- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

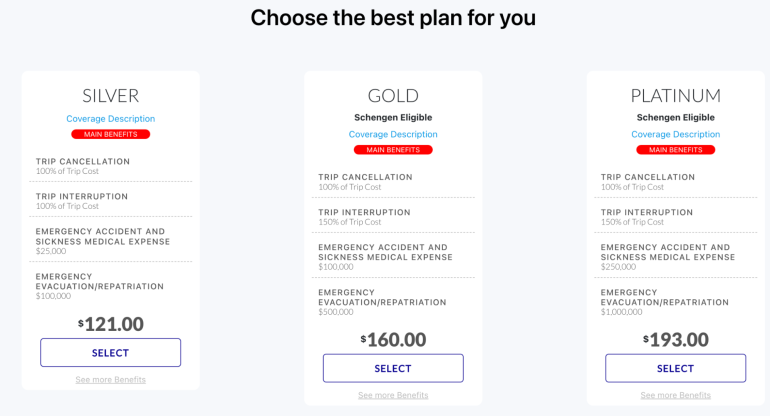

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

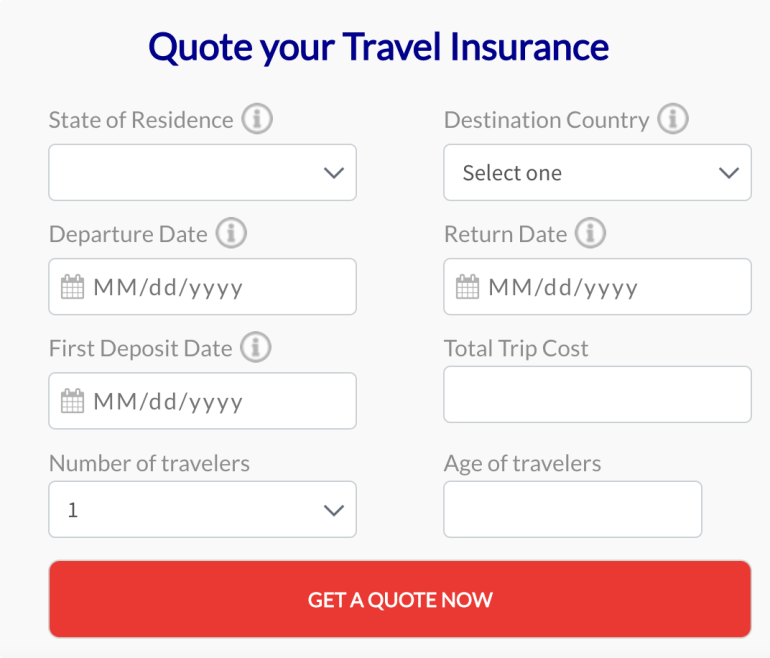

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

What is Travel Insurance?

Travel insurance is a type of insurance that offers coverage for losses or medical expenses that may occur while you are traveling. It can help protect you from eligible unforeseen events that may disrupt your travel plans, such as medical emergencies, trip cancellations or delays, lost or stolen baggage. Travel insurance policies typically offer a variety of coverage options that you can select based on your needs and travel plans. These may include emergency medical coverage, trip cancellation or interruption coverage, baggage loss or delay coverage, rental car coverage, and more. When you purchase travel insurance, you pay a premium in exchange for coverage during the period of your trip. The cost of your premium depends on a variety of factors, including the length and destination of your trip, your age, and the level of coverage you select. Travel insurance can help ease your mind during your travels and help you mitigate financial and medical risks that may arise. However, it's important to carefully review your policy and understand what is and isn't covered, as well as any exclusions or limitations that may apply. Planning an exciting trip? Get your AXA Travel Protection plan today and ease your mind knowing that you have coverage in case of eligible, unexpected and unforeseen events that could occur during your trip.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Related articles.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage.

Asia travel insurance: how to choose the best coverage

Travel insurance for asia.

Asia is known for its incredible diversity and is home to more than half the world’s population. From culture and history to religion to terrain, the world’s largest continent boasts unparalleled variety in every aspect, making it a popular destination for millions of tourists annually. Whether you’re looking to spend weeks in the mountains surrounded by nature, wish to experience living in a secluded village, or enjoy the best of city life, Asia has it all. This region's fantastic variety of food works like the cherry on top. While this region welcomes people from all across the world, there are specific requirements that tourists have to fulfill to visit and explore it.

Discover our travel insurance for Asia.

India Travel Insurance | Japan Travel Insurance | Thailand Travel Insurance | Vietnam Travel Insurance

Do You Need Travel Insurance for Asia?

It depends on the country you’re traveling to. Considering there are 48 countries in Asia, no single rule applies across the region. Some Asian countries require all foreign tourists to carry travel insurance, while some only require tourists from specific countries to have travel insurance, allowing others to visit without it. Moreover, the coverage requirement for each country that mandates travel insurance may also vary. Several countries that previously allowed international travelers to visit and explore their lands without insurance have made it necessary post-COVID.

Which Asian Countries Require Travel Insurance?

To facilitate your travel planning for Asia, here’s the list of countries that require tourists to carry insurance:

Countries with Fluid Insurance Coverage Rules for Travelers

Indonesia made it mandatory for all international travelers to carry travel insurance with COVID-19 coverage when it opened up for tourists post-pandemic. However, it is no longer a legal requirement. You have to show your COVID-19 vaccination proof.

Philippines

Philippine laws require unvaccinated tourists to get travel insurance with COVID-19 treatment coverage for a minimum of USD 35,000 from a reputable insurance company. The policy should remain valid for their entire duration of stay. However, fully vaccinated travelers are exempted from this condition and can travel to the Philippines without insurance. The term ‘fully vaccinated’ here refers to two standard doses and a booster for adults over 18 years and two classic shots for tourists aged 17 and under.

Russia requires all tourists who require a visa to enter the country to get travel insurance. It’s part of the visa requirements. However, tourists from countries with visa-free access to Russia can travel without insurance. American citizens (as anyone can guess) belong to the first category, which means they need travel insurance for Russia.

You’re only required to have travel health insurance for visiting Thailand when your next destination requires you to take a COVID-19 test before leaving Thailand.

Travel insurance is necessary for obtaining a Turkey visa. So, everyone needing a visa to travel to Turkey must buy a travel insurance policy. There is no minimum amount limit for coverage; however, it should be for the entire trip duration.

Asian Countries That Require All Tourists to Carry Travel Insurance

- Israel – travel medical insurance with COVID-19 coverage

- Jordan – travel medical insurance

- Nepal – travel medical insurance with emergency assistance and medical repatriation coverage if tested positive for COVID-19

- Oman – travel– travel medical insurance

- Saudi Arabia – travel medical insurance with full coverage for COVID-19 treatment.

- Singapore – travel insurance with COVID-19 treatment and hospitalization coverage for a minimum of USD30,000.

- Sri Lanka – requires COVID insurance, regardless of travelers’ vaccination status.

- UAE – The insurance must cover international healthcare for the entire trip duration.

- Vietnam – Travel or medical insurance with COVID-19 treatment coverage for a minimum of USD 10,000.

- Laos – travel medical insurance with a minimum coverage of USD 50,000

- Iran – requires all foreign visitors to carry travel insurance

- Qatar – All international tourists must have travel insurance

Apart from these, no other Asian country mandates travel insurance.

Travel Insurance is Always Encouraged

Though you are legally allowed to visit most Asian countries without travel insurance, it is still highly encouraged to carry one for several reasons. Traveling is never 100% risk-free. No matter how well-planned your trip is or how safe and secure the country or city you’re visiting is, there is always a chance that things might go wrong. You may fall sick, have an accident, miss a flight, or become a victim of crime. Insurance can come in handy in such unfortunate situations and save you from getting into any financial trouble in a foreign country.

Why Choose AXA Travel Insurance for Asia?

AXA is consistently ranked as the most reliable insurance company for a decade. There are several reasons why travelers trust us with their travel insurance plans. Here are some of the major ones:

We Offer the Most Flexible Travel Coverage

Unlike many other travel policies that just cover emergency medical expenses, for a limited amount, AXA travel insurance plans protect you against what could potentially go wrong on your foreign trip. Our travel insurance covers: ✔ Emergency medical expenses due to an illness or accident ✔ Emergency medical repatriation ✔ Reimbursement of Non-refundable costs in case of trip interruption ✔ Baggage loss benefits AXA travel insurance also offers 75% coverage for all prepaid, non-refundable trip cost amounts in the event of trip cancellation for any reason and 100% coverage for trip cancelation due to illness, or many other unforeseen situations.

We Have Multiple Plan Options

Considering that not all travelers’ insurance needs are the same, we offer three different types of travel insurance policies: ✔ Silver – the most basic and cost-effective plan ✔ Gold – offers the same benefits as the silver plan but at a higher coverage amount ✔ Platinum – maximum benefits, highest coverage. It also includes coverage for rental sports equipment, lost ski days, and lost golf rounds.

We Also Offer Travel Assistance Services

Facing an unforeseen situation in a foreign country can overwhelm many people. Considering this, we also offer travel assistance services to our travel insurance policyholders to ensure they have the necessary information, support, and guidance they may need to deal with the situation 24 hours a day and 7 days a week.

Talk to Our Licensed Representatives to Find the Best Policy for Your Trip to Asia

With our travel insurance we can take great care of you too

Discover all our Travel Insurance stores

Protected, wherever you are

If you want to know more about our travel insurance plans & get a quote , visit the store corresponding to your country:

Our travel insurance plans protect you from the unexpected

Anything could happen while you travel. You could walk across the lawns of the oldest university in Europe, come across a herd of wild reindeer, visit the birthplace of Alexander the Great... Not only are you likely to encounter something wonderful, but you are just as likely to encounter unforeseen circumstances and stressful situations.

Unfortunately, flight delays, cancellations, lost baggage and medical emergencies are more common than most would assume; that's when we step in.

While we can't prevent anything bad from happening, we can cover you when plans go sour. Simply sign up for our Online Travel Insurance today to receive medical coverage adapted to your individual needs, with a global network ready to assist you 24 hours a day, 7 days a week, wherever you happen to be in the world. Find out what makes AXA the world's leading insurance provider .

GET A QUOTE

What are the requirements for Schengen Visa Travel Insurance?

What are the requirements for schengen visa insurance.

If you’re planning a trip to or around Europe, you might need a Schengen Visa. And to both apply for and get a Schengen Visa, you’ll need to have travel insurance.

AXA offers comprehensive travel insurance online that meets all the Schengen Visa requirements. And it also offers general comprehensive coverage at the best value, which means — whether you need a visa or not — you can travel throughout the Schengen (and beyond) confidently and with peace of mind.

- What kind of travel insurance do I need to be approved for a Schengen visa?

- What are the Schengen visa insurance requirements for a multiple-entry Schengen Visa?

- European Parliament’s Regulations for Travel Insurance in the Schengen Area

- What documentation do I need to provide to visa officials?

- What insurance products does AXA offer those traveling to the Schengen Area?

- Does AXA have a refund policy?

What kind of travel insurance do I need to be approved for a Schengen visa?

Depending on the nature of your trip, you have a few options when it comes to Schengen Visa Travel Insurance. But whether you’re on vacation, traveling for work, visiting friends and/or family, studying, or anything in between — to be approved for a Schengen visa , your insurance is going to have to meet a number of requirements. Here’s a breakdown of what you’ll need:

- An insurance plan that’s valid for the duration of your entire time in Europe — be it a day, a year, or longer.

- Not only that, but your insurance will need to cover all the Schengen Area countries . And this is regardless of whether you plan to visit all of them or just one.

- It must cover the cost of medical expenses such as : hospitalization , emergency treatment and repatriation (in case of accident or death)

- You’ll need a minimum coverage of at least €30,000.

What are the Schengen visa insurance requirements for a multiple-entry Schengen Visa?

Multiple-entry Schengen visas allow you to make multiple trips within the Schengen zone. Applicants for visas for more than two entries will need the following:

- Proof that they have valid travel medical insurance covering only the duration of their first intended visit to receive their visa.

- However, you’ll also need to sign a document stating you understand that you need insurance for any and all future trips. But, of course, it’s best to have insurance coverage for all your planned trips ahead of time. That way you can continue your journey at any point confidently and stress-free.

If you do plan to travel to and throughout the Schengen area with multiple entries, AXA offers a comprehensive Multi-Trip coverage option too.

European Parliament’s Regulations for Travel Insurance in the Schengen Area

Above is a general overview of all the necessary requirements for obtaining a Schengen Visa. However, if you want to learn the specifics, you can see a more detailed breakdown of the above requirements in “Article 15 - Travel Medical Insurance” of the European Parliament’s Regulation (EC) No. 810/2009 , provided courtesy of the Official Journal of the European Union . You’ll find them on page 10.

What documentation do I need to provide to visa officials?

The exact documents you need to present will obviously depend on your country of destination, as well as the country you're coming from. But you’ll most likely need your passport (and/or your residency card, etc.), your itinerary, maybe a letter of invitation, something stating the purpose of your trip, and so on.

One thing you’ll need for sure, however, is a certificate proving you have Schengen travel insurance .

Fortunately, AXA provides a personalized, printable certificate online . And you can obtain it instantly once you’ve purchased your policy.

The AXA certificate meets all the Schengen visa insurance requirements of the EU (and other Schengen countries like Iceland, Norway, etc.) and is accepted by all Schengen member embassies and consulates.

What insurance products does AXA offer those traveling to the Schengen Area?

AXA offers three types of Schengen Area travel insurance options. All three meet all the requirements for obtaining a Schengen Visa. But the one that works best for you depends on your trip. They are:

- Low Cost , which starts from as little as €22/week. It covers you for medical expenses up to €30,000 in all Schengen countries and offers coverage in case of hospitalization or repatriation. This policy is best for those who want basic coverage and/or are traveling on a budget.

- Europe Travel , which costs €33/week, covers expenses of up to €100,000, and can help with a number of emergencies (such as the loss of important documents or items, search and rescue costs, and so on). An added bonus of Europe Travel is that, along with the 27 Schengen states, it also covers EU countries not in the Schengen area, San Marino, the Principalities of Andorra and Monaco, Vatican City and the United Kingdom.

- Multi-Trip , available from €328/year and perfect for those who plan to travel frequently throughout the Schengen, the EU, and the U.K. It offers the same comprehensive benefits as Europe Travel, but it also allows you multiple entries throughout your stay in the Schengen area (and beyond). This policy is perfect for those who travel regularly.

Does AXA have a refund policy?

Yes. On the off-chance that you are refused a Schengen Visa (despite having the right travel insurance), AXA will refund your fees in most circumstances. But the refund is subject to certain terms and conditions. We’ll ask that you provide official documentation explaining the reasons why your visa was refused by the relevant embassy, consulate, or visa application center.

Related topics on Schengen insurance

- What is the health insurance for Schengen visa?

- What is the minimum coverage required for a Schengen Visa?

- Is Schengen travel insurance mandatory?

- How much does Schengen travel insurance cost?

- How to book Schengen insurance online ?

- How to choose the best Schengen travel insurance online?

- Where can I get my Schengen travel insurance certificate?

- What are the warranties for Schengen travel insurance?

Will declaring pre-existing conditions when taking out travel insurance have any impact on my policy’s validity?

You will need to disclose any pre-existing conditions when taking out your insurance. AXA has made it easy for you to do so by answering a few quick and confidential questions during the quote process. This means we should be able to make sure you are covered for the conditions you have declared. If you fail to declare conditions- you may not be covered during your trip.

What happens if I give you the wrong information?

If you give the wrong information on your application-your policy may be declared void - and in some circumstances - you may face a fraud investigation. If this is discovered before you apply for your visa it could impact your application.

If I am only traveling to one country- can I buy insurance for just that place?

If you need a Schengen Visa to travel to Europe then you must obtain travel insurance that covers you in all 27 Schengen countries.

Get Schengen insurance

Copyright AXA Assistance 2023 © AXA Assistance is represented by INTER PARTNER ASSISTANCE SA/NV, a public limited liability company governed by Belgian law with registered office at Regentlaan 7, 1000 Brussel, Belgium – Insurance company authorized by the National Bank of Belgium under number 0487 and registered with the Crossroads Bank for Enterprises under number 0415 591 055 – RPR Brussels- VAT BE0415 591 055

AXA Travel Insurance Global | AXA Assicurazione Viaggio | AXA Assurance Voyage | AXA Seguros y asistencia en viajes | AXA Seguro de viagem

COMMENTS

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage. ...

With our travel insurance we can take great care of you too. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace of mind ...

From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. GET A QUOTE 855-327-1441. If you become ill with COVID while on your trip you may be covered for Medical Expense, Emergency Evacuation, Trip Interruption, and/or Trip Delay benefits with a confirmed diagnosis, including ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

There are several reasons why travelers trust us with their travel insurance plans. Here are some of the major ones: 1. Complete coverage: AXA covers a wide range of travel-related incidents, such as trip cancellation, trip interruption, medical emergencies, and lost or stolen luggage. 2. 24/7 emergency assistance: AXA offers 24/7 emergency ...

GET A QUOTE 855-327-1441. Travel insurance is a type of insurance that provides coverage for financial losses or medical expenses that may occur while you are traveling. It can help protect you from unforeseen events that may disrupt or ruin your travel plans, such as medical emergencies, trip cancellations or delays, lost or stolen baggage, or ...

Insure your vacation to Europe with AXA Travel Insurance with international travel insurance Europe. File Claim Our Plans Our Plans Protect your trip from unforeseen events while traveling. ... Don't expect everyone to know English in countries other than the UK. Beware of pick-pocketing; it's common in many parts of Europe. In Italy ...

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year ...

AXA travel insurance offers competitive pricing, though premiums do vary. To get an accurate quote for your specific trip, use the quote tool on AXA's website or contact the company at 855-327-1441. AXA Travel Insurance financial stability. AXA Assistance USA operates as a subsidiary of AXA Group, a French firm, which has a strong financial ...

AXA travel insurance is accepted with all Schengen visa applications. Schengen visa insurance meets all the European visa requirements. It is approved and accepted by the consulates and embassies of all the countries of the Schengen Area. It guarantees coverage of at least €30,000 and up to €100,000 (depending on the chosen option).

AXA travel medical insurance agents will make sure you have peace of mind when travelling abroad. One simple payment and the right coverage will make sure that an unexpected hospitalisation or even a tragedy do not become a big financial burden that could make a dream vacation a real nightmare. Policies are easy to understand and cover anything ...

AXA Europe Travel is the Europe visa insurance you need to stay anywhere in the Schengen area as well as in any country of the European Union. After subscribing to your Europe Travel insurance on line, you will receive a certificate by email. You must enclose it with your Schengen visa application: it meets all the requirements of the countries ...

Medical expenses covered up to €100,000. Extended protection in all Schengen countries and Ireland. Repatriation. COVID coverage under conditions. 24-hour assistance. READ MORE.

English French Deutsch Russian Espanol ... Do you need Schengen insurance? Buy your AXA travel insurance online. Get a Schengen visa travel insurance policy now. Submit the certificate with your visa application Take advantage of our money-back guarantee. Get Schengen insurance ...

Considering that not all travelers' insurance needs are the same, we offer three different types of travel insurance policies: Silver - the most basic and cost-effective plan. Gold - offers the same benefits as the silver plan but at a higher coverage amount. Platinum - maximum benefits, highest coverage.

AXA can help by providing you with Low Cost Schengen Area travel insurance that meets your visa requirements from as little as €22 per week - a fee that will cover you for medical expenses up to €30,000 in all Schengen countries. A certificate proving you are insured will be available immediately, meaning you can get on with your application.

Simply sign up for our Online Travel Insurance today to receive medical coverage adapted to your individual needs, with a global network ready to assist you 24 hours a day, 7 days a week, wherever you happen to be in the world. Find out what makes AXA the world's leading insurance provider. Discover all our travel insurance shops around the ...

But you'll most likely need your passport (and/or your residency card, etc.), your itinerary, maybe a letter of invitation, something stating the purpose of your trip, and so on. One thing you'll need for sure, however, is a certificate proving you have Schengen travel insurance. Fortunately, AXA provides a personalized, printable ...

Customer Service. AXA Callcenter. 02 118 8111. Travel Insurance with health and personal accident coverage including Covid-19 insurance. Travel with peace of mind. Buy online easily in 3 minutes and get instant coverage. Covers Medical costs, Personal Liability, Trip Cancellation, Trip Curtailment and more.