- Best companies

- Cost of CFAR policies

- Factors to consider

Travel insurance offers financial protection for unforeseen events related to your trip, like loss of luggage, trip cancellations, and flight delays. Cancel for any reason (CFAR) coverage offers reimbursements if you need to cancel your trip for reasons not covered by your trip cancellation insurance.

Travelers who prefer greater flexibility in their travel insurance may benefit from adding this coverage to their policy. Here’s what you need to know about CFAR travel insurance.

Understanding cancel for any reason travel insurance

Say you cancel your trip for covered reasons, like an unexpected natural disaster or a serious injury. In that case, trip cancellation coverage offers reimbursements for all non-refundable trip costs (such as airline, hotel, etc.).

Meanwhile, CFAR travel insurance is an optional upgrade that increases trip cancellation coverage. It offers reimbursements between 50% and 75% on non-refundable trip costs if you cancel for virtually any reason, like personal emergencies or fear of traveling. [1]

What CFAR covers

CFAR insurance covers trip cancellations for any reason — even a known event like forecasted harsh weather. Below are a few other common cancellation scenarios that CFAR insurance covers:

Change of plans

Fear of travel

Family emergencies

Financial hardship

Current events

Disease outbreaks

Work-related situations

What CFAR doesn’t cover

While you can use your CFAR policy for almost any reason, you must use it correctly to get a refund on your canceled travel plans. Some exclusions include:

Last-minute cancellations: Most insurers require you to cancel your trip at least 48 hours before your departure date. Trip interruption offers coverage if you have to end your trip shortly after it has started.

Late purchases: Most travel insurance companies only allow you to purchase CFAR coverage within 14 to 21 days after your initial trip payment. [2]

Partially insured trips: You must insure all non-refundable trip payments.

Best companies for CFAR travel insurance

A handful of travel insurance companies exclude CFAR travel insurance coverage, as it increases liability. If you’d like to add CFAR travel insurance to your policy, consider checking out C&F Travel Insured, Travel Guard, Seven Corners, Travelex, and Trawick International travel insurance.

Best overall: C&F Travel Insured

C&F Travel Insured is the best travel insurance for CFAR coverage due to its affordable rates and high reimbursement limits. Insurify found that a 35-year-old male with a $4,000 trip to France will pay $218 for a Travel Insured Worldwide Trip Protector policy. A CFAR travel insurance add-on will cost this traveler $96, or about 44% more than their trip insurance cost.

Travel Insured CFAR insurance also reimburses you 75% of your trip cost. However, you can only add CFAR to its most comprehensive policy, the Travel Insured Worldwide Trip Protector. [3]

Here’s a glimpse of what you’ll get with this travel insurance plan:

100% trip cancellation

150% trip interruption

Up to $1,000 in travel delay

$100,000 in medical coverage

$1 million in medical evacuation coverage

If you make any additional travel plans after purchasing CFAR insurance, you must insure the full cost of those plans within 21 days of your payment date. This coverage is only available no later than 48 hours before your scheduled departure date.

Best for cheap coverage: Travel Guard

Travel Guard is an excellent option for travelers who want additional protection within their budget. For a 35-year-old male with a $4,000 trip to France, a Travel Guard Deluxe policy costs $275. Adding CFAR coverage costs an additional $87, or about 32% of their policy’s cost without the add-on. While budget-friendly, Travel Guard’s CFAR insurance only reimburses 50% of your travel cost.

In order to qualify for the CFAR upgrade, all trip costs must have coverage at the time of purchase. You must also buy CFAR within 15 days of your first trip deposit. If you need to use it, you’ll have to cancel your trip no less than 48 hours before your departure date. [4]

Best for medical coverage: Seven Corners

Suppose you get injured abroad and can’t use your health insurance. Travel insurance medical coverage can kick in to pay for medical care and emergency evacuation. Seven Corners offers pre-existing conditions waivers, up to $500,000 in medical expenses, and up to $1 million in medical evacuation coverage.

You must purchase CFAR insurance within 20 days of your initial trip deposit and insure the cost of your entire trip within 15 days. Additionally, if you want to insure any other travel arrangements, you must do so within 15 days of paying for them.

You must cancel your trip two or more days before departure to qualify for CFAR coverage. It’s worth noting that this add-on excludes coverage for financial loss if a travel supplier goes out of business. [5]

Best for families: Travelex

If you’re planning your next family vacation, consider Travelex’s Family Travel Insurance. This plan offers coverage for you and all children younger than 17 at no extra charge. In addition to CFAR at a 75% refund up to $7,500, you can add adventure sports and car rental collision to your policy. [6]

The insurer requires you to insure your entire trip and purchase your CFAR plan within 15 days of your trip’s initial deposit. Trips longer than 30 days aren’t eligible for this add-on.

Best for customizability: Trawick International

Trawick International offers seven different trip cancellation insurance plans, from an affordable, basic policy to more comprehensive travel insurance plans. You can add CFAR coverage to four of its travel insurance policies.

Trawick International — like other insurers that offer CFAR coverage — requires you to purchase the add-on within a certain number of days from your trip’s first deposit or final payment date. This time frame will vary based on the plan you choose. Additionally, if you must cancel your trip, you must do so at least two days before departure. [7]

Cost of CFAR travel insurance per trip

A CFAR upgrade may increase your standard policy premium by 40% to 50%. For example, say your travel insurance policy costs $250 without CFAR. In that case, your travel insurance plan may cost $350 to $375 after CFAR coverage.

Is CFAR travel insurance worth it?

CFAR plans may be worth the additional cost if you foresee any potential reasons to file a claim for reasons not covered by your trip cancellation insurance. For example, say you’re traveling to a country with political unrest. Your CFAR coverage partially reimburses you for travel costs if you opt out of your trip due to growing tensions in the destination you’re traveling to.

)

How Much Is Travel Insurance?

Factors to consider when buying cfar travel insurance.

Before purchasing CFAR travel insurance, consider the following factors:

Cost of trip: If you’re going on an expensive trip, CFAR can provide financial protection if you change your mind. In contrast, you may not want to spend the extra money on CFAR insurance for a low-cost, domestic trip — especially if you can quickly recoup financial losses after cancellation.

Type of trip planned: While standard trip cancellation insurance covers many unforeseen reasons, it doesn’t cover personal reasons like fear of travel. CFAR may come in handy if you’re heading to a country with a high degree of political or health-related uncertainty and decide to opt out of your trip.

Personal reasons: If you foresee any personal matters, conflicting with your trip, such as a pregnancy or job-related issue, it may be a good idea to include CFAR insurance.

Reimbursement: With CFAR, most insurers will reimburse 50% to 75% of your prepaid, non-refundable travel costs if you cancel. You’ll want to choose an insurer that provides enough coverage based on your circumstances and the nature of your trip.

Cost of coverage: It’s important to weigh the cost of adding CFAR insurance against the type of trip, the price of your trip, and the likelihood you’ll need this coverage to determine if it’s a worthwhile financial decision.

)

How COVID-19 Travel Insurance Works

Cancel for any reason (cfar) travel insurance faqs.

Below, you’ll find answers to some of the most commonly asked questions about CFAR travel insurance by travelers.

How much does cancel for any reason travel insurance cost?

Cancel for any reason (CFAR) travel insurance usually costs between 40% and 50% of your travel insurance policy. It’s important to weigh the extra cost against the nature of your trip to determine if it’s worth purchasing.

Can you add CFAR coverage to an existing travel insurance policy?

Yes. Travel insurance companies won’t automatically include CFAR insurance to your policy, so you must add it yourself. However, CFAR is time-sensitive, and you must purchase it within 21 days of your first trip payment.

What are the best companies with CFAR travel insurance?

The best companies for CFAR insurance are C&F Travel Insured, Travel Guard, Seven Corners, Travelex, and Trawick International. Each has different pros and cons, so it’s worth comparing policies from each company to see what’s best for you.

How can you get a refund through your CFAR travel insurance?

You can get a refund for your CFAR insurance by filing a claim with your travel insurance company. Most insurers allow you to file a claim through their website, mobile app, or by calling a representative.

Related articles

- Airbnb Travel Insurance: What Guests Should Know

- Does Travel Insurance Cover Pre-Existing Conditions?

- National Association of Insurance Commissioners . " Travel Insurance ."

- SquareMouth Travel Insurance . " What is Cancel For Any Reason travel insurance? ."

- Travel Insured International . " Optional Cancel For Any Reason ."

- Travel Guard . " Cancel for Any Reason ."

- Seven Corners . " Travel Insurance ."

- Travelex Insurance Services . " Family Travel Insurance ."

- Trawick International . " Cancel for Any Reason (CFAR) Travel Cancellation Insurance Plans ."

)

Alani Asis is a personal finance freelance writer with nearly three years of experience in content creation. She has landed bylines with leading publications and brands like Insider, Fortune, LendingTree, and more. Alani aims to make personal finance approachable through fun, relatable, and digestible content.

Latest Articles

)

Cheapest Travel Insurance (April 2024)

Travel insurance can be beneficial, especially for people traveling to risky areas and people with health concerns.

)

How to Find the Best Travel Insurance for Seniors

Travel insurance can be beneficial for senior travelers, especially those with health concerns. Find out how you can secure your next trip.

)

What Does Cruise Insurance Cover?

Cruise insurance is a type of travel insurance that can include international medical insurance, trip delays, and complete cancellation of your trip.

)

Visitor Insurance for Parents: What to Know

Learn how to find visitor insurance for parents, why you need it, and the best companies offering medical coverage for visitors from abroad.

)

Is Flight Insurance Worth It?

Is flight insurance worth it? Weigh the pros, cons, typical costs, and coverage options to decide whether it’s worth purchasing.

)

Travel Medical Insurance: What to Know

Travel medical insurance can provide financial protection in case of unforeseen circumstances while traveling, such as illness or medical emergencies.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Payroll Services

- Best HR Software

- Best HR Outsourcing Services

- Best HRIS Software

- Best Performance Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Guide to Cancel for Any Reason (CFAR) Travel Insurance

Is your next planned trip to an unpredictable destination? Cancel for any reason travel insurance may be the protection you need.

in under 2 minutes

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Roxanne Downer has more than 15 years as a news, finance and lifestyle writer and editor. A graduate of the University of Pennsylvania, she has previously worked at Deutsche Bank, BNY Mellon, Financial Week and MSN Money.

A “cancel for any reason” (CFAR) travel insurance add-on upgrades your travel insurance policy to reimburse you for cancellations outside of the company’s list of covered reasons, such as weather or simply not wanting to travel. However, the CFAR add-on will nearly double the cost of the travel insurance policy.

Based on our research of CFAR availability, cost, and reimbursement percentages and terms, the travel insurance with top-notch CFAR coverage is Faye and Seven Corners. Read on to learn more about how CFAR coverage works, what it covers and more.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Is “Cancel For Any Reason” Travel Insurance?

Cancel for any reason travel insurance is an add-on you can purchase to upgrade your standard travel insurance policy. CFAR coverage entitles you to a percentage reimbursement if you need to cancel your vacation, no matter the reason. This is contrary to standard travel insurance policies, which include specific circumstances when you can claim a reimbursement for nonrefundable trip expenses. These are usually limited to a major injury or illness, death in the family, or major political or international events that could make travel unsafe or impossible.

How Does Cancel for Any Reason Travel Insurance Work?

Travel insurance policies are widely available and come in many forms. These policies have become especially popular since the COVID-19 pandemic has made overseas and air travel more unpredictable.

If you want or need to cancel your trip (or even move your scheduled departure date and return date), standard travel insurance policies require that you provide a reason for your trip cancellation. Your reason must match an approved reason listed under their policy rules. Approved cancellation reasons are usually stringent. Some common approved cancellation reasons include the following:

- Acts of terrorism or war in your home country or the country to which you’re traveling

- Death of a family member

- Death of a traveling companion

- Hospitalization

- Jury duty or another type of unforeseen court-ordered appointment

- Military orders or deployment

Your travel insurance provider may require you to submit proof of your claim before you receive reimbursement.

With CFAR travel insurance coverage, you can cancel your trip for reasons not listed as viable and reasonable under the standard travel insurance policy. You can use almost any reason to cancel your travel plans and still get partial reimbursement for prepaid and non-refundable trip costs, provided a few specific criteria.

Perhaps you develop a sudden fear of travel. Maybe your travel companion insists they can no longer make the trip with you. Perhaps you have unexpected medical expenses that take precedence over your trip and need that money back. The optional CFAR upgrade allows you to receive the majority of your money back using the aforementioned reasons or nearly any other reason. In most cases, whatever reason you provide is accepted under CFAR policies, although there are a few exclusions.

Let’s take a look at an example of how you might use CFAR coverage. Say you planned a week-long trip to Bermuda with a total of $2,500 in nonrefundable travel expenses, including your flight and lodging. You lose your job after you book your trip and decide now is not the best time to travel. You decide to cancel your vacation to save money and file a claim with your travel insurance provider.

While this cancellation reason would not usually entitle you to a refund under standard travel insurance coverage, you could request reimbursement with CFAR coverage. In this instance, you would receive a maximum refund up to the percentage outlined in your policy. For example, if you bought a policy with a 70% CFAR reimbursement, in this example, you would get a total refund of $1,750 for your $2,500 vacation.

Can I Get CFAR Coverage At Any Time?

No, you cannot purchase CFAR coverage at any time. Each travel insurance provider institutes its own limitations on how far away from your initial trip deposit you can upgrade to CFAR-level insurance. You typically need to purchase travel insurance between 14 to 21 days from your initial trip payment to qualify to add CFAR coverage. We recommend getting travel insurance quotes sooner rather than later if you’re interested in protecting your trip with a CFAR upgrade.

How Much Does “Cancel For Any Reason” Coverage Cost?

Regular travel insurance costs between 5% and 6% of your total trip cost. In our review, we found the average CFAR upgrade added 90% of the standard premium cost to your total insurance price. This means that in most cases, you can expect your premium to double when you upgrade to CFAR insurance.

To estimate pricing for your CFAR upgrade, we collected quotes for a series of travel insurance policies offered by our top providers. We requested a custom quote for a $5,000 vacation to Canada for a 35-year-old traveler. The table below represents the quotes we received for base plans and how much it would cost to add a CFAR upgrade.

“Cancel for Any Reason” (CFAR) Insurance vs. Standard Travel Insurance

We’ve already mentioned some significant differences between CFAR and standard travel insurance. However, inclusions on CFAR insurance upgrades can vary depending on the company issuing your travel insurance. You should consider the following as you compare CFAR insurance options between providers.

Cost: CFAR travel insurance is always pricier than standard travel insurance. However, it’s not exorbitantly expensive and provides you with a broader range of cancellation flexibility. While CFAR insurance won’t cost more than 150% of regular travel insurance, it can provide much greater peace of mind when exploring abroad, especially in post-pandemic times.

Eligibility Requirements: You cannot purchase CFAR insurance on its own. This insurance is an optional add-on benefit to a standard travel insurance policy. Make sure you’re eligible for CFAR travel insurance by purchasing it no later than three weeks from your original travel insurance plan. Should you need to implement it, use it no fewer than 48 hours before your trip.

Fear of Illness: Standard travel insurance providers do not include fear of illness as a covered reason under most trip cancellation benefit plans. CFAR travel insurance does. The pandemic has changed the travel climate for the foreseeable future, and fear of possible illness is a perfectly acceptable cancellation option when using CFAR insurance. If you’re traveling abroad and think you might need to cancel because you’re at an increased risk of illness, purchasing CFAR insurance can be wise.

Insurance Providers: Some travel insurance companies may not offer CFAR coverage and only offer trip cancellation insurance with restrictions. Be especially mindful of this if you are a New York state resident, where policies are more heavily restricted.

Compare the Best “Cancel For Any Reason” Travel Insurance Providers

Ready to start comparing coverage providers? The table below summarizes our top picks for CFAR travel insurance upgrades.

What Does CFAR Insurance Cover?

CFAR upgrades cover a variety of nonrefundable trip expenses, such as:

- Accommodations: CFAR coverage can reimburse you for nonrefundable hotel or hostel reservations.

- Airfare: If you bought nonrefundable or exchangeable airline seats, CFAR coverage can reimburse you for the cost of tickets.

- Travel arrangements: If you have must cancel prescheduled nonrefundable golf tee times, dinner reservations or rental car costs, CFAR coverage can reimburse you for a percentage of the cost.

- Event and concert tickets: Similar to travel arrangements, CFAR coverage can reimburse you for event tickets you aren’t able to sell or get refunded.

- Lost deposits: Even if you did not put down a full payment for an excursion or event, you can claim a partial refund of lost deposits with a CFAR insurance upgrade.

It’s important to note that CFAR insurance often comes with specific terms and conditions, which can include a deadline for purchasing coverage and a reimbursement requirement to cancel your trip within a specified timeframe. Review your policy documents to learn more about specific items included and excluded from your coverage.

What’s Not Covered by “Cancel for Any Reason” Travel Insurance?

Standard travel insurance policies typically reimburse the total amount of your deposit (or close to it) if you act within the time-sensitive parameters and cancel for the reasons accepted under the policy. On the other hand, CFAR policies will typically offer you between 50% and 75% reimbursement of your deposit or total trip cost if you cancel for reasons not explicitly listed under the terms of the policy.

Additionally, CFAR policies are time-sensitive. You must purchase the CFAR travel insurance add-on within a specific time frame of when you purchased your initial travel insurance policy. The time frame for implementing your CFAR benefits is between one and four weeks (depending on the company) after your initial trip deposit and purchase of standard travel insurance.

Most companies offer CFAR trip cancellation coverage if you cancel your trip within a specific time frame. For travel insurance companies Travelex and Seven Corners, it’s within 48 hours of your scheduled departure date.

CFAR policies don’t cover some circumstances. For example, Seven Corners insists that, should a travel supplier cancel your trip, the responsibility for refunding your trip expenses falls on the operator, not the CFAR insurance policy. So, review the fine print and individual limitations of your policy before you buy travel insurance to be sure you’re getting the benefits you think you are.

Best “Cancel For Any Reason” (CFAR) Travel Insurance

Not every travel insurance provider offers the same level of CFAR coverage. The following are our top picks for travel insurance with CFAR benefits:

- Faye: Our top pick

- Seven Corners Travel Insurance : Our pick for international travelers

- AIG Travel Guard : Our pick for families

- Travelex Insurance : Our pick for budget travelers

- Nationwide Travel Insurance : Our pick for cruise travel

- Trawick International : Our pick for college students

- AXA Assistance USA : Our pick for leisure travelers

- HTH Travel Insurance : Our pick for group travel

- International Medical Group : Our pick for medical coverage

- Generali Global Assistance : Our pick for emergency assistance

- CFAR coverage amount: 75% of trip cost

- Average plan cost : $298

- CFAR upgrade cost : 16%–39% added to premium

Why We Picked Faye

Faye travel insurance is our choice for travelers who prioritize a streamlined, online buying process. With 100% online underwriting and the ability to access quick, general coverage, Faye is a good option for those purchasing travel insurance a few days before their trip. Though Faye only offers one travel insurance policy, it includes CFAR coverage that can reimburse up to 75% of your nonrefundable trip costs.

Faye’s CFAR upgrade is one of the most affordable we reviewed, adding an average of 16% to 39% to your premium cost. Compared to other insurance providers like Trawick, which doubled our quote when we added to CFAR coverage, Faye is a good choice for budget shoppers. However, you can only purchase CFAR coverage within two weeks of your initial trip deposit.

Pros & Cons

Plans and cost breakdown.

Unlike most travel insurance providers, Faye only offers one policy, which includes the following coverages:

- Trip interruption: 150%

- Medical expense: $250,000

- Emergency evacuation and repatriation of remains: $500,000

- Lost baggage: $150

- Trip delay: $4,500 ($300 per day)

- Baggage delay: $200

According to our review, the average Faye customer will pay $298 for an insurance policy.

Seven Corners Travel Insurance

- Average plan cost : $169–$236

- CFAR upgrade cost : 4 0%–42% added to premium

Why We Picked Seven Corners

Seven Corners is our top travel insurance provider for international adventures because of its wide range of coverage options. From annual travel insurance plans to options that offer limited, affordable medical coverage, Seven Corners is known for its inclusive selection of plan offerings. While most coverage providers limit CFAR coverage availability to only the most expensive policy, Seven Corners makes this add-on available with two plan options.

Seven Corners’ CFAR upgrades were consistently affordable in our review, adding 40% of the cost of your coverage to most sample quotes we received. You can also upgrade to CFAR coverage 20 days after your initial trip payment, which is longer than some competitors. However, this upgrade is only available on single-trip policies and is not offered on a rolling basis for annual plans.

Seven Corners offers two travel insurance policies that allow you to upgrade to CFAR insurance: Trip Protection Basic and Trip Protection Choice. Both options are single-trip plans, with the Basic policy being Seven Corners’ budget option. It includes the following coverages:

- Trip interruption: 100%

- Medical expense: $100,000

- Emergency evacuation and repatriation of remains: $250,000

- Lost baggage: $250

- Trip delay: $600

- Baggage delay: $500

In our review, we found the average Trip Protection Basic policyholder will pay $169 for Basic coverage.

The Trip Protection Choice policy includes more optional coverage than the Basic policy, including a waiver for pre-existing conditions and event ticket registration. This policy also includes extended benefits over the Basic plan, including:

- Medical expense: $500,000

- Emergency evacuation and repatriation of remains: $1 million

- Trip delay: $2,000

- Baggage delay: $2,500

We found that the average Choice policyholder will pay about $236 for travel insurance.

AIG Travel Guard

- CFAR coverage amount: 50% of trip cost

- Average plan cost : $171–$319

- CFAR upgrade cost : 3 1%–38% added to premium

Why We Picked AIG

AIG is our top pick for families looking for more inclusive group coverage because one child under age 17 is included with the purchase of an adult Travel Guard Deluxe plan. This policy also includes the option to add CFAR coverage at a lower rate than most competitors. However, the Deluze policy is not the only option for CFAR travel insurance — you can also upgrade to the lower-cost Preferred plan with the same coverage rates and reimbursement percentage.

While AIG’s CFAR upgrade is more affordable than competitors, it does come with a few limitations. You can only add up to 50% reimbursement, which limits your benefits. You also must purchase the upgrade within 14 days of your initial trip deposit purchase, which is on the lower end of the spectrum compared to other providers.

AIG offers two policy options that support CFAR upgrades: Travel Guard Preferred and Travel Guard Deluxe. The Travel Guard Deluxe plan includes the following coverages:

- Medical expense: $50,000

- Lost baggage: $1,000

- Trip delay: $800 ($200 per day)

- Baggage delay: $300

In our review, we found the average AIG customer could expect to pay about $263 for coverage.

The Travel Guard Deluxe policy is AIG’s more comprehensive single-trip option and includes a wider breadth of coverage than the Deluxe plan. For example, this policy includes coverage for one child under the age of 17 along with adult coverage. It also includes the following policy basics:

- Medical expense: $150,000

- Lost baggage: $2,500

- Trip delay: $1,000 ($200 per day)

Based on quotes we collected, we found that the average AIG customer could expect to pay about $319 for Deluxe-tier coverage.

- CFAR coverage amount: 7 5% of trip cost

- Average plan cost : $176–$248

- CFAR upgrade cost : 71% to 110% added to premium

Why We Picked Travelex

Travelex offers a low-cost choice for travelers looking for a budget policy they can purchase at the last minute. Travelex also allows you to purchase CFAR coverage for up to 20 days from your initial trip payment. CFAR upgrades include 75% reimbursements, which is about average in the travel insurance industry.

In our review, we found that Travelex only offers one policy that supports a CFAR upgrade with its Travel Select plan. This may be disappointing for budget travelers purchasing the low-cost Travel Basic policy, which is offered at a flat rate of $40. CFAR upgrades added between 71% to 110% to the value of our quoted premium.

CFAR coverage is available with the Travel Select policy, which offers the following protections:

- Trip delay: $2,000 ($200 per day)

According to our review, the average Travelex policyholder can expect to pay between $176 and $248 for coverage depending on policy selection.

Nationwide Travel Insurance

- Average plan cost : $132–$219

- CFAR upgrade cost : 85%–120% added to premium

Why We Picked Nationwide

While Nationwide is typically our top recommended provider if you’re taking a cruise vacation, its cruise policies do not include CFAR upgrade options. The company only offers a CFAR add-on with its standard travel insurance plan, the Prime policy. With CFAR coverage, the company will reimburse 75% of your nonrefundable trip costs, which is average in the industry. You can purchase the CFAR upgrade up to 21 days after your initial trip payment, which is about a week longer than most other providers.

The only Nationwide policy that includes the option to add CFAR coverage is the Prime travel insurance plan, which includes the following benefits:

- Trip interruption: 200%

- Trip delay: $2,000 ($250 per day)

- Baggage delay: $600

In our review, we found the average customer choosing Prime travel insurance level coverage from Nationwide can expect to pay $219 .

Trawick International

- CFAR coverage amount: 50%–75% of trip cost

- Average plan cost : $159–$265

- CFAR upgrade cost : 81%–215% added to premium

Why We Picked Trawick

Trawick offers CFAR upgrades with five of its Safe Travels policy options for U.S. residents, which is more than any other provider on our list. Additionally, Trawick is our top choice for college students thanks to its wide range of coverage for student-oriented visas.

While Trawick offers a variety of coverage options, you’ll need to be within 14 days of your initial trip deposit to invest in CFAR upgrades on most policies. Depending on the plan you choose, you may have the option to add between 50% and 75% in reimbursements, which may leave you with less coverage than some competitors. Depending on your selected coverage option, CFAR upgrades may also be prohibitively expensive with Trawick.

Trawick offers CFAR add-on options with a variety of plan options, but three of the most popular include Safe Travels Armor, Safe Travels Voyager and Safe Travels First Class. The Safe Travels Armor policy is Trawick’s most popular policy choice and includes the following coverages:

- Trip delay: $1,000 ($100 per day)

- Baggage delay: $250

The Safe Travels Voyager policy is a more affordable option and includes the following coverages:

- Medical expense: $25,000

- Lost baggage: $300

- Trip delay: $1,000 ($250 per day)

Finally, the Safe Travels First Class policy includes a bit more coverage, including the following options:

- Emergency evacuation and repatriation of remains: $200,000

- Lost baggage: $200

- Trip delay: $1,000 ($150 per day)

Based on quotes we gathered, customers can expect to pay between $159 to $265 for a Trawick travel insurance policy.

AXA Assistance USA

- CFAR coverage amount: 75% of trip cost

- Average plan cost : $188–$274

- CFAR upgrade cost : 118%–170% added to premium

Why We Picked AXA

We selected AXA as our top pick for leisure travelers because of the unique benefits included with its Platinum Plan, such as coverage for lost leisure activities like lost rounds of golf and ski days. The Platinum Plan also includes generous coverages for baggage — and is AXA’s only option that includes CFAR upgrade options.

AXA’s CFAR coverage includes 75% in reimbursements, which meets the industry average. Customers must purchase a CFAR upgrade within 14 days of their initial trip deposit, which is also average compared to competitors. However, CFAR coverage from AXA is more expensive than most competitors — in our review, adding a CFAR upgrade at least doubled the price of our quoted premium.

AXA’s Platinum Plan includes the following standard coverages:

- Lost baggage: $500

- Trip delay: $1,250 ($300 per day)

We collected quotes from the company and found the average AXA customer can expect to pay $274 for Platinum Plan-level coverage.

HTH Travel Insurance

- Average plan cost : $168–$284

- CFAR upgrade cost : 50% added to premium

Why We Picked HTH

HTH is our top choice for group coverage thanks to its premium discounts — when you buy travel insurance as a group, each individual member can save 10% on their coverage. However, if you want to purchase CFAR coverage you will need to opt for the most inclusive and higher-cost TripProtector Preferred policy. Each member must purchase the same coverage when buying as a group, which can make HTH’s CFAR upgrade less beneficial for multiple people.

Based on our research, HTH offers competitively priced CFAR coverage — after collecting a series of quotes, we noticed a consistent increase in premium cost by around 50%. When combined with average premiums and reimbursement rates, HTH is a solid choice for CFAR coverage. If your full group is interested in higher-value coverage and CFAR upgrades, HTH’s discounts could be right for you.

The only plan from HTH that offers the option for CFAR coverage is TripProtector Preferred, which includes the following coverages:

- Trip delay: $2,000 ($500 per day)

- Baggage delay: $400

According to our review, the average HTH policyholder will pay between $168 to $284 for coverage depending on their policy choice.

International Medical Group

- Average plan cost : $95–$356

Why We Picked International Medical Group

Our team recommends the International Medical Group (IMG) for its extensive medical coverage options. With more than 10 individual travel insurance options and medical-only plans, IMG is a strong choice for students and education professionals with visas necessitating medical coverage. However, only one policy option, the iTravelInsured Travel LX plan, includes the choice to add CFAR coverage.

The CFAR upgrade to the iTravelInsured Travel LX plan includes 75% reimbursement, which is average within the industry. We found that IMG’s policy pricing was consistent in terms of adding CFAR coverage, consistently adding 50% of your initial premium to your total cost. While IMG’s higher-than-average premium pricing may negate this benefit in some cases, it is worth considering if you’re looking to combine CFAR coverage with all-inclusive medical protections.

IMG’s only policy that offers a CFAR add-on option is the iTravelInsured Travel LX policy, which includes the following coverages:

- Trip delay: $2,500 ($250 per day)

Our review found the average IMG customer can expect to pay $356 for travel insurance, which is higher than most competitors we reviewed.

Generali Global Assistance

- CFAR coverage amount: 60% of trip cost

- Average plan cost : $211–$322

Why We Picked Generali

Generali is worth considering if you’re planning an adventure to a country where your primary language is not as commonly spoken. All of Generali’s policies include access to 24/7 bilingual travel assistance — which can add peace of mind for those taking their first international trip. Based on our research, Generali also consistently quoted its CFAR upgrade at 50% of the price of the original premium.

While Generali’s CFAR upgrade is more affordable, you must be within 24 hours of your initial trip deposit to add coverage. The company also caps reimbursements at 60% of your total trip cost, which is less than most other providers on our list.

If you’d like to opt into CFAR travel insurance, you’ll need to buy Generali’s most expensive coverage option, the Premium plan, which includes the following basic coverages:

- Trip interruption: 175%

- Lost baggage: $2,000

- Trip delay: $1,000 ($300 per day)

Based on the quotes we gathered, we determined Generali Platinum coverage came at an average premium of $322 .

How We Ranked CFAR Coverage Providers

Most travel insurance providers offer some type of CFAR coverage. We requested quotes from dozens of insurers for policies with CFAR add-ons and compared rates in the following areas to determine our company rankings.

- Percentage reimbursed: Companies with reimbursement rates over 75% received higher ratings, while those offering lower reimbursement percentages ranked lower.

- Cost: CFAR coverage is billed as an add-on to a standard travel insurance premium, not as its own policy. Companies with CFAR add-ons with lower percentage price increases received higher rankings.

- Purchase timeframe: To qualify to purchase CFAR coverage, you’ll need to be within a specific window from your initial trip deposit. This window varies by company, with the average being 14 to 21 days from your initial purchase date. Companies with wider CFAR add-on purchase windows received higher rankings and vice versa.

- Policy availability: Most travel insurance providers that offer CFAR upgrades limit the add-on to higher, more expensive tiers of coverage. Companies with multiple policies offering CFAR add-ons received more points in our review.

Will CFAR Coverage Refund My Whole Trip?

No — even the most generous cancel for any reason coverage will not refund 100% of your trip costs. When you enroll in a travel insurance policy and upgrade to CFAR-inclusive coverage, your travel insurance provider will reimburse you up to a certain percentage if you file a valid claim.

In our review, we found you can expect most CFAR upgrades to offer a 75% reimbursement of trip expenses. As an example, say you planned a trip to Canada with a total of $5,000 in nonrefundable trip expenses. You opted into CFAR coverage, which entitles you to a 75% trip cost reimbursement. In this example, if you needed to cancel your trip for any reason, you’d get a maximum refund of $3,750 — 75% of your total trip cost of $5,000.

How Do I Get “Cancel for Any Reason” Travel Insurance?

If you have experience with travel insurance sites and know what you’re looking for, all you need to do to get CFAR insurance is choose this upgrade when purchasing your plan online. However, if this is new to you, you have several options for buying your first policy.

Begin by comparing some of the major travel insurance providers to see which one suits your needs the best. The options above all have CFAR options, so you can focus on factors like price, medical coverage, medical evacuation , baggage loss benefits , and natural disaster policies of each travel insurance provider as you shop.

Begin by purchasing your travel insurance policy, and add the option for CFAR travel insurance during the checkout process. Paying with a debit or credit card makes this easy, but most travel insurance agencies accept many different forms of payment. Once you sign onto coverage, review your confirmation of benefits, and continue planning your next international adventure.

Is “Cancel For Any Reason” Travel Insurance Worth It?

Given the COVID-19 pandemic’s uncertain nature, travel insurance is a worthwhile investment if you want to recoup the money you’ve spent on a trip you may no longer wish to take. If you believe you may need to cancel your trip for a reason not covered under standard travel insurance policies, purchasing cancel for any reason, insurance is probably worth it. After all, the extra money you’d spend would be far less than the money you’d lose if you opted not to purchase CFAR insurance and canceled your trip for an excluded reason.

Frequently Asked Questions About “Cancel for Any Reason” Travel Insurance

When should i purchase cfar insurance.

For most travel insurance companies, the cut-off for adding on cancel for any reason insurance to your travel insurance plan is between 10 days and three weeks from the date of purchase and varies from company to company. Optimally, you should purchase the optional cancel for any reason add-on when purchasing your standard travel insurance policy.

Does Allianz offer “cancel for any reason” coverage?

No, Allianz does not offer cancel for any reason add-ons to their plans. The only exception is if you need to cancel your trip due to COVID-19-related medical complications. Trip cancellation is covered if you get sick due to the illness and your trip must be canceled or interrupted , and emergency medical care due to contraction of the virus is also covered in most cases.

Does CFAR coverage cover cancellations due to a fear of flying?

Yes. Fear of any travel — whether fear of motion sickness, ocean travel, getting sick, or flying — is included in the coverage cost of cancel for any reason insurance.

What is a good reason to cancel a trip?

Some good reasons to cancel a trip that would be covered by CFAR but may not be covered by standard insurance include the following:

- You’ve been planning a trip with a companion who no longer wishes to go with you, but you don’t wish to travel alone.

- You have a sick family member or sick pet you must tend to.

- You’ve seen disturbing news stories about your destination, and you no longer feel comfortable traveling there.

- You discover you don’t like your destination’s COVID protocols.

- You develop a fear of travel.

My credit card offers travel insurance. Should I still get CFAR insurance?

Most credit card travel insurance benefits do not include CFAR coverage. You should get CFAR coverage if being able to cancel your trip for any reason gives greater peace of mind than you can get with standard travel insurance.

How We Rated Travel Insurance Providers

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Resources:

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance That Includes Cancel For Any Reason Coverage

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

So you’re organizing a trip and you’re interested in purchasing travel insurance. That makes sense — making plans these days can be pretty stressful. This is one reason that Cancel For Any Reason (CFAR) insurance is so popular.

As the name implies, CFAR allows you to cancel your plans without specifying a covered reason.

We looked at the top Cancel For Any Reason travel insurance companies, comparing their coverage and pricing to find out which was the best. Here’s our shortlist of best options:

Battleface .

USI Affinity Travel Insurance Services .

Seven Corners .

John Hancock .

Travel Insured International .

Factors we considered when picking best Cancel For Any Reason insurance companies

We used these factors when choosing best companies for Cancel For Any Reason insurance:

Types of coverage. Including CFAR, trip delay , baggage loss and emergency medical .

Amount of coverage. Including reimbursements for claims.

Total cost. We checked out the price for each plan compared to what you’ll receive.

Usability . What’s the point in purchasing an insurance plan if you cannot use it? We considered user-friendly websites.

Customizability. We scoured what add-ons were available, such as rental car insurance or sports equipment loss.

An overview of the best Cancel For Any Reason travel insurance

We searched for quotes using Squaremouth for a 46-year-old Texas resident traveling to France for two weeks with a total trip cost of $10,000, including airfare.

When filtering for those providers that offered a Cancel For Any Reason add-on, our list of eligible insurance plans dropped from 103 down to 27.

Note that to purchase Cancel For Any Reason insurance, you’ll need to do so reasonably quickly after putting down your first deposit for your trip. The window to purchase is an average of 14 days after initial purchase, though some plans offer up to three weeks.

The average cost for these basic plans came out to about $635, but there’s a wide variety of coverage levels.

Top Cancel For Any Reason travel insurance options

Here’s a breakdown of the different insurance companies and why they stood out among the best. Note that these plans offer 75% of your total costs back if you cancel your trip.

What makes Battleface a top choice for CFAR insurance:

Absolute cheapest CFAR insurance option.

Also solid second-cheapest plan — the Explorer Plan — includes extras such as trip interruption, emergency medical and travel delay reimbursement.

The Battleface Explorer Plan offers terrific baggage loss, missed connection and travel delay insurance.

For our test trip, two of Battleface’s plans came out significantly cheaper than all the others. The Discovery plan lacked much of anything but CFAR coverage, which is still a decent offering considering it’s just $285.03 and you’ll still receive 75% of your trip costs refunded if you cancel.

What makes GoReady a top choice for CFAR insurance:

Less expensive than average.

Reimburses 150% of expenses in the event of a trip interruption.

Includes financial default coverage.

Offers $50,000 in primary medical insurance.

Our third-best option is GoReady, whose $603 offering is expensive but still costs less than average. With 150% for trip interruption, primary emergency medical and a $50 deductible for care, the GoReady plan offers comprehensive coverage for nearly any situation.

What makes Tin Leg a top choice for CFAR insurance:

Employment layoff is covered if employed for three years.

$500,000 in primary emergency medical.

$500,000 for medical evacuation and repatriation

Tin Leg stands out for its massive medical budget. Although some of its coverage isn’t as good as others, it makes up for it with a combined million dollars in emergency medical and evacuation.

USI Affinity Travel Insurance Services

What makes USI a top choice for CFAR insurance:

No medical deductible.

$250,000 in primary emergency medical.

Includes $15,000 for 24-hour accidental death and dismemberment coverage.

Pre-existing conditions covered.

This plan from USI doesn’t have a single standout feature; instead, it’s a well-rounded plan that provides coverage across a wide range of scenarios, including mandatory evacuations, terrorism and travel delays.

Seven Corners

What makes Seven Corners a top choice for CFAR insurance:

Hurricane warnings covered.

Employer layoff, if employed for one year.

$500 per person for baggage delay after 6 hours.

Seven Corners’ RoundTrip Basic plan is reasonably costly at $768.22 for the trip, but you’ll receive better-than-average coverage.

This includes reimbursement if you get laid off after working somewhere for just one year — other companies have a three-year minimum.

John Hancock

What makes John Hancock a top choice for CFAR insurance:

$1,000 per person for baggage loss; $1,000 specific item limit.

$750 for missed connection after a three-hour delay.

$750 for travel delay after a three-hour delay.

$100,000 for 24-hour AD&D.

John Hancock’s best feature is its reimbursement for travel woes. If you’re delayed, your bags are lost or you end up missing a connection, John Hancock’s plan offers some of the highest coverage around.

And unlike other companies, it doesn’t limit missed connection reimbursements to cruises or tours only.

Travel Insured International

What makes Travel Insured International a top choice for CFAR insurance:

$1,000,000 for medical evacuation and repatriation.

$150,000 for non-medical evacuation.

$1,500 for travel delay after three hours.

$500 for baggage delay after three hours.

As our most expensive option, Travel Insured International may be a hard sell. This is especially true if you’re looking for basic CFAR coverage.

However, it’s worth researching as the plan includes high-dollar reimbursements after very short delays, such as $1,500 for a three-hour travel delay.

More resources for travel insurance shoppers

Take a look at these other resources if you’re trying to decide when and where to purchase travel insurance.

Is Cancel For Any Reason travel insurance worth it?

What is travel insurance?

10 credit cards that provide travel insurance .

How to find the best travel insurance .

Trip cancellation insurance explained .

Is travel insurance worth it?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

American Express® Trip Cancel Guard™

Book with optimism., cancel with confidence..

With Trip Cancel Guard, you can cancel your flight for any reason up to 2 full calendar days before departure and receive up to 75% reimbursement when an airline credit or voucher is not available or expires. Available exclusively with flights booked on AmexTravel.com.

Please review the FAQs below to learn more.

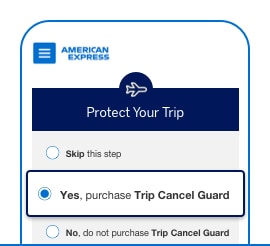

Purchase and Use Trip Cancel Guard in 3 easy steps ✝ :

1. Purchase Your Trip and Trip Cancel Guard

Purchase Trip Cancel Guard when booking an eligible flight itinerary through AmexTravel.com

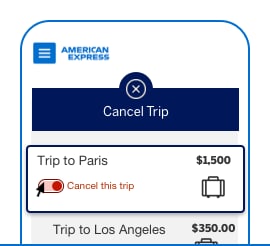

2. If You Cancel Your Trip

Contact your airline or American Express Travel® to cancel your flight for any reason at least two calendar days before your departure date

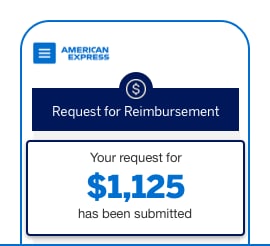

3. Make A Request for Reimbursement

Once your trip is cancelled, submit a request online through the Digital Claims Center* or by phone and you may receive up to 75% reimbursement of nonrefundable flight costs

✝ Illustration only

Watch To Learn More

Terms apply. click here for terms and conditions..

QUICK FACTS:

Available for purchase with all US American Express® Cards

Cancel for any reason you choose at least 2 days before departure

Up to 75% reimbursement with a convenient digital process*

*Currently available for American Express Card Members only

American Express® Trip Cancel Guard™

The flexibility to change your mind.

There are some things you just can't plan for. Luckily, there's Trip Cancel Guard.

HOW IT WORKS:

Add Trip Cancel Guard and get up to 75% reimbursement if you cancel your eligible flight at least two full calendar days before. Available exclusively through AmexTravel.com at the time of booking.

Trip Cancel Guard is in effect until you cancel your benefit, submit a request for reimbursement on a canceled flight, or you reach your benefit end date. This benefit applies only before your trip starts and does not offer coverage during your trip or return flight. If you want to update or change your trip, you must call the Benefit Administrator to determine if the benefit can be applied to your updated itinerary. If you get a travel credit or airline voucher for your cancelled trip, Trip Cancel Guard can provide reimbursement once the credit or voucher has expired or is forfeited by its own terms and conditions.

Trip Cancel Guard is not insurance and may be purchased in addition to any other travel insurance.

Click here for Terms & Conditions

Ready to book your travel?

Purchase Trip Cancel Guard when booking an eligible flight itinerary through AmexTravel.com.

Frequently Asked Questions

What is Trip Cancel Guard?

Trip Cancel Guard is an optional add-on benefit available for certain travel itineraries booked through American Express TRS that allows You to receive reimbursement when You cancel Your trip for any reason at least two (2) full calendar days before Your Departure Date and before the Benefit End Date, as defined by the benefit terms & conditions. You may receive reimbursement of up to the amount stated on Your Schedule of Benefits, which is up to 75% of Your Nonrefundable Prepaid Expenses. This benefit is a cancellation fee waiver and is not an insurance product .

When do I need to cancel my trip Itinerary by to be eligible for Trip Cancel Guard reimbursement?

You must cancel Your trip with American Express TRS or Your airline carrier prior to the restricted period, which includes the 2 full calendar days before Your original scheduled Departure Date. The Benefit End Date is the date by which You need to cancel before 11:59 PM in order to be eligible for benefits and is listed on Your Schedule of Benefits. Below are illustrative examples of eligible and non-eligible trip cancellation:

- This cancellation meets eligibility requirements

- This cancellation does not meet eligibility requirements. July 13th is one of the 2 full calendar days prior to the trip Departure Date

Can I purchase Trip Cancel Guard in addition to Travel Insurance?

Yes! You may purchase Trip Cancel Guard in addition to any other travel insurance. Trip Cancel Guard will provide reimbursement if You decide to cancel Your trip for any reason at least two (2) full calendar days before Your Departure Date and before the Benefit End Date, as defined by the benefit terms & conditions. Please review Your travel insurance policy details for the specific reasons that trip cancellation insurance coverage is different from Trip Cancel Guard and whether You are eligible for benefits under one or both.

Will I receive reimbursement from Trip Cancel Guard if I receive a travel credit or voucher for my cancelled trip?

If You have purchased Trip Cancel Guard and receive a travel credit or airline voucher for Your cancelled itinerary, Your eligibility for reimbursement from Trip Cancel Guard may be delayed until the credit or voucher expires or is forfeited by its own terms and conditions. If the credit or voucher expires or is forfeited, You may reopen Your request for benefit.

If You are charged and pay an additional penalty fee due to cancellation to receive or use a travel credit or voucher provided for Your cancelled itinerary, You may make a request to receive reimbursement for those penalty fees charged and paid due to cancellation, regardless of credit or voucher status or when fee is charged.

Cancellation fees charged by airlines may go by different names, but only fees that were charged and paid directly as a result of trip cancellation will be eligible for reimbursement.

Am I eligible to receive this benefit for itineraries purchased with frequent flyer points or other travel credits?

This benefit is available for itineraries paid with American Express Membership Rewards® points only when used through the Pay with Points Program. This benefit is not available, however, for travel purchased with travel award credits such as loyalty points, vouchers, credits, coupons or similar programs offered by travel suppliers including airlines or American Express Travel & Lifestyle Services. Additionally, this benefit is not available for travel purchased with travel supplier credits obtained by exchanging American Express Membership Rewards points for those travel supplier credits.

Can I add Trip Cancel Guard to an existing itinerary?

No, this benefit may only be purchased at the time of booking the itinerary and cannot be added after the booking is completed.

If I experience a website error, can I call in to purchase Trip Cancel Guard?

If You are experiencing a website error, please check back later as the Trip Cancel Guard is not available for purchase offline.

What if I change my original flight itinerary after the purchase date?