Ukraine war: international tourism hit as Russian travellers disappear

Senior Lecturer in International Tourism Management, Glasgow Caledonian University

Disclosure statement

Michael O'Regan does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

View all partners

- Bahasa Indonesia

Tourism destinations globally are seeing a significant hit to their economies as Russians stay at home due to war-related sanctions , with possible long-term effects on international tourism.

This comes as European countries with Russian borders say they may ban all Russian tourists.

Russians were the world’s seventh biggest tourist spenders before the pandemic, splashing out US$36 billion (£31 billion) annually.

Vietnam’s Nha Trang , nicknamed “Little Russia” , attracted a large number of Russian tourists before the war. The beach resort saw a fast post-pandemic recovery thanks to the return of Russian tourists in 2019. Russian tourists spent an average of US$1,600 per stay in Vietnam, while the average for foreign visitors is US$900 .

Upmarket Vietnamese hotels, previously popular with Russian tourists, are almost empty or have been sold . The tour guide business has also been affected .

Nha Trang isn’t alone. In Thailand’s resort Phuket , shops and bazaars would normally be bustling with Russian tourists. Hotel companies remain uncertain about their future after many Russians cancelled their holidays when Russian airlines suspended flights to Phuket in March 2022. While foreign arrivals represented 59% of arrivals in Phuket airport before the pandemic, this figure was 35% in the first half of 2022 .

Read more: Ukraine war prompts Baltic states to remove Soviet memorials

Now resorts dotted around the globe, from Sharm el-Sheikh in Egypt to Varadero in Cuba, are all suffering economic hits with low hotel occupancy levels , resulting in lost jobs, bankruptcies and falls in income .

Disappearing visitors

Turkey attracted seven million Russian visitors in 2019 to tourist destinations such as the Mediterranean resort of Antalya. It was popular with Russians because of its beaches, all-inclusive tours packages, and easy-to-obtain tourist visas on arrival . The city saw more than 3.5 million Russian visitors in 2021.

With forecasts of fewer than 2 million Russian tourists in 2022 and a US$3 billion to US$4 billion drop in tourism revenues, the change has led to job losses , just as fuel and other prices increase.

It’s an economic blow , as each tourist in Turkey generates roughly three temporary jobs and each tourism dollar generates up to US$2.50 worth of revenue for industries supplying tourist resorts , according to Al Jazeera.

The fall in tourist receipts and hard currency is putting pressure on the Turkish economy and its currency, as tourism accounted for 13% of GDP before the war and the pandemic.

Tourism issues

The EU has already suspended the European Union-Russia visa facilitation agreement, which made it relatively easy for Russians to obtain travel documents. Earlier sanctions had included bans on EU and Russian airlines flying to and from Russia. They also limited Russian tourists access to international credit overseas.

Many wealthy Russian tourists have switched to trips to Dubai. However, high-end shops in New York, London and Milan, and in glitzy destinations like St. Moritz and Sölden and popular spa towns such as Karlovy Vary in the Czech Republic, are missing the business of the wealthiest Russian visitors.

On the French Côte d’Azur , luxury boutique hotels and expensive seafood restaurants have experienced a drop in business. They have not been able to replace wealthy Russian tourists with enough travellers from countries such as Bahrain .

Smaller countries, which hosted large numbers of Russian tourists as lockdowns eased, including Cyprus, the Maldives, Seychelles and the Dominican Republic found their post-pandemic tourism recovery short-lived. Cyprus, whose service industry including tourism, accounts for more than 80% of the economy is at risk of losing up to 2% of annual GDP if Russian and Ukrainian tourists do not return to the country.

Cuba saw an increase of 97.5% in Russian tourists in 2021, according to the country’s National Office of Statistics and Information . When that market collapsed , Cuba’s economic recovery plans were hit . Russians were expected to account for 20% of Cuba’s visitors in 2022, with far fewer tourists visiting the resort of Varadero .

Finding alternative visitors

Thai resorts are hoping for a growth in Middle Eastern visitors and Indians to help fill their hotels. Egypt is looking to increase visitor numbers from Latin America, Israel and Asia. Germans and others , including Iranians, are already replacing Russians in Antalya. In Vietnam, there are efforts to increase visitors from Korea, Japan, western Europe and Australia.

However, many destinations were unprepared for the shortfall in Russian tourists, and are not capable of replacing 30-40% of their market with new travellers.

Now that Russian tourists are cancelling trips to the resorts of Crimea as it comes under fire in the Ukraine war, some destinations are hoping Russians seek an escape by transiting through Serbia , Dubai and Qatar. Destinations such as Armenia, Vietnam and Turkey are also embracing the Russian payment system Mir to make it easier for Russian tourists to pay.

The efforts that destinations are making to replace Russian visitors will take considerable diversification, marketing and time, as tourists from new markets look for different activities. While Vietnam hopes for 5 million tourists in 2022, this is far from the 18 million visitors they received in 2019.

Even when the war ends, there is little likelihood that tourism will return to normal. Many European countries may not want to welcome Russian tourists for some time.

It will be interesting to see whether signs written in Russian in the Egyptian beach town of Sharm el-Sheikh or Varadero in Cuba will remain, or be replaced with Chinese or other languages in the upcoming tourist seasons.

- Ukraine invasion 2022

Project Officer, Student Volunteer Program

Audience Development Coordinator (fixed-term maternity cover)

Lecturer (Hindi-Urdu)

Director, Defence and Security

Opportunities with the new CIEHF

UN Tourism | Bringing the world closer

Market Intelligence

- UN Tourism Data Dashboard

- UN Tourism World Tourism Barometer

- Impact of the Russian Offensive in Ukraine on International Tourism

- Publications on Tourism Market Intelligence

- Market Intelligence - Webinars

- COVID-19 and Tourism

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Impact of the Russian offensive in Ukraine on international tourism

UNWTO Tourism Market Intelligence and Competitiveness

Overall assessment of the impact on tourism

Added risk to a weak and uneven tourism recovery

Disruption of Russian & Ukrainian outbound travel

which accounts for some 3% of global spending = US$ 14 billion in 2020

Lower consumer confidence

particularly in more risk averse markets and segments

Impact on traditional destinations but also emerging ones

especially island and coastal destinations

Weaker economic growth and higher inflation

Higher oil prices + inflation + interest rates = higher travel costs for consumers & pressure on businesses, specially MSMEs

Threatens tourism-related jobs and businesses

impacting livelihoods

A risk to the ongoing recovery of tourism

First and foremost, the biggest concern is for the human tragedy unfolding in Ukraine. Our thoughts go to the people suffering from this conflict.

Russia’s military offensive in Ukraine represents a downside risk for international tourism. It has exacerbated already high oil prices and transportation costs, increased uncertainty and caused a disruption of travel in Eastern Europe.

The destinations most impacted so far (aside from Russia and Ukraine) are the Republic of Moldova with a 69% drop in flights since 24 Feb. (compared to 2019 levels), Slovenia (-42%), Latvia (-38%) and Finland (-36%) according to data from Eurocontrol. Russian bookings of outbound flights also plunged in late February and early March but have since rebounded according to data from Forwardkeys.

Despite the conflict, European air traffic has grown steadily from mid March to early May. Air bookings also show rising demand for intra European travel and for flights from the US to Europe.

The easing of travel restrictions are contributing to the normalization of travel (36 countries had lifted all COVID 19 related travel restrictions as of 13 May 2022) but the conflict continues to pose a serious threat to the recovery.

A possible loss of US$ 14 billion for the tourism economy

The military offensive risks hampering the return of confidence to global travel . The US and Asian source markets could be particularly impacted, especially regarding travel to Europe, as these markets are historically more risk averse.

As source markets, Russia and Ukraine represent a combined 3% of global spending on international tourism as of 2020. A prolonged conflict could translate into a loss of US$ 14 billion in tourism receipts globally in 2022.

In 2019, Russian spending on travel abroad reached US$ 36 billion and Ukrainian spending US$ 8.5 billion. In 2020, these values were down to US$ 9.1 billion and US$ 4.7 billion, respectively .

As tourism destinations, Russia and Ukraine account for 4% of international tourist arrivals in Europe but only 1% of Europe’s international tourism receipts .

The importance of both markets is significant for neighboring countries, but also for European sun and sea destinations. The Russian market gained significant weight during the crisis in long-haul destinations such as Maldives, Seychelles and Sri Lanka.

Russia and Ukraine's international tourism spending (% of world total)

Destinations with highest share of russian visitors (%) (various indicators) 2019-2021, european flights, january - april 2022 (% change vs. 2019), european countries with largest decline in number of flights 24 feb - 11 may 2022 (% change vs. 2019), air bookings for intra-european travel, january to may 2022 (index)*, air bookings for all outbound travel from russia january to may 2022 (index)*.

International tourist arrivals: 2020, 2021 and Scenarios for 2022 (monthly % change over 2019)

- Impact assessment, Issue 4 · 16 May 2022 (PDF)

- Impact assessment, Issue 3 · 28 April 2022 (PDF)

- Impact assessment, Issue 2 · 11 April 2022 (PDF)

- Impact assessment, Issue 1 · 24 March 2022 (PDF)

- Travel, Tourism & Hospitality ›

Leisure Travel

Travel and tourism in Russia - statistics & facts

Covid-19 impact on russians' travel destinations, impact of the war in ukraine on tourism in russia, key insights.

Detailed statistics

Travel and tourism's total contribution to GDP in Russia 2019-2023

Travel and tourism's total contribution to employment in Russia 2019-2023

Tourism spending in Russia 2019-2022, by travel purpose

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Destinations

Leading outbound travel destinations in Russia 2021-2022

Number of outbound tourism trips from Russia 2014-2022

Leading source markets for travel to Russia 2020-2022, by arrivals

Related topics

Recommended.

- Inbound tourism in Europe

- Outbound tourism in European countries

- Travel and tourism in Europe

- Domestic tourism in European countries

- COVID-19: impact on the tourism industry worldwide

Recommended statistics

- Premium Statistic Countries with the highest outbound tourism expenditure worldwide 2019-2022

- Premium Statistic Travel industry revenue distribution in Russia 2021, by segment

- Premium Statistic Tourism spending in Russia 2019-2022, by travel purpose

- Basic Statistic Travel and tourism's total contribution to GDP in Russia 2019-2023

- Basic Statistic Travel and tourism's total contribution to employment in Russia 2019-2023

Countries with the highest outbound tourism expenditure worldwide 2019-2022

Countries with the highest outbound tourism expenditure worldwide from 2019 to 2022 (in billion U.S. dollars)

Travel industry revenue distribution in Russia 2021, by segment

Distribution of travel industry revenue in Russia in 2021, by segment

Travel and tourism spending in Russia from 2019 to 2022, by purpose (in billion U.S. dollars)

Travel and tourism's total contribution to GDP in Russia 2019-2023

Total contribution of travel and tourism to gross domestic product (GDP) in Russia from 2019 to 2023 (in billion Russian rubles)

Travel and tourism's total contribution to employment in Russia 2019-2023

Total contribution of travel and tourism to employment in Russia from 2019 to 2023 (in million jobs)

Outbound tourism

- Basic Statistic Outbound travel expenditure in Russia 2011-2022

- Premium Statistic Number of outbound tourism trips from Russia 2014-2022

- Premium Statistic Leading outbound travel destinations in Russia 2021-2022

- Premium Statistic Number of outbound tourists from Russia 2022, by territory

- Premium Statistic Outbound tourist flow growth in Russia 2022, by destination

- Premium Statistic European Union (EU) Schengen visas issued in Russia 2010-2021

Outbound travel expenditure in Russia 2011-2022

Outbound travel expenditure in Russia from 2011 to 2022 (in billion U.S. dollars)

Number of outbound tourism trips from Russia from 2014 to 2022 (in 1,000s)

Number of outbound travel visits from Russia from 2021 to 2022, by destination (in 1,000s)

Number of outbound tourists from Russia 2022, by territory

Number of Russians travelling abroad with tourism purposes in 2022, by territory (in 1,000s)

Outbound tourist flow growth in Russia 2022, by destination

Growth in outbound travelers with tourism purposes from Russia in 2022 compared to 2019, by selected destination

European Union (EU) Schengen visas issued in Russia 2010-2021

Number of Schengen Area visas issued from applications to consulates in Russia from 2010 to 2021*

Inbound and domestic tourism

- Basic Statistic International tourism spending in Russia 2011-2022

- Premium Statistic Leading source markets for travel to Russia 2020-2022, by arrivals

- Basic Statistic Domestic travel spending in Russia 2019-2022

- Basic Statistic Number of nature protected areas in Russia 2015-2022, by type

- Premium Statistic Estimated demand for inbound tourism in Russia Q1 2014-Q3 2023

- Premium Statistic Inbound tourist flow growth in Russia 2020-2023

- Premium Statistic Number of inbound tourist arrivals in Russia 2014-2022

International tourism spending in Russia 2011-2022

Spending of international tourists in Russia from 2011 to 2022 (in billion U.S. dollars)

Leading inbound tourism markets visiting Russia from 2020 to 2022, by number of trips (in 1,000s)

Domestic travel spending in Russia 2019-2022

Domestic tourism expenditure in Russia from 2019 to 2022 (in billion U.S. dollars)

Number of nature protected areas in Russia 2015-2022, by type

Number of nature conservation areas in Russia from 2015 to 2022, by type

Estimated demand for inbound tourism in Russia Q1 2014-Q3 2023

Estimated balance of demand for inbound tourism in Russia from 1st quarter 2014 to 3rd quarter 2023

Inbound tourist flow growth in Russia 2020-2023

Year-over-year growth in inbound tourism trips with tourism purposes in Russia from 2020 to 2023

Number of inbound tourist arrivals in Russia 2014-2022

Number of inbound tourism visits to Russia from 2014 to 2022 (in 1,000s)

Travel companies

- Premium Statistic Travel industry organizations distribution in Russia 2021, by segment

- Premium Statistic Number of tourism companies in Russia 2010-2022

- Premium Statistic Most popular travel websites in Russia 2023, by traffic

Travel industry organizations distribution in Russia 2021, by segment

Distribution of travel industry organizations in Russia in 2021, by segment

Number of tourism companies in Russia 2010-2022

Number of travel agencies and reservation service establishments in Russia from 2010 to 2022

Most popular travel websites in Russia 2023, by traffic

Leading travel and tourism websites in Russia in August 2023, by monthly visits (in millions)

Package tours

- Premium Statistic Number of package tours sold in Russia 2014-2021, by type

- Premium Statistic Value of package tours sold in Russia 2014-2021, by type

- Premium Statistic Package tour cost in Russia 2014-2021, by type

- Premium Statistic Most popular travel destinations on package tours in Russia 2022

Number of package tours sold in Russia 2014-2021, by type

Number of package tours sold in Russia from 2014 to 2021, by tourism type (in 1,000s)

Value of package tours sold in Russia 2014-2021, by type

Total value of package tours sold in Russia from 2014 to 2021, by tourism type (in billion Russian rubles)

Package tour cost in Russia 2014-2021, by type

Average cost of a package tour in Russia from 2014 to 2021, by tourism type (in 1,000 Russian rubles)

Most popular travel destinations on package tours in Russia 2022

Number of outbound tourists sent on tours by travel agencies in Russia in 2022, by destination (in 1,000s)

Transportation

- Premium Statistic Number of domestic airline passengers in Russia monthly 2020-2022

- Premium Statistic Passenger traffic growth of airlines in Russia 2021

- Premium Statistic Travel transportation consumer price in Russia 2021, by type

Number of domestic airline passengers in Russia monthly 2020-2022

Number of passengers boarded by domestic airlines in Russia from January 2020 to May 2022 (in millions)

Passenger traffic growth of airlines in Russia 2021

Year-over-year growth rate in air passengers in Russia in 2021, by carrier

Travel transportation consumer price in Russia 2021, by type

Average consumer price of travel transportation in Russia in 2021, by type (in Russian rubles)

Accommodation

- Basic Statistic Paid travel accommodation services value in Russia 2015-2022

- Premium Statistic Travel accommodation establishments in Russia 2022, by federal district

- Basic Statistic Total room area in travel accommodation in Russia 2013-2022

- Premium Statistic Number of visitors in hotels in Russia 2010-2022

- Basic Statistic Number of hotel visitors in Russia 2022, by travel purpose

- Premium Statistic Overnight accommodation cost in Moscow monthly 2020-2023

- Premium Statistic Hotel occupancy rate in Moscow 2023, by segment

- Premium Statistic Average daily hotel rate in Moscow 2023, by segment

Paid travel accommodation services value in Russia 2015-2022

Value of paid services provided by travel accommodation establishments in Russia from 2015 to 2022 (in billion Russian rubles)

Travel accommodation establishments in Russia 2022, by federal district

Number of collective accommodation establishments in Russia in 2022, by federal district

Total room area in travel accommodation in Russia 2013-2022

Total area of rooms in travel accommodation establishments in Russia from 2013 to 2022 (in 1,000 square meters)

Number of visitors in hotels in Russia 2010-2022

Number of visitors in hotels and similar accommodation establishments in Russia from 2010 to 2022 (in 1,000s)

Number of hotel visitors in Russia 2022, by travel purpose

Number of visitors in hotels and similar accommodation establishments in Russia in 2022, by purpose of travel (in 1,000s)

Overnight accommodation cost in Moscow monthly 2020-2023

Average cost of overnight accommodation in Moscow from May 2020 to September 2023 (in euros)

Hotel occupancy rate in Moscow 2023, by segment

Occupancy rate of quality hotels in Moscow from January to March 2023, by segment

Average daily hotel rate in Moscow 2023, by segment

Average daily rate (ADR) in hotels in Moscow from January to March 2023, by segment (in Russian rubles)

Travel behavior

- Premium Statistic Reasons to not travel long-haul in Russia 2022

- Premium Statistic Intention to travel to Europe in Russia 2019-2022

- Basic Statistic Summer vacation plans of Russians 2012-2023

- Premium Statistic Travel frequency for private purposes in Russia 2023

- Basic Statistic Average holiday spend per person in Russia 2011-2023

- Premium Statistic Attitudes towards traveling in Russia 2023

- Premium Statistic Travel product online bookings in Russia 2023

Reasons to not travel long-haul in Russia 2022

Main reasons for avoiding travel outside the Commonwealth of Independent States (CIS) in Russia from September to December 2022

Intention to travel to Europe in Russia 2019-2022

Index of intention to travel to Europe from Russia from January 2019 to December 2022 (in points)

Summer vacation plans of Russians 2012-2023

Where do you plan to spend your vacation this summer?

Travel frequency for private purposes in Russia 2023

Travel frequency for private purposes in Russia as of March 2023

Average holiday spend per person in Russia 2011-2023

How much money did you spend per person on holidays this summer? (in Russian rubles)

Attitudes towards traveling in Russia 2023

Attitudes towards traveling in Russia as of March 2023

Travel product online bookings in Russia 2023

Travel product online bookings in Russia as of March 2023

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

- Travel and tourism in Turkey

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Interfax Group

- Due diligence & KYC

- Reputational Risk

- News Products

- Top Stories

- Exclusive Interviews

- Press Releases

- REQUEST A DEMO

Russia sees almost 30% decline in inbound tourism in 2022 - Border Service

MOSCOW. Feb 8 (Interfax) - Over 200,000 foreign tourists visited Russia in 2022, down 28.8% from the year before, the Federal Security Service (FSB)'s Border Service said in its statistical report.

A total of 205,100 foreigners visited Russia as tourists last year, it said.

Most of the tourists came from Germany (25,300, or 33.4% fewer than the year before), followed by Turkey with 22,600 tourists (down 2.5%) and Iran with 14,600 tourists, up 25 times from 2021.

Also in the top five are Kazakhstan (13,270 tourists) and Cuba (11,300). They are followed by Uzbekistan (8,860), Kyrgyzstan (6,600), India (6,400), the United States (5,580) and Armenia (5,200).

Israel, Latvia, the United Arab Emirates, Serbia, Azerbaijan, South Korea, Turkmenistan, Italy, France and Lithuania are in the top 20.

Inbound tourism in Russia drastically fell amid the coronavirus pandemic. The border closure in 2020 cut tourist arrivals 93%, compared to 2019 when Russia was visited by over 5 million foreign tourists. There were 288,000 foreign tourist arrivals in Russia in 2021, or 14% less than in 2020.

- Privacy Policy

News and other data on this site are provided for information purposes only, and are not intended for republication or redistribution. Republication or redistribution of Interfax content, including by framing or similar means, is expressly prohibited without the prior written consent of Interfax.

© 1991—2024 “Interfax Information Group” www.interfax.com. All rights reserved.

The Impact of Russia’s War on Travel: New Skift Travel Health Index

Wouter Geerts , Skift

March 16th, 2022 at 9:45 AM EDT

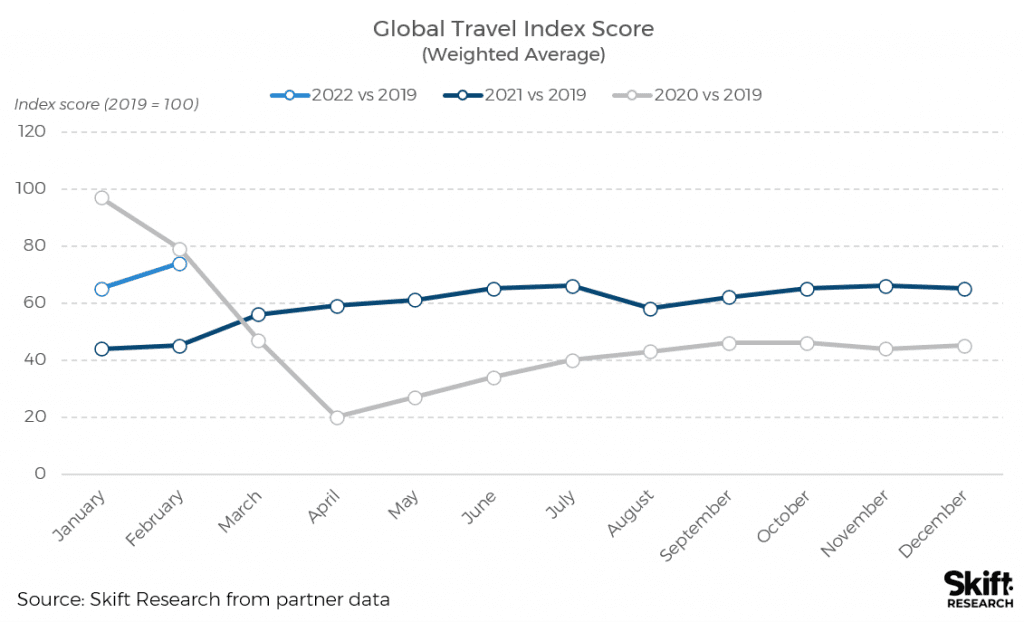

The travel industry registered one of its strongest months of recovery since the inception of our index, with performance up across all sectors and almost all countries. The war in Ukraine, however, is casting a long shadow over travel's performance moving into March.

Wouter Geerts

While the invasion of Ukraine is understandably taking all the highlights, the overall improvement of the travel industry’s performance was impressive during the month of February.

The overall travel performance hasn’t grown this fast month-over-month since March 2021, with the latest Skift Travel Health Index data registering a 9 percentage point increase between January and February 2022. This means that the travel industry performance currently tracks 26 percent below 2019 levels.

The February data is not showing the full force of current circumstances on travel’s performance yet. The Russian invasion of Ukraine started on February 24, with most analysts and officials holding out hope that the invasion would not happen. This means that only four days of February data was impacted by the war. Nevertheless, Russia was only one of two countries that showed a decline in performance during February.

The Russian travel industry has been one of the strongest performers since the inception of the Skift Travel Health Index. The decline in February now pulls Russia close to the global average, and March is likely to see Russian travel performance dive below this average.

Russia’s pandemic travel performance particularly benefited from a strong domestic market. While international seat capacity from flights to and from Russia remains down, domestic airline seat capacity has been above 2019 levels since early 2021, and Russian airports have been seeing some of the highest throughput according to OAG data.

Data from Aviasales , a major Eastern European booking site and one of our data partners, shows that searches for domestic Russian flights were still 88 percent above 2019 levels during February 2022, and domestic bookings 94 percent higher than in 2019.

In January, new bookings made for Russia outperformed the global average in aviation and vacation rentals, while hotel bookings were on par. In February, the situation turned on its head. Aviation and hotel bookings saw strong improvements at a global level, but in Russia, they took a step back, with the negative gap to 2019 levels widening. February flight bookings, however, still performed better in Russia than globally.

A deeper dive into the last week of February data, however, gives us a more accurate outlook into what might unfold for the Russian travel market in the months to come.

According to data from our partner ForwardKeys , on February 25, every booking that was made for travel to Russia was outweighed by six cancellations of pre-existing bookings. The Russian outbound market has also collapsed, with 11 airports completely shuttering operations for now, according to an industry source.

The domestic market will also suffer. Many foreign leasing companies have recalled planes leased to Russian airlines, although the Russian government moved in and impounded many of these before they could be returned. Furthermore, major manufacturers like Boeing and Airbus will no longer provide parts and maintenance to Russian airlines anymore, meaning that an increasing amount of planes will become grounded.

But the rest of the world will feel the impact too.

According to data from ForwardKeys, flight tickets issued during the week after the invasion were down across Europe, with the exception of only a few countries. This is not only due to the closing of borders to Russian travelers, but also travelers to other countries postponing or altering travel plans due to the increased uncertainty.

Olivier Ponti, vice president of insights at ForwardKeys, noted, however, that Western European destinations are not severely hit by the war as of yet. He said: “What I find surprising is that transatlantic travel and western European destinations have been less badly affected than I feared – North Americans can tell the difference between war in Ukraine and war in Europe, and so far, it seems that travelers regard the rest of Europe as relatively safe.”

This does not mean that there are no impacts on future travel plans. Russia’s airspace is now closed to many airlines from Europe and North America, and many others are avoiding it for safety reasons, meaning that long haul flights from Europe and North America to Asia will become longer, and potentially will require a refuelling stop. With oil prices also surging due to the war, some airlines like Malaysian Airlines have already started adding fuel surcharges to their prices.

Two countries in Europe are interesting to watch: Turkey and Serbia.

Turkey has condemned the Russian violence and closed its straits for Russian warships to enter or exit the Black Sea, but its airspace remains open for now. The country will walk a fine line, as Russia is important to the country’s energy supplies, but also as a tourism source market. According to data from the Turkish Ministry of Culture and Tourism, Russia is the country’s largest source market, with 7 million Russians arriving in 2019, 16% of total international arrivals. During the pandemic, the share of Russian tourists even grew to 19% in 2021.

Despite pressure from the EU to rescind their neutrality, Serbia has taken a neutral stance and has remained open to Russian flights, making it a gateway for flights to the rest of Europe from Russia. According to ForwardKeys, “60% more flight tickets were issued for travel from Russia to another destination via Serbia in the week immediately after the invasion than there were in the whole of January.”

The sanctions on Russian outbound travel are also seen as an opportunity by other countries, including the United Arab Emirates . ForwardKeys data shows that airlines including Flydubai, Emirates Airlines, and Etihad Airways did not see a decrease in capacity since the invasion, and actually slightly increased available seats for flight to and from Russia. Russian airlines like Azimuth Airlines are launching new routes to Dubai, with the emirate welcoming the Russian superrich . Russian travelers will increasingly look to the UAE, as well as countries like Egypt and Asian hotspots, like Thailand, if sanctions from the U.S. and EU remain, which seems very likely.

With the Ukraine war raging on, and China now seeing some of its highest infection rates recorded, it is likely that the Skift Travel Health Index for March will be less positive than February, although in many other parts of the world final travel restrictions are being lifted. If nothing else, the travel industry has become accustomed to the fluctuations that come with this choppy recovery.

Skift Travel Health Index: February 2022 Highlights

Purchase this report, or subscribe to Skift Research to read our latest analysis on the performance of the travel industry.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery , covid-19 , russia , skift travel health index , ukraine

Eurasia Review

A Journal of Analysis and News

Ukraine War Hits Russia’s Tourism Industry – OpEd

By Kester Kenn Klomegah

Russia’s tourism, both in-bound and out-bound, is severely hit by the war-ravaged crisis that unfolded in the former Soviet republic of Ukraine late February. For more than two years, the tourism industry was affected due to the widespread Covid-19 that shattered the world.

Industry operators say that the impact on tourism due to Russia’s “special military operation” in Ukraine has pushed the United States and Canada, European Union, Australia, New Zealand and many other countries to impose a series of sanctions, which are currently affecting the smooth operation of tourism business.

According to statistics, over these past three years that included the Covid-19 restrictions and Russia-Ukraine crisis, foreign airlines have carried an estimated 128.1 million passengers, but most passengers were stuck due to border closures and repatriated in 2020. As Covid-19 subsided, and the latest volley of sanctions have cut foreign travel especially to the United States and Europe for Russians.

Analysts expect tourism business to develop considerably inside Russia. Russian tourists might instead opt for South America and Caribbean, Asian and African destinations such as Cyprus, Thailand, Turkey, Malta, Maldives, Zanzibar, and Egypt. Russian citizens might not fear a sharp rise in airplane ticket prices, as during the spring and upcoming summer seasons costs are being determined, among other factors, by demand and purchasing power.

Many Russian tourists stranded due to economic sanctions, handicapped by bank withdrawals using international credit card system. Zarina Doguzova at the Russian Federal Agency for Tourism told the local Russian media that nearly 90,000 tourists were repatriated in March.

According to the agency, Egypt has the largest number of packaged tourists from Russia. The repatriation process has been hampered and takes more time due to new Western sanctions targeting the planes expected to be used for special flights from Egypt to Russia. The tour operators struggled to bring back Russian packaged tourists by using different ways, including connecting flights of foreign airlines through third countries from the United Arab Emirates, Turkey, the Maldives and Thailand.

On April 4, Russian Prime Minister Mikhail Mishustin announced that from April 9, Russia would cancel restrictions on flights to 52 countries imposed due to the pandemic, including Argentina, India, China, South Africa, and other friendly countries. It applies to regular and charter flights between Russia and several other foreign countries.

It will take into account the epidemiological situation in individual countries: a previous decision was made to completely lift restrictions on regular and charter flights with Algeria, Argentina, Afghanistan, Bahrain, Bosnia and Herzegovina, Botswana, Brazil, Venezuela, Vietnam, Hong Kong, Egypt and Zimbabwe.

The rest include Israel, India, Indonesia, Jordan, Iraq, Kenya, China, North Korea, Costa Rica, Kuwait, Lebanon, Lesotho, Mauritius, Madagascar, Malaysia, Maldives, Morocco, Mozambique, Moldova, Mongolia, Myanmar, Namibia, Oman, Pakistan, Peru, Saudi Arabia, Seychelles, Serbia, Syria, Thailand, Tanzania, Tunisia, Turkey, Uruguay, Fiji, Philippines, Sri Lanka, Ethiopia, South Africa, and Jamaica.

The protracted Ukraine war threatens several tourist destinations that rely on Russian visitors. Turkey, Uzbekistan, the UAE, Tajikistan, Armenia, Greece, Egypt, Kazakhstan, and Cyprus are among the top 25 countries for outbound Russian tourism by flight capacity, according to Mabrian Technologies, an intelligence platform for the tourism industry.

For instance, Egypt’s economy relies heavily on tourism from Russia and Ukraine, with the two countries accounting for roughly one-third of all visitors each year. Egypt is working to open tourism markets, particularly for Germany, England, the Czech Republic, Italy, and Switzerland, following the lifting of travel restrictions to Egypt.

Thousands of Russian tourists visit Thailand’s beach resorts. The Russia-Ukraine crisis with Europe might further push Russian tourists for popular destinations in Asia and a few destinations in Africa. While Covid-19 restrictions have been lifted, not all these countries are considered as popular destinations for Russian tourists. Russia is looking to develop and promote domestic tourism.

According to statistics, Russian tourists spent over $300 billion abroad over the past 20 years, and their money could build domestic tourism infrastructure. Experts also argue that the Russian tourism infrastructure has been demonstrating some growth over the past year, and it is important not to lose this pace under the current circumstances in the world.

Federal Agency for Tourism, which promotes tours both domestic and foreign, underscored steps being taken by the Russian government to put tourism on track including subsidy offers for local destinations, an effort towards encouraging and promoting domestic tourism, which are safe and have comfortable conditions for Russian tourists, during the forthcoming seasons.

Russian government’s latest package of measures to support the economy in the face of sanctions will address the tourism industry and a number of other sectors, and it provides for tax incentives, Federation Council Deputy Speaker Nikolai Zhuravlev said this month.

According to the Association of Tour Operators of Russia (ATOR), external tourism will steadily pick up despite the current international situation and the rising dollar and euro exchange rates, and the decline in the share of foreign tours in the volume of sales during February and March, during the months of the Russia-Ukraine crisis.

Russia’s membership has been stripped off international organizations, the latest was the United Nations Human Rights Council. On March 8, the Executive Council proposed holding an extraordinary assembly to consider a possible suspension of Russia’s membership from the United Nations World Tourism Organization.

- ← Former Myanmar Army Officer Says Rohingya Crackdown Is ‘Genocide,’ Offers To Testify – Interview

- Heroic Ukrainian Resistance To Russian Aggression Giving Rise To New World – OpEd →

Kester Kenn Klomegah

Kester Kenn Klomegah is an independent researcher and a policy consultant on African affairs in the Russian Federation and Eurasian Union. He has won media awards for highlighting economic diplomacy in the region with Africa. Currently, Klomegah is a Special Representative for Africa on the Board of the Russian Trade and Economic Development Council. He enjoys travelling and visiting historical places in Eastern and Central Europe. Klomegah is a frequent and passionate contributor to Eurasia Review.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Skip to main content

- Keyboard shortcuts for audio player

Ukraine invasion — explained

The roots of Russia's invasion of Ukraine go back decades and run deep. The current conflict is more than one country fighting to take over another; it is — in the words of one U.S. official — a shift in "the world order." Here are some helpful stories to make sense of it all.

With Ukraine at war, officials hope to bring tourism back to areas away from fighting

Ashley Westerman

Tourists by the boulevard at a Black Sea resort in Odesa, Ukraine, on Sept. 3. Tourists are not allowed to enter the public beach due to the presence of land mines and other explosives. Dominika Zarzycka/NurPhoto via Getty Images hide caption

Tourists by the boulevard at a Black Sea resort in Odesa, Ukraine, on Sept. 3. Tourists are not allowed to enter the public beach due to the presence of land mines and other explosives.

SLAVSKE, Ukraine — Ukraine's war-battered economy is expected to shrink by at least a third this year, hitting virtually every sector. This includes the tourism industry, which officials say had started to recover from the COVID-19 pandemic before Russia invaded Ukraine in February.

But the Ukrainian government still hopes its people will continue to travel within the country — and spend money in locales on the Black Sea and in the Carpathian Mountains in the west.

"A lot of people in Ukraine still don't feel it's OK to go on vacation or travel," Mariana Oleskiv, chair of Ukraine's State Agency for Tourism Development, tells NPR.

More than seven months into the war, "we understand that many people in our country live in very bad conditions, that some people don't have electricity and our soldiers sleep in trenches," she says.

According to agency data provided to NPR, domestic tourism, which the agency defines as leaving your home city for leisure, increased 24% between 2019 and 2021. Nearly 4.2 million foreign tourists visited Ukraine in 2021 — a 30% jump over the previous year.

Oleskiv says she forecasted that the trend would continue into 2022, but then the war started.

Trips into Ukraine by international tourists are down between 85% and 90%, says Oleskiv. Tour operators in safer areas of Ukraine reported to the government that occupancy rates are down 50% this summer compared to last. She says tourism in places such as Odesa and other parts of southern Ukraine closer to the front line of the conflict has "stopped completely."

Tourists take the Soviet-era Zakhar Berkut resort chairlift in Slavske, Ukraine, in August. The tourist town is located in the Carpathian Mountains, a wildly popular vacation destination for Ukrainians. Ashley Westerman/NPR hide caption

Tourists take the Soviet-era Zakhar Berkut resort chairlift in Slavske, Ukraine, in August. The tourist town is located in the Carpathian Mountains, a wildly popular vacation destination for Ukrainians.

The slowdown is being felt across the country, including in the Carpathian Mountains, a popular vacation destination in the relatively safe western part of the country.

Katerina Minich manages the Dvir Kniazhoiy Korony hotel in Slavske, a popular ski resort town about 85 miles south of Lviv. Minich tells NPR that the number of guests at her 15-room hotel is down about 60% from last year.

"Overall, from February to [August], the hotel's earnings are 70 to 80% lower" compared to last year, Minich said by text message. She says other hotels in Slavske, whose population has shrunk since the war broke out, have experienced a similar drop in guests and revenues.

Tourists ski near the Chornohora mountain range, part of the Carpathian Mountains, in western Ukraine on Feb. 21, 2021, one year before the Russian invasion. Markiian Lyseiko/Ukrinform/Future Publishing via Getty Images hide caption

Tourists ski near the Chornohora mountain range, part of the Carpathian Mountains, in western Ukraine on Feb. 21, 2021, one year before the Russian invasion.

The true damage Russia's full-scale ground invasion has wrought on Ukraine's domestic tourism sector won't be fully known for months, Oleskiv says. But her agency plans to start trying to turn things around with a new tourism campaign called "Get Inspired by Ukraine" — which she says aims to tell Ukrainians they have a right to take a rest.

"At some point, we need to stop and take a breath and don't be so involved in the news," Oleskiv says.

Some Ukrainians are already following the advice.

"I think that in order to be more effective, you have to relax sometimes," Natalii Baliuk, 35, from Kyiv said on a visit to Slavske in August. "Otherwise, you just will not be able to do anything and you cannot serve this country."

Baliuk and her friends traveled to the Carpathians for Ukrainian Independence Day not only because they believed it to be safe, but also because one of her friends could not travel abroad because martial law prevents men between the ages of 18 and 60 from leaving Ukraine.

The conflict in Ukraine could affect tourism throughout all of Europe, according to a report by the Economist Intelligence Unit . Russian and Ukrainian tourists spend a combined $45 billion a year, but that number is expected to decrease. In addition to the loss of tourists, the report says the conflict will also raise food and fuel prices, affect traveler confidence and disposable incomes, and restrict airlines and airspace.

Vendors sell food, beverages and souvenirs at a lookout spot in Slavske, Ukraine, in August. The week of Ukrainian Independence Day, the tourist town saw a small spike in visitors, but overall tourism this summer was down significantly across the Carpathian Mountains because of the war. Ashley Westerman/NPR hide caption

Vendors sell food, beverages and souvenirs at a lookout spot in Slavske, Ukraine, in August. The week of Ukrainian Independence Day, the tourist town saw a small spike in visitors, but overall tourism this summer was down significantly across the Carpathian Mountains because of the war.

- Russia-Ukraine war

- Russia-Ukraine

- Ukraine economy

- Russia Ukraine

Russian tourism in Crimea is down, but many still shrug off risks

- This content was produced in Russian-annexed Crimea, where the law restricts coverage of Russian military operations in Ukraine.

'NEW CHALLENGES'

Fatal crossing.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Reuters; Writing by Mark Trevelyan and Alexander Marrow; Editing by Gareth Jones and Sharon Singleton

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Germany's Scholz joins TikTok in bid to reach young voters

German Chancellor Olaf Scholz sent his first post on TikTok on Monday, joining a growing roster of Western politicians who have set aside security concerns to use the Chinese-owned social media platform.

Home » News » How conflict continues to shape Russian tourism in 2023

How conflict continues to shape Russian tourism in 2023

After 14 months of continued fighting in Eastern Ukraine, Russian citizens are looking to evade conscription, but not all nations are on board.

While much of the world is united in the way of foreign aid to Ukraine and sanctions against the Russian economy, things are slightly different when it comes to Russians looking to head abroad.

For example, in the European Union and Britain numbers from the Russian Federation have dropped by 99 per cent, whereas Egypt has seen a 181 per cent increase.

Bali quickly became a hot spot for Russians looking to holiday, or avoid conscription to the Russian army with tens of thousands flocking to the country due to its accessible ‘Visa on arrival’.

The visa does not require any paperwork and is granted after paying a small fee on arrival. However, following the deportation of four Russian Nationals in March alone due to visa violations, the Governor of Bali, Wayan Koster announced that access to the visa on arrival program would be revoked.

Indonesia arrival visa closeup. (iStock – undefined)

Thailand is another nation that has seen an increase in arrivals from Russia, in particular in the resort island Phuket with over 233,000 landing between 1 November 2022 and 21 January 2023.

Dar, a masseuse who formerly worked in Russia and moved back to Phuket told Al Jazeera (under a fake name), “The women tell me they are desperate to get their husbands, boyfriends or children to come over here to stay, so they come over first and find houses and try to make visas for their men,” she said.

Beach in Phuket, Thailand. (Image: VOA News)

In Greece, the INSETE (the national tourism confederation) recently stated that overall tourism related revenue is down 575.5 million Euro (AUD$930 million), largely linked to the decline in Russian tourism as well as lower cruise ship arrivals.

Sri Lanka, on the other hand has seen Russian tourists make up 27 per cent of all tourists in recent months, with 29,084 arriving in February alone according to Aviation & Aviation Services Sri Lanka. Other leading countries for Russian tourist arrivals include Azerbaijan, Turkey and Uzbekistan.

Featured Image: Egypt Independent

Email the Travel Weekly team at [email protected]

Latest news.

- Destinations

The Gold Coast’s latest offering calling you to the Sunshine State

Anchored aside the rolling seas of Bilinga Beach on the southernmost end of the Gold Coast, Rolling Seas Bilinga, is a masterfully-curated home that pays homage to the Gold Coast’s sun-kissed shores and laidback lifestyle. Accommodating up to 12 guests across two freestanding villas – The Residence and The Cottage – it is a sophisticated […]

Profile: Delta CEO Ed Bastian

Bastian says the airline business isn't for the faint hearted. We're sure Alan Joyce would agree!

Tourists banned in Kyoto streets after locals say neighbourhood is “not a theme park”

At first this seemed a bit xenophobic but after hearing what the tourists did, fair play Japan.

Final Call: Travel DAZE Exec early birds are about to expire

Much like the auctioneer at the hottest sale of the year, we're giving you one more chance to jump at this deal!

Frenchman arrested in Mumbai for smoking and defecating in seat

Still riddled with shame after you accidentally spilt tea on your neighbour mid-flight? Yeh, could be worse.

Ponant’s new luxury catamaran taking guests to breathtaking destinations in style

The new yacht can only house 12 people, so if you're looking to brush a few friends next trip, here's a great excuse!

Forget the weekend! Experience Gold Coast launches mid-week travel campaign

Your boss might be a bit bothered if you jet off mid-week, but you'll be the envy of all of your Instagram followers.

NCL’s strategic updates in APAC spearheaded by Damien Borg & Angela Middleton

Meanwhile, we've made updates to our lunch reconnaissance team. Both equally important roles!

Royal Princess makes maiden call to Kangaroo Island

Koalas and wombats said to be incredibly bitter that their islands are yet to get a visit.

“This looks incredible!!!!” – social media goes WILD over Intrepid’s women’s expedition in Saudi Arabia

Can confirm that women at TW are also going wild over this news! Where do we sign up?

Qantas unveils major frequent flyer program expansion

Big Qantas news before 9 am on Monday morning. Who needs coffee!

What to expect when Luxury Escapes CEO Adam Schwab hits centre stage at Travel DAZE Exec 2024

We were expecting all things 'luxury', but Schwab threw us a curveball with his chat about supersonic air travel!

Castille Paris – Starhotels Collezione unveils Grand Tour Suite

This might be the prettiest hotel room we've ever seen, and we see A LOT of hotel rooms.

Tourism WA awards new five-year contract to The Brand Agency

Western Australia locals said to be on high alert as the world discovers Australia's best kept secret.

Fred Dixon Appointed President And CEO of Brand USA

President AND CEO? You have to give it to the US - they have better job titles than we do here in Aus.

Scotland’s most ‘Instagrammable’ tourist destinations revealed

Surprisingly, Edinburgh Castle is declared more Instagrammable than a Scotsman lifting his kilt.

Lithuania takes the piss out of itself in hilarious new tourism campaign

If you've got the Friday blues we strongly recommend this genuinely laugh-out-loud ad!

United Airline CEO’s pay doubled in 2023 to AUD $27 million

Kirby's salary finally lifts to pre-Covid levels after a hard few years of roughing it.

Christine Anu ready to headline QLD Music Trails’ ‘Between The Tides’

They did ask TW if we would headline that weekend but unfortunately we were already booked.

Susan Coghill on destination marketing: “It’s all about the power of screens — particularly in tourism”

With TW's screen time now averaging a shameful 6 hours a day, we agree with Coghill that screens are indeed powerful.

Qantas launches tenth sale of the year with return flights to NZ for $549

10th sale of the year and we're only in April? Can you imagine the emotional pain of buying your flights at full price?

Guess who’s back? Back again? Aperitivo with Uniworld client events have returned!

Remember agents, this is a CLIENT event. Please remove those arancini balls from your purse.

Smartraveller advises Aussies to exercise “normal safety precautions” if visiting Taiwan

Thoughts are with all those personally impacted by the earthquake.

MSC Cruises unveils seven ‘districts’ for MSC World America

Maybe you've heard of the seven wonders of the world, but have you heard of the the seven districts of World America?

Air New Zealand Introduces ‘A Taste of Aotearoa’ menu

Once a terrifying experience, peeling back the tinfoil lid has become a decidedly less frightening ordeal.

One dead in tragic safari incident with bull elephant in Zambia

Four other guests were treated for minor injuries, all parties involved are assisting police with inquiries.

“If you don’t look after your brand you’ll end up in a price war” – Gruen star and government ad guru to speak at Travel DAZE exec

This might have been handy for a few travel companies in the last 12 months. So how could you miss Travel DAZE 2024?

- Attractions

“Best April fools I’ve seen in years” – internet divided over whether Hawaiian shuttle submarine is real

Not real!? Next they will be telling us that mermaids and singing crabs don't exist either!

NCL guests clean up 514 kg of rubbish with Take 3 For The Sea in Fiji

In other words, there was more rubbish collected in one day on the beaches than the Fijian Rugby Team could eat in food!

Atout France celebrates French tourism with 17th Rendez-vous en France

The Champagne and the snails were flowing! We know which of the two we would have been enjoying more.

- Tour Operators

Federal Government recognises strength of travel trade, bumps funding to CATO members

Cue major crash on CATO website as this news hits inboxes.

Travelmarvel reveals pre-release trips to Canada and Alaska for 2025

Travelmarvel has revealed its pre-release journeys through Canada and Alaska for 2025. With an extensive array of experiences, travellers can now embark on unforgettable adventures across this region’s most iconic destinations. Guests can experience a journey aboard the Rocky Mountaineer, renowned as one of the world’s most remarkable train experiences, sail through Alaska’s Glacier Bay […]

Aussies flock to the Solomon Islands in January as numbers near pre COVID figures

We reckon there are a few who would like to get back to their pre COVID figures... Ourselves included!

- Road & Rail

Can I bring my dog? Rail Europe answers its most common FAQ’s

Given the way some of our office dogs are known to behave, we don't think we'd take our K-9 on a luxury rail journey.

Victorian Tourism Industry Council warns of losing tourism dollars to NSW & QLD

Trendy cafe's hidden in CBD laneways can only get so many tourism dollars, clearly!

Kick-off in Fiji – Where footy and hospitality score big!

This article will leave you wanting to travel to Fiji...It will also probably make you want to try Kava (be warned).

You are using an outdated browser

Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Signing in with LinkedIn

Please wait while we sign you in with LinkedIn.

This may take some time.

Please be patient and do not refresh the page.

(A new window from LinkedIn should open for you to authorize the Travel Weekly login. If you don't see this please check behind this window, and if it is still not there check your browser settings and turn off the pop-up blocker.)

SUBSCRIBE NOW FOR FREE

Never miss a story again. Sign up for daily newsletter now.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- March Madness

- AP Top 25 Poll

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Countries brace for hit to tourism from Russia-Ukraine war

A clothes shop keeper waits for clients in a deserted tourist shopping area in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

A shop clerk carries mannequins at a soccer jerseys stand at a tourist shopping area, in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

Maya Ozen works in her cafeteria in a tourist shopping area, in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

Textile store clerk Devrim Akcay pushes a clothes rack as he waits for clients, in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

Spices are displayed with boards in English and Russian at a street market in a tourist shopping area, in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

Spice shop owner, Nurullah Ekinciler, works in his shop, in a tourist shopping area in Belek, Antalya, Turkey, Saturday, March 12, 2022. After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat. But Russia’s war in Ukraine is fast dampening their spirits. (AP Photo/Riza Ozel)

Agricultural farm workers collect red bell peppers in a greenhouse in Aksu, Antalya, Turkey, Sunday, March 13, 2022. The Antalya region is haunted by the memory of 2016, when Russia inflicted a serious blow to Turkey’s economy by barring the import of some agricultural produce and stopping charter flights there after the Turkish military shot down a Russian fighter plane in 2015. (AP Photo/Riza Ozel)

Agricultural farm worker Mahmut Gezgin pushes a cart with red bell peppers in a greenhouse in Aksu, Antalya, Turkey, Sunday, March 13, 2022. The Antalya region is haunted by the memory of 2016, when Russia inflicted a serious blow to Turkey’s economy by barring the import of some agricultural produce and stopping charter flights there after the Turkish military shot down a Russian fighter plane in 2015. (AP Photo/Riza Ozel)

- Copy Link copied

BELEK, Turkey (AP) — After losing two years to the COVID-19 pandemic, shopkeepers in the heart of the Turkish Riviera had hoped for a strong tourism season this year to help keep their businesses afloat . But Russia’s war in Ukraine is fast dampening their spirits.

“We’re trying to earn our bread through tourism, but it looks like the war has finished off this (tourism) season, too,” Devrim Akcay said outside his clothing shop in the resort town of Belek, along the Mediterranean coast’s Antalya province.

Nowhere is the threat of just one ripple effect of the war — lost tourism — felt more strongly than in Antalya, a region dotted with shimmering beaches and archeological sites where visitors from Russia and Ukraine, along with Germany, make up the top contributors to tourism revenue.

Countries from Turkey to Thailand, Egypt and Cuba are bracing for the loss of Russian and Ukrainian visitors just as their travel sectors were looking to rebound from the pandemic. With many tourist-dependent economies also struggling with surging inflation and other woes , hotel workers, guides and others who serve visitors from the two warring nations expect more pain.

The turquoise waters and white sand beaches of the Cuban resort of Varadero, which until recently received a significant number of tourists — mainly Russians — are now almost empty.

Russians accounted for almost a third of Cuba’s visitors last year — more than 146,000 — and some saw them as the way to get some oxygen to an industry ailing from the pandemic and tighter sanctions imposed by former U.S. President Donald Trump.

“Now, we also have to get by without the Russian tourism,” said José Luis Perelló Cabrera, a Cuban economist and tourism expert.

The Association of Tour Operators of Russia estimated that between 6,000 and 8,000 Russian tourists were on the island when the war in Ukraine broke out. Several flights left from Varadero in early March to bring them home.

“Losing that market is a strong blow to Cuba,” said Natasha Strelkova, Russian-Cuban tour operator and guide on the island.

Across the Atlantic, Russians and Ukrainians can represent up to 35% of Egypt’s tourists annually, said Hisham el-Demiry, former head of the government-run Tourism Development Authority.

He worries the economic crisis brought on by the war could mean fewer guests overall.

“It’s a huge impact, a domino effect. ... The war has changed people’s priorities, and tourism, which is a very sensitive industry, will be the first victim,” he said.

Rania Ali, a reception manager at a four-star hotel in Hurghada, said they “were over 75% occupied early before the war, now we are just 35%.”

Russians were just among the top 10 groups of visitors to Thailand until late last year, when the country began to reopen to international tourists. Russia restarted charter flights relatively early and in winter, when Thailand’s balmy temperatures make it a highly desirable destination, helping its people become the top visitors among the modest numbers that Thailand started welcoming back.

The November-to-March season when Russians usually visit is drawing to an end, and the plunge in the ruble’s value makes travel to Thailand and anywhere else far more costly now, said Chattan Kunjira Na Ayudhya, deputy governor for International Marketing for the Tourism Authority of Thailand.

“This probably will lead Russian tourists to shift to destinations that offer them all-inclusive packages with better prices,” he said.

In Turkey, officials had hoped that with pandemic restrictions easing, tourism could replicate or exceed the numbers from 2019, when some 52 million visitors — including about 7 million Russians and 1.6 million Ukrainians — brought $34 billion in revenue. The overall number of visitors dropped to 15 million in 2020 but recovered to around 29 million last year.

President Recep Tayyip Erdogan had strategized that opening up the economy and delivering big growth this year could help him get reelected next year, experts say. It’s a tall order for a country with a currency crisis and inflation exceeding 54%, making it difficult for consumers to purchase even basic goods.

“For that to happen, Turkey needs to have its robust tourism and trade ties with Russia unhindered,” said Soner Cagaptay, a Turkey analyst at the Washington Institute for Near East Policy.

The expectation before the war was “maybe 10, 15 million Russians would be visiting Turkey this summer that will be spending 10 billion dollars, a shot in the arm for Turkey’s ailing economy,” Cagaptay said.

Now, business groups say they’re seeing erosion in trade both ways, including a fall in demand for Turkish produce because Russian buyers are struggling to make payments. That’s despite Turkey not joining in sanctions against Moscow.

Agricultural grower and exporter Nevzat Akcan worries he may not be able to ship the red bell peppers he grows in greenhouses in the district of Aksu solely for Russian and Ukrainian markets.

“May God protect us if we join the sanctions against Russia. This would be a disaster for Turkish agriculture. We would be ruined and finished,” Akcan said. “I don’t even want to think about it.”

NATO-member Turkey, which has cultivated close ties with both Russia and Ukraine, is trying to balance those relations and has positioned itself as a neutral party trying to mediate. Turkey has criticized Russia’s military actions in Ukraine as “unacceptable” but also said it would not give up on either side.

The Antalya region is haunted by the memory of 2016, when Russia inflicted a serious blow to Turkey’s economy by barring the import of some agricultural produce and stopping charter flights there after the Turkish military shot down a Russian fighter plane in 2015.

Agriculture has already started to suffer from the effects of the war, said Davut Cetin, head of the Antalya Chamber of Commerce and Industry.

“The Ukrainian market has been shut down. No fresh fruit or vegetable is leaving for Ukraine now,” Cetin said.

Associated Press journalists Mehmet Guzel in Belek, Turkey; Samy Magdy in Cairo; Juan Zamorano in Havana and Chalida Ekvitthayavechnukul in Bangkok contributed.

Want to comment on Asia Times stories?

Sign up here

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Covering geo-political news and current affairs across Asia

The disappearing Russian tourist

Share this:

- Click to share on WhatsApp (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to print (Opens in new window)

Tourism destinations globally are seeing a significant hit to their economies as Russians stay at home due to war-related sanctions , with possible long-term effects on international tourism.

This comes as European countries with Russian borders say they may ban all Russian tourists.

Russians were the world’s seventh biggest tourist spenders before the pandemic, splashing out US$36 billion annually.

Vietnam’s Nha Trang , nicknamed “Little Russia” , attracted a large number of Russian tourists before the war. The beach resort saw a fast post-pandemic recovery thanks to the return of Russian tourists in 2019. Russian tourists spent an average of $1,600 per stay in Vietnam, while the average for foreign visitors is $900 .

Upmarket Vietnamese hotels, previously popular with Russian tourists, are almost empty or have been sold . The tour guide business has also been affected .

Nha Trang isn’t alone. In Thailand’s resort Phuket , shops and bazaars would normally be bustling with Russian tourists. Hotel companies remain uncertain about their future after many Russians canceled their holidays when Russian airlines suspended flights to Phuket in March 2022.

While foreign arrivals represented 59% of arrivals in Phuket airport before the pandemic, this figure was 35% in the first half of 2022 . Now resorts dotted around the globe, from Sharm el-Sheikh in Egypt to Varadero in Cuba, are all suffering economic hits with low hotel occupancy levels , resulting in lost jobs, bankruptcies and falls in income .

Disappearing visitors

Turkey attracted seven million Russian visitors in 2019 to tourist destinations such as the Mediterranean resort of Antalya. It was popular with Russians because of its beaches, all-inclusive tour packages and easy-to-obtain tourist visas on arrival . The city saw more than 3.5 million Russian visitors in 2021.

With forecasts of fewer than 2 million Russian tourists in 2022 and a $3 billion to $4 billion drop in tourism revenues, the change has led to job losses , just as fuel and other prices increase.

It’s an economic blow , as each tourist in Turkey generates roughly three temporary jobs and each tourism dollar generates up to $2.50 worth of revenue for industries supplying tourist resorts , according to Al Jazeera.

The fall in tourist receipts and hard currency is putting pressure on the Turkish economy and its currency, as tourism accounted for 13% of GDP before the war and the pandemic.

Tourism issues

The EU has already suspended the European Union-Russia visa facilitation agreement, which made it relatively easy for Russians to obtain travel documents. Earlier sanctions had included bans on EU and Russian airlines flying to and from Russia. They also limited Russian tourists’ access to international credit overseas.

Many wealthy Russian tourists have switched to trips to Dubai. However, high-end shops in New York, London and Milan, and in glitzy destinations like St Moritz and Sölden and popular spa towns such as Karlovy Vary in the Czech Republic, are missing the business of the wealthiest Russian visitors.

On the French Côte d’Azur , luxury boutique hotels and expensive seafood restaurants have experienced a drop in business. They have not been able to replace wealthy Russian tourists with enough travelers from counties such as Bahrain .

Smaller countries, which hosted large numbers of Russian tourists as lockdowns eased, including Cyprus, the Maldives, Seychelles and the Dominican Republic found their post-pandemic tourism recovery short-lived.

Cyprus, whose service industry including tourism, accounts for more than 80% of the economy is at risk of losing up to 2% of annual GDP if Russian and Ukrainian tourists do not return to the country.

Cuba saw an increase of 97.5% in Russian tourists in 2021, according to the country’s National Office of Statistics and Information . When that market collapsed , Cuba’s economic recovery plans were hit . Russians were expected to account for 20% of Cuba’s visitors in 2022, with far fewer tourists visiting the resort of Varadero .

Finding alternative visitors

Thai resorts are hoping for a growth in Middle Eastern visitors and Indians to help fill their hotels. Egypt is looking to increase visitor numbers from Latin America, Israel and Asia. Germans and others , including Iranians, are already replacing Russians in Antalya. In Vietnam, there are efforts to increase visitors from Korea, Japan, Western Europe and Australia.

However, many destinations were unprepared for the shortfall in Russian tourists, and are not capable of replacing 30-40% of their market with new travelers.

Now that Russian tourists are canceling trips to the resorts of Crimea as it comes under fire in the Ukraine war, some destinations are hoping Russians seek an escape by transiting through Serbia , Dubai and Qatar. Destinations such as Armenia, Vietnam and Turkey are also embracing the Russian payment system Mir to make it easier for Russian tourists to pay.

The efforts that destinations are making to replace Russian visitors will take considerable diversification, marketing and time, as tourists from new markets look for different activities. While Vietnam hopes for 5 million tourists in 2022, this is far from the 18 million visitors they received in 2019.

Even when the war ends, there is little likelihood that tourism will return to normal. Many European countries may not want to welcome Russian tourists for some time.

It will be interesting to see whether signs written in Russian in the Egyptian beach town of Sharm el-Sheikh or Varadero in Cuba will remain, or be replaced with Chinese or other languages in the upcoming tourist seasons.

Michael O’Regan , Senior Lecturer in International Tourism Management, Glasgow Caledonian University

This article is republished from The Conversation under a Creative Commons license. Read the original article .

We've recently sent you an authentication link. Please, check your inbox!

Sign in with a password below, or sign in using your email .

Get a code sent to your email to sign in, or sign in using a password .

Enter the code you received via email to sign in, or sign in using a password .

Subscribe to our newsletters:

- The Daily Report Start your day right with Asia Times' top stories

- AT Weekly Report A weekly roundup of Asia Times' most-read stories

Sign in with your email

Lost your password?

Try a different email

Send another code

Sign in with a password

A Growing Backlash Against Russian Tourists Is Dividing Europe

L aplandia greets the shopper with the powerful aroma of smoked salmon. The sprawling warehouse of a store—located on the outskirts of Lappeenranta, Finland—opens to a display counter stocked with great slabs of the fish on plastic trays, some of it cured with herbs, some of it sprinkled with local lingonberries. But Elena wasn’t there for fish. On the morning of Aug 31, the 30-year-old Russian (who declined to give her last name to avoid social media criticism) had driven about 125 miles from St. Petersburg, Russia to buy warm clothing and shoes for her young son, plus other household supplies that EU and American sanctions had made it difficult to find at home . There was an urgency to her shopping as she beelined past the candy-colored heaps of plastic sandals and gigantic bags of chips, to a row containing industrial-sized bottles of laundry detergent—aware of a looming decision by the Finnish government “I’m worried they’re going to close the border again,” she said. “So we’ve been stocking up. This is my third trip in a week.”

Elena had reason for concern. Ever since Aug. 8, when Ukrainian president Volodymyr Zelensky called for Western countries to ban visas for Russian tourists, some European countries have been taking the suggestion very seriously. On Sept. 1, Finland—which shares a 830-mile land border with Russia—began sharply restricting the number of tourist visas it issued, from 1,000 to 100 per day. And the day before, when Elena made her third trip to Laplandia, the E.U.’s foreign ministers agreed at a meeting in Prague to make it harder—but not impossible—for Russians to travel. If some of those ministers have their way, more restrictions could be coming.

“It’s not right that at the same time as Russia is waging an aggressive, brutal war of aggression in Europe, Russians can live a normal life, travel in Europe, be tourists,” Finland’s Prime Minister Sanna Marin told broadcaster Yle on Aug. 8.

Read More: ‘There’s an Atmosphere of Fear.’ With Flights Banned, Russians Are Fleeing By Train for Europe

Marin’s country is one of the few access points into Europe after the E.U. imposed a blanket flight ban to and from Russia three days after Russia launched a full-scale invasion of Ukraine on Feb. 24. Since Russia lifted its remaining COVID-19 restrictions on July 15, the number of people driving across at border station Nuijamaa near Lappeenranta—as well as others—has surged. “I would say it has grown about 5% per week,” says Petri Kurkinen, deputy chief of the local Finnish border police. “Right now, we’re at about 3,000 people per day.”

Many of those people, like Elena, had just come for a day’s shopping and would return to Russia that same evening. But others would travel to coastal cottages in Finland for summer vacations or drive straight to the airport in Helsinki, the country’s capital, and then board flights for Spain, France, and Greece. According to Frontex, the E.U.’s border agency, more than 1 million Russians have done just that since the invasion, most of them via Finland and Estonia, which also shares a land border with Russia.

For some of Europe’s leaders, the sight of Russian tourists sunning themselves on their beach or sitting in outdoor cafés while some of their fellow citizens participate in the devastation of Ukraine, was morally untenable. They also worried about the security threat. “What do the chemical attack in Salisbury in 2018, the Czech arms depot explosion in 2014 and the killing of a Chechen dissident in Germany in 2019 have in common?” wrote Estonian Prime Minister Kaja Kallas in a statement to TIME. “The answer: Russian agents using European tourist visas. We can see a clear pattern. Amidst aggressive Russia next door, the risk of Russian agents posing as tourists in [the] E.U. is logically higher than ever. And they do not just spy, they are often an active part of Russia’s hybrid and information warfare that’s happening alongside conventional war.”

On Aug. 18, Estonia stopped issuing tourist visas to Russians and stopped permitting entry under ones previously issued. Since then, it and other countries like Lithuania, Denmark, and the Czech Republic, have advocated for an outright ban on all Russian tourists throughout the Schengen Area—which covers 26 European countries and stretches across most of the continent. (European travel for other purposes, such as humanitarian reasons, visiting family, or to seek asylum, would remain protected.) “I simply don’t think that it is appropriate that at the same time when Ukrainian men and families have to defend their country, Russian men and Russian families can enjoy beaches in southern Europe,” says Estonian Member of the European Parliament (MEP) Urmas Paet, who serves as vice-chair of the E.U.’s Committee on Foreign Affairs.