Protect your future with GInsure

Easy application every time.

Application is as easy as 1, 2, 3! Tap on GInsure in the GCash app or use SMS to get insurance within minutes.

Affordable Insurance for Everyone

Stay prepared, stay protected. Get insured with top insurance providers for as low as ₱10.00 a month.

Reliable Insurance for Everything

GInsure offers a wide variety of insurance products for all your needs. Get coverage for your health, car, pets, and more!

Open the GCash app and tap on GInsure on the dashboard.

Choose a product from Our Featured Products, or search for a specific product in the Search bar.

Steps may vary depending on your chosen insurance. Follow on-screen instructions to proceed.

Review that they are correct and accurate and proceed.

Read and agree to the terms and conditions and proceed to pay.

We’ll show you a success page confirming your transaction. You may view your policy or quote at any time.

Accessible insurance for everything that matters

Download GCash today!

GCash is regulated by the Bangko Sentral ng Pilipinas https://www.bsp.gov.ph For concerns, please reach us through any of the channels listed in the GCash Contact Us Page W Global Center, Lane P Cor. 9th Avenue, Bonifacio Global City, Taguig, Philippines

Copyright © 2024 GCash. All Rights Reserved.

Hrmm. Looks like you're using an older browser, which means some site features may not work they way they should. For the full gadventures.com experience, we recommend upgrading to the most recent version of your browser . It's worth it! Honest!

View all tours

North America

Central america & caribbean, south america, north africa & middle east.

Few travellers make it to this icy continent, but the lucky ones who do get to explore a frozen Eden ruled by the elements and teeming with wildlife.

G Adventures Land

G adventures sailing & cruises, g adventures private travel.

Whether it’s a family retreat or a girls trip, you can surround yourself with a hand-picked crew and customize a tour that fits you all perfectly.

The Geluxe Collection

Our new line of premium active adventures is officially here. With perfectly paced itineraries, one-of-a-kind accommodations and elevated dining, this is adventure at its finest.

National Geographic Journeys

Go deeper into the cultures and habitats of the places we explore. More is included and you’ll enjoy greater hands-on exploration, interactions with local experts, and freedom to roam.

National Geographic Family Journeys

Are you an adventure-loving family in search of meaningful ways to discover the world together? These tours are specially designed for travellers seven and up and their inquisitive families.

Jane Goodall Collection

Step deeper into the animal kingdom while respecting all of its inhabitants. Our incredible collection of wildlife-focused tours is endorsed by the world-renowned ethologist.

Roamies by Hostelworld

The thrill of adventure. The awesomeness of hostels. Get ‘em both on these immersive small group trips for 18 to 35-year-old travellers.

Why choose us

As the leader in small group travel for 30 years, we know how to do it right: flexible itineraries, freedom to roam, safety, peace of mind, and locally based guides.

Change the world just by having the time of your life. When you travel with us, you become a force for good by acting responsibly and creating positive impact.

Together with our non-profit partner, Planeterra, we ensure local communities touched by our tours benefit from our visits in as many ways possible.

Trees for Days

Leave your destination even greener than you found it! For every day on tour, we’ll plant a tree in your honour and ensure that our forests get to live their best lives.

Travel resources

Last minute deals.

Looking to have the time of your life in the next 90 days or so? You can save big if you’re ready to book now.

Loyalty discount

Back home from a G Adventures tour? Submit a quick trip evaluation to save 5% on your next tour with us.

Student discount

Got proof that you’re pursuing higher learning? Then we’ve got a travel voucher with your name on it.

All travel deals

New ways to save pop up all the time. Here’s where you’ll find every hot deal in one easy place.

G Adventures Travel Insurance

Things can happen when you're travelling that are out of your control, so travel insurance is an important step in creating peace of mind. Considering the unpredictable nature, remote destinations, and conditions encountered on many G Adventures tours you must have travel medical insurance, and trip cancellation insurance is highly recommended. If you're going to spend your hard-earned money to enjoy your holiday, it pays to spend a bit more to safeguard it.

Upon starting your tour, the G Adventures leader or guide will ask everyone to provide a copy of their insurance details to keep on record. Failure to provide this information can, and has, resulted in travellers being unable to continue on tour, so don't leave home without it.

What insurance is required?

Travel medical insurance is mandatory. With a wide variety of company, credit card and travel policies out there, how do you know if your coverage is sufficient for our style of adventure travel? Our minimum required insurance policy coverage for medical expenses, evacuation, and repatriation benefits when combined together is 200,000 USD per traveller (or equivalent in other currency). If your pre-existing coverage does not meet these needs, you will be required to purchase travel medical insurance.

Why should I get cancellation insurance?

Adding cancellation insurance to your medical insurance is optional, but always recommended. By having 'all-inclusive' coverage you do not need to worry about emergencies that can happen any time, any where, before or during your travels. Including the cost of your airfare, as well as your tour(s), ensures that you do not have to worry about any unforeseen situations such as having to rush home to a family member or having a tour changed or cancelled because of a natural disaster.

How much does it cost?

Travel insurance costs less than you'd expect! Travel medical insurance is based on the number of days of coverage, so how long you will be away. All-inclusive insurance, which adds cancellation to your medical insurance, is based on the dollar value of the tours, airfare, hotel nights and other services being covered.

Example Typical costs, in USD, on a 10-day tour valued at $1000 with airfare coverage at $1000:

- Medical insurance only for 10 days = around $81

- All-inclusive insurance (medical + cancellation) for $2000 (tour + airfare) = around $183

GCashResource

Making GCash relatable to the ordinary Filipino

GInsure – The How’s and Why’s Explained

GInsure offers affordable insurance products within GCash and makes insurance accessible to all of its users.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

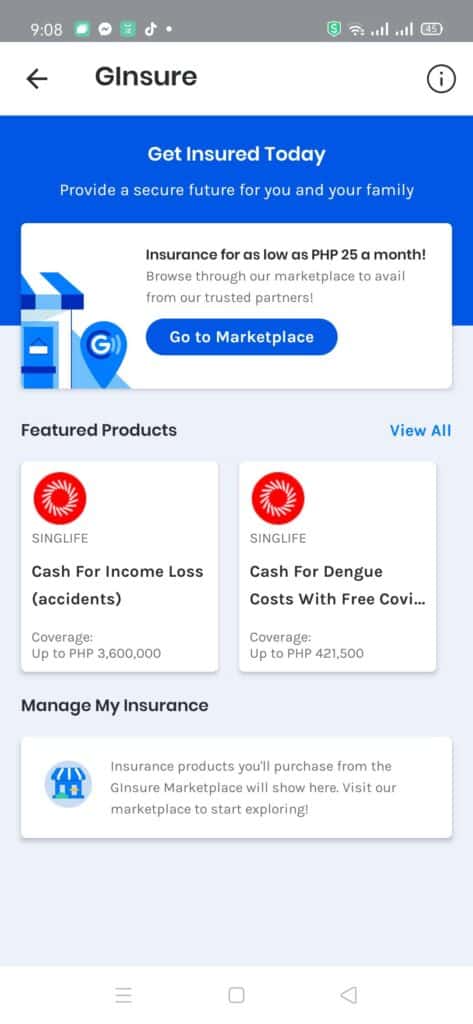

GCash now has a built-in insurance marketplace, the first of its kind in the Philippines. In its pursuit of being an all-around lifestyle app, just like Alipay, they’ve also delved into selling insurance products. This is quite timely since we’ve all needed some kind of support, especially during the pandemic.

A benefit of this is we can do this without going to a separate app or site to manage or purchase these insurance products as it’s all being handled by GInsure.

Table of Contents

What is the difference between investment and insurance?

Investment is something that grows in value over time when you give either your time and/or money to it. Insurance is something you are paying for that takes into account any bad thing that may happen that would cost you significant amounts of money.

An investment is an activity you have control over, as you actively select where you put your effort and your money. However, when an emergency happens, you would often need to draw from your investments if you have no other funds to take away from.

For insurance, you will need to pay an amount called a premium to cover you during a specific event you want protection from. An example can be disability insurance, which protects you from being disabled, or car insurance, which protects your car from damage due to accidents.

This premium enables you to have a security blanket in case this event actually happens. The good thing about this is you won’t need to take from your investments to pay for such emergencies. The only caveat is that you need to pay for the premium while being insured. Generally, the higher the premium, the better and more favorable the coverages are.

Another insurance example for employed individuals is HMO insurance, which is a type of medical insurance provided as a benefit to employees. The premiums are generally covered by the company or partly subsidized, but the benefit is to help employees (and sometimes their dependents) with medical emergencies and check-ups.

The distinction between insurance and investment is sometimes not explained well by those that sell insurance products, hoping to make a quick buck from the commission of the insurance product purchase. Oftentimes insurance products can have investment components (like Variable Universal Life Insurance or VULs), but the buyer should keep in mind that he is purchasing insurance first and hence the payment of premiums naturally take precedence over the “growing” of the investment component.

What are the requirements to enroll in GInsure?

You need to be Fully Verified to be able to use GInsure. The main requirements are already handled by KYC (know-your-customer) policies in the GCash app.

Basically, you only need one valid ID to be able to buy an insurance product in GCash. This goes a long way in providing financial services to the people that really need them.

Subscribing to GInsure Products

The very first provider was Singlife, but there have been more products added since it was introduced, depending on the category:

- Health (Singlife)

- Pet Insurance (Malayan, Standard)

- Phone Insurance (Etiqa, Igloo)

- Online Shopping Insurance (Igloo)

- VULs (Singlife)

- Personal Accident (FPG, Singlife, Cebuana Lhuillier, Sunlife, Generali)

- Vehicle (Kwik.insure, FPG, BPIMS, Standard)

- Property (FPG)

- Travel (Malayan, Standard)

- Business (Malayan)

As an example of how to avail, here is the step-by-step guide for Singlife:

Singlife is a life insurance company partly owned by Singapore Life Private Ltd, Aboitiz Equity Ventures (a local conglomerate), and a Singaporean investment company Di-Firm.

They specialize in offering digital insurance products, which are cheap, accessible, and customizable because they leverage technology in providing their products. They also offer them in their app (which removes middlemen) and in-app partnerships like GCash.

Singlife is the first partner for GInsure, hence we can see Singlife products within the marketplace.

What are the products by Singlife in GInsure?

There are multiple products offered by Singlife, not limited to:

- Cash for Income Loss (Accidents)

- Cash for Dengue Costs with Free COVID-19 Cover – provides COVID-19 test allowance, confinement allowance, and medical cost reimbursement for severe cases

- 3-in-1 Protection Plan – protection against accidents, dengue, and COVID-19

- Cash for Medical Costs – hospitalization insurance

There are typically 3 levels of coverage. The cheapest is bronze and works its way to silver, then to gold. A higher level of coverage means you get more benefits, but you also need to pay a higher premium. You can also include your family in the coverage with additional premiums if you need to.

What are some considerations before buying a Singlife insurance product?

Here are some things I took note of before buying a plan for my family:

- You can include a Life Partner in your plan, which covers those who are not married but have kids or have been together for years.

- Check for a preexisting conditions clause – one of my family members was not included because of diabetes. Also, children below a certain age have a higher premium for certain products.

- The premium is taken from your GCash wallet, so keep in mind to fund your wallet if you wish to continue your coverage the following year. Don’t worry, you will receive a notification before your scheduled auto-debit.

- If you change your mind, you can apply for a full refund within 15 days of purchase. Additionally, before claims, you will need to wait for 15 days for coverage to begin.

How do I buy a Singlife Product?

- From the main menu, click on the GInsure button.

- Once inside GInsure, either select a featured product from that page or click on “Go to Marketplace” and click a product from the list.

- You will be able to see the details of the product (Benefits, Premium, Family, Not Covered). Once everything is clear, click on “Buy Now”.

- Click the Plan Type you want (for Myself, or for Me & my family).

- If you selected “For Myself”, then you can choose your coverage level. Otherwise, you need to enter how many family members you want to join and select the coverage level for them.

- Confirm your profile details (basically this is already provided by GCash verification).

- If you have family members, enter their details.

- Review the details you’ve set, tick the Declarations, and click “Confirm and Pay”.

- Pay for the premium.

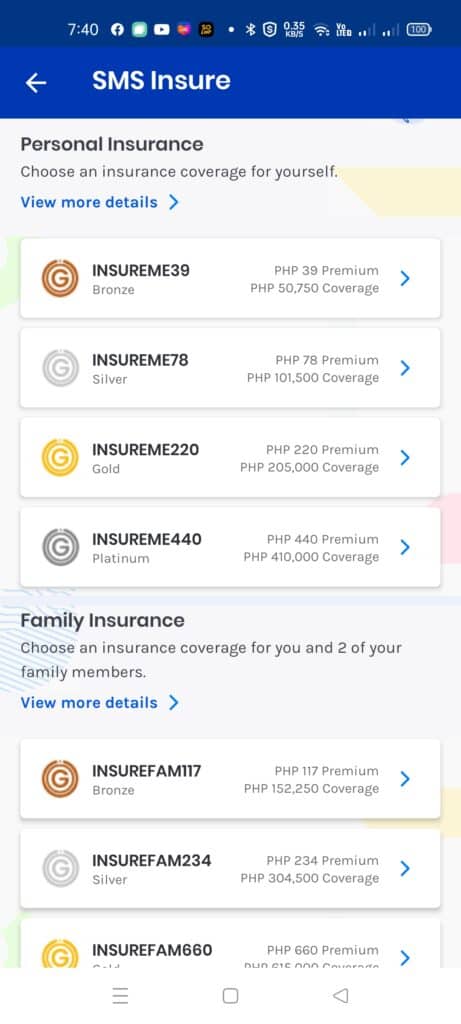

GCash has also its own insurance product, named SMS Insure. It’s a partnership with Microensure and underwritten by AXA. Basically, it allows you to apply for annual term insurance using SMS, paid monthly.

What are the SMSInsure product details?

All of the products offer a term coverage of 1 year. For personal insurance, the insured is the GCash user; for family insurance, it includes the user as well as 2 family members. Coverage includes each person insured.

Before claims, you need to wait for 15 days for coverage to begin.

Is COVID-19 covered in these products?

Yes, they are covered for both death and hospitalization benefits.

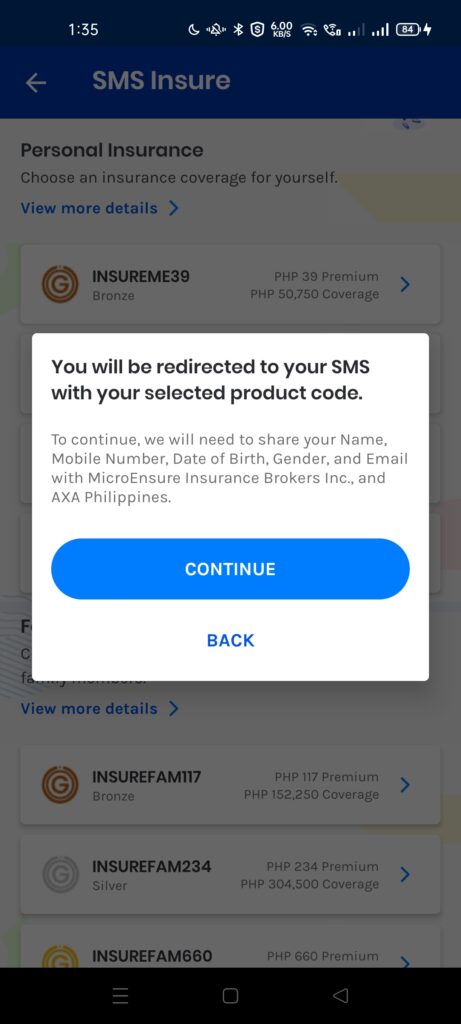

How do I avail of the SMSInsure product?

You can just click on the product, and it will redirect to your SMS with the keyword and number already populated.

How to File a Claim from GInsure

Filing a claim in singlife.

Claiming is easy as you don’t need to go anywhere. You can submit all the requirements within the GCash app.

Here are the steps:

- Within the GInsure page, click on “Manage my Insurance”.

- Click “File a claim” and then input the details.

- Upload your supporting documents, then click Next.

How long do I wait before I get the benefit?

For medical test allowances, generally, you will be getting your reimbursement in your GCash wallet within 24 hours of filing a claim. For confinement allowances, it can take up to 3 days.

How to File a Claim in SMSInsure

You can send an email to gc*****************@mi*********.com . You need to include the details of your insurance as well as any supporting documents for assessment. It can take a few days for processing.

Other Questions

Will i be getting a copy of the policy.

Yes, within a day you will be getting an e-policy within the GCash app, as well as a confirmation email with the contract attached.

Can I use GCredit to pay for my insurance?

No, currently you can only use your balance.

Are there other insurance products in GCash aside from GInsure?

Yes, there is a Cebuana Insurance mini-app under GLife and you can buy personal accident insurance for only Php 10.

We talked about GInsure, the insurance marketplace within the GCash ecosystem. This allows anyone to avail of, and manage insurance products from within the GCash app. We talked about how to avail of a product and also the conditions surrounding it. Everything is within the GCash app, including payments and claims, making it really easy to use.

Related Topics

- Getting CTPL from GInsure

- Availing Bill Protect

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is , here are the main GCash features:

Fund Transfers:

- Bank Transfer

- Request Money

Cashing In/Out:

- Cash in or Cash out

- Receiving Remittances

Other Services:

- Payment via QR

Financial Services:

- GScore/GCredit

New Services:

19 thoughts on “GInsure – The How’s and Why’s Explained”

The info provided has been very useful for me to decide and choose well which insurance I plan to avail/buy

Hi, I just want to clarify if I did not used the insurance, will I be getting back the total money I paid monthly?

No, I don’t think you understand what insurance is. You are paying for the off chance that something happens to you and if that’s the case, you won’t be leaving behind your family without a bit of financial support. It’s not something like an investment where you get returns.

I think i have not read on how long are we going to pay?

Currently, the contracts are renewed yearly. So you can choose not to renew. Kind of like a subscription.

Until when is the coverage?

when you start your payment, the coverage is until the next year after that.

How can my family file a claim in case of my death? Or will I need to give them my GCash password?

Your family can initiate a claim via an email to he**@si******.com or by calling 82993737

Hello. Does life partner also include partners of the same gender?

The rules doesn’t really say anything about gender so most likely it is allowed.

Hi, nag avail po kame ng INSUREFAM1320 Php 1320 last Aug 8. Magaavail po ba ulit kami at magbabayad ng Php 1320 ngayong September 8? Bale monthly po ba o 1 year na po yung binayad naming Php 1320?

Mukhang 1 year yan

bago lng po ako nag apply, within 1yr lng po ba ang validity? so after paying po ng 1 yr sa GInsure tapos di ko na po i-contine, wala na rin po ba ang benefits?

Yes, per year lang ang validity/term niya currently.

What if I purchase GCash x Singlife (GInsure – Cash for Income Loss) and I continue to pay monthly until such time I reached my retirement age, can I refund all the payment I made from the start of my purchase availment?

I don’t think you understand how insurance works — you are paying for the security blanket if something happens to you. If nothing happens, you can’t refund the insurance back.

I suddenly got an email from CHUBB PH . I did not apply for this insurance. May I know why is this and am I suppoed to be paying this?

Maybe you mistakenly clicked the bill protect — they provide insurance based on that

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in August 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

800-874-2442

"We have used CSA in the past and it now looks like Generali Global Assistance is improving the product even more. Thank you for the peace of mind!"

-Ed B. from Arizona

Insure Your Trip with Generali Global Assistance, the New CSA Travel Protection

Terms of Use | Privacy Policy | California Privacy Policy | Do Not Sell My Personal Information

Trusted by over 6 million travelers every year

Copyright© 1997 - 2024 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: A 353 17 05

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures , Terms and Conditions, and Assistance Service pricing.

Compare Plans

Frequently Asked Questions

Who is generali global assistance.

We are a full-service travel insurance and assistance provider. Formerly doing business as CSA Travel Protection, our customers will receive the same quality plans and outstanding customer service they have come to expect from us over the past 25 years, now backed by one of the largest insurance companies in the world. Our plans are built on the diverse needs of today’s travelers, designed to help you travel smarter.

Generali Global Assistance is part of the multinational Generali Group, which for more than 185 years has built a presence in 60 countries with over 76,000 employees. We pride ourselves on delivering a simpler, smarter approach to insuring and servicing millions of customers each year. Read more about us

Where can I compare travel insurance plans and prices?

You can view the three Generali Global Assistance travel protection plans in a side-by-side comparison to easily see the different coverages, features and services. If you get a quote first, you can also compare plan prices.

We'll take you from distress to relief, anytime, anywhere

What you love about CSA hasn't changed.

Travel Protection That You Need

When you buy one of our new plans, the key features you expect from CSA travel insurance are as strong as they've ever been:

We've helped millions of travelers through tough situations over the years. From common travel issues like canceled trips and travel delays, to on-the-ground 24/7 assistance with emergencies like hurricanes and medical evacuations by helicopter, we're there when your trip doesn't go as planned.

That tradition continues under our new brand name -- Generali Global Assistance.

Sources: 1. U.S. Travel Insurance Association survey 2. Centers for Disease Control

“My husband and I were really surprised by how very smoothly and quickly we received our check.”

“This company has always given us excellent customer service even when we have had a claim in the past. I will always use CSA/Generali for our trip insurance needs.”

“I have used CSA, now Generali, for years - fantastic insurance. Had to use it once for a delay and the customer service is fantastic! Do not go on a trip without this insurance.”

Smooth booking with improved website

Easily buy travel insurance on any device. The new site is packed full of guides and other information to better understand travel insurance before you buy and help you Travel Smarter™.

Get to know our new brand

Now known as Generali Global Assistance, you will experience the same quality of travel insurance, emergency assistance and outstanding customer service that travelers have come to expect from CSA for more than 30 years.

Compare Updated Travel Protection Plans

Choose from three new travel insurance plans to help protect your trip even better than before. The plans combine the best of CSA Travel Protection, with some extras, like Sporting Equipment coverage.

No hassle refund

Buy with confidence, knowing you have at least 10 days from the time of purchase to review your travel insurance and cancel the plan for a full refund of the plan cost if it doesn't meet your needs (as long as you have not left on your trip or filed a claim).

Top notch customer service

Travel insurance is great for more peace of mind around a trip, but a plan is only as good as its customer service. When things get real and you need help while traveling or need to file a claim, our focus on service makes us stand out from other companies.

Experience better travel insurance

Buying travel insurance online just got easier.

Buy Travel Protection View Our Plans Reviews

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

AIG Women’s Open 2024

Corporate Accident & Health Insurance

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Search Search Please fill out this field.

Cost of Travel Insurance

- Factors Influencing Cost

- Top Companies

- How To Save

- How To Choose

The Bottom Line

We independently evaluate all of our recommendations. If you click on links we provide, we may receive compensation.

- Personal Finance

How Much Does Travel Insurance Cost?

Average costs and how travel insurance premiums are set

:max_bytes(150000):strip_icc():format(webp)/LindsayFrankel-0e50cf9508f64df899aea94f1640c276-2fc39a1b539547cba44e7b84423e2d0f.jpeg)

d3sign / Getty Images

Travel insurance can protect your financial investment in a trip by offering reimbursement if your travel plans are canceled or interrupted due to covered reasons, as well as providing emergency medical care and other benefits. Generally speaking, you can expect travel insurance to cost between 4% and 10% of your total prepaid, nonrefundable trip cost. Younger travelers will usually pay less for comparable coverage than older travelers. Benefits also vary by plan, and you’ll pay more for comprehensive coverage with higher limits.

We’ll cover the cost of travel insurance from six popular companies, the factors influencing the cost of travel insurance, and the best companies to consider.

Key Takeaways

- Travel insurance can protect your financial investment in a trip by offering reimbursement if your travel plans are canceled or interrupted due to covered reasons, as well as providing emergency medical care and other benefits.

- Generally speaking, you can expect travel insurance to cost between 4% and 10% of your total prepaid, nonrefundable trip cost.

- Younger travelers will usually pay less for comparable coverage than older travelers.

- Benefits also vary by plan, and you’ll pay more for comprehensive coverage with higher limits.

Compare travel insurance quotes on TravelInsurance.com .

The cost of travel insurance varies based on your age, trip cost, and the company and plan you select. To give you an idea of what you might pay for a travel insurance plan, we collected quotes for two ages and trip costs for an eight-day trip to Costa Rica booked the day of the query and departing from Florida in three months. Quotes are per traveler and do not include optional upgrades.

Emergency medical coverage in a travel insurance policy is often secondary to your primary health insurance. This means you must first file a claim with your primary insurance company to determine how much your travel insurance policy will cover.

Other Companies to Consider

- InsureMyTrip

- World Nomads

- GeoBlue (medical only)

Factors Influencing Travel Insurance Costs

When purchasing travel insurance, your trip length may impact which policies you can get, and the timing of your purchase might impact whether preexisting medical conditions are covered—but these factors don’t typically impact your premium. Your destination also doesn’t influence your premium. Costa Rica travel insurance will cost the same as travel insurance for a trip to Europe, provided all other factors are equal. Instead, the cost of travel insurance is based on the following factors.

Travel insurance is more expensive for people who are older since they’re at a greater risk of having medical problems. Travel insurance companies charge a higher premium to account for that risk. However, even if you’re traveling in retirement, you probably can find low-cost travel insurance that meets your needs.

Premiums are also calculated based on your total trip cost. Since it costs more to reimburse a $10,000 canceled trip than a $1,000 trip, insurance companies charge higher premiums for more expensive trips.

The higher your coverage limits and the more benefits you add (e.g., cancel for any reason , adventure sports coverage, pet medical), the more expensive your premium will be. Companies often present a selection of plans at different tiers or benefit levels.

Top Travel Insurance Companies

- Travelex : Travelex offers plans with trip interruption coverage of up to 150% and emergency evacuation coverage of up to $500,000. Optional upgrades include adventure sports coverage, cancel-for-any-reason coverage , pet medical, pet return, and additional medical coverage of $50,000 for medical expenses and $500,000 of medical evacuation coverage. Travelex policies are underwritten by two reliable companies, Berkshire Hathaway and Zurich Insurance Group, which earn an A++ (Superior) and A+ (Superior) AM Best financial-strength rating, respectively.

- Allianz Travel Insurance : Allianz offers a variety of single and multi-trip plans, and you can opt to buy medical coverage or travel cancellation coverage separately. The company offers high coverage limits, and most plans include epidemic coverage for COVID-19. For a single trip, Allianz offers up to $50,000 in emergency medical coverage and up to $250,000 for emergency medical transportation. Cancel anytime coverage and rental car coverage are available as optional upgrades. Also, the two underwriters for Allianz, Jefferson Insurance Company and BCS Insurance Company, earned financial strength ratings of A+ (Superior) and A- (Excellent) from AM Best.

- HTH Travel Insurance : HTH offers short and long-term medical plans along with full trip protection plans. Plans offer high medical coverage limits, with at least $50,000 in emergency medical coverage and $500,000 in coverage for emergency medical evacuation. The company reimburses up to 200% of the trip cost due to interruption. All plans also include at least $500 in trip-delay coverage and $250 in missed-connection coverage. Plans are underwritten by Nationwide, which has an A (Excellent) financial strength rating from AM Best. Also, more than 90% of customers on travel insurance marketplace InsureMyTrip recommend the coverage.

- Nationwide : Nationwide offers single- and multi-trip plans along with a package designed for cruises. Plans are comprehensive, covering at least $75,000 in emergency medical and $250,000 for medical evacuation coverage, as well as reimbursement for up to 125% of the trip cost due to interruption, depending on the plan. Accidental death and dismemberment (AD&D) and rental car coverage are available as add-ons, and COVID-19 diagnosis may be covered as part of your trip-cancellation coverage. Nationwide has an A (Excellent) financial strength rating with AM Best.

- Seven Corners : Seven Corners’ offerings include travel medical, trip insurance, and annual plans. Trip insurance plans offer at least $100,000 in emergency medical coverage and $250,000 for emergency medical evacuation. However, the basic plan doesn’t cover pre-existing conditions. Add-ons include rental car coverage and optional cancel-for-any-reason and interrupt-for-any-reason coverage. COVID-19 diagnoses are treated the same as other illnesses that trigger coverage. Trip interruption and cancellation policies are underwritten by United States Fire Insurance (USFI), which has an A (Excellent) financial strength rating from AM Best. Travel medical policies are underwritten by USFI if you live in Colorado, Maryland, New York, and South Dakota, and either Lloyd’s of London or Crum & Forster SPC if you live in other states.

- Travel Guard by AIG : Travel Guard offers some of the cheapest premiums we could find, especially for young people, but medical limits on the basic plan may not be sufficient. Trip insurance plans offer at least $15,000 in emergency medical coverage and $150,000 for emergency medical evacuation. However, you may need to purchase an exclusion waiver to get coverage for preexisting medical conditions. COVID-19 is treated like other illnesses under the plan. The company offers few upgrades, but rental car coverage is available. AIG has an A (Excellent) financial strength rating with AM Best.

How To Save Money on Travel Insurance Costs

- Don’t pay for coverage you don’t need : Check what’s covered by your credit card, health insurance, homeowners insurance, and, in some cases, car insurance, and try to get a policy that fills in the gaps.

- Compare premiums across companies : While the cheapest plan isn’t necessarily the best, some companies may offer better rates than others for the same coverage. For example, some companies are more affordable for older travelers. It’s a good idea to compare quotes for the coverage you need.

- Consider an annual plan : If you travel frequently, you may save money by purchasing an annual plan. But you should compare a plan’s benefits and make sure you’re getting more bang for your buck vs. a trip-based plan. Also, keep in mind that annual plans may not be available in all states.

- Avoid cancel-for-any-reason coverage if possible : You might think you can rest easier with cancel-for-any-reason coverage, but these policies typically cost significantly more and often provide inferior coverage. You should avoid this coverage type unless it’s necessary for your trip.

How To Choose the Best Travel Insurance

Decide which coverage types are important to you.

Travel insurance is a package of coverages that may include some or all of the following:

- Travel cancellation and interruption : Provides reimbursement if your trip is canceled or interrupted for certain reasons, like an injury or unforeseen natural disaster

- Travel medical coverage : Provides temporary health insurance if you become sick or injured while traveling

- Emergency medical evacuation : Pays to evacuate you to the closest adequate medical facility if necessary

- Accidental death & dismemberment : Pays a sum to you if you lose a limb or to your beneficiaries if you die in an accident

- Baggage loss or damage : Reimburses you for lost or damaged baggage and personal items

- Cancel-for-any-reason coverage : Allows you to cancel in any circumstance and receive partial reimbursement, but it’s more costly.

Some travel insurance packages may also include extras like car rental coverage, baggage delay, pet medical, and missed connection coverage. Most travel insurance plans also include some form of travel assistance. Decide which coverages you want, then check to see what’s already covered by your credit card and your existing insurance policies before purchasing a travel insurance plan.

Evaluate Company Ratings

In the process of comparing companies, you’ll want to consider more than just the price of the policy and the coverage offered. You should also check that the insurer has an A- (Excellent) financial strength grade or better from AM Best , and evaluate customer reviews from third-party companies like TrustPilot, ConsumerAffairs, and the BBB.

Compare Premiums

Depending on your age and trip cost, some travel insurance companies may offer a lower premium than others. That’s why it’s important to compare quotes. You can collect quotes directly from each insurance company’s website, or you can use an insurance aggregator site that allows you to view quotes from a handful of companies with just one application.

Review Policy Limits and Exclusions

When comparing premiums, look at the policy details and compare limits and exclusions. For example, some insurance companies won’t reimburse you if your trip is delayed, and some may exclude coverage for preexisting conditions. Additionally, medical coverage may exclude injuries from certain activities, like scuba diving.

Consider Endorsements

Some insurers offer commonly excluded coverages as endorsements to your travel insurance plan for an additional premium or as an included feature in certain packages. Pay attention to what’s available if you’re looking for an extra layer of protection. For example, while travel insurance plans commonly exclude pandemics and epidemics, most plans from Allianz include an epidemic coverage endorsement that will cover cancellation, interruption, medical care, and more in the event of a COVID-19 diagnosis.

Buy As Soon As Possible

To get coverage for preexisting conditions, you typically need to buy travel insurance soon after purchasing your trip or making a deposit on the trip. Furthermore, travel insurance typically only provides coverage for unforeseen circumstances, so if you wait until a weather event has been announced to buy coverage, that weather event may not be covered. The sooner you buy travel insurance after purchasing your trip, the fewer exclusions you’ll have to worry about.

What Is Travel Insurance?

The term “travel insurance” typically refers to a package of coverages that helps protect against a variety of things that can go wrong before and during your trip. The best travel insurance will reimburse you for the total cost of your trip if it gets canceled or interrupted for certain reasons, like an injury or the death of a family member. It also provides temporary major medical coverage and emergency evacuation coverage should you become injured or ill while traveling. Many plans also offer additional benefits or optional endorsements, such as cancel-for-any-reason coverage.

Is Travel Insurance Worth It?

It’s up to you. You’ll need to weigh the risks of forgoing travel insurance against the cost of a policy. You may have sufficient coverage from a travel credit card or other insurance policies that make travel insurance coverage unnecessary. However, if you’ve purchased an expensive vacation that’s nonrefundable, or if your health insurance plan won’t cover you where you’re traveling, then travel insurance is likely worth it.

How to Get Travel Insurance

If you’re looking to buy travel insurance , a good place to start is with company reviews. Then, get travel insurance quotes to compare costs and coverage. Almost all travel insurance companies allow you to buy coverage instantly online, and it’s best to pay for the coverage as soon as possible after you book your trip.

What Does Travel Insurance Cover?

While coverages vary from one plan to the next, most travel insurance policies cover trip cancellation and interruption, short-term major medical coverage, emergency evacuation, and lost or damaged baggage. Most also offer additional benefits, such as cancel-for-any-reason coverage , pet medical, and adventure sports coverage.

Travel insurance can be helpful since it covers medical expenses and trip protection for cancellations and delays. Travel insurance also provides emergency medical evacuation. However, not all plans cover preexisting conditions and younger travelers tend to pay less than older travelers. Be sure to read the fine print within the plan to fully understand the coverage.

InsureMyTrip. “ How Much Does Travel Insurance Cost? ”

Travelex. “ Compare Travel Insurance Plans .”

AM Best. “ AM Best Affirms Credit Ratings of Zurich Insurance Group Ltd and Its Main Rated Subsidiaries .”

AM Best. “ AM Best Affirms Credit Ratings of Berkshire Hathaway Homestate Insurance Company and Its Affiliates .”

Allianz Travel. “ Trip Cancellation & Travel Insurance .”

Allianz Travel. " Travel Insurance and COVID-19: The Epidemic Coverage Endorsement Explained ."

Allianz Travel. " OneTrip Emergency Medical Plan ."

AM Best. “ BCS Insurance Company .”

AM Best. “ AM Best Affirms Credit Ratings of Allianz SE and Its Rated Subsidiaries .”

HTH Travel Insurance. " Benefits Schedule ."

HTH Travel Insurance. " TripProtector Economy Benefits ."

AM Best. “ AM Best Downgrades Credit Ratings of Nationwide Mutual Insurance Co & Its P/C Subs; Affirms Credit Ratings of Life Affiliates .”

Insuremytrip. “ Travel Insurance Reviews HTH Worldwide .”

Nationwide. " Single-Trip Essential Plan ."

AM Best. “ United States Fire Insurance .

Seven Corners. " Seven Corners Trip Protection Basic ."

Travel Guard. " Essential Travel Insurance Plan ."

AM Best. “ United States Fire Insurance .”

Washington, D.C. Department of Insurance, Securities, and Banking. “ Taking a Trip? Information About Travel Insurance You Should Know before You Hit the Road .”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1365609230-4636d33ba0ec41799d44f64e1d85ddac.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

All products

Business property, business liability, construction all risks, contractors equipment, tour liability.

Mobile Insurance Pass

Our company, business hours:, contact page.

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- Dutch Caribbean

- All Other Territories

Travel with Confidence

Drive with Confidence

Live with Confidence

Live Healthy

Boat with Confidence

Choose your product

Our commitment.

At CG United, we are committed to providing quality service and absolute insurance protection. Our delivery on this commitment is the reason we’re one of the largest general insurers in the Caribbean offering all major classes of insurance.

FINANCIAL STRENGTH

CG United’s financial strength has resulted in an A Excellent rating by AM Best Co., USA. AM Best’s ratings are recognized worldwide as the benchmark for assessing a company’s financial security. Our annual strong ratings provide validation that CG United has the resources available to be there when our customers need us most.

CORALISLE GROUP

CG United Insurance Ltd. is a member of Coralisle Group Ltd . Coralisle Group (CG) is a Bermuda-based regional insurance provider with operations in 20 countries throughout the Caribbean and annual revenues in excess of US$600 million. CG is comprised of independently incorporated companies offering property and casualty insurance, employee benefits for pensions and health, personal life insurance and investment products. Coralisle Group Ltd. is a subsidiary of Edmund Gibbons Limited in Bermuda.

Thank you for your interest in CG United . Please complete the form below to receive more information on our products and services.

Select Your Island

Select desired coverage, select the option that best describes your cargo needs.

- Car Insurance

- Travel Insurance

- Home Insurance

- AA Membership

- Van Insurance

- Car Service

- EU Breakdown

AA Travel Insurance

Single Trip Travel Insurance: Is a One-Time Policy Right for You?

Published 13th September 2024 Read Time 6 min

Are you planning a single vacation this year? If so, single trip travel insurance might be the perfect solution to protect your journey. This specialized coverage offers peace of mind for one-time travelers, safeguarding against unexpected mishaps and emergencies that could derail your plans. From medical issues to lost luggage and last-minute cancellations, a comprehensive single trip policy has you covered. But is this type of insurance right for you? In this guide, we’ll explore the ins and outs of single trip travel insurance , helping you determine if it’s the best choice for your upcoming adventure. You’ll learn about coverage options, potential limitations, and how to select the ideal policy for your needs.

When Single Trip Travel Insurance Makes Sense

For infrequent travelers.

Single trip travel insurance is ideal if you’re planning just one vacation this year. It provides comprehensive coverage for that specific journey, including protection against medical emergencies, lost luggage, and unexpected cancellations. This type of policy is cost-effective for those who travel occasionally, as you’re not paying for coverage you won’t use.

For Budget-Conscious Adventurers