Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

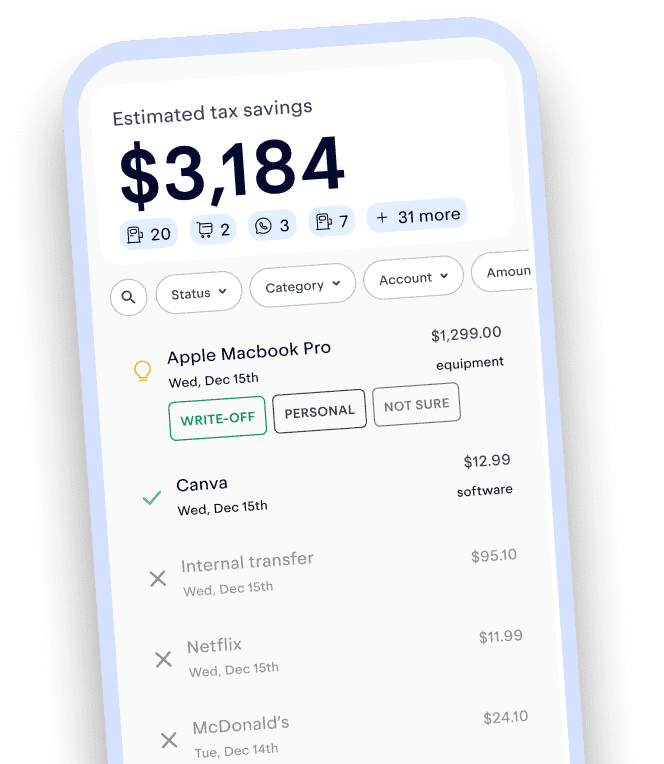

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips

The allocation of travel expenses on foreign trips is slightly different from the rules above. Round-trip transportation for foreign trips must be allocated to business and personal based on the number of business vs personal days on the trip. This is different from the “all or nothing” rule for the cost of domestic round-trip travel.

If your spouse joins you on a business trip, you usually cannot deduct any of their expenses. However, if your spouse’s trip satisfies a business purpose, then expenses must be otherwise deductible by the spouse.

Generally, for the travel costs of a spouse, dependent, or any other person to be tax-deductible, they must work for the business or be a co-owner.

Frequently Asked Questions (FAQs)

Are travel expenses tax deductible for business.

Yes, roundtrip travel is 100% tax deductible as long as the primary purpose of the trip is business. Once at your destination, expenses must be allocated between business and personal. However, all meals are deductible as long as the reason for your continued stay is business.

Can I deduct travel expenses for my employees?

Yes, you can generally deduct travel expenses for your employees as long as the expenses are ordinary and necessary, directly related to your business, and properly substantiated.

Is there a limit to the amount of travel expenses I can deduct?

Yes, there are some such as business travel on a cruise ship, where the expense is limited to $2,000 per year. Also, your expenses are limited to the non-lavish or extravagant cost of the trip, so you may want to be careful before booking a 5-star hotel.

Travel expenses are ordinary and necessary expenses you incur while you are temporarily away from home, so these expenses cannot be lavish in nature. To determine if a travel expense is deductible, it must be directly related to your trade or business.

When it comes to travel expenses, having well-organized records makes it much simpler to complete your tax return. Keep track of any records that may be used to substantiate a deduction, such as receipts, canceled checks, and other documentation.

About the Author

Find Timothy On LinkedIn

Tim Yoder, Ph.D., CPA

Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

- Guide to Repair and Maintenance Expense Deductions

- What Happens at the IRS After You File Your Taxes?

- What Tax Deductions Can You Claim Without Receipts?

- What is a W-9 Form & Why You Need To Fill It Out

- Tax Brackets 2022-2023: How Much Tax You Owe

- What Is a 1099 Form, and How Do I Fill It Out?

- Form 1096: A Simple Guide

- 1099-NEC vs 1099-MISC: Differences, Deadlines, and How-To's

- How to Deduct Meals and Entertainment in 2024

- 17 Big Tax Deductions (Write Offs) for Businesses

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

7 Rules You Should Know About Deducting Business Travel Expenses

:max_bytes(150000):strip_icc():format(webp)/DanielRathburn-a16946b87e45469aaae5b4998db2397a.jpeg)

- What Is Your "Tax Home"?

Charges on Your Hotel Bill

The 50% rule for meals, the cost of bringing a spouse, friend or employee.

- Using Per Diems To Calculate Employee Travel Costs

Combined Business/Personal Trips

International business travel.

- The Cost of a Cruise (Within Limits)

Frequently Asked Questions (FAQs)

Helde Benser / Getty Images

The IRS has a specific definition for business travel when it comes to determining whether these expenses are tax deductible. The agency says business travel is travel that takes you away from your tax home and is "substantially longer than an ordinary day's work." It requires that you sleep or rest while you're away from home, and that you do so. The travel must be "temporary." This means it can't last a year or more.

Key Takeaways

- You can deduct expenses that take you away from your tax home for a period of time that would require you to spend the night.

- Your tax home is the city or area where your regular place of business is located.

- You’re limited to 50% of the cost of your meals.

- Your trip must be entirely business-related for costs to be deductible, but special rules apply if you travel outside the U.S.

What Is Your "Tax Home"?

Your tax home is a concept set by the IRS to help determine whether a trip is tax deductible. It's defined by the IRS as the entire city or general area where your regular place of business is located. It's not necessarily the area where you live.

Your tax home can be used to determine whether your business travel expenses are deductible after you've determined where it's located. You can probably count your expenses during travel as business deductions if you have to leave your tax home overnight or if you otherwise need time to rest and sleep while you're away.

Check with a tax professional to make sure you're accurately identifying the location of your tax home.

Charges for your room and associated tax are deductible, as are laundry expenses and charges for phone calls or for use of a fax machine. Tips are deductible as well. But additional personal charges, such as gym fees or fees for movies or games aren't deductible.

You can deduct the cost of meals while you're traveling, but entertainment expenses are no longer deductible and you can't deduct "lavish or extravagant" meals.

Meal costs are deductible at 50%. The 50% limit also applies to taxes and tips. You can use either your actual costs or a standard meal allowance to take a meal cost deduction, as long as it doesn't exceed the 50% limit.

The cost of bringing a spouse, child, or anyone else along on a business trip is considered a personal expense and isn't deductible. But you may be able to deduct travel expenses for the individual if:

- The person is an employee

- They have a bona fide business purpose for traveling with you

- They would otherwise be allowed to deduct travel expenses

You may be able to deduct the cost of a companion's travel if you can prove that the other person is employed by the business and is performing substantial business-related tasks while on the trip. This may include taking minutes at meetings or meeting with business clients.

Using Per Diems To Calculate Employee Travel Costs

The term "per diem" means "per day." Per diems are amounts that are considered reasonable for daily meals and miscellaneous expenses while traveling.

Per diem rates are set for U.S. and overseas travel, and the rates differ depending on the area. They're higher in larger U.S. cities than for sections of the country outside larger metropolitan areas. Companies can set their own per diem rates, but most businesses use the rates set by the U.S. government.

Per diem reimbursements aren't taxable unless they're greater than the maximum rate set by the General Service Administration. The excess is taxable to the employee.

If you don't spend all your time on business activities during an international trip, you can only deduct the business portion of getting to and from the destination. You must allocate costs between business and personal activities.

Your trip must be entirely business-related for you to take deductions for travel costs if you remain in the U.S., but some "incidental" personal time is okay. It would be incidental to the main purpose of your trip if you travel to Dallas for business and you spend an evening with family in the area while you're there.

But attempting to turn a personal trip into a business trip won't work unless the trip is substantially for business purposes. The IRS indicates that “the scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, will not change what is really a vacation into a business trip."

The rules are different if part or all of your trip takes you outside the U.S. Your international travel may be considered business-related if you were outside the U.S. for more than a week and less than 25% of the time was spent on personal activities.

You can deduct the costs of your entire trip if it takes you outside the U.S. and you spend the entire time on business activities, but you must have "substantial control" over the itinerary. An employee traveling with you wouldn't have control over the trip, but you would as the business owner would.

The trip may be considered entirely for business if you spend less than 25% of the time on personal activities if your trip takes you outside the U.S. for more than a week.

You can only deduct the business portion of getting to and from the destination if you don't spend all your time on business activities during an international trip. You must allocate costs between your business and personal activities.

The Cost of a Cruise (Within Limits)

The cost of a cruise may be deductible up to the specified limit determined by the IRS, which is $2,000 per year as of 2022. You must be able to show that the cruise was directly related to a business event, such as a business meeting or board of directors meeting.

The IRS imposes specific additional strict requirements for deducting cruise travel as a business expense.

How do you write off business travel expenses?

Business travel expenses are entered on Schedule C if you're self-employed . The schedule is filed along with your Form 1040 tax return. It lists all your business income, then you can subtract the cost of your business travel and other business deductions you qualify for to arrive at your taxable income.

What are standard business travel expenses?

Standard business travel expenses include lodging, food, transportation costs , shipping of baggage and/or work items, laundry and dry cleaning, communication costs, and tips. But numerous rules apply so check with a tax professional before you claim them.

The Bottom Line

These tax deduction regulations are complicated, and there are many qualifications and exceptions. Consult with your tax and legal professionals before taking actions that could affect your business.

IRS. " Topic No. 511: Business Travel Expenses ."

IRS. " Publication 463 (2021), Travel, Gift, and Car Expenses ."

IRS. " Here’s What Taxpayers Need To Know About Business-Related Travel Deductions ."

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1438586989-7d9e1cf9763a40f3881148236cb239a6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

LAST CHANCE: Get $100 off when a Full Service expert files for you by 3/31 | Learn more

Tax Deductions for Business Travelers

When you are self-employed, you generally can deduct the ordinary and necessary expenses of traveling away from home for business from your income. But before you start listing travel deductions, make sure you understand what the Internal Revenue Service (IRS) means by "home," "business," and "ordinary and necessary expenses."

Ordinary vs. necessary expenses

Business home, not home sweet home, transportation expenses on a business trip are deductible, fees for getting around are deductible, lodging, meals and tips are deductible.

Key Takeaways

- Typically, you can deduct travel expenses if they are ordinary (common and accepted in your industry) and necessary (helpful and appropriate for your business).

- You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home).

- Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

- You can also deduct 50% of either the actual cost of meals or the standard meal allowance, which is based on the federal meals and incidental expense per diem rate.

The IRS defines expense ordinary and necessary expenses this way:

- An expense is ordinary if it is common and accepted in your industry

- An expense is necessary if it is helpful and appropriate for your business

You can claim business travel expenses when you're away from home but "home" doesn't always mean where your family lives. You also have a tax home—the city where your main place of business is located—which may not be the same as the location of your family home.

For example, if you live in Petaluma, California but your permanent work location is in San Jose where you stay in hotels and eat out during the work week, you typically can't deduct your expenses in San Jose or your transportation home on weekends.

- In this situation San Jose is your tax home , so no deductions are permitted for ordinary and necessary expenses there.

- Your trips to your home in Petaluma are not mandated by business.

Go by plane, train or bus—the actual cost of the ticket to ride is deductible, as well as any baggage fees. If you have to pay top dollar for a last-minute flight, the high-priced ticket is a business expense, but if you use frequent-flyer miles for a free ticket, the deduction is zero.

If you decide to rent a car to go on a business trip, the car rental is deductible. If you drive your own vehicle, you can usually take actual costs or the IRS standard mileage rate. For 2023 the rate is 65.5 cents per mile. You also can add tolls and parking costs onto your deduction. This amount increases to 67 cents per mile for 2024.

TurboTax Tip: Even if you use the federal meals and incidental expense per diem rates to calculate your deductions, be sure to keep receipts from all your meals and incidental expenses.

Fares for taxis or shuttles can be deducted as business travel expenses. For example, you can deduct the fare or other costs to go to:

- Airport or train station

- Hotel from the airport or train station

- Between your hotel and the work location

- Between clients in the area

If you rent a car when you arrive at your destination, the expense is deductible as long as the car is used exclusively for business. If you use it both for business and personal purposes, you can only deduct the portion of the rental used for business.

The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstances—not lavish or extravagant.

You would have to eat if you were home, so this might explain why the IRS limits meal deductions to 50% of either the:

- Actual cost of the meal

- Standard meal allowance

This allowance is based on the federal meals and incidental expense per diem rate that depends on where and when you travel.

Generally, you can deduct 50% of the cost of meals. Alternatively, if you do not incur any meal expenses nor claim the standard meal allowance, you can deduct the amount of $5 per day for incidental expenses. You can also deduct incidental expenses, such as:

- Fees and tips given to hotel staff

- Fees for porters and baggage carriers

But don't forget to keep track of the actual costs.

Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service . Your expert will uncover industry-specific deductions for more tax breaks and file your taxes for you. Backed by our Full Service Guarantee . You can also file taxes on your own with TurboTax Premium . We’ll search over 500 deductions and credits so you don’t miss a thing.

File 100% FREE with expert help.

~37% of taxpayers qualify. Form 1040 + limited credits only . Get unlimited live help from tax experts plus a final review with TurboTax Live Assisted Basic .

Limited Time Offer. Must file by 3/31.

100% free filing, max refund guarantee.

~37% of taxpayers qualify. Form 1040 + limited credits only . Answer simple questions and TurboTax Free Edition takes care of the rest.

Looking for more information?

Related articles, more in jobs and career.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

TaxCaster Tax Calculator

Estimate your tax refund and where you stand

I’m a TurboTax customer

I’m a new user

Tax Bracket Calculator

Easily calculate your tax rate to make smart financial decisions

Get started

W-4 Withholding Calculator

Know how much to withhold from your paycheck to get a bigger refund

Self-Employed Tax Calculator

Estimate your self-employment tax and eliminate any surprises

Crypto Calculator

Estimate capital gains, losses, and taxes for cryptocurrency sales

Self-Employed Tax Deductions Calculator

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

ItsDeductible™

See how much your charitable donations are worth

Read why our customers love Intuit TurboTax

Rated 4.6 out of 5 stars by our customers.

(101065 reviews of TurboTax Online)

Star ratings are from 2023

Your security. Built into everything we do.

File faster and easier with the free turbotax app.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible. If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition or TurboTax Live Assisted Basic (if available), or you can file with TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Situations not covered:

- Itemized deductions claimed on Schedule A

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales (including crypto investments)

- Rental property income

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

Turbotax online guarantees.

TurboTax Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current 2023 tax year and for individual, non-business returns for the past two tax years (2022, 2021). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

TurboTax Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Audit Support Guarantee – Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your 2023 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current 2023 tax year. Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals for this question-and-answer support, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. Additional terms and limitations apply. See Terms of Service for details.

TURBOTAX ONLINE/MOBILE PRICING:

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year 2023.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form 1040 and limited credits only, as detailed in the TurboTax Free Edition disclosures. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state(s) and one (1) federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after 11:59pm EST, March 31, 2024, you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here.

- Full Service $100 Back Offer: Credit applies only to federal filing fees for TurboTax Full Service and not returns filed using other TurboTax products or returns filed by Intuit TurboTax Verified Pros. Excludes TurboTax Live Full Service Business. Credit does not apply to state tax filing fees or other additional services. If federal filing fees are less than $100, the remaining credit will be provided via electronic gift card. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Must file by March 31, 2024 11:59 PM ET.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

- Pays for itself (TurboTax Premium, formerly Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2022. Actual results will vary based on your tax situation.

TURBOTAX ONLINE/MOBILE:

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund up to 5 days early: Individual taxes only. When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

- For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.

- Pay for TurboTax out of your federal refund or state refund (if applicable): Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details.

- Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live Assisted or as an upgrade from another version, and available through December 31, 2024. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not limited to multiple sources of business income, large amounts of cryptocurrency transactions, taxable foreign assets and/or significant foreign investment income. Offer details subject to change at any time without notice. Intuit, in its sole discretion and at any time, may determine that certain tax topics, forms and/or situations are not included as part of TurboTax Live Full Service. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. See Terms of Service for details.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare 2023 tax returns starting January 8, 2024. Based on completion time for the majority of customers and may vary based on expert availability. The tax preparation assistant will validate the customer’s tax situation during the welcome call and review uploaded documents to assess readiness. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service -- Verified Pro -- “Local” and “In-Person”: Not all feature combinations are available for all locations. "Local" experts are defined as being located within the same state as the consumer’s zip code for virtual meetings. "Local" Pros for the purpose of in-person meetings are defined as being located within 50 miles of the consumer's zip code. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through 11/1/2024. Terms and conditions may vary and are subject to change without notice.

- My Docs features: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.