Apply for a new national championship PCard or Travel Card

Sep 11, 2024 | News

Procurement Services has partnered with JPMorgan Chase to offer a limited edition PCard and Travel Card that celebrates the football team’s 2023 National Championship.

Why use a PCard or Travel Card?

There are many benefits to using a PCard or Travel Card for business and travel-related expenses—both for you and U-M. Using a PCard or Travel Card:

- Provides a more secure form of payment, with the ability to track issues and address any improper or fraudulent charges with the support of JP Morgan Chase

- Eliminates the need for employees to use personal resources and seek reimbursement for U-M business purchases

- Makes submitting expense reports easier, with most expense information pre-populated and already attached to your user profile

- Eliminates the risk of taxation on late-submitted expenses

- Offers faster, simpler payment to suppliers (vs. a purchase order and invoice)

- Provides more accurate data reporting

Who should apply for a PCard or Travel Card?

Employees should apply for a PCard if they are making purchases on behalf of their department, are submitting reimbursements for hosting, supplies, and/or travel for business purposes. While all employees with a regular, active appointment are eligible to apply for a PCard or Travel Card, please check with your department, as it may have specific guidelines on who can apply for a PCard or Travel Card.

Examples of appropriate PCard purchases:

- Travel expenses (e.g., hotel, ground transportation, baggage fees, gas for rental vehicles, train fare, car rental, conference fees and travel parking)

- Conference fees

- Memberships, dues, and subscriptions

- Office supplies (not including furniture)

You can find the detailed steps, including links to training, resources, and the application form on our website .

Finance Customer Care

Phone: (734) 764-8212, prompt 2 Fax: (734) 615-6235

Customer service is available from 8 a.m. to 5 p.m. Monday-Friday.

Procurement Services 7071 Wolverine Tower 3003 South State Street Ann Arbor, MI 48109-1282 By appointment only

Marks & Spencer Travel Money

Find out more about marks & spencer's travel money options with our useful guide..

In this guide

- What services does Marks & Spencer offer?

- What currencies can I order through Marks & Spencer?

- How much can I transfer with Marks & Spencer?

How soon can I get my money?

How safe is my money, are there any fees i might have to pay.

- Customer service information for M&S

As well as socks, pants, and sandwiches Marks & Spencer also buy and sell travel money. If you need some cash you can visit your nearest M&S Bureau de Change – available in over 120 M&S stores across the UK.

- Wide range of foreign currencies

- SameDay Click & Collect

- Order between £150 and £2,500

What services does Marks & Spencer offer?

M&S offers two services:

- Buy in store. You’re able to visit your nearest store to get hold of some travel money. Head to the M&S website to find your nearest store!

- Home delivery. If you have an M&S Credit Card or Chargecard, you can order between £100 and £2,500 of foreign currency online or over the phone. And if you order your travel money before 1pm, M&S will deliver it to your home address the next working day.

M&S also offer a buy-back service, so you can sell your leftover travel money at the buy-back rate on the same day you return it.

What currencies can I order through Marks & Spencer?

Here’s a list of some of the main currencies that are available with M&S:

- Argentine Peso (ARS)

- Australian Dollar (AUD)

- Bahraini Dinar (BHD)

- Brazilian Real (BRL)

- Brunei Dollar (BND)

- Bulgarian Lev (BGN)

- Canadian Dollar (CAD)

- Chilean Peso (CLP)

- Chinese Yuan Renmibi (CNY)

- Croatian Kuna (HRK)

- Czech Koruna (CZK)

- Fiji Dollar (FJD)

- Hong Kong Dollar (HKD)

- Hungarian Forint (HUF)

- Iceland Krona (ISK)

- Indonesaian Rupiah (IDR)

- New Israeli Sheqel (ILS)

- Jamaican Dollar (JMD)

- Japanese Yen (JPY)

- Jordanian Dinar (JOD)

- Kenyan Shilling (KES)

- Kuwaiti Dinar (KWD)

- Malaysian Ringgit (MYR)

- Mauritius Rupee (MUR)

- Mexican Peso (MXN)

- New Zealand Dollar (NZD)

- Norwegian Krone (NOK)

- Omani Rial (OMR)

- Peruvian Nuevo Sol (PEN)

- Philippine Peso (PHP)

- Polish Zloty (PLN)

- Qatari Rial (QAR)

- Romanian Leu (RON)

- Russian Ruble (RUB)

- Saudi Riyal (SAR)

- Singapore Dollar (SGD)

- South African Rand (ZAR)

- South Korean Won (KRW)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

- New Taiwan Dollar (TWD)

- Thai Baht (THB)

- Trinidad and Tobago Dollar (TTD)

- Turkish Lira (TRY)

- UAE Dirham (AED)

- US Dollar (USD)

- Vietnamese Dong (VND)

- Aland Islands (ALA)

- Andorra (AND)

- Argentina (ARG)

- Australia (AUS)

- Austria (AUT)

- Bahrain (BHR)

- Belgium (BEL)

- Brazil (BRA)

- Brunei (BRN)

- Bulgaria (BGR)

- Canada (CAN)

- Chile (CHL)

- China (CHN)

- Croatia (HRV)

- Cyprus (CYP)

- Czech Republic (CZE)

- Estonia (EST)

- Finland (FIN)

- France (FRA)

- French Guiana (GUF)

- French Southern Territories (ATF)

- Germany (DEU)

- Greece (GRC)

- Guadeloupe (GLP)

- Hong Kong (HKG)

- Hungary (HUN)

- Iceland (ISL)

- Indonesia (IDN)

- Ireland (IRL)

- Israel (ISR)

- Italy (ITA)

- Jamaica (JAM)

- Japan (JPN)

- Jordan (JOR)

- Kenya (KEN)

- Kuwait (KWT)

- Latvia (LVA)

- Lithuania (LTU)

- Luxembourg (LUX)

- Malaysia (MYS)

- Malta (MLT)

- Martinique (MTQ)

- Mauritius (MUS)

- Mayotte (MYT)

- Mexico (MEX)

- Monaco (MCO)

- Montenegro (MNE)

- Netherlands (NLD)

- New Zealand (NZL)

- Norway (NOR)

- Philippines (PHL)

- Poland (POL)

- Portugal (PRT)

- Qatar (QAT)

- Reunion (REU)

- Romania (ROU)

- Russia (RUS)

- Saint Barthelemy (BLM)

- Saint Martin (MAF)

- Saint Pierre And Miquelon (SPM)

- San Marino (SMR)

- Saudi Arabia (SAU)

- Singapore (SGP)

- Slovakia (SVK)

- Slovenia (SVN)

- South Africa (ZAF)

- South Korea (KOR)

- Spain (ESP)

- Sweden (SWE)

- Switzerland (CHE)

- Taiwan (TWN)

- Thailand (THA)

- Trinidad And Tobago (TTO)

- Turkey (TUR)

- United Arab Emirates (ARE)

- United States (USA)

- Vietnam (VNM)

How much can I transfer with Marks & Spencer?

Orders are subject to a minimum value of £150 and a maximum value of £2,500.

Once you have ordered your card it can take up to ten working days for you to receive it. However, providing there are no delays with Royal Mail, you will typically receive your card within five working days . FairFX do not have a fast track service and you cannot collect our cards from any collection points.

Unlike cash, if you lose it or it’s stolen, FairFX have you covered. (See FairFX’s terms and conditions for further details). You’re also covered against shocks on your statement when you get home. It’s all there, in real time, upfront.

There is a £5 post and packaging charge for orders with a total value of less than £500. Orders of £500 or more are delivered free.

Customer service information for M&S

We show offers we can track - that's not every product on the market...yet. Unless we've said otherwise, products are in no particular order. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. This is subject to our terms of use . When you make major financial decisions, consider getting independent financial advice. Always consider your own circumstances when you compare products so you get what's right for you. Most of the data in Finder's comparison tables has the source: Moneyfacts Group PLC. In other cases, Finder has sourced data directly from providers.

Matthew Boyle

Matthew Boyle is a banking and mortgages publisher at Finder. He has a 7-year history of publishing helpful guides to assist consumers in making better decisions. In his spare time, you will find him walking in the Norfolk countryside admiring the local wildlife. See full bio

- Helping first-time buyers apply for a mortgage

- Comparing bank accounts and highlighting useful features

- Publishing easy-to-understand guides

More guides on Finder

A new survey by personal finance comparison site Finder has revealed that the average interest rate Brits are getting on their easy-access savings accounts is 2.39%.

We delve into the data behind the September effect and stock market performance – what are the best and worst months?

We explore Cheddar’s free-to-join finance app and its range of cashback incentives at popular retailers.

Solicitors may be keeping millions in client interest. They hold client money for inheritance and other reasons, but some firms offer minimal interest (less than 1%) while earning higher rates themselves.

Nearly half of UK students plan to commute due to rising costs. The most affordable city is Stoke-on-Trent (£1,047/month), while London is the most expensive (£2,210/month).

The government-backed Growth Guarantee Scheme aims to improve the terms of business loans on offer

If you need funding for your Scottish business we look at the type of business loans and financing available to you.

Compare different uni towns and cities with your home town and see the cost of living in each area.

Find out how to grow traffic to your small business website using an analytics tool. We’ve used Semrush as an example. Paid content.

Solicitors are pocketing millions in interest on their clients’ money. The watchdog has warned them to be fair. Here’s what you need to know.

2 Responses

I want to buy $100 & 100 euros at handforth dean

Hi Dr. Russ,

Thank you for reaching out to Finder.

If you want to purchase currency. M&S offers two services:

Buy in store. You’re able to visit your nearest store to get hold of some travel money. Head to the M&S website to find your nearest store! Home delivery. If you have an M&S Credit Card or Chargecard, you can order between £100 and £2,500 of foreign currency online or over the phone. And if you order your travel money before 1pm, M&S will deliver it to your home address the next working day.

Hope this helps!

Cheers, Reggie

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The offers on this page are from advertisers who pay us. That may influence which products we write about, but it does not affect what we write about them. Here's an explanation of how we make money and our Advertiser Disclosure.

World of Hyatt Business Credit Card review: A great fit for frequent business travelers

Business travelers who are Hyatt loyalists will like the nice welcome offer and high earning potential when they stay at Hyatt hotels and resorts. While there’s an annual fee, it’s less than other high-end business travel credit cards on the market.

The World of Hyatt Business Credit Card may fit the wallets of many business owners, especially those who travel frequently for work. But it might not be the right fit for everyone. Here’s a breakdown of what you can expect and how it stacks up against others.

World of Hyatt Business Credit Card

- Annual fee $199

- Welcome offer Earn up to 75,000 bonus points — 60,000 bonus points after spending $5,000 in your first three months and 15,000 more bonus points after you spend $12,000 in your first six months.

- Card type(s) Hotel, Travel

- Purchase APR 21.49% - 29.99% variable

- Recommended credit score Good to Excellent

- Earn up to 9 total points at Hyatt (4 bonus points per $1 spent at Hyatt hotels and resorts plus 5 base points per eligible $1 spent as a World of Hyatt member)

- Earn 2 bonus points per $1 spent in your top three eligible spend categories each quarter

- Earn 2 bonus points per $1 spent on fitness club and gym memberships

- Earn 1 bonus point per $1 on everything else

No foreign transaction fees

10,000 referral bonus points for each business that gets approved for the World of Hyatt Business® credit card (up to 50,000 bonus points per year)

World of Hyatt Discoverist status

Additional benefits

Aside from the tiered points system, the World of Hyatt Business Credit Card comes with other benefits, including:

Free additional employee cards

Up to $100 in annual Hyatt credits (up to $50 in statement credits when you spend at least $50 at a Hyatt property up to two times each anniversary year)

5 Tier-Qualifying night credits toward status for every $10,000 you spend per calendar year

Spend $50,000 and receive 10% of the points you redeem back for the rest of the year (up to 200,000 points redeemed)

Use Chase Pay Over Time for eligible credit card purchases

Travel and purchase protections

Learn more: Our top picks for business credit cards

How to earn rewards

You can earn the most rewards when you stay at a Hyatt hotel or resort. Then, you can earn double points in your top three shopping categories. You can select the ones that your business spends the most money on. For instance, if you rely most on internet and phone services, this might be among the most important categories. Local transit or filling up at gas stations might also be on the list if you commute for work.

How to redeem rewards

You can use your World of Hyatt points for free nights, upgraded room stays, or a combination of points and cash for free nights.

You can only redeem the points you earn with a World of Hyatt Business Credit Card for Hyatt-related stays, not on cash-back options or statement credits.

Learn more: How do travel credit cards work?

Who is the World of Hyatt Business Credit Card best for?

The World of Hyatt Business Credit Card is best for business owners who travel a lot for work and prefer hotel stays on Hyatt properties. It’s also a great option if you have employees who travel for work — either with you or separately — and have access to Hyatt properties when they travel for business.

World of Hyatt Business Credit Card pros

Generous welcome offer. The welcome offer is great for business owners who plan to spend a significant amount of money after opening their account.

Select top spending categories. With the option of earning points in top spending categories, you can maximize your spending with bonus categories where you spend the most.

Extra coverage. You’ll get free employee cards, travel protections, and purchase coverage on all your purchases. Because it’s a Chase card, you can access Chase Pay Over Time to make equal monthly payments on your card for eligible purchases of $100 or more. There’s no credit check, but there is a 1.72% fee for each purchase on the plan.

World of Hyatt Business Credit Card cons

Limited rewards redemption. You can only redeem rewards for Hyatt hotel stays or room upgrades. There’s no cash-back option or statement credit choice.

High annual fee. The $199 annual fee for a card with limited redemption options is expensive.

No free hotel night. Many travel credit cards offer free hotel nights on your anniversary or similar extra perks, but the World of Hyatt Business Credit Card doesn’t come with that.

Where can you use the World of Hyatt Business Credit Card?

You can use the World of Hyatt Business Credit Card anywhere Visa is accepted, at millions of merchants worldwide. Since there aren’t foreign transaction fees, you can use the World of Hyatt Business Credit Card when you travel globally for business trips. You can also use it locally for business-related purchases, including dining , filling your gas tank, or paying your business internet bill.

How to make a World of Hyatt Business Credit Card payment

JP Morgan Chase issues the World of Hyatt Business Credit Card, so you’ll need a Chase account to manage your card. Create a Chase account online . From there, you can make a one-time payment, set up auto payments, add authorized users, and more.

The Chase mobile app is available in Google Play and the App Store , which means it’s compatible with most phones. Once you download the app and add your login information, you can navigate to your World of Hyatt Business Credit Card details. You can make a one-time payment, set up auto-pay, and other account-related activity from there.

You can pay your World of Hyatt Business Credit Card over the phone by calling the number on the back of your card or calling 1-800-436-7958.

You can mail your check or money order to

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

Make sure your payment includes your 16-digit card number on the memo line and don’t fold or staple your payment to something else.

World of Hyatt Business Credit Card customer service info

Availability: 24/7

Phone number: The number on the back of your card or 1-800-432-3117

Chase login page

Alternative cards to consider

The World of Hyatt Business Credit Card is one option for business owners, but other cards on the market might be a better fit. Here are a few alternative business credit cards to consider when comparing your options.

American Express® Business Gold Card

- Annual fee $375

- Welcome offer Earn 100,000 Membership Rewards® points after you spend $15,000 on purchases within the first 3 months. NEW: The Business Gold Card now comes in three metal designs — Gold, Rose Gold, and Limited Edition White Gold (while supplies last).

- Card type(s) Business, Rewards

- Introductory Purchases APR 0% on purchases for 6 months from the date of account opening

- Ongoing Purchases APR 19.49% - 28.49% Variable

- Recommended credit score Excellent/Good

- Earn 4x Membership Rewards points on the top two eligible categories (out of 6 total categories) where your business spends the most each month. Although your top 2 categories may change each month, you will earn 4x points on the first $150,000 in combined purchases from these categories each calendar year, then 1x after that (only the top 2 categories each billing cycle will count towards the $150,000 cap; terms apply).

- 3x points on flights and prepaid hotels booked on AmexTravel.com

- 1x points on all other purchases

Read our full review of the American Express Business Gold

Ink Business Preferred® Credit Card

- Annual fee $95

- Welcome offer Earn 90,000 points after spending $8,000 in first 3 months (that's $900 cash back or $1,125 toward travel when redeemed through Chase Travel℠)

- Card type(s) Business, Travel

- Ongoing Purchases APR 21.24% - 26.24% Variable

- Recommended credit score Good, Excellent

- 3x on the first $150,000 spent each account anniversary year in the following categories: shipping purchases; advertising purchases via social media sites and search engines; internet, cable, and phone services; and travel

- 1x on all other purchases with no earning cap

- Redeem points for cash back, gift cards, travel and more

- Points are worth 25% more when you redeem for travel through Chase Travel

- Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account

Read our full review of the Ink Business Preferred Credit Card

Ink Business Cash® Credit Card

- Annual fee $0

- Welcome offer Earn $350 after spending $3,000 in the first 3 months, plus an additional $400 after spending $6,000 in the first 6 months

- Card type(s) Business, Cash-Back

- Introductory Purchases APR 0% Intro APR on Purchases for 12 months

- Ongoing Purchases APR 18.49% - 24.49% Variable

- 5% cash back on the first $25,000 in combined spending at office supply stores and on internet, cable, and phone services each account anniversary year

- 2% cash back on the first $25,000 in combined spending at gas stations and restaurants each account anniversary year

- 1% cash back on all other purchases

- Earn 5% cash back on Lyft rides through March 2025

- Get a 10% bonus on the cash back you earn in your first year if you have a Chase Business Checking account on your card anniversary (available on cards opened between March and November 2024)

Read our full review of the Ink Business Cash Credit Card

This article was edited by Kendall Little

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. All opinions belong solely to Yahoo Finance and are not those of any other entity. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn't include all currently available offers. Credit score alone does not guarantee or imply approval for any financial product.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

3 Reasons Why the Wells Fargo One Key Card Is a Must-Have for Casual Travelers

Carissa Rawson

Senior Content Contributor

284 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Editor & Content Contributor

87 Published Articles 77 Edited Articles

Countries Visited: 54 U.S. States Visited: 36

Stella Shon

Senior Features Editor

122 Published Articles 806 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

1. one key card has no annual fee, 2. earn no-fuss rewards, 3. score travel and lifestyle benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

I’m part of a small group of travelers willing to spend endless hours searching for award flights, pay hefty credit card annual fees, and go to great lengths to earn elite airline status — but I realize most aren’t.

And that’s why the new One Key™ Card , issued by Wells Fargo, is an excellent option. With a $0 annual fee, the ability to earn strong rewards on everyday spending, and even complimentary travel insurance, the One Key card is one of the best options out there for casual travelers . Let’s talk about it.

In fact, there are 2 One Key cards from Wells Fargo :

- One Key+™ Card : Charges a $99 annual fee

- One Key card : $0 annual fee

While the higher-end One Key+ card offers higher One Key elite status, $100 in OneKeyCash each card anniversary, and a $100 TSA PreCheck or Global Entry credit , that’s where its superior benefits end.

Many travelers already have PreCheck or Global Entry, and while the $100 in OneKeyCash is great at face value, I still think the no-annual-fee card is the way to go.

Both cards earn the same amount of OneKeyCash on your purchases. Plus, they’re both World Elite Mastercards , which means they come with many benefits, including travel insurance , cell phone protection , and shopping protection — making for a strong case for the base-level One Key card.

One of the main reasons people shy away from points and miles is because it can be overly complicated — and I get it. While it’s something I enjoy, many travelers simply don’t have the time for it.

That’s why the One Key card is a solid alternative. It offers generous rewards on everyday expenses, with no caps to the rewards you earn:

- 3% OneKeyCash at gas stations, grocery stores, restaurants, and food delivery

- 3% OneKeyCash at Expedia, Vrbo, and Hotels.com

- 1.5% back everywhere else

Your OneKeyCash can be used for anything within the Expedia Group’s platform , which includes flights, hotels, rental cars, vacation packages, cruises, activities, and U.S. Vrbo rentals . However, when using rewards for flights, you must have enough OneKeyCash to cover the full cost of the flight , including taxes and fees.

OneKeyCash isn’t like other travel rewards. It functions as cash-back rewards, so you can redeem them for anything you like without finding award availability . This makes it simple to use and a good option for those who don’t want to mess around with points and miles but still want to earn valuable rewards for travel.

You can stack more rewards with Vrbo when booking through a portal such as Rakuten .

OneKeyCash aside, what truly impresses me about the One Key card is the fact that it’s a World Elite Mastercard . That’s not a common feature on credit cards with no annual fee, and there’s a good reason for that: World Elite Mastercards come with some really strong benefits.

Complimentary Travel Insurance

The most impressive benefit you’ll get with the One Key card is complimentary travel insurance . While you can purchase your own travel insurance policies, this credit card also offers a level of insurance at no cost.

For a $0 annual fee card, this is a great benefit. While the best benefits are usually reserved for premium travel credit cards (with annual fees that cost $400+ per year), the ones provided by the One Key card are more than solid:

- Trip cancellation insurance

- Trip interruption insurance

- Travel accident insurance

- Rental car insurance

Cell Phone Insurance

Sure, your cell phone carrier will let you pay extra for insurance , but why bother when your credit card offers complimentary cell phone protection ? To be eligible for this coverage, you’ll need to pay your phone bill with your One Key card.

Then, if you have a claim, you’ll need to pay a $25 deductible . Coverage is included if your phone is damaged, stolen, or unrecoverable — cracked screens don’t count. You can claim a maximum of $1,000 per incident and a maximum of 2 claims per 12-month period.

ShopRunner Membership

I use ShopRunner approximately once a year since most of my shopping is done through Amazon. That said, I always appreciate that my World Elite Mastercard covers a ShopRunner membership. This entitles me to free 2-day shipping at popular online retailers , including Bloomingdale’s, Under Armour, and more.

Other Benefits

There are a whole host of other benefits available to those who have a One Key card (or any World Elite Mastercard), including:

- Up to $5 off a monthly Peacock subscription

- $10 off your second Instacart order each month

- $30 statement credit on a $200+ ResortPass booking

- 7% off Booking.com stays

While not all of these are travel-oriented benefits, that’s a good thing. It’s just one more way the One Key card does the work to become an excellent all-in-one option for consumers.

The One Key card provides a whole host of travel and lifestyle benefits, which pair nicely with the easy-to-use rewards it earns.

The One Key card isn’t for everyone, especially if you’re looking to maximize your rewards. But there are a lot of folks who just don’t have the time to spend poring over points and miles — nor can they stomach the annual fees that some cards charge.

Instead, the One Key card makes it easy to earn and redeem travel rewards , while still offering strong benefits, including travel insurance and cell phone insurance.

The information regarding the One Key+™ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the One Key™ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Credit Cards and Loyalty Programs featuring TSA PreCheck®

If you are a member or customer of one of the following organizations, you may qualify to have some or the entire TSA PreCheck® application fee covered or be able to pay with frequent flyer miles/points. Contact your credit card company or loyalty program to learn more.

TSA provides these links for convenience only and does not endorse any of these companies, their products or services. This information is subject to change without notice in the sole discretion of the vendor and TSA cannot guarantee that it is accurate or up to date.

Credit Card Offers

The following credit cards provide a statement credit towards the TSA PreCheck® application or renewal fee regardless of enrollment provider.

- Aeroplan® Credit Card

- American Airlines Credit Union Visa® Signature credit

- Arvest Visa Signature® Credit Card

- Bank of America® Premium Rewards® credit card

- Capital One® Spark® Miles Card

- Capital One® Venture® Card

- Capital One® Venture X® Business Card

- Capital One® Venture X® Card

- Certain American Express® Credit Cards

- Chase Sapphire Reserve® Credit Card

- Choice Privileges® Select Mastercard®

- Citi® / AAdvantage® Executive World EliteTM MasterCard®

- Citi Prestige® Card

- Commerce Bank® World Elite Mastercard®

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Diners Club® Carte Blanche® Corporate Card

- HSBC Elite World Elite Mastercard®

- HSBC Premier World Mastercard®

- IHG One Rewards Premier Credit Card

- IHG One Rewards Premier Business Credit Card

- Marriott Bonvoy Brilliant™ American Express® Card

- MasterCard® Black Card™

- MasterCard® Gold Card™

- Navy Federal's Visa Signature® Flagship Rewards Card

- PenFed Pathfinder® Rewards Visa Signature® Card

- Provident World+ Travel®

- Southwest Rapid Rewards® Performance Business Credit Card

- Truist Business Travel Rewards credit card

- Truist Enjoy Beyond credit card

- Truist Enjoy Travel credit card

- UBS Visa Infinite Credit Card

- United ClubSM Infinite Card

- UnitedSM Explorer Card

- United QuestSM Card

- USAA Eagle Navigator™ Visa Signature® Credit Card

- U.S. Bank Altitude® Connect Visa Signature® Card

- U.S. Bank Altitude® Reserve Visa Infinite® Card

- U.S. Bank FlexPerks® Gold American Express® Card

Loyalty Program Offers

The following rewards programs have partnered with IDEMIA to provide TSA PreCheck® enrollment as a member benefit or by redeeming points/miles. Only redeemable through IDEMIA.

- IHG® One Rewards

- Marriott Bonvoy

- Orbitz Rewards Platinum Members

- Southwest Airlines More Rewards

- United Mileage Plus

Renew your TSA PreCheck® membership online today.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Documents Library

Changing a Universe: Quick Reference Card

ACE training resources for trade users.

CBP Publication Number

- Accessories

- Entertainment

- PCs & Components

- Wi-Fi & Networks

- Newsletters

- Digital Magazine – Subscribe

- Digital Magazine – Info

- Smart Answers

- Back to School

- Best laptops

- Best antivirus

- Best monitors

- Laptop deals

- Desktop PC deals

When you purchase through links in our articles, we may earn a small commission. This doesn't affect our editorial independence .

This easy $30 tech purchase is the best travel investment I ever made

The best investment you can make for an overseas trip? Not jamming a week’s worth of clothes in a carry-on. Not paying hundreds for more legroom on the plane. It’s buying a local SIM or eSIM, specifically one that offers unlimited 5G data so you’re never disconnected.

In the past year, I’ve traveled to cover both Computex (in Taiwan) and IFA (in Germany), and on both occasions I purchased local SIM access for relative peanuts — about $30 or so for 7 to 10 days’ worth of data. Each plan I bought offered unlimited data on networks that were as good or better than what’s offered here in the United States.

Consider this: you’re likely going to be out and about, visiting museums, eating out at restaurants, streaming Netflix by the pool… Yes, you can use your hotel’s Wi-Fi, but only within range of the hotel. And with all the concerns about malicious actors lurking on public Wi-Fi , a dedicated cellular connection can be convenient and safe!

SIM and eSIM to the rescue

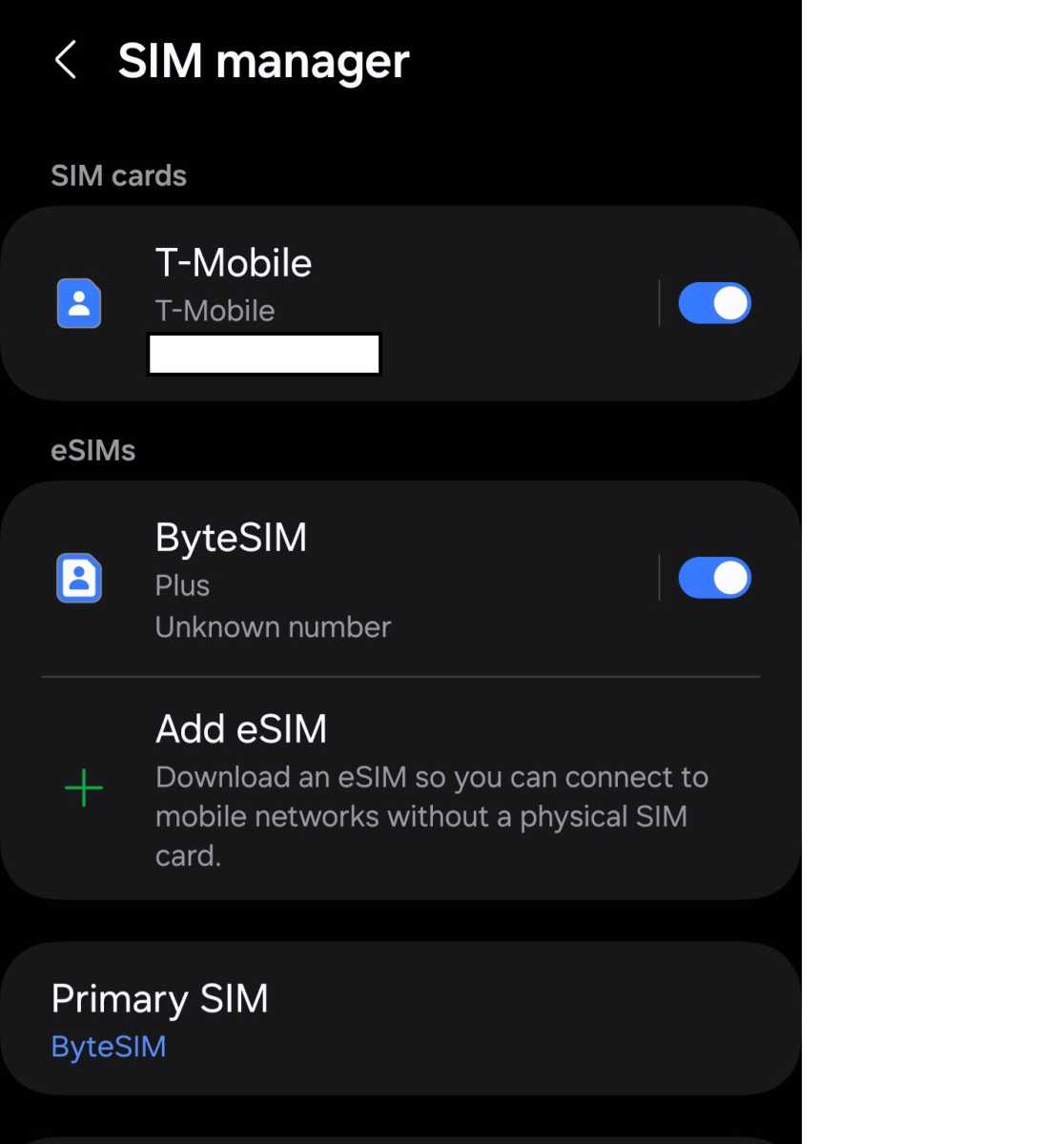

I opted for a local SIM over what my carrier already provides. T-Mobile (my wireless ISP) offers about 5GB of high-speed data when overseas, and your carrier may have a similar option. But if that limit is exceeded, throttling happens — not only does it slow down cellular data speeds, it also kicks you down to 4G or worse.

There’s a world of difference between the amount of data provided by a 4G network and how quick that data is. I’m willing to pay a little extra for the peace of mind in knowing that I’ll have all the data I want, when I want it! That’s thanks to local SIMs and eSIMs.

Mark Hachman / IDG

Most modern phones offer the option to use either a dedicated SIM card (physical) or an eSIM (digital). For the last several years, buying a new phone has generally meant swapping out your SIM card from the old phone to the new one. When you travel overseas, a local SIM provider gives you a different SIM card, which you then pop into your phone (and hold onto your personal SIM card for when you return home).

That process of popping a SIM in and out isn’t convenient, though. You have to make sure you don’t lose or break that tiny little card, and you need the dexterity to fiddle around with the SIM tray on your phone, get it open, insert your card, and close it again. That’s why eSIM is far more useful and what I recommend — if your phone supports it.

Why eSIM is better for travel

An eSIM (short for “embedded SIM”) essentially works by telling your phone to roam onto a local network with the authentication token to do so. When you buy an eSIM, the carrier sends data to your phone for activation, at which point you’re authorized to use their network.

What’s nice is that eSIMs work in conjunction with your home SIM — the eSIM can be programmed to access local data while your home SIM is still used for texts and calls. That’s especially useful if you rarely make phone calls but still want to send texts to friends and family.

Note: For me, T-Mobile offers unlimited texts overseas, so I can easily keep in touch with my friends and family that way. Just keep in mind that if you do place calls while overseas, you may be charged international rates.

When I visited Taiwan, I used a local SIM provider with my spare phone to be a dedicated “Taiwan” phone. And it worked! But having to walk around and hunt down a SIM provider after a 13-hour plane flight wasn’t exactly fun. That’s why when I visited Germany, I used this ByteSIM option that was about $30 for unlimited 5G data.

Picking the right eSIM provider does take a bit of research. Our sister site TechAdvisor recommends Saily , an app that serves as a front door to eSIM plans around the world. And if there’s a gotcha, it’s this: eSIM plans are activated in different ways. Some activate immediately (so your available time begins counting down as soon as the purchase is completed), others only kick in after you “redeem” the eSIM. The best ones only activate after your phone successfully connects to their network.

I particularly liked how ByteSIM advised me of what speeds to expect: I did get about 180Mbps on Germany’s Telekom network, and the SIM roamed freely between it and its competitors.

I also noticed an unexpected benefit: if you’re traveling in Europe, websites recognize you as an EU “citizen” and offer to clear your cookies. Hurray for EU privacy laws!

So, think about this the next time you’re traveling abroad: if you’re already going to spend thousands of dollars on airfare, hotels, meals, and activities, isn’t it worth spending just a few more bucks on a good foreign SIM or eSIM? Honestly, it’s the best travel investment you can make.

Further reading: Essential travel gadgets for your next trip

Author: Mark Hachman , Senior Editor, PCWorld

Mark has written for PCWorld for the last decade, with 30 years of experience covering technology. He has authored over 3,500 articles for PCWorld alone, covering PC microprocessors, peripherals, and Microsoft Windows, among other topics. Mark has written for publications including PC Magazine, Byte, eWEEK, Popular Science and Electronic Buyers' News, where he shared a Jesse H. Neal Award for breaking news. He recently handed over a collection of several dozen Thunderbolt docks and USB-C hubs because his office simply has no more room.

Free delivery when you spend £60 | Free returns for online orders | Free store collection

- How it works

- Other M&S Credit Card offers

- Sign in to Internet Banking

Get a head start with 5x Rewards Points*

Earn £5 in M&S vouchers for every £100 spent at M&S for the first six months with the M&S Rewards Credit Card.

Credit is subject to status. M&S plc acts as a credit broker not a lender.

REPRESENTATIVE EXAMPLE

Purchase rate p.a. (variable)

Representative (variable)

Assumed credit limit

Representative example.

Lenders offer different rates and credit limits depending on people's personal circumstances, but when you first start searching for a credit card you'll typically see the representative example. It shows the rate that at least 51% of those accepted for the credit deal will get on any given product. However, that does mean that almost half the people who are approved for the deal may not be eligible for the advertised rate and will get a different rate – usually a higher one.

Representative APR (Variable)

APR stands for Annual Percentage Rate and it refers to the yearly cost of borrowing money. APR factors in how much interest you will have to pay. Variable APR means that the APR isn't fixed, and can change over time. So, the amount of interest you are charged each month will vary depended on the APR at that time. There are lots of reasons your APR might change, though it will usually be to stay in line with the Bank of England interest rate.

Purchase rate p.a. (Variable)

It is the annual interest rate on purchases. If you pay your credit card bill in full and on time, then you won't have to pay any interest on your purchases. It's only when you carry a balance over into a new month that you will have to pay interest.

For standard credit cards, representative APR is based on a credit limit of £1,200 – this is the same for all lenders. Representative APR assumes you spend the full £1,200 on the first day and then pay it back in equal, regular instalments over a year without spending anything else. The credit limit you will get depends on your specific account and unique credit score.

Meet the card that gives you more of what you love, with points that add up to M&S vouchers.

EXTRA BENEFITS, NO ANNUAL FEES

Zero interest on shopping for 9 months

Shop interest free when you pay at least your minimum payment on time each month.

Zero interest on balance transfers for 9 months

Available for 90 days from account opening. 3.49% fee applies, minimum £5.

Checking your eligibility will not affect your credit score.

HOW REWARDS POINTS WORK

Earn every time you tap.

Get Rewards Points on your day-to-day-spending at M&S, and everywhere else.

Enjoy your rewards four times a year

We’ll turn them into M&S vouchers for you quarterly - just like magic.

Points for M&S shopping

5x Rewards Points at M&S for the first six months. 1 Rewards Point for every £1 spent at M&S thereafter*.

Points for spending outside M&S

Earn 1 Rewards Point per £5 spent outside M&S (e.g. petrol, shopping, traveling)

Calculate how much you'll get back each year to enjoy in M&S vouchers.

Monthly spend at M&S

Online and in-store

Rewards Points: 0

Monthly spend elsewhere

(e.g. petrol, shopping, travelling)

Voucher amount

Total Rewards Points: 0

It pays to start today. Boost your rewards with 5x the points at M&S for the first six months - that means the more you shop, the more you earn, the bigger the vouchers*.

Customers have enjoyed £100 million of vouchers since 2020, and counting...

And there's more

Stay in control with the M&S Banking App

- Access your account safely and securely

- See recent transactions and check your balance

- Make a payment to your M&S Credit Card using a debit card

- Get in touch via Chat with account specific queries

88% of M&S Bank customers in Finder.com’s customer satisfaction survey would recommend the brand to a friend.

ACCOUNT ACCESS IN YOUR POCKET

- For iOS and Android

Looking to transfer a credit card balance?

Check out the transfer plus offer instead., 24.9% apr representative (variable), balance transfer fees apply., find out more.

- You are a UK resident, aged 18 or over, with a regular annual income.

- You have an annual income/ pension of at least £6,800.

- You have not been declined for an M&S Credit Card within the last 30 days.

- You are happy for us to undertake a credit register and credit scoring search.

- You have not held an M&S Credit Card within the previous 12 months.

- Residential address

- Employment history

- Income (please ensure this reflects any impact directly or indirectly, from Covid-19).

- Email address

- The account number and sort code of your bank or building society

- Your previous address, if you've lived at your current address for less than 3 years.

- Can be used to spend up to £500 at marksandspencer.com or in any M&S store (but you won't be able to use them anywhere else). If you're using them in store, you'll need a secondary form of ID and the email including your temporary card number

- Can be used for 5 days including the day you open your account

- Can't be used to purchase M&S gift cards

Get support

Terms & conditions.

Marks and Spencer plc, Waterside House, 35 North Wharf Road, London W2 1NW acts as a credit broker and not a lender. Authorised and regulated by the Financial Conduct Authority (Register no. 718711). Credit is provided subject to status by Marks & Spencer Financial Services plc to UK residents aged 18 or over. We receive a payment from Marks & Spencer Financial Services plc for introducing customers who apply and are approved for credit. The payment is made to cover the costs we incur by offering credit products to our customers and may therefore vary depending on the credit product. It will not affect the amount you pay for credit.

*Full offer and credit card T&Cs apply and can be viewed here .

Offer can be withdrawn at any time. We accept balance transfers from most credit or store cards held with other lenders.

OUR TOP PICKS

You currently have no recently viewed items

Would you like to continue shopping ?

You currently have no saved items

Continue shopping

- YOUR BAG ( )

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

Travel insurance

M&S Travel Insurance offers a choice of single or annual multi-trip policies which include * :

Travel disruption cover

- Protection against your transport or accommodation provider going insolvent so you can recover your costs

- 10% discount for new policies purchased online †

Get a quote

Retrieve a quote

M&S Travel Insurance is underwritten by Aviva Insurance Limited.

Features and benefits

Medical emergency.

If you’re ill or have an accident abroad, your medical expenses could be covered up to £10 million.

M&S Travel Insurance will cover you for emergency medical expenses if you catch Covid-19 during your trip abroad.

Subject to policy terms and conditions. Please read the ‘Your health’ section in the policy booklet on existing medical conditions.

Cancelling or coming home early

Claim for unrecoverable costs up to £6,000 if you need to cancel your trip or come home early.

Claim for cancelling your trip if the Foreign, Commonwealth & Development Office (FCDO) advise against travel to your destination in the 31 days leading up to your holiday.

Subject to policy terms and conditions.

Medical screening

You’ll be asked questions about your medical conditions when you complete your quote.

You’ll need to tell us if, in the last 12 months, any traveller has been prescribed medication, received or is awaiting medical treatment, tests or investigations, or have been admitted to hospital for any illness, injury or disease, including Covid-19.

All policies include travel disruption cover as standard. This offers additional protection for non-refundable travel costs.

Insolvency of transport or accommodation provider

This cover offers protection against your transport or accommodation provider going insolvent so you can recover your costs.

Enhance your policy

Baggage – protection if your bags go missing or get damaged.

Winter sports – cover for winter sports and the loss or damage of your sports equipment.

*M&S Travel Insurance is underwritten by Aviva Insurance Limited. Terms, conditions, exclusions and limitations apply. In addition there are important conditions relating to health which may affect your cover.

Annual multi-trip age limit of under 80, with no age limit for single trip policies.

Existing travel insurance customer information

Instant help

Ask our Virtual Assistant

Important documents

M&S Travel Insurance Product Information Document

M&S Travel Insurance policy booklet

M&S Travel Insurance Summary of Cover limits

M&S Travel Insurance - Important Information

You may require Adobe PDF reader to view PDF documents. Download Adobe Reader

How do I make a claim?

To make a claim you will need to contact Aviva.

- For medical emergency claims please call Aviva on 0800 051 6561 or +44 160 360 4906 if calling from abroad.

- If you don’t need urgent medical attention you can make a claim online or by calling Aviva on 0800 051 4780 or +44 160 360 3783 from abroad.

- You’ll need to provide the following information when making a claim:

- Your personal details, plus details for anyone else claiming on this policy.

- Details about your trip, for example, date of travel and airline (if it’s relevant).

- Your bank account details so that Aviva can settle your claim as soon as a decision is made.

- You can also make a claim if you do not require urgent medical attention by calling 0800 051 4780 or +44 160 360 3783 from overseas. Lines are open 8am-8pm Monday to Friday, 8am-4pm Saturday and public holidays.

What's a policy excess?

This is the amount of money you have to pay if you make a claim.

M&S Travel Insurance has an excess of £100 per person per claim and you can choose to reduce the excess to £50 which will increase your premium.

Are there any charges to change or cancel my policy?

To make sure that you have the right cover in place, please let us know of any changes during the annual policy term. We do not make any charges for mid term changes.

If you cancel your policy within 14 days of receiving your policy documentation we will refund all premiums paid provided you have not travelled or made a claim, and there has been no incident which may result in a claim being raised.

If you wish to cancel the policy after the 14 days then there will be no cancellation charge and no refund of premium will be made.

Will I have to declare any medical conditions?

You need to tell us if you, or anyone else on your policy, have had any illness, injury or disease within the last 12 months where they have:

- Been prescribed medication and/or

- Received or are awaiting, medical treatment, tests or investigations and/or

- Been referred to, or had a follow up with, a specialist and/or

- Been admitted to hospital or had surgery

You may also want to

Find out more about single trip travel insurance

Find out more about multi-trip travel insurance

View exchange rates for M&S Travel Money

Get a car insurance quote

Get a pet insurance quote

Get a home insurance quote

Compare travel insurance cover options

Cover you can rely on.

We offer a choice of cover options so you can tailor your travel insurance to meet your needs. You can compare the level and types of cover in the table below. Whether you decide to add any cover options to your policy or not, you can relax knowing we'll deal with any claim quickly and fairly if something goes wrong with your travel plans.

Cover options

Available for single trip and annual multi-trip travel insurance policies. All cover levels are per person.

What's not covered

- Known events; there is no cover in relation to any event, circumstances or incident you knew about (or were reasonably expected to know about) at the time you booked your trip or purchased your policy (whichever is later) and could reasonably be expected to affect your travel plans.

- Costs which are recoverable from your travel and/or accommodation provider/agent, your debit/credit card provider, PayPal, ABTA, ATOL or similar.

- Travelling against Foreign Commonwealth and Development Office (FCDO) advice. This includes advice or measures put in place by governments and local authorities in the UK or abroad.

- Travelling with the intention of seeking medical treatment or advice abroad, for example to have cosmetic surgery or dental treatment.

Please ensure you read the policy booklet for full details on what is and isn’t covered, in particular the Exclusions which apply to the policy.

Get a quote for M&S Travel Insurance

Apply over the phone: 0800 051 3263

Retrieve your saved quote

Lines are open 8am - 8pm Monday to Friday, 9am - 6pm Saturday, and 10am - 2pm Sunday. Calls are recorded.

† Discount is available for new policies only and excludes renewals or amendments to existing policies

COMMENTS

Find out more about M&S Travel Money Buy Back service. Up to 55 days' interest-free credit when purchasing with an M&S Credit ... ** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month. † Next Day collection is subject to availability. ...

Why use a PCard or Travel Card? There are many benefits to using a PCard or Travel Card for business and travel-related expenses—both for you and U-M. Using a PCard or Travel Card: Provides a more secure form of payment, with the ability to track issues and address any improper or fraudulent charges with the support of JP Morgan Chase ...

Top prepaid travel cards. New. Zing - no fee on £500/mth till Dec. Revolut - top rates on weekdays. Wise - top rates with low fees. Top cards for under-18s to use abroad. HyperJar - fee-free spending, can't use ATMs. Nationwide - fee-free spending & withdrawals. GoHenry - free for two months + £5 cashback.

Information in the table was updated on 25 April 2024. The Post Office Travel Money Card and Travelex card can load the most currencies, however, charges apply for some cash withdrawals at an ATM wth the Post Office deal. Asda Money, Caxton, EasyFX, Sainsbury's and Travelex had similar offers with free ATM withdrawals.

Features of Click & Collect currency. Get our best rates on euro and US dollars when you order currency online. Order and collect euro and US dollars the same day from over 450 stores. There is no extra charge for Click & Collect currency collection. Order between £150 and £2,500.

The doctor says she used a travel SIM card that came with a virtual private network (VPN) to access her usual mobile apps such as Google Translate. (More on this in the Q&A section below.)

Option 1: Travel credit cards. Spend on a credit card abroad and normally your card provider gets near-perfect rates, but then adds a 3%-ish 'non-sterling exchange fee'. This means that every £100 worth of euros or dollars costs you £103, and some add even more fees on top.

Prepaid travel cards enable you to preload currency ready to spend when you're overseas. You can load one, or multiple currencies in advance - depending on the type of card you have. With a ...

M&S Credit Card. For example, if you made a non-sterling (foreign currency) transaction of €100 using your M&S Credit Card and applied the MasterCard exchange rate on 6 June 2022 of 1 euro = 0.8848056 GBP = £88.48, the following fees would be added:

Home delivery. If you have an M&S Credit Card or Chargecard, you can order between £100 and £2,500 of foreign currency online or over the phone. And if you order your travel money before 1pm, M&S will deliver it to your home address the next working day. M&S also offer a buy-back service, so you can sell your leftover travel money at the buy ...

This guide includes the top-pick travel cards, the cards to avoid, and how to check what your card's charging you. Top travel credit and debit cards. Chase - fee-free + 1% cashback. Barclaycard Rewards - fee-free + 0.25% cashback. First Direct - fee-free + TOP service. Currensea - links to your bank account + £10 cashback.

You'll get free employee cards, travel protections, and purchase coverage on all your purchases. Because it's a Chase card, you can access Chase Pay Over Time to make equal monthly payments on ...

The World of Hyatt Credit Card. $95. 30,000 bonus points after spending $3,000 on purchases in the first 3 months of account opening, plus up to 30,000 more bonus points by earning 2 bonus points ...

3. Score Travel and Lifestyle Benefits. OneKeyCash aside, what truly impresses me about the One Key card is the fact that it's a World Elite Mastercard.That's not a common feature on credit cards with no annual fee, and there's a good reason for that: World Elite Mastercards come with some really strong benefits.

Rewards: 1.5 points per $1 on purchases. Welcome bonus: 25,000 points after spending $1,000 on purchases in the first 90 days of account opening. APR: 0% intro APR for 15 billing cycles for ...

M&S Credit Card Fees Abroad. Although they're easy and convenient to use abroad, M&S credit cards come with some costs you should consider before travelling abroad. We've summarised them below (ignoring non-travel-related costs like annual fees, cash advance, and interest charges): Foreign Exchange Margin. 0.1% - 0.3%.

Travel certificates are issued if you volunteer to give up your seat on a flight, or as a gesture of goodwill. These credits, sometimes known as electronic travel certificates, can be used in much the same way as future flight credits. You can book travel on most flights, and purchase some non-ticket items, like Economy Plus seating.

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

Contact your credit card company or loyalty program to learn more. TSA provides these links for convenience only and does not endorse any of these companies, their products or services. This information is subject to change without notice in the sole discretion of the vendor and TSA cannot guarantee that it is accurate or up to date.

M&S Rewards Credit Card. 23.9% APR representative (variable) Learn more. Credit is subject to status. M&S plc acts as a credit broker not a lender. ... M&S plc acts as a credit broker not a lender. M&S Travel Money Learn more. M&S Club Rewards Learn more. Explore our credit offers . Sparks Pay. Up to 45 days interest free on all purchases at M ...

Travel. Travel. U.S. Citizens/LPR. Mobile Passport Control; Canada and Mexico Travel; Know Before You Go; Naturalization Resources; International Visitors. ESTA; ... Quick Reference Card. ACE training resources for trade users. Attachment Ext. Size Date; Changing a Universe: Quick Reference Card PDF: 1.23 MB 09/09/2024

Most modern phones offer the option to use either a dedicated SIM card (physical) or an eSIM (digital). For the last several years, buying a new phone has generally meant swapping out your SIM ...

Earn 1 Rewards Point per £5 spent outside M&S (e.g. petrol, shopping, traveling) Points are converted to M&S vouchers and sent to you by post quarterly to spend at M&S. Calculate how much you'll get back each year to enjoy in M&S vouchers. Checking your eligibility will not affect your credit score.

The M&S plan is £56.36, whereas the comparable plan, with greater levels of protection, is £34.50. A saving to our traveller of 40%. What is also interesting to note is that whereas the comparable plan has £3,000 cover for baggage loss, the M&S plan only offers £2,500 as an optional upgrade, at an additional fee.

Travel insurance. M&S Travel Insurance offers a choice of single or annual multi-trip policies which include *: Travel disruption cover. Protection against your transport or accommodation provider going insolvent so you can recover your costs. 10% discount for new policies purchased online †.