Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

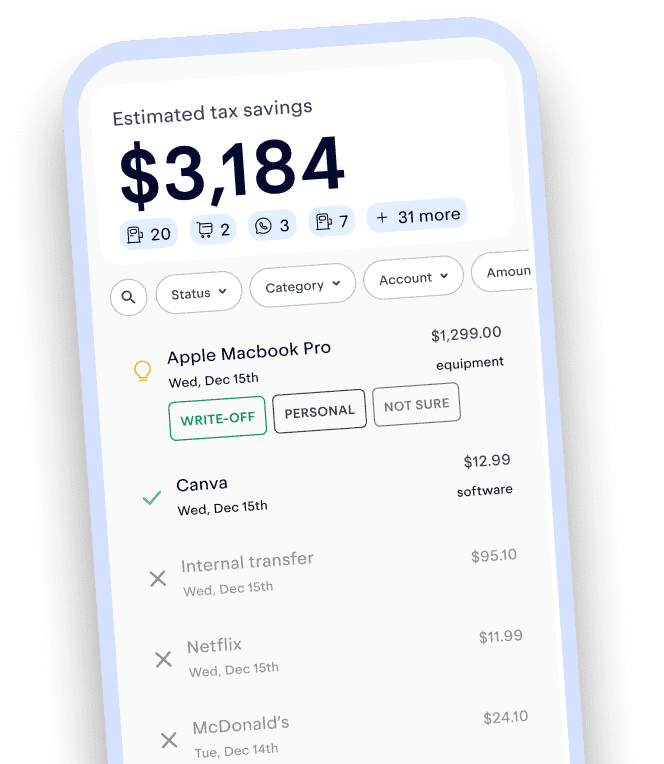

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- Life Stages

- Tax Breaks and Money

- View all Tax Center topics

Deductions For Business Travel Expenses

If you travel away from home overnight on business, you can deduct these travel expenses:

- Airline, train, or bus fares — This includes first-class.

- Actual expenses or standard mileage rate

- Business-related tolls and parking

You might rent a car while you’re away from home on business. If you do, you can deduct only the business-use portion of the expenses. To learn more, see the Car and Truck Expenses tax tip.

- To and from the airport or station

- From one customer to another

- From one place of business to another

- Transportation from your temporary lodging to your temporary work assignment

- Baggage charges and transportation costs for sample and display materials

- Your own meal

- Another person’s meal

To learn more, see the Meals and Entertainment tax tip.

- Dry cleaning and laundry expenses

- Phone, fax, and Internet expenses

- Tips relating to deductible travel expenses

- Other expenses, like public stenographer’s fees or computer rental fees

You can’t deduct expenses if they’re lavish or extravagant.

If your trip is mainly for business but includes some personal activities, you can deduct these expenses:

- Travel expenses to and from the business destination

- Food and lodging during the business portion of the stay

However, if the trip is mainly for personal reasons, you can’t deduct those expenses. This is true even if you conduct some business at the destination. You can deduct business expenses you incur at the destination, regardless of the purpose of the trip.

If you attend a convention that benefits or advances your business, you can also deduct appropriate expenses. These include:

- Round-trip travel

- Meals and lodging

- Display costs

Travel outside the United States

You can deduct the cost of travel outside the United States if your entire trip is devoted to business activities. You could take a trip mainly for business, but engage in some personal activities there. If so, you have to prorate travel costs between your business and personal activities. Prorated costs include meals and lodging en route.

You can’t deduct expenses for travel as a form of education. Ex: If you’re a professor of Asian history, you can’t deduct the cost of a tour of Japan, even though the trip will enhance your lectures.

Special rules apply for conventions held outside the North American area and on cruise ships.

To learn more, see Publication 463: Travel, Entertainment, Gift, and Car Expenses at www.irs.gov.

Was this topic helpful?

Yes, loved it

Could be better

Related topics

Find out about your state taxes—property taxes, tax rates and brackets, common forms, and much more.

Confused about tax deductions? Find out what adjustments and deductions are available and whether you qualify.

Need to know how to claim a dependent or if someone qualifies? We’ll help you find the answers you need.

We can help you with your taxes without leaving your home! Learn about our remote tax assist options.

Recommended articles

Personal tax planning

Filing taxes for a deceased taxpayer: FAQs

Adjustments and deductions

Don’t overlook these 11 common tax deductions

New baby or house? How major life changes affect your taxes

No one offers more ways to get tax help than H&R Block.

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips

The allocation of travel expenses on foreign trips is slightly different from the rules above. Round-trip transportation for foreign trips must be allocated to business and personal based on the number of business vs personal days on the trip. This is different from the “all or nothing” rule for the cost of domestic round-trip travel.

If your spouse joins you on a business trip, you usually cannot deduct any of their expenses. However, if your spouse’s trip satisfies a business purpose, then expenses must be otherwise deductible by the spouse.

Generally, for the travel costs of a spouse, dependent, or any other person to be tax-deductible, they must work for the business or be a co-owner.

Frequently Asked Questions (FAQs)

Are travel expenses tax deductible for business.

Yes, roundtrip travel is 100% tax deductible as long as the primary purpose of the trip is business. Once at your destination, expenses must be allocated between business and personal. However, all meals are deductible as long as the reason for your continued stay is business.

Can I deduct travel expenses for my employees?

Yes, you can generally deduct travel expenses for your employees as long as the expenses are ordinary and necessary, directly related to your business, and properly substantiated.

Is there a limit to the amount of travel expenses I can deduct?

Yes, there are some such as business travel on a cruise ship, where the expense is limited to $2,000 per year. Also, your expenses are limited to the non-lavish or extravagant cost of the trip, so you may want to be careful before booking a 5-star hotel.

Travel expenses are ordinary and necessary expenses you incur while you are temporarily away from home, so these expenses cannot be lavish in nature. To determine if a travel expense is deductible, it must be directly related to your trade or business.

When it comes to travel expenses, having well-organized records makes it much simpler to complete your tax return. Keep track of any records that may be used to substantiate a deduction, such as receipts, canceled checks, and other documentation.

About the Author

Find Timothy On LinkedIn

Tim Yoder, Ph.D., CPA

Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

How to manage challenging tax clients

Managing supply chain issues and mitigating risk

How BOI reporting combats tax fraud

How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Small Business Trends

10 tax deductions for travel expenses (2023 tax year).

Tax season can be stressful, especially if you’re unaware of the tax deductions available to you. If you’ve traveled for work throughout the year, there are a number of deductions for travel expenses that can help reduce your taxable income in 2024 and save you money.

Read on for 10 tax deductions for travel expenses in the 2023 tax year.

Are business travel expenses tax deductible?

Business travel expenses incurred while away from your home and principal place of business are tax deductible. These expenses may include transportation costs, baggage fees, car rentals, taxis, shuttles, lodging, tips, and fees.

It is important to keep receipts and records of the actual expenses for tax purposes and deduct the actual cost.

What kinds of travel expenses are tax deductible?

To deduct business travel expenses, they must meet certain criteria set by the IRS.

The following are the primary requirements that a travel expense must meet in order to be eligible for a tax deduction:

- Ordinary and necessary expenses: The expense must be common and accepted in the trade or business and be helpful and appropriate for the business.

- Directly related to trade or business: The expense must be directly related to the trade or business and not of a personal nature.

- Away from home overnight: The expense must have been incurred while away from both the taxpayer’s home and the location of their main place of business (tax home) overnight.

- Proper documentation: The taxpayer must keep proper documentation, such as receipts and records, of the expenses incurred.

Eligible Business Travel Tax Deductions

Business travel expenses can quickly add up. Fortunately, many of these expenses are tax deductible for businesses and business owners.

Here is an overview of the types of business travel expenses that are eligible for tax deductions in the United States:

Accommodation Expenses

Accommodation expenses can be claimed as tax deductions on business trips. This includes lodging at hotels, rental costs of vacation homes, and other lodgings while traveling.

Meal Expenses

Food and beverage expenses incurred on a business trip may be deducted from taxes. This includes meals while traveling and meals during meetings with clients or contractors.

Transportation Expenses

Deducting business travel expenses incurred while on a business trip may also be claimed.

This includes flights, train tickets, car rentals, gas for personal vehicles used for the business trip, toll fees, parking fees, taxi rides to and from the airport or train station, and more.

Expenses of operating and maintaining a car

Expenses of operating and maintaining a car used for business travel may also be claimed as tax deductions.

This includes fuel, insurance, registration costs, actual costs of repairs, and maintenance fees. Fees paid to hire a chauffeur or driver may also be deducted.

Operating and maintaining house-trailers

Operating and maintaining house trailers for business travel may be eligible for tax deductions, provided that the use of such trailers is considered “ordinary” and “necessary” for your business.

This includes any costs associated with renting or owning a trailer, such as fuel costs, repair and maintenance fees, insurance, and registration charges.

Internet and phone expenses

Internet and phone expenses associated with business travel can also be claimed as tax deductions. This includes the cost of any internet service, such as Wi-Fi or data plans, and phone services, such as roaming charges or international calls.

Any communication devices purchased for business use, such as smartphones and laptops, may also be eligible for tax deductions.

Computer rental fees

Rental fees for computers and other computing devices used during business travel may also be deducted from taxes. This includes any applicable charges for purchasing, leasing, or renting a computer, as well as the related costs of connecting to the Internet and other digital services.

All such expenses must be necessary for the success of the business trip in order to qualify for a tax deduction.

Travel supplies

Travel supplies, such as suitcases and other bags, are also eligible for tax deductions when used for business travel. Any costs associated with keeping the items protected, such as locks and tracking devices, can also be claimed as tax deductions.

Other necessary supplies, such as office equipment or reference materials, may also be eligible for deductions.

Conference fees and events

Conference fees and events related to business travel may also be eligible for tax deductions. This includes fees associated with attending a conference, such as registration, accommodation, and meals.

Any costs related to the organization of business events, such as venue hire and catering, may also be claimed as tax deductions.

Cleaning and laundry expenses

Business travel expenses associated with cleaning and laundry may also be claimed as tax deductions. This includes a portion of the cost of hotel and motel services, such as cleaning fees charged for laundering clothing, as well as any other reasonable expenses related to keeping clean clothes while traveling away from home.

Ineligible Travel Expenses Deductions

When it comes to business expenses and taxes, not all travel expenses are created equal. Some expenses are considered “Ineligible Travel Expenses Deductions” and cannot be claimed as deductions on your income taxes.

Here is a list of common travel expenses that cannot be deducted, with a brief explanation of each:

- Personal Vacations: Expenses incurred during a personal vacation are not deductible, even if you conduct some business while on the trip. In addition, expenses related to personal pleasure or recreation activities are also not eligible for deductions.

- Gifts: Gifts purchased for business reasons during travel are not deductible, even if the gifts are intended to benefit the business in some way.

- Commuting: The cost of commuting between your home and regular place of business is not considered a deductible expense.

- Meals: Meals consumed while traveling on business can only be partially deducted, with certain limits on the amount.

- Lodging: The cost of lodging is a deductible expense, but only if it is deemed reasonable and necessary for the business trip.

- Entertainment: Entertainment expenses, such as tickets to a show or sporting event, are not deductible, even if they are associated with a business trip.

How to Deduct Travel Expenses

To deduct travel expenses from income taxes, the expenses must be considered ordinary and necessary for the operation of the business. This means the expenses must be common and accepted business activities in your industry, and they must be helpful, appropriate, and for business purposes.

In order to claim travel expenses as a deduction, they must be itemized on Form 2106 for employees or Schedule C for self-employed individuals.

How much can you deduct for travel expenses?

While on a business trip, the full cost of transportation to your destination, whether it’s by plane, train, or bus, is eligible for deduction.

Similarly, if you rent a car for transportation to and around your destination, the cost of the rental is also deductible. For food expenses incurred during a business trip, only 50% of the cost is eligible for a write-off.

How do you prove your tax deductions for travel expenses?

To prove your tax deductions for travel expenses, you should maintain accurate records such as receipts, invoices, and any other supporting documentation that shows the amount and purpose of the expenses.

Some of the documentation you may need to provide include receipts for transportation, lodging, and meals, a detailed itinerary or schedule of the trip, an explanation of the bona fide business purpose of the trip, or proof of payment for all expenses.

What are the penalties for deducting a disallowed business expense?

Deducting a disallowed business expense can result in accuracy-related penalties of 20% of the underpayment, interest charges, re-assessment of the tax return, and in severe cases, fines and imprisonment for tax fraud. To avoid these penalties, it’s important to understand expense deduction rules and keep accurate records.

Can you deduct travel expenses when you bring family or friends on a business trip?

It is not usually possible to deduct the expenses of taking family or friends on a business trip. However, if these individuals provided value to the company, it may be possible. It’s advisable to speak with an accountant or financial expert before claiming any deductions related to bringing family and friends on a business trip.

Can you deduct business-related expenses incurred while on vacation?

Expenses incurred while on a personal vacation are not deductible, even if some business is conducted during the trip. To be eligible for a deduction, the primary purpose of the trip must be for business and the expenses must be directly related to conducting that business.

Can you claim a travel expenses tax deduction for employees?

Employers can deduct employee travel expenses if they are ordinary, necessary, and adequately documented. The expenses must also be reported as taxable income on the employee’s W-2.

What are the limits on deducting the cost of meals during business travel?

The IRS permits a 50% deduction of meal and hotel expenses for business travelers that are reasonable and not lavish. If no meal expenses are incurred, $5.00 daily can be deducted for incidental expenses. The federal meals and incidental expense per diem rate is what determines the standard meal allowance.

YOU MIGHT ALSO LIKE:

- nondeductible expenses

- standard deduction amounts

- Hipmunk small business

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

- Sign in to Community

- Discuss your taxes

- News & Announcements

- Help Videos

- Event Calendar

- Life Event Hubs

- Champions Program

- Community Basics

Find answers to your questions

Work on your taxes

- Community home

- Discussions

- Get your taxes done

Meal Deductions for both Overnight and Non-Overnight Travel

Do you have a turbotax online account.

We'll help you get started or pick up where you left off.

- Mark as New

- Subscribe to RSS Feed

- Report Inappropriate Content

- Not A Product Question

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Still have questions?

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

I used turbo tax deluxe and it applied wrong standard deduction for married filing separately and both over 65

Interest Income is reducing my carry forward balance in Investment Income Deduction, Form 4952 but doesn't reduce my Income by that amount

Oregon Return in TurboTax has MULTIPLE BUGS: Kicker & Deductions

Does anyone know where to access the Qualified Business Income Deduction in the Home and Business desktop software?

If my work has a mobile unit as a place of business and I choose to follow that unit can I deduct that mileage or is that my place of business?

Did the information on this page answer your question?

Thank you for helping us improve the TurboTax Community!

Sign in to turbotax.

and start working on your taxes

File your taxes, your way

Get expert help or do it yourself.

Access additional help, including our tax experts

Post your question.

to receive guidance from our tax experts and community.

Connect with an expert

Real experts - to help or even do your taxes for you.

You are leaving TurboTax.

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- EXPENSES & DEDUCTIONS

Business meal deductions after the TCJA

- Individual Income Taxation

- C Corporation Income Taxation

The business meal tax deduction has been debated for decades, the subject of presidential ire and of incremental diminution. In just the past few years, uncertainty has reigned regarding the availability and requirements for the business meal deduction because of its abrupt separation from its historic tax deduction counterpart — the business entertainment expense deduction. However, with the adoption of final regulations in 2020, the IRS has provided guidance on deducting the costs of business meals separately from entertainment. Since then, the deduction has even been temporarily restored to its former magnitude, allowing the full cost of such meals to be deducted under certain circumstances.

This article examines the history of the deduction and considers the 2020 final regulations and their implied separate treatment of business meals consumed while traveling away from the taxpayer's home. Also, with the rapidly rising return of the dine - in restaurant meal as pandemic restrictions in many areas across the United States ease, 1 this article provides a framework by which taxpayers may effectively document and substantiate their claims to the business meal deduction.

A brief history of the business meal tax deduction

The deductibility of business meals and other expenses is among the most contentious issues in tax law. Business travel expenses deducted under Sec. 274(d) were 20% of all the business tax issues litigated in cases brought in federal courts during a 2019-2020 one - year period and reviewed by the national taxpayer advocate (NTA). Combined with issues of substantiation and deductibility of other business expenses under Sec. 162, these were 53% of the issues litigated. 2 It thus appears that taxpayer confusion 3 over how and when business tax deductions may be claimed is likely the catalyst for many disputes with the IRS. 4 This article attempts to help taxpayers avoid an adverse encounter with the tax authorities with respect to business meals. 5

The business meal deduction was cut to 80% of the cost in 1986, 6 then to 50% of the cost, effective Jan. 1, 1994. 7 (For 2021 and 2022, the deduction is 100% for meals purchased from a restaurant. 8 ) Over 56 years after President John F. Kennedy denounced the tax deductibility of business "expense account living," 9 Section 13304 of the law known as the Tax Cuts and Jobs Act (TCJA) 10 effectively eliminated from Sec. 274 the deduction for most entertainment expenses, without regard to how the entertainment may relate to a business relationship or activity. Because the TCJA did this by simply striking references to the most common allowable entertainment expenses from Sec. 274, the historic practice of treating meals and entertainment as largely interchangeable caused some confusion. Rumors soon abounded that the IRS would treat "business meals" as a form of entertainment and they too would be nondeductible. 11

The confusion signaled two important issues. First, the long - standing legal overlap between a business meal and business entertainment had, in fact, reflected the practical overlap between business meals and business entertainment. The line was blurred because, in this context, there was no line. 12 The business meal has never been about acquisition of nutrition; it has only ever been about a shared experience. Second, Congress had failed to define "entertainment" as a concept separate from "meals" in the business context when it excised references to entertainment from Sec. 274. Because of the long practice of treating business meals and entertainment as merely different perspectives on the same transactions, removal of the entertainment deduction called into question the continued validity of the other.

IRS guidance

On Oct. 3, 2018, the IRS stepped into the information gap with Notice 2018 - 76 , which provided interim rules until final regulations were issued. In February 2020, the IRS issued proposed regulations ( REG - 100814 - 19 ), and in October 2020 the IRS issued final regulations that obsoleted Notice 2018 - 76 .

Entertainment definition in final regulations : Regs. Sec. 1. 274 - 11 (b)(1) of the final regulations, as had Notice 2018 - 76 , incorporated the definition of entertainment found in Regs. Sec. 1. 274 - 2 (b)(1). Regs. Sec. 1. 274 - 11 (b)(1)(i) defines "entertainment" as "any activity which is of a type generally considered to constitute entertainment, amusement, or recreation," listing as examples "entertaining at bars, theaters, country clubs, golf and athletic clubs, sporting events, and on hunting, fishing, vacation and similar trips."

Under Regs. Sec. 1. 274 - 11 (b)(1)(ii), a taxpayer applies an "objective test" to evaluate whether an activity is "of a type generally considered to constitute entertainment." If, under the objective test, the activity is generally considered to be entertainment, it is entertainment for purposes of Sec. 274(a) and the regulations, regardless of whether it could be described as something other than entertainment and even if the expense relates to the taxpayer alone. The objective test precludes arguments that "entertainment" means only entertainment of others or that entertainment expenses should be treated as advertising or public relations expenses.

However, Regs. Sec. 1. 274 - 11 (b)(1)(ii) further provides that a taxpayer's trade or business is taken into consideration. For example, a theatrical performance is not entertainment for a professional theater critic attending the performance in a professional capacity, and a fashion show by a dress manufacturer to introduce its products to a group of store buyers generally would not constitute entertainment.

Meal expense deduction rules in final regulations : Under Regs. Sec. 1. 274 - 12 (a)(1), a taxpayer may deduct 50% of an otherwise allowable 13 meal expense if:

- The expense is not lavish or extravagant under the circumstances;

- The taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages; and

- The food and beverages are provided to a taxpayer or a business associate.

In addition, in the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. This rule may not be circumvented through inflating the amount charged for food and beverages. 14

In the third requirement in the final version of Regs. Sec. 1. 274 - 12 (a)(1), the IRS made a critical change from the proposed regulations to the description of persons who are considered suitable recipients of tax - deductible business meals, adding "taxpayer" to that description. This change allows self - employed taxpayers to access the deduction. 15

Business associate definition : For the definition of "business associate," the IRS inserted in Regs. Sec. 1. 274 - 12 (b)(3), nearly intact, the definition from Regs. Sec. 1. 274 - 2 (b)(2)(iii), which addressed the now - repealed "active conduct of business" requirement of Sec. 274(a) before its references to deductibility of entertainment expenses were eliminated by the passage of Section 13304(a) of the TCJA. Thus, as Regs. Sec. 1. 274 - 2 (b)(2)(iii) does, Regs. Sec. 1. 274 - 12 (b)(3) includes a taxpayer's employee within the scope of the business - associate requirement, thereby enabling tax - deductible business meals to include a mix of employees and customers. The relevant regulation section now reads:

Business associate. Business associate means a person with whom the taxpayer could reasonably expect to engage or deal in the active conduct of the taxpayer's trade or business such as the taxpayer's customer, client, supplier, employee, agent, partner, or professional adviser, whether established or prospective. 16

Absent from the types of relationships that are at least nominally included within the scope of a "business associate" for purposes of the deduction are persons with whom a taxpayer is simply cultivating goodwill. For instance, a business person working to grow or maintain his or her name recognition and reputation within a community might routinely host meals with local business leaders with whom he or she does not expect ever to directly do business but who might eventually be in a position to refer someone else to him or her. It is not clear that the word "prospective" in the regulation saves such indirect relationships from exclusion from the defined category. 17

Travel and nontravel meal expenses

Not amended by the TCJA were the rules for travel meal expenses. Nonetheless, the regulations consolidate the nontravel meal expense deduction rules with those for travel, underscoring that a deduction of the cost of meals purchased while traveling is subject to the heightened substantiation requirements of Sec. 274(d).

Definition of a travel meal : Sec. 274(d) disallows insufficiently documented deductions for meals while away from home, but neither the Code nor the regulations explain what the phrase "away from home" means for tax purposes. The Supreme Court took up the issue in Correll 18 and opined that the IRS's long - standing position, summarized initially as the overnight rule and later adopted as the "sleep or rest rule," 19 was legally valid. The sleep - or - rest rule disallows any deductions associated with business travel away from home unless the travel requires sleep or rest to meet the needs or exigencies of the taxpayer's employment. 20

Thus, for purposes of deductions under Sec. 274(d), a taxpayer's tax "home" is the taxpayer's regular or principal (if more than one regular) place of business. 21

Deductibility of travel meals : The regulations concerning travel meals apply the above three tests for deductibility of nontravel meals. 22 They also apply the enhanced substantiation requirements of Sec. 274(d), which disallows any deduction for, among other things, meals as part of traveling expenses unless:

the taxpayer substantiates by adequate records or by sufficient evidence corroborating the taxpayer's own statement (A) the amount of such expense or other item, (B) the time and place of the travel or the date and description of the gift, (C) the business purpose of the expense or other item, and (D) the business relationship to the taxpayer of the person receiving the benefit. The Secretary may by regulations provide that some or all of the requirements of the preceding sentence shall not apply in the case of an expense which does not exceed an amount prescribed pursuant to such regulations. 23

In Temp. Regs. Sec. 1. 274 - 5T (b)(2), the IRS provides that for purposes of Sec. 274(d), in the case of expenses for travel, the taxpayer is only required to substantiate the amount, time, place, and business purpose of the expense. However, with respect to time, the taxpayer must substantiate the date of departure and return for the travel, and that with respect to place, the taxpayer must substantiate the destination or locality of the travel, by city or town or similar designation. The regulations further provide that the four elements must be substantiated "by adequate records or by sufficient evidence" that corroborates the taxpayer's own statement. 24

Temp. Regs. Sec. 1. 274 - 5T (a) states that the substantiation requirements of Sec. 274(d) supersede the judicial doctrine in Cohan , 39 F.2d 540 (2d Cir. 1930), under which, if a taxpayer provides evidence that an expense occurred, but not its exact amount, a court may estimate the amount of the expense and not disallow the entire deduction. Thus, if the IRS disallows a deduction for travel meals, and the taxpayer cannot provide adequate records or evidence to substantiate all the elements in Temp. Regs. Sec. 1. 274 - 5T (b)(2), a court must uphold the disallowance of the entire deduction.

Documentation needed for travel and nontravel business meals deductions

Sec. 6001 imposes on taxpayers the duty to maintain records that support their tax positions. The regulations elaborate that a taxpayer "shall keep such permanent books of account or records, including inventories, as are sufficient to establish the amount of gross income, deductions, credits, or other matters required to be shown by such person in any return of such tax or information." 25 In short, taxpayers must prepare and keep written records that support everything that appears on their federal tax returns.

The responsibility for documenting claims associated with the tax return rests exclusively on the persons whose names appear at the top of those returns. A taxpayer fails to maintain or produce such records at his or her own peril. Thus, the taxpayer must consider what records support a claimed deduction for a business meal that includes a taxpayer and a prospective customer of that taxpayer.

Nontravel business meals : First, the documentation must demonstrate compliance with the threshold requirements of Sec. 162(a) and Regs. Sec. 1. 162 - 1 in three ways: The meal expense must be ordinary, necessary, and directly connected with, or pertaining to, the taxpayer's trade or business.

Next, as mentioned above, Regs. Sec. 1. 274 - 12 (a)(1) requires that:

- The taxpayer, or an employee of the taxpayer, is present at the furnishing of such food or beverages; and

- The food or beverages are provided to the taxpayer or a business associate.

A long trail of Tax Court opinions describes the results of inadequate documentation of claimed business deductions — generally, their disallowance, principally because adequately supportive records of the business relationship of the expenses to the taxpayer were not provided, or the records substantiating the business purpose of the expense were not prepared contemporaneously with the expense.

Observe that these issues do not go directly to deductibility but, rather, to the recordkeeping requirement of Sec. 6001. Indeed, these reasons have substantial probative overlap but, in cases reviewed by the author, are frequently distinguished by the courts. 26

In short, business meals must be substantiated in five respects:

- Amount of the expense;

- Date of the expense;

- Location of the expense;

- Business purpose of the meal; and

- Identification of who was present at the meal.

Travel meals : Deductibility of a travel meal gets different, higher scrutiny. 27 Regs. Sec. 1. 274 - 12 (a)(4) provides special rules for travel meals. This subsection invokes by reference paragraphs (a)(1) and (a)(2) of the regulation, so the three requirements of Regs. Sec. 1. 274 - 12 (a)(1) must be substantiated, just as they must be for nontravel meals. In addition, Regs. Sec. 1. 274 - 12 (a)(4) also refers to the statutory substantiation requirements of Sec. 274(d). Accordingly, a taxpayer who qualifies as away from his or her tax home and wants to deduct the cost of a meal must, in addition to documenting the requirements in Sec. 162(a) and its associated regulations and Regs. Secs. 1. 274 - 12 (a)(1) and (2), document that the substantiation requirements of Sec. 274(d) were met. The business purpose of a meal consumed by just the taxpayer is impliedly demonstrated by meeting the requirements of the sleep - or - rest rule of Correll described above .

Publication 463 : Likely adding to, or at least not resolving, the uncertainty surrounding the substantiation issues for business meals is the IRS guidance in Publication 463, 28 which indicates, with regard to business meals, that a restaurant receipt is enough to prove an expense for a business meal if it has all of the following information:

- The name and location of the restaurant;

- The number of people served; and

- The date and amount of the expense. 29

According to the final regulations, however, a restaurant receipt with this information on its own would not be adequate substantiation for either a nontravel or travel business meal, as it would not address the requirements of either subparagraph (ii) or (iii) of Regs. Sec. 1. 274 - 12 (a)(1) and only addresses the requirement of subparagraph (i) by implication (presumably, some evaluation that the meal was not lavish is made by division of the total cost by the number of people served). For travel meals, a receipt with this information also would be inadequate to substantiate either the time, place, or business purpose elements in Sec. 274(d) and Temp. Regs. Sec. 1. 274 - 5T (b)(2). Sec. 274(d), as discussed above, provides that all travel expenses, including travel meal expenses, are not allowed unless that taxpayer "substantiates by adequate records or by sufficient evidence corroborating the taxpayer's own statement" each of the required elements for the expense. 30

Form of documentation : The documentation requirement for substantiating both travel and nontravel meals can be met by simply writing on the back of the restaurant receipt the names of the persons present at the meal and a summary of the business discussion. If the meal is a travel meal and just the taxpayer consumes it, a note about the business purpose of the travel is adequate to satisfy the sleep - or - rest rule. In his own practice, the author advises clients that, in the event of an IRS examination of a return, the note should be sufficiently detailed to credibly prompt their memories and support reasonably meticulous recitations of the business content of meetings that, by the time of an IRS examination, may have occurred several years before.

Establishing sound recordkeeping habits

Recordkeeping for business meals is the product of a plan combined with the sound habit of execution. Insofar as insufficient records are connected by a straight line to disallowance of deductions and resultant underreporting of income, practitioners should anticipate the confusion precipitated by the abrupt fashion in which the TCJA amended the scope of business meal deductions and advise clients of the similar, but distinguishable, purposes and demands of the travel and nontravel rules concerning substantiation of deductions.

1 See, e.g., data from "Seated diners at restaurants open for reservations" at OpenTable (available at www.opentable.com ) showing that U.S. restaurant seatings on Feb. 1, 2021, were only 56.5% of the Feb. 1, 2019, level but by April 19, 2021, had increased to 90.6% of the level two years earlier.

2 National Taxpayer Advocate , Annual Report to Congress 2020 , at p. 200 (tabulating cases decided between June 1, 2019, and May 31, 2020).

3 Id. at p. 201 ("most opinions in this area resulted either from taxpayer confusion regarding the applicable legal requirements or from taxpayers' occasional attempts to push the envelope").

4 Id. at p. 201. The NTA report also shows a significantly lower percentage of pro se taxpayer wins on issues of trade or business expenses than for represented taxpayers.

5 This article is limited to conventional, small - scale business meals, whether or not consumed while traveling. The wider scope of Sec. 274 and its associated regulations, which includes numerous other scenarios, such as business entertainment events, expenses treated as compensation, attendance at conventions, and similar situations, is not treated here.

6 Tax Reform Act of 1986 (TRA 1986), P.L. 99 - 514 .

7 Omnibus Budget Reconciliation Act of 1993, P.L. 103 - 66 .

8 Section 210(a) of the Taxpayer Certainty and Disaster Relief Act of 2020, enacted as Division EE of the Consolidated Appropriations Act, 2021, P.L 116 - 260 , temporarily provides that the 50% deductibility limitation of Sec. 274(n)(1) is inapplicable to expenses paid or incurred between Jan. 1, 2021, and Dec. 31, 2022, of otherwise deductible business food or beverages provided by a restaurant, with the result that the cost of such meals is completely deductible (Sec. 274(n)(2)(D)). Notice 2021 - 25 provides some initial guidance on what a "restaurant" is for purposes of this temporary exception.

9 Kennedy's Special Message to the Congress on Taxation, April 20, 1961 ("This is a matter of national concern, affecting not only our public revenues, our sense of fairness, and our respect for the tax system, but our moral and business practices as well. This widespread distortion of our business and social structure is largely a creature of the tax system, and the time has come when our tax laws should cease their encouragement of luxury spending as a charge on the Federal treasury. The slogan — 'It's deductible' — should pass from our scene").

10 P.L. 115 - 97 .