- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

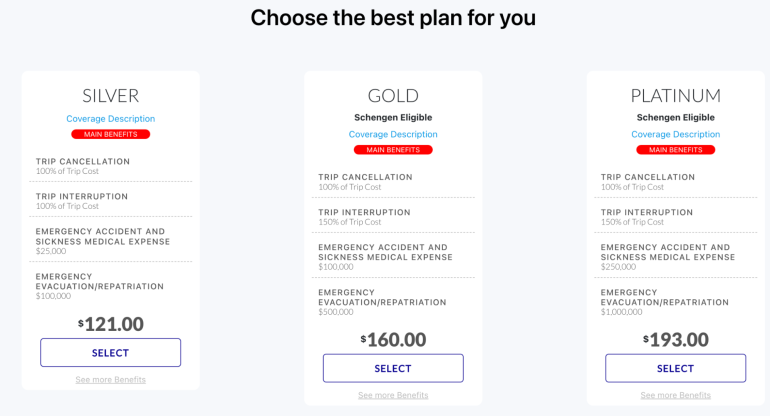

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

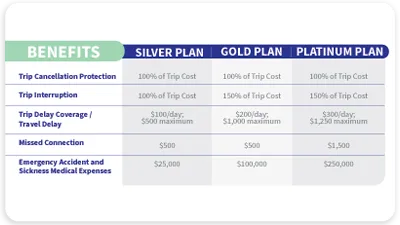

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

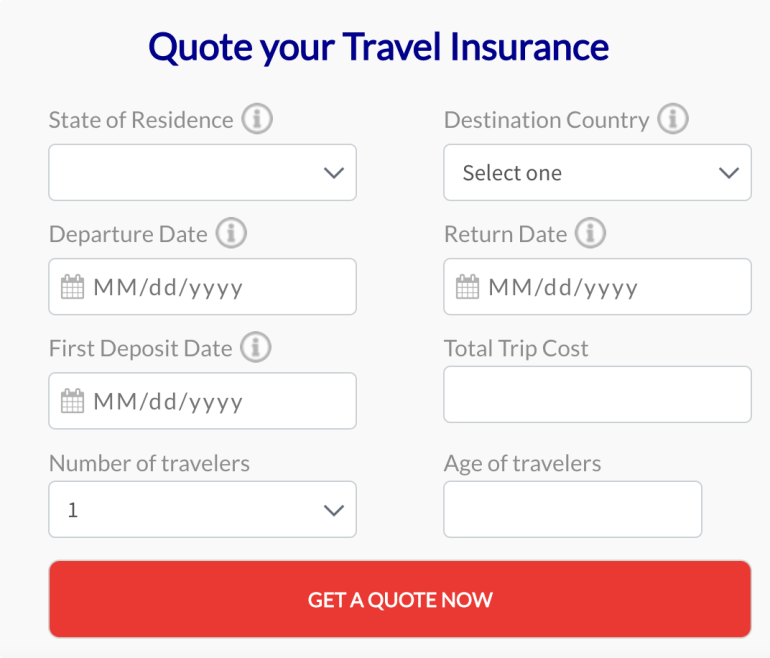

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Payroll Services

- Best HR Software

- Best HR Outsourcing Services

- Best HRIS Software

- Best Performance Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

AXA Assistance USA Travel Insurance Review (2024)

AXA Assistance USA offers affordable travel insurance plans that cover unexpected medical and cancellation expenses

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

AXA Assistance USA, a global insurance provider, offers travel insurance and travel medical insurance with benefits that go above and beyond many other providers — but is it the best choice for your next trip? AXA.

We at the MarketWatch Guides team examined AXA’s coverage options, what you might pay for insurance and how it compares to the best travel insurance companies . Read on to find out whether it’s a good fit for you.

- Average Cost: $230

- BBB Rating: A-

- AM Best Score: A+

- Medical Expense Max: $250,000

- Emergency Evacuation Max: $1,000,000

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Our Take on AXA Assistance USA Travel Insurance

After reviewing dozens of travel insurance providers, AXA ranks high on our list with 4.2 out of 5 stars. We also named the company as the best travel insurance choice for leisure.

AXA’s Platinum travel insurance plan — its top-tier offering — comes with unique perks, such as $500 for lost rounds of golf and $25 per lost ski day. Its Gold and Platinum plans also provide pre-existing medical coverage when you purchase the plan within 14 days of your initial trip deposit date.

While AXA offers unique benefits and competitive pricing, there are some limitations on its policies. Cancel-for-any-reason (CFAR) upgrades are only available on its most expensive plans, and add-on options are more limited than other insurers.

AXA is best for travelers with pre-planned activities and those looking for medical coverage on affordable plan options. If you’re looking for more customization, Trawick may be a better choice.

AXA Assistance USA Pros and Cons

AXA Assistance USA is part of AXA Group, which is a multinational conglomerate of companies that offer a wide variety of insurance products. We recommend AXA travel insurance as one of the top-rated providers of travel insurance in the U.S., particularly for leisure travelers looking for insurance.

AXA’s tiered policy plan system provides even basic policyholders with comprehensive coverage including medical costs, baggage loss and trip delays or interruptions. The range of insurance plans is limited, with fewer add-ons available compared to competitors, but we think the overall value of AXA’s insurance is very good.

AXA Assistance Travel Insurance Plans

AXA offers three plan options for international travel:

- Silver: AXA’s most affordable option, the Silver plan includes 100% trip cancellation and interruption coverage. It also includes $100 a day in trip delay coverage , $25,000 in medical expense coverage and $100,000 in emergency evacuation coverage.

- Gold: The Gold plan extends trip interruption coverage to include a 150% reimbursement and extends medical coverage to include $100,000 worth of protection. It also provides $500,000 in emergency evacuation coverage.

- Platinum: The Platinum plan extends coverage to include $250,000 worth of medical coverage and up to $1 million in evacuation coverage. The plan comes with a few leisure-related benefits, including coverage for lost ski days.

All plans include complimentary concierge coverage, 24/7 travel assistance and free identity theft protection.

AXA Add-On Options

Travel insurance add-ons, which are also referred to as riders, are optional extras that you can personalize your insurance policy with, depending on the kind of coverage you need. AXA travel insurance only has a couple of add-on options for their travel insurance plans, along with additional coverage in their Gold and Platinum Plans.

AXA’s coverage add-ons include:

- Cancel for any reason (CFAR)

- Collision damage waiver

Their Platinum Plan also includes:

- $25 for a lost skier day

- $500 for lost golf rounds

- $1,000 for sports equipment rental

Cost of AXA Travel Insurance Plans

How much you pay for an AXA travel insurance plan depends largely on which coverage tier you choose. Different plans provide reimbursements for varying situations, which means the risk the insurer takes on also varies.

AXA Assistance USA International Travel Cost

To help give an idea of the cost of AXA Assistance USA Insurance policies, below is an estimate we received for a travel insurance policy from AXA for an international trip to Croatia. Two citizens from the U.S., aged 25 and 27 years old, are traveling. Their trip is from September 1st, 2023 until September 9th, 2023 and costs $4,000. The initial deposit for the trip was made on May 5th, 2023.

Your trip cost will also play a role in coverage costs . For example, if you are traveling internationally and spend a high amount on airfare, the insurer will need to pay more to reimburse you if you file a claim.

AXA Assistance USA Domestic Travel Insurance

AXA Travel insurance works for trips both domestic and abroad. Take a look at how much you might pay for Gold-level domestic travel insurance based on where you are starting your trip, the trip’s cost and your age.

Read More: Travel Insurance For United States Tourists

AXA Assistance USA Travel Insurance Reviews

The majority of positive reviews about AXA travel insurance show that customers are pleased with the coverage options and the peace of mind that trip insurance provides. While many customers have positive claims experiences, others mentioned slow claims processing, slow response times from customer support staff and a generally low standard of customer service.

Below are company reviews that were found on Better Business Bureau (BBB) and Trustpilot .

“I found myself in a medical emergency whilst abroad and required surgery. Every single member of staff I spoke to [was] helpful, friendly and empathetic to my situation. They ensured additional seats for my journey home as well as airport assistance. I have made an additional claim on returning to the UK for expenses I incurred whilst in the hospital — this has been processed quickly and without issue. I feel very strongly that people only tend to complain on the back of a negative experience, but I felt compelled to make people aware of my experience which was completely positive.” —Abigail N. via Trustpilot “Every time I've made a claim with this company it's been dealt with superbly, no issues at all. Paid on two [COVID-19] claims this year, a cancelled holiday for illness a few ago and the sickness whilst away 7 years ago, comes as part of my bank package. Would have no hesitation in recommending them to anybody.” — Silver F. via Trustpilot “They paid very slowly, but they eventually did pay. I took a trip in June 2022. While there, I got COVID just before I was to return. My return home was delayed by 9 days, and I had to buy a new return ticket home. They do not respond to emails (other than the standard automatic "We received your correspondence, blah blah") but no personal communication until 8 to 10 weeks later. Don't bother calling because you will be put on hold for a very long time, then be disconnected. Can I recommend them? No. Will I be insured with them in the future? Certainly not. But to their credit, they did reimburse me, and for the full amount I asked for.” — William S. via BBB “Worst company to buy travel insurance . I had to cancel my return ticket due to being sick last year and I already provided all the asked documents and submitted the claim in December 2021 and am still awaiting a response. No updates, no progress on my claim, and it's been almost 6 months now. [...]” — Dilshadahemad K. via BBB

How To File a Claim with AXA Travel Insurance

Filing a travel insurance claim with AXA is straightforward. Follow these steps:

- Gather documentation: Once you are able to do so, gather documentation that proves your claim. If you are filing a claim for medical bills, gather a summary of the treatment you received and bills you owe or paid.

- Call or submit documentation online: Next, connect with a representative to submit your claim. You can reach AXA at 888-975-5015 or by logging into your online portal.

- Wait for reimbursement: Once you have filed your claim and any necessary documentation, the last step is to wait for reimbursement. You can contact AXA for updates as needed.

AXA Assistance USA vs. Competitors

Check out how AXA compares with some of the other top international travel insurance providers we have reviewed.

The destination you select plays a significant role in your pricing. Browse the table below to learn more.

Is AXA Assistance USA a Good Choice for Travel Insurance?

We found that AXA’s travel insurance coverage is best suited for adventure travelers and those looking for top-tier coverage. AXA’s Platinum plan can offer travelers more unique benefits, including payments for lost ski days and medical coverage for pre-existing conditions.

AXA might not be best for those looking for quick, cheap coverage . While its pricing is in line with other companies, it limits its CFAR coverage and most inclusive benefits to the highest pricing tier. Options like Faye Travel Insurance specialize in offering streamlined, quick coverage choices at lower prices, which can be beneficial for last-minute travelers.

Frequently Asked Questions About AXA Travel Insurance

What are the benefits of axa travel insurance.

One of the key benefits of AXA Travel Insurance is that they have a huge international network, which means you’ll receive travel assistance services along with insurance coverage. They also advertise a 24/7 concierge service that can be used before you travel for advice or recommendations on what to book and where to visit.

Who owns AXA Travel Insurance?

AXA Assistance USA is part of AXA Group, which is a multinational insurance company that was originally founded in France. The group is a collection of independently run businesses which includes travel insurance companies in countries across the world, primarily in North America, Western Europe and the Middle East.

Does AXA cover me abroad?

If you purchase a travel insurance policy from AXA, then you will be covered when you travel abroad. This includes coverage if you require medical treatment while in another country and emergency evacuation due to medical conditions or an unrelated incident.

What travel insurance is underwritten by AXA?

Many different travel insurance providers and policies are underwritten by AXA Insurance, which means that AXA determines the coverage that can be offered and how much this will cost. Travel insurance providers underwritten by AXA include TUI Travel Insurance, Coverwise travel insurance, Just Travel Cover and ABTA Travel Insurance.

Other Travel Insurance Providers to Consider

- Faye Travel Insurance Review

- TravelSafe Travel Insurance Review

- Nationwide Travel Insurance Review

- WorldTrips Travel Insurance Review

- World Nomads Travel Insurance Review

- Allianz Travel Insurance Review

- GeoBlue Travel Insurance Review

Methodology: Our System for Ranking the Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

AXA Travel Benefits

For your holidays in the USA and abroad

Pre- Departure Travel Benefits

Post- departure travel benefits.

Trip Interruption Rental Car Collision Damage Waiver Missed Connection Lost Golf Days Lost Skier Days

Medical Benefits

Emergency Medical Expenses Emergency Evacuation & Repatriation Non-Emergency Medical Evacuation & Repatriation Accidental Death and Dismemberment Accidental Death and Dismemberment (Air Only)

Baggage Benefits

Luggage Delay Lost or Stolen Luggage

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Trip Delay Benefits

What is trip delay.

Trip Delay coverage helps protect travelers against unexpected delays while traveling. This coverage can provide reimbursement for additional expenses incurred due to travel delays, such as meals, room accommodations, and transportation.

Do I Need Trip Delay Coverage?

Whether you need trip delay coverage or not depends on your circumstances. Trip Delay is a wise decision because it offers coverage if a delay occurs during your travels.

• Any pre-paid, unused, non-refundable land and water accommodations • Any reasonable expenses incurred, such as meals, room accommodations, transportation • One-way economy fare to catch up with your trip • A one-way economy fare to your originally scheduled return destination

What warrants a Trip Delay?

If you are en route to or from the trip and it becomes delayed for twelve (12) or more hours due to: • Common carrier delay • Severe weather • Traffic delay due to an accident in which you are not involved • Lost or stolen passports, travel documents, money • Quarantine • Hijacking • Unannounced strike • Natural disaster • Civil commotion or riot • Road closure by state police, state officials, or other government authority

Is Trip Delay coverage necessary?

Worried about unexpected trip delays ruining your travel plans? With our Trip Delay coverage, you can rest easy knowing you're protected against delays caused by unforeseeable events like inclement weather, stolen travel documents, or strikes. This coverage can reimburse you for additional expenses like accommodations, meals, and transportation so you can focus on enjoying your trip instead of worrying about the unexpected.

Why choose AXA Travel Protection?

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include: • Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency • 24/7 global team of travel experts that offers assistance and assurance while traveling We understand that the needs of every traveler are unique, which is why our travel plans allow customers to choose their coverage based on their specific needs. Having your travel insured by an industry leader like AXA means having greater peace of mind.

How to get a Travel Protection Quote

Disclaimer: It is important to note that the specifics of trip delay will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have .

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

National News | What we know about the Dali, the cargo vessel…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Restaurants, Food and Drink

- Entertainment

- Immigration

- Sports Betting

National News

National news | what we know about the dali, the cargo vessel that crashed into baltimore’s key bridge.

A 948-foot-long cargo vessel pulling out of the Port of Baltimore struck a support column of the Francis Scott Key Bridge early Tuesday morning, sending cars and eight people into the Patapsco River.

The Sri Lanka-bound ship, known as the Dali, was traveling at 8 knots, or about 9 mph, when it struck a support column at 1:27 a.m., collapsing the bridge and leading Maryland Gov. Wes Moore and Baltimore Mayor Brandon Scott to declare states of emergency.

Two people were rescued from the river, including one who was later released from the hospital after being treated for injuries. Six construction workers were still unaccounted for Tuesday night as authorities pledged to resume recovery efforts Wednesday morning . None of the men have been officially identified, though Moore said he had spoken to their families, and Scott said the city would “wrap our arms around them and our entire community.”

Darrell Wilson, a spokesperson representing Dali’s owner, Singaporean firm Grace Ocean Pte. Ltd., and manager, Synergy Marine Group, said the two firms were “fully cooperating” with federal and state government agencies.

Here’s what we know about the Dali:

Its shipper was cited last summer for violating maritime whistleblower protection law

The Occupational Safety and Health Administration ruled last summer that the Danish cargo company Maersk Line Limited had violated the Seaman Protection Act by firing an employee who had complained about safety violations to the U.S. Coast Guard. The Dali was carrying Maersk customers’ cargo at the time of the Tuesday collision, though no Maersk crew or personnel were onboard. The Seaman’s Protection Act ensures that employees are not punished or retaliated against for reporting maritime safety violations to the U.S. Coast Guard or other federal agencies.

In an 11-page letter dated July 20, 2023 , OSHA Assistant Regional Administrator Michael Mabee said Maersk had violated maritime law and ordered it to reinstate the unnamed employee and reimburse his legal fees, damages and back pay totaling $372,597.07. The employee had complained that the ship had a leak and needed repairs to its cargo hold bilge system before Maersk fired him in March 2021, according to OSHA.

In an emailed statement, Maersk spokesperson Kevin Doell said the company disagreed with the OSHA finding, which was first reported by investigative outlet The Lever, and intended to appeal “this flawed decision.”

“Maersk Line Limited is proud of its safety culture and its highest priority remains the safety and security of our mariners and shoreside colleagues,” Doell said.

The ship had docked in Baltimore since Friday

The Dali had landed in Baltimore on Friday, according to Andy Middleton, director of the Apostleship of the Sea.

The director of the Catholic ministry, which assists crew members while their ships are docked at the Port of Baltimore, had taken the Dali’s crew members shopping at Walmart. They were anticipating a 28-day sojourn to Colombo, Sri Lanka, and planned to sail around South Africa to avoid unrest in the Red Sea.

“We’re a friendly face when they come into the Port of Baltimore,” Middleton said of crew members whom Apostleship of the Sea assists. “I’m glad we were able to provide services for them before they sailed.”

The cause of the Baltimore collision is unknown

It’s not clear what exactly caused the ship to strike the bridge’s support column. The ship left the port around 1 a.m. and collided with the bridge at 1:27 a.m.

Clayton Diamond, executive director of the American Pilots Association, confirmed earlier news reports that the ship had a “complete blackout” and lost power to its engine and navigation equipment a few minutes before the collision. It never regained power, Diamond confirmed via email.

Crew members onboard issued a “mayday” alert before impact, allowing authorities to halt traffic from entering the bridge before it crumbled.

The Dali was cited for deficiencies with its propulsion and auxiliary machinery during a June 2023 inspection at the Port of San Antonio in Chile, according to the Electronic Quality Shipping Information System, a shipping information website.

The National Transportation Safety Board is investigating the collision with assistance from the Coast Guard. The probe will examine problems with the ship’s power, its structure, and design, according to Jennifer Homendy, the chair of the safety board.

The Dali’s owners said all of its 22 crew members and two pilots were accounted for.

It had previously been in a port collision

The Dali, which was built in 2015, had previously been in an accident at a Belgian port.

In July 2016, the ship struck a quay while leaving the Port of Antwerp, according to Vessel Finder. The collision caused significant damage to its hull, requiring the vessel to be docked and detained at the port until it was operational again.

Baltimore Sun reporter Lorraine Mirabella contributed to this article.

More in National News

National News | Free blue checks are back for some accounts on Elon Musk’s X. Not everyone is happy about it

National News | US charges 8 in beer heists that targeted trains and warehouses, mostly Modelo and Corona

National News | Powerball jackpot jumps to $1.23 billion

National News | What we know: Trump uses death of Michigan woman to stoke fears over immigration

Trending nationally.

- Massive cranes on ‘standby’ at Key Bridge collapse have storied pasts

- Muslim women push Chicago community to join green Ramadan: ‘We are the caretakers of the Earth’

- Aaron Taylor-Johnson, the reported new James Bond, accused of improperly building a lake on his English estate

- Outer Banks bridge known for purple martin migration to close for 6 months starting in May

- Florida’s 6-week abortion ban will have nationwide impact, critics warn

Here's who could be responsible for paying for the Baltimore bridge disaster

- The Francis Scott Key Bridge in Baltimore collapsed after a container ship collided with it.

- Several entities could be on the hook to foot the bill in the aftermath of the disaster.

- The maritime insurance industry will likely be saddled with the highest costs.

The Francis Scott Key Bridge in Baltimore collapsed on Tuesday after a large container ship ran into it, leading to six presumed deaths and millions of dollars in possible damage.

It's still too early to estimate the total economic impact of the disaster, but between the cost of rebuilding the decades-old bridge, compensating the victims' families , and paying out damages for disruptions to the supply chain, the eventual cost of the disaster is expected to be significant.

Who will pay to rebuild the bridge?

President Joe Biden said on Tuesday the federal government should be responsible for paying to reconstruct the damaged Francis Scott Key Bridge.

"It is my intention that the federal government will pay for the entire cost of reconstructing that bridge, and I expect Congress to support my effort," Biden said.

The bridge was built in the 1970s for about $60 million, but the cost of rebuilding it could be 10 times its original price tag, an engineering expert told Sky News.

Baltimore is among the busiest ports in the nation , with more than a million shipping containers passing through each year. The collapse — which closed the port to all maritime and most road traffic until further notice — is already beginning to wreak havoc on the supply chain.

The cost of building the bridge back fast enough to offset diversions as much as possible could saddle the government with a more than $600 million bill, David MacKenzie, the chair of the engineering and architecture consultancy COWIfonden, told Sky News.

Who will pay for damages to the ship and its cargo?

The container ship, the Dali , is owned by a Singapore-based firm. The ship's charterer, Maersk, confirmed to Business Insider that vessel company Synergy Group operates the ship.

However, the companies with cargo aboard the Dali could ultimately be responsible for some of the ship's damages and cargo costs, according to Ryan Petersen , the CEO of the supply-chain-logistics company Flexport, which had two containers on the ship.

Related stories

The Dali was carrying 330 containers that must now be rerouted, Petersen said in an X thread.

An ancient maritime law known as " general average " dictates that companies with even a single container aboard a ship split certain damages pro rata based on the number of containers they had on board, ensuring all the stakeholders benefiting from the voyage are splitting the risk, Petersen said.

General average situations can occur when a ship is stranded or when cargo is damaged or thrown overboard to save the vessel, according to Flexport . The concept helps ensure that all parties who have a vested interest in the vessel share the cost and concern of protecting it.

It's too soon to know whether damages incurred to free the Dali in the coming days will qualify as a case of general average.

Who will pay for everything else?

The majority of the financial fallout is likely to lay primarily with the insurance industry, according to media reports.

Industry experts told the Financial Times that insurers could pay out losses for bridge damage, port disruption, and any loss of life.

The collapse could drive "one of the largest claims ever to hit the marine (re)insurance market," John Miklus, the president of the American Institute of Marine Underwriters, told Insurance Business.

He told the outlet that the loss of revenue from tolls while the bridge is being rebuilt will be expensive, as will any liability claims from deaths or injuries.

The Dali is covered by the Britannia Steam Ship Insurance Association Ltd., known as Britannia P&I Club, according to S&P Global Market Intelligence.

In a statement to Business Insider, Britannia said it was "working closely with the ship manager and relevant authorities to establish the facts and to help ensure that this situation is dealt with quickly and professionally."

Britannia is one of 12 mutual insurers included in the International Group of P&I Clubs, which maintains more than $3 billion of reinsurance cover, sources familiar with the matter told Insurance Business.

Britannia itself is liable for the first $10 million in damages, both FT and Insurance Business reported. Whatever remains is dealt with by the wider mutual insurance group and Lloyd's of London, a reinsurance market in the UK, the FT reported.

Update: March 28, 2024 — This story has been updated to include additional information about general average and clarify that it is too soon to know whether general average will apply in the case of the Dali.

Watch: The container ship that destroyed the Francis Scott Key Bridge has crashed before

- Main content

IMAGES

VIDEO

COMMENTS

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Travel insurance coverages within the Adventure Travel Product are underwritten by United States Fire Insurance Company (NAIC #21113) under policy form series T210. Travel protection plans are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893)

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don't have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That's because travel insurance coverage is regulated by state.)

Customer support phone number: 855-341-9877 . AXA Travel Insurance claim support: 888-957-5015. AXA Travel Assistance phone number: 855-327-1442. AXA Travel Insurance email address: [email protected].

Compare AXA Travel Insurance Plans which includes benefits like trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay to help give you peace of mind before and during your trip. Optional benefits are also available to enhance our travel insurance plans and offer additional protection for your trip.

From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. GET A QUOTE 855-327-1441. If you become ill with COVID while on your trip you may be covered for Medical Expense, Emergency Evacuation, Trip Interruption, and/or Trip Delay benefits with a confirmed diagnosis, including ...

Travel insurance is a type of insurance that offers coverage for a variety of unexpected events that may occur while you are traveling. The coverage and benefits of travel insurance vary depending on the policy and the provider, but here are some features AXA Travel Protection plans offers:

So, it's best to purchase travel insurance as soon as possible after booking your trip to ensure you have the coverage available. Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time Related Articles What is the cost of travel insurance?

Enter your travel details, such as the destination, travel dates, and number of travelers, select the type of insurance policy you need based on your travel plans and needs then review the coverage options and select the one that best fits your needs and budget. Enter your personal and payment information to complete the purchase.

Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services are provided by AXA Assistance USA, Inc. and are not underwritten by Nationwide Mutual Insurance Company.

Travelers in need of assistance worldwide can tap into AXA's extensive international network of assistance services. AXA Assistance USA's Platinum plan (above) is its highest-rated plan ...

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage. GET A QUOTE 855-327-1441. Trip interruption offers compensation if a trip is ...

All three of AXA's travel plans include Trip Cancellation, maximum coverage per person up to: Silver. Maximum Benefit: 100% of Insured Trip Cost Airline Reissue or Cancelation Fees: $100. Gold. Maximum Benefit: 100% of Insured Trip Cost ... Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8 AM ...

AXA Assistance USA. 4.3. COMPARE QUOTES. AXA Travel Insurance is a top-rated travel insurance company. Quick Facts. Plan Options. Average Cost: $230. BBB Rating: A-. AM Best Score: A+.

With our travel insurance we can take great care of you too. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace of mind ...

NO - There is no cover to cancel a trip due to the event which you were due to attend is no longer going ahead for any reason including Covid-19 and you should contact the Event organiser directly for a refund. Your policy holds a list of circumstances in which you would be covered for your reference. 10.

If you are traveling to a remote or high-risk destination, or participating in adventure activities such as skiing, scuba diving or mountain climbing, it's highly recommended to purchase travel insurance. It can also be useful if you have a pre-existing medical condition or if you're traveling with expensive equipment.

This coverage can provide reimbursement for additional expenses incurred due to travel delays such as meals, room accommodations, and transportation. File Claim Our Plans Our Plans Protect your trip from unforeseen events while traveling. Be it domestic or international, get a quote and compare our three plans that includes benefits like cancel ...

So a Schengen visa for one adult in the U.S. will cost €80 (i.e., around $80). For children between the ages of 6 and 12, the fee is €40. And children under 6 can get a Schengen visa for free .*. * In certain cases, the visa fee may also be waived for: participants in certain seminars, conferences, sporting, cultural, and/or educational ...

An insurance plan that fully protects your particular trip is a vital part of any travel planning process. Unforeseen circumstances such as flight delays or cancellations, lost baggage, and medical emergencies can be very stressful, time-consuming and expensive. While we can't prevent or predict an unfortunate turn of events, we can prepare ...

Why choose AXA Schengen Insurance? Those traveling to the Schengen Area, including Portugal, need travel cover. AXA's Low Cost Travel Insurance costs just €22 ($24) per week of your trip and will meet your visa requirements, while the AXA Schengen Europe Travel Insurance offers extended coverage up to costs of €100,000.

Schengen Visa costs are universal. A standard Schengen Visa for one adult — in Saudi Arabia or elsewhere — costs €80. Children between the ages of 6 and 12 get a 50% discount (i.e., €40). The Schengen Visa is free for children under the age of 6. In some cases, the fee may also be waived for:

The RoundTrip Choice plan offers a cancel for any reason travel insurance add-on that covers up to 75% of total trip costs, with a maximum of up to $75,000 in reimbursement. Medical coverage is ...

Despite them having won travel industry awards!! An update - I sent off a letter of complaint last week, but I think the claim itself should still be handled independently of that. So I gave them a call. The claim was successful and the payment will be in my bank account within 5 working days.

A 948-foot-long cargo vessel pulling out of the Port of Baltimore struck a support column of the Francis Scott Key Bridge early Tuesday morning, sending cars and eight people into the Patapsco ...

President Joe Biden said on Tuesday the federal government should be responsible for paying to reconstruct the damaged Francis Scott Key Bridge. "It is my intention that the federal government ...