You are using an outdated browser. Please upgrade your browser to improve your experience.

PLATINUM INSURANCE

Travel insurance benefits for you, your Supplementary Cardmembers, from the moment you use your card for a trip, rent a car or purchase an item.

Terms and conditions apply

If you need Baggage Assistance

In the event that your checked baggage is lost by a commercial carrier, Platinum Travel Assistance will make every effort to track down your missing luggage and keep you posted on their progress. Should Platinum Travel Assistance not be able to recover your luggage, you will be reimbursed up to a maximum of US$1,200 per trip.

WHO'S COVERED? Platinum Travel Assistance services are provided by AXA Assistance USA, a division of the AXA Group, are given the name of Platinum Travel Assistance and are valid only for American Express International Dollar Platinum Card Members or the Additional Card Members. The Platinum Travel Assistance services will be valid only during the time in which the American Express Platinum Card account continues active and in good standing.

Platinum Travel Assistance is underwritten by AXA Assistance USA Coverage is determined by the Terms, Conditions, and Exclusions of service and is subject to change without notice.

KEY EXCLUSIONS & LIMITATIONS Depending on the case, different coverage may apply. The coverage provided by AXA Assistance USA is restricted to emergent situations that arise directly and independently of all other causes.

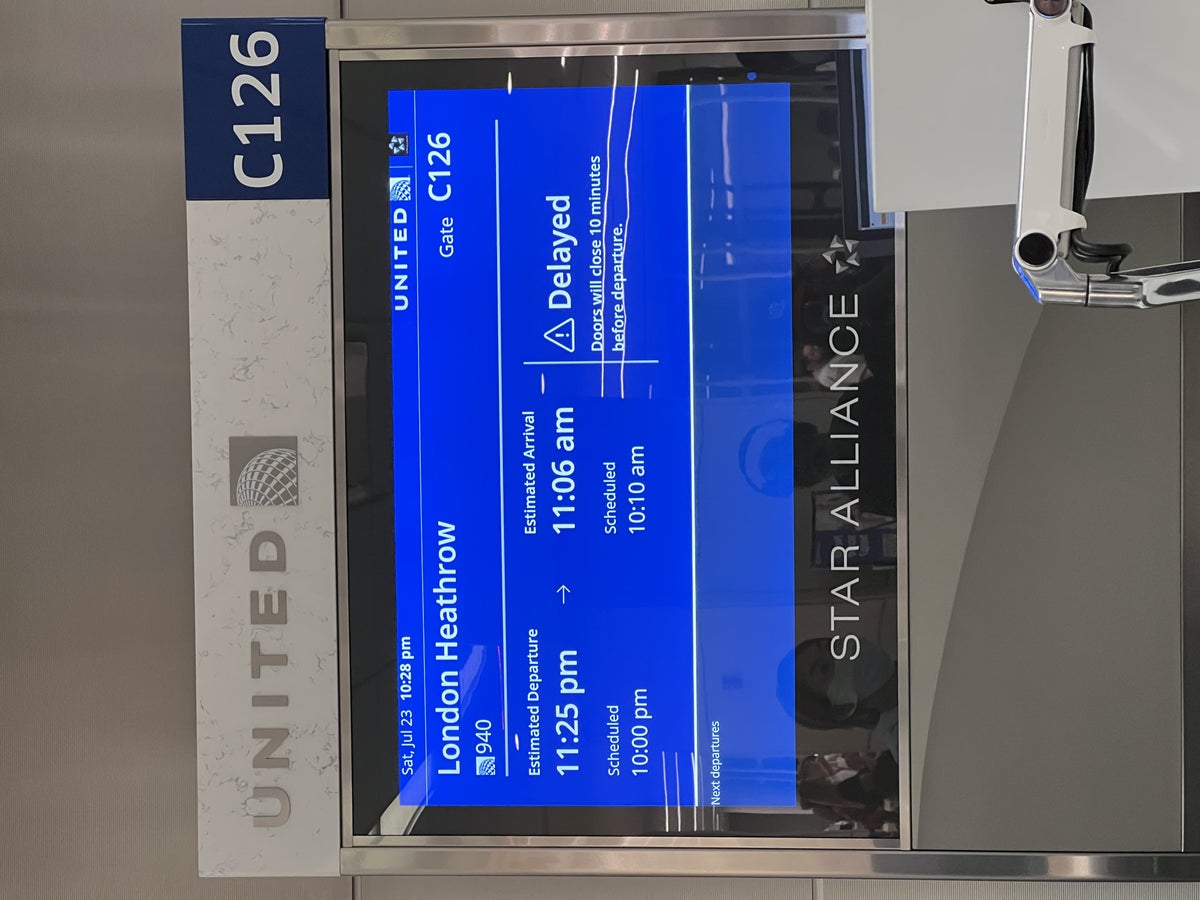

If you experience a delay on your journey, missed a connection or overbooked flight

The Travel Inconvenience Insurance Plan provides benefits in the event of: Missed Departures and Missed Connections; delay, cancellation or overbooked flights; and Luggage Delay and Extended Luggage Delay when the Covered Trip is purchased and charged to your American Express International Dollar Card (IDC).

- Up to US$250 per covered person for alternate travel, restaurant meals or refreshments

- Up to US$1,000 if your baggage is delayed after four hours for purchasing of essential clothing.

WHO'S COVERED?

You are eligible for coverage if you are an American Express International Dollar Card Platinum Card Member.

The Travel Inconvenience Insurance Plan is underwritten by Indemnity Insurance Company of North America Administrative Office, The Corporate Center 33 Resolución Street, Suite 500 San Juan, Puerto Rico 00920-2707. Coverage is determined by the Terms, Conditions, and Exclusions of policy 58US3760 and is subject to change with notice. This document does not supplement or replace the policy.

KEY EXCLUSIONS & LIMITATIONS

In no event will duplicate or multiple American Express Cards obligate the Company in excess of the limit stated herein for expenses incurred by any one individual Covered Person as a result of any one incident covered under this Policy.

EXCLUSIONS The Policy does not cover

1) additional costs where the airline, rail or ship operator has offered alternative travel arrangements and these have been refused or where the Covered Person has voluntarily accepted compensation from the airline, train or ship operator in exchange for not traveling on an overbooked flight.

2) Claims where the Covered Person has failed to obtain a Property Irregularity Report from the relevant airline authorities of missing baggage at scheduled destination.

3) Industrial Action which has commenced or has been announced prior to booking your Covered Trip.

4) Covered Trips in, or booked to, countries where a government agency has advised against traveling or which are officially under embargo by the United Nations.

5) Any fraudulent, dishonest or criminal act committed by the Covered Person, or any with whom the Covered Person is in collusion.

6) Terrorist activities except while on a public vehicle.

7) Declared or undeclared war or hostilities.

8) Biological, chemical, nuclear or radioactive incidents.

If you need Medical Assistance

Should you have a medical emergency while traveling, Platinum Travel Assistance can provide you with medical assistance in consultation with local treating physicians. Medical visits to your hotel can also be arranged, depending on the circumstances and the resources available in each country. This assistance includes the following benefits per trip among others*:

- US$100,000 for emergency medical transportation**

- US$250,000 for emergency medical services

- US$1,000 for emergency dental treatment

- US$1,000 for prescription expenses

*Benefit limits apply. Please read important exclusions, restrictions and Terms and Conditions . Card Members whose permanent address of residence is in Spain or Switzerland are not eligible for Platinum Travel Assistance.

**While traveling more than 100KMs away from home in the same country of residence, only the emergency medical transportation service is available

If you suffer serious injury on your trip

Travel Accident Insurance offers a coverage of up to US$500,000 in case of accidental death or dismemberment while traveling on a Common Carrier Conveyance (plane, train, ship or bus), when the entire fare has been charged to The Platinum Card.

WHO IS COVERED? A person shall be a Covered Person under the Master Policy No. 58US3199 only if: He or she is: a. a Basic or Additional Card Member who has the International Dollar Card Platinum Card issued by American Express Travel Related Services (“American Express”) in his or her name; or b. the legally married spouse or Dependent Child under age 23 of any eligible person described in a) above. For the purpose of this Policy, a common law marriage is not considered a legal marriage. Dependent Child means a legally dependent child, including a stepchild or legally adopted child of any eligible person described in a) or b) above; and who is wholly dependent on such eligible person(s) for financial support.

Travel Accident Insurance Plan is underwritten by Indemnity Insurance Company of North America, Administrative Office, Doral Bank Center Calle Resolución #33, Suite 500, San Juan, Puerto Rico 00920. Coverage is determined by the Terms, Conditions, and Exclusions of policy No. 58US3199 and is subject to change with notice. This document does not supplement or replace the policy.

KEY EXCLUSIONS & LIMITATIONS The Policy does not cover any Loss caused or contributed to by:

- suicide or self-destruction or any attempt threat;

- war or any act of war whether declared or undeclared;

- injury to which a contributory cause was the commission of or attempt to commit, an illegal act by or on behalf of the Covered Person or his or her beneficiaries;

- injury received while serving as an operator or crew member of any conveyance.

If you need Legal Assistance

Platinum Travel Assistance can put you in contact with a lawyer in the country in which you are traveling. Should you need legal defense, Platinum Travel Assistance will provide legal assistance in the form of advanced legal and bail fees, up to US$10,000 per trip. All legal assistance funds advanced will be charged to your Platinum Card account automatically.

WHO IS COVERED?

Platinum Travel Assistance. The Travel Assistance services are provided by AXA Assistance USA, Inc. ("AXA"), an AXA Group company, are given the name of Platinum Travel Assistance and are valid only for American Express International Dollar Card Platinum Card Members or the Additional Card Members. The Platinum Travel Assistance services will be valid only during the time in which the American Express Platinum Card account is active and in good standing.

The use of the Platinum Travel Assistance Service implies that the Basic Card member understands and accepts the General Conditions.

KEY EXCLUSIONS & LIMITATIONS The following general terms and conditions are in effect when services are provided by AXA and/or vendors and providers through which services are coordinated on behalf of the Card Member while traveling outside of his or her country of permanent residence or when 100 KMs away from home. The services provided by AXA are restricted to emergency situations that arise directly and independently of all other causes, resulting in external bodily injury, of violent and/or accidental means or of a medical condition which is sudden, unanticipated and urgent which requires immediate medical or surgical evaluation or treatment to provide relief of acute pain and suffering

If you are renting a vehicle

Car Rental Loss and Damage Insurance reimburses a Card Member for payments for damage to or theft of a Rental Auto that the Card Member is required to make, up to the lesser of:

- the actual cost to repair the Rental Auto, or

- the published Book value or, if not available, the purchase invoice price of the Rental Auto minus salvage and depreciation costs, or

- fair market commercial value of the Rental Auto.

The coverage also reimburses the Card Member for reasonable charges (those charges incurred at the closest facility that are usual and customary in the vicinity in which the loss or disablement took place) imposed by the Rental Company, such as towing, storage, loss of use (loss of use means proven loss of income to the Commercial Car Rental Company where no additional sources of income exist to offset this loss. Reasonable and customary charges are substantiated by documentation supporting loss of use such as fleet utilization logs; loss of use does not include Commercial Car Rental Company administrative fees), which the Rental Company would not have imposed had the Card Member accepted its full CDW, or partial collision damage waiver. Car Rental Loss and Damage Insurance covers no other type of loss. For example, in the event of a collision involving the Card Member’s Rental Auto, damage to any other driver’s car or the Injury of anyone or anything is not covered. Note: This policy does not provide liability coverage for Uninsured Motorists; benefits under any Worker’s Compensation law, Disability benefits law or other mandated Government Plans.

Certain restrictions apply. Some vehicles are not covered.

WHO IS COVERED? Any individual who has been issued an American Express IDC Platinum Card and who has an American Express Card Account.

Car Rental Loss and Damage Insurance Plan is underwritten by Indemnity Insurance Company of North America, Administrative Office, Doral Bank Center Calle Resolución #33, Suite 500, San Juan, Puerto Rico 00920. Coverage is determined by the Terms, Conditions, and Exclusions of Policy No. 58US3775 and is subject to change with notice. This document does not supplement or replace the policy.

KEY EXCLUSIONS & LIMITATIONS Vehicles Not Covered Car Rental Loss and Damage Insurance does not cover rentals of:

- expensive cars, which means cars with an original manufacturer’s suggested retail price of $50,000 or more when new;

- exotic cars regardless of year or value, including but not limited to Chevrolet Corvette, Toyota Supra,Mazda RX-7, Dodge Viper and Stealth, Plymouth Prowler, Mitsubishi 3000 GT, Nissan 300 ZX, Jaguar XJS, Acura NSX,Mercedes SL, SLK, S Coupe and E320 Coupe and Convertible, BMWM3, Z3 and 8 Series, Cadillac Allante and all Porsche, Ferrari, Lamborghini, Maserati, Aston Martin, Lotus, Bugatti, Vector, Shelby Cobra, Bentley, Rolls Royce;

- trucks, pick-ups, cargo vans, custom vans;

- full-sized vans, including but not limited to, Ford Econoline or ClubWagon, Chevy Van or Sportvan, GMC Vandura and Rally, Dodge Ram Vans and RamWagon;

- vehicles which have been customized or modified from the manufacturer’s factory specifications except for driver’s assistance equipment for the physically challenged;

- vehicles used for hire or commercial purposes;

- mini-vans used for commercial hire; Note: PassengerMini-Vans (Not CargoMini-Vans) with factory specified seating capacity of 8 passengers or less, including but not limited to, Dodge Caravan, Plymouth Voyager, FordWindstar and Nissan Quest, are covered when rented for personal or business use only.

- antique cars, which means cars that are 20 years old or have not been manufactured for 10 or more years;

- limousines;

- full sized sport utility vehicles, including but not limited to, Chevrolet/GMC Suburban, Tahoe and Yukon, Ford Expedition, Lincoln Navigator, Toyota Land Cruiser, Lexus LX450, Range Rover or fullsized Ford Bronco;

- sport/utility vehicles when driven “off-road”; and Note: Compact sport/utility vehicles, including but not limited to Ford Explorer, Jeep Grand Cherokee, Nissan Pathfinder, Toyota Four Runner, Chevrolet Blazer and Isuzu Trooper and Rodeo are covered when driven on paved roads.

- off-road vehicles, motorcycles, mopeds, recreational vehicles, golf or motorized carts, campers, trailers and any other vehicle which is not a Rental Auto.

If you need to protect your purchases

Purchase Protection provides coverage for your purchases for ninety (90) days from the date of purchase when you charge any portion of the price of the purchased item to your Account. You will be reimbursed only for the amount charged to your Account.

Purchase Protection Program is underwritten by Indemnity Insurance Company of North America Administrative Office, The Corporate Center 33 Resolución Street, Suite 500 San Juan, Puerto Rico 00920-2707. Coverage is determined by the Terms, Conditions, and Exclusions of policy 58US3762 and is subject to change with notice. This document does not supplement or replace the policy.

KEY EXCLUSIONS & LIMITATIONS Benefits are not payable if the loss for which coverage is sought was directly or indirectly, wholly or partially, contributed to or caused by:

- Intentional damage to the covered item;

- war or any act of war, whether declared or undeclared;

- any activity directly related to and occurring while in the service of any armed military force of any nation state recognized by the United Nations;

- participation in a riot, civil disturbance, protest or insurrection;

- violation of a criminal law, offense or infraction by the Cardmember;

- natural disasters, including, but not limited to, hurricanes, floods, tornados, earthquakes or any other event in the course of nature, that occurs at the same time or in separate instances;

- fraud or abuse or illegal activity of any kind by the Cardmember;

- confiscation by any governmental authority, public authority, or customs official;

- negligent failure of a duty to care by any third party in whose possession the property purchased by a Cardmember has been temporarily placed;

- not being reasonably safeguarded by You;

- theft from baggage not carried by hand and under Your personal supervision or under the supervision of a traveling companion known by You;

- damage through alteration (including, but not limited to, cutting, sawing and shaping);

- normal wear and tear, inherent product defect or manufacturer's defects or normal course of play;

- damage or theft while under the care and control of a common carrier;

- food spoilage;

- leaving property at an unoccupied construction site; or

- purchases lost or misplaced.

Deductible applicable to Purchase Protection Cover $75 per claim

If you need to extend the warranty of your purchases

Extended Warranty will extend the terms of the Original Warranty for a period of time equal to the duration of the Original Warranty, up to one (1) additional year on warranties of five (5) years or less that are eligible in a Covered Territory*.

The coverage provided under this benefit is EXCESS of other sources of indemnity.

*Covered Territory means the 50 States of the United States of America, District of Columbia Commonwealth of Puerto Rico and the Virgin Islands of the United States.

Extended Warranty Program is underwritten by Indemnity Insurance Company of North America Administrative Office, The Corporate Center 33 Resolución Street, Suite 500 San Juan, Puerto Rico 00920-2707. Coverage is determined by the Terms, Conditions, and Exclusions of policy 58US3763 and is subject to change with notice. This document does not supplement or replace the policy.

KEY EXCLUSIONS & LIMITATIONS Benefits are not payable if the Loss for which coverage is sought was directly or indirectly wholly or partially, contributed to or caused by:

- any physical damage, including, but not limited to, damage as a direct result of natural disaster or a power surge, except to the extent the Original Warranty covers such damage;

- mechanical failure covered under product recall; or

- fraud or abuse or illegal activity of any kind by the Cardmember

IMPORTANT INFORMATION: Descriptions of Platinum Card® insurance coverages are provided on this Web site for informational purposes only. The Terms and Conditions provide complete coverage information and supersede all other sources.

To review Terms and Conditions, please download

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards, trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, premium global assist, global assist hotline, standalone american express travel insurance plans, should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

For example, The Platinum Card® from American Express includes trip cancellation protection, trip interruption coverage, trip delay insurance, rental car insurance, baggage coverage and access to a 24/7 hotline called Premium Global Assist. Terms apply.

» Learn more: How The Platinum Card® from American Express travel insurance works

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas.

You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

The Platinum Card® from American Express .

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve American Express Card .

Delta SkyMiles® Reserve Business American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant® American Express® Card .

Terms apply.

Covered amount

The maximum reimbursed amount for the trip cancellation benefit is $10,000 per covered trip and $20,000 per year. The trip interruption benefit is also $10,000 per covered trip and $20,000 per year. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold, and you are allowed two claims per 12-month period. As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

As of Jan. 1, 2020, the Hilton Honors American Express Card , The Amex EveryDay® Preferred Credit Card from American Express and The Blue Business® Plus Credit Card from American Express no longer offer baggage insurance protections.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

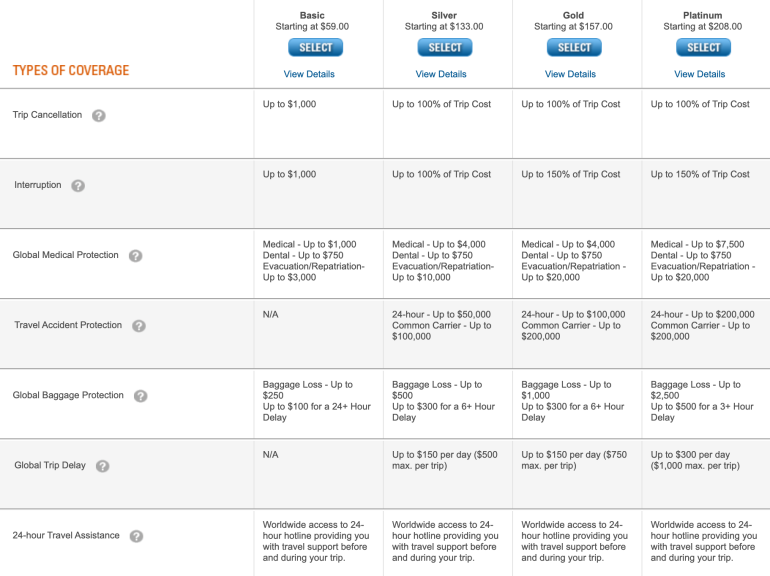

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip. Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

All information about The Platinum Card® from American Express , Business Green Rewards Card from American Express , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Gold American Express Card , Delta SkyMiles® Blue American Express Card , Amex EveryDay® Credit Card , Blue Cash Preferred® Card from American Express , Centurion® Card from American Express, Business Centurion® Card from American Express, The Corporate Centurion® Card from American Express, The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, The Corporate Platinum Card® and the Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. The Platinum Card® from American Express, Business Green Rewards Card from American Express, Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Platinum American Express Card, Delta SkyMiles® Gold American Express Card, Delta SkyMiles® Blue American Express Card, Amex EveryDay® Credit Card, Blue Cash Preferred® Card from American Express, Centurion® Card from American Express, Business Centurion® Card from American Express, The Corporate Centurion® Card from American Express, The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, The Corporate Platinum Card® and the Hilton Honors American Express Aspire Card are no longer available through NerdWallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Comparing travel protections with the Chase Sapphire Reserve and Amex Platinum

The Chase Sapphire Reserve and The Platinum Card® from American Express are two of the most popular travel rewards cards . After all, both cards offer valuable transferable rewards , lounge access and the ability to receive elite-like perks when booking hotels through Amex's Fine Hotels & Resorts program and Chase's Luxury Hotel & Resort Collection .

Like many of the top rewards cards , the Chase Sapphire Reserve and Amex Platinum Card also provide travel insurance when you use your card to book travel. In particular, these two premium travel rewards cards offer an excellent combination of trip insurance and bonus earnings on select travel purchases. So, in this guide, let's compare the travel insurance provided by these two cards.

Overview of the travel insurance provided by these cards

* Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company. ^ Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc. # Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers. † Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

As you can see in the table above, the Amex Platinum doesn't provide baggage delay insurance , emergency medical and dental benefits , roadside assistance or travel accident insurance . For brevity, I won't discuss the types of insurance the Amex Platinum doesn't provide any further in this guide.

Instead, I'll compare the protections head-to-head for the types of insurance provided by both cards. You can find the guide to benefits for both cards as follows:

- Chase Sapphire Reserve benefits guide

- Amex Platinum benefits guide

And to learn more about both cards, check out our Chase Sapphire Reserve credit card review and Amex Platinum card review .

Related: Amex Platinum vs. Chase Sapphire Reserve: Which card is right for you?

Trip delay insurance

Trip delay insurance may provide reimbursement for reasonable expenses during a delay when traveling on a common carrier. Here's a comparison of the Chase Sapphire Reserve 's and Amex Platinum Card 's trip delay insurance.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

As you may gather from the above table, the primary differences in trip delay coverage are:

- The Amex Platinum requires round-trip travel, which you must buy with your card (in whole or combination with other eligible methods).

- The Amex Platinum doesn't cover overnight delays that are less than six hours.

- The Amex Platinum caps your claims to two per 12-month period.

- The Amex Platinum covers traveling companions as long as you pay for their round-trip common carrier fares with your card.

- The Chase Sapphire Reserve explicitly covers delays due to strikes, while the Amex Platinum explicitly covers delays due to lost or stolen passports or travel documents.

Related: Chase paid for my $1,100-per-night hotel room thanks to built-in trip delay coverage

Trip cancellation/interruption insurance

Trip cancellation and interruption insurance may provide reimbursement for nonrefundable, prepaid trip expenses when you must cancel or alter a trip due to a covered situation. In some cases, you may be covered for additional expenses. Here's a comparison of the Chase Sapphire Reserve 's and Amex Platinum Card 's trip cancellation and interruption insurance:

* Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

As you can see in the above table and the related benefits guides, the primary differences in trip cancellation and trip interruption coverage are:

- The Amex Platinum requires round-trip travel , paid with your card (in whole or in combination with other eligible methods). Only travel expenses put on the card used for round-trip common carrier travel will be covered.

- The Amex Platinum may cover the cost to return home or rejoin the trip if your trip is interrupted.

- The Chase Sapphire Reserve may reimburse redeposit fees imposed by a rewards program if your trip is canceled or interrupted, as well as change fees and car positioning fees if your trip is interrupted.

- The Chase Sapphire Reserve covers more types of losses, including if your accommodation at your destination is made uninhabitable or your host at your destination dies or is hospitalized.

- The Amex Platinum excludes losses related to mental or emotional disorders unless hospitalized. The Amex Platinum also excludes losses that occur when you're intoxicated. The Chase Sapphire Reserve excludes any loss for any trip booked while on a waiting list for specified medical treatment.

Check out American Express' trip cancellation and interruption insurance coronavirus frequently asked questions if you're wondering whether the Amex Platinum's insurance will cover coronavirus -related cancellations or interruptions.

Related: Be careful: Avoiding outbreaks isn't covered by most travel insurance

Auto rental collision damage waiver

The collision damage waiver offered by both cards can cover your rental car if you're in an accident or if it's stolen or damaged. Here's a comparison of the Chase Sapphire Reserve 's and Amex Platinum Card 's rental car insurance.

^ Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc.

As you can see in the above table and the related guide to benefits, the primary differences in car rental collision damage protection are:

- The Chase Sapphire Reserve covers more types of vehicles.

- The Chase Sapphire Reserve provides primary coverage.

- The Chase Sapphire Reserve doesn't have country exclusions.

- The Amex Platinum offers coverage to spouses when payment is made with an eligible card.

- While the Amex Platinum coverage specifically mentions peer-to-peer rentals, it's unlikely your Sapphire Reserve would cover Turo rentals .

If you'd prefer to get primary coverage for rental cars when using American Express cards , you can enroll in American Express' Premium Car Rental protection .

Related: 11 common rental car mistakes — and how to avoid them

Emergency evacuation and transportation insurance

The emergency evacuation and transportation insurance provided by these cards can arrange and pay for necessary emergency medical transport and evacuation under eligible circumstances. Here's a comparison of the Chase Sapphire Reserve 's and Amex Platinum Card 's emergency evacuation and transportation insurance.

# Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

As you can see in the above table and the related guide to benefits, the primary differences in the emergency medical evaluation benefit are:

- You're covered by the Amex Platinum even if you use another card to purchase your common carrier fare, whereas you must at least partially pay with the Chase Sapphire Reserve or associated rewards to be covered.

- The Chase Sapphire Reserve has stricter requirements for trip length.

- Both cards offer additional benefits that can bring a family member to your side or return now-unaccompanied minors home.

Related: A Medjet medical transport membership is different than travel insurance. Here's why you need both

Lost luggage reimbursement

The lost luggage benefit offered by both cards may reimburse you if your baggage is lost, damaged or stolen during a trip. Here's a comparison of the lost luggage reimbursement provided by the Chase Sapphire Reserve and Amex Platinum Card .

† Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

As you can see in the above table and the related guide to benefits, the primary differences in lost luggage reimbursement are:

- The Amex Platinum explicitly notes that losses due to confiscation by TSA aren't excluded.

- The Chase Sapphire Reserve covers a broader selection of family members when you pay for their ticket using your card.

- The cards exclude different types of items and types of loss.

Related: Everything you need to know about Amex's baggage insurance plan

When should I use the Chase Sapphire Reserve vs. the Amex Platinum?

The Platinum Card from American Express earns 5 Amex Membership Rewards points per dollar spent on flights booked directly with airlines or with American Express Travel (on up to $500,000 of these purchases per calendar year, then 1 point per dollar) for an approximate 10% return based on TPG's valuations . The Chase Sapphire Reserve earns 10 Chase Ultimate Rewards points per dollar on hotels and rental cars purchased through the Chase Travel portal , 5 points per dollar on flights booked through this portal, 10 points per dollar on Lyft rides through March 2025 and 3 points per dollar on all other travel (bonus points earning comes into effect after exhausting the $300 annual travel credit ).

The Sapphire Reserve has an annual fee of $550 while the Amex Platinum Card has a $695 annual fee (see rates and fees ).

Related: Amex Membership Rewards vs. Chase Ultimate Rewards: Which is the best?

Despite the earning gap (which can sway one way or the other, depending on how you book your flights), you may want to use the Chase Sapphire Reserve when booking some common carrier travel. I recommend checking out the guide to both cards' benefits and considering which card is best for your travel expenses. To help, here are some reasons to consider each card.

Reasons to use the Chase Sapphire Reserve

- Offers a baggage delay benefit , an emergency medical and dental benefit, and roadside assistance up to $50 up to four times a year.

- Only a portion of your travel expenses must be charged to your card to unlock most benefits (whereas the Amex Platinum generally only provides benefits when you charge the entire common carrier fare to your card).

- No requirement for round-trip travel.

- Provides trip delay benefits if you're delayed overnight for less than six hours.

- Provides primary car rental coverage.

- Offers travel accident insurance (although the Amex Platinum provides some travel accident insurance on car rentals).

- Includes strikes as an eligible reason for trip delay insurance.

- May reimburse redeposit fees imposed by a rewards program under trip cancellation/interruption insurance .

OFFICIAL APPLICATION LINK: Chase Sapphire Reserve

Reasons to use the Amex Platinum

- Provides an emergency medical evacuation benefit to cardmembers regardless of whether you charged any trip expenses to the card.

- Covers traveling companions for trip delay insurance and trip cancellation/interruption insurance when you purchase their round-trip fare with your card.

- May reimburse additional transportation expenses to rejoin the common carrier covered trip or return to the place of origin; also may cover the purchase of tickets for a new departure, under trip interruption insurance.

- Includes lost or stolen passports or travel documents as an eligible reason for trip delay insurance.

- Has a higher cap on high-value items for lost, damaged or stolen baggage.

- Some readers have found the claim process to be more straightforward and simple.

OFFICIAL APPLICATION LINK: The Platinum Card from American Express

Bottom line

Some travelers who have both cards put their flights on the Amex Platinum to earn 5 points per dollar and put other travel expenses on the Chase Sapphire Reserve to earn 3 points per dollar and activate their trip cancellation and interruption protections.

You might want to keep the Amex Platinum primarily for Centurion Lounge access , hotel elite status and access to Amex Fine Hotels & Resorts , as well as nearly $1,500 in annual credits available to cardmembers.

However, you might want to avoid booking flights with the Amex Platinum because of the round-trip requirement and the lack of baggage delay protection . Instead, you'd prefer to use the Chase Sapphire Reserve for common carrier fares and other travel expenses .

Additional reporting by Ryan Smith.

For rates and fees of the Amex Platinum card, click here .

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

American Express Travel Insurance

Travel Insurance Plans from AMEX

American Express is one of the world’s oldest financial institutions . It offers the public its famous credit cards and traveler’s checks. Many people don’t know that it also offers travel insurance that can be purchased independently. Their travel insurance is available in conjunction with other services for credit card members. It’s also available on its own! You don’t need to be a cardholder to carry American Express travel insurance or to benefit from its many excellent features. Even as a cardholder, you’ll likely want to supplement your included coverage with extra insurance for the greatest coverage and flexibility.

American Express, one of the best travel insurance companies , offers stand-alone travel insurance that is well respected for its easy-to-understand coverage and benefits. The company offers a wide variety of plans and the only specialty program they are lacking is student-focused coverage . As with many companies, some American Express travel insurance plans require a medical questionnaire. However, a few travelers report that they find American Express policies on pre-existing conditions confusing. Make sure you understand what is and is not covered. As always, answer all questions accurately.

What can you expect from American Express travel insurance? No matter where you are from, you can depend on them for great service and coverage. But when it comes to the particulars of the program, it can vary by country. This is a global company, after all!

Here are two examples of how American Express travel insurance works, in the United States and Canada.

AmEx Travel Insurance – Coverage Options for United States Citizens

For American travelers, American Express travel insurance offers many options – but they’re not neatly categorized. Right off the bat, American travelers will notice something unique. They have the option of choosing between a number of pre-set packages or building their own insurance package. This flexibility is fantastic. There really is something for everyone, from the traveler who wants simple, affordable coverage for a short trip to a frequent flyer who needs a tricky combination to meet their unique needs.

Another feature that is unique to American travelers? They also have to enter information about which state they reside in, as well as the cost of their trip. For semi-nomadic domestic travelers, answering a question about residency might be easier said than done.

The AMEX travel insurance will cover trip cancellation , interruption and delays, travel medical, lost luggage, and provides worldwide travel assistance services. You have the option to buy multiple levels of coverage, including Basic, Silver, Gold, and Platinum, with each providing an increasing amount of coverage for each benefit.

American Express Trip Cancellation Insurance Options

The Basic package is all about affordable peace of mind. It includes moderate coverage for trip interruption, trip cancellation, and global baggage protection. Coverage for medical expenses is more generous, and medical evacuation is included too. Costs start at less than $100, making it the perfect choice for frugal adventurers.

The costs of the Silver package are about double that of the Basic package. But for the price, you get a lot more bang for your buck. The coverage levels in every category are significantly higher. For instance, while the Basic package offers up to $1,000 for Trip Interruption coverage, the Silver package offers up to 100% of the trip cost. Medical coverage is up to 5 times as comprehensive as what’s offered in the Basic package. There’s also extra coverage for a Global Trip delay. Given that rates for the Silver package can still be less than $100, this is an extremely high-value package.

The Gold package really shines with Trip Interruption and Global Baggage Protection. This is an excellent choice for anyone who feels comfortable with the amount of medical coverage offered at the Silver level but wants to have extra protection for their trip-of-a-lifetime investment. If you’re heading on a safari with awesome new travel gear, this is the package for you.

Just as the name suggests, the Platinum package excels in every single level of coverage. It’s the perfect choice for anyone who seeks the broadest amount of protection, peace of mind, and reassurance.

US Citizens Can Build Your Own Plan: Choices, Choices, Choices

With the variety found in the packaged plans, American travelers who are interested in American Express travel insurance might wonder why they’d check out the “Build Your Own Coverage”. The answer is incredible flexibility and fantastic choices. From a long menu of clearly presented choices, complete with prices, all options are clearly outlined.

Health-focused travelers can direct their money to medical coverage and accident protection. Travelers carrying medical coverage through their workplace can top up their protection and focus on trip interruption and baggage protection. Adventure travelers who had to pre-purchase mandatory insurance from an activity provider can supplement their coverage for the rest of their trip. It’s an excellent solution for anyone whose travel plans seem to fall outside the box.

No matter which way you go, you can’t go wrong. It’s all about choosing the right plan for you – just like travel!

Related: Health Insurance for US Citizens Living Abroad

How Much Does AMEX US Travel Insurance Cost

For a 35-year-old traveler with a trip cost of $2,500, the Platinum Plan will cost $180 for a one-week trip.

The Voyager plan from GeoBlue is an excellent option for US citizens traveling abroad. Although this plan does not provide trip cancellation benefits, it does cover emergency medical, trip interruption, lost luggage, and more. The cost for this plan is less than $20 per week.

GeoBlue Voyager Plan

- For U.S. citizens up to age 95

- Includes pregnancy coverage, baggage loss, trip interruption & more

- 24/7/365 service and assistance

Another option Seven Corners Trip Insurance Plan , with similar coverage, including trip cancellation benefits, will cost $133 . Both AMEX and Round Trip offer more affordable options (with fewer benefits).

We Recommend Seven Corners Trip Insurance for Your Coverage

Seven Corners Trip Protection Insurance

- Comprehensive trip protection for U.S. residents traveling abroad.

- Optional rental car collision coverage available.

- Optional Cancel for Any Reason coverage available (if eligible).

AmEx Travel Insurance – Coverage Options For Canadian Citizens

In Canada, travelers can sign up for an annual travel insurance plan or buy coverage trip by trip. Multi-trip coverage has a choice of plans built around journeys of less than ten days or trips up to 31 days long. This flexibility is particularly well suited for Canadian travelers, who might make frequent trips to the United States or enjoy spontaneous last-minute trips to sunny destinations.

Whether Canadians choose an annual plan or coverage for just one trip, American Express offers four different levels of insurance plans.

The Basic Medical plan is straightforward and does just as the name suggests. It’s classic emergency medical travel insurance – and nothing else! You won’t get any compensation if your luggage goes missing or if you have to cancel your trip. However, it’s a fine choice for anyone who is focused on frugality and feels comfortable covering travel delays on their own.

One step up is the Essential Travel plan. This combines the peace of mind that comes from Basic Medical’s emergency medical travel insurance along with added trip interruption and baggage loss. As a result, it’s a really nice combination of coverage for serious health concerns and the most aggravating travel problems.

However, Essential Travel does NOT include trip cancellation coverage. You’ll find that under the Select Travel plan. It’s designed to keep your trip running smoothly, with trip cancellation insurance, trip interruption insurance, and baggage loss. Select Travel doesn’t include any element of emergency medical coverage, however. As such, it’s perfect for any traveler whose health-based insurance needs are already covered.

American Express travel insurance’s most comprehensive coverage of all, Ultimate Travel , combines all of the above. It includes emergency travel medical insurance, trip cancellation, trip interruption, and baggage loss. You’re covered for everything! That includes minor annoyances like losing your luggage as well as serious catastrophes when you can no longer continue your trip. While it is the most expensive option, it’s also the most comprehensive. Therefore, virtually every aspect of your journey is covered. Given how hard and long you’ve worked towards your trip, you don’t want anything to ruin the experience!

Best Travel Insurance Plan for Canadians Traveling Abroad

Patriot Platinum Travel Insurance

- Maximum limits up to $8,000,000

- IMG pays 100% of medical expenses in-network

- Evacuation due to Natural Disasters & Political Unrest

How Much Does AMEX Canadian Travel Insurance Cost

For a 35-year-old traveler with a trip cost of $2,500, the Ultimate Plan will cost $150 for a one-week trip.

Consider a Travel Medical Insurance Plan Instead

The above plans provide both trip cancellation coverage along with other benefits, including travel medical insurance . If you do not want to pay extra for the trip cancellation benefit, which can be expensive, and only want the other benefits, consider buying a travel medical insurance plan to save some money. Our recommended travel medical insurance plans are the Atlas Plan , for all travelers, and the GeoBlue Voyager plan, for US citizens. Instead of paying $100 or more for a Trip Cancellation plan, a travel medical plan can cost as little as $15 for a one-week trip!

- Emergency medical, evacuation, repatriation benefits

- Choose between the basic and more extensive coverage

- Meets Schengen visa insurance requirements

- 24/7 worldwide travel and emergency medical assistance

Also read: Choosing a Travel Medical Insurance Plan

American Express Travel Insurance in Other Countries

American Express does offer a variety of plans in other countries. They all vary in costs and benefits. They are regulated locally so are typically underwritten by a local service provider. In general, you will be able to find other options that provide similar coverage at a more affordable price. It is also best to shop around:

What Travel Insurance Benefits Do I Get With My American Express Card

This is a difficult question, primarily because each card’s benefits vary so dramatically. You need to do your research on their website to drill down into what you get based on the card you have. AMEX offers an AMEX Benefits page with details on the benefits provided with each card.

Contact Information if You Bought an AMEX Plan

For customer service or to file a claim for an AMEX policy, contact AMEX directly through the claims phone number or address, listed below, and found in your Certificate of Insurance/Policy under the benefit for which you are submitting a claim. To have an electronic copy of your Certificate of Insurance/Policy sent to you, call us with your request and the identification number you received at the time of your purchase.

- AMEX Servicing/Claims TollFree Number: 1-800-228-6855

- AMEX International Collect Number: 303-273-6497

- AMEX Mailing Address for Claims: PO-BOX 981553, EL PASO TX 79998-9920

Also read: Does My Credit Card Include Travel Insurance

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2023]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

81 Published Articles 457 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Compliance Editor & Content Contributor

78 Published Articles 639 Edited Articles

Countries Visited: 40 U.S. States Visited: 27

![american express platinum international travel insurance Full List of Travel Insurance Benefits for the Amex Gold Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Why We Like the Card Overall

Car rental loss and damage insurance, trip delay insurance, baggage insurance plan, travel accident insurance, emergency travel assistance, no foreign transaction fees, additional travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

Amex Gold Card — Snapshot

American Express ® Gold Card

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter