- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Cover-More Comprehensive Travel Insurance Review

Published: Mar 20, 2024, 2:42pm

Cover-More Travel Insurance offers Australians high-quality cover within its comprehensive plan, including unlimited medical cover that extends to Covid-19. While dental isn’t included in the unlimited medical cover, it is still covered up to $2,000. Plus, Cover-More provides automatic cover for nearly 100 sports and activities, making it a great choice for the adventurous traveller.

Related: Best Travel Insurance Providers for Australians

- Unlimited medical cover

- Maximum age limit of 99 years of age

- Automatic cover for nearly 100 sports and activities

- Snow, cruise and adventure cover cost extra

- Dental not included in unlimited medical cover

- No online discounts

Table of Contents

About cover-more travel insurance, what is covered by cover-more, does it cover me for covid, what about pregnancy, what about sports and activities, customer service.

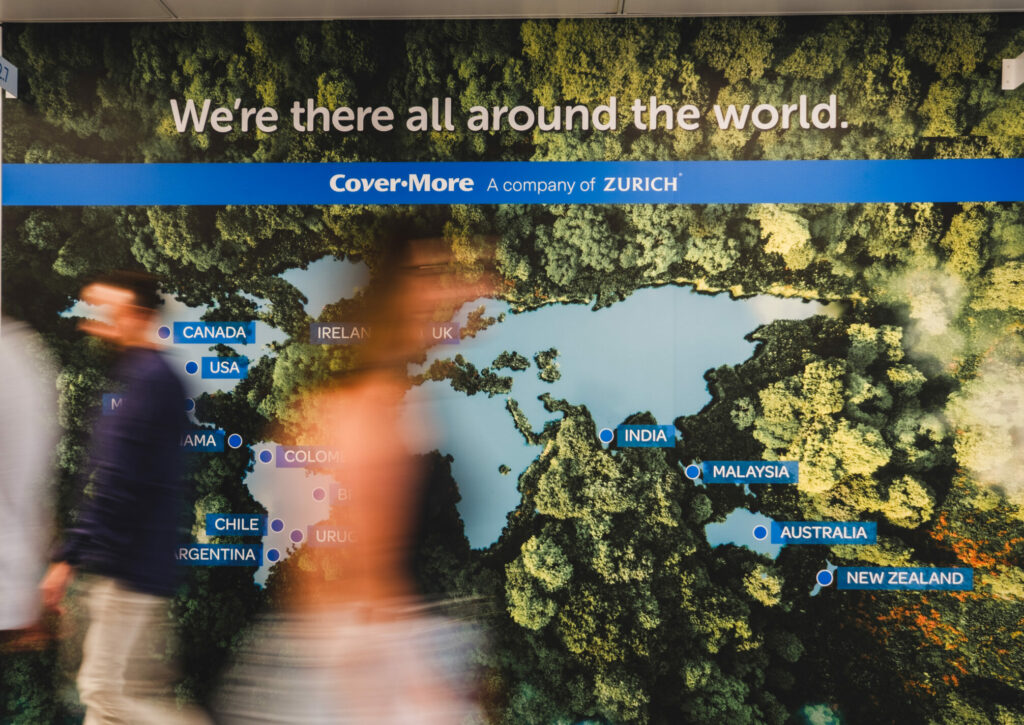

Cover-More Travel Insurance is part of the Zurich Insurance Group, with the Australian Cover More Travel Insurance policies underwritten by Zurich Australian Insurance Limited. Cover-More was established in 1986 in Sydney, and claims to protect more than 15 million travellers per year with its policies.

The company has won numerous industry awards over the years, and its comprehensive policy has received a 3.3 star ranking from 2843 customer reviews on Australia’s leading consumer review site, ProductReview.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

Covid Cover?

Maximum age limit?

99 years old

Lost luggage cover?

Yes, up to $15,000

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

Cover-More’s Comprehensive Travel Insurance policy is available for travellers up to 99 years of age, subject to meeting the acceptance criteria. Dependent children are also automatically included up to 21 years of age, provided they are financially dependent and are not in full time employment–making this policy a good choice for family holidays.

While Cover-More doesn’t state a maximum amount of credit card fraud it will cover in its comprehensive plan, it does say that it will repay the legal liability of illegal use and also provide a replacement. As for personal liability, this is covered up to $2.5 million.

Additionally, missed connecting flights are covered up to $3000, and there is cover for hire car excess up to $5000 as well. Cancellations are also covered, with the amount chosen by the customer upon taking out the policy.

Lost luggage

Yes, the Cover-More Comprehensive Travel Insurance policy includes lost luggage cover up to $15,000. Sub limits apply; however, item limits can be increased when taking out the policy if required.

Cover-More’s Comprehensive Travel Insurance policy comes with unlimited medical cover. This includes COVID-19 (as explained below) and some pre-existing medical conditions.

There are 32 conditions that are automatically covered in Cover-More’s policy, provided they meet certain criteria. These conditions include epilepsy, asthma, coeliac disease and more.

Other medical conditions require an assessment to determine whether cover will be provided, and may incur an additional premium on the policy. Cover-More urges policyholders to disclose all medical conditions upon taking out a policy to ensure the correct level of cover is provided throughout the trip.

Is Dental Cover Included in Medical?

Dental is not included in Cover-More’s unlimited medical cover. However, policyholders are covered for dental costs up to $2,000.

Related: Review of Travel Insurance Saver Insurance

Yes, Cover-More includes Covid-related medical expenses within its unlimited medical cover. There is also cover up to $5,000 for trip cancellations due to Covid, and additional expenses–such as emergency accommodation if required to isolate–are covered up to $2,500.

Related: Are You Covered for Covid?

When it comes to pregnancy, a single-child pregnancy is automatically covered with Cover-More’s comprehensive plan. For multiple babies, or if the pregnancy was IVF-assisted, policyholders must apply for extra cover upon taking out the policy.

The pregnancy cover that Cover-More provides is only up to week 24 of the pregnancy, and only for serious and unexpected complications. Childbirth is not covered.

Cover-More provides its customers with plenty of choice when it comes to cover for sports and activities on their holiday. Automatically included in the travel insurance policy are 96 different activities, which range from windsurfing and swimming with dolphins to paint balling and archery.

Some activities that are automatically included come with extra conditions in order to be covered, such as hiking/trekking only up to 2000 metres, and hot air ballooning as a passenger through an organised activity only.

Cover-More adds that all activities listed within its 96 automatic-inclusions must be undertaken recreationally and in a non-professional capacity, with certain limits and sub-limits applying.

For travellers looking for travel insurance that covers other sports and activities outside of the 96 listed, Cover-More provides optional add-ons at an extra cost. This includes adventure activities, snow packs and cruise cover.

Cover-More offers its customers 24/7 emergency assistance via a dedicated overseas medical and emergency assistance team known as Cover-More Assist. Policyholders can contact Cover-More Assist by calling +61 2 8907 5619 from anywhere in the world.

There is also a general customer service phone line, and a separate claims line. Alternatively, customers can choose to submit claims online via the Cover-More website.

Frequently Asked Questions (FAQs)

Is there a discount for cover-more travel insurance.

No. At the time of writing, there are currently no online discounts for Cover-More Travel Insurance.

Cover-More does frequently run promotions for its customers (such as the chance to win a $2,000 Visa giftcard or 15% off your policy), with these promotions and deadlines found online at the Cover-More website.

Does Cover-More Travel Insurance cover Covid-19?

Yes, Cover-More’s Comprehensive Travel Insurance policy includes cover for Covid-19. As Cover-More offers unlimited medical cover, COVID-19 related medical needs are included within this.

There is also cover up to $5000 for trip cancellations due to Covid, and additional expenses that incur due to contracting COVID-19 are covered up to $2500.

Is Cover-More Travel Insurance good?

Forbes Advisor compared a wide range of travel insurance policies to find the best choices for Australians. Cover-More Travel Insurance was rated 4.5 out of 5 stars by Forbes Advisor, and also has a 3.3 star ranking from 2,843 customers on independent site, ProductReview.

It is considered a good travel insurance option for Australians, largely due to its unlimited medical cover–which includes Covid coverage–and its many automatically included sports and activities.

Where Can I Find The Cover-More Policy Document?

Cover-More offers a range of different travel insurance policies to Australians, each with differing product disclosure statements (PDS) outlining their inclusions and limitations. The comprehensive plus policy’s PDS can be found here , while the standard comprehensive offering’s policy document can be found here .

For all PDS’ from Cover-More, including its domestic travel insurance offering , you can find them online on the Cover-More website .

Who underwrites Cover-More Travel Insurance?

Cover-More travel insurance is underwritten by Zurich Australian Insurance Limited.

How do I contact Cover-More Travel Insurance?

For general enquiries, Australians can contact Cover-More Travel Insurance by calling 1300 72 88 22.

For policy holders requiring emergency assistance, you can call Cover-More Assist 24/7 from any country on +612 8907 5619.

To make a claim over the phone, policyholders should call 1300 36 26 44.

Complaints can be made via the general enquiries line, by submitting a form online , or emailing [email protected].

Does Cover-More offer domestic travel insurance?

Yes. Along with Cover-More’s comprehensive offering, as reviewed above, the travel insurance provider also provides plans for those travelling domestically.

Cover-More’s domestic plan made it onto Forbes Advisor Australia’s list for our pick of the Best Domestic Travel Insurance , scoring 4 stars out of 5.

From our review, we found that the Cover-More Domestic policy is available for all ages up to 99 years, subject to acceptance criteria such as pre-existing medical conditions. Delays are covered up to $1000, missed connections are also covered up to the value of $2000, and the value of cancellation cover is chosen by the customer.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany site, Sophie has worked closely with finance experts and columnists around Australia and internationally. Sophie grew up on the Gold Coast and now lives in Melbourne.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Cruise Travel Insurance

- Best Domestic Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

More from

Was discovery travel insurance review: features, pros and cons, fast cover comprehensive travel insurance review: pros and cons, our pick of the best domestic travel insurance for australians, travel insurance for indonesia: everything you need to know, travel insurance for singapore: the complete guide, the new travel document aussies will need to visit europe.

- Travel Insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency Assistance

- Travel Alerts COVID-19 International Travel Tool Cover-More App

- Manage Policy

Travel insurance that’s always by your side

- travel_explore Not sure? See region list.

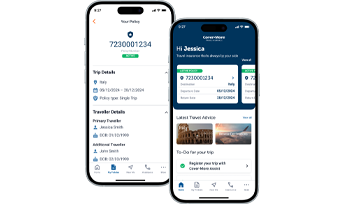

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Feel in control by choosing the most suitable plan for you

Feel safe with 24/7 access to Emergency Assistance

Feel joy with 80+ adventure activities included

Feel confident with our 35+ years of travel expertise

Looking for the best travel insurance plan for your holiday?

Whatever your travel budget, style or needs, let's travel the world together - safely.

International Basic

Essential cover designed for Australian travellers on a budget.

Pre-trip cover if you're diagnosed with COVID-19

On-trip cover if you're diagnosed with COVID-19^##

Unlimited~ overseas emergency medical expenses^

Up to $5,000 luggage cover

Existing medical conditions cover available

Optional cancellation cover

Single Trip policies

Annual Multi-Trip policies^

Rental vehicle insurance excess

International Comprehensive

Extensive cover and benefit limits to provide extra financial protection.

Pre-trip cover if you're diagnosed with COVID-19#

On-trip cover if you’re diagnosed with COVID-19 while travelling^##

Up to $15,000 luggage cover*

Optional cancellation cover with Cancellation Extensions

Single Trip or Annual Multi-Trip^^ policies

Rental vehicle comprehensive cover

International Comprehensive +

Everything our Comprehensive Plan includes and more + higher benefit limits.

Pre-trip cover if you’re diagnosed with COVID-19 before travelling#

Up to $25,000 luggage cover*

Business trip benefits

* Item limits apply.

~ Cover will not exceed 12 months from onset of the illness, condition, or injury.

^ For cruise-related expenses, Cruise Cover must be included in the policy. There is no cover for cabin confinement related to COVID-19.

^^ Policy availability subject to age, trip duration and area of travel. Policies may not be available to all travellers.

# Up to $5,000 per policy (or the amount chosen if this is less) applies to International Comprehensive Plan and Comprehensive+ Plan policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply.

## Up to $5,000 per policy (or the amount chosen if this is less) applies per policy for policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply. A special excess applies.

Searching for COVID-19 cover?

To help you explore the world with confidence, our travel insurance provides cover for COVID-19-related:

Overseas medical costs*~#

Amendment and cancellation costs*^

Additional expenses*#^

*Limits, sub-limits, conditions, and exclusions apply.

~Medical cover will not exceed 12 months from onset.

#Cover for medical costs related to COVID-19 is not available on our Domestic Plans.

^A special excess will apply.

Holiday hasn't gone to plan?

You can submit a Cover-More travel insurance claim online at any time – and from anywhere.

Get emergency support, fast. We're here 24/7.

When adventure awaits... we can help provide cover.

Setting sail for two or more nights? You'll need to let us know and Cruise Cover will be added to your policy.

Snow Sports

Hitting the slopes? Consider protecting your winter getaway with one of our two levels of Snow Sports Cover.

Adventure Activities

Planning on engaging in extreme activities? We've got two additional Adventure Activities Cover options for you.

Motorcycle & Moped

Want to take to the road on two wheels? See if one of our Motorcycle/Moped Riding Cover options is right for your trip.

We're by your side when you need us most

We've been protecting Australian travellers for over 35 years. Read our customers' Cover-More travel insurance reviews to discover how our expert team provides exceptional care during uncertain times.

Mosquito bite in Bali

Shannon was bitten by a mosquito in Bali, which caused Dengue Fever.

"Cover-More were absolutely fantastic. I wasn't responding well to medical treatment, so they flew in a specialist from Singapore to accompany me all the way home. I'm so glad I had Cover-More travel insurance."

Boat crash in Thailand

Natalie was involved in a speedboat crash in Thailand, which resulted in a fractured pelvis and a brain haemorrhage.

"Luckily I had Cover-More insurance. They took care of everything and made sure we had the best medical treatment available."

Accidental fall in Poland

Irene was visiting family in Poland when she had a fall, which resulted in a bad fracture and extensive medical costs.

"Amazing. I can't praise them highly enough. Wonderful, wonderful people... Nobody should travel without insurance."

Protect your trip with us - get a free travel insurance quote now.

How can we help you travel smarter.

Whether you’re a seasoned traveller or a first-timer, we’re here to help you feel empowered to travel further, safely.

Finding cover for Existing Medical Conditions (EMCs)

Have an EMC? We can provide cover for various conditions to help keep you exploring, safely.

7 ways COVID-19 has changed the way we travel

Worried about travel risks during COVID-19? Discover how you can help ensure a safer trip.

What you should know before you hit the slopes

Planning a ski trip at home or abroad? Don't depart without reading our expert advice.

Got a question about travel insurance? We're here to help

What is travel insurance.

Travel insurance is a specific type of insurance that helps cover several costs and disruptions when travelling both domestically and overseas. Levels of cover differ per plan; however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, overseas medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. Things like the destination, length of trip, optional additional cover for specific activities and pre-existing medical conditions all help determine the cost of a travel insurance policy.

How much does travel insurance cost?

The cost of a travel insurance policy varies from traveller to traveller because various factors affect the amount payable.

At Cover-More, we consider a number of factors when calculating the total amount payable. The following is a guide on these key factors, how they combine and how they may impact the assessment of risk and therefore the premium paid:

- Area: higher risk areas cost more.

- Departure date and trip duration: the longer the period until you depart and the longer your trip duration, the higher the cost may be.

- Age: higher risk age groups cost more.

- Plan: International Comprehensive+, which provides more cover, costs more than International Comprehensive or Domestic.

- Excess: the higher the excess the lower the cost.

- Cruise cover: additional premium applies.

- Cancellation cover: on some policies you can choose your own level of cancellation cover. The more cancellation cover you require, the higher the cost may be.

- Adding cover for Existing Medical Conditions and pregnancy (where available): additional premium may apply if a medical assessment is completed and cover is accepted by us.

- Options to vary cover (where available): additional premium applies.

While a cheaper policy cost upfront may seem appealing, always read the Product Disclosure Statement to ensure your needs are adequately covered should an incident occur.

How does travel insurance work?

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. By purchasing travel insurance with cancellation cover prior to departure, your policy can help by providing cover for the costs of trip cancellations should you no longer be able to travel, as well as the costs of overseas medical treatment, lost passports, and personal items while you’re travelling.

The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval. To approve a claim, travel insurers require documentation such as medical reports, itemised medical bills or police reports to confirm the incident occurred.

However, at Cover-More, if our customer becomes ill overseas, they can also contact our 24-Hour Emergency Assistance team for support and to seek approval for expensive medical bills to be paid directly by us to the medical care provider/s instead.

Always read the Product Disclosure Statement before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

What does – and doesn’t – travel insurance cover?

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Product Disclosure Statement before purchasing to avoid becoming frustrated if claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including cancellation, pre-existing medical conditions, theft or loss of belongings, adventure sports, COVID-19 scenarios and more.

For full details of the exclusions within our Cover-More travel insurance plans, consult the Product Disclosure Statement .

When is the best time to purchase travel insurance?

The best time to purchase travel insurance is as soon as a trip is booked, as this can increase protection. When purchased ahead of time, a Cover-More customer can cancel their travel insurance policy for a full refund within the 21-day cooling-off period. If the policy is purchased before departing on the trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made where cancellation cover is added to the policy.

- New Zealand

- United Kingdom

- Latin America

- North America

- Sustainability & Community

- Products and Services

- Geographies

Life at Cover-More is caring, committed and packed with opportunity.

We’re there every step of a traveller’s journey..

We are here for travellers before, during and after they travel, keeping them safe, protected and cared for every step of their journey.

A global group with specialist capability in travel insurance, assistance and travel risk management.

Where we’ve come from: our australian heritage..

Global reach, personalised feel.

We are a global company where empathy and respect, diversity and inclusion are at our core.

Travel Insurance

Ready for your next adventure? Get award winning Medibank Travel Insurance to help protect your trip.

Whether you're travelling internationally or within Australia, Medibank Travel Insurance offers a range of cover options to suit your needs. Plus, Medibank and ahm health members save 15%.

What is travel insurance?

Travel insurance is designed to help cover you for a range of unexpected events while you're travelling overseas or in Australia. Depending on your cover, it could help protect you against costly overseas medical emergencies, lost or damaged luggage, rental car insurance excess, cost of cancellation or delays due to certain unforeseeable circumstances, and more.

Medibank Travel Insurance offers cover for both international and domestic trips, also provides you with the flexibility to add ski and snow cover , motorcycle and mopped cover , cruise cover or increase your item limits for luggage .

Multi-award winning travel insurance

We're proud to be winners of Mozo's Experts Choice awards in 2022 & 2023 and Canstar's 2023 Most Satisfied Customer - Travel Insurance award.

Did you know that if you're a Medibank or ahm health member, you can save 15% on any Medibank Travel Insurance policy?

Our travel insurance options

Whether you travel once a year or you're a frequent flyer, we have travel cover options for single and annual multi-trips.

Our International Comprehensive Travel Insurance provides our highest level of protection when travelling abroad. It's designed to provide cover for lost/stolen luggage,² cancellation & delays,¹ as well as overseas medical cover including dental emergencies.³

International Comprehensive Travel Insurance

Our International Comprehensive Travel Plan provides our highest level of protection when travelling abroad. It's designed to provide cover for lost/stolen luggage,² cancellation & delays,¹ as well as overseas medical cover including dental emergencies.³

Our basic international travel insurance provides cover for Overseas Medical and Hospital Expenses that occur while travelling.³ It also includes 24/7 emergency assistance in case you need help finding appropriate medical treatment.

International Medical Only Travel Insurance

Our basic international travel plan provides cover for Overseas Medical and Hospital Expenses that occur while travelling.³ It also includes 24/7 emergency assistance in case you need help finding appropriate medical treatment.

Our travel insurance for Australia provides cover for cancellation, amendment & delays.¹ It also includes up to $8k in cover for lost/stolen luggage and personal effects,² and up to $5k to help cover the cost of car insurance excess whilst travelling.

Domestic Travel Insurance

Our domestic travel plan for Australia provides cover for cancellation, amendment & delays.¹ It also includes up to $8k in cover for lost/stolen luggage and personal effects,² and up to $5k to help cover the cost of car insurance excess whilst travelling.

For frequent travellers, our annual multi-trip plan could save time and money. Customise your policy to where you are travelling and select your maximum trip length to secure 12 months of Medibank Travel Insurance.⁴

Annual Multi-Trip Travel Insurance

Why medibank travel cover.

Whatever your travel plans are, it's important to know that you have some cover for unexpected events.

Our international travel insurance gives you hospital, accident and medical evacuation expense cover while overseas. 3 And if you're travelling within Australia, then our Domestic Plan includes cover for your valuables, rental car excess and some cancellation costs.

COVID-19 cover

We’ve added a number of benefits related to COVID-19 onto our domestic and international policies. Including cover for overseas medical costs if you are diagnosed with COVID-19 whilst travelling.

$Unlimited cancellation costs

Expense cover for accommodation and other prepaid costs if you have to cancel due to certain unforeseen circumstances such as a family emergency. 1

Luggage insurance and personal effects cover

Help protect your valuables, with cover for lost, stolen or damaged items. Get up to $15,000 cover on our International Comprehensive Plan, and up to $8,000 cover on our Domestic Plan. 2

Rental car insurance excess

Whether you’re in Australia or abroad, if your rental vehicle is in an accident, damaged or stolen you could be liable to pay an expensive excess. We’ll provide cover up to your included limit.

Additional cover options

For an additional premium, you can add cover for additional scenarios like snow sports activities, moped riding and multi-night sea or ocean cruises. And if you're travelling with valuables, you can also opt to increase your item limits for your luggage and personal effects.

Want extra luggage insurance for when you're travelling with high-value items?

If you're travelling with an item that is worth more than the limit shown in the PDS, then you can increase the item limit cover (on a per item basis) by specifying the item and paying an additional premium for the increased cover. Some examples of valuable items might include camera equipment, jewellery, watches and phones.

Refer to the PDS for full details of luggage cover, limits and exclusions.

Please note that the option to increase luggage item limits is not available on the International Medical Only Plan since this plan does not include any cover for luggage and personal effects.

Going on a multi-night sea or ocean cruise and need Cruise Cover?

If your trip includes travel on a multi-night sea or ocean cruise, then you'll need to add Cruise Cover to be insured for claims relating to a cancelled cruise, cruise travel, or certain claims that arise whilst on a cruise.

By adding Cruise Cover to your policy, you will also receive a range of additional cruise benefits such as cover for cabin confinement and sea sickness. A summary of additional cruise benefits including any COVID-19 related exclusions can be found in the PDS .

Learn more about cruise cover .

Please note: if you are travelling on a river cruise then no additional cover is required. To add Cruise Cover for a multi-night sea or ocean cruise, you must take out an International Plan.*

- For multi-night domestic cruises which involve travel from one port in Australia to another port(s) (e.g. Sydney to Brisbane), the destination used when quoting should be entered as "Domestic Cruise".

- When getting a quote for a multi-night cruise which involves an international port, please choose the area or destination where you will spend the most time on your trip and then select "Yes" to Cruise Cover.

* If you are travelling on a domestic cruise which does not leave Australian coastal waters (e.g. Kimberley cruise), or is an Australian river cruise (e.g. Murray river cruise), then no Cruise cover is required and a Domestic Plan can be purchased.

Cover for cancellation is not available on an International Medical Only Plan.

Need cover for snow activities like skiing, snowboarding and snowmobiling?

Cover for skiing, snowboarding or snowmobiling is not automatically included in your policy. If you wish to have cover for these snow activities during your trip, then you’ll need to purchase cover for snow sports.

Learn more about winter sports cover .

Conditions and exclusions apply to snow sports cover (e.g. you must not be participating in the activity in a professional capacity). See the PDS for full details.

Need motorcycle and moped cover for your travels?

If you're planning to use a motorcycle or a moped during your travels, then you'll need to select moped/motorcycle cover option to be able to claim for incidents related to driving or riding on a motorcyle/moped.

Learn more about moped and motorcycle cover .

Conditions and exclusions apply for motorcycle/moped cover (e.g. you must wear a helmet, the engine capacity must be 250cc or less). See the PDS for full details.

Emergency assistance whilst travelling

Every Medibank Travel Insurance policy comes with 24 hour emergency assistance.

Our team of experienced doctors, nurses, travel consultants and case managers are ready to help you 24 hours a day, 365 days a year. We can help if you need support finding appropriate medical treatment, if you need to organise medical evacuation, or if you require assistance replacing lost travel documents and credit cards.

Learn more about our 24/7 emergency assistance .

Frequently Asked Questions

Why do i need travel insurance.

As SmartTraveller suggests, "If you're going overseas, travel insurance is as important as a passport". Whilst you plan for all the fun and adventure for your trip, you can't always plan for the unexpected events that could take the fun away, or even worse, could have you incur a large financial burden. Unexpected overseas medical treatment and hospitalisation are particularly costly when most countries do not provide free care for overseas tourists.

Medibank's international and domestic comprehensive travel insurance policies also offer cover on cancellation costs, loss of luggage and personal effects, travel delay expenses, and rental car excess.

How do I choose travel insurance?

When choosing a travel insurance policy, you need to carefully consider a variety of factors - such as destination, budget, time spent travelling, your health conditions, type of activities you'll participate in, possible unexpected medical expenses - just to name a few. It's also very important to understand what you are and aren't covered for by your chosen travel insurance policy.

Hospital, accident and medical evacuation cover are just some of the essential travel insurance benefits that could be pivotal if you get into a medical emergency while travelling, particularly when you travel to countries with expensive medical costs.

Trip cancellation cover can also be very helpful at a time when you need to cancel your non-refundable accommodation, transport fees and other prepaid costs due to certain unforeseen circumstances such as family emergency. The earlier you purchase your eligible travel insurance policy after you booked your trip, the earlier you'd be covered by this benefit. *

It's important to choose the right level of cover for you and your trip when purchasing travel insurance. Please read Medibank's combined PDS/FSG , and Target Market Determination to see the coverage of each benefit and to ensure the product is right for you if you are considering a Medibank Travel Insurance Policy. You can compare Medibank Travel Insurance policies online , by phone , or at one of our retail stores .

* For cancellation cover relating to COVID-19 scenarios, refer to our COVID benefits page - Buying a policy and pre-trip cancellation.

Can I purchase travel insurance after I have started my trip?

If you wish to purchase a policy after you’ve already left home (or your current travel insurance policy has expired), Medibank Travel Insurance cover is subject to a three day no-cover period. In practical terms, this means there is no cover under any section of the policy for any event that has occurred already or that arises within the first three days of buying your new policy.

Can my 'pre-existing medical condition' be covered by travel insurance?

If you are taking out a policy, you can check if you have a pre-existing medical condition without the need to visit your doctor or supply a medical report - simply read through the ‘Existing Medical Conditions' section in the Product Disclosure Statement or conduct a self-assessment as part of the online application process.

There are three categories of medical conditions:

- conditions we automatically include cover for.

- conditions which cannot be covered.

- conditions we need to assess.

Please review each of these categories to determine which category applies to you. You can view the Product Disclosure Statement to find a full definition of 'Existing Medical Conditions' and what we automatically cover.

Note: If you have an existing condition that does not fit the criteria under “Existing Medical Conditions we automatically include” and you do not apply for and purchase the appropriate cover, we will not pay any claim arising from, relating to, or associated with, your condition.

View more FAQs

Popular travel destinations

Medibank Travel Insurance has been helping protect Aussie travellers for over 15 years.

Travel Guide to Japan

Plan the perfect trip with Medibank Travel Insurance for Japan. We offer hospital, accident and medical evacuation cover while in Japan. Get a quote today.

Travel Guide to New Zealand

Whether it's a summer getaway or winter break, New Zealand has many activities and sites to enjoy on both North and South Islands.

Travel Guide to the UK

The United Kingdom has long been a place where Australians go on holiday, visit friends and family, sightsee, and more.

Things you should know

1 Conditions apply to cancellation cover including COVID-19 related limits. Cancellation cover applies to the International Comprehensive and Domestic policies. See the Combined FSG/PDS for more information.

2 Item limits and sub-limits apply. See the Combined FSG/PDS for more information.

3 Medical cover will not exceed 12 months from the onset of the illness or injury. Limits will be shown on the Certificate of Insurance. Medical evacuation cover subject to claim approval.

4 Cover is limited to a maximum duration of up to 30, 45 or 60 days for international trips and 15 or 30 days for domestic trips, depending on the duration choice you make. International policies include trips within Australia too.

Limits, sub-limits, exclusions and conditions apply. This is general advice only. Medibank Private Limited, ABN 47 080 890 259, an Authorised Representative, AR 286089, of Travel Insurance Partners Pty Limited, ABN 73 144 049 230 AFSL 360138 arranges the insurance on behalf of the insurer. The insurer is Zurich Australian Insurance Limited ABN 13 000 296 640, AFSL 232507. Please consider your own needs and the Combined FSG/PDS to decide if this product is right for you. For information on the Target Market and Target Market Determinations , visit medibank.com.au/travel-insurance/help/

Request a call back

Leave your details and a Medibank expert will be in touch to take you through your options. In providing your telephone number, you consent to Medibank contacting you about health insurance.

We'll have someone call you soon to help with any questions you have.

COVID-19 Health Assist - Expression of interest

Complete this form to express your interest in one of our programs. If you're eligible, a member of our team will call you within 2-3 business days.

What program are you interested in?

Sorry, only members with current Hospital cover are eligible to participate in these programs

Eligible Medibank members with Extras cover are able to access a range of telehealth services included on their cover - you can find out more here . Alternatively, if you would like to talk to one of our team about your cover, we're here on 132 331 .

Your membership details

Please provide your details so we can know how to contact you.

Your contact details

By clicking Submit, I understand that Medibank or its subsidiaries may contact me to discuss my eligibility for the Covid-19 Heath Assist program(s), and will disclose my personal information within the Medibank Group of companies and to third party service providers. Please see Medibank’s privacy policy for further information about how Medibank will handle my personal information, and how to contact Medibank: https://www.medibank.com.au/privacy/

Thank you for expressing your interest in one of our COVID-19 Health Assist programs.

If you are eligible, one of our health professionals will call you in 2-3 business days to discuss your situation and help to enrol you in the relevant program.

There is no cost to participate, however some referred services may incur an out of pocket cost.

The only travel insurance that earns you Airpoints Dollars ™

Start your travel insurance quote

Where are you going.

Single Trip

Select a country in the area of travel based on where you will spend the most time on your journey

Note: If you plan to spend more than 20% of your time in the Americas or Antarctica, you must select a country from the area that includes these countries.

Annual Multi-Trip

Select a country you are planning to visit in the area which will cover all the countries you plan on visiting over the year. If you plan to visit a country in the Americas, or Antarctica, you must select a country in the area that includes these countries.

Cover includes domestic journeys provided the destination is more than 100 km from your home in New Zealand. If less than 100 km, your trip must include at least one night paid accommodation booked with an accommodation supplier or provider.

- United States of America (USA)

- Cook Islands

- Not Sure? See Region List

- Antarctica - Sightseeing Flight

- Antigua And Barbuda

- Cayman Islands

- Dominican Republic

- El Salvador

- Falkland Islands

- Northern Mariana Islands

- Puerto Rico

- St. Kitts and Nevis

- St. Vincent and Grenadines

- São Tomé and Príncipe

- United States of America

- Virgin Islands, U.S.

- Afghanistan

- Bosnia and Herzegovina

- Burkina Faso

- Cape Verde Islands

- Central African Republic

- Congo, The Democratic Republic Of

- Czech Republic

- Equatorial Guinea

- Faroe Islands

- French Guiana

- Guinea-Bissau

- Ivory Coast

- Korea, Republic Of

- Liechtenstein

- Moldova, Republic Of

- Netherlands

- Saudi Arabia

- Sierra Leone

- South Africa

- Switzerland

- Trinidad And Tobago

- Turkmenistan

- United Arab Emirates

- Vatican City

- Northern Ireland

- United Kingdom

- Lao People's Democratic Republic

- Marshall Islands

- Philippines

- American Samoa

- French Polynesia

- New Caledonia

- Norfolk Island

- Papua New Guinea

- Solomon Islands

- Western Samoa

- New Zealand

Dates of Travel

Departure date (travel start date).

Single Trips

The date you depart your home in New Zealand

If you purchase this policy on your trip after leaving home, this cover is subject to a 3-day no-cover period. This means there is no cover under any section of the policy for any event that has occurred already or that arises within the first 3 days of buying the policy.

Cover under the 'Amendment or cancellation costs' benefit begins from the time you buy your policy.

Cover under all other sections begins from the departure date you select.

Annual Multi-Trips

The date your policy will commence

For further information we recommend you read the definition of 'Relevant Time' and 'Period Of Insurance' in the Policy Wording.

Return Date (Travel End Date)

The date you return to your home in New Zealand

Your Annual Multi-trip Policy will expire 12 months from the commencement date of the policy.

Ages of travellers

Who is going.

Enter the current age (at todays date) of each traveller, including children, who you want to cover with insurance.

Click Add+ if you need to add more travellers

Accompanied Children are your children or grandchildren plus one non-related child per adult policyholder who are identified on the Certificate of Insurance and travelling with You on the Journey, provided they are not in full-time employment, they are financially dependent on You and they are under the age of 21 years. See the Policy Wording for more information.

Do all travellers live in NZ?

Most policies can only be issued to New Zealand citizens and permanent residents of New Zealand who:

- Will be returning to New Zealand at the completion of the period of insurance and within 12 months of the journey commencing;

If you are visiting New Zealand from another country you should select New Zealand as your Destination

Travel insurance for your flight, holiday or adventure

Whether you travel once a year or you're a frequent flyer, we have comprehensive travel insurance options for single and annual multi-trips – overseas or travel around New Zealand.

Air New Zealand travel insurance also includes medical expenses and limited cancellation expenses related to Covid-19.

Plus, you can earn Airpoints Dollars™ on every policy or pay using Airpoints Dollars.

Covid-19 cover included

We provide Covid-19 benefits on both Single Trip and Annual Multi-Trip policies to help you travel with greater confidence.

Access to a Travel Doctor

As a policyholder you have access to our bonus Travel GP service free of charge. If you're feeling ill and need to talk to a doctor we can put you in touch with an Australian-based doctor via telemedicine.

Existing Medical Conditions

We can cover a range of existing medical conditions. There are 39 already included in our policies, and you can apply online as part of your policy purchase.

Free cover for children

Free travel cover for accompanying children or grandchildren under 21.

Travel Delay

We automatically include coverage in our comprehensive policies for travel delay of over 6 hours.

Use your Airpoints Dollars™

You can use your Airpoints Dollars to purchase your travel insurance policy. Sign in at any time.

Free look period

Once you’ve purchased make sure you read the policy. If you're not sure you can cancel within 21 days and get a full refund. **

Why choose Travel insurance from us?

Air New Zealand has partnered with Cover-More Travel Insurance to bring you world-leading comprehensive insurance for travel within New Zealand and around the world.

Cover-More is part of the Zurich Insurance Group, one of the world’s largest insurance companies. For more than 30 years, Cover-More travel insurance and their 24/7 emergency assistance services have helped Kiwis all over the world.

Frequently asked questions

How can we help you.

Speak with our support team

We're available every day 7am–7pm (AEST/AEDT)

IMAGES

COMMENTS

We offer Travel Insurance that is tailored for small-to-medium-sized businesses all the way through to multinational corporates. Zurich Insurance is available through independent insurance brokers who can assist you to obtain the right cover for your needs. You can find a broker with the free needabroker service or call NIBA* on 1300 53 10 73.

Rate it below. Heading to New York, Rio, Tokyo… or just a weekend trip to the alps? We all want our holidays and journeys to be safe and have peace of mind. Therefore, our teams provide support in all kinds of situations when it comes to travel, all around the world.

Zurich's Travel Insurance is designed to reflect the complexity of risks that come with business trips. Whether it's a volcanic eruption, an air traffic controllers' strike or a natural disaster that interrupts your client's employee's travel plans, our policies are designed to help your client's people cope, recover and get back on their way.

Cover-More travel insurance is underwritten by Zurich Australian Insurance Limited. How do I contact Cover-More Travel Insurance? For general enquiries, Australians can contact Cover-More Travel ...

We are Cover-More Travel Insurance Australia. ... Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial situation, needs and objectives and read the Combined FSG/PDS before deciding to buy this insurance. For information on the Target Market and Target Market ...

Under the Zurich Business Travel Insurance Policy, Lisa would be reimbursed for the cost of replacing clothing and toiletries (up to the applicable sum insured). Zurich Australian Insurance Limited-ABN 13 000 296 640, AFS Licence No: 232507 Head Office: 5 Blue Street, North Sydney NSW 2060 Client enquiries Telephone: 132 687 www.zurich.com.au OD 8-

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. ... on behalf of the product issuer, Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial ...

Media Relations. Zurich Insurance Group. Austrasse 46. 8045 Zurich. +41 44 625 21 00. [email protected]. Subscribe for email alerts. Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With about 55,000 employees, it provides a wide range of property and casualty, and life ...

We are Cover-More Group - proudly part of Zurich Insurance Group. We are a global leader in travel insurance, assistance and travel risk management, and a trusted partner to many well-known brands across the globe. We look after many millions of the world's leisure and business travellers with well-known customer-facing brands: Travelex ...

1. Cover-More Group Limited is a top three global travel insurance and assistance provider based in Sydney, Australia. Zurich Insurance Group acquired Cover-More in 2017 through the wholly owned subsidiary Zurich Travel Solutions Pty Limited. Travelex Insurance Services, based in Omaha, was acquired by Cover-More in 2016.

Our travel insurance for Australia provides cover for cancellation, amendment & delays.¹ It also includes up to $8k in cover for lost/stolen luggage and personal effects,² and up to $5k to help cover the cost of car insurance excess whilst travelling. ... The insurer is Zurich Australian Insurance Limited ABN 13 000 296 640, AFSL 232507.

Limits, sub-limits, conditions and exclusions apply. Freely is a brand of Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713), who administers the Freely Travel Insurance Product and Cancellation plan on behalf of the product issuer, Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507).

Travel insurance for your flight, holiday or adventure. ... Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. Consider the Policy Brochure and wording therein before deciding to buy this product.

The insurer of this product is Zurich Australian Insurance Limited (ZAIL), ABN 13 000 296 640, AFS Licence Number 232507. Welcome SGIC has been insuring Australians for over 85 years. And that's the difference we offer you - experience. It's this experience that helps us provide you with great customer value.

Limits, sub-limits, conditions and exclusions apply. Freely is a brand of Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713), who administers the Freely Travel Insurance Product and Cancellation plan on behalf of the product issuer, Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507).

Travel Insurance Effective 09 August 2023 Combined Financial Services Guide and Product Disclosure Statement The insurer of this product is Zurich Australian Insurance Limited (ZAIL), ABN 13 000 296 640, AFS Licence Number 232507. 2 ... Australia - Personal vehicle insurance excess No $2,500

Get a quote for your next trip with Fast Cover Travel Insurance. Underwritten by certain underwriters at Lloyd's. Consider the PDS. 4.6 from 2,283 reviews. Ad. Visit Official Website. Zurich Travel Insurance (Travel Insurance): 2.1 out of 5 stars from 7 genuine reviews on Australia's largest opinion site ProductReview.com.au.