Expedia Rewards is now One Key™

Vacation payment plans - book now, pay later.

- Things to do

I only need accommodations for part of my trip

Better together

Save up to $580 when you book a flight and hotel together*

Find the right fit

With over 300,000 hotels worldwide, it's easy to create a perfect package

Plan, book, and manage your trip all in one place

Vacation payment plans

Jet off on your dream 2024 getaway with vacation payment plans by Expedia Affirm. From relaxing beach escapes to European city breaks, your next adventure is more affordable than you think thanks to Expedia’s book now, pay later vacations. Instead of paying the entire trip cost up front, pay-later travel deal lets you make monthly payments towards your adventure whether it’s in 2024 or 2025. Expedia Affirm gives you the option to spread the cost over 3, 6, or 12 months, with no hidden fees. This means you can bag the best travel deals with monthly vacation payment plans.

Wondering where to take your kids for a summer break in the sun? Choose from a vast array of family vacation packages with payment plans. Your kids could soon be swimming with dolphins in Cancun or riding rollercoasters in Florida’s theme parks. If it’s a romantic retreat you’re seeking, whisk your partner away to an adults-only resort by the beach. You’ll encounter a plethora of all-inclusive vacations with payment plans to hot destinations, including the Caribbean and the Maldives. Play around with the easy-to-use search wizard to view a wide range of book now, pay later vacations. Simply select “Monthly payments” at checkout to book your pay-later travel deal.

Worried your 2024 plans may change? No problem. Expedia Affirm lets you cancel or modify your booking at no extra cost. You’ll encounter epic vacation payment plans with flexible booking conditions for a vast array of accommodation, car rental, and travel packages. Read on for ideas and inspiration, with everything from romantic weekend getaways to all-inclusive vacations with payment plans.

Book now, pay later vacations

1. choose your dream expedia vacation.

Take your pick from hundreds of book now, pay later vacation packages. Need inspiration for 2024? Scroll down and you’ll encounter plenty of ideas for relaxing vacations with payment plans, including short getaways and international adventures. If you’ve got somewhere in mind, tap your dates and destination into the search wizard to compare the best pay-later travel deals.

2. Select the plan that works for you

Ready to snatch up one of Expedia’s book now, pay later vacations? Then click “Monthly payments” at checkout, “Continue to Affirm”, and enter a few pieces of information. It’ll give you an instant, real-time decision and display the vacation payment plans available. Pick the one that suits you best and you’re all set – your dream escape is booked.

3. Make simple and easy payments

Once you’ve reserved one of Expedia’s book now, pay later vacation packages, create your account to set up monthly payments. You can do so through the Affirm website or by downloading the app. Whichever option you choose, you can set up automatic payments in a few quick and easy steps.

Why book now, pay later with Expedia?

Whether it’s catching a tan in the Caribbean or soaking up the culture in Europe, you can now jet off on the adventure you’ve been dreaming of for years. With a vast array of destinations and vacation types available, Expedia Affirm makes travel more affordable than ever. Here are just some of the benefits of booking Expedia’s buy now, pay later vacations.

waiting until pay day to score the best discounts.

Frequently asked questions about payment plans to book now, pay later on Expedia

Can i pay monthly for my vacation with expedia.

Yes, you can pay monthly for your vacation with Expedia Affirm vacation payment plans. Simply choose your dream travel package and select “Monthly payments” at checkout. You’ll have the option to spread the cost over 3, 6, or 12 months, giving you financial flexibility when planning your dream getaway. These pay-later travel deals include all-inclusive escapes, family breaks, weekend getaways, and more. Thanks to Expedia’s vacation payment plans, you can now jet off on the adventure you’ve been dreaming of for years.

How to use Affirm on Expedia and where can I find this payment option?

To take advantage of Affirm’s vacation payment plans, choose your travel package and select “Monthly payments” at checkout. Click “Continue to Affirm”, enter your details, and you’ll get an instant, real-time decision. It’ll then display the final cost for spreading the cost over 3, 6, or 12 months. Choose the plan that’s right for you and you’re all set. You can then log in to Affirm or download the app to set up automatic payments.

How do I use Afterpay on Expedia?

Affirm is Expedia’s trusted partner for pay-later travel. Book with Expedia Affirm to spread the cost over 3, 6, or 12 monthly payments with simple interest and no hidden fees. You can even set up automatic payments on Affirm’s website or through the app. Expedia’s vacation payment plans are available on a vast array of packages, accommodation, and car rentals.

Is there a credit check when paying with a payment plan?

Yes, there is a credit check to see if you qualify for Expedia Affirm’s vacation payment plans. The good news is this pre-check will have no impact on your credit score. It’s quick and easy to perform, and you’ll get a real-time decision instantly. All you need to do is enter a few brief details to do the check.

Can I book all-inclusive vacations with payment plans?

With Expedia Affirm, you can book a vast array of all-inclusive vacations with payment plans. Choose to split the total cost of your escape into 3, 6, or 12 monthly installments. If you’re open to ideas and need inspiration, check out Expedia’s all-inclusive vacation packages to view some of the most popular deals. If you know where you’d like to jet off to, tap your dates and destination into the search wizard. Select the “All-inclusive” filter under “Meal plans available” to view hundreds of the best vacations with payment installments. Whether you’re craving white-sand beaches in the Bahamas or the tropical shores of Hawaii, your next getaway is more affordable than you think.

Can I book family vacation packages with payment plans?

You can book a wide range of family vacation packages with payment plans thanks to Expedia Affirm. Once you’ve found your perfect 2024 escape, click the “Monthly payment” tab at checkout and follow the quick and easy steps. You’ll have the option to pay in 3, 6, or 12 monthly installments with simple interest and no hidden fees. Take a peek at Expedia’s family vacations for ideas and inspiration. If you’ve got somewhere in mind already, enter your dates and destination into the search wizard to view hundreds of the best pay-later travel deals. From Florida’s exhilarating theme parks to the Dominican Republic’s fun-filled kid-friendly resorts, your family adventure is just a few clicks away.

What are the benefits of vacation payment plans?

Expedia’s book now, pay later vacations mean you can jet off on the dream trip you wouldn’t otherwise be able to afford in 2024. From romantic sunsets on Jamaica’s beaches to the elegant streets of Paris, the world is more accessible with Expedia Affirm. You’ll have the option to pay in 3, 6, or 12 monthly installments, and you’ll see the total cost up front. There are no hidden fees or late payment fees either, so you can rest assured that what you see is what you pay. Automatic payments are easy to set up and make for a hassle-free booking. Many of Expedia’s vacation packages even allow you to modify or cancel your trip at no extra cost, giving you peace of mind in case your 2024 plans change. As you no longer have to pay up front, you can nab the best travel deals before they’re gone – no need to save up or wait until payday.

How can I find great deals on vacation packages with payment plans?

If you’re keen to score the best deals on book now, pay later vacations in 2024, it’s a good idea to be flexible with your dates. You may find cheaper vacations on different days. For travel during peak season dates, be sure to book early to nab the best prices and your first choice of hotels – accommodation can fill up during busier months. If you plan to get away in low season, you may score a great deal for a last-minute escape. Another way to score great travel discounts is to take advantage of special offers, discounts, and promotions.

Are there any additional fees or interest charges for pay monthly vacations?

You’ll be pleased to know there are no hidden fees with Expedia Affirm’s monthly payment vacation plans. What you see is what you’ll pay. Before you confirm, you’ll be able to view the total cost of your book now, pay later vacation package. While most credit cards charge compound interest that’s complicated to work out, with Affirm you’ll pay simple interest on your monthly installments. Best of all, there are no late payment fees or just-because fees. Expedia Affirm’s simple and transparent pricing make booking your dream 2024 escape a breeze.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

Explore other types of vacation packages

All Inclusive Vacations

Beach Vacations

Kid Friendly Vacations

Golf Vacations

Luxury Vacations

Romantic Vacations

Ski Vacations

Adventure Vacations

Gay & Lesbian Vacations

Where to go when

- More Vacation Ideas

- Getaway Ideas

- Vacation Deals & Tips

- Top Vacation Destinations

- Best Travel Destinations by Month

- New Year's vacation deals

- Christmas vacation deals

- Spring travel deals

- Spring break vacation deals

- National Park Vacation Deals

- Northern Lights Vacations

- Memorial Day Weekend Getaways

- Fourth of July Weekend Getaways

- Labor Day Weekend Getaways

- MLK Day Weekend Getaways

- Thanksgiving Getaways

- Weekend Getaways

- 1 Day Getaways

- 2 Day Getaways

- 3 Day Getaways

- 4 Day Getaways

- 5 Day Getaways

- 6 Day Getaways

- One Week Getaways

- 8 Day Getaways

- Las Vegas Getaway

- Vacation Rental Deals

- Vacations under $1000

- Vacations under $500

- Last Minute Vacation Deals

- Last Minute Hotel Deals

- Travel Deals + Vacation Ideas

- Plan a vacation

- Deposit and Vacation Payment Plans

- London Vacations

- Paris Vacations

- Cabo San Lucas Vacations

- Playa Del Carmen Vacations

- New York Vacations

- New Orleans Vacations

- Punta Cana Vacations

- Montego Bay Vacations

- Puerto Vallarta Vacations

- Honolulu Vacations

- Orlando Vacations

- Miami Vacations

- Cancun Vacations

- Los Angeles Vacations

- Fort Lauderdale Vacations

- January Vacations

- February Vacations

- March Vacations

- April Vacations

- May Vacations

- June Vacations

- July Vacations

- August Vacations

- September Vacations

- October Vacations

- November Vacations

- December Vacations

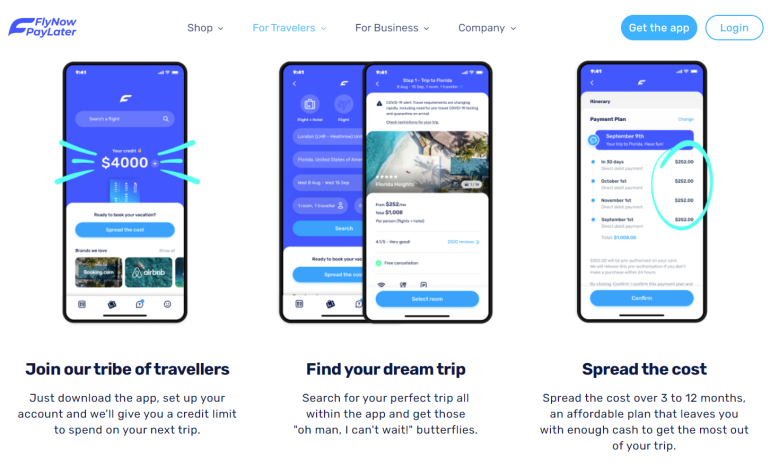

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

Lufthansa has a list of payment methods on its website . Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website .

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit . As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Related Articles

Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

Images below are for illustrative purposes only

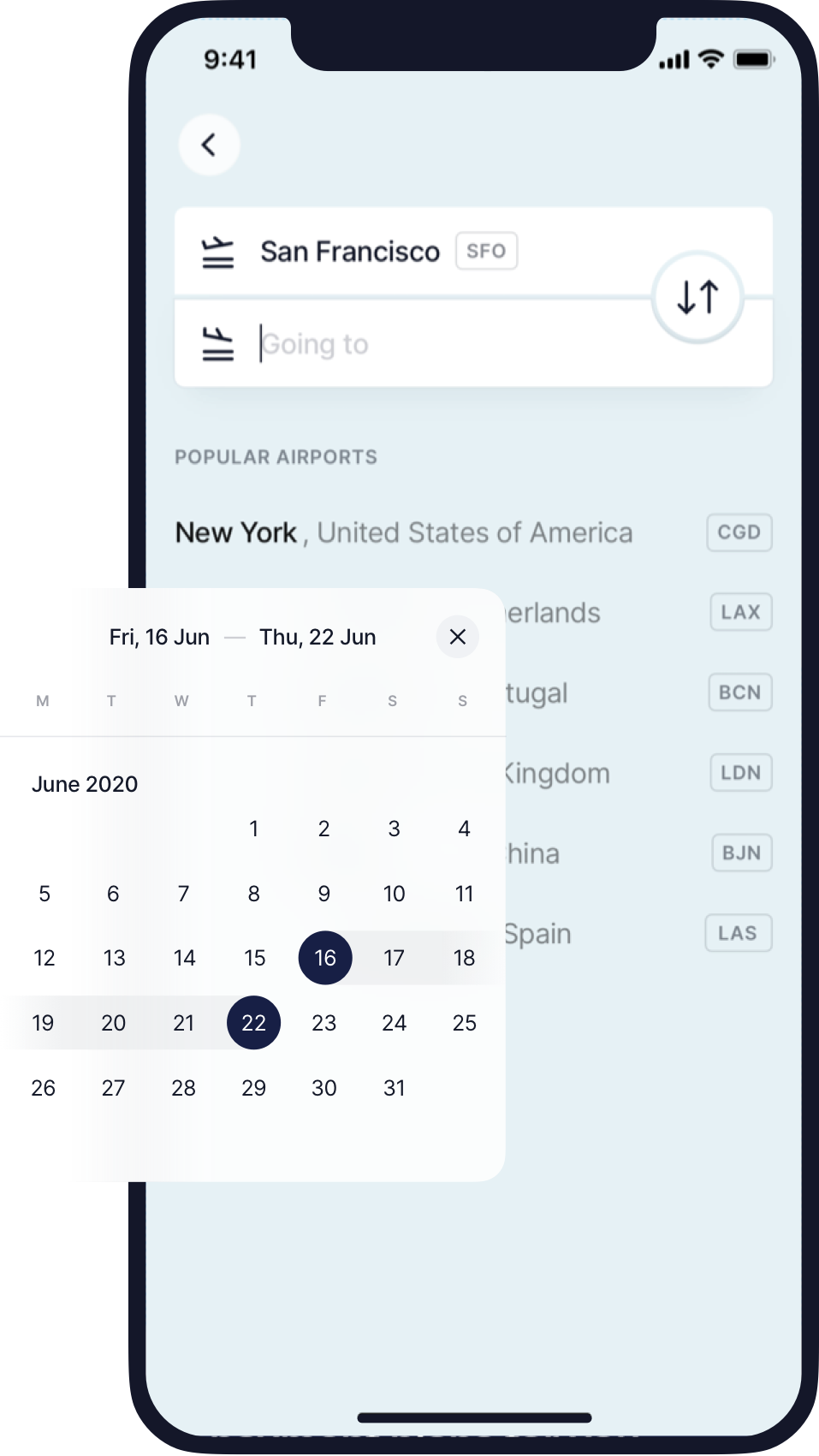

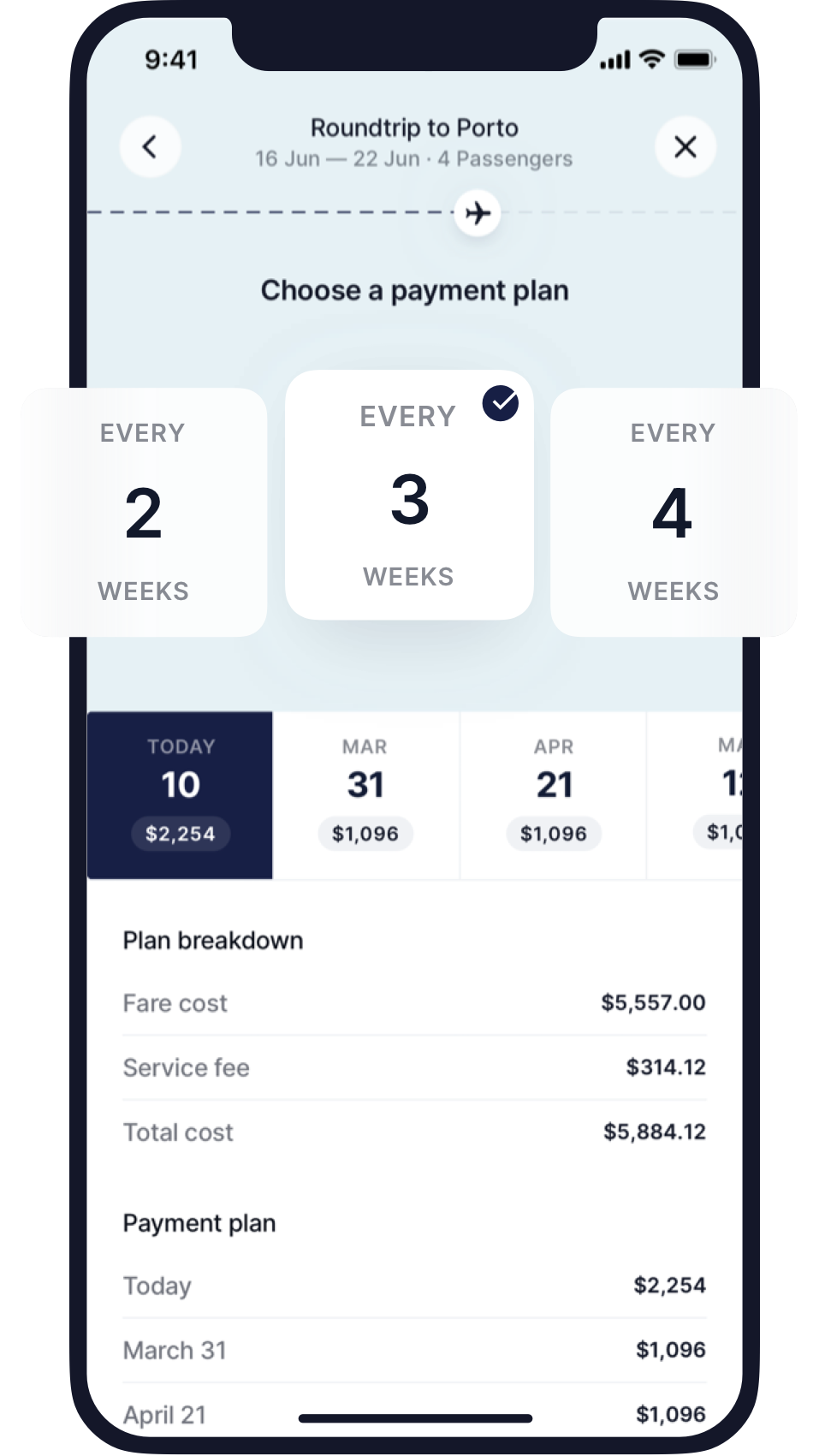

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

*Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses .

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

NEW: Book your hotel with Airfordable! 🏨 Download our app to get started now.

Get Started!

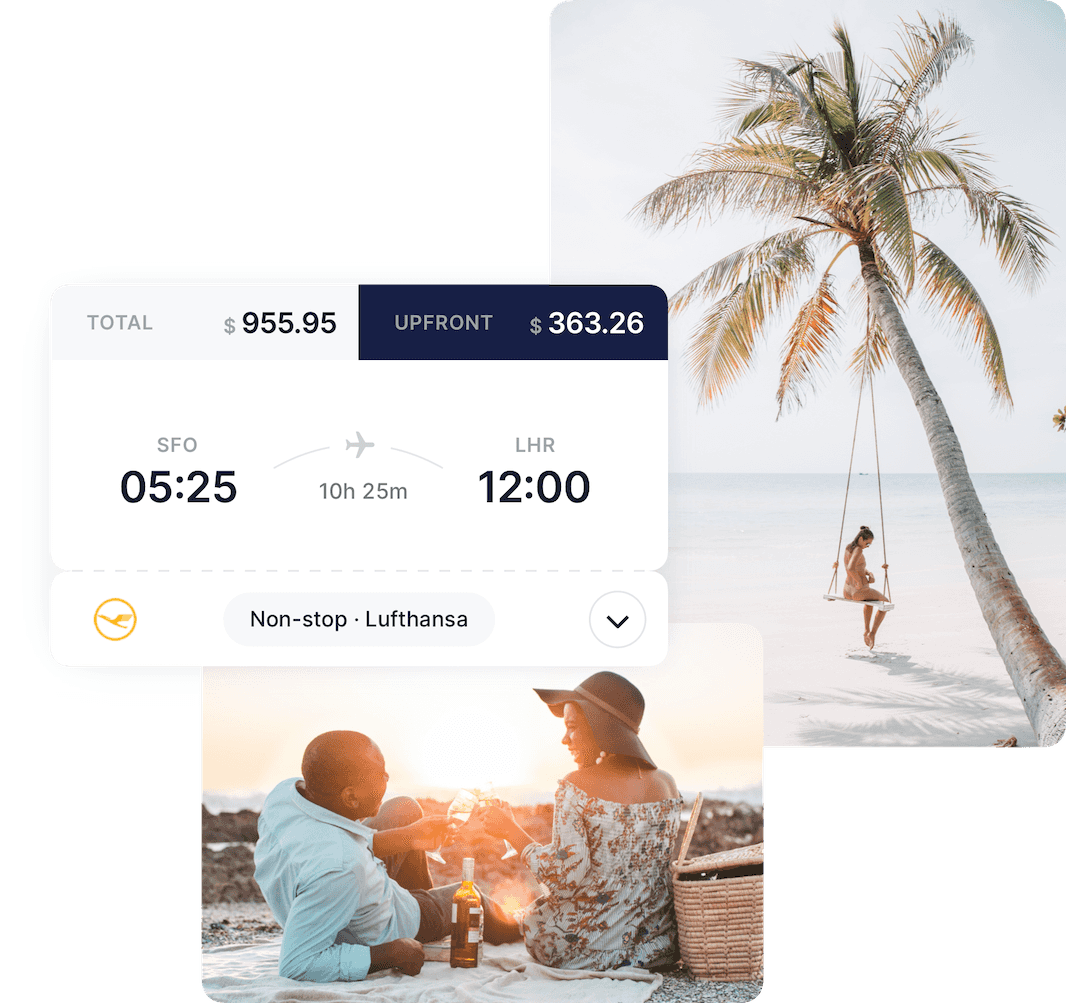

Your flight for only a fraction upfront

Get an estimate.

How much is your ticket?

Your upfront payment now is

And the rest in installments

No credit check, no interest

Just a transparent one-time service fee

Flexible payment plan

Choose the plan that works for you

Lock in your fare now

Don't miss out on a great deal

24/7 customer support

Focus on the fun of travel - not the stress

Scan to download

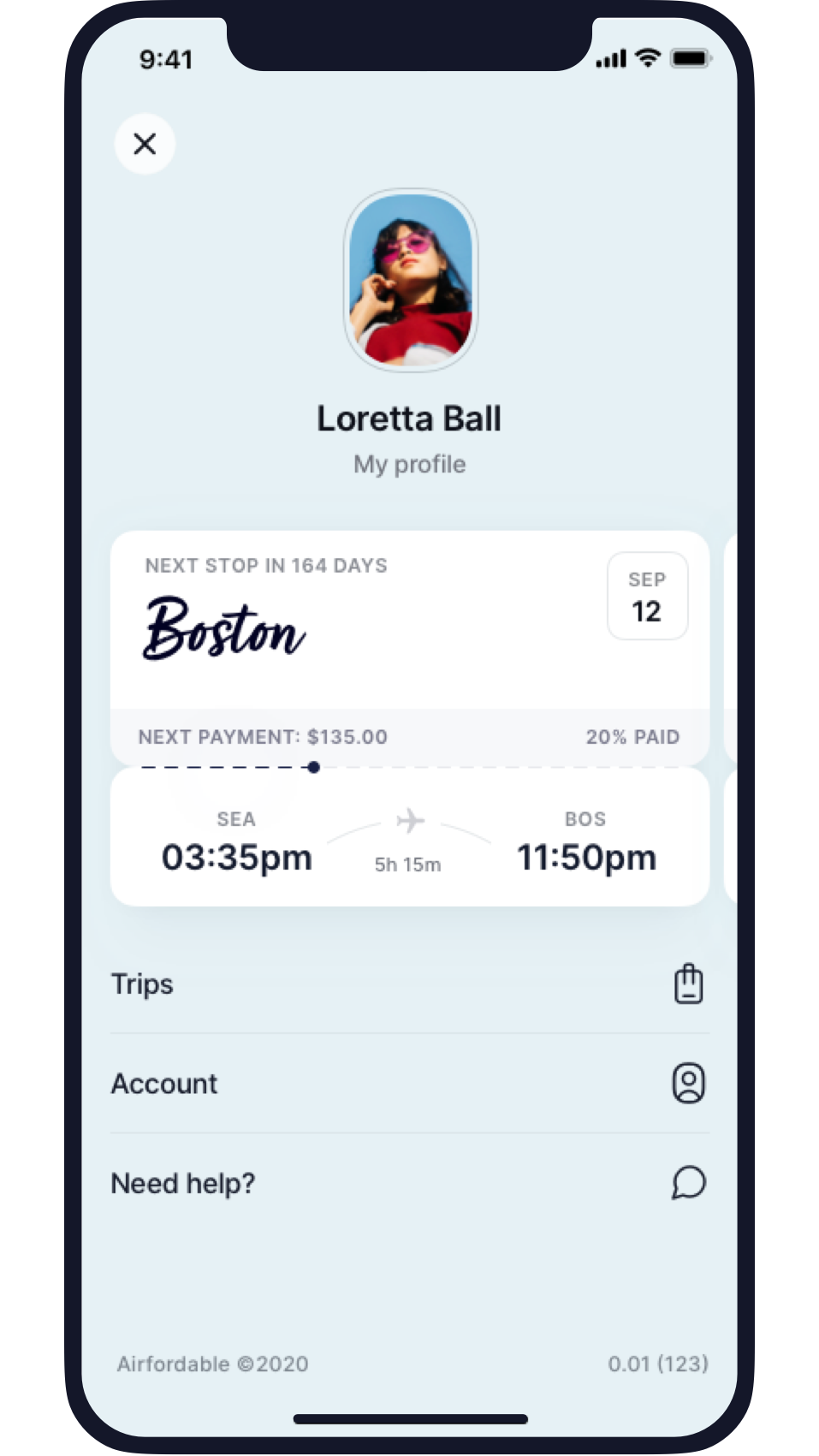

Accessible. Flexible. Easy. And done!

Fraction upfront

Book your flight for a fraction now, pay the rest later

Payment options

Pick what works best for your wallet

Progress tracking

Track all your payments and trips in one place

Discover the Airfordable difference

Planning your trip doesn’t need to feel like a chore. We put in the work so you don’t have to!

Book your favorite airlines

Complete control over your payment schedule

Manage multiple trips

Airfordable is the way to go!

Trusted by 500,000+ satisfied travelers, each with their unique stories and incredible adventures to share. Read real Airfordable traveler reviews.

What makes us different

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Price protection

When you book with us, you can secure your airfare well in advance when prices are cheaper. Protect yourself from the notorious airline price hikes no one likes.

Amazing community

Our travelers are a diverse group looking for creative ways to travel and budget. Airfordable is the bond that brings them together.

In good hands

The Airfordable team's sole mission is to help you travel more, but in an easy and financially responsible way. We're here for you.

Flexible and guaranteed

Pay only a fraction upfront for your flights. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Just accessible travel for your needs.

Safe and secure

Every interaction with Airfordable uses bank-level security and encryption. Your sensitive data is safe with us.

Great support at your fingertips

Dealing with airlines can be a hassle. Our team does the legwork for you, so you can focus on the fun — not the stress.

Available 24/7

We're always here to help you, day or night, with any support you need to book your perfect trip.

Reach us by email

Have a question, comment, or review? Our team can always be reached by email at [email protected].

Talk to support

Our in-app chat will send you directly to a member of our team for the one-on-one support you need.

Approved by the press

“Airfordable's value comes at the intersection of volatile ticket prices.... By locking in a ticket price up front, users can benefit by securing a better price on airfare while demand stays low and the date of departure is still far away.”

“A service like Airfordable could mean the difference between someone being able to take a trip or not – turning it into a priceless service.”

“The best part about Airfordable is that your ticket is paid off before your trip, so you don’t have to deal with debt once you return home. For someone who doesn’t want to miss out on a trip to see family and friends, a vacation or a life milestone, this can be a really great service.”

“Airfare is usually cheaper when you buy further in advance, but what if you haven't planned for a trip, or saved up the cash yet? One new solution is Airfordable.”

How to Use ‘Travel Now, Pay Later’ Services When Planning a Trip

By Jennifer Bradley Franklin

All products featured on Condé Nast Traveler are independently selected by our editors. However, when you buy something through our retail links, we may earn an affiliate commission.

All products featured in this story are independently selected by our editors. However, when you buy something through our retail links, we may earn an affiliate commission.

After more than a year of sticking close to home, travelers are ready to budget for a vacation once again. But if the desire to travel outpaces your finances, a growing number of “travel now, pay later” services are making immediate vacations possible.

“Services such as Klarna and Afterpay are giving us the flexibility to afford that extra-nice hotel or to stay on vacation that extra day by staggering payments and slicing them into four rather than requiring one upfront payment,” says Michelle Halpern, the founder of the Live Like It's the Weekend travel blog.

Here’s how it works: If you find a trip, flight, or hotel and see the Klarna or Afterpay option, you can undergo a 30-second soft credit check, either through the apps or online, to determine the amount you qualify to pay in installments. You make the first payment—one-quarter of the total purchase—and get your trip or flight confirmation immediately. The service charges the remaining interest-free installments of the total every two weeks directly from your preferred payment method until the total is paid. You secure the deal instantly, there’s no impact on your credit score and there are no fees. However, using these services doesn’t help build credit and their charges are initiated automatically, which means that even if your linked bank account gets low or your credit card is near its limit, those charges are still going to happen.

“Afterpay saved my life on many occasions,” says Shawn Richards, a U.K.-based expedition coordinator for Ultimate Kilimanjaro, who spent years as a nomad. Richards recalls times when he’d decide spontaneously to go somewhere new, but wouldn’t have the ready funds. “Afterpay was like having a virtual father, as it gave me the kick I needed; I had to find a job in my destination very quickly to be able to pay for how I got there,” he says. Four years ago Richards used Afterpay to score the $1,400 open-ended flight to Tanzania that led to working with his current tour company.

The idea is catching on fast: Afterpay reported that it’s signed up more than 13 million users in North America as of January 2021. Different retailers have partnerships with different payment systems, so you might need accounts with multiple service providers to build the trip you want. For example, Airbnb offers payment through Zip (formerly Quadpay), while you can pay for trips on Booking.com and Expedia through Klarna. Here are some other things to consider.

Should I spring for a pricier trip?

While these services can be a great way to avoid credit card debt and the interest that can come with it, financial pros caution against spending more than your budget allows.

“Just because you have more time to spend your money doesn’t mean you have more money to spend,” says Tony Palazzo, CFA and Managing Partner at Berkeley Capital Partners & Access Private Capital in Atlanta , who notes that pay in four services may ease the psychological impact of a purchase, but that doesn’t mean you’re paying less. “You need to ask yourself, ‘If I can’t afford it now, how will I afford it within a [six]-week time period?’” he says.

Palazzo is currently seeing his financial services clients plan to take bigger trips , either because they haven’t spent money on travel during the pandemic or they’re rewarding themselves for a difficult 2020. “‘Revenge spending’ is a real thing, and travel appears to be a popular target,” he says.

When he was a nomad traveling the world , Richards tried to keep his budget conservative by thinking of Afterpay like borrowing money from a friend. “Then you are likely to only borrow what you need, and not more,” he says.

How to maximize the benefits

When you see an ultra-low price on a flight to your dream destination or an unheard-of deal on a hotel, services like Klarna and Afterpay can help you book it before it’s gone. “Time pressure to lock in a great deal is common with travel,” Palazzo says. “Offers appear at a moment’s notice and often require you to act quickly. Having quick access to the cash you might not have readily on hand, could better position you to nab that heavily discounted red-eye to Paris .”

Dolores Mason-Stokes, a Chicago-based plus-size fashion and travel blogger, used Klarna to book an upcoming trip to Catalina Island in California, and she’s planning to use it again to pay for a 2022 anniversary trip to Bali . She says that using the service strategically makes it easy to budget for a bigger trip because she’ll buy one element (like a flight) and pay it off before adding the next (like a hotel). “It doesn’t matter if it’s flights, transportation, places to stay or even excursions, you can pay through [Klarna],” Mason-Stokes says. “You could book an entire trip abroad.”

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Pay for your flight with Uplift

Feel good about where you fly and how you pay for it. With Uplift, you can book your trip now and pay for it over time with budget-friendly monthly payments.

Low monthly payments

Budget-friendly loan options.

Easy application

Receive a quick decision.

No surprises

That means no late fees, no prepayment penalties.

Automatic payments

So you don't have to remember due dates either.

How Uplift works

Step 1: Select Uplift at checkout

Shop for your trip on our website or app like you normally do and select Uplift as your payment method at checkout.

Step 2: Complete a quick application

Provide a few pieces of information and receive a quick decision without ever leaving the payment page.

Step 3: Enjoy your trip

Relax knowing you can travel now and pay for it over time with low monthly payments.

Frequently asked questions

What is uplift.

Uplift gives you the freedom to purchase travel now and pay over time with simple monthly payments. Some plans include interest while some are interest-free.

How do I apply?

Shop for your flights like you normally would. Then, select Uplift as your payment method at checkout. You’ll complete a short application and receive a quick decision letting you know if you’ve been approved. You can choose the terms of your plan before you complete checkout and enjoy your trip.

How is my loan term offer determined?

Uplift looks at a number of factors, including your credit information, purchase details and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and selecting the “Loans” tab. From there, select the "Make a Payment" button.

Uplift recommends you enable AutoPay at the time of purchase so your payments are automatically deducted from your bank account each month. You can enable AutoPay on the "Accounts" page on pay.uplift.com. You can also update your payment method here at any time.

Can I travel before paying off my trip with Uplift?

Yes! You do need to allow a few days between booking your trip and departure for things to process. Other than that, you are free to travel whenever—even before you’re all paid off.

Where can I find Uplift’s Privacy Policy and Terms of Use?

Here is the Privacy Policy and Terms of Use for Uplift.

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by their lending partners . Privacy Policy and Terms of Use . Uplift’s address: 440 N Wolfe Road, Sunnyvale, CA 94085

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Fly Now Pay Later: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

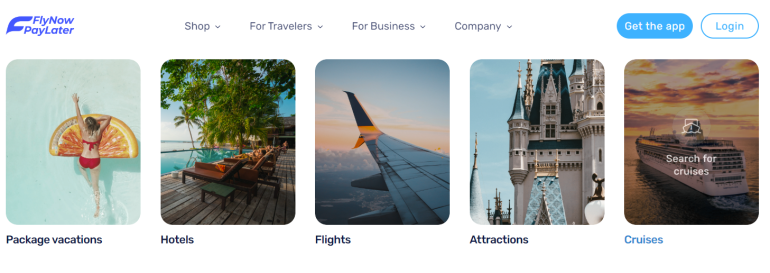

What is Fly Now Pay Later?

Who can use fly now pay later, how does fly now pay later work, is fly now pay later legit, downsides to fly now pay later, is fly now pay later worth it.

Whether you're taking a long-awaited vacation or need to book travel urgently for an emergency, you may not currently have all of the funds necessary to book a trip. Enter a service like Fly Now Pay Later that lets you "buy now, pay later" for flights, hotels and other travel expenses.

But you may be wondering how Fly Now Pay Later works or if it's legit. Let's dive into the details and discuss the advantages and disadvantages of using the deferred-payment service.

Not to be confused with a general term for deferring travel costs, Fly Now Pay Later is a company offering services that allow you to spread the cost of your vacation over time. After you are approved, Fly Now Pay Later will pay for the travel upfront and charge you monthly installments. You can choose to split up the cost of your trip over a time period of up to 12 months.

At the time of writing, the interest rate on these installments is between a 9.99% and 29.99% annual percentage rate, depending on your credit.

You can use Fly Now Pay Later to pay for all types of travel expenses. You can buy now and pay later for:

Attractions.

Vacation packages.

» Learn more: Easy tricks to save money on travel

U.S. residents hoping to use Fly Now Pay Later must be 18 or older. If you reside in Alabama and Nebraska, you must be at least 19 years old. You'll also need a debit card and a mobile phone with a U.S. number, as the Fly Now Pay Later service is currently only available through its app. You'll also need a driver's license or passport to verify your identity.

A debit card is the only accepted form of payment for Fly Now Pay Later.

You’ll also need to undergo a soft credit check, which doesn't affect your score. Fly Now Pay Later doesn’t disclose its credit score requirements. But it recommends checking your score before applying, so you may want to double-check your credit profile for any mistakes and make sure your credit accounts aren’t frozen in order to be eligible.

In addition to being available to United States residents, Fly Now Pay Later is also currently available to residents of the United Kingdom and Germany.

» Learn more: Can Americans travel to Europe?

To start using Fly Now Pay Later, you'll need to download the app and set up an account. As part of setting up a new account, Fly Now Pay Later will run a credit check to determine your eligibility, interest rate and credit limit. Then you can use the app to find the flights, hotels or travel packages you wish to book.

Depending on which airline or hotel you want, you may be able to book the trip directly through the app. For example, you can buy now and pay later for flights with American Airlines, United, Qatar Airways or TAP Portugal through the app. For other travel purchases, you'll be issued a virtual card that you can use to pay for the travel expenses.

After making your travel purchase or during the process of issuing the travel card, Fly Now Pay Later will prompt you to choose the number of installments you want to pay. You can spread the cost of your trip across — and up to — 12 months.

Your first installment is due one month from the date your account was set up, and subsequent payments will be taken on the same day each month after that. However, you can change your payment date by contacting Fly Now Pay Later customer support.

Fly Now Pay Later is legit. Its payment options are provided by Pay Later Financial Services Inc. in partnership with an FDIC member bank Cross River Bank.

Fly Now Pay Later mostly receives positive reviews from customers, carrying a 4.2 Trustpilot rating. However, negative reviews of Fly Now Pay Later focus on the difficulty of contacting a representative when something goes wrong and also on issues using Fly Now Pay Later's virtual payment card to book directly with travel providers.

» Learn more: Should you use buy now, pay later services on travel?

Using Fly Now Pay Later may sound appealing. After all, you only have to pay a deposit now to book your travel. However, there are several downsides to using Fly Now Pay Later — and similar deferred travel payment plans:

High interest rates: At the time of writing, Fly Now Pay Later charges between 9.99% and 29.99% APR on installments. You may be able to pay a lower interest rate by using a low- or no-interest credit card instead of Fly Now Pay Later for your purchase. Other BNPL options, including Uplift, could offer as low as 0% APR for certain eligible applicants.

A credit check is required: As part of the process of setting up an account, Fly Now Pay Later checks your credit to determine what interest rate to charge.

Requirement to use the app: Fly Now Pay Later has a splashy, well-designed website. However, you can't actually use the service on the website. Instead, you have to download and use the Fly Now Pay Later app.

Issues booking with the virtual card: For some types of travel expenses, Fly Now Pay Later issues travelers a virtual card that they then can use to book travel with a travel provider. Some travelers report having their virtual card declined by travel providers.

Lack of travel protections: You won't get travel protections offered by travel rewards credit cards — such as trip delay insurance, delayed baggage insurance, and trip cancellation insurance.

No rewards on travel purchases: As you'll be paying a travel provider through Fly Now Pay Later, you won't earn any rewards on the purchase. Additionally, Fly Now Pay Later only accepts payments through debit cards. So, you won't earn rewards when paying your balance unless you use a debit card that earns rewards.

» Learn more: The best travel credit cards right now

Fly Now Pay Later is an appealing service for avoiding having to pay your travel expenses immediately. Just note that there are several downsides to doing so — everything from having to pay interest to losing out on credit card rewards and travel protections.

If you're OK with these tradeoffs and don't have a better alternative, using Fly Now Pay Later can be a good option. Just make sure to set realistic payment goals to balance minimizing interest and avoiding late payment fees.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

We'll Be Right Back!

A guide to using buy now, pay later for travel

PayPal Editorial Staff

January 5, 2024

Planning a vacation? Buy now, pay later (BNPL) may be offered as a payment option when booking flights, hotels, or other travel accommodations.

Discover how BNPL options work for travel, from potential pros and cons to responsible practices and strategies if considering using it.

What is buy now, pay later for travel?

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares.

If BNPL is an available payment option for an airline, hotel, or travel retailer, individuals can opt for a payment plan at checkout. Normally, they would select the BNPL provider and apply in the checkout, but some providers may redirect applicants to their website to create an account and apply. Typically, applicants receive a near-instant decision, which may mean those looking to use buy now, pay later for travel can book their travel or vacation without a significant delay.

Depending on the BNPL provider , there may be interest fees and other charges, though some providers may offer plans with no interest. Be sure to review any terms before applying.

While application and approval requirements may vary depending on provider, here’s a breakdown of the general eligibility requirements and approval process:

- Meet the eligibility requirements: These can vary based on the provider. People typically need to be at least 18 years old and provide personal details like their social security number and home address. Some BNPL providers may also assess income, payment history, and credit score.

- Agree to the terms: Individuals must agree to the terms and conditions of a BNPL plan, including an installment schedule and any associated fees or interest charges.

- Receive a decision and book travel: People usually receive a BNPL approval decision in seconds. If approved, they can book their travel using BNPL as their payment method.

Potential benefits of using buy now, pay later for travel

Before using buy now, pay later for a trip, consider the potential advantages:

- Flexibility: BNPL may offer flexibility to spread the cost of a trip over time, allowing travelers to manage their budget and avoid a significant upfront expense.

- Interest-free options: Some BNPL services may provide interest-free payment plans. For example, PayPal’s Pay in 4 allows people to split eligible purchases into four interest-free, bi-weekly installments. 1

- Accessibility: Buy now, pay later may help make travel accessible to those with limited credit histories or low credit scores.

Potential downsides of using buy now, pay later for travel

There are some potential disadvantages to using buy now, pay later for travel expenses. Some examples include:

- Interest and fees: Some BNPL providers may charge interest or fees if travelers miss payments or choose longer repayment terms, potentially increasing the overall cost of their trip.

- Overspending: While BNPL offers flexibility, it can also lead to overspending if travelers don't carefully budget for their installment payments. It also may tempt some to book more expensive trips than they can comfortably afford.

- Credit impact: Although certain buy now, pay later providers may not conduct hard credit checks initially, missed payments or defaults may negatively impact credit scores in the long run.

- Limited booking options: Not all travel providers or agencies accept BNPL as a payment option.

Using buy now, pay later for travel responsibly

Here are some factors to consider when signing up for a BNPL plan for travel:

- Budget and plan: Establish a personal budget for travel plans that includes not only the upfront trip cost but also the future installment payments to ensure the overall expense remains manageable and within budget.

- Read the fine print: Carefully read and understand the terms and conditions. Pay close attention to any interest rates, fees for missed payments, and the total cost of a trip when opting for BNPL.

- Responsible spending: Avoid the temptation to overspend just because BNPL offers flexibility. It’s important to only buy on credit responsibly .

- Ensure timely payments : Commit to making payments on schedule to avoid late fees or interest charges. Setting up automatic payments can help prevent missed deadlines.

Using BNPL for travel may offer convenience and flexibility for those looking to travel or book a vacation, but it should be done with careful consideration. Be sure to consider any fees or interest that may apply and keep track of when payments need to be made.

Learn about PayPal Pay Later .

BNPL for travel FAQ

What is buy now, pay later.

Buy now, pay later is a type of short-term financing method that allows people to split a purchase into several smaller installments over weeks or months. Some BNPL plans may be interest free, while others may include interest and fees.

Can buy now, pay later be used for flights?

Buy now, pay later can often be used for flights. Many airlines and travel booking platforms offer BNPL as a payment option at checkout. Travelers should budget and plan their payments accordingly before committing to a payment plan.

Can I book a vacation with buy now, pay later?

Individuals may be able to book a vacation using buy now, pay later. BNPL options are increasingly available for vacation planning, including flights, accommodations, and activities. Travelers can opt for BNPL at checkout and split the total cost into smaller installments. However, be sure to budget carefully and be aware of any potential interest or fees.

Was this content helpful?

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies

Book Your travel & enjoy a flexible payment plan that’s great for you

Flexible repayments, fast and easy, safe & secure, do you live in the uk, are you over 18, do you have a mobile, do you have a uk debit card, choose your next flight, go to the checkout, sign up & pay, frequently asked questions, when will i receive my flight tickets if i book fly now pay later flights, is there a credit check, are there any charges if my application is declined, can i book multi-city trips on a fly now pay later plan, can i change my repayment date, what could my repayment plan look like, legal statement, regulatory statement, travel made simple with our easy to use app.

3 Reasons Why I'd Never Use 'Buy Now, Pay Later' When Planning a Vacation

I s there anything better than taking a much-needed vacation? It's surely one of the biggest joys in life to pack a suitcase and hit the road. Paying for it can get a little sticky, though. You've likely heard of "buy now, pay later" (BNPL) services. This method of financing a purchase over several weeks or months has become quite popular, and a lot of merchants (online and in person) are offering it alongside options to pay with cash or credit card.

In brief, BNPL works by giving you the chance to pay for a purchase by splitting it into equal payments over a period of several weeks. Some services offer 0% APR, too, so using this payment option won't cost you anything extra -- assuming you can make the payments on time and in full. If you can't, you might face interest charges, delinquent accounts, or major credit score damage (if the payment service reports to the credit bureaus; not all do). Some travel websites, like Expedia, are now offering BNPL to cover the cost of travel.

But before you rejoice and rush off to book flights and hotels and pay for them in installments, wait just one second. Personally, I wouldn't use BNPL to cover vacation costs, and you might want to reconsider, too. Here's why.

1. A vacation is not a necessity -- it's better to save ahead of time

First and foremost, I'd skip the BNPL for travel costs because a vacation isn't a necessity. It's really not a good idea to borrow money for a vacation -- it's best to avoid debt for all but necessary expenses. As good as it feels to plan a trip, it feels much better to do so knowing that you're not committing your future self to make loan payments. It's a much better idea for my personal finances (and perhaps also yours) to save money ahead of time to cover flights, hotel rooms, and beyond.

I've been saving for a big 40th birthday vacation for the last few months, and in addition to ensuring I pay myself first , I'm also keeping that money in a special place. I opened a high-yield savings account with an online bank last year, and I've seen my APY climb over that time, to the point that I've earned more than $1,000 this year on the money in the account -- for doing absolutely nothing but keeping it in there. If a big vacation is in your future, I recommend taking a look at the best savings accounts and picking a winner.

2. I don't want a credit score hit

Not all of these BNPL providers run a credit check, but some do, and depending on the provider, it could be either a soft or hard credit check . A soft credit check doesn't impact your credit score, but a hard inquiry could ding your score by a few points. A hard inquiry is more likely if you're borrowing over a longer period of time (which makes sense -- more risk for the lender). For most people and in most situations, this isn't really a big deal -- your credit score will recover.

But if you're already between two credit score ranges and have a big expense coming up (like buying a home with a mortgage loan ), losing a few credit score points could be enough to impact your eligibility for the loan, as well as increase the interest rate you qualify for. Hard credit checks are impossible to avoid in most borrowing circumstances, be it for that mortgage loan or even a new credit card application. But I certainly wouldn't want to lose a few points from my credit score because of a vacation.

3. There are better ways to pay for travel

When it comes time to start paying for more of the bits and pieces of my big trip, I'll be leaning on my favorite travel rewards credit card (which I'll be paying off using that aforementioned saved cash). Why bother paying with a credit card if I have the money put aside? Well, for starters, I can't pay for online purchases with cash, and my debit card doesn't come with as many robust fraud protections as credit cards do.

The best travel credit cards offer other benefits -- I booked the flights through my card issuer's travel portal, meaning I could use points to pay for part of the cost and also earn a higher rewards rate on the money I spent. My card also comes with rental car insurance -- I hope not to need it, but since I'll be booking a few daily car rentals, I will feel a lot better knowing I'm protected. Some travel credit cards also offer broader travel insurance, as well as free checked bags and status with airlines and hotels. No matter the kind of traveler you are, there's a travel credit card out there for you.

Ultimately, BNPL is best approached with caution, no matter what you're using it for. You should probably think twice before using it for a vacation. Explore other options to pay for your upcoming travels instead.

Alert: highest cash back card we've seen now has 0% intro APR until 2025

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick , which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes.

Read our free review

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a disclosure policy .

Politics latest: MoD contractor hacked by China 'has contracts across Whitehall'

The defence secretary has given a statement about a hacking attack on the UK's Ministry of Defence, which Sky News understands China was behind. The government has been criticised for not naming the perpetrator, and concern is mounting over the contractor that was targeted.

Tuesday 7 May 2024 23:09, UK

- China hacked Ministry of Defence, Sky News learns

- Contractor behind system named in House of Commons

- Sam Coates: This could get quite sticky

- Scotland's new first minister voted in

- Labour rejects PM's election prediction

- Jon Craig: MPs hold most heated Gaza debate since war began

- Live reporting by Ben Bloch and (earlier) Faith Ridler

Thank you for joining us on the Politics Hub for a busy day in Westminster.

Here's what happened:

- The defence secretary, Grant Shapps, gave a statement to the Commons confirming that a hack had hit the Ministry of Defence's payroll system, run by an external contractor, with personal details of British service people targeted;

- But he did not confirm Sky's revelation that China is behind the hack because it is a months-long process for such a formal designation to be made by ministers (China firmly denies it is behind the cyber attack);

- The refusal to blame China provoked fury from many MPs who want stronger action from the government against China - but Rishi Sunak defended his policy as "robust";

- The defence secretary did state in the Commons that contractor SSCL was responsible, with the government launching an investigation into all SSCL work with government;

- The deputy foreign secretary told the Commons that the government is firmly opposed to an Israeli offensive in the Rafah area of Gaza, with the PM saying he is "deeply concerned" by the prospect;

- Shadow chancellor Rachel Reeves gave a speech in which she blasted Tory "economic fiction", saying ministers arguing the economy is turning a corner is not reflecting "reality";

- New SNP leader John Swinney was formally elected the new first minister of Scotland, with him expected to formally take the role as soon as tomorrow.

Join us again from 6am for the very latest political news - and the first PMQs since the local elections at noon.

The Garrick Club, a central London gentlemen's club, has voted to accept women into the ranks of its membership for the first time in its near two-century history.

Founded in 1831, it is one of the oldest members' clubs in the world, and its membership is drawn from across the British establishment.

Among its ranks are said to be 1,500 members including at least 160 senior legal professionals, at least 10 serving MPs, dozens of Lords, heads of public institutions, actors, artists and businessmen.

King Charles is even said to be a member, along with around 150 men with knighthoods who cough up the around £1,000 a year to get access to its dining rooms, luxury lounges and exclusive bedrooms.

Women have been effectively banned from becoming members, and until 2010 were barred from even visiting the club as the guest or spouse of a member.

But in a vote this evening, the membership changed the rules to allow women to become full members.

One member told Sky News that 944 members attended a meeting tonight, either in person or remotely, and said: "It was fairly clear the majority was in favour of admitting women."

The club had been at the centre of a controversy after the UK's chief civil servant, Simon Case, came under heavy criticism for his membership, which he eventually resigned in March ( more here ).

A list of members of the club was recently published by The Guardian newspaper, which included the King, Deputy Prime Minister Oliver Dowden and Sir Richard Moore, the head of MI6.

Read more about the club from our political reporter Tim Baker here:

An early release prison measure, used to relieve capacity problems in jails across England and Wales, has been extended for a second time since its introduction in October.

As of 23 May, some male prisoners will now be freed up to 70 days before the end of their sentence in order to free up space, under the End of Custody Supervised License scheme.

Originally - it was 18 days, later extended to between 35 and 60 days.

In an email sent to prison and probation officers informing them of the extension, seen by Sky News, staff were told that "despite the push" and efforts of the scheme in previous months, that "pressures continue" in male prisons, and so further extensions to this emergency scheme are necessary.

Sex offenders, terrorists and category A prisoners, plus those serving four years or more, are excluded and aren't eligible for release.

However, sources close to the service have expressed concern about the extent to which the scheme is being amended, at pace, and often with little warning.

Read the full story from our news correspondent Mollie Malone here:

By Jenness Mitchell, Scotland reporter

John Swinney will become Scotland's new first minister after being backed by a majority of MSPs.

Following his victory in the SNP leadership race on Monday, the 60-year-old faced a vote at Holyrood to confirm him as Humza Yousaf's successor.

The Scottish Greens abstained from the vote, with Mr Swinney able to fend off challenges from Scottish Tory leader Douglas Ross, Scottish Labour leader Anas Sarwar, and Scottish Liberal Democrats leader Alex Cole-Hamilton.

His name will now be submitted to the King, with an official swearing-in ceremony expected to take place at the Court of Session in Edinburgh as early as Wednesday.

Mr Swinney will then be able to appoint his cabinet.

Read the full story here:

We've just had a statement from the Home Office amid chaos at UK airports due to a nationwide issue with the border system.

A spokesperson said: "We are aware of a technical issue affecting eGates across the country.

"We are working closely with Border Force and affected airports to resolve the issue as soon as possible and apologise to all passengers for the inconvenience caused."

Queues are building at airports across the country as flights land, but passengers are unable to be processed.

Follow live updates on the outage affecting the UK border on our dedicated live page here:

Are you affected? Send us a message on WhatsApp . Check our contact us page for more information.

By Tim Baker , political reporter

The government is "gaslighting" the public about the state of the economy, the shadow chancellor has said.

Rachel Reeves attacked the Conservatives in a speech in the City of London, as the opposition takes the fight to the government on their own turf ahead of the general election.

Running a strong economy has long been the focus of Conservative election campaigns.

And with a raft of economic data coming out this week, Ms Reeves is looking to get ahead of the government's messaging - saying Chancellor Jeremy Hunt and Prime Minister Rishi Sunak claiming the economy is improving is "deluded".

Over a year ago, Rishi Sunak made five pledges for voters to judge him on.

The prime minister met his promise to halve inflation by the end of 2023.

But with the general election approaching, how is Mr Sunak doing on delivering his other promises?

You can see the progress for yourself below:

Chaos has been reported at airports across the UK - as two airports have confirmed a nationwide border issue.

A Heathrow spokesperson said: "Border Force is currently experiencing a nationwide issue which is impacting passengers being processed through the border.

"Our teams are supporting Border Force with their contingency plans to help resolve the problem as quickly as possible and are on hand to provide passenger welfare. We apologise for any impact this is having to passenger journeys."

Manchester Airport also confirmed that the UK Border System is down as part of a nationwide outage.

It said its teams are working to assist passengers in the airport.

Sky News has contacted the Home Office for comment and further details:

The Sky News live poll tracker - collated and updated by our Data and Forensics team - aggregates various surveys to indicate how voters feel about the different political parties.

With the local elections complete, Labour is still sitting comfortably ahead, with the Tories trailing behind.

See the latest update below - and you can read more about the methodology behind the tracker here .

Two of Westminster's best-connected journalists, Sky News's Sam Coates and Politico's Jack Blanchard, guide you through their top predictions for the next seven days in British politics.

Following the local and mayoral elections, Jack and Sam discuss how Rishi Sunak will try to get back onto the front foot and whether the Conservative rebels will continue to plot against him.

They also predict that the country will come out of recession and look forward to a new SNP leader in Scotland following the resignation of Humza Yousaf.

Email with your thoughts and rate how their predictions play out: [email protected] or [email protected]

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

COMMENTS

Yes, you can pay monthly for your vacation with Expedia Affirm vacation payment plans. Simply choose your dream travel package and select "Monthly payments" at checkout. You'll have the option to spread the cost over 3, 6, or 12 months, giving you financial flexibility when planning your dream getaway. These pay-later travel deals include ...

Uplift is the leader in Buy Now, Pay Later for travel. When you pay monthly for a flight, a cruise, a hotel, or vacation package - you're giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say "yes" to all those bucket ...

Book Now & Pay Later with Southwest and Uplift! Now you can book your flight and pay in simple monthly payments that work with your budget. ... Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select ...

These sites offer book-now, pay-later flights. If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now ...

Alternative Airlines can help. With Alternative Airlines, you can book flights now on over 650 airlines such as United, British Airways and American Airlines and pay later with different payment plan options available. Check out with either Affirm, Klarna , Zip, Afterpay, Clearpay, Postpay, Laybuy, Tabby, or one of our other options, and pay ...

Step 5 - Review your final payment plan. Review the payment options for your booking and complete your reservation by paying with Affirm. *Rates from 10-36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending ...

With Affirm, you can create an account and use their app to manage payments across a range of vendors. The company has a system called "Affirm Pay in 4," whereby you can make four interest-free payments every two weeks once you've clicked "Buy.". For larger costs, you also have the option to pay monthly. This can be split across as ...

Up to $50 off - $10 off per passenger, up to 5 passengers per booking. T&C's: AFFIRM50 is for flight purchases over $200 only. Non-refundable. Can only be applied to up to 5 passengers in one booking, with a maximum of $10 being discounted per person. Flight seats and prices are subject to availability. Non-refundable and for over 18s only.

Book your flight for a fraction now, pay the rest later. Payment options. Pick what works best for your wallet. Progress tracking. Track all your payments and trips in one place. Fraction upfront. Book your flight for a fraction now, pay the rest later. Payment options. ... The Airfordable team's sole mission is to help you travel more, but in ...

Book Flights Now, Pay Later. Lock-in today's price & pay in up to 26 weekly payments. No interest, no credit checks & no hidden fees. Book your next trip.

Book Flights Now, Pay Later. Lock-in today's price & pay in up to 26 weekly payments. No interest, no credit checks & no hidden fees. ... Pay weekly or fortnightly for up to 26 weeks before you travel. No interest. No credit checks. Travel with confidence. Once all your payments are made you'll receive your e-ticket within 24 hours.

Travel now, pay later services like Klarna and Afterpay are making it easier to budget for travel expenses—but there could be downsides to them, too. ... 24 Best Travel Deals to Book Before ...

Alaska, Delta, Frontier, JetBlue, Southwest and United all offer some form of buy now, pay later payment options. » Learn more: How travel credit cards work Alternatives to Uplift

Uplift is a payment method that lets you book your flight with United Airlines and pay for it over time with low monthly payments. You can apply online, choose your plan, and travel without late fees or prepayment penalties.

Pay later is becoming a popular travel tool. In 2019, $10 million was spent on travel-related "buy now, pay later."However, by 2021, $800 million was spent on travel-related buy now, pay later.

After you are approved, Fly Now Pay Later will pay for the travel upfront and charge you monthly installments. You can choose to split up the cost of your trip over a time period of up to 12 ...

Best book-now, pay-later options for entire vacations: Uplift. Best for air travel: Fly Now Pay Later. Best for lodging: Expedia. Best for families: Affirm. Best for buying what you need to bring on your vacation: Afterpay. Best for rewards: Bank of America® Travel Rewards credit card. What you should know about book-now, pay-later options.

Customers can pay the total cost of the trip in three, six, or 12 monthly installments. Fixed payments come with interest rates ranging from 10% to 30% APR based on your credit profile. Airlines: Airlines are also offering a book now, pay later option for those looking to fly to their destination. American Airlines, Delta, United, Southwest ...

With our flexible payment options, you only need a deposit to reserve your trip. Then settle the bill before you travel. For a stress-free, interest-free holiday. 1. Choose your trip. The earlier you plan your trip, the better the offer: you can choose from hotels or flight + hotel packages for thousands of destinations. 2. Reserve with a deposit.

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares. If BNPL is an available payment option for an airline ...

You can book now and pay later! We just charge a transaction fee at the time of booking and spread the cost over 3-12 months from 0% APR! Flexible Repayments. ... But ATOL protection does not apply to all holiday and travel services listed on this website. Please ask us to confirm what protection may apply to your booking.

Some travel websites, like Expedia, are now offering BNPL to cover the cost of travel. But before you rejoice and rush off to book flights and hotels and pay for them in installments, wait just ...

We're now hearing from tonight's panel on the issue of Israel and Gaza, which is still very much dominating British politics. Amid public controversy about Labour's stance over the last few months ...