Chapter 2 - Travel Expense and Reimbursement

- State Regulations

- § 200 KAR 2:006 - Employees' reimbursement for travel

State regulations are updated quarterly; we currently have two versions available. Below is a comparison between our most recent version and the prior quarterly release. More comparison features will be added as we have more versions to compare.

- A to Z Index

- A - Z Index

- Banner at EKU

- Accounts Payable

- General Accounting

- Student Organization Accounts

- Travel FAQ's

- Staff Directory

- Financial Affairs

- Financial Aid

- Purchases and Stores

- Sponsored Programs

- Student Accounting Services

- Accounting & Financial Services

- 521 Lancaster Avenue

- Coates CPO 3A

- Richmond, KY 40475

- Phone: (859)622-1810

- Fax: (859)622-8069

- [email protected]

Overview of EKU Travel Regulations

Eastern Kentucky University follows the travel requirements and procedures found on EKU's Policy and Regulation website . (If the link to the Travel policy is unavailable, the policy may be undergoing review.) These regulations apply to everyone traveling on official University business. This includes employees, students, and contractors.

Reimbursement of Travel Expenses

A Travel Expense Voucher must be properly completed and documented, inclusive of the entire travel period, properly approved and forwarded to the University Accounts Payable Office as soon as possible but no later than 60 days.

- Travelers should be aware that Internal Revenue Service (IRS) regulations (26 CFR 1.62-2) require that Travelers report all travel expenses accurately and completely within 60 days or the amount will be treated as personal wages on the Traveler’s IRS Form W-2. Travelers must include sufficient documentation as described herein (or original documentation as required herein) to support the amount, time, place, and business purpose of the travel expense. Travel expenses that are not accurately and completely reported are required to be included as personal wages on the Traveler’s IRS Form W-2.

- Travel voucher forms are generally updated at the beginning of each quarter. You should ensure that the correct form for the appropriate time period is completed.

- Do not split one trip between two separate vouchers unless the trip includes travel in two different quarters. If more than one source of funding is used for a trip, the one travel voucher should include all budget account numbers to be charged along with the appropriate financial manager's signatures.

- Vouchers must include documentation for all expenses incurred during the trip whether paid by EKU or by the traveler.

- A Travel Expense Voucher must be submitted even when all travel expenses are paid with a University procurement card.

- Vouchers are processed on a first-in, first-out basis. Vouchers submitted without all required documenation will not be processed until the documentation has been received.

Travel to Canada: All amounts shown on the travel voucher must be converted to U.S. funds with documentation attached certifying the actual exchange rate of currency during the trip. Please visit www.oanda.com or other online currency conversion websites for assistance with obtaining exchange rates and conversions.

Travel Outside of the United States and Canada:

- Meal reimbursement is based on actual expenses, not per diem.

- You must submit original receipts, including meal receipts, with the travel voucher; and,

- All amounts shown on the travel voucher must be in U.S. funds. All receipts must be converted to U.S. funds with documentation attached certifying the actual exchange rate of currency during the trip. Please visit www.oanda.com or other online currency conversion websites for assistance with obtaining exchange rates and conversions.

Transportation

Travelers shall use the most economical, standard transportation available and the most direct and usually-traveled routes. Expenses added by the use of other transportation or routes shall be assumed by the individual.

- Buses and subways are encourgaged for city travel. Taxi fare shall be allowed if more economical transportation is not feasible.

- Commercial airline travel shall be the lowest negotiated coach or tourist class. Additional expense for first-class travel or other upgrades shall not be reimbursed by the University.

- State owned vehicles with their credit cards may be used for state business travel if available and feasible. Mileage payment shall not be claimed if state-owned vehicles are used.

- Vehicle rentals shall adhere to the following:

- Rental vehicles may be used only for Approved Business (as defined in the Motor Vehicle Use Regulation ). All drivers of rental vehicles must qualify under University’s Motor Vehicle Use Regulation.

- Vehicle rentals for Approved Business are covered by the University’s automobile insurance policy in generally the same way as coverage is provided for University-owned vehicles. Various forms of insurance (Collision Damage Waiver [CDW], Loss Damage Waiver [LDW], Physical Damage Waiver [PDW], Liability Insurance Supplement [LIS], Personal Accident Insurance [PAI], Personal Effects Coverage [PEC], etc.) if purchased from the rental agency by the Traveler are neither authorized nor payable as an approved University travel expenditure.

- When renting a vehicle, ensure that Eastern Kentucky University is listed as the lessee (i.e. "Eastern Kentucky University / Jane Doe").

- Employees should seek the most practical and economical vehicle for rental.

- The use of or rental of fifteen (15)-passenger vans is not permitted.

- When returning a rental vehicle, please adhere to the rental agency’s policy regarding refueling and do not purchase fuel through the rental agency.

Mileage Reimbursement

Mileage reimbursement rates are established on a sliding scale according to the AAA Daily Fuel Gauge Report average retail fuel cost for Kentucky. The rate is adjusted quarterly on July 1, October 1, January 1, and April 1.

- The current mileage rate and history is maintained on the Kentucky Finance and Administration Cabinet's website under "State Employee Travel."

- Mileage may be calculated using www.mapquest.com , www.randmcnally.com , or any similar mileage software.

- Mileage claims, based on official mileage maps, must be more economical than alternate means of transportation, including vehicle rental and air transportation. Please attach an airfare and rental car quote to your Out of State Travel Request form.

- Mileage commuting between home and workstation will not be reimbursed.

- Mileage claims for the use of privately-owned vehicles shall be allowed if a state vehicle was not available or feasible.

- If an employee's point of origin for travel is the employee's residence, mileage will be paid for the shorter of the mileage between:

- Residence and travel destination; or

- Workstation and travel destination.

- If an employee's point of origin for travel is the employee's workstation, and after proceeding to a travel destination, the employee's final destination is the employee's residence, mileage will be paid for the shorter of mileage between:

Accommodations

Lodging shall be the most economical, as determined by considering the location of the lodging. Reimbursement is made for actual expense incurred including tax but cannot exceed the single room rate. Traveler must attach a hotel folio as well as proof of payment to the travel voucher.

Subsistence Per Diem

- Subsistence per diem is paid when the Traveler’s authorized work requires an overnight stay and a travel destination of more than 40 miles away (one way) from the Traveler’s Regular University Workstation or home, whichever is less. Lodging receipts are required to substantiate an overnight stay.

- The University subsistence per diem rate for Approved Travel meals, including associated taxes and gratuity (no more than 20% of the cost of the meal), is $36 for low rate travel areas and $44 high rate travel areas. The University will prorate the subsistence per diem rate for departure days and return days as shown by the chart below:

*High rate travel areas: https://finance.ky.gov/office-of-the-controller/office-of-statewide-accounting-services/Documents/High%20Rate%20Travel%20Areas.pd f

- Receipts are not required for subsistence per diem reimbursements.

- Meal expenses that exceed the subsistence per diem rate are the personal responsibility of the Traveler.

- There is no subsistence per diem for meals included in the cost of lodging, conference or meeting registration expenses, or otherwise provided at no cost to the Traveler as part of the event. Travelers must deduct all included meals from the subsistence per diem rate as follows:

- Low rate areas: $8 for breakfast, $10 for lunch, and $18 for dinner

- High rate areas: $10 for breakfast, $11 for lunch, and $23 for dinner

- For international business travel meals, the reimbursement rate is the actual meal costs substantiated by an original, itemized receipt. Expenses associated with travel to Canada will be treated the same as travel in the U.S. Credit card receipts without itemization are not acceptable documentation. If the Traveler does not submit original, itemized receipts, then the Traveler will be reimbursed at the subsistence per diem rate of $44.

- The purchase of alcoholic beverages is not a permitted reimbursable expense and will not be paid or reimbursed by the University.

Other Meals

- Travelers attending a function such as a luncheon or dinner meeting may be reimbursed for the actual meal cost instead of subsistence per diem when the employee’s attendance is required. The Traveler must submit with the travel voucher the original, itemized receipt for the meal and a memorandum from his or her supervisor noting the employee’s required attendance.

- Employees chaperoning student group travel that does not include an overnight stay and who are required to remain on duty during a group meal may be reimbursed at 75% of the Away Day subsistence per diem rate.

- Students traveling on University activities with faculty and staff may be exempt from the subsistence per diem limits. Exemptions must be reasonable and justifiable and must be substantiated with original, itemized receipts.

R egistration

Departmental pro-cards can be used to pay registration fees when credit card payments are accepted by the vendor. If the registration amount exceeds the limit on the departmental pro-card, please contact the Pro-card Administrator for assistance.

- Registration fees may be paid by University check. Complete a direct pay request and submit it along with the completed registration form to Accounting & Financial Services, Coates CPO 3A. If the vendor does not have an EKU ID number, please have them complete a W9 form and submit it to Purchasing. Once Purchasing has assigned the vendor an ID number, you will be able to complete the direct pay request in EKU Direct. Please submit your request in a timely manner so that a check can be processed and mailed to the vendor before any deadline.

- Registration fees prepaid by the University, either by check or pro card, should be listed on the travel voucher under "Prepaid Expense Items." Please attach supporting documentation.

- Travelers may elect to pay registration fees out of their personal funds. In order to be reimbursed for this expense, please list the amount on the travel voucher under "Other Expense Items" and attach your receipt and supporting documentation.

- Travelers cannot be reimbursed for registration expenses until after the registered event has occurred. Travelers are encouraged to use the University pro-card or University checks to limit their out of pocket expenses.

- Administration

- Board of Regents

- Class Schedule

- Colonel's Compass

- Computing Services

- Faculty/Staff Email

- Student Email

- Event Services

- Faculty & Staff

- Green Initiatives

- Noel Studio

- Planetarium

Public Relations

- Alumni Magazine

- EKU Fact Book

- EKU Students Today

- Eastern Progress

- Weather Info

© Copyright Eastern Kentucky University | EO/AA Statement | Privacy Statement | 521 Lancaster Ave, Richmond, KY 40475 | (859) 622-1000 | Login EKU

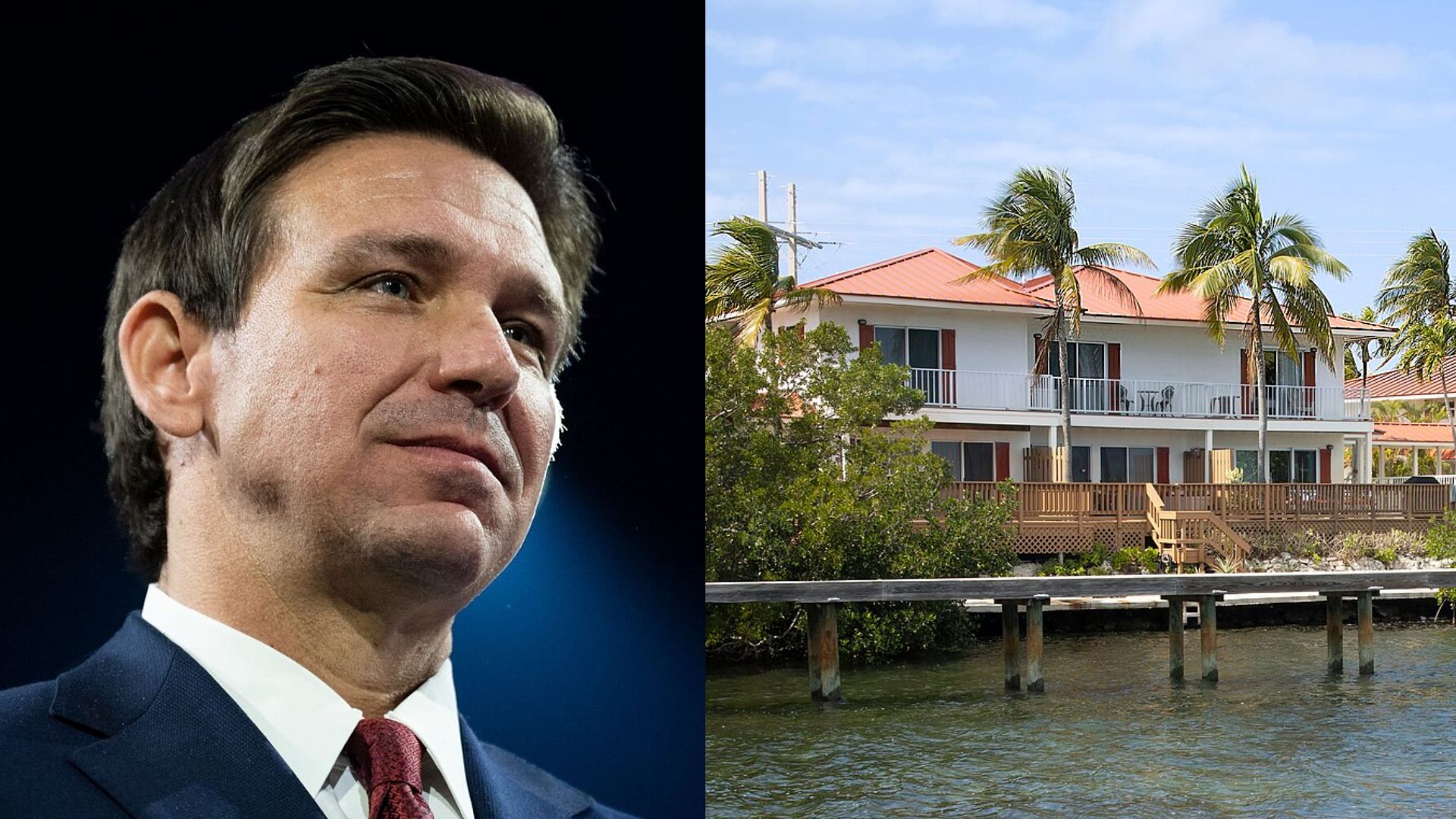

Florida Cracks Down on Airbnb Sparking Backlash

Posted: March 26, 2024 | Last updated: March 26, 2024

The Florida State Senate has recently passed a legislative proposal granting state authorities enhanced regulatory powers over the short-term vacation rental market.

This move is aimed at companies like Airbnb and Vrbo, marking a significant shift from local to state-level oversight. Lawmakers throughout Florida have shown resistance to this change, signaling a complex debate surrounding the balance between state control and local autonomy in the vacation rental industry.

State Supersedes Local Regulations

Under the new bill, SB 280 , the state's power would overrule city and county regulations concerning short-term vacation rentals that were approved since 2016.

However, any regulations enacted before this date would remain unaffected . This legislative action represents a centralized approach to managing the short-term rental market, aiming to standardize regulations across the state.

New Requirements for Rentals

The legislation introduces several new requirements for short-term rentals, including occupancy limits of two people per bedroom, with an additional allowance for two people in common areas.

Moreover, rental owners will be mandated to register their properties with the local government. Failure to comply with these registration requirements could result in fines up to $500 if not rectified within 15 days.

Dedicated Response Personnel Required

An additional provision in the legislation mandates that all short-term vacation rentals must have a designated person available 24/7 to respond to renter complaints and emergencies.

This requirement aims to ensure that any issues can be promptly addressed, improving the experience for renters and addressing potential concerns from neighboring residents.

Statewide Database and Tax Collection

The Department of Business and Professional Regulation (DBPR) is tasked with creating a comprehensive database of all short-term vacation rentals within Florida.

Furthermore, platforms and operators, such as Airbnb and Vrbo, are required to collect and remit specified taxes on behalf of the counties, streamlining the tax collection process from these rentals.

![Enforcement and Oversight <p>To facilitate the enforcement of these new regulations, the DBPR will hire nine additional officers. This decision, however, has faced criticism from individuals like Brevard County Republican Randy Fine, who expressed concerns about the effectiveness of such a small team managing the vast vacation rental market across the state. </p> <p>Fine <a href="https://floridaphoenix.com/2024/03/06/short-term-vacation-rental-bill-barely-passes-florida-house/">stated</a>, "There will be nine people – not in your homes. Not in your neighborhoods, not in your counties. Not in your cities – there'll be nine people here [in Tallahassee]." </p>](https://img-s-msn-com.akamaized.net/tenant/amp/entityid/BB1kyUag.img)

Enforcement and Oversight

To facilitate the enforcement of these new regulations, the DBPR will hire nine additional officers. This decision, however, has faced criticism from individuals like Brevard County Republican Randy Fine, who expressed concerns about the effectiveness of such a small team managing the vast vacation rental market across the state.

Fine stated , "There will be nine people – not in your homes. Not in your neighborhoods, not in your counties. Not in your cities – there'll be nine people here [in Tallahassee]."

Florida's Vacation Rental Market

The short-term vacation rental market is a significant component of Florida's tourism industry, attracting over 100 million American tourists annually since 2019.

Last year, the state welcomed approximately 122.89 million U.S. tourists, illustrating the economic importance of this sector to the Sunshine State's economy.

Airbnb's Economic Contributions

In a demonstration of the economic impact of short-term rentals, Airbnb reported generating $387 million in tourism taxes for the state of Florida in 2023 alone.

This figure represents the highest amount of tourism taxes collected by Airbnb in any state, highlighting the significant role that short-term rentals play in Florida's tourism and economic landscape.

Opposition and Calls for a Veto

The bill's passage has sparked considerable opposition , with many urging Republican Governor Ron DeSantis to veto the legislation.

Critics argue that the bill centralizes too much control at the state level, removing the ability of cities and counties to regulate the short-term rental market effectively according to their local needs and concerns.

Stakeholder Reactions

Various stakeholders, including the Florida Realtors Association and the Florida Alliance for Vacation Rentals (FAVR), have publicly called on Governor DeSantis to veto SB 280 .

They argue that the legislation is "a unique example of very 'imperfect' legislation" and emphasize the importance of maintaining a balance between private property rights and local government regulation.

Potential Impacts on Tourism and Local Governance

The bill's critics, including city officials and local government representatives, have raised concerns about its potential to disrupt local tourism economies and undermine local regulatory efforts.

They emphasize the importance of local autonomy in addressing the unique challenges and opportunities presented by the short-term rental market in their communities.

The Path Forward

The legislation is now awaiting Governor Ron DeSantis's decision. If signed into law, it would take effect on July 1, 2024 , marking a significant change in how short-term vacation rentals are regulated in Florida.

The outcome of this decision could have far-reaching implications for the state's tourism industry, local governance, and the short-term rental market.

More for You

Jared Kushner Called to Face the Music

Ukraine takes out a $169,000,000 warship stolen by Putin

Utah Rep. Phil Lyman blames Baltimore bridge collapse on DEI

Too sweet: 24 of the oldest candy bars still available

Mega Millions announces winner of $1.13 billion jackpot

McDonald's menu brings back a new take on an iconic item

Former Kansas City Chiefs Cheerleader Dies of Sepsis After Stillbirth

Ukraine Damages Crimean Bridge, a Key Russian Supply Line, After Moscow Missile Attack Injures Kyiv Residents

11 Vegetables That Are Safe For Dogs To Eat

Caitlin Clark Called Out For Behavior During NCAA Tournament Win

6 Cuts Of Meat That Are Perfect For Pot Roast And 6 You Should Avoid

McDonald's set to sell major doughnuts brand in all US stores

Marjorie Taylor Greene Hit With Community Note on Baltimore Bridge Post

3 Expenses You Should Never Put on a Credit Card

Gym Tips: 40 Foods to Exclude from Your Diet

25 Large Dog Breeds That Make Great Pets

We Tried the Most Popular Beer Brands and Here’s What We Thought

This McDonald's Cult Favorite Menu Item Is Finally Coming Back

Mike Lindell's MyPillow is getting evicted from its Minnesota warehouse after the company failed to cough up over $200,000 in unpaid rent

Chinese businessman sentenced to death in Nigeria

How will Kentucky's medical marijuana program be regulated? Here's where things stand

The Kentucky Medical Cannabis Program — which regulates the legal cultivation, production, sale and use of medical marijuana products — is set to officially start Jan. 1, 2025.

But before patients and businesses can take part, the state still needs to finalize its regulations to oversee the emerging industry in the commonwealth.

Gov. Andy Beshear signed Senate Bill 47 into law last March, legalizing the medical marijuana industry in Kentucky. The bill put the Cabinet for Health and Family Services in charge of regulations for the industry.

In early January, Beshear's administration filed its first set of 10 regulations governing the industry and providing a framework for how businesses will operate.

These regulations were filed the same day, Beshear urged the expansion of the medical cannabis program to include 15 additional qualifying conditions.

Prep for the polls: See who is running for president and compare where they stand on key issues in our Voter Guide

The 10 regulations focus on cultivators, processors, producers, safety compliance facilities, dispensaries and more.

They include tracking from seed to sale, establishment of product safety testing standards and a license requirement for both consumers and businesses to participate in the industry.

According to the website for the state medical cannabis program, the cabinet is in the process of developing additional regulations.

"In the coming weeks and months, the Cabinet will promulgate additional regulations on how patients and caregivers can become cardholders and how individuals and businesses can apply for a medical cannabis business license," Brice Mitchell, a cabinet spokesperson, told The Courier Journal in an email.

The simple act of filing regulations does not guarantee they will go into effect. First, there will be a public comment period. Afterward, the cabinet will review and consider the public input and potentially tweak the regulations. Then, the regulations head to the General Assembly for approval.

A public comment hearing on the regulations will be held March 25 at 9 a.m. via Zoom. To attend, interested parties must notify the cabinet in writing by March 18 at [email protected].

Here's a look at three key points in the 10 medical marijuana regulations filed by the Beshear administration:

Medical marijuana must be grown indoors

Despite Kentucky's natural agricultural advantages that help the region produce high quality bourbon, racehorses and hemp, the regulations say all medical cannabis must be planted, grown, cultivated and harvested " in an enclosed, locked facility ," including a room, greenhouse, building or other indoor enclosed area.

Currently, the state allows for hemp, a cannabis plant with less than 0.3% THC content, to be grown outside .

Strict packaging and labeling requirements for products

Following in Beshear's footsteps when he filed an executive order in 2022 to regulate the packaging of delta-8, a hemp derived marijuana alternative , the cabinet has placed an emphasis on controlling packaging standards in an effort to protect the public from accidental consumption of medical marijuana and to ensure there is no confusion about what is in a product.

"The packaging and labeling regulation provides a consistent standard for how packaging and labeling medicinal cannabis products will occur and how information required under state law ... will be displayed on product labeling to protect and inform Kentucky consumers," Mitchell said.

The packaging and labeling regulations require medical cannabis products to not resemble commercially available major-brand, edible non-cannabis products, such as popular candies or snack foods. The package must clearly state the item inside contains medical cannabis.

The state government also wants no representation that could mislead consumers to believe the medical marijuana product has been endorsed by the state or any packaging that would be attractive to minors.

Packages must also be child resistant, have a two-step opening process and be labeled with product warnings, THC content, CBD content and more.

Dispensaries are final line of consumer safety defense

By the time products have reached a dispensary, they will have been vetted for a variety of safety factors in multiple steps along the way before ever reaching the customer.

But it's up to the dispensary and its employees to ensure consumers buy what they legally can and what they intend to buy. For example, "vaporizing" methods of medical marijuana can't be sold to those under the age of 21. Also, no medical cannabis products can be sold directly to a minor. One caveat is that a patient's caregiver, such as a parent, can be legally authorized to buy medical marijuana for a minor to use.

Dispensaries will be allowed to sell raw flower, a part of the cannabis plant often used for smoking, but not "any medicinal cannabis accessory that is used solely for the purpose of smoking medicinal cannabis, including rolling papers and lighters."

Mitchell said the sale of raw flower is aimed at allowing patients the ability to make "homemade edibles/baked goods and teas."

Industry experts like Dee Dee Taylor, the owner of 502 Hemp Wellness Center, 812 Hemp and a member of Beshear's medical cannabis advisory committee , finds it "comical" and "naive" to not allow smoking for patients, noting many patients would likely still use flower to smoke.

Others like Jim Higdon, the co-founder of Cornbread Hemp, which sees the medical cannabis industry as a "natural progression" of his business, said the no-smoking provision in the state program is "unique in the nation."

The dispensary regulations also require that a dispensary cannot be located in a shared space with a medical cannabis practitioner. Medical marijuana can be sold only within a licensed, enclosed building or secure structure.

Dispensaries will be allowed to operate only within the hours of 8 a.m. to 8 p.m.

Contact business reporter Olivia Evans at [email protected] or on X, the platform formerly known as Twitter at @oliviamevans_ .

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

City Pair Program (CPP)

The OMB-designated Best-in-Class City Pair Program procures and manages discounted air passenger transportation services for federal government travelers. At its inception in 1980 this service covered only 11 markets, and now covers over 13,000 markets. Today, CPP offers four different contract fares.

Fare finder

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

Contract Awards CSV

Download the FY24 City Pair Contract Awards [CSV - 1 MB] to have them available offline. The file updates after 11:59 pm Eastern Time on standard business days. Previous fiscal year contract awards can be found on the Fiscal documents and information page . To read more about the contract award highlights, please see our Award highlights .

Instructions for the FY24 CSV file

All fares are listed one-way and are valid in either direction. In the CSV file, Origin and Destination are in alphabetical order regardless of travel direction. The Origin is the airport code (domestic travel) or city code (international travel) that comes first alphabetically and the Destination is the airport or city code that comes second alphabetically.

For example, you are traveling from Washington, DC to London, England. You know the city codes are WAS and LON respectively. The city code LON comes first alphabetically and WAS comes second alphabetically. To find the contract fares, you filter:

City Pair Program benefits and info

CPP offers government travelers extra features and flexibility when planning official travel, in addition to maintaining deep program discounts. These include:

- Fully refundable tickets.

- No advance purchase required.

- No change fees or cancelation penalties.

- Stable prices which enables accurate travel budgeting.

- No blackout dates.

- Fares priced on one-way routes, permitting agencies to plan multiple destinations.

CPP is a mandatory use, government-wide program, designated as a Best-In-Class procurement by OMB. The program delivers best value airfares, and ensures federal agencies effectively and efficiently meet their mission.

CPP saves the federal government time and money by maintaining one government-wide air program. At the acquisition level CPP delivers data analysis, compliance, and uses strategic sourcing to optimize its service.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

IMAGES

COMMENTS

Guidance. 2 00 KAR 2:006 - Updated Feb. 17, 2021 200 KAR 2:006E as it applies to state employee travel expense reimbursement. Non-Overnight Travel Division of Social Security fact sheet designed for KY state government agencies explaining the federal employment tax treatment of meal reimbursements paid without overnight travel.

Kentucky Administrative Regulations . Kentucky Administrative Regulations; KAR List by Title; Registers; ... An employee shall be entitled to travel expenses as established by 200 KAR 2:006; ... subject to applicable copyright law, at the Personnel Cabinet, State Office Building 501 High Street, 3rd Floor, Frankfort, Kentucky 40601, Monday ...

Pay shall be issued to state employees on the 15th and 30th day of each month. (2) If the regularly scheduled pay date falls on a weekend, state employees shall be issued pay on the preceding Friday. (3) If the regularly scheduled pay date falls on a state holiday, as defined in KRS 18A.190, pay shall be issued on the workday preceding the holiday.

The employees of the Commonwealth are one of its greatest resources and we are pleased to have you join our team. The information contained in this handbook provides an overview of state government and will assist you as you transition into your new role. It explains the laws, regulations, and policies governing your employment, as well as the ...

State Regulations; Kentucky Administrative Regulations; Title 200 - FINANCE AND ADMINISTRATION CABINET; Chapter 2 - Travel Expense and Reimbursement; Chapter 2 - Travel Expense and Reimbursement . State Regulations ; Compare § 200 KAR 2:006 - Employees' reimbursement for travel; State regulations are updated quarterly; we currently have two ...

Travel Authorization - (TE): For all in-state,out-of -state and out-of-country travel; the travel destination defines the approval roles required. All out-of-state travel must be approved on the TE document by the Office of the Controller. Refer to the "Commonwealth of Kentucky's Administrative Regulation on Travel Expense and

commonwealth of kentucky transportation cabinet frankfort, ky 40622 manual title: traffic operations guidance manual revision no.: 9 date requested: february 25, 2015 reprint: requested by: brad webb new: new & revised policies chapter/ section explanation old pages to be deleted new

KENTUCKY CORRECTIONS Policies and Procedures Policy Number 2.9 Date Filed Effective Date Total Pages 3 * May 24, 2021 Authority/References 200 KAR 2:006 State Employee Travel Regulations 200 KAR 38:070 Internal Controls and pre audit FAP 120-17-03 Subject EMPLOYEE TRAVEL. ... L. Out of State Travel requests shall follow the procedures issued by ...

The following new regulation, 200 KAR 041:010 The Kentucky State Plane Coordinate System, was filed with the Administrative Regulation Review Subcommittee on September 14, 2022.A public hearing is tentatively scheduled for November 30, 2022 at 10:00 a.m., at Kentucky Finance and Administration Cabinet, Office of General Counsel, 200 Mero Street, 5th Floor, Frankfort, Kentucky 40622.

Welcome to the KYEM Travel Page! Whether you are a Kentucky resident or an out of state visitor, we hope you find information on this page useful to help ensure safe travels. ... In Kentucky, should an emergency arise, please call 911, or visit Kentucky State Police for KSP post locations and contact information, or the local County Emergency ...

Pursuant to KRS 13A.050 (1), the Kentucky Administrative Regulations Service shall constitute the official state publication of administrative regulations. Pursuant to KRS 61.874, it is unlawful to use any records available on this site for a commercial purpose without agreement with the Legislative Research Commission.

State Travel Voucher 2018.xlsx State employees and non‐state employees must submit the Travel Voucher Reimbursement Form and Other Expenses - Continuation Form (when applicable) The Multiple Cost Distribution form is located on the last tab titled "Multiple Cost Dist" on the attached State Travel Voucher.

CNN —. US travel restrictions instituted in the early months of the Covid-19 pandemic by states have been eliminated. However, the US Centers of Disease Control and Prevention suggests delaying ...

Travel Regulations 37 Use of Information Technology Resources 38 Work Schedules 41 Employee Services/Recognition Communications 42 Kentucky Employee Suggestion System (KESS) 42 ... in the Kentucky State Police. Certified and equivalent employees of the Education and Workforce Development Cabinet, are governed by KRS Chapter 156 and 780 KAR ...

State ZIP/Postal Code ... KY Laws and Regulations for Bicycle Travel. Kentucky Laws and Regulations for Pedestrians. Bicycle & Bikeways Commission (KBBC) / KRS 174.125 . Classes of Trails Established. Statewide Bicycle & Pedestrian Program. Bicycle Safety Regulations & Standards.

KRS 219.041 requires the cabinet to adopt a State Hotel Code, which includes the requirements for the issuance, suspension, and revocation of permits to operate; submission of plans for construction and equipment layout; plumbing; lighting; ventilation; water supply; sewage disposal; sanitary standards for operation; and other matters deemed ...

Eastern Kentucky University follows the travel requirements and procedures found on EKU's Policy and Regulation website. (If the link to the Travel policy is unavailable, the policy may be undergoing review.) ... regulations (26 CFR 1.62-2) require that Travelers report all travel expenses accurately and completely within 60 days or the amount ...

State Supersedes Local Regulations Under the new bill, SB 280 , the state's power would overrule city and county regulations concerning short-term vacation rentals that were approved since 2016.

A public comment hearing on the regulations will be held March 25 at 9 a.m. via Zoom. To attend, interested parties must notify the cabinet in writing by March 18 at [email protected].

Your agency's authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page. Domestic. Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees.