RewardExpert.com is an independent website that is supported by advertising. RewardExpert.com may be compensated by credit card issuers whose offers appear on the site. Because we are paid by our advertising partners it may impact placement of products on the site, including the order in which they appear. Not all available credit card issuers or card offers are included on the site.

- Credit Cards

Which Credit Card Issuer Has the Best Travel Insurance: American Express vs. Discover vs. Barclays?

Many credit card users are familiar with travel benefits offered by their credit cards including car rental coverage and lost luggage protection. Some credit cards go beyond this level of coverage, providing travel insurance that covers cardholders in the event of unforeseen events, accidents or illnesses. We’ll take a look at three big credit card issuers and the types of credit card travel insurance they offer. This coverage may factor into your decision when you’re choosing which credit card to use when booking a trip, which is an important decision to make in case you need to make a claim.

Two Types of Credit Card Travel Insurance

There are two types of travel insurance offered by credit cards:

- Trip Cancellation Insurance

Travel Accident Insurance

Trip cancellation insurance covers the cost of your travel, up to a certain amount, if you have to cancel or delay your trip because of an illness, accident or a death in your immediate family. To take advantage of this insurance, you must have booked the trip with the credit card that includes the coverage. The insurance will most often cover the cost of carrier transportation including airfare or a train ticket, but not the cost of lodging.

Travel accident insurance is similar to life insurance, providing coverage for you and your immediate family, up to a certain amount, in the event of an illness, accident or fatality that occurs while you’re traveling. Policies are often very specific on what is covered and when it is covered. It helps to pay close attention to the terms of the policy to know when you’re covered.

Let’s take a closer look at credit card travel protection offered by American Express, Barclays and Discover.

Best American Express Cards With Travel Insurance

All American Express credit cards include travel insurance when you purchase the flight with your Amex credit card or use Membership Rewards. The coverage amount depends on the credit card.

- Amex cards with up to $100,000 in coverage

- Amex cards with up to $250,000 in coverage

- Amex cards with up to $500,000 in coverage

What Does American Express Travel Insurance Cover?

American Express travel insurance provides coverage for loss of life and dismemberment that occurs while on a common carrier. To be covered, you must pay for the entire trip using your credit card . You won’t be covered if you use frequent flyer points from another program or another form of payment for any part of the trip. However, if you combine American Express Membership Rewards Points and a credit card to pay for your ticket, you will be covered.

While American Express does not automatically provide coverage for trip cancellation or trip delays, they do offer a separate travel insurance package that consumers can purchase regardless of the credit card used to book travel. Coverage includes trip cancellation and interruption, travel accident protection, global medical protection, global baggage protection, global trip delay, and 24-hour travel assistance starting at $59. You can also choose individual coverage for as low as $11.

What Does Discover Flight Accident Insurance Cover?

Your Discover credit card includes up to $500,000 in flight accident insurance. The benefit covers you, a domestic partner and any eligible dependent children in the event of an accidental death or bodily injury while you’re on a trip. The loss of life benefit is paid to the beneficiary who you’ve designated in writing and filed with the plan administrator. Or, if you haven’t designated a beneficiary, the benefit will be paid to your first surviving beneficiary in this order: your spouse, your children, your parents, your brothers, and sisters or your estate. Claims must be filed with the plan administrator within 90 days.

Best Barclays Cards With Travel Insurance

A few of Barclays’ credit cards include travel insurance, trip cancellation coverage, and trip delay coverage:

- Luxury Card™ Mastercard® Black Card™

- Luxury Card™ Mastercard® Titanium Card™

What Does Barclay Travel Insurance Cover?

Barclays travel insurance provides medical expense, loss of life coverage and reimbursement for trip cancellation, interruption or delay. Coverage applies when you use one of Barclaycards credit cards to pay for your trip.

Barclays provides $250,000 in travel accident insurance which covers you, your spouse, and unmarried dependent children. Your family is insured against accidental loss of life, limb, sight, speech or hearing while you’re a passenger on a carrier that you’ve paid for with your credit card.

Trip Interruption/Cancellation Insurance

Barclaycards credit cards include trip interruption/cancellation insurance which will reimburse you for up to $1,500 towards the cost of a trip that is canceled due to sickness, accident or death. Barclays travel insurance coverage kicks in if your trip is interrupted because of:

- severe weather

- a change in military orders

- a medical quarantine

- jury duty or subpoena

- terrorist attack or hijacking

- an uninhabitable dwelling

Bonus: Trip Delay Insurance

World Elite credit cards also include Trip Delay. You’ll be reimbursed up to $300 when your trip is delayed by six hours or more. So, for example, if you needed to book a hotel because a flight was delayed, your card benefits would reimburse you up to $300 for the hotel stay.

Which Credit Card Includes the Most Travel Insurance?

First place.

Barclays covers not only accident insurance and trip interruption/cancellation but also includes trip delay insurance. This extensive travel coverage makes Barclays the winner.

SECOND PLACE

American express.

American Express credit cards come with varying levels of coverage and only cover loss of life and dismemberment. The premium credit cards that come with higher coverage amounts also have high annual fees. If you want trip cancellation insurance, you’ll have to purchase a separate policy.

THIRD PLACE

While Discover cards all come with $500,000 of travel accident insurance, coverage only applies to loss of life, not medical expenses related to dismemberment.

Editorial Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

UGC Disclosure: The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

- Search Search Please fill out this field.

- Credit Cards

- Credit Card Basics

How Does Credit Card Travel Accident Insurance Work?

Know the key coverages before you leave

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

What Is Travel Accident Insurance?

- What Does Credit Card Travel Accident Insurance Cover?

What Does Credit Card Travel Accident Insurance Not Cover?

How to file a travel accident claim, do i need travel accident insurance on my credit card.

Ippei Noei / Getty Images

We already know that travel is stressful. From planning to budgeting to packing, going on a trip involves a great deal of effort. Although it’s worth it in the end, juggling all the details can leave you feeling overwhelmed—especially when things go awry.

Fortunately, certain credit cards can offer aid in these circumstances. Depending on your card issuer, you may be eligible for credit card travel accident insurance. This insurance will cover you and your immediate family members in case of severe injury or death while you travel.

Credit card travel accident insurance is a benefit offered by a variety of card issuers. This insurance offers a payout in cases of severe injury or death for you and your family members while traveling. The maximum benefit varies based on the card you have, how you sustain your injuries, how severe those injuries are, and if you sustained them in transit or during a non-travel period of your trip.

Issuers That Offer Cards With Travel Accident Insurance

Chase offers travel accident insurance on many of its travel cards. The Chase Sapphire Reserve offers a maximum payout of up to $1 million depending on when and where the accident happens. Other Chase cards provide coverage up to $500,000:

- Chase Sapphire Preferred

- World of Hyatt

- Marriott Bonvoy Bold

- United Quest

Capital One’s Visa Signature cards offer up to $250,000 in coverage, while its World and World Elite Mastercard options provide up to $1 million.

Barclays credit cards provide travel accident insurance, but the coverage amounts and benefits vary based on which network (Visa or Mastercard) the card is part of, a Barclays representative told The Balance by email.

Most credit card policies offer “common carrier” travel accident insurance, which covers you while you’re entering, exiting, or riding as a passenger on a common carrier (plane, bus, taxi, courtesy shuttle, etc.). Chase Sapphire cards, however, offer 24-hour travel accident insurance. This insurance continues to cover you during the first 30 days of your trip. For trips longer than 30 days, check your guide to benefits for coverage limits.

Not every credit card has travel accident insurance. To find out if yours offers this service, check the guide to benefits that comes with your credit card. Within it, you’ll find all the perks your card offers, including travel accident insurance—if it’s available.

Fortunately for cardholders, it’s simple to qualify for your credit card’s travel accident insurance: Pay for the trip with your card. Some cards may specify that you’ll need to pay for the trip in full with your card, so splitting payments with other travelers may disqualify you. This doesn’t necessarily apply to using points or vouchers, so you can combine those with your card payment and still be eligible for travel accident insurance.

If you are involved in an accident while traveling or preparing for transit to and from your destination, you’ll need to file a claim with the credit card issuer’s benefits administrator. If the benefits administrator approves your claim, you or your beneficiaries will receive a cash benefit within the limits of the benefit.

What Does Credit Card Travel Accident Insurance Cover?

Warning: The following section contains information some readers may find disturbing.

In general, credit-card travel accident insurance covers accidental loss of life, limb, sight, speech, or hearing. Credit card issuers tend to have very specific rules for the maximum benefit you can receive based on when injury or death occurs.

For example, Chase travel accident insurance covers:

- Loss of at least four fingers above your middle knuckle, even if the fingers are reattached.

- Loss of at least three fingers and your thumb above their middle knuckles, even if the fingers are reattached.

- Permanent loss of vision in one or both eyes, where remaining eyes have 20/200 vision or worse.

- Loss of feet severed at or above the ankle joint.

- A death that occurs during travel, or that occurs because of the accident within 365 days of the incident.

- Injury caused by accidental consumption of a substance contaminated by bacteria.

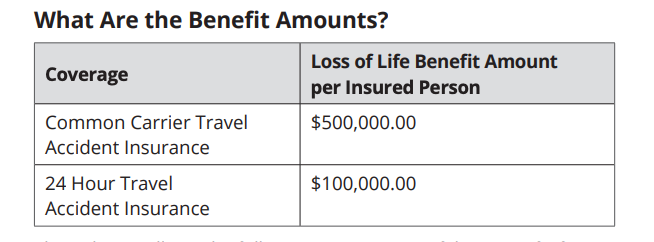

Coverage amounts for each injury depend on the severity of the injury. Travel insurance available on Capital One Visa Signature cards pays out the full $250,000 for accidental loss of life, two or more body parts, and sight in both eyes, but only pays $125,000 for the loss of one body part, sight in one eye, and speech or hearing.

Your card’s guide to benefits has all the specific details about what is covered and coverage amounts. If you have any questions, call the benefits administrator listed in the benefits guide.

In most cases, your travel accident insurance won’t cover injuries or death that happen during certain types of activities.

Capital One Visa Signature cards don’t cover death or injury resulting from war, acts of terrorism, travel between your residence and work, and flights on planes owned by Capital One Financial.

The Chase Sapphire Reserve doesn’t cover death or injury resulting from the commission of an illegal act, parachute jumping and vehicular races, sporting events in which there is a cash prize, and trips taken on aircraft that don’t have government registration or certification.

Neither Capital One nor Chase cover the cost of emotional trauma, mental illness, disease, pregnancy, childbirth, or miscarriage.

If you find yourself in an accident resulting in an injury severe enough to warrant using your travel accident insurance, then you’ll need to file a claim. The process for filing a claim varies by card. Chase and Capital one, for example, both require you to file a written claim within 20 days after your accident.

Credit-card issuers typically use a third-party insurance company to handle travel accident claims. The company's contact information should be available in your card’s benefits guide.

The benefits administrator or insurance company will send you forms within a defined period. You’ll need to return them soon thereafter to receive your payout, although you may get leeway if you aren’t able to respond quickly because of your injuries. Documents you may have to provide include:

- Completed and signed claim form

- Travel itinerary

- Police report confirming the claimed accident

- The credit card account statement showing the charge for the common carrier or scheduled airline fare

- Copy of the death certificate

Be sure to check with your card issuer for specific details about filing a travel accident claim.

Finally, be aware that filing a claim for your travel accident insurance isn’t affected by any other health or travel insurance that you possess. You’ll receive your payout regardless of other coverages you have.

Since credit card travel accident insurance covers instances of severe injury or death, it may make sense for you if you’re a frequent traveler and would like a supplement to a life insurance policy.

If that doesn’t sound like something that applies to you, you may want to look for a credit card that provides a different type of travel insurance. Cards like the Platinum Card from American Express offer benefits such as a global assistance hotline through which you can arrange for emergency medical evacuation at no cost to you. Additional types of insurance include trip delay or trip cancellation insurance , which can reimburse in the case of lost luggage , missed flight connections, or delayed flight departures.

Chase. " Sapphire Reserve Travel Benefits ."

Chase. " Marriott Bonvoy Bold Benefits ."

United Quest Card. " Travel Protection ."

World of Hyatt Credit Card. " Travel Protection ."

Chase Sapphire Preferred. " Travel Accident Insurance ."

Capital One. " Your Guide to Benefits: Visa Signature Card ," Page 8.

Capital One. " Capital One World Mastercard Guide to Benefits ," Page 12.

Capital One. " Capital One World Elite Mastercard Guide to Benefits ," Page 12.

When you use our links to explore products, we may earn a fee but that in no way affects our editorial independence. Some of these links are from our partners and terms apply.

Advertiser Disclosure

Terms Apply

On Discover 's Secure Website.

Discover it® Miles

Discover it® Miles offers flexible travel rewards but lacks the benefits that come with some other travel rewards cards.

Credit Needed

Excellent, Good

Intro Offer

Discover will match all the Miles you’ve earned at the end of your first year.

Rewards Rate

1.5X Miles on every dollar of every purchase

Cardholders automatically earn unlimited 1.5x Miles on every dollar of every purchase .

Offers flexible redemption options to help you avoid blackout dates.

Lacks a traditional sign-up bonus.

Gives no opportunities to earn bonus rewards.

Offers no airline or hotel partners to transfer rewards.

Why Trust U.S. News

Your trust is important to us. To earn it, we conduct a rigorous, unbiased analysis with a transparent methodology, and maintain strict editorial standards and independence.

Discover it® Miles Summary

Discover it® Miles is a flexible travel rewards credit card with no annual fee. Cardholders automatically earn unlimited 1.5x Miles on every dollar of every purchase , which you can redeem as cash, a statement credit for travel purchases, at checkout with Amazon or as a PayPal payment.

Instead of a traditional sign-up bonus, Discover will match all the Miles you’ve earned at the end of your first year. Discover it® Miles features include Online Privacy Protection at no cost offered by Discover Bank, and free access to your FICO credit score.

- Rates and Fees

- Highlights from Issuer

- Issuer Name Discover

- Credit Needed Excellent, Good

- Annual Fee $0

- Regular APR 17.24% - 28.24% Variable APR

- Purchases Intro APR 0% Intro APR for 15 months

- Balance Transfer Fee 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*

- Cash Advance Fee Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Foreign Transaction Fee None

On Discover's Secure Website.

Is the Discover it® Miles Right for Me?

Yes, if you:

- Want to earn flexible flat-rate travel rewards with no annual fee.

- Spend enough to get a lot of value out of the first-year miles matching bonus.

- Don’t need extensive travel benefits.

Tips for Using the Discover it® Miles

The Discover it® Miles card offers a lot of value in the first year, since Discover will match all the Miles you’ve earned at the end of your first year. It’s a good idea to maximize this bonus if you need to make big purchases in the first year.

New cardholders can take advantage of the 0% intro APR for 15 months on purchases. You’ll also get 0% intro APR for 15 months on balance transfers from the date of your first transfer. After that, the 17.24% to 28.24% variable APR applies, so you should plan to pay off your balance before the introductory rate expires.

Editor's Take

This card is good if you want flexible travel rewards and don’t want to pay an annual fee. With a $0 annual fee and a flat-rate 1.5x Miles per dollar travel rewards, you can get a lot of value out of the Discover it® Miles card, especially if you can capitalize on the fact Discover will match all the Miles you’ve earned at the end of your first year.

But the Discover it® Miles card’s 1.5x Miles per dollar isn’t the greatest rewards rate you can earn with a travel rewards card. You could get more value from a card that charges an annual fee but offers more in rewards and travel benefits. For example, the Capital One Venture Rewards Credit Card has a $95 annual fee but earns a flat-rate 2 Miles per dollar on every purchase, every day , with the opportunity to earn 5 miles per dollar on Capital One Travel hotel and rental car bookings. ( See Rates & Fees )

Current Welcome Offers

You won’t get a traditional sign-up bonus with the Discover it® Miles card, but Discover will match all the Miles you’ve earned at the end of your first year.

How to Maximize Rewards With Discover it® Miles

With a flat-rate 1.5x Miles per dollar on all purchases, there are no bonus categories to keep track of to maximize earnings – you can just use your card to earn miles. You'll get a boost in earning rewards since Discover will match all the Miles you’ve earned at the end of your first year.

Comparing the Discover it® Miles With Other Credit Cards

U.s. news credit card rating methodology, alternative pick.

On Capital One 's Secure Website.

Capital One Venture Rewards Credit Card

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

What’s covered by credit card travel accident and emergency evacuation insurance?

Many perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance , delayed baggage insurance , lost baggage insurance , and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we'll explain a couple of lesser-known benefits that you hopefully won't have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you. You can easily find the coverage and terms of any protection your travel credit card offers by doing a quick web search for the card's updated benefits guide. These benefits are not exclusive to travel credit cards and many standard credit cards come with travel protection and insurance.

Travel accident insurance

Often called common carrier insurance , this is a policy that pays in case of death, losing eyesight or losing a limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you typically have to pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance , not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don't compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start looking like you'll need assistance. Nothing that you decide to pay for on your own will be reimbursed.

- Evacuation does not mean repatriation. You won't be evacuated back to the U.S. if you're far overseas. Most policies state you'll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider's expense being denied. Read your credit card's full terms and benefits guide to see which exclude these conditions and the credit card's definition of a pre-existing condition.

- The coverage is only for the cost of evacuation and medical care during transportation. You still need medical insurance to pay the doctors and staff who provide you care once you're back on the ground.

- Some cards have country exclusions, so don't expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, make sure you download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

Related: The best credit cards with travel insurance

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, the card still offers one of the most generous emergency evacuation insurance of any card. There's no cost cap and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don't even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home, and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*

Other American Express cards offer access to the Premium Global Assist Hotline. However, anything they coordinate will be at your expense. Make sure you read your Amex card's benefits guide carefully.

For more details, see our full review of the Amex Platinum .

Related: Your complete guide to Amex travel protections

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Apply here: Amex Platinum

Chase Sapphire Reserve® and Chase Sapphire Preferred® Cards

The Chase Sapphire Reserve offers two different travel accident insurance benefits : common carrier travel accident insurance and 24-hour travel accident insurance. The former applies while riding as a passenger in, entering or exiting any common carrier. The latter applies any time during your trip — but you cannot be paid out on both the common carrier and 24-hour policies.

If you use your Chase Ultimate Rewards points to book your trip, you are covered under the card's benefits.

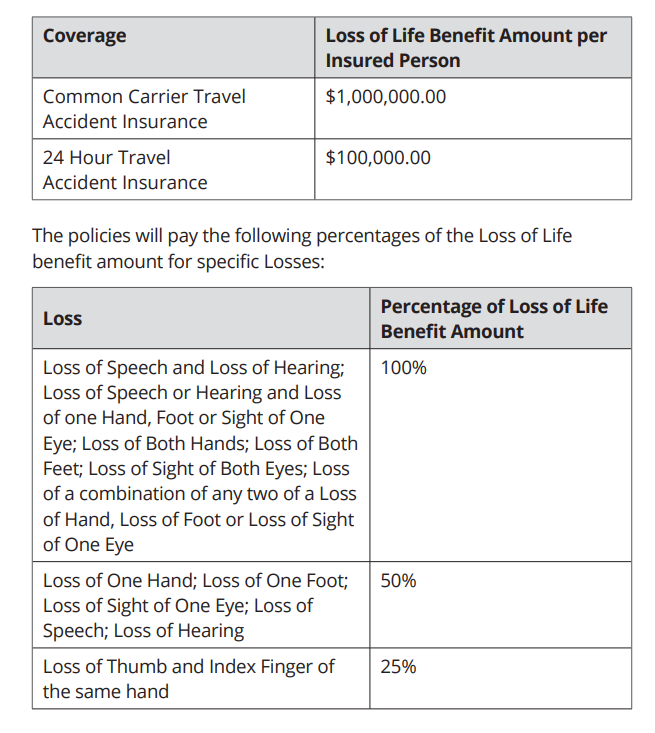

People eligible for coverage include "you, your spouse, your spouse's or domestic partner's children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews." Chase pays up to $1,000,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

Some interesting exclusions with Chase that would prevent a payout include the insured person participating in a motorized vehicular race or speed contest, the insured person participating in any professional sporting activity for which they received a salary or prize money or if the insured person traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket-launched aircraft.

The Chase Sapphire Reserve also offers emergency evacuation insurance. If at least a portion of your or an immediate family member's trip was paid for with the card, you're eligible for up to $100,000 in emergency medical evacuation. Your covered trip must be between five and 60 days and be at least 100 miles from your residence. If you are hospitalized for more than eight days, the benefits administrator can arrange for a relative or friend to fly round-trip in economy class to your location. You can also be reimbursed for the cost of an economy ticket home if your original ticket cannot be used. In a worst-case situation, the benefit also pays up to $1,000 to repatriate your remains.

The Chase Sapphire Preferred Card offers the same travel accident insurance as the Reserve, except with lower payouts on the common carrier policy. The benefits pay up to $500,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

For more details, see our full reviews of the Chase Sapphire Reserve and Chase Sapphire Preferred .

Related: Your guide to Chase's trip insurance coverage

Apply here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Club Infinite Card

The top-tier United Club Infinite Card offers both travel accident insurance and emergency evacuation insurance. The travel accident insurance benefits pay up to $500,000 for a common carrier loss.

The card also carries the same benefit as the Chase Sapphire Reserve for emergency evacuation coverage, with up to $100,000 of coverage provided for evacuation.

For more details, see our full review of the United Club Infinite Card .

Apply here: United Club Infinite

Bottom line

We hope none of us perfectly ever have to worry about either of these policies, but it's nice to have peace of mind if you or your family need emergency assistance. This reassurance is just one more reason to ensure one of these cards is always in your wallet when traveling. The benefit guides of all cards are updated regularly, so make sure you don't toss them in the trash when updates show up in the mail and read the online guides for the latest terms and conditions.

Additional reporting by Emily Thompson and Stella Shon.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The 8+ Best Credit Cards for Travel Accident Insurance [2023]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

31 Published Articles 3100 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![discover travel accident insurance The 8+ Best Credit Cards for Travel Accident Insurance [2023]](https://upgradedpoints.com/wp-content/uploads/2018/11/Airport-Boarding-Line.jpg?auto=webp&disable=upscale&width=1200)

What is Travel Accident Insurance?

Card summary, chase travel accident insurance, chase cards that provide travel accident insurance, chase coverage details and conditions, additional credit cards with travel accident insurance, how to file a claim, other useful travel protections and benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1024+ Expert Credit Card Guides

You don’t embark on a journey thinking something bad will happen because chances are that the worst won’t happen. It’s good to know, however, that if something did happen and you were severely injured or even worse, there is coverage available — and it comes complimentary on your credit card.

Travel Accident Insurance is widely available but seldom used. In fact, news and media provider Reuters reports that there were zero accidental deaths on scheduled commercial U.S. air carriers in 2017, which is the most recent data available.

And while you don’t normally base your credit cards on this coverage, it’s helpful to know which cards come with this coverage. Travel protections and benefits can save you money when you travel and provide peace of mind knowing you have coverage should something drastic happen during your trip.

Travel Accident Insurance, specifically, is one of those peace-of-mind coverages that can be a welcome resource should you need it.

Here’s a look into travel accident insurance with the objective of defining the coverage and letting you know which popular cards carry the protection as part of a broader package of travel protections and benefits.

Travel Accident Insurance is a complimentary travel protection that is offered on certain travel rewards credit cards. The coverage pays out a specified benefit should you or your immediate family become severely injured, including dismemberment, loss of sight, hearing, or speech, or death due to a covered accident on a common carrier during your travels.

The coverage works similar to life insurance in the case of accidental death. Dismemberment and severe injury is handled differently in that a percentage of the total death benefit is paid out depending on the severity of the injury. The limits of the benefit payouts are depicted in a table published within the Guide to Benefits for each specific credit card.

Travel Accident Insurance is different than trip cancellation, trip interruption , and trip delay insurance in that it only pays a benefit in the case of accidental death or specified severe injuries when traveling on a common carrier.

Also, unlike most travel insurance policies that come with your credit card, travel accident insurance is not secondary coverage . This means it will pay benefits in addition to other life, disability, or medical coverage you hold.

Primary and additional cardholders can generally designate a beneficiary for the accident life insurance portion of the coverage.

Bottom Line: Travel Accident Insurance comes complimentary on many travel rewards credit cards. It works similar to an accidental life insurance policy in the case of death and pays out a percentage of that benefit in the case of severe injury.

The Best Credit Cards for Travel Accident Insurance

The best credit cards for travel accident insurance coverage have travel protections and benefits beyond that of just travel accident insurance. The following travel rewards credit cards offer some of the best travel insurance packages available and all of the coverages come complimentary with the card .

Chase actually has 2 types of travel accident insurance:

- Common Carrier Travel Accident Benefit — this protection covers you while you are a passenger on any common carrier or at the airport/terminal/station immediately before or after your trip.

- 24-Hour Travel Accident Benefit — you will be covered as soon as you begin your trip, during your qualifying trip, and until you return for accidental death, dismemberment, and loss of speech, sight, or hearing.

Chase Sapphire Preferred ® Card (Top Pick)

The Chase Sapphire Preferred provides up to $500,000 for the Common Carrier Benefit, or $100,000 for the 24 Hour Benefit. In addition to travel Accident insurance, the Chase Sapphire Preferred card offers additional travel insurance .

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Ink Business Preferred ® Credit Card

The Ink Business Preferred card provides up to $500,000 for the Common Carrier Benefit, or $100,000 for the 24 Hour Benefit.

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- Trip cancellation and interruption insurance

- Rental car insurance

- Extended warranty coverage

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

- Best Business Credit Cards

- The Chase Ink Business Preferred 100k Bonus Offer

- Benefits of the Ink Business Preferred

- Chase Ink Business Preferred Cell Phone Protection

- Chase Ink Business Preferred vs Amex Business Gold

- Ink Business Cash vs Ink Business Preferred

- Amex Business Platinum vs. Chase Ink Business Preferred

- Ink Business Preferred vs Ink Business Unlimited

- Best Chase Business Credit Cards

- Best Business Credit Card for Advertising

- High Limit Business Credit Cards

- Best Credit Cards with Travel Insurance

- Best Credit Cards for Car Rental Insurance

Chase Sapphire Reserve ®

In addition to Travel Accident Insurance of up to $1,000,000 , the Chase Sapphire Reserve card offers complimentary emergency evacuation insurance up to $100,000 and $2,500 in emergency medical/dental expenses.

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Marriott Bonvoy ® Bold Credit Card

The Marriott Bonvoy Bold card offers up to $500,000 in travel accident insurance benefits when you purchase your common carrier ticket with your card.

Marriott Bonvoy Bold ® Credit Card

A great option for Marriott hotel fans who want a no annual fee card and automatic Marriott Bonvoy elite status.

Casual travelers who like to frequent properties that are part of the Marriott Bonvoy collection of brands may want to consider the Marriott Bonvoy Bold ® Credit Card.

The Marriott Bold card rewards cardholders for Marriott stays and gives them a boost towards Marriott Bonvoy elite status.

- Up to 14x points per $1 on Marriott purchases

- 2x points per $1 on travel purchases

- 15 Elite Night Credits each year (automatically gives you Silver Elite status)

- No foreign transaction fees

- No annual fee

- Lower point earn rate than other Marriott Bonvoy cards

- Marriott Bonvoy Silver Elite status is the lowest status tier

- Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

- Pay no annual fee with the Marriott Bonvoy Bold ® Credit Card from Chase ® !

- Earn up to 14X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Bold ® Card.

- 1X point for every $1 spent on all other purchases.

- Your points don't expire as long as you make purchases on your card every 24 months.

- No Foreign Transaction Fees.

- APR: 21.49%–28.49% Variable

- Hotel Credit Cards

- No Annual Fee Cards

Marriott Bonvoy

- Marriott Transfer Partners

- Best Credit Cards for Marriott Loyalists

- Best Marriott Credit Cards

The World of Hyatt Credit Card

Pay for your transportation ticket with your World of Hyatt card and receive up to $500,000 in travel accident insurance due to a covered loss.

The World of Hyatt card offers a fast track to Hyatt elite status, an annual free night, and up to 9x points per $1 on Hyatt stays.

The World of Hyatt Credit Card makes your Hyatt stays more rewarding and helps you get coveted World of Hyatt elite status faster. This card is a must-have for any traveler who regularly stays at Hyatt hotels, or even for anyone who’s able to take advantage of the card’s annual free night certificate.

When you factor in all the benefits the World of Hyatt card offers, it’s easy to see why it is one of the best co-branded hotel credit cards on the market.

- Up to 9 points total for Hyatt stays: 4 Bonus Points per $1 spent at Hyatt hotels and 5 Base Points per $1 from Hyatt as a World of Hyatt member

- 2x points per $1 at restaurants, on airline tickets purchased directly from the airline, local transit, rideshares, and fitness clubs/gym memberships

- 1x point per $1 on all other purchases

- 1 Free Night Award each cardmember anniversary (Category 1 to 4)

- A second Free Night Award when you spend $15,000 on the card

- Hyatt Discoverist status

- 5 automatic elite night credits each year

- 2 elite night credits for every $5,000 spent on the card

- DoorDash DashPass subscription

- Trip cancellation/interruption and luggage insurance

- Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

- Enjoy complimentary World of Hyatt Discoverist status for as long as your account is open.

- Get 1 free night each year after your Cardmember anniversary at any Category 1-4 Hyatt hotel or resort

- Receive 5 tier qualifying night credits towards status after account opening, and each year after that for as long as your account is open

- Earn an extra free night at any Category 1-4 Hyatt hotel if you spend $15,000 in a calendar year

- Earn 2 qualifying night credits towards tier status every time you spend $5,000 on your card

- Earn up to 9 points total for Hyatt stays - 4 Bonus Points per $1 spent at Hyatt hotels & 5 Base Points per $1 from Hyatt as a World of Hyatt member

- Earn 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

- APR: 21.49% - 28.49% Variable

World of Hyatt

- Benefits of the Hyatt Credit Card

- How to Earn Globalist Status With World of Hyatt Credit Card Spend

- Best Credit Cards for World of Hyatt Loyalists

- Best Hotel Credit Cards for Free Nights

- Best Ways To Earn Hyatt Points

United-branded Credit Cards

United℠ Explorer Card

With priority boarding privileges, no foreign transaction fees and more, MileagePlus members will definitely enjoy their partnered card.

You travel United all the time, but you have heard that there could be ways to make your travel experiences even better, including priority boarding, free bags, and more miles.

You should consider the United℠ Explorer Card , because this card does all that and more!

- 2x miles per $1 on United purchases, dining purchases (including delivery services), and hotel stays

- 1x mile per $1 on all other purchases

- First checked bag free for you and up to 1 traveling companion

- 25% statement credit on United inflight purchases

- Priority boarding

- Global Entry, TSA PreCheck, or NEXUS statement credit

- 2 United Club 1-time passes each year

- Premier upgrades on award tickets

- Travel and purchase protections

- $0 intro for the first year, then $95 annual fee

- Does not earn transferable rewards

- Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $95.

- Earn 2 miles per $1 spent on dining, hotel stays, and United ® purchases

- Up to $100 Global Entry, TSA PreCheck ® or NEXUS fee credit

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card

- Free first checked bag - a savings of up to $140 per roundtrip. Terms Apply.

- Enjoy priority boarding privileges and visit the United Club℠ with 2 one-time passes each year for your anniversary

- APR: 21.99% - 28.99% Variable

- Airline Credit Cards

United MileagePlus Frequent Flyer Program

- Benefits of the United Explorer Card

- Best Credit Cards for Airport Lounge Access

- Best Chase United Credit Cards

- Best Credit Cards for Global Entry and TSA PreCheck

United Club℠ Infinite Card

Perfect for frequent United flyers who want premium perks like United Club access and free baggage benefits.

The United Club℠ Infinite Card is a premium card designed for the most dedicated of United frequent flyers who are looking for a card that provides the opportunity to earn extra United MileagePlus miles and receive lounge access via a yearly United Club membership.

United frequent flyers will find that the United Club Infinite card provides an enhanced experience on their United flights thanks to the money saved on each flight and the conveniences it provides.

- 4x miles per $1 on United purchases

- 2x miles per $1 on travel and dining purchases

- Complimentary United Club membership

- Free first and second checked bag for you and 1 traveling companion

- United Premier Access

- 25% back on United inflight purchases

- Complimentary Premier Upgrades on United-operated award tickets (when available)

- Expanded award availability

- Up to 10,000 Premier Qualifying Points

- $100 Global Entry/TSA PreCheck/NEXUS credit

- Trip protections like trip delay insurance, lost and delayed luggage insurance, and rental car insurance

- Shopping protections like return protection, purchase protection, and extended warranty protection

- IHG One Rewards Platinum Elite status and a $75 annual credit

- Avis President’s Club elite status

- 10% discount on United Economy Saver Awards within the continental U.S. and Canada

- $525 annual fee

- Earn 80,000 bonus miles after qualifying purchases

- Earn 4 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent on all other travel and dining

- Earn 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and Premier Access ® travel services

- 10% United Economy Saver Award discount within the continental U.S. and Canada

- Earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

- Best Credit Cards for United Flyers

- United Club Lounge Locations

- New Benefits for United Club Infinite Card [IHG Elite Status, 10% Off Awards]

United Quest℠ Card

The United Quest card is a fantastic option for United flyers looking to earn more miles and enhance their flights.

The newest addition to United’s lineup of cards is the United Quest℠ Card . With it, you can bolster your United MileagePlus miles, thanks to the bonus categories, while enjoying the card’s many perks designed to help save you money on each United flight.

With an annual fee that falls between the United℠ Explorer Card and United Club℠ Infinite Card , the United Quest card makes for a fantastic card option for United frequent flyers.

- 3x miles per $1 on United purchases

- 2x miles per $1 spent on travel, dining, and select streaming services

- $125 annual United credit

- 2 5,000-mile anniversary award flight credits

- Up to 3,000 Premier Qualifying Points

- Up to $100 Global Entry/TSA PreCheck/NEXUS credit

- Travel and shopping protections including trip delay insurance, lost/delayed luggage insurance, rental car insurance, purchase protection, and extended warranty protection

- Does not offer airport lounge access

- $250 annual fee

- Earn 60,000 bonus miles and 500 PQP after qualifying purchases

- Earn 3 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent on all other travel, dining and select streaming services

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and priority boarding

- Up to a $125 United ® purchase credit and up to 10,000 miles in award flight credits each year (terms apply)

- Earn up to 6,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

United Gateway℠ Card

The United Gateway card is a great option for those looking to earn more United miles without paying an annual fee.

The United Gateway℠ Card is a great option for those looking to earn more United miles without wanting to pay a credit card annual fee. Plus, the card offers other solid benefits like a 25% back on United inflight purchases, purchase protection, and rental car insurance.

- 2x miles per $1 on United purchases

- 2x miles per $1 at gas stations and on local transit and commuting, including rideshare services, taxicabs, train tickets, tolls, and mass transit

- 25% back on inflight purchases

- Trip cancellation and trip interruption insurance

- If you are a frequent United flyer, other cards offer more perks

- It does not earn transferable rewards

- Earn 20,000 bonus miles

- Earn 2 miles per $1 spent on United ® purchases, at gas stations and on local transit and commuting

- Earn 2 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent at gas stations, on local transit and commuting

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

- APR: 0% Intro APR on Purchases for 12 months; after that, 21.99% - 28.99% Variable

- Best No-Annual-Fee Credit Cards for Hotel & Airline Benefits

United Club℠ Business Card

The United Club Business card is a great option for frequent United flyers looking for United Club access.

The United Club℠ Business Card is a premium card option for dedicated United loyalists seeking a card that offers complimentary United Club access, helps them earn and retain status, and doesn’t skip on the benefits.

From free checked bags to upgrades on award tickets and the ability to earn Premier qualifying points, there is plenty to the United Club Business card that United flyers are sure to love.

- 2x miles per $1 spent on United purchases

- 1.5x miles per $1 spent on all other purchases

- Free checked bags

- Premier Access travel services

- Discount on inflight purchases

- Upgrades on award tickets

- Employee cards at no additional cost

- $450 annual fee

- Earning rate for United purchases is poor compared to other United cards

- Earn 75,000 bonus miles + 1,000 Premier qualifying points (PQP) after $5,000 on purchases in the first 3 months your account is open

- Earn 2x miles on United purchases

- Earn 1.5x miles on all other purchases

- United Club membership — up to a $650 value per year. Relax in comfort while waiting for your flight with complimentary beverages, snacks, high-speed Wi-Fi, and more

- Free first and second checked bags for you and a companion, save up to $320 per round-trip

- APR: 21.99%–28.99% Variable

- Foreign Transaction Fees: $0

- Business Credit Cards

- Best Ways To Book United Polaris Business Class Using Points

- Best Ways To Earn United MileagePlus Miles

- Best Ways To Redeem 60,000 United Airlines Miles

- Best Ways To Redeem United MileagePlus Miles

- Best Ways to Earn 100k+ United MileagePlus Miles

- How To Get United Airlines Elite Status

- What Is United MileagePlus Elite Status Worth: Seating & Upgrades

These United-branded credit cards come with complimentary travel accident insurance of up to $500,000 .

Who is covered on Chase-issued credit cards?

The primary cardholder, additional card holder, and immediate family members are covered for Chase Travel Accident Insurance.

Immediate family is defined as you (the cardholder), your spouse or domestic partner, you or your domestic partner’s children, including adopted children or step-children. Additionally, legal guardians or wards, siblings or siblings-in-law, parents or parents-in-law, grandparents, grandchildren, aunts/uncles, and nieces/nephews are covered.

Conditions for Coverage on Chase Cards

- Pay for the common carrier fare in full or in part with your eligible Chase card

- The accident occurs while riding as a passenger, boarding, exiting, or being struck by a common carrier on a covered trip

- The accident occurs at the airport, terminal, or station at the beginning or end of the common carrier-covered trip

Bottom Line: Many Chase credit cards come with travel accident insurance and since the definition of covered persons is so broad, benefits are provided for even extended family members.

There are several other travel rewards cards that offer Travel Accident Insurance to varying degrees.

Capital One-Issued Rewards Cards — All of Capital One’s Visa Signature and Mastercard Rewards cards come with Travel Accident Insurance coverage. Charge your entire travel fare to your card and receive up to $250,000 in benefits. You can read about our recommended Capital One Cards here.

Visa Infinite Credit Cards — Cardholders and dependents are covered when the common carrier ticket is purchased with the eligible card. Coverage is provided up to $500,000 for accidental death or dismemberment.

Wells Fargo Visa Signature Cards — Pays up to $1,000,000 when your common carrier ticket is paid for in full with your card.

Filing a claim for accidental death or severe injury is straightforward regardless of the issuing credit card institution. The first step is to contact the benefits administrator as soon as possible after the accident, generally no later than 30 days, by calling the number on the back of your card.

You could be asked to submit any of the following for documentation:

- Completed and signed claim form

- Proof of payment method for common carrier ticket

- Explanation of loss

- Death certificate, if applicable

- Medical records, if applicable

Bottom Line: Regardless of the credit card issuer, you’ll want to submit your claim on a timely basis and confirm that all the required documentation has been received by the benefits administrator to avoid any chance your claim being delayed or denied due to lack of information.

Travel Accident Insurance is just one travel protection offered complimentary on travel rewards credit cards. Look for these additional travel benefits when selecting a travel rewards card.

- Car rental collision damage waiver insurance — one of the most valuable travel benefits you can have is primary rental car insurance. Learn which cards are best for car rental insurance .

- Trip cancellation and trip interruption coverage — When your trip is canceled or delayed, it’s bound to result in unplanned expenses. Trip cancellation and interruption coverage will reimburse you for covered events that cause you to cancel your trip or cause disruption while your trip is in progress.

- Trip delay reimbursement — If your flight is delayed a specified number of hours, usually 12 hours or more, a benefit is paid to reimburse you for expenses such as lodging, transportation, meals, and necessary personal items

- Lost, damaged, or delayed luggage insurance — Chances are you’ll get paid by the airline if your baggage is lost, damaged, or delayed. This coverage will pay for eligible incidents where your out-of-pocket costs are more than the common carrier will cover.

- Travel and emergency assistance services — Help is just a phone call away, day or night, if something goes wrong during your travels. Get help finding an English speaking medical provider, legal services, or assistance replacing a lost passport.

- Emergency evacuation insurance — A few premium travel rewards cards such as the Amex Platinum Card and the Chase Sapphire Reserve provide emergency evacuation transportation services.

- Emergency medical coverage — The Amex Platinum Card, Chase Sapphire Preferred, and Chase Sapphire Reserve all offer limited reimbursement coverage for medical emergency expenses.

- Roadside dispatch – Premium travel rewards cards such as the Amex Platinum Card come with free roadside assistance. Other cards charge a flat discounted fee per service call. Roadside dispatch is a handy coverage to have on your card, in either case, if you should break down on the side of the road.

Bottom Line: Finding a card that has a package of complimentary travel protections and benefits you can use brings extra value that can save you money or provide peace of mind during your travels.

No one likes to think about having a severe accident happening during their travels. Chances are, you’ll never have to worry about using the travel accident insurance that comes with your card. However, just knowing it exists is enough.

It is not a key travel insurance coverage that causes you to weigh one travel rewards card over another. Selecting a card that offers a broader collection of travel protections and benefits you can use is a more prudent approach.

Always compare the coverage that comes on your card with a comprehensive travel insurance policy to determine if the complimentary coverage is adequate for your trip. If not, you can supplement the complimentary coverage easily and inexpensively.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the United Club℠ Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How does travel accident insurance work.

Travel accident insurance is an ancillary coverage that comes complimentary with many credit cards. It functions like a life insurance policy in the case of accidental death and pays a benefit in case of severe accidental injury (dismemberment or the loss of sight or hearing).

Coverage can range from $100,000 to $1,000,000 depending on the credit card for accidental death or severe injury when traveling on a common carrier such as a plane, train, or cruise ship.

The definition of who is covered also differs by credit card. Some cards cover only the cardholder, spouse, and dependent children under a certain age.

Other cards extend coverage to immediate family including in-laws, and step-children.

Travel accident insurance is not a secondary excess coverage. This means that even if you have other insurance coverage it will still pay the full appropriate benefit.

Some cards require that you pay for your entire common carrier ticket with your eligible card, others require that only a portion of your ticket be paid for with your card.

How do I know if my card has travel accident insurance?

The easiest way to find out if you have travel accident insurance is to call the number on the back of your card.

You can also access your printed Guide to Benefits that came with your card or go to your online credit card account and access the information there.

Additionally, you can request a copy of the Guide to Benefits be sent to you.

Does travel accident insurance cover rental cars?

Travel accident insurance does not cover accidents that happen with rental cars. However, chances are you have coverage for damage to the rental car either on your own auto insurance policy, car rental coverage that comes with your credit card, or coverage you purchased from the rental car company.

Travel accident insurance also does not cover accidental death or severe injury from an accident involving a rental car. Coverage is limited to accidents involving common carriers such as planes, trains, and cruises.

Is travel accident insurance important?

Chances are you will never have to use travel accident insurance. However, having it can give you peace of mind that if something drastic should happen during your travels, the coverage is there.

Travel accident insurance is just one benefit among many travel insurance benefits you should look for when selecting a travel rewards card.

It often comes included with other important travel benefits such as car rental insurance, trip interruption, trip cancellation, trip delay reimbursement, emergency travel assistance, and roadside assistance, plus others.

Selecting a card that has a full package of travel benefits you can use will bring the most value.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Action required: Update your browser

We noticed that you're using an old version of your internet browser to access this page. To protect your account security, you must update your browser as soon as possible. You'll be unable to log in to Discover.com in the future if your browser has not been updated. Learn more in the Discover Help Center

Please Note: JavaScript is not enabled in your web browser. In order to enjoy the full experience of the Discover website, please turn JavaScript on. If JavaScript is disabled, some of the functionality on our website will not work, such as the display of rates and APRs.

- Card Help Center

- Card Smarts

- Banking Help Center

- Home Loans Help Center

- Student Loans Help

- Personal Loans Help

- Gift Card Help

- Search Search Discover When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

- Log In Opens modal dialog

- Credit Card Products

- Credit Cards by Feature

- Tools and Resources

- All Credit Cards

- Discover it® Cash Back Earn cash back rewards

- Discover it® Student Cash Back Start building credit in college

- Discover it® Student Chrome Earn restaurant & gas rewards as a student

- Discover it® Secured Build or rebuild your credit

- Discover it® Miles Explore with the travel rewards credit card

- Discover it® Chrome Earn restaurant & gas rewards

- NHL Credit Card Represent your team & earn cash back

- Cash Back Credit Cards

- Airline Travel Credit Card

- Low Interest Credit Cards

- Balance Transfer Credit Cards

- Credit Cards for College Students

- Credit Cards for No Credit History

- Credit Cards to Build Credit

- No Annual Fee Credit Cards

- Credit Card Interest Calculator

- Respond to Mail Offer

- Check Application Status

- Card Smarts Articles

- - Getting a credit card

- - Using your credit card

- - Credit card rewards

- Free Credit Score for Cardmembers

Travel Credit Card

Travel rewards that go where you're going..

The flexible, travel card with reliable rewards, that matches every Mile you earned at the end of your first year. 2 Plus! No annual fee .

Intro purchase APR is x % for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x % variable to x % variable, based on your creditworthiness. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

No annual fee

x Average of x Reviews 7

See how we calculate our ratings

x out of 5 Average of x Reviews 7

Earn travel rewards on every purchase

There's no limit to how many Miles you can earn. And however you redeem, Miles have the same value. 1

- We'll automatically match all the Miles you've earned at the end of your first year. 2

- You could turn 35,000 Miles to 70,000 Miles, which is $700 all for you.

- No minimum spending requirement on your new card.

99% nationwide acceptance — Discover is accepted nationwide by 99% of the places that take credit cards. 3

Be your own tour guide

Get a travel rewards card that lets you redeem how you want–travel credit or cash.

Get cash for the things you want

No blackout dates. Once you make a travel purchase, simply redeem your Miles as a statement credit towards that purchase. However you redeem, Miles have the same value. 1

Use Miles at Amazon. com 4 checkout and when you pay using PayPal. 5

How many Miles can you earn?

You'll earn unlimited 1.5x Miles on every purchase that you make with your Discover it ® Miles card. See if this is the best credit card for you.

What do you spend on credit card purchases each month?

What you'd earn each year.

which equals

What you'd automatically earn after your first year with Discover Match ®

Easily redeem Miles as a statement credit for travel purchases or get cash. 1 Where could your Discover it ® Miles Credit Card take you?

How does the Discover ® Travel Card work?

Earn miles on all purchases, redeem miles for travel purchases or cash.

Every dollar you spend on purchases with your travel card earns 1.5x Miles that never expire 1 , with no annual fee .

Redeem your Miles the way you want

Turn Miles into cash, or redeem as a statement credit for your travel purchase like airfare, hotels, rideshares, gas stations, restaurants, and more. 1

Discover matches all your Miles your first year

Discover is the only major credit card that gives you an unlimited match of all the Miles you've earned at the end of your first year. 2

Where is the Discover travel card accepted?

Discover it ® Miles is accepted at 99% of places that take credit cards nationwide, according to the Feb. 2023 issue of the Nilson Report. 3 And best of all, it's a travel rewards card that works just like your favorite credit card. Use it for travel expenses and purchases like airfare, getting a rental car, or booking a hotel stay. And just as easily use it for everyday purchases like groceries, gas, and paying bills.

What is the interest rate on a Discover travel card?

Your interest rate will be determined when you submit your travel card application for a Discover it ® Miles card. The APR you qualify for depends on your credit history and other factors. You can see if you're pre-approved for a personalized offer now or apply for the travel credit card offer on this page. Remember: Discover it ® Miles has no annual fee .

What are the different ways I can redeem Miles?

When you think of the best travel credit card for you, you likely want a card with a signup bonus, a card that allows you to have flexibility when you travel, and a card with rewards that you can use for travel expenses—or in other ways, if you want. With Discover it ® Miles, you get all of that. And as soon as you start earning rewards on your card, you can redeem them as a statement credit for a previous travel purchase—which means no blackout dates. Because once you make a travel purchase, you simply redeem your Miles as a statement credit towards that purchase. 1 So book the travel that works for you, and use your Miles to credit yourself back. Eligible purchases include airfare, car rentals, hotels, rideshares, gas stations, restaurants and more. 1 You can also use Miles like cash, without losing any value for your rewards. Turn Miles into cash in any amount, any time 1 , by depositing into your bank account; or use Miles to pay when you check out at Amazon. com 4 or when you pay with PayPal. 5 However you redeem, Miles keep the same value. And Miles never expire. 1

How many Discover credit card Miles does it take to redeem for a flight or other travel purchase?

With the Discover it ® Miles Credit Card, when you're ready to redeem your Miles, 100 Miles = $1 to redeem for cash or travel credit. The great thing about the Miles that you earn with the Discover ® travel card is that they can be used to cover all or part of a travel expense. So the amount of credit card Miles that you'll need to redeem to cover your entire airline ticket will depend on the price of the flight that you booked. This goes for other travel purchases, too, including rideshares or rental car bookings. Remember—you can redeem your Miles for a statement credit for all or part of your travel purchase, to help keep your total costs down.

Which airlines accept the Discover travel rewards credit card?